As filed with the Securities and Exchange Commission on MarchMay 19, 20042020

Registration No. 333- 333-237928

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

DIGIRAD CORPORATION

(Exact Namename of Registrantregistrant as Specifiedspecified in its Charter)charter)

| Delaware | 3845 | 33-0145723 | ||

| (State or | (Primary Standard Industrial | (I.R.S. Employer | ||

| incorporation or organization) | Classification Code Number) | Identification Number) | ||

1048 Industrial Court

Suwanee, Georgia 30024

(858) 726-1600

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Matthew G. Molchan

President and Chief Executive Officer

Digirad Corporation

1048 Industrial Court

Suwanee, Georgia 30024

(858) 726-1600

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to: | ||||

| Adam W. Finerman, Esq. | ||||

| Olshan Frome Wolosky LLP | ||||

| 1325 Avenue of the Americas | ||||

| New York, New York 10019 | ||||

| Telephone: (212) 451-2300 | ||||

Angela Dowd, Esq. Loeb & |

|

(212) 407-4000 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement becomes effective.registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. o☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.o☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o☐

If delivery

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the prospectus is expectedExchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | |

| Non-accelerated filer ☒ | Smaller reporting company ☒ | |

| Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to be madeuse the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Rule 434, checkSection 7(a)(2)(B) of the following box. oSecurities Act. ☐

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price(1) | Amount of Registration Fee | ||

|---|---|---|---|---|

| Common Stock, $0.001 par value per share | $86,250,000 | $10,928 | ||

| Title of each Class of Security being registered | Proposed Maximum Price(2) | Amount of Fee(3) | ||||||

| Common stock, par value $0.0001 per share(1) (5) | $ | 5,750,000 | $ | 746.35 | ||||

| Pre-funded warrants, each warrant exercisable for one share of common stock(4) (5) | — | — | ||||||

| Shares of common stock issuable upon exercise of the pre-funded warrants to purchase shares of common stock(5) (7) | — | — | ||||||

| Common stock purchase warrants to purchase shares of common stock(8) | — | — | ||||||

| Common stock underlying common stock purchase warrants(7) (8) | 3,593,750 | 466.47 | ||||||

| Underwriter’s warrant to purchase shares of common stock(6) | — | — | ||||||

| Common stock issuable upon exercise of the underwriter’s warrant(7) | 158,125 | 20.53 | ||||||

| Total | $ | 9,501,875 | (7) | $ | 1,233.35 | (9) | ||

| (1) | Includes shares to cover the exercise of the over-allotment option granted to the underwriter. |

| (2) | Estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended (the “Securities Act”). Includes the offering price of any additional securities that the underwriter has the option to purchase. In accordance with Rule 457(o) under the Securities Act, the number of securities being registered and the proposed maximum offering price per pre-funded warrant and per common stock purchase warrant are not included in this table. | |

| (3) | Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price. | |

| (4) | No separate fee is required pursuant to Rule 457(i) of the Securities Act. | |

| (5) | The proposed maximum aggregate offering price of the common stock proposed to be sold in the offering will be reduced on a dollar-for-dollar basis based on the aggregate offering price of any pre-funded warrants offered and sold in the offering, and the proposed maximum aggregate offering price of the pre-funded warrants to be sold in the offering will be reduced on a dollar-for-dollar basis based on the aggregate offering price of any shares of common stock sold in the offering. Accordingly, the proposed maximum aggregate offering price of the common stock and the pre-funded warrants (including the common stock issuable upon exercise of the pre-funded warrants and the underwriter’s over-allotment option), if any, is $5,750,000. | |

| (6) | Represents a warrant issuable to the underwriter (the “Underwriter’s Warrant”) to purchase a number of shares of common stock equal to 2.5% of the number of shares of common stock (including the shares of common stock issued pursuant to the underwriter’s exercise of its over-allotment option and upon exercise of the pre-funded warrants) being offered at an exercise price equal to 110% of the public offering price of the common stock. See the “Underwriting” section of the prospectus included in this registration statement. In accordance with Rule 457(g) under the Securities Act, because the common stock of the registrant underlying the Underwriter’s Warrant is registered hereby, no separate registration fee is required with respect to the Underwriter’s Warrant registered hereby. | |

| (7) | Pursuant to Rule 416 under the Securities Act, the securities being registered hereunder include such indeterminate number of additional securities as may be issued after the date hereof as a result of stock splits, stock dividends or similar transactions. | |

| (8) | Each share of common stock and pre-funded warrant is being sold together with an accompanying warrant to purchase 0.5 of a share of our common stock Two common stock purchase warrants will be exercisable for one share of common at a per share exercise price of up to 125% of the public offering price of one share of common stock. The proposed maximum aggregate public offering price of the shares of common stock issuable upon exercise of the common warrants was calculated to be $3,593,750, which is equal to 125% of one-half of the proposed maximum aggregate public offering price of the shares of common stock in this offering. In accordance with Rule 457(g) under the Securities Act, because the common stock of the registrant underlying the common stock purchase warrants is registered hereby, no separate registration fee is required with respect to the common stock purchase warrants registered hereby. | |

| (9) | A filing fee of $766.88 was previously paid. |

The Registrantregistrant hereby amends this Registration Statementregistration statement on such date or dates as may be necessary to delay its effective date until the Registrantregistrant shall file a further amendment which specifically states that this Registration Statementregistration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statementregistration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting offersan offer to buy these securities in any state or jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 19, 2020

SubjectPRELIMINARY PROSPECTUS

Digirad Corporation

Up to CompletionPreliminary Prospectus dated , 2004

PROSPECTUS

[●] Shares

of Common Stock

Up to [●] Pre-funded Warrants (each Pre-funded Warrant to purchase one Share of Common Stock)

Up to [●] Shares of Common Stock underlying the Pre-funded Warrants

Common Warrants to Purchase up to [●] Shares of Common Stock and

Up to [●] Shares of Common Stock underlying the Common Warrants

This is our initial publican offering of [●] shares of our common stock. stock, par value of $0.0001 per share, which we refer to as the “common stock”, together with a number of common stock purchase warrants (the “warrants”) to purchase up to an aggregate of [●] shares of common stock (and the shares of common stock that are issuable from time to time upon exercise of the warrants).

We are also offering shares.to each purchaser whose purchase of shares in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% of our outstanding shares of common stock immediately following the consummation of this offering, the opportunity to purchase, if any such purchaser so chooses, pre-funded warrants, in lieu of shares that would otherwise result in such purchaser’s beneficial ownership exceeding 4.99% of our outstanding shares of common stock. Each pre-funded warrant will be exercisable for one share of common stock. The purchase price of each pre-funded warrant will be equal to the price per share being sold to the public in this offering, minus $0.01, and the exercise price of each pre-funded warrant will be $0.01 per share. The pre-funded warrants will be certificated and will be immediately exercisable and may be exercised at any time until all of the pre-funded warrants are exercised in full. Any exercise of the pre-funded warrants which would result in a holder beneficially owning more than 4.99% of our outstanding shares of common stock will be subject to our consent. We expectmay, in our sole discretion, waive the initial4.99% ownership limitation in connection with this offering with respect to one or more potential purchasers.

For each pre-funded warrant we sell, the number of shares we are offering will be decreased on a one-for-one basis. Each share of common stock and pre-funded warrant is being sold together with an accompanying warrant to purchase 0.5 of a share of our common stock, at an exercise price of $[●] per whole share (at least 100%, and up to 125%, of the public offering price to be between $of one share of common stock). Because we will issue a warrant for each share of our common stock and $ per share.

Currently, no public market exists for each pre-funded warrant sold in this offering, the shares. After pricingnumber of warrants sold in this offering will not change as a result of a change in the mix of the offering, we expect that the shares of our common stock and pre-funded warrants sold.

The warrants will be quotedexercisable immediately, and will expire five years from the date of issuance. The warrants will only be exercisable for whole shares of common stock. The shares of common stock or pre-funded warrants can be purchased only with the accompanying warrants (other than the over-allotment option), but will be issued separately and will be immediately separable upon issuance.

Our common stock is listed on the Nasdaq NationalGlobal Market under the symbol "DRAD."“DRAD”. On May 15, 2020, the last reported sale price of our common stock on the Nasdaq Global Market was $2.37 per share. The actual public offering price per share of common stock or pre-funded warrant, as the case may be, will be determined between us and the investors in the offering and may be at a discount to the current market price. Therefore, the assumed public offering price used throughout this prospectus may not be indicative of the final offering price. There is no established public trading market for the warrants or the pre-funded warrants, and we do not expect a market to develop. In addition, we do not intend to apply for a listing of the warrants or pre-funded warrants on any national securities exchange or other nationally recognized trading system. Without an active trading market, the liquidity of the warrants and the pre-funded warrants will be limited.

Investing in our securities involves a high degree of risk. See the common stock involves risks that are described in the "Risk Factors" section entitled “Risk Factors” beginning on page 724 of this prospectus.prospectus and in the documents incorporated by reference into this prospectus for a discussion of risks that should be considered in connection with an investment in our securities.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY OTHER REGULATORY BODY HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

| Per | Per Pre-funded Warrant and Accompanying Warrant | Total(2) | |||||||||||||

| Public offering price(1) | $ | $ | |||||||||||||

| $ | |||||||||||||||

| Underwriting discounts and commissions (3) | $ | $ | $ | ||||||||||||

| Proceeds, before expenses, to us | $ | $ | $ | ||||||||||||

| (1) | The public offering price is $[●] per share of common stock and $0.01 per accompanying warrant and $[●] per pre-funded warrant and $0.01 per accompanying warrant. | |

| (2) | Assumes no exercise of the underwriters’ over-allotment option. | |

| (3) | See “Underwriting” for a description of the compensation payable to the underwriters; including reimbursable expenses. |

The underwriters may alsounderwriter has the option to purchase up to an additional [●] shares of common stock, or pre-funded warrants and/or warrants to purchase up to an additional [●] shares of common stock from us at the public offering price, less the underwriting discounts and commissions, within 3045 days fromafter the date of this prospectus to cover over-allotments.over-allotments, if any.

NeitherJeffrey E. Eberwein, the SecuritiesChairman of our Board of Directors, and Exchange Commission norMitchell Quain, one of our directors, have indicated to us their intention to purchase up to $100,000 of common stock and/or pre-funded warrants each (representing up to 42,194 shares based on an assumed offering price of $2.37 per share), along with accompanying warrants for the purchase of up to an additional 21,097 shares, in this offering. In addition, Matthew Molchan, our Chief Executive Officer, and David Noble, our Chief Financial Officer and Chief Operating Officer, have indicated to us their intention to purchase up to $5,000 and $50,000, respectively, of common stock and/or pre-funded warrants each (representing up to 2,109 and 21,097 shares, respectively, based on an assumed offering price of $2.37 per share), along with accompanying warrants for the purchase of up to an additional 1,054 and 10,548 shares, respectively). Certain other non-executive employees of our company may also purchase shares, warrants and/or pre-funded warrants in this offering. However, because indications of interest are not binding agreements or commitments to purchase, there can be no assurance that the underwriter will determine to sell shares of common stock, warrants and/or pre-funded warrants in this offering to any state securities commission has approved or disapproved of these persons or entities, or that any of these persons or entities will determine to purchase securities in this offering. Any securities sold to our employees, officers and directors will be at the same price and on the same terms as the securities sold to other investors in this offering. The underwriter will receive the same underwriting discount on any securities purchased by these persons or determined if this prospectus is truthful or complete. Any representationentities as they will on any other securities sold to the contrary is a criminal offense.public in this offering.

The underwriter expects to deliver the shares, will be ready for deliverywarrants and pre-funded warrants against payment in New York, New York on or about[●], 2004.2020.

JointSole Book-Running ManagersManager

Maxim Group LLC

|

The date of this prospectus is [●], 2004.

| Page | ||

| PROSPECTUS SUMMARY | 1 | |

| 22 | ||

| 24 | ||

| USE OF PROCEEDS | 46 | |

| 46 | ||

| 46 | ||

| 48 | ||

| 50 | ||

| 63 | ||

| 70 | ||

| 74 | ||

| 74 | ||

| 74 | ||

| 74 | ||

| DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITIES | 75 |

You should rely only on the information contained or incorporated into this prospectus. Neither we nor the underwriter has authorized anyone to provide any information or to make any representations other than those contained in this prospectus.prospectus or in any free writing prospectuses we have prepared. We have not,take no responsibility for, and can provide no assurance as to the underwriters have not, authorizedreliability of, any other person to provide you with different information. If anyone provides you with different or inconsistent information you should not rely on it. We are not, and the underwriters are not, makingthat others may give you. This prospectus is an offer to sell theseonly the securities offered hereby, but only under circumstances and in any jurisdictionjurisdictions where the offer or saleit is not permitted. You should assume that thelawful to do so. The information appearingcontained in this prospectus is accuratecurrent only as of its date regardless of the date on the front covertime of delivery of this prospectus.prospectus or any sale of our securities. Our business, financial condition, results of operations and prospects may have changed since that date.

i

PROSPECTUS SUMMARY

You should also read this prospectus together with the additional information described under “Where You Can Find More Information” and “Incorporation of Information by Reference”.

No action is being taken in any jurisdiction outside the U.S. to permit a public offering of our securities or possession or distribution of this prospectus in any such jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the U.S. are required to inform themselves about and to observe any restrictions about this offering and the distribution of this prospectus applicable to those jurisdictions.

i

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, including the sections entitled “Prospectus Summary,” “Risk Factors” and “Use of Proceeds,” as well as the information we incorporate herein by reference contain forward-looking statements within the meaning of the federal securities laws. Forward-looking statements include, but are not limited to, statements regarding expectations, intentions and strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “target,” “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predicts,” “project,” “should,” “would,” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements contained in this prospectus are based on current expectations and beliefs concerning future developments and their potential effects on our company and its subsidiaries. There can be no assurance that future developments will be those that have been anticipated. Factors that might cause such differences include, but are not limited to, those discussed in the section of this prospectus entitled “Risk Factors”. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all the risks and uncertainties that could have an impact on the forward-looking statements, including without limitation, risks and uncertainties relating to:

| ● | our financial performance, including our ability to generate revenue; |

| ● | our recent conversion into a diversified holding company; |

| ● | business interruptions resulting from health epidemics or pandemics or other contagious outbreaks, such as the recent coronavirus outbreak or geopolitical actions, including war and terrorism, natural disasters, including earthquakes, typhoons, floods and fires; |

| ● | ability of our products and services to achieve and/or maintain market success; |

| ● | success in retaining or recruiting, or changes required in, our officers, key employees or directors; |

| ● | potential ability to obtain additional financing when and if needed; |

| ● | our ability to protect our intellectual property; |

| ● | our ability to complete strategic acquisitions; |

| ● | our ability to complete strategic divestitures; |

| ● | our ability to manage growth and integrate acquired operations; |

| ● | our inability to pay dividends at the present time; |

| ● | our ability to maintain compliance with The Nasdaq Stock Market LLC’s listing maintenance standards; |

| ● | potential liquidity and trading of our securities; |

| ● | regulatory or operational risks; |

| ● | the effects of outbreaks of pandemic or contagious diseases, including the length and severity of the recent worldwide outbreak of Coronavirus, now named as COVID-19, including its impact on our business; |

| ● | downward revisions to, or withdrawals of, our credit ratings, if any, by third-party rating agencies; and |

ii

| ● | our estimates regarding expenses, future revenue, capital requirements and needs for additional financing. |

We cannot guarantee future results, levels of activity or performance. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this prospectus. These cautionary statements should be considered with any written or oral forward-looking statements that we may issue in the future. Except as required by applicable law, including the securities laws of the U.S., we do not intend to update any of the forward-looking statements to conform these statements to reflect actual results, later events or circumstances or to reflect the occurrence of unanticipated events. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or other investments or strategic transactions we may engage in.

iii

ThisThe following summary highlights selected information contained in other parts of this prospectus or incorporated by reference into this prospectus from our filings with the Securities and Exchange Commission, or SEC, listed in the section of the prospectus entitled “Incorporation of Certain Information by Reference”. Because it is only a summary, it does not contain all of the information that you should consider before buying shares ofpurchasing our common stock.securities in this offering and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere or incorporated by reference into this prospectus. You should read the entire prospectus, carefully, especially the "Risk Factors" sectionregistration statement of which this prospectus is a part, and the information incorporated by reference herein in their entirety, including our consolidated financial statements and the related notes appearing at the end ofincorporated by reference into this prospectus, before deciding to invest in sharesmaking an investment decision. Some of our common stock. Referencesthe statements in this prospectus to our certificate of incorporation and bylaws refer to the certificate of incorporationdocuments incorporated by reference herein constitute forward-looking statements that involve risks and bylaws that will be in effect upon completion of this offering.uncertainties. See information set forth under the section “Special Note Regarding Forward-Looking Statements.”

Unless the context otherwise requires or indicates, all references in this prospectus supplement and the accompanying prospectus to “we,” “our,” “us,” “Digirad” and the “Company” each mean Digirad Corporation,

a Delaware corporation, and its consolidated subsidiaries.

We are

Overview

Upon Digirad’s acquisition of ATRM Holdings, Inc. (“ATRM”) on September 10, 2019 (the “ATRM Merger” or the “ATRM Acquisition”), Digirad converted into a leader in the development, manufacturediversified holding company (the “HoldCo Conversion”). As a diversified holding company, Digirad has three divisions:

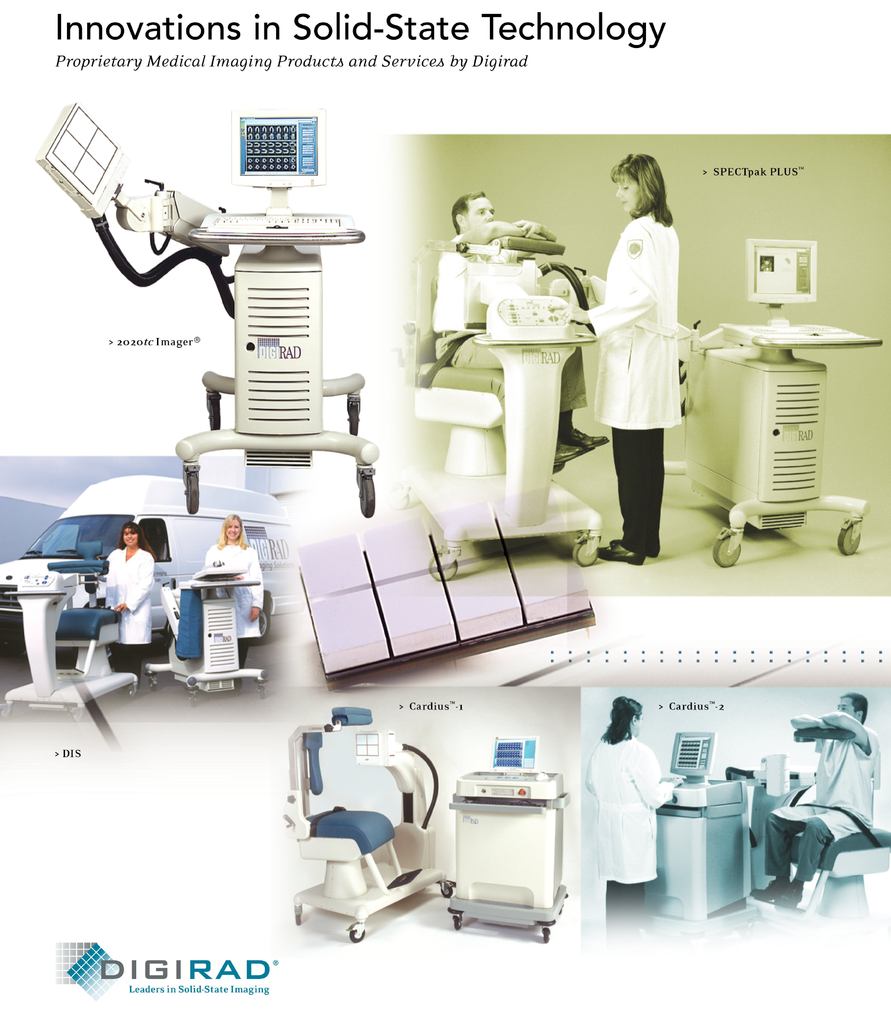

| ● | Healthcare (Digirad Health): designs, manufactures, and distributes diagnostic medical imaging products. Digirad Health operates in three businesses: Diagnostic Services, Mobile Healthcare, and Diagnostic Imaging. The Diagnostic Services business offers imaging and monitoring services to healthcare providers as an alternative to purchasing the equipment or outsourcing the job to another physician or imaging center. The Mobile Healthcare business provides contract diagnostic imaging, including computerized tomography (“CT”), magnetic resonance imaging (“MRI”), positron emission tomography (“PET”), PET/CT, and nuclear medicine and healthcare expertise through a convenient mobile service. The Diagnostic Imaging business develops, sells, and maintains solid-state gamma cameras. |

| ● | Building and Construction (ATRM): services residential and commercial construction projects by manufacturing modular housing units, structural wall panels, permanent wood foundation systems, and other engineered wood products, and supplies general contractors with building materials. |

| ● | Real Estate and Investments: manages real estate assets (currently three manufacturing plants in Maine) and investments. |

Healthcare (Digirad Health) delivers convenient, effective, and distributionefficient healthcare solutions on an as needed, when needed, and where needed basis. Digirad’s diverse portfolio of solid-state medicalmobile healthcare solutions and diagnostic imaging productsequipment and services for the detection of cardiovascular disease and other medical conditions. We designed and commercialized the first solid-state gamma camera. Our initial focus is on nuclear cardiology imaging procedures performed with gamma cameras, which we believe generate revenue of approximately $10.0 billion annually in the United States. Our target markets are primarilyprovides hospitals, physician practices, and outpatient clinics,imaging centers throughout the United States access to technology and services necessary to provide patient care in the rapidly changing healthcare environment. Digirad’s direct and indirect subsidiaries that are included in this division are referred to collectively herein as the “Healthcare Subsidiaries”.

Building and Construction (ATRM) manufactures modular housing units for commercial and residential applications. ATRM operates in two businesses: (i) modular building manufacturing and (ii) structural wall panel and wood foundation manufacturing, including building supply retail operations. The modular building manufacturing business is operated by KBS Builders, Inc. (“KBS”), and the structural wall panel and wood foundation manufacturing segment is operated by EdgeBuilder, Inc. (“EdgeBuilder”), and the retail building supplies are sold through Glenbrook Building Supply, Inc. (“Glenbrook” and together with EdgeBuilder, “EBGL”). KBS, EdgeBuilder and Glenbrook are wholly-owned subsidiaries of ATRM and are referred to collectively herein, and together with ATRM, as the “Construction Subsidiaries”.

1

Real Estate & Investments generates revenue from the lease of commercial properties and equipment through Star Real Estate Holdings USA, Inc. (“SRE”), a wholly-owned subsidiary of Digirad, and provides services that include investment advisory services and the servicing of pooled investment vehicles through Lone Star Value Management, LLC (“LSVM”), a Connecticut based exempt reporting advisor. LSVM, which we believe constitute approximately 25%was a wholly owned subsidiary of ATRM on the ATRM Acquisition Date (as defined below), was acquired by the Company in the ATRM Acquisition. In April 2019, as an initial transaction to create Digirad’s real estate division under SRE and launch that aspect of the total market,HoldCo Conversion, Digirad funded the initial purchase of three modular building manufacturing facilities in Maine and then leased those three properties to KBS. The funding of the assets acquisition was primarily through the revolver loan under our credit facility with Sterling National Bank (“Sterling” or $2.5 billion.“SNB”), a national banking association. LSVM, SRE and the subsidiaries of SRE that are included in this division are referred to collectively herein as the “Investments Subsidiaries”.

On September 10, 2019, Digirad completed its acquisition of ATRM pursuant to an Agreement and Plan of Merger, dated as of July 3, 2019 (the “ATRM Merger Agreement”), among Digirad, Digirad Acquisition Corporation, a Minnesota corporation and wholly-owned subsidiary of Digirad (“Merger Sub”), and ATRM. Under the terms of the ATRM Merger Agreement, Merger Sub merged with and into ATRM, with ATRM surviving as a wholly owned subsidiary of Digirad.

At the effective time of the ATRM Merger, (i) each share of ATRM common stock was converted into the right to receive three one-hundredths (0.03) of a share of 10.0% Series A Cumulative Perpetual Preferred Stock, par value $0.0001 per share, of the Company (“Series A Preferred Stock”) and (ii) each share of ATRM 10.00% Series B Cumulative Preferred Stock, par value $0.001 per share (“ATRM Preferred Stock”), converted into the right to receive two and one-half (2.5) shares of Series A Preferred Stock, for an approximate aggregate total of 1.6 million shares of Series A Preferred Stock. No fractional shares of Series A Preferred Stock were issued to any ATRM shareholder in the ATRM Merger. Each ATRM shareholder who would otherwise have been entitled to receive a fraction of a share of Company common stock in the ATRM Merger received one whole share of Series A Preferred Stock.

As a result of the ATRM Merger, ATRM’s operations have been included in our consolidated financial statements since the ATRM Acquisition Date. Digirad’s aim with this acquisition is to continue to grow its business into an integrated healthcare services company while simultaneously converting into a diversified holding company through the acquisition of businesses that meet Digirad’s internally developed financial screen for acquisitions. The Company expects to achieve significant synergies and cost reductions by eliminating redundant processes and facilities.

Our gamma cameras use small semiconductors to replace the bulky vacuum tubes used historically in gamma cameras. By utilizing solid-state technology,Competitive Strengths

Healthcare Services and Products

For Digirad Health, we believe that our competitive strengths are our streamlined and cost-efficient approach to providing healthcare solutions to our customers at the point of need, while providing an array of industry-leading, technologically-relevant healthcare imaging and monitoring services:

| ● | Broad Portfolio of Imaging Services.Approximately 77.9% of our revenues are derived from diagnostic imaging services to our customers. We have developed and continue to refine an industry-leading, customer-service focused approach to our customers. We have found our focus in this area is a key factor in acquiring and keeping our service-based customers. |

| ● | Unique Dual Sales and Service Offering. For the majority of our businesses, we offer a service-based model to our customers, allowing them to avoid making costly capital and logistical investments required to offer these services internally. Further, for a portion of our business, we have the ability to sell the underlying capital equipment directly to our customers should their needs change and they desire to provide services on their own with the underlying capital equipment. This ability to serve our customers in a variety of capacities from selling equipment directly, or providing more flexibility through a service-based model, allows us to serve our customers according to their exact needs, as well as the ability to capture both ends of the revenue spectrum. |

2

| ● | Utilization of Highly Trained Staff.We recruit and maintain highly trained staff for our clinical and repair services, which in turn allows us to provide superior and more efficient services. |

| ● | Leading Solid-State Technology. Our solid-state gamma cameras utilize proprietary photo detector modules that enable us to build smaller and lighter cameras that are portable with a degree of ruggedness that can withstand the vibration associated with transportation. Our dedicated cardiac imagers require a floor space of as little as seven feet by eight feet, can generally can be installed without facility renovations, and use standard power. Our portable cameras are ideal for mobile operators or practices desiring to service multiple office locations or imaging facilities. |

Construction Services and Products

Our competitive strengths at KBS include our ability to provide high quality products for both commercial and residential buildings with a focus on customization to suit the project requirements, provide value with our engineering and design expertise, and to meet the time frame needed by the customer:

| ● | Customization of high quality products for both commercial and residential buildings.KBS is able to adapt any floor plan and engineer it to modular design. KBS and its highly trained engineering and sales staff work with builders and designers to create a fully customized building plan, using the latest and most advanced materials and products available. KBS’ long-term experience across a broad range of market sectors, building types and geographies allows us to provide a compelling end-to-end modular solution for ground-up construction, including integrated design, engineering, materials selection and manufacturing. Our highly skilled staff utilizes technology and proven construction methods to achieve high quality results. |

| ● | Environmentally friendly building processes. We maintain precise dimensional tolerances throughout our building process, improving quality and speed of construction, reducing waste, and causing less disruption to the environment than traditional on-site construction methods. KBS is committed to offering homes and buildings that use recognized sustainable building techniques to meet the highest standards of energy efficiency, while creating high performance, healthy and architecturally distinctive designs. |

| ● | Utilization of experienced and highly trained engineering and design experts. KBS’ engineering department has over 30 years of combined work experience in modular design, giving us the ability to execute technically complex and challenging designs. Our in-house knowledge base spans across materials, construction practices and state building codes. Utilizing CADWORKS, an advanced three-dimensional drawing technology platform, our engineering and design team consistently produces timely, cost-effective residential and commercial designs. Our staff is able to export digital drawings and information directly into our state-of-the-art machinery. This allows for the precise milling of structural components for each module in any given project. New automation features have been developed and implemented in our CADWORKS software, which also allow us to create detailed bills of materials, which improve costing and inventory control. Our engineering and design team members are encouraged to work on all aspects of our projects, cultivating a team-centric culture, which supports mentorship and professional growth. The hallmark of KBS’ engineering department is communication and teamwork, with a strong focus on collaboration with the client. |

Our competitive strengths at Glenbrook include high quality building materials and unmatched service and attention to detail to building professionals and homeowners. In addition, we provide highly personalized service, knowledgeable salespeople and attention to detail that the larger, big-box chain home stores do not provide. In EdgeBuilder, we offer a superior product unique to the project’s requirements, provide value with our engineering and design expertise, and deliver product when required by the customer, while staying cost-competitive. Our production strategy is to utilize automation and the most efficient methods of manufacturing and high-quality materials in all EBGL projects.

3

| ● | High quality products are used in our building contracts.We provide brand name, high quality windows, such as Andersen, Marvin and Thermo-Tech. We also supply well-known composite decking, including Trex, TimberTech, Azek and Fiberon. All brands available through Glenbrook add profit margin to our larger commodities business, including premium brands like Selkirk, Cedar and Bessemer Plywood. |

| ● | Utilization of knowledgeable sales force.Our experienced sales force provides knowledgeable personal service to our customers to help bring our products to “life” in the form of a successful project through partnership with our customers. |

| ● | Efficiencies and reliability from our indoor manufacturing facility.We utilize efficiencies and reliability provided by our indoor manufacturing facility, which allows us to maximize labor productivity, reduce waste and foresee project specific design conflicts among trades before they arise on site. |

Real Estate and Investments

Our competitive strengths in real estate include a focus on acquisition opportunities that have underappreciated real estate value, which assets the Company anticipates placing into SRE. SRE expects to be largely self-funded over time by raising its own capital through commercial mortgages on its properties and other forms of external capital.

Our competitive strengths in investments include shareholder activism through the Lone Star Value brand name, which will be less confusing to investment targets and the investing public than pursuing investments through one of our operating companies. We also expect to make strategic acquisitions in the future. Investments and acquisitions will be made using our internally developed financially disciplined approach for acquisitions.

Strategy

We seek to grow our business by, among other things:

| ● | Organic growth from our core businesses.We believe that we operate in markets and geographies that will allow us to continue to grow our core businesses, allowing us to benefit from our scale and strengths. We plan to focus our efforts on markets in which we already have a presence in order to take advantage of personnel, infrastructure, and brand recognition we have in these areas. |

| ● | Introduction of new services.We plan to continue to focus on healthcare solutions related businesses that deliver necessary assets, services and logistics directly to the customer site. We believe that over time we can either purchase or develop new and complementary businesses and take advantage of our customer loyalty and distribution channels. In addition, as we transform into a multi-industry holding company, our largest near-term growth opportunity is to execute a successful turnaround of the KBS modular business that we acquired pursuant to the ATRM Merger. While we intend to continue to pursue and grow our residential modular building business, which provides us with positive margins and cash flow, we are also targeting large multi-family projects in the 25 to 100-building modules range. |

| ● | Acquisition of complementary businesses.The current economic environment offers significant opportunities for strategic acquisitions which can be either be bolt-on acquisitions for existing platform businesses, or new core businesses complementary to our new holding company structure. We will have a disciplined approach for making any potential acquisitions and will focus on faster growing and higher margin businesses. We believe there are many potential targets in the range of $3 million to $10 million in annual revenues that can be acquired over time and integrated into our businesses. We will also look at larger, more transformational acquisitions if we believe the appropriate mix of value, risk and return is present for our shareholders. The timing of these potential acquisitions will always depend on market conditions, available capital, and the value for each transaction. In general, we want to be “value” buyers, and will not pursue any transaction unless we believe the post-transaction potential value is high for shareholders. |

4

| ● | Divestiture of business units. From time to time we consider divestitures of business units and/or assets which are not consistent with the future strategy of our business, or if we believe the sale of such units and/or assets could be in the best interests of our business and its stockholders, subject to our ability to agree on acceptable terms with a prospective buyer. We currently are considering several possible transactions, including discussions regarding the sale of a business unit. Upon any such sale, a significant portion of the proceeds would be used to repay indebtedness, with the remainder being used for working capital purposes, and potentially the acquisition of complementary businesses as discussed above. There is no assurance that any such divestiture will occur, or if it does, if it would occur for a sales price currently contemplated. If it occurs, there is no assurance that we will be able to use the proceeds in the acquisition of a complementary business, or if we do if such acquisition will be successful. Because we have concluded, as of the date of this prospectus, that such divestiture is not “probable” under the applicable rules of the Securities Act of 1933, as amended, we are not including additional information about it in this prospectus and you will, therefore, not have the opportunity to evaluate such information as part of this offering. |

We continue to explore strategic alternatives to improve the market position and profitability of our product offerings in the marketplace, generate additional liquidity, and enhance our valuation. We may pursue our goals through organic growth and through strategic alternatives. Some of these alternatives have included, and could continue to include, selective acquisitions of business segments or entire businesses, divestitures of assets or divisions, or a restructuring of our company.

History of our Business

In January 2016 we acquired Project Rendezvous Holding Corporation (“PRHC”), the ultimate parent company of DMS Health Technologies, Inc. (collectively referred to hereinafter as “DMS Health Technologies” or “DMS Health”) for $32.3 million. DMS Health is a provider of mobile diagnostic imaging services and provides medical product sales and service. The acquisition resulted in two new reportable segments: Mobile Healthcare and Medical Device Sales and Services.

In February of 2018, we completed the sale of our customer contracts relating to our Medical Device Sales and Service (“MDSS”) post-warranty service business to Philips for $8.0 million. On October 31, 2018, we sold our Telerhythmics, LLC (“Telerhythmics”) business to G Medical Innovations USA, Inc., for $1.95 million cash.

On December 14, 2018, Digirad and ATRM entered into a joint venture and formed Star Procurement, LLC, with Digirad and ATRM each holding a 50% interest. The purpose of the joint venture is to provide the service of purchasing and selling building materials and related goods to KBS with which Star Procurement entered into a Services Agreement on January 2, 2019. In accordance with the terms of the Star Procurement Limited Liability Company Agreement, Digirad made a $1.0 million capital contribution to the joint venture, which was made in January 2019. This entity was subsequently consolidated within the consolidated financial statements upon completion of the ATRM Merger.

Digirad formed SRE in March 2019 in connection with establishing its Real Estate and Investments Division. In April 2019, as an initial transaction for the Real Estate and Investments Division under SRE, Digirad funded the initial purchase of three manufacturing facilities in Maine and leased those three properties.

On September 10, 2019 (the “ATRM Acquisition Date”), Digirad completed the ATRM Acquisition and thereby converted into a diversified holding company. As a result of the ATRM Acquisition, ATRM became a wholly owned subsidiary of Digirad and KBS, EdgeBuilder, Glenbrook and LSVM became wholly owned indirect subsidiaries of Digirad. As a result of internal restructuring, LSVM is now a direct wholly owned subsidiary of Digirad.

5

Business Segments

Prior to September 10, 2019, we were organized as four reportable segments: Diagnostic Services, Diagnostic Imaging, Mobile Healthcare, and Medical Device Sales and Service. On February 1, 2018, we sold our Medical Device Sales and Service (“MDSS”) business. As of March 31, 2020, our business is organized into five reportable segments: Diagnostic Services, Mobile Healthcare, Diagnostic Imaging, Building and Construction, and Real Estate and Investments. See Note 11.Segments, within the notes to our unaudited condensed consolidated financial statements included in our Quarterly Report on Form 10-Q for the three months ended March 31, 2020 and incorporated herein by reference for financial data relating to our segments. For discussion purposes, we categorized our Diagnostic Imaging, Diagnostic Services and Mobile Healthcare reportable segments as “Healthcare”. For the last periods indicated below, Healthcare had the following relative contribution to consolidated revenues:

| Three Months Ended March 31, | Year Ended December 31, | |||||||||||||||

| 2020 | 2019 | 2019 | 2018 | |||||||||||||

| Healthcare Revenues: | ||||||||||||||||

| Diagnostic Services | 37.5 | % | 49.0 | % | 41.8 | % | 47.3 | % | ||||||||

| Mobile Healthcare | 33.5 | % | 40.4 | % | 36.1 | % | 41.2 | % | ||||||||

| Diagnostic Imaging | 9.9 | % | 10.6 | % | 12.1 | % | 11.5 | % | ||||||||

| Total Healthcare revenues | 80.9 | % | 100.0 | % | 90.0 | % | 100.0 | % | ||||||||

Building and Construction

Building and construction revenue is summarized as follows:

| Three Months Ended March 31, | Year Ended December 31, | |||||||||||||||

| 2020 | 2019 | 2019 | 2018 | |||||||||||||

| Building and Construction | 19.0 | % | — | % | 9.9 | % | — | % | ||||||||

| Total Building and Construction Revenue | 19.0 | % | — | % | 9.9 | % | — | % | ||||||||

Real Estate and Investments

Real estate and investments revenue is summarized as follows:

| Three Months Ended March 31, | Year Ended December 31, | |||||||||||||||

| 2020 | 2019 | 2019 | 2018 | |||||||||||||

| Real Estate and Investments | 0.1 | % | — | % | 0.1 | % | — | % | ||||||||

| Total Real Estate and Investments | 0.1 | % | — | % | 0.1 | % | — | % | ||||||||

Diagnostic Services

Through Diagnostic Services, we offer a convenient and economically efficient imaging and monitoring services program as an alternative to purchasing equipment or outsourcing the procedures to another physician or imaging center. For physicians who wish to perform nuclear imaging, echocardiography, vascular or general ultrasound tests, we provide imaging systems, qualified personnel, radiopharmaceuticals, licensing services, and the logistics required to perform imaging in their own offices, and thereby the ability to bill Medicare, Medicaid, or one of the third-party healthcare insurers directly for those services, which are primarily cardiac in nature. We provide imaging services primarily to cardiologists, internal medicine physicians, and family practice doctors who typically enter into annual contracts for a set number of days ranging from once per month to five times per week. Many of our physician customers are reliant on reimbursements from Medicare, Medicaid, and third-party insurers. Although reimbursement for procedures provided by our services have been stable during the last several years, any future changes to underlying reimbursements may require modifications to our current business model in order for us to maintain imagea viable economic model.

6

Our portable nuclear and ultrasound imaging operations utilize a “hub and spoke” model in which centrally located regional hubs anchor multiple van routes in the surrounding metropolitan areas. At these hubs, clinical personnel load the equipment, radiopharmaceuticals, and other supplies onto specially equipped vans for transport to customer locations, where they set up the equipment for the day. After quality while offering significant advantages over vacuum tube-basedassurance testing, a technologist under the physician’s supervision will gather patient information, inject the patient with a radiopharmaceutical, and then acquire images for interpretation by the physician. At the conclusion of the day of service, all equipment and supplies are removed from the customer location and transported back to the central hub location. Our model relies on density and customer concentration to allow for efficiencies and maximum profitability, and therefore we are only located in geographies where there is a high concentration of people, cardiac disease and associated likely customer locations.

For our nuclear imaging services, we have obtained Intersocietal Accreditation Commission (“IAC”) and Intersocietal Commission for Echocardiography Laboratories (“ICAEL”) accreditation for our services. Our licensing infrastructure provides radioactive materials licensing, radiation safety officer services, radiation safety training, monitoring and compliance policies and procedures, and quality assurance functions, to ensure adherence to applicable state and federal nuclear regulations.

Mobile Healthcare

Through Mobile Healthcare, we provide contract diagnostic imaging, including computerized tomography (“CT”), magnetic resonance imaging (“MRI”), positron emission tomography (“PET”), PET/CT, and nuclear medicine and healthcare expertise to hospitals, integrated delivery networks (“IDNs”), and federal institutions on a long-term contract basis, as well as provisional (short-term) services to institutions that are in transition. Rather than our customers owning the equipment directly and operating the related services, we provide this service when there is a cost, ease, and efficiency benefit.

Our Mobile Healthcare operations operate throughout the United States, with a heavier concentration in rural areas, particularly in the Upper Midwest region of the United States. We have a range of customer types, but our most typical customer is a small or regional hospital that does not have enough volume of activity to justify owning a piece of imaging equipment on a full-time basis. Our services typically offer the diagnostic imaging equipment, placed in a large patient friendly coach or tractor-trailer, coupled with either an owned or operator-owned tractor, which is then transported to each customer location. Our mobile routes are designed to provide for maximum utilization and efficiency by allowing our units to travel to the next customer location during non-working hours of a typical imaging clinic, meeting our technical staff at each location. Our customers commit to annual contracts ranging from service once every two weeks to up to two days of service per week, depending on modality type and their local demand for services.

Diagnostic Imaging

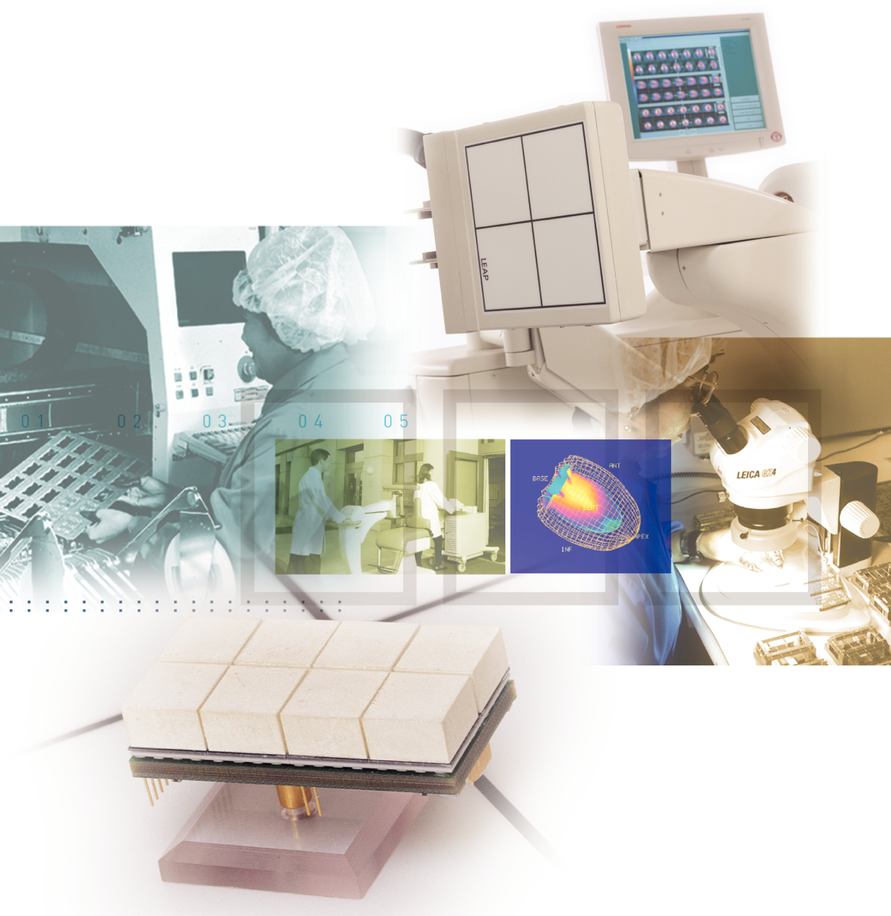

Through Diagnostic Imaging, we sell our internally developed solid-state gamma cameras, imaging systems including mobility through reduced size and weight,camera maintenance contracts. Our imaging systems include nuclear cardiac imaging systems, as well as general purpose nuclear imaging systems. We sell our imaging systems to physician offices and hospitals primarily in the United States, although we have sold a small number of imaging systems internationally. Our imaging systems are sold in both portable and fixed configurations, provide enhanced operability and reliability and improved patient comfort, and utilization. Our imaging systems, consisting of a gamma camera and accessories,fit easily fit into floor spaces as small as seven feet by eight feet. Due tofeet, and facilitate the size and other limitationsdelivery of vacuum tube cameras, nuclear imaging has traditionally been confined to dedicated and customized space within a hospital or imaging center. The mobility of our imaging systems enables us to deliver nuclear imagingmedicine procedures in a wide range of clinical settings—physician offices,physician’s office, an outpatient clinicshospital setting, or within multiple departments inof a hospital.hospital (e.g., emergency and operating rooms). Our Diagnostic Imaging segment revenues derive primarily from selling solid-state gamma cameras and post-warranty camera maintenance contracts.

We sell our imaging systems to physicians, outpatient clinics hospitals. In addition, through our wholly-owned subsidiary, Digirad Imaging Solutions, Inc., or DIS, we also offer

The central component of a comprehensive and mobile imaging leasing service, called FlexImaging®, for physicians who wish to perform nuclear cardiology imaging procedures in their offices but do not have the patient volume, capital or resources to justify purchasing a gamma camera. DIS provides our physician customers with an imaging system, certified personnel, required licensure and other support for the performance of nuclear imaging procedures under the supervision of our physician customers. Physicians enter into annual contracts for imaging services delivered on a per-day basis ranging from one day per month to several days per week. DIS currently operates 23 regional hubs and seven fixed sites in 17 states.

Our unique dual sales and leasing distribution model offers physicians, clinics and hospitals versatile delivery options that appeal to medical establishments of all sizes, capabilities and imaging expertise. The mobility of our imaging systems and the flexibility of our DIS service allow cardiologists to provide nuclear imaging procedures in their offices to patients that they historically had to refer to hospitals or imaging centers. As a result, we provide physicians with more control over the diagnosis and treatment of their patients and enable physicians to capture revenue from procedures that would otherwise be referred to these hospitals and imaging centers.

Nuclear imaging is a clinical diagnostic tool, with established reimbursement codes, that has been in use for over 40 years. According to industry sources, approximately 18.4 million nuclear imaging procedures were performed in the United States in 2002, of which approximately 9.9 million were cardiac procedures, a volume that is expected to grow by approximately 25% annually over the next three years. We believe the growth in nuclear cardiology imaging will be driven by an increase in coronary heart disease resulting from the aging of baby boomers and the record rate of obesity and diabetes in all age groups. We estimate that the growth rate in 2002 for nuclear imaging procedures performed in physician offices was approximately 44% and in hospitals was approximately 6%. We expect the mobility of our imaging systems

1

to continue to allow us to capitalize on this shift in the delivery of nuclear cardiology imaging services from hospitals to physician offices.

The target market for our productscamera is the approximately 30,000 cardiologists indetector, which ultimately determines the United States that performoverall clinical quality of images a camera produces. Our nuclear cardiology procedures. To date, wecameras feature detectors with advanced proprietary solid-state technology developed by us. Solid-state systems have sold or provided imaging services through DISa number of benefits over conventional photomultiplier tube-based camera designs typically offered by our competitors. Our solid-state technology systems are typically 2 to approximately 500 physicians. In 2003, DIS performed over 66,000 patient procedures.

5 times lighter and considerably more compact than most traditional nuclear systems, making them far easier and less costly to build, very reliable, and able to be utilized for mobile applications. We sold our first gamma camera in March 2000, and we established DIS in September 2000. We had consolidated revenues and net losses of $41.5 million and $12.8 million, respectively, in fiscal 2002 and $56.2 million and $1.7 million, respectively, in fiscal 2003. Revenues from DIS and from our camera sales constituted 62% and 38%, respectively, of our 2003 consolidated revenues. We believe DIS will continue to provide us with recurring annual contractual revenue and comprise the largest component of our consolidated revenues.

Our Competitive Strengths

We believe that our position asare a market leader in the mobile solid-state nuclear cardiac imaging market is a product of the following competitive strengths:

7

We believe our current imaging systems, with their state-of-the-art technology and underlying patents, will continue to be relevant for the foreseeable future. We will continue to enhance and adjust our existing systems for the changing nuclear imaging market, including software updates and smaller enhancements. However, to accomplish any significant changes and enhancements, we will utilize what we believe is a deep available pool of contract engineers on a flexible, as needed basis and do not maintain a high-quality image despitestaff research and development department, thereby eliminating the rigorsfixed costs of a mobile environment.

Building and Construction

ATRM through its wholly-owned subsidiaries KBS, Glenbrook and EdgeBuilder, services residential and commercial construction projects by manufacturing modular housing units, structural wall panels, permanent wood foundation systems, and other engineered wood products, and supplies general contractors with building materials. KBS is a Maine-based manufacturer that started business in 2001 as a manufacturer of modular homes. Our focus is to offer high quality products for both commercial and residential buildings with a focus on customization to suit the project requirements, provide value with our engineering and design expertise, and deliver product when required by the customer. Having operated at below 50% capacity at our South Paris, Maine facility throughout 2019, we have rebuilt our sales team and embarked on a new strategy that broadens our target market beyond single-family residential installations, which typically involve producing three to four building modules per project. While we intend to continue to pursue and grow our residential modular building business, which provides us with positive margins and cash flow, we are also targeting large multi-family projects in the 25 to 100 building modules range.

Having produced approximately 230 building modules in 2019, we are in advanced discussions for various large commercial construction projects in New England that together will account for nearly 250 building modules and over $10.0 million in potential revenue. The modular manufacturing industry brings different financial challenges than the conventional real estate construction industry, as factory production requires that materials be purchased up front and well ahead of final payment for a project. We recently received $2.0 million in financing from Gerber to add to our working capital in preparation for projects of our KBS subsidiary, which are anticipated to begin in May 2020 and be completed later in 2020.

Glenbrook is a retail supplier of lumber, windows, doors, cabinets, drywall, roofing, decking and other building materials and conducts its operations in Oakdale, Minnesota. EdgeBuilder is a manufacturer of structural wall panels, permanent wood foundation systems and other engineered wood products and conducts its operations in Prescott, Wisconsin. We provide high quality building materials and unmatched service and attention to detail to building professionals, as well as homeowners. In addition, we provide highly personalized service, knowledgeable salespeople and attention to detail that the larger, big-box chain home stores do not provide. We offer a superior products unique to each project’s requirements, provide value with our engineering and design expertise that meet the customer’s needs, while staying cost-competitive and on schedule. While EdgeBuilder supplies the wall panels, Glenbrook supplies “loose lumber” such as floor and roof sheathing, bracing, and hardware with a “tandem” approach to every project. Residential home projects require much less production time than larger projects. The framing on a single-family home can be manufactured in a few hours, while larger buildings take many weeks. Our production strategy is to utilize automation and the most efficient methods of manufacturing and high-quality materials in all of our projects.

Real Estate and Investments

As part of the HoldCo Conversion, Digirad formed a real estate division under a newly formed subsidiary named Star Real Estate Holdings USA, Inc. (“SRE”) for the purposes of holding significant real estate assets that Digirad acquires. As an initial transaction to create Digirad’s real estate division under SRE and launch that aspect of the HoldCo Conversion, in April 2019, Digirad funded the initial purchase of three manufacturing facilities in Maine that manufacture modular buildings and leased those three properties. The funding of the asset acquisition was primarily through the revolver loan under our credit facility with Sterling. Digirad expects SRE to be substantially self-funded over time by raising its own capital in the form of commercial mortgages on the properties it owns or by raising other forms of external capital. Lone Star Value Management, LLC (LSVM), which was a wholly owned subsidiary of ATRM on the ATRM Acquisition Date, is a Connecticut based exempt reporting advisor that was acquired by the Company in the ATRM Acquisition. LSVM provides services that include investment advisory services and the servicing of pooled investment vehicles. The Company expects to use LSVM to make strategic investments in future potential acquisition targets for the Company.

8

Market Opportunity

Healthcare Services and Products

Diagnostic imaging depictions of the internal anatomy or physiology are generated primarily through non-invasive means. Diagnostic imaging facilitates the early diagnosis of diseases and disorders, often minimizing the scope, cost, and amount of care required and reducing the need for more invasive procedures. Currently, the major types of non-invasive diagnostic imaging technologies available are: x-ray, MRI, CT, ultrasound, PET, and nuclear imaging. The most widely used imaging acquisition technology utilizing gamma cameras is single photon emission computed tomography, or SPECT. All our current internally-developed cardiac gamma cameras employ SPECT technology.

Diagnostic imaging is the standard of care in diagnosis of diseases and disorders. We offer, through our businesses, the majority of these diagnostic imaging modalities. All of the diagnostic imaging modalities that we offer (both from provision of services and product sales) have been consistently utilized in clinical applications for many years, and are stable in their use and need. By offering a wide array of these modalities, we believe that we have strategically diversified our operations in possible changing trends of utilization of one diagnostic imaging modality from another.

Construction Services and Products

In the building and construction business, KBS markets its modular homes products through a direct sales organization and through inside sales, outside sales, a network of independent dealers, builders, and contractors in the New England states (Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island, and Vermont). KBS’s direct sales organization is responsible for all commercial building projects, and works with developers, architects, owners, and general contractors to establish the scope of work, terms of payment, and general requirements for each project. KBS’s sales people also work with independent dealers, builders, and contractors to accurately configure and place orders for residential homes for their end customers. KBS’s network of independent dealers and contractors do not work with it exclusively, although many have KBS model homes on display at their retail centers. KBS does not assign exclusive territories to its independent dealers and contractors, but they tend to sell in areas of New England where they will not be competing against another KBS dealer or contractor. KBS’s backlog and pipeline, along with its market initiatives to build more workforce housing, are expected to position KBS for growth in 2020.

EBGL markets its engineered structural wall panels and permanent wood foundation systems through direct sales people and a network of builders, contractors and developers in and around Minneapolis and St. Paul areas. EBGL’s direct sales organization is responsible for both residential and commercial projects and it works with general contractors, developers and builders to provide bids and quotes for specific projects. Our marketing efforts include participation in industry trade shows, production of product literature, and sales support tools. These efforts are designed to generate sales leads for our independent builders and dealers, and direct salespeople. EBGL’s backlog and pipeline are currently estimated to exceed $20.0 million, as EBGL also strives to build more workforce housing.

Competition

The market for diagnostic products and services is highly competitive. Our business, which is focused primarily on the private practice and hospital sectors, continues to face challenges of demand for diagnostic services and imaging equipment, which we believe is due in part to the impact of the Deficit Reduction Act on the reimbursement environment and the 2010 Healthcare Reform laws, as well as general uncertainty in overall healthcare and legislative changes in healthcare, such as the Affordable Care Act. These challenges have impacted, and will likely continue to impact, our operations. We believe that the principal competitive factors in our market include acceptance by hospitals and physicians, relationships that we develop with our customers, budget availability for our capital equipment, requirements for reimbursement, pricing, ease-of-use, reliability, and mobility.

9

Diagnostic Services.In providing diagnostic services, we compete against many smaller local and regional nuclear and/or ultrasound providers, often owner-operators that may have lower operating costs. The fixed-installation operators often utilize older, used equipment, and the mobile operators may use older Digirad single-head cameras or newer dual-head cameras. We are the only mobile provider with our own exclusive source of triple-head mobile systems. Some competing operators place new or used cameras into physician offices and then provide the staffing, supplies, and other support as an alternative to a Diagnostic Services service contract. In addition, we compete against imaging centers that install fixed nuclear gamma cameras and make them available to referring physicians in their geographic vicinity. In these cases, the physician sends their patients to the imaging center.

Diagnostic Imaging. In selling our imaging systems, providewe compete against several large medical device manufacturers who offer a full line of imaging cameras for each diagnostic imaging technology, including x-ray, MRI, CT, ultrasound, nuclear medicine, or SPECT/CT and PET/CT hybrid imagers. The existing nuclear imaging systems sold by these competitors have been in use for a longer period of time than internally developed nuclear gamma cameras, and are more convenient operation, better power efficiencywidely recognized and increased durabilityused by physicians and hospitals for nuclear imaging; however, they are generally not solid-state, lightweight, as compared to vacuum tube cameras.

Mobile Healthcare. The market for selling, servicing, and operating diagnostic imaging services, patient monitoring equipment, and imaging systems through DIS.

is highly competitive. In providing our Mobile Healthcare services, we compete against a few large national and regional providers. In addition to direct competition from other providers of services similar to those offered by us, we compete with freestanding imaging centers and healthcare providers that have their own diagnostic imaging systems, as well as with equipment manufacturers that sell imaging equipment directly to healthcare providers for permanent installation. Some of the direct competitors, which provide contract MRI and PET/CT services, have access to greater financial resources than we do. In addition, some of our customers are capable of providing the same services we provide to their patients directly, subject only to their decision to acquire a high-cost diagnostic imaging system, assume the financial and technology risk, and employ the necessary technologists, rather than obtain equipment and services from us. We may also experience greater competition in states that currently have certificate of need laws if such laws were repealed, thereby reducing barriers to entry and competition in those states. We also compete against other similar providers in quality of services, quality of imaging systems, relationships with healthcare providers, knowledge and service quality of technologists, price, availability, and reliability.

Building and Construction. The market for building and construction is highly competitive. KBS is a regional manufacturer of modular housing units with its primary market in the New England states. Several modular manufacturers are located in these New England states and in nearby Pennsylvania. Some competitors have manufacturing locations in Canada and ship their products to the United States. KBS’s competitors include Apex Homes, Commodore Corporation, Skyline Champion Homes, Custom Building Systems, Durabuilt, Excel Homes, Huntington Homes, Icon Legacy Homes, Kent Homes (Canada), Maple Leaf Homes (Canada), Muncy Homes, New England Homes, New Era, Pennwest, Premier Builders (PA), Professional Builders Systems, RCM (Canada), Redmond Homes, Ritz-Craft, Simplex Homes, and Westchester Modular. EBGL is a regional manufacturer of engineered structural wall panels and permanent wood foundation systems, and also has a local retail business. EBGL’s market is primarily the Upper Midwest states (Iowa, Minnesota, Missouri, North Dakota, South Dakota, and Wisconsin). EBGL’s competitors include Precision Wall Systems, Component Manufacturing Company, JL Schwieters Construction, Arrow Building Center, and Marshall Truss Systems Incorporated. EBGL’s professional building supply business competes on a local level against both small, local lumber yards, regional building supply companies and to a certain degree, the “big box” stores such as Home Depot, Lowe’s, and Menard’s.

10

Intellectual Property Portfolio

We rely on a combination of patent, trademark, copyright, trade secret, and other intellectual property laws, nondisclosure agreements, and other measures to protect our intellectual property. We require our employees, consultants, and advisors to execute confidentiality agreements and to agree to disclose and assign to us all inventions conceived during the workday, using our property, or which relate to our business. Despite any measures taken to protect our intellectual property, unauthorized parties may attempt to copy aspects of our products or to obtain and use information that we regard as proprietary. As discussed herein, Digirad Health intellectual property is currently subject to a security interest to Sterling. ATRM’s intellectual property, consisting of a registered copyright and its domain name, and EBGL’s intellectual property, consisting of registered trademarks, unregistered trademarks and domain names, are currently subject to a security interest to Gerber Finance Inc. (“Gerber”).

Patents.

We have developed an intellectual propertya patent portfolio that includes product, componentcovers our products, components, and processprocesses. We have 15 non-expired U.S. patents. The patents covering variouscover, among other things, aspects of solid-state radiation detectors that make it possible for Digirad to provide mobile imaging services, and our scan technology that provides for lower patient doses and more specific cardiac images. Our patents expire between 2021 (U.S. Patent 6,504,178) and 2030 (U.S. Patent 8,362,438). While each of our patents applies to nuclear medicine, many also apply to the construction of area detectors for other types of medical and non-medical imagers and imaging systems. Currently, we have 21 patents issuedmethods.

Trademarks and 10 pending patent applicationsCopyrights

Our registered trademark portfolio consists of registrations in the United States for Digirad® and CARDIUS®. Digirad has produced proprietary software for Digirad Imaging systems including: nSPEED™ 3D-OSEM Reconstruction, SEEQUANTA™ acquisition, and STASYS™ motion correction software. We also license certain software products, and their related copyrights, on a nonexclusive basis from Cedars-Sinai Health System. The license includes updates to the software. The license may be terminated at any time by either party upon notice if the other party materially breaches the agreement. Non-payment to licensor is considered a material breach. The license may also be automatically terminated by licensor if (i) an “event of default” occurs under indebtedness for borrowed money of licensee; (ii) licensee ceases business operations; (iii) licensee dissolves or (iv) licensee commences bankruptcy proceedings. On May 23, 2018, the parties entered into an amendment to the license agreement to, among other things, extend the term of license through July 1, 2023.

Raw Materials

Diagnostic Imaging.We and our contract manufacturers use a wide variety of materials, metals, and mechanical and electrical components for production of our nuclear imaging gamma cameras. These materials are primarily purchased from external suppliers, some of which are single-source suppliers. Materials are purchased from selected suppliers based on quality assurance, cost effectiveness, and constraints resulting from regulatory requirements, and we work closely with our suppliers to assure continuity of supply while maintaining high quality and reliability. Global commodity supply and demand can ultimately affect pricing of certain of these raw materials. Though we believe we have two patents issued and 21 pending patent applications internationally.

Our Business Strategyadequate available sources of raw materials, there can be no guarantee that we will be able to access the quantity of raw material needed to sustain operations, as well as at a cost-effective price.

Diagnostic Services and Mobile Healthcare.Our Diagnostic Services and Mobile Healthcare operations utilize radiopharmaceuticals for our nuclear services. The underlying raw material for creation of the array of doses utilized in nuclear medicine is produced from a total of five main production facilities throughout the world, typically from highly enriched uranium resources. These resources have been and are expected to continue to produce enough raw materials to address the global market, but there continues to be pressure to utilize low or non-enriched uranium resources to produce the underlying nuclear doses.

11

Building and Construction. KBS is a Maine-based manufacturer that started business in 2001 as a manufacturer of modular homes. The majority of underlying raw material for KBS are produced locally, with a small percentage coming from Canada. EdgeBuilder (EB) and Glenbrook (GL), referred to together as EBGL, maintain corporate offices in Oakdale, Minnesota. EdgeBuilder, manufactures wall panels, at its facility in Prescott, Wisconsin. Glenbrook, which is located in Oakdale, MN, is a retail supplier of lumber, windows, doors, cabinets, drywall, roofing, decking and other building materials. The underlying raw materials for EdgeBuilder and Glenbrook are dimensional lumber and structural panels (oriented strand board (OSB), plywood, and exterior gypsum sheathing). These resources have been and are expected to continue to produce high quality of wood panels to address global needs.

Manufacturing