UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Amendment No. 1

Filed by the Registrant [X]☒

Filed by a Party other than the Registrant [ ]☐

Check the appropriate box:

| Preliminary Proxy Statement | |

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| Definitive Proxy Statement | |

| Definitive Additional Materials | |

| Soliciting Materials Pursuant to §240.14a-12 |

AKERS BIOSCIENCES, INC.MyMD Pharmaceuticals, Inc.

(Name of Registrant as Specified in Itsits Charter)

N/A

N/A

(Names of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (check the appropriate box):

| No fee required | ||

| Fee paid previously with preliminary | ||

| ☐ | ||

| 0-11 |

201 Grove Road

Thorofare, New Jersey 08086

855 N. Wolfe Street, Suite 601

Baltimore, MD 21205

(856) 848-8698

_________, 2020October 26, 2022

To the Stockholders of Akers Biosciences,MyMD Pharmaceuticals, Inc.:

You are cordially invited to attend the 20202022 Annual Meeting of Stockholders (the “Annual Meeting”) of Akers Biosciences,MyMD Pharmaceuticals, Inc. (the “Company”), to be conducted in a virtual format only via live audio webcast at 11:3010:00 a.m., Eastern Time, on Thursday, August 27, 2020,Wednesday, December 14, 2022, at www.virtualshareholdermeeting.com/AKER2020.MYMD2022.

In lightTo provide access to our stockholders regardless of public health concerns regarding the coronavirus (“COVID-19”) outbreak, this year’s Annual Meeting will be conducted in a virtual format only in order togeographic location and assist in protecting the health and well-being of our stockholders and employees, and to provide access to our stockholders regardless of geographic location.this year’s Annual Meeting will be conducted in a virtual format only. Stockholders will not be able to attend the Annual Meeting in person; however, stockholders of record will be able to participate, vote electronically and submit questions during the live websitewebcast of the Annual Meeting by visiting www.virtualshareholdermeeting.com/AKER2020MYMD2022 and entering the 16-digit control number found on your Notice of Internet Availability or on the enclosed proxy card or voting form.form (if you requested paper proxy materials). If you encounter any difficulties accessing the virtual Annual Meeting, please call the technical support number available on the virtual meeting page on the morning of the Annual Meeting.

Your vote is very important, regardless of the number of shares of our voting securities that you own. Whether or not you expect to be present at the Annual Meeting, after receiving the Notice of Internet Availability or proxy materials, please vote as promptly as possible to ensure your representation and the presence of a quorum at the Annual Meeting. As an alternative to voting during the Annual Meeting, you may vote via the Internet byor telephone or, if you requested paper proxy materials, by signing, dating, and returning the proxy card that is mailed. If your shares are held in the name of a broker, trust, bank or other nominee, and you receive these materials through your broker or through another intermediary, please complete and return the materials in accordance with the instructions provided to you by such broker or other intermediary or contact your broker directly in order to obtain a proxy issued to you by your nominee holder to attend the meeting and vote in person. Failure to do so may result in your shares not being eligible to be voted by proxy at the Annual Meeting.

On behalf of the Board of Directors, I urge you to submit your vote as soon as possible, even if you currently plan to attend the meeting in person.

Thank you for your support of our company. I look forward to seeing you at the virtual Annual Meeting.

| By Order of the Board, | |

| /s/ | |

Important Notice Regarding The Availability Of Proxy Materials For The STOCKholder Meeting To Be Held On Wednesday, December 14, 2022:

Our official Notice of Annual Meeting of Stockholders and Proxy Statement are available at: www.proxyvote.com.

AKERS BIOSCIENCES, INC.

201 Grove Road

Thorofare, New Jersey 08086

(856) 848-8698

NOTICE OF 2020 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON August 27, 2020MyMD Pharmaceuticals, Inc.

855 N. Wolfe Street, Suite 601

Baltimore, MD 21205

(856) 848-8698

Notice of 2022 Annual Meeting of Stockholders

to be Held on December 14, 2022

The 20202022 Annual Meeting of Stockholders (the “Annual Meeting”) of Akers BiosciencesMyMD Pharmaceuticals, Inc., a New Jersey corporation (the “Company”), will be held at 11:3010:00 a.m. Eastern Time, on Thursday, August 27, 2020,Wednesday, December 14, 2022, in a virtual format only via live audio website at www.virtualshareholdermeeting.com/AKER2020.MYMD2022. We will consider and act on the following items of business at the Annual Meeting:

| 1. | ||

| ||

| 2. |

|

|

|

| |

| ||

| Such other matters as may properly come before the Annual Meeting or any adjournment(s) or postponement(s) thereof. |

Stockholders are referred to the Proxy Statement for more detailed information with respect to the matters to be considered at the Annual Meeting. After careful consideration, the Board of Directors recommends a vote “FOR” Proposals 1-61 and “FOR” for the option of “every three years” for Proposal 7.2.

In lightTo provide access to our stockholders regardless of public health concerns regarding the coronavirus (“COVID-19”) outbreak, this year’s Annual Meeting will be conducted in a virtual format only in order togeographic location and assist in protecting the health and well-being of our stockholders and employees, and to provide access to our stockholders regardless of geographic location.this year’s Annual Meeting will be conducted in a virtual format only. Stockholders will not be able to attend the Annual Meeting in person; however, stockholders of record will be able to participate, vote electronically and submit questions during the live websitewebcast of the Annual Meeting by visiting www.virtualshareholdermeeting.com/AKER2020MYMD2022 and entering the 16-digit control number found on your Notice of Internet Availability or on the enclosed proxy card or voting form.form (if you requested paper proxy materials). If you encounter any difficulties accessing the virtual Annual Meeting, please call the technical support number available on the virtual meeting page on the morning of the Annual Meeting.

The Board of Directors has fixed the close of business on July 10, 2020,October 18, 2022, as the record date (the “Record Date”) for the Annual Meeting. Only holders of record of shares of our common stock and Series D Preferred Stock on the Record Date are entitled to receive notice of the Annual Meeting and to vote at the Annual Meeting or at any postponement(s) or adjournment(s) of the Annual Meeting. A complete list of registered stockholders entitled to vote at the Annual Meeting will be available for examination during normal business hours for ten (10) calendar days before the Annual Meeting at our address above. To the extent office access is impracticable, due to the recent COVID-19 pandemic, you may email Karen Smith of Advantage Proxy, Inc., our proxy solicitor, at ksmith@advantageproxy.com for alternative arrangements to examine the stockholder list. The email should state the purpose of the request and provide proof of ownership of our voting securities as of the Record Date. The stockholder list will also be available online during the Annual Meeting.

YOUR VOTE AND PARTICIPATION IN THE COMPANY’S AFFAIRS ARE IMPORTANT.

If your shares are registered in your name, even if you plan to attend the Annual Meeting or any postponement or adjournment of the Annual Meeting in person, we request that you complete, date, signvote your shares electronically via the Internet (or by completing, dating, signing and mailmailing the enclosed form of proxy card if you requested paper proxy materials) in accordance with the instructions set out in the form of proxy card and in the Proxy Statement to ensure that your shares will be represented at the Annual Meeting.

If your shares are held in the name of a broker, trust, bank or other nominee, and you receive these materials through your broker or through another intermediary, please complete and return the materials in accordance with the instructions provided to you by such broker or other intermediary or contact your broker directly in order to obtain a proxy issued to you by your nominee holder to attend the Annual Meeting and vote in person. Failure to do so may result in your shares not being eligible to be voted by proxy at the Annual Meeting.

| By Order of the Board, | |

| /s/ | |

TABLE OF CONTENTSTable Of Contents

AKERS BIOSCIENCES, INC.

201 Grove Road

Thorofare, New Jersey 08086

(856) 848-8698MyMD Pharmaceuticals, Inc.

855 N. Wolfe Street, Suite 601

Baltimore, MD 21205

(856) 848-8698

PROXY STATEMENTProxy Statement

for

2022 Annual Meeting of Stockholders

FOR

2020 ANNUAL MEETING OF STOCKHOLDERS

To be Held on August 27, 2020December 14, 2022

Unless the context otherwise requires, references in this Proxy Statement to “we,” “us,” “our,” “the Company,the “Company,” or “Akers”“MyMD” refer to Akers Biosciences,MyMD Pharmaceuticals, Inc., a New Jersey corporation, and its consolidated subsidiaries as a whole. In addition, unless the context otherwise requires, references to “stockholders” are to the holders of our voting securities, which consist of our common stock, no par value (the “Common Stock”), and our Series D Convertible Preferred Stock (the “Series D Preferred Stock”) entitled to vote at the 20202022 annual meeting of stockholders of the Company (the “Annual Meeting”).

The accompanyingYour proxy is solicited by the Board of Directors (the “Board”) on behalf of Akers Biosciences,MyMD Pharmaceuticals, Inc. to be voted at the Annual Meeting to be held on August 27, 2020,December 14, 2022, at the time and platform and for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders (the “Notice”) and at any adjournment(s) or postponement(s) of the Annual Meeting. In lightTo provide access to our stockholders regardless of publicgeographic location and assist in protecting the health concerns regarding the coronavirus (“COVID-19”) outbreak,and well-being of our stockholders and employees, this year’s Annual Meeting will be conducted in a virtual format only in order to assist in protecting the health and well-being of our stockholders and employees and to provide access to our stockholders regardless of geographic location.i. Stockholders will not be able to attend the Annual Meeting in person; however, stockholders of record will be able to participate, vote electronically and submit questions during the live websitewebcast of the Annual Meeting. ThisWe will mail to most of our stockholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access our Proxy Statement and accompanying formthe Form 10-K and vote electronically via the Internet. This notice will also contain instructions on how to receive a paper copy of the proxy materials. All stockholders who are dated ___________, 2020 and are expected tonot sent a notice, or who otherwise request, will be first sent a paper copy of the proxy materials by mail or given to stockholdersan electronic copy of the proxy materials by email. See “About the Annual Meeting” beginning on or about _________, 2020.page 2 for more information.

The executive offices of the Company are located at, and the mailing address of the Company is 201 Grove Road, Thorofare, New Jersey 08086.855 N. Wolfe Street, Suite 601, Baltimore, MD 21205.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE STOCKHOLDER MEETING TO BE HELD ON AUGUST 27, 2020:December 14, 2022:

Our officialAs permitted by the “Notice and Access” rules of the U.S. Securities and Exchange Commission (the “SEC”), we are making this Proxy Statement, the proxy card and our 2021 Annual Report, which includes our annual report on Form 10-K for the fiscal year ended December 31, 2021 available to stockholders electronically via the Internet at the following website: www.virtualshareholdermeeting.com/MYMD2022. The Notice of Annual MeetingInternet Availability of Stockholders,Proxy Materials (the “Notice of Internet Availability”), this Proxy Statement Proxy Card and 2019the accompanying proxy card or voting instruction card, including an Internet link to our Annual Report on Form 10-K for fiscal 2021, are expected to Stockholders arebe made available at www.virtualshareholdermeeting.com/AKER2020.

Onto stockholders on or about ___________, 2020, we began mailingOctober 26, 2022. If you received a Notice of Internet Availability by mail, you will not receive a printed copiescopy of the proxy materials in the mail unless you request a copy. If you received a Notice of Internet Availability by mail and would like to stockholders.

ABOUT THE ANNUAL MEETINGreceive a printed copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice of Internet Availability.

Additionally, you can find a copy of our 2021 Annual Report on Form 10-K, which includes our financial statements, for the fiscal year ended December 31, 2021 on the SEC’s website, at www.sec.gov, or in the “SEC Filings” section of the “Investors” section of our website at www.mymd.com.

What is a proxy?

A proxy is another person that you legally designate to vote your stock. If you designate someone as your proxy in a written document, that document is also called a “proxy” or a “proxy card.” If you are a “street name” holder, you must obtain a proxy from your broker or nominee in order to vote your shares in person at the Annual Meeting.

What is a proxy statement?

A proxy statement is a document that regulations of the SEC require that we give to you when we ask you to sign a proxy card to vote your stock at the Annual Meeting.

Why did I receive a Notice of Internet Availability of Proxy Materials instead of paper copies of the proxy materials?

We are using the SEC’s Notice and Access model, which allows us to deliver proxy materials over the Internet as the primary means of furnishing proxy materials. We believe Notice and Access provides stockholders with a convenient method to access the proxy materials and vote, while allowing us to conserve natural resources and reduce the costs of printing and distributing the proxy materials. The Notice of Internet Availability is not a proxy card and cannot be used to vote your shares. If you received a Notice of Internet Availability this year, you will not receive paper copies of the proxy materials unless you request the materials by following the instructions on the Notice of Internet Availability.

What is “householding” and how does it affect me?

With respect to eligible stockholders who share a single address, we may send only one Notice of Internet Availability or Proxy Statement to that address unless we receive instructions to the contrary from any stockholder at that address. This practice, known as “householding,” is designed to reduce our printing and postage costs. However, if a stockholder of record residing at such address wishes to receive a separate noticeNotice of Internet Availability or proxy statementProxy Statement in the future, he or she may contact Akers Biosciences,MyMD Pharmaceuticals, Inc., by sending an email to info@akersbio.comprivard@mymd.com, Attn: Secretary,General Counsel, or callcalling (856) 848-8698 and askasking for the Secretary.Mr. Rivard. Eligible stockholders of record receiving multiple copies of our Notice or Proxy Statement can request householding by contacting us in the same manner. Stockholders who own shares through a bank, broker or other intermediary can request householding by contacting the intermediary.

We hereby undertake to deliver promptly, upon written or oral request, a copy of the Notice of Internet Availability or Proxy Statement to a stockholder at a shared address to which a single copy of the document was delivered. Requests should be directed to the address or phone number set forth above.

What is the purpose of the Annual Meeting?

At our Annual Meeting, stockholders will act upon the matters outlined in the Notice, which include the following:

| (1) | ||

| Election of | ||

| Ratification of the appointment of | ||

| Such other business as may arise and that may properly be conducted at the Annual Meeting or any adjournment or postponement thereof. |

| 2 |

What should I do if I receive more than one set of voting materials?

You may receive more than one set of voting materials, including multiple copies of theour Notice of Internet Availability or this Proxy Statement and multiple proxy cards or voting instruction card.cards. For example, if you hold your shares in more than one brokerage account, you will receive a separate voting instruction card for each brokerage account in which you hold shares. Similarly, if you are a stockholder of record and hold shares in a brokerage account, you willmay receive a Notice of Internet Availability or Proxy Statement for shares held in your name and a voting instruction card for shares held in “street name.” Please follow the separate voting instructions that you received for your shares of common stockCommon Stock held in each of your different accounts to ensure that all of your shares are voted.

What is the record date and what does it mean?

The record date to determine the stockholders entitled to notice of and to vote at the Annual Meeting is the close of business on July 10, 2020October 18, 2022 (the “Record Date”). The Record Date is established by the Board as required by New Jersey law. On the Record Date, 6,125,03939,470,009 shares of common stockCommon Stock were issued and outstanding. On the Record Date, 208,57772,992 shares of Series D Preferred Stock were issued and outstanding, and, after application of the beneficial ownership limitation and the Exchange Cap (as defined herein) pursuant to the terms of the Series D Preferred Stock as set forth in the certificate of designation for the Series D Preferred Stock, certain holdersthe holder of Series D Preferred Stock areis entitled to an aggregate of 43,36036,496 votes on the proposals described in this Proxy Statement. See “What are the voting rights of the stockholders?” below.

Who is entitled to vote at the Annual Meeting?

Holders of common stockCommon Stock and the Series D Preferred Stock at the close of business on the Record Date may vote at the Annual Meeting.

What are the voting rights of the stockholders?

The Company has two outstanding classes of voting stock entitled to vote at the Annual Meeting, common stockCommon Stock and Series D Preferred Stock. Each holder of common stockCommon Stock is entitled to one vote per share of common stockCommon Stock on all matters to be acted upon at the Annual Meeting. Each holder of Series D Preferred Stock is entitled to the number of votes equal to the number of whole shares of common stockCommon Stock into which the shares of Series D Preferred Stock held by such holder are then convertible (subject to the 4.99% beneficial ownership limitations and the Exchange Cap) with respect to any and all matters presented to the stockholders for their action or consideration. Holders of the Series D Preferred Stock vote together with the holders of common stockCommon Stock as a single class, except as provided by law and except as set forth in the respective certificates of designation for the Series D Preferred Stock. Holders of our common stockCommon Stock and Series D Preferred Stock will vote together as a single class on all matters described in this Proxy Statement. Notwithstanding

What constitutes a quorum for the foregoing, holders of 414,179 shares of our common stock and shares of Series D Preferred Stock issued in connection with the MIPA (as defined herein) are not entitled to vote such shares on Proposal 1 and Proposal 2.Annual Meeting?

The presence, in person or by proxy,holders of the holders of 33.34%shares entitled to cast a majority of the voting powervotes at a meeting of the issued and outstanding shares of stock entitled to vote at the Annual Meeting is necessary tostockholders shall constitute a quorum to transact business.at such meeting. If a quorum is not present or represented at the Annual Meeting, then the Chairman at the meeting may adjourn the meeting from time to time, without notice other than announcement at the meeting, until a quorum is present or represented.

What is the difference between a stockholder of record and a “street name” holder?

If your shares are registered directly in your name with VStockAction Stock Transfer, LLC, the Company’s stock transfer agent, you are considered the stockholder of record with respect to those shares. The Notice of Internet Availability has been sent directly to you by the Company.

If your shares are held in a stock brokerage account or by a bank or other nominee, the nominee is considered the record holder of those shares. You are considered the beneficial owner of these shares, and your shares are held in “street name.” The Notice of Internet Availability or Proxy Statement and voting instruction card have been forwarded to you by your nominee. As the beneficial owner, you have the right to direct your nominee concerning how to vote your shares by using the voting instructions the nominee included in the mailing or by following such nominee’s instructions for voting.

What is a broker non-vote?

Broker non-votes occur when shares are held indirectly through a broker, bank or other intermediary on behalf of a beneficial owner (referred to as held in “street name”) and the broker submits a proxy but does not vote for a matter because the broker has not received voting instructions from the beneficial owner and (i) the broker does not have discretionary voting authority on the matter or (ii) the broker chooses not to vote on a matter for which it has discretionary voting authority. Under the rules of the New York Stock Exchange (the “NYSE”) that govern how brokers may vote shares for which they have not received voting instructions from the beneficial owner, brokers are permitted to exercise discretionary voting authority only on “routine” matters when voting instructions have not been timely received from a beneficial owner. Proposal 52 is considered a “routine matter.” Therefore, if you do not provide voting instructions to your broker regarding such proposal, your broker will be permitted to exercise discretionary voting authority to vote your shares on such proposal. In the absence of specific instructions from you, your broker does not have discretionary authority to vote your shares with respect to Proposal 1, Proposal 2, Proposal 3, Proposal 4, Proposal 6 and Proposal 7.1.

| 3 |

How do I vote my shares?

If you are a record holder, you may vote your shares at the Annual Meeting in person or by proxy.

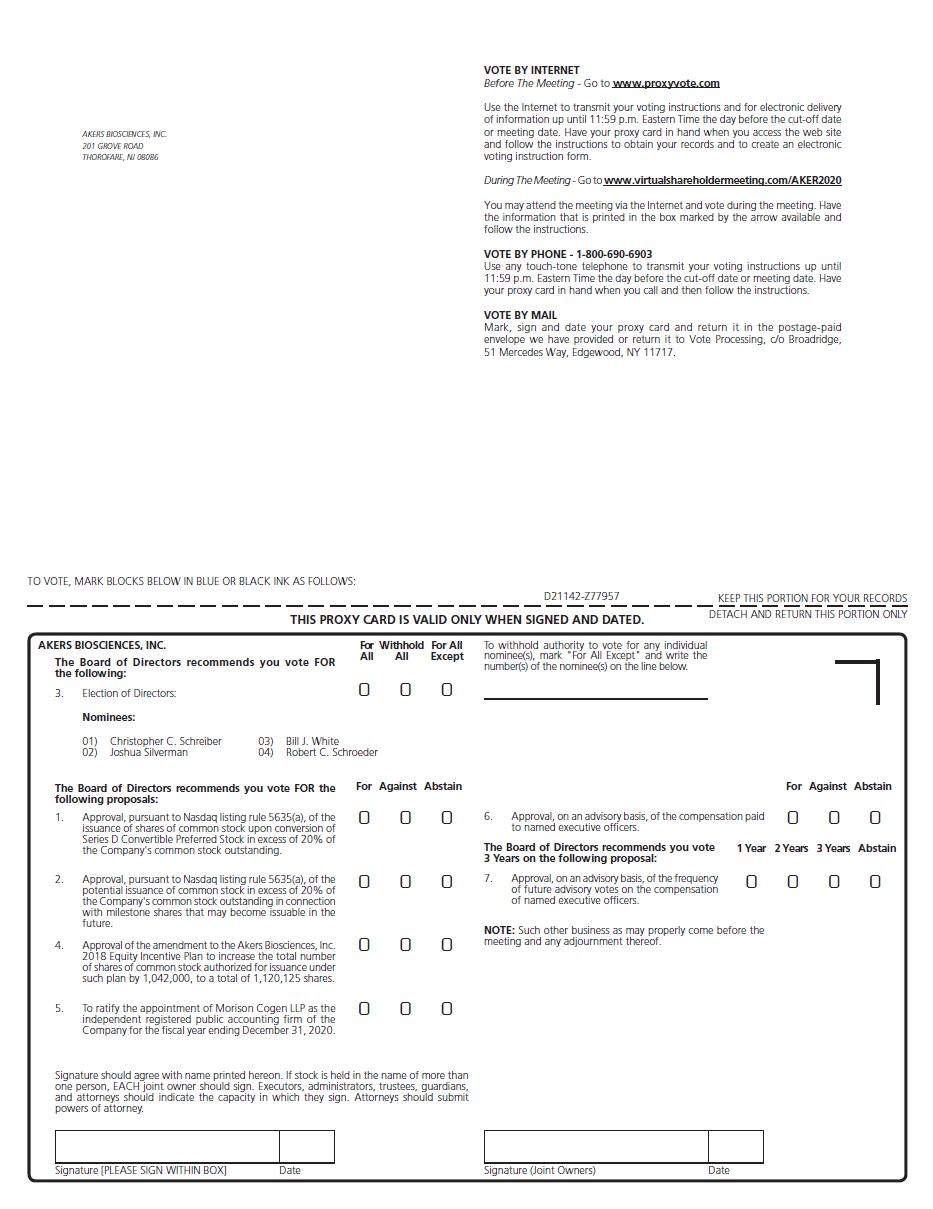

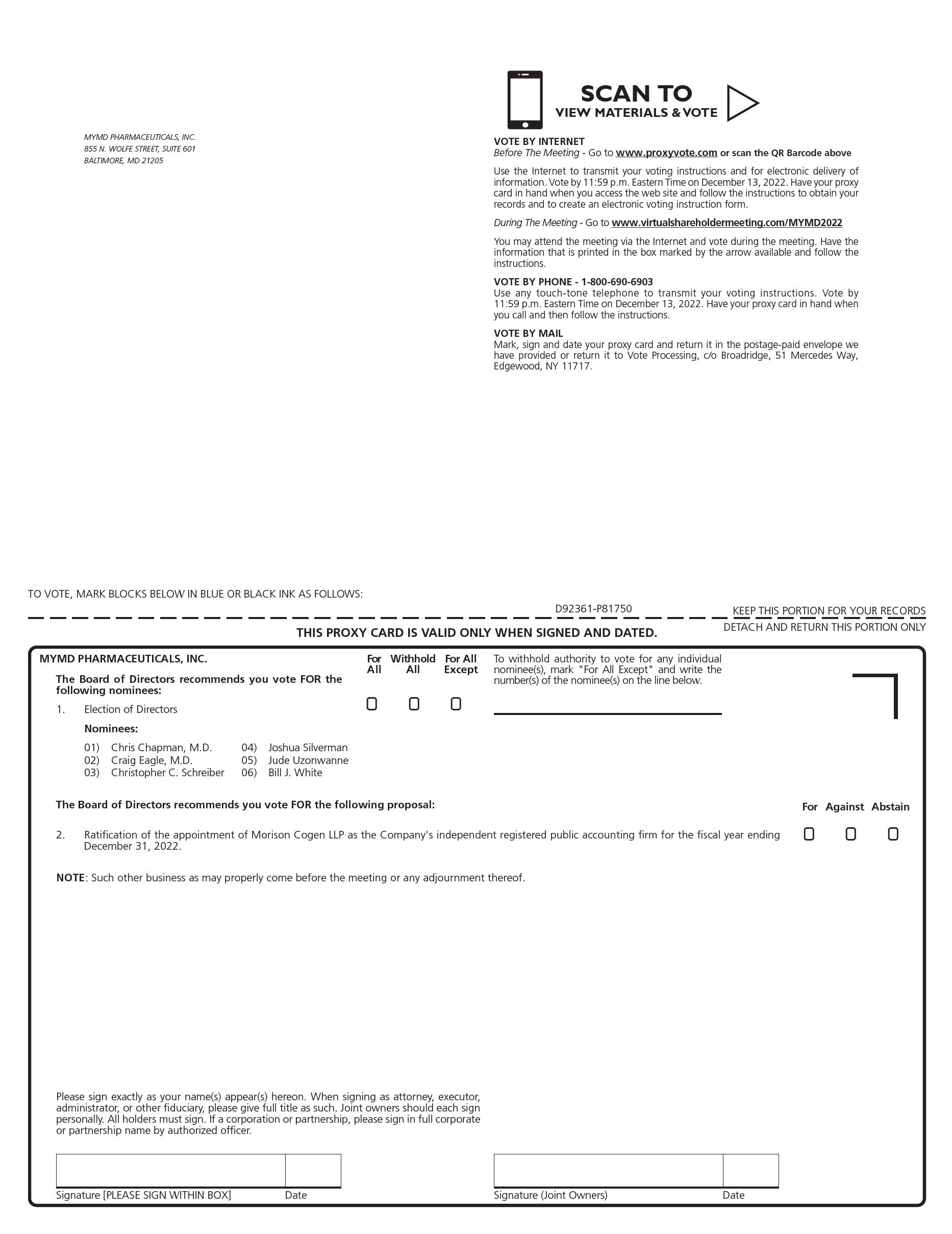

| ● | You may submit your proxy on the Internet or by phone. Stockholders may vote via the Internet at www.proxyvote.com or by phone (as per instructions on the Notice of Internet Availability or proxy card), 24 hours per day and seven days per week. You will need the control number included on your Notice of Internet Availability or proxy card (if you requested paper materials) or on the voting instruction form. Votes submitted via the Internet or phone must be received by 11:59 p.m., Eastern Time, on | |

| ● | You may submit your proxy by mail. Stockholders may vote by signing and dating the proxy card or voting instruction form and mailing it in the enclosed prepaid and addressed envelope. If you mark your choices on the card or voting instruction form, your shares will be voted as you instruct. Please note that if you received a Notice of Internet Availability, you cannot vote by marking the Notice of Internet Availability and returning it. The Notice of Internet Availability provides instructions on how to vote by Internet and how to request paper copies of the proxy materials. | |

| ● | You may vote during the Annual Meeting. Instructions on how to vote while participating in the Annual Meeting via live webcast are posted at www.virtualshareholdermeeting.com/ |

The proxy is fairly simple to complete, with specific instructions on the electronic ballot, telephone or card. By completing and submitting it, you will direct the designated person (known as a “proxy”) to vote your stock at the Annual Meeting in accordance with your instructions. The Board has appointed Christopher C. SchreiberChris Chapman, M.D. to serve as the proxy for the Annual Meeting.

Your proxy will be valid only if you complete and return it before the Annual Meeting. If you properly complete and transmit your proxy but do not provide voting instructions with respect to a proposal, then the designated proxies will vote your shares “FOR” for Proposals 1-61 and “FOR” the option of every three years for Proposal 7 as to which you provide no voting instructions in accordance with the Board’s recommendation in the manner described under “What if I do not specify how I want my shares voted?” below.2. We do not anticipate that any other matters will come before the Annual Meeting, but if any other matters properly come before the meeting, then the designated proxies will vote your shares in accordance with applicable law and their judgment.

If you hold your shares in “street name,” your bank, broker or other nominee should provide to you a request for voting instructions along with the Company’s proxy solicitation materials. By completing the voting instruction card, you may direct your nominee how to vote your shares. If you partially complete the voting instruction but fail to complete one or more of the voting instructions, then your nominee may be unable to vote your shares with respect to the proposal as to which you provided no voting instructions. See “What is a broker non-vote?” Alternatively, if you want to vote your shares in person atduring the Annual Meeting, you must contact your nominee directly in order to obtain a proxy issued to you by your nominee holder. Note that a broker letter that identifies you as a stockholder is not the same as a nominee-issued proxy.If you fail to bring a nominee-issued proxy to

What if I have technical difficulties or trouble accessing the Annual Meeting,Meeting?

We will have technicians ready to assist you will not be able to vote your nominee-held shareswith any technical difficulties you may have in person ataccessing the Annual Meeting. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the virtual meeting log in page.

Who counts the votes?

All votes will be tabulated by Christopher C. Schreiber,Ian Rhodes, the inspector of election appointed for the Annual Meeting. Each proposal will be tabulated separately.

| 4 |

Can I vote my shares at the Annual Meeting?

Yes. If you are a stockholder of record, you may vote your shares at the Annual Meeting by submitting your vote electronically during the Annual Meeting.

If you hold your shares in “street name,” you may vote your shares in personat the Annual Meeting only if you obtain a proxy issued by your bank, broker or other nominee giving you the right to vote the shares.

Even if you currently plan to attend the Annual Meeting, we recommend that you also returnsubmit your proxy or voting instructions as described above so that your votes will be counted if you later decide not to attend the Annual Meeting or are unable to attend.

What are my choices when voting?

Proposal 1:

When you cast your vote on:

Proposalson Proposal 1, 2, 4, 5, 6:

You may vote for the proposal, against the proposal or abstain from voting on the proposal.

Proposal 3:

Youyou may vote for all director nominees or you may withhold your vote as to one or more director nominees.

Proposal 7:2:

YouWhen you cast your vote on Proposal 2, you may vote to choose an advisoryfor the proposal, vote on executive compensation every one, twoagainst the proposal or three years or to abstain from voting on the proposal.

What are the Board’s recommendations on how I should vote my shares?

The Board recommends that you vote your shares as follows:

“FOR” ProposalsProposal 1 through 6 and “FOR” the option of every three years for Proposal 7.2.

What if I do not specify how I want my shares voted?

If you are a record holder who returns a completed proxy that does not specify how you want to vote your shares on one or more proposals, the proxy will vote your shares for each proposal as to which you provide no voting instructions, and such shares will be voted in the following manner:

“FOR” ProposalsProposal 1 through 6 and “FOR” the option of every three years for Proposal 7.2.

If you are a “street name” holder and do not provide voting instructions on one or more proposals, your bank, broker or other nominee will be unable to vote those shares with respect to ProposalsProposal 1 2, 3, 4, 6 and 7, but will be able to vote those shares with respect to Proposal 5.2. See “What is a broker non-vote?”

Can I change my vote?

Yes. If you are a record holder, you may revoke your proxy at any time by any of the following means:

| ● | Attending the Annual Meeting and voting at the Annual Meeting. Your attendance at the Annual Meeting will not by itself revoke a proxy. You must vote your shares by submitting your vote by accessing the voting link at the Annual Meeting to revoke your proxy. | |

| ● | Completing and submitting a new valid proxy bearing a later |

| ● | Giving written notice of revocation to the Company addressed to |

If you are a “street name” holder, your bank, broker or other nominee should provide instructions explaining how you may change or revoke your voting instructions.

What votes are required to approve each proposal?

Assuming the presence of a quorum, with respect toapproval of Proposal 3,1 will require the affirmative vote of the holders of a plurality of the votes cast at the Annual Meeting is required for the election of the director nominees,directors, i.e., the foursix director nominees who receive the most votes will be elected. Assuming the presence of a quorum, approval of Proposals 1,Proposal 2 4, 5 and 6 will require the affirmative vote of a majority of the votes cast for or againstat the proposal. For Proposal 7,Annual Meeting by the numberholders of years (1, 2 or 3) that receives the highest number of votes will be deemedshares entitled to be preferred by our stockholders. Please note that the vote on Proposal 6 and Proposal 7 are non-binding advisory votes.2.

| 5 |

How are abstentions and broker non-votes treated?

Any stockholder who is present at the Annual Meeting, either in person or by proxy, who abstains from voting will still be counted for purposes of determining whether a quorum exists for the meeting. If you hold your shares in “street name” and you do not instruct your bank, broker or other nominee how to vote, your shares will be included in the determination of the number of shares present at the Annual Meeting for determining a quorum at the meeting but may constitute broker non-votes, resulting in no votes being cast on your behalf with respect to certain proposals. See “What is a broker non-vote?”

An abstention or failure to instruct your broker how to vote with respect to Proposal 31 will not be counted as an affirmative or negative vote in the election of directors and will have no effect on the outcome of the vote with respect to Proposal 3.1. An abstention or broker non-vote with respect to Proposals 1,Proposal 2 4, 5, 6 and 7 will likewise not be counted as an affirmative or negative vote against the proposal and will have no effect on the outcome of the vote on such proposals. Failure to instruct your broker how to vote with respect to Proposals 1, 2, 3, 4, 6 and 7 will have no effect on the outcome of the vote because broker non-votes are not considered shares entitled to vote. However, ifIf you do not give your broker specific instructions on how to vote your shares with respect to Proposal 5,2, your broker may vote your shares at its discretion.discretion, and therefore, broker non-votes are not applicable to Proposal 2.

Do I have any dissenters’ or appraisal rights with respect to any of the matters to be voted on at the Annual Meeting?

No. None of our stockholders has any dissenters’ or appraisal rights with respect to the matters to be voted on at the Annual Meeting.

What are the solicitation expenses and who pays the cost of this proxy solicitation?

Our Board is asking for your proxy and we will pay all of the costs of asking for stockholder proxies. We will reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding solicitation material to the beneficial owners of common stockCommon Stock and collecting voting instructions. We may use officers and employees of the Company to ask for proxies, as described below. In addition, we have retained Advantage Proxy, Inc. (“Advantage”) to assist in the solicitation of proxies for a fee of $10,000 plus customary expenses.

Is this Proxy Statement the only way that proxies are being solicited?

No. In addition to the solicitation of proxies by use of the mail, officers and employees of the Company, as well as Advantage, the proxy solicitation firm hired by the Company, may solicit the return of proxies, either by mail, telephone, telecopy, e-mail or through personal contact. These officers and employees will not receive additional compensation for their efforts but will be reimbursed for out-of-pocket expenses. The fees of Advantage as well as the reimbursement of expenses of Advantage will be borne by us. Brokerage houses and other custodians, nominees and fiduciaries, in connection with shares of the common stockCommon Stock registered in their names, will be requested to forward solicitation material to the beneficial owners of shares of common stock.Common Stock.

Are there any other matters to be acted upon at the Annual Meeting?

Management does not intend to present any business at the Annual Meeting for a vote other than the matters set forth in the Notice of Internet Availability and has no information that others will do so. If other matters requiring a vote of the stockholders properly come before the Annual Meeting, it is the intention of the personsperson named in the form of proxy to vote the shares represented by the proxies held by them in accordance with applicable law and their judgment on such matters.

Where can I find voting results?

We expect to publish the voting results in a current report on Form 8-K, which we expect to file with the Securities and Exchange Commission (the “SEC”)SEC within four business days after the Annual Meeting.

Who can help answer my questions?

The information provided above in this “Question and Answer” format is for your convenience only and is merely a summary of the information contained in this Proxy Statement. We urge you to carefully read this entire Proxy Statement, including the documents we refer to in this Proxy Statement. If you have any questions, or need additional materials, please feel free to contact the firm assisting us in the solicitation of proxies, Advantage. Banks and brokers and stockholders may call Advantage at 1-877-870-8565.

PROPOSALProposal 1: APPROVAL, PURSUANT TO NASDAQ LISTING RULE 5635(A), OF THE ISSUANCE OF SHARES OF OUR COMMON STOCK UPON CONVERSION OF SERIES D CONVERTIBLE PREFERRED STOCK in excessElection of 20% of our common stock outstandingDirectors

At the Annual Meeting, holders of our common stock will be asked to approve the issuance of more than 19.99% of our outstanding common stock upon the conversion of Series D Preferred Stock issued by us pursuant to the MIPA (as defined below) on March 24, 2020, for purposes of compliance with Nasdaq Listing Rule 5635(a) and as required by the MIPA.

Background

Overview

In March 2020, we entered into several transactions to obtain the license rights (the “License Rights”) of Cystron Biotech, LLC (“Cystron”) under that certain License and Development Agreement (the “Initial License Agreement”), dated March 10, 2020, by and between Cystron and Premas Biotech PVT Ltd. (“Premas”). Based on discussions among transaction parties, we determined that for the purposes of obtaining these License Rights, in lieu of Cystron assigning its rights under the Initial License Agreement to us, it would be more efficient for us to acquire Cystron since Cystron (i) had no assets other than its rights under the Initial License Agreement, (ii) had no paid employees, financial results or business operations other than entering into the Initial License Agreement and matters related to its acquisition by us and (iii) was serving as a holding company for the License Rights. Accordingly, on March 23, 2020, we entered into a membership interest purchase agreement with the members of Cyston (the “Sellers”) and thereby acquired the License Rights through the acquisition of Cystron. Concurrently with our negotiations to acquire Cystron, we worked with Cystron and Premas to amend and restate the Initial License Agreement in order to make certain changes to the terms and conditions from the Initial License Agreement. Through these transactions, we in-licensed a novel coronavirus vaccine candidate under development by Premas using Premas’ genetically engineered S. cerevisiae platform, D-Crypt, and are now working with Premas to develop this vaccine candidate. For a more detailed discussion of the agreements and transactions related to our acquisition of the License Rights, please see the following descriptions.

Membership Interest Purchase Agreement

On March 23, 2020, we entered into that certain membership interest purchase agreement (the “Original MIPA” and, as subsequently amended by Amendment No. 1 on May 14, 2020, the “MIPA”) with the Sellers, pursuant to which we acquired 100% of the membership interests (the “Membership Interests,” and such acquisition, the “Acquisition”) of Cystron.

As consideration for the Membership Interests, pursuant to the MIPA, we were required to deliver to the Sellers (1) that number of newly issued shares of our common stock equal to 19.99% of the issued and outstanding shares of our common stock and the number of shares underlying pre-funded warrants outstanding as of March 23, 2020, but, to the extent that the issuance of our common stock would have resulted in any Seller owning in excess of 4.9% of our outstanding common stock, then, at such Seller’s election, such Seller could receive “common stock equivalent” preferred shares with a customary 4.9% blocker, and (2) $1,000,000 in cash. Accordingly, on March 24, 2020, we delivered to the Sellers: (1) (i) an aggregate of 411,403 shares of our common stock (the “Initial Common Stock Shares”) and (ii) an aggregate of 211,353 shares of Series D Preferred Stock (together with the Initial Common Stock Shares, the “Common Stock Consideration”), which may be converted into 211,353 shares of our common stock (the “Converted Common Stock Shares”), and (2) $1,000,000.

Additionally, we are required to (A) make an initial payment to the Sellers of up to $1,000,000 upon our receipt of cumulative gross proceeds from the consummation of an initial equity offering after March 23, 2020, of $8,000,000, and (B) pay to Sellers an amount in cash equal to 10% of the gross proceeds in excess of $8,000,000 raised from future equity offerings after March 23, 2020, until the Sellers have received an aggregate additional cash consideration equal to $10,000,000 (collectively, the “Equity Offering Payments”). On May 14, 2020, we and the Sellers entered into an Amendment No. 1, which provided that any Equity Offering Payments in respect of an equity offering that is consummated prior to September 23, 2020, shall be accrued, but shall not be due and payable until September 24, 2020. Upon the achievement of certain milestones, including the completion of a Phase 2 study for a COVID-19 vaccine that meets its primary endpoints, Sellers will be entitled to receive an additional 750,000 shares of our common stock (the “Milestone Shares”) or, in the event we are unable to obtain stockholder approval for the issuance of such shares, 750,000 shares of non-voting preferred stock that are valued following the achievement of such milestones and shall bear a 10% annual dividend. Sellers will also be entitled to contingent payments from us of up to $20,750,000 upon the achievement of certain milestones, including the approval of a new drug application by the FDA. Pursuant to the Original MIPA, upon our consummation of the registered direct equity offering closed on April 8, 2020, we paid the Sellers $250,000 on April 20, 2020. In addition, the consummation of the registered direct equity offering closed on May 18, 2020, triggered an accrued payment to the Sellers of approximately $892,500 pursuant to the MIPA, which will be due and payable on September 24, 2020.

We shall also make quarterly royalty payments to Sellers equal to 5% of the net sales of a COVID-19 vaccine or combination product by the Company (the “COVID-19 Vaccine”) for a period of five (5) years following the first commercial sale of the COVID-19 Vaccine, provided that such payment shall be reduced to 3% for any net sales of the COVID-19 Vaccine above $500 million.

In addition, Sellers shall be entitled to receive 12.5% of the transaction value, as defined in the MIPA, of any change of control transaction, as defined in the MIPA, that occurs prior to the fifth (5th) anniversary of the closing date of the MIPA, provided that are still developing the COVID-19 Vaccine at that time. Following the consummation of any change of control transaction, the Sellers shall not be entitled to any payments as described above under the MIPA.

We are seeking our stockholders’ approval for the issuance of the Common Stock Consideration pursuant to the MIPA in this Proposal 1.

We are seeking a separate stockholder approval for the issuance of the Milestone Shares pursuant to the MIPA in Proposal 2. See page 10 of this Proxy Statement.

Support Agreement

On March 23, 2020, as an inducement to enter into the MIPA, and as one of the conditions to the consummation of the transactions contemplated by the MIPA, the Sellers entered into a stockholder voting agreement with us, pursuant to which each Seller agreed to vote their shares of our common stock or preferred stock in favor of each matter proposed and recommended for approval by our management at every meeting of the stockholders and on any action or approval by written consent of the stockholders.

License Agreement

As discussed above,Cystron was a party to the Initial License Agreement with Premas. As a condition to our entry into the MIPA, Cystron amended and restated the Initial License Agreement on March 19, 2020 (as amended and restated, the “License Agreement”). Pursuant to the License Agreement, Premas granted Cystron, among other things, an exclusive license with respect to Premas’ vaccine platform for the development of a vaccine against COVID-19 and other coronavirus infections using Premas’ genetically engineered S. cerevisiae platform, D-Crypt.

Upon the achievement of certain developmental milestones by Cystron, Cystron shall pay to Premas a total of up to $2,000,000. On April 16, 2020, we paid Premas $500,000 for the achievement of the first two development milestones, of which $250,000 was accrued as research and development expense for the three months ended March 31, 2020. On May 14, 2020, we and Premas agreed that the third milestone under the License Agreement has been satisfied, and on May 22, 2020, we paid Premas $500,000. On July 7, 2020, we and Premas agreed that the fourth milestone under the License Agreement has been satisfied. Due to the achievement of this milestone, Premas is entitled to receive a payment of $1,000,000 from us.

Registration Rights Agreement

To induce the Sellers to enter into the MIPA, we also entered into the Registration Rights Agreement with the Sellers, pursuant to which we agreed to prepare and file with the SEC a registration statement covering all of the shares of our common stock issued and shares of our common stock issuable upon conversion of the Series D Preferred Stock issued as Common Stock Consideration pursuant to the MIPA and use reasonable best efforts to have such registration statement and any amendments thereof declared effective by the SEC at the earliest possible date. Pursuant to the Registration Rights Agreement, we filed a registration statement on Form S-3 registering such shares of common stock, which was declared effective on June 12, 2020.

We have also agreed to use reasonable best efforts to keep such registration statement effective until earlier of the selling stockholders have sold all of the share of common stock offered hereby or the shares of common stock covered thereby may be resold by the selling stockholders pursuant to Rule 144 of the Securities Act without any public information requirements or volume or manner of sale limitations.

Series D Preferred Stock

On March 24, 2020, we filed the Certificate of Designation of Preferences, Rights and Limitations of Series D Preferred Stock (the “Certificate of Designation”) with the Secretary of State of the State of New Jersey. As discussed above, on March 24, 2020, we issued 211,353 shares of Series D Preferred Stock to the Sellers under the MIPA. Pursuant to the Certificate of Designation, in the event of our liquidation or winding up, the holders of Series D Preferred Stock are entitled to receive the same amount that a holder of our common stock would receive if the Series D Preferred Stock were fully converted to common stock which amounts shall be paid pari passu with all holders of our common stock. Each share of Series D Preferred Stock has a stated value equal to $0.01 (the “Stated Value”), subject to increase as set forth in Section 7 of the Certificate of Designation. As of the Record Date, 208,577 shares of Series D Preferred Stock were issued and outstanding.

A holder of Series D Preferred Stock is entitled at any time to convert any whole or partial number of shares of Series D Preferred Stock into shares of our common stock determined by dividing the Stated Value by the conversion price of $0.01 per share.

A holder of Series D Preferred Stock is prohibited from converting Series D Preferred Stock into shares of our common stock if, as a result of such conversion, the holder, together with its affiliates, would own more than 4.99% of the total number of shares of our common stock then issued and outstanding (with such ownership restriction referred to as the “Beneficial Ownership Limitation”). However, any holder may increase or decrease such percentage to any other percentage not in excess of 9.99%, provided that any increase in such percentage shall not be effective until 61 days after such notice to us. In addition, a holder of Series D Preferred Stock are prohibited from converting any portion of the Series D Preferred Stock if, as a result of such conversion, the holder, together with its affiliates, would exceed the aggregate number shares of our common stock which we may issue under the MIPA without breaching our obligations under the rules or regulations of Nasdaq (the number of shares which may be issued without violating such rules and regulations, the “Exchange Cap”). Pursuant to the Exchange Cap, the Series D Preferred Stock were convertible into up to 46,136 shares of common stock, of which 2,776 shares have been converted as of the Record Date.

Subject to the Beneficial Ownership Limitation and the Exchange Cap, on any matter presented to our stockholders for their action or consideration at any meeting of stockholders (or by written consent of stockholders in lieu of a meeting), each holder of Series D Preferred Stock is entitled to cast the number of votes equal to the number of whole shares of our common stock into which the shares of Series D Preferred Stock beneficially owned by such holder are convertible as of the record date for determining stockholders entitled to vote on or consent to such matter (taking into account all Series D Preferred Stock beneficially owned by such holder). Except as otherwise required by law or by the other provisions of our amended and restated certificate of incorporation, as amended, the holders of Series D Preferred Stock will vote together with the holders of our common stock and any other class or series of stock entitled to vote thereon as a single class.

A holder of Series D Preferred Stock is entitled to receive dividends as and when paid to the holders of our common stock on an as-converted basis.

Stockholder Approval Requirement

Our common stock is listed on the Nasdaq Capital Market under the symbol “AKER,” and we are subject to the Nasdaq listing standards set forth in its Marketplace Rules. Nasdaq Marketplace Rule 5635(a) requires stockholder approval prior to the issuance of securities in connection with the acquisition of the stock or assets of another company, including pursuant to an “earn-out” or similar provision, where due to the present or potential issuance of common stock (or securities convertible into or exercisable for common stock), other than a public offering for cash, the common stock to be issued (a) constitutes voting power in excess of 20% of the outstanding voting power prior to the issuance or (b) is or will be in excess of 20% of the outstanding common stock prior to the issuance.

Prior to closing the Acquisition, we had 2,288,837 shares of common stock outstanding. Therefore, the issuance of the Initial Common Stock Shares and the potential issuance of the Converted Common Stock Shares would have constituted approximately 27% of the shares of common stock outstanding prior to giving effect to the Acquisition. Consequently, issuance of the 165,217 shares of common stock (the “Excess Shares”) issuable upon conversion of the Series D Preferred Stock, which, in absence of the Exchange Cap, would be in excess of 19.99% of the shares of common stock outstanding on the date of entry into the Original MIPA, is subject to stockholder approval pursuant to the Nasdaq Stock Market Rule 5635(a). As of the Record Date, 2,776 shares of Series D Preferred Stock have been converted into 2,776 shares of our common stock. Moreover, pursuant to the terms of the MIPA, we are obligated to seek and are therefore seeking stockholder approval of the issuance of the Excess Shares and the Milestone Shares.

We generally have no control over whether the Sellers convert their shares of Series D Preferred Stock. For this reason, we are unable to accurately forecast or predict with any certainty the timing or the total amount of shares that may be issued under the Series D Preferred Stock. The potential issuance of the Excess Shares that are subject to this Proposal 1 would result in an increase in the number of shares of common stock outstanding, and our stockholders will incur dilution of their percentage ownership to the extent that the Sellers convert their Series D Preferred Stock. Further, the issuance or resale of common stock issued to the holders of Series D Preferred Stock could cause the market price of our common stock to decline.

Consequences of Not Approving this Proposal

If our stockholders do not approve this proposal, the Series D Preferred Stock will only be convertible into up to 43,360 additional shares of common stock but, will not be convertible into the Excess Shares. Also, if the stockholders do not approve this proposal, pursuant to the MIPA, we will be obligated to incur additional management resources and expenses to call and hold a stockholder meeting every six months until we obtain the stockholder approval to issue the Excess Shares. The Original MIPA and the Certificate of Designations were filed with the SEC in connection with our Current Report on Form 8-K filed on March 24, 2020, and the Amendment No.1 was filed with the SEC in connection with our Quarterly Report on Form 10-Q filed on May 15, 2020.

Required Vote and Board Recommendation

The affirmative vote of the holders of a majority of the votes cast for or against the proposal is required to approve, pursuant to NASDAQ listing rule 5635(a), the issuance of the Excess Shares upon conversion of Series D Preferred Stock issued pursuant to the MIPA. Abstentions and broker non-votes will have no effect on the outcome of the vote on this proposal.

In accordance with applicable NASDAQ Marketplace Rules, holders of 414,179 shares of our common stock and Series D Preferred Stock issued in connection with the MIPA are not entitled to vote such shares on this proposal.

PROPOSAL 2: APPROVAL, PURSUANT TO NASDAQ LISTING RULE 5635(A) OF THE POTENTIAL ISSUANCE OF OUR COMMON STOCK in excess of 20% of our common stock outstanding IN CONNECTION WITH MILESTONE SHARES THAT MAY BECOME ISSUABLE IN THE FUTURE

At the Annual Meeting, holders of our common stock will be asked to approve the potential issuance of our common stock in excess of 20% of our common stock outstanding in connection with potential milestone shares that may become issuable in the future pursuant to the MIPA, for purposes of compliance with Nasdaq Listing Rule 5635(a) and as required by the MIPA.

Background

As discussed under Proposal 1, pursuant to MIPA, we are required to pay future contingent payments in Milestone Shares of an additional 750,000 shares of our common stock (subject to adjustments for any stock splits, stock dividends, share combinations or the like) to the Sellers upon the achievement of any one of the following milestones (each, an “Equity Trigger Milestone”):

For the avoidance of doubt, the maximum number of shares of common stock that may be issued as Milestone Shares is 750,000 shares.

Stockholder Approval Requirement

Our common stock is listed on the Nasdaq Capital Market under the symbol “AKER,” and we are subject to the Nasdaq listing standards set forth in its Marketplace Rules. Nasdaq Marketplace Rule 5635(a) requires stockholder approval prior to the issuance of securities in connection with the acquisition of the stock or assets of another company, including pursuant to an “earn-out” or similar provision, where due to the present or potential issuance of common stock (or securities convertible into or exercisable for common stock), other than a public offering for cash, the common stock to be issued (a) constitutes voting power in excess of 20% of the outstanding voting power prior to the issuance or (b) is or will be in excess of 20% of the outstanding common stock prior to the issuance.

The Common Stock Consideration already exceeded 20% of the shares of common stock outstanding prior to giving effect to the Acquisition. The issuance of Milestone Shares to the Sellers would be aggregated with the Common Stock Consideration for purposes of Nasdaq Marketplace Rule 5635(a) as an “earn-out.” Accordingly, issuance of the Milestone Shares to the Sellers will result in the aggregate number of shares issued by us in connection with the Acquisition is subject to stockholder approval pursuant to the Nasdaq Stock Market Rule 5635(a). Therefore, we are requesting a stockholder approval for Proposal 2 under this Nasdaq listing standard to ensure that we have stockholder approval to issue the Milestone Shares to the extent that any such shares issued. Moreover, pursuant to the terms of the MIPA, we are obligated to seek and are therefore seeking stockholder approval of the issuance of the Milestone Shares.

The issuance of the Milestone Shares will depend on whether any of the Equity Trigger Milestone is actually achieved. The issuance of the Milestone Shares would result in an increase in the number of shares of common stock outstanding, and our stockholders will incur dilution of their percentage ownership to the extent that we issue the Milestone Shares. Such issuance may cause a significant reduction in the percentage interests of our current stockholders in the voting power, any liquidation value, our book and market value, and in any future earnings.

Consequences of Not Approving this Proposal

If our stockholders do not approve this proposal, pursuant to the MIPA, we will be obligated to incur additional management resources and expenses to call and hold a stockholder meeting every six months until we obtain the stockholder approval to issue the Milestone Shares. Furthermore, if we fail to receive the stockholder approval on this proposal, we are obligated to issue to Sellers 750,000 shares of non-voting preferred stock and use our commercially reasonable efforts to obtain stockholder approval for such shares to be convertible into common stock. Such preferred stock shall have a conversion price equal to the stated value and will be entitled to an annual 10% cash dividend on the stated value. Such preferred stock shall be non-redeemable by the holders thereof and will not participate with our common stock; however, the holder may require us to redeem the preferred stock for redemption price equal to its stated value and accrued and unpaid dividends upon consummation of a change of control transaction as defined in MIPA.

The Original MIPA and the Certificate of Designations were filed with the SEC in connection with our Current Report on Form 8-K filed on March 24, 2020, and the Amendment No.1 was filed with the SEC in connection with our Quarterly Report on Form 10-Q filed on May 15, 2020.

Required Vote and Board Recommendation

The affirmative vote of the holders of a majority of the votes cast for or against the proposal is required to approve, pursuant to NASDAQ listing rule 5635(a), the issuance of the Milestone Shares. Abstentions and broker non-votes will have no effect on the outcome of the vote on this proposal.

In accordance with applicable NASDAQ Marketplace Rules, holders of 414,179 shares of our common stock and Series D Preferred Stock issued in connection with the MIPA are not entitled to vote such shares on this proposal.

PROPOSAL 3: ELECTION OF DIRECTORS

Nominees for Election

The Board is currently comprised of foursix directors. Our Board, upon the recommendation of the Nominating and Corporate Governance Committee, has nominated the following foursix individuals to serve as directors (collectively, the “Company Nominees”):

| Name | Age | |

| Chris Chapman, M.D. | 70 | |

| Craig Eagle, M.D. | 54 | |

| Christopher C. Schreiber | ||

| Joshua Silverman | ||

| Jude Uzonwanne | 48 | |

| Bill J. White | ||

Our board has fixed the size of the Board to be seven directors. Currently there is a vacancy created upon the passing of Robert C. Schroeder on September 1, 2021. As of October 26, 2022, our board has not nominated anyone to fill the vacancy.

If elected, respectively, these nominees will serve until our 20212023 annual meeting of stockholders or until their successors are elected and qualified or until their earlier incapacity, removal or resignation. Our Board believes that all of our current directors, who are the four nominees for election,six Company Nominees, possess personal and professional integrity, good judgment, a high level of ability and business acumen.

If a quorum is present, the Company Nominees will be elected by a plurality of the votes cast atfor the Annual Meeting.election of the directors. Abstentions and broker non-votes have no effect on the vote. The foursix Company Nominees receiving the highest number of affirmative votes will be elected directors of the Company. Shares of voting stock represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the foursix nominees named above. Should any Company Nominee become unable or unwilling to accept nomination or election, the proxy holders may vote the proxies for the election, in his or her stead, of any other person the Board may nominate or designate. Each Company Nominee has agreed to serve, if elected, and the Board has no reason to believe that any Company Nominee will be unable to serve.

The biographies of the Company Nominees are as follows:

Chris Chapman, M.D. has been our director since April 16, 2021 and currently serves as our President and Chief Medical Officer. Dr. Chapman previously served as President and Chief Medical Officer of MyMD Pharmaceuticals (Florida), Inc., a Florida corporation previously known as MyMD Pharmaceuticals, Inc. (“MyMD Florida”) effective as of November 1, 2020. Prior to joining MYMD Florida and since 1999, Dr. Chapman has also served as the Chief Executive Officer of Chapman Pharmaceutical Consulting, Inc., a consulting organization that provides support to pharmaceutical and biotech companies in North America, Europe, Japan, India and Africa on issues such as product safety, pharmacovigilance, medical devices, clinical trials and regulatory issues. In addition, from 2003-2004, Dr. Chapman served as the Associate Director of Drug Safety, Pharmacovigilance, and Clinical Operations for Organon Pharmaceuticals, where he was responsible for the supervision of four fellow M.D.s and 10 drug safety specialists. Prior to his time at Organon, Dr. Chapman served as Director, Medical Affairs, Drug Safety and Medical Writing Departments at Quintiles (currently known as IQVIA), from 1995-2003, where he grew the division from no employees to forty employees, including eight board certified physicians, four RNs, two pharmacists, eight medical writers and supporting staff. Dr. Chapman has also served on the board of directors of Rock Creek Pharmaceuticals, Inc. (f/k/a Star Scientific, Inc.) from 2007-2016, including as a member of the Audit Committee from 2007-2014, chairperson of the Compensation Committee from 2007-2014, and chairperson of the Executive Search Committee from 2007 to 2014. Dr. Chapman is an experienced executive and global medical expert and has extensive experience in providing monitoring and oversight for ongoing clinical trials including both adult and pediatric subjects. Dr. Chapman is also the founder of the Chapman Pharmaceutical Health Foundation, an IRS Section 501(c)(3) nonprofit organization established to solicit public funds and to support healthcare needs such as AIDS, diabetes, hypertension, lupus, sickle cell anemia, malaria and tuberculosis, which was organized in 2006. Dr. Chapman is a graduate of the Harvard Kennedy School of Cambridge, Massachusetts for financial management in 2020. Dr. Chapman received his M.D. degree from Georgetown University in Washington, D.C. in 1987, and completed his internship in Internal Medicine, a residency in Anesthesiology and a fellowship in Cardiovascular and Obstetric Anesthesiology at Georgetown. Dr. Chapman’s qualifications to sit on the Board include his extensive experience and leadership roles within the pharmaceutical industry.

| 7 |

Craig Eagle, M.D. has been our director since April 16, 2021. Dr. Eagle is currently the Chief Medical Officer of Guardant Health, Inc. since 2021. Previously, Dr. Eagle was Vice President of Oncology for Genentech, where he oversaw the medical programs across Genentech’s oncology portfolio. Prior to his current role, Dr. Eagle worked in several positions at Pfizer from 2009 to 2019, including as the oncology business lead in the United Kingdom and Canada, the global lead for Oncology Strategic Alliances and Partnerships based in New York, and as the head of the Oncology Therapeutic Area Global Medical and Outcomes Group, including the U.S. oncology medical business. Through his multiple roles at Pfizer, Dr. Eagle delivered significant business growth and was involved in multiple strategic acquisitions and divestitures. In addition, while at Pfizer, Dr. Eagle oversaw extensive oncology clinical trial programs, multiple regulatory and payer approvals across Pfizer’s oncology portfolio, health outcomes assessments and scientific collaborations with key global research organizations like the National Cancer Institute (NCI), and the European Organisation for Research and Treatment of Cancer (EORTC), and led worldwide development of several compounds including celecoxib, aromasin, irinotecan, dalteparin and ozagomicin. Dr. Eagle currently serves as a member of the board of directors and chair of the Science and Policy Committee of Pierian Biosciences, a privately held life sciences company. Dr. Eagle attended Medical School at the University of New South Wales, Sydney, Australia and received his general internist training at Royal North Shore Hospital in Sydney. He completed his hemato-oncology and laboratory hematology training at Royal Prince Alfred Hospital in Sydney and was granted Fellowship in the Royal Australasian College of Physicians (FRACP) and the Royal College of Pathologists Australasia (FRCPA). After his training, Dr. Eagle performed basic research at the Royal Prince of Wales hospital to develop a new monoclonal antibody to inhibit platelets before moving into the pharmaceutical industry. Dr. Eagle’s qualifications to sit on the Board include his long and successful career in the international pharmaceutical industry, his senior executive experience in areas such as business growth, strategic alliances and mergers and acquisition transactions, his experience as a member of both public and private company boards in the healthcare and life science industries, and his wealth of oncology experience, including leading and participating in scientific research, regulatory, pricing & re-imbursement negotiations for compounds in therapeutic areas.

Christopher C. Schreiber has been our director since August 8, 2017 and currently serveshe previously at various times as our Chief Executive Chairman. Mr. Schreiber has been ourOfficer, President, since July 21, 2020.and Executive Chairman of the Board. Mr. Schreiber combines over 30 years of experience in the securities industry. As the managing directorManaging Director of capital marketsCapital Markets at Taglich Brothers, Inc., Mr. Schreiber builds upon his extensive background in capital markets, deal structures, and syndications. Prior to his time at Taglich Brothers, Inc., he was a member of the board of directors of Paulson Investment Company, a 40-year-old full service investment banking firm. In addition, Mr. Schreiber serves as a director and partner of Long Island Express North, an elite lacrosse training organization for teams and individuals. He also volunteers on the board of directors for Fox Lane Youth Lacrosse, a community youth program. Mr. Schreiber is a graduate of Johns Hopkins University, where he received a Bachelor’s Degreebachelor’s degree in Political Science. Mr. Schreiber’s qualifications to sit on the Board include his financial expertise and his experience with the Company.

Joshua Silverman has been our director since September 6, 2018 and currently serves as ourChairman of the Board. Prior to the completion of the Merger, Mr. Silverman was also the lead independent director. Mr. Silverman currently serves as the managing member of Parkfield Funding LLC. Mr. Silverman was the co-founder, and a principal and managing partner of Iroquois Capital Management, LLC (“Iroquois”), an investment advisory firm. Since its inception in 2003 until July 2016, Mr. Silverman served as co-chief investment officer of Iroquois. While at Iroquois, he designed and executed complex transactions, structuring and negotiating investments in both public and private companies and has often been called upon by the companies solve inefficiencies as they relate to corporate structure, cash flow, and management. From 2000 to 2003, Mr. Silverman served as co-chief investment officer of Vertical Ventures, LLC, a merchant bank. Prior to forming Iroquois, Mr. Silverman was a director of Joele Frank, a boutique consulting firm specializing in mergers and acquisitions. Previously, Mr. Silverman served as assistant press secretary to the president of the United States. Mr. Silverman currently serves as a director of Ayro Inc., Protagenic Therapeutics,Pharmacyte, Inc., Synaptogenix, Inc. and Neurotrope,Petros Pharmaceutical, Inc., all of which are public companies. He previously served as a director of National Holdings Corporation from July 2014 through August 2016 and as a director of Marker Therapeutics, Inc. from August 2016 until October 2018. Mr. Silverman received his B.A. from Lehigh University in 1992. Mr. Silverman’s qualifications to sit on the Board include his experience as an investment banker, management consultant and as a director of numerous public companies.

| 8 |

Jude Uzonwanne has been our director since April 16, 2021. Mr. Uzonwanne is currently the Chief Business Officer for 54gene, Inc., a US based biopharmaceutical company focused on developing new genomic based drugs. Prior to 54gene, he was a Principal with ZS Associates, Inc., a consulting and professional services firm focusing on consulting, software and technology that provides services for clients in the private equity, healthcare, and technology industries, a position he has held since January 2021. Prior to joining ZS Associates, Mr. Uzonwanne was a Principal at IQVIA, Inc. from 2018 to 2020, where he served as the head of the firm’s US Financial Investors Consulting practice and as management consulting lead for IQVIA’s service to a top-6 global pharmaceutical company and select emerging biopharmaceutical companies. Prior to joining IQVIA, Mr. Uzonwanne served as Vice President (Associate Partner) at EY-Parthenon LLP from 2016 to 2018, where he managed teams advising corporate and private equity investors on a range of commercial due diligence targets in healthcare strategies and advised clients on growth accelerating strategies and investments. Prior to this role, Mr. Uzonwanne has worked for several other companies including Bain & Company, Dalberg Global Development Advisers, the Bill and Melinda Gates Foundation, and Monitor Group. Since 2019, Mr. Uzonwanne has served as a member of the board of directors of Bonita Foods, a privately held emerging market specialty food and snacks company. Mr. Uzonwanne is a graduate of Swarthmore College (double Honors B.A in Economics and Political Science). Mr. Uzonwanne’s qualifications to sit on the Board include his experience as a corporate strategy and transaction services adviser in the healthcare markets globally.

Bill J. White has been our director since August 8, 2017. Mr. White has more than 30 years of experience in financial management, operations and business development. He currently serves as chief financial officer, treasurer and secretary of Intellicheck, Mobilisa, Inc., a technology company listed on the NYSE MKT. Prior to working at Intellicheck, Mobilisa, Inc., he served 11 years as the chief financial officer, secretary and treasurer of FocusMicro, Inc. (“FM”). As co-founder of FM, Mr. White played an integral role in growing the business from the company’s inception to over $36 million in annual revenue in a five-year period. Mr. White has broad domestic and international experience including managing rapid and significant growth, import/export, implementing tough cost management initiatives, exploiting new growth opportunities, merger and acquisitions, strategic planning, resource allocation, tax compliance and organization development. Prior to co-founding FM, he served 15 years in various financial leadership positions in the government sector. Mr. White started his career in Public Accounting. Mr. White holds a Bachelor of Arts in Business Administration from Washington State University and is a Certified Fraud Examiner. Mr. White was selected to serve on the Board of Directors in part because of his significant financial and accounting experience with public companies.

Robert C. Schroeder has been our director since November 1, 2019. Mr. Schroeder is currently the vice president of investment banking at Taglich Brothers, a brokerage firm, and specializes in advisory services and capital raising for small public and private companies. Prior to his time at Taglich Brothers, Mr. Schroeder served as a Senior Equity Analyst publishing sell-side research on publicly traded companies and served in various other positions in the brokerage and public accounting industry. Mr. Schroeder currently serves on the board of directors of publicly traded Intellinetics, Inc., a document solutions software development, sales and marketing company, Air Industries Group (NYSE:AIRI), a manufacturer of aerospace parts and assemblies, and Decisionpoint Systems, Inc., a leading provider and integrator of Enterprise Mobility, Wireless Applications and RFID solutions. Mr. Schroeder received a B.S. degree in accounting and economics from New York University. The Board believes Mr. Schroeder is well qualified to serve on the Board of Directors due to his leadership skills, capital markets expertise, and extensive experience as a director of the board for other public companies.

Family Relationships

There are no family relationships between any of our officers or directors.

Required Vote and Board Recommendation

If a quorum is present and voting, the foursix Company Nominees receiving the highest number of votes will be elected as directors. If you hold your shares in your own name and abstain from voting on the election of directors, your abstention will have no effect on the vote. If you hold your shares through a broker and you do not instruct the broker on how to vote for the four Company Nominees, your broker will not have the authority to vote your shares. Abstentions and broker non-votes will each be counted as present for purposes of determining the presence of a quorum but will not have any effect on the outcome of the vote.

| The Board recommends that you vote “FOR” each Company Nominee. |

CORPORATE GOVERNANCECorporate Governance

Akers,MyMD, with the oversight of the Board and its committees, operates within a comprehensive plan of corporate governance for the purpose of defining independence, assigning responsibilities, setting high standards of professional and personal conduct and assuring compliance with such responsibilities and standards. We regularly monitor developments in the area of corporate governance.

Proposed Corporate Governance Reforms

On May 28, 2020, the United StatedStates District Court for the District of New Jersey approved that certain Amended Stipulation and Agreement of Settlement, dated October 1, 2019 (the “Settlement”) among the settling parties in connection with a consolidated shareholder derivative action, Case No.: 2:18-cv-15992. Pursuant to the Settlement, effective as of July 21, 2020, we made various modifications to our corporate governance and business ethics practices as further discussed below.

Code of Business Ethics and Conduct and Whistleblower Policy

We have adopted a Code of Business Ethics and Conduct, which applies to our Board, our executive officers and our employees, outlines the broad principles of ethical business conduct we adopted, covering subject areas such as, compliance with applicable laws and regulations, handling of books and records, public disclosure reporting, insider trading, conflicts of interest, competition and fair dealing, and other violations. Our Code of Business Ethics and Conduct is available on our website at www.akersbio.com www.mymd.comin the “Corporate Governance” section found under the “Investor Center”“Investors” tab. Pursuant to the Settlement, we will conduct a review of our Code of Business Ethics and Conduct on an annual basis and to monitor compliance. We intend to disclose any amendments to, or waivers from, our Code of Business Ethics and Conduct at the same website address provided above.

In addition, pursuant to the Settlement, we adopted a Whistleblower Policy to encourage employees, officers and directors to bring forward ethical and legal violations. We have disclosed a copy of the Whistleblower Policy, and intend to disclose any amendments to the Whistleblower Policy, at the same website address provided above.

Pursuant to the Settlement, we formed a Risk and Disclosure Committee, which is served by the members of the Audit Committee, which reviews our ethics and risk program and internal controls over compliance and identifies and recommends to the Board any changes that it deemed necessary. The Risk and Disclosure Committee also monitors compliance with our Code of Business Ethics and Conduct, reviews and evaluates our public disclosures and disclosure controls and procedures and handlehandles any whistleblower complaints.

Board Composition and Committees

Our Amended and Restated Certificate of Incorporation, as amended (the “Charter”), and our Amended and Restated Bylaws (“Bylaws”) provide that our Board will consist of no more than election (11) and no less than two (2) members, sucha number of directors to be determined from time to time pursuant to asolely by resolution adopted by a majority of the total number of authorizedBoard, which is currently set at seven directors. Vacancies or newly created directorships resulting from an increase in the authorized number of directors elected by all of the stockholders having the right to vote as a single class may be filled by a majority of the directors then in office, although less than a quorum, or by a sole remaining director.

Board Diversity