If to the Company:

TRANS-LUX CORPORATION

26 Pearl Street

Norwalk, CT 06850

Facsimile: 203-229-0691

E-mail: jmallain@trans-lux.com

Attention: J.M. Allain, President and CEO

If to the Holder:

NAME OF HOLDER

ADDRESS OF HOLDER

Facsimile:

E-mail:

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Information Required in Proxy Statement

Schedule 14a Information

Proxy Statement Pursuant to Section 14(a) of The Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ý

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨

Preliminary Proxy Statement

¨

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

ý

Definitive Proxy Statement

¨

Definitive Additional Materials

¨

Soliciting Material Under Rule 14a-12

Trans-Lux Corporation |

(Name of Registrant as Specified in Its Charter) |

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

ý

No fee required.

¨

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1)

Title of each class of securities to which transaction applies:

(2)

Aggregate number of securities to which transaction applies:

(3)

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4)

Proposed maximum aggregate value of transaction:

(5)

Total fee paid:

¨

Fee paid previously with preliminary materials:

¨

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

(1)

Amount previously paid:

(2)

Form, Schedule or Registration Statement No.:

(3)

Filing Party:

(4)

Date Filed:

TRANS-LUX CORPORATION26 Pearl Street445 Park Avenue, Suite 2001Norwalk, Connecticut 06850New York, New York 10022

_________________________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD OCTOBER 2, 2013JUNE 29, 2015

_________________________

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of TRANS-LUX CORPORATION (the “Corporation” or the “Company”) will be held at the Company’s Atlanta office,Olshan Frome Wolosky LLP, located at 680 Douthit Ferry Road, Suite 201, Cartersville, Georgia 30120 ,Park Avenue Tower, 65 East 55th Street, New York, NY 10022, on October 2, 2013June 29, 2015 at 10:11:00 A.M. local time for the following purposes:

1.

To consider and act upon a proposal to vote on (a) an advisory resolution on executive compensation and (b) an advisory resolution on the frequency of future advisory votes on executive compensation;

2.

To consider and act upon a proposal to approve the grant of warrants to the following members of the Board of Directors of the Corporation: (a) George Schiele, (b) Salvatore Zizza and (c) Jean Firstenberg;

3.

To consider and act upon a proposal to approve amendments to our amended and restated certificate of incorporation granting our board the discretion to (a) effect a reverse stock split by a ratio of up to 1-for-1,000, with the exact ratio to be determined by our Board of Directors in its sole discretion, followed by a forward stock split by a ratio of up to 50-for-1, with the exact ratio to be determined by our Board of Directors in its sole discretion, and (b) reduce the Company’s authorized common stock, par value $0.001 (“Common Stock”); implementation of this proposal no. 3(b) is conditioned upon the approval of proposal no. 3(a); if proposal no. 3(a) is not approved, then proposal no. 3(b) will not be implemented;

4.1.

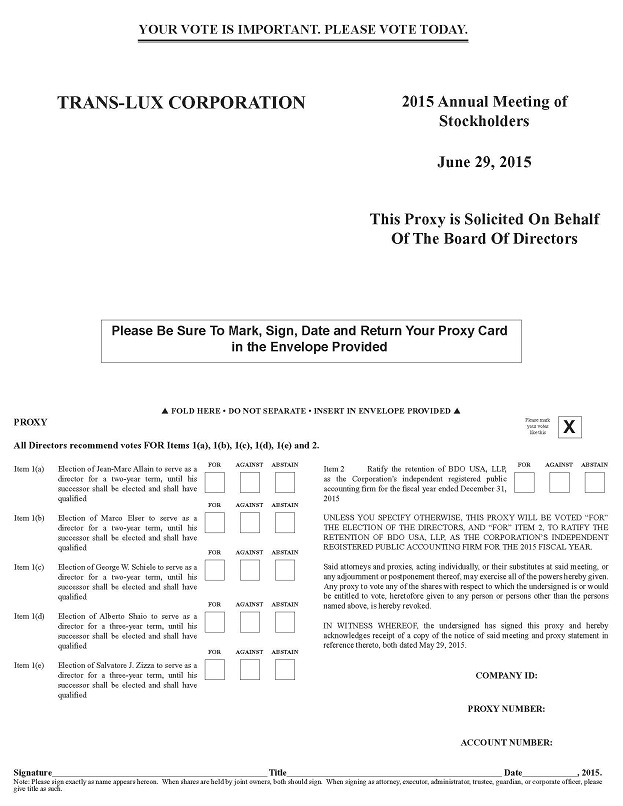

To elect three directors to serve for a term of threetwo years and elect two directors to serve for a term of three years; in each case until their respective successors shall have been duly elected and qualified, namely (a) Jean Firstenberg,Jean-Marc Allain, (b) Alan K. Greene,Marco Elser and (c) George W. Schiele, respectively, for a term of two years, and (d) Alberto Shaio;Shaio and (e) Salvatore J. Zizza, respectively, for a term of three years;

5.

2.

To ratify the appointment of BDO USA, LLP, as the Corporation’s independent registered public accounting firm for the ensuing fiscal year;year ending December 31, 2015; and

6.

3.

To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.

The close of business on August 5, 2013May 21, 2015 has been fixed as the record date for the determination of the

stockholders entitled to notice of and to vote at the Annual Meeting.

| By Order of the Board of Directors, |

|

|

|

|

Dated and Mailed:

Norwalk, ConnecticutNew York, New York

August __, 2013May 29, 2015

Please mark, date, sign and return promptly the enclosed proxy so that your shares may be represented at the Annual Meeting. A return envelope, which requires no postage if mailed in the United States, is enclosed for your convenience. |

PROXY STATEMENT

of

TRANS-LUX CORPORATION

for the Annual Meeting of Stockholders

To Be Held on October 2, 2013June 29, 2015

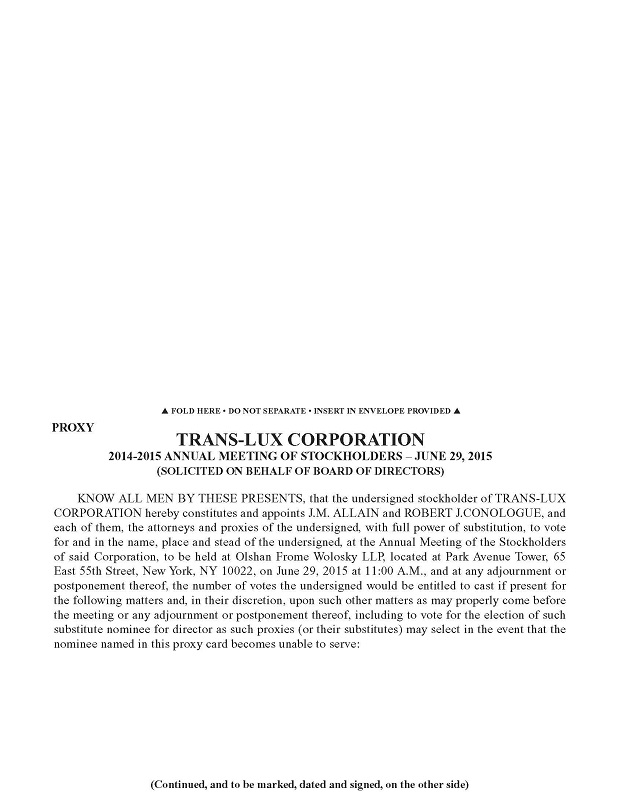

_________________________

Introduction

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of TRANS-LUX CORPORATION (the “Corporation” or the “Company”) of proxies in the accompanying form to be used at the Annual Meeting of the Stockholders of the Corporation to be held on Wednesday, October 2, 2013Monday, June 29, 2015 (the “Meeting”), and at any adjournment or postponement thereof, for the purposes set forth in the accompanying Notice of Annual Meeting. This Proxy Statement and the proxies solicited hereby are being mailed to stockholders on August __, 2013.May 29, 2015. The shares represented by the proxies timely received and properly executed pursuant to the solicitation made hereby and not revoked will be voted at the Meeting.

Meeting of Stockholders

The Meeting will be held at the Company’s Atlanta office,Olshan Frome Wolosky LLP, located at 680 Douthit Ferry Road, Suite 201, Cartersville, Georgia 30120,Park Avenue Tower, 65 East 55th Street, New York, NY 10022, on October 2, 2013June 29, 2015 at 10:11:00 A.M. local time.

Purposes of the Meeting

The purposes of the Meeting are to vote upon: (1) (a) an advisory resolution on executive compensation and (b) an advisory resolution on the frequency of future advisory votes on executive compensation; (2) the granting of certain warrants to the following members of the Board of Directors of the Corporation: (a) George Schiele, (b) Salvatore Zizza and (c) Jean Firstenberg; (3) the approval of certain amendments to our amended and restated certificate of incorporation granting our board the discretion to (a) effect a reverse stock split by a ratio of up to 1-for-1,000, with the exact ratio to be determined by our Board of Directors in its sole discretion, followed by a forward stock split by a ratio of up to 50-for-1, with the exact ratio to be determined by our Board of Directors in its sole discretion, and (b) reduce the Company’s authorized Common Stock; implementation of this proposal no. 3(b) is conditioned upon the approval of proposal no. 3(a); if proposal no. 3(a) is not approved, then proposal no. 3(b) will not be implemented; (4) the election of three directors to serve for a term of two years and the election of two directors to serve for a term of three years, orin each case until their respective successors shall have been duly elected and qualified, namely (a) Jean Firstenberg,Jean-Marc Allain, (b) Alan K. Greene,Marco Elser and (c) George W. Schiele, respectively, for a term of two years, and (d) Alberto Shaio; (5)Shaio and (e) Salvatore Zizza, respectively, for a term of three years; (2) the ratification of the appointment of BDO USA, LLP, as the Corporation’s independent registered public accounting firm for the fiscal year ending December 31, 2013;2015; and (6)(3) to transact such other business as may properly come before the Meeting or any adjournment ofor postponement thereof.

Record Date and Voting

The close of business on August 5, 2013May 21, 2015 has been fixed as the record date (the “Record Date”) for the determination of the stockholders entitled to notice of and to vote at the Meeting. There were outstanding as of the close of business on August 5, 2013May 21, 2015 and entitled to notice of and to vote at the Meeting, approximately 25,895,4241,685,085 shares of Common Stock, $0.001 par value of the Corporation.Corporation ("Common Stock"). Each outstanding share of Common Stock is entitled to one vote on all matters voted on at the Meeting.

Voting Required

Only stockholders of record of the Common Stock as of the close of business on the Record Date will be entitled to vote at the Meeting.

A majority of the voting power of all shares of the Common Stock outstanding must be present or represented by proxy at the Meeting to constitute a quorum. Abstentions and broker non-votes will be treated as shares present for the purpose of determining the presence of a quorum for the transaction of business at the Meeting. If a quorum is not present, the Meeting may be adjourned to a subsequent date for the purpose of obtaining a quorum.

On April 8, 2013 and on June 26, 2013,May 22, 2015, the Board of Directors of the Corporation unanimously adopted resolutions approving, declaring advisable and recommending to the Corporation’s stockholders the adoption of each of the Proposals.

Proposal 1(a) requires the affirmative vote of a majority of the votes cast affirmatively or negatively of the Common Stock. The alternative selected under Proposal 1(b) will be based on the alternative which receives the most votes. Proposal Numbers 2(a), 2(b) and 2(c) require the affirmative vote of a majority of the votes cast affirmatively or negatively of the Common Stock. Proposal Numbers 3(a) and 3(b) require the affirmative vote of a majority of the outstanding shares of Common Stock; implementation of Proposal No. 3(b) is conditioned upon the approval of Proposal No. 3(a); if Proposal No. 3(a) is not approved, then Proposal No. 3(b) will not be implemented. Proposal Number 41 requires a plurality vote. Proposal Number 52 requires the affirmative vote of a majority of the votes cast affirmatively or negatively of the Common Stock.

Broker Non-Votes

If stockholders do not give their brokers instructions as to how to vote shares held in street name, the brokers have discretionary authority to vote those shares on ‘routine’ matters, such as the ratification of the independent registered public accounting firm, but not on ‘non-routine’ proposals, such as the election of directors. As a result, if you hold your shares in street name and do not provide voting instructions to your broker, your shares will not be voted on any proposal on which your broker does not have discretionary authority to vote. Shares held by brokers who do not have discretionary authority to vote on a particular matter and who have not received voting instructions from their customers will be counted as present for the purpose of determining whether there is a quorum at the Meeting, will be treated as a vote AGAINST any Proposal requiring the affirmative vote of a percentage of outstanding stock or outstanding voting power and will have no effect for the purpose of determining whether our stockholders have approved a matter requiring a majority of votes cast affirmatively or negatively or a plurality vote.

Abstentions

Abstentions will not affect the outcome of the vote on the election of Directors, but will have the same effect as a vote “AGAINST” the proposal to ratify the appointment of BDO USA, LLP.

How to Vote

You may own shares either (1) directly in your name, in which case you are the record holder of such shares, or (2) indirectly through a broker, bank or other nominee, in which case such nominee is the record holder. If your shares are registered directly in your name, we are sending these proxy materials directly to you. If the record holder of your shares is a nominee, you will receive proxy materials from such nominee. If you are a record holder, you may vote in person at the Meeting or by proxy. We recommend that you vote by proxy even if you plan to attend the Meeting. You can always change your vote at the Meeting. To vote by proxy, mark your proxy card, date and sign it, and return it as soon as possible in the postage-paid envelope provided. If your shares are held by a broker, bank or other nominee, such nominee will provide you with instructions that you must follow in order to have your shares voted. If you plan to attend the Meeting and vote in person, you will need to contact the broker, bank or other nominee to obtain evidence of your ownership of shares on August 5, 2013.May 21, 2015.

Proxies

A stockholder who shall sign and return a proxy in the form enclosed with this statement has the power to revoke it at any time before it is exercised by giving written notice of revocation or a proxy of later date, or by voting in person at the Meeting, each as more fully described in the following paragraph. Unless otherwise specified, the proxies in the accompanying form will be voted in favor of all of the proposals set forth in the Notice of Annual Meeting. In the discretion of the proxy holders, the proxies will also be voted for or against such other matters as may properly come before the Meeting. The Board of Directors is not aware that any other matters are to be presented for action at the Meeting.

Revoking a Proxy

A proxy may be revoked by delivery of a written statement to Continental Stock Transfer & Trust, Co., Attention: Proxy Department, via email at: proxy@continentalstock.com or via facsimile at: 212-509-5152. Such revocation must state that the proxy is revoked. A proxy may also be revoked by a subsequent proxy executed by the person executing the prior proxy and presented at the Meeting, or by voting in person at the Meeting.

Proxy Solicitation and Expenses

The Company will pay for the entire cost of soliciting proxies on its behalf. We will also reimburse brokerage firms, banks and other agents for the cost of forwarding the Company’s proxy materials to beneficial owners. In addition, our directors and employees may solicit proxies in person, by mail, by telephone, via the internet, press releases or advertisements. Directors and employees will not be paid any additional compensation for soliciting proxies.

Proxy Materials Available on the Internet

These proxy materials and the Company’s 20122014 Annual Report on Form 10-K are available on the internet on the following website: http://proxystatements.trans-lux.com/.

PROPOSAL TO APPROVE (A) THE ADVISORY RESOLUTION

ON EXECUTIVE COMPENSATION AND (B) THE FREQUENCY OF CONDUCTING

FUTURE ADVISORY VOTES ON EXECUTIVE COMPENSATIONProposal Nos. 1(a) and 1(b) (Items 1(a) and 1(b) on Proxy Card)

Proposal No. 1(a)—Advisory Resolution on Executive Compensation

Background

The Board of Directors recognizes the significant interest of shareholders in executive compensation matters. Pursuant to recent amendments to Section 14A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) (which were added by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”)), we are providing our shareholders with an opportunity to cast an advisory vote to approve the compensation of our named executive officers as disclosed in the Summary Compensation Table and other tables and the related narrative discussion, as well as in the Compensation Discussion and Analysis section of this Proxy Statement, in accordance with SEC rules. In connection therewith, the Company is requesting shareholders to approve the following non-binding advisory resolution at the 2013 Annual Meeting of Stockholders:

RESOLVED, that the compensation paid to the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the compensation tables and narrative discussion, as well as the Compensation Discussion and Analysis, set forth in this Proxy Statement, is hereby APPROVED, on an advisory basis, by the shareholders of the Company.

Summary and Recommendation

The Board of Directors recommends a vote FOR this resolution because it believes that the policies and practices of the Company with respect to executive compensation are effective in achieving the Company’s goals of rewarding sustained financial and operating performance and leadership excellence, aligning the executives’ long-term interests with those of the shareholders and motivating the executives to remain with the Company for long and productive careers. Our executive compensation program is designed to enable us to attract, motivate and retain executive talent, who are critical to our success. Our compensation philosophy and framework have resulted in compensation for our named executive officers that is commensurate with the Company’s financial results. Our executive compensation program is designed to attract, motivate and retain executives and professionals of the highest level of quality and effectiveness. These programs focus on rewarding the types of performance that increase shareholder value, link executive compensation to the Company’s long-term strategic objectives and align executive officers’ interests with those of our shareholders. The Company believes that its executive compensation program satisfies these goals. Named executive officer compensation currently reflects amounts of cash consistent with periods of economic stress and lower earnings, and equity incentives aligning with our actions to stabilize the Company and to position it for a continued recovery.

We urge shareholders to review the 2012 Summary Compensation table and related compensation tables and narrative discussion set forth in this Proxy Statement, which provide detailed information on the Company’s compensation of our named executive officers.

This advisory resolution, commonly referred to as a “say-on-pay” resolution, is non-binding on the Company, its Board of Directors or its Compensation Committee. Although non-binding, the Company, its Board of Directors and its Compensation Committee will review and consider the voting results when evaluating our executive compensation program.

Proposal No. 1(b)—Advisory Vote on the Frequency of Future Advisory Votes on Executive Compensation

Background

In Proposal No. 1(a) above, the Company is requesting shareholders to vote on an advisory resolution on executive compensation. Pursuant to recent amendments to Section 14A of the Securities Exchange Act of 1934 added by the Dodd-Frank Act, in this Proposal No. 1(b) the Company is asking shareholders to vote, on a non-binding advisory basis, on whether future advisory votes on executive compensation should occur every year, every two years or every three years. Shareholders will be able to specify one of four choices for this proposal on the proxy card: one year, two years, three years or abstain. Shareholders are not voting to approve or disapprove the Board’s recommendation. This advisory vote on the frequency of future advisory votes on executive compensation is non-binding on the Company, its Board of Directors or its Compensation Committee. Shareholders are not being asked to approve or disapprove of the Board’s recommendation, but rather to indicate their own choice as among the frequency options.

Recommendation

The Board understands that there are different views as to what is an appropriate frequency for advisory votes on executive compensation. For the reasons described below, the Board of Directors is recommending that shareholders vote for holding the advisory vote on executive compensation of our named executive officers EVERY THREE YEARS pursuant to the following resolution:

RESOLVED, that an advisory shareholder vote to approve the compensation paid to the Company’s named executive officers, as disclosed in the compensation tables and narrative discussion, as well as the Compensation Discussion and Analysis, set forth in this Proxy Statement, be submitted to the Company’s shareholders every: (i) three years, (ii) two years or (iii) one year; with such frequency that receives the highest number of votes cast being the preferred advisory vote of shareholders.

The following describes the reasons for the Board’s recommendations:

● A triennial approach provides regular input by shareholders, while allowing shareholders to better judge our compensation program in relation to our long-term performance. This benefits our institutional and other shareholders, who have historically held our stock over the long-term.

● Our executive compensation program is designed to operate over the long-term and to support long-term value creation. Equity awards provide significant leverage if our long-term growth objectives are achieved, while placing a significant portion of our executives’ compensation at risk if our long-term objectives are not achieved.

● A triennial vote will provide our Board of Directors and its Compensation Committee sufficient time to thoughtfully evaluate the results of the most recent advisory vote on executive compensation, discuss the implications of the vote with our shareholders and develop and implement any changes to our executive compensation program that may be appropriate in light of the vote. A triennial vote will also allow for these changes to our executive compensation program to be in place long enough for shareholders to see and evaluate the effectiveness of these changes.

● The composition and level of compensation paid to executives in the market evolves over multiple years. A triennial approach will allow us to review evolving practices in the market to ensure our compensation program reflects best practices.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR:

(1) APPROVAL OF THE ADVISORY RESOLUTION ON EXECUTIVE

COMPENSATION AS DESCRIBED IN THIS PROPOSAL 1(A) AND

(2) CONDUCTING FUTURE ADVISORY VOTES ON EXECUTIVE COMPENSATION EVERY THREE YEARS AS DESCRIBED IN THIS PROPSAL 1(B).

IT IS INTENDED THAT PROXIES SOLICITED HEREBY WILL BEVOTED “FOR” (A) THE APPROVAL OF THE ADVISORY RESOLUTION

ON EXECUTIVE COMPENSATION AND (B) CONDUCTING FUTURE

ADVISORY VOTES ON EXECUTIVE COMPENSATION EVERY THREE YEARS,

UNLESS THE STOCKHOLDER SPECIFIES OTHERWISE.

PROPOSAL TO GRANT CERTAIN WARRANTS TO THE FOLLOWING MEMBERS OF THE BOARD OF DIRECTORS OF THE CORPORATION: (A) GEORGE SCHIELE, (B) SALVATORE ZIZZA AND (C) JEAN FIRSTENBERGProposal Nos. 2(a), 2(b) and 2(c) (Items 2(a), 2(b) and 2(c) on Proxy Card)The Board of Directors is asking the Corporation’s stockholders to approve the grant of warrants to purchase common shares of the Company to the following members of the Board of Directors of the Company: (a) George Schiele, (b) Salvatore Zizza and (c) Jean Firstenberg, in each case on the terms set forth below. A majority of the Board of Directors has approved, subject to stockholder approval, the granting of such warrants (the “Warrants”). The objectives of the Board in granting the Warrants is to provide compensation to Directors Schiele, Zizza and Firstenberg for future extraordinary services they each may perform for and/or on behalf of the Company.Proposal No. 2(a)—Grant of 500,000 Warrants to George SchieleDirector Schiele has agreed to continue providing the executive services beyond normal Board duties he has contributed to the Company since joining the Board in 2010, including finding and vetting senior management officers, and being available to help the Chief Executive Officer deal with operational and administrative issues as they arise and on his request. Going forward he has additionally agreed to continue the pursuit of and negotiations with the leads opened through his business and political connections for the development of state and local support of the Company in any future physical location and construction efforts. In consequence of his prior experience in the development and construction of manufacturing plants, he has also agreed to provide continuing oversight of any such potential project.Proposal No. 2(b)—Grant of 500,000 Warrants to Salvatore ZizzaMr. Zizza anticipates being continuously called upon by management to help mitigate the various challenges that the Company is facing relating to, among other things, financing and raising capital, obtaining lines of credit with banking institutions, operating decisions relating to productivity, and assisting in the negotiation and resolution of ongoing litigation and strategy relating thereto. Mr. Zizza anticipates continuous conference calls and meetings well beyond the regularly scheduled board meetings until such time that the Company is sufficiently capitalized and profitable.Proposal No. 2(c)—Grant of 50,000 Warrants to Jean FirstenbergDirector Firstenberg has served on the board since 1989 and is the Company’s longest serving director. Going forward, as the Company seeks the development of an LED lighting system tailored to the needs of film and television production entities, her extensive knowledge and connections to the moving image production community as the long-term President of the American Film Institute and her ongoing role as President Emeritus and Lifetime Director assure the Company of access at the most significant and respected levels of the image production community. In addition, Ms. Firstenberg will continue to navigate through her political connections for the development of any State of California, Los Angeles County or Los Angeles City efforts that might be optimal for the Company’s third-party relationships.The closing sale price of the Common Stock on the Over-the-Counter Bulletin Board (the “OTCQB”) on August 16, 2013 was $0.19 per share. The closing sale price of the Company’s Common Stock on the OTCQB on the date the Board of Directors approved the grant of the Warrants to Messrs. Schiele and Zizza was $0.17, and to Ms. Firstenberg, was $0.26.

Warrants Summary

The material provisions of the Warrants, as proposed to be adopted pursuant to this Proposal No. 2, are summarized below. This summary does not purport to be complete and is qualified in its entirety by reference to the full text of the Warrants attached as Appendix A to this Proxy Statement.

Duration and Vesting of the Warrants. The Warrants will be granted and effective on the date that the granting of the Warrants is approved by our stockholders and will terminate on the five-year anniversary thereof. The Warrants shall vest ratably over three years commencing on year after the grant date, vesting 33% each year.

Type of Warrants/Exercise Price. The Warrants will be non-cashless and shall have an exercise price of $0.50 per warrant share of Common Stock purchased thereunder.

Dilution Provisions/Transferability. The Warrants shall contain mechanical dilution provisions only (i.e. stock splits, stock dividends, etc.) and shall not contain any economic dilution provisions (i.e. re-pricing or ratchet, etc.). The Warrants are not transferable. Once exercised, the shares underlying the Warrants are transferable in accordance with applicable securities laws.

Rights Upon Removal, Resignation or Expiration of Term as a Director of the Company. All terms not otherwise defined below are defined in Attachment A:

Termination for Reasons Other Than Cause, Death, Disability. If the continuous service as a Director of the Company (“Continuous Service”) of the holder of the Warrant (the “Holder”) is terminated for any reason other than Cause, death or disability, the Holder may exercise the vested portion of the Warrant, but only within such period of time ending on the earlier of: (a) the date three months following the termination of the Holder’s Continuous Service or (b) the Termination Date of the Warrant.

Termination for Cause. If the Holder’s Continuous Service is terminated by virtue of a formal removal of such Director by the shareholders of the Company (“for Cause”), the Warrant (whether vested or unvested) shall immediately terminate and cease to be exercisable. The expiration of such Director’s term (and simultaneous failure for such Director to be re-elected) shall not constitute “for Cause”.

Termination Due to Disability. If the Holder’s Continuous Service terminates as a result of the Holder’s disability, the Participant may exercise the vested portion of the Warrant, but only within such period of time ending on the earlier of: (a) the date 12 months following the Holder’s termination of Continuous Service or (b) the Termination Date of the Warrant.

Termination Due to Death. If the Holder’s Continuous Service terminates as a result of the Holder’s death, the vested portion of the Warrant may be exercised by the Holder’s estate, by a person who acquired the right to exercise the Warrant by bequest or inheritance or by the person designated to exercise the Warrant upon the Holder’s death, but only within the time period ending on the earlier of: (a) the date 12 months following the Holder’s termination of Continuous Service or (b) the Termination Date of the Warrant.

Legal Limitations

The issuance of any shares upon exercise of the Warrants may be subject to the prior listing thereof on any exchange on which such shares are traded. The shares will be held by the recipient for investment unless the Corporation registers such shares under the Securities Act of 1933, as amended.

THE MAJORITY OF THE BOARD OF DIRECTORS RECOMMENDS

THAT THE STOCKHOLDERS VOTE “FOR” (1) THE

GRANT OF WARRANTS TO GEORGE SCHIELE, AS DESCRIBED IN THIS PROPOSAL

NO. 2(A), (2) THE GRANT OF WARRANTS TO SALVATORE ZIZZA, AS DESCRIBED IN THIS PROPOSAL NO. 2(B), AND THE GRANT OF WARRANTS TO JEAN FIRSTENBERG,

AS DESCRIBED IN THIS PROPOSAL NO. 2(C).

IT IS INTENDED THAT PROXIES SOLICITED HEREBYWILL BE VOTED “FOR” (1) THE GRANT OF WARRANTS TO GEORGE SCHIELE,

AS DESCRIBED IN THIS PROPOSAL NO. 2(A), (2) THE GRANT OF WARRANTS TO SALVATORE ZIZZA, AS DESCRIBED IN THIS PROPOSAL NO. 2(B), AND THE

GRANT OF WARRANTS TO JEAN FIRSTENBERG, AS DESCRIBED IN THIS PROPOSAL NO. 2(C), UNLESS THE STOCKHOLDER SPECIFIES OTHERWISE.

PROPOSAL TO APPROVE AMENDMENTS TO OUR AMENDED AND RESTATED CERTIFICATE OF INCORPORATION GRANTING OUR BOARD THE DISCRETION TO

(A) EFFECT A REVERSE STOCK SPLIT FOLLOWED BY A FORWARD STOCK SPLIT

AND (B) REDUCE THE COMPANY’S AUTHORIZED COMMON STOCKProposal Nos. 3(a) and 3(b) (Items 3(a) and 3(b) on Proxy Card)

IMPLEMENTATION OF PROPOSAL NO. 3(B) IS CONDITIONED UPON THE

APPROVAL OF PROPOSAL NO. 3(A); IF PROPOSAL NO. 3(A) IS NOT APPROVED,

THEN PROPOSAL NO. 3(B) WILL NOT BE IMPLEMENTED

Introduction

The Board of the Company has unanimously approved, subject to shareholder approval solicited hereby, proposals to amend the Company’s Amended and Restated Certificate of Incorporation authorizing the Board, at its discretion, to amend the Amended and Restated Certificate of Incorporation to (a) effect a reverse stock split of all outstanding and treasury shares of our Common Stock by a ratio ranging between 1-for-500 and 1-for-1,000 such that all shareholders owning fewer shares of Common Stock than the amount necessary to receive at least one share of post-split Common Stock, based on the ratio chosen by the Board, will have such shares cancelled and converted into the right to receive a cash payment per pre-split share as described below under “Payment for Fractional Shares” (the “Reverse Split”), (b) effect, immediately following the Reverse Split, a forward stock split of all outstanding and treasury shares of the Company’s Common Stock by a ratio ranging between 10-for-1 and 50-for-1 (the “Forward Split,” and together with the Reverse Split, the “Reverse/Forward Split”), and (c) reduce the authorized number of shares of Common Stock from 60,000,000 to 10,000,000 (the “Reduction in Common Stock”). Fractional shares would be treated as provided below and outstanding options and warrants to purchase Common Stock would be adjusted accordingly. The Reverse/Forward Split and Reduction in Common Stock would become effective upon the filing with the Secretary of State of the State of Delaware of the amendments to the Company’s Amended and Restated Certificate of Incorporation. If the proposed amendments to our Amended and Restated Certificate of Incorporation are approved, our Board will have the sole discretion to elect, based on the ranges above, as it determines to be in the best interests of the Company and our stockholders, whether or not to effect the Reverse/Forward Split and Reduction in Common Stock and at which exchange ratios. Our Board may elect not to implement the Reverse/Forward Split and Reduction in Common Stock at its sole discretion, even if it is approved by our stockholders. If the Company implements the reverse stock split, the ratio chosen would not be reasonably likely to, or would not have the purposes of producing a going private effect or deregistering the Company as a reporting company.

Proposal No. 3(a) — Proposed Reverse/Forward Split

Purposes for the Proposed Reverse/Forward Split

Trans-Lux Corporation’s Common Stock currently trades in limited volume on the OTCQB. The Reverse/Forward Split would benefit the Company and our stockholders by reducing the Company’s administrative burdens and costs in servicing shareholders who own relatively small numbers of shares of Common Stock by cashing out such smaller stockholders as described below under the heading entitled “Payment for Fractional Shares”.

The Reverse/Forward Split is also intended to result in a price level for our Common Stock that will broaden institutional investor interest. We believe that a number of investment funds and other institutional investors are reluctant to invest, and in some cases may be prohibited from investing, in lower-priced stocks, and that brokerage firms are reluctant to recommend lower-priced stocks to their clients. By decreasing the number of our shares of Common Stock outstanding through the Reverse/Forward Split, we believe we may be able to raise our Common Stock price to a level where our Common Stock could be viewed more favorably by potential investors. Investors may also be dissuaded from purchasing lower-priced stocks because the brokerage commissions, as a percentage of the total transaction, tend to be higher for lower-priced stocks. A higher stock price could alleviate this concern. The combination of lower transaction costs and increased interest from institutional investors could have the effect of improving the trading liquidity of our Common Stock. Additionally, the Reverse/Forward Split will enable holders of smaller numbers of our shares of Common Stock to dispose of their investment without paying brokerage fees on the transactions.

The Company intends to effect the Forward Split immediately following the Reverse Split in order to bring the shareholders of our Common Stock remaining after the Reverse Split closer to the original position they held prior to the Reverse Split. The desired effects of the Forward Split are to attract investor attention, which could potentially result in an increase of the price of our Common Stock, thereby increasing the liquidity of our Common Stock to the benefit of all of our shareholders, and to increase the number of shares of our Common Stock that are issued and outstanding, which could potentially have an anti-dilutive effect to the benefit of our shareholders. Additionally, by effecting the Forward Split, the Company hopes to broaden its investor base and improve shareholder value.

The Board believes that stockholder approval of the proposal granting the Board discretion to set the actual exchange ratios within the described ranges, rather than stockholder approval of a specified exchange ratio, provides it with maximum flexibility to react to market conditions, including the liquidity and the likely effect on the market price of our Common Stock. If the Board elects to effect a Reverse/Forward Split utilizing one of the reverse exchange ratios and one of the forward exchange ratios, the Board will be deemed to have abandoned its authorization related to any other reverse exchange ratios or forward exchange ratios.

Our Board intends to implement the Reverse/Forward Split if it believes that this action is in the best interests of Trans-Lux Corporation and our stockholders. Such determination shall be based upon a variety of factors, including but not limited to, existing and expected marketability and liquidity of our Common Stock, prevailing market conditions and the likely effect on the market price of our Common Stock. If our Board ultimately determines to effect the Reverse/Forward Split, the Board will determine the exact ratios within the approved exchange ratios that it believes will result in the greatest marketability of our Common Stock based on prevailing market conditions. No further action on the part of our stockholders would be required to either effect or abandon the Reverse/Forward Split. Notwithstanding approval of any of the proposed exchange ratios by our stockholders, our Board may, in its sole discretion, determine to delay the effectiveness of the Reverse/Forward Split.

Principal Effects of the Reverse/Forward Split

If the shareholders approve the proposal to authorize the Board to implement the Reverse/Forward Split and the Board decides to implement the Reverse/Forward Split, then the Reverse/Forward Split would take effect on the date that we subsequently file the Certificates of Amendment to our Amended and Restated Certificate of Incorporation with the Secretary of State of the State of Delaware, the forms of which are attached hereto as Attachment B and Attachment C, or on any later date that we may specify in such Certificates of Amendment (the “Effective Date”). The par value of our Common Stock at $0.001 per share would remain unchanged.

Upon the Effective Date, any shareholder owning fewer shares than the number of shares or treasury shares of Common Stock for which the Reverse Split is executed (ranging between 500 and 1,000) (as determined in accordance with the applicable exchange ratio being applied and hereinafter referred to as the “Minimum Number”) will have the right to receive a cash payment per pre-split share, without interest and as described below under the heading entitled “Payment for Fractional Shares” (the “Cash Out Price”), in exchange for each share held immediately before the Reverse Split and will no longer be a shareholder of the Company (the “Cashed Out Shareholders”). Any shareholder (including any shareholder holding Common Stock in “street name” through a nominee (such as a bank or broker)), owning at least the Minimum Number shares held prior to the Reverse Split (the “Continuing Shareholders”) will hold one share of Common Stock for each multiple of the Minimum Number shares held immediately prior to the Reverse Split.

Immediately after the completion of the Reverse Split, we will effect at a ratio ranging between 10-for-1 and 50-for-1 a forward stock split, pursuant to which shareholders owning one or more shares or treasury shares of Common Stock immediately after the Reverse Split will immediately after the Forward Split hold a number of shares or treasury shares of Common Stock equal to the number of shares for which the Forward Split is executed (up to 50) multiplied by the post-Reverse Split shares held by such shareholder. Any Continuing Shareholder who otherwise would be entitled to receive a fractional share as a result of the Forward Split will be entitled to receive cash consideration in lieu of such fractional share in an amount equal to the Cash Out Price, as adjusted to take account for the Reverse Split, multiplied by such fractional share, as described below under the heading entitled “Payment for Fractional Shares”.

The proposed Reverse/Forward Split will likely affect the Continuing Shareholders’ proportionate equity interest in the Company. The Reverse/Forward Split will likely affect our shareholders’ equity (deficit) as it is reflected in our financial statements to indicate that the number of issued and outstanding shares of Common Stock has been reduced. The extent of any change in the Continuing Shareholders’ proportionate equity interest in the Company and our shareholders’ equity (deficit) will depend on the split ratios chosen by the Board. In addition, the conversion ratios and exercise prices, to the extent applicable, of the Company’s outstanding stock options and warrants, will be proportionately adjusted upon the consummation of the Reverse/Forward Split. The $0.001 per share par value of the Common Stock will not be affected by the proposed amendments.

Payment for Fractional Shares

If the shareholders approve the proposal to authorize the Board to implement the Reverse/Forward Split and the Board decides to implement the Reverse/Forward Split, shareholders will be notified on or after the Effective Date. The Company’s transfer agent, Continental Stock Transfer & Trust Co., will act as the Company’s exchange agent (the “Exchange Agent”) for shareholders in implementing the tender or exchange of their certificates.

As of the Effective Date, all Cashed Out Shareholders will have their stock certificate(s) cancelled without any further action. Those certificates will no longer represent an ownership interest in the Company, but will represent only the right to receive the Cash Out Price in lieu of the fractional shares to which a shareholder would otherwise be entitled. No certificates or scrip representing fractional share interests in the Common Stock will be issued, and no such fractional share interest would entitle the holder thereof to any rights as a shareholder of the Company. Certificates representing the shares owned by Cashed Out Shareholders subsequently presented for transfer will not be transferred on our books or records.

After the Effective Date, (a) all Cashed Out Shareholders will have an opportunity to exchange their stock certificate(s) for cash consideration in the amount of the Cash Out Price for each share held immediately prior to the Reverse Split in accordance with the terms of the next paragraph below, and (b) all Continuing Shareholders will have an opportunity to exchange their stock certificate(s) for a new stock certificate(s) that will bear a new CUSIP number and cash consideration in the amount of the Cash Out Price, as adjusted to take account for the Reverse Split, multiplied by any fractional shares resulting from the Forward Split, in accordance with the terms of the next paragraph below. The Exchange Agent will furnish shareholders with the necessary materials and instructions to effect the surrender and exchange promptly following the Effective Date. The letter of transmittal included in the materials will direct how old certificates are to be surrendered for new certificates and/or cash in lieu of fractional shares. Shareholders must complete and sign the letter of transmittal and return it with their stock certificate(s) to the Exchange Agent in accordance with the instructions set forth in the transmittal letter before they can receive their new stock certificate(s) for those shares and/or cash in lieu of fractional shares. The letter of transmittal will also contain instructions in the event that certificate(s) have been lost, destroyed or mutilated. Shareholders should not send their stock certificate(s) to the Exchange Agent until they have received a letter of transmittal and followed the instructions in the letter of transmittal.

No fractional shares of our Common Stock will be issued as a result of the implementation of the Reverse/Forward Split. Instead, the Exchange Agent will aggregate all fractional shares of Cashed Out Shareholders and any fractional shares of remaining stockholders after the Reverse/Forward Splitand sell them as soon as practicable after the Effective Date at the then prevailing prices on the open market, on behalf of those stockholders who would otherwise be entitled to receive a fractional share. We expect that the Exchange Agent will conduct the sale in an orderly fashion at a reasonable pace and that it may take several days to sell all of the aggregated fractional shares of our Common Stock. After the Exchange Agent’s completion of such sale, stockholders will receive a cash payment from the Exchange Agent in an amount equal to their respective pro rata shares of the total net proceeds of that sale.

SHAREHOLDERS WILL NOT RECEIVE CASH AND/OR CERTIFICATES FOR SHARES OF POST-REVERSE/FORWARD SPLIT COMMON STOCK UNLESS AND UNTIL THE CERTIFICATES REPRESENTING THEIR SHARES OF PRE-REVERSE/FORWARD SPLIT COMMON STOCK ARE SURRENDERED AND THEY PROVIDE SUCH EVIDENCE OF OWNERSHIP OF SUCH SHARES AS THE COMPANY OR THE EXCHANGE AGENT MAY REQUIRE. SHAREHOLDERS SHOULD NOT DESTROY ANY STOCK CERTIFICATE. SHAREHOLDERS SHOULD NOT FORWARD THEIR CERTIFICATES TO THE EXCHANGE AGENT UNTIL THEY HAVE RECEIVED NOTICE FROM THE EXCHANGE AGENT PURSUANT TO THE LETTER OF TRANSMITTAL THAT THE REVERSE/FORWARD SPLIT HAS BECOME EFFECTIVE.

Beginning on the Effective Date, each certificate representing shares and treasury shares of the Company’s pre-Reverse/Forward Split Common Stock will be deemed for all corporate purposes to evidence ownership of the appropriate number of shares of post-Reverse/Forward Split Common Stock and/or the right to receive a cash payment, as the case may be. No service charge or transaction cost shall be payable by shareholders in connection with the exchange of certificates, all costs of which will be borne and paid by the Company. Stockholders will not be entitled to receive interest for the period of time between the Effective Date and the date payment is made for their fractional share interest in our Common Stock. Shareholders should also be aware that, under the escheat laws of certain jurisdictions, sums due for fractional interests that are not timely claimed after the funds are made available may be required to be paid to the designated agent for each such jurisdiction. Thereafter, stockholders otherwise entitled to receive such funds may have to obtain the funds directly from the state to which they were paid.

Discretion of Board to Implement the Reverse/Forward Split

The Board has retained for itself the absolute authority to reject (and not implement) the Reverse/Forward Split (even after approval by the shareholders) if it subsequently determines that the Reverse/Forward Split, for any reason including but not limited to preserving the Company’s net operating loss is not then in the Company’s and its shareholders’ best interests. Such reasons include any change in the nature of the Company’s shareholdings prior to the Effective Date.

Certain Risks Associated with the Reverse/Forward Split

If the Reverse/Forward Split is implemented, the resulting per-share price may not attract institutional investors or investment funds and may not satisfy the investing guidelines of these investors, and consequently, the trading liquidity of our Common Stock may not improve. While we believe that a higher stock price may help generate investor interest in our Common Stock, the Reverse/Forward Split may not result in a stock price that will attract institutional investors or investment funds or satisfy the investing guidelines of institutional investors or investment funds. A decline in the market price of our Common Stock after the Reverse/Forward Split may result in a greater percentage decline than would occur in the absence of the Reverse/Forward Split. If the Reverse/Forward Split is implemented and the market price of our Common Stock declines, the percentage decline may be greater than would occur in the absence of the split. The market price of our Common Stock is also based on our performance and other factors, which are unrelated to the number of shares of Common Stock outstanding.

The Reverse/Forward Split may reduce the liquidity and increase the volatility of our stock. Following the Reverse/Forward Split, our outstanding shares will be reduced by an exchange ratio chosen by our Board, which may lead to reduced trading and a smaller number of market makers for our Common Stock. In addition, stocks trading at a 30-day average below $5 generally may not be sold short. Following the Reverse/Forward Split, to the extent our per-share trading price is consistently above $5, investors may short our stock. This may increase the volatility of our stock price.

Our total market capitalization immediately after the proposed Reverse/Forward Split may be lower than immediately prior to the proposed Reverse/Forward Split. There are numerous factors and contingencies that could affect our stock price following the proposed Reverse/Forward Split, including the status of the market for our Common Stock at the time, our reported results of operations in future periods, and general economic, market and industry conditions. Accordingly, the market price of our Common Stock may not be sustainable at the direct arithmetic result of the Reverse/Forward Split. If the market price of our Common Stock declines after the Reverse/Forward Split, our total market capitalization (the aggregate value of all of our outstanding Common Stock at the then existing market price) after the Reverse/Forward Split will be lower than before the Reverse/Forward Split.

The Reverse/Forward Split may result in some stockholders owning “odd lots” that may be more difficult to sell or require greater transaction costs per share to sell. The Reverse/Forward Split may result in some stockholders owning “odd lots” of less than 100 shares of our Common Stock on a post-split basis. Odd lots may be more difficult to sell, or require greater transaction costs per share to sell than shares in “round lots” of even multiples of 100 shares.

Potential Effects of the Proposed Reverse/Forward Split

Effects on Trans-Lux Corporation

The immediate effect of a Reverse/Forward Split would be to reduce the number of shares of our outstanding Common Stock, and shares of Common Stock held in our treasury, and to increase the trading price of our Common Stock. However, as discussed above, the effect of the Reverse/Forward Split upon the market price of our Common Stock cannot be predicted, and the history of reverse/forward splits by companies (which have the effect of reducing the number of outstanding shares of the any such company’s outstanding stock) shows that sometimes these reverse/forward splits improve stock performance and sometimes they do not. We cannot assure you that the trading price of our Common Stock after the Reverse/Forward Split will rise in proportion to the reduction in the number of shares of our Common Stock outstanding as a result of the Reverse/Forward Split. Also, we cannot assure you that a Reverse/Forward Split would lead to a sustained increase in the trading price of our Common Stock. The trading price of our Common Stock may change due to a variety of other factors, including our operating results, other factors related to our business and general market conditions.

The following table is an illustration only and reflects the approximate number of shares of our Common Stock that would be outstanding and held in treasury as a result of the Reverse/Forward Split being implemented, subject to equity incentive plans that are unreserved and available for future issuance, assuming implementation of a Reverse Split of 1-for-1,000 shares of Common Stock (the maximum reverse exchange ratio in the range to be authorized), followed immediately by a Forward Split of 50-for-1 (the maximum forward exchange ratio to be authorized). The table is based on 25,895,424 shares of our Common Stock outstanding as of August 5, 2013 without accounting for fractional shares which will be cashed out in the manner described above under the heading entitled “Payment for Fractional Shares”.

|

| Common Stock Authorized |

|

|

|

| Reverse Split Ratio |

|

|

| Forward Split Ratio |

|

|

| 60,000,000 |

|

|

|

| 1-for-1,000 |

|

|

| 50-for-1 |

|

|

|

|

|

|

|

|

|

|

| |||

|

| Number of Shares Prior |

|

| Number of Shares |

|

| Number of Shares |

| |||

|

|

|

|

|

|

|

|

|

|

|

|

|

Issued and Outstanding |

| 25,895,424 |

|

|

|

| 25,729 |

|

|

| 1,286,450 |

|

Authorized, Reserved and Available for Future Issuance under our Equity Compensation Plans |

| 5,020,000 |

|

|

|

| 5,020 |

|

|

| 251,000 |

|

Authorized, Reserved and Available for Future Issuance under Warrants |

| 11,190,000 |

|

|

|

| 11,190 |

|

|

| 559,500 |

|

Authorized Unreserved and Available for Future Issuance |

| 17,894,576 |

| (1) |

|

| 18,061 | (1) |

|

| 903,050 | (1) |

|

|

Effects on Ownership by Individual Stockholders

If we implement the Reverse/Forward Split, the Reverse Split and Forward Split will take effect nearly simultaneously and in the same ratio for all outstanding shares and treasury shares of our Common Stock. The Reverse/Forward Split will affect all holders of shares and treasury shares of our Common Stock uniformly and will not affect any stockholder’s percentage ownership interest in us, except to the extent that stockholders are Cashed Out Shareholders or will otherwise hold fractional shares following the Reverse/Forward Split. As described above under the heading entitled “Payment for Fractional Shares,” Cashed Out Shareholders and stockholders that would otherwise receive fractional shares following the Reverse/Forward Split will be entitled to a cash payment in lieu of such fractional shares held by such stockholders following the Reverse/Forward Split. The cash payments will reduce the number of post-Reverse/Forward Split holders of our Common Stock to the extent there are stockholders who would otherwise receive less than one share of Common Stock after the Reverse/Forward Split. In addition, the Reverse/Forward Split will not affect any remaining stockholder’s proportionate voting power (subject to the treatment of fractional shares).

Options, Benefit Plans, Warrants and Other Securities

If the Reverse/Forward Split is implemented, outstanding and unexercised options, all warrants and other securities convertible into, or exercisable or exchangeable for, shares of the Company’s Common Stock would be automatically converted into an economically equivalent option, warrant or other security to purchase shares of the Common Stock by decreasing the number of shares underlying the option, warrant or other security and increasing the exercise price appropriately.

Rights and Preferences of Shares of Common Stock

With the exception of the number of shares issued and outstanding, the rights and preferences of shareholders who continue to hold outstanding shares of the Company’s Common Stock prior and subsequent to the Reverse/Forward Split would remain the same. Holders of the Company’s Common Stock would continue to have no preemptive rights. Following the Reverse/Forward Split, each full share of the Company’s Common Stock resulting from the Reverse/Forward Split will entitle the holder thereof to one vote per share and would otherwise be identical to the shares of the Company’s Common Stock held by such holder immediately prior to the Reverse/Forward Split. Each share of our Common Stock issued pursuant to the Reverse/Forward Split would be fully paid and nonassessable.

Certain Federal Income Tax Consequences

The following is a summary of certain material federal income tax consequences of the Reverse/Forward Split; however, this does not purport to be a complete discussion of all of the possible federal income tax consequences of the Reverse/Forward Split. It does not discuss any state, local, foreign or minimum income or other U.S. federal tax consequences. Also, it does not address the tax consequences to shareholders who are subject to special tax rules, such as banks, insurance companies, regulated investment companies, personal holding companies, foreign entities, nonresident alien individuals, partnerships, broker-dealers, tax-exempt entities and shareholders who hold Common Stock as part of a position in a straddle or as part of a hedging, conversion or integrated transaction. This discussion is based on the provisions of the U.S. federal income tax law as of the date hereof, which is subject to change retroactively as well as prospectively. This summary also assumes that the pre-Reverse/Forward Split shares were, and the post-Reverse/Forward Split shares will be, held as “capital assets,” as defined in the Internal Revenue Code of 1986, as amended (the “Code”) (generally, property held for investment). Tax treatment may vary depending upon particular facts and circumstances.

Accordingly, shareholders should consult with their own tax advisors concerning the particular U.S. federal tax consequences of the Reverse/Forward Split, as well as any consequences arising under state, local or foreign law.

Each shareholder should recognize no gain or loss upon the exchange of pre-Reverse/Forward Split shares for post-Reverse/Forward Split shares pursuant to the Reverse/Forward Split (except to the extent of any cash received in lieu of a fraction of a post-Reverse/Forward Split share). Cash payments in lieu of a fractional post-Reverse/Forward Split share should generally be treated as if the fractional share were issued and then redeemed for cash. Each shareholder should then recognize capital gain or loss equal to the difference, if any, between the amount of cash received and the basis in the fractional share.

The aggregate tax basis of the post-Reverse/Forward Split shares received in the Reverse/Forward Split (including any fraction of a post-Reverse/Forward Split share cashed out as part of the Reverse/Forward Split) will be the same as the aggregate tax basis in the pre-Reverse/Forward Split shares exchanged. The holding period for the post-Reverse/Forward Split shares will include the period during which the pre-Reverse/Forward Split shares surrendered in the Reverse/Forward Split were held.

The Company believes that the Reverse/Forward Split will qualify as a “recapitalization” under Section 368(a)(1)(E) of the Code. As a result, the Company will not recognize any gain or loss as a result of the Reverse/Forward Split.

To ensure compliance with Treasury Department Circular 230, each holder of Common Stock is hereby notified that: (a) any discussion of U.S. federal tax issues in this proxy statement is not intended or written to be used, and cannot be used, by such holder for the purpose of avoiding penalties that may be imposed on such holder under the Code; (b) any such discussion has been included by the Company in furtherance of the Reverse/Forward Split on the terms described herein; and (c) each such holder should seek advice based on its particular circumstances from an independent tax advisor.

Information returns may be required to be filed with the IRS in connection with cash payments with respect to fractional shares. If so, unless the shareholder establishes an exemption from information reporting, a shareholder will be subject to U.S. backup withholding on these payments if the shareholder fails to provide its taxpayer identification number to the Exchange Agent or to establish an exemption from backup withholding. The amount of any backup withholding will be allowed as a credit against the shareholder’s U.S. federal income tax liability.

NOL Implications

The Company has experienced substantial operating and capital losses in previous years. Under the Code and the Treasury Department regulations thereunder, the Company may “carry forward” these losses in certain circumstances to offset current and future earnings and thus reduce its federal income tax liability, subject to certain requirements and restrictions. Assuming that the Company has future earnings, the Company may be able to realize the benefits of a substantial amount of net operating loss carryforwards (“NOLs”) and capital loss carryforwards and the Company believes these NOLs and capital loss carryforwards constitute a substantial asset to the Company. If the Company experiences an “ownership change,” as defined in Section 382 of the Code, its ability to use the NOLs and capital loss carryforwards could be substantially limited or lost altogether.

As a result of the cancellation of the shares of Common Stock held by the Cashed Out Shareholders that will likely occur as a result of the Reverse/Forward Split, each of the Continuing Shareholders will experience an increase in their proportionate interest in the Common Stock. However, the Reverse/Forward Split is not expected to trigger an “ownership change” as defined in Section 382 of the Code and, therefore, is not expected to adversely impact the Company’s ability to utilize its NOLs.

Appraisal Rights

No appraisal rights are available under the Delaware General Corporation Law or under the Company’s Amended and Restated Certificate of Incorporation or Amended and Restated Bylaws to any shareholder who dissents from the proposal to approve the amendments to the Company’s Amended and Restated Certificate of Incorporation to effect the Reverse/Forward Split.

Vote Required

The adoption of the amendments to our Amended and Restated Certificate of Incorporation granting our Board the discretion to effect a reverse stock split followed by a forward stock split as set forth in Proposal No. 3(a) requires the affirmative vote of a majority of Common Stock of the Corporation outstanding. If the adoption of the amendments to our Amended and Restated Certificate of Incorporation granting our Board the discretion to effect a reverse stock split followed by a forward stock split is not approved by the affirmative note of a majority of the outstanding Common Stock of the Corporation cast at the Meeting, then this Proposal No. 3(a) will not pass. If you hold your shares in your own name and indicate that you wish to abstain from voting on this matter, your shares will be counted as present for purposes of determining the presence of a quorum and your abstention will have the same effect as a vote “against” this Proposal No. 3(a). If you hold your shares through a broker and you do not instruct the broker on how to vote on this Proposal No. 3(a), your broker will not have the authority to vote your shares. Broker non-votes will be counted as present for purposes of determining the presence of a quorum and will have the same effect as a vote “against” this Proposal No. 3(a).

THE BOARD RECOMMENDS A VOTE “FOR” THE APPROVAL OF

THE PROPOSED AMENDMENTS TO OUR AMENDED AND RESTATED CERTIFICATE OF INCORPORATION, GRANTING OUR BOARD THE DISCRETION TO EFFECT THE REVERSE/FORWARD SPLIT OF THE COMPANY’S OUTSTANDING AND TREASURY SHARES OF COMMON STOCK DESCRIBED IN THIS PROPOSAL NO. 3(A).

IT IS INTENDED THAT PROXIES SOLICITED HEREBYWILL BE VOTED “FOR” SUCH GRANT UNLESS THESTOCKHOLDER SPECIFIES OTHERWISE.

Proposal No. 3(b) — Proposed Reduction in Common Stock

IMPLEMENTATION OF THIS PROPOSAL NO. 3(B) IS CONDITIONED UPON THE APPROVAL OF PROPOSAL NO. 3(A); IF PROPOSAL NO. 3(A) IS NOT APPROVED,

THEN THIS PROPOSAL NO. 3(B) WILL NOT BE IMPLEMENTED

Purposes for the Proposed Reduction in Common Stock

In addition to the Reverse/Forward Split, the Company is asking for shareholder approval to amend the existing provision of the Amended and Restated Certificate of Incorporation relating to the Company’s authorized capital. Specifically, the provision in Article Fourth of the Amended and Restated Certificate of Incorporation relating to the Company’s authorized capital would be amended to read in all material respects as provided in Attachment D, effectively reducing the authorized number of shares of the Company’s Common Stock from 60,000,000 to 10,000,000.

The principal purpose of the Reduction in Common Stock is to prevent any significant increase in the Company’s Delaware franchise tax liability that would occur in the event the Reverse/Forward Split is implemented and the number of authorized shares is not reduced. It is expected that the Reduction in Common Stock would keep the Company’s Delaware franchise tax liability at or below current levels. The Reduction in Common Stock would also reduce the potential for substantial dilution to the shareholders as a result of the change in the Company’s capital structure after implementation of the Reverse/Forward Split.

Principal Effects of the Reduction in Common Stock

If the shareholders approve the proposal to authorize the Board to implement the Reduction in Common Stock and the Board decides to implement the Reduction in Common Stock, then the Reduction in Common Stock would take effect on the date that we subsequently file the Certificate of Amendment to our Amended and Restated Certificate of Incorporation with the Secretary of State of the State of Delaware, the form of which is attached hereto as Attachment D, or on any later date that we may specify in such Certificate of Amendment. The par value of our Common Stock at $0.001 per share would remain unchanged. The immediate effect of a Reduction in Common Stock would be to reduce the number of our authorized shares of Common Stock.

Discretion of Board to Implement the Reduction in Common Stock

The Board has retained for itself the absolute authority to reject (and not implement) the Reduction in Common Stock (even after approval by the shareholders) if it subsequently determines that the Reduction in Common Stock, for any reason, is not then in the Company’s and its shareholders’ best interests. Such reasons include any change in the nature of the Company’s shareholdings prior to the Effective Date. In addition, to the extent that Proposal No. 3(a) is not approved, then this Proposal No. 3(b) to reduce the authorized capital stock will not be implemented.

Vote Required

The adoption of the amendment to our Amended and Restated Certificate of Incorporation granting our Board the discretion to reduce the Company’s authorized Common Stock as set forth in Proposal No. 3(b) requires the affirmative vote of a majority of Common Stock of the Corporation outstanding. If the adoption of the amendment to our Amended and Restated Certificate of Incorporation granting our Board the discretion to reduce the Company’s authorized Common Stock is not approved by the affirmative note of a majority of the outstanding Common Stock of the Corporation cast at the Meeting, then this Proposal No. 3(b) will not pass. If you hold your shares in your own name and indicate that you wish to abstain from voting on this matter, your shares will be counted as present for purposes of determining the presence of a quorum and your abstention will have the same effect as a vote “against” this Proposal No. 3(b). If you hold your shares through a broker and you do not instruct the broker on how to vote on this Proposal No. 3(b), your broker will not have the authority to vote your shares. Broker non-votes will be counted as present for purposes of determining the presence of a quorum and will have the same effect as a vote “against” this Proposal No. 3(b). Notwithstanding the foregoing, implementation of this Proposal No. 3(b) is conditioned upon the approval of Proposal No. 3(a); if Proposal No. 3(a) is not approved, then this Proposal No. 3(b) will not be implemented.

THE BOARD RECOMMENDS A VOTE “FOR” THE APPROVAL OF

THE PROPOSED AMENDMENT TO OUR AMENDED AND RESTATED CERTIFICATE OF INCORPORATION, GRANTING OUR BOARD THE DISCRETION TO REDUCE THE COMPANY’S AUTHORIZED COMMON STOCK DESCRIBED IN THIS PROPOSAL NO. 3(B); IMPLEMENTATION OF THIS PROPOSAL NO. 3(B) IS CONDITIONED UPON THE APPROVAL OF PROPOSAL NO. 3(A); IF PROPOSAL NO. 3(A) IS NOT APPROVED, THEN THIS PROPOSAL NO. 3(B) WILL NOT BE IMPLEMENTED.

IT IS INTENDED THAT PROXIES SOLICITED HEREBYWILL BE VOTED “FOR” SUCH GRANT UNLESS THESTOCKHOLDER SPECIFIES OTHERWISE.

ELECTION OF DIRECTORS

Proposal Nos. 4(a)1(a), 4(b)1(b), 1(c), 1(d) and 4(c)1(e) (Items 4(a)1(a), 4(b)1(b), 1(c), 1(d) and 4(c)1(e) on Proxy Card)

The Board of Directors of Trans-Lux Corporation is divided into three classes with the term of office of one of the three classes of directors expiring each year and with each class being elected for a three-year term. The Bylaws of the Corporation allow for the Board of Directors to consist of a minimum of five and a maximum of fifteen members. The Company did not hold an annual meeting in 2014. If elected at the Annual Meeting of Stockholders to be held on October 2, 2013,June 29, 2015, (a) the directors listed under Class BA below will serve until the Annual Meeting of Stockholders in 2016,2017, or until his successor is duly elected and qualified, (b) the directors listed under Class C below will serve until the Annual Meeting of Stockholders in 2018, or heruntil his successor is duly elected and qualified, and (c) the directors listed under Classes A and CClass B below will continue to serve the terms to which they were elected until the Annual Meeting of Stockholders in 2014 or 2015,2016, respectively, or until their successors are duly elected and qualified. If elected at the 2013 Annual Meeting of Stockholders, Alberto Shaio will be a Class C director and he and Salvatore J. Zizza, the other Class C director, will serve until the Annual Meeting of Stockholders in 2015, or until their successors are duly elected and qualified.

Management has no reason to believe that the directors will not be available or will not serve if elected, but if any director should not become available to serve, full discretion is reserved to the persons named as proxies to vote for such other persons as may be nominated. Proxies will be voted “FOR” the nominee unless the stockholder specifies otherwise.

Directors and Nominees Standing for Election

Name | Age | Since | Expiration of Proposed Term | Age | Since | Expiration of Proposed Term |

CLASS B |

| |||||

Jean Firstenberg | 77 | 1989 | 2016 | |||

Alan K. Greene | 73 | N/A | 2016 | |||

|

| |||||

CLASS A |

| |||||

Jean-Marc (J.M.) Allain | 45 | 2011 | 2017 | |||

Marco Elser | 56 | 2012 | 2017 | |||

George W. Schiele | 83 | 2009 | 2017 | |||

CLASS C |

|

| ||||

Alberto Shaio | 65 | N/A | 2015 | 66 | 2013 | 2018 |

Salvatore J. Zizza | 69 | 2009 | 2018 | |||

Directors Whose Term Continues

Name | Age | Since | Expiration of Term |

CLASS C |

|

|

|

Salvatore J. Zizza | 67 | 2009 | 2015 |

|

|

|

|

CLASS A |

|

|

|

Jean-Marc (J.M.) Allain | 43 | 2011 | 2014 |

George W. Schiele | 81 | 2009 | 2014 |

Marco Elser | 54 | 2012 | 2014 |

Name | Age | Since | Expiration of Term |

CLASS B |

|

|

|

Alan K. Greene | 75 | 2013 | 2016 |

Yaozhong Shi | 46 | 2014 | 2016 |

Directors Whose Terms Expire at the 2013 Annual Meeting and Are Not Standing for Election

Name | Age | Since | Expiration of Term |

Richard Nummi | 53 | 2012 | 2013 |

Elliot Sloyer | 48 | 2012 | 2013 |

Set forth below is a summary of the business experience for each of the persons named above and the primary aspects of their experience, qualifications, attributes or skills that led to the conclusion that each individual is qualified to serve on the Board. The members of the Nominating Committee recommended to the Board that each of the directors listed below serve as members of the Board of Directors.

DIRECTOR AND NOMINEEDIRECTORS STANDING FOR ELECTION –

CLASS B: Three-YearA: Serving a Two-Year Term Expiring 20162017

Jean FirstenbergJ.M. Allain became the President and CEO of Trans-Lux Corporation on February 16, 2010 and has served as a director since 1989. Ms. Firstenberg has been retired since 2007. Before her retirement sheJune 2011. Mr. Allain served from 1980 to 2007 as President and CEO of the American Film Institute (AFI). During her 27 years at the AFI she built it into a national organization with an acclaimed exhibition and cultural center in the Metropolitan Washington DC area, two major film festivals, an accredited film Conservatory ranked #1 in the world and the leading authority on America’s film heritage. She has served on the Trans-Lux board since 1989 and currently serves as the chair of the Compensation Committee. She was named in 2002 to the Citizen Stamp Advisory Committee by the Postmaster General of the US to recommend stamp subjects and images and was named chair in 2006. She was elected to the Women’s Sports Foundation in 2007 and was namedPanasonic Solutions Company from July 2008 through October 2009; Vice President of Duos Technologies from August 2007 through June 2008; General Manager of Netversant Solutions from October 2004 through June 2005; and Vice President of Adesta, LLC from May 2002 through September 2004. Mr. Allain has familiarity with the Governance Committeeoperational requirements of complex organizations and has served on the Executive Committee since 2010. Ms. Firstenberg’s more than twenty years of experience as a director of the Corporationdealing with reorganizations and her prior role as Chair of the Audit Committee gives her aturnarounds. Mr. Allain’s experience and deep understanding of the operations of the Corporation and allow herhim to make valuable contributions to the Board.

Alan K. Greene Marco M. Elserhas served as a director of Trans-Lux Corporation since May 25, 2012. For over five years, Mr. Elser has been a partner with AdviCorp Plc, a London-based investment banking firm. Mr. Elser also serves on the Board of Directors of Protalex, a Florham Park, NY based biotechnology company, since 2014. He is a also one of the independent directors of North Hills Signal Processing Corporation, a Long Island, NY based technology company. Mr. Elser previously served as International Vice President of Northeast Securities, managing distressed funds for family offices and small institutions from 1994 to 2001; he served as a Partnerfirst Vice President of Price Waterhouse from 1974 to 1995, acting at various times as Managing Partner for cross border transactionsMerrill Lynch Capital Markets in Rome and as National Director of tax services for M&A, and in connection with foreign banks and mutual funds with respect to acquisition and investment strategies. Currently,London until 1994. Mr. Greene serves on the board of directors of Intellicorp, Inc. (since 2001), RAVE, Inc. (since 2005), Enduro Medical Technologies LLC (since 2005), Greene Rees Technologies, LLC (since 1995), and Connecticut Innovations, Inc. (from 2005), serving as its vice chairman. Previously, heElser was a directorformerly Chairman of the Connecticut Clean Energy Fund from 2007 until June, 2011,Board of Pine Brook Capital, a Shelton, CT based engineering company and Metromedia International Group, Inc. from 2007 until February, 2011. Mr. Greene has also held prior board positions at Fortistar Capital, Oswego Hydro, Access Shipping and various other public and private companies through thehad served in that role for over five years. Mr. Greene’s experience serving as chairmanElser was also the president of various audit committeesthe Harvard Club of manyItaly until 2014, an association he founded in 2002 with other Alumni in Italy where he has been living since 1984. He received his BA in Economics from Harvard College in 1981. Mr. Elser’s extensive knowledge of these organizationsinternational finance and strong aptitude for technologies will enablecommerce allows him to providemake valuable contributions to the Board.

George W. Schiele has served as a director of Trans-Lux Corporation since 2009. Mr. Schiele was elected Chairman of the Board (a non-executive position) of Trans-Lux Corporation on September 29, 2010. Mr. Schiele currently serves as President of George W. Schiele, Inc., a trust management and private investment company and has held such position since 1974. He is also President of four other private companies since 1999, 2005, 2006 and 2009, respectively; from 2003 until 2013 he was a Director of Connecticut Innovations, Inc., one of the nation’s five most active venture capital firms, and was Chairman of its Investment Advisory and Investment Committees from 2004 until 2013, responsible during his tenure for more than 200 VC investments. Mr. Schiele additionally serves as Trustee of seven private trusts since 1974, 1999, 2007, 2009, 2010, 2011 and 2012, respectively, serving as President of one since 2000, and as an Officer and Director of two others. Mr. Schiele also serves as a Trustee to various other private charitable foundations since 2006, as the Managing Partner of two private investment partnerships since 2008, and as a Director and Executive Board member of The Yankee Institute since 2000. Mr. Schiele was initially elected in accordance with a Settlement Agreement approved by the United States District Court for the Southern District of New York described in the Corporation’s proxy statement for the December 11, 2009 Annual Meeting of Stockholders and re-elected by the shareholders at the 2010/2011 Annual Meeting of Stockholders. Mr. Schiele’s long experience in previous start-ups and corporate restructurings and his service to other boards of directors allow him to make valuable contributions to the Board.

NOMINEEDIRECTORS STANDING FOR ELECTION –

CLASS C: Two-YearServing a Three-Year Term Expiring 20152018