As filed with the Securities and Exchange Commission on December 31, 2014February 9, 2023

Registration Statement No. 333-333-269293

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1PRE-EFFECTIVE AMENDMENT NO. 2

TO

FORM S-1/A

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

MOBIQUITY TECHNOLOGIES, INC.

Mobiquity Technologies, Inc.

(NameExact name of registrant as specified in its charter)

| New York | 7373 | |||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer

|

|

35 Torrington Lane Shoreham, NY11786 (516)246-9422 (Address and telephone number of registrant’s principal executive offices) |

Dean L. Julia

|

Chief Executive Officer Mobiquity Technologies, Inc. 35 Torrington Lane Shoreham, NY 11786 (516) 246-9422 (Name, address, including zip code, and telephone number, including area code, of agent for service) |

Copies to:

|

Tel: | Thomas J. Poletti, Esq.

Tel: (714) 312-7500 |

Approximate date of commencement of proposed sale to the public: From time to time

As soon as practicable after the effective date of this registration statement.statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box.xbox: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.o☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.o☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.o☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”filer,” “smaller reporting company” and “smaller reporting“emerging growth company” in Rule 12b-2 of the Exchange Act:Act.

☐ Large accelerated filer | ☐ Accelerated filer | ☒ Non-accelerated filer | ☒ Smaller reporting company | ||

☐Emerging growth company |

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities To Be Registered | Proposed Maximum Price(1)(2) | Amount of Registration Fee | ||

| Common Stock, $0.0001 par value per share(3) | $11,500,000 | $1,336.30 | ||

| Underwriter’s Warrant to Purchase Common Stock(4) | $100 | $0.01 | ||

| Common Stock Underlying Underwriter’s Warrant(5)(6) | $460,000 | $53.46 | ||

| Total | $11,960,100 | $1,389.77 | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

Under Rule 429 of the Securities Act, this Registration Statement also acts as a post-effective amendment to Registration Statement File Number 333-260364 covering 2,807,937 shares of common stock issuable upon the exercise of outstanding publicly held five-year warrants exercisable at $4.98 per share which warrants were issued in December 2021.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until thisthe registration statement shall become effective on such date as the Securities and Exchange Commission acting pursuant to said Section 8(a), may determine.

| Subject to completion | Preliminary Prospectus dated February 9, 2023 |

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated December 31, 2014Mobiquity Technologies, Inc.

P R O S P E C T U S

8,500,000 Shares of Common Stock

and 8,500,000 accompanying Series 2023 Warrants to Purchase 12,750,000 Shares of Common Stock

and 8,500,000 accompanying Series 2023 Warrants to Purchase 12,750,000 Shares of Common Stock

Representative Warrants to Purchase 425,000 Shares of Common Stock

We are sellingoffering in a firm commitment offering 8,500,000 of shares of our common stock, par value $0.0001 per share, together with 8,500,000 warrants to purchase 12,750,000 shares of common stock, (the “Series 2023 Warrants”) at a combined price per share and Series 2023 Warrant of $_____, pursuant to this prospectus. The common stock and Series 2023 Warrants will be sold in a fixed combination, with each share of common stock accompanied by one Series 2023 Warrant to purchase one and one-half shares of common stock. The shares of common stock and Series 2023 Warrants are immediately separable and will be issued separately in this offering, but must be purchased together in this offering. Each Series 2023 Warrant has an exercise price of $_____ per share, will be exercisable upon issuance and will expire on ________, 2028. Additionally, on or after _____, 2023 (i.e. 180 days after the date of this prospectus), in the event that the Nasdaq Capital Market (“Nasdaq CM”) closing price of our common stock equals or exceeds $___ per share (i.e. 400% of the combined public offering price per common share and 2023 Warrant) for a period of at least ten consecutive trading days, then, provided that a current registration statement covering the resale of the shares underlying the 2023 Warrants is in effect, we have the right to redeem the 2023 Warrants on ten days prior written notice at a redemption price of $.001 per 2023 Warrant, subject to the warrant holder’s right to convert at any time through the close of business on the trading date prior to the redemption date.

We are also offering to certain purchasers whose purchase of shares of common stock in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock immediately following the consummation of this offering, the opportunity to purchase, if any such purchaser so chooses, pre-funded warrants, in lieu of shares of common stock that would otherwise result in such purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock. The purchase price of each pre-funded warrant will be equal to the price at which a share of common stock is sold to the public in this offering, minus $0.0001, and the exercise price of each pre-funded warrant will be $0.0001 per share. The pre-funded warrants will be immediately exercisable and may be exercised at any time until all of the pre-funded warrants are exercised in full. The shares of common stock and pre-funded warrants can only be purchased together in this offering but will be issued separately and will be immediately separable upon issuance.

We are also seeking to register the issuance of 425,000 Representative’s warrants to purchase 425,000 shares of Common Stock, plus up to an additional 63,750 Representative’s warrants to purchase 63,750 shares of Common Stock to the underwriter if the underwriter’s over-allotment purchase option is exercised, as a portion of the underwriting compensation payable in connection with this offering, as well as an aggregate of 488,750 shares of Common Stock, issuable upon exercise by the Underwriter of the Representative’s warrants at an exercise price of $___ per share (110% of public offering price). We will receive proceeds from the sale of the securities being registered in this offering which are sold on a firm commitment underwrittenbasis. See “Use of Proceeds” for information about how we will use the proceeds of this offering.

Our common stockThere is quoted onno established public trading market for the OTCQB underSeries 2023 Warrants, pre-funded warrants and the symbol “MOBQ.” WeRepresentative’s warrants and we do not expect a market to develop. Without an active trading market, the liquidity of these warrants will be limited. In addition, we do not intend to apply to list the Series 2023 Warrants, pre- funded warrants or the Representative’s warrants on The Nasdaq Capital Market (“Nasdaq CM”), any other national securities exchange or any other trading system. On February 8, 2023, the last quoted price of our common stock as reported on the NYSE MKT with such listing to commence upon the closing of this offering. No assurances can be given thatNasdaqCM was $0.50 per share. There is a limited public trading market for our applicationcommon stock.

The final combined public offering price per share and Series 2023 Warrant will be approved. On December 18, 2014,determined through a negotiation between us and the last reported saleunderwriters in the offering and will take into account the recent market price of our common stock, the general condition of the securities market at the time of the offering, the history of, and the prospects for, the industry in which we compete, and our past and present operations and our prospects for future revenues. The final combined offering price for the securities may be at a discount to the trading price of our common stock on the OTCQB was $3.50NasdaqCM. This price will fluctuate based on the demand for our common stock. The assumed public offering price used throughout this prospectus may not be indicative of the actual final offering price. The final number of shares, Series 2023 Warrants, pre-funded warrants, Representative warrants and shares underlying the warrants being offered in this prospectus will be determined based on the final combined offering price.

This Prospectus also relates to the possible issuance of 2,807,937 shares upon exercise of five year warrants, exercisable at $4.98 per share, after giving retroactive effect towhich we issued in a presumed one-for-ten reverse stock split to be completed prior to the effectiveness of thepublic offering December 2021 (the “2021 Warrants”) along with other securities. The registration statement, of which this prospectus is a part.part, acts as a post-effective amendment to Registration Statement which registered 2021 Warrants and underlying shares. Our common stock and 2021 Warrants are listed on The NasdaqCM under the symbols “MOBQ” and “MOBQW”, respectively.

Our business and an investmentInvesting in our common stock involve significant risks. These risks are described under the caption “Risk Factors”involves a high degree of risk. See “Risk Factors” beginning on page 86 of this prospectus.

The underwriter may also exercise its option to purchase up to an additional shares of common stock from us, at the public offering price, less the underwriting discount and commissions, for 30 days after the date of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacydetermined if this prospectus is truthful or accuracy of this prospectus.complete. Any representation to the contrary is a criminal offense.

| Per Share and Series 2023 Warrants | Per Pre-Funded Warrant and Series 2023 Warrants | Total | |||

| Public offering price | |||||

| Underwriters discounts and commissions(1) | |||||

| Proceeds to us, before expenses(2) |

The underwriter expects

(1) We have agreed to deliverpay the underwriters a total cash fee equal to 8% of the gross proceeds raised in this offering. We have also agreed to reimburse the underwriters for certain of its offering-related expenses of up to $214,900 plus 1% of the gross proceeds of this offering. In addition, we have agreed to issue the Representative Warrants to purchase up to a number of shares of our common stock equal to 5% of the aggregate number of shares of common stock and pre-funded warrants being offered at an exercise price equal to purchasers on or about , 2015.110% of the public offering price of the shares common stock. See “Plan of Distribution” for additional information and a description of the compensation payable to the underwriters.

National Securities Corporation(2) We estimate the total expenses of this offering payable by us, excluding the underwriters’ discount, will be approximately $500,000.

TheWe have granted the underwriters an option for a period of 45 days from the date of this prospectus is to purchase up to an additional 1,275,000 shares of common stock (or pre-funded warrants in lieu of shares), 2015.together with 1,275,000 Series 2023 Warrants to purchase 1,912,500 shares of common stock, at a combined offering price of $___ per share and Series 2023 Warrant (110% of the combined public offering price per share and warrants), less the underwriting discount, solely to cover over-allotments, if any.

We anticipate that delivery of the securities against payment will be made on or about ________, 2023.

Prospectus dated , 2023

![]()

TABLE OF CONTENTS

We and the underwriters have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in is accurate only as of its date regardless of the time of delivery of this prospectus or of any sale of common stock.

| ||||

For investors outside the United States: neitherNeither we nor the underwriter hasunderwriters have done anything that would permit this offering or possession or distribution of this prospectus or any free writing prospectus we may provide to you in connection with this offering in any jurisdiction where action for that purpose is required, other than in the United States. YouPersons who come into possession of this prospectus and any free writing prospectus in jurisdictions outside the United States are required to inform yourselvesthemselves about and to observe any restrictions relatingas to this offering and the distribution of this prospectus and any such free writing prospectus outsideapplicable to that jurisdiction.

This prospectus contains market data and industry statistics and forecasts that are based on independent industry publications and other publicly available information. Although we believe that these sources are reliable, we do not guarantee the accuracy or completeness of the United States.

Wethis information and we have not independently verified this information. Although we are not aware of any misstatements regarding the market and industry data presented, these estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the underwriter has not, authorized any other person to provide you with different information than that contained in this prospectusheading “Risk Factors” and any related free writing prospectus that we may provide to you in connection with this offering. If anyone provides you with different or inconsistent information, youprospectus. Accordingly, investors should not relyplace undue reliance on it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.information.

Unless otherwise indicated, information contained in this prospectus concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity and market size, is based on information from various sources, on assumptions that we have made that are based on those data and other similar sources and on our knowledge of the markets for our services. These data involve a number of assumptions and limitations. We have not independently verified the accuracy of any third party information. In addition, projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate is necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors’ and elsewhere in this prospectus. These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

TABLE OF CONTENTS

| i |

PROSPECTUS SUMMARY

This summary provides an overview of selectedhighlights information contained elsewhere in this prospectus andprospectus. Because this is only a summary, it does not contain all of the information that may be important to you. You should read this entire prospectus and should consider, among other things, the matters set forth under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes thereto appearing elsewhere in this prospectus before making your investment decision. This prospectus contains forward-looking statements and information relating to Mobiquity Technologies, Inc. See “Cautionary Statement Regarding Forward-Looking Statements” on page 27.

Our Company

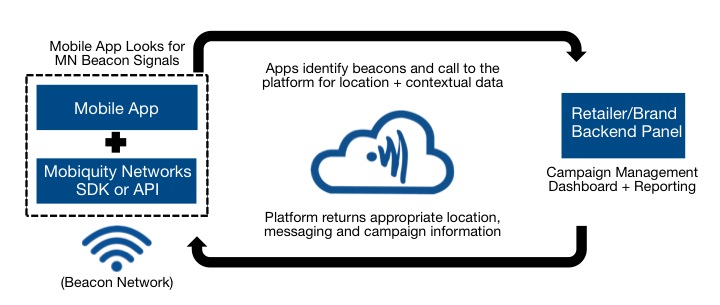

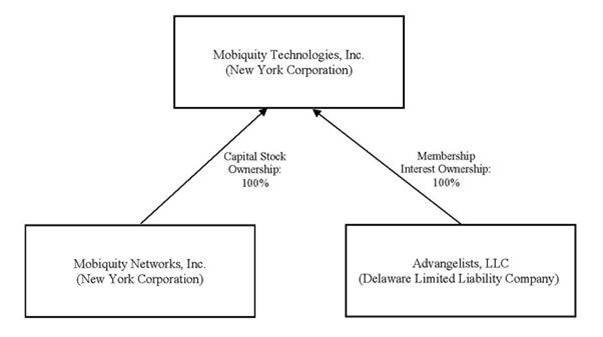

We are a next-generation advertising technology, data compliance and intelligence company which operates through our three proprietary software platforms in the programmatic advertising industry.

The Programmatic Advertising Industry

Programmatic advertising refers to the automated buying and selling of digital ad space. In contrast to manual advertising, which relies on human interaction and negotiation between publishers and marketers, programmatic ad buying harnesses technology to purchase digital display space. This use of software and algorithms helps streamline ad buying processes, which is why programmatic has become one of the most indispensable digital marketing tools worldwide. According to Statista, in 2021, global programmatic ad spend reached an estimated 418.4 billion U.S. dollars, with spending set to surpass 493 billion by 2022. The United States remains the leading programmatic advertising market worldwide.

Our Mission

Our mission is to help enterprises in the programmatic industry become more efficient and effective regarding the monetization of advertising, audience segments and data compliance. We do this by offering three proprietary solutions: Our ATOS platform for brands and agencies, our data intelligence platform for audience segments and targeting, and our publisher platform for privacy compliance and publisher monetization.

Our Opportunity

Due to the recent changes to Privacy Laws, such as GDPR and CCPA, along with Apple and Google’s removal of Identifiers, we believe Publishers are facing two significant issues: increasing costs due to privacy compliance laws and decreasing revenue, due to the lack of audience targeting. We believe there is a major paradigm shift occurring in the market, where user data and the targeting intelligence to use it must shift from middlemen directly to the content publishers. Publishers must own their first party data and manage their audiences segments in-house. We believe that irrespective of whether a publisher chooses to work with us or not, they need to find a solution that allows advertisers to buy directly from them.

Our Solutions

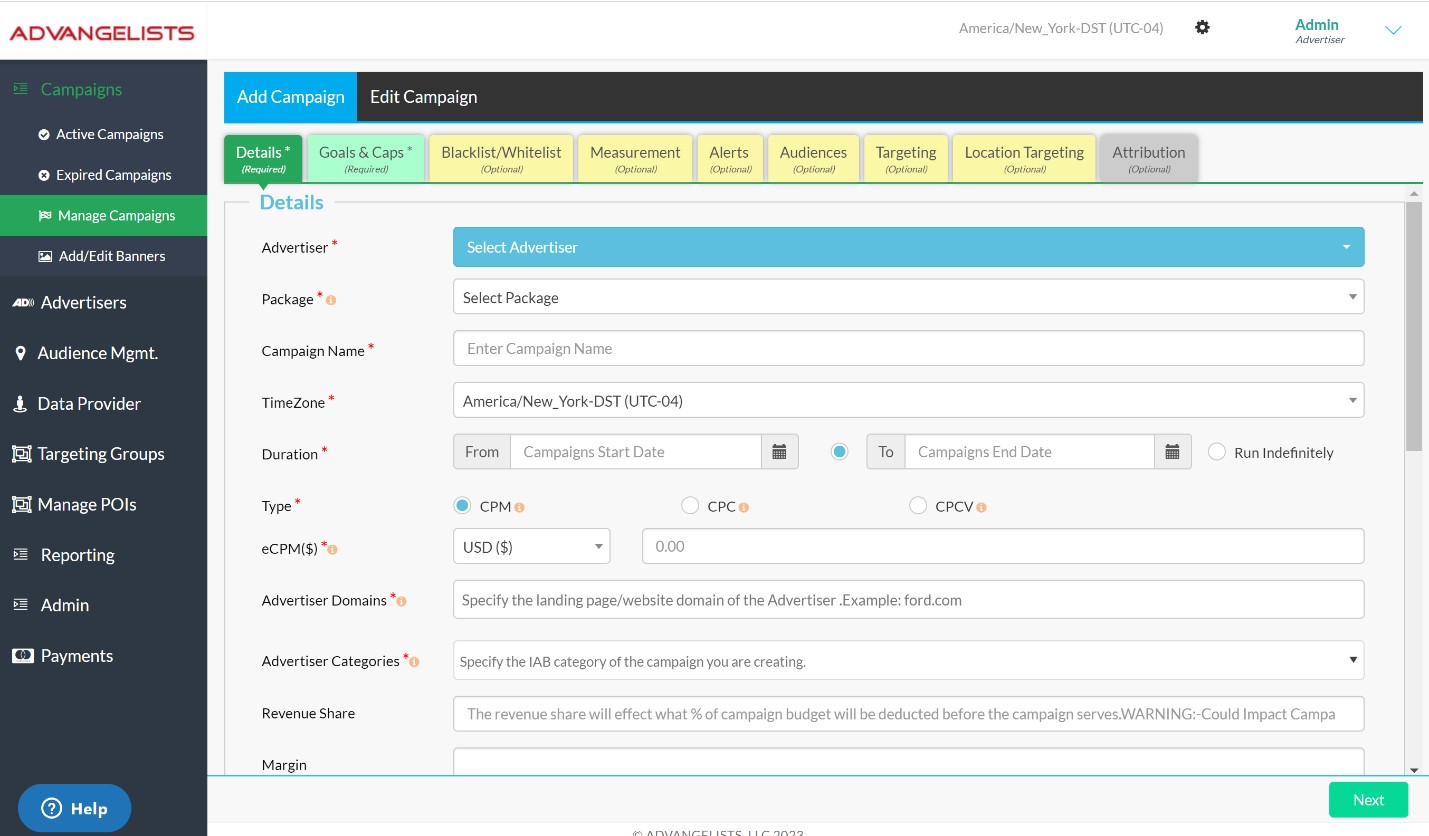

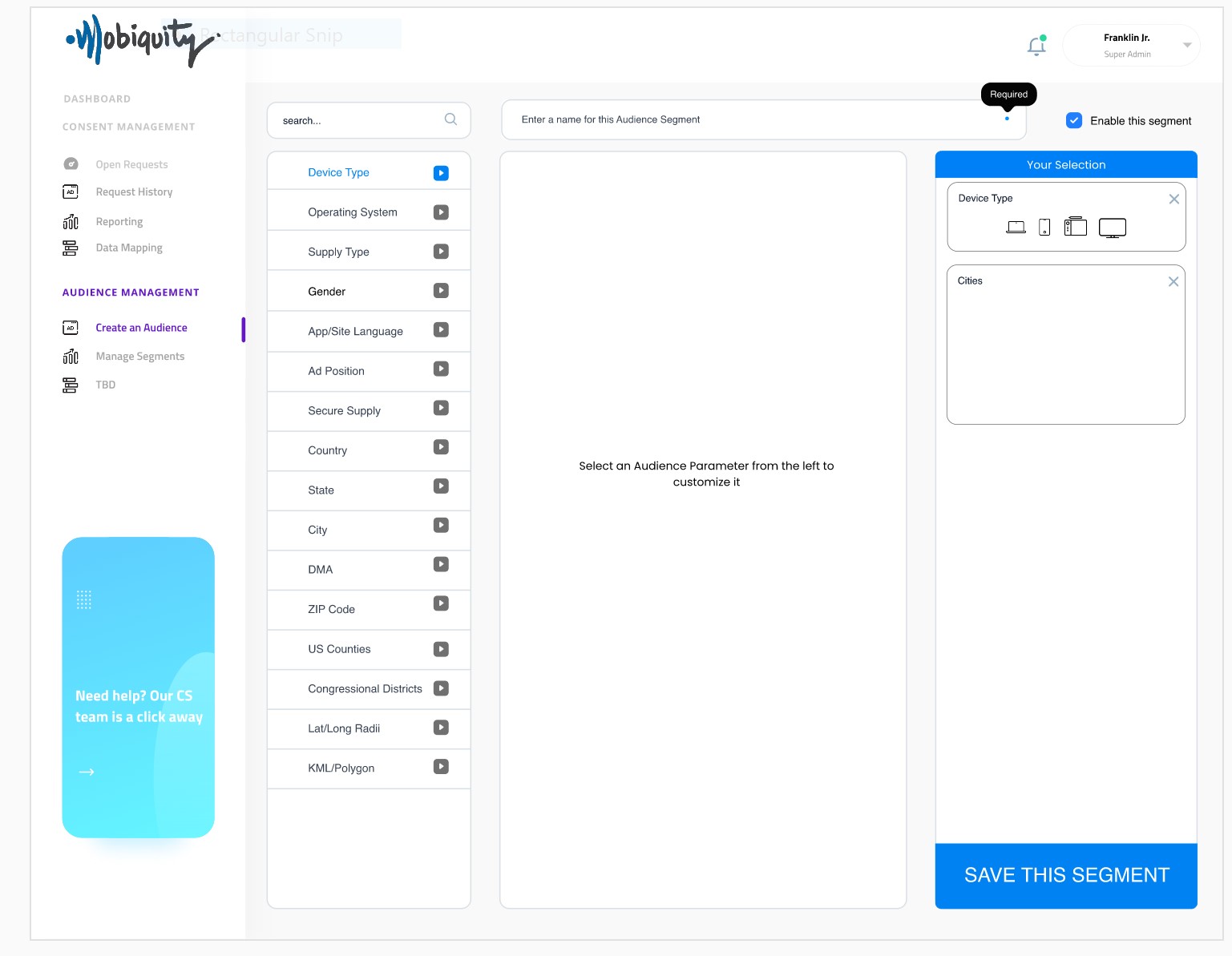

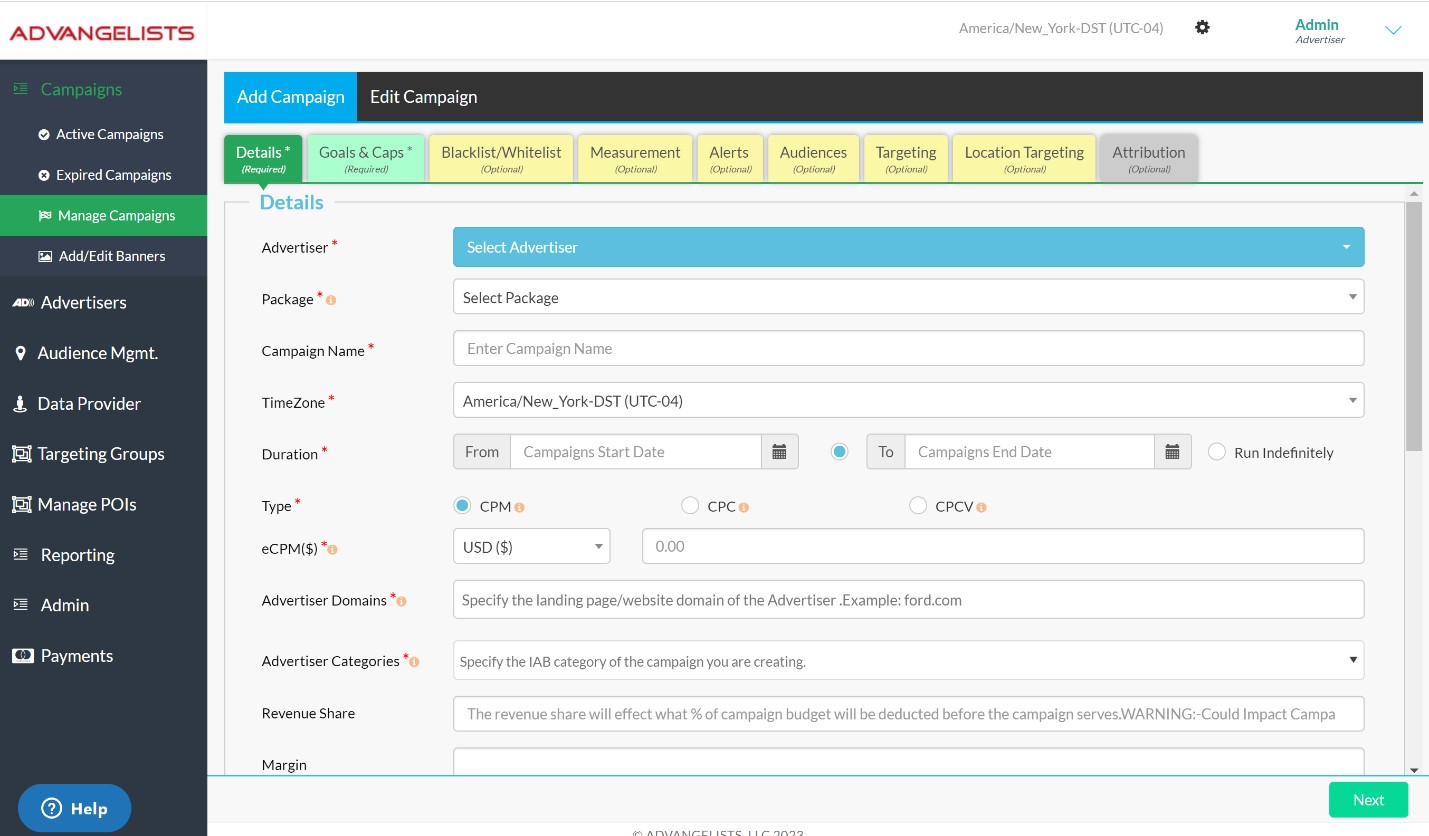

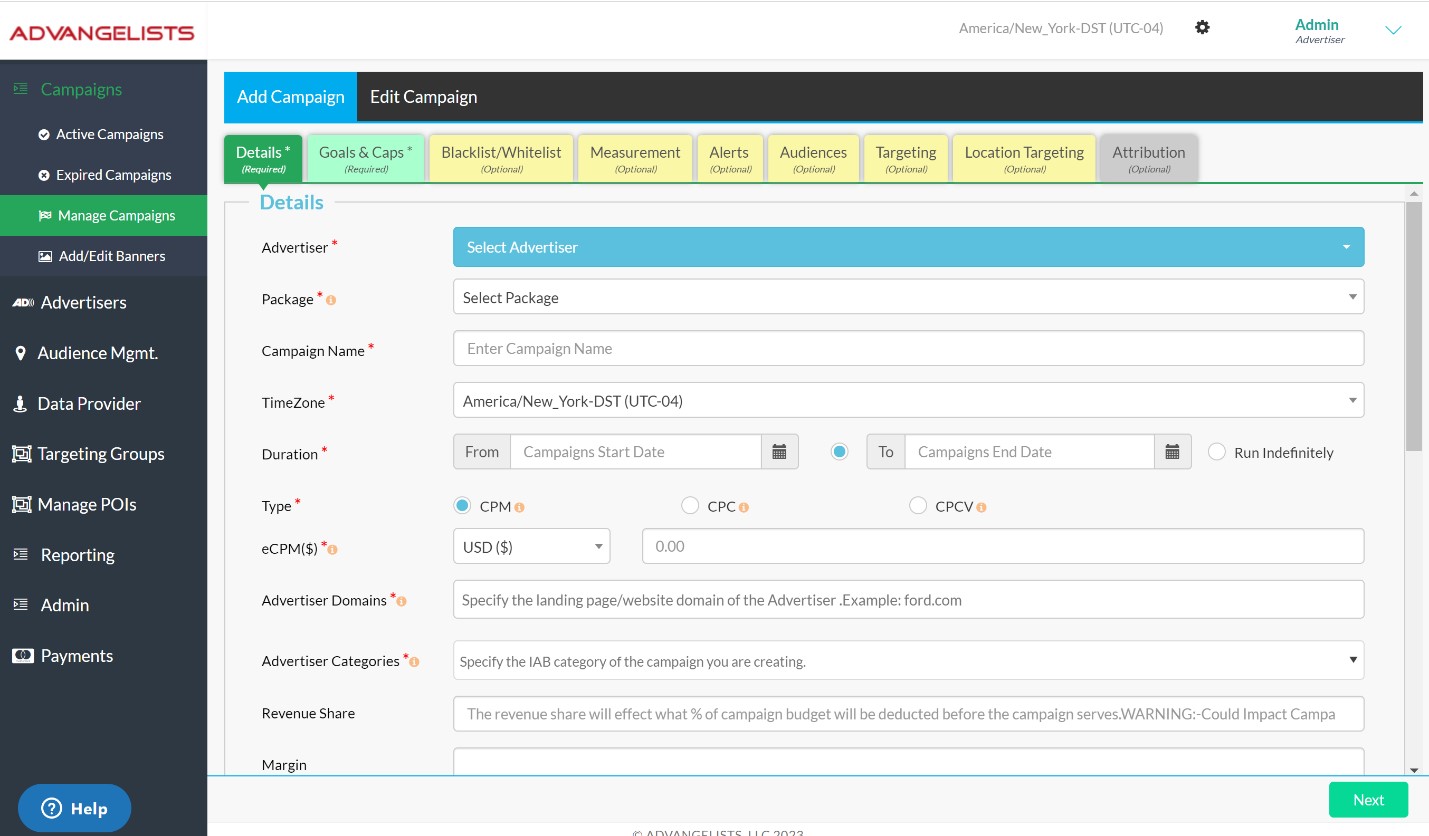

Programmatic Advertising Platform

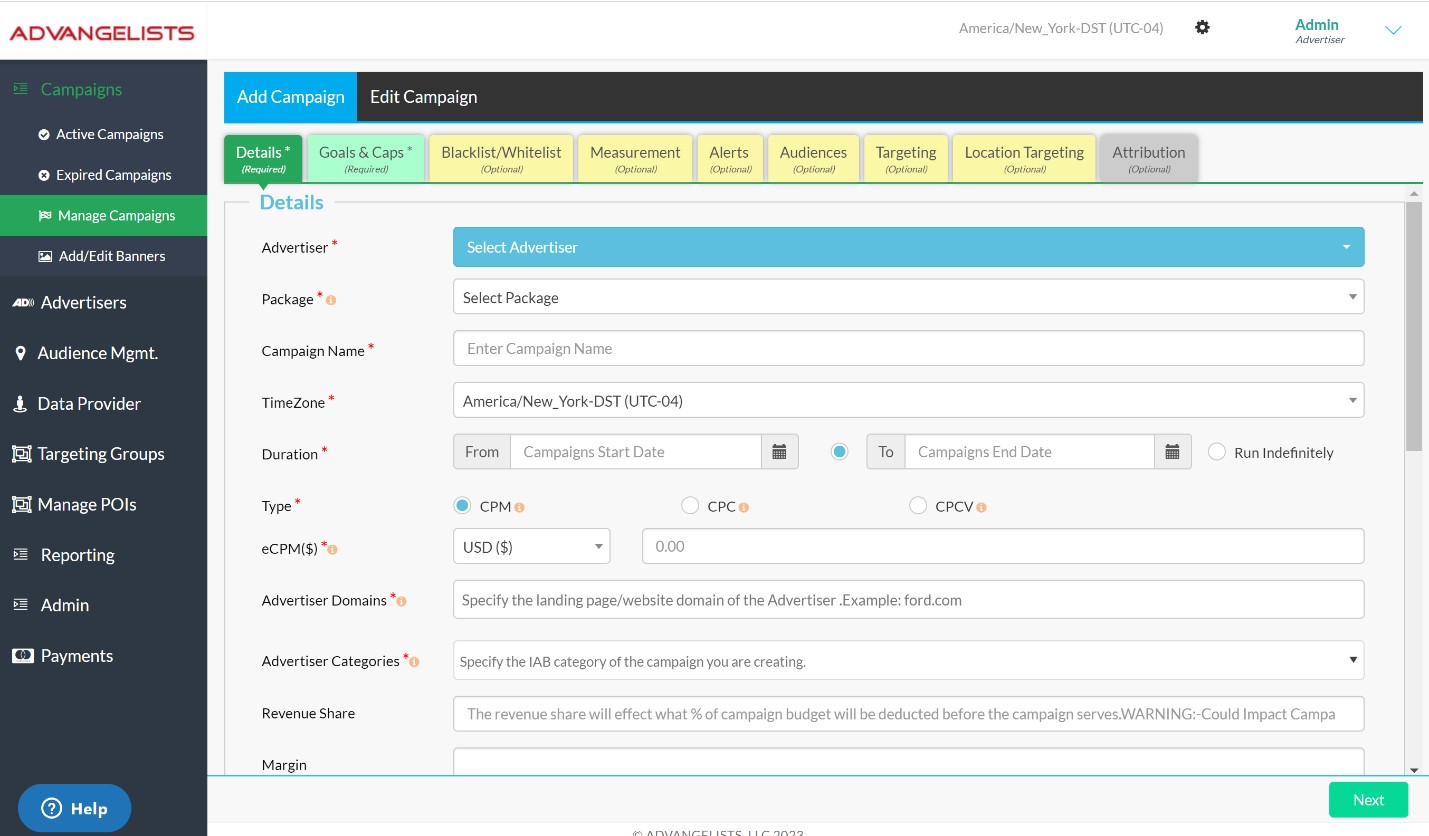

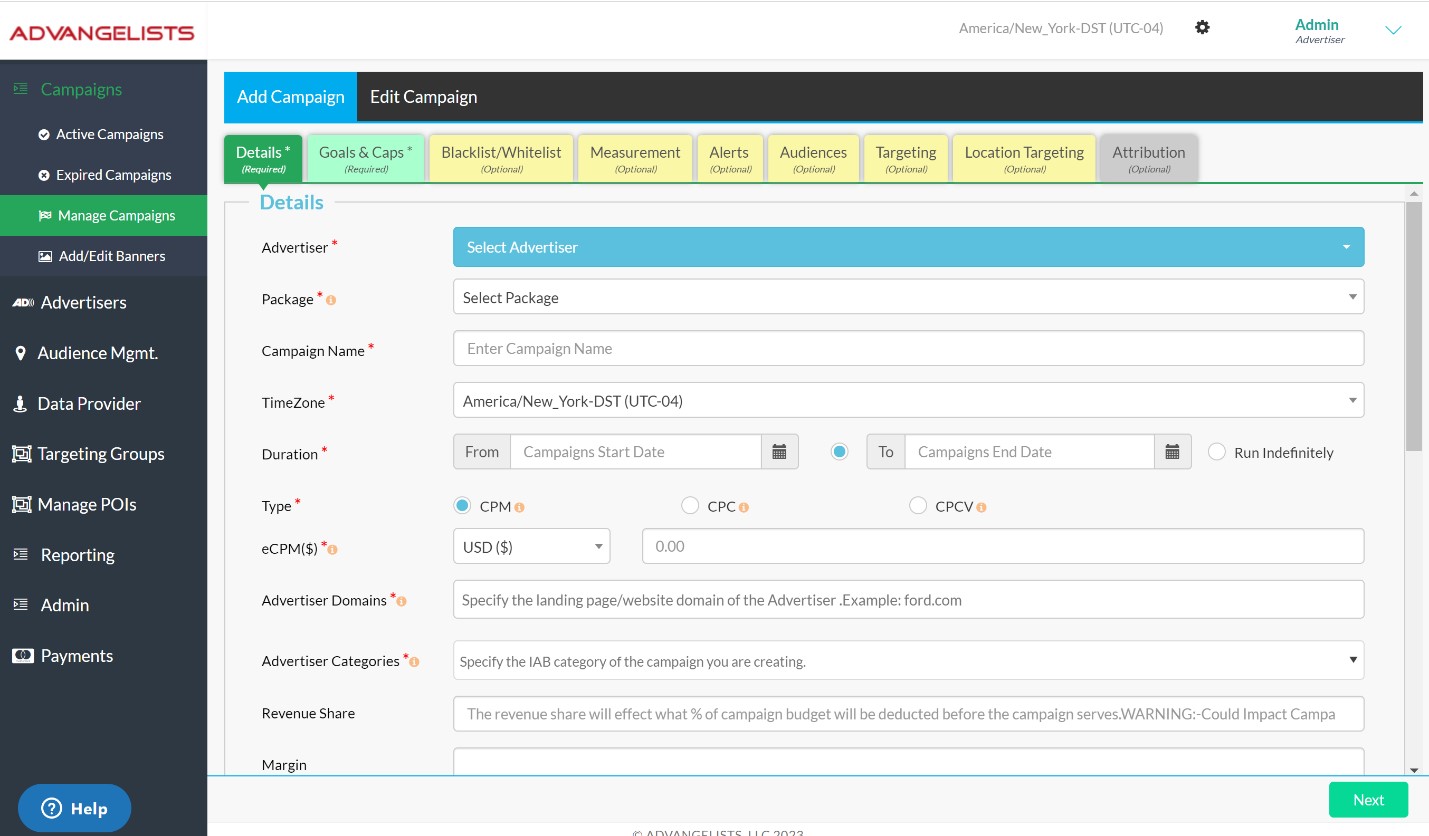

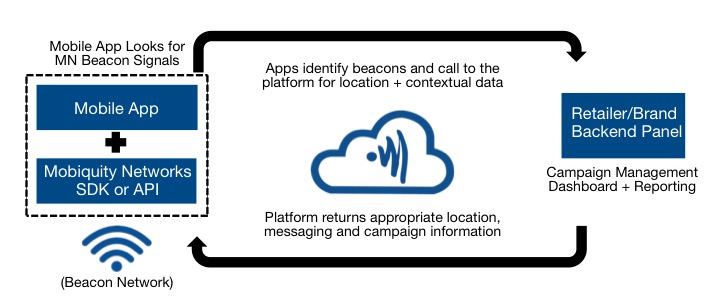

Our advertising technology operating system (or ATOS) platform is a single-vendor end-to-end solution that blends artificial intelligence (or AI) and machine learning (or ML)-based optimization technology that automatically serves advertising and manages digital advertising campaigns. Our ATOS platform engages with approximately 10 billion advertisement opportunities per day.

| 1 |

As an automated programmatic ecosystem, ATOS increases speed and performance, by providing dynamic technology that scales in real-time. It is this proprietary cloud-based architecture that keeps costs down and allows us to pass along savings to our customers. Also, by offering more of the features inherent in a digital advertising campaign, and removing the need for third-party integration of those features, we believe that our ATOS platform can be substantially more time efficient and cost efficient than other Demand-Side Platforms (or DSPs). Our ATOS platform also decreases the effective cost basis for users by integrating all the necessary capabilities at no additional cost as compared to the costs to outsource these capabilities to one or more providers in a fragmented ecosystem. DSP and bidding technologies, AdCop™ Fraud Protection, rich media and ad serving, attribution, reporting dashboard and DMP are all included in our ATOS platform.

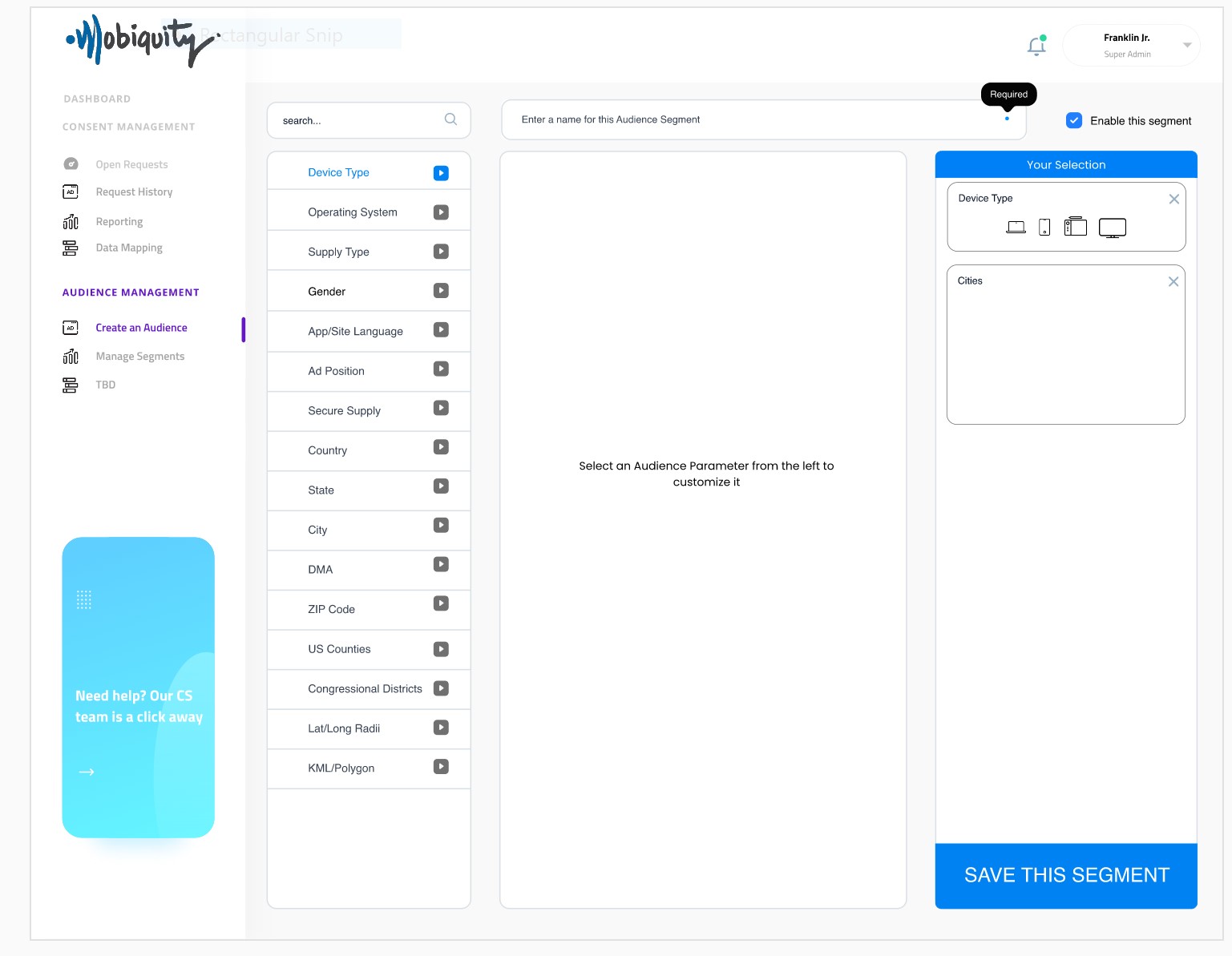

Data Intelligence Platform

Our data intelligence platform provides precise data and insights on consumer’s real-world behavior and trends for use in marketing and research. Our management believes, based our experience in the industry, that we provide one of the most accurate and scaled solution for data collection and analysis, utilizing multiple internally developed proprietary technologies.

We provide our data intelligence platform to our customers on a managed services basis, and also offer a self-service alternative through our MobiExchange product, which is a software-as-a-service (or SaaS) fee model. MobiExchange is a data-focused technology solution that enables users to rapidly build actionable data and insights for its own use. MobiExchange’s easy-to-use, self-service tools allow anyone to reduce the complex technical and financial barriers typically associated with turning offline data, and other business data, into actionable digital products and services. MobiExchange provides out-of-the box private labeling, flexible branding, content management, user management, user communications, subscriptions, payment, invoices, reporting, gateways to third party platforms, and help desk, among other things.

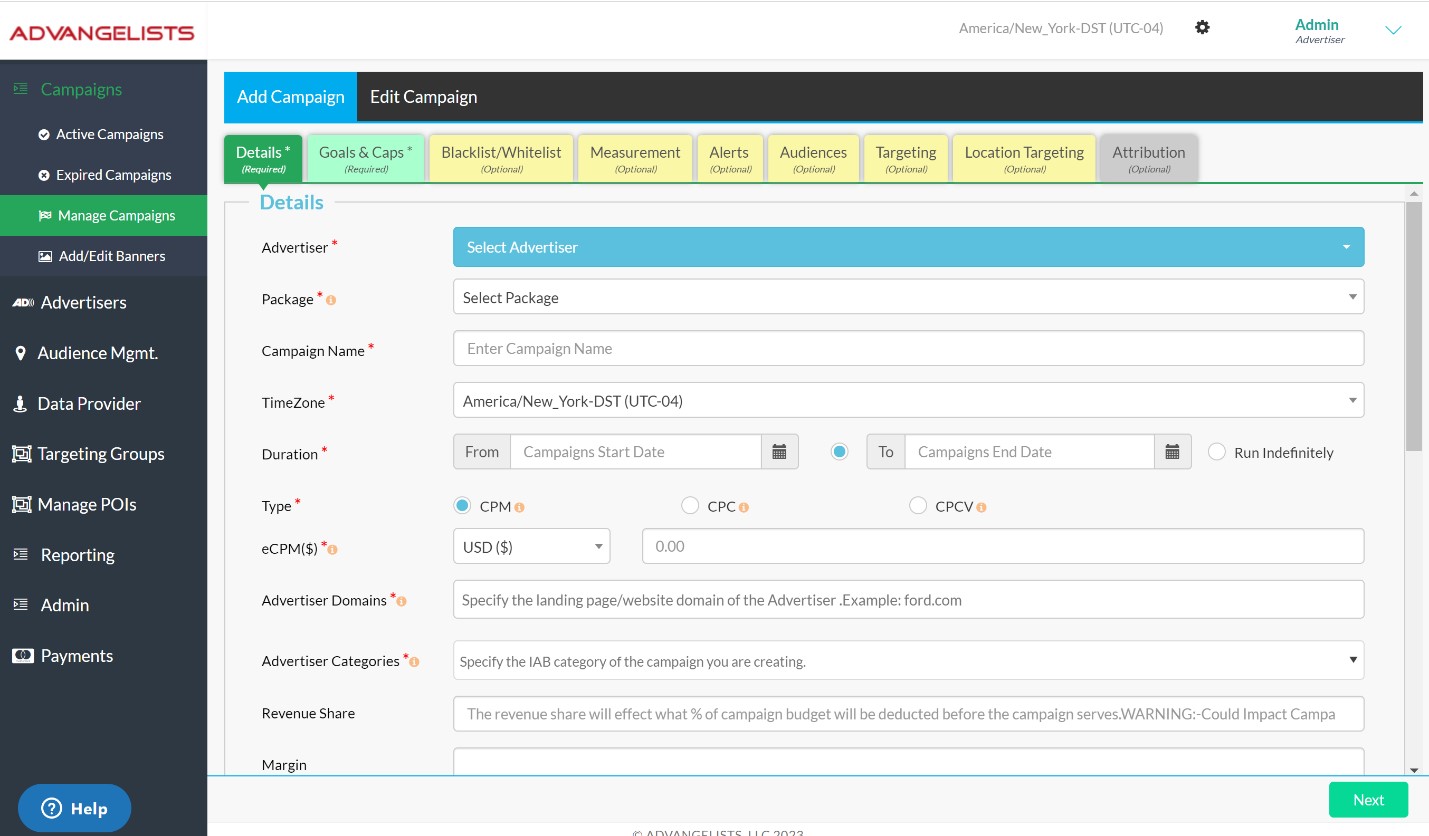

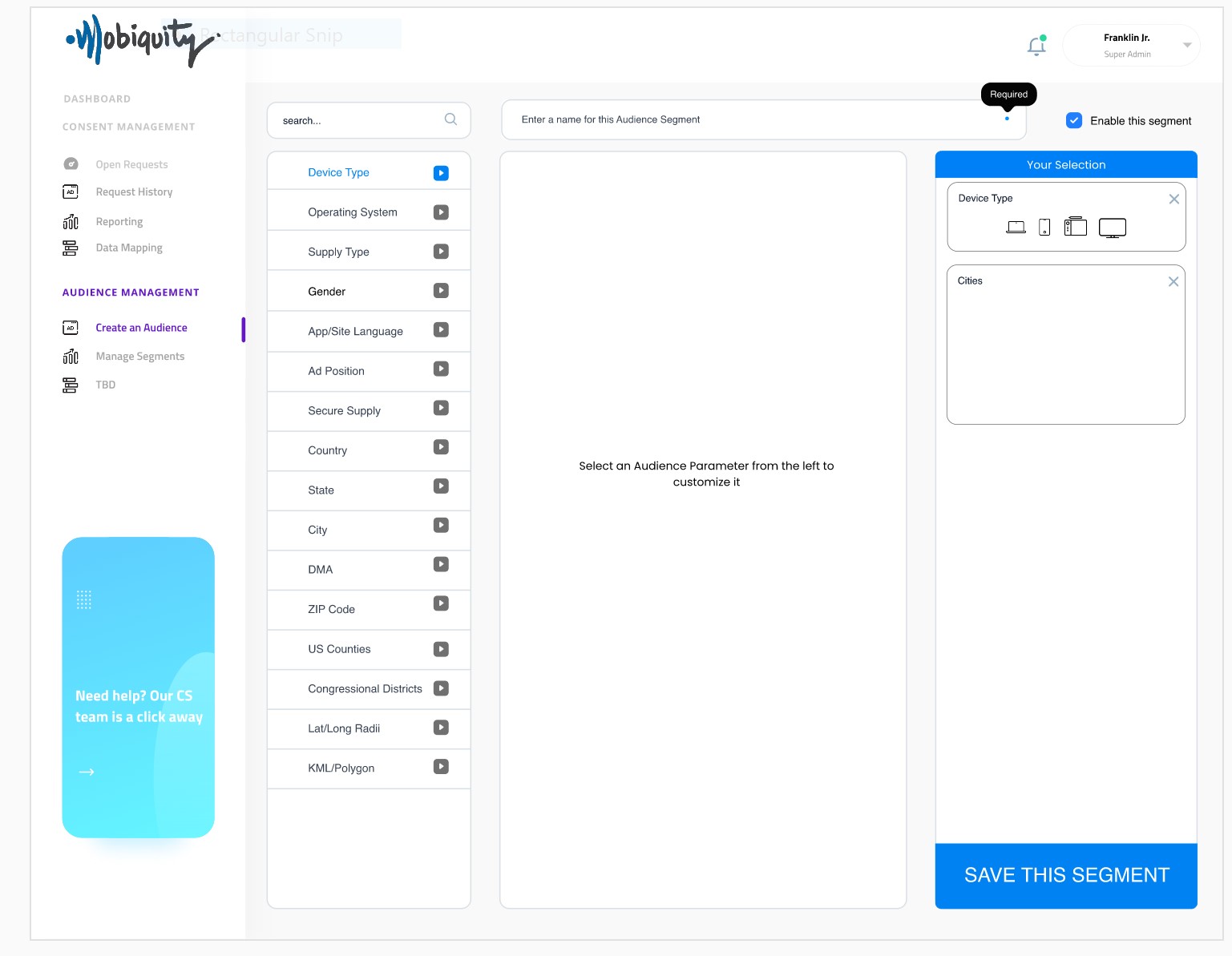

Publisher Platform for Monetization and Compliance

Our content publisher platform is a single-vendor ad tech operating system that allows publishers to better monetize their opt-in user data and advertising inventory. The platform includes tools for: consent management, audience building, a direct advertising interface and inventory enhancement. Our publisher platform provides content publishers the functionality to use its user identifier data to create inventories of profiled data segments and to target audiences with advertising using that data, in a data privacy compliant manner.

Our Revenue Sources

We target publishers, brands, advertising agencies and other advertising technology companies as our audience for our three platform products. Our sales and marketing strategy is focused on providing a de-fragmented operating system that facilitates a considerably more efficient and effective way for advertisers and publishers to transact with each other. Our goal is to become the programmatic display advertising industry standard for small and medium sized advertisers. We generate revenue from our platforms through two verticals:

| · | The first is licensing one or more of our platforms as a white-label product for use by advertising agencies, demand-side platforms (or DSP’s), brands and publishers. Under the white-label scenario, the user licenses a platform from us and is responsible for running its own business operations and is billed a percentage of amounts spent on advertising run through the platform. | |

| · | The second revenue stream is a managed services model, in which, the user is billed a higher percentage of revenue run through a platform, but all services are managed by us. |

| 2 |

Risk Factors

Investing in our securities involves risks. You should carefully consider the risks described in the “Risk Factors” section beginning on page 6 before making a decision to invest in our securities. If any of these risks actually occur, our business, financial condition and/or results of operations would likely be materially adversely affected. In each case, the trading price of our securities would likely decline, and you may lose all or part of your investment. We have engaged Spartan Securities Capital LLC, as Representative of the underwriters, to act as our underwriters in connection with this offering on a firm commitment basis. We will bear all costs associated with the offering. See “Plan of Distribution” on page __ of this prospectus for more information regarding these arrangements. The following is a summary of some of the additional principal risks we face:

| · | We have a history of operating losses and our management has concluded that factors raise substantial doubt about our ability to continue as a going concern and our auditor has included an explanatory paragraph relating to our ability to continue as a going concern in its audit report for the past several fiscal years. | |

| · | We cannot predict our future capital needs and we may not be able to secure additional financing. | |

| · | The Company’s financial condition and results of operations have been and may continue to be adversely affected by the COVID-19 pandemic. | |

| · | The reliability of our product solutions is dependent on data from third-parties and the integrity and quality of that data. | |

| · | Our business practices with respect to data and consumer protection could give rise to liabilities or reputational harm as a result of governmental regulation, legal requirements or industry standards relating to consumer privacy, data protection and consumer protection. | |

| · | We face intense and growing competition, which could result in reduced sales and reduced operating margins, and limit our market share. | |

| · | The market for programmatic advertising campaigns is relatively new and evolving. If this market develops slower or differently than we expect, our business, growth prospects and financial condition would be adversely affected. | |

| · | If we fail to innovate and make the right investment decisions in our offerings and platform, we may not attract and retain advertisers and publishers and our revenue and results of operations may decline. | |

| · | We need to protect our intellectual property or our operating results may suffer. | |

| · | Our business practices with respect to data and consumer protection could give rise to liabilities or reputational harm as a result of governmental regulation, legal requirements or industry standards relating to consumer privacy, data protection and consumer protection. | |

| · | Our failure to recruit or the loss of management and highly trained and qualified personnel could adversely affect our operations. | |

| · | Our substantial amount of indebtedness may adversely affect our cash flow and our ability to operate our business, and make payments on our indebtedness. | |

| · | We currently have identified significant deficiencies in our internal control over financial reporting that, if not corrected, could result in material misstatements of our financial statements. | |

· | There is a very limited public trading market for our common stock and 2021 Warrants; therefore, our investors may not be able to sell their shares and the price of our common stock may fluctuate substantially. Further, there is can be no assurances that an established trading market will develop. | |

| · | We will likely need to seek additional equity or debt financing even following this offering to provide the capital required to maintain or expand our operations and to satisfy indebtedness. If we are unable to raise additional capital in sufficient amounts or on terms acceptable to us, we could be substantially harmed, and it could lead to the termination of our business. |

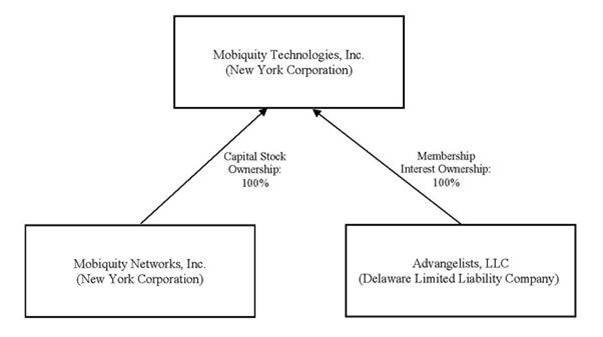

Corporate Information

We are based in New York and were incorporated in New York on March 16, 1998.

Our principal executive offices are located at 35 Torrington Lane, Shoreham, NY 11786. Our telephone number is (516) 246-9422, and our website is www.mobiquitytechnologies.com.

Our website and the information contained therein, or connected thereto, are not intended to be incorporated into this Registration Statement on Form S-1.

| 3 |

THE OFFERING

Securities Offered by Us

8,500,000 shares of common stock and 8,500,000 accompanying Series 2023 Warrants to purchase 12,750,000 shares of common stock, and 8,500,000 pre-funded warrants to purchase 8,500,000 shares of common stock and accompanying Series 2023 Warrants to purchase 12,750,000 shares of common stock. The shares of common stock or pre-funded warrants, respectively, and accompanying Series 2023 Warrants are immediately separable and will be issued separately in this offering, but must initially be purchased together in this offering. Each Series 2023 Warrant has an exercise price of $______ per share of common stock, is immediately exercisable and will expire five years from the date of the issuance. Additionally, on or after _____, 2023 (i.e. 180 days after the date of this prospectus), in the event that the Nasdaq CM closing price of our common stock equals or exceeds $___ per share (i.e. 400% of the combined public offering price per common share and 2023 Warrant) for a period of at least ten consecutive trading days, then, provided that a current registration statement covering the resale of the shares underlying the 2023 Warrants is in effect, we have the right to redeem the 2023 Warrants on ten days prior written notice at a redemption price of $.001 per 2023 Warrant, subject to the warrant holder’s right to convert at any time through the close of business on the trading date prior to the redemption date. See “Description of Securities sold in the Offering”. We are also registering 8,500,000 shares of common stock issuable upon exercise of the pre-funded warrants, and 12,750,000 shares of common stock issuable upon exercise of the Series 2023 Warrants. This Prospectus also covers the possible exercise of five-year 2021 Warrants to purchase 2,807,937 shares exercisable at $4.98 per share which were issued in December 2021 under Registration Statement File Number 333-260364.

Pre-Funded Warrants Offered

We are also offering to certain purchasers whose purchase of shares of common stock in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock immediately following the closing of this offering, the opportunity to purchase, if such purchasers so choose, pre-funded warrants to purchase shares of common stock, in lieu of shares of common stock that would otherwise result in any such purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock. Each pre-funded warrant will be exercisable for one share of our common stock. The purchase price of each pre-funded warrant and accompanying Series 2023 Warrants (as described below) will be equal to the price at which a share of common stock and accompanying Series 2023 Warrants is being sold to the public in this offering, minus $0.0001, and the exercise price of each pre-funded warrant will be $0.0001 per share. The pre-funded warrants will be exercisable immediately and may be exercised at any time until all of the pre-funded warrants are exercised in full. This offering also relates to the shares of common stock issuable upon exercise of any pre-funded warrants sold in this offering. For each pre-funded warrant we sell, the number of shares of common stock we are offering will be decreased on a one-for-one basis. See “Description of Securities sold in the Offering”.

Firm Commitment Basis

We are offering the shares of common stock (and pre-funded warrants to purchase shares of common stock in lieu of shares of common stock) and Series 2023 Warrants on a firm commitment basis at a combined public offering price of $__ per share and Series 2023 Warrant We have granted the underwriters an option for a period of 45 days from the date of this prospectus to purchase up to an additional 1,275,000 shares of common stock (or pre-funded warrants in lieu thereof) together with 1,275,000 Series 2023 Warrants to purchase 1,912,500 shares of common stock at a combined offering price of $___ per share and Series 2023 Warrant (110% of the combined public offering price per share), less the underwriting discount, solely to cover over-allotments, if any.

Common Stock Outstanding Prior to this Offering

9,834,366 shares as of February 6, 2023.

| 4 |

Common Stock to be Outstanding After this Offering

18,334,366 shares assuming full exercise or non-issuance of the pre-funded warrants, but no exercise of the Series 2023 Warrants issued in this offering or the Representative Warrants issued to the underwriters or the exercise of the 2021 Warrants. The foregoing number of shares of common stock do not include the possible exercise of other outstanding options and warrants or the conversion of outstanding preferred stock. Unless we indicate otherwise, all information in this prospectus:

· | excludes 1,162,721 shares of our common stock issuable upon exercise of outstanding stock options by the members of our board of directors and third parties at a weighted average exercise price of $16.16 per share as of January 6, 2023; | |

| · | excludes 2,613,636 shares of our common stock issuable upon exercise of warrants issued to our secured lender at an exercise price of $.44 per share; | |

| · | excludes 2,807,937 shares of our common stock issuable upon exercise of outstanding 2021 Warrants held by investors at an exercise price of $4.98 per share as of January 6, 2023; | |

| · | excludes 74,458 shares of common stock issuable upon the full exercise of the warrants at an exercise price of $5.1875 per share we granted to Spartan as an underwriter of our 2021 public offering; | |

| · | excludes 1,800,155 shares of our common stock issuable upon the exercise of other warrants that are outstanding as of the date of this prospectus exercisable at an average exercise price of $25.86 per share; and | |

| · | excludes 162,073 shares issuable upon conversion of outstanding Preferred Stock. |

Except as otherwise indicated herein, all information in this prospectus assumes, no exercise of the warrants or Representative Warrants issued in this offering, and no exercise of options issued under our Plans or of warrants described above.

Use of Proceeds

We estimate that our net proceeds from this offering, assuming all securities offered by means of this prospectus are sold, will be approximately $_____ million, after deducting the estimated underwriters’ fees and commissions and estimated offering expenses payable by us. We intend to use the net proceeds of this offering for continuing operating expenses and general working capital.

Risk Factors

See “Risk Factors” beginning on page 6 of this prospectus, as well as other information included in this prospectus, for a discussion of factors you should read and consider carefully before investing in our securities.

NasdaqCMs Symbols

Our common stock and 2021 Warrants are listed on The NasdaqCM under the symbols “MOBQ” and “MOBQW”, respectively. There is no established trading market for the Series 2023 Warrants or the pre-funded warrants, and we do not expect a trading market to develop. We do not intend to list the Series 2023 Warrants or the pre-funded warrants on any securities exchange or other trading market. Without a trading market, the liquidity of the Series 2023 Warrants and pre-funded warrants will be extremely limited.

| 5 |

RISK FACTORS

An investment in our securities is highly speculative, involves a high degree of risk and should be made only by investors who can afford a complete loss. If any of the following risks actually occurs, then our business, financial condition or results of operations could be materially adversely affected, the trading of our common stock and 2021 Warrants could decline, and you may lose all or part of your investment therein. In addition to the risks outlined below, risks and uncertainties not presently known to us or that we currently consider immaterial may also impair our business operations. Potential risks and uncertainties that could affect our operating results and financial condition include, without limitation, the following:

Risks Relating to our Business Operations

We have a history of operating losses, and our management has concluded that factors raise substantial doubt about our ability to continue as a going concern and our auditor has included an explanatory paragraph relating to our ability to continue as a going concern in its audit report for the past several fiscal years.

To date, we have not been profitable and have incurred significant losses and cash flow deficits. For the nine months ended September 30, 2022 and the fiscal years ended December 31, 2021, and 2020, we reported net losses of $ 5,721,201, $18,333,383 and $11,745,835 (as restated), respectively, and net cash used in operating activities of $5,502,991, $6,717,324 and $3,286,764 (as restated), respectively. As of September 30,2022, we had an aggregate accumulated deficit of $208,236,095. Our operating losses for the past several years are primarily attributable to the transformation of our company into an advertising technology corporation. We can provide no assurances that our operations will generate consistent or predictable revenue or be profitable in the foreseeable future. Our management has concluded that our historical recurring losses from operations and negative cash flows from operations as well as our dependence on private equity and other financings raise substantial doubt about our ability to continue as a going concern, and our auditor has included an explanatory paragraph relating to our ability to continue as a going concern in its audit report for the past several fiscal years.

Our consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty. These adjustments would likely include substantial impairment of the carrying amount of our assets and potential contingent liabilities that may arise if we are unable to fulfill various operational commitments. In addition, the value of our securities, including common stock issued in this offering, would be greatly impaired. Our ability to continue as a going concern is dependent upon generating sufficient cash flow from operations and obtaining additional capital and financing, including funds to be raised in this offering. If our ability to generate cash flow from operations is delayed or reduced and we are unable to raise additional funding from other sources, we may be unable to continue in business even if this offering is successful. For further discussion about our ability to continue as a going concern and our plan for future liquidity.

We cannot predict our future capital needs and we may not be able to secure additional financing.

From January 2013 through December 2022, we raised a total of over $60 million in private equity and debt financing to support our transformation from an integrated marketing company to a technology company. Since we might be unable to generate recurring or predictable revenue or cash flow to fund our operations, we will likely need to seek additional (perhaps substantial) equity or debt financing even following this offering to provide the capital required to maintain or expand our operations. We expect that we will also need additional funding for developing products and services, increasing our sales and marketing capabilities, and acquiring complementary companies, technologies and assets (there being no such acquisitions which we have identified or are pursuing as of the date of this prospectus), as well as for working capital requirements and other operating and general corporate purposes. We cannot predict our future capital needs with precision, and we may not be able to secure additional financing on terms satisfactory to us, if at all, which could lead to termination of our business.

If we elect to raise additional funds or additional funds are required, we may seek to raise funds from time to time through public or private equity offerings, debt financings or other financing alternatives. Additional equity or debt financing may not be available on acceptable terms, if at all. If we are unable to raise additional capital in sufficient amounts or on terms acceptable to us, we will be prevented from pursuing operational development and commercialization efforts and our ability to generate revenues and achieve or sustain profitability will be substantially harmed.

| 6 |

If we raise additional funds by issuing equity securities, our shareholders will experience dilution. Debt financing, if available, would result in increased fixed payment obligations and may involve agreements that include covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making capital expenditures or declaring dividends. Any debt financing or additional equity that we raise may contain terms, such as liquidation and other preferences, which are not favorable to us or our stockholders. If we raise additional funds through collaboration and licensing arrangements with third parties, it may be necessary to relinquish valuable rights to our technologies, future revenue streams or product candidates or to grant licenses on terms that may not be favorable to us. Should the financing we require to sustain our working capital needs be unavailable or prohibitively expensive when we require it, our business, operating results, financial condition and prospects could be materially and adversely affected, and we may be unable to continue our operations. Failure to secure additional financing on favorable terms could have severe adverse consequences to us.

Our previously issued December 31, 2021 consolidated financial statements and related disclosures as filed on Form 10-K/A and quarterly periods within fiscal years 2021 and 2020 as filed on Form 10-Q were restated in December 2022.

On December 1, 2022, we filed Amendment No. 2 to our Form 10-K for the fiscal year ended December 31, 2021, and we reached a determination to restate our previously issued December 31, 2021 consolidated financial statements and related disclosures as filed on Form 10-K/A and quarterly periods within fiscal years 2021 and 2020 as filed on Form 10-Q. The restatement primarily related to the following:

| · | The recording of expense for common stock and warrants issued in equity financings. The warrants were a direct offering cost and should have been recorded as a reduction in additional paid-in capital; | |

| · | The recording of the sale of warrants for cash that should have increased additional paid-in capital and not other income; | |

| · | The recording of a mark to market adjustment for stock sold to a third party. The Company recognized a gain as a part of other income and a decrease to additional paid-in capital, this entry was made in error as the Company was not a holder of an investment of its own stock; and | |

| · | Various reclassifications throughout our balance sheets, statements of operations, stockholders’ equity and cash flows to better reflect the nature or classification of each transaction. |

The restatement of the consolidated financial statements does not affect the Company’s previously reported total assets, total liabilities or revenues. Additionally, there are no compliance matters with any lender or other third parties as a result of the restatement. In addition, management has concluded that the Company’s disclosure controls and procedures were not effective as of December 31, 2021 and that the Company’s internal control over financial reporting was not effective as of December 31, 2021 solely as a result of a material weakness in controls related to the aforementioned. As a result, we have incurred unanticipated costs for accounting and legal fees in connection with or related to the restatement and may become subject to additional risks and uncertainties related to the restatement, such as a negative impact on investor confidence in the accuracy of our financial disclosures and may raise reputational risks for our business.

We could become subject to shareholder litigation and other risks as a result of the restatement and material weakness in our internal control over financial reporting.

We may be come subject to shareholder litigation as a result of the Restatement if stockholders assert that the trading price of our common stock was adversely affected by the Restatement. In addition, as part of the Restatement, we identified material weaknesses in our internal controls over financial reporting. As a result of the Restatement and such material weakness, we face potential for litigation or other disputes which may include, among others, claims invoking the federal and state securities laws, contractual claims or other claims arising from the Restatement and the material weakness in our internal control over financial reporting and the preparation of our financial statements. As of the date of this prospectus, we have no knowledge of any such litigation or dispute. However, we can provide no assurance that such litigation or dispute will not arise in the future. Any such litigation or dispute, whether successful or not, could have a material adverse effect on our business, results of operations and financial condition.

| 7 |

In addition, the market for our securities may be characterized by significant price volatility when compared to seasoned issuers, and we expect that our share price may continue to be more volatile than a seasoned issuer for the indefinite future. In the past, plaintiffs have often initiated securities class action litigation against a company following periods of volatility in the market price of its securities. We may become the target of similar litigation. Securities litigation will result in substantial costs and liabilities and will divert management’s attention and resources.

The Company’s financial condition and results of operations have been and may continue to be adversely affected by the COVID-19 pandemic.

Since March 2020, COVID -19 has caused a material and substantial adverse impact on our general economy and our business operations. It has caused there to be a substantial decrease in our sales, cancellations of purchase orders and has resulted in accounts receivables not being timely paid as anticipated. Further, it has caused us to have concerns about our ability to meet our obligations as they become due and payable. In this respect, our business is directly dependent upon and correlates closely to the marketing levels and ongoing business activities of our existing clients. If material adverse developments in domestic and global economic and market conditions adversely affect our clients’ businesses, such as COVID-19, our business and results of operations could (and in the case of COVID-19) equally suffer. Our results of operations are affected directly by the level of business activity of our clients, which in turn is affected by the level of economic activity in the industries and markets that they serve. COVID-19 future widespread economic slowdowns in any of these markets, particularly in the United States, may negatively affect the businesses, purchasing decisions and spending of our clients and prospective clients, and payment of accounts receivable due us, which could result in reductions in our existing business as well as our new business development and difficulties in meeting our cash obligations as they become due. In the event of continued widespread economic downturn caused by COVID-19, we will likely continue to experience a reduction in projects, longer sales and collection cycles, deferral or delay of purchase commitments for our data products, processing functionality, software systems and services, and increased price competition, all of which could substantially adversely affect revenue and our ability to remain a going concern.

In the event we remain a going concern, the impacts of the global emergence of Coronavirus disease (COVID-19) on our business, sources of revenues and the general economy, are currently not fully known. We are conducting business as usual with some modifications to employee work locations, and cancellation of certain marketing events, among other modifications. We lost a purchase order in excess of one million dollars with a major US sports organization. We have observed other companies taking precautionary and preemptive actions to address COVID-19 and companies may take further actions that alter their normal business operations. We will continue to actively monitor the situation and may take further actions that alter our business operations as may be required by federal, state or local authorities or that we determine are in the best interests of our employees, customers, partners, suppliers and stockholders. It is not clear what the potential effects any such alterations or modifications may have on our business, including the effects on our customers and prospects, although we do anticipate it to continue to negatively impact our financial results during fiscal years 2023.

Forecasts of our revenue are difficult.

When purchasing our products and services, our clients and prospects are often faced with a significant commitment of capital, the need to integrate new software and/or hardware platforms and other changes in company-wide operational procedures, all of which result in cautious deliberation and evaluation by prospective clients, longer sales cycles and delays in completing transactions. Additional delays result from the significant up-front expenses and substantial time, effort and other resources necessary for our clients to implement our solutions. For example, depending on the size of a prospective client’s business and its needs, a sales cycle can range from two weeks to 12 months. Because of these longer sales cycles, revenues and operating results may vary significantly from period to period. As a result, it is often difficult to accurately forecast our revenues for any fiscal period as it is not always possible for us to predict the fiscal period in which sales will actually be completed. This difficulty in predicting revenue, combined with the revenue fluctuations we may experience from period to period, can adversely affect and cause substantial fluctuations in our stock price.

| 8 |

The reliability of our product solutions is dependent on data from third parties and the integrity and quality of that data.

Much of the data that we use is licensed from third-party data suppliers, and we are dependent upon our ability to obtain necessary data licenses on commercially reasonable terms. We could suffer material adverse consequences if our data suppliers were to withhold their data from us. For example, data suppliers could withhold their data from us if there is a competitive reason to do so; if we breach our contract with a supplier; if they are acquired by one of our competitors; if legislation is passed restricting the use or dissemination of the data they provide; or if judicial interpretations are issued restricting use of such data. Additionally, we could terminate relationships with our data suppliers if they fail to adhere to our data quality standards. If a substantial number of data suppliers were to withdraw or withhold their data from us, or if we sever ties with our data suppliers based on their inability to meet our data standards, our ability to provide products and services to our clients could be materially adversely impacted, which could result in decreased revenues.

The reliability of our solutions depends upon the integrity and quality of the data in our database. A failure in the integrity or a reduction in the quality of our data could cause a loss of customer confidence in our solutions, resulting in harm to our brand, loss of revenue and exposure to legal claims. We may experience an increase in risks to the integrity of our database and quality of our data as we move toward real-time, non-identifiable, consumer-powered data through our products. We must continue to invest in our database to improve and maintain the quality, timeliness and coverage of the data if we are to maintain our competitive position. Failure to do so could result in a material adverse effect on our business, growth and revenue prospects.

Our business practices with respect to data and consumer protection could give rise to liabilities or reputational harm as a result of governmental regulation, legal requirements or industry standards relating to consumer privacy, data protection and consumer protection.

Federal, state and international laws and regulations govern the collection, use, retention, sharing and security of data that we collect. We strive to comply with all applicable laws, regulations, self-regulatory requirements and legal obligations relating to privacy, data protection and consumer protection, including those relating to the use of data for marketing purposes. It is possible, however, that these requirements may be interpreted and applied in a manner that is inconsistent from one jurisdiction to another and may conflict with other rules or our practices. We cannot assure you that our practices have complied, comply, or will comply fully with all such laws, regulations, requirements and obligations. Any failure, or perceived failure, by us to comply with federal, state or international laws or regulations, including laws and regulations regulating privacy, data security, marketing communications or consumer protection, or other policies, self-regulatory requirements or legal obligations could result in harm to our reputation, a loss in business, and proceedings or actions against us by governmental entities, consumers, retailers or others. We may also be contractually liable to indemnify and hold harmless performance marketing networks or other third parties from the costs or consequences of noncompliance with any laws, regulations, self-regulatory requirements or other legal obligations relating to privacy, data protection and consumer protection or any inadvertent or unauthorized use or disclosure of data that we store or handle as part of operating our business. Any such proceeding or action, and any related indemnification obligation, could hurt our reputation, force us to incur significant expenses in defense of these proceedings, distract our management, increase our costs of doing business and cause consumers and retailers to decrease their use of our marketplace, and may result in the imposition of monetary liability. Furthermore, the costs of compliance with, and other burdens imposed by, the data and privacy laws, regulations, standards and policies that are applicable to the businesses of our clients may limit the use and adoption of, and reduce the overall demand for, our products.

A significant breach of the confidentiality of the information we hold or of the security of our or our customers’, suppliers’, or other partners’ computer systems could be detrimental to our business, reputation and results of operations. Our business requires the storage, transmission and utilization of data. Although we have security and associated procedures, our databases may be subject to unauthorized access by third parties. Such third parties could attempt to gain entry to our systems for the purpose of stealing data or disrupting the systems. We believe we have taken appropriate measures to protect our systems from intrusion, but we cannot be certain that advances in criminal capabilities, discovery of new vulnerabilities in our systems and attempts to exploit those vulnerabilities, physical system or facility break-ins and data thefts or other developments will not compromise or breach the technology protecting our systems and the information we possess. Furthermore, we face increasing cyber security risks as we receive and collect data from new sources, and as we and our customers continue to develop and operate in cloud-based information technology environments. In the event that our protection efforts are unsuccessful, and we experience an unauthorized disclosure of confidential information or the security of such information or our systems are compromised, we could suffer substantial harm. Any breach could result in one or more third parties obtaining unauthorized access to our customers’ data or our data, including personally identifiable information, intellectual property and other confidential business information. Such a security breach could result in operational disruptions that impair our ability to meet our clients’ requirements, which could result in decreased revenues. Also, whether there is an actual or a perceived breach of our security, our reputation could suffer irreparable harm, causing our current and prospective clients to reject our products and services in the future and deterring data suppliers from supplying us data. Further, we could be forced to expend significant resources in response to a security breach, including repairing system damage, increasing cyber security protection costs by deploying additional personnel and protection technologies, and litigating and resolving legal claims, all of which could divert the attention of our management and key personnel away from our business operations. In any event, a significant security breach could materially harm our business, financial condition and operating results.

| 9 |

Significant system disruptions, loss of data center capacity or interruption of telecommunication links could adversely affect our business and results of operations.

Our product platforms are hosted and managed on Amazon Web Service (AWS) and takes full advantage of open standards for processing, storage, security and big data technology. Specifically, our data intelligence platform uses the following AWS services: EC2, Lambda, Kafka, Kinesis, S3, Storm, Spark, Machine Learning, RDS, Redshift, Elastic Map Reduction, CloudWatch, DataBricks, and Elastic Search Service with built-in Kibana integration. Significant system disruptions, loss of data center capacity or interruption of telecommunication links could adversely affect our business, results of operations and financial condition. Our business is heavily dependent upon highly complex data processing capability. The ability of our platform hosts and managers to protect these data centers against damage or interruption from fire, flood, tornadoes, power loss, telecommunications or equipment failure or other disasters is beyond our control and is critical to our ability to succeed.

We rely on information technology to operate our business and maintain competitiveness, and any failure to adapt to technological developments or industry trends could harm our business.

We depend on the use of information technologies and systems. As our operations grow in size and scope, we will be required to continuously improve and upgrade our systems and infrastructure while maintaining or improving the reliability and integrity of our infrastructure. Our future success also depends on our ability to adapt our systems and infrastructure to meet rapidly evolving consumer trends and demands while continuing to improve the performance, features and reliability of our solutions in response to competitive services and product offerings. The emergence of alternative platforms will require new investment in technology. New developments in other areas, such as cloud computing, could also make it easier for competition to enter our markets due to lower up-front technology costs. In addition, we may not be able to maintain our existing systems or replace or introduce new technologies and systems as quickly as we would like or in a cost-effective manner.

Our technology and associated business processes may contain undetected errors, which could limit our ability to provide our services and diminish the attractiveness of our offerings.

Our technology may contain undetected errors, defects or bugs. As a result, our customers or end users may discover errors or defects in our technology or the systems incorporating our technology may not operate as expected. We may discover significant errors or defects in the future that we may not be able to fix. Our inability to fix any of those errors could limit our ability to provide our solution, impair the reputation of our brand and diminish the attractiveness of our product offerings to our customers. In addition, we may utilize third party technology or components in our products, and we rely on those third parties to provide support services to us. Failure of those third parties to provide necessary support services could materially adversely impact our business.

We need to protect our intellectual property, or our operating results may suffer.

Third parties may infringe our intellectual property and we may suffer competitive injury or expend significant resources enforcing our rights. As our business is focused on data-driven results and analytics, we rely heavily on proprietary information technology. Our proprietary portfolio consists of various intellectual property including source code, trade secrets, and know-how. The extent to which such rights can be protected is substantially based on federal, state and common law rights as well as contractual restrictions. The steps we have taken to protect our intellectual property may not prevent the misappropriation of our proprietary information or deter independent development of similar technologies by others. If we do not enforce our intellectual property rights vigorously and successfully, our competitive position may suffer which could harm our operating results.

| 10 |

We could incur substantial costs and disruption to our business as a result of any claim of infringement of another party’s intellectual property rights, which could harm our business and operating results.

From time to time, third parties may claim that one or more of our products or services infringe their intellectual property rights. We analyze and take action in response to such claims on a case-by-case basis. Any dispute or litigation regarding patents or other intellectual property could be costly and time-consuming due to the complexity of our technology and the uncertainty of intellectual property litigation, which could divert the attention of our management and key personnel away from our business operations. A claim of intellectual property infringement could force us to enter into a costly or restrictive license agreement, which might not be available under acceptable terms or at all, or could subject us to significant damages or to an injunction against development and sale of certain of our products or services.

We face intense and growing competition, which could result in reduced sales and reduced operating margins, and limit our market share.

We compete in the data, marketing and research business and in all other facets of our business against small, medium and large companies throughout the United States. Some examples include companies such as LiveRamp, The TradeDesk and OneTrust. If we are unable to successfully compete for new business our revenue growth and operating margins may decline. The market for our advertising and marketing technology operating system platform is competitive. We believe that our competitors’ product offerings do not provide the end-to-end solutions our product solutions do, and their minimum fees are substantially higher than ours for a comparative suite of solutions. However, barriers to entry in our markets are relatively low. With the introduction of new technologies and market entrants, we expect competition to intensify in the future. Some of these competitors may be in a better position to develop new products and strategies that more quickly and effectively respond to changes in customer requirements in our markets. The introduction of competent, competitive products, pricing strategies or other technologies by our competitors that are superior to or that achieve greater market acceptance than our products and services could adversely affect our business. Our failure to meet a client’s expectations in any type of contract may result in an unprofitable engagement, which could adversely affect our operating results and result in future rejection of our products and services by current and prospective clients. Some of our principal competitors offer their products at a lower price, which may result in pricing pressures. These pricing pressures and increased competition generally could result in reduced sales, reduced margins or the failure of our product and service offerings to achieve or maintain more widespread market acceptance.

Many of our competitors are substantially larger than we are and have significantly greater financial, technical and marketing resources, and established direct and indirect channels of distribution. As a result, they are able to devote greater resources to the development, promotion and sale of their products than we can.

We can provide no assurance that our business will be able to maintain a competitive technology advantage in the future.

Our ability to generate revenues is substantially based upon our proprietary intellectual property that we own and protect through trade secrets and agreements with our employees to maintain ownership of any improvements to our intellectual property. Our ability to generate revenues now and in the future is based upon maintaining a competitive technology advantage over our competition. We can provide no assurances that we will be able to maintain a competitive technology advantage in the future over our competitors, many of whom have significantly more experience, more extensive infrastructure and are better capitalized than us.

No assurances can be given that we will be able to keep up with a rapidly changing business information market.

Consumer needs and the business information industry as a whole are in a constant state of change. Our ability to continually improve our current processes and products in response to these changes and to develop new products and services to meet those needs are essential in maintaining our competitive position and meeting the increasingly sophisticated requirements of our customers. If we fail to enhance our current products and services or fail to develop new products in light of emerging industry standards and information requirements, we could lose customers to current or future competitors, which could result in impairment of our growth prospects and revenues.

| 11 |

The market for programmatic advertising campaigns is relatively new and evolving. If this market develops slower or differently than we expect, our business, growth prospects and financial condition would be adversely affected.

A substantial portion of our revenue has been derived from customers that programmatically purchase and sell advertising inventory through our platform. We expect that spending on programmatic ad buying and selling will continue to be a significant source of revenue for the foreseeable future, and that our revenue growth will largely depend on increasing spend through our platform. The market for programmatic ad buying is an emerging market, and our current and potential customers may not shift quickly enough to programmatic ad buying from other buying methods, reducing our growth potential. Because our industry is relatively new, we will encounter risks and difficulties frequently encountered by early-stage companies in similarly rapidly evolving industries, including the need to:

| · | Maintain our reputation and build trust with advertisers and digital media property owners; | |

| · | Offer competitive pricing to publishers, advertisers, and digital media agencies; | |

| · | Maintain quality and expand quantity of our advertising inventory; | |

| · | Continue to develop, launch and upgrade the technologies that enable us to provide our solutions; | |

| · | Respond to evolving government regulations relating to the internet, telecommunications, mobile, privacy, marketing and advertising aspects of our business; | |

| · | Identify, attract, retain and motivate qualified personnel; and | |

| · | Cost-effectively manage our operations, including our international operations. |

If the market for programmatic ad buying deteriorates or develops more slowly than we expect, it could reduce demand for our platform, and our business, growth prospects and financial condition would be adversely affected.

Our failure to maintain and grow the customer base on our platform may negatively impact our revenue and business.

To sustain or increase our revenue, we must regularly add both new advertiser customers and publishers, while simultaneously keeping existing customers to maintain or increase the amount of advertising inventory purchased through our platform and adopt new features and functionalities that we add to our platform. If our competitors introduce lower cost or differentiated offerings that compete with or are perceived to compete with ours, our ability to sell access to our platform to new or existing customers could be impaired. Our agreements with our customers allow them to change the amount of spending on our platform or terminate our services with limited notice. Our customers typically have relationships with different providers and there is limited cost to moving budgets to our competitors. As a result, we may have limited visibility as to our future advertising revenue streams. We cannot assure you that our customers will continue to use our platform or that we will be able to replace, in a timely or effective manner, departing customers with new customers that generate comparable revenue. If a major customer representing a significant portion of our business decides to materially reduce its use of our platform or to cease using our platform altogether, it is possible that our revenue could be significantly reduced.

We rely substantially on a limited number of customers for a significant percentage of our sales.

For the year ended December 31,2021 and the nine months ended September 30, 2022, sales of our products to four customers generated approximately 31% and 52% of our revenues, respectively. Our contracts with our customers generally do not obligate them to a specified term and they can generally terminate their relationship with us at any time with a minimal amount of notice. If we lose any of our customers, or any of them decide to scale back on purchases of our products, it will have a material adverse effect on our financial condition and prospects. Therefore, we must engage in continual sales efforts to maintain revenue, sustain our customer relationships and expand our client base or our operating results will suffer. If a significant client fails to renew a contract or renews the contract on terms less favorable to us than before, our business could be negatively impacted if additional business is not obtained to replace or supplement that which was lost. We may require additional financial resources to expand our internal and external sales capabilities, although we plan to use a portion of the net proceeds of this offering for this purpose. We cannot assure that we will be able to sustain our customer relationships and expand our client base. The loss of any of our current customers or our inability to expand our customer base will have a material adverse effect on our business plans and prospects.

| 12 |

If we fail to innovate and make the right investment decisions in our offerings and platform, we may not attract and retain advertisers and publishers and our revenue and results of operations may decline.

Our industry is subject to rapid and frequent changes in technology, evolving customer needs and the frequent introduction by our competitors of new and enhanced offerings. We must constantly make investment decisions regarding our offerings and technology to meet customer demand and evolving industry standards. We may make wrong decisions regarding these investments. If new or existing competitors have more attractive offerings or functionalities, we may lose customers or customers may decrease their use of our platform. New customer demands, superior competitive offerings or new industry standards could require us to make unanticipated and costly changes to our platform or business model. If we fail to adapt to our rapidly changing industry or to evolving customer needs, demand for our platform could decrease and our business, financial condition and operating results may be adversely affected.

We may not be able to integrate, maintain and enhance our advertising solutions to keep pace with technological and market developments.

The market for digital video advertising solutions is characterized by rapid technological change, evolving industry standards and frequent introductions of new products and services. To keep pace with technological developments, satisfy increasing publisher and advertiser requirements, maintain the attractiveness and competitiveness of our advertising solutions and ensure compatibility with evolving industry standards and protocols, we will need to anticipate and respond to varying product lifecycles, regularly enhance our current advertising solutions and develop and introduce new solutions and functionality on a timely basis. This requires significant investment of financial and other resources. For example, we will need to invest significant resources into expanding and developing our platforms in order to maintain a comprehensive solution. Ad exchanges and other technological developments may displace us or introduce an additional intermediate layer between us and our customers and digital media properties that could impair our relationships with those customers.

If we fail to detect advertising fraud, we could harm our reputation and hurt our ability to execute our business plan.

As we are in the business of providing services to publishers, advertisers and agencies, we must deliver effective digital advertising campaigns. Despite our efforts to implement fraud protection techniques in our platforms, some of our advertising and agency campaigns may experience fraudulent and other invalid impressions, clicks or conversions that advertisers may perceive as undesirable, such as non-human traffic generated by computers designed to simulate human users and artificially inflate user traffic on websites. These activities could overstate the performance of any given digital advertising campaign and could harm our reputation. It may be difficult for us to detect fraudulent or malicious activity because we do not own content and rely in part on our digital media propertiesto control such activity. Industry self-regulatory bodies, the U.S. Federal Trade Commission and certain influential members of Congress have increased their scrutiny and awareness of, and have taken recent actions to address, advertising fraud and other malicious activity. If we fail to detect or prevent fraudulent or other malicious activity, the affected advertisers may experience or perceive a reduced return on their investment and our reputation may be harmed. High levels of fraudulent or malicious activity could lead to dissatisfaction with our solutions, refusals to pay, refund or future credit demands or withdrawal of future business.

The loss of advertisers and publishers as customers could significantly harm our business, operating results and financial condition.

Our customer base consists primarily of advertisers and publishers. We do not have exclusive relationships with advertising agencies, companies that are advertisers, or publishers, such that we largely depend on agencies to work with us as they embark on advertising campaigns for advertisers. The loss of agencies as customers and referral sources could significantly harm our business, operating results and financial condition. If we fail to maintain satisfactory relationships with an advertising agency, we risk losing business from the advertisers represented by that agency.

Furthermore, advertisers and publishers may change advertising agencies. If an advertiser switches from an agency that utilizes our platform to one that does not, we will lose revenue from that advertiser. In addition, some advertising agencies have their own relationships with publishers that are different than our relationships, such that they might directly connect advertisers with such publishers. Our business may suffer to the extent that advertising agencies and inventory suppliers purchase and sell advertising inventory directly from one another or through intermediaries other than us.

| 13 |

Our sales efforts with advertisers and publishers require significant time and expense.