As filed with the Securities and Exchange Commission on May 12,September 27, 2004.

Registration No. 333- 333-115434

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 4

To

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

HURON CONSULTING GROUP INC.

(Exact name of registrant as specified in its charter)

| Delaware | 8742 | 01-0666114 | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code number) | (IRS Employer Identification Number) |

550 West Van Buren Street

Chicago, Illinois 60607

(312) 583-8700

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Ronald C. Provenzano, Esq.Gary E. Holdren

Vice President, Chief LegalExecutive Officer and SecretaryPresident

Huron Consulting Group Inc.

550 West Van Buren Street

Chicago, Illinois 60607

(312) 583-8700

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies To:

| Charles W. Mulaney, Jr., Esq. | Herbert S. Wander, Esq. | |

| Kimberly A. deBeers, Esq. | Adam R. Klein, Esq. | |

| Skadden, Arps, Slate, Meagher & Flom LLP | Katten Muchin Zavis Rosenman | |

| 333 West Wacker Drive | 525 West Monroe Street | |

| Chicago, Illinois 60606 | Chicago, Illinois 60661 | |

| (312) 407-0700 | (312) 902-5200 |

APPROXIMATE DATE OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement number for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. ¨

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price (1) | Amount of Registration Fee | ||||

Common stock, par value $.01 per share | $ | 100,000,000 | $ | 12,670 | ||

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. Neither we nor the selling stockholder may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and neither we nor the selling stockholder are soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | Subject to Completion |

5,000,000 Shares

Huron Consulting Group Inc.

Common Stock

This is the initial public offering of shares of our common stock.stock of Huron Consulting Group Inc. Prior to this offering, there has been no public market for our common stock. We are offering 3,333,333 shares of common stock and the selling stockholder identified in this prospectus is offering 1,666,667 shares of common stock. We will not receive any proceeds from the sale of any shares by the selling stockholder. The initial public offering price of our common stock is expected to be between $$14.00 and $$16.00 per share.

We intend to applyhave applied for the quotation of our common stock on the NASDAQ National Market under the symbol “HURN.”

Investing in our common stock involves a high degree of risk. Before buying any shares, you should carefully read the discussion of material risks of investing in our common stock in “Risk factors” beginning on page 913 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||

| Public offering price | $ | $ | ||

| Underwriting discounts and commissions | $ | $ | ||

| Proceeds, before expenses, to us | $ | $ | ||

| Proceeds, before expenses, to the selling stockholder | $ | $ | ||

The underwriters may also purchase up to an additional 750,000 shares of common stock from the selling stockholder at the public offering price, less underwriting discounts and commissions, within 30 days from the date of this prospectus to cover over-allotments, if any. If the underwriters exercise this option in full, the total underwriting discounts and commissions will be $ and total proceeds, before expenses, to the selling stockholder will be $ .

The underwriters are offering the common stock as set forth under “Underwriting.” Delivery of the shares of common stock will be made on or about , 2004.

Joint Book-Running Managers

| UBS Investment Bank | Deutsche Bank Securities |

William Blair & Company

You should only rely on the information contained in this prospectus. Neither we, the selling stockholder nor the underwriters have authorized anyone to provide you with information different from that contained in this prospectus. We and the selling stockholder are offering to sell, and seeking offers to buy, shares of common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accuratecurrent only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of common stock.prospectus.

| 1 | ||

Management’s discussion and analysis of financial condition and results of operations | ||

Material U.S. federal tax considerations for non-U.S. holders of our common stock | ||

| F-1 | ||

Through and including , 2004 (the 25th day after commencement of this offering), federal securities law may require all dealers effecting transactions in our common stock, whether or not participating in this offering, to deliver a prospectus. This delivery requirement is in addition to the obligation of dealers to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

Huron Consulting Group Inc., Huron Consulting Group, our logo and certain other names of our services are our trademarks, trade names or service marks. Each trademark, trade name or service mark of any other company appearing in this prospectus belongs to its holder.

i

The following is a summary of some of the information contained in this prospectus. In addition to this summary, we urge you to read the entire prospectus carefully, especially the risks of investing in our common stock discussed under “Risk factors” and the consolidated financial statements and notes to those financial statements included elsewhere in this prospectus. In this prospectus, unless the context otherwise requires, the terms “Huron,” “company,” “we,” “us” and “our” refer to Huron Consulting Group Inc. and its subsidiaries.

OUR BUSINESS

We are an independent provider of financial and operational consulting services. Our highly experienced and credentialed professionals employ their expertise in accounting, finance, economics and operations to provide our clients with specialized analysis and customized advice and solutions that are tailored to address each client’s particular challenges and opportunities.

We provide our services through two segments: Financial Consulting and Operational Consulting. Our Financial Consulting segment helps clients effectively address complex challenges that arise from litigation, disputes, investigations, regulation, financial distress and other sources of significant conflict or change. Our services in this segment include financial and economic analysis; forensic accounting; expert support and testimony services; restructuring, turnaround and bankruptcy advisory services; and valuation analysis. Our Operational Consulting segment helps clients improve the overall efficiency and effectiveness of their operations, reduce costs, manage regulatory compliance and maximize procurement efficiency. For the year ended December 31, 2003 and the threesix months ended March 31,June 30, 2004, we derived 68.9% and 61.6%62.3%, respectively, of our revenues from Financial Consulting and 31.1% and 38.4%37.7%, respectively, of our revenues from Operational Consulting.

ManyWe believe many organizations are facing increasingly large and complex business disputes and lawsuits, a growing number of regulatory and internal investigations and more intense public scrutiny. Concurrently, we believe increased competition and regulation are presenting significant operational and financial challenges for organizations. Distressed companies are responding to these challenges by restructuring and reorganizing their businesses and capital structures, while financially healthy organizations are striving to take advantage of business opportunities by improving operations, reducing costs and maximizing revenue. Many organizations have limited dedicated resources to respond effectively to these challenges and opportunities. Consequently, we believe these organizations will increasingly seek to augment their internal resources with experienced independent consultants like us.

We provide our services to a wide variety of both financially sound and distressed organizations, including Fortune 500 companies, medium-sized and large businesses, leading academic institutions, healthcare organizations and the law firms that represent these various organizations. Since May 2002, we have conducted over 1,000 engagements for over 500 clients, and we have worked on engagements with 35 of the 40 largest U.S. law firms listed inThe American Lawyer 20032004 Am Law 100.

As of March 31,September 17, 2004, we had 588604 employees, including 483486 billable professionals, whom we refer to as consultants. In addition to our headquarters in Chicago, we have five other core offices located in Boston, Houston, New York City, San Francisco and Washington, D.C. and two smaller offices located in Charlotte and Los Angeles.

1

OUR HISTORY

Huron was formed in March 2002 and commenced operations in May 2002. We were founded by a core group of experienced financial and operational consultants that consisted primarily of former Arthur

Andersen LLP partners and professionals, including our chief executive officer, Gary E. Holdren, with

1

equity sponsorship from a group of investors led by Lake Capital Management LLC. For purposes of holding their investment in us, these investors formed our parent, HCG Holdings LLC, a Delaware limited liability company. HCG Holdings LLC, which is the selling stockholder in this offering, currently owns approximately 93% of our outstanding common stock. After giving effect to this offering (without giving effect to the underwriters’ over-allotment option) and the issuance of 769,700 shares of restricted common stock to our executive officers and certain of our employees on the date of this prospectus, HCG Holdings LLC will own approximately 59% of our outstanding common stock. As a result, HCG Holdings LLC will continue to have the power to control all matters submitted to our stockholders for approval after the consummation of this offering. After giving effect to this offering (without giving effect to the underwriters’ over-allotment option), the issuance of 769,700 shares of restricted common stock to our executive officers and certain of our employees on the date of this prospectus and the grant to each of our four independent directors of options exercisable for 13,333 shares of common stock, assuming a public offering price of $15.00 per share, the mid-point of the range shown on the cover of this prospectus, our executive officers, board members and director nominees will collectively own approximately 6% of our outstanding common stock, assuming all outstanding options that will be vested at the time of consummation of this offering, including the options held by these persons, were exercised and that the exercise price was paid in cash. See “Prospectus summary—Background and certain transactions,” “Certain relationships and related transactions” and “Principal and selling stockholders” for further information.

We created Huron because we believed that a financial and operational consulting business that is unaffiliated with a public accounting firm is better suited to serve its clients’ needs. As an independent consulting firm, Huron is not subject to the legal restrictions placed on public accounting firms that prohibit them from providing certain non-audit services to their audit clients. We also believed that many other consulting firms provided only a limited scope of services and, therefore, a company such as ours with a wide array of services would be better positioned to serve the diverse and complex needs of various organizations.

In response to strong demand for our services, we began aggressively hiring consultants in the first quarter of 2003 and added over 200 new consultants during 2003. While this aggressive hiring negatively impacted our utilization rates (determined by dividing the number of hours all of our consultants worked on client assignments during a period by the total available working hours for all of our consultants during the same period, assuming a forty-hour work week, less paid holidays and vacation days) as we integrated our new hires, we believe the early results of this growth initiative are evident in our recent financial results. Revenues in 2002 totaled $35.1 million for our first eight months of operations and rose to $101.5 million in 2003, our first full year of operations. Revenues totaled $40.1$81.6 million in the threesix months ended March 31,June 30, 2004 compared to $23.2$46.9 million in the threesix months ended MarchJune 30, 2003, representing 74.0% year-over-year growth. We incurred a net loss of $4.2 million for the partial year ended December 31, 2002 and a net loss of $1.1 million for the year ended December 31, 2003 representing 72.8% year-over-year growth.and generated net income of $7.2 million for the six months ended June 30, 2004 compared to $1.9 million for the six months ended June 30, 2003. At June 30, 2004, we had a total stockholders’ deficit of $0.2 million.

OUR COMPETITIVE STRENGTHS

We believe our key competitive strengths include:

| Ø | Experienced and highly qualified consultants. Our consultants combine proficiency in accounting, finance, economics and operations with deep knowledge of specific industries. In addition, many of our consultants are highly credentialed and include certified public accountants, MBAs, accredited valuation specialists and forensic accountants. |

| Ø | Independent provider of financial and operational consulting services. We believe increased regulations, growing public scrutiny and concern regarding auditor conflicts of interests provide us with a competitive advantage over public accounting firms in securing consulting |

2

engagements. We also believe that the relatively small number of large public accounting firms will lead some organizations to engage independent consultants like us to preserve their flexibility to hire large public accounting firms for audit or other attest services. |

| Ø | Complementary service offerings and integrated approach. We offer a broad array of financial and operational consulting services that can be delivered through teams of consultants from our different practices. Our integrated approach enables us to provide solutions tailored to specific client needs. In addition, our range of service offerings reduces our dependence on any one service offering or industry, provides a stimulating work environment for our consultants and enhances our flexibility in managing the utilization and career development of our directors, managers, associates and analysts. |

| Ø | Distinctive culture. We believe we have been successful in attracting and retaining top talent because of our distinctive culture, which combines the energy and flexibility of a high-growth company with the professionalism of a major professional services firm. We believe our performance-based compensation program, which both recognizes individual performance and reinforces teamwork, also contributes to our recruiting and retention success. |

2

OUR GROWTH STRATEGY

We have grown significantly since we commenced operations, more than doubling the number of our consultants from 213 on May 31, 2002 to 483486 on March 31,September 17, 2004. We believe there are a number of opportunities to continue to grow our business, including:

| Ø | Attracting additional highly qualified consultants. We believe our stimulating work environment, performance-based compensation program and distinctive culture will enable us to attract additional top talent from other consulting firms, accounting firms, targeted industries and on-campus recruiting. In the near term, our focus will primarily be on hiring and developing additional managers, associates and analysts to expand support for our existing practices and better leverage our managing directors and directors. |

| Ø | Growing our existing relationships and developing new relationships. We work hard to maintain and grow our existing client and law firm relationships. The goodwill created from these relationships leads to referrals from satisfied clients and their law firms, which also enables us to secure engagements with new clients. |

| Ø | Continuing to promote and deliver an integrated approach to service delivery. We will continue to utilize our experience with the financial and operational challenges facing our clients to identify and provide additional value-added services as part of an integrated solution. Frequently, a particular engagement is expanded or a new engagement secured with an existing client as a direct result of our quality work for that client. |

| Ø | Continuing to build our brand. We intend to continue to build our reputation and a common identity for the services we provide under the Huron brand name. We believe that using a common brand name and identity for our services enhances our visibility in the marketplace and improves our ability to compete for new business. |

| Ø | Expanding our service offerings. We believe there will be opportunities to expand our current capabilities or broaden the scope of our existing services, and we will evaluate these in response to client and general market demands. |

RISKS RELATING TO OUR BUSINESS AND GROWTH STRATEGY

While we believe focusing on the key areas set forth above will provide us with opportunities to reach our goals, there are a number of risks and uncertainties that may limit our ability to achieve our goals, including that:

| Ø | our success depends largely on our ability to attract, develop, motivate and retain highly skilled individuals in an industry where there is great competition for talent; |

| Ø | growing our business places demands on our management and internal systems, processes and controls, and the increased costs associated with successfully managing these demands may adversely affect our profitability; |

3

| Ø | our profitability depends to a large extent on the utilization and billing rates for our consultants, which are affected by a number of factors, many of which are beyond our control; |

| Ø | our ability to maintain and attract new business depends upon our reputation, the professional reputation of our consultants and the quality of our services, and any factor that diminishes our reputation or that of our consultants or calls into question the quality of our services could make it substantially more difficult for us to attract new engagements and clients; |

| Ø | our ability to build our brand could be negatively impacted if another company were to successfully challenge our right to use the Huron name, or if we were unable to prevent a competitor from using a name that is similar to our name; and |

| Ø | our industry includes a large number of participants and is intensely competitive, and, if we are unable to compete successfully, our financial results will be adversely affected. |

For more information about these and other risks related to our business and an investment in our common stock, see “Risk factors” beginning on page 13. You should consider carefully all of these risks before making an investment in our common stock.

BACKGROUND AND CERTAIN TRANSACTIONS

HCG HOLDINGSHoldings LLC

HCG Holdings LLC, our parent and the selling stockholder, is controlled by Lake Capital Partners LP and Lake Capital Management LLC. The remaining equity interests in HCG Holdings LLC are held by certain other institutional investors, some of our executive officers and 24 of our other managing directors, each of our board members, a director nominee and 31 other holders. Our executive officers, board members and the director nominee holding interests in HCG Holdings LLC are Gary Holdren, our Chief Executive Officer and a board member, George Massaro, our Chief Operating Officer and a board member, Gary Burge, our Chief Financial Officer, Daniel Broadhurst, our Vice President, and John McCartney, a director nominee. These individuals collectively hold 2.1% of the common interests and 2.3% of the preferred interests in HCG Holdings LLC. Paul Yovovich, whom we expect to add to our board after the consummation of this offering, is president and a member of Lake Capital Management LLC and controls Lake Capital Partners LP. Mr. Yovovich also directly holds 2.9% of the common interests and 1.0% of the preferred interests in HCG Holdings LLC.

HCG Holdings LLC currently owns approximately 94%93% of our outstanding common stock and all of our outstanding 8% preferred stock and 8% promissory notes. Some of our executive officers, each of our board members and some of our current and former employees own the remaining approximately 6%7% of our outstanding common stock. HCG Holdings LLC is controlled by Lake Capital Partners LP and Lake Capital Management LLC. The remaining equity interests in HCG Holdings LLC are held by certain institutional investors, some

Equity compensation awards

On the date of this prospectus, we intend to grant equity-based compensation awards to our executive officers and certain of our employees and each of our board members,independent directors.

| Ø | Restricted stock awards. We intend to grant a total of 769,700 shares of restricted common stock to our executive officers and certain of our employees. Our executive officers who will be granted shares of restricted common stock are Messrs. Holdren, Massaro, Burge and Broadhurst, Natalia Delgado, our General Counsel and Corporate Secretary, and Mary Sawall, our Vice President, Human Resources, who will be granted 158,700, 32,600, 10,900, 10,900, 8,700 and 6,500 shares of restricted common stock, respectively. Based on a public offering price of $15.00 per share, the mid-point of the range shown on the cover of this prospectus, the aggregate value of the shares of restricted common stock to be granted to Messrs. Holdren, Massaro, Burge and Broadhurst, Ms. Delgado and Ms. Sawall is $2,380,500, $489,000, $163,500, $163,500, $130,500 and $97,500, respectively. |

4

| Ø | Employee stock option awards. We intend to grant options to purchase 75,800 shares of our common stock to certain of our employees on the date of this prospectus, including one of our executive officers, Ms. Delgado, who will receive options to purchase 13,100 of these shares. These options will have a per share exercise price equal to the public offering price. |

| Ø | Independent director stock option awards. We intend to grant to each of our four independent directors options exercisable for 13,333 shares of our common stock, assuming a public offering price of $15.00 per share, the mid-point of the range shown on the cover of this prospectus. These options will have a per share exercise price equal to the public offering price. |

All of the awards described above will be made under our 2004 Omnibus Stock Plan after we file a director nomineeregistration statement on Form S-8 relating to that plan. This Form S-8, which will also relate to our three other equity incentive plans, is expected to be filed on the date of this prospectus after the effectiveness of the registration statement of which this prospectus forms a part. The Form S-8 will become effective upon filing.

Redemption of 8% preferred stock and repayment of 8% promissory notes

As described in the section of this prospectus entitled “Use of proceeds,” we will use approximately $15.1 million of our net proceeds from this offering to redeem our outstanding 8% preferred stock and approximately 30 other holders.$10.7 million to repay in full our outstanding 8% promissory notes. All of our 8% preferred stock and 8% promissory notes are owned by HCG Holdings LLC. We expect that HCG Holdings LLC iswill distribute substantially all of the selling stockholderproceeds it receives from the sale of the shares being offered by it in this offering. offering, the redemption of the outstanding 8% preferred stock and the repayment by us of the 8% promissory notes to its members in accordance with its governing documents. Assuming that this offering is consummated at a public offering price of $15.00 per share, the mid-point of the range shown on the cover of this prospectus, and HCG Holdings LLC distributes the entire amount of its proceeds from the foregoing transactions, we estimate that Messrs. Holdren, Massaro, Burge, Broadhurst and McCartney will receive a payment of approximately $875,000, $87,500, $43,800, $43,800 and $43,800, respectively.

See “Use of proceeds,” “Certain relationships and related transactions,” “Principal and selling stockholders” and “Description of capital stock” for further information.information regarding the matters discussed above.

35

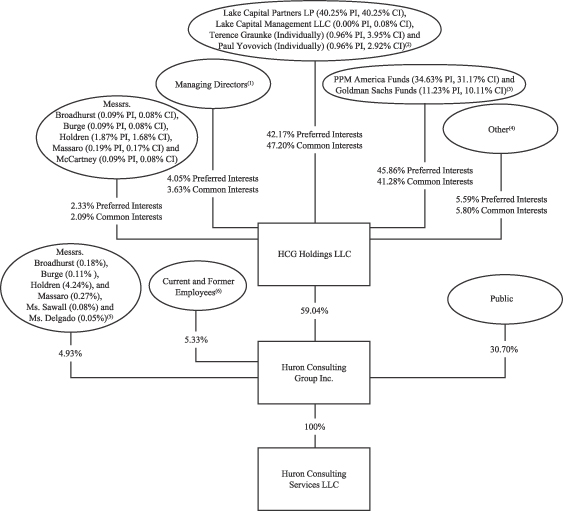

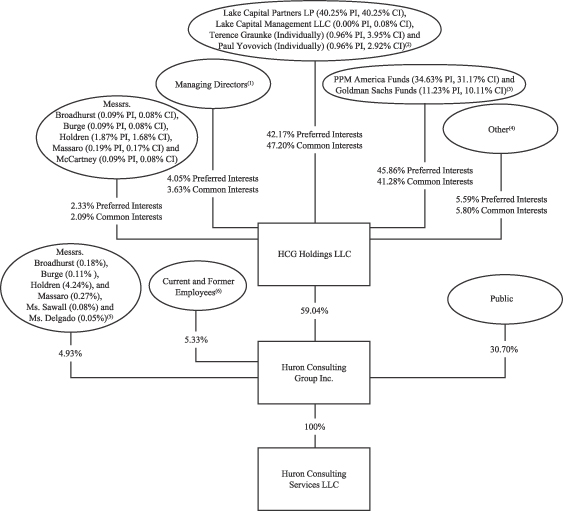

Post-offering corporate structure and ownership

The following organizational chart sets forth the corporate structure and percentage ownership of preferred interests (“PI”) and common interests (“CI”) in HCG Holdings LLC and of our common stock after giving effect to this offering (without giving effect to the exercise of the underwriters’ over-allotment option). Our post-offering ownership structure gives effect to the issuance by us of the 769,700 shares of restricted common stock to be granted to our executive officers and certain of our employees on the date of this prospectus, but does not give effect to 1,670,041 shares of common stock issuable upon the exercise of outstanding options at September 17, 2004, 75,800 shares of common stock issuable upon the exercise of options to be granted to one of our executive officers and certain of our employees on the date of this prospectus or 53,332 shares of common stock issuable upon the exercise of options to be granted to our independent directors on the date of this prospectus.

| (1) | The preferred and common interests in HCG Holdings LLC held by this group reflects the interests held by 24 of our managing directors that are not executive officers. None of these 24 other managing directors individually owns more than 1.0% of either the preferred or common interests in HCG Holdings LLC. |

| (2) | Lake Capital Partners LP and Lake Capital Management LLC collectively have investment and voting control over the shares of our common stock held by HCG Holdings LLC. Lake Capital Investment Partners LP is the sole general partner of Lake |

(Footnotes continued on following page.)

6

| Capital Partners LP and Lake Partners LLC is the sole general partner of Lake Capital Investment Partners LP. Terence M. Graunke and Paul G. Yovovich are the members and managers of Lake Partners LLC as well as members of an investment committee of Lake Capital Investment Partners LP and, in such roles, these individuals have investment and voting control over, and may be deemed to be the beneficial owners of, the shares ultimately controlled by Lake Capital Investment Partners LP. Mr. Graunke is also the controlling member of Lake Capital Management LLC and, pursuant to the Lake Capital Management LLC operating agreement, has investment and voting control over, and may be deemed to be the beneficial owner of, the shares controlled by that entity. Each of Mr. Graunke and Mr. Yovovich disclaims beneficial ownership of the shares of common stock owned by HCG Holdings LLC. Each of Mr. Graunke and Mr. Yovovich individually own preferred and common interests in HCG Holdings, as reflected in the chart. |

| (3) | The PPM America Funds consist of PPM America Private Equity Fund, L.P. and a related fund, Old Hickory Fund I, LLC, which own 34.4% and 0.3%, respectively, of the preferred interests and 30.9% and 0.2%, respectively, of the common interests in HCG Holdings LLC. The Goldman Sachs Funds consist of seven related Goldman Sachs private equity funds, consisting of GS Private Equity Partners 2000, L.P., GS Private Equity Partners 2000 Offshore Holdings, L.P., GS Private Equity Partners 2000 – Direct Investment Fund, L.P., GS Private Equity Partners 2002, L.P., GS Private Equity Partners 2002 Offshore Holdings, L.P., GS Private Equity Partners 2002 – Direct Investment Fund, L.P. and GS Private Equity Partners 2002 Employee Fund, L.P., which own 3.3%, 1.1%, 1.3%, 1.1%, 2.9%, 1.0% and 0.5%, respectively, of the preferred interests and 3.0%, 1.0%, 1.2%, 1.0%, 2.6%, 0.9% and 0.4%, respectively, of the common interests in HCG Holdings LLC. |

| (4) | This group consists of 31 other investors holding the interests. None of the holders in this group own more than 1.0% of the total preferred interests or total common interests in HCG Holdings LLC, except for The Hamilton Companies LLC, which owns 1.4% of the preferred interests and 1.4% of the common interests. |

| (5) | Mr. Holdren has been attributed for purposes of this chart ownership of 4.24% of the common stock, which is held in a trust for the benefit of the family of Mr. Holdren. See “Principal and selling stockholders.” |

| (6) | Reflects the shares of common stock held by current and former employees of Huron Consulting Group Inc. None of the holders of the common stock in this group owns more than 1.0% of the total common stock. |

CORPORATE INFORMATION

We were incorporated in Delaware in March 2002, commenced operations in May 2002 and conduct all of our consulting activities through a wholly-owned subsidiary, Huron Consulting GroupServices LLC. Our headquarters are located at 550 West Van Buren Street, Chicago, Illinois 60607 and our telephone number is (312) 583-8700. Our web site is www.huronconsultinggroup.com. Information contained on our web site is not incorporated by reference into this prospectus. You should not consider information contained on our web site as part of this prospectus.

47

The offering

Common stock offered by us | 3,333,333 shares | |

Common stock offered by the selling stockholder | 1,666,667 shares | |

| Total | 5,000,000 shares | |

Common stock to be outstanding immediately after this offering | 16,285,960 shares | |

Over-allotment option | 750,000 shares of common stock to be offered by the selling stockholder if the underwriters exercise the over- allotment option in full. | |

Proposed NASDAQ National Market symbol | HURN | |

Use of proceeds | We estimate that the net proceeds to us from this offering will be approximately | |

The number of shares of our common stock outstanding immediately after this offering is based on the number of shares outstanding at ,September 17, 2004. This number includes the 769,700 shares of restricted common stock that we intend to grant to our executive officers and certain of our employees on the date of this prospectus, but does not include:

| Ø | 1,670,041 shares of common stock issuable upon the exercise of outstanding stock options issued under our equity incentive plans, with a weighted average exercise price of |

| Ø |

| Ø | 53,332 shares of common stock issuable upon the exercise of options that we intend to grant on the date of this prospectus to our independent directors, with a per share exercise price equal to the public offering price and assuming a public offering price of |

8

| Ø | 1,242,168 shares reserved and available for future grant |

Unless otherwise indicated, all information in this prospectus assumes:

| Ø | a 1 for 2.3 reverse stock split of our outstanding shares of Class A and Class B common stock, which will be effected prior to the consummation of this offering; |

| Ø | the conversion of each outstanding share of our Class B common stock into a share of our Class A common stock and the renaming of our Class A common stock to “common stock,” which will occur immediately prior to the consummation of this offering pursuant to the terms of our certificate of incorporation; and |

| Ø | the underwriters do not exercise their over-allotment option, which entitles them to purchase up to 750,000 additional shares of our common stock from the selling |

59

Summary consolidated financial and other operating data

We have derived the following summary consolidated financial data for the period from March 19, 2002 (inception) to December 31, 2002 and for the year ended December 31, 2003 from our audited consolidated financial statements, except for the pro forma data. We have derived the following summary consolidated financial data for the threesix months ended March 31,June 30, 2003 and 2004 and as of March 31,June 30, 2004 from our unaudited interim consolidated financial statements, except for the pro forma data. In the opinion of management, this information contains all adjustments, consisting only of normal recurring accruals, necessary for a fair presentation of our results of operations and financial position for such periods. The summary information set forth below is not necessarily indicative of the results of future operations and should be read in conjunction with “Selected consolidated financial and other operating data,” “Management’s discussion and analysis of financial condition and results of operations” and the consolidated financial statements and related notes included elsewhere in this prospectus.

The pro forma as adjusted balance sheet data gives effect to the following transactions as if each had occurred on March 31,June 30, 2004:

| Ø | the issuance of 769,700 shares of restricted common stock to our executive officers and certain of our employees, which will occur on the date of this |

The pro forma as adjusted balance sheet data gives effect to the foregoing transactions as well as the following transactions as if each had occurred on March 31, 2004:

| Ø | the sale by us of 3,333,333 shares of our common stock in this offering at an assumed public offering price of |

| Ø | the use of approximately |

| Ø | the use of approximately |

For further information regarding the redemption of our 8% preferred stock and the repayment of our 8% promissory notes, see the section of this prospectus entitled “Use of proceeds.”

610

| March 19, 2002 (inception) to December 31, 2002 | Year ended December 31, 2003 | Three months March 31, | March 19, 2002 (inception) to December 31, 2002 | Year ended December 31, 2003 | Six months June 30, | ||||||||||||||||||||||||

| Consolidated statements of operations data: | 2003 | 2004 | 2003 | 2004 | |||||||||||||||||||||||||

| (unaudited) | (unaudited) | ||||||||||||||||||||||||||||

| (in thousands, except per share and other operating data) | (in thousands, except per share and other operating data) | ||||||||||||||||||||||||||||

Revenues and reimbursable expenses: | |||||||||||||||||||||||||||||

Revenues | $ | 35,101 | $ | 101,486 | $ | 23,212 | $ | 40,101 | $ | 35,101 | $ | 101,486 | $ | 46,923 | $ | 81,604 | |||||||||||||

Reimbursable expenses | 2,921 | 8,808 | 2,069 | 3,443 | 2,921 | 8,808 | 3,906 | 7,090 | |||||||||||||||||||||

Total revenues and reimbursable expenses | 38,022 | 110,294 | 25,281 | 43,544 | 38,022 | 110,294 | 50,829 | 88,694 | |||||||||||||||||||||

Direct costs and reimbursable expenses: | |||||||||||||||||||||||||||||

Direct costs | 26,055 | 69,401 | 13,581 | 24,868 | 26,055 | 69,401 | 29,320 | 47,591 | |||||||||||||||||||||

Reimbursable expenses | 2,921 | 8,929 | 2,069 | 3,523 | 2,921 | 8,929 | 3,917 | 7,065 | |||||||||||||||||||||

Total direct costs and reimbursable expenses | 28,976 | 78,330 | 15,650 | 28,391 | 28,976 | 78,330 | 33,237 | 54,656 | |||||||||||||||||||||

Gross profit | 9,046 | 31,964 | 9,631 | 15,153 | 9,046 | 31,964 | 17,592 | 34,038 | |||||||||||||||||||||

Operating expenses: | |||||||||||||||||||||||||||||

Selling, general and administrative expenses Depreciation and amortization expense | | 8,813 3,048 | | | 25,185 5,328 | | | 4,826 1,290 | | 8,158 603 | | 8,813 3,048 | | | 25,185 5,328 | | | 11,093 2,658 | | 17,840 1,075 | | ||||||||

Other operating expenses(1) | 3,715 | 1,668 | — | 2,139 | 3,715 | 1,668 | — | 2,139 | |||||||||||||||||||||

Total operating expenses | 15,576 | 32,181 | 6,116 | 10,900 | 15,576 | 32,181 | 13,751 | 21,054 | |||||||||||||||||||||

Operating (loss) income | (6,530 | ) | (217 | ) | 3,515 | 4,253 | (6,530 | ) | (217 | ) | 3,841 | 12,984 | |||||||||||||||||

Other expense: | |||||||||||||||||||||||||||||

Interest expense | 332 | 856 | 198 | 245 | 332 | 856 | 418 | 516 | |||||||||||||||||||||

Other | 1 | 112 | 1 | — | 1 | 112 | 112 | (1 | ) | ||||||||||||||||||||

Total other expense | 333 | 968 | 199 | 245 | 333 | 968 | 530 | 515 | |||||||||||||||||||||

(Loss) income before (benefit) provision for income taxes | (6,863 | ) | (1,185 | ) | 3,316 | 4,008 | (6,863 | ) | (1,185 | ) | 3,311 | 12,469 | |||||||||||||||||

(Benefit) provision for income taxes | (2,697 | ) | (122 | ) | 1,375 | 1,661 | (2,697 | ) | (122 | ) | 1,451 | 5,237 | |||||||||||||||||

Net (loss) income | (4,166 | ) | (1,063 | ) | 1,941 | 2,347 | (4,166 | ) | (1,063 | ) | 1,860 | 7,232 | |||||||||||||||||

Accrued dividends on 8% preferred stock | 646 | 1,066 | 253 | 273 | 646 | 1,066 | 516 | 558 | |||||||||||||||||||||

Net (loss) income attributable to common stockholders | $ | (4,812 | ) | $ | (2,129 | ) | $ | 1,688 | $ | 2,074 | $ | (4,812 | ) | $ | (2,129 | ) | $ | 1,344 | $ | 6,674 | |||||||||

Net (loss) income attributable to common stockholders per share: | |||||||||||||||||||||||||||||

Basic | $ | (0.18 | ) | $ | (0.08 | ) | $ | 0.01 | $ | 0.05 | $ | (0.41 | ) | $ | (0.18 | ) | $ | 0.05 | $ | 0.50 | |||||||||

Diluted | $ | (0.18 | ) | $ | (0.08 | ) | $ | 0.01 | $ | 0.05 | $ | (0.41 | ) | $ | (0.18 | ) | $ | 0.05 | $ | 0.47 | |||||||||

Weighted average shares used in calculating net (loss) income attributable to common stockholders per share: | |||||||||||||||||||||||||||||

Basic | 27,147 | 27,303 | 27,147 | 27,540 | 11,803 | 11,871 | 11,806 | 12,011 | |||||||||||||||||||||

Diluted | 27,147 | 27,303 | 27,147 | 29,319 | 11,803 | 11,871 | 12,357 | 13,005 | |||||||||||||||||||||

Unaudited pro forma net (loss) income attributable to common stockholders(2) | $ | (580 | ) | $ | 2,464 | ||||||||||||||||||||||||

Cash dividend per common share(2) | — | — | — | $ | 0.09 | ||||||||||||||||||||||||

Unaudited pro forma net (loss) income attributable to common stockholders per share: | |||||||||||||||||||||||||||||

Unaudited pro forma net (loss) income attributable to common stockholders(3) | $ | (580 | ) | $ | 7,477 | ||||||||||||||||||||||||

Unaudited pro forma net (loss) income attributable to common stockholders per share(3): | |||||||||||||||||||||||||||||

Basic | $ | $ | $ | (0.04 | ) | $ | 0.50 | ||||||||||||||||||||||

Diluted | $ | $ | $ | (0.04 | ) | $ | 0.47 | ||||||||||||||||||||||

Unaudited pro forma weighted average shares outstanding used in calculating net (loss) income attributable to common stockholders per share(3): | |||||||||||||||||||||||||||||

Unaudited pro forma weighted average shares outstanding used in calculating unaudited pro forma net (loss) income attributable to common stockholders per share(4): | |||||||||||||||||||||||||||||

Basic | 14,787 | 14,981 | |||||||||||||||||||||||||||

Diluted | 14,787 | 15,975 | |||||||||||||||||||||||||||

| Other operating data (unaudited): | ||||||||||||||||

Number of consultants (at end of period)(4) | 262 | 477 | 294 | 483 | ||||||||||||

Utilization rate(5) | 57.3 | % | 66.1 | % | 75.8 | % | 73.4 | % | ||||||||

Average billing rate per hour(6) | $ | 206 | $ | 217 | $ | 228 | $ | 229 | ||||||||

| Other operating data (unaudited): | ||||||||||||||||

Number of consultants (at end of period)(5) | 262 | 477 | 355 | 499 | ||||||||||||

Utilization rate(6) | 57.3 | % | 66.1 | % | 72.4 | % | 72.6 | % | ||||||||

Average billing rate per hour(7) | $ | 206 | $ | 217 | $ | 224 | $ | 238 | ||||||||

7(See footnotes on the following page.)

11

As of March 31, 2004 | As of June 30, 2004 | ||||||||||||||

| Consolidated balance sheet data: | Actual | Pro forma | Pro forma as adjusted | Actual | Pro forma as adjusted | ||||||||||

| (unaudited) | (unaudited) | ||||||||||||||

| (in thousands) | (in thousands) | ||||||||||||||

Cash and cash equivalents | $ | 70 | $ | 943 | $ | 18,461 | |||||||||

Working capital | 13,073 | 16,838 | 34,759 | ||||||||||||

Total assets | 42,542 | 48,932 | 66,450 | ||||||||||||

Long-term debt (consisting of 8% promissory notes) | 10,076 | 10,076 | — | ||||||||||||

Total 8% preferred stock | 14,485 | 14,770 | — | ||||||||||||

Total stockholders’ (deficit) equity | (4,536 | ) | (170 | ) | 42,597 | ||||||||||

| (1) | Other operating expenses |

| (2) | On May 12, 2004, we declared a special dividend on each outstanding share of our common stock and 8% preferred stock payable to holders of record on May 25, 2004. We paid the special dividend on June 29, 2004. The 8% preferred stock participated on an as converted basis. The aggregate amount of the dividend was $1.25 million, or $0.09 per share of common stock and $22.18 per share of 8% preferred stock. Other than the special dividend, we have not declared or paid any dividends on our common stock since our inception and do not intend to pay any dividends on our common stock in the foreseeable future. See “Dividend policy.” |

| (3) | The total pro forma adjustments to net (loss) income attributable to common stockholders are approximately $1,549 and |

| The pro forma weighted average shares outstanding represents an increase of 2,916 and 2,970 weighted average shares as of December 31, 2003 and |

| Consultants consist of our billable professionals. |

| We calculate the utilization rate for our consultants by dividing the number of hours all of our consultants worked on client assignments during a period by the total available working hours for all of our consultants during the same period, assuming a forty-hour work week, less paid holidays and vacation days. |

| Average billing rate per hour is calculated by dividing revenues for a period by the number of hours worked on client assignments during the same period. |

812

Investing in our common stock involves a high degree of risk. You should carefully consider the risks below before making an investment decision. The risks described below are not the only ones facing us. Additional risks not presently known to us or that we currently deem immaterial may also impair our operations.

Our business, financial condition or results of operations could be materially adversely affected by any of these risks. In such an event, the trading price of our common stock could decline, and you may lose all or part of your investment.

RISKS RELATED TO OUR BUSINESS

Our inability to retain our senior management team and other managing directors would be detrimental to the success of our business.

We rely heavily on our senior management team, including Gary Holdren, our Chief Executive Officer, and George Massaro, our Chief Operating Officer, and other managing directors, and our ability to retain them is particularly important to our future success. Given the highly specialized nature of our services, these people must have a thorough understanding of our service offerings as well as the skills and experience necessary to manage an organization consisting of a diverse group of professionals. In addition, we rely on our senior management team and other managing directors to generate and market our business. Further, in light of our limited operating history, our senior management’s and other managing directors’ personal reputations and relationships with our clients are a critical element in obtaining and maintaining client engagements. Although we enter into non-solicitation agreements with our senior management team and other managing directors, we do not enter into non-competition agreements. Accordingly, members of our senior management team and our other managing directors are not contractually prohibited from leaving or joining one of our competitors, and some of our clients could choose to use the services of that competitor instead of our services. If one or more members of our senior management team or our other managing directors leave and we cannot replace them with a suitable candidate quickly, we could experience difficulty in securing and successfully completing engagements and managing our business properly, which could harm our business prospects and results of operations.

Our senior management team and our other managing directors will receive substantial financial benefits as a result of this offering, which may reduce the financial incentive for them to stay with us.

Our senior management team and our other managing directors collectively hold options to purchase 1,502,630 shares of our common stock. Of these, options to purchase 145,608 shares are currently vested, options to purchase 420,659 shares will vest upon consummation of this offering pursuant to their terms and the remaining options to purchase 936,363 will fully vest at various times over the next four years. These options have exercise prices ranging from $0.02 to $1.96 per share. An individual may be more likely to leave us after their options fully vest, especially if the shares underlying the options have significantly appreciated in value relative to the option exercise price. In addition, a trust for the benefit of the family of Mr. Holdren, our Chief Executive Officer, holds 521,740 shares of restricted common stock that he purchased for $0.02 per share, of which 163,043 shares are currently vested and the remaining 358,697 will fully vest immediately prior to the consummation of this offering. On the date of this prospectus, we intend to grant 769,700 shares of restricted common stock to our executive officers and certain of our employees. The restricted shares will vest over a four year period, with 25% vesting on each anniversary of the grant date during that period. Our executive officers who will be granted shares of restricted common stock are Messrs. Holdren, Massaro, Burge and Broadhurst, Ms. Delgado and Ms. Sawall, who will be granted 158,700, 32,600, 10,900, 10,900, 8,700 and 6,500 shares of restricted common stock, respectively. In addition, we intend to grant options to purchase 75,800 shares of our common stock to certain of our employees on the date of this prospectus, including one of

13

Risk factors

our executive officers, Ms. Delgado, who will receive options to purchase 13,100 shares of our common stock. These options will have a per share exercise price equal to the public offering price and will vest over a four-year period, with 25% vesting on each anniversary of the grant date during that period. We also intend to grant to each of our independent directors options exercisable for 13,333 shares of our common stock, assuming a public offering price of $15.00 per share, the mid-point of the range shown on the cover of this prospectus. These options will have a per share exercise price equal to the public offering price and will vest over a three-year period, with one-third vesting on the grant date and one-third vesting on the date of each of the next two annual meetings.

In addition, some of our executive officers and other managing directors, each of our board members and a director nominee are members of HCG Holdings LLC, which is our parent and the selling stockholder, and collectively hold 5.7% of the common interests and 6.4% of the preferred interests in HCG Holdings LLC. Our executive officers, board members and the director nominee holding interests in HCG Holdings LLC are Messrs. Holdren, Massaro, Burge, Broadhurst and McCartney. These individuals collectively hold 2.1% of the common interests and 2.3% of the preferred interests in HCG Holdings LLC. If any of the above-described individuals realize substantial financial benefits as a result of their securities ownership in us or HCG Holdings LLC, their financial incentive to stay with us may be reduced. These individuals already realized a financial benefit when HCG Holdings LLC used the proceeds it received from the special dividend that we paid on June 29, 2004 together with other funds of HCG Holdings LLC to redeem a portion of its outstanding preferred interests on a pro rata basis, including a portion of the preferred interests held by these people. In connection with this redemption, Messrs. Broadhurst, Burge, Holdren, Massaro and McCartney received an aggregate amount of approximately $4,540, $4,540, $90,788, $9,079 and $4,540, respectively, of which approximately $1,097, $1,097, $21,933, $2,193 and $1,097, respectively, was paid out of the proceeds of the dividend. These individuals will also realize a financial benefit if HCG Holdings LLC makes a distribution to its members of the proceeds it receives from (1) the sale of the shares being offered by it in this offering, (2) the redemption of the 8% preferred stock and (3) the repayment of the 8% promissory notes held by HCG Holdings LLC. Assuming that this offering is consummated at a public offering price of $15.00 per share, the mid-point of the range shown on the cover of this prospectus, and HCG Holdings LLC distributes the entire amount of its proceeds from the foregoing transactions, we estimate that Messrs. Broadhurst, Burge, Holdren, Massaro and McCartney will receive a payment of approximately $43,800, $43,800, $875,000, $87,500 and $43,800, respectively.

Our inability to hire and retain talented people in an industry where there is great competition for talent could have a serious negative effect on our prospects and results of operations.

Our business involves the delivery of professional services and is highly labor-intensive. Our success depends largely on our general ability to attract, develop, motivate and retain highly skilled consultants. The loss of a significant number of our consultants or the inability to attract, hire, develop, train and retain additional skilled personnel could have a serious negative effect on us, including our ability to manage, staff and successfully complete our existing engagements and obtain new engagements. Qualified consultants are in great demand, and we face significant competition for both senior and junior consultants with the requisite credentials and experience. Our principal competition for talent comes from other consulting firms, accounting firms and other similar enterprises.technical and economic advisory firms, as well as from organizations seeking to staff their internal professional positions. Many of these competitors may be able to offer significantly greater compensation and benefits or more attractive lifestyle choices, career paths or geographic locations than we do. Therefore, we may not be successful in attracting and retaining the skilled consultants we require to conduct and expand our operations successfully. Increasing competition for these consultants may also significantly increase our labor costs, which could negatively affect our margins and results of operations.

914

Risk factors

We have experienced net losses for most of our history, and our limited operating history makes evaluating our business difficult.

We have been operating since May 2002. For the period from March 19, 2002 (inception) through December 31, 2002 and for the year ended December 31, 2003, we experienced net losses of $4.2 million and $1.1 million, respectively. Although we generated net income of $2.3$7.2 million for the threesix months ended March 31,June 30, 2004, we may not sustain profitability in the future. For example, we generated net income of $1.9 million for the threesix months ended March 31,June 30, 2003, but experienced a net loss for the year ended December 31, 2003. Our net losses, among other things, have had, and should net losses occur in the future, will have, an adverse effect on our stockholders’ equity and working capital. As of March 31,June 30, 2004, we had a total stockholders’ deficit of $4.5$0.2 million. To sustain profitability, we must:

| Ø | attract, integrate, retain and motivate highly qualified consultants; |

| Ø | achieve and maintain adequate utilization and |

| Ø | expand our existing relationships with our clients and identify new clients in need of our services; |

| Ø | maintain and enhance our brand recognition; and |

| Ø | adapt to meet changes in our markets and competitive developments. |

We may not be successful in accomplishing these objectives. Further, our limited operating history makes it difficult to evaluate our business and prospects. Our prospects must be considered in light of the risks, uncertainties, expenses and difficulties frequently encountered by companies in their early stages of development, particularly companies in highly competitive industries. The historical information in this prospectus may not be indicative of our future financial condition and future performance. For example, we expect that our future annual growth rate in revenues will moderate and likely be less than the growth rates experienced in 2003 and the first six months of 2004.

If we are unable to manage the growth of our business successfully, we may not be able to sustain profitability.

We have grown significantly since we commenced operations, more than doubling the number of our consultants from 213 on May 31, 2002 to 483486 as of March 31,September 17, 2004. As we continue to increase the number of our consultants, we may not be able to successfully manage a significantly larger workforce. Additionally, our significant growth has placed demands on our management and our internal systems, procedures and controls and will continue to do so in the future. To successfully manage growth, we must add administrative staff and periodically update and strengthen our operating, financial, accounting and other systems, procedures and controls, which will increase our costs and may adversely affect our gross profits and our ability to sustain profitability if we do not generate increased revenues to offset the costs. This need to augment our support infrastructure due to growth is compounded by our decision to become a public reporting company and the increased expense that will arise in complying with existing and new regulatory requirements. As a public company, our information and control systems must enable us to prepare accurate and timely financial information and other required disclosure. If we discover deficiencies in our existing information and control systems that impede our ability to satisfy our reporting requirements, we must successfully implement improvements to those systems in an efficient and timely manner.

Our financial results could suffer if we are unable to achieve or maintain adequate utilization and suitable billing rates for our consultants.

Our profitability depends to a large extent on the utilization and billing rates of our consultants. Utilization of our consultants is affected by a number of factors, including:

| Ø | the number and size of client engagements; |

| Ø | the timing of the commencement, completion and termination of engagements, which in many cases is unpredictable; |

15

Risk factors

| Ø | our ability to transition our consultants efficiently from completed engagements to new engagements; |

| Ø | the hiring of additional consultants because there is generally a transition period for new consultants that results in a temporary drop in our utilization rate; |

10

Risk factors

| Ø | unanticipated changes in the scope of client engagements; |

| Ø | our ability to forecast demand for our services and thereby maintain an appropriate level of consultants; and |

| Ø | conditions affecting the industries in which we practice as well as general economic conditions. |

The billing rates of our consultants that we are able to charge are also affected by a number of additional factors, including:

| Ø | our clients’ perception of our ability to add value through our services; |

| Ø | the market demand for the services we provide; |

| Ø | introduction of new services by us or our competitors; |

| Ø | our competition and the pricing policies of our competitors; and |

| Ø | general economic conditions. |

If we are unable to achieve and maintain adequate overall utilization as well as maintain or increase the billing rates for our consultants, our financial results could materially suffer.

A significant portion of our revenues are derived from a limited number of clients, and our engagement agreements, including those related to our largest clients, can be terminated by our clients with little or no notice and without penalty, which may cause our operating results to be unpredictable.

As a consulting firm, we have derived, and expect to continue to derive, a significant portion of our revenues from a limited number of clients. Our ten largest clients accounted for 36.3% of our revenues in the partial year ended December 31, 2002, 32.1% of our revenues in the year ended December 31, 2003 and 30.9%32.5% of our revenues in the threesix months ended March 31,June 30, 2004. Our clients typically retain us on an engagement-by-engagement basis, rather than under fixed-term contracts, and the volume of work performed for any particular client is likely to vary from year to year, and a major client in one fiscal period may not require or decide to use our services in any subsequent fiscal period. Accordingly, the failure to obtain new large engagements or multiple engagements from existing or new clients could have a material adverse effect on the amount of revenues we generate.

In addition, almost all of our engagement agreements can be terminated by our clients with little or no notice and without penalty. For example, in engagements related to litigation, if the litigation were to be settled, our engagement for those services would no longer be necessary and therefore would be terminated. In client engagements that involve multiple engagements or stages, there is a risk that a client may choose not to retain us for additional stages of an engagement or that a client will cancel or delay additional planned engagements. These terminations, cancellations or delays could result from factors unrelated to our services or the progress of the engagement. When engagements are terminated, we lose the associated future revenues, and we may not be able to recover associated costs or redeploy the affected employees in a timely manner to minimize the negative impact. In addition, our clients’ ability to terminate engagements with little or no notice and without penalty makes it difficult to predict our operating results in any particular fiscal period.

16

Risk factors

Our ability to maintain and attract new business depends upon our reputation, the professional reputation of our consultants and the quality of our services.

As a professional services firm, our ability to secure new engagements depends heavily upon our reputation and the individual reputations of our consultants. Any factor that diminishes our reputation or that of our consultants, including not meeting client expectations or misconduct by our consultants, could make it substantially more difficult for us to attract new engagements and clients. Similarly, because we obtain many of our new engagements from former or current clients or from referrals by those clients or by law

11

Risk factors

firms that we have worked with in the past, any client that questions the quality of our work or that of our consultants could impair our ability to secure additional new engagements and clients.

The consulting services industry is highly competitive, and we may not be able to compete effectively.

The consulting services industry in which we operate includes a large number of participants and is intensely competitive. We face competition from other business operations and financial consulting firms, general management consulting firms, the consulting practices of major accounting firms, technical and economic advisory firms, regional and specialty consulting firms and the internal professional resources of organizations. In addition, because there are relatively low barriers to entry, we expect to continue to face additional competition from new entrants into the business operations and financial consulting industries. We have six core offices and two smaller offices in the United States and do not have any international offices. Many of our competitors have a greater national presence and are also international in scope, as well as have significantly greater personnel, financial, technical and marketing resources. In addition, these competitors may generate greater revenues and have greater name recognition than we do. Our ability to compete also depends in part on the ability of our competitors to hire, retain and motivate skilled consultants, the price at which others offer comparable services and our competitors’ responsiveness to their clients. If we are unable to compete successfully with our existing competitors or with any new competitors, our financial results will be adversely affected.

Additional hiring and any acquisitions could disrupt our operations, increase our costs or otherwise harm our business.

Our business strategy is dependent in part upon our ability to grow by hiring individuals or groups of consultants and by potentially acquiring complementary businesses. However, we may be unable to identify, hire, acquire or successfully integrate new consultants and complementary businesses without substantial expense, delay or other operational or financial problems. Competition for future hiring and acquisition opportunities in our markets could increase the compensation we offer to potential consultants or the price we pay for businesses we wish to acquire. In addition, we may be unable to achieve the financial, operational and other benefits we anticipate from any hiring or acquisition. Hiring additional consultants or acquiring complementary businesses could also involve a number of additional risks, including:

| Ø | the diversion of management’s time, attention and resources from managing and marketing our company; |

| Ø | the failure to retain key acquired personnel; |

| Ø | potential impairment of existing relationships with our clients, such as client satisfaction or performance problems, whether as a result of integration or management difficulties or otherwise; |

| Ø | the creation of conflicts of interest that require us to decline or resign from engagements that we otherwise could have accepted; |

| Ø | the potential need to raise significant amounts of capital to finance a transaction or the potential issuance of equity securities that could be dilutive to our existing stockholders; |

17

Risk factors

| Ø | increased costs to improve, coordinate or integrate managerial, operational, financial and administrative systems; and |

| Ø | difficulties in integrating diverse backgrounds and experiences of consultants, including if we experience a transition period for newly hired consultants that results in a temporary drop in our utilization rates or margins. |

If we fail to successfully address these risks, our ability to compete may be impaired.

12

Risk factors

If the number of large bankruptcies continues to decline or other factors affectingcause a decrease in demand for our corporate advisory services, declines, our revenues and profitability could suffer.

Our corporate advisory services practice provides various turnaround, restructuring and bankruptcy services to companies in financial distress or their creditors or other stakeholders. This practice accounted for 30.7% and 27.1%27.0% of our revenues for the year ended December 31, 2003 and threesix months ended March 31,June 30, 2004, respectively. We are typically engaged in connection with a bankruptcy case when the bankruptcy is of the size and complexity that generally requires the debtor or other constituents to retain the services of financial advisors. A number of other factors also affect demand for this practice. These factors include:

| Ø | over-expansion by various businesses; |

| Ø | management’s inability to address critical operational and financial issues; |

| Ø | the level of lending activity and over-leveraging of companies; and |

| Ø | challenging general economic conditions in the |

If the number of large bankruptcies continues to decline or other factors cause a decrease in demand for our corporate advisory services, decreases, the revenues from our turnaround, restructuring and bankruptcy services could decline, which could harm our ability to sustain profitability.

We face an increased risk of fee nonpayment or reduced payment in our corporate advisory services practice.

Many of the clients in our corporate advisory services practice have engaged us because they are experiencing financial distress. These clients may not have sufficient funds to continue operations or to pay for our services. We usually do not receive retainers before we begin performing services on a client’s behalf in connection with our restructuring business, and we are not always able to obtain retainers from clients in bankruptcy as the bankruptcy court must approve our retainers for those clients. When we do receive retainers, the retainers may not adequately cover our fees for the services we perform on behalf of these clients. Even if a bankruptcy court approves our retainer or engagement, a bankruptcy court has the discretion to require us to return all, or a portion of, our fees or to reduce our fees for the duration of the engagement. Therefore, we face the risk of nonpayment or reduced payment, either of which can result in write-offs.

The profitability of our fixed-fee engagements with clients may not meet our expectations if we underestimate the cost of these engagements.

Fixed-fee engagements generated approximately 11.9% and 15.6%12.3% of our revenues for the year ended December 31, 2003 and the threesix months ended March 31,June 30, 2004, respectively. When making proposals for fixed-fee engagements, we estimate the costs and timing for completing the engagements. These estimates reflect our best judgment regarding the efficiencies of our methodologies and consultants as we plan to deploy them on engagements. Any increased or unexpected costs or unanticipated delays in connection with the performance of fixed-fee engagements, including delays caused by factors outside our control, could make these contracts less profitable or unprofitable, which would have an adverse effect on our profit margin.

18

Risk factors

Revenues from our performance-based engagements are difficult to predict, and the timing and extent of recovery of our costs is uncertain.

From time to time, primarily in our corporate advisory services and strategic sourcing practices, we enter into engagement agreements under which our fees include a significant performance-based component. Performance-based fees are contingent on the achievement of specific measures, such as our clients meeting cost-saving or other contractually defined goals. The achievement of these contractually-defined goals is often impacted by factors outside of our control, such as the actions of our client or third parties. Because performance-based fees are contingent, revenues on such engagements, which are recognized when all revenue recognition criteria are met, are not certain and the timing of receipt is difficult to predict and may not occur evenly throughout the year, thereby affecting our quarter by quarter results and potentially the price of our common stock.year. While performance-based fees comprised 3.3% and 5.6%6.9% of our revenues for the year ended December 31, 2003 and the threesix months ended March 31,June 30, 2004, respectively, we intend to continue to enter into performance-based fee arrangements and these engagements may takeimpact our revenues to a greater extent in the future. Should performance-based fee arrangements represent a greater percentage of our business in the future, we may experience increased volatility in our working capital requirements and greater variations in our quarter-to-quarter results, which could affect the price of our common stock. In addition, an increase in the proportion of performance-based fee arrangements may offset the positive effect on added importance to our results.operating results from increases in our utilization rate or average billing rate per hour.

13

Risk factors

Conflicts of interest could preclude us from accepting engagements thereby causing decreased utilization and revenues.

We provide services in connection with bankruptcy proceedings and litigation proceedings that usually involve sensitive client information and frequently are adversarial. In connection with bankruptcy proceedings, we are required by law to be “disinterested” and in litigation we would generally be prohibited from performing services in the same litigation for the party adverse to our client. In addition, our engagement agreement with a client or other business reasons may preclude us from accepting engagements with our clients’ competitors or adversaries. As we increase the size of our operations, the number of conflict situations can be expected to increase. Moreover, in many industries in which we provide services, there has been a continuing trend toward business consolidations and strategic alliances. These consolidations and alliances reduce the number of companies that may seek our services and increase the chances that we will be unable to accept new engagements as a result of conflicts of interest. If we are unable to accept new engagements for any reason, our consultants may become underutilized, which would adversely affect our revenues and results of operations in future periods.

Expanding our service offerings or number of offices may not be profitable.

We may choose to develop new service offerings or open new offices because of market opportunities or client demands. Developing new service offerings involves inherent risks, including:

| Ø | our inability to estimate demand for the new service offerings; |

| Ø | competition from more established market participants; |

| Ø | a lack of market understanding; and |

| Ø | unanticipated expenses to recruit and hire qualified consultants and to market our new service offerings. |

In addition, expanding into new geographic areas and/or expanding current service offerings is challenging and may require integrating new employees into our culture as well as assessing the demand in the applicable market. For example, in August 2003, we established a small office in Palo Alto, California to service the Silcon Valley marketplace and, in September 2003, we established a small office in Miami, Florida to deepen our corporate finance capabilities. These offices did not meet our expectations and, therefore, we subsequently closed those offices and incurred a restructuring charge of $2.1

19

Risk factors

$2.1 million in the threesix months ended March 31,June 30, 2004. In September 2004, we decided to eliminate a service offering of a practice area in our operational consulting segment that was not meeting our expectations. Additionally, in a continual effort to streamline our operations and allocate resources more appropriately, we reduced our headcount in certain other practice areas across both segments. In connection with these actions, we expect to record charges in the third quarter of approximately $2.1 million for severance payments. If we cannot manage the risks associated with new service offerings or new locations effectively, we are unlikely to be successful in these efforts, which could harm our ability to sustain profitability and our business prospects.

Our engagements could result in professional liability, which could be very costly and hurt our reputation.

Our engagements typically involve complex analyses and the exercise of professional judgment. As a result, we are subject to the risk of professional liability. If a client questions the quality of our work, the client could threaten or bring a lawsuit to recover damages or contest its obligation to pay our fees. Litigation alleging that we performed negligently or breached any other obligations to a client could expose us to significant legal liabilities and, regardless of outcome, is often very costly, could distract our management and could damage our reputation. We are not always able to include provisions in our engagement agreements that are designed to limit our exposure to legal claims relating to our services. Even if these limiting provisions are included in an engagement agreement, they may not protect us or may not be enforceable under some circumstances. In addition, we carry professional liability insurance to cover many of these types of claims, but the policy limits and the breadth of coverage may be inadequate to cover any particular claim or all claims plus the cost of legal defense. For example, we provide services on engagements in which the impact on a client may substantially exceed the limits of

14

Risk factors

our errors and omissions insurance coverage. If we are found to have professional liability with respect to work performed on such an engagement, we may not have sufficient insurance to cover the entire liability.

Our intellectual property rights in our “Huron Consulting Group” name are important, and any inability to use that name could negatively impact our ability to build brand identity.

We believe that establishing, maintaining and enhancing the “Huron Consulting Group” name is important to our business. We believe that we have the right to use the “Huron Consulting Group” name in connection with our services, and to date have not received any objections from third parties to the use of our name. We are, however, aware of a number of other companies that use names containing “Huron.” There could be potential trade name or service mark infringement claims brought against us by the users of these similar names and marks and those users may have trade name or service mark rights that are senior to ours. If another company were to successfully challenge our right to use our name, or if we were unable to prevent a competitor from using a name that is similar to our name, our ability to build brand identity could be negatively impacted.

We or some of our consultants could be named in lawsuits because we were founded by former Arthur Andersen LLP partners and professionals and contracted with Arthur Andersen for releases from non-competition agreements.

We were founded by a core group of consultants that consisted primarily of former Arthur Andersen LLP partners and professionals, and we entered into a contract with Arthur Andersen to release these partners and professionals from non-competition agreements with Arthur Andersen. These circumstances might lead creditors of Arthur Andersen and other parties to bring claims against us or some of our managing directors or other consultants seeking recoveries for liabilities of Arthur Andersen. WhileAndersen and we domay not believe that our founding by former Arthur Andersen partners and professionals or our contract with Arthur Andersen gives rise to any liability for us or them, we cannot assure you that, should persons or entities with claims against Arthur Andersen seek to hold us or our managing directors or consultants liable, we will be able to successfully avoid liability for such claims. In addition, litigation of this nature or otherwise could divert the time and attention of our managing directors and consultants, and we could incur substantial defense costs.

20

Risk factors

As a holding company, we are totally dependent on distributions from our operating subsidiary to pay obligations.dividends or other obligations and there may also be other restrictions on our ability to pay dividends in the future.