Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on October 14, 2004May 2, 2005

Registration No. 333-

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PLAINS ALL AMERICAN PIPELINE, L.P.

(Exact Name of Registrant as Specified in Its Charter)

Delaware (State or Other Jurisdiction of Incorporation or Organization) | 4610 (Primary Standard Industrial Classification Code Number) | 76-0582150 (I.R.S. Employer Identification Number) | ||

333 Clay Street, Suite 1600 Houston, Texas 77002 (713) 646-4100 (Address, Including Zip Code, and Telephone Number, including Area Code, of Registrant's Principal Executive Offices) | ||||

Tim Moore Vice President and General Counsel 333 Clay Street, Suite 1600 Houston, Texas 77002 (713) 646-4100 (Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service) | ||||

Copies to:

David P. Oelman

Vinson & Elkins L.L.P.

1001 Fannin Street, Suite 2300

Houston, Texas 77002

(713) 758-2222

Approximate date of commencement of proposed sale to the public:From time to time after this Registration Statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ý

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. o

CALCULATION OF REGISTRATION FEE

| Title Of Each Class Of Securities To Be Registered | Amount to be Registered | Proposed Maximum Offering Price Per Unit | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Units representing limited partner interests | 19,469,207 units | (1) | $ | $ | ||||||||

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion Dated October , 2004May 2, 2005

P R O S P E C T U S

3,245,70019,469,207 Common Units

Plains All American Pipeline, L.P.

Representing Limited Partner Interests

Up to 3,245,70019,469,207 of our common units may be offered from time to time by the selling unitholders named in this prospectus. The selling unitholders may sell the common units at various times and in various types of transactions, including sales in the open market, sales in negotiated transactions and sales by a combination of methods. We will not receive any proceeds from the sale of common units by the selling unitholders.

Our common units are listed on the New York Stock Exchange under the symbol "PAA."

Limited partnerships are inherently different from corporations. You should carefully consider each of the factors described under "Risk Factors" which begins on page 2 of this prospectus before you make an investment in the securities.

NEITHER THE SECURITIES AND EXCHANGE COMMISSIONCOMMISION NOR ANY STATE SECURITIES COMMISSIONCOMMISION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

In connection with certain sales of securities hereunder, a prospectus supplement may accompany this prospectus.

The date of this prospectus is October , 2004[ ], 2005

i

| Directors and Executive Officers | |

| Executive Compensation |

i

ii

| Tax Consequences of Unit Ownership | |

| Tax Treatment of Operations | |

| Disposition of Common Units | |

| Uniformity of Units | |

ii

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or SEC, using a "shelf""shelf' registration process. Under this shelf process, the selling unitholders may sell up to 3,245,70019,469,207 of our common units. In connection with certain sales of securities hereunder, a prospectus supplement may accompany this prospectus. The prospectus supplement may also add, update or change information contained in this prospectus. Therefore, before you invest in our securities, you should read this prospectus and any attached prospectus supplements.

In this registration statement, the terms "we," "our," "ours," and "us" refer to Plains All American Pipeline, L.P. and its subsidiaries, unless otherwise indicated or the context requires otherwise.

iii

We are a publicly traded Delaware limited partnership, formed in 1998 and engaged in interstate and intrastate crude oil transportation, and crude oil gathering, marketing, terminalling and storage, as well as the marketing and storage of liquefied petroleum gas and othernatural gas related petroleum products. We refer to liquefied petroleum gas and othernatural gas related petroleum products collectively as "LPG." We have an extensive network of pipeline transportation, storage and gathering assets in key oil producing basins and at major market hubs in the United States and Canada. Several members of our existing management team founded this midstream crude oil business in 1992, and we completed our initial public offering in 1998.

We haveOur operations in the United States and Canada, which can be categorized into two primary business activities: crude oil pipeline transportation operations and gathering, marketing, terminalling and storage operations.

Our principal business strategy is to capitalize on the regional crude oil supply and demand imbalances that exist in the United States and Canada by combining the strategic location and distinctive capabilities of our transportation and terminalling assets with our extensive marketing and distribution expertise to generate sustainable earnings and cash flow.

We intend to execute our business strategy by:

To a lesser degree, we also engage in a similar business strategy with respect to the wholesale marketing and storage of LPG, which we began as a result of an acquisition in mid-2001.

You should carefully consider the following risk factors together with all of the other information included in this prospectus in evaluating an investment in us. If any of the following risks were actually to occur, our business, financial condition or results of operations could be materially adversely affected.

The level of our profitability is dependent upon an adequate supply of crude oil from fields located offshore and onshore California. Production from these offshore fields has experienced substantial production declines since 1995.

A significant portion of our segment profit is derived from pipeline transportation margins associated with the Santa Ynez and Point Arguello fields located offshore California. We expect that there will continue to be natural production declines from each of these fields as the underlying reservoirs are depleted. We estimate that a 5,000 barrel per day decline in volumes shipped from these fields would result in a decrease in annual pipeline segment profit of approximately $3.1$3.2 million. In addition, any significant production disruption from these fieldsthe Santa Ynez field due to production problems, transportation problems or other reasons wouldcould have a material adverse effect on our business.

Our trading policies cannot eliminate all price risks. In addition, any non-compliance with our trading policies could result in significant financial losses.

Generally, it is our policy that as we purchase crude oil we establish a margin for crude oil purchased by selling crude oil for physical delivery to third party users, such as independent refiners or major oil companies, or by entering into a future delivery obligation under futures contracts on the NYMEX and over-the-counter.over the counter. Through these transactions, we seek to maintain a position that is substantially balanced between purchases, on the one hand, and sales or future delivery obligations, on the other hand. Our policy is generally not to acquire and hold crude oil, futures contracts or derivative products for the purpose of speculating on price changes. This policyThese policies and practices cannot, however, eliminate all price risks. For example, we engage in a controlled trading program for up to an aggregate of 500,000 barrels of crude oil. While this activity is monitored independently by our risk management function, it exposes us to price risks within predefined limits and authorizations. In addition, any event that disrupts our anticipated physical supply of crude oil could expose us to risk of loss resulting from price changes. Moreover, we are exposed to some risks that are not hedged, including certain basis risks and price risks on certain of our inventory, such as pipeline linefill, which must be maintained in order to transport crude oil on our pipelines. In addition, we engage in a controlled trading program for up to an aggregate of 500,000 barrels of crude oil. Although this activity is monitored independently by our risk management function, it exposes us to price risks within predefined limits and authorizations.

In addition, our trading operations involve the risk of non-compliance with our trading policies. For example, we discovered in November 1999 that our trading policy was violated by one of our former employees, which resulted in aggregate losses of approximately $181.0 million. We have taken steps within our organization to enhance our processes and procedures to detect future unauthorized trading. We cannot assure you, however, that these steps will detect and prevent all violations of our trading policies and procedures, particularly if deception or other intentional misconduct is involved.

If we do not make acquisitions on economically acceptable terms our future growth may be limited.

Our ability to grow and to increase distributions to unitholders is substantially dependent on our ability to make acquisitions that result in an increase in adjusted operating surplus per unit. If we are unable to make such accretive acquisitions either because (i) we are unable to identify attractive acquisition candidates or negotiate acceptable purchase contracts with them, (ii) we are unable to raise financing for such acquisitions on economically acceptable terms or (iii) we are outbid by competitors, our future growth and ability to raise distributions will be limited. In particular, competition for midstream assets and businesses has intensified substantially and as a result such assets and businesses

have become more costly. As a result, we may not be able to complete the number or size of acquisitions that we have targeted internally or to continue to grow as quickly as we have historically.

Our acquisition strategy requires access to new capital. Tightened creditcapital markets or other factors which increase our cost of capital could impair our ability to grow.

Our business strategy is substantially dependent on acquiring additional assets or operations that will allow us to increase distributions to unitholders.operations. We continuously consider and enter into discussions regarding potential acquisitions. These transactions can be effected quickly, may occur at any time and may be significant in size relative to our existing assets and operations. Any material acquisition will require access to capital. Any limitations on our access to capital or increase in the cost of that capital could significantly impair our ability to execute our acquisition strategy. Our ability to maintain our targeted credit profile, including maintaining our credit ratings, could impact our cost of capital as well as our ability to execute our acquisition strategy.

Our acquisition strategy involves risks that may adversely affect our business.

Any acquisition involves potential risks, including:

Any of these factors could adversely affect our ability to achieve anticipated levels of cash flows from our acquisitions, realize other anticipated benefits and our ability to makepay distributions to you.or meet our debt service requirements.

The nature of our assets and business could expose us to significant environmental compliance costs and liabilities.

Our operations involving the storage, treatment, processing, and transportation of liquid hydrocarbons including crude oil and are subject to stringent federal, state, and local laws and regulations governing the discharge of materials into the environment, orand otherwise relating to protection of the environment.environment, operational safety and related matters. Compliance with these laws and regulations increases our overall cost of business, including our capital costs to construct, maintain and upgrade equipment and facilities.facilities, or claims for damages to property or persons resulting from our operations. Failure to comply with these laws and regulations may result in the assessment of administrative, civil, and criminal penalties, the imposition of investigatory and remedial liabilities, and even the issuance of injunctions that may restrict or prohibit our operations, or claims of damages to property or persons resulting from our operations. EnvironmentalThe laws and regulations applicable to our operations are subject to change, and we cannot provide any assurance that compliance with current and future laws and regulations will not have a material affecteffect on our results of operations or earnings. A discharge of hazardous liquids into the environment could, to the extent such event is not insured, subject us to substantial expense, including both the cost to comply with applicable laws and regulations and any claims made by neighboring landowners and other thirdliability to private parties for personal injury andor property damage.

The profitability of our pipeline operations depends on the volume of crude oil shipped by third parties.shipped.

Third party shippers generally do not have long-termlong term contractual commitments to ship crude oil on our pipelines. A decision by a shipper to substantially reduce or cease to ship volumes of crude oil on our pipelines could cause a significant decline in our revenues. For example, we estimate that an

average 10,00020,000 barrel per day variance in the Basin Pipeline System within the current operating window, equivalent to an approximate 4%7% volume variance on that pipeline system, would change annualized segment profit by approximately $1.0$1.8 million. In addition, we estimate that an average 10,000 barrel per day variance on the Capline Pipeline System, equivalent to an approximate 7% volume variance on that system, would change annualized segment profit by approximately $1.5 million.

The success of our business strategy to increase and optimize throughput on our pipeline and gathering assets is dependent upon our securing additional supplies of crude oil.

Our operating results are dependent upon securing additional supplies of crude oil from increased production by oil companies and aggressive lease gathering efforts. The ability of producers to increase production is dependent on the prevailing market price of oil, the exploration and production budgets of the major and independent oil companies, the depletion rate of existing reservoirs, the success of new wells drilled, environmental concerns, regulatory initiatives and other matters beyond our control. There can be no assurance that production of crude oil will rise to sufficient levels to cause an increase in the throughput on our pipeline and gathering assets.

Our operations are dependent upon demand for crude oil by refiners in the Midwest and on the Gulf Coast. Any decrease in this demand could adversely affect our business.

Demand for crude oil is dependent upon the impact of future economic conditions, fuel conservation measures, alternative fuel requirements, governmental regulation or technological advances in fuel economy and energy generation devices, all of which could reduce demand. Demand also depends on the ability and willingness of shippers having access to our transportation assets to satisfy their demand by deliveries through those assets, and any decrease in this demand could adversely affect our business.

We face intense competition in our gathering, marketing, terminalling and storage activities and gathering and marketing activities.

Our competitors include other crude oil pipelines, the major integrated oil companies, their marketing affiliates, and independent gatherers, brokers and marketers of widely varying sizes, financial resources and experience. Some of these competitors have capital resources many times greater than ours and control greater supplies of crude oil. We estimate that a $0.01 per barrel variance in the aggregate average segment profit per barrel would have an approximate $2.5$2.6 million annual effect on segment profit.

The profitability of our gathering and marketing activities is generally dependent on the volumes of crude oil we purchase and gather.

To maintain the volumes of crude oil we purchase, we must continue to contract for new supplies of crude oil to offset volumes lost because of natural declines in crude oil production from depleting wells or volumes lost to competitors. Replacement of lost volumes of crude oil is particularly difficult in an environment where production is low and competition to gather available production is intense. Generally, because producers experience inconveniences in switching crude oil purchasers, such as delays in receipt of proceeds while awaiting the preparation of new division orders, producers typically do not change purchasers on the basis of minor variations in price. Thus, we may experience difficulty acquiring crude oil at the wellhead in areas where there are existing relationships between producers and other gatherers and purchasers of crude oil. We estimate that a 5,00015,000 barrel per day decrease in barrels gathered by us would have an approximate $1.0$3.0 million per year negative impact on segment profit. This impact is based on a reasonable margin throughout various market conditions. Actual margins vary based on the location of the crude oil, the strength or weakness of the market and the grade or quality of crude oil.

We are exposed to the credit risk of our customers in the ordinary course of our gathering and marketing activities.

There can be no assurance that we have adequately assessed the credit-worthinesscredit worthiness of our existing or future counter-partiescounterparties or that there will not be an unanticipated deterioration in their credit worthiness, which could have an adverse impact on us.

In those cases wherein which we provide division order services for crude oil purchased at the wellhead, we may be responsible for distribution of proceeds to all parties. In other cases, we pay all of or a portion of the production proceeds to an operator who distributes these proceeds to the various interest owners. These arrangements expose us to operator credit risk, and there can be no assurance that we will not experience losses in dealings with other parties.

Our pipeline assets are subject to federal, state and provincial regulation.

Our domestic interstate common carrier pipelines are subject to regulation by the Federal Energy Regulatory Commission (FERC) under the Interstate Commerce Act. The Interstate Commerce Act requires that tariff rates for petroleum pipelines be just and reasonable and non-discriminatory. We are also subject to the Pipeline Safety Regulations of the U.S. Department of Transportation. Our intrastate pipeline transportation activities are subject to various state laws and regulations as well as orders of regulatory bodies.

Our Canadian pipeline assets are subject to regulation by the National Energy Board and by provincial agencies. With respect to a pipeline over which it has jurisdiction, each of these Canadian agencies has the power to determine the rates we are allowed to charge for transportation on such pipeline. The extent to which regulatory agencies can override existing transportation contracts has not been fully decided.

Our pipeline systems are dependent upon their interconnections with other crude oil pipelines to reach end markets.

Reduced throughput on these interconnecting pipelines as a result of testing, line repair, reduced operating pressures or other causes could result in reduced throughput on our pipeline systems that would adversely affect our profitability.

Fluctuations in demand can negatively affect our operating results.

Fluctuations in demand for crude oil, such as caused by refinery downtime or shutdown, can have a negative effect on our operating results. Specifically, reduced demand in an area serviced by our transmission systems will negatively affect the throughput on such systems. Although the negative impact may be mitigated or overcome by our ability to capture differentials created by demand fluctuations, this ability is dependent on location and grade of crude oil, and thus is unpredictable.

The terms of our indebtedness may limit our ability to borrow additional funds or capitalize on business opportunities.

As of June 30,December 31, 2004, pro forma for the third quarter equity and debt offerings, our total outstanding long-term debt was approximately $797.1$949 million. Various limitations in our indebtedness may reduce our ability to incur additional debt, to engage in some transactions and to capitalize on business opportunities. Any subsequent refinancing of our current indebtedness or any new indebtedness could have similar or greater restrictions.

Changes in currency exchange rates and foreign currency restrictions and shortages could adversely affect our operating results.

Because we conduct operations in Canada, we are exposed to currency fluctuations and exchange rate risks that may adversely affect our results of operations. In addition, legal restrictions or shortages in currencies outside the U.S. may prevent us from converting sufficient local currency to enable us to

complyCash distributions are not guaranteed and may fluctuate with our currency placement obligations not denominated in local currency or to meet our operating needsperformance and debt service requirements.

Our tax treatment depends on our status as a partnership for federal income tax purposes, as well as our not being subject to entity-level taxation by states. If the IRS treats us as a corporation or we become subject to entity-level taxation for state tax purposes, it would substantially reduce our ability to make distributions to you.establishment of financial reserves.

IfBecause distributions on the common units are dependent on the amount of cash we were classified as a corporation for federal income tax purposes, we would pay federal income taxgenerate, distributions may fluctuate based on our income atperformance. The actual amount of cash that is available to be distributed each quarter will depend on numerous factors, some of which are beyond our control and the corporate rate. Treatmentcontrol of us as a corporation would cause a material reduction in our anticipatedthe general partner. Cash distributions are dependent primarily on cash flow, including cash flow from financial reserves and working capital borrowings, and not solely on profitability, which would materiallyis affected by non-cash items. Therefore, cash distributions might be made during periods when we record losses and adversely affect our ability to make distributions to you.

In addition, because of widespread state budget deficits, several states are evaluating ways to subject partnerships to entity-level taxation through the imposition of state income, franchise or other forms of taxation. Imposition of such forms of taxation would reduce our cash flow.

We willmight not be required to comply with Section 404 of the Sarbanes-Oxley Act for the first time.

The Sarbanes-Oxley Act of 2002 has imposed many new requirements on public companies regarding corporate governance and financial reporting. Among these is the requirement under Section 404 of the Act, beginning with our 2004 Annual Report, for management to report on our internal control over financial reporting and for our independent public accountants to attest to management's report. During 2003,made during periods when we commenced actions to enhance our ability to comply with these requirements, including but not limited to the addition of staffing in our internal audit department, documentation of existing controls and implementation of new controls or modification of existing controls as deemed appropriate. We have continued to devote substantial time and resources to the documentation and testing of our controls, and to planning for and implementation of remedial efforts in those instances where remediation is indicated. At this point, we have no indication that management will be unable to favorably report on our internal controls nor that our independent auditors will be unable to attest to management's findings. Both we and our auditors, however, must complete the process (which we have never completed before), so we cannot assure you of the results. It is unclear what impact failure to comply fully with Section 404 or the discovery of a material weakness in our internal control over financial reporting would have on us, but presumably it could result in the reduced ability to obtain financing, the loss of customers, and additional expenditures to meet the requirements.record profits.

Risks Inherent in an Investment in Plains All American Pipeline

Cost reimbursements due to our general partner may be substantial and will reduce our cash available for distribution to you.

Prior to making any distribution on the common units, we will reimburse our general partner and its affiliates, including officers and directors of the general partner, for all expenses incurred on our behalf. The reimbursement of expenses and the payment of fees could adversely affect our ability to make distributions. The general partner has sole discretion to determine the amount of these expenses. In addition, our general partner and its affiliates may provide us services for which we will be charged reasonable fees as determined by the general partner.

You may not be able to remove our general partner even if you wish to do so.

Our general partner manages and operates Plains All American Pipeline. Unlike the holders of common stock in a corporation, you will have only limited voting rights on matters affecting our business. You will have no right to elect the general partner or the directors of the general partner on an annual or other continuing basis. Because the owners of our general partner own more than

one-third of our outstanding units, these owners have the practical ability to prevent the removal of our general partner.

In addition, the following provisions of our partnership agreement may discourage a person or group from attempting to remove our general partner or otherwise change our management:

As a result of these provisions, the price at which the common units will trade may be lower because of the absence or reduction of a takeover premium in the trading price.

We may issue additional common units without your approval, which would dilute your existing ownership interests.

Our general partner may cause us to issue an unlimited number of common units, without your approval. The issuance of additional common units or other equity securities of equal or senior rank will have the following effects:

We may also issue at any time an unlimited number of equity securities ranking junior or senior to the common units without the approval of the unitholders.

Our general partner has a limited call right that may require you to sell your units at an undesirable time or price.

If at any time our general partner and its affiliates own 80% or more of the common units, the general partner will have the right, but not the obligation, which it may assign to any of its affiliates, to acquire all, but not less than all, of the remaining common units held by unaffiliated persons at a price generally equal to the then current market price of the common units. As a result, you may be required to sell your common units at a time when you may not desire to sell them or at a price that is less than the price you would like to receive. You may also incur a tax liability upon a sale of your common units.

You may not have limited liability if a court finds that unitholder actions constitute control of our business.

Under Delaware law, you could be held liable for our obligations to the same extent as a general partner if a court determined that the right of unitholders to remove our general partner or to take other action under our partnership agreement constituted participation in the "control" of our business.

Our general partner generally has unlimited liability for our obligations, such as our debts and environmental liabilities, except for those contractual obligations that are expressly made without recourse to our general partner.

In addition, Section 17-607 of the Delaware Revised Uniform Limited Partnership Act provides that under some circumstances, a unitholder may be liable to us for the amount of a distribution for a period of three years from the date of the distribution.

Conflicts of interest could arise among our general partner and us or the unitholders.

These conflicts may include the following:

Tax Risks to Common Unitholders

You should read "Tax Considerations" for a more complete discussion of the following expected material federal income tax consequences of owning and disposing of common units.

The IRS could treat us as a corporation for tax purposes, which would substantially reduce the cash available for distribution to you.

The anticipated after-tax benefit of an investment in the common units depends largely on our being treated as a partnership for federal income tax purposes. We have not requested, and do not plan to request, a ruling from the IRS on this or any other matter affecting us.

If we were classified as a corporation for federal income tax purposes, we would pay federal income tax on our income at the corporate tax rate, which is currently a maximum of 35%. Distributions to you would generally be taxed again to you as corporate distributions, and no income, gains, losses, deductions or credits would flow through to you. Because a tax would be imposed upon

us as a corporation, the cash available for distribution to you would be substantially reduced. Treatment of us as a corporation would result in a material reduction in the after-tax return to the unitholders, likely causing a substantial reduction in the value of the common units.

Current law may change so as to cause us to be taxed as a corporation for federal income tax purposes or otherwise subject us to entity-level taxation. In addition, because of widespread state budget deficits, several states are evaluating ways to subject partnerships to entity-level taxation through the imposition of state income, franchise or other forms of taxation. If any state were to impose a tax upon us as an entity, the cash available for distribution to you would be reduced. Our partnership agreement provides that, if a law is enacted or existing law is modified or interpreted in a manner that subjects us to taxation as a corporation or otherwise subjects us to entity-level taxation for federal, state or local income tax purposes, then the minimum quarterly distribution and the target distribution levels will be decreased to reflect that impact on us.

A successful IRS contest of the federal income tax positions we take may adversely impact the market for common units.

We have not requested a ruling from the IRS with respect to any matter affecting us. The IRS may adopt positions that differ from the conclusions of our counsel expressed in this registration statement or from the positions we take. It may be necessary to resort to administrative or court proceedings to sustain our counsel's conclusions or the positions we take. A court may not concur with our counsel's conclusions or the positions we take. Any contest with the IRS may materially and adversely impact the market for common units and the price at which they trade. In addition, the costs of any contest with the IRS, principally legal, accounting and related fees, will be borne by us and directly or indirectly by the unitholders and the general partner.

You may be required to pay taxes even if you do not receive any cash distributions.

You will be required to pay federal income taxes and, in some cases, state and local income taxes on your share of our taxable income even if you do not receive any cash distributions from us. You may not receive cash distributions from us equal to your share of our taxable income or even equal to the actual tax liability that results from your share of our taxable income.

Tax gain or loss on disposition of common units could be different than expected.

If you sell your common units, you will recognize gain or loss equal to the difference between the amount realized and your tax basis in those common units. Prior distributions in excess of the total net taxable income you were allocated for a common unit, which decreased your tax basis in that common unit, will, in effect, become taxable income to you if the common unit is sold at a price greater than your tax basis in that common unit, even if the price you receive is less than your original cost. A

substantial portion of the amount realized, whether or not representing gain, may be ordinary income to you. Should the IRS successfully contest some positions we take, you could recognize more gain on the sale of units than would be the case under those positions, without the benefit of decreased income in prior years. Also, if you sell your units, you may incur a tax liability in excess of the amount of cash you receive from the sale.

If you are a tax-exempt entity, a regulated investment company or an individual not residing in the United States, you may have adverse tax consequences from owning common units.

Investment in common units by tax-exempt entities, regulated investment companies or mutual funds and foreign persons raises issues unique to them. For example, virtually all of our income allocated to organizations exempt from federal income tax, including individual retirement accounts and other retirement plans, will be unrelated business taxable income and will be taxable to them. VeryRecent legislation treats net income derived from the ownership of certain publicly traded partnerships (including us) as qualifying income to a regulated investment company. However, this legislation is only effective for taxable years beginning after October 22, 2004, the date of enactment. For taxable years beginning on or before the date of enactment, very little of our income will be qualifying income to a regulated investment company or mutual fund.company. Distributions to foreign persons will be reduced by withholding taxes at the highest effective U.S.

federal income tax rate for individuals, and foreign persons will be required to file federal income tax returns and pay tax on their share of our taxable income.

We are registered as a tax shelter. This may increase the risk of an IRS audit of us or a unitholder.

We are registered with the IRS as a "tax shelter." Our tax shelter registration number is 99061000009. The IRS requires that some types of entities, including some partnerships, register as "tax shelters" in response to the perception that they claim tax benefits that the IRS may believe to be unwarranted. As a result, we may be audited by the IRS and tax adjustments could be made. Any unitholder owning less than a 1% profits interest in us has very limited rights to participate in the income tax audit process. Further, any adjustments in our tax returns will lead to adjustments in the unitholders' tax returns and may lead to audits of unitholders' tax returns and adjustments of items unrelated to us. You will bear the cost of any expense incurred in connection with an examination of your personal tax return.

Recently issued Treasury Regulations require taxpayers to report certain information on Internal Revenue Service Form 8886 if they participate in a "reportable transaction." Unitholders may be required to file this form with the IRS if we participate in a "reportable transaction." A transaction may be a reportable transaction based upon any of several factors. Unitholders are urged to consult with their own tax advisor concerning the application of any of these factors to their investment in our common units. Congress is considering legislative proposals that, if enacted, would impose significant penalties for failure to comply with these disclosure requirements. The Treasury Regulations also impose obligations on "material advisors" that organize, manage or sell interests in registered "tax shelters." As stated above, we have registered as a tax shelter, and, thus, one of our material advisors will be required to maintain a list with specific information, including unitholder names and tax identification numbers, and to furnish this information to the IRS upon request. Unitholders are urged to consult with their own tax advisor concerning any possible disclosure obligation with respect to their investment and should be aware that we and our material advisors intend to comply with the list and disclosure requirements.

We treat a purchaser of units as having the same tax benefits without regard to the units purchased. The IRS may challenge this treatment, which could adversely affect the value of the units.

Because we cannot match transferors and transferees of common units, we have adopted depreciation and amortization positions that do not conform with all aspects of the Treasury regulations. A successful IRS challenge to those positions could adversely affect the amount of tax benefits available to you. It also could affect the timing of these tax benefits or the amount of gain from your sale of common units and could have a negative impact on the value of the common units or result in audit adjustments to your tax returns. Please read "Tax Considerations—Uniformity of Units" in this prospectus for further discussion of the effect of the depreciation and amortization positions we have adopted.

You will likely be subject to foreign, state and local taxes in jurisdictions where you do not live as a result of an investment in units.

In addition to federal income taxes, you will likely be subject to other taxes, including foreign taxes, state and local taxes, unincorporated business taxes and estate, inheritance or intangible taxes that are imposed by the various jurisdictions in which we do business or own property and in which you do not reside. We own property and conduct business in Canada and in most states in the United States. You may be required to file Canadian federal income tax returns and to pay Canadian federal and provincial income taxes and to file state and local income tax returns and pay state and local income taxes in many or all of the jurisdictions in which we do business or own property. Further, you may be subject to penalties for failure to comply with those requirements. It is your responsibility to file all federal, state, local and foreign tax returns. Our counsel has not rendered an opinion on the foreign, state or local tax consequences of an investment in the common units.

We will not receive any proceeds from the sale of common units by the selling unitholders.

PRICE RANGE OF COMMON UNITS AND DISTRIBUTIONS

As of September 30, 2004,April 18, 2005, there were 62,740,21867,293,108 common units outstanding, held by approximately 34032,000 holders of record, including common units held in street name. The number of common units outstanding on this date includes the 3,245,700 Class C common units and the 1,307,190 Class B common units that converted in February 2005. The common units are traded on the New York Stock Exchange under the symbol "PAA." An additional 1,307,190 Class B common units and 3,245,700 Class C common units were outstanding as of such date. The Class B common units are held by an affiliate of Plains Holdings Inc. and the Class C common units are held by six holders of record. The Class B common units and the Class C common units arepari passu with and have economic terms substantially similar to the common units but are not publicly traded. Holders of the Class B common units and the Class C common units have the right to demand a meeting of limited partners to vote on whether the Class B common units and Class C common units may be converted at the option of the holders into an equal number of common units. We anticipate that notice of the exercise of such right will be given on October 15, 2004.

The following table sets forth, for the periods indicated, the high and low sales prices for the common units, as reported on the New York Stock Exchange Composite Transactions Tape, and quarterly cash distributions declared per common unit. The last reported sale price of common units on the New York Stock Exchange on October 11, 2004April 18, 2005 was $36.41$38.84 per common unit.

| | Price Range | | Price Range | | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Cash Distributions per Unit(1) | Cash Distributions per Unit(1) | ||||||||||||||||

| | High | Low | High | Low | ||||||||||||||

| 2002 | ||||||||||||||||||

| First Quarter | $ | 26.79 | $ | 23.60 | $ | 0.5250 | ||||||||||||

| Second Quarter | 27.30 | 24.60 | 0.5375 | |||||||||||||||

| Third Quarter | 26.38 | 19.54 | 0.5375 | |||||||||||||||

| Fourth Quarter | 24.44 | 22.04 | 0.5375 | |||||||||||||||

2003 | ||||||||||||||||||

| First Quarter | $ | 26.90 | $ | 24.20 | $ | 0.5500 | $ | 26.90 | $ | 24.20 | $ | 0.5500 | ||||||

| Second Quarter | 31.48 | 24.65 | 0.5500 | 31.48 | 24.65 | 0.5500 | ||||||||||||

| Third Quarter | 32.49 | 29.10 | 0.5500 | 32.49 | 29.10 | 0.5500 | ||||||||||||

| Fourth Quarter | 32.82 | 29.76 | 0.5625 | 32.82 | 29.76 | 0.5625 | ||||||||||||

2004 | ||||||||||||||||||

| First Quarter | $ | 35.23 | $ | 31.18 | $ | 0.5625 | $ | 35.23 | $ | 31.18 | $ | 0.5625 | ||||||

| Second Quarter | 36.13 | 27.25 | 0.5775 | 36.13 | 27.25 | 0.5775 | ||||||||||||

| Third Quarter | 35.98 | 31.63 | (2) | 35.98 | 31.63 | 0.6000 | ||||||||||||

| Fourth Quarter (through October 11, 2004) | 36.99 | 35.76 | (2) | |||||||||||||||

| Fourth Quarter | 37.99 | 34.51 | 0.6125 | |||||||||||||||

2005 | ||||||||||||||||||

| First Quarter | $ | 40.98 | $ | 36.50 | $ | 0.6375 | ||||||||||||

| Second Quarter (through April 18, 2005) | $ | 39.61 | $ | 38.00 | (2) | |||||||||||||

SELECTED HISTORICAL FINANCIAL AND OPERATING DATA

We have derived the historical financial information and operating data below from our audited consolidated financial statements as of and for the years ended December 31, 2004, 2003, 2002, 2001, 2000 and 1999 and from our unaudited financial statements as of and for the six months ended June 30, 2004 and 2003.2000. The selected financial data should be read in conjunction with the consolidated financial statements, including the notes thereto, and "Management's Discussion and Analysis of Financial Condition and Results of Operations" included in this prospectus.

| | | Six Months Ended June 30, | Year Ended December 31, | Year Ended December 31, | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | 2004 | 2003 | 2003 | 2002 | 2001 | 2000 | 1999 | 2004 | 2003 | 2002 | 2001 | 2000 | |||||||||||||||||||||||||||

| | | (in millions except per unit data) | (in millions except per unit data) | |||||||||||||||||||||||||||||||||||||

| Statement of operations data: | Statement of operations data: | |||||||||||||||||||||||||||||||||||||||

| Revenues | $ | 8,936.4 | $ | 5,991.1 | $ | 12,589.8 | $ | 8,384.2 | $ | 6,868.2 | $ | 6,641.2 | $ | 10,910.4 | ||||||||||||||||||||||||||

| Cost of sales and field operations (excluding LTIP charge) | 8,782.2 | 5,878.2 | 12,366.6 | 8,209.9 | 6,720.9 | 6,506.5 | 10,800.1 | |||||||||||||||||||||||||||||||||

| Revenues(10) | $ | 20,975.5 | $ | 12,589.8 | $ | 8,384.2 | $ | 6,868.2 | $ | 6,641.2 | ||||||||||||||||||||||||||||||

| Cost of sales and field operations (excluding LTIP charge)(10) | (20,641.1 | ) | (12,366.6 | ) | (8,209.9 | ) | (6,720.9 | ) | (6,506.5 | ) | ||||||||||||||||||||||||||||||

| Unauthorized trading losses and related expenses | Unauthorized trading losses and related expenses | — | — | — | — | — | 7.0 | 166.4 | — | — | — | — | (7.0 | ) | ||||||||||||||||||||||||||

| Inventory valuation adjustment | Inventory valuation adjustment | — | — | — | — | 5.0 | — | — | (2.0 | ) | — | — | (5.0 | ) | — | |||||||||||||||||||||||||

| LTIP charge—operations(1) | LTIP charge—operations(1) | 0.5 | — | 5.7 | — | — | — | — | (0.9 | ) | (5.7 | ) | — | — | — | |||||||||||||||||||||||||

| General and administrative expenses (excluding LTIP charge) | General and administrative expenses (excluding LTIP charge) | 35.1 | 25.2 | 50.0 | 45.7 | 46.6 | 40.8 | 23.2 | (75.8 | ) | (50.0 | ) | (45.7 | ) | (46.6 | ) | (40.8 | ) | ||||||||||||||||||||||

| LTIP charge—general and administrative(1) | LTIP charge—general and administrative(1) | 3.7 | — | 23.1 | — | — | — | — | (7.0 | ) | (23.1 | ) | — | — | — | |||||||||||||||||||||||||

| Depreciation and amortization | Depreciation and amortization | 29.1 | 22.2 | 46.8 | 34.0 | 24.3 | 24.5 | 17.3 | (67.2 | ) | (46.8 | ) | (34.0 | ) | (24.3 | ) | (24.5 | ) | ||||||||||||||||||||||

| Restructuring expense | — | — | — | — | — | — | 1.4 | |||||||||||||||||||||||||||||||||

| Total costs and expenses | Total costs and expenses | 8,850.6 | 5,925.6 | 12,492.3 | 8,289.6 | 6,796.8 | 6,578.8 | 11,008.4 | (20,794.0 | ) | (12,492.3 | ) | (8,289.6 | ) | (6,796.8 | ) | (6,578.8 | ) | ||||||||||||||||||||||

| Gain on sale of assets | Gain on sale of assets | 0.6 | — | 1.0 | 48.2 | 16.4 | 0.6 | 0.6 | — | 1.0 | 48.2 | |||||||||||||||||||||||||||||

| Asset impairment | (2.0 | ) | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Operating income | Operating income | 85.7 | 65.4 | 98.2 | 94.6 | 72.4 | 110.6 | (81.6 | ) | 180.1 | 98.2 | 94.6 | 72.4 | 110.6 | ||||||||||||||||||||||||||

| Interest expense | Interest expense | (19.5 | ) | (17.7 | ) | (35.2 | ) | (29.1 | ) | (29.1 | ) | (28.7 | ) | (21.1 | ) | (46.7 | ) | (35.2 | ) | (29.1 | ) | (29.1 | ) | (28.7 | ) | |||||||||||||||

| Interest income and other, net(2) | Interest income and other, net(2) | 0.5 | — | (3.6 | ) | (0.2 | ) | 0.4 | (4.4 | ) | (0.6 | ) | (0.3 | ) | (3.6 | ) | (0.2 | ) | 0.4 | (4.4 | ) | |||||||||||||||||||

| Income (loss) from continuing operations before cumulative effect of change in accounting principle(12) | $ | 66.7 | $ | 47.7 | $ | 59.4 | $ | 65.3 | $ | 43.7 | $ | 77.5 | $ | (103.4 | ) | |||||||||||||||||||||||||

| Income from continuing operations before cumulative effect of change in accounting principle(2)(3) | $ | 133.1 | $ | 59.4 | $ | 65.3 | $ | 43.7 | $ | 77.5 | ||||||||||||||||||||||||||||||

| Basic net income (loss) per limited partner unit before cumulative effect of change in accounting principle(2)(12) | $ | 1.03 | $ | 0.87 | $ | 1.01 | $ | 1.34 | $ | 1.12 | $ | 2.13 | $ | (3.21 | ) | |||||||||||||||||||||||||

| Diluted net income (loss) per limited partner unit before cumulative effect of change in accounting principle(2)(12) | $ | 1.03 | $ | 0.87 | $ | 1.00 | $ | 1.34 | $ | 1.12 | $ | 2.13 | $ | (3.21 | ) | |||||||||||||||||||||||||

| Basic net income per limited partner unit before cumulative effect of change in accounting principle(2)(3) | $ | 1.94 | $ | 1.01 | $ | 1.34 | $ | 1.12 | $ | 2.13 | ||||||||||||||||||||||||||||||

| Diluted net income per limited partner unit before cumulative effect of change in accounting principle(2)(3) | $ | 1.94 | $ | 1.00 | $ | 1.34 | $ | 1.12 | $ | 2.13 | ||||||||||||||||||||||||||||||

| Basic weighted average number of limited partner units outstanding | Basic weighted average number of limited partner units outstanding | 60.0 | 51.2 | 52.7 | 45.5 | 37.5 | 34.4 | 31.6 | 63.3 | 52.7 | 45.5 | 37.5 | 34.4 | |||||||||||||||||||||||||||

| Diluted weighted average number of limited partner units outstanding | Diluted weighted average number of limited partner units outstanding | 60.0 | 51.2 | 53.4 | 45.5 | 37.5 | 34.4 | 31.6 | 63.3 | 53.4 | 45.5 | 37.5 | 34.4 | |||||||||||||||||||||||||||

Balance sheet data (at end of period): | Balance sheet data (at end of period): | |||||||||||||||||||||||||||||||||||||||

| Total assets | Total assets | 2,682.0 | 1,710.4 | 2,095.6 | 1,666.6 | 1,261.2 | 885.8 | 1,223.0 | $ | 3,160.4 | $ | 2,095.6 | $ | 1,666.6 | $ | 1,261.2 | $ | 885.8 | ||||||||||||||||||||||

| Total long-term debt(3)(4) | 934.8 | 526.5 | 519.0 | 509.7 | 354.7 | 320.0 | 424.1 | |||||||||||||||||||||||||||||||||

| Total debt(4) | 956.8 | 544.5 | 646.2 | 609.0 | 456.2 | 321.3 | 482.8 | |||||||||||||||||||||||||||||||||

| Total long-term debt(4) | 949.0 | 519.0 | 509.7 | 354.7 | 320.0 | |||||||||||||||||||||||||||||||||||

| Total debt | 1,124.5 | 646.3 | 609.0 | 456.2 | 321.3 | |||||||||||||||||||||||||||||||||||

| Partners' capital | Partners' capital | 865.6 | 600.8 | 746.7 | 511.6 | 402.8 | 214.0 | 193.0 | 1,070.2 | 746.7 | 511.6 | 402.8 | 214.0 | |||||||||||||||||||||||||||

Other data: | Other data: | |||||||||||||||||||||||||||||||||||||||

| Maintenance capital expenditures | Maintenance capital expenditures | $ | 3.1 | $ | 4.2 | $ | 7.6 | $ | 6.0 | $ | 3.4 | $ | 1.8 | $ | 1.7 | $ | 11.3 | $ | 7.6 | $ | 6.0 | $ | 3.4 | $ | 1.8 | |||||||||||||||

| Net cash provided by (used in) operating activities(5) | Net cash provided by (used in) operating activities(5) | 147.1 | 204.8 | 115.3 | 185.0 | (16.2 | ) | (33.5 | ) | (71.2 | ) | 104.0 | 115.3 | 185.0 | (16.2 | ) | (33.5 | ) | ||||||||||||||||||||||

| Net cash provided by (used in) investing activities(5) | Net cash provided by (used in) investing activities(5) | (474.6 | ) | (139.8 | ) | (272.1 | ) | (374.9 | ) | (263.2 | ) | 211.0 | (186.1 | ) | (651.2 | ) | (272.1 | ) | (374.9 | ) | (263.2 | ) | 211.0 | |||||||||||||||||

| Net cash provided by (used in) financing activities | Net cash provided by (used in) financing activities | 334.0 | 63.0 | 157.2 | 189.5 | 279.5 | (227.8 | ) | 305.6 | 554.5 | 157.2 | 189.5 | 279.5 | (227.8 | ) | |||||||||||||||||||||||||

| Declared distributions per limited partner unit(6)(7)(8) | Declared distributions per limited partner unit(6)(7)(8) | 1.13 | 1.09 | 2.19 | 2.11 | 1.95 | 1.83 | 1.59 | 2.30 | 2.19 | 2.11 | 1.95 | 1.83 | |||||||||||||||||||||||||||

Table continued on following page. | ||||||||||||||||||||||||||||||||||||||||

| | | Year Ended December 31, | ||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | 2004 | 2003 | 2002 | 2001 | 2000 | ||||||||||||||||||||||||||||||

Operating Data: | Operating Data: | Operating Data: | ||||||||||||||||||||||||||||||||||

| Volumes (thousands of barrels per day)(9) | Volumes (thousands of barrels per day)(9) | Volumes (thousands of barrels per day)(9) | ||||||||||||||||||||||||||||||||||

| Pipeline segment: | Pipeline segment: | Pipeline segment: | ||||||||||||||||||||||||||||||||||

| Tariff activities | Tariff activities | |||||||||||||||||||||||||||||||||||

| All American | 57 | 61 | 59 | 65 | 69 | 74 | 103 | All American | 54 | 59 | 65 | 69 | 74 | |||||||||||||||||||||||

| Link acquisition | 185 | N/A | N/A | N/A | N/A | N/A | N/A | Link acquisition | 283 | N/A | N/A | N/A | N/A | |||||||||||||||||||||||

| Capline | 112 | N/A | N/A | N/A | N/A | N/A | N/A | Capline | 123 | N/A | N/A | N/A | N/A | |||||||||||||||||||||||

| Basin | 273 | 245 | 263 | 93 | N/A | N/A | N/A | Basin | 265 | 263 | 93 | N/A | N/A | |||||||||||||||||||||||

| Other domestic(10) | 408 | 26 | 299 | 219 | 144 | 130 | 61 | Other domestic | 424 | 299 | 219 | 144 | 130 | |||||||||||||||||||||||

| Canada | 250 | 181 | 203 | 187 | 132 | N/A | N/A | Canada | 263 | 203 | 187 | 132 | N/A | |||||||||||||||||||||||

| Pipeline margin activities | 73 | 81 | 78 | 73 | 61 | 60 | 54 | Pipeline margin activities | 74 | 78 | 73 | 61 | 60 | |||||||||||||||||||||||

| Total | 1,358 | 829 | 902 | 637 | 406 | 264 | 218 | Total | 1,486 | 902 | 637 | 406 | 264 | |||||||||||||||||||||||

Gathering, marketing, terminalling and storage segment: | Gathering, marketing, terminalling and storage segment: | Gathering, marketing, terminalling and storage segment: | ||||||||||||||||||||||||||||||||||

| Lease gathering | 550 | 430 | 437 | 410 | 348 | 262 | 265 | Crude oil lease gathering | 589 | 437 | 410 | 348 | 262 | |||||||||||||||||||||||

| Bulk purchases(11) | 135 | 78 | 90 | 68 | 46 | 28 | 138 | Crude oil bulk purchases | 148 | 90 | 68 | 46 | 28 | |||||||||||||||||||||||

| Total | 685 | 508 | 527 | 478 | 394 | 290 | 403 | Total | 737 | 527 | 478 | 394 | 290 | |||||||||||||||||||||||

| LPG sales | LPG sales | 48 | 38 | 35 | 19 | N/A | ||||||||||||||||||||||||||||||

| LPG sales | 40 | 35 | 38 | 35 | 19 | N/A | N/A | |||||||||||||||||||||||||||||

MANAGEMENT'S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion is intended to provide investors with an understanding of our financial condition and results of our operations and should be read in conjunction with our historical consolidated financial statements and accompanying notes included elsewhere in this prospectus.notes.

Our discussion and analysis includes the following:

Company Overview.Overview

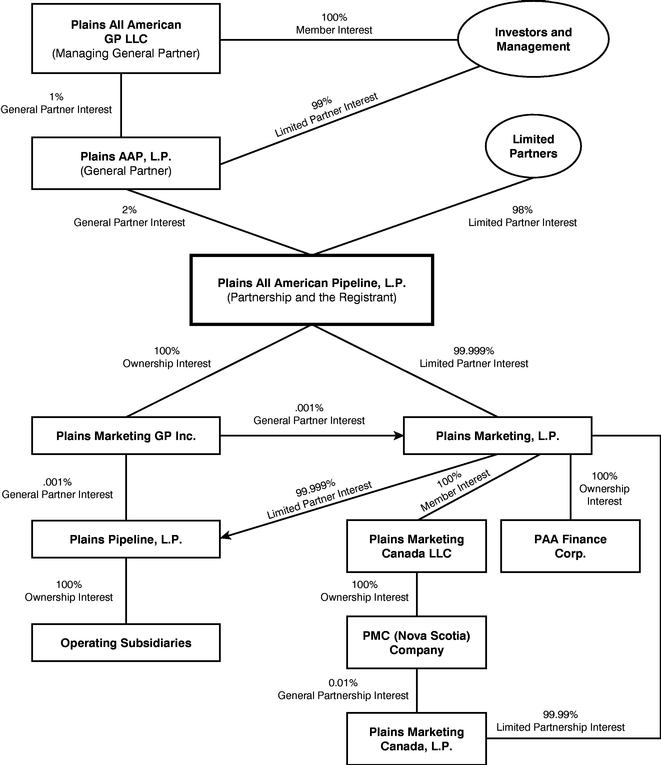

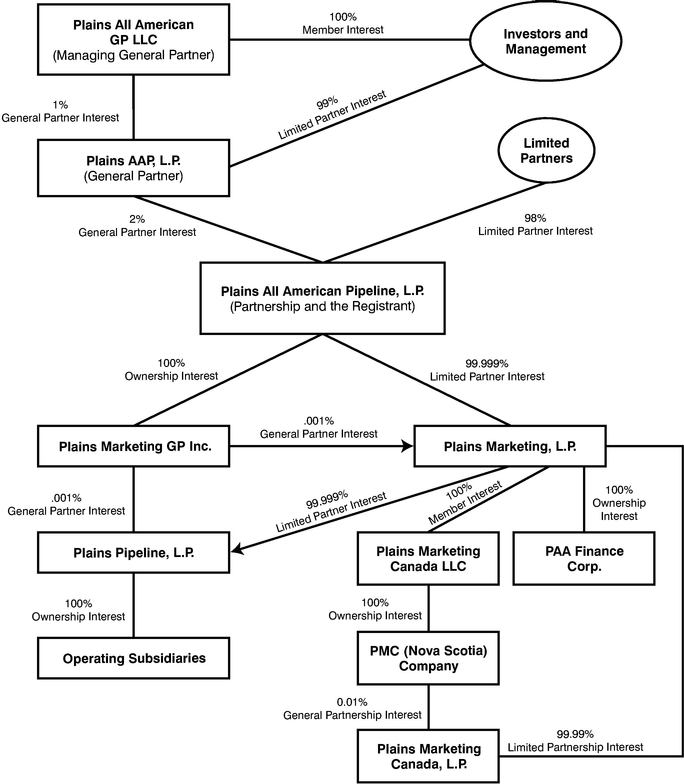

Plains All American Pipeline, L.P. is a Delaware limited partnership formed in September of 1998. Our operations are conducted directly and indirectly through our operating subsidiaries, Plains Marketing, L.P., Plains Pipeline, L.P. and Plains Marketing Canada, L.P. We are engaged in interstate and intrastate crude oil transportation, and crude oil gathering, marketing, terminalling and storage, as well as the marketing and storage of liquefied petroleum gas and other petroleum products. We refer to liquified petroleum gas and other petroleum products collectively as "LPG." We ownhave an extensive network of pipeline transportation, terminalling, storage and gathering assets in key oil producing basins and at major market hubs in the United States and Canada.

We are one of the largest midstream crude oil companies in North America. As of June 30,December 31, 2004, we owned approximately 15,000 miles of active crude oil pipelines, approximately 37 million barrels of active terminalling and storage capacity and a full complement of truck transportation and injection assets.over 400 transport trucks. Currently, we handle an average of over 2.62.4 million barrels per day of physical crude oil through our extensive network of assets located in major oil producing regions of the United States and Canada. Our operations consist of two operating segments: (i) pipeline operations ("Pipeline Operations") and (ii) gathering, marketing, terminalling and storage operations ("GMT&S"). Through our pipeline segment, we engage in interstate and intrastate crude oil pipeline transportation and certain related margin activities. Through our GMT&S segment, we engage in purchases and resales of crude oil and LPG at various points along the distribution chain and we operate certain terminalling and storage assets.

Overview of Operating Results and Significant Activities

Six Months Ended June 30, 2004.During the first six months of 2004, we recognized net income and earnings per limited partner unit of $63.5$130.0 million and $0.98,$1.89, respectively, both of which was a 33%were substantial increases over 2003 and 13% increase, respectively, over the first six months of 2003.2002. The results for the first six months of 2004 as compared to the first six months of 2003two previous years include significant contributions from the acquisitions completed during the second half of 2003 and the first half of 2004. In addition, the 2004 results

include a non-cash gain of approximately $0.5 million resulting from the mark-to-market of open derivative instruments pursuant to Statement of Financial Accounting Standard No. 133, as amended ("SFAS 133"), while the first six months of 2003 includes a non-cash gain of approximately $1.1 million.

Significant events in the first six months of 2004 that affected The following significant activities impacted our operations, operating results of operations included the following:or our financial position during 2004:

Fiscal Year 2003. During 2003:

simplifying our capital structure. The conversion also triggered the vesting in 2003 and 2004 of a portion of the outstanding phantom units under our Long-Term Incentive Plan. During 2003, we accrued a portion of the estimated expense associated with the anticipated 2004 vesting, resulting in a charge of approximately $28.8 million.

Prospects for the Future.Future

We believe we have access to equity and debt capital and that we are well situated to optimize our position in and around our existing assets and to expand our asset base by continuing to consolidate, rationalize and optimize the North American crude oil infrastructure. We have deliberately configured

our assets to provide a counter-cyclical balance between our gathering and marketing activities and our terminalling and storage activities. We believe the combination of these balanced activities adds stability to the portion of our business that is highly cyclical, and with our relatively stable, fee-based pipeline assets, enables us to generate stable financial results in an industry that is highly cyclical.results.

During fiscal year 2004 we have further strengthened our positionbusiness by expanding our asset base through acquisitionacquisitions and internal growth projects. We operate in a mature industry and believe that our primary source of growth will come from acquisitions, and we believe that there are opportunities for acquisitions. We will continue to pursue the purchase of midstream crude oil assets, and we will also continue to initiate projects designed to optimize crude oil flows in the areas in which we operate. We believe the outlook is positive for, and have a strategic initiative of increasing our participation in, the importing of foreign crude oil, primarily through building a meaningful asset presence to enable us to receive foreign crude oil via the Gulf Coast. We also believe there are opportunities for us to grow our LPG business. In addition, we believe we can, and will pursue opportunities to, leverage our assets, business model, knowledge and expertise into investments in businesses complementary to our crude oil and LPG activities. Although we believe that we are well situated in the North American crude oil infrastructure, we face various operational, regulatory and financial challenges that may impact our ability to execute our strategy as planned. See "Risk Factors" and "Forward-Looking Statements"Factors—Risks Related to Our Business" for further discussion of these items. We can give no assurance that our current or future acquisition efforts will be successful or that any such acquisition will be completed on terms considered favorable to us.

We completed a number of acquisitions in 2004, 2003 and 2002 that have impacted the results of operations and liquidity discussed herein. The following acquisitions were accounted for, and the purchase price was allocated, in accordance with the purchase method of accounting. We adopted SFAS No. 141, "Business Combinations" in 2001 and followed the provisions of that statement for all business combinations initiated after June 30, 2001. Our ongoing acquisition activity is discussed further in "—Liquidity"Liquidity and Capital Resources" below.

2004 Acquisitions

During the first six months ofIn 2004, we have completed several acquisitions for aggregate consideration of approximately $506.1$549.5 million. The aggregate consideration includes cash paid, estimated transaction costs and assumed liabilities and net working capital items. The following table

summarizes our 2004 acquisitions, (in millions) for the first six months of 2004, and a description of each of these follows the table:

| Acquisition | Effective Date | Acquisition Price | Operating Segment | |||||

|---|---|---|---|---|---|---|---|---|

| Capline and Capwood Pipeline Systems | 03/01/04 | $ | 158.5 | Pipeline | ||||

| Link Energy LLC | 04/01/04 | 326.1 | Pipeline/GMT&S | |||||

| Cal Ven Pipeline System | 05/01/04 | 19.0 | Pipeline | |||||

| Other(1) | 06/01/04 | 2.5 | Pipeline | |||||

| Total 2004 Acquisitions through June 30, 2004 | $ | 506.1 | ||||||

| Acquisition | Effective Date | Acquisition Cost | Operating Segment | |||||

|---|---|---|---|---|---|---|---|---|

| Capline and Capwood Pipeline System | 03/01/04 | $ | 158.5 | Pipeline | ||||

| Link Energy LLC | 04/01/04 | 332.3 | Pipeline/GMT&S | |||||

| Cal Ven Pipeline System | 05/01/04 | 19.0 | Pipeline | |||||

| Schaefferstown Propane Storage Facility | 08/25/04 | 32.0 | GMT&S | |||||

| Other | various | 7.7 | GMT&S | |||||

| Total 2004 Acquisitions | $ | 549.5 | ||||||

Capline and Capwood Pipeline Systems. In March 2004, we completed the acquisition of all of Shell Pipeline Company LP's interests in two entities for approximately $158.0 million in cash (including a $15.8 million deposit paid in December 2003) and approximately $0.5 million of transaction and other costs. In December 2003, subsequent to the announcement of the acquisition and in anticipation of closing, we issued approximately 2.8 million common units for net proceeds of approximately $88.4 million, after paying approximately $4.1 million of transaction costs. The proceeds

from this issuance were used to pay down the outstanding balances under our revolving credit facility. At closing, the cash portion of this acquisition was funded from cash on hand and borrowings under our revolving credit facility.

The principal assets of the entities are: (i) an approximate 22% undivided joint interest in the Capline Pipeline System, and (ii) an approximate 76% undivided joint interest in the Capwood Pipeline System. The Capline Pipeline System is a 633-mile, 40-inch mainline crude oil pipeline originating in St. James, Louisiana, and terminating in Patoka, Illinois. The Capwood Pipeline System is a 57-mile, 20-inch mainline crude oil pipeline originating in Patoka, Illinois, and terminating in Wood River, Illinois. The results of operations and assets from this acquisition (the "Capline acquisition") have been included in our consolidated financial statements and in our pipeline operations segment since March 1, 2004. These pipelines provide one of the primary transportation routes for crude oil shipped into the Midwestern U.S. and delivered to several refineries and other pipelines.

The purchase price was allocated as follows (in millions):

| Crude oil pipelines and facilities | Crude oil pipelines and facilities | $ | 151.4 | $ | 151.4 | ||

| Crude oil storage and terminal facilities | Crude oil storage and terminal facilities | 5.7 | 5.7 | ||||

| Land | Land | 1.3 | 1.3 | ||||

| Office equipment and other | Office equipment and other | 0.1 | 0.1 | ||||

| Total | $ | 158.5 | $ | 158.5 | |||

Link Energy LLC. On April 1, 2004, we completed the acquisition of all of the North American crude oil and pipeline operations of Link for approximately $326$332 million, including $268 million of cash (net of approximately $5.5 million subsequently returned to PAA from an indemnity escrow account) and approximately $58$64 million of net liabilities assumed and acquisition related costs. The Link crude oil business consists of approximately 7,000 miles of active crude oil pipeline and gathering systems, over 10 million barrels of active crude oil storage capacity, a fleet of approximately 200 owned or leased trucks and approximately 2 million barrels of crude oil linefill and working inventory. The Link assets complement our assets in West Texas and along the Gulf Coast and allow us to expand our presence in the Rocky Mountain and Oklahoma/Kansas regions. The results of operations and assets from this acquisition (the "Link acquisition") have been included in our consolidated financial statements and both our pipeline operations and GMT&S operations segments since April 1, 2004.

The purchase price was allocated as follows and includes goodwill primarily related to Link's gathering and marketing business (in millions):

| Fair value of assets acquired: | |||||||||||

| Cash paid for acquisition(1) | Cash paid for acquisition(1) | $ | 268.0 | ||||||||

Fair value of net liabilities assumed: | Fair value of net liabilities assumed: | ||||||||||

| Accounts receivable(2) | Accounts receivable(2) | 409.4 | |||||||||

| Other current assets | Other current assets | 1.8 | |||||||||

| Accounts payable and accrued liabilities(2) | Accounts payable and accrued liabilities(2) | (459.6 | ) | ||||||||

| Other current liabilities | Other current liabilities | (8.5 | ) | ||||||||

| Other long-term liabilities | Other long-term liabilities | (7.4 | ) | ||||||||

| Total net liabilities assumed | (64.3 | ) | |||||||||

| Total purchase price | Total purchase price | $ | 332.3 | ||||||||

Purchase price allocation | Purchase price allocation | ||||||||||

| Property and equipment | Property and equipment | $ | 256.3 | Property and equipment | $ | 260.2 | |||||

| Inventory | Inventory | 1.1 | Inventory | 3.4 | |||||||

| Linefill | Linefill | 48.4 | Linefill | 55.4 | |||||||

| Inventory in third party assets | Inventory in third party assets | 15.1 | Inventory in third party assets | 8.1 | |||||||

| Goodwill | Goodwill | 5.0 | Goodwill | 5.0 | |||||||

| Other long term assets | Other long term assets | 0.2 | Other long term assets | 0.2 | |||||||

| Subtotal | 326.1 | Total | $ | 332.3 | |||||||

Accounts receivable | 405.4 | ||||||||||

| Other current assets | 1.8 | ||||||||||

| Subtotal | 407.2 | ||||||||||

Total assets acquired | 733.3 | ||||||||||

Fair value of liabilities assumed: | |||||||||||

| Accounts payable and accrued liabilities | (448.9 | ) | |||||||||

| Other current liabilities | (8.5 | ) | |||||||||

| Other long-term liabilities | (7.4 | ) | |||||||||

| Total liabilities assumed | 464.8 | ||||||||||

Cash paid for acquisition(1) | $ | 268.5 | |||||||||

We areThe total purchase price includes (i) $9.4 million in transaction costs, (ii) approximately $7.4 million related to a plan to involuntarily terminate and relocate employees in conjunction with the acquisition, and (iii) approximately $11.0 million related to costs to terminate a contract assumed in the processacquisition. These activities are substantially complete and the majority of evaluating certain estimates made in the purchase price allocation; thus, the allocation is subject to refinement.related costs have been incurred as of December 31, 2004. In addition, we anticipate making capital expenditures of approximately $20.0$28.0 million ($9.018.0 million of which will be spent in 2004)2005) to upgrade certain of the assets and comply with certain regulatory requirements.

On April 2, 2004, the Office of the Attorney General of Texas (the "Texas AG") delivered written notice to us that itThe acquisition was investigating the possibility that the acquisition of Link's assets might reduce competition in one or more markets within the petroleum products industry in the State of Texas.initially funded with cash on hand and borrowings under our existing credit facilities as well as under a new $200 million, 364-day credit facility. In connection with the Link purchase, both PAA and Linkacquisition, on April 15, 2004, we completed all necessary filings required under the Hart-Scott-Rodino Act,private placement of 3,245,700 Class C common units to a group of institutional investors. During the third quarter of 2004, we completed a public offering of common units and the required 30-day waiting period expired on March 24, 2004 without any inquiry or request for additional information from the U.S. Departmentsale of Justice or the Federal Trade Commission. Representatives from the Antitrust and Civil Medicaid Fraud Divisionunsecured senior notes. A portion of the Texas AG indicated their investigationproceeds from these transactions was prompted by complaints received from allegedly interested industry parties regardingused to retire the potential impact on competition in the Permian Basin area of West Texas. We understand that similar complaints have been received by the Federal Trade Commission, and that, consistent with federal-state protocols for conducting joint merger investigations, appropriate federal and state antitrust authorities are coordinating their activities. In connection with the April notice and again in June 2004, the Texas AG requested information from us. We have complied with these requests and are cooperating fully with the antitrust enforcement authorities.$200 million, 364-day credit facility.

Cal Ven Pipeline System. On May 7, 2004 we completed the acquisition of the Cal Ven Pipeline System from Cal Ven Limited, a subsidiary of Unocal Canada Limited. The total purchase price was approximately $19 million, including transaction costs. The transaction was funded through a combination of cash on hand and borrowings under our revolving credit facilities. The Cal Ven Pipeline

System includes approximately 195 miles of 8-inch and 10-inch gathering and mainline crude oil pipelines. The system is located in northern Alberta and delivers crude oil into the Rainbow Pipeline System. The Rainbow Pipeline System then transports the crude south to the Edmonton market, where it can be used in local refineries or shipped on connecting pipelines to the U.S. market. The results of

operations and assets from this acquisition have been included in our consolidated financial statements and our pipeline operations segment since May 1, 2004.

Schaefferstown Propane Storage Facility. In August 2004, we completed the acquisition of the Schaefferstown Propane Storage Facility from Koch Hydrocarbon, L.P. The total purchase price was approximately $32 million, including transaction costs. In connection with the transaction, we also acquired an additional $14.2 million of inventory. The transaction was funded through a combination of cash on hand and borrowings under our revolving credit facilities. The results of operations and assets from this acquisition have been included in our consolidated financial statements and our gathering, marketing, terminalling and storage operations segment since August 25, 2004.

2003 Acquisitions

During 2003, we completed ten acquisitions for aggregate consideration of approximately $159.5 million. The aggregate consideration includes cash paid, estimated transaction costs, assumed liabilities and estimated near-term capital costs. The acquisitions were initially financed with borrowings under our credit facilities, which were subsequently repaid with a portion of the proceeds from our equity issuances and the issuance of senior notes. See "—Liquidity and Capital Resources." The businesses acquired during 2003 impacted our results of operations subsequent tocommencing on the effective date of each acquisition as indicated below. These acquisitions included mainline crude oil pipelines, crude oil gathering lines, terminal and storage facilities, and an underground LPG storage facility. With the exception of $0.5 million that was allocated to goodwill and other intangible assets and $4.7 million associated with crude oil linefill and working inventory, the remaining aggregate purchase price was allocated to property and equipment. The following table details our 2003 acquisitions (in millions):

| Acquisition | Acquisition | Effective Date | Acquisition Price | Operating Segment | Effective Date | Acquisition Price | Operating Segment | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Red River Pipeline System | Red River Pipeline System | 02/01/03 | $ | 19.4 | Pipeline | 02/01/03 | $ | 19.4 | Pipeline | |||||||

| Iatan Gathering System | Iatan Gathering System | 03/01/03 | 24.3 | Pipeline | 03/01/03 | 24.3 | Pipeline | |||||||||

| Mesa Pipeline Facility | Mesa Pipeline Facility | 05/05/03 | 2.9 | Pipeline | Mesa Pipeline Facility | 05/05/03 | 2.9 | Pipeline | ||||||||

| South Louisiana Assets | South Louisiana Assets | 06/01/03 | 13.4 | Pipeline/GMT&S | South Louisiana Assets | 06/01/03 | 13.4 | Pipeline/G,M,T,&S | ||||||||

| Alto Storage Facility | Alto Storage Facility | 06/01/03 | 8.5 | GMT&S | 06/01/03 | 8.5 | G,M,T&S | |||||||||

| Iraan to Midland Pipeline System | Iraan to Midland Pipeline System | 06/30/03 | 17.6 | Pipeline | 06/30/03 | 17.6 | Pipeline | |||||||||

| ArkLaTex Pipeline System | ArkLaTex Pipeline System | 10/01/03 | 21.3 | Pipeline/GMT&S | 10/01/03 | 21.3 | Pipeline | |||||||||

| South Saskatchewan Pipeline System | South Saskatchewan Pipeline System | 11/01/03 | 47.7 | Pipeline | 11/01/03 | 47.7 | Pipeline | |||||||||

| Atchafalaya Pipeline System | Atchafalaya Pipeline System | 12/01/03 | 4.4 | Pipeline | Atchafalaya Pipeline System | 12/01/03 | 4.4 | Pipeline | ||||||||

| Total 2003 Acquisitions | $ | 159.5 | ||||||||||||||

| Total 2003 Acquisitions | $ | 159.5 | ||||||||||||||

2002 Acquisitions

Shell West Texas Assets. On August 1, 2002, we acquired interests in approximately 2,000 miles of gathering and mainline crude oil pipelines and approximately 9.0 million barrels (net to our interest) of above-groundabove ground crude oil terminalling and storage assets in West Texas from Shell Pipeline Company LP and Equilon Enterprises LLC (the "Shell acquisition") for approximately $324 million. The primary assets included in the transaction are interests in the Basin Pipeline System, the Permian Basin Gathering System and the Rancho Pipeline System. The entire purchase price was allocated to property and equipment.

The acquired assets are primarily fee-based mainline crude oil pipeline transportation assets that gather crude oil in the Permian Basin and transport the crude oil to major market locations in the Mid-Continent and Gulf Coast regions. The Permian Basin has long been one of the most stable crude

oil producing regions in the United States, dating back to the 1930s. The acquired assets complement our existing asset infrastructure in West Texas and represent a transportation link to Cushing, Oklahoma, where we provide storage and terminalling services. In addition, we believe that the Basin Pipeline System is poised to benefit from potential shut-downs of refineries and other pipelines due to the shifting market dynamics in the West Texas area. The Rancho Pipeline System was taken out of service in March 2003, pursuant to the operating agreement. See "Business—Acquisitions and Dispositions—Shutdown and Partial Sale of Rancho Pipeline System."

Other 2002 Acquisitions. During February and March of 2002, we completed two other acquisitions for aggregate consideration totaling $15.9 million, with effective dates of February 1, 2002 and March 31, 2002, respectively. These acquisitions include an equity interest in a crude oil pipeline company and crude oil gathering and marketing assets.

2001 Acquisitions