We will announce preliminary voting results at the Special Meeting. We expect to publish final voting results in a Current Report on Form 8-K filed with the Securities and Exchange Commission (“SEC”)

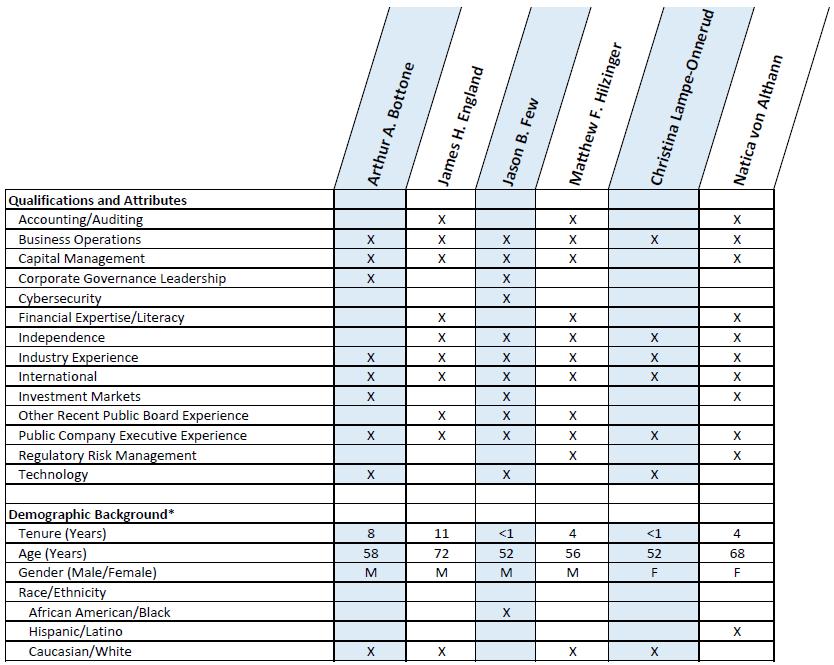

and the Nasdaq Stock Market, including Nasdaq Rule 5605(a)(2): James H. England, Jason B. Few, Matthew F. Hilzinger, Christina Lampe-Onnerud, and Natica von Althann. The Board has also determined that John A. Rolls, who served on the Board through fiscal 2018 but has elected to retire from the Board and is not standing for re-election at the Annual Meeting, is an independent Director in accordance with the director independence standards of the SEC and the Nasdaq Stock Market, including Nasdaq Rule 5605(a)(2). Christopher S. Sotos, who served as a member of the Board during fiscal 2018 and has elected not to stand for re-election at the Annual Meeting, is not an independent Director under the director independence standards of the SEC and the Nasdaq Stock Market. Finally, the Board previously determined that Secretary Togo Dennis West, Jr., who served on the Board during early fiscal 2018, was an independent Director in accordance with the director independence standards of the SEC and the Nasdaq Stock Market, including Nasdaq Rule 5605(a)(2).The Board and its committees meet regularly to review and discuss the Company’s progress, strategy and business. The Board meets regularly with management and outside advisors. The independent Directors also hold regular executive sessions without Mr. Bottone or other members of management. Board members are also kept apprised of Company progress and issues that arise between Board meetings.

All Directors serving at the time of the Company’s 2018 Annual Meeting were in attendance at the meeting, with the exception of Mr. England, who attended the Board meeting on the same day, but not the 2018 Annual Meeting. Regular attendance at Board meetings and annual stockholder meetings by each Board member is expected. The Board held 10 meetings in fiscal 2018. Each Director serving during fiscal 2018 attended more than 75% of the total number of Board and, if a Director served on a committee, committee meetings held during fiscal 2018.

BOARD COMMITTEES

The Board has four standing committees: the Audit and Finance Committee, the Compensation Committee, the Executive Committee and the Nominating and Corporate Governance Committee. These committees assist the Board in performing its responsibilities and making informed decisions.

The table below identifies the current members of these four standing committees:

| Director | Audit and

Finance | Compensation | Executive | Nominating

and Corporate

Governance |

| Arthur A. Bottone | | |  | |

| James H. England (Chairman of the Board) |  | |  | |

| Jason B. Few |  |  | | |

| Matthew F. Hilzinger |  |  | |  |

| Christina Lampe-Onnerud | |  | |  |

| John A. Rolls(1) | |  |  |  |

| Christopher S. Sotos(2) | | | | |

| Natica von Althann |  | | |  |

(1)Mr. Rolls has elected to retire from the Board and is therefore not standing for re-election to the Board at the Annual Meeting.

(2) Mr. Sotos is a non-independent Director and therefore does not serve on any standing committees. Mr. Sotos has elected not to stand for re-election to the Board at the Annual Meeting.

The Board believes it is more effective for the Board, as a whole, to monitor and oversee the Company’s government affairs strategy and initiatives, including federal and state legislative and regulatory proceedings, in addition to monitoring the Company’s ongoing relations with government agencies.

FUELCELLENERGY, INC.| PROXY STATEMENT 15 |

Audit and Finance Committee ■Current Members: Matthew F. Hilzinger, James H. England, Jason B. Few and Natica von Althann Current Chair: Matthew F. Hilzinger Our Committee structure changed on November 8, 2018 with the election of Mr. Few and Dr. Lampe-Onnerud as Directors. The members of the Audit and Finance Committee in fiscal 2018 were James H. England, Matthew F. Hilzinger, John A. Rolls, and Natica von Althann. Mr. Hilzinger was Chair of the Audit and Finance Committee throughout fiscal 2018. Each of the current and fiscal 2018 Audit and Finance Committee members satisfies the definition of independent director and is financially literate under the applicable Nasdaq and SEC rules. In accordance with Section 407 of the Sarbanes-Oxley Act of 2002, the Board has designated Mr. Hilzinger and Mr. England as the Audit and Finance Committee’s “Audit Committee Financial Experts.” The Audit and Finance Committee represents and provides assistance to the Board with respect to matters involving the accounting, auditing, financial reporting, internal controls, and legal compliance functions of the Company and its subsidiaries, including assisting the Board in its oversight of the integrity of the Company’s financial statements, compliance with legal and regulatory requirements, the qualifications, independence, and performance of the Company’s independent auditors, the performance of the Company’s service firm used to assist management in its assessment of internal controls, and effectiveness of the Company’s financial risk management. The Audit and Finance Committee routinely holds executive sessions with the Company’s independent registered public accounting firm without the presence of management. Responsibilities of the Audit and Finance Committee include: ■ Overseeing management’s conduct of the Company’s financial reporting process, including reviewing the financial reports and other financial information provided by the Company, and reviewing the Company’s systems of internal accounting and financial controls; ■ Overseeing the Company’s independent auditors’ qualifications and independence and the audit and non-audit services provided to the Company; ■ Overseeing the performance of the Company’s independent auditors as well as parties engaged to assist the Company with its assessment of internal controls; ■ Reviewing potential financing proposals and referring them to the Board as necessary; and ■ Overseeing the Company’s analysis and mitigation strategies for enterprise risk (reporting any findings to the Board as necessary). The Audit and Finance Committee held 10 meetings during fiscal 2018. The complete Audit and Finance Committee charter can be found in the Corporate Governance sub-section of the section entitled “Investors” on our website atwww.fuelcellenergy.com. The Audit and Finance Committee’s report appears on page 44 of this Proxy Statement. |

Compensation Committee ■Current Members: Jason B. Few, Matthew F. Hilzinger, Christina Lampe-Onnerud and John A. Rolls Current Chair: Matthew F. Hilzinger Our Committee structure changed on November 8, 2018 with the election of Mr. Few and Dr. Lampe-Onnerud as Directors. The members of the Compensation Committee in fiscal 2018 were James H. England, Matthew F. Hilzinger, Togo D. West, Jr., and Natica von Althann. Mr. England was Chair of the Compensation Committee throughout fiscal 2018, prior to his election as Chairman of the Board. Each of the current and fiscal 2018 Compensation Committee members is an independent Director under applicable Nasdaq and SEC rules, and the Compensation Committee is governed by a Board-approved charter stating its responsibilities. Members of the Compensation Committee are appointed by the Board. The Compensation Committee is responsible for reviewing and approving the compensation plans, policies and programs of the Company to compensate the officers and Directors in a reasonable and cost-effective manner. The Compensation Committee’s overall objectives are to ensure the attraction and retention of superior talent, to motivate the performance of the executive officers in the achievement of the Company’s business objectives and to align the interests of the officers and Directors with the long-term interests of the Company’s stockholders. To that end, it is the responsibility of the Compensation Committee to develop, approve and periodically review a general compensation policy and salary structure for executive officers of the Company, which considers business and financial objectives, industry and market pay practices and/or such other information as may be deemed appropriate. |

FUELCELLENERGY, INC.| PROXY STATEMENT 16 |

Responsibilities of the Compensation Committee include: ■ Reviewing and recommending for approval by the independent Directors of the Board the compensation (salary, bonus and other incentive compensation) of the Chief Executive Officer of the Company; ■ Reviewing and approving the compensation (salary, bonus and other incentive compensation) of the other executive officers of the Company; ■ Reviewing and approving milestones and strategic initiatives relevant to the compensation of executive officers of the Company and evaluating performance in light of those goals and objectives; ■ Reviewing and approving all employment, retention and severance agreements for executive officers of the Company; and ■ Reviewing the management succession program for the Chief Executive Officer, the NEOs and selected executives of the Company. The Compensation Committee acts on behalf of the Board in administering compensation plans approved by the Board in a manner consistent with the terms of such plans (including, as applicable, the granting of stock options, restricted stock, stock units and other awards, the review of performance goals established before the start of the relevant plan year, and the determination of performance compared to the goals at the end of the plan year). The Committee reviews and makes recommendations to the Board with respect to new compensation incentive plans and equity-based plans; reviews and recommends the compensation (annual retainer, committee fees and other compensation) of the Directors to the full Board for approval; and reviews and makes recommendations to the Board on changes in major benefit programs of the Company. Compensation Committee agendas are established in consultation with the committee chair. The Compensation Committee meets in executive session at each Committee meeting. The Compensation Committee held 7 meetings during fiscal 2018. The complete Compensation Committee charter can be found in the Corporate Governance sub-section of the section entitled “Investors” on our website atwww.fuelcellenergy.com. The Compensation Committee’s report appears on page 21 of this Proxy Statement. |

Executive Committee ■Current Members: Arthur A. Bottone, James H. England and John A. Rolls Current Chair: Arthur A. Bottone During the intervals between Board meetings, the Executive Committee has and may exercise all the powers of the Board in the management of the business and affairs of the Company, in such manner as the Committee deems in the best interests of the Company, in all cases in which specific instructions have not been given by the Board. Mr. England and Mr. Rolls are independent directors under applicable Nasdaq rules. The current members of the Executive Committee were also members of the Executive Committee in fiscal 2018. Togo D. West was also a member of the Executive Committee in fiscal 2018. |

Nominating and Corporate Governance Committee ■Current Members: Natica von Althann, Matthew F. Hilzinger, John A. Rolls and Christina Lampe-Onnnerud Current Chair: Natica von Althann Our Committee structure changed on November 8, 2018 with the election of Mr. Few and Dr. Lampe-Onnerud as Directors. The members of the Nominating and Corporate Governance Committee in fiscal 2018 were Matthew F. Hilzinger, John A. Rolls and Natica von Althann. Ms. von Althann was Chair of the Compensation Committee throughout fiscal 2018. The current and fiscal 2018 members of the Nominating and Corporate Governance Committee are all independent directors under applicable Nasdaq rules. Members of the Nominating and Corporate Governance Committee are appointed by the Board. Responsibilities of the Nominating and Corporate Governance Committee include: ■ Identifying individuals qualified to become members of the Board and recommending the persons to be nominated by the Board for election as Directors at the annual meeting of stockholders or elected as Directors to fill vacancies; ■ Reviewing the Company’s corporate governance principles, assessing and recommending to the Board any changes deemed appropriate; ■ Periodically reviewing, discussing and assessing the performance of the Board and the committees of the Board; |

FUELCELLENERGY, INC.| PROXY STATEMENT 17 |

■ Reviewing the Board’s committee structure and making recommendations to the full Board concerning the number and responsibilities of Board committees and committee assignments; and ■ Periodically reviewing and reporting to the Board any questions of possible conflicts of interest or related party transactions involving Board members or members of senior management of the Company. The Nominating and Corporate Governance Committee will consider nominees for the Board recommended by stockholders. Nominations by stockholders must be in writing, and must include the full name of the proposed nominee, a brief description of the proposed nominee’s business experience for at least the previous five years, and a representation that the nominating stockholder is a beneficial or record owner of the Company’s common stock. Any such submission must also be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as Director if elected. All recommendations for nomination received by the Corporate Secretary that satisfy our amended and restated by-law requirements relating to such Director nominations will be presented to the Nominating and Corporate Governance Committee for its consideration. Stockholders must also satisfy the notification, timeliness, consent and information requirements set forth in our amended and restated by-laws. Nominations must be delivered to the Nominating and Corporate Governance Committee at the following address: Nominating and Corporate Governance Committee FuelCell Energy, Inc. Office of the Corporate Secretary 3 Great Pasture Road Danbury, CT 06810 The Nominating and Corporate Governance Committee weighs the characteristics, experience, independence and skills of potential candidates for election to the Board and recommends nominees for Director to the Board for election (without regard to whether a nominee has been recommended by stockholders). In considering candidates for the Board, the Nominating and Corporate Governance Committee also assesses the size, composition and combined expertise of the Board. As the application of these factors involves the exercise of judgment, the Nominating and Corporate Governance Committee does not have a standard set of fixed qualifications that is applicable to all Director candidates, although the Nominating and Corporate Governance Committee does at a minimum assess each candidate’s strength of character, mature judgment, industry knowledge or experience, ability to work collegially with the other members of the Board and ability to satisfy any applicable legal requirements or listing standards. The Nominating and Corporate Governance Committee is committed to actively seeking highly qualified individuals, and requires a diverse candidate pool, including individuals of diverse gender and ethnicity, from which Board nominees are selected. In identifying prospective Director candidates, the Nominating and Corporate Governance Committee may seek referrals from other members of the Board, management, stockholders and other sources. The Nominating and Corporate Governance Committee also may, but need not, retain a search firm in order to assist it in identifying candidates to serve as Directors of the Company. The Nominating and Corporate Governance Committee utilizes the same criteria for evaluating candidates regardless of the source of the referral. When considering Director candidates, the Nominating and Corporate Governance Committee seeks individuals with backgrounds and qualities that, when combined with those of our incumbent Directors, provide a blend of skills and experience to further enhance the Board’s effectiveness. In fiscal 2018, the Nominating and Corporate Governance Committee retained the services of Egon Zhender to assist it in identifying qualified candidates to serve on the Board and vetting those candidates in accordance with the qualifications and attributes sought by the Committee. Egon Zhender identified and proposed Jason B. Few and Christina Lampe-Onnerud, both of whom were elected to the Board in November 2018. In connection with its annual recommendation of a slate of Director nominees, the Nominating and Corporate Governance Committee may also assess the contributions of those Directors recommended for re-election in the context of the Board evaluation process and other perceived needs of the Board. The Nominating and Corporate Governance Committee held 6 meetings during fiscal 2018. The complete Nominating and Corporate Governance Committee charter, which includes the general criteria for nomination as a Director, can be found in the Corporate Governance subsection of the section entitled “Investors” on our website atwww.fuelcellenergy.com. |

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

No member of the Compensation Committee was an officer or employee of the Company during the fiscal year ended October 31, 2018. During the fiscal year ended October 31, 2018, none of our executive officers served as a member of the board of directors or compensation committee, or other committee serving an equivalent function, of any entity that has one or more executive officers who served as members of our Board of Directors or our Compensation Committee. During the fiscal year ended October 31, 2018, no member of the Compensation Committee other than Mr. James H. England had a relationship with the Company that required disclosure under Item 404 of Regulation S-K.

FUELCELLENERGY, INC.| PROXY STATEMENT 18 |

NASDAQ LISTING RULES – COMPENSATION COMMITTEE MEMBERS

Upon assessing the independence of the Compensation Committee members in accordance with the Nasdaq Listing Rules, the Board has determined that each Compensation Committee member satisfies the following independence criteria, in addition to qualifying as an independent director under Nasdaq Rule 5605(a)(2):

| ■ | No Compensation Committee member has received compensation from the Company for any consulting or advisory services nor has any Compensation Committee member received any other compensatory fees paid by the Company (other than Directors’ fees); and |

| ■ | No Compensation Committee member has an affiliate relationship with the Company, a subsidiary of the Company or an affiliate of a subsidiary of the Company. |

NASDAQ LISTING RULES – COMPENSATION COMMITTEE ADVISOR

Upon assessing the independence of, and any potential conflicts of interest of, the Company’s Compensation Advisor, Compensia, Inc. (the “Advisor”), in accordance with the Nasdaq Listing Rules, the Compensation Committee has determined that the Advisor satisfies the following independence criteria:

| ■ | The Advisor has not provided, in the last completed fiscal year ended October 31, 2018 or any subsequent interim period, any services to the Company or its affiliated companies, other than the Advisor’s work as a compensation advisor to the Company’s Compensation Committee; |

| ■ | Less than 1% of the Advisor’s total revenue was derived from fees paid by the Company in the last completed fiscal year ended October 31, 2018 and any subsequent interim period for work on behalf of the Company’s Compensation Committee; |

| ■ | The Advisor has implemented policies and procedures designed to prevent conflicts of interest; |

| ■ | Neither the Advisor nor any of its employees or their spouses has any business or personal relationships with any members of the Company’s Compensation Committee or any of the Company’s executive officers; |

| ■ | Neither the Advisor nor any of its employees or their immediate family members currently own any Company securities (other than through a mutual fund or similar externally-managed investment vehicle); and |

| ■ | The Advisor is unaware of any relationship not identified in the statements above that could create an actual or potential conflict of interest with the Company or its affiliated entities, any members of the Company’s Compensation Committee or any of the Company’s executive officers. |

FUELCELLENERGY, INC.| PROXY STATEMENT 19 |

BIOGRAPHIES OF EXECUTIVE OFFICERS WHO ARE NOT DIRECTORS

| MICHAEL S. BISHOP |

Age 51 | Mr. Bishop was appointed Senior Vice President, Chief Financial Officer, and Treasurer in June 2011. He has more than 20 years of experience in financial operations and management with public high growth technology companies with a focus on capital raising, project finance, debt/treasury management, investor relations, strategic planning, internal controls, and organizational development. Since joining the Company in 2003, Mr. Bishop has held a succession of financial leadership roles including Assistant Controller, Corporate Controller and Vice President and Controller. Prior to joining FuelCell Energy, Mr. Bishop held finance and accounting positions at TranSwitch Corporation, Cyberian Outpost, Inc. and United Technologies, Inc. He is a certified public accountant and began his professional career at McGladrey and Pullen, LLP. Mr. Bishop also served four years in the United States Marine Corps. Mr. Bishop received a Bachelor of Science in Accounting from Boston University in 1993 and a MBA from the University of Connecticut in 1999. PRINCIPAL OCCUPATION: ■ Senior Vice President, Chief Financial Officer and Treasurer |

| JENNIFER D. ARASIMOWICZ |

Age 47 | Ms. Arasimowicz was appointed Senior Vice President, General Counsel and Corporate Secretary in April 2017. In this position, Ms. Arasimowicz, a licensed attorney in Connecticut, New York and Massachusetts, is the chief legal officer and chief compliance officer of the Company, having responsibility for oversight of all of the Company’s legal and government affairs, and providing leadership in all aspects of the Company’s business, including compliance, corporate governance and board activities. Ms. Arasimowicz joined the Company in 2012 as Associate Counsel and was promoted to Vice President in 2014. Prior to joining the Company, Ms. Arasimowicz served as General Counsel of Total Energy Corporation, a New York based diversified energy products and services company providing a broad range of specialized services to utilities and industrial companies. Previously, Ms. Arasimowicz was a partner at Shipman & Goodwin, LLP in Hartford, Connecticut chairing the Utility Law Practice Group and began her legal career as an associate at Murtha Cullina, LLP. Ms. Arasimowicz earned her Juris Doctor at Boston University School of Law and holds a bachelor’s degree in English from Boston University. PRINCIPAL OCCUPATION: ■ Senior Vice President, General Counsel and Corporate Secretary |

| ANTHONY F. RAUSEO |

Age 59 | Mr. Rauseo was appointed Senior Vice President and Chief Operating Officer in July 2010. In this position, Mr. Rauseo has responsibility for closely integrating the manufacturing operations with the supply chain, product development and quality initiatives. Mr. Rauseo is an organizational leader with a strong record of achievement in product development, business development, manufacturing, operations, and customer support. Mr. Rauseo joined the Company in 2005 as Vice President of Engineering and Chief Engineer. Prior to joining the Company, Mr. Rauseo held a variety of key management positions in manufacturing, quality and engineering including five years with CiDRA Corporation. Prior to joining CiDRA, Mr. Rauseo was with Pratt and Whitney for 17 years where he held various leadership positions in product development, production and customer support of aircraft turbines. Mr. Rauseo received a Bachelor of Science in Mechanical Engineering from Rutgers University in 1983 and a Masters of Science in Mechanical Engineering from Rensselaer Polytechnic Institute in 1987. PRINCIPAL OCCUPATION: ■ Senior Vice President and Chief Operating Officer |

FUELCELLENERGY, INC.| PROXY STATEMENT 20 |

EXECUTIVECOMPENSATION

COMPENSATION COMMITTEE REPORT

The Compensation Committee has reviewed and discussed with management the Compensation Discussion and Analysis as set forth in this Proxy Statement. Based upon this review and discussion, the Compensation Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be incorporated by reference in the Company’s Annual Report on Form 10-K for its fiscal year ended October 31, 2018 and included in the Company’s 2019 Proxy Statement filed in connection with the Company’s 2019 Annual Meeting of Stockholders.

Respectfully submitted by the Compensation Committee of the Board of Directors.

Matthew F. Hilzinger (Chair)

Jason B. Few

Christina Lampe-Onnnerud

John A. Rolls

COMPENSATION DISCUSSION AND ANALYSIS

INTRODUCTION AND SUMMARY

This Compensation Discussion and Analysis describes the philosophy and objectives of the executive compensation program underlying the compensation which is reported in the executive compensation tables included in this Proxy Statement for the following executive officers (the “NEOs” or “named executive officers”):

| ARTHUR A. BOTTONE | President and Chief Executive Officer (the “CEO”); |

| |

| MICHAEL S. BISHOP | Senior Vice President, Chief Financial Officer and Treasurer (the “CFO”); |

| |

| JENNIFER D. ARASIMOWICZ | Senior Vice President, General Counsel and Corporate Secretary (the “GC”); and |

| |

| ANTHONY F. RAUSEO | Senior Vice President and Chief Operating Officer (the “COO”). |

The total compensation of each NEO is reported in the Fiscal 2018 Summary Compensation Table presented on page 31 of this Proxy Statement. The individuals identified above as our NEOs are all of our executive officers, which is why we only provide compensation-related disclosure with respect to our CEO, CFO and next two most highly compensated executive officers.

Our compensation program is intended to motivate and incentivize our NEOs to achieve our corporate objectives and increase stockholder value. The Compensation Committee continues to evaluate how best to structure our compensation programs to ensure that our executives are being appropriately and competitively compensated while also maintaining compensation levels commensurate with our business performance.

FUELCELLENERGY, INC.| PROXY STATEMENT 21 |

During fiscal 2018, we continued to progress toward sustainable profitability with the development of our generation portfolio. We recognize that there is still more work to be done in order to reach our full potential. Fiscal 2018 was focused on the continued advancement of our business plan. Despite challenging industry and market conditions, our executives capitalized on opportunities and achieved favorable results on a number of important business initiatives, including but not limited to:

■ Lobbying for the restoration of the federal investment tax credit for stationary fuel cells and expansion of the carbon sequestration credit;

■ Delivery, commissioning and operation of the 20 MW KOSPO project in Incheon, South Korea; and

■ Award of 22.2 MW of projects in the Connecticut Department of Energy and Environmental Protection competitive solicitation.

THE 2018 SAY-ON-PAY VOTE AND COMPENSATION HIGHLIGHTS

Our Compensation Committee pays close attention to the views of our stockholders when making determinations regarding executive compensation. At our 2018 Annual Meeting, only 65.57% of the votes cast on the advisory proposal regarding the compensation of our named executive officers were voted in favor of our 2018 executive compensation program. Although the stockholders approved the compensation program, we are concerned with the declining level of stockholder support for our executive compensation program. As we did with our corporate governance policies and practices, we undertook an evaluation of our executive compensation programs and practices to ensure that those programs and practices were, in fact, aligned with our business goals and the interests of our stockholders.

We believe that our continued efforts to grow our business, enhance liquidity, improve margins and grow revenue are positioning us to achieve sustainable profitability. Nevertheless, we understand stockholder discontent regarding our current stock price and financial performance. It is important to note that, although our NEOs delivered on a number of opportunities and strategic initiatives as outlined above, in light of our stock performance during the year, the Compensation Committee did not approve any cash bonuses for fiscal 2018.

As part of our review of our executive compensation program in fiscal 2018, we implemented a six-fold increase in our minimum stock ownership guidelines and made modifications to our peer group, both as discussed further below. The Compensation Committee is also considering additional ways to redesign some of the features of our executive compensation program for the future.

We are also endeavoring in this Proxy Statement to clarify certain elements of our executive compensation program so that our stockholders can better understand the reported versus realizable total compensation of our executives, how our current compensation program is structured, and why our compensation program is appropriate for our Company. In looking at these types of programs among our peer group companies (which are listed below under the heading “Competitive Positioning”), only 30% of our peer group companies grant performance-based shares, while 60% of our peer group companies grant restricted stock in line with the Company’s compensation program. The Compensation Committee hopes that our stockholders will consider these factors, as well as the positive momentum of our business and the attributes of our compensation program, when casting “say-on-pay” votes at the Annual Meeting.

The Compensation Committee will continue to consider the results of annual stockholder advisory votes on executive compensation in its ongoing evaluation of our programs and practices.

During fiscal 2018, we enhanced or maintained the following compensation-related governance policies and practices, including both policies and practices we have implemented to drive performance and policies and practices that either prohibit or minimize behaviors that we do not believe serve our stockholders’ long-term interests.

What We Do:

| ■ | Maintain an Independent Compensation Committee– Our Compensation Committee consists solely of independent directors who establish our compensation practices. |

| ■ | Retain an Independent Compensation Advisor– Our Compensation Committee has engaged its own compensation consultant to provide information, analysis, and other advice on executive compensation independent of management. |

| ■ | Annual Executive Compensation Review– At least once a year, our Board conducts a review of our compensation strategy. |

| ■ | Compensation At-Risk– Our executive compensation program is designed so that a significant portion of our NEO’s compensation is “at risk” based on corporate performance, to align the interests of our NEOs and stockholders. |

| ■ | Stock Ownership Guidelines– We maintain minimum stock ownership guidelines and stock holding requirements applicable to the NEOs and the non-employee independent members of our Board. In December 2018, our Board approved a six-fold increase in the ownership guidelines; and, as of October 31, 2018, each of the NEOs satisfied the requirements of the minimum stock ownership policy. |

| ■ | Compensation Recovery (“Clawback”) Policy– We maintain an Executive Compensation Recovery Policy that enables our Board to seek recovery of any erroneously paid incentive compensation received by any current or former executive officer of the Company (who was actively employed as an executive officer of the Company on or after December 18, 2014, the date this policy was first adopted) in the event of an accounting restatement. |

FUELCELLENERGY, INC.| PROXY STATEMENT 22 |

| ■ | Conduct an Annual Stockholder Advisory Vote on NEO Compensation– We conduct an annual stockholder advisory vote on the compensation of our NEOs. Our Board considers the results of this advisory vote during the course of its deliberations on NEO compensation. |

| ■ | Compensation-Related Risk Assessment– We conduct regular risk assessments of our compensation programs and practices. |

| ■ | “Double-Trigger” Change in Control Arrangements– We have established “double-trigger” change-in-control severance agreements with each of the NEOs, with a payment equal to two times base salary plus the average of the bonuses paid since the effective date of his employment agreement (for Mr. Bottone) and payments of one times base salary plus the average of the bonuses paid since their appointment as executive officers of the Company (for Messrs. Bishop and Rauseo and Ms. Arasimowicz). |

What We Do Not Do:

| ■ | No Guaranteed Bonuses – We do not provide guaranteed bonuses to our NEOs. |

| ■ | No Defined Benefit Retirement Plans– We do not currently offer, nor do we have plans to offer, defined benefit pension plans or any non-qualified deferred compensation plans or arrangements to our NEOs other than arrangements that are available generally to all employees. Our NEOs are eligible to participate in our 401(k) retirement plan on the same basis as our other employees. |

| ■ | Prohibition on Hedging and Pledging– We maintain a policy that prohibits our employees, including our NEOs and members of the Board, from hedging or pledging any Company securities. |

| ■ | No Perquisites or Tax Gross-Ups– We do not offer our NEOs any perquisites, executive class benefits, or tax “gross-ups.” |

| ■ | No Stock Option Re-pricing– We do not permit options to purchase shares of our common stock to be repriced to a lower exercise price without the approval of our stockholders. |

“REPORTED” VS. “REALIZABLE” SHARE-BASED COMPENSATION

Following the “say-on-pay” voting results at the 2018 Annual Meeting, we wanted to provide a clearer understanding of how our equity-based compensation as reported in our proxy statements compares to the value actually paid to our NEOs in subsequent years and how this compensation structure is designed to be performance-based. This is commonly referred to as “reported” versus “realizable” pay. Reported pay refers to the compensation value reported in the compensation tables required under Item 402 of Regulation S-K, which we calculate based on applicable SEC rules and guidance. Realizable pay refers to the value of compensation received by our NEOs as of the applicable vesting dates.

We believe that it is important for our stockholders to understand, in reviewing the compensation information provided in this Proxy Statement, that all annual cash bonus and equity compensation are performance-based. Annual cash bonuses are dependent on achievement of the Company’s pre-established milestones and strategic initiatives. For fiscal 2018, the Company did not achieve the specific milestones and strategic initiatives that were established under the 2018 Management Incentive Plan. As a result of the Company’s performance, the stock price and the financial condition of the Company at fiscal year-end, our Compensation Committee determined that cash bonuses for fiscal 2018 were not earned. Annual equity awards are reported in the compensation tables at grant date fair value, which is not necessarily the actual compensation received by the NEOs at vesting. If our stock price declines over time, the NEO will receive less than the grant date fair value reported for those awards.

The table below compares the grant date fair values as reported in the proxy statements for the 2016, 2017, and 2018 Annual Meetings of the Stockholders to the fair market value of the shares on the applicable vesting dates. To calculate these fair market values, we multiplied the number of shares vesting by the closing price of our common stock on the applicable vesting dates. For shares not yet vested, we multiplied the number of unvested shares by the closing price of our common stock on December 31, 2018.

| Name | Grant Date | Quantity

Granted | Reported Grant Date

Value | Aggregate Value Realized on Vesting(1) | % change from reported value |

| ARTHUR A. BOTTONE | 4/2/2015 | 43,373 | $ | 661,005 | $ | 110,613 | -83% |

| | 4/7/2016 | 102,640 | $ | 661,002 | $ | 117,035 | -82% |

| | 4/6/2017 | 330,500 | $ | 495,750 | $ | 319,593 | -36% |

| | 4/5/2018 | 308,989 | $ | 550,000 | $ | 170,098 | -69% |

| | 4/5/2018 | 100,000 | $ | 178,000 | $ | 55,050 | -69% |

| | Total | 885,502 | $ | 2,545,757 | $ | 772,389 | -70% |

FUELCELLENERGY, INC.| PROXY STATEMENT 23 |

| Name | Grant Date | Quantity

Granted | Reported Grant Date

Value | Aggregate Value Realized on Vesting(1) | % change from reported value |

| MICHAEL S. BISHOP | 4/2/2015 | 16,405 | $ | 250,012 | $ | 41,834 | -83% |

| | 4/7/2016 | 54,348 | $ | 350,001 | $ | 61,970 | -82% |

| | 4/6/2017 | 175,000 | $ | 262,500 | $ | 169,225 | -36% |

| | 4/5/2018 | 168,539 | $ | 299,999 | $ | 92,781 | -69% |

| | 4/5/2018 | 100,000 | $ | 178,000 | $ | 55,050 | -69% |

| | Total | 514,292 | $ | 1,340,513 | $ | 420,860 | -69% |

| | | | | | |

| JENNIFER D. ARASIMOWICZ | 4/7/2016 | 9,473 | $ | 61,006 | $ | 12,746 | -79% |

| | 4/6/2017 | 200,000 | $ | 300,000 | $ | 176,364 | -41% |

| | 4/5/2018 | 168,539 | $ | 299,999 | $ | 92,781 | -69% |

| | 4/5/2018 | 100,000 | $ | 178,000 | $ | 55,050 | -69% |

| | Total | 478,012 | $ | 839,006 | $ | 336,940 | -60% |

| | | | | | |

| ANTHONY F. RAUSEO | 4/2/2015 | 16,405 | $ | 250,012 | $ | 41,834 | -83% |

| | 4/7/2016 | 54,348 | $ | 350,001 | $ | 61,970 | -82% |

| | 4/6/2017 | 175,000 | $ | 262,500 | $ | 169,225 | -36% |

| | 4/5/2018 | 168,539 | $ | 299,999 | $ | 92,781 | -69% |

| | 4/5/2018 | 100,000 | $ | 178,000 | $ | 55,050 | -69% |

| | Total | 514,292 | $ | 1,340,513 | $ | 420,860 | -69% |

| | | | | | |

| (1) | Aggregate value realized on vesting assumes all unvested shares vested in full on December 31, 2018. Does not take into account shares tendered back to the Company to cover applicable tax withholdings. |

COMPENSATION PHILOSOPHY AND OBJECTIVES

The Compensation Committee is responsible for developing and reviewing executive compensation plans, policies and practices consistent with our compensation philosophy. Our compensation philosophy is designed around certain key objectives:

| ■ | Attract and Retain Top Executive Talent– We have designed our compensation program to be competitive and cost-effective, while allowing us to attract and retain executives critical to our long-term success. |

| ■ | Pay for Performance– Our compensation program aligns compensation with Company and individual performance on both a short-term and long-term basis. |

| ■ | Significant Portion of Pay is in the Form of Variable Compensation– We have aligned NEO compensation with stockholder interests by tying a significant portion of total direct compensation to the achievement of performance goals or stock price appreciation. With variable compensation, the NEO will not realize value unless performance goals are met or our stock price appreciates. |

To achieve these objectives, our executive compensation program:

| ■ | must be competitive with compensation paid by companies in the same or similar markets for executive talent; |

| ■ | rewards performance by linking compensation to Company performance and achievment of individual performance goals; |

| ■ | drives long-term stockholder returns by delivering a significant portion of NEO compensation in the form of equity compensation, the value of which is directly linked to our stock price; |

| ■ | aligns NEO and stockholder interests by requiring NEOs to own and hold our stock for a specified period of time; |

| ■ | provides no NEO perquisites; |

| ■ | is comprised of a “fixed” component, which consists of base salary, health and welfare benefits and contributions to the Company’s Section 401(k) Retirement Savings plan (the “401(k) Plan”), which benefits and contributions are the same as those offered to all other employees; and |

| ■ | has a “variable” component, which consists of an annual performance-based incentive award (the target amount of which is expressed as a percentage of base salary) and a long-term incentive award linked to individual and Company performance. |

FUELCELLENERGY, INC.| PROXY STATEMENT 24 |

COMPENSATION-SETTING PROCESS

The Compensation Committee reviews the base salary, target annual incentive award, long-term incentive award and target total direct compensation opportunity (which represents the sum of these three elements) for each of the NEOs annually. The CEO makes recommendations to the Compensation Committee for annual increases in base salary, the annual incentive award payments and long-term incentive awards for each of the NEOs (other than with respect to his own compensation). The Compensation Committee has the final authority to approve annual increases in base salary, annual incentive award payments and long-term equity incentive awards for the NEOs other than the CEO, whose compensation is approved by the independent members of our Board.

The Compensation Committee makes any necessary adjustments to base salaries effective in July of each year. More information regarding the fiscal 2018 base salary adjustments for the NEOs can be found on page 26 of this Proxy Statement.

Prior to the start of each fiscal year, the CEO develops operational milestones and strategic initiatives for the year for our salaried employees, including the NEOs. These operational milestones and strategic initiatives represent key performance objectives which are incorporated into the MIP, which is then submitted to the Compensation Committee for consideration and approval. After our fiscal year-end financial results are available, the annual incentive award pool for employees and individual annual incentive award payments for the NEOs for the just-completed fiscal year are approved by the Compensation Committee, except with respect to the CEO, whose annual incentive award payment is approved by the independent members of our Board.

The Compensation Committee formulates its compensation decisions for the NEOs with input from the CEO (other than with respect to his own compensation), considering such factors as each NEO’s professional experience, job scope, past performance, tenure and retention risk. The Compensation Committee also considers prior fiscal year adjustments to compensation, historical annual incentive award payments and long-term incentive awards. Finally, the Compensation Committee considers current market practices, based on its review of executive compensation data for comparable companies, as well as current compensation trends, to ensure that the compensation of the NEOs is both competitive and reasonable, while also maintaining compensation levels commensurate with our financial and stock performance.

Since 2010, the Compensation Committee has engaged Compensia, Inc., a national compensation consulting firm (the “Advisor”), to support its compensation planning activities. In fiscal 2018, the Advisor did not provide any other services to the Company and worked with management only on matters for which the Compensation Committee is responsible.

Based on its consideration of the various factors as set forth in the rules promulgated by the SEC and the Nasdaq Marketplace Rules, the Compensation Committee has determined that the work of the Advisor has not raised any conflict of interest.

COMPETITIVE POSITIONING

We periodically perform a competitive market analysis of our executive and Director compensation programs to ensure that the total compensation packages of our executive officers and the non-employee members of our Board are within a reasonably competitive range. In connection with its fiscal 2018 compensation actions and decisions, the Compensation Committee considered the competitive market analysis that was prepared by the Advisor in 2018, as described below.

COMPETITIVE MARKET ANALYSIS

In March 2018, the Advisor conducted a competitive market analysis that was used by the Compensation Committee in connection with its executive and non-employee Director compensation decisions for fiscal 2018. To develop an understanding of the competitive marketplace, the Compensation Committee reviewed the executive compensation practices of a group of publicly-traded companies (the “Peer Group”) based on compensation data gathered from publicly-available filings and as supplemented with additional data drawn from the Radford Global Technology Survey, based on data cuts for technology companies with revenues between $50 million and $200 million, and also between $200 million and $500 million.

The Advisor worked with the Compensation Committee to develop the Peer Group by screening an initial list of publicly-traded companies on the basis of industry focus, revenue, market capitalization, geographical location and revenue to market capitalization ratio. These companies were then narrowed by identifying companies whose revenue at the time ranged from approximately $35 million to $375 million compared to our trailing four fiscal quarters’ revenue of $96 million, and whose market capitalization ranged from approximately 0.2 to 5.8 times ($40 million to $650 million) our then-market capitalization of $123 million. The list was further refined by focusing on companies in the electrical equipment and components sectors and eliminating companies with headquarters outside of North America, as pay practices and disclosure requirements may vary significantly from those found in the United States.

The Compensation Committee and the Advisor also reviewed and considered other factors such as revenue growth, profitability, valuation (for example, market capitalization as a multiple of sales) and business model. The Peer Group was selected based on the subjective evaluation of all of these factors, and consisted of the following 20 companies (almost half of which are different than the peer companies we benchmarked in fiscal 2017):

FUELCELLENERGY, INC.| PROXY STATEMENT 25 |

| American Superconductor | Hydrogenics |

| Amyris | Maxwell Technologies |

| Ballard Power Systems | Park Electrochemical |

| Broadwind Energy | Plug Power |

| Capstone Turbine | Revolution Lighting Technologies |

| CECO Environmental | Thermon Group Holdings |

| Clean Energy Fuels | Vicor |

| Digi International | Vishay Precision Group |

| EMCORE | Vivint Solar |

| Enphase Energy | Westport Fuel Systems |

To complete the competitive market analysis of the executive compensation program, the Advisor then blended the Peer Group data with the Radford Global Technology Survey data (weighted equally) to compare the various market compensation levels for each of the NEO positions. Based on the foregoing approach, the analysis indicated the fiscal 2017 target total direct compensation opportunities of the NEOs approximated the 45th percentile of the competitive market, with significant variation for cash compensation among executives. In addition, the analysis showed that the fiscal 2017 equity awards granted to the NEOs approximated the 25th percentile of the competitive market, with only one executive near the median, and with little retention hold as most outstanding equity awards were substantially vested.

The Compensation Committee uses the market analysis as a reference point to ensure that our executive compensation program is competitive with market practice. In the case of each NEO, the Compensation Committee compares the overall compensation of each individual against the compensation data developed through the market analysis, if his or her position is sufficiently similar to the positions identified in the data to make the comparison meaningful. However, the Compensation Committee does not target a particular percentile of the competitive market with respect to any portion of the NEOs’ pay. Ultimately, the Compensation Committee’s decisions with respect to each NEO’s total compensation, and each individual compensation element, are based in large part on its assessment of Company and individual performance as well as other factors, such as internal equity.

FIXED COMPENSATION

BASE SALARY

The purpose of base salary, from the perspective of the Compensation Committee, is to fairly and competitively compensate our NEOs with a fixed amount of cash for the jobs they perform. In addition, base salaries are used to recognize the experience, skills, knowledge and responsibilities required of our NEOs. Accordingly, we seek to ensure that base salary levels are competitive and consistent with industry practices.

FISCAL 2018 BASE SALARIES

In June 2018, the Compensation Committee reviewed the base salaries of the NEOs, taking into consideration their past performance and expected future contributions, their ongoing roles and responsibilities and the performance of the Company. The Compensation Committee also reviewed the competitive market analysis discussed in the preceding section of this Compensation Discussion and Analysis and the recommendations of the CEO (other than with respect to his own base salary). After considering the foregoing factors, including the competitive market analysis, and certain additional information, the Compensation Committee approved the base salaries for the NEOs (other than the CEO) set forth in the table below. The Compensation Committee determined that base salary increases were warranted to recognize the contributions that each individual had made during the preceding 12 months and to address its retention objectives. With respect to the CEO, after considering his performance during the preceding 12 months, including the significant progress that he had made on several of the Company’s longer-term initiatives and to recognize his strong leadership skills, the Compensation Committee recommended to the independent members of our Board the following base salary adjustment for the CEO (which recommendation was approved by the independent members of the Board). All base salary increases were effective July 2, 2018:

| | | Base Salary Changes Effective July 2, 2018 |

| Name | | 2017 Base

($) | | 2018 Base

($) | | Increase

($) | | Increase

% |

| Mr. Bottone | | 428,816 | | 475,000 | | 46,184 | | 10.7% |

| Mr. Bishop | | 326,025 | | 350,000 | | 23,975 | | 7.3% |

| Ms. Arasimowicz | | 300,000 | | 330,000 | | 30,000 | | 10.0% |

| Mr. Rauseo | | 341,550 | | 360,000 | | 18,450 | | 5.4% |

| | | | | | | | | | |

FUELCELLENERGY, INC.| PROXY STATEMENT 26 |

BENEFITS

We offer medical and dental insurance to our NEOs, and pay a portion of the premiums for these benefits consistent with the arrangements for non-executive employees. We also provide the NEOs and other eligible employees, at our expense, with group life and accidental death and dismemberment insurance benefits; short-term and long-term disability insurance benefits; paid time off benefits; and other ancillary benefits (for example, flexible spending accounts and an employee assistance program). Further, we offer participation in the 401(k) Plan to our employees, including the NEOs, subject to the terms of the 401(k) Plan.

Contributions to the 401(k) Plan are limited to an annual maximum amount as determined by the Internal Revenue Service. For Plan Year 2018, the Compensation Committee approved a matching contribution equal to 25% of the first 8% of elective salary deferrals, not to exceed 2% of eligible earnings. These contributions to the retirement savings accounts of our employees are subject to a five year graded vesting schedule. Participants are not permitted to receive or purchase shares of our common stock through the 401(k) Plan.

The compensation program for the NEOs does not include any of the following pay practices:

| ■ | Supplemental executive retirement benefits; |

| ■ | Supplemental health or insurance benefits; or |

| ■ | Perquisites or other personal benefits. |

VARIABLE COMPENSATION

Annual Incentive Compensation

All salaried exempt employees, including the NEOs, are eligible to participate in our annual cash bonus plan, which we refer to as the Management Incentive Plan or the “MIP.” The MIP is intended to motivate employee performance in, and align compensation levels with, the achievement of our annual business objectives.

The Compensation Committee periodically reviews and determines the target annual incentive award opportunities (expressed as a percentage of base salary) that each of the named executive officers may earn under the MIP. The target annual incentive award opportunities for each NEO (expressed as a percentage of base salary) were established in 2011 at 90% for Mr. Bottone and 50% for each of the other NEOs (except Ms. Arasimowicz), based on an assessment of the competitive market performed by the Advisor at that time. The target annual incentive award opportunity of Ms. Arasimowicz was set at 50% of her base salary at the time of her appointment as our Senior Vice President, General Counsel and Corporate Secretary in 2017. These target award opportunities remained unchanged in fiscal 2018.

The actual amount of annual cash compensation earned under the MIP each year for our NEOs may be more or less than the target amount depending on our performance against a set of pre-established Company operational milestones (which represent 75% of their target annual incentive award opportunity) and a set of pre-established Company strategic initiatives (which represent the remaining 25% of their target annual incentive award opportunity). In addition, the Compensation Committee retains the right to exercise its discretion to adjust the size of potential award payments as it deems appropriate to take into account factors that enhance or detract from results achieved relative to the Company operational milestones and strategic initiatives. In this way, the Compensation Committee does not confine itself to a purely quantitative approach and retains discretion in determining award payments based on its review and assessment of other results for the fiscal year. The Compensation Committee believes that linking the annual incentive awards for the NEOs to Company operational milestones and strategic initiatives creates a performance-based compensation opportunity that furthers stockholder interests, but by retaining some discretion, reduces the risk that executives will overemphasize performance on the pre-established objectives to the detriment of the Company’s overall performance.

The operational milestones and strategic initiatives on which the 2018 MIP awards were based, as well as our performance with respect to such milestones and initiatives, are discussed below.

FISCAL 2018 OPERATIONAL MILESTONES AND STRATEGIC INITIATIVES

The pre-established Company operational milestones for fiscal 2018 (and their respective weighting) involved:

| (1) | achieving a specified level of total revenue for the fiscal year (20%); |

| (2) | securing new orders (40%); |

| (3) | achieving a specified gross margin for the fiscal year (20%); |

| (4) | controlling operating expenses (10%); and |

| (5) | enhancing fleet performance (10%). |

The Compensation Committee developed target performance levels for each of these milestones that were consistent with our annual operating plan for fiscal 2018.

FUELCELLENERGY, INC.| PROXY STATEMENT 27 |

FISCAL 2018 STRATEGIC INITIATIVES

The pre-established Company strategic initiatives for fiscal 2018 (which were equally weighted) involved:

| (a) | developing a new strategic business alliance and restructuring the business in Europe; |

| (b) | executing on specified regulatory initiatives; |

| (c) | growing the Advanced Technology business; and |

| (d) | executing specified project finance and legal initiatives. |

Under the 2018 MIP, performance against each of the Company operational milestones was evaluated based on a range of pre-established performance levels to obtain scores ranging from 0% to a maximum of 125%.

PERFORMANCE RESULTS AND ANNUAL INCENTIVE AWARD PAYMENTS FOR FISCAL 2018

After the end of fiscal 2018, the Compensation Committee reviewed the Company’s actual performance as measured against the Company operational milestones and strategic initiatives, which resulted in an annual incentive award achievement percentage of 38% of the target award levels, determined as follows. Comparing the Company’s actual performance against the range of pre-established target levels for these operational milestones, the Compensation Committee calculated a weighted score for each milestone, the sum of which yielded a total weighted score. The Company’s overall performance with respect to the operational milestones for fiscal 2018 resulted in a calculated aggregate weighted score of 18%.

With respect to the fiscal 2018 Company strategic initiatives, the Compensation Committee compared the Company’s actual performance against the pre-established target objectives for these initiatives, and calculated a weighted score for each strategic initiative, the sum of which yielded a total weighted score. Our overall performance with respect to the strategic initiatives for fiscal 2018 resulted in a calculated weighted score of 20%.

Applying the relative weighting of each performance category (75% for the operational milestones and 25% for the strategic initiatives), the Compensation Committee determined that the blended annual incentive award achievement percentage was equal to 38% of the target award levels.

After reviewing the blended annual incentive award achievement percentage and evaluating the Company’s performance, financial position and stock performance, and after considering the recommendations of the CEO, the Compensation Committee did not approve annual incentive award payments for the NEOs (other than our CEO) for fiscal 2018 and also recommended, and the independent members of the Board agreed, that no annual incentive award payment be made to the CEO.

FISCAL 2019 MANAGEMENT INCENTIVE PLAN

For fiscal 2019, Company operational milestones and strategic initiatives have been updated to further advance our business. The pre-established Company operational milestones for fiscal 2019 (and their respective weighting) are as follows: (1) achieve specified total revenue for the fiscal year (20%); (2) secure new orders (40%); (3) achieve a specified gross margin (20%); (4) control operating expenses (10%); and (5) enhance fleet performance (10%). The Compensation Committee has developed target performance levels for each of these milestones that are consistent with our fiscal 2019 annual operating plan.

The Compensation Committee has also established strategic initiatives for fiscal 2019 applicable to all participants including the NEOs. The pre-established Company strategic initiatives for fiscal 2019 (which are equally weighted) are as follows: (a) develop a new strategic partner; (b) execute on specified regulatory initiatives; (c) grow the Advanced Technology business; (d) develop project finance partners to support growth; and (e) reorganize the commercial development team.

LONG-TERM INCENTIVE COMPENSATION

ANNUAL RESTRICTED STOCK UNIT (RSU) GRANTS

Each of the NEOs is eligible to receive long-term incentive compensation in the form of RSUs under the 2018 Omnibus Incentive Plan (the “OIP”). These awards are intended to align a significant portion of the NEOs’ compensation with stockholders’ interests and the long-term success of the Company by providing a direct link to an NEO’s future earnings potential and the market value of our common stock. Our annual RSU grants typically vest over three years at a rate of 33.3% per year.

The Compensation Committee, in determining the value of equity awards to be granted to our employees, including the NEOs, considers relevant competitive market data as well as the recommendations of the CEO and other factors, including the individual’s job scope, past performance, expected future contributions, tenure and retention risk. The Compensation Committee approves all equity awards for the NEOs, except in the case of the CEO, whose award is approved by the independent members of our Board.

FUELCELLENERGY, INC.| PROXY STATEMENT 28 |

In April 2018, the Compensation Committee considered the relevant market data, the recommendations of the CEO for the equity awards to be granted to our executives (including the other NEOs), and the other factors described above. The Compensation Committee then approved the awards for the NEOs (other than the CEO) as recommended and set forth in the table below. In addition, the Compensation Committee considered and recommended to the independent members of our Board the grant of an equity award for the CEO. Its decisions (and, in the case of the CEO, its recommendation) were based on the factors described above, as well as the Company’s overall performance for fiscal 2017 and its retention objectives. Accordingly, the following equity awards were granted to the NEOs on April 5, 2018:

| | | 2018 Long-Term Equity Incentive Awards |

| Name | | # Shares/

Units | | Grant Date

Fair Value ($) | | Vesting

Period | | Vesting Rate

Per Year |

| Mr. Bottone | | 308,989 | | $550,000 | | 3 years | | 33.3% |

| Mr. Bishop | | 168,539 | | $299,999 | | 3 years | | 33.3% |

| Ms. Arasimowicz | | 168,539 | | $299,999 | | 3 years | | 33.3% |

| Mr. Rauseo | | 168,539 | | $299,999 | | 3 years | | 33.3% |

The number of shares of our common stock subject to each RSU granted to each of the NEOs was based on the dollar value of the award approved for each individual by the Compensation Committee (or, in the case of the CEO, the independent members of our Board) divided by the closing market price of our common stock on the date of grant. As discussed on page 23 of this Proxy Statement, these equity awards are the “reported” equity award amounts and do not necessarily reflect the realizable award amounts.

Special One-Time Equity Awards

In conjunction with its consideration of the annual equity awards described above, the Compensation Committee also discussed with the CEO the grant of a special, one-time equity award to each of the other NEOs. In determining whether to grant such awards, the Compensation Committee considered its 2017 decision to reduce the size of future equity awards to the NEOs by 25% of the value of previous year’s awards and the resulting impact that such decision has had on the target total compensation opportunities of the NEOs, in the context of the highly competitive market for senior executive talent in the New England region and the Company’s desire to retain the continued services of the NEOs. After weighing these factors, the Compensation Committee determined that it was in the best interests of the Company and its stockholders to approve a special equity award of RSUs for each of the NEOs to retain their services in the competitive market environment, and recommend for approval by the independent Directors, a special equity award of RSUs for the CEO, valued in each case at $178,000, and subject to the following terms and conditions: (i) the RSUs vest 100% on the third anniversary of the grant date, provided that the executive remains in the continuous employment of the Company through such vesting date; and (ii) the awards are subject to the terms of the Company’s 2018 Omnibus Incentive Plan. As discussed on page 32 of this Proxy Statement, these special equity awards are “reported” in accordance with FASB Accounting Standards Codification (“ASC”) Topic 718 for all stock-based awards and do not necessarily reflect the realizable compensation amounts.

The annual restricted stock unit grant and the special one-time equity award granted to the NEOs in fiscal 2018 are both set forth in the Fiscal 2018 Summary Compensation Table and the Fiscal 2018 Grants of Plan-Based Awards Table on pages 31 and 32, respectively, of this Proxy Statement.

COMPENSATION POLICIES

PROHIBITION ON OPTION RE-PRICING AND BACKDATING

The Compensation Committee does not re-price and has not re-priced options to purchase shares of our common stock, consistent with the OIP, which prohibits re-pricing of equity awards without stockholder approval. The grant date for each equity award is based on the date the award is approved by the Compensation Committee or the independent members of our Board, as applicable. Options to purchase shares of our common stock are granted with an exercise price equal to the closing market price of our common stock on the date of grant.

EQUITY AWARD GRANT POLICY

We maintain an Equity Award Grant Policy, which was most recently amended in December 2018. This policy includes the following key provisions: (a) all equity awards of more than 40,000 shares must be submitted to the Compensation Committee for approval; (b) all equity awards granted to executives at the level of vice president (or above) must be submitted to the Compensation Committee for approval; and (c) the Compensation Committee has authorized a pool of up to 100,000 shares from which the CEO may approve equity awards for special recognition or retention purposes, provided that such grants are limited to a grant date fair value of $40,000 or less, and further provided that no grants may be made from this pool to employees at the level of vice president or above.

FUELCELLENERGY, INC.| PROXY STATEMENT 29 |

COMPENSATION RECOVERY POLICY

We maintain an Executive Compensation Recovery Policy. A description of this policy can be found on page 13 of this Proxy Statement under “Corporate Governance.”

ANTI-HEDGING POLICY

A description of our anti-hedging policy can be found on page 13 of this Proxy Statement under “Corporate Governance.”

STOCK OWNERSHIP GUIDELINES

We maintain minimum stock ownership guidelines which were increased in December 2018. A description of these guidelines can be found on page 13 of this Proxy Statement under “Corporate Governance.”

TAX AND ACCOUNTING CONSIDERATIONS

Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”) generally prohibits public companies from taking a tax deduction for a taxable year for compensation in excess of $1 million paid to its covered executives. For compensation paid for the 2018 fiscal year, our covered executives were the chief executive officer and each of the other three most highly compensated executive officers (not including the chief financial officer) who were employed by a company as of the end of the year. For our 2018 fiscal year, qualifying “performance-based compensation” was not subject to the $1 million deduction limitation if specified requirements were met. The Compensation Committee has historically reviewed the potential consequences of Section 162(m) on the components of our executive compensation program, but has always reserved the discretion to grant or pay compensation that is not tax deductible as a result of the application of Section 162(m) if it believes that doing so is in the best interests of the Company and its stockholders.

As a result of changes made by the Tax Cuts and Jobs Act, starting with compensation paid in our 2019 fiscal year (the year beginning on November 1, 2018 and ending on October 31, 2019), Section 162(m) will limit us from deducting compensation, including performance-based compensation, in excess of $1 million paid to anyone who, starting with our 2018 fiscal year, serves as the chief executive officer or chief financial officer, or who is among the three most highly compensated executive officers for any fiscal year beginning with the 2018 fiscal year. Once an officer becomes a covered executive, the provisions of Section 162(m) will continue to apply, notwithstanding if such covered executive ceases to be an officer. The only exception to this rule is for compensation (including performance-based compensation) that is paid pursuant to a binding contract in effect on November 2, 2017, that would have otherwise been deductible under the prior Section 162(m) rules. Going forward, the Compensation Committee will retain full discretion to award compensation packages that best attract, retain, and reward successful executive officers. Therefore, the Compensation Committee may award compensation that is not fully deductible under Section 162(m) if the Compensation Committee believes it will contribute to the achievement of our business objectives.

We follow Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718 for all stock-based awards. ASC Topic 718 requires companies to measure the compensation expense for all share-based payment awards made to employees and directors, including stock options and full value stock awards, based on the aggregate grant date “fair value” of these awards. This calculation is performed for accounting purposes and reported in the compensation tables on pages 31, 32, and 40 of this Proxy Statement. ASC Topic 718 also requires companies to recognize the compensation cost of their stock-based compensation awards in their income statements over the period that an executive officer is required to render service in exchange for the option or other award.

COMPENSATION RISK ASSESSMENT

In connection with its annual review of the executive compensation program, the Compensation Committee considers and assesses whether any aspects of the program encourage unnecessary or excessive risk-taking. This assessment examines the various compensation programs for all of our employees, including, but not limited to, the NEOs.

Based on its most recent review, the Compensation Committee has determined that the executive compensation program does not create risks that are reasonably likely to have a material adverse effect on the Company. In reaching this conclusion, the Compensation Committee considered the following:

| ■ | Base salaries, which represent fixed compensation, do not encourage excessive risk-taking. |

| ■ | Annual incentive awards are capped at 125% of the target award opportunities and if actual performance falls below the threshold level of 50%, payment of an award is at the discretion of the Compensation Committee and the amount of the award could be zero, as it was for fiscal 2018. Moreover, the annual incentive award opportunity represents approximately 15% to 20% of each NEO’s target total direct compensation opportunity and, thus, is not likely to lead to excessive risk-taking. The Compensation Committee believes that the annual incentive award program is based on balanced, quantitative performance measures that promote disciplined progress towards longer-term goals and, as such, are well-aligned with the business strategy and stockholder interests. |

FUELCELLENERGY, INC.| PROXY STATEMENT 30 |

| ■ | The long-term incentive compensation in the form of equity awards granted to our executives helps to align their interests with those of our stockholders. The Compensation Committee has identified a number of factors that discourage excessive risk-taking including: (i) the relative size of the awards as compared to each executive’s target total direct compensation opportunity; (ii) the minimum vesting requirements for awards; and (iii) our policy which prohibits hedging transactions involving shares of our common stock and prevents our executives from insulating themselves from the effects of poor stock price performance. The Compensation Committee also noted that these awards do not encourage excessive-risk taking since their ultimate value is tied to our stock price, and they are granted on a staggered basis, subject to long-term vesting schedules, which help ensure that our executives have significant value tied to long-term stock price performance. |

We have also historically granted equity awards to a significant number of employees. Like the equity awards granted to our executives, the relative size of these awards is modest compared to each employee’s target total compensation opportunity. All awards are subject to minimum vesting requirements and our policy which prohibits hedging transactions involving shares of our common stock is applicable to all grantees.

Further, the OIP, which governs the terms of such awards, includes several provisions designed to mitigate risk and protect stockholder interests, including, but not limited to, the following:

| ■ | Options to purchase shares of our common stock and stock appreciation rights for shares of our common stock may not have an exercise or strike price that is less than the fair market value of our common stock on the date of grant; |

| ■ | With limited exceptions, no portion of any award granted uner the OIP may vest prior to the first anniversary of the award’s grant date; |

| ■ | The OIP was approved by stockholders at the 2018 Annual Meeting, and material amendments of the OIP, including an increase in the number of shares available thereunder, require stockholder approval; and |

| ■ | The OIP is administered by an independent committee of our Board. |

The Compensation Committee has reviewed the compensation programs for our employees generally and has determined that these programs do not create risks that are reasonably likely to have a material adverse effect on the Company.

FISCAL 2018 SUMMARY COMPENSATION TABLE

The following table presents summary information regarding the total compensation awarded to, earned by or paid to the NEOs for the fiscal years ended October 31, 2018, 2017, and 2016 (except for Ms. Arasimowicz for whom information is provided only with respect to the fiscal years ended October 31, 2018 and 2017).

| Name and Principal Position | | Year | | Salary

($) | | Bonus

($) | | Stock

Awards

($)(1) | | Non-Equity

Incentive Plan

Compensation

($)(2) | | All Other

Compensation

($) | | Total

($) |

| Arthur A. Bottone | | 2018 | | 443,026 | | — | | 728,000 | | — | | 3,141 | | 1,174,167 |

President and

Chief Executive Officer | | 2017 | | 428,816 | | — | | 495,750 | | 282,000 | | 3,016 | | 1,209,582 |

| | 2016 | | 426,414 | | — | | 661,000 | | 192,967 | | 4,026 | | 1,284,406 |

| Michael S. Bishop | | 2018 | | 333,402 | | — | | 478,000 | | — | | 10,076 | | 821,478 |

Senior Vice President,

Chief Financial Officer and Treasurer | | 2017 | | 318,392 | | — | | 262,500 | | 125,520 | | 4,572 | | 710,894 |

| | 2016 | | 307,904 | | — | | 350,000 | | 78,750 | | 4,255 | | 740,909 |

| Jennifer D. Arasimowicz(3) | | 2018 | | 309,231 | | — | | 478,000 | | — | | 7,433 | | 794,664 |

Senior Vice President,

General Counsel and Corporate Secretary | | 2017 | | 254,615 | | — | | 300,000 | | 115,500 | | 2,615 | | 672,730 |

| | | | | | | | | | | | | | |

| Anthony F. Rauseo | | 2018 | | 347,227 | | — | | 478,000 | | — | | 4,625 | | 829,852 |

Senior Vice President and

Chief Operating Officer | | 2017 | | 333,554 | | — | | 262,500 | | 131,497 | | 4,933 | | 732,484 |

| | 2016 | | 325,546 | | — | | 350,000 | | 82,500 | | 5,873 | | 763,919 |

| (1) | The amounts reported in the “Stock Awards” column reflect the aggregate grant date fair value of stock awards granted during each of the fiscal years 2018, 2017, and 2016, computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation-Stock Compensation (“ASC Topic 718”). These values have been determined under the principles used to calculate the grant date fair value of equity awards for purposes of our financial statements. For a discussion of the assumptions and methodologies used to value the awards reported in this column, please see the discussion of stock awards contained in Note 16 of the Notes to Consolidated Financial Statements in our Annual Report on Form 10-K for the fiscal year ended October 31, 2018. These amounts represent the “reported” value of the awards, and do not necessarily represent the “realizable” value of the awards. See page 23 of this Proxy Statement for a discussion of reported versus realizable value of the awards. |

| (2) | The amounts reported in the “Non-Equity Incentive Plan Compensation” column represent the value of the annual incentive award payment earned by each NEO for fiscal years 2018, 2017, and 2016 under our Management Incentive Plan. The amounts reported for fiscal years 2018, 2017, and 2016 were paid in cash. |

| (3) | Ms. Arasimowicz was appointed our Senior Vice President, General Counsel and Corporate Secretary on April 6, 2017. |

FUELCELLENERGY, INC.| PROXY STATEMENT 31 |

FISCAL 2018 GRANTS OF PLAN-BASED AWARDS TABLE

The following table presents, for each of the NEOs, information with respect to the awards under the fiscal 2018 Management Incentive Plan and grants of long-term incentive compensation in the form of restricted stock unit awards made to the NEOs in fiscal 2018. For further information regarding the restricted stock unit awards included in the Fiscal 2018 Grants of Plan-Based Award Table, refer to the discussion of Long-Term Incentive Compensation on page 28 of this Proxy Statement. For further information concerning the reported value of these awards versus the realizable value of these awards, refer to the discussion on page 23 of this Proxy Statement.

| | | Estimated Future Payouts Under Incentive

Compensation Awards(1) | | | | |

| Name | | Grant

Date | | Threshold

Non-Equity

Incentive

Comp ($) | | Target

Non-Equity

Incentive

Comp ($) | | Maximum

Non-Equity

Incentive

Comp ($) | | All Other

Stock Awards:

Number of

Units (#)(2) | | Grant Date

Fair Value

of Stock and

Option Awards

($)(3) |