As filed with the Securities and Exchange Commission on April 11, 2016.18, 2022

Registration No. 333-333-261771

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________________

AMENDMENT NO. 2

to

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

______________________

MASSROOTS,GREENWAVE TECHNOLOGY SOLUTIONS, INC. (f/k/a MassRoots, Inc.)

(Exact name of registrant as specified in its charter)

| Delaware | 7370 | 46-2612944 | ||||

| (State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer | ||||

| incorporation or organization) | Classification Code | Identification Number) |

1624 Market Street, Suite 201, Denver, CO 80202(720) 442-0052

277 Suburban Drive, Suffolk, VA23434

(757) 966-1432

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

______________________

Isaac Dietrich, Danny Meeks

Chief Executive Officer

MassRoots, Inc.1624 Market Street, Suite 201, Denver, CO 80202277 Suburban Drive

(720) 442-0052

Suffolk, VA23434

(757) 966-1432

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

______________________

Please send copies of all communicationsCopies to:

|

|

______________________M. Ali Panjwani

Pryor Cashman LLP

As soon as practicable after the effective date of this Registration Statement.7 Times Square

(New York, NY 10036

212-326-0820

Approximate date of commencement of proposed sale to the public)public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: [ ]☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act of 1933 registration statement number of the earlier effective registration statement for the same offering. [ ]

☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act of 1933 registration statement number of the earlier effective registration statement for the same offering. [ ]☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act of 1933 registration statement number of the earlier effective registration statement for the same offering. [ ]☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☐ | ||

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [ ] Smaller reportingIf an emerging growth company, [X]indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

(Do not check if a smaller reporting company)

____________________

Calculation of Registration Fee

| Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price (1) | Amount of Registration Fee (2) | ||||||

| Common Stock, par value $0.001 per share (3) | [ ] | [ ] | ||||||

| Warrants to Purchase Common Stock (3)(4) | [ ] | [ ] | ||||||

| Common Stock Issuable upon Exercise of Warrants (3) | [ ] | [ ] | ||||||

| Total | $ | 6,500,000 | $ | 654.55 | ||||

(1) Estimated solely for purposes of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended (“Securities Act”)

(2) Calculated pursuant to Rule 457(o) under the Securities Act based on an estimate of the proposed maximum aggregate offering price.

(3) Pursuant to Rule 416 under the Securities Act, the securities being registered hereunder include such indeterminate number of additional shares of common stock as may be issued after the date hereof as a result of stock splits, stock dividends or similar transactions.

(4) No fee pursuant to Rule 457(g).

____________________

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

____________________

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any statejurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS -SUBJECT TO COMPLETION

Dated [ ], 2016April 18, 2022

Technology Platform for the Cannabis Industry

MassRoots, Inc.

An Offering of up to [ ]15,238,461 Shares of Common Stock andWarrants to Purchase up to [ ] Shares of Common Stock

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (the “SEC”). This prospectus relates to the offeringsale or other disposition from time to time by the selling stockholders of Greenwave Technology Solutions, Inc., a Delaware corporation (f/k/a MassRoots, Inc.) (the “Company”) identified in this prospectus of up to [ ]15,238,461 shares of our common stock, par value par value $0.001 per share (“Common Stock”), and warrants to purchase up to [ ] shares of our Common Stock (each whole warrant, a “Warrant”). This prospectus also includes theincluding 2,565,059 shares of Common Stock that are issuable from time to time upon exerciseconversion of the Warrants (the Common Stock, the Warrants,outstanding convertible debt and the Common Stock underlying the Warrants, the “Securities”). We will offer one share of Common Stock in a fixed combination with a Warrant to purchase [ ]2,514,428 shares of Common Stock issuable upon exercise of outstanding warrants (collectively, the “Resale Shares”). All of the Resale Shares were initially purchased from the Company in private placement transactions and are being offered for resale by the selling stockholders. For a public offering pricedescription of $[ ]the transactions pursuant to which this resale registration statement relates, please see “Recent Unregistered Financings.”

The Resale Shares may be sold by the selling stockholders to or through underwriters or dealers, directly to purchasers or through agents designated from time to time. For additional information regarding the methods of sale you should refer to the section entitled “Plan of Distribution” in this Prospectus.

The Resale Shares may be sold by the selling stockholder at $15.00 per share until the shares are listed on a national securities exchange or quoted on the OTC Bulletin Board, the OTCQX marketplace or the OTCQB marketplace. Thereafter, the prices at which the selling stockholders may sell the Resale Shares will be determined by the prevailing market price for shares of the Company’s Common Stock or in negotiated transactions. We will not receive any proceeds from the sale of the Resale Shares by the selling stockholders; however, we will receive the proceeds from any cash exercise of warrants.

On July 1, 2021, our Board of Directors, and $[ ] per Warrant,on September 3, 2021, stockholders holding a majority of our outstanding voting shares, authorized a reverse stock split of the outstanding shares of our common stock in a range of up to one-for-one thousand (1:1,000), with our Board of Directors retaining discretion of whether to implement the reverse stock split and at which exchange ratio to effect the reverse stock split. The Board of Directors approved a stock split ratio of one-to-three hundred (1:300), which reverse stock split became effective on February 17, 2022, and all share numbers in this prospectus have been adjusted to give effect to such reverse stock split, except for the financial statements and notes thereto.

We will bear all costs relating to the registration of the Resale Shares, other than any selling stockholders legal or of $[ ] per combination of share and warrant, less theaccounting costs or commissions. We will not be paying any underwriting discounts and commissions. Each Warrant is immediately exercisable for one share of ouror commissions in this offering.

Our Common Stock at an exercise price of $[ ] per share, or [ ]%is presently quoted on the OTC Pink tier of the per shareOTC Markets Group, Inc. (“OTC Pink”) under the symbol “GWAV.” The closing price of our Common Stock in this offering. Each Warrant expires on [ ], 20[ ]. The shares of Common Stock and Warrants will be issued and delivered separately.April 14, 2022, as reported by OTC Markets Group, Inc., was $7.07 per share.

Our Common Stock is currently quoted on the OTCQB under the symbol “MSRT.” On [ ], the closing sale price ofInvesting in our Common Stock was $[ ] per share. Currently, there is no established public trading market in the United States for our Common Stock and quotes of our stock on an OTCQB may not be indicative of the market price on a national securities exchange. We are applying to list our Common Stock on the NASDAQ Capital Market under the symbol “MSRT”. No assurance can be given that our application will be approved.

See “Underwriting” beginning on page [] of the prospectus for more information on this Offering.

Our common stock involves a high degree of risk. You should readSee the "RISK FACTORS" section beginning on page 10 before you decide to purchase any of our Common Stock.

We qualify as an “emerging growth company” as defined in the Jumpstart our Business Startups Act (“JOBS Act”). For more information, see the prospectus subsection titled “Emerging Growth Company Status” starting on page 7.

(1) We have also agreed to reimburse the underwriter for expenses incurred by it in an amount not to exceed $150,000. See "Underwriting" for additional information regarding underwriter compensation.

(2) We estimate our total expenses for this offering to be approximately $ [ ].

The underwriters expects to deliver the shares of Common Stock and Warrants to purchasers against payment on or about [], 2016.

We have granted the underwriters an option for a period of 45 days to purchase up to an additional 15% of the total number of shares of Common Stock and/or 15% of total number of Warrants sold in the Offering in any combination thereof at the public offering price, less the underwriting discounts and commissions, to cover over-allotments, if any.

The Company has minimal revenues to date and there can be no assurance that the Company will be successful in furthering its operations and/or revenues. Persons should not invest unless they can afford to lose their entire investment. Investing in our securities involves a high degree of risk. You should purchase these securities only if you can afford a complete loss of your investment. Seeentitled “Risk Factors” beginning on page 107 of this prospectus.prospectus and elsewhere in this prospectus for a discussion of information that should be considered in connection with an investment in our Common Stock.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments or supplements carefully before you make your investment decision.

We have not registered the sale of the Resale Shares under the securities laws of any state. Brokers or dealers effecting transactions in the Resale Shares should confirm that the shares have been registered under the securities laws of the state or states in which sales of the shares occur as of the time of such sales, or that there is an available exemption from the registration requirements of the securities laws of such states.

We have not authorized anyone, including any salesperson or broker, to give oral or written information about this offering, Greenwave Technology Solutions, Inc., or the Resale Shares that is different from the information included in this prospectus. You should not assume that the information in this prospectus, or any supplement to this prospectus, is accurate at any date other than the date indicated on the cover page of this prospectus or any supplement to it.

Neither the SECSecurities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Chardan Capital Markets, LLC

Book Running Manager

The date of this prospectus is [ ], 2016 April ___, 2022.

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus andor in any free writing prospectus prepared by usthat we may specifically authorize to be delivered or on our behalf.made available to you. We have not authorized anyone to provide you with information that is different from that contained in this prospectus or additional information. If anyone provides you with differentin any free writing prospectus we may authorize to be delivered or additionalmade available to you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information you should not rely on it.that others may give you. This prospectus may only be used where it is legal to offer and sell our securities. The information in this prospectus is accurate only as of the date on the front of this prospectus.prospectus, regardless of the time of delivery of this prospectus or any sale of our securities. Our business, financial condition, results of operations and prospects may have changed since the date of this prospectus. This prospectus isthat date. We are not making an offer or solicitation relating to thesell these securities and are not soliciting an offer to buy these securities in any jurisdiction in which such an offer or solicitation relating to the securities is not authorized. You should not consider this prospectus to be an offer or solicitation relating to the securities if the person makingstate where the offer or solicitationsale is not qualified to do so, or if it is unlawful for you to receive such an offer or solicitation.permitted.

| i |

PROSPECTUS SUMMARY

This summary highlights certain information appearing elsewhere in this prospectus. This summary is not complete and does not contain all

CAUTIONARY NOTICE REGARDING FORWARD-LOOKING STATEMENTS

Some of the information you should consider prior to investing. After you read this summary, you should read and consider carefully the more detailed information and financial statements and related notes that we include in this prospectus especiallyare “forward-looking statements” within the sections entitled “Risk Factors”meaning of the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements regarding our current beliefs, goals and “Management’sexpectations about matters such as our expected financial position and operating results, our business strategy and our financing plans. The forward-looking statements in this prospectus are not based on historical facts, but rather reflect the current expectations of our management concerning future results and events. The forward-looking statements generally can be identified by the use of terms such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “foresee,” “may,” “guidance,” “estimate,” “potential,” “outlook,” “target,” “forecast,” “likely” or other similar words or phrases. Similarly, statements that describe our objectives, plans or goals are, or may be, forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be different from any future results, performance and achievements expressed or implied by these statements. We cannot guarantee that our forward-looking statements will turn out to be correct or that our beliefs and goals will not change. Our actual results could be very different from and worse than our expectations for various reasons. You should review carefully all information, including the discussion under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.Operations” Ifin this prospectus or under similar headings in any accompanying prospectus supplement. Any forward-looking statements in this prospectus are made only as of the date hereof and, except as may be required by law, we do not have any obligation to publicly update any forward-looking statements contained in this prospectus to reflect subsequent events or circumstances.

| ii |

PROSPECTUS SUMMARY

This summary highlights certain information about us, this offering and selected information contained elsewhere in this prospectus. Because this is only a summary, it does not contain all of the information that may be important to you investor that you should consider before investing in our securities, you are assuming a high degree of risk.

Unlesscommon stock. You should read the entire prospectus carefully, especially the information under “Risk Factors” set forth in this prospectus and the information included in any prospectus supplement or free writing prospectus that we have indicated otherwise orauthorized for use in connection with this offering. This prospectus contains forward-looking statements, based on current expectations and related to future events and our future financial performance, that involve risks and uncertainties. Our actual results may vary materially from those discussed in the forward-looking statements as a result of various factors, including, without limitation, those set forth under “Risk Factors,” as well as other matters described in this prospectus. See “Cautionary Notice Regarding Forward-Looking Statements.”

Unless the context indicates or otherwise requires, references in the prospectus to “MassRoots,” the “Company,” “we,” “us”“us,”, “our” “Greenwave” of the “Registrant” refer to Greenwave Technology Solutions, Inc., a Delaware corporation, and “our” or similar terms are to MassRoots, Inc. its subsidiaries.

Unless otherwise indicated, all share and per share information relating to our common stockCommon Stock in this prospectus has been adjusted to reflect the “Exchange”Exchange which occurred during our “Reorganization”.Reorganization. See “The Reorganization And Previous Offerings”Exchange” for additional discussion of the Exchange and Reorganization.

On July 1, 2021, our Board of Directors, and on September 3, 2021, stockholders holding a majority of our outstanding voting shares, authorized a reverse stock split of the outstanding shares of our common stock in a range of up to one-for-one thousand (1:1,000), with our Board of Directors retaining discretion of whether to implement the reverse stock split and at which exchange ratio to effect the reverse stock split. The MassRoots Story – Our CompanyBoard of Directors approved a stock split ratio of one-to-three hundred (1:300), which reverse stock split became effective on February 17, 2022, and all share numbers in this prospectus have been adjusted to give effect to such reverse stock split, except for the financial statements and notes thereto.

MassRoots was incorporated in DelawareOverview

We were formed in April 26, 2013 as a technology platform developer under the name MassRoots, Inc. In October 2021, we changed our corporate name from “MassRoots, Inc.” to “Greenwave Technology Solutions, Inc.” We sold all of our social networkmedia assets on October 28, 2021 for cash consideration equal to $10,000 and has discontinued all operations related to its social media business. On September 30, 2021, we closed our acquisition of Empire Services, Inc. (“Empire”), which operates 11 metal recycling facilities in Virginia and North Carolina. The acquisition was effective October 1, 2021 upon the cannabis community.effectiveness of the Certificate of Merger in Virginia.

Upon the acquisition of Empire, we transitioned into the scrap metal industry which involves collecting, classifying and processing appliances, construction material, end-of-life vehicles, boats, and industrial machinery. We process these items by crushing, shearing, shredding, separating, and sorting, into smaller pieces and categorize these recycled ferrous, nonferrous, and mixed metal pieces based on density and metal prior to sale. In July 2013,cases of scrap cars, we launchedremove the catalytic converters, aluminum wheels, and batteries for separate processing and sale prior to shredding the vehicle. We have designed our systems to maximize the value of metals produced from this process.

We operate an industrial shredder at our Kelford, North Carolina location. Our shredder is designed to produce a denser product and, in concert with advanced separation equipment, more refined recycled ferrous metals, which are more valuable as they require less processing to produce recycled steel products. In totality, this process reduces large metal objects like auto bodies into baseball-sized pieces of shredded recycled metal.

The shredded pieces are then placed on a conveyor belt under magnetized drums to separate the ferrous metal from the mixed nonferrous metal and residue, producing consistent and high-quality ferrous scrap metal. The nonferrous metals and other materials then go through a number of additional mechanical systems which separate the nonferrous metal from any residue. The remaining nonferrous metal is further processed to sort the metal by type, grade, and quality prior to being sold as products, such as zorba (mainly aluminum), zurik (mainly stainless steel), and shredded insulated wire (mainly copper and aluminum).

| 1 |

One of our main corporate priorities is to open a facility with rail or deep-water port access to enable us to efficiently transport our products to domestic steel mills and overseas foundries. Because this would greatly expand the number of potential buyers of our processed scrap products, we believe opening a facility with port or rail access could result in an increase in both the revenue and profitability of our existing operations.

Empire is headquartered in Suffolk, Virginia and employs 89 people as of April 4, 2022.

Background

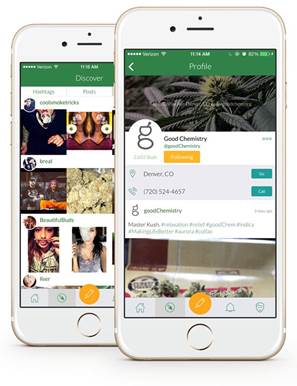

We were incorporated in the App Storestate of Delaware on April 26, 2013 as a technology platform. Our principal executive office is located at 277 Suburban Drive, Suffolk, VA 23434, and since that time have grown into a community of 775,000 users. Our network allows users to share their cannabis experiences, follow their favorite dispensaries, and stay informed of legalization updates. Businesses use MassRoots to advertise their products directly to cannabis consumers. Our growth has been primarily driven by MassRoots’ increasing popularity as one of the first national cannabis brands and word of mouth enthusiasm from our users. We believe that by creating a central community of cannabis consumers, we are creating a valuable marketing channel for cannabis and its ancillary products.

MassRoots’ Value Proposition to Advertisers:

After a period where we solely focused on user growth, we started monetizing MassRoots through advertising in mid-August 2015. The reasons businesses advertise on MassRoots are:

MassRoots’ Value Proposition to Developers:

Over the coming months, we will be introducing an Application Programming Interface (API) to developers looking to integrate MassRoots’ network into their cannabis-related platform. We believe the benefits to developers are:

MassRoots’ Value Proposition to Investors:

For investors looking to capitalize on the rapidly growing cannabis industry permissible under laws of certain states, we believe MassRoots presents a unique and valuable opportunity for the following reasons:

Government Regulation

Our business plan includes allowing cannabis dispensaries to advertise on our network which we believe could be deemed to be aiding and abetting illegal activities, a violation of Federal law. We intend to remain within the guidelines outlined in the Cole Memo (as more fully described in this prospectus), which does not alter the Department of Justice's authority to enforce Federal law, including Federal laws relating to cannabis, but does recommend that U.S. Attorneys prioritize enforcement of Federal law away from the cannabis industry operating as permitted under certain state laws so long as certain conditions are met. However, we cannot provide complete assurance that we are in full compliance with the Cole Memo or any other laws or regulations relating to the cannabis industry. In addition, we cannot provide any assurance that such federal and state enforcement policies may deviate from the current policies in effect. See the “Risk Factors” and “Description of Business – Government Regulation” sections of this prospectus for more information.

Company Information

We are a Delaware corporation. Our address is 1624 Market Street, Suite 201, Denver, CO 80202, our telephone number is (720) 442-0052 and our website is www.MassRoots.com. The information on our website or mobile apps is not(757) 966-1432.

On January 25, 2017, we consummated a part of this prospectus.

Emerging Growth Company

We are an "emerging growth company," as defined in the JOBS Act, andreverse triangular merger (the “Whaxy Merger”) pursuant to which we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies.

Section 107(b)acquired all of the JOBS Act provides that an “emerging growth company” can take advantageoutstanding common stock of DDDigtal Inc. d.b.a. Whaxy (“DDDigtal”), a Colorado corporation. Upon closing of the extended transition period provided in Section 7(a)(2)(B)Whaxy Merger, each share of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have irrevocably opted out of the extended transition period for complying with new or revised accounting standards pursuant to Section 107(b) of the JOBS Act.

We could remain an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues are $1 billion, as adjusted, or more, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which would occur if the market value of ourDDDigtal’s common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, and (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three-year period.

THE OFFERING

The number of shares of our common stock (or a fraction thereof) based on an exchange ratio equal to approximately 5.273-for-1, such that 1 share of our common stock was issued for every 5.273 shares of DDDigtal’s common stock. At the closing of the Whaxy Merger, all shares of common stock of our newly-formed merger subsidiary formed for the sole purpose of effectuating the Whaxy Merger, were converted into and exchanged for one share of common stock of DDDigtal, and all shares of DDDigtal’s common stock that were outstanding beforeimmediately prior to the closing of the Whaxy Merger were automatically cancelled and retired. Upon the closing of the Whaxy Merger, DDDigtal continued as our surviving wholly-owned subsidiary, and the merger subsidiary ceased to exist.

On July 13, 2017, we consummated a reverse triangular merger (the “Odava Merger”) pursuant to which we acquired all of the outstanding common stock of Odava Inc. (“Odava”), a Delaware corporation. Upon closing of the Odava Merger, each share of Odava’s common stock was exchanged for such number of shares of our common stock (or a fraction thereof), based on an exchange ratio equal to approximately 4.069-for-1, such that 1 share of our common stock was issued for every 4.069 shares of Odava’s common stock. At the closing of the Odava Merger, all shares of common stock of our newly-formed merger subsidiary formed for the sole purpose of effectuating the Odava Merger, were converted into and exchanged for one share of common stock of Odava, and all shares of Odava’s common stock that were outstanding immediately prior to the closing of the Odava Merger automatically cancelled and retired. Upon the closing of the Odava Merger, Odava continued as our surviving wholly-owned subsidiary, and the merger subsidiary ceased to exist.

On October 1, 2021, we consummated a reverse triangular merger (the “Empire Merger”) pursuant to which we acquired all of the outstanding common stock of Empire Services, Inc. (“Empire”), a Virginia corporation. Upon closing of the Empire Merger, all of the shares of Empire’s common stock was exchanged for 1,650,000 shares of our common stock. At the closing of the Empire Merger, all shares of common stock of our newly-formed merger subsidiary formed for the sole purpose of effectuating the Empire Merger, were converted into and exchanged for one share of common stock of Empire, and all shares of Empire’s common stock that were outstanding immediately prior to the closing of the Empire Merger automatically cancelled and retired. Upon the closing of the Empire Merger, Empire continued as our surviving wholly-owned subsidiary, and the merger subsidiary ceased to exist.

COVID-19

We continue to proactively monitor and assess the COVID-19 global pandemic. The full impact of the COVID-19 pandemic is inherently uncertain. The COVID-19 pandemic has caused us to modify our business practices (including but not limited to curtailing or physical contact with customers). We further continue to monitor developments of the COVID-19 pandemic and we may take additional actions as may be required by government authorities or that we determine are in the best interests of our employees, patients, and business partners. We have implemented appropriate safety measures, following guidance from the Center for Disease Control and the Occupational Safety and Health Administration. The extent of the impact of the COVID-19 pandemic on our future liquidity and operational performance will depend on certain developments.

| 2 |

Products and Services

Our main product is selling ferrous metal, which is used in the recycling and production of finished steel. It is categorized into heavy melting steel, plate and structural, and shredded scrap, with various grades of each of those categorized based on the content, size and consistency of the metal. All of these attributes affect the metal’s value.

We also process nonferrous metals such as aluminum, copper, stainless steel, nickel, brass, titanium, lead, alloys and mixed metal products. Additionally, we sell the catalytic converters recovered from end-of-life vehicles to processors which extract the nonferrous precious metals such as platinum, palladium and rhodium.

We provide metal recycling services to a wide range of customers, including large corporations, industrial manufacturers, retail customers, and government organizations.

Pricing and Customers

Prices for our ferrous and nonferrous products are based on prevailing market rates and are subject to market cycles, worldwide steel demand, government regulations and policy, and supply of products that can be processed into recycled steel. Our main buyer adjusts the prices they pay for scrap metal products based on market rates usually on a monthly or bi-weekly basis. We are paid for the scrap metal we deliver to Sims on the same business day that we deliver the metal.

Based on any price changes from Sims or our other buyers, we in turn adjust the price for unprocessed scrap we pay customers in order to manage the impact on our operating income and cashflows.

The spread we are able to realize between the sales prices and the cost of purchasing scrap metal is determined by a number of factors, including transportation and processing costs. Historically, we have experienced sustained periods of stable or rising metal selling prices, which allow us to manage or increase our operating income. When selling prices decline, we adjust the prices we pay customers to minimize the impact to our operating income.

Sources of Unprocessed Metal

Our main sources of unprocessed metal we purchase are end-of-life vehicles, old equipment, appliances and other consumer goods, and scrap metal from construction or manufacturing operations. We acquire this Offeringunprocessed metal from a wide base of suppliers including large corporations, industrial manufacturers, retail customers, and government organizations who unload their metal at our facilities or we pick it up and transport it from the supplier’s location. Currently, all of our operations and the suppliers are located in the Hampton Roads and northeastern North Carolina markets.

Our supply of scrap metal is influenced by overall health of economic activity in the United States, changes in prices for recycled metal, and, to a lesser extent, seasonal factors such as severe weather conditions, which may prohibit or inhibit scrap metal collection.

Technology

In May 2021, we launched our new website. For the first time, Empire’s customers can see the current prices for each type of scrap metal. Our website is also integrated with Google’s Business Profiles, listing many of Empire’s locations on Google for the first time. In late May 2021, the Empire launched a junk car buying platform, where people looking to sell their scrap cars can get a quote within minutes, and integrated Google Ads, enabling Empire to micro-target their advertising based on location, age, income, and other factors.

Additionally, during 2021, the Company moved the operations of each of their yards to WeighPay, a cloud-based Enterprise Resource Planning “ERP” system, which enables management to track sales, inventory, and operations at each facility in real time, while also establishing stronger internal controls and systems. Additionally, in 2021, the Company moved Empire’s accounting systems over to a cloud-based QuickBooks to facilitate collaboration and further growth.

| 3 |

The technology systems and improvements Empire implemented have resulted in a significant increase in new customers, hundreds of quotes and dozens of purchases of junk cars, and we believe a material increase in Empire’s revenues as a result of these improvements. These systems have also streamlined Empire’s accounting and internal operations to enable any future acquisitions to be closed quickly and efficiently. Lastly, through the data-driven decision processes that have been introduced, Empire’s strategy on future locations and pricing is being informed by accurate and relevant data.

Now that strong foundational systems are in place, management has begun to repurpose Greenwave’s technology platform that it developed from 2013 to 2020 into a marketing and CRM platform for scrap metal yards. This system will enable each facility to:

| ● | Send text and email updates and special deals to their customers; | |

| ● | Implement a points-based rewards system; | |

| ● | Enable consumers to view scrap metal yards in their local area along with prices; | |

| ● | Receive quotes for junk cars in real-time; | |

| ● | Leave and respond to reviews of scrap yards; and | |

| ● | View analytics and conversion data. |

Over the past ten years, Greenwave has invested approximately $10 million developing these technologies which we believe we can re-purpose for a fraction of the cost of development, give our metal recycling facilities and those who pay to use our platform a significant competitive advantage, and grow our revenues and profits as a result.

There are very few companies developing technology solutions for the scrap metal industry and we believe that by focusing our experience and assets on this highly-profitable but often overlooked industry, we can create significant value for our shareholders.

Competition

We compete with several large, well-financed recyclers of scrap metal, steel mills which own their own scrap metal processing operations, and with smaller metal recycling companies. Demand for metal products are sensitive to global economic conditions, the relative value of the U.S. dollar, and availability of material alternatives, including recycled metal substitutes. Prices for recycled metal are also influenced by tariffs, quotas, and other import restrictions, and by licensing and government requirements.

We aim to create a competitive advantage through our ability to process significant volumes of metal products, our use of processing and separation equipment, the number and location of our facilities, and the operating synergies we have been able to develop based on our experience.

Recent Developments

Financings and Other Sources of Funding

On February 16, 2021, the Company entered into a securities purchase agreement with an accredited investor for the sale of five (5) shares of the Company’s Series X Convertible Preferred Stock, par value $0.0001 per share, resulting in aggregate proceeds of $100,000. The purchase and issuance of such shares of Series X Preferred Stock closed on February 18, 2021.

| 4 |

On February 22, 2021, the Company entered into a securities purchase agreement with an accredited investor for the sale of 1.25 shares of the Company’s Series X Convertible Preferred Stock, par value $0.0001 per share, resulting in aggregate proceeds of $25,000. The purchase and issuance of such shares of Series X Preferred Stock closed on February 24, 2021.

On March 10, 2021, the Company entered into a securities purchase agreement with an accredited investor for the sale of 3.75 shares of the Company’s Series X Convertible Preferred Stock, par value $0.0001 per share, resulting in aggregate proceeds of $75,000. The purchase and issuance of such shares of Series X Preferred Stock closed on March 12, 2021.

On November 30, 2021, the Company entered into securities purchase agreements with accredited investors for the placement of secured convertible promissory notes in the principal amount of $37,714,966 together with warrants to purchase 2,514,728 shares of common stock (“November 2021 Offering”). The Company paid $2,200,000 and a warrant to purchase 200,000 shares of common stock as commission for the November 2021 Offering. The Company’s Chief Executive Officer rolled $4,762,838 of debt into the offering. Aggregate proceeds from the offering were $27,585,450.

Employees and Human Capital Resources

Greenwave has 89 full-time employees as of March 30, 2016,April 4, 2022.

We view our diverse employee population and our culture as key to our success. Our company culture prioritizes learning, supports growth and empowers us to reach new heights. We recruit employees with the skills and training relevant to succeed and thrive in their functional responsibilities. We assess the likelihood that a particular candidate will contribute to the Company’s overall goals, and beyond their specifically assigned tasks. Depending on the position, our recruitment reach can be local as well as national. We provide competitive compensation and best in class benefits that are tailored specifically to the needs and requests of our employees. During 2021, we worked to manage through the effects of the COVID-19 pandemic and entered 2022 stronger than ever. As appropriate, others were provided the option of working remotely or at our facilities with appropriate safeguards. We uphold our commitment to shareholders by working hard, being thoughtful about how we use resources and doing the right thing for the Company at every turn.

Available Information

We file Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other information with the Securities and Exchange Commission (SEC). Our filings with the SEC are available free of charge on the SEC’s website at www.sec.gov and on our website under the “Investors” tab as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC.

Corporate Actions Approved at a Meeting of Stockholders

On September 3, 2021, the Company held its 2021 annual meeting of stockholders. At the annual meeting, stockholders approved (i) the two director nominees, (ii) an amendment to the Company’s Second Amended and Restated Certificate of Incorporation to increase the number of authorized shares of common stock, par value $0.001, of the Company from 500,000,000 shares to 1,200,000,000 shares, (iii) the grant of discretionary authority to the Company’s Board of Directors to amend the Certificate of Incorporation to effect one or more consolidations of the issued and outstanding shares of Common Stock, pursuant to which the shares of Common Stock would be combined and reclassified into one share of Common Stock at a ratio within the range from 1-for-2 up to 1-for-1,000 (each, a “Reverse Stock Split”), provided that, (X) the Company shall not effect Reverse Stock Splits that, in the aggregate, exceed 1-for-1,000, and (Y) any Reverse Stock Split is completed no later than the first anniversary of the Record Date, (iv) the Company’s 2021 Equity Incentive Plan and the availability of 50,000,000 shares of common stock for issuance thereunder, (v) the ratification of RBSM LLP as the Company’s independent public account for the fiscal year ending December 31, 2021, and (vi) an advisory vote on executive compensation.

| 5 |

The Offering

This prospectus relates to the resale from time to time by the selling stockholders identified herein of up to an aggregate 15,238,461 shares of our Common Stock, consisting of: 2,565,059 shares of Common Stock issuable upon conversion of convertible Notes and warrants to purchase up to 2,514,428 shares of Common Stock issued pursuant to a November 2021 Private Placement.

| Common stock offered by selling stockholders: | 15,238,461 shares which includes 2,565,059 shares of common stock issuable upon conversion of convertible debt and 2,514,428 shares of Common Stock issuable upon exercise of outstanding warrants. | |

| Offering price: | Market price or privately negotiated prices. | |

| Common stock outstanding after the offering: | 8,417,903 shares, including shares of Common Stock issuable upon exercise of warrants. |

| Use of proceeds: | We will not receive any proceeds from the sale of the Resale Shares by the selling stockholders; however, we will receive the proceeds from any cash exercise of warrants. | |

Risk factors: | An investment in our securities involves a high degree of risk and could result in a loss of your entire investment. Prior to making an investment decision, you should carefully consider all of the information in this prospectus and, in particular, you should evaluate the risk factors set forth under the caption “Risk Factors” beginning on page 7. | |

| Symbol on OTC Pink: | GWAV |

Assumptions Used Throughout This Prospectus

Unless otherwise stated in this prospectus, the number of shares of our common stock to be outstanding before and after this Offering excludes:

Unless otherwise stated in this prospectus, the number of shares of our common stock to be outstanding after this offering excludes:excludes the following other securities that may be issuable in the future:

| ● | 2,752,941 shares of common stock issuable upon the exercise of outstanding warrants at a weighted average exercise price of $19.77 per share; | |

| ● | 92,116 shares of common stock issuable upon the exercise of outstanding stock options; | |

| ● | 167,300 shares of common stock available for future issuance under our 2021 Equity Incentive Plan; and | |

| ● | 2,565,059 shares of common stock issuable upon conversion of outstanding convertible notes at a conversion price of $15.00 per share. |

| 6 |

SUMMARY FINANCIAL DATA

RISK FACTORS

An investment in our common stock involves a high degree of risk. The following summary ofrisks described below include all material risks to our financial data should be read in conjunction with, and is qualified in its entirety by referencecompany or to “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements, appearing elsewhereinvestors in this prospectus.

Statements of Operations Data

| For the year-ended December 31, 2015 | For the year-ended December 31, 2014 | |||||||

| Revenue | 213,963 | $ | 9,030 | |||||

| Loss from operations | (6,125,100 | ) | $ | (1,607,223 | ) | |||

| Net loss | (8,472,898 | ) | $ | (2,436,142 | ) | |||

Balance Sheet Data

| As of December 31, 2015 | As of December 31, 2014 | |||||||

| Cash | $ | 386,316 | $ | 141,928 | ||||

| Total assets | $ | 720,279 | $ | 366,529 | ||||

| Total liabilities | $ | 403,542 | $ | 1,313,328 | ||||

| Total stockholders’ equity (deficit) | $ | 316,737 | $ | (946,799 | ) | |||

RISK FACTORS

offering that are known to our company. You should carefully consider thesuch risks described below and other informationbefore participating in this prospectus, including the financial statements and related notes that appear at the end of this prospectus, before deciding to invest in our securities. These risks should be considered in conjunction with any other information included herein, including in conjunction with forward-looking statements made herein.offering. If any of the following risks actually occur, they could materially adversely affect our business, financial condition operating results or prospects. Additional risks and uncertainties that we do not presently know or that we currently deem immaterial may also impair our business, financial condition, operating results and prospects.

Risks Relating to Our Financial Condition

Our independent registered accounting firm has expressed concerns about our ability to continue as a going concern.

The report of our independent registered accounting firm expresses concern about our ability to continue as a going concern based on the absence of significant revenues, our significant losses from operations and our need for additional financing to fund all of our operations. It is not possible at this time for us to predict with assurance the potential success of our business. The revenue and income potential of our proposed business and operations are unknown. If we cannot continue as a viable entity, we may be unable to continue our operations and you may lose some or all of your investment in our common stock.

In the past we have experienced material weaknesses in our internal control over financial reporting, which if continued, could impair our financial condition.

As reported in our Annual Report on Form 10-K, our management concluded that our internal control over financial reporting was not effective as of December 31, 2015. Such ineffectiveness was due to material weaknesses regarding our controls and procedures, which were as follows: (i) due to the small size of its staff and limited resources, the Company did not have sufficient segregation of duties to support its internal control over financial reporting; (ii) lack of an Audit Committee; and (iii) lack of a majority of disinterested directors on the Board of Directors. We have since changed the structure of our Board of Directors such that it now contains a majority of disinterested directors and created an Audit Committee comprised of only disinterested directors. Due to our size and nature, segregation of all conflicting duties has not always been possible and may not be economically feasible in the near term; however, we do expect to hire additional accounting personnel over the coming year. We have and do endeavor to take appropriate and reasonable steps to make improvements to remediate these deficiencies, and intend to consider the results of our remediation efforts and related testing as part of our year-end 2015 assessment of the effectiveness of our internal control over financial reporting in light of our strategic plan and make any other changes that our management deems appropriate. If we have continued material weaknesses in our internal financial reporting, our financial conditionoperations could be impaired or we may have to restate our financials, which could cause us to expend additional funds that would have a material impact on our ability to generate profits and on the success of our business.

We have limited operational history in an emerging industry, making it difficult to accurately predict and forecast business operation.

As we have less than three years of corporate operational history and have only begun to generate revenue, it is extremely difficult to make accurate predictions and forecasts on our finances. This is compounded by the fact we operate in both the technology and cannabis industries, two rapidly transforming industries. There is no guarantee that our products or services will remain attractive to potential and current users as these industries undergo rapid change or that potential customers will utilize our services.

materially harmed. As a growing technology company, we have yet to achieve a profit and may not achieve a profit inresult, the near future, if at all.

We have not yet produced a net profit and may not in the near future, if at all. While we expect our revenue to grow significantly, we have not achieved profitability and cannot be certain that we will be able to sustain our current growth rate or realize sufficient revenue to achieve profitability. Further, many of our competitors in the technological fields, such as Twitter, Inc., have a significantly larger user base and revenue stream, but have yet to achieve profitability. Our ability to continue as a going concern may be dependent upon raising capital from financing transactions, increasing revenue throughout the year and keeping operating expenses below our revenue levels in order to achieve positive cash flows, none of which can be assured.

We may require additional capital to support business growth, and this capital might not be available on acceptable terms, if at all.

We intend to continue to make investments to support our business growth and may require additional funds to respond to business challenges, including the need to develop new features and products or enhance our existing products, improve our operating infrastructure or acquire complementary businesses and technologies. Accordingly, we may need to engage in continued equity or debt financings to secure additional funds. If we raise additional funds through future issuances of equity or convertible debt securities, our existing stockholders could suffer significant dilution, and any new equity securities we issue could have rights, preferences and privileges superior to thosetrading price of our common stock. Any debt financing we securestock could decline, and you might lose all or part of your investment. When determining whether to buy our common stock, you should also refer to the other information in this prospectus, including our financial statements and the future could involve restrictive covenants relating to our capital raising activities and other financial and operational matters, which may make it more difficult for us to obtain additional capital and to pursue business opportunities, including potential acquisitions. We may not be able to obtain additional financing on terms favorable to us, if at all. If we are unable to obtain adequate financing or financing on terms satisfactory to us when we require it, our ability to continue to support our business growth and to respond to business challenges could be impaired, and our business may be harmed.related notes included elsewhere in this prospectus.

Risk Factors Summary

Risks Relating to Our Business and Industry

| ● | The coronavirus disease (COVID-19) pandemic has had, and may continue to have, an adverse effect on our business, results of operations, financial condition and cash flows. Future epidemics or other public health emergencies could have similar effects. | |

| ● | We operate in industries that are cyclical and sensitive to general economic conditions, which could have a material adverse effect on our operating results, financial condition and cash flows. | |

| ● | Changing conditions in global markets including the impact of sanctions and tariffs, quotas and other trade actions and import restrictions may adversely affect our operating results, financial condition and cash flows. | |

| ● | Changes in the availability or price of inputs such as raw materials and end-of-life vehicles could reduce our sales. | |

| ● | Significant decreases in scrap metal prices may adversely impact our operating results. | |

| ● | Imbalances in supply and demand conditions in the global steel industry may reduce demand for our products. | |

| ● | Impairment of long-lived assets and equity investments may adversely affect our operating results. | |

| ● | We may be unable to renew facility leases, thus restricting our ability to operate. | |

| ● | Increases in the value of the U.S. dollar relative to other currencies may reduce the demand for our products. | |

| ● | Equipment upgrades, equipment failures and facility damage may lead to production curtailments or shutdowns. | |

| ● | We are subject to legal proceedings and legal compliance risks that may adversely impact our financial condition, results of operations and liquidity. | |

| ● | Climate change may adversely impact our facilities and our ongoing operations. | |

| ● | Catastrophic events may disrupt our business and impair our ability to provide our platform to clients and consumers, resulting in costs for remediation, client and consumer dissatisfaction, and other business or financial losses. | |

| ● | We depend on a small number of suppliers for the materials necessary to run our business. The loss of these suppliers, or their failure to supply us with these materials, would materially and adversely affect our business. |

| 7 |

| ● | We have substantial customer concentration, with a limited number of customers accounting for a substantial portion of our 2021 and 2020 revenues. | |

| ● | We have a limited history upon which an evaluation of our prospects and future performance can be made and have no history of profitable operations. | |

| ● | We are highly dependent on the services of key executives, the loss of whom could materially harm our business and our strategic direction. If we lose key management or significant personnel, cannot recruit qualified employees, directors, officers, or other personnel or experience increases in our compensation costs, our business may materially suffer. | |

| ● | We may need to obtain additional financing to fund our operations. | |

| ● | Our independent registered accounting firm has expressed concerns about our ability to continue as a going concern. | |

| ● | In the past we have experienced material weaknesses in our internal control over financial reporting, which if continued, could impair our financial condition. |

Cannabis remains illegal under Federal law.

Risks Relating to Government Laws and Regulations

| ● | Tax increases and changes in tax rules may adversely affect our financial results. | |

| ● | We may not realize our deferred tax assets in the future. | |

| ● | Environmental compliance costs and potential environmental liabilities may have a material adverse effect on our financial condition and results of operations. | |

| ● | Governmental agencies may refuse to grant or renew our licenses and permits, thus restricting our ability to operate. | |

| ● | Compliance with existing and future climate change and greenhouse gas emission laws and regulations may adversely impact our operating results. |

Risks Relating to Intellectual Property

| ● | We may not be able to protect our intellectual property rights throughout the world. | |

| ● | We may be involved in lawsuits to protect or enforce our intellectual property, which could be expensive, time-consuming and unsuccessful and the outcome might have an adverse effect on the success of our business. | |

| ● | We may be subject to claims by third parties asserting that our employees or we have misappropriated their intellectual property or claiming ownership of what we regard as our own intellectual property. |

Risks Related to our Common Stock

| ● | There can be no assurance that our common stock will ever be approved for listing on a national securities exchange. | |

| ● | The market price of our common stock may be volatile and adversely affected by several factors. |

| 8 |

Despite

| ● | If our shares of common stock become subject to the penny stock rules, it would become more difficult to trade our shares. | |

| ● | We are a “smaller reporting company” within the meaning of the Securities Act, and if we decide to take advantage of certain exemptions from various reporting requirements applicable to smaller reporting companies, our common stock could be less attractive to investors. | |

| ● | We do not anticipate paying dividends on our common stock, and investors may lose the entire amount of their investment. | |

| ● | You could lose some or all of your investment. | |

| ● | Our management controls a large block of our common stock that will allow them to control us. | |

| ● | Because we can issue additional shares of Common Stock, purchasers of our Common Stock may incur immediate dilution and experience further dilution. | |

| ● | Provisions in our Second Amended and Restated Certificate of Incorporation and Bylaws and Delaware law might discourage, delay or prevent a change in control of our Company or changes in our management and, therefore, depress the market price of our Common Stock. | |

| ● | If securities or industry research analysts do not publish research or reports about our business, or if they issue unfavorable or misleading opinions regarding common stock, the market price and trading volume of our Common Stock could decline. | |

| ● | Future sales and issuances of our Common Stock or rights to purchase our Common Stock, including pursuant to our equity incentive plans, could result in additional dilution of the percentage ownership of our stockholders and could cause our stock price to fall. | |

| ● | We have broad discretion in the use of the net proceeds from our public offerings and may not use them effectively. | |

| ● | Our disclosure controls and procedures may not prevent or detect all errors or acts of fraud. |

Risks Relating to Our Business and Industry

The coronavirus disease (COVID-19) pandemic has had, and may continue to have, an adverse effect on our business, results of operations, financial condition and cash flows. Future epidemics or other public health emergencies could have similar effects.

Our operations expose us to risks associated with pandemics, epidemics or other public health emergencies, such as the developmentCOVID-19 pandemic which spread to many other countries including the United States. In March 2020, the World Health Organization characterized COVID-19 as a pandemic, and the President of the United States declared the COVID-19 outbreak a national emergency. The outbreak resulted in governments around the world implementing stringent measures to help control the spread of the virus, followed by phased regulations and guidelines for reopening communities and economies. In addition, governments and central banks in several parts of the world have enacted fiscal and monetary stimulus measures to counteract the impacts of COVID-19.

We are a company operating in a critical infrastructure industry, as defined by the U.S. Department of Homeland Security. Consistent with federal guidelines and with state and local orders to date, we have continued to operate across our footprint. Notwithstanding our continued operations, COVID-19 has negatively impacted and may have further negative impacts on our financial performance, operations, supply chain and flows of raw materials, transportation and logistics networks and customers. Due in large part to the impacts of and response to the spread of COVID-19, global economic conditions declined sharply during the second quarter of fiscal 2020, resulting in historic unemployment levels, rapid changes in supply and demand in certain industry sectors, businesses switching to remote work or ceasing operations, and consumers eliminating, restricting or redirecting spending. The economic downturn adversely affected demand for our products and contributed to weaker supply and demand conditions affecting prices and volumes in the markets for our products, services and raw materials. During fiscal 2020, in particular the second quarter, our operations, margins and results were adversely impacted by lower sales volumes of recycled metals driven by severely constrained supplies of scrap metal including end-of-life vehicles, leading to lower processed volumes at our recycling facilities. We also experienced significant decreases in selling prices for our recycled metal products, softer demand, supply chain disruptions, reduced availability of shipping containers, and other logistics constraints. During 2021, metal prices recovered, contributing to an increase in revenues, although supply chain disruptions persisted.

| 9 |

The COVID-19 pandemic could further negatively impact our business or results of operations through the temporary closure of our operating locations or those of our customers or suppliers, disrupting scrap metal inflows to our recycling facilities, limiting our ability to process scrap metal through our shredder, inhibiting the manufacture of steel products at our steel mill, and delaying or preventing deliveries to our customers, among others. In addition, the ability of our employees and our suppliers’ and customers’ employees to work may be significantly impacted by individuals contracting or being exposed to COVID-19, or as a result of prevention and control measures, which may significantly hamper our production throughout the supply chain and constrict sales channels.

Because the severity, magnitude and duration of the COVID-19 pandemic and its economic consequences are uncertain, continually changing and difficult to predict, the pandemic’s impacts on our operations and financial performance, as well as its impact on our ability to successfully execute our business strategies and initiatives, are also uncertain and difficult to predict. Further, the ultimate impact of the COVID-19 pandemic on our operations and financial performance depends on many factors that are not within our control, including, but not limited to: governmental, business and individuals’ actions that have been and continue to be taken in response to the pandemic (including restrictions on travel and transportation and workforce pressures); the impact of the pandemic and actions taken in response on global and regional economies and on levels of economic activity; the availability of federal, state or local funding programs; general economic uncertainty in key global markets and financial market volatility; global economic conditions and levels of economic growth; and the pace of recovery when the COVID-19 pandemic subsides. While we expect the COVID-19 pandemic to continue to negatively impact our results of operations, cash flows and financial position, the current level of uncertainty over the economic and operational impacts of COVID-19 means the related financial impact cannot be reasonably estimated at this time.

We operate in industries that are cyclical and sensitive to general economic conditions, which could have a material adverse effect on our operating results, financial condition and cash flows.

Demand for most of our products is cyclical in nature and sensitive to general economic conditions. The timing and magnitude of the cycles in the industries in which our products are used, including global steel manufacturing and nonresidential and infrastructure construction in the U.S., are difficult to predict. The cyclical nature of our operations tends to reflect and be amplified by changes in economic conditions, both domestically and internationally, and foreign currency exchange fluctuations. Economic downturns or a prolonged period of slow growth in the U.S. and foreign markets or any of the industries in which we operate could have a material adverse effect on our results of operations, financial condition and cash flows.

Changing conditions in global markets including the impact of sanctions and tariffs, quotas and other trade actions and import restrictions may adversely affect our operating results, financial condition and cash flows.

A significant portion of the metal we process is sold to end customers located outside the U.S., including countries in Asia, the Mediterranean region and North, Central and South America. Our ability to sell our products profitably, or at all, is subject to a number of risks including adverse impacts of political, economic, military, terrorist or major pandemic events; labor and social issues; legal cannabis industry underand regulatory requirements or limitations imposed by foreign governments including quotas, tariffs or other protectionist trade barriers, sanctions, adverse tax law changes, nationalization, currency restrictions, or import restrictions for certain types of products we export; and disruptions or delays in shipments caused by customs compliance or other actions of government agencies. The occurrence of such events and conditions may adversely affect our operating results, financial condition and cash flows.

| 10 |

For example, in fiscal 2017, regulators in China began implementing the lawsNational Sword initiative involving inspections of Chinese industrial enterprises, including recyclers, in order to identify rules violations with respect to discharge of pollutants or illegally transferred scrap imports. Restrictions resulting from the National Sword initiative include a ban on certain imported recycled products, lower contamination limits for permitted recycled materials, and more comprehensive pre- and post-shipment inspection requirements. Disruptions in pre-inspection certifications and stringent inspection procedures at certain Chinese destination ports have limited access to these destinations and resulted in the renegotiation or cancellation of certain states, these state laws legalizing medical and adult cannabis use arenonferrous customer contracts in conflictconnection with the Federal Controlled Substances Act, which classifies cannabis as a schedule-I controlled substanceredirection of such shipments to alternate destinations. Commencing July 1, 2019, China imposed further restrictions in the form of import license requirements and makes cannabis usequotas on certain scrap products, including certain nonferrous products we sell. Chinese import licenses and possession illegalquotas are issued to Chinese scrap consumers on a national level. The United States Supreme Courtquarterly basis for the importation of scrap products. Since the implementation of this program, the size of import quotas has ruledbeen steadily reduced on a quarter-over-quarter basis. We have continued to sell our recycled metal products into China; however, additional or modified license requirements and quotas, as well as additional product quality requirements, may be issued in the future. We believe that the Federal government haspotential impact on our recycling operations of the rightChinese regulatory actions described above could include requirements that would necessitate additional processing and packaging of certain nonferrous recycled scrap metal products, increased inspection and certification activities with respect to regulate and criminalize cannabis, even for medical purposes, and thus Federal law criminalizingexports to China, or a change in the use of cannabis preempts state lawsour sales channels in the event of delays in the issuance of licenses, restrictive quotas or an outright ban on certain or all of our recycled metals products by China. As regulatory developments progress, we may need to make further investments in nonferrous processing equipment beyond existing planned investments where economically justified, incur additional costs in order to comply with new inspection requirements, or seek alternative markets for the impacted products, which may result in lower sales prices or higher costs and may adversely impact our business or results of operations.

In March 2018, the U.S. imposed a 25% tariff on certain imported steel products and a 10% tariff on certain imported aluminum products under Section 232 of the Trade Expansion Act of 1962. These new tariffs, along with other U.S. trade actions, have triggered retaliatory actions by certain affected countries, and other foreign governments have initiated or are considering imposing trade measures on other U.S. goods. For example, China has imposed a series of retaliatory tariffs on certain U.S. products, including a 25 percent tariff on all grades of U.S. scrap and an additional 25 percent tariff on U.S. aluminum scrap. These tariffs and other trade actions could result in a decrease in international steel demand beyond that legalize its use. However,already experienced and further negatively impact demand for our products, which would adversely impact our business. Given the Obama Administration has determined that it is not an efficient use of resources to direct Federal law enforcement agencies to prosecute those lawfully abiding by state laws allowing the use and distribution of medical and recreational cannabis. Yet, there is no guarantee that the Obama Administration will not change its stated policyuncertainty regarding the low-priority enforcementscope and duration of Federal laws in states where cannabis has been legalized. Additionally, we face another presidential election cycle in 2016 and a new administrationthese trade actions by the U.S. or other countries, the impact of the trade actions on our operations or results remains uncertain, but this impact could introduce a less favorable policy or decide to enforce the Federal laws strongly. Any such changebe material.

Changes in the Federal government’s enforcementavailability or price of Federal lawsinputs such as raw materials and end-of-life vehicles could cause significant financial damagereduce our sales.

Our businesses require certain materials that are sourced from third party suppliers. Industry supply conditions generally involve risks, including the possibility of shortages of raw materials, increases in raw material and other input costs, and reduced control over delivery schedules. We procure our scrap inventory from numerous sources. These suppliers generally are not bound by long-term contracts and have no obligation to sell scrap metal to us. In periods of declining or lower scrap metal prices suppliers may elect to hold scrap metal to wait for higher prices or intentionally slow their metal collection activities, tightening supply. If a substantial number of suppliers cease selling scrap metal to us, we will be unable to recycle metal at desired levels, and our shareholders.results of operations and financial condition could be materially adversely affected. For instance, in the second quarter of fiscal 2020 a lower price environment for recycled metals in combination with economic and other restrictions on suppliers relating to COVID-19 severely constricted the supply of scrap metal including end-of-life vehicles, which resulted in significantly reduced processed volumes. A slowdown of industrial production in the U.S. may also reduce the supply of industrial grades of metal to the metals recycling industry, resulting in less recyclable metal available to process and market. Increased competition for domestic scrap metal, including as a result of overcapacity in the scrap recycling industry in the U.S. and Canada, may also reduce the supply of scrap metal available to us. Failure to obtain a steady supply of scrap material could both adversely impact our ability to meet sales commitments and reduce our operating margins. Failure to obtain an adequate supply of end-of-life vehicles could adversely impact our ability to attract customers and charge admission fees and reduce our parts sales. Failure to obtain raw materials and other inputs to steel production such as graphite electrodes, alloys and other required consumables, could adversely impact our ability to make steel to the specifications of our customers.

| 11 |

AsSignificant decreases in scrap metal prices may adversely impact our operating results.

The timing and magnitude of the possessioncycles in the industries in which we operate are difficult to predict and useare influenced by different economic conditions in the domestic market, where we typically acquire our raw materials, and foreign markets, where we typically sell the majority of cannabisour products. Purchase prices for scrap metal including end-of-life vehicles and selling prices for recycled scrap metal are subject to market forces beyond our control. While we attempt to respond to changing recycled scrap metal selling prices through adjustments to our metal purchase prices, our ability to do so is illegal under the Federal Controlled Substances Act, we may be deemed to be aidinglimited by competitive and abetting illegal activities through the services that we provide to users and advertisers.other market factors. As a result, we may not be able to reduce our metal purchase prices to fully offset a sharp reduction in recycled scrap metal sales prices, which may adversely impact our operating income and cash flows. In addition, a rapid decrease in selling prices may compress our operating margins due to the impact of average inventory cost accounting, which causes cost of goods sold recognized in the Consolidated Statements of Operations to decrease at a slower rate than metal purchase prices.

For instance, in fiscal 2020, weaker market conditions for recycled metals, including as a result of the sharp decline in global economic conditions during the third quarter of fiscal 2020 in large part due to the impacts of the COVID-19 pandemic, and structural changes to the market for certain recycled nonferrous products primarily from Chinese import restrictions and tariffs, resulted in periods of sharply declining commodity prices and lower average net selling prices for our ferrous and nonferrous recycled metal products compared to fiscal 2019. As a result, operating margins in fiscal 2020 compressed as the decline in average net selling prices for our recycled metal products outpaced the reduction in purchase costs for raw materials. In fiscal 2021, prices for our ferrous and non-ferrous metals increased significantly, resulting in an increase in revenue and purchasing costs for raw materials.

Imbalances in supply and demand conditions in the global steel industry may reduce demand for our products.

Economic expansions and contractions in global economies can result in supply and demand imbalances in the global steel industry that can significantly affect the price of commodities used and sold by our business, as well as the price of and demand for finished steel products. In a number of foreign countries, such as China, steel producers are generally government-owned and may therefore make production decisions based on political or other factors that do not reflect free market conditions. In the past, overcapacity and excess steel production in these foreign countries resulted in the export of aggressively priced semi-finished and finished steel products. This led to disruptions in steel-making operations within other countries, negatively impacting demand for our recycled scrap metal. Existing or new trade laws and regulations may cause or be inadequate to prevent disadvantageous trade practices, which could have a material adverse effect on our financial condition and results of operations. Although trade regulations restrict or impose duties on the importation of certain products, if foreign steel production significantly exceeds consumption in those countries, global demand for our recycled scrap metal products could decline and imports of steel products into the U.S. could increase, resulting in lower volumes and selling prices for our recycled metal products and finished steel products.

Impairment of long-lived assets and equity investments may adversely affect our operating results.