The information in this prospectus is not complete and may be changed. The selling securityholdersWe may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any statejurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JANUARY 22, 2015

PRELIMINARY PROSPECTUS

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED AUGUST [●], 2018 |

13,593,214 Shares

FLEXSHOPPER, INC.

Common Stock

FlexShopper, Inc.

This prospectus relates to the offer for sale of 13,593,214We are offering [●] shares of our common stock, $0.0001 par value, $0.0001at a price of $ per share of FlexShopper, Inc. by the existing holders of the securities named in this prospectus, whom we refer to as selling securityholders throughout this prospectus. a firm commitment underwritten offering.

Our common stock is quotedlisted on the OTCQBNasdaq Capital Market under the symbol “FPAY”. On December 31, 2014,August 10, 2018, the last reported sale price of our common stock on the OTCQBNasdaq Capital Market was $1.00$3.58 per share. Before you invest, you

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 9 for a discussion of information that should read carefully this prospectus and any prospectus supplement. For information concerning the selling securityholders and the mannerbe considered in which they may offer and sell shares ofconnection with an investment in our common stock, see “Selling Securityholders” and “Plan of Distribution” in this prospectus.securities.

The distribution of securities offered hereby may be effected in one or more transactions that may take place through the OTCQB or, if our common stock is then listed, on a national securities exchange. These transactions may include ordinary brokers’ transactions, privately negotiated transactions, or sales to one or more dealers for resale of such securities as principals. The transactions may be executed at market prices prevailing at the time of sale, at prices related to such prevailing market prices, or at negotiated prices. Usual and customary or specifically negotiated brokerage fees or commissions may be paid by the selling securityholders. The selling securityholders and intermediaries through whom such securities are sold may be deemed “underwriters” under the Securities Act of 1933, as amended, with respect to the securities offered hereby, and any profits realized or commissions received may be deemed underwriting compensation. See “Plan of Distribution.”

We will not receive any of the proceeds from the sale of our common stock by the selling securityholders. We have agreed to pay expenses of registration of the offered common stock, other than transfer taxes and brokerage fees or commissions.

| Per Share | Total | |||||||

| Public offering price | $ | |||||||

| Underwriting discount(1) | $ | |||||||

| Proceeds, before expenses, to us(2) | $ | |||||||

Investing in our

| (1) | We have also agreed to reimburse the underwriters for certain expenses incurred by them. See “Underwriting” for a description of the compensation payable by us to the underwriters. |

| (2) | We estimate the total expenses payable by us, excluding the underwriting discount, will be approximately $300,000. |

We have granted the underwriters a 45-day option to purchase additional shares of common stock involves significant risks. See “Risk Factors” beginning on page 5in an amount up to read about factors you should consider15% of shares sold to the public in this offering to cover over-allotments, if any. If the underwriters exercise the option in full, the total underwriting discounts and commissions payable by us will be $ and the total proceeds to us, before buying our common stock.expenses, will be $ .

Neither the Securities and Exchange Commission nor any state securities regulatorcommission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock to investors on or about , 2018, subject to customary closing conditions.

ThinkEquity

a division of Fordham Financial Management, Inc.

The date of this prospectus is , 20152018.

Unless otherwise stated or the context otherwise requires, the terms “FlexShopper,” “we,” “us,” “our” and the “Company” refer to FlexShopper, Inc., a Delaware corporation, and its consolidated subsidiaries.

You should rely only on the information contained in this document.prospectus and any related free writing prospectus that we may provide to you in connection with this offering. We have not, and the underwriters have not, authorized anyone to provide you with additional or different information from that contained in this prospectus.information. If anyone provides you with additional, different or inconsistent information, you should not rely on it. The selling securityholdersWe are offeringnot, and the underwriters are not, making an offer to sell and seeking offers to buy, shares of our common stock onlythese securities in jurisdictionsany jurisdiction where offers and sales arethe offer or sale is not permitted. TheYou should assume that the information appearing in this document mayprospectus is accurate only be accurateas of the date on the datefront cover of this document,prospectus, regardless of itsthe time of delivery of this prospectus or of any sales of sharessale of our common stock. Our business, financial condition, results of operations or cash flowsand prospects may have changed since suchthat date.

Unless otherwise indicated or unless the context requires otherwise, all references in this prospectus to FlexShopper, Inc. “FlexShopper,” the “Company,” “we,” “us,” “our,” or similar references, mean FlexShopper, Inc. and its subsidiaries on a consolidated basis.

The registration statement containing this prospectus, including the exhibits to the registration statement, provides additional information about us and the shares of our common stock covered by this prospectus. The registration statement, including the exhibits, can be read on the SEC website or at the SEC offices mentioned under the heading “Where You Can Find More Information.”

For investors outside the United States,States: neither we nor the underwriters have not done anything that would permit this offering or possession or distribution of this prospectus or any free writing prospectus we may provide to you in connection with this offering in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.prospectus and any such free writing prospectus outside of the United States.

MARKET AND INDUSTRY DATA

Unless otherwise indicated, information contained in this prospectus concerning our industry and the markets in which we operate is based on information from independent industry and research organizations, other third-party sources (including industry publications, surveys and forecasts), and management estimates. Management estimates are derived from publicly available information released by independent industry analysts and third-party sources, as well as data from our internal research, and are based on assumptions made by us upon reviewing such data and our knowledge of such industry and markets, which we believe to be reasonable. Although we believe the data from these third-party sources is reliable, we have not independently verified any third-party information. In addition, projections, assumptions and estimates of the future performance of the industry in which we operate and our future performance are necessarily subject to uncertainty and risk due to a variety of factors, including those described in “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements and Other Information Contained In This Prospectus.” These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

i

This summary highlights selected information contained elsewhere in this prospectus and does not contain all of the information that you should consider before investing in our securities. This summary is not complete and does not contain all of the information that should be considered before investing in our securities. Potential investors should read the entire prospectus carefully, including the more detailed information regarding our business provided under the “Business” section, the risks of purchasing our securities discussed under the “Risk Factors” section, and our financial statements and the accompanying notes to the financial statements.

Our Company

For more than 60 years the rent-to-own (“RTO”) consumer has primarily been limited to shopping in traditional brick and mortar RTO stores, which have both a limited selection of products and brands and products that are primarily in used condition. In 2013, FlexShopper developed its business with the mission to enable RTO consumers to shop like traditional consumers and provide an “endless aisle” experience by providing access to all durable products from any national or regional retailer through its B2C online and digital channels and its B2B “save the sale” solutions for retailers. In retail, the phrase “save the sale” means offering consumers other finance options when they do not qualify for traditional credit. These channels, located outside traditional brick and mortar RTO stores, comprise the virtual lease-to-own (“LTO”) market.

We focus on improving the quality of life of our customers by providing them the opportunity to obtain ownership of high-quality durable products, such as consumer electronics, appliances, computers (including tablets and wearables), smartphones, tires, jewelry and furniture (including accessories), under affordable payment, LTO agreements with no long-term obligation. We have successfully developed and are currently processing LTO transactions using our “LTO Engine,” FlexShopper’s proprietary technology that automates the process of consumers receiving spending limits and entering into leases for durable goods within seconds. The LTO Engine is the basis for FlexShopper’s primary sales channels, which include B2C and B2B channels, as described in further detail below.

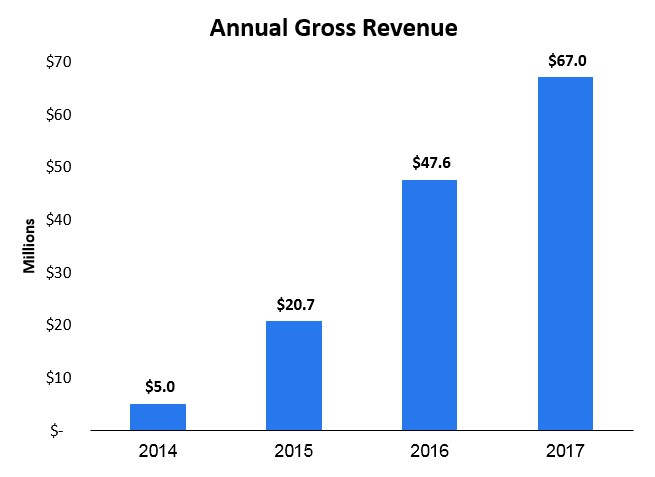

The Company is quickly penetrating the LTO market as evidenced by the increase in its gross revenue, illustrated in the chart below.

While most of FlexShopper’s historical growth has been driven by its B2C channel, the Company recently launched its LTO “save the sale” program with a national tire retailer in its 726 corporate stores, which is expected to grow the program’s door count from 31 locations as of March 31, 2018 to over 750 locations by August 31, 2018.

| 1 |

Industry Overview The LTO industry offers consumers an alternative to traditional methods of obtaining electronics, computers, home furnishings, appliances and other durable goods. FlexShopper’s customers typically do not have sufficient cash or credit to obtain these goods, so they find the short-term nature and affordable payments of LTO attractive. The Lease-Purchase Transaction A lease-purchase transaction is a flexible alternative for consumers to obtain and enjoy brand name merchandise with no long-term obligation. Key features of our lease-purchase transactions include: Brand name merchandise. FlexShopper offers well-known brands such as LG, Samsung, Sony and Vizio home electronics; Frigidaire, General Electric, LG, Samsung and Whirlpool appliances; Acer, Apple, Asus, Samsung and Toshiba computers and/or tablets; Samsung and Apple smartphones; and Ashley, Powell and Standard furniture, among other brands. Convenient payment options. Our customers make payments on a weekly, bi-weekly or monthly basis. Payments are automatically deducted from the customer’s authorized checking account or debit card. Additionally, customers may make additional payments or exercise early payment options, which enable them to save money. No long-term commitment. A customer may terminate a lease-purchase agreement at any time with no long-term obligation by paying amounts due under the lease-purchase agreement and returning the leased item to FlexShopper. Applying has no impact on credit or FICO score. We do not use FICO scores to determine customers’ spending limits so our underwriting does not impact consumers’ credit with the three main credit bureaus. Flexible options to obtain ownership. Ownership of the merchandise generally transfers to the customer if the customer makes all payments during the lease term, which is one year, or exercises early payment options, which typically save the customer money. Key Trends Driving the Industry: Non-prime consumers represent the largest segment of the credit market.Today, 38% of Americans have low credit scores according to Experian, and approximately one in ten adult Americans are credit invisible, or have no credit history, according to the Consumer Financial Protection Bureau. This segment of consumers represents a significant and underserved market.

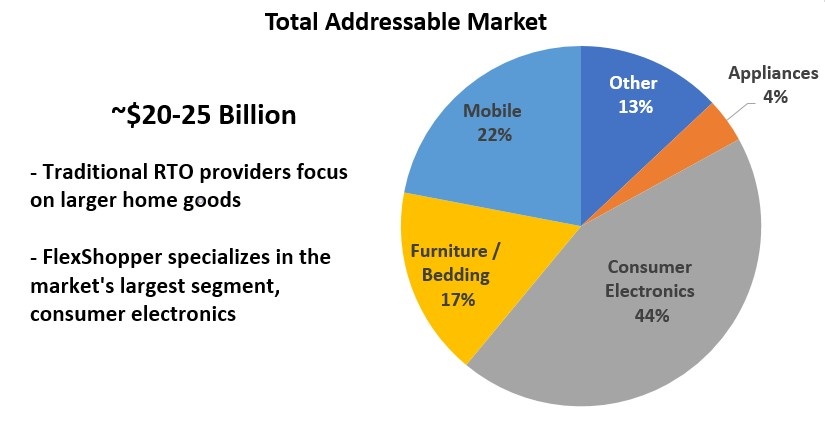

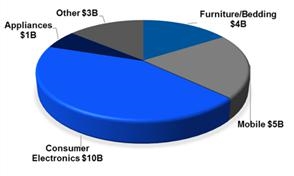

According to Wall Street and industry research, the current addressable market size for non-prime consumers is between $20 and $25 billion, with consumer electronics constituting 44% of such amount. We believe that underwriting consumer electronics online is one of our competitive advantages since this is the majority of our business and has not been a focus of our peers.

Additional industry trends include:

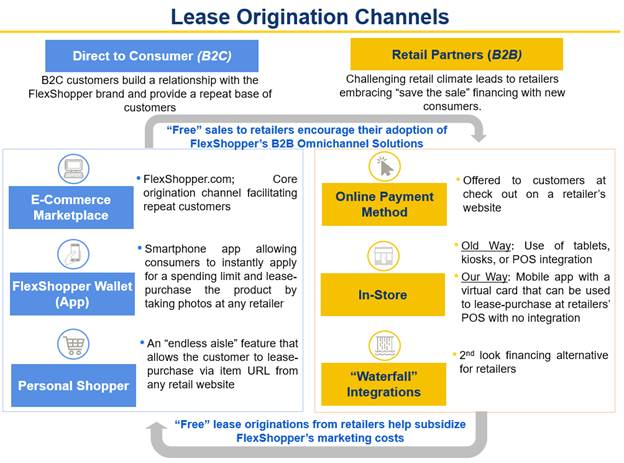

OUR COMPETITIVE STRENGTHS A Unique LTO Platform We believe we have created a unique platform whereby our B2B and B2C sales channels beneficially support and advance each other. For our B2C channels, we directly market to LTO consumers to shop at FlexShopper.com, where they can choose from over 150,000 of the latest products shipped directly to them by certain of the nation’s largest retailers. This generates sales with no acquisition cost for our retail partners; FlexShopper uses this incremental business we have provided to encourage these retailers to incorporate our B2B solutions into their online and in-store sales channels. The lease originations by our retail partners using our B2B LTO programs, which have little to no customer acquisition cost to us, subsidize our B2C customer acquisition costs. This platform is illustrated in the diagram below:

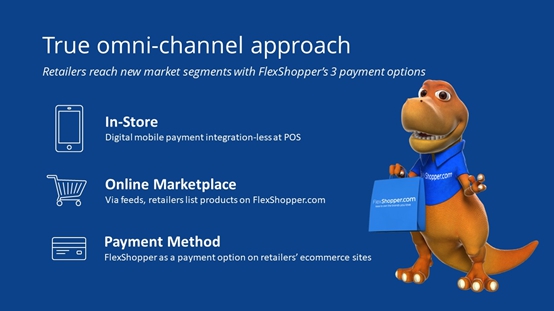

Underwriting and Risk Management Specialized technology and proprietary risk analytics optimized for the non-prime credit market. We have made substantial investments in our underwriting technology and analytics platforms to support rapid scaling, innovation and regulatory compliance. Our team of data scientists and risk analysts uses our risk infrastructure to build and test strategies across the entire underwriting process, using alternative credit data, device authentication, identity verification, and many more data elements. We believe our real-time proprietary technology and risk analytics platform is unique among our competitors in successfully underwriting online consumers and consumer electronics; most of our peers focus on in-store consumers that acquire furniture and appliances, which we believe are easier to underwrite based on our own experiences. In addition, all our applications are processed instantly with approvals and spending limits provided within seconds of submission. LTO Products for Consumers and Retailers Expansive online LTO marketplace.We have made substantial investments in our custom e-commerce platform to provide consumers the greatest selection of popular brands delivered by certain of the nation’s largest retailers, including Best Buy, Walmart, Overstock, Serta and many more. Our platform is custom-built for online LTO transactions, which include underwriting our consumers, serving them LTO leases, syncing and communicating with our retail partners to fulfill orders and all front- and back-end customer relationship management functions, including collections and billing. The result is a comprehensive technology platform that manages all facets of our business and enables us to scale with hundreds of thousands of visitors and products. Omnichannel “save the sale” product for retailers. In retail, the phrase “save the sale” means offering consumers other finance options when they do not qualify for traditional credit. We believe that we have the best omnichannel solution for retailers to “save the sale” with LTO options. To our knowledge, no competitor has an LTO marketplace that provides retailers incremental sales with no acquisition cost. In addition, compared to our peers, our product for consumers typically requires no money down and fewer application fields. We believe this leads to more in-store and online sales. We also believe that we have the best LTO payment technology at checkout for e-tailers, whereby consumers can seamlessly checkout out on a third party’s e-commerce site with our LTO payment plugin. In addition, our “integrationless” in-store technology was a strong selling point for our recent 726-store rollout, since it required no equipment or technology investment from either party. Providing LTO consumers an “endless aisle” of products for lease-to-own.As illustrated by our B2C channels in the above diagram, we offer consumers three ways to acquire products on an LTO basis. At FlexShopper.com our customers can choose from over 150,000 of the latest products shipped by certain of the nation’s largest retailers. If customers want products that are not available on our marketplace, they may use our “personal shopper” service and simply complete a form with a link to the webpage of the desired durable good. We will then facilitate their purchase by providing an LTO arrangement. We also offer consumers the ability to acquire durable goods with our FlexShopper Wallet smartphone application available on Apple and Android devices. With FlexShopper Wallet, consumers may apply for a spending limit and take a picture of a qualifying item in any major retail store and we will fill the order for them. With our B2C channels we believe we are providing LTO consumers with a superior LTO experience and fulfilling our mission to help improve their quality of life by shopping for what they want where they want. A Lean and Scalable Model Compared to the brick-and-mortar LTO industry, which is suffering from the same headwinds as traditional retail stores, we have been successful in addressing the LTO consumer through online channels as also illustrated in the above diagram. We believe our model is efficient and scalable for the following reasons: We have no inventory risk and are completely drop-ship. We do not have any of the costs associated with buying, storing and shipping inventory. Instead, our suppliers ship goods directly to consumers. We serve LTO consumers across the United States without brick-and-mortar stores.We do not have any of the costs associated with physical stores and the personnel needed to operate them.

As our sales grow we achieve more operating leverage.Our model is primarily driven by a technology platform that does not require significant increases in operating overhead to support sales growth. Potential Industry Differentiator: Notice of Allowance from the United States Patent and Trademark Office (“USPTO”) FlexShopper received a Notice of Allowance from the USPTO for its patent application directed to a system that enables e-commerce servers the ability to complete LTO transactions through their e-commerce websites. FlexShopper believes this patent will constitute a significant differentiator for the Company in the industry. Growth Opportunities and Strategies B2B Growth Drivers

B2C Growth Drivers

General

The information below is only a summary of more detailed information included elsewhere in this prospectus. This summary may not contain all the information that is important to you or that you should consider before making a decision to invest in our common stock. Please read this entire prospectus, including the risk factors, carefully.

SUMMARY HISTORICAL AND CONDENSED COMBINED FINANCIAL DATA We report our financial results in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”). The summary historical combined statement of operations data for the six months ended June 30, 2018 and 2017 and the summary historical combined balance sheet data as of June 30, 2018 presented below have been derived from our unaudited combined financial statements included elsewhere in this prospectus. The summary historical combined statement of operations data for the years ended December 31, 2017 and 2016 and the combined balance sheet data as of December 31, 2017 and 2016 presented below have been derived from our audited combined financial statements included elsewhere in this prospectus. The summary historical combined financial statements should be read in conjunction with such combined financial statements.

Non-GAAP Financial Measures Adjusted EBITDA Adjusted EBITDA represents net income before interest, stock-based compensation, taxes, depreciation (other than depreciation of leased inventory) and amortization. We believe that Adjusted EBITDA provides us with an understanding of one aspect of earnings before the impact of investing and financing charges and income taxes. Adjusted EBITDA may be useful to an investor in evaluating our operating performance and liquidity because this measure:

Adjusted EBITDA is a supplemental measure of FlexShopper’s performance that is neither required by, nor presented in accordance with, U.S. GAAP. Adjusted EBITDA should not be considered as a substitute for U.S. GAAP metrics such as operating loss, net income or any other performance measure derived in accordance with U.S. GAAP.

An investment in our Our business, prospects, results of operations and financial condition could Risks Related to Business

FlexShopper, LLC, which was formed in June 2013 to enter the

We may be unable to successfully implement our ambitions of targeting very large markets in an intensely competitive industry segment without significantly increasing our resources. We do not currently have sufficient funds to fully implement our business plan and will need to raise capital through new financings in addition to the offering described in this prospectus. Such financings could include equity financing, which may be dilutive to stockholders, or debt financing, which would likely restrict our ability to borrow from other sources. In addition, such securities may contain rights, preferences or privileges senior to those of the rights of our current stockholders. There can be no assurance that additional funds will be available on terms attractive to us, or at all. If adequate funds are not available, we may be required to curtail or reduce our operations or forced to sell or dispose of our rights or assets. An inability to raise adequate funds on commercially reasonable terms would have a material adverse effect on our business, results of operation and financial condition, including the possibility that a lack of funds could cause our business to fail and liquidate with little or no return to investors. Our business liquidity and capital resources are dependent upon our credit agreement with an institutional lender and our compliance with the terms thereof. We may lose access to new loans under our credit agreement on August 31, 2018 if this offering is

FlexShopper, through FlexShopper 2, LLC (the “Borrower”), is party to a credit agreement (as amended, the “Credit Agreement”) with Wells Fargo Bank, National Association, various lenders from time to time party thereto and WE2014-1, LLC (the “Lender”). The Borrower is permitted to borrow funds under the Credit Agreement based on the Borrower’s cash on hand and the Amortized Order Value of the Borrower’s Eligible Leases (as such terms are defined in the Credit Agreement), less certain deductions described in the Credit Agreement. Under the terms of the Credit Agreement, subject to the satisfaction of certain conditions, the Borrower may borrow up to $25,000,000 from the Lender for a term of two years; however, as of June 30, 2018, there was approximately $8,798,528 in additional availability under the Credit Agreement and the outstanding balance under the Credit Agreement was $16,201,472. The Lender holds security interests in certain leases as collateral under the Credit Agreement. For the term of the Credit Agreement, FlexShopper and its subsidiaries may not incur additional indebtedness (subject to certain exceptions) without the permission of the Lender. In addition, the Lender and its affiliates have a right of first refusal on certain FlexShopper transactions involving leases or other financial products. The Credit Agreement includes customary events of default, including, among others, failures to make payment of principal and interest, breaches or defaults under the terms of the Credit Agreement and related agreements entered into with the Lender, breaches of representations, warranties or certifications made by or on behalf of the Borrower in the Credit Agreement and related documents (including certain financial and expense covenants), deficiencies in the borrowing base, certain judgments against the Borrower and bankruptcy events.

On January 9, 2018, the Lender extended the Commitment Termination Date (as defined in the Credit Agreement) from April 1, 2018 to August 31, 2018. Upon the Commitment Termination Date, the Lender is no longer obligated to lend money to the Borrower and all amounts outstanding under the Credit Agreement will be due on the twelve-month anniversary thereof. We are currently exploring various possible financing options that may be available to us, including the offering described in this Failure to effectively manage our costs could have a material adverse effect on our profitability. Certain elements of our cost structure are largely fixed in nature while consumer spending remains uncertain, which makes it challenging for us to maintain or increase our operating income. The competitiveness in our industry and increasing price transparency mean that the need to achieve efficient operations is greater than ever. As a result, we must continuously focus on managing our cost structure. Failure to manage our labor and benefit rates, advertising and marketing expenses, operating leases, charge-offs or indirect spending could materially adversely affect our profitability.

Our LTO business depends on the success of our third-party retail partners and our continued relationships with them. Our

Our growth will depend on our ability to develop our brands, and these efforts may be costly. Our ability to develop the FlexShopper brand will be critical to achieving widespread acceptance of our services and will require a continued focus on active marketing efforts. We will need to continue to spend substantial amounts of money on, and devote substantial resources to, advertising, marketing, and other efforts to create and maintain brand loyalty among our customers. If we fail to promote and maintain our brand, or if we incur substantial expenses in an unsuccessful attempt to

Our LTO business The business of selling goods over the

Failure to successfully manage and grow our FlexShopper.com e-commerce platform could materially adversely affect our business and future prospects. Our FlexShopper.com e-commerce platform provides customers the ability to apply, shop, review our product offerings and prices and enter into lease agreements as well as make payments on existing leases from the comfort of their homes and on their mobile devices. Our e-commerce platform is a significant and essential component of our strategic plan and we believe will drive future growth of our business. In order to promote our products and services and allow customers to transact online and reach new customers, we must effectively maintain, improve and grow our e-commerce platform. There can be no assurance that we will be able to maintain, improve or grow our e-commerce platform in a profitable manner. The success of our business is dependent on factors affecting consumer spending that are not under our control. Consumer spending is affected by general economic conditions and other factors including levels of employment, disposable consumer income, prevailing interest rates, consumer debt and availability of credit, inflation, recession and fears of recession, tax rates and rate increases, timing of receipt of tax refunds, consumer confidence in future economic conditions and political conditions, and consumer perceptions of personal well-being and security. Unfavorable changes in factors affecting discretionary spending could reduce demand for our products and services, such as consumer electronics and residential furniture, resulting in lower revenue and negatively impacting our business and its financial results.

Our customer base presents significant risk of default for non-payment. We bear the risk of non-payment or

Our customers can return merchandise without penalty.

When our customers acquire merchandise through the

We rely on These third-party payment processors may consider our business a high risk since our customer base

We rely on internal models to manage risk, to provide accounting estimates and to make other business decisions. Our results could be adversely affected if those models do not provide reliable estimates or predictions of future activity. The accurate modeling of risks is critical to our business, particularly with respect to managing underwriting and spending limits for our customers. Our expectations regarding customer repayment levels, as well as our allowances for doubtful accounts and other accounting estimates, are based in large part on internal modeling. We also rely heavily on internal models in making a variety of other decisions crucial to the successful operation of our business. It is therefore important that our models are accurate, and any failure in this regard could have a material adverse effect on our results.

Our operations are regulated by and subject to the requirements of various federal and state laws and regulations. These laws and regulations, which may be amended or supplemented or interpreted by the courts from time to time, could expose us to significant compliance costs or burdens or force us to change our business practices in a manner that may be materially adverse to our operations, prospects or financial condition. Currently,

Our virtual LTO business differs in some potentially significant respects from the risks of a typical LTO brick-and-mortar store business, which implicates certain additional regulatory risks. We offer LTO products directly to consumers through our e-commerce marketplace and through the stores and e-commerce sites of third-party retailers. This novel business model implicates certain regulatory risk including, among others:

Any of these risks could have a material adverse effect on FlexShopper’s business. Changes in regulations or customer concerns, in particular as they relate to privacy and protection of customer data, could adversely affect our business. Our business is subject to laws relating to the collection, use, retention, security and transfer of personally identifiable information about our customers. The interpretation and application of privacy and customer data protection laws are in a state of flux and may vary from jurisdiction to jurisdiction. These laws may be interpreted and applied inconsistently and our current data protection policies and practices may not be consistent with those interpretations and applications. Complying with these varying requirements could cause us to incur substantial costs or require us to change our business practices in a manner adverse to our business. Any failure, or perceived failure, by us to comply with our own privacy policies or with any regulatory requirements or orders or other privacy or consumer protection related laws and regulations could result in proceedings or actions against us by governmental entities or others, subject us to significant penalties and negative publicity and adversely affect our operating results. If we fail to protect the integrity and security of customer and employee information, we could damage our reputation or be exposed to litigation or regulatory enforcement, and our business could be adversely impacted. We collect and store certain personal information provided to us by our customers and employees in the ordinary course of our business. Despite instituted safeguards for the protection of such information, we cannot be certain that all of our systems are entirely free from vulnerability to attack. Computer hackers may attempt to penetrate our network security and, if successful, misappropriate confidential customer or employee information. In addition, one of our employees, contractors or other third party with whom we do business may attempt to circumvent our security measures in order to obtain such information, or inadvertently cause a breach involving such information. Loss of customer or employee information could disrupt our operations, damage our reputation and expose us to claims from customers, employees, regulators and other persons, any of which could have an adverse effect on our business, financial condition and results of operations. In addition, the costs associated with information security, such as increased investment in technology, the costs of compliance with privacy laws and costs incurred to prevent or remediate information security breaches, could adversely impact our business.

The transactions offered to consumers by our businesses may be negatively characterized by consumer advocacy groups, the media and certain federal, state and local government officials, and if those negative characterizations become increasingly accepted by consumers and/or FlexShopper’s retail partners, demand for our goods and the transactions we offer could decrease and our business could be materially adversely affected. Certain consumer advocacy groups, media reports and federal and state legislators have asserted that laws and regulations should be broader and more restrictive regarding LTO transactions. The consumer advocacy groups and media reports generally focus on the total cost to a consumer to acquire an item, which is often alleged to be higher than the interest typically charged by banks or similar lending institutions to consumers with better credit histories. This “cost-of-rental” amount, which is generally defined as lease fees paid in excess of the “retail” price of the goods, is from time to time characterized by consumer advocacy groups and media reports as predatory or abusive without discussing benefits associated with LTO programs or the lack of viable alternatives for our customers’ needs. If the negative characterization of these types of LTO transactions becomes increasingly accepted by consumers or FlexShopper’s retail and merchant partners, demand for our products and services could significantly decrease, which could have a material adverse effect on our business, results of operations and financial condition. Additionally, if the negative characterization of these types of transactions is accepted by legislators and regulators, we could become subject to more restrictive laws and regulations, which could have a material adverse effect on our business, results of operations and financial condition. The vast expansion and reach of technology, including social media platforms, has increased the risk that our reputation could be significantly impacted by these negative characterizations in a relatively short amount of time. If we are unable to quickly and effectively respond to such characterizations, we may experience declines in customer loyalty and traffic and our relationships with our retail partners may suffer, which could have a material adverse effect on our business, results of operations and financial condition. The loss of any of our key personnel could harm our business. Our future financial performance will depend to a significant extent on our ability to motivate and retain key management personnel. Further, FlexShopper is seeking to hire additional qualified management for its FlexShopper business. Competition for qualified management personnel is intense, and there can be no assurance that we will be able to hire additional qualified management on terms satisfactory to FlexShopper. Further, in the event we experience turnover in our senior management positions, we cannot assure you that we will be able to recruit suitable replacements. We must also successfully integrate all new management and other key positions within our organization to achieve our operating objectives. Even if we are successful, turnover in key management positions may temporarily harm our financial performance and results of operations until new management becomes familiar with our business. At present, we do not maintain key-man life insurance on any of our executive officers, although we entered into

We depend on hiring an adequate number of hourly employees to run our business and are subject to government regulations concerning these and our other employees, including wage and hour regulations. Our workforce is comprised primarily of employees who work on an hourly basis. To grow our operations and meet the needs and expectations of our customers, we must attract, train, and retain a large number of hourly associates, while at the same time controlling labor costs. These positions have historically had high turnover rates, which can lead to increased training, retention and other costs. In certain areas where we operate, there is significant competition for employees, including from retailers and the restaurant industries. The lack of availability of an adequate number of hourly employees, or our inability to attract and retain them, or an increase in wages and benefits to current employees could adversely affect our business, results of operations, cash flows and financial condition. We are subject to applicable rules and regulations relating to our relationship with our employees, including wage and hour regulations, health benefits, unemployment and payroll taxes, overtime and working conditions and immigration status. Accordingly, federal, state or local legislated increases in the minimum wage, as well as increases in additional labor cost components such as employee benefit costs, workers’ compensation insurance rates, compliance costs and fines, would increase our labor costs, which could have a material adverse effect on our business, prospects, results of operations and financial condition.

Employee misconduct or misconduct by third parties acting on our behalf could harm us by subjecting us to monetary loss, significant legal liability, regulatory scrutiny and reputational harm. Our reputation is critical to maintaining and developing relationships with our existing and potential customers and third parties with whom we do business. There is a risk that our employees or the employees of a third-party retailer with whom we partner could engage in misconduct that adversely affects our reputation and business. For example, if an employee or a third party associated with our business were to engage in, or be accused of engaging in, illegal or suspicious activities including fraud or theft of our customers’ information, we could suffer direct losses from the activity and, in addition, we could be subject to regulatory sanctions and suffer serious harm to our reputation, financial condition, customer relationships and ability to attract future customers. Employee or third-party misconduct could prompt regulators to allege or to determine based upon such misconduct that we have not established adequate supervisory systems and procedures to inform employees of applicable rules or to detect violations of such rules. The precautions that we take to detect and prevent misconduct may not be effective in all cases. Misconduct by our employees or third-party contractors, or even unsubstantiated allegations of misconduct, could result in a material adverse effect on our reputation and our business. Our operations are subject to certain laws generally prohibiting companies and their intermediaries from making improper payments to government officials for the purpose of obtaining or retaining business, such as the U.S. Foreign Corrupt Practices Act, and similar anti-bribery laws in other jurisdictions. Our employees, contractors or agents may violate the policies and procedures we have implemented to ensure compliance with these laws. Any such improper actions could subject us to civil or criminal investigations, could lead to substantial civil and criminal, monetary and non-monetary penalties, and related shareholder lawsuits, could cause us to incur significant legal fees, and could damage our reputation.

Competition in the LTO business The

Much of our customer base continues to experience prolonged economic uncertainty and, in certain areas, unfavorable economic conditions. We believe

The application of indirect taxes, such as sales tax, is a complex and evolving issue, particularly with respect to the LTO industry generally and our virtual LTO business more specifically. Many of the fundamental statutes and regulations that impose these taxes were established before the growth of the LTO industry and e-commerce and, therefore, in many cases it is not clear how existing statutes apply to our various businesses. In addition, governments are increasingly looking for ways to increase revenues, which has resulted in discussions about tax reform and other legislative action to increase tax revenues, including through indirect taxes. This also could result in other adverse changes in or

System interruption and the lack of integration and redundancy in our order entry and online systems may adversely affect our net sales. Customer access to our customer service center and websites is key to the continued flow of new orders. Anything that would hamper or interrupt such access could adversely affect our net sales, operating results and customer satisfaction. Examples of risks that could affect access include problems with the

We face risk related to the strength of our operational, technological and organizational infrastructure. We are exposed to operational risks that can be manifested in many ways, such as errors related to failed or inadequate processes, faulty or disabled computer systems, fraud by employees, contractors or third parties and exposure to external events. In addition, we are heavily dependent on the strength and capability of our technology systems that we use to manage our internal financial, credit and other systems, interface with our customers and develop and implement effective marketing campaigns. Our ability to operate our business to meet the needs of our existing customers and attract new ones and to run our business in compliance with applicable laws and regulations depends on the functionality of our operational and technology systems. Any disruptions or failures of our operational and technology systems, including those associated with improvements or modifications to such systems, could cause us to be unable to market and manage our products and services and to report our financial results in a timely and accurate manner, all of which could have a negative impact on our results of operations. In some cases, we outsource delivery, maintenance and development of our operational and technological functionality to third parties. These third parties may experience errors or disruptions that could adversely impact us and over which we may have limited control. Any increase in the amount of our infrastructure that we outsource to third parties may increase our exposure to these risks.

If we do not respond to technological changes, our services could become obsolete, and we could lose customers. To remain competitive, we must continue to enhance and improve the functionality and features of our e-commerce websites and other technologies. We may face material delays in introducing new products and enhancements. If this happens, our customers may forego the use of our websites and use those of our competitors. The

We may not be able to adequately protect our intellectual property rights or may be accused of infringing intellectual property rights of third parties. FlexShopper received a Notice of Allowance from the USPTO for its patent application directed to a system that enables We cannot be certain that the intellectual property used in our business does not and will not infringe the intellectual property rights of others, and we are from time to time subject to third party infringement claims. Due to recent changes in patent law, we face the risk of a temporary increase in patent litigation due to new restrictions on including unrelated defendants in patent infringement lawsuits in the future particularly from entities that own patents but that do not make products or services covered by the patents. Any third party infringement claims against us, whether or not meritorious, may result in the expenditure of significant financial and managerial resources, injunctions against us or the payment of damages. Moreover, should we be found liable for infringement, we may be required to seek to enter into licensing agreements, which may not be available on acceptable terms or at all.

In deciding whether to provide a spending limit to customers, we rely on the accuracy and completeness of information furnished to us by or on behalf of our customers. If we and our systems are unable to detect any misrepresentations in this information, this could have a material adverse effect on our results of operations and financial condition. In deciding whether to provide a customer with a spending amount, we rely heavily on information furnished to us by or on behalf of our customers and our ability to validate such information through third-party services, including personal financial information. If a significant percentage of our customers intentionally or negligently misrepresent any of this information, and we or our systems do not or did not detect such misrepresentations, it could have a material adverse effect on our ability to effectively manage our risk, which could have a material adverse effect on our results of operations and financial condition. If we fail to timely contact delinquent customers, then the number of delinquent customer receivables eventually being charged off could increase. We contact customers with delinquent account balances soon after the account becomes delinquent. During periods of increased delinquencies it is important that we are proactive in dealing with these customers rather than simply allowing customer receivables to go to charge-off. During periods of increased delinquencies, it becomes extremely important that we are properly staffed and trained to assist customers in bringing the delinquent balance current and ultimately avoiding charge-off. If we do not properly staff and train our collections personnel, or if we incur any downtime or other issues with our information systems that assist us with our collection efforts, then the number of accounts in a delinquent status or charged-off could increase. In addition, managing a substantially higher volume of delinquent customer receivables typically increases our operational costs. A rise in delinquencies or charge-offs could have a material adverse effect on our business, financial condition, liquidity and results of operations.

Our management information systems may not be adequate to meet our evolving business and emerging regulatory needs and the failure to successfully implement them could negatively impact the business and its financial results. We are investing significant capital in new information technology systems to support our growth plan. These investments include redundancies, and acquiring new systems and hardware with updated functionality. We are taking appropriate actions to ensure the successful implementation of these initiatives, including the testing of new systems, with minimal disruptions to the business. These efforts may take longer and may require greater financial and other resources than anticipated, may cause distraction of key personnel, may cause disruptions to our systems and our business, and may not provide the anticipated benefits. The disruption in our information technology systems, or our inability to improve, integrate or expand our systems to meet our evolving business and emerging regulatory requirements, could impair our ability to achieve critical strategic initiatives and could adversely impact our sales, collections efforts, cash flows and financial condition.

If we fail to maintain adequate systems and processes to detect and prevent fraudulent activity, our business could be adversely impacted. Criminals are using increasingly sophisticated methods to engage in illegal activities such as paper instrument counterfeiting, fraudulent payment or refund schemes and identity theft. As we make more of our services available over the internet and other media we subject ourselves to consumer fraud risk. We use a variety of tools to protect against fraud; however, these tools may not always be successful.

Our failure to maintain an effective system of internal controls could result in inaccurate reporting of financial results and harm our business. We are required to comply with a variety of reporting, accounting and other rules and regulations. As a public reporting company subject to the rules and regulations established from time to time by the SEC and the Nasdaq, we are required to, among other things, establish and periodically evaluate procedures with respect to our disclosure controls and procedures. In addition, as a public company, we are required to document and test our internal control over financial reporting pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 so that our management can certify, on an annual basis, that our internal control over financial reporting is effective. As such, we maintain a system of internal control over financial reporting, but there are limitations inherent in internal control systems. A control system can provide only reasonable, not absolute, assurance that the objectives of the control system are met. In addition, the design of a control system must reflect the fact that there are resource constraints and the benefit of controls must be appropriate relative to their costs. Furthermore, compliance with existing requirements is expensive and we may need to implement additional finance and accounting and other systems, procedures and controls to satisfy our reporting requirements. If our internal control over financial reporting is determined to be ineffective, such failure could cause investors to lose confidence in our reported financial information, negatively affect the market price of our common stock, subject us to regulatory investigations and penalties, and adversely impact our business and financial condition.

Increased costs associated with corporate governance compliance may significantly impact our results of operations. Changing laws, regulations and standards relating to corporate governance, public disclosure and compliance practices, including the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, the Sarbanes-Oxley Act of 2002, and new SEC regulations, may create difficulties for companies such as ours in understanding and complying with these laws and regulations. As a result of these difficulties and other factors, devoting the necessary resources to comply with evolving corporate governance and public disclosure standards has resulted in and may in the future result in increased general and administrative expenses and a diversion of management time and attention to compliance activities. We also expect these developments to increase our legal compliance and financial reporting costs. In addition, these developments may make it more difficult and more expensive for us to obtain director and officer liability insurance, and we may be required to accept reduced coverage or incur substantially higher costs to obtain coverage. Moreover, we may be unable to comply with these new laws and regulations on a timely basis. These developments could make it more difficult for us to retain qualified members of our board of directors, or qualified executive officers. We are presently evaluating and monitoring regulatory developments and cannot estimate the timing or magnitude of additional costs we may incur as a result. To the extent these costs are significant, our general and administrative expenses are likely to increase.

Risks Related to our Common Stock and this Offering As an investor, you may lose all of your investment. Investing in our securities involves a high degree of risk. As an investor, you may never recoup all, or even part, of your investment and you may never realize any return on your investment. You must be prepared to lose all of your investment. Because of their significant stock ownership and ability to select nominees to our Board of Directors, certain beneficial owners of our stock, as well as our executive officers and directors, will be able to exert control over the Company and significant corporate decisions. B2 FIE V LLC (“B2 FIE”), a holder of our Series 2 Convertible Preferred Stock issued in June 2016, beneficially owns 31.1% of the voting power of our outstanding stock as of August 2, 2018. Our secured lender under our Credit Agreement beneficially owns 26.6% of the voting power of our outstanding stock as of August 2, 2018. Also, our executive officers and directors beneficially own an additional 9.3% of the voting power of our outstanding stock as of the same date. In the event that they act in concert on future stockholder matters, such persons may have the ability to affect the election of all of our directors and the outcome of all issues submitted to our stockholders. Such concentration of ownership could limit the price that certain investors might be willing to pay in the future for shares of Common Stock and could have the effect of making it more difficult for a third party to acquire, or of discouraging a third party from attempting to acquire, control of us. Additionally, pursuant to Investor Rights Agreements entered into in connection with their investments in the Company, each of B2 FIE and our secured lender currently has the right to designate on our Board of Directors two and one nominee, respectively. As a result, the presence of directors on our Board of Directors nominated by these investors enables such investors to influence and impact future actions taken by our Board of Directors. The price of our common stock may fluctuate significantly. During the six months ended June 30, 2018, the price for our common stock on the Nasdaq Capital Market ranged from $4.80 to $2.62. The market price for our common stock can fluctuate as a result of a variety of factors, including the factors listed in this Risk Factors section, many of which are beyond our control. These factors include: actual or anticipated variations in quarterly operating results; announcements of new services by our competitors or us; announcements relating to strategic relationships or acquisitions; our ability to meet market expectations with respect to the growth and profitability of each of our operating segments; quarterly variations in our competitors’ results of operations; state or federal legislative or regulatory proposals, initiatives, actions or changes that are, or are perceived to be, adverse to our operations; changes in financial estimates or other statements by securities analysts; and other changes in general economic conditions. Because of this, we may fail to meet or exceed the expectations of our stockholders or others, and the market price for our common stock could fluctuate as a result. In addition, the securities markets have from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of our common stock.

We have never declared or paid cash dividends on our Common Stock, and we do not anticipate paying any cash dividends on our Common Stock in the foreseeable future. We currently intend to retain future earnings, if any, to fund the development and growth of our business. Any future determination to pay cash dividends will be dependent upon our financial condition, operating results, capital requirements, applicable contractual restrictions and other such factors as our Board of Directors may deem relevant. If we sell shares of our common stock or securities convertible into our common stock in future financings, the ownership interest of existing shareholders will be diluted and, as a result, our stock price may go down. We may from time to time issue additional shares of common stock, possibly at a discount from the current trading price of our common stock. As a result, our existing shareholders will experience immediate dilution upon the purchase of any shares of our

Because the offering price per share of our Our certificate of incorporation allows for our Board of Directors to create new series of preferred stock without further approval by our stockholders, which could adversely affect the rights of the holders of our common stock. Our Board of Directors has the authority to

We may allocate the net proceeds from this offering in ways that differ from the estimates discussed in the section titled “Use of Proceeds” and with which you may not agree. The allocation of net proceeds of this offering set forth in the “Use of Proceeds” section below represents our estimates based upon our current plans and assumptions regarding industry and general economic conditions and our future revenues and expenditures. The amounts and timing of our actual expenditures will depend on numerous factors, including market conditions, cash generated by our operations, business developments and related rate of growth. We may find it necessary or advisable to use portions of the proceeds from this offering for other purposes. Circumstances that may give rise to a change in the use of proceeds and the alternate purposes for which the proceeds may be used are discussed in the section entitled “Use of Proceeds” below. You may not have an opportunity to evaluate the economic, financial or other information on which we base our decisions on how to use our proceeds. As a result, you and other stockholders may not agree with our decisions. See “Use of Proceeds” for additional information. A large number of shares issued in this offering may be sold in the market A large number of shares issued in this offering may be sold in the market

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS AND OTHER INFORMATION CONTAINED IN THIS PROSPECTUS Certain information set forth in this prospectus

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the following:

Any forward-looking statement made by us in this prospectus is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise, except as may be required under applicable law. We anticipate that subsequent events and developments will cause our views to change. You should read this prospectus and the documents filed as exhibits to the registration statement, of which this prospectus is a

We estimate that we will receive net proceeds of approximately $ from this offering, or approximately $ if the underwriters exercise their over-allotment option in full, in each case after deducting the underwriting discount and estimated offering expenses payable by us. We expect to use $[●] of the net proceeds of this offering to repay indebtedness owing under our Credit Agreement, approximately $[●] to repay outstanding subordinated notes and the balance for working capital and other general corporate purposes. Amounts borrowed under the Credit Agreement accrue interest at a The subordinated promissory notes accrue interest at a rate of 3% per annum in excess of the non-default rate of interest from time to time in effect under

Pending our use of the net proceeds from this offering, we intend to invest the net proceeds in a variety of capital preservation investments, including short-term, investment-grade, interest-bearing instruments and U.S. government securities.

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS Market Information and Holders Our common stock is currently traded on the Nasdaq Capital Market under the symbol “FPAY.” Prior to November 18, 2016, our common stock was quoted on the OTC Market (OTCQB) under the same symbol.

As of

The following table sets forth the high and low sales prices (or closing bid prices with respect to periods prior to November 18, 2016) for our common stock for the fiscal quarters indicated, as reported on Nasdaq (or on OTC Markets with respect to closing bids for periods prior to November 18, 2016). OTC Market quotations for periods prior to November 18, 2016 reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions.

Dividend Policy

The following table sets forth our actual cash and capitalization, each as of

You should read the following table in conjunction with the sections of this prospectus titled “Use of Proceeds” and “Management's Discussion and Analysis of Financial Condition and Results of Operations” and our audited consolidated financial statements as of and for the years ended December 31, 2017 and 2016 and the notes thereto and our unaudited consolidated financial statements for the three and six months ended June 30, 2018 and 2017 and the notes thereto, each of which is included herein, for additional information.

The foregoing table and calculations are based on 5,469,501 shares of common stock outstanding as of June 30, 2018 and excludes the following:

If you purchase shares of common stock in this offering, you will experience dilution to the extent of the difference between the public offering price per share in this offering and our pro forma net tangible book value per share immediately after this offering. Net tangible book value per share represents total tangible assets less total liabilities, divided by the number of shares of common stock outstanding. Our historical net tangible book value as of June 30, 2018 was $2,642,666, or $0.48 per share of common stock. After giving effect to our sale of [●] shares of common stock in this offering at an assumed public offering price of $[●] per share, which was the last reported sale price of our common stock on the Nasdaq Capital Market on [●], 2018, and after deducting the underwriting discount and estimated offering expenses payable by us, our net tangible book value as of June 30, 2018 would have been $[●], or $[●] per share. This represents an immediate increase in net tangible book value of $[●] per share to existing stockholders and an immediate dilution in net tangible book value of $[●] per share to investors in this offering. The following table illustrates this dilution on a per share basis:

If the underwriters exercise in full their option to purchase additional shares of common stock, the tangible book value per share after giving effect to this offering would be $[●] per share, which amount represents an immediate increase in net tangible book value of $[●] per share of our common stock to existing stockholders and an immediate dilution in net tangible book value of $[●] per share of our common stock to investors purchasing shares in this offering.

The above discussion and tables are based on 5,469,501 shares of common stock outstanding as of June 30, 2018 and excludes the following:

To the extent that any of these options or warrants are exercised, new options are issued under our 2018 Omnibus Equity Compensation Plan or we issue additional shares of common stock or other equity securities in the future, there may be further dilution to new investors participating in this offering.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Executive Overview

The results of operations

Summary of Critical Accounting Policies

Management’s Discussion and Analysis of Financial Condition and Results of Operations discusses our financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of

The allowance is a significant percentage of the balance because FlexShopper does not charge off any customer account until it has exhausted all collection efforts with respect to each account including attempts to repossess items. In addition, while collections are pursued, the same delinquent customers will continue to accrue weekly charges until they are

Lease Merchandise

Stock Based Compensation - The fair value of transactions in which FlexShopper exchanges its equity instruments for employee services (share-based payment transactions) is recognized as an expense in the financial statements as services are performed. Compensation expense is determined by reference to the fair value of an award on the date of grant and is amortized on a straight-line basis over the vesting period. We have elected to use the

We regularly review several metrics, including the following key metrics, to evaluate our business, measure our performance, identify trends affecting our business, formulate financial projections and make strategic decisions. Key performance metrics for the three months ended June 30, 2018 and 2017 are as follows:

* Represents loss Key performance metrics for the six months ended June 30, 2018 and 2017 are as follows:

* Represents loss Key performance metrics for the years ended December 31, 2017 and 2016 are as follows:

* Represents loss Management believes that Adjusted Gross Profit and Adjusted EBITDA, provide relevant and useful information which is widely used by analysts, investors and competitors in our industry in assessing performance. Adjusted Gross Profit represents GAAP revenue less the provision for doubtful accounts and cost of leased inventory and inventory sold. Adjusted Gross Profit provides us with an understanding of the results from the primary operations of our business. We use Adjusted Gross Profit to evaluate our period-over-period operating performance. This measure may be useful to an investor in evaluating the underlying operating performance of our business. Adjusted EBITDA represents net income before interest, stock-based compensation, taxes, depreciation (other than depreciation of leased inventory) and amortization. We believe that Adjusted EBITDA provides us with an understanding of one aspect of earnings before the impact of investing and financing charges and income taxes. Adjusted EBITDA may be useful to an investor in evaluating our operating performance and liquidity because this measure:

Adjusted Gross Profit and Adjusted EBITDA are supplemental measures of FlexShopper’s performance that are neither required by, nor presented in accordance with, GAAP. Adjusted Gross Profit and Adjusted EBITDA should not be considered as substitutes for GAAP metrics such as operating loss, net income or any other performance measures derived in accordance with GAAP. Results of Operations Three Months Ended June 30, 2018 compared to Three Months Ended June 30, 2017 The

FlexShopper

Cost of lease revenue and merchandise sold for the three months ended June 30, 2018 was $9,312,117 compared to $8,353,149 for the Provision for Marketing expenses in the three months ended June 30, 2018 was $1,260,237 compared to $818,609 in the three months ended June 30, 2017, an increase of $441,628, or 53.9%. The Company strategically increased marketing expenditures in its digital channels where it is acquiring customers efficiently at it targeted acquisition cost. Salaries and benefits in the three months ended June 30, 2018 was $2,031,788 compared to $1,898,005 in the three months ended June 30, 2017, an increase of $133,783, or 7.0%. Investments in our Other operating expenses for the

Six Months Ended June 30, 2018 compared to Six Months Ended June 30, 2017

FlexShopper

Cost of lease revenue and merchandise sold for the six months ended June 30, 2018 was $20,053,626 compared to $17,123,550 for the six months ended June 30, 2017, representing an increase of $2,930,076, or 17.1%. Cost of lease revenue and merchandise sold for the six months ended June 30, 2018 is comprised of depreciation expense on lease merchandise of $19,395,158 and the net book value of merchandise sold of $658,468. Cost of lease revenue and merchandise sold for the six months ended June 30, 2017 is comprised of depreciation expense on lease merchandise of $16,587,622, the net book value of merchandise sold of $535,928. As the Company’s lease revenues increase, the direct costs associated with them also increase. Provision for doubtful accounts was $10,658,805 and $9,675,629 for the six months ended June 30, 2018 and 2017, respectively. The primary reason for the increase is that the Company does not charge off any customer accounts until it has exhausted all collection efforts, including attempts to repossess items. While collection efforts are pursued, delinquent customers continue to accrue weekly charges resulting in a significant balance requiring a reserve. During the six months ended June 30, 2018 and 2017, $7,442,190 and $13,580,054 of accounts receivable balances were charged off against the allowance, respectively, after the Company exhausted all collection efforts with respect to such accounts. The provision increase was primarily driven by the increase in FlexShopper’s lease portfolio revenue. Marketing expenses in the first half of 2018 were $2,429,187 compared to $1,630,791 in the first half of 2017, an increase of $798,396, or 49.0%. The Company strategically increased marketing expenditures in the first half of 2018 in its digital channels where it is acquiring customers efficiently at its targeted acquisition cost. Salary and benefits expenses in the first half of 2018 were $4,211,164 compared to $3,666,157 in the first half of 2017, an increase of $545,007, or 14.9%. Investments in our software engineering team, much of which occurred throughout 2017, and certain key management hires are the primary reasons for the increase in salaries and benefits expenses. Other operating expenses for the six months ended June 30, 2018 and 2017 included the following:

Twelve Months Ended December 31, 2017 compared to Twelve Months Ended December 31, 2016

The following table details the operating results from

Lease revenues for the

Cost of

Salary and benefits expenses for the year ended December 31,

Key operating expenses for the

Our computer and internet expenses represented the most significant increase, which was

Plan of Operation

We plan to promote our FlexShopper products and services across all sales channels through

For each of our sales

Liquidity and Capital Resources As of June 30, 2018, the Company had cash of $2,055,948 compared to $4,968,915 as of December 31, 2017. As of June 30, 2018, the Company had accounts receivable of $9,905,651 offset by an allowance for doubtful accounts of $5,800,968, resulting in net accounts receivable of $4,104,683. Accounts receivable are principally comprised of lease payments owed to the Company. An allowance for doubtful accounts is estimated based upon historical collection and delinquency percentages. Recent Financings From January 1, 2017, FlexShopper completed the following transactions, each of which has provided liquidity and cash resources to FlexShopper.

Cash Flow Summary Cash Flows from Operating Activities Net cash used in operating activities was $2,412,710 for the six months ended June 30, 2018 and was primarily due to the net loss for the period. Net cash provided by operating activities was $1,873,670 for the six months ended June 30, 2017 and was primarily due to the increase in net revenues and gross profit and more efficient marketing spend for the period. Net cash used by operating activities was $6,598,834 for the year ended December 31, 2017 and was primarily due to the net loss for the period combined with cash used for the purchases of leased merchandise. Net cash used by operating activities was $17,372,429 for the year ended December 31, 2016 and was primarily due to the net loss for the period combined with cash used for the purchases of leased merchandise. Cash Flows from Investing Activities For the six months ended June 30, 2018, net cash used in investing activities was $1,021,551, comprised of $14,164 for the purchase of property and equipment and $1,007,387 for capitalized software costs. For the six months ended June 30, 2017, net cash used in investing activities was $979,562, comprised of $41,595 for the purchase of property and equipment and $937,967 for capitalized software costs. For the year ended December 31, 2017, net cash used in investing activities was $2,021,538 comprised of $127,367 for the purchase of property and equipment and $1,894,171 for capitalized software costs. For the year ended December 31, 2016, net cash used in investing activities was $1,855,088 comprised of $81,514 for the purchase of property and equipment and $1,773,574 for capitalized software costs. Cash Flows from Financing Activities Net cash provided by financing activities was $521,294 for the six months ended June 30, 2018 due to $3,465,000 of funds drawn on the Promissory Notes and $3,550,000 of funds drawn on the Credit Agreement, partially offset by loan repayments on the Credit Agreement of $6,420,852. Net cash provided by financing activities was $8,176,792 for the year ended December 31, 2017 primarily due to the funds drawn on the Credit Agreement of $10,450,000, offset by repayments of amounts borrowed under the Credit Agreement of $2,288,208. Net cash provided by financing activities was $21,243,806 for the year ended December 31, 2016 primarily due to the proceeds from the sale of Series 2 Convertible Preferred Stock of $21,952,000 offset by related costs of $1,519,339, funds drawn on the Credit Agreement of $4,941,359, offset by repayments of amounts borrowed under the Credit Agreement of $4,172,714. Capital Resources To date, funds derived from the sale of FlexShopper’s common stock and Series 2 Convertible Preferred Stock and the Company’s ability to borrow funds against the lease portfolio have provided the liquidity and capital resources necessary to fund its operations. The Company’s ability to borrow additional funds under its credit agreement can be terminated if the Company does not raise $20 million of equity prior to August 31, 2018 (see Note 6). Additionally, the holder of one of its subordinated promissory notes (as described in Notes 5 and 13) provided the Company with a 30-day written notice for payment of $2.5 million of principal and accrued interest. Repayment has been extended to August 31, 2018. Further, pursuant to the terms of the subordinated promissory notes, repayment is not permitted and remedies are not available, other than default interest, without the consent of the Credit Agreement lender. The Company is currently exploring various financing options to provide additional equity capital as well as both extend and lower the cost of our credit facilities going forward, including the offering described in this prospectus. The Company expects that in connection with the completion of this offering (1) it will repay in full the subordinated promissory notes and (2) the Commitment Maturity Date under the credit agreement will be extended to no earlier than [●]. If the Company is unable to obtain additional equity capital and extend the credit facilities, management believes the Company would be able to maintain a positive cash position by servicing and collecting its existing lease portfolio and paying its obligations as they become due but would be forced to curtail or suspend normal business operations, including its discretionary marketing expenditures. Off-Balance Sheet Arrangements The Company does not have any off balance sheet arrangements.