As filed with the Securities and Exchange Commission on May 5, 2023

Registration No. 333-333-271413

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1 TO

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

| MODULAR MEDICAL, INC. |

| (Exact name of registrant as specified in its charter) |

| Nevada | 3841 | 87-0620495 | ||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) | ||

16772 W. Bernardo Drive

10740 Thornmint Road

San Diego,, California92127

(858)800-3500

(Address, including zip code, and telephone number, including

area code, of registrant’s principal executive offices)

James E. Besser

Chief Executive Officer

16772 W. Bernardo Drive

10740 Thornmint Road

San Diego, California 92127

(858) 800-3500

(Name, address, including zip code, and telephone

number, including

area code, of agent for service)

With copies to:

Joseph M. Lucosky, Esq.

Lawrence Metelitsa, Esq.

Lucosky Brookman LLP

101 Wood Avenue South, 5th Floor

Woodbridge, New Jersey 08830

Tel. No.: (732) 395-4400

Fax No.: (732) 395-4401

Joseph Lucosky Lawrence Metelitsa Lucosky Brookman LLP 101 Wood Avenue South Woodbridge, NJ 08830 (732) 395-4400 | Stephen E. Older David S. Wolpa McGuireWoods LLP 1251 Avenue of the Americas, 20th Floor New York, NY 10020 (212) 548-2100 |

| As soon as practicable after the effective date of this registration statement |

| (Approximate date of commencement of proposed sale to the public) |

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o☐

If this Form is a post-effective amendment filed pursuant to ruleRule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company”company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer | ||

| Non-accelerated Filer ☒ | Smaller reporting company | ||

| Emerging growth company |

If an emerging growth company, indicate by checkmarkcheck mark if the registrant has elected not elected to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. o☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuantpursuant to said Section 8(a), may determine.

PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION DATED JUNE 6, 2022

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities andnor does it is not soliciting offersseek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

This prospectus relatesPRELIMINARY PROSPECTUS

2,116,402 Units

Each Unit Consisting of Two Shares of Common Stock and

One Warrant to Purchase One Share of Common Stock

We are offering 2,116,402 units (each a “unit” and collectively, the resale“units”) of up to 1,438,202Modular Medical, Inc. (the “Company,” “Modular Medical,” “we,” “our” or “us”) with each unit consisting of two shares of our common stock, par value $0.001 per share, which we refer to as the “common stock,” and one warrant (a “warrant”) to purchase one share of Modular Medical, Inc. (“we,” “us,” “our,”our common stock. The public offering price is $ per unit. The units have no stand-alone rights and will not be certificated or issued as stand-alone securities. We do not intend to apply for listing of the “Company”), consistingwarrants on any national securities exchange. The shares of up to 1,438,202our common stock and the warrants comprising the units will be issued separately. The warrants included in the units are exercisable immediately, will expire five years from the date of issuance and have an exercise price of $ per share (120% of the public offering price per unit sold in this offering.) This offering also includes the shares of common stock issuable from time to time upon exercise of the warrants. The warrants (the “May Warrants”) to purchase shares of common stock at an exercise price of $6.60 per share originallywill be issued by us on May 5, 2022 in a private placement of warrants that occurred concurrently with a registered offering of shares of common stock (the “May Offering”).

This registration does not mean that the selling stockholder named herein will actually offer or sell any of these shares. We will not receive any proceeds from the resale of any of the shares of common stock being registered hereby sold by the selling stockholders. However, we may receive proceeds from the exercise of the May Warrants held by the selling stockholders exercised, other thanbook-entry form pursuant to any applicable cashless exercise provisions of such warrants.a warrant agency agreement between us and Colonial Stock Transfer Company, Inc. as warrant agent (the “Warrant Agent”).

Our common stock is listed on the Nasdaq Capital Market, or Nasdaq, under the symbol “MODD.” On JuneMay 2, 2022,2023, the last reported sale price of our common stock was $4.75$1.89 per share.

Following the effectiveness of the registration statement of which this prospectus forms a part, the sale and distribution of securities offered hereby may The public offering price per unit will be effected from time to time in one or more transactions that may take place on Nasdaq (or such other market or quotation system on which our common stock is then listed or quoted), including ordinary brokers’ transactions, privately negotiated transactions or through sales to one or more dealers for resale of such securities as principals, at market prices prevailingdetermined at the time of sale, at prices related to such prevailing market prices or at negotiated prices. Usualpricing and customary or specifically negotiated brokerage fees or commissions may be paid byat a discount to the selling stockholders.current market price. The selling stockholders and intermediaries through whom such securities are soldrecent market price used throughout this prospectus may not be deemed “underwriters” within the meaningindicative of the Securities Act of 1933, as amended (the “Securities Act”), with respectfinal offering price. There is no established trading market for the warrants, and we do not expect a market to the securities offered hereby, and any profits realized or commissions received may be deemed underwriting compensation.develop.

| Effective Price Per Share and Accompanying Warrant | Total | |||||||

| Public offering price(1) | $ | $ | ||||||

| Underwriting discounts and commissions(2) | $ | $ | ||||||

| Proceeds to us (before expenses) | $ | $ | ||||||

| (1) | Based on a price of $ per unit, with each unit consisting of two (2) shares of common stock and one warrant to purchase one share of common stock. |

| (2) | The underwriter will receive compensation in addition to the underwriting discount. See “Underwriting” beginning on page 71. |

| (3) | The amount of offering proceeds to us presented in this table does not give effect to any exercise of the: (i) over-allotment Option we have granted to the underwriter as described below and (ii) the Underwriter’s Warrants (as defined herein) being issued to the underwriter as described below. |

This prospectus describes the general manner in which shares of common stock may be offered and sold by any selling stockholders. When the selling stockholders sell shares of common stock under this prospectus, we may, if necessary and required by law, provide a prospectus supplement that will contain specific information about the terms of that offering. Any prospectus supplement may also add to, update, modify or replace information contained in this prospectus. We urge you to read carefully this prospectus, any accompanying prospectus supplement and any documents we incorporate by reference into this prospectus and any accompanying prospectus supplement before you make your investment decision.

We are an “emerging growth company” under applicable Securities and Exchange Commission rules and will be subject to reduced public company reporting requirements.

Investing in our common stock is highly speculative andsecurities involves a significanthigh degree of risk. See “Risk Factors,” beginning on page 14 of this prospectus for a discussion of information that should be considered before making a decision to purchase our common stock.10.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined ifpassed upon the adequacy or accuracy of this prospectus is truthful or complete.prospectus. Any representation to the contrary is a criminal offense.

The underwriter expects to deliver the units to investors on or about , 2023.

Sole Book-Running Manager

Newbridge Securities Corporation

The date of this prospectus is June 6, 2022., 2023

TABLE OF CONTENTS

Please read this prospectus carefully. It describes our business, our financial condition and our results of operations. We have prepared this prospectus so that you will have the information necessary to make an informed investment decision. You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with any information or to make any representations about us, the securities being offered pursuant toother than those contained in this prospectus or in any other matter discussed in this prospectus, other thanfree writing prospectuses we have prepared. We take no responsibility for, and can provide no assurance as to the information and representations contained in this prospectus. Ifreliability of, any other information or representationthat others may give you. This prospectus is given or made, such information or representation may not be relied upon as having been authorized by us.

an offer to sell only the units offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is accuratecurrent only as of its date.

For investors outside the dateUnited States: We have not, and the underwriter has not, done anything that would permit this offering or possession or distribution of this prospectus regardlessin any jurisdiction where action for that purpose is required, other than the United States. Persons outside of the time of deliveryUnited States who come into possession of this prospectus ormust inform themselves about, and observe any restrictions relating to, the offering of any sale of our common stock. Neither the deliveryunits and the distribution of this prospectus nor any distribution of securities in accordance with this prospectus shall, under any circumstances, imply that there has been no change in our affairs since the date of this prospectus. This prospectus will be updated and made available for delivery to the extent required by the federal securities laws.

We further note that the representations, warranties and covenants made by us in any document that is filed as an exhibit to the registration statement of which this prospectus is a part were made solely for the benefitoutside of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.United States.

Market and Other Industry Data

Unless otherwise indicated, market data and certain industry forecasts used throughout this prospectus were obtained from various sources, including from internal surveys, market research, consultant surveys, publicly available information and industry publications and surveys. Industry surveys, publications, consultant surveys and forecasts generally state that the information contained therein has been obtained fromWhile we believe these sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. We have not independently verified any of the data from third-party sources nor have we ascertained the underlying economic assumptions relied upon therein. Similarly, internal surveys, industry forecasts and market research, which we believe to be reliable based upon our management’s knowledge of the industry, have not been independently verified. The future performance of the industry and markets in which we operate and intend to operate is necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the sections titled “Risk Factors”“Risk Factors” and “Special“Special Note Regarding Forward-looking Statements”Statements” and elsewhere in this prospectus. These and other factors could cause results to differ materially from those expressed in these publications and reports.

All brand names or trademarks appearing in this prospectus are the property of their respective holders. Use or display by us of other parties’ trademarks, trade dress, or products in this prospectus is not intended to, and does not, imply a relationship with, or endorsements or sponsorship of, us by the trademark or trade dress owners.

i

This summary highlights selected information contained elsewhere in this prospectus and does not contain all the information that you should consider before making your investment decision. Before investing in our securities, you should carefully read this entire prospectus, including the information set forth under the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of this prospectus and our consolidated financial statements and the accompanying notes included in this prospectus. Except as otherwise indicated herein or as the context otherwise requires, references in this prospectus to “Modular Medical,” the “Company,” “we,” “us,” and “our” refer to Modular Medical, Inc. and its wholly-owned subsidiary, Quasuras, Inc.

Overview

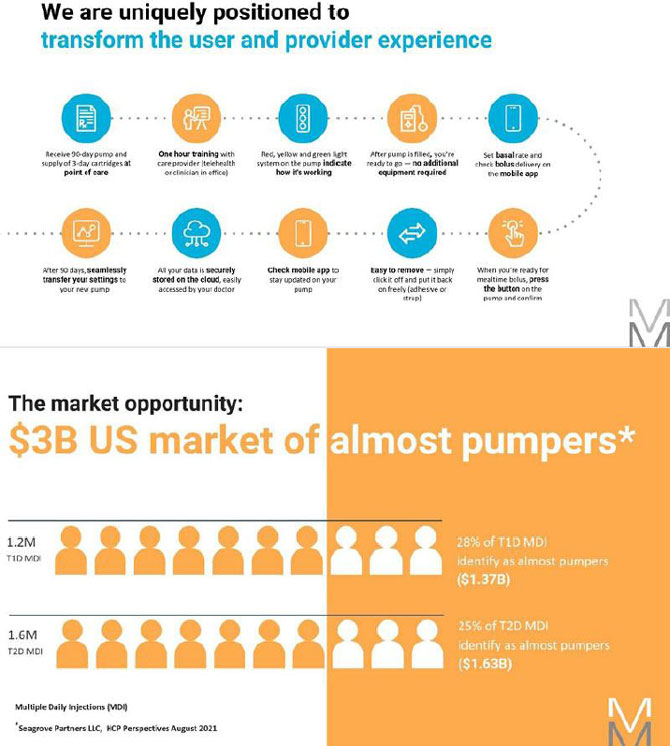

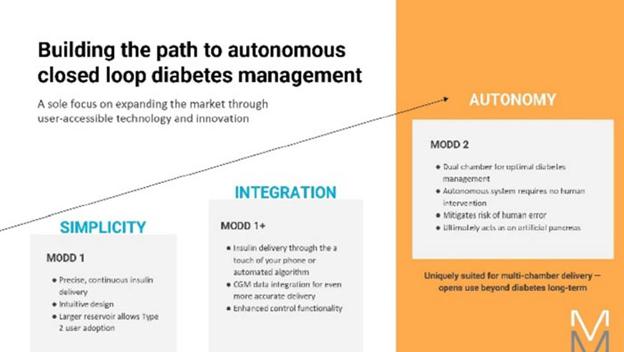

Modular Medical is a development stagedevelopment-stage, medical device company focused on the design, development, and commercialization of an innovative insulin pump using modernized technology to increase pump adoption in the diabetes marketplace. Through the creation of a novel two-part patch pump, our MODD1 product candidate, or MODD1,“MODD1,” the Company seeks to fundamentally alter the trade-offs between cost and complexity and access to the higher standards of care that presently available insulin pumps provide. By simplifying and streamlining the user experience from introduction, prescription, reimbursement, training, and day-to-day use, we seek to expand the wearable insulin delivery device market beyond the highly motivated “super users” and expand the category into the mass market. The product candidate seeks to serve both the type 1 and the rapidly growing, especially in terms of device adoption, type 2 diabetes markets.

Differentiation

We believe that there are a number of shortcomings and issues with currently available insulin pumps that prevent a substantial number of people who require insulin on a daily basis from choosing an insulin pump to treat their diabetes. We believe that by tailoring our insulin pump to address such factors, we can expand the scope and adoption rate of insulin pump usage. We believe that to achieve broader market acceptance, an insulin pump must improve the clinical experience of the user, be easier to learn toand use, less time consumingtime-consuming to operate, more intuitive to both patients and physicians, and meet the standards for coverage by insurance providers so that co-payments required from patients are affordable and the hurdles to insurance coverage are significantly reduced.

Among the more prominent issues are:

| Complexity: Many existing pumps are highly complex and require significant technical expertise to use effectively. We believe such pumps were designed for “super users,” who have high levels of motivation, technical competence and |

| ● | ||

| ● | ||

| Cost: Costs associated with insulin pump therapy are high and can be prohibitive, especially for those on fixed or limited incomes. These costs vary by pump, but multi-thousand-dollar upfront payments, often with substantial co-payments in addition to |

1

Our team has substantial knowledge of the diabetes industry and experience in developing, obtaining regulatory authorization for, and bringing insulin pumps to market. Based on this experience, we believe that our innovative insulin pump, using a new, low cost and proprietary method of pumping insulin, can address most or all of these shortcomings. It provides a state-of-the-art insulin pump capable of both basal (steady flow) and bolus (mealtime dosing) insulin disbursement. It also has been designed considering a natural migration path to multi-chamber/multi-liquid pumps, potentially offering an exciting array of new therapies to patients with diabetes and other conditions.conditions in the future.

Our goal is to become the leader in expanding access to insulin pump technology to a wider portion of diabetes sufferers and provide not just care for the super users, but “diabetes care for the rest of us.”

The MODD1 is a high-precision first-line pumpproduct that we believe represents the best choice for new pump patients because it is easy to afford, easy to learn, easy to use, and has a revolutionary design and technology that enable precision with low-cost manufacture and high reproducibility.

Key features include:

A proprietary survey of American healthcare payors representing 50 million covered lives (approximately 1/3 of U.S. covered lives) performed for us by industry leading survey firm ISA has demonstrated that a majority of payors are willing to grant equivalent or preferential coverage for a product with this feature set at launch in exchange for about a 20% rebate. These costs are built into all of our models.

Diabetes Classifications and Therapies

Diabetes is typically classified as either type 1, or T1D,“T1D,” or type 2, or T2D:“T2D”:

| T1D is an auto-immune condition characterized by the body’s nearly complete inability to produce insulin. It is frequently diagnosed during childhood or |

| T2D represents over 90% of all individuals diagnosed with diabetes and is characterized by the body’s inability to either properly utilize insulin or produce sufficient insulin. Initially, many people with T2D attempt to manage their condition with improvements in diet and exercise and/or the use of oral medications and/or injection of glucagon-like peptide-1 (GLP-1) drugs. However, as their diabetes advances, patients often progress to requiring insulin therapies such as once-daily long-acting insulin and ultimately to intensified mealtime rapid-acting insulin therapy. This represents an important portion of the diabetes market in the United States with an estimated 1.6 million T2D intensively treated (multiple daily injections) with |

Glucose, the primary source of energy for cells, must be maintained at certain levels in the blood in order to permit optimal cell function and health. In people with diabetes, blood glucose levels are not well controlled and frequently become very high, a condition known as hyperglycemia, and very low, a condition called hypoglycemia. Hyperglycemia can lead to serious long-term complications, including blindness, kidney disease, nervous system disorders, occlusive vascular diseases, lower-limb amputation, stroke, cardiovascular disease, and death. Hypoglycemia can lead to confusion or loss of consciousness, often requiring a visit to the emergency room or, in certain cases, result in seizures, coma, and/or death.

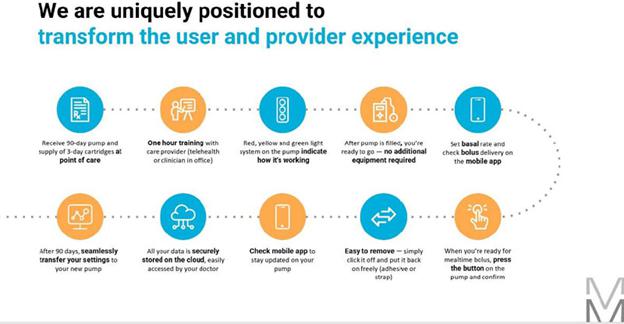

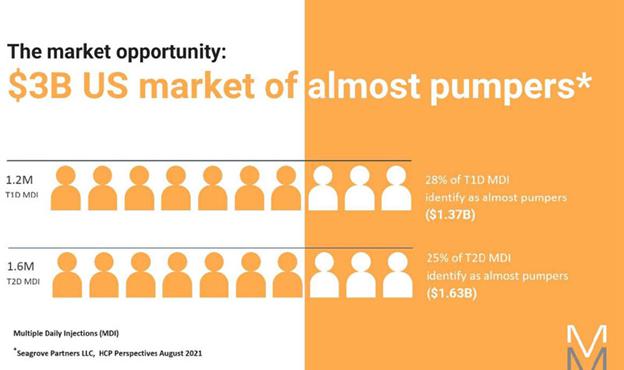

All people with T1D, which is our primary market, require daily insulin. According to the Seagrove 2021 Diabetes Blue Book, approximately 18% of people with T2D in the United States, or approximately 4.7 million people, also require insulin (basal (steady supply) alone representsinsulin. These 4.7 million people comprise 3.1 million who require multiple daily injections (“MDI”) and the remainder, 1.6 million, who require basal plus mealtime represent 1.6 million)delivery only to manage their diabetes. In this prospectus, we refer to people with T1D and people with T2D who require mealtime insulin as “insulin-requiring people with diabetes.”

2

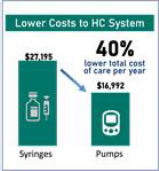

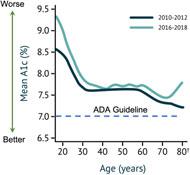

Currently, there are two primary therapies available for insulin-requiring people with diabetes: multiple daily insulin injections directly into the body through syringes or insulin pens referred to as Multiple Daily Injection, or MDI therapy,(a type of syringe) or the use of an insulin pump to deliver mealtime insulin boluses (single doses) to help with glucose absorption after carbohydrate consumption andalong with a continuous subcutaneous insulin infusion, or CSII“CSII therapy,” into the body. Generally, CSII therapy is considered to provide a number of advantages over MDI therapy, primarily an improvement in glycemic control, as measured by certain diabetes management tests such as hemoglobin A1c (HbA1c) measure and more recently Time in Range (TIR) where a continuous glucose measuring device is used to calculate this test. Among other medicalclinical benefits, it has beena study conducted by Tandem Diabetes Care, Inc. in 2021 demonstrated that insulin pump use can decrease glucose variability, reduce the number of hypoglycemia decrease the daily doses of insulinevents, and reduce the fear of hypoglycemia.

Notwithstanding these advantages, the difficulty in use resulting from the complexity and cumbersome design of available insulin pumps, optimized for the well-motivated, educated and well-insured, as well as high and often prohibitive costs for both the patient and insurance provider has resulted not only in dissatisfaction among many existing pump users (fewer than half purchase a newreplacement pump after the warranty expires per a Seagrove Partners estimate)estimate in 2020), but also has severely limited the adoption rate of insulin pumps by a large segment of the MDI diabetes population, whowhom we refer to in this prospectus as “Almost Pumpers.”

We define Almost Pumpers as individuals who treat their diabetes with MDI. These individuals are aware of pumps, may have been on pumps and understand the potential benefits, however, for a variety of reasons, they choose to continue giving themselves shots. WeIn 2018, we undertook one-on-one interviews with over 200 of these individuals to understand their past experiences on or considering pumps, existing pump shortcomings, the cost and insurance hurtles challenges, complexity to learn and time and complexity to operate that drives them to remain on MDI. With this detailed understanding, we brought a series of prototype models to them to react to, so we could refine the design and include features that would motivate them to be able to use this technology to better care for their diabetes. To date, the MODD1 pump has been well received by these individuals.individuals and our clinical advisors.

It is estimated that 32%33% of Americans with T1D use insulin pump therapy. Clinicians were surveyed on potential pump users and identified that 28% of Americans with T1D, including 44% of those who currently utilize MDI, can be classified as i) having an interest in pump adoption and ii) meeting the American Diabetes Association guidelines for required glucose control. These individuals often do not want to closely manage their glucose levels and incur the associatedconsiderable time and effort involved with the existing offerings - they are the Almost Pumpers. We have developed what we believe to be the most technologically advanced delivery system to overcome their objections and provide motivation. We believe that there are four addressable hurdles to adoption:perform with the motivation level they can provide.

Our initial focus for our insulin pump is the almost pumperAlmost Pumper segment population located in the United States. We will then focus on a European introduction, and we believe our cost position and reuse of part of the product, which eliminates waste, will have significant environmental and financial appeal.

We believe this conversion process, engaging people to try and thereby receive the benefits of our technology will substantially increase adoption of insulin pumps among both those with T1D and T2D who remain reliant upon multiple daily injections. Diabetes is a disease that appears throughout the world. Therefore, we cannot segment the market by socioeconomics, education or level of care. We intend to create an insulin pump that appeals to all Almost Pumpers.

3

Our Insulin Pump

Risk Factor Summary

Instead of building complex, bespoke, and difficult to manufacture and maintain pumping and control systems, we began with the technology and the user in mind. Using proprietary and patented methods of insulin measurement, we were able to eschew the complex mechanisms used today and instead build a product candidate using only parts from high volume consumer electronics manufacturing lines, breaking the cost vs. functionality curve that has existed in the insulin pump space and representing the first truly modern insulin pump design.

The pre-production models of our low-cost insulin pump are now undergoing the testing required to submit to the Food and Drug Administration, or FDA, for clearance to market them in the United States. We expect to submit our product candidate to the FDA in March 2022 through a premarket notification (or 510(k)) process (see the section titled Government Regulation below for a discussion of the FDA submission process and requirements). After submission, we expect to receive two rounds of comments from the FDA, and we believe it will take approximately six months to obtain clearance from the FDA. After we obtain clearance from the FDA, we can commence our commercialization process, as discussed in the section titled Commercialization Strategy: Overcoming the Insurance Hurdles below. We continue to devote substantial time and resources to better understand the needs and preferences of Almost Pumpers and the specific patent/provider/payor requirements to motivate change from MDI patients.

MODD1 has several distinguishing features:

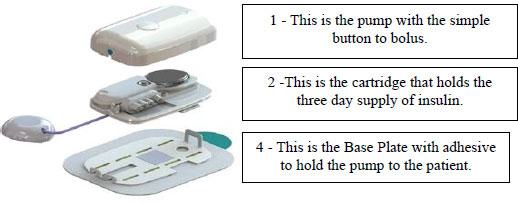

1 - The pump has a simple button to press to deliver insulin as the patient requires it. The electronic pump uses a simple motor and rotating cam to motivate the insulin into the patient along with low power Bluetooth (LPBT) and near field communication (NFC) chips to allow the patient to communicate with their smart phone, tablet, or other mobile computing platform, as appropriate.

2 - The pump snaps together with a three-day disposable cartridge that is patient filled with insulin for delivery. It includes the power source and a simple coin cell that allows it to run through the 80-hour life of the cartridge.

3 - There is a set (not shown) that contains a soft 6 mm cannula and an introducer for insertion into the skin and removal of the needle used to transfer insulin to the body.

4 - MODD1 comes with a variety of methods for the patient to wear the pump. Options include: a base plate with adhesive (shown) for attaching to the body that has features for holding the pump to the patient; overwraps to hold the product candidate to the patient; and a velcro strap with a base plate suitable for wrapping around the arm or leg of the patient. The system will deliver a small continuous rate, called a basal, that will provide approximately 50% of the total daily dose required and the user will use the on-pump button to administer boluses, typically before and after meals.

The objective is to make the product candidate simple to acquire and take home, simple to learn and most importantly, simple to use to expand the pump market, drive adoption and ultimately better clinical outcomes.

Technological Advantages

The adoption of new ultra-high volume technologies will result in far easier manufacturing scale up as parts sourcing and assembly processes are far easier. The MODD1 was designed from the beginning for mass manufacturing processes and fully automated production assembly lines. This advantage is compounded by the high availability and already optimized cost reduction in its components. This has resulted in a cost of goods, estimated on our competitors’ announced margins and sales, 50% lower than our closest patch pump competitor.

The adoption of modern, miniaturized technologies has led to numerous other advantages as well. The MODD1 pump is smaller in overall volume than Insulet’s popular Omnipod product and has a lower profile to the skin. Despite this, it holds a full 3mL (300 units) of insulin in line with full sized pumps such as Tandem and Medtronic, 50% more than the 2mL reservoir in the Omnipod. We believe that this volume advantage over other patch pumps will be significant as 24% of type 1 and over 50% of the rapidly growing type 2 market require more than 2 milliliters of insulin every 3 days (the expected wear time of patch pumps).

In addition, our new and patented pumping modality will provide what we believe is the most even (and thus closest to the function of a healthy pancreas) delivery of basal insulin in the industry. Basal rate can be delivered almost continuously while other pumps are delivering micro-boluses every five minutes for the Tandem, Omnipod and Medtronic pumps. We plan to demonstrate the impact of our system on glycemic control in a future clinical study.

The technology allows the patient to simply add insulin and operate. The battery is included in each cartridge and the device is operated without a controller. Nothing requires charging. MODD1 has been made push button simple to appeal to a wider audience of users.

This new technology has also made the MODD1 lighter than existing offerings. Compared to the Insulet Omnipod pump, MODD1 weighs 20 grams (vs. 26 grams) empty and 23 grams (vs. 28 grams) fully filled (despite carrying 50% more insulin), a reduction of 23% and 18% respectively. Also, unlike existing patch pumps, the MODD1 can be removed from the needle and taken off and replaced later if the user desires. This avoids loss of insulin in a pump due to accidental dislodging of the soft canula, an issue that users have expressed considerable dissatisfaction with on other patch pumps.

This technology is also uniquely suited to dual (or more) chamber pumps. We believe that such pumps will be integral to the realization of high time in range artificial pancreas solutions that require no human intervention, the next step forward from the cumbersome and awkward solutions today that require the user to announce meals, count and input carbs, and adjust delivery for exercise and sleep. The advantages of cost and miniaturization are multiplied in a multi-chamber setup and we expect to be able to reach price points, ease of use, and form factor unlike anything seen in the industry thus far. We believe that a prefilled, multi-hormone peel and stick-patch pump able to function in a fully autonomous closed loop system with CGM’s represents the next generation of diabetes care. We believe that we have demonstrated our technology and are securing the intellectual property on our approach.

We believe this technology, especially in dual chamber, will open up numerous applications outside of diabetes where medication compliance of complex therapy regimes is difficult, addressing such spaces as weight loss and fertility, and simplifying complex delivery of multi-drug cocktails, especially those with diverse and challenging dosing schedules.

Commercialization Strategy: Overcoming the Insurance Hurdles

Our goal is to establish MODD1 as the best option for new pump patients as we expand the market into the Almost Pumpers (Type 1 and Type 2) and the newly motivated CGM users. We seek to grow the market by providing first-line insulin pump therapy that is well suited to meet the needs of both diabetes patients requiring insulin and their clinicians.

Europe represents another large potential market for MODD1. Sixty million people in Europe live with diabetes, and approximately $161 billion is spent annually on diabetes healthcare costs in Europe. At present, cost containment is restricting pump uptake across Europe. Current pump usage across Europe hovers between 10% and 20% in many markets. Single payor healthcare systems across Europe traditionally attempt to contain costs in the short term and seek low price technologies with moderate medical benefits. MODD1 will offer a rebalance of this risk/reward strategy in that payors will incur only minor incremental short-term costs with the benefit of longer-term cost savings associated with reliable pump use. We intend to employ a partnership strategy across Europe following in-house managed regulatory and pricing activities in the major markets (e.g., the United Kingdom) and more cost receptive markets (e.g., Nordics). We are targeting European and United Kingdom approval towards early 2023.

Intellectual Property

Our success depends in part on our ability to obtain patents and trademarks, maintain trade secrets and know-how protection, enforce our proprietary rights against infringers, and operate without infringing on the proprietary rights of third parties. Because of the length of time and expense associated with developing new products and bringing them through the regulatory approval process, the health care industry places considerable emphasis on obtaining patent protection and maintaining trade secret protection for new technologies, products, processes, know-how, and methods.

As of May 31, 2022, we had one issued U.S. utility patent, five published U.S. utility patents, two pending foreign patent applications, and two pending international Patent Cooperation Treaty (PCT) patent applications covering various aspects of our technology, including our proprietary fluid movement technology. There can be no assurance that our pending patent applications will result in the issuance of patents, that patents issued to or licensed by us will not be challenged or circumvented by competitors, or that these patents will be found to be valid or sufficiently broad to protect our technology or provide us with a competitive advantage.

Recent Developments

On May 2, 2022, we entered into a securities purchase agreement (the “May 2022 Purchase Agreement”) with Sio Capital Management, LLC, an institutional investor (the “Investor”), pursuant to which we agreed to sell, in a registered direct offering (the “May 2022 Registered Offering”), an aggregate of 449,438 shares (the “Shares”) of our common stock, at a purchase price per Share of $4.45 and pre-funded warrants (the “Pre-Funded Warrants”) to purchase an aggregate of 1,348,314 shares of common stock at a purchase price per Pre-Funded Warrant of $4.44. The Pre-Funded Warrants will be exercisable immediately on the date of issuance at an exercise price of $0.01 per share and may be exercised at any time until all of the Pre-Funded Warrants are exercised in full.

In a concurrent private placement (the “May 2022 Private Placement” and together with the Registered Offering, the “May 2022 Offerings”) under the May 2022 Purchase Agreement, we issued to the Investor warrants (the “Private Placement Warrants”) to purchase an aggregate of 1,438,202 shares of our common stock at an exercise price of $6.60 per share. The May 2022 Private Placement Warrants will be exercisable six months from date of issuance and have a five-year term.

Risks Related to Our Business

Our business is subject to many significant risks, as more fully described in the section entitled “Risk Factors”titled “Risk Factors” immediately following this prospectus summary. You should read and carefully consider these summary risks, together with the risks set forth under the section entitled “Risk Factors”titled “Risk Factors” and all of the other information in this prospectus, including the financial statements and the related notes included elsewhere in this prospectus, before deciding whether to invest in our common stock.securities. If any of the risks discussed in this prospectus actually occur, our business, prospects, financial condition or operating results could be materially and adversely affected. In particular, our risks include, but are not limited to, the following:

Risk Factors

| We might not be able to continue as a going concern; |

| ● | We are a developmental-stage, medical-device company and have a history of significant operating losses; we expect to continue to incur operating losses for the foreseeable future, and we may never achieve or maintain profitability; |

| ● | We will need substantial additional funding to complete subsequent phases of our insulin pump product candidate and to operate our business, and such funding may not be available or, if it is available, is likely to substantially dilute our existing stockholders; |

| ● | We have a limited operating history and historical financial information upon which you may evaluate our performance; |

| ● | The amount of financing we require will depend on a number of factors, many of which are beyond our control. Our results of operations, financial condition and stock price are likely to be adversely affected if our funding requirements increase or are otherwise greater than we expect; |

| ● | We are subject to extensive regulation by the FDA, which could restrict the sales and marketing of our insulin pump product candidate and could cause us to incur significant costs; |

| ● | Even if we are able to obtain all regulatory approvals and have completed all other steps needed to be taken to commercialize our insulin pump, if we or any contract manufacturers we select fails to comply with the FDA’s quality system regulations, the manufacturing and distribution of our product candidate could be interrupted, and our product sales and operating results could |

| ● | ||

| We will need to outsource and rely on third parties for various aspects relating to the development, manufacture, sales and marketing of our insulin pump as well as in connection with assisting us in the preparation and filing of our FDA submission, and our future success will be dependent on the timeliness and effectiveness of the efforts of these third |

| ● | Our future cash requirements may differ significantly from our current estimates; |

| We may not receive the necessary regulatory clearance or approvals for our insulin pump, and failure to timely obtain necessary clearances and/or approvals could harm our then operations, including our ability to commercialize our product |

| Obtaining marketing authorization in the United States will not obviate the need to obtain marketing authorization in other jurisdictions We must obtain approval from foreign regulatory authorities before we can market and sell any of our product candidates in countries outside the United States. We will incur additional costs in seeking such approvals, may experience delays in obtaining such approvals and cannot be certain that such approvals will be |

| Although our product candidate does not presently require clinical trials to apply to the FDA for clearance, and even if a clinical trial is conducted, the results of our clinical testing may not demonstrate the safety and efficacy of the device or may be equivocal or otherwise not be sufficient for us to obtain approval of our product |

| We |

| Our competitors may develop products that are more effective, safer and less expensive than |

4

| Sales of a significant number of shares of our |

| We have limited internal research and development personnel, making us dependent on consulting |

| Technological breakthroughs in diabetes monitoring, treatment or prevention could render our insulin pump |

| We may not be able to identify, negotiate and maintain the strategic alliances necessary to develop and commercialize our products and technologies, and we will be dependent on our corporate partners if we |

Implications of Being an Emerging Growth Company

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, as amended, or the JOBS Act. We will remain an emerging growth company until the earlier of (1) December 31, 2024 (2) the last day of the fiscal year in which we have total annual gross revenue of at least $1.07 billion, (3) the last day of the fiscal year in which we are deemed to be a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, or the Exchange Act, which would occur on the date on which we have issued more than $1.0 billion in non-convertible debt securities during the prior three-year period. An emerging growth company may take advantage of specified reduced reporting requirements and is relieved of certain other significant requirements that are otherwise generally applicable to public companies. As an emerging growth company, we may:

| ● | We may be subject to potential product liability and other claims that could materially impact our business and financial condition; |

| ● | If we are sued for infringing on third-party intellectual property rights, it will be costly and time-consuming, and an unfavorable outcome would have a significant adverse effect on our business; |

| ● | If we are unable to protect the confidentiality of |

| ● | Healthcare reform laws could adversely affect our product candidate and financial |

| ● | We may bring infringement claims or other legal proceedings against third parties, causing us to spend substantial resources on litigation and exposing our own intellectual property portfolio to challenge; |

| ● | Assuming our insulin pump receives FDA clearance or approval, our insulin pump will still be subject to recalls, which would harm our reputation, business operations and financial |

| ● | Because our current insulin pump is still in the pre clearance stage with the FDA, it does not have reimbursement and is not approved for insurance coverage. If in the future we are cleared for and are otherwise able to commercialize our insulin pump, but are unable to obtain adequate reimbursement or insurance coverage for such product candidate from third-party payors, we will be unable to generate significant revenue; |

| ● | If we fail to establish and maintain an effective system of internal controls, we may not be able to report our financial results accurately or prevent fraud. Any inability to report and file our financial results accurately and timely could harm our reputation and adversely affect the trading price of our common stock; |

| ● | Our board of directors is able to adopt recapitalizations through forward or reverse splits of our outstanding shares of common stock without stockholder approval; |

| ● | We are a “smaller reporting company” and, as a result of the reduced disclosure and governance requirements applicable to smaller reporting companies, our common stock may be less attractive to investors; |

| ● | As we have broad discretion in how we use the proceeds from this offering, we may use the proceeds in ways with which you disagree; |

| ● | Holders of our warrants will have no rights as a common stockholder until they acquire our common stock; |

| ● | Provisions of the warrants offered by this prospectus could discourage an acquisition of us by a third party; |

| ● | The warrants offered by this prospectus are speculative in nature and may not have any |

| ● | There is no public market for the warrants being offered in this |

| ● | You may experience future dilution as a result of future equity offerings and other issuances of our |

In addition, under the JOBS Act, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have irrevocably elected not to avail ourselves of this extended transition period, and, as a result we will adopt new or revised accounting standards on relevant dates on which adoption of such standards is required for other public companies.

We are also a “smaller reporting company” as defined in Rule 12b-2 of the Exchange Act and have elected to take advantage of certain of the scaled disclosure available to smaller reporting companies.

Corporate Information

Our principal executive offices are located at 16772 West Bernardo Drive,10740 Thornmint Road, San Diego, CA 92127 and our telephone number is (858) 800-3500. We maintain a website at www.modular-medical.com to which we regularly post copies of our press releases, as well as additional information about us. Our filings with the Securities and Exchange Commission, or SEC, will be available free of charge through the website as soon as reasonably practicable after being electronically filed with or furnished to the SEC.www.modular-medical.com. Information contained on, or accessible through, our website does not constitute a part of this prospectus or our other filings with the SEC, and you should not consider any information contained on, or that can be accessed through, our website as part of this prospectus or in deciding whether to purchase our securities.

5

All brand names or trademarks appearing in this prospectus are the property of their respective holders. Use or display by us of other parties’ trademarks, trade dress, or products in this prospectus is not intended to, and does not, imply a relationship with, or endorsements or sponsorship of, us by the trademark or trade dress owners.THE OFFERING

SUMMARY RISK FACTORS

Our business is subject to a number of risks, including risks that could prevent us from achieving our business objectives or financial goals or that otherwise could adversely affect our business, results of operations, financial condition and liquidity, that you should carefully consider before making a decision to invest in our common stock. These risks are discussed more fully in “Risk Factors.” These risks include the following:

Securities offered by us: |

THE OFFERING

| Common stock outstanding prior to this offering(1): | 10,949,389 shares of common stock outstanding as of May | |||

| Common stock to be outstanding after this offering(1): | 15,182,193 shares, or 15,817,113 shares, if the | |||

| Use of | We estimate that the net proceeds from this We intend to use the net proceeds of this offering for general corporate | |||

| Over-allotment option | We have granted a 30-day option to the underwriter, exercisable one or more times in whole or in part, to purchase up to an additional 634,920 shares of common stock at the effective public offering price per share of $ and additional warrants to purchase up to 317,460 additional shares of common stock at a price of $0.01 per warrant, in each case less underwriting discounts and commissions, to cover over-allotments, if any. | |||

| Risk factors: | Investing in our securities involves substantial risk. You should read the “Risk Factors | |||

| We and our directors and officers and holders of | ||||

| Nasdaq Capital Market | MODD |

The number of shares of our Common Stock to becommon stock outstanding before and after this offering is based on 10,911,68410,949,389 shares of our Common Stockcommon stock outstanding as of June 2, 2022,May 4, 2023 and excludes:

| 2,116,402 shares of our common stock issuable upon the exercise of the warrants to be issued as part of the units; |

| ● | 296,296 shares of common stock issuable upon exercise by the underwriter of the underwriter’s warrants; |

| ● | 767,796 shares of our |

| 1,348,314 |

6

The following tables summarize our financial data for the periods presented and should be read together with the sections of this prospectus titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our financial statements and related notes thereto appearing elsewhere in this prospectus. The following summary statements of operations data for the nine months ended December 31, 2022 and 2021 have been derived from our unaudited consolidated financial statements and footnotes included elsewhere in this prospectus and the summary statements of operations data for the years ended March 31, 2022 and 2021 have been derived from our audited consolidated financial statements and footnotes included elsewhere in this prospectus. The summary balance sheet information as of December 31 and March 31, 2022 has been derived from our unaudited condensed consolidated financial statements and footnotes included elsewhere in this prospectus. Our historical results are not necessarily indicative of our future results or of the results we expect in the future and results of interim periods are not necessarily indicative of results for the entire year.

| Twelve Months Ended March 31, | ||||||||

| 2022 | 2021 | |||||||

| Operating expenses | ||||||||

| Research and development | $ | 7,729,240 | $ | 4,083,303 | ||||

| General and administrative | 7,197,162 | 3,253,412 | ||||||

| Total operating expenses | 14,926,402 | 7,336,715 | ||||||

| Loss from operations | (14,926,402 | ) | (7,336,715 | ) | ||||

| Other income | 368,920 | 130 | ||||||

| Interest expense | (2,752,229 | ) | (39,791 | ) | ||||

| Loss on debt extinguishment | (1,321,450 | ) | — | |||||

| Loss before income taxes | (18,631,161 | ) | (7,376,376 | ) | ||||

| Provision for income taxes | 1,600 | 1,600 | ||||||

| Net loss | $ | (18,632,761 | ) | $ | (7,377,976 | ) | ||

| Net loss per share | ||||||||

| Basic and diluted | $ | (2.74 | ) | $ | (1.20 | ) | ||

| Shares used in computing net loss per share | ||||||||

| Basic and diluted | 6,807,710 | 6,211,562 | ||||||

7

| Three Months Ended December 31, | Nine Months Ended December 31, | |||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||

| Operating expenses | ||||||||||||||||

| Research and development | $ | 2,196,546 | $ | 1,849,399 | $ | 6,804,069 | $ | 5,742,911 | ||||||||

| General and administrative | 1,161,351 | 1,981,665 | 3,502,029 | 5,156,152 | ||||||||||||

| Total operating expenses | 3,357,897 | 3,831,064 | 10,306,098 | 10,899,063 | ||||||||||||

| Loss from operations | (3,357,897 | ) | (3,831,064 | ) | (10,306,098 | ) | (10,899,063 | ) | ||||||||

| Other income (expense) | (587 | ) | 4 | 16 | 368,876 | |||||||||||

| Interest expense | — | (1,010,247 | ) | — | (2,204,917 | ) | ||||||||||

| Loss on debt extinguishment | — | — | — | (1,321,450 | ) | |||||||||||

| Loss before income taxes | (3,358,484 | ) | (4,841,307 | ) | (10,306,082 | ) | (14,056,554 | ) | ||||||||

| Provision for income taxes | — | — | 1,600 | 1,600 | ||||||||||||

| Net loss | $ | (3,358,484 | ) | $ | (4,841,307 | ) | $ | (10,307,682 | ) | $ | (14,058,154 | ) | ||||

| Net loss per share | ||||||||||||||||

| Basic and diluted | $ | (0.31 | ) | $ | (0.76 | ) | $ | (0.95 | ) | $ | (2.22 | ) | ||||

| Shares used in computing net loss per share | ||||||||||||||||

| Basic and diluted | 10,925,862 | 6,354,145 | 10,863,082 | 6,331,982 | ||||||||||||

8

| December 31, 2022 (Unaudited) | March 31, 2022 | |||||||

| ASSETS | ||||||||

| CURRENT ASSETS | ||||||||

| Cash and cash equivalents | $ | 7,690,957 | $ | 9,076,372 | ||||

| Prepaid expenses and other | 180,164 | 313,422 | ||||||

| Security deposit | 100,000 | — | ||||||

| TOTAL CURRENT ASSETS | 7,971,121 | 9,389,794 | ||||||

| Property and equipment, net | 716,409 | 235,959 | ||||||

| Right of use asset, net | 51,312 | 120,693 | ||||||

| Security deposit | — | 100,000 | ||||||

| TOTAL NON-CURRENT ASSETS | 767,721 | 456,652 | ||||||

| TOTAL ASSETS | $ | 8,738,842 | $ | 9,846,446 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| CURRENT LIABILITIES | ||||||||

| Accounts payable | $ | 382,080 | $ | 299,951 | ||||

| Accrued expenses | 255,545 | 524,891 | ||||||

| Short-term lease liability | 77,672 | 144,857 | ||||||

| TOTAL CURRENT LIABILITIES | 715,297 | 969,699 | ||||||

| Long-term lease liability | — | 39,957 | ||||||

| TOTAL LIABILITIES | 715,297 | 1,009,656 | ||||||

| Commitments and Contingencies (Note 8) | ||||||||

| STOCKHOLDERS’ EQUITY | ||||||||

| Preferred Stock, $0.001 par value, 5,000,000 shares authorized, none issued and outstanding | — | — | ||||||

| Common Stock, $0.001 par value, 50,000,000 shares authorized; 10,932,098 and 10,461,898 shares issued and outstanding as of December 31, 2022 and March 31, 2022, respectively | 10,932 | 10,462 | ||||||

| Additional paid-in capital | 52,900,066 | 43,406,099 | ||||||

| Accumulated deficit | (44,887,453 | ) | (34,579,771 | ) | ||||

| TOTAL STOCKHOLDERS’ EQUITY | 8,023,545 | 8,836,790 | ||||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 8,738,842 | $ | 9,846,446 | ||||

9

Investing in our securities involves a high degree of risk. Before you invest in the units, the warrants and the common stock, involves a great dealyou should carefully consider the following risks, as well as general economic and business risks, and all of risk. Careful consideration should be madethe other information contained in this registration statement. Any of the following factors as well as other information included in this prospectus before deciding to purchase our common stock. There are many risks that affectcould harm our business, andoperating results of operations, some of which are beyond our control. Our business,and financial condition or operating results could be materially harmed by any of these risks. This couldand cause the trading price of our common stock to decline, andwhich would cause you mayto lose all or part of your investment. Additional risks that we do not yet know of or that we currently think are immaterial mayWhen determining whether to invest, you should also affectrefer to the other information contained in this prospectus, including our businessfinancial statements and results of operations.the related notes thereto.

Risks Related To Our Operations

We might not be able to continue as a going concern.

Our unaudited condensed consolidated financial statements as of December 31, 2022 have been prepared under the assumption that we will continue as a going concern for the next twelve months. At December 31, 2022, we had cash and cash equivalents of $7.7 million and an accumulated deficit of $44.9 million. Without the proceeds of this offering, we do not believe that our cash, cash equivalents and investments would be sufficient to fund our operations for the next 12 months, and we would need to raise additional capital. As a result of our expected operating losses and cash burn for the foreseeable future and recurring losses from operations, if we are unable to raise sufficient capital through this offering or additional debt or equity arrangements, there will be uncertainty regarding our ability to maintain liquidity sufficient to operate our business effectively, which raises substantial doubt as to our ability to continue as a going concern. If we cannot continue as a viable entity, our stockholders would likely lose most or all of their investment in us.

If we are unable to generate sustainable operating profit and sufficient cash flows, then our future success will depend on our ability to raise capital. In addition to this offering, we are seeking additional financing and evaluating financing alternatives in order to meet our cash requirements for the next 12 months. We cannot be certain that raising additional capital, whether through this offering, selling additional debt or equity securities or obtaining a line of credit or other loan, will be available to us or, if available, will be on terms acceptable to us. If we issue additional securities to raise funds, these securities may have rights, preferences, or privileges senior to those of our common stock, and our current stockholders may experience dilution. If we are unable to obtain funds when needed or on acceptable terms, we may be required to curtail our current product development programs, cut operating costs, forego future development and other opportunities or even terminate our operations.

We are a developmental stage medical device company and have a history of significant operating losses; we expect to continue to incur operating losses, and we may never achieve or maintain profitability.

As a development-stage enterprise, we do not currently have revenues to generate cash flows to cover operating expenses. Since our inception, we have incurred operating losses in each year due to costs incurred in connection with research and development activities and general and administrative expenses associated with our operations. For the yearsnine months ended December 31, 2022 and year ended March 31, 2021 and 2020,2022, we incurred net losses of approximately $7.4$10.3 million and $5.3$18.6 million, respectively. At March 31, 2021,As a result, we had an accumulated deficit of approximately $15.9 million. Forneed to raise additional capital in the nine months ended December 31, 2021, we incurred a net loss of approximately $4.8 million. At December 31, 2021, we had an accumulated deficit of approximately $30 million.future, which may or may not be available to us at all or only on unfavorable terms.

We expect to incur losses for the foreseeable future as we continue the development of, and seek regulatory clearance and approvals for, our insulin pump. As our prototypeMODD1 insulin pump is currently our only product, candidate, if it fails to gain regulatory approval and market acceptance, we will not be able to generate any revenue, or explore other opportunities to enhance shareholderstockholder value, such as through a sale. If we fail to generate revenue and eventually become profitable, or if we are unable to fund our continuing losses, our shareholdersstockholders could lose all or a substantial part of their investment.

We might not be able to continue as a going concern which would likely cause our stockholders to lose most or all of their investment.

Our audited financial statements for the year ended March 31, 2021 were prepared under the assumption that we would continue as a going concern. However, our independent registered public accounting firm included a “going concern” explanatory paragraph in its report on our financial statements for the year ended March 31, 2021, indicating that, without additional sources of funding, our cash at March 31, 2021 was not sufficient for us to operate as a going concern for a period of at least one year from the date of issuance of the financial statements. Management’s plans concerning these matters, including our need to raise additional capital, are described in Management’s Discussion and Analysis of Financial Conditions and Results of Operations included in this prospectus and in Note 1 to our audited consolidated financial statements included in this prospectus. However, we cannot assure you that our plans will be successful. In light of the foregoing, there is substantial doubt about our ability to continue as a going concern. If we cannot continue as a viable entity, our stockholders would likely lose most or all of their investment in us.

The full effects of COVID-19 and other potential future public health crises, epidemics, pandemics or similar events are uncertain and could have a material and adverse effect on our business, financial condition, operating results and cash flows.

The global outbreak of the coronavirus disease 2019, or COVID-19, was declared a pandemic by the World Health Organization and a national emergency by the U.S. government in March 2020. This has negatively affected the world economy, disrupted global supply chains, significantly restricted travel and transportation, resulted in mandated closures and orders to “shelter-in-place” and created significant disruption of the financial markets. The extent of the impact on our operational and financial performance will depend on future developments, including the duration and spread of the pandemic and related actions taken by U.S. and foreign government agencies to prevent disease spread, all of which are uncertain, out of our control and cannot be predicted.

We have been complying with county and state orders and, until May 2021, had implemented a teleworking policy for our employees and contractors and significantly minimized the number of employees who visit our office. However, a facility closure, work slowdowns or temporary stoppage at one of our suppliers could occur, which could have a longer-term impact and could delay our prototype production and ability to conduct business.

If our workforce is unable to work effectively, including because of illness, quarantines, absenteeism, government actions, facility closures, travel restrictions or other restrictions in connection with the COVID-19 pandemic, our operations will be negatively impacted. We may be unable to develop our product candidate, and our costs may increase as a result of the COVID-19 outbreak. The impacts could worsen if there is an extended duration of any COVID-19 outbreak or a resurgence of COVID-19 infection in affected regions after they have begun to experience improvement.

We rely on other companies to provide components and to perform services for us. An extended period of supply chain disruption caused by the response to COVID-19 could impact our ability to produce our initial product quantities and, if we are not able to implement alternatives or other mitigations, product deliveries would be adversely impacted and negatively impact our business, financial condition, operating results and cash flows. Limitations on government operations can also impact regulatory approvals that are necessary for us to operate our business.

The continued spread of COVID-19 has also led to disruption and volatility in the global capital markets. We were recently able to raise additional capital through equity offerings in February 2022 and May 2022, however, we will need to raise additional capital to support our operations in the future. We may be unable to access the capital markets, and additional capital may only be available to us on terms that could be significantly detrimental to our existing stockholders and to our business.

We will need substantial additional funding to complete subsequent phases of the development of our insulin pump product candidate and to operate our business and such funding may not be available or, if it is available, such financing is likely to substantially dilute our existing shareholders.stockholders.

The discovery, development, and commercialization of new medical devices, such as our insulin pump, entails significant costs. While we believe that we have generally completed the engineering and mechanical aspects of our insulin pump prototype,and cartridge along with production-level assembly equipment, we still must modify, refine and finalize our insulin pump to, among other things, meet the general needs and preferences of the almost pumperAlmost Pumper marketplace and the guidelines of third-party payors. To enable us to accomplish these and other related items and continue to operate our business, we will need to raise substantial additional capital and/or enter into strategic partnerships or joint ventures to enable us to:

| fund clinical studies and seek regulatory approvals; |

| build or access manufacturing and commercialization capabilities; |

| develop, test, and, if approved, market our product candidate; |

| acquire or license additional internal systems and other infrastructure; and |

| hire and support additional management, engineering and scientific personnel. |

Until we can generate a sufficient amount of product revenue to finance our cash requirements, which we may never achieve, we expect to finance our cash needs primarily through public or private equity offerings, debt financings or through the establishment of possible strategic alliances. WeThis offering is being conducted to obtain such funding, although there can be no guarantee that we will successfully raise all the funding we require in this offering. Depending on the amount of funding we receive in this offering, as well as other factors, we may in the future seek additional capital from public or private offerings of our capital stock or borrow additional amounts under new credit lines or from other sources. If we issue equity or debt securities to raise additional funds, our existing stockholders may experience dilution, we may incur significant financing costs, and the new equity or debt securities may have rights, preferences and privileges senior to those of our existing stockholders. In addition, if we raise additional funds through collaborations, licensing, joint ventures, strategic alliances, partnership arrangements or other similar arrangements, it may be necessary to relinquish valuable rights to the MODD1 pump or our potential future products or proprietary technologies or grant licenses on terms that are not favorable to us.

We cannot be certain that additional funding will be available on acceptable terms, or at all. If we are not able to secure additional equity funding when needed, we may have to delay, reduce the scope of, or eliminate one or more of our clinical studies, development programs or future commercialization initiatives. In addition, any additional equity funding that we do obtain will dilute the ownership held by our existing equity holders. The amount of this dilution may be substantially increased if the trading price of our Common Stockcommon stock is lower at the time of any financing. Regardless, the economic dilution to shareholdersstockholders will be significant if our stock price does not increase significantly, or if the effective price of any sale is below the price paid by a particular shareholder.stockholder. Any debt financing that we obtain in the future could involve substantial restrictions on activities and creditors could seek a pledge of some or all of our assets. We have not identified potential sources for such financing that we will require, and we do not have commitments from any third parties to provide any future debt financing. If we fail to obtain funding as needed, we may be forced to cease or scale back operations, and our business, prospects, results of operations, financial condition and stock price would be adversely affected.

We have a limited operating history and historical financial information upon which you may evaluate our performance.

You should consider, among other factors, our prospects for success in light of the risks and uncertainties encountered by companies that, like us, are in their early stages of development. We may not successfully address these risks and uncertainties or successfully complete our studies and/or implement our existing and new products. If we fail to do so, it could materially harm our business and impair the value of our Common Stock.common stock. Unanticipated problems, expenses and delays are frequently encountered in establishing a new business, conducting research, and developing new products. These include, but are not limited to, inadequate funding, failure to obtain regulatory approval, unforeseen research issues, lack of consumer, physician or third-party payor acceptance, competition, sluggish product development, and inadequate sales and marketing. The failure by us to meet any of these conditions would have a materially adverse effect upon us and may force us to reduce or curtail operations. No assurance can be given that we can or will ever operate profitably.

We may not be able to meet our future capital needs.

To date, we have no revenue and we have limited cash liquidity and capital resources. We will need additional capital in the near future. Any equity financings will result in dilution and may contain other terms that are not favorable to our then-existing stockholders. We currently have debt financing, and any additional sources of debt financing that we may obtain in the future may result in a high interest expense. Any financing, if available, may be on unfavorable terms. If adequate funds are not obtained, we will be required to reduce or curtail operations.

The amount of financing we require will depend on a number of factors, many of which are beyond our control. Our results of operations, financial condition and stock price are likely to be adversely affected if our funding requirements increase or are otherwise greater than we expect.

Our future funding requirements will depend on many factors, including, but not limited to:

| the testing costs for our insulin pump product candidate and other development activities conducted by us directly, and our ability to successfully conclude the studies and activities and achieve favorable results; |

| our ability to attract future strategic partners to pay for or share costs related to our product development efforts; |

| the costs and timing of seeking and obtaining regulatory clearance and approvals for our product candidate; |

| the costs of filing, prosecuting, maintaining and enforcing any patents and other intellectual property rights that we may have and defending against potential claims of infringement; |

| decisions to hire additional scientific, engineering or administrative personnel or consultants; |

| our ability to manage administrative and other costs of our operations; and |

| the presence or absence of adverse developments in our research program. |

If any of these factors cause our funding needs to be greater than expected, our operations, financial condition, ability to continue operations and stock price may be adversely affected.

11

Our future cash requirements may differ significantly from our current estimates.

Our cash requirements may differ significantly from our estimates from time to time, depending on a number of factors, including:

| the costs and results of our clinical studies regarding our insulin pump product candidate; |

| the time and costs involved in obtaining regulatory clearance and approvals; |

| whether we are able to obtain funding under future licensing agreements, strategic partnerships, or other collaborative relationships, if any; |

| the costs of compliance with laws, regulations, or judicial decisions applicable to us; and |

| the costs of general and administrative infrastructure required to manage our business and protect corporate assets and |

If we fail to raise additional funds on a timely basis, even after the completion of this offering, we will need to scale back our business plans, which would adversely affect our business, prospects, results of operations, financial condition, and stock price, and we may even be forced to discontinue our operations and liquidate our assets.

Technological breakthroughs in diabetes monitoring, treatment or prevention could render our insulin pump obsolete.

The diabetes treatment market is subject to rapid technological change and product innovation. Our insulin pump is based on our proprietary technology, but a number of companies, medical researchers and existing pharmaceutical companies are pursuing new delivery devices, delivery technologies, sensing technologies, procedures, drugs and other therapeutics for the monitoring, treatment and/or prevention of insulin-dependent diabetes. Any technological breakthroughs in diabetes monitoring, treatment or prevention could render our insulin pump obsolete, which, since our insulin pump is our only product candidate, would have a material adverse effect on our business, financial condition andprospectus, results of operations and financial condition and could result in shareholdersstockholders losing their entire investment.

Any failure to attract and retain skilled directors, executives, employees and consultants could impair our product development and commercialization activities.

Our business depends on the skills, performance, and dedication of our directors, executive officers and key engineering, scientific and technical advisors. Many of our current engineering or scientific advisors are independent contractors and are either self-employed or employed by other organizations. As a result, they may have conflicts of interest or other commitments, such as consulting or advisory contracts with other organizations, which may affect their ability to provide services to us in a timely manner. We will need to recruit additional directors, executive management employees, and advisers, particularly engineering, scientific and technical personnel, which will require additional financial resources. In addition, there is currently intense competition for skilled directors, executives and employees with relevant engineering, scientific and technical expertise, and this competition is likely to continue. If we are unable to attract and retain persons with sufficient engineering, scientific, technical and managerial experience, we may be forced to limit or delay our product development activities or may experience difficulties in successfully conducting our business, which would adversely affect our business, prospects, results of operations and financial condition.

Our operations are substantially dependent upon key personnel.

Our performance is substantially dependent on the continued services and performance of our senior management and certain other key personnel The loss of services of any of our executive officers or other key employees could have a material adverse effect on our business, financial condition and results of operations. In addition, any future expansion of our business will depend on our ability to identify, attract, hire, train, retain and motivate other highly skilled managerial, marketing, customer service and manufacturing personnel, and our inability to do so could have a material adverse effect on our business, financial condition and results of operations.

We are dependent on the performance and continued engagement of our Chairman, President and Principal Financial Officer.

We are dependent on the performance and continued engagement of Paul DiPerna, our Chairman, President and Principal Financial Officer. Although we believe we will be able to engage qualified personnel for such purposes, an inability to do so could materially adversely affect our ability to market, sell, and enhance our products. While Mr. DiPerna is currently devoting his full-time working efforts to us, other employees and consultants may only be available to us on a part-time basis. The loss of one or more of our key employees, especially Mr. DiPerna, or our inability to hire and retain other qualified employees, including but not limited to research and development, sales, manufacturing, and administrative support staff, could have a material adverse effect on our business, prospects, results of operations and financial condition.

We have limited internal research and development personnel, making us dependent on consulting relationships.

We consider research and development to be an important part of the process of designing, developing, obtaining regulatory required approvals and the eventual commercialization of our insulin pump. We continue to incur increased research and development expenditures, which are primarily attributable to effort and expenses incurred in designing and developing our innovative insulin pump. We expect to continue to incur substantial costs related to research and development.

12

We will need to outsource and rely on third parties for various aspects relating to the development, manufacture, sales and marketing of our insulin pump as well as in connection with assisting us in the preparation and filing of our FDA submission, and our future success will be dependent on the timeliness and effectiveness of the efforts of these third parties.