| 1. | DESCRIPTION OF BUSINESS AND SUBSIDIARIES AND

GLOBAL WATER MANAGEMENT, LLC

COMBINED CONSOLIDATED STATEMENTS OF CASH FLOWS

For the Years Ended December 31, 2007, 2006 and 2005| | | | | | | | | | | | | | | | | 2007 | | | 2006 | | | 2005 | | | | | CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | | | | | | | | | | Net income | | $ | 6,069,323 | | | $ | 6,584,308 | | | $ | 5,485,460 | | | Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | | | | | | | Depreciation | | | 6,069,133 | | | | 3,817,112 | | | | 1,921,778 | | | Amortization of intangible assets | | | 2,623,865 | | | | 2,229,216 | | | | 1,751,506 | | | Interest accretion on deferred payments for acquisitions | | | (95,363 | ) | | | 1,247,951 | | | | — | | | (Gain) on sale of discontinued operations | | | (6,484,488 | ) | | | — | | | | — | | | (Gain) loss on sale of fixed assets | | | 35,361 | | | | (34,169 | ) | | | 4,262 | | | Deferred income tax expense (benefit) | | | 1,145,753 | | | | (678,744 | ) | | | 43,585 | | | Changes in assets and liabilities—excluding effects of acquisitions: | | | | | | | | | | | | | | Accounts receivable | | | (37,980 | ) | | | 749 | | | | (717,766 | ) | | Other receivables | | | 70,760 | | | | (446,180 | ) | | | — | | | Infrastructure coordination and financing fees receivable | | | 157,950 | | | | 517,248 | | | | (306,648 | ) | | Accrued utility revenue | | | (111,723 | ) | | | (134,295 | ) | | | (38,091 | ) | | Other current assets | | | (746,791 | ) | | | (236,673 | ) | | | 32,748 | | | Income taxes payable | | | (293,611 | ) | | | 10,353 | | | | — | | | Accounts payable and other current liabilities | | | (1,164,376 | ) | | | 4,361,633 | | | | (1,888,417 | ) | | Deferred revenue and prepaid ICFA fees | | | (1,346,735 | ) | | | 19,544,696 | | | | 17,146,454 | | | | | | | | | | | | | | | | | Net cash provided by operating activities | | | 5,891,078 | | | | 36,783,205 | | | | 23,434,871 | | | | | | | | | | | | | | | | | CASH FLOWS FROM INVESTING ACTIVITIES: | | | | | | | | | | | | | | Capital expenditures | | | (67,842,091 | ) | | | (51,171,979 | ) | | | (27,692,818 | ) | | Proceeds from sale of fixed assets | | | 19,539,153 | | | | 43,036 | | | | 49,824 | | | Withdrawals (deposits) of restricted cash | | | 29,475 | | | | (126,887 | ) | | | — | | | Deposits | | | (295,535 | ) | | | (265,982 | ) | | | — | | | Intangible asset additions | | | (8,781 | ) | | | (242,501 | ) | | | — | | | Acquisition of utilities—net of cash acquired | | | — | | | | (15,547,028 | ) | | | (5,920,963 | ) | | Deferred payments for acquisitions | | | (3,466,357 | ) | | | — | | | | — | | | Deferred acquisition costs incurred | | | (29,735 | ) | | | (46,432 | ) | | | (47,709 | ) | | | | | | | | | | | | | | | | Net cash used in investing activities | | | (52,073,871 | ) | | | (67,357,773 | ) | | | (33,611,666 | ) | | | | | | | | | | | | | | | | CASH FLOWS FROM FINANCING ACTIVITIES: | | | | | | | | | | | | | | Proceeds from bonds | | | 53,624,175 | | | | 36,495,000 | | | | — | | | Proceeds deposited to bond reserve fund | | | (5,454,597 | ) | | | (3,597,106 | ) | | | — | | | Bank loan borrowings | | | 101,423,436 | | | | 71,784,855 | | | | 20,818,929 | | | Bank loan repayments | | | (87,477,495 | ) | | | (72,396,729 | ) | | | (5,165,506 | ) | | Debt issuance costs incurred | | | (1,332,650 | ) | | | (1,447,265 | ) | | | — | | | Distributions to members | | | (19,421,198 | ) | | | (4,824,970 | ) | | | (8,737,644 | ) | | Advances in aid of construction | | | 4,997,836 | | | | 5,022,315 | | | | 2,110,364 | | | Refunds of advances for construction | | | (424,235 | ) | | | (185,697 | ) | | | (26,405 | ) | | | | | | | | | | | | | | | | Net cash provided by financing activities | | | 45,935,272 | | | | 30,850,403 | | | | 8,999,738 | | | | | | | | | | | | | | | |

(continued)

F-7

GLOBAL WATER RESOURCES, LLC AND SUBSIDIARIES AND

GLOBAL WATER MANAGEMENT, LLC

COMBINED CONSOLIDATED STATEMENTS OF CASH FLOWS—(Continued)

For the Years Ended December 31, 2007, 2006 and 2005

| | | | | | | | | | | | | | | | | 2007 | | | 2006 | | | 2005 | | | | | INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | | $ | (247,521 | ) | | $ | 275,835 | | | $ | (1,177,057 | ) | | CASH AND CASH EQUIVALENTS—Beginning of year | | | 414,017 | | | | 138,182 | | | | 1,315,239 | | | | | | | | | | | | | | | | | CASH AND CASH EQUIVALENTS—End of year | | $ | 166,496 | | | $ | 414,017 | | | $ | 138,182 | | | | | | | | | | | | | | | | | SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION: | | | | | | | | | | | | | | Cash paid for interest | | $ | 6,118,442 | | | $ | 2,752,422 | | | $ | 1,057,272 | | | | | | | | | | | | | | | | | Cash paid for income taxes | | $ | 309,306 | | | $ | — | | | $ | — | | | | | | | | | | | | | | | | | Acquisition liability incurred in connection with business combinations and acquisitions of intangible assets | | $ | — | | | $ | 39,939,225 | | | $ | 17,200,458 | | | | | | | | | | | | | | | | | Noncash advances in aid of construction—line extensions | | $ | 16,287,132 | | | $ | 13,640,921 | | | $ | 1,908,744 | | | | | | | | | | | | | | | | | Capital expenditures included in accounts payable and accrued expenses | | $ | 5,750,581 | | | $ | 8,805,836 | | | $ | 4,414,795 | | | | | | | | | | | | | | | | | Change in members’ distributions payable | | $ | (5,866,530 | ) | | $ | 6,646,818 | | | $ | 1,262,170 | | | | | | | | | | | | | | | |

See notes to combined consolidated financial statements.

F-8

| | 1. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

BasisBusiness—Global Water Resources, Inc. and its subsidiaries (collectively, the “Company”, “GWRI”, “we”, “us”, or “our”) operate in the Western United States as a water resource management company that owns, operates and manages water, wastewater and recycled water utilities in strategically located communities, principally in metropolitan Phoenix, Arizona. The Company’s model focuses on the broad issues of Presentationwater supply and Principlesscarcity and applies principles of Combinationwater conservation through water reclamation and reuse. The Company’s basic premise is that the world’s water supply is limited and yet can be stretched significantly through effective planning, the use of recycled water and by providing individuals and communities resources that promote wise water usage practices. The Company deploys its integrated approach, Total Water Management (“TWM”), a term which it uses to mean managing the entire water cycle, both to conserve water and to maximize its total economic and social value. The Company uses TWM to promote sustainable communities in areas where it expects growth to outpace the existing potable water supply.

History—The combined consolidated financial statements of Global Water Resources, LLC (“GWR”) and Global Water Management, LLC (“GWM”) include the accounts of GWR and all of its subsidiaries as well as GWM (collectively, the “Company”). GWR and GWM are under common ownership and common management. All intercompany account balances and transactions between GWR and its subsidiaries and GWM have been eliminated. Business—GWR was organized in 2003 to acquire, own, and manage a portfolio of water and wastewater utilities in North America. GWMthe Southwestern United States. Global Water Management, LLC (“GWM”) was formed as an affiliated company to provide business development, management, construction project management, operations, and administrative services to GWR and all of its regulated subsidiaries.

Our regulated utilities are regulated by the Arizona Corporation Commission (the “Commission” or “ACC”).On February 4, 2004, GWR purchased its first two utilities, Santa Cruz Water Company, LLC (“Santa Cruz”) and Palo Verde Utilities Company, LLC (“Palo Verde”) and Santa Cruz Water Company, LLC (“Santa Cruz”). Santa Cruz and Palo Verde provide water and wastewater operations, respectively, to residential and commercial customers in the vicinity of the City of Maricopa in Pinal County, AZArizona and are regulated by the Arizona Corporation Commission (the “Commission”). On June 15,ACC. Effective March 31, 2005, GWR executed the purchase ofpurchased the assets of Sonoran Utility Services, LLC (“Sonoran”), an unregulated utility, effective March 31, 2005.utility. The Sonoran assets arewere used to provide water and wastewater operations to residential and commercial customers in a water improvement district and a wastewater improvement district adjacent to the service area of Santa Cruz and Palo Verde. The Sonoran assets were contributed to Santa Cruz and Palo Verde upon acquisition. In March 2005, Global Water, Inc. (“GWI”), an Arizona corporation, was established as a subsidiary of GWR to acquire, own, and manage a portfolio of water and wastewater utilities. On March 3, 2005, GWI purchased the issuedIn 2006, Santa Cruz and outstanding sharesPalo Verde were reorganized as C corporations and became subsidiaries of Cave Creek Water Company, Inc. (“Cave Creek”) and Pacer Equities, Inc. (“Pacer”). Cave Creek provided water utility operations and water distribution to residential and commercial customers in the vicinity of the Town of Cave Creek in Maricopa County, AZ and was regulated by the Commission. Pacer owned the water treatment facility utilized by Cave Creek. In 2007, the assets of Cave Creek and Pacer were sold to the Town of Cave Creek to settle a condemnation (see Note 10). On July 6, 2005, GWI established Hassayampa Utilities Company, Inc. (“Hassayampa”). Hassayampa is astart-up wastewater utility that anticipates beginning to serve customers in western Maricopa County, AZ in 2010 upon completion of numerous permits and construction.

GWI.On July 11, 2006, GWI acquired 100% of the outstanding common shares of West Maricopa Combine (WMC)(“WMC”), the parent company of Valencia Water Company (“Valencia Water”) in the CityTown of Buckeye, Willow Valley Water Company (“Willow Valley”) near Bullhead City, Water Utility of Greater Buckeye (“Greater Buckeye”) near the town of Buckeye, Water Utility of Greater Tonopah (“Greater Tonopah”) west of the Hassayampa River, and Water Utility of Northern Scottsdale (“WUNS”Northern Scottsdale”) in northeast Scottsdale, all within the state of Arizona. On December 30, 2006, GWI purchased the total issued and outstanding shares of Francisco Grande Utility Company (“FG”), an Arizona corporation owning the right to provide water and wastewater services near the cities of Maricopa and Casa Grande, Arizona. Also, on December 30, 2006, GWI purchased the total issued and outstanding sharesnet assets of CP Water Company (“CP”CP Water”), an Arizona corporation providing water services near the cities of Maricopa and Casa Grande, AZ. Arizona.GWI formed Global Water-Picacho Cove Water Company (“Picacho Water”) and Global Water-Picacho Cove Utilities Company (“Picacho”(collectively, “Picacho”) in October 2006, to provide integrated water, wastewater and recycled water service to an area in the vicinity of Eloy, Arizona along Interstate 10 about midway between Tucson and Phoenix.

F-9

GLOBAL WATER RESOURCES, LLC AND SUBSIDIARIES AND

GLOBAL WATER MANAGEMENT, LLC

NOTES TO COMBINED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Transfer On April 8, 2008, the Commission approved the application for the creation of Assets and Change in Tax Status—In 2005, GWR concluded that the preferred legal form for Palo Verde and Santa Cruz was as corporations, and began the necessary actions to transfer the Certificatesa Certificate of Convenience and Necessity (CC&Ns)(“CC&N”) for Picacho, granting it the exclusive right to provide services to an area of approximately 1,480 acres with 4,900 homes planned for the initial phase. On July 28, 2009, the Commission approved an expansion application for an additional 2,300 acres planned primarily for a rail served industrial park.-F-7-

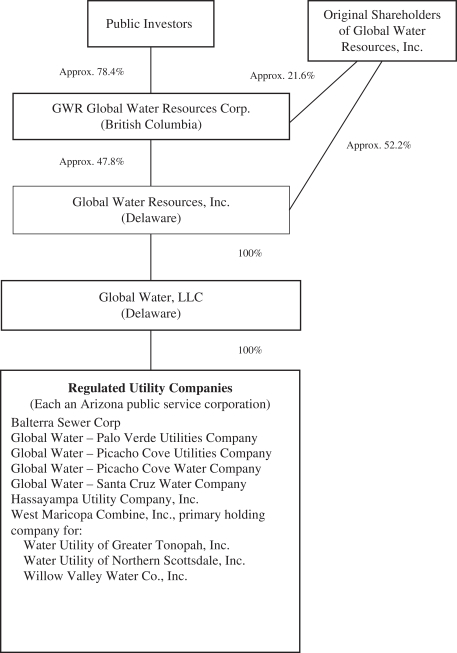

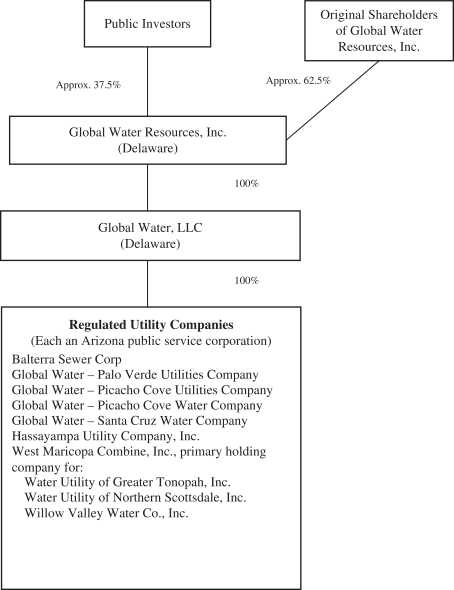

GLOBAL WATER RESOURCES, INC. Notes to Consolidated Financial Statements Reorganization—In early 2010, the members of GWR and GWM made the decision to raise money through the capital markets. The members established a new entity, GWR Global Water Resources Corp. (“GWRC”), relatedwhich was incorporated under the Business Corporations Act (British Columbia) to acquire shares of the Company. On December 30, 2010, GWRC completed its initial public offering in Canada (the “Offering”) on the Toronto Stock Exchange, raising gross proceeds totaling C$65,659,583 (including gross proceeds received January 28, 2011 of C$4,272,083 pursuant to the underwriters’ exercise of their over-allotment option). The proceeds of the Offering were used to acquire a 48.1% interest in the Company. In connection with the Offering, GWR and GWM (collectively, “GWRI’s predecessor entities”) were reorganized to form GWRI (the “Reorganization”). Accordingly, all references herein to GWRI with respect to periods prior to December 30, 2010 should be understood as meaning GWRI’s predecessor entities. Basis of Presentation and Principles of Consolidation—The consolidated financial statements include the accounts of GWRI and all of its subsidiaries. All intercompany account balances and transactions between GWRI and its subsidiaries have been eliminated. We prepare our financial statements in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and with the rules and regulations of the Securities and Exchange Commission (“SEC”). The preparation of the financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and utility operationsliabilities and disclosure of Palo Verdecontingent assets and Santa Cruz to newly formed corporations wholly owned by GWI, Global Water-Palo Verde Utilities Company (“GW-PV”) and Global Water-Santa Cruz Water Company (“GW-SC”), respectively. The transferliabilities at the date of the CC&Nsfinancial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates. The U.S. dollar is our reporting currency and the Company’s functional currency. As a company with less than $1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), under the rules and regulations of the Securities and Exchange Commission (“SEC”). An emerging growth company may take advantage of specified reduced reporting and other requirements that are otherwise applicable generally to public companies. We may take advantage of these provisions for up to five years or such earlier time that we are no longer an emerging growth company. We have elected to take advantage of some of the reduced disclosure obligations regarding financial statements and may elect to take advantage of other reduced requirements in future filings. We may also take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies. If we choose to take advantage of this provision, we would not be required to comply with new or revised accounting standards until those standards would otherwise apply to private companies. Corporate Transactions—Sale of certain MXA and WMA contracts—In September 2013, the Company sold its Wastewater Facilities Main Extension Agreements (“MXAs) and Offsite Water Management Agreements (“WMAs”) along with their related assetsrights and obligations to a third party (the “Transfer of Project Agreement”, or “Loop 303 Contracts”). Pursuant to the Transfer of Project Agreement, GWRI will receive total proceeds of approximately $4.1 million over a multi-year period. As part of the consideration, GWRI agreed to complete certain engineering work required Commission approval. On March 9, 2006, Palo Verde and Santa Cruz filed a joint application within the Commission for the transfer, to be effective retroactiveWMAs, which work had been completed prior to January 1, 2006. On October 25, 2006,2014. As the Commission’s Utility Division issued its Staff Report recommending approvalengineering work has been completed, the Company effectively has no further obligations under the WMAs, MXAs or the Transfer of Project Agreement. Prior to January 1, 2014, the application. An evidentiary hearing was held before an administrative law judge on January 12, 2007, at which no objectionsCompany had received $2.8 million of proceeds and recognized income of approximately $3.3 million within other income (expense) in the statement of operations related to the application were raised. The final Opinion and Order to approve the application effective January 1, 2006, was issued by the Commissiongain on September 27, 2007. The memberssale of GWR agreed to assign all beneficial interests in distributionsthese agreements and the proceeds from any salereceived prior to January 1, 2014 for engineering work required in the WMAs. The Company received additional proceeds of approximately $296,000 in April 2015 and recognized those amounts as income at that time. Receipt of the member interestsremaining $1.0 million of Palo Verde or Santa Cruzproceeds will occur and be recorded as additional income over time as certain milestones are met between the third party acquirer and the developers/landowners.-F-8-

GLOBAL WATER RESOURCES, INC. Notes to GW-PV or GW-SC, respectively, effective January 1, 2006. As a result, Palo Verde and Santa Cruz are considered to be consolidated subsidiaries of GW-PV and GW-SC for financial reporting and income tax purposes, effective January 1, 2006. Consolidated Financial StatementsSignificant Accounting Policies—The Company prepares its financial statements in accordance with accounting principles generally accepted in the United States of America. Significant accounting policies are as follows: Use of EstimatesRegulation—The preparation ofOur regulated utilities and certain other balances are subject to regulation by the financial statements in conformity with accounting principles generally accepted in the United States of America requires managementACC and are therefore subject to make estimatesAccounting Standards Codification Topic 980,Regulated Operations (“ASC Topic 980”) (See Note 3).

Property, plant and assumptions that affect the reported amounts of assetsequipment—Property, plant and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates. Utility Plant—Utility plant in serviceequipment is stated at cost less accumulated depreciation provided on a straight-line basis at annual(see Note 4).Depreciation rates ranging from 2% to 20% for each depreciable asset class as setclasses of utility property, plant and equipment are established by the CommissionCommission. The cost of additions, including betterments and replacements of units of utility fixed assets are charged to utility property, plant and equipment. When units of utility property are replaced, renewed or retired, their cost plus removal or disposal costs, less salvage proceeds, is charged to accumulated depreciation. For non-utility property, plant and equipment, depreciation is calculated by the straight-line method over the estimated useful lives of depreciable assets. Cost and accumulated depreciation for non-utility property, plant and equipment retired or disposed of are removed from the accounts and any resulting gain or loss is included in the absence of a set rate, by waterearnings. In addition to third party costs, direct personnel costs and wastewater treatment industry standard.indirect construction overhead costs may be capitalized. Interest incurred during the construction period is also capitalized as a component of the cost of the constructed assets.assets, which represents the cost of debt associated with construction activity. Expenditures for maintenance and repairs are charged to expense. The cost of replacements and improvements is capitalized. When assets are retired or otherwise disposed of, the cost is eliminated from the accounts, and is charged to the related accumulated depreciation. Revenue Recognition—Water Services—Water usageservices revenues are recorded when service is rendered or water is delivered to customers. However, in addition to the monthly basic service charge, the determination and billing of water sales to individual customers is based on the reading of their meters, which occurs on a systematic basis throughout the month. At the end of each reporting period, amounts of water delivered to customers since the date of the last meter reading are estimated and the corresponding accrued, utilitybut unbilled revenue is recorded. Water meter connection fees are the fees associated with the application process to set up a customer to receive utility service on an existing water meter. These fees are approved by the ACC through the regulatory process and are set based on the costs incurred to establish services including the application process, billing setup, initial meter reading and service transfer. Because the amounts charged for water connection fees are set by our regulator and not negotiated in conjunction with the pricing of ongoing water service, the connection fees represent the culmination of a separate earnings process and are recognized when the service is provided. Meter installation fees are the fees charged to developers or builders associated with installing new water meters. Certain fees for meters are regulated by the ACC, and are refundable pursuant to the end customer over a period of time. Refundable meter installation fees are recorded as a liability upon receipt. Other certain meter fees are negotiated directly with developers or builders and are not subject to ACC regulation and represent the culmination of a separate earnings process. These fees are recognized as revenue when the service is rendered, for new customer connections. Revenue fromor when a water meter sales that is not refundable pursuant to an advance in aid of construction agreement with the developer are generally recognized at the time the water meters are installed and service begins to a particular lot. installed.Revenue Recognition—Wastewater and Recycled Water Services—Wastewater service revenues are generally recognized when service is rendered. Wastewater services are billed at a fixed monthly amount per connection, and recycled water services are billed monthly based on volumetric fees.

F-10

GLOBAL WATER RESOURCES, LLC AND SUBSIDIARIES AND

GLOBAL WATER MANAGEMENT, LLC

NOTES TO COMBINED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Revenue Recognition— Unregulated Revenues—Unregulated Revenues represent those revenues that are not subject to the ratemaking process of the ACC. Unregulated revenues are limited to rental revenue and imputed revenues resulting from certain ICFA arrangements.-F-9-

GLOBAL WATER RESOURCES, INC. Notes to Consolidated Financial Statements Allowance for Doubtful Accounts—Provisions are made for doubtful accounts due to the inherent uncertainty around the collectability of accounts receivable. The allowance for doubtful accounts is recorded as bad debt expense, and is classified as general and administrative expense. The allowance for doubtful accounts is determined considering the age of the receivable balance, type of customer (e.g., residential, commercial), payment history as well as specific identification of any known or expected collectability issues (see Note 5). Infrastructure Coordinationcoordination and Financing Feesfinancing fees—GWR finances the capital improvement obligations of its subsidiaries with a combination of equity and debt. The Company has infrastructureInfrastructure coordination and financing agreements (ICFAs)(“ICFAs”) are agreements with developers and homebuilders whereby GWRI, which owns the operating utilities, provides services to plan, coordinate and finance the water and wastewater infrastructure that would otherwise be required to their respective land parcels on abe performed or subcontracted by the developer or homebuilder. Services provided within these agreements include coordination of construction services for water and wastewater treatment facilities as well as financing, arranging and coordinating the provision of utility services. ICFA revenue is recognized when the following conditions are met: The fee per lot basis. ICFAsis fixed and determinable The cash received is nonrefundable Capacity currently exists to serve the specific lots There are voluntary, alternative financing mechanisms the Company periodically employs to allowno additional significant performance obligations As these arrangements are with developers and homebuildersnot with the end water or wastewater customer, revenue recognition coincides with the completion of our performance obligations under the agreement with the developer and our ability to defer financial participation in the up-front investment in infrastructure. Revenue from these infrastructure agreements is recognized at the timeprovide fitted capacity for water meters are installed and service begins to a particular lot. Cashwastewater service. Payments received under the agreements prior to the commencement of water service is nonrefundable and isare recorded as deferred revenue inuntil the combined consolidated balance sheets. point at which all of the conditions described above are met. Historically ICFAs have been accounted for as revenue pursuant to the obligations being met as outlined above, or as CIAC when funds were received. Pursuant to Rate Decision no. 74364, approximately 70% of ICFAs are now recorded as a hook-up fee (“HUF”), with 30% recorded as revenue once all components of revenue recognition are met (See Note 3).Cash and Cash Equivalents—Cash and cash equivalents include all highly liquid investments in debt instruments with an original maturity of three months or less. Book overdrafts of $3,028,831 and $4,141,031 at December 31, 2007 and 2006 respectively, are included in accounts payable in the combined consolidated balance sheets. These amounts represent outstanding checks that have not been presented to the bank for payment. Upon presentment, the Company will access the Company’s line of credit to fund the cash account. Restricted Cash—Restricted cash represents cash deposited as a debt service reserve for certain loans and bondsbonds. The following table summarizes the restricted cash balance as of the Company. The deposits must stay in place until the loans have been fully repaid. December 31, 2014 (in thousands of US$): | | | | | | | | 12/31/2014 | | Bond Reserve | | $ | 9,823 | | Certificate of Deposits | | | 104 | | | | | | | | | $ | 9,927 | | | | | | |

Income Taxes—GWR and GWM are limited liability companies and have elected to be treated as partnerships for income tax purposes. Accordingly, elements of income and expense flow through and are taxed to the members on an individual basis; therefore, a provision or liability for income taxes for these entities is not included in the combined consolidated financial statements. Through December 31, 2005, Santa Cruz and Palo Verde were also organized as limited liability companies and were treated as partnerships for income tax purposes. Effective January 1, 2006, the assets and activities of Santa Cruz and Palo Verde were transferred to new taxable corporations which are subsidiaries of GWI. The provision for income taxes in the combined consolidated financial statements relates to GWI and its taxable incorporated subsidiaries. For such taxable entities, the Company utilizes the asset and liability method of accounting for income taxes. Under the asset and liability method, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized. There was noThe Company’s valuation allowance recordedtotaled $8,500 as of December 31, 2007 and 2006. In June 2006, the2014 (see Note 11).-F-10-

GLOBAL WATER RESOURCES, INC. Notes to Consolidated Financial Accounting Standards Board (“FASB”) issued Interpretation No. 48, “Accounting for Uncertainty in Income Taxes—An Interpretation of FASB No. 109,” (“FIN 48”). This interpretation, among other things, createsStatements We evaluate uncertain tax positions using a two-step approach for evaluating uncertain tax positions.approach. Recognition (step one) occurs when an enterprise concludeswe conclude that a tax position, based solely on its technical merits, is more-likely-than-not to be sustained upon examination. Measurement (step two) determines the amount of benefit that more-likely-than-not will be realized upon settlement. Derecognition of a tax position that was previously recognized would occur when a companywe subsequently determinesdetermine that a tax position no longer meets the more-likely-than-not threshold of being sustained. FIN 48 specifically prohibits theThe use of a valuation allowance as a substitute for derecognition of tax positions is prohibited, and itto the extent that uncertain tax positions exist, we provide expanded disclosures. Basic and Diluted Earnings per Common Share—The Company has expanded disclosure requirements. Adoption431 options outstanding to acquire an equivalent number of FIN 48 on January 1, 2007 did not have a material impact on the Company’s financial statements.

F-11

GLOBAL WATER RESOURCES, LLC AND SUBSIDIARIES AND

GLOBAL WATER MANAGEMENT, LLC

NOTES TO COMBINED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Deferred Acquisition Costs—shares of GWRI common stock. As of December 31, 2007 and 2006,2014, these options are out of the money. Therefore, the Company had deferred certain legal and other costs directly relateddoes not have any common share equivalents to ongoing acquisitions that will be allocatedconsidered for purposes of calculating earnings per share. See Note 12. Any changes in the weighted average common shares relate only to the net assetsbuy-back of the acquired entities or written off for unconsummated acquisitions.

shares. See Note 15.Advances and Contributions in Aid of ConstructionGoodwill—GWR’s regulated utility subsidiaries have various agreements with real estate development and homebuilding companies (the “Developers”), whereby funds, water line extensions, and wastewater line extensions are provided to the companies by the Developers and are considered refundable advances for construction. These advances in aid of construction are non interest-bearing and are subject to refund to the Developers through annual payments that are computed as a percentage of the total annual gross revenue earned from customers connected to utility services constructed under the agreement over a specified period. Upon the expiration of the agreements, the remaining balance of the advance becomes nonrefundable and at that time is considered a contribution in aid of construction. Contributions in aid of construction are amortized as a reduction of depreciation expense over the estimated remaining life of the related utility plant.

Goodwill and Other Intangible Assets—Goodwill represents the excess of acquisition cost over the fair value of net tangible and identifiable intangible assets acquired in business combinations. Goodwill is tested for impairment at least annually on October 1 and more frequently if circumstances indicate that it may be impaired. Goodwill impairment testing is performed at the reporting unit level. The goodwill impairment model is a two-step process. First, it requires a comparison of the book value of net assets to the fair value of the related operations that have goodwill assigned to them. We use the terminal valuation method in estimating fair value which assumes a business will be sold at the end of the projection period at a specific terminal value. Earnings and discounted cash flows were developed from our internal forecasts. Additionally, management must make an estimate of a weighted-average cost of capital to be used as a company-specific discount rate, which takes into account certain risk and size premiums, risk-free yields, and the capital structure of the industry. We have also considered other qualitative and quantitative factors including the regulatory environment that can significantly impact future earnings and cash flows and the effects of the volatile current economic environment. Changes in these projections or estimates could result in a reporting unit either passing or failing the first step in the goodwill impairment model.If the fair value of a reporting unit is determined to be less than book value, a second step is performed to determine if goodwill is impaired, and if so, the amount of such impairment. In this process, an implied fair value for goodwill is estimated by allocating the fair value of the reporting unit to the applicable reporting unit’s assets and liabilities resulting in any excess fair value representing the implied fair value of goodwill. The amount by which carrying value exceeds the implied fair value represents the amount of goodwill impairment (see Note 7). Intangible Assets—Intangible assets not subject to amortization consist of certain permits expected to be renewable indefinitely, water rights and certain service areas acquired in transactions which did not meet the definition of business combinations for accounting purposes, and are considered to have indefinite lives. Goodwill and intangibleIntangible assets with indefinite lives are not amortized but are tested for impairment annually, or more often if certain circumstances indicate a possible impairment may exist. OtherAmortized intangible assets consist primarily of acquired ICFA contract rights,rights. Pursuant to Rate Decision No. 71878 issued by the ACC on September 15, 2010 for the February 2009 filed rate cases for Santa Cruz, Palo Verde, Valencia, Greater Buckeye, Greater Tonopah and Willow Valley (the “2010 Regulatory Rate Decision”), ICFA funds received were accounted for as CIAC. The Company established a regulatory liability against the Company’s intangible assets balance to offset the value of the intangible assets related to the expected receipt of ICFA fees in the future. As of December 31, 2013 the Company had a regulatory liability balance of $11.4 million. However, in 2014, in conjunction with Rate Decision No. 74364, the ACC determined that ICFA funds were no longer to be recorded as CIAC, but rather approximately 70% of funds received should be recorded as HUF, with the remaining 30% to be -F-11-

GLOBAL WATER RESOURCES, INC. Notes to Consolidated Financial Statements deferred and recognized according to the Company’s ICFA revenue recognition policy (see Note 3). Accordingly, in 2014 30%, or $3.4 million, of the regulatory liability was reversed in connection with the recognition of the rate decision. Debt Issuance Costs—In connection with the issuance of some of our long-term debt, we have incurred legal and other costs that we believe are beingdirectly attributable to realizing the proceeds of the debt issued. These costs are capitalized in other assets and amortized as interest expense using the effective interest method over the contract terms proportionatelyterm of the respective debt. Amortization of debt issuance costs and discounts totaled $1.0 million for the year ended December 31, 2014, of which $696,000 was for the write off of debt issuance costs and $327,000 was for the current year amortization related to the related revenues. Series 2012A and 2012B bonds and the Regions Term loan, which were retired in 2014.Impairment of Long-Lived Assets—Management evaluates the carrying value of long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying value of such assets may not be recoverable. If an indicator of possible impairment exists, an undiscounted cash flow analysis would be prepared to determine whether there is an actual impairment. Measurement of the impairment loss is based on the fair value of the asset. Generally, fair value will be determined using appraisals or valuation techniques such as the present value of expected future cash flows. Advances and Contributions in Aid of Construction—The Company has various agreements with Developers and builders, whereby funds, water line extensions, or wastewater line extensions are provided to us by the Developers and are considered refundable advances for construction. These advances in aid of construction (“AIAC”) arenon-interest-bearing and are subject to refund to the Developers through annual payments that are computed as a percentage of the total annual gross revenue earned from customers connected to utility services constructed under the agreement over a specified period. Upon the expiration of the agreements’ refunding period, the remaining balance of the advance becomes nonrefundable and at that time is considered contributions in aid of construction (“CIAC”). CIAC are amortized as a reduction of depreciation expense over the estimated remaining life of the related utility plant. For rate-making purposes, utility plant funded by advances and contributions in aid of construction are excluded from rate base. For the year ended December 31, 2014, the Company transferred $7.4 million of AIAC balances to CIAC for amounts for which the refunding period had expired. Fair Value of Financial Instruments—The carrying values of cash equivalents, trade receivables, and accounts payable approximate fair value due to the short-term maturities of these instruments. See Note 910 for information as to the fair value of the Company’sour long-term debt. The Company’sOur refundable advances in aid of constructionAIAC have a carrying value of $69,405,414 and $51,063,891$89.2 million at December 31, 2007 and 2006, respectively.2014. Portions of these noninterest-bearingnon-interest-bearing instruments are payable annually through 20302032 and amounts not paid by the contract expiration dates become nonrefundable. Their relative fair values cannot be accurately estimated because future refund payments depend on several variables, including new customer connections, customer consumption levels, and future rate increases. However, the fair value of these amounts would be less than their carrying value due to the noninterest-bearingnon-interest-bearing feature. StoredAsset Retirement Obligations—Liabilities for asset retirement obligations are typically recorded at fair value in the period in which they are incurred. When the liability is initially recorded, the entity capitalizes a cost by increasing the carrying amount of the related long-lived asset. Over time, the liability is accreted to its present value each period, and the capitalized cost is depreciated over the useful life of the related asset. Upon settlement of the liability, an entity either settles the obligation for its recorded amount or incurs a gain or loss upon settlement. Our legal obligations for retirement reflect principally the retirement of wastewater treatment facilities, which are required to be closed in accordance with the Clean Closure Requirements of the Arizona Department of Environmental Quality (ADEQ). The Clean Closure Requirements of ADEQ for wastewater facilities are driven by a need to protect the environment from inadvertent contamination associated with the decommissioning of these systems. As such, our

-F-12-

GLOBAL WATER RESOURCES, INC. Notes to Consolidated Financial Statements regulated subsidiaries incur asset retirement obligations. We have provided $229,000 of certificates of deposit or letters of credit to benefit ADEQ for such anticipated closure costs. Water Credits—Stored water creditssystems, unlike wastewater systems, do not require Aquifer Protection Permits or the associated Clean Closure Requirement obligation. Amounts recorded for asset retirement obligations are accounted forsubject to various assumptions and determinations, such as inventorydetermining whether a legal obligation exists to remove assets; estimating the fair value of the costs of removal; estimating when final removal will occur; and determining thecredit-adjusted, risk-free interest rates to be utilized on discounting future liabilities. Changes that may arise over time with regard to these assumptions will change amounts recorded in the future. Estimating the fair value of the costs of removal were determined based on third-party costs. Segments—Operating segments are defined as components of an enterprise about which separate financial information is available that is evaluated regularly by the chief operating decision maker (“CODM”) in deciding how to allocate resources and in assessing operating performance. In consideration of ASC 280—Segment Reporting the Company notes it is not organized around specific products and services, geographic regions or regulatory environments. The Company currently operates in one geographic region within the State of Arizona, wherein each operating utility operates within the same regulatory environment. While the Company reports its revenue, disaggregated by service type, on the face of its Statements of Operations, the Company does not manage the business based on any performance measure at the cost incurredindividual revenue stream level. The Company does not have any customers that contribute more than 10% to takethe Company’s revenues or revenue streams. Additionally we note that the CODM uses consolidated financial information to evaluate the Company’s performance, which is the same basis on which he communicates the Company’s results and performance to the Board of Directors. It is upon this consolidated basis from which he bases all significant decisions regarding the allocation of the Company’s resources on a consolidated level. Based on the information described above and in accordance with the applicable literature, management has concluded that the Company is currently organized and operated as one operating and reportable segment. | 2. | NEW ACCOUNTING PRONOUNCEMENTS |

In April 2014, the Financial Accounting Standards Board (“FASB”) issued Auditing Standards Update (“ASU”) 2014-08,Presentation of Financial Statements (Topic 205) and Property, Plant, and Equipment (Topic 360): Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity, which change the criteria for reporting discontinued operations and changing the disclosures for disposals that meet the definition under the new guidance. Under the new guidance, only disposals representing a strategic shift in a company’s strategy would be deemed a discontinued operation. To meet the definition of strategic shift, the disposal should have a major effect on the organization’s operations and financial results. Certain examples of the type of disposals that would qualify as a discontinued operation include a disposal of a major geographic area, a major line of business, or a major equity method investment. For those disposals that meet the criteria, expanded disclosures on assets, liabilities, income and expenses would apply. The Company’s adoption of ASU 2014-08 in the first quarter of 2015 did not have a material effect on our consolidated financial statements. In May 2014, FASB issued ASU 2014-09,Revenue from Contracts with Customers, which completes the joint effort between the FASB and IASB to converge the recognition of revenue between the two boards. The new standard affects any entity using U.S. GAAP that either enters into contracts with customers to transfer goods or services or enters into contracts for the transfer of nonfinancial assets not included within other FASB standards. The guiding principal of the new standard is that an entity should recognize revenue in an amount that reflects the consideration to which an entity expects to be entitled for the delivery of -F-13-

GLOBAL WATER RESOURCES, INC. Notes to Consolidated Financial Statements goods and store waterservices. ASU 2014-09 may be adopted using either of two acceptable methods: (1) retrospective adoption to each prior period presented with the option to elect certain practical expedients; or (2) adoption with the cumulative effect recognized at the date of initial application and providing certain disclosures. To assess at which time revenue should be recognized, an entity should use the following steps: (1) identify the contract(s) with a customer; (2) identify the performance obligations in connection withthe contract; (3) determine the transaction price; (4) allocate the transaction price to the performance obligations in the contract; and (5) recognize revenue when, or as, the entity satisfies a performance obligation. For public business entities, ASU 2014-09 is effective for annual reporting periods beginning after December 15, 2017, including interim periods within the reporting period. For private companies, ASU 2014-09 is effective for annual reporting periods beginning after December 15, 2018 and interim reporting periods beginning after December 15, 2019. Earlier application allowed in certain recharge permits (see Note 3.) Future Adoption of New Accounting Pronouncements—circumstances. The Company is currently assessing the impact that this guidance may have on our consolidated financial statements.In September 2006,August 2014, the FASB issued SFAS No. 157,ASU 2014-15,Fair Value MeasurementsDisclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern (SFAS No. 157). SFAS No. 157, which defines fair value, establishesmanagement’s responsibility in evaluating whether there is substantial doubt about an organizations ability to continue as a framework for measuring fair value in generally accepted accountinggoing concern. The new standard provides that an entity’s management should evaluate whether conditions or events exist that would raise substantial doubt about an entity’s ability to continue as a going concern. If substantial doubt exists, the guidance provides principles and expands disclosures about fair value measurements. SFAS No. 157definitions to assist management in assessing the appropriate timing and content in their financial statement disclosures. ASU 2014-15 is effective for annual periods ending after December 15, 2016. The adoption of ASU 2014-15 is not expected to have a material effect on our consolidated financial statements. In April 2015, the FASB issued ASU 2015-03,Interest—Imputation of Interest: Simplifying the Presentation of Debt Issuance Costs, which requires debt issuance costs be presented in the balance sheet as a direct deduction from the carrying amount of the associated debt liability, consistent with the accounting of debt discounts. The effects of this update are to be applied retrospectively as a change in accounting principal. For public business entities, ASU 2015-03 is effective for financial statements issued for fiscal years beginning after NovemberDecember 15, 2007,2015, and interim periods within those fiscal years. In February 2008,For all other entities, the FASBamendments are effective for financial statements issued a staff position delaying the effective date of certain non-financial assets and liabilities tofor fiscal periodsyears beginning after NovemberDecember 15, 2008.2015, and interim periods within fiscal years beginning after December 15, 2016. The adoption of ASU 2015-03 will require the Company to reclassify debt issuance costs retrospectively beginning January 1, 2016. The Company is currently reviewingassessing the effect of SFAS No. 157, if any,

F-12

GLOBAL WATER RESOURCES, LLC AND SUBSIDIARIES AND

GLOBAL WATER MANAGEMENT, LLC

NOTES TO COMBINED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

impact that this guidance may have on its combinedour consolidated financial statements; however, it is not expected to have a material impact on its combined results. The Company currently does not believe that SFAS 157 will have a material impact on its financial statements statements.In February 2007,November 2015, the FASB issued SFAS No. 159,ASU 2015-17,Income Taxes: Balance Sheet Classification of Deferred Taxes, which requires that deferred tax liabilities and assets be classified as noncurrent in the classified statement of financial position. The Fair Value Option for Financial Assets and Financial Liabilities (SFAS No. 159). SFAS No. 159 allows entities to choose to measure eligible financial instruments at fair value with changes in fair value recognized in earningspurpose of each subsequent reporting date. The fair value election is available for most financial assets and liabilities on aninstrument-by-instrument basis andthis update is to be elected onsimplify the datepresentation of the financial instrument is initially recognized. SFAS No. 159deferred liabilities and assets. For public business entities, ASU 2015-17 is effective for annual periods beginning after December 15, 2016, and interim periods within those annual periods. For private companies, the ASU is effective for financial statements for annual periods beginning after December 15, 2017, and interim periods within annual periods beginning after December 15, 2018. Early application is permitted for all entities as of the beginning of aan interim or annual reporting entity’s first fiscal year that begins after November 15, 2007 (with earlier application permitted under certain circumstances).period. The Company did not chooseis currently assessing the impact this guidance may have on our consolidated financial statements. | 3. | REGULATORY DECISION AND RELATED ACCOUNTING AND POLICY CHANGES |

Our regulated utilities and certain other balances are subject to take the fair value election allowedregulation by the standard. ACC and meet the requirements for regulatory accounting found within ASC Topic 980.In December 2007,accordance with ASC Topic 980, rates charged to utility customers are intended to recover the FASB issued SFAS No. 141 (revised 2007), “Business Combinations.” SFAS No. 141(R) replaces SFAS No. 141 and, although it retains certain requirementscosts of that guidance, it is broader in scope. SFAS No. 141(R) establishes principles and requirementsthe provision of service plus a reasonable return in the recognitionsame period. Initial rates are set by the ACC at the -F-14-

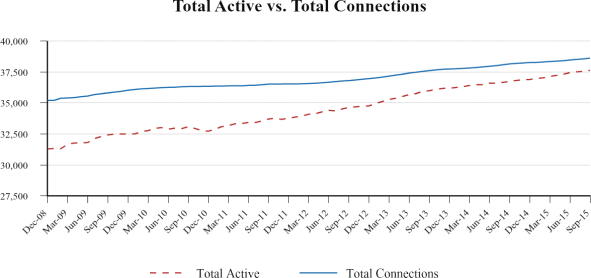

GLOBAL WATER RESOURCES, INC. Notes to Consolidated Financial Statements time the CC&N is established for an area. The initial rates are determined based on an application submitted by us that includes anticipated customer counts and measurementrequired infrastructure with rates set to achieve a rate of return on equity invested in the utility. Changes in rates, if any, are made through further formal rate applications. On July 11, 2012, we filed rate applications with the ACC to adjust the revenue requirements for seven utilities representing a collective rate increase of approximately 28% over 2011’s revenue. In August 2013, the Company entered into a settlement agreement with ACC Staff, the Residential Utility Consumers Office, the City of Maricopa, and other parties to the rate case. The settlement required approval by the ACC’s Commissioners before it could take effect. In February 2014, the rate case proceedings were completed and the ACC issued Rate Decision No. 74364, effectively approving the settlement agreement. The rulings of the assets acquired,decision include, but are not limited to, the liabilitiesfollowing: For the Company’s utilities, a collective revenue requirement increase of $4.3 million based on 2011 test year service connections, phased-in over time, with the first increase in January 2015 as follows (in thousands of US$): | | | | | | | | | | | | Incremental | | | Cumulative | | 2015 | | $ | 1,416 | | | $ | 1,416 | | 2016 | | | 1,219 | | | | 2,635 | | 2017 | | | 335 | | | | 2,970 | | 2018 | | | 336 | | | | 3,306 | | 2019 | | | 335 | | | | 3,641 | | 2020 | | | 335 | | | | 3,976 | | 2021 | | | 335 | | | | 4,311 | |

Whereas this phase-in of additional revenues was determined using a 2011 test year, to the extent that the number of active service connections increases from 2011 levels, the additional revenues may be greater than the amounts set forth above. Full reversal of the imputation of CIAC balances associated with funds previously received under ICFAs, as required in the Company’s last rate case. The reversal restores rate base or future rate base, and has a significant impact of restoring shareholder equity on the balance sheet. The Company has agreed to not enter into any new ICFAs. Existing ICFAs will remain in place, but a portion of future payments to be received under the ICFAs will be considered as hook-up fees, which are accounted for as CIAC once expended on plant. A 9.5% return on common equity will be adopted. None of the Company’s utilities will file another rate application before May 31, 2016. GWRI’s subsidiaries, Santa Cruz Water Company (“Santa Cruz”) and Palo Verde Utilities Company (“Palo Verde”) may not file for another rate increase before May 31, 2017. The following provides additional discussion on accounting and policy changes resulting from Rate Decision No. 74364. Infrastructure Coordination and Financing Agreements—ICFAs are agreements with developers and homebuilders whereby the GWRI parent company, which owns the operating utilities, provides services to plan, coordinate and finance the water and wastewater infrastructure that would otherwise be required to be performed or subcontracted by the developer or homebuilder. Under the ICFAs, GWRI has a contractual obligation to ensure physical capacity exists through its regulated utilities for water and wastewater to the landowner/developer when needed. This obligation persists regardless of connection growth. Fees for these services are typically a negotiated amount per equivalent -F-15-

GLOBAL WATER RESOURCES, INC. Notes to Consolidated Financial Statements dwelling unit for the specified development or portion of land. Payments are generally due in installments, with a portion due upon signing of the agreement, a portion due upon completion of certain milestones, and the final payment due upon final plat approval or sale of the subdivision. The payments are non-refundable. The agreements are generally recorded as a lien against the land and must be assumed in the event of a sale or transfer. The regional planning and any non-controlling interestscoordination of the infrastructure in the various service areas has been an important part of GWRI’s business model. Prior to January 1, 2010, GWRI accounted for funds received under ICFAs as revenue once the obligations specified in the ICFA were met. As these arrangements are with developers and not with the end water or wastewater customer, the timing of revenue recognition coincided with the completion of GWRI’s performance obligations under the agreement with the developer and with GWRI’s ability to provide fitted capacity for water and wastewater service through its regulated subsidiaries. The 2010 Regulatory Rate Decision established new rates for the recovery of reasonable costs incurred by the utilities and a return on invested capital. In determining the new annual revenue requirement, the ACC imputed a reduction to rate base for all amounts related to ICFA funds collected by the Company that the ACC deemed to beContributions in Aid of Construction (“CIAC”) for rate making purposes. As a business combination. Among other requirements, direct acquisition costsresult of the decision by the ACC, GWRI changed its accounting policy for the accounting of ICFA funds. Effective January 1, 2010, GWRI recorded ICFA funds received as CIAC. Thereafter, the ICFA-related CIAC was amortized as a reduction of depreciation expense over the estimated depreciable life of the utility plant at the related utilities. With the issuance of Rate Decision No. 74364, in February 2014, the ACC changed how ICFA funds would be characterized and acquisition-related restructuring costs mustaccounted for going forward. Most notably, ICFA funds would no longer be CIAC. ICFA funds which were already received or which had become due prior to the date of Rate Decision No. 74364 would be accounted for separately fromin accordance with the business combination. In addition, SFASCompany’s ICFA revenue recognition policy that had been in place prior to the 2010 Regulatory Rate Decision. For ICFA funds to be received in the future, Rate Decision No. 141(R) provides guidance in accounting for step acquisitions, contingent liabilities, goodwill, contingent consideration, and other aspects74364 prescribes that 70% of business combinations. SFAS No. 141(R) applies prospectivelyICFA funds to business combinations for which the acquisition date is on or after the beginning of the first annual reporting period beginning on or after December 15, 2008. Accordingly,be received by the Company will adopt SFASbe recorded in the associated utility subsidiary as a HUF liability, with the remaining 30% to be recorded as deferred revenue, to be accounted for in accordance with the Company’s ICFA revenue recognition policy. In relation to the change in accounting brought about by Rate Decision No. 141(R)74364, the Company recognized a gain on regulatory order of $50.7 million for the twelve months ended December 31, 2014. The Company intends to account for the portion allocated to the HUF as a contribution, similar to CIAC. However, from the regulator’s perspective, the HUF is not technically CIAC and does not impact rate base until the related funds are expended. Such funds will be segregated in a separate bank account and used for plant. A HUF liability will be established and will be relieved once the HUF funds are utilized for the construction of plant. For facilities required under a HUF or ICFA, the utilities must first use the HUF moneys received, after which, it may use debt or equity financing for the remainder of construction. The Company will record the 30% as deferred revenue, which is to be recognized as revenue once the obligations specified within the ICFA are met. As of December 31, 2014, ICFA deferred revenue recorded on the consolidated balance sheet totaled $19.7 million, which represents deferred revenue recorded for ICFA funds received on contracts that had become due prior to Rate Decision No. 74364. For ICFA contracts coming due after Rate Decision No. 74364, 30% will be added to this balance with the remaining 70% recorded to a HUF liability. Regulatory asset—Under ASC Topic 980, rate regulated entities defer costs and credits on the balance sheet as regulatory assets and liabilities when it is probable that these costs and credits will be recognized in the rate making process in a period different from the period in which they would have been reflected in income by an unregulated company. Certain costs associated with our rate cases have been deferred on our balance sheet as regulatory assets as approved by the ACC. At December 31, 2014, the Company has one -F-16-

GLOBAL WATER RESOURCES, INC. Notes to Consolidated Financial Statements regulatory asset in the amount of $400,000 related to costs incurred in connection with our most recent rate case. This amount will be amortized over a three-year period beginning January 2015, which period is aligned with the phase-in of the new rates provided by Rate Decision No. 74364. Intangible assets / Regulatory liability—The Company had previously recorded certain intangible assets related to ICFA contracts obtained in connection with our Santa Cruz, Palo Verde and Sonoran Utility Services (“Sonoran”) acquisitions. The intangible assets represented the benefits to be received over time by virtue of having those contracts. Prior to January 1, 20092010, the ICFA-related intangibles were amortized when ICFA funds were recognized as revenue. Effective January 1, 2010, in connection with the 2010 Regulatory Rate Decision, these assets became fully offset by a regulatory liability of $11.2 million since the imputation of ICFA funds as CIAC effectively resulted in the Company not being able to benefit (through rates) from the acquired ICFA contracts. Effective January 1, 2010, the gross ICFAs intangibles began to be amortized when cash was received in proportion to the amount of total cash expected to be received under the underlying agreements. However, such amortization expense was offset by a corresponding reduction of the regulatory liability in the same amount. As a result of Rate Decision No. 74364, the Company changed its policy around the ICFA related intangible assets. As discussed above, pursuant to Rate Decision No. 74364, approximately 70% of ICFA funds to be received in the future will be recorded as a HUF at the Company’s applicable utility subsidiary. The remaining approximate 30% of future ICFA funds will be recorded at the parent company level and will applybe subject to the Company’s ICFA revenue recognition accounting policy. Since the Company now expects to experience an economic benefit from the 30% portion of future ICFA funds, 30% of the regulatory liability, or $3.4 million, was reversed during the three months ended March 31, 2014. The remaining 70% of the regulatory liability, or $7.9 million, will continue to be recorded on the balance sheet. At December 31, 2014, this is the Company’s sole regulatory liability. Subsequent to Rate Decision No. 74364, the intangible assets will continue to amortize when the corresponding ICFA funds are received in proportion to the amount of total cash expected to be received under the underlying agreements. The recognition of amortization expense will be partially offset by a corresponding reduction of the regulatory liability. Income taxes—As a result of the additional revenues expected to be provided by Rate Decision No. 74364, as well as other factors, the Company performed an evaluation of its provisions prospectively. deferred income taxes and determined that sufficient evidence now exists that the majority of the Company’s net deferred tax assets will be utilized in the future. Accordingly in 2014, the Company reversed substantially all of the deferred tax asset valuation allowance previously recorded (see Note 11).-F-17-

GLOBAL WATER RESOURCES, INC. Notes to Consolidated Financial Statements | 4. | | 2. | PROPERTY, PLANT AND EQUIPMENT |

Property, plant and equipment at December 31, 2007 and 20062014 consist of the following: | | | | | | | | | | | | | | | 2007 | | | 2006 | | | Depreciation Rate | | | Utility plant and equipment:

Mains/lines—sewers | | $ | 101,825,890 | | | $ | 67,696,120 | | | 2% - 5% | | Plant | | | 56,539,545 | | | | 37,093,946 | | | 2 - 10 | | Equipment | | | 32,371,801 | | | | 17,670,363 | | | 3 - 20 | | Meters | | | 4,631,086 | | | | 4,775,382 | | | 5 - 8 | | Land | | | 409,866 | | | | 979,428 | | | | Constructionwork-in-process | | | 43,991,015 | | | | 49,711,512 | | | | | | | | | | | | | | | | | Utility plant and equipment | | | 239,769,203 | | | | 177,926,751 | | | | | Office equipment/furniture | | | 2,206,764 | | | | 1,403,488 | | | 14 - 20 | | | | | | | | | | | | | | Total property, plant and equipment | | | 241,975,967 | | | | 179,330,239 | | | | | Less accumulated depreciation | | | (11,744,158 | ) | | | (6,581,502 | ) | | | | | | | | | | | | | | | | Net property, plant and equipment | | $ | 230,231,809 | | | $ | 172,748,737 | | | | | | | | | | | | | | | |

F-13

| | | | | | | | | | December 31,

2014 | | | Average

Depreciation Life

(in years) | PROPERTY, PLANT AND EQUIPMENT: | | | | | | | Mains/lines/sewers | | $ | 138,116 | | | 47 | Plant | | | 79,983 | | | 25 | Equipment | | | 44,286 | | | 10 | Meters | | | 6,336 | | | 12 | Furniture, fixture and leasehold improvements | | | 430 | | | 8 | Computer and office equipment | | | 1,006 | | | 5 | Software | | | 163 | | | 3 | Land and land rights | | | 986 | | | | Other | | | 139 | | | | Construction work-in-process | | | 47,550 | | | | | | | | | | | Total property, plant and equipment | | | 318,995 | | | | Less accumulated depreciation | | | (78,571 | ) | | | | | | | | | | Net property, plant and equipment | | $ | 240,424 | | | | | | | | | | |

GLOBAL WATER RESOURCES, LLC AND SUBSIDIARIES AND

GLOBAL WATER MANAGEMENT, LLC

NOTES TO COMBINED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

| 5. | | 3. | OTHER INTANGIBLE ASSETSACCOUNTS RECEIVABLE |

Other intangible assets at December 31, 2007 and 2006 consist of the following:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | 2007 | | | 2006 | | | | | Gross

| | | Accumulated

| | | Net

| | | Gross

| | | Accumulated

| | | Net

| | | | | Amount | | | Amortization | | | Amount | | | Amount | | | Amortization | | | Amount | | | | | Unamortized intangible assets: | | | | | | | | | | | | | | | | | | | | | | | | | | Hassayampa recharge permits | | $ | 6,435,531 | | | | | | | $ | 6,435,531 | | | $ | 6,435,531 | | | | | | | $ | 6,435,531 | | | Water rights | | | — | | | | | | | | — | | | | 515,158 | | | | | | | | 515,158 | | | Francisco Grande and CP CC&N service area | | | 9,052,890 | | | | | | | | 9,052,890 | | | | 9,042,027 | | | | | | | | 9,042,027 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Total unamortized intangible assets | | | 15,488,421 | | | | | | | | 15,488,421 | | | | 15,992,716 | | | | | | | | 15,992,716 | | | Amortized intangible assets: | | | | | | | | | | | | | | | | | | | | | | | | | | Acquired ICFAs | | | 17,977,890 | | | $ | (6,179,210 | ) | | | 11,798,680 | | | | 17,977,890 | | | $ | (3,974,050 | ) | | | 14,003,840 | | | Sonoran contract rights | | | 7,406,297 | | | | (1,070,363 | ) | | | 6,335,934 | | | | 7,406,297 | | | | (759,660 | ) | | | 6,646,637 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Total amortized intangible assets | | | 25,384,187 | | | | (7,249,573 | ) | | | 18,134,614 | | | | 25,384,187 | | | | (4,733,710 | ) | | | 20,650,477 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Total other intangible assets | | $ | 40,872,608 | | | $ | (7,249,573 | ) | | $ | 33,623,035 | | | $ | 41,376,903 | | | $ | (4,733,710 | ) | | $ | 36,643,193 | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Estimated annual amortization expense through 2012 and thereafter is as follows:

| | | | | | | 2008 | | $ | 8,852,040 | | | 2009 | | | 3,440,910 | | | 2010 | | | 881,440 | | | 2011 | | | 367,760 | | | 2012 | | | 363,150 | | | Thereafter | | | 4,229,314 | | | | | | | | | Total | | $ | 18,134,614 | |

Accounts receivable at December 31, 2007 and 20062014 consist of the following: | | | | | | | | | | | | | 2007 | | | 2006 | | | | | Billed utility revenue | | $ | 2,205,745 | | | $ | 2,150,194 | | | Other | | | 4,455 | | | | 29,108 | | | | | | | | | | | | | | | | 2,210,200 | | | | 2,179,302 | | | Less allowance for doubtful accounts | | | (226,443 | ) | | | (233,525 | ) | | | | | | | | | | | | Accounts receivable, net | | $ | 1,983,757 | | | $ | 1,945,777 | |

F-14

| | | | | | | | December 31, 2014 | | Billed receivables | | $ | 1,523 | | Less allowance for doubtful accounts | | | (158 | ) | | | | | | Accounts receivable—net | | $ | 1,365 | | | | | | |

GLOBAL WATER RESOURCES, LLC AND SUBSIDIARIES AND

GLOBAL WATER MANAGEMENT, LLC

NOTES TO COMBINED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

The following table summarizes the changes in the Company’s allowance for doubtful accounts: | | | | | | | | | | | | | | | | | 2007 | | | 2006 | | | 2005 | | | | | Balance at January 1, | | | $233,525 | | | $ | 182,733 | | | $ | 138,060 | | | Amounts charged to expense | | | 366,611 | | | | 62,947 | | | | 44,890 | | | Accounts written off | | | (373,693 | ) | | | (12,155 | ) | | | (217 | ) | | | | | | | | | | | | | | | | Balance at December 31, | | | $226,443 | | | $ | 233,525 | | | $ | 182,733 | |

| | | | | | | | December 31, 2014 | | Beginning balance December 31, 2013 | | $ | (102 | ) | Allowance additions | | | (92 | ) | Write-offs | | | 57 | | Recoveries | | | (21 | ) | | | | | | Ending balance December 31, 2014 | | $ | (158 | ) | | | | | |

| 6. | | 5. | ACQUISITIONSEQUITY METHOD INVESTMENT AND CONVERTIBLE NOTE |

On December 30, 2006, GWI purchasedJune 5, 2013, the total issuedCompany sold GWM a wholly-owned subsidiary of GWRI that owned and outstanding shares of FG, an Arizona corporation owningoperated the right to provide water and wastewater services near the cities of Maricopa and Casa Grande, Arizona, for $8,000,000. Also, on December 30, 2006, GWI purchased the total issued and outstanding shares of CP, an Arizona corporation providing water services near the cities of Maricopa and Casa Grande, AZ from CHI ConstructionFATHOM business (“CHI”FATHOM”) for $1,250,000. Contemporaneously. In connection with the two acquisitions,sale of GWM, the Company entered intomade an ICFA with CHI for Legends Ranch, a 7,000-acre master planned community owned by CHI. The majority of the 7,000 acres wereinvestment in the utility service areas of CP and FG, and CHI agreed to prepay a portion of its ICFA fees in order to partially finance the utility acquisitions. The purchase consideration of $1,250,000FATHOM Partnership. This limited partnership investment is accounted for CP will be paid by way of future reductions of the ICFA fee of $250 per lot for lots 2,001 through 7,000, and has been recorded at its estimated fair value of $934,225. For the purchase price of FG, CHI has placed a letter of credit in escrow of $4,800,000, representing its ICFA fee prepayment, and the Company has placed a letter of credit in escrow of $3,200,000 (see Note 9). The letters of credit will be converted to cash once the Commission approves the transfer of the service area to GW-SC and GW-PV, which is expected to occur in 2008. The ICFA fees prepaid by CHI will be reimbursed by way of reducing the ICFA fee $750 per lot for lots 2,001 through 8,400. The total purchase price of the CP and FG shares has been allocated to the respective service areas acquired, which are considered to be indefinite life intangible assets. Legends Ranch was sold in 2007 and the buyer has assumed CHI’s rights and obligations under the agreements. On July 11, 2006, GWI purchased the total issued and outstanding shares of WMCequity method due to our investment being considered more than minor.The original investment in order to obtain utilities and service areas in the western portion of Maricopa County, Arizona . The purchase priceFATHOM consisted of an initial paymentinvestment of $18.5 million, of which $6.2 million was funded by the prepayment of ICFA fees by developers seeking service from Greater Tonopah and Hassayampa, and additional noninterest-bearing purchase consideration totaling $41.5 million with the first payment due to be paid July 11, 2007,$750,000 in the amountSeries A preferred units and $98,000 of $5 million. The balance due is payable in the form of future growth premiums, which have the potential to accelerate the payment schedule; however, the growth premium will not be less than $6 million in each of the years 2008 through 2011 and $12.5 million in 2012. The growth premiums are payable on March 31, 2008, and on March 31 of each year thereafter through 2012, in an amount equal to $3,000 for each new meter connected during the previous calendar year, except for the payment due in 2008 which will be based on the meters installed from July 12, 2006 through December 31, 2007, until the date on which the cumulative growth premium equals $36,500,000. The future purchase consideration was recorded at its fair value of $30,976,000, based on an imputed interest rate of 8.5% based on the Company’s weighted average cost of capital and the minimum payment amounts set forth above, resultingcommon units. Additionally, GWRI invested $750,000 in a total purchase price of $46,672,081, net of $2,803,919 cash acquired.

F-15

-F-18-

GLOBAL WATER RESOURCES, LLC AND SUBSIDIARIES AND

GLOBAL WATER MANAGEMENT, LLC

NOTES TO COMBINED CONSOLIDATED FINANCIAL STATEMENTS—(Continued) The total purchase priceINC.Notes to Consolidated Financial Statements note of WMC was allocated among tangible assets, identifiable intangible assets, goodwill and assumable liabilities at their fair value as at the acquisition date of July 11, 2006 as follows: | | | | | Utility plant in service | | | $18,002,601 | | Current assets (including cash of $2,803,919) | | | 3,609,377 | | Goodwill (not deductible for tax purposes) | | | 45,809,111 | | Intangible asset — Hassayampa recharge permits | | | 6,435,531 | | Current liabilities | | | (1,003,533 | ) | Deferred tax liability | | | (3,225,968 | ) | Advances in aid of construction | | | (17,612,715 | ) | Contributions in aid of construction | | | (846,202 | ) | Assumed debt | | | (1,692,202 | ) | | | | | | Net assets acquired | | | $49,476,000 | | | | | | |

On June 15, 2005, the Company completed the purchase of the assets of Sonoran. The effective purchase date was March 31, 2005. As part of the purchase, the Company acquired rights under certain ICFAsGWM with landowners within the designated service area. The purchase price consisted of an initial payment of $7.2 million, additional purchase consideration totaling $10.5 million payable as a defined number of homes are sold in the designated service area, and contingent consideration of $300-$500 per meter installed for a period not to exceed 18 years from the initial payment date in a portion of the service area. The initial payment is payable upon approval by the Commission of the necessary expansion of the GW-SC and GW-PV CC&Ns to include the Sonoran service area. Such expansion has been preliminarily approved by the Commission pending the dissolution of the unregulated water and wastewater improvement district, and the Company expects to make the initial payment in 2009. The additional purchase consideration is contingently payable as follows: $2.5 million upon the sale of 2,500 homes, $3.75 million upon the sale of an additional 2,500 homes, and $4.25 million upon the sale of an additional 5,000 homes. Irrespective of these milestones, any unpaid portion of the first $10 million of additional consideration is payable in full upon the 10th anniversary of the initial payment date. Asoriginal maturity of December 31, 2007, there have been 4,946 homes sold.

The Company has recognized a purchase liability consisting2014. In May 2014, the maturity date of the initial payment and,note was extended to June 30, 2015. We accounted for this investment in accordance with FASB Statement No. 141,Business Combinations,relevant accounting guidance for debt and equity securities which requires the portionfair value measurement of the contingent consideration (approximately $10 million) necessaryinvestment pursuant to cause the allocated cost of the acquired entity to equal theASC Topic 820,Fair Value Measurement. The fair value of the net assets acquired. Wheninvestment in the contingencies are resolved, any excessconvertible notes at initial recognition was determined using the transaction price, of which the price paid by the Company was consistent with the price paid by third party investors for comparable convertible notes.In November 2014, FATHOM experienced a qualified financing event (qualified financing was defined as an equity financing by FATHOM Partnership in which FATHOM Partnership sells its units for at least $1.75 per unit and the aggregate proceeds from such financing was at least $15 million, exclusive of convertible note amounts converted). At the time of the consideration paid overqualified financing, the convertible promissory note was converted into Series B Preferred Units, and accounted for under the equity method. The Company’s resulting ownership of common and preferred units represented an approximate 8.0% ownership (on a fully diluted basis). In conjunction with the qualified financing, our equity interest in the Series A and Series B preferred shares was adjusted in accordance with ASC 323, wherein we recorded a gain of $1.0 million. The adjustment to the carrying value of our investments was calculated using our proportionate share of FATHOM’s adjusted net equity. The gain was recorded within other income and expense in our consolidated statement of operations. At December 31, 2014, the carrying value of our equity investment was $1.2 million. The carrying value of our investment is a reflection of our initial liability recorded willinvestment, the adjustment related to the qualified financing and our proportionate share of FATHOM’s cumulative losses. We evaluate our investment in FATHOM Partnership/GWM for impairment whenever events or changes in circumstances indicate that the carrying value of our investment may have experienced an “other-than-temporary” decline in value. Since the sale of GWM, the losses incurred on the investment were greater than anticipated; however, based upon our evaluation of various relevant factors, including the recent equity event, the ability of FATHOM to achieve and sustain an earnings capacity that would justify the carrying amount of our investment, as of December 31, 2014 we do not believe the investment to be impaired. We have evaluated whether GWM qualifies as a variable interest entity (“VIE”) pursuant to the accounting guidance of ASC 810,Consolidations. Considering the potential that the total equity investment in FATHOM Partnership/GWM may not be sufficient to absorb the losses of FATHOM, we believe it is currently appropriate to view GWM as a VIE. However, considering GWRI’s minority interest and limited involvement with the FATHOM business, the Company would not be required to consolidate the financial statements of GWM. Rather, we have accounted for our investment under the equity method. | 7. | GOODWILL AND INTANGIBLE ASSETS |

The carrying value of goodwill totaled $13.1 million as of December 31, 2014, which included balances of $12.7 million and $398,000 in the Valencia and Willow Valley reporting units, respectively. No impairments were recognized as additional costduring the year ended December 31, 2014. -F-19-

GLOBAL WATER RESOURCES, INC. Notes to Consolidated Financial Statements Intangible assets at December 31, 2014 consisted of the acquisition. The recognized costfollowing (in thousands of theUS$): | | | | | | | | | | | | | | | | December 31, 2014 | | | | | Gross

Amount | | | Accumulated

Amortization | | | Net