Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on May 2,20, 2005

Registration No. 333-

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PLAINS ALL AMERICAN PIPELINE, L.P.

(Exact Name of Registrant as Specified in Its Charter)

Delaware (State or Other Jurisdiction of Incorporation or Organization) | 4610 (Primary Standard Industrial Classification Code Number) | 76-0582150 (I.R.S. Employer Identification Number) | ||

333 Clay Street, Suite 1600 Houston, Texas 77002 (713) 646-4100 (Address, Including Zip Code, and Telephone Number, including Area Code, of Registrant's Principal Executive Offices) | ||||

Tim Moore Vice President and General Counsel 333 Clay Street, Suite 1600 Houston, Texas 77002 (713) 646-4100 (Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service) |

Copies to:

David P. Oelman

Vinson & Elkins L.L.P.

1001 Fannin Street, Suite 2300

Houston, Texas 77002

(713) 758-2222

Approximate date of commencement of proposed sale to the public:From time to time after this Registration Statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ý

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. o

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion Dated May 2,20, 2005

P R O S P E C T U S

19,469,20719,461,702 Common Units

Plains All American Pipeline, L.P.

Representing Limited Partner Interests

Up to 19,469,20719,461,702 of our common units may be offered from time to time by the selling unitholders named in this prospectus. The selling unitholders may sell the common units at various times and in various types of transactions, including sales in the open market, sales in negotiated transactions and sales by a combination of methods. We will not receive any proceeds from the sale of common units by the selling unitholders.

Our common units are listed on the New York Stock Exchange under the symbol "PAA."

Limited partnerships are inherently different from corporations. You should carefully consider each of the factors described under "Risk Factors" which begins on page 2 of this prospectus before you make an investment in the securities.

NEITHER THE SECURITIES AND EXCHANGE COMMISION NOR ANY STATE SECURITIES COMMISION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

In connection with certain sales of securities hereunder, a prospectus supplement may accompany this prospectus.

The date of this prospectus is [ ], 2005

i

i

ii

| Liquidation and Distribution of Proceeds | |

| Change of Management Provisions | |

| Limited Call Right | |

| Indemnification | |

| Registration Rights | |

| TAX CONSIDERATIONS | |

| Partnership Status | |

| Limited Partner Status | |

ii

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or SEC, using a "shelf' registration process. Under this shelf process, the selling unitholders may sell up to 19,469,20719,461,702 of our common units. In connection with certain sales of securities hereunder, a prospectus supplement may accompany this prospectus. The prospectus supplement may also add, update or change information contained in this prospectus. Therefore, before you invest in our securities, you should read this prospectus and any attached prospectus supplements.

In this registration statement, the terms "we," "our," "ours," and "us" refer to Plains All American Pipeline, L.P. and its subsidiaries, unless otherwise indicated or the context requires otherwise.

iii

We are a publicly traded Delaware limited partnership, formed in 1998 and engaged in interstate and intrastate crude oil transportation, and crude oil gathering, marketing, terminalling and storage, as well as the marketing and storage of liquefied petroleum gas and natural gas related petroleum products. We refer to liquefied petroleum gas and natural gas related petroleum products collectively as "LPG." We have an extensive network of pipeline transportation, storage and gathering assets in key oil producing basins and at major market hubs in the United States and Canada. Our operations can be categorized into two primary business activities: crude oil pipeline transportation operations and gathering, marketing, terminalling and storage operations.

Our principal business strategy is to capitalize on the regional crude oil supply and demand imbalances that exist in the United States and Canada by combining the strategic location and distinctive capabilities of our transportation and terminalling assets with our extensive marketing and distribution expertise to generate sustainable earnings and cash flow.

We intend to execute our business strategy by:

To a lesser degree, we also engage in a similar business strategy with respect to the wholesale marketing and storage of LPG, which we began as a result of an acquisition in mid-2001.

The level of our profitability is dependent upon an adequate supply of crude oil from fields located offshore and onshore California. Production from these offshore fields has experienced substantial production declines since 1995.

A significant portion of our segment profit is derived from pipeline transportation margins associated with the Santa Ynez and Point Arguello fields located offshore California. We expect that there will continue to be natural production declines from each of these fields as the underlying reservoirs are depleted. We estimate that a 5,000 barrel per day decline in volumes shipped from these fields would result in a decrease in annual pipeline segment profit of approximately $3.2 million. In addition, any significant production disruption from the Santa Ynez field due to production problems, transportation problems or other reasons could have a material adverse effect on our business.

Our trading policies cannot eliminate all price risks. In addition, any non-compliance with our trading policies could result in significant financial losses.

Generally, it is our policy that we establish a margin for crude oil purchased by selling crude oil for physical delivery to third party users, such as independent refiners or major oil companies, or by entering into a future delivery obligation under futures contracts on the NYMEX and over the counter. Through these transactions, we seek to maintain a position that is substantially balanced between purchases, on the one hand, and sales or future delivery obligations, on the other hand. Our policy is generally not to acquire and hold crude oil, futures contracts or derivative products for the purpose of speculating on price changes. These policies and practices cannot, however, eliminate all price risks. For example, any event that disrupts our anticipated physical supply of crude oil could expose us to risk of loss resulting from price changes. Moreover, we are exposed to some risks that are not hedged, including certain basis risks and price risks on certain of our inventory, such as pipeline linefill, which must be maintained in order to transport crude oil on our pipelines. In addition, we engage in a controlled trading program for up to an aggregate of 500,000 barrels of crude oil. Although this activity is monitored independently by our risk management function, it exposes us to price risks within predefined limits and authorizations.

In addition, our trading operations involve the risk of non-compliance with our trading policies. For example, we discovered in November 1999 that our trading policy was violated by one of our former employees, which resulted in aggregate losses of approximately $181.0 million. We have taken steps within our organization to enhance our processes and procedures to detect future unauthorized trading. We cannot assure you, however, that these steps will detect and prevent all violations of our trading policies and procedures, particularly if deception or other intentional misconduct is involved.

If we do not make acquisitions on economically acceptable terms our future growth may be limited.

Our ability to grow is substantially dependent on our ability to make acquisitions that result in an increase in adjusted operating surplus per unit. If we are unable to make such accretive acquisitions either because (i) we are unable to identify attractive acquisition candidates or negotiate acceptable purchase contracts with them, (ii) we are unable to raise financing for such acquisitions on economically acceptable terms or (iii) we are outbid by competitors, our future growth will be limited. In particular, competition for midstream assets and businesses has intensified substantially and as a result such assets and businesses have become more costly. As a result, we may not be able to complete the number or size of acquisitions that we have targeted internally or to continue to grow as quickly as we have historically.

Our acquisition strategy requires access to new capital. Tightened capital markets or other factors which increase our cost of capital could impair our ability to grow.

Our business strategy is substantially dependent on acquiring additional assets or operations. We continuously consider and enter into discussions regarding potential acquisitions. These transactions can be effected quickly, may occur at any time and may be significant in size relative to our existing assets and operations. Any material acquisition will require access to capital. Any limitations on our access to capital or increase in the cost of that capital could significantly impair our ability to execute our acquisition strategy. Our ability to maintain our targeted credit profile, including maintaining our credit ratings, could impact our cost of capital as well as our ability to execute our acquisition strategy.

Our acquisition strategy involves risks that may adversely affect our business.

Any acquisition involves potential risks, including:

Any of these factors could adversely affect our ability to achieve anticipated levels of cash flows from our acquisitions, realize other anticipated benefits and our ability to pay distributions or meet our debt service requirements.

The nature of our assets and business could expose us to significant compliance costs and liabilities.

Our operations involving the storage, treatment, processing, and transportation of liquid hydrocarbons including crude oil are subject to stringent federal, state, and local laws and regulations governing the discharge of materials into the environment, and otherwise relating to protection of the environment, operational safety and related matters. Compliance with these laws and regulations increases our overall cost of business, including our capital costs to construct, maintain and upgrade equipment and facilities, or claims for damages to property or persons resulting from our operations. Failure to comply with these laws and regulations may result in the assessment of administrative, civil, and criminal penalties, the imposition of investigatory and remedial liabilities, the issuance of injunctions that may restrict or prohibit our operations, or claims of damages to property or persons resulting from our operations. The laws and regulations applicable to our operations are subject to change, and we cannot provide any assurance that compliance with current and future laws and regulations will not have a material effect on our results of operations or earnings. A discharge of hazardous liquids into the environment could, to the extent such event is not insured, subject us to substantial expense, including both the cost to comply with applicable laws and regulations and liability to private parties for personal injury or property damage.

The profitability of our pipeline operations depends on the volume of crude oil shipped.

Third party shippers generally do not have long term contractual commitments to ship crude oil on our pipelines. A decision by a shipper to substantially reduce or cease to ship volumes of crude oil on our pipelines could cause a significant decline in our revenues. For example, we estimate that an

average 20,000 barrel per day variance in the Basin Pipeline System within the current operating window, equivalent to an approximate 7% volume variance on that system, would change annualized segment profit by approximately $1.8$1.7 million. In addition, we estimate that an average 10,000 barrel per day variance on the Capline Pipeline System, equivalent to an approximate 7%6% volume variance on that system, would change annualized segment profit by approximately $1.5$1.4 million.

The success of our business strategy to increase and optimize throughput on our pipeline and gathering assets is dependent upon our securing additional supplies of crude oil.

Our operating results are dependent upon securing additional supplies of crude oil from increased production by oil companies and aggressive lease gathering efforts. The ability of producers to increase production is dependent on the prevailing market price of oil, the exploration and production budgets of the major and independent oil companies, the depletion rate of existing reservoirs, the success of new wells drilled, environmental concerns, regulatory initiatives and other matters beyond our control. There can be no assurance that production of crude oil will rise to sufficient levels to cause an increase in the throughput on our pipeline and gathering assets.

Our operations are dependent upon demand for crude oil by refiners in the Midwest and on the Gulf Coast. Any decrease in this demand could adversely affect our business.

Demand for crude oil is dependent upon the impact of future economic conditions, fuel conservation measures, alternative fuel requirements, governmental regulation or technological advances in fuel economy and energy generation devices, all of which could reduce demand. Demand also depends on the ability and willingness of shippers having access to our transportation assets to satisfy their demand by deliveries through those assets, and any decrease in this demand could adversely affect our business.

We face intense competition in our gathering, marketing, terminalling and storage activities.

Our competitors include other crude oil pipelines, the major integrated oil companies, their marketing affiliates, and independent gatherers, brokers and marketers of widely varying sizes, financial resources and experience. Some of these competitors have capital resources many times greater than ours and control greater supplies of crude oil. We estimate that a $0.01 variance in the average segment profit per barrel would have an approximate $2.6$2.4 million annual effect on segment profit.

The profitability of our gathering and marketing activities is generally dependent on the volumes of crude oil we purchase and gather.

To maintain the volumes of crude oil we purchase, we must continue to contract for new supplies of crude oil to offset volumes lost because of natural declines in crude oil production from depleting wells or volumes lost to competitors. Replacement of lost volumes of crude oil is particularly difficult in an environment where production is low and competition to gather available production is intense. Generally, because producers experience inconveniences in switching crude oil purchasers, such as delays in receipt of proceeds while awaiting the preparation of new division orders, producers typically do not change purchasers on the basis of minor variations in price. Thus, we may experience difficulty acquiring crude oil at the wellhead in areas where there are existing relationships between producers and other gatherers and purchasers of crude oil. We estimate that a 15,000 barrel per day decrease in barrels gathered by us would have an approximate $3.0$4.3 million per year negative impact on segment profit. This impact is based on a reasonable margin throughout various market conditions. Actual margins vary based on the location of the crude oil, the strength or weakness of the market and the grade or quality of crude oil.

We are exposed to the credit risk of our customers in the ordinary course of our gathering and marketing activities.

There can be no assurance that we have adequately assessed the credit worthiness of our existing or future counterparties or that there will not be an unanticipated deterioration in their credit worthiness, which could have an adverse impact on us.

In those cases in which we provide division order services for crude oil purchased at the wellhead, we may be responsible for distribution of proceeds to all parties. In other cases, we pay all of or a portion of the production proceeds to an operator who distributes these proceeds to the various interest owners. These arrangements expose us to operator credit risk, and there can be no assurance that we will not experience losses in dealings with other parties.

Our pipeline assets are subject to federal, state and provincial regulation.

Our domestic interstate common carrier pipelines are subject to regulation by the Federal Energy Regulatory Commission (FERC) under the Interstate Commerce Act. The Interstate Commerce Act requires that tariff rates for petroleum pipelines be just and reasonable and non-discriminatory. We are also subject to the Pipeline Safety Regulations of the U.S. Department of Transportation. Our intrastate pipeline transportation activities are subject to various state laws and regulations as well as orders of regulatory bodies.

Our Canadian pipeline assets are subject to regulation by the National Energy Board and by provincial agencies. With respect to a pipeline over which it has jurisdiction, each of these Canadian agencies has the power to determine the rates we are allowed to charge for transportation on such pipeline. The extent to which regulatory agencies can override existing transportation contracts has not been fully decided.

Our pipeline systems are dependent upon their interconnections with other crude oil pipelines to reach end markets.

Reduced throughput on these interconnecting pipelines as a result of testing, line repair, reduced operating pressures or other causes could result in reduced throughput on our pipeline systems that would adversely affect our profitability.

Fluctuations in demand can negatively affect our operating results.

Fluctuations in demand for crude oil, such as caused by refinery downtime or shutdown, can have a negative effect on our operating results. Specifically, reduced demand in an area serviced by our transmission systems will negatively affect the throughput on such systems. Although the negative impact may be mitigated or overcome by our ability to capture differentials created by demand fluctuations, this ability is dependent on location and grade of crude oil, and thus is unpredictable.

The terms of our indebtedness may limit our ability to borrow additional funds or capitalize on business opportunities.

As of DecemberMarch 31, 2004,2005, our total outstanding long-term debt was approximately $949$930 million. Various limitations in our indebtedness may reduce our ability to incur additional debt, to engage in some transactions and to capitalize on business opportunities. Any subsequent refinancing of our current indebtedness or any new indebtedness could have similar or greater restrictions.

Changes in currency exchange rates could adversely affect our operating results.

Because we conduct operations in Canada, we are exposed to currency fluctuations and exchange rate risks that may adversely affect our results of operations.

Cash distributions are not guaranteed and may fluctuate with our performance and the establishment of financial reserves.

Because distributions on the common units are dependent on the amount of cash we generate, distributions may fluctuate based on our performance. The actual amount of cash that is available to be distributed each quarter will depend on numerous factors, some of which are beyond our control and the control of the general partner. Cash distributions are dependent primarily on cash flow, including cash flow from financial reserves and working capital borrowings, and not solely on profitability, which is affected by non-cash items. Therefore, cash distributions might be made during periods when we record losses and might not be made during periods when we record profits.

Risks Inherent in an Investment in Plains All American Pipeline

Cost reimbursements due to our general partner may be substantial and will reduce our cash available for distribution to you.

Prior to making any distribution on the common units, we will reimburse our general partner and its affiliates, including officers and directors of the general partner, for all expenses incurred on our behalf. The reimbursement of expenses and the payment of fees could adversely affect our ability to make distributions. The general partner has sole discretion to determine the amount of these expenses. In addition, our general partner and its affiliates may provide us services for which we will be charged reasonable fees as determined by the general partner.

You may not be able to remove our general partner even if you wish to do so.

Our general partner manages and operates Plains All American Pipeline. Unlike the holders of common stock in a corporation, you will have only limited voting rights on matters affecting our business. You will have no right to elect the general partner or the directors of the general partner on an annual or other continuing basis.

In addition, the following provisions of our partnership agreement may discourage a person or group from attempting to remove our general partner or otherwise change our management:

As a result of these provisions, the price at which the common units will trade may be lower because of the absence or reduction of a takeover premium in the trading price.

We may issue additional common units without your approval, which would dilute your existing ownership interests.

Our general partner may cause us to issue an unlimited number of common units, without your approval. The issuance of additional common units or other equity securities of equal or senior rank will have the following effects:

We may also issue at any time an unlimited number of equity securities ranking junior or senior to the common units without the approval of the unitholders.

Our general partner has a limited call right that may require you to sell your units at an undesirable time or price.

If at any time our general partner and its affiliates own 80% or more of the common units, the general partner will have the right, but not the obligation, which it may assign to any of its affiliates, to acquire all, but not less than all, of the remaining common units held by unaffiliated persons at a price generally equal to the then current market price of the common units. As a result, you may be required to sell your common units at a time when you may not desire to sell them or at a price that is less than the price you would like to receive. You may also incur a tax liability upon a sale of your common units.

You may not have limited liability if a court finds that unitholder actions constitute control of our business.

Under Delaware law, you could be held liable for our obligations to the same extent as a general partner if a court determined that the right of unitholders to remove our general partner or to take other action under our partnership agreement constituted participation in the "control" of our business.

Our general partner generally has unlimited liability for our obligations, such as our debts and environmental liabilities, except for those contractual obligations that are expressly made without recourse to our general partner.

In addition, Section 17-607 of the Delaware Revised Uniform Limited Partnership Act provides that under some circumstances, a unitholder may be liable to us for the amount of a distribution for a period of three years from the date of the distribution.

Conflicts of interest could arise among our general partner and us or the unitholders.

These conflicts may include the following:

Tax Risks to Common Unitholders

You should read "Tax Considerations" for a more complete discussion of the following expected material federal income tax consequences of owning and disposing of common units.

The IRS could treat us as a corporation for tax purposes, which would substantially reduce the cash available for distribution to you.

The anticipated after-tax benefit of an investment in the common units depends largely on our being treated as a partnership for federal income tax purposes. We have not requested, and do not plan to request, a ruling from the IRS on this or any other matter affecting us.

If we were classified as a corporation for federal income tax purposes, we would pay federal income tax on our income at the corporate tax rate, which is currently a maximum of 35%. Distributions to you would generally be taxed again to you as corporate distributions, and no income, gains, losses, deductions or credits would flow through to you. Because a tax would be imposed upon us as a corporation, the cash available for distribution to you would be substantially reduced. Treatment of us as a corporation would result in a material reduction in the after-tax return to the unitholders, likely causing a substantial reduction in the value of the common units.

Current law may change so as to cause us to be taxed as a corporation for federal income tax purposes or otherwise subject us to entity-level taxation. In addition, because of widespread state budget deficits, several states are evaluating ways to subject partnerships to entity-level taxation through the imposition of state income, franchise or other forms of taxation. If any state were to impose a tax upon us as an entity, the cash available for distribution to you would be reduced. Our partnership agreement provides that, if a law is enacted or existing law is modified or interpreted in a manner that subjects us to taxation as a corporation or otherwise subjects us to entity-level taxation for federal, state or local income tax purposes, then the minimum quarterly distribution and the target distribution levels will be decreased to reflect that impact on us.

A successful IRS contest of the federal income tax positions we take may adversely impact the market for common units.

We have not requested a ruling from the IRS with respect to any matter affecting us. The IRS may adopt positions that differ from the conclusions of our counsel expressed in this registration statement or from the positions we take. It may be necessary to resort to administrative or court proceedings to sustain our counsel's conclusions or the positions we take. A court may not concur with our counsel's conclusions or the positions we take. Any contest with the IRS may materially and adversely impact the market for common units and the price at which they trade. In addition, the costs of any contest with the IRS, principally legal, accounting and related fees, will be borne by us and directly or indirectly by the unitholders and the general partner.

You may be required to pay taxes even if you do not receive any cash distributions.

You will be required to pay federal income taxes and, in some cases, state and local income taxes on your share of our taxable income even if you do not receive any cash distributions from us. You may not receive cash distributions from us equal to your share of our taxable income or even equal to the actual tax liability that results from your share of our taxable income.

Tax gain or loss on disposition of common units could be different than expected.

If you sell your common units, you will recognize gain or loss equal to the difference between the amount realized and your tax basis in those common units. Prior distributions in excess of the total net taxable income you were allocated for a common unit, which decreased your tax basis in that common unit, will, in effect, become taxable income to you if the common unit is sold at a price greater than your tax basis in that common unit, even if the price you receive is less than your original cost. A

substantial portion of the amount realized, whether or not representing gain, may be ordinary income to you. Should the IRS successfully contest some positions we take, you could recognize more gain on the sale of units than would be the case under those positions, without the benefit of decreased income in prior years. Also, if you sell your units, you may incur a tax liability in excess of the amount of cash you receive from the sale.

If you are a tax-exempt entity, a regulated investment company or an individual not residing in the United States, you may have adverse tax consequences from owning common units.

Investment in common units by tax-exempt entities, regulated investment companies or mutual funds and foreign persons raises issues unique to them. For example, virtually all of our income allocated to organizations exempt from federal income tax, including individual retirement accounts and other retirement plans, will be unrelated business taxable income and will be taxable to them. Recent legislation treats net income derived from the ownership of certain publicly traded partnerships (including us) as qualifying income to a regulated investment company. However, this legislation is only effective for taxable years beginning after October 22, 2004, the date of enactment. For taxable years beginning on or before the date of enactment, very little of our income will be qualifying income to a regulated investment company. Distributions to foreign persons will be reduced by withholding taxes at the highest effective U.S. federal income tax rate for individuals, and foreign persons will be required to file federal income tax returns and pay tax on their share of our taxable income.

We treat a purchaser of units as having the same tax benefits without regard to the units purchased. The IRS may challenge this treatment, which could adversely affect the value of the units.

Because we cannot match transferors and transferees of common units, we have adopted depreciation and amortization positions that do not conform with all aspects of the Treasury regulations. A successful IRS challenge to those positions could adversely affect the amount of tax benefits available to you. It also could affect the timing of these tax benefits or the amount of gain from your sale of common units and could have a negative impact on the value of the common units or result in audit adjustments to your tax returns. Please read "Tax Considerations—Uniformity of Units" in this prospectus for further discussion of the effect of the depreciation and amortization positions we have adopted.

You will likely be subject to foreign, state and local taxes in jurisdictions where you do not live as a result of an investment in units.

In addition to federal income taxes, you will likely be subject to other taxes, including foreign taxes, state and local taxes, unincorporated business taxes and estate, inheritance or intangible taxes that are imposed by the various jurisdictions in which we do business or own property and in which you do not reside. We own property and conduct business in Canada and in most states in the United States. You may be required to file Canadian federal income tax returns and to pay Canadian federal and provincial income taxes and to file state and local income tax returns and pay state and local income taxes in many or all of the jurisdictions in which we do business or own property. Further, you may be subject to penalties for failure to comply with those requirements. It is your responsibility to file all federal, state, local and foreign tax returns. Our counsel has not rendered an opinion on the foreign, state or local tax consequences of an investment in the common units.

We will not receive any proceeds from the sale of common units by the selling unitholders.

PRICE RANGE OF COMMON UNITS AND DISTRIBUTIONS

As of April 18,May 16, 2005, there were 67,293,10867,914,576 common units outstanding, held by approximately 32,000 holders of record, including common units held in street name. The number of common units outstanding on this date includes the 3,245,700 Class C common units and the 1,307,190 Class B common units that converted in February 2005. The common units are traded on the New York Stock Exchange under the symbol "PAA."

The following table sets forth, for the periods indicated, the high and low sales prices for the common units, as reported on the New York Stock Exchange Composite Transactions Tape, and quarterly cash distributions declared per common unit. The last reported sale price of common units on the New York Stock Exchange on April 18,May 16, 2005 was $38.84$40.20 per common unit.

| | Price Range | | Price Range | | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Cash Distributions per Unit(1) | Cash Distributions per Unit(1) | ||||||||||||||||

| | High | Low | High | Low | ||||||||||||||

| 2003 | ||||||||||||||||||

| First Quarter | $ | 26.90 | $ | 24.20 | $ | 0.5500 | $ | 26.90 | $ | 24.20 | $ | 0.5500 | ||||||

| Second Quarter | 31.48 | 24.65 | 0.5500 | 31.48 | 24.65 | 0.5500 | ||||||||||||

| Third Quarter | 32.49 | 29.10 | 0.5500 | 32.49 | 29.10 | 0.5500 | ||||||||||||

| Fourth Quarter | 32.82 | 29.76 | 0.5625 | 32.82 | 29.76 | 0.5625 | ||||||||||||

2004 | ||||||||||||||||||

| First Quarter | $ | 35.23 | $ | 31.18 | $ | 0.5625 | $ | 35.23 | $ | 31.18 | $ | 0.5625 | ||||||

| Second Quarter | 36.13 | 27.25 | 0.5775 | 36.13 | 27.25 | 0.5775 | ||||||||||||

| Third Quarter | 35.98 | 31.63 | 0.6000 | 35.98 | 31.63 | 0.6000 | ||||||||||||

| Fourth Quarter | 37.99 | 34.51 | 0.6125 | 37.99 | 34.51 | 0.6125 | ||||||||||||

2005 | ||||||||||||||||||

| First Quarter | $ | 40.98 | $ | 36.50 | $ | 0.6375 | $ | 40.98 | $ | 36.50 | $ | 0.6375 | ||||||

| Second Quarter (through April 18, 2005) | $ | 39.61 | $ | 38.00 | (2) | |||||||||||||

| Second Quarter (through May 16, 2005) | $ | 42.77 | $ | 38.00 | (2) | |||||||||||||

SELECTED HISTORICAL FINANCIAL AND OPERATING DATA

We have derived the historical financial information and operating data below from our audited consolidated financial statements as of and for the years ended December 31, 2004, 2003, 2002, 2001, and 2000.2000 and from our unaudited financial statements as of and for the three months ended March 31, 2005 and 2004. The selected financial data should be read in conjunction with the consolidated financial statements, including the notes thereto, and "Management's Discussion and Analysis of Financial Condition and Results of Operations" included in this prospectus.

| | Year Ended December 31, | Three Months Ended March 31, | Year Ended December 31, | |||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2004 | 2003 | 2002 | 2001 | 2000 | 2005 | 2004 | 2004 | 2003 | 2002 | 2001 | 2000 | ||||||||||||||||||||||||||

| | (in millions except per unit data) | (in millions except per unit data) | ||||||||||||||||||||||||||||||||||||

| Statement of operations data: | ||||||||||||||||||||||||||||||||||||||

| Revenues(10) | $ | 20,975.5 | $ | 12,589.8 | $ | 8,384.2 | $ | 6,868.2 | $ | 6,641.2 | ||||||||||||||||||||||||||||

| Cost of sales and field operations (excluding LTIP charge)(10) | (20,641.1 | ) | (12,366.6 | ) | (8,209.9 | ) | (6,720.9 | ) | (6,506.5 | ) | ||||||||||||||||||||||||||||

| Revenues(1) | $ | 6,638.5 | $ | 3,804.6 | $ | 20,975.5 | $ | 12,589.8 | $ | 8,384.2 | $ | 6,868.2 | $ | 6,641.2 | ||||||||||||||||||||||||

| Cost of sales and field operations (excluding LTIP charge)(1) | (6,549.7 | ) | (3,731.2 | ) | (20,641.1 | ) | (12,366.6 | ) | (8,209.9 | ) | (6,720.9 | ) | (6,506.5 | ) | ||||||||||||||||||||||||

| Unauthorized trading losses and related expenses | — | — | — | — | (7.0 | ) | — | — | — | — | — | — | (7.0 | ) | ||||||||||||||||||||||||

| Inventory valuation adjustment | (2.0 | ) | — | — | (5.0 | ) | — | — | — | (2.0 | ) | — | — | (5.0 | ) | — | ||||||||||||||||||||||

| LTIP charge—operations | (0.9 | ) | (5.7 | ) | — | — | — | (0.3 | ) | (0.6 | ) | (0.9 | ) | (5.7 | ) | — | — | — | ||||||||||||||||||||

| General and administrative expenses (excluding LTIP charge) | (75.8 | ) | (50.0 | ) | (45.7 | ) | (46.6 | ) | (40.8 | ) | (20.2 | ) | (15.5 | ) | (75.8 | ) | (50.0 | ) | (45.7 | ) | (46.6 | ) | (40.8 | ) | ||||||||||||||

| LTIP charge—general and administrative | (7.0 | ) | (23.1 | ) | — | — | — | (1.9 | ) | (3.7 | ) | (7.0 | ) | (23.1 | ) | — | — | — | ||||||||||||||||||||

| Depreciation and amortization | (67.2 | ) | (46.8 | ) | (34.0 | ) | (24.3 | ) | (24.5 | ) | (19.1 | ) | (13.1 | ) | (67.2 | ) | (46.8 | ) | (34.0 | ) | (24.3 | ) | (24.5 | ) | ||||||||||||||

| Total costs and expenses | (20,794.0 | ) | (12,492.3 | ) | (8,289.6 | ) | (6,796.8 | ) | (6,578.8 | ) | (6,591.2 | ) | (3,764.1 | ) | (20,794.0 | ) | (12,492.3 | ) | (8,289.6 | ) | (6,796.8 | ) | (6,578.8 | ) | ||||||||||||||

| Gain on sale of assets | 0.6 | 0.6 | — | 1.0 | 48.2 | — | — | 0.6 | 0.6 | — | 1.0 | 48.2 | ||||||||||||||||||||||||||

| Asset impairment | (2.0 | ) | — | — | — | — | — | — | (2.0 | ) | — | — | — | — | ||||||||||||||||||||||||

| Operating income | 180.1 | 98.2 | 94.6 | 72.4 | 110.6 | 47.3 | 40.5 | 180.1 | 98.2 | 94.6 | 72.4 | 110.6 | ||||||||||||||||||||||||||

| Interest expense | (46.7 | ) | (35.2 | ) | (29.1 | ) | (29.1 | ) | (28.7 | ) | (14.6 | ) | (9.5 | ) | (46.7 | ) | (35.2 | ) | (29.1 | ) | (29.1 | ) | (28.7 | ) | ||||||||||||||

| Interest income and other, net | (0.3 | ) | (3.6 | ) | (0.2 | ) | 0.4 | (4.4 | ) | 0.1 | — | (0.3 | ) | (3.6 | ) | (0.2 | ) | 0.4 | (4.4 | ) | ||||||||||||||||||

| Income from continuing operations before cumulative effect of change in accounting principle | $ | 133.1 | $ | 59.4 | $ | 65.3 | $ | 43.7 | $ | 77.5 | $ | 32.8 | $ | 31.0 | $ | 133.1 | $ | 59.4 | $ | 65.3 | $ | 43.7 | $ | 77.5 | ||||||||||||||

| Basic net income per limited partner unit before cumulative effect of change in accounting principle | $ | 1.94 | $ | 1.01 | $ | 1.34 | $ | 1.12 | $ | 2.13 | $ | 0.43 | $ | 0.49 | $ | 1.94 | $ | 1.01 | $ | 1.34 | $ | 1.12 | $ | 2.13 | ||||||||||||||

| Diluted net income per limited partner unit before cumulative effect of change in accounting principle | $ | 1.94 | $ | 1.00 | $ | 1.34 | $ | 1.12 | $ | 2.13 | $ | 0.43 | $ | 0.49 | $ | 1.94 | $ | 1.00 | $ | 1.34 | $ | 1.12 | $ | 2.13 | ||||||||||||||

| Basic weighted average number of limited partner units outstanding | 63.3 | 52.7 | 45.5 | 37.5 | 34.4 | 67.5 | 58.4 | 63.3 | 52.7 | 45.5 | 37.5 | 34.4 | ||||||||||||||||||||||||||

| Diluted weighted average number of limited partner units outstanding | 63.3 | 53.4 | 45.5 | 37.5 | 34.4 | 68.2 | 59.0 | 63.3 | 53.4 | 45.5 | 37.5 | 34.4 | ||||||||||||||||||||||||||

Balance sheet data (at end of period): | ||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 3,160.4 | $ | 2,095.6 | $ | 1,666.6 | $ | 1,261.2 | $ | 885.8 | $ | 3,934.2 | $ | 2,162.0 | $ | 3,160.4 | $ | 2,095.6 | $ | 1,666.6 | $ | 1,261.2 | $ | 885.8 | ||||||||||||||

| Total long-term debt | 949.0 | 519.0 | 509.7 | 354.7 | 320.0 | 930.2 | 687.8 | 949.0 | 519.0 | 509.7 | 354.7 | 320.0 | ||||||||||||||||||||||||||

| Total debt | 1,124.5 | 646.3 | 609.0 | 456.2 | 321.3 | 1,491.2 | 702.4 | 1,124.5 | 646.3 | 609.0 | 456.2 | 321.3 | ||||||||||||||||||||||||||

| Partners' capital | 1,070.2 | 746.7 | 511.6 | 402.8 | 214.0 | 1,010.6 | 733.1 | 1,070.2 | 746.7 | 511.6 | 402.8 | 214.0 | ||||||||||||||||||||||||||

Other data: | ||||||||||||||||||||||||||||||||||||||

| Maintenance capital expenditures | $ | 11.3 | $ | 7.6 | $ | 6.0 | $ | 3.4 | $ | 1.8 | $ | 4.0 | $ | 1.7 | $ | 11.3 | $ | 7.6 | $ | 6.0 | $ | 3.4 | $ | 1.8 | ||||||||||||||

| Net cash provided by (used in) operating activities | 104.0 | 115.3 | 185.0 | (16.2 | ) | (33.5 | ) | (271.8 | ) | 133.0 | 104.0 | 115.3 | 185.0 | (16.2 | ) | (33.5 | ) | |||||||||||||||||||||

| Net cash provided by (used in) investing activities | (651.2 | ) | (272.1 | ) | (374.9 | ) | (263.2 | ) | 211.0 | (61.7 | ) | (155.9 | ) | (651.2 | ) | (272.1 | ) | (374.9 | ) | (263.2 | ) | 211.0 | ||||||||||||||||

| Net cash provided by (used in) financing activities | 554.5 | 157.2 | 189.5 | 279.5 | (227.8 | ) | 342.6 | 21.1 | 554.5 | 157.2 | 189.5 | 279.5 | (227.8 | ) | ||||||||||||||||||||||||

| Declared distributions per limited partner unit | 2.30 | 2.19 | 2.11 | 1.95 | 1.83 | 0.61 | 0.56 | 2.30 | 2.19 | 2.11 | 1.95 | 1.83 | ||||||||||||||||||||||||||

| | | Year Ended December 31, | | Three Months Ended March 31, | Year Ended December 31, | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | 2004 | 2003 | 2002 | 2001 | 2000 | | 2005 | 2004 | 2004 | 2003 | 2002 | 2001 | 2000 | ||||||||||||||

| Operating Data: | Operating Data: | Operating Data: | ||||||||||||||||||||||||||

| Volumes (thousands of barrels per day)(9) | ||||||||||||||||||||||||||||

| Volumes (thousands of barrels per day)(10) | Volumes (thousands of barrels per day)(10) | |||||||||||||||||||||||||||

| Pipeline segment: | Pipeline segment: | Pipeline segment: | ||||||||||||||||||||||||||

| Tariff activities | Tariff activities | |||||||||||||||||||||||||||

| All American | 54 | 59 | 65 | 69 | 74 | All American | 54 | 55 | 54 | 59 | 65 | 69 | 74 | |||||||||||||||

| Link acquisition | 283 | N/A | N/A | N/A | N/A | Basin | 277 | 275 | 265 | 263 | 93 | N/A | N/A | |||||||||||||||

| Capline | 123 | N/A | N/A | N/A | N/A | Capline(11) | 160 | 54 | 123 | N/A | N/A | N/A | N/A | |||||||||||||||

| Basin | 265 | 263 | 93 | N/A | N/A | West Texas/New Mexico Area Systems(12) | 401 | 209 | 338 | 195 | 110 | 84 | 75 | |||||||||||||||

| Other domestic | 424 | 299 | 219 | 144 | 130 | Canada | 268 | 240 | 263 | 203 | 187 | 132 | N/A | |||||||||||||||

| Canada | 263 | 203 | 187 | 132 | N/A | Other | 494 | 143 | 369 | 104 | 109 | 60 | 55 | |||||||||||||||

| Pipeline margin activities | 74 | 78 | 73 | 61 | 60 | Pipeline margin activities | 75 | 72 | 74 | 78 | 73 | 61 | 60 | |||||||||||||||

| Total | 1,486 | 902 | 637 | 406 | 264 | Total | 1,729 | 1,048 | 1,486 | 902 | 637 | 406 | 264 | |||||||||||||||

| Gathering, marketing, terminalling and storage segment: | Gathering, marketing, terminalling and storage segment: | Gathering, marketing, terminalling and storage segment: | ||||||||||||||||||||||||||

| Crude oil lease gathering | 589 | 437 | 410 | 348 | 262 | Crude oil lease gathering | 622 | 460 | 589 | 437 | 410 | 348 | 262 | |||||||||||||||

| Crude oil bulk purchases | 148 | 90 | 68 | 46 | 28 | Crude oil bulk purchases | 157 | 122 | 148 | 90 | 68 | 46 | 28 | |||||||||||||||

| Total | 737 | 527 | 478 | 394 | 290 | Total | 779 | 582 | 737 | 527 | 478 | 394 | 290 | |||||||||||||||

| LPG sales | LPG sales | 48 | 38 | 35 | 19 | N/A | LPG sales | 84 | 59 | 48 | 38 | 35 | 19 | N/A | ||||||||||||||

MANAGEMENT'S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion is intended to provide investors with an understanding of our financial condition and results of our operations for the years ended December 31, 2004, 2003 and 2002, as well as the three month periods ended March 31, 2005 and 2004, and should be read in conjunction with our historical consolidated financial statements and accompanying notes.

Our discussion and analysis includes the following:

Company Overview

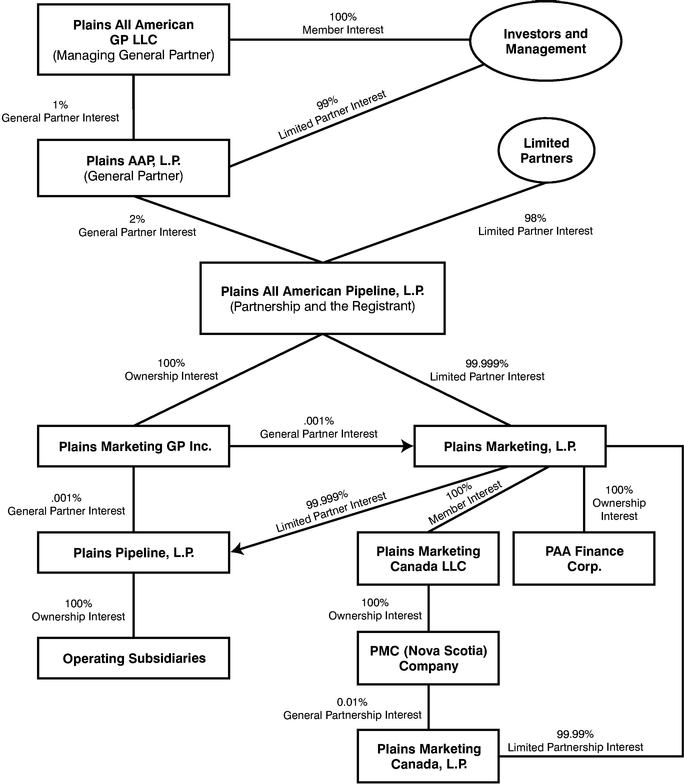

Plains All American Pipeline, L.P. is a Delaware limited partnership formed in September of 1998. Our operations are conducted directly and indirectly through our operating subsidiaries, Plains Marketing, L.P., Plains Pipeline, L.P. and Plains Marketing Canada, L.P. We are engaged in interstate and intrastate crude oil transportation, and crude oil gathering, marketing, terminalling and storage, as well as the marketing and storage of liquefied petroleum gas and other petroleum products. We refer to liquified petroleum gas and other petroleum products collectively as "LPG." We have an extensive network of pipeline transportation, terminalling, storage and gathering assets in key oil producing basins and at major market hubs in the United States and Canada.

We are one of the largest midstream crude oil companies in North America. As of December 31, 2004, we owned approximately 15,000 miles of active crude oil pipelines, approximately 37 million barrels of active terminalling and storage capacity and over 400 transport trucks. Currently, we handle an average of over 2.42.9 million barrels per day of physical crude oil through our extensive network of assets located in major oil producing regions of the United States and Canada. Our operations consist of two operating segments: (i) pipeline operations ("Pipeline Operations") and (ii) gathering, marketing, terminalling and storage operations ("GMT&S"). Through our pipeline segment, we engage in interstate and intrastate crude oil pipeline transportation and certain related margin activities. Through our GMT&S segment, we engage in purchases and resales of crude oil and LPG at various points along the distribution chain and we operate certain terminalling and storage assets.

Years Ended December 31, 2004, 2003 and 2002

Overview of Operating Results and Significant Activities

During 2004, we recognized net income and earnings per limited partner unit of $130.0 million and $1.89, respectively, both of which were substantial increases over 2003 and 2002. The results for 2004 as compared to the two previous years include significant contributions from acquisitions completed during 2003 and 2004.

The following significant activities impacted our operations, operating results or our financial position during 2004:

necessary to continue service and we shifted the majority of the gathering and transport activities to trucks. As a result, we were able to maintain most of our margins.

Prospects for the Future

We believe we have access to equity and debt capital and that we are well situated to optimize our position in and around our existing assets and to expand our asset base by continuing to consolidate, rationalize and optimize the North American crude oil infrastructure. We have deliberately configured

our assets to provide a counter-cyclical balance between our gathering and marketing activities and our terminalling and storage activities. We believe the combination of these balanced activities adds stability to the portion of our business that is highly cyclical, and with our relatively stable, fee-based pipeline assets, enables us to generate stable financial results.

During 2004 we strengthened our business by expanding our asset base through acquisitions and internal growth projects. We operate in a mature industry and believe that our primary source of growth will come from acquisitions, and we believe that there are opportunities for acquisitions. We will continue to pursue the purchase of midstream crude oil assets, and we will also continue to initiate projects designed to optimize crude oil flows in the areas in which we operate. We believe the outlook is positive for, and have a strategic initiative of increasing our participation in, the importing of foreign crude oil, primarily through building a meaningful asset presence to enable us to receive foreign crude oil via the Gulf Coast. We also believe there are opportunities for us to grow our LPG business. In addition, we believe we can, and will pursue opportunities to, leverage our assets, business model, knowledge and expertise into investments in businesses complementary to our crude oil and LPG activities. Although we believe that we are well situated in the North American crude oil infrastructure, we face various operational, regulatory and financial challenges that may impact our ability to execute our strategy as planned. See "Risk Factors—Risks Related to Our Business" for further discussion of these items. We can give no assurance that our current or future acquisition efforts will be successful or that any such acquisition will be completed on terms considered favorable to us.

We completed a number of acquisitions in 2004, 2003 and 2002 that have impacted the results of operations and liquidity discussed herein. The following acquisitions were accounted for, and the purchase price was allocated, in accordance with the purchase method of accounting. We adopted SFAS No. 141, "Business Combinations" in 2001 and followed the provisions of that statement for all business combinations initiated after June 30, 2001. Our ongoing acquisition activity is discussed further in "Liquidity and Capital Resources" below.

2004 Acquisitions

In 2004, we completed several acquisitions for aggregate consideration of approximately $549.5 million. The aggregate consideration includes cash paid, estimated transaction costs and assumed

liabilities and net working capital items. The following table summarizes our 2004 acquisitions, and a description of each of these follows the table:

| Acquisition | Effective Date | Acquisition Cost | Operating Segment | |||||

|---|---|---|---|---|---|---|---|---|

| Capline and Capwood Pipeline System | 03/01/04 | $ | 158.5 | Pipeline | ||||

| Link Energy LLC | 04/01/04 | 332.3 | Pipeline/GMT&S | |||||

| Cal Ven Pipeline System | 05/01/04 | 19.0 | Pipeline | |||||

| Schaefferstown Propane Storage Facility | 08/25/04 | 32.0 | GMT&S | |||||

| Other | various | 7.7 | GMT&S | |||||

| Total 2004 Acquisitions | $ | 549.5 | ||||||

Capline and Capwood Pipeline Systems. In March 2004, we completed the acquisition of all of Shell Pipeline Company LP's interests in two entities for approximately $158.0 million in cash (including a $15.8 million deposit paid in December 2003) and approximately $0.5 million of transaction and other costs. In December 2003, subsequent to the announcement of the acquisition and in anticipation of closing, we issued approximately 2.8 million common units for net proceeds of approximately $88.4 million, after paying approximately $4.1 million of transaction costs. The proceeds

from this issuance were used to pay down the outstanding balances under our revolving credit facility. At closing, the cash portion of this acquisition was funded from cash on hand and borrowings under our revolving credit facility.

The principal assets of the entities are: (i) an approximate 22% undivided joint interest in the Capline Pipeline System, and (ii) an approximate 76% undivided joint interest in the Capwood Pipeline System. The Capline Pipeline System is a 633-mile, 40-inch mainline crude oil pipeline originating in St. James, Louisiana, and terminating in Patoka, Illinois. The Capwood Pipeline System is a 57-mile, 20-inch mainline crude oil pipeline originating in Patoka, Illinois, and terminating in Wood River, Illinois. The results of operations and assets from this acquisition (the "Capline acquisition") have been included in our consolidated financial statements and in our pipeline operations segment since March 1, 2004. These pipelines provide one of the primary transportation routes for crude oil shipped into the Midwestern U.S. and delivered to several refineries and other pipelines.

The purchase price was allocated as follows (in millions):

| Crude oil pipelines and facilities | $ | 151.4 | |

| Crude oil storage and terminal facilities | 5.7 | ||

| Land | 1.3 | ||

| Office equipment and other | 0.1 | ||

| $ | 158.5 | ||

Link Energy LLC. On April 1, 2004, we completed the acquisition of all of the North American crude oil and pipeline operations of Link for approximately $332 million, including $268 million of cash and approximately $64 million of net liabilities assumed and acquisition related costs. The Link crude oil business consists of approximately 7,000 miles of active crude oil pipeline and gathering systems, over 10 million barrels of active crude oil storage capacity, a fleet of approximately 200 owned or leased trucks and approximately 2 million barrels of crude oil linefill and working inventory. The Link assets complement our assets in West Texas and along the Gulf Coast and allow us to expand our presence in the Rocky Mountain and Oklahoma/Kansas regions. The results of operations and assets from this acquisition (the "Link acquisition") have been included in our consolidated financial statements and both our pipeline operations and GMT&S operations segments since April 1, 2004.

The purchase price was allocated as follows and includes goodwill primarily related to Link's gathering and marketing business (in millions):

| Cash paid for acquisition(1) | $ | 268.0 | |||

Fair value of net liabilities assumed: | |||||

| Accounts receivable(2) | 409.4 | ||||

| Other current assets | 1.8 | ||||

| Accounts payable and accrued liabilities(2) | (459.6 | ) | |||

| Other current liabilities | (8.5 | ) | |||

| Other long-term liabilities | (7.4 | ) | |||

| Total net liabilities assumed | (64.3 | ) | |||

| Total purchase price | $ | 332.3 | |||

Purchase price allocation | |||||

| Property and equipment | $ | 260.2 | |||

| Inventory | 3.4 | ||||

| Linefill | 55.4 | ||||

| Inventory in third party assets | 8.1 | ||||

| Goodwill | 5.0 | ||||

| Other long term assets | 0.2 | ||||

| Total | $ | 332.3 | |||

The total purchase price includes (i) $9.4 million in transaction costs, (ii) approximately $7.4 million related to a plan to involuntarily terminate and relocate employees in conjunction with the acquisition, and (iii) approximately $11.0 million related to costs to terminate a contract assumed in the acquisition. These activities are substantially complete and the majority of the related costs have been incurred as of December 31, 2004. In addition, we anticipate making capital expenditures of approximately $28.0 million ($18.0 million in 2005) to upgrade certain of the assets and comply with certain regulatory requirements.

The acquisition was initially funded with cash on hand and borrowings under our existing credit facilities as well as under a new $200 million, 364-day credit facility. In connection with the acquisition, on April 15, 2004, we completed the private placement of 3,245,700 Class C common units to a group of institutional investors. During the third quarter of 2004, we completed a public offering of common units and the sale of unsecured senior notes. A portion of the proceeds from these transactions was used to retire the $200 million, 364-day credit facility.

Cal Ven Pipeline System. On May 7, 2004 we completed the acquisition of the Cal Ven Pipeline System from Cal Ven Limited, a subsidiary of Unocal Canada Limited. The total purchase price was approximately $19 million, including transaction costs. The transaction was funded through a combination of cash on hand and borrowings under our revolving credit facilities. The Cal Ven Pipeline System includes approximately 195 miles of 8-inch and 10-inch gathering and mainline crude oil pipelines. The system is located in northern Alberta and delivers crude oil into the Rainbow Pipeline System. The Rainbow Pipeline System then transports the crude south to the Edmonton market, where it can be used in local refineries or shipped on connecting pipelines to the U.S. market. The results of

operations and assets from this acquisition have been included in our consolidated financial statements and our pipeline operations segment since May 1, 2004.

Schaefferstown Propane Storage Facility. In August 2004, we completed the acquisition of the Schaefferstown Propane Storage Facility from Koch Hydrocarbon, L.P. The total purchase price was approximately $32 million, including transaction costs. In connection with the transaction, we also acquired an additional $14.2 million of inventory. The transaction was funded through a combination of cash on hand and borrowings under our revolving credit facilities. The results of operations and assets from this acquisition have been included in our consolidated financial statements and our gathering, marketing, terminalling and storage operations segment since August 25, 2004.

2003 Acquisitions

During 2003, we completed ten acquisitions for aggregate consideration of approximately $159.5 million. The aggregate consideration includes cash paid, estimated transaction costs, assumed liabilities and estimated near-term capital costs. The acquisitions were initially financed with borrowings under our credit facilities, which were subsequently repaid with a portion of the proceeds from our equity issuances and the issuance of senior notes. See "—Liquidity and Capital Resources." The businesses acquired during 2003 impacted our results of operations commencing on the effective date of each acquisition as indicated below. These acquisitions included mainline crude oil pipelines, crude oil gathering lines, terminal and storage facilities, and an underground LPG storage facility. With the exception of $0.5 million that was allocated to goodwill and other intangible assets and $4.7 million associated with crude oil linefill and working inventory, the remaining aggregate purchase price was allocated to property and equipment. The following table details our 2003 acquisitions (in millions):

| Acquisition | Effective Date | Acquisition Price | Operating Segment | ||||

|---|---|---|---|---|---|---|---|

| Red River Pipeline System | 02/01/03 | $ | 19.4 | Pipeline | |||

| Iatan Gathering System | 03/01/03 | 24.3 | Pipeline | ||||

| Mesa Pipeline Facility | 05/05/03 | 2.9 | Pipeline | ||||

| South Louisiana Assets(1) | 06/01/03 | 13.4 | Pipeline/G,M,T,&S | ||||

| Alto Storage Facility | 06/01/03 | 8.5 | G,M,T&S | ||||

| Iraan to Midland Pipeline System | 06/30/03 | 17.6 | Pipeline | ||||

| ArkLaTex Pipeline System | 10/01/03 | 21.3 | Pipeline | ||||

| South Saskatchewan Pipeline System | 11/01/03 | 47.7 | Pipeline | ||||

| Atchafalaya Pipeline System(2) | 12/01/03 | 4.4 | Pipeline | ||||

| Total 2003 Acquisitions | $ | 159.5 | |||||

2002 Acquisitions

Shell West Texas Assets. On August 1, 2002, we acquired interests in approximately 2,000 miles of gathering and mainline crude oil pipelines and approximately 9.0 million barrels (net to our interest) of above ground crude oil terminalling and storage assets in West Texas from Shell Pipeline Company LP and Equilon Enterprises LLC (the "Shell acquisition") for approximately $324 million. The primary assets included in the transaction are interests in the Basin Pipeline System, the Permian Basin Gathering System and the Rancho Pipeline System. The entire purchase price was allocated to property and equipment.

The acquired assets are primarily fee-based mainline crude oil pipeline transportation assets that gather crude oil in the Permian Basin and transport the crude oil to major market locations in the Mid-Continent and Gulf Coast regions. The Permian Basin has long been one of the most stable crude oil producing regions in the United States, dating back to the 1930s. The acquired assets complement our existing asset infrastructure in West Texas and represent a transportation link to Cushing, Oklahoma, where we provide storage and terminalling services. The Rancho Pipeline System was taken out of service in March 2003, pursuant to the operating agreement. See "Business—Dispositions—Shutdown and Sale of Rancho Pipeline System."

Other 2002 Acquisitions. During February and March of 2002, we completed two other acquisitions for aggregate consideration totaling $15.9 million, with effective dates of February 1, 2002 and March 31, 2002, respectively. These acquisitions include an equity interest in a crude oil pipeline company and crude oil gathering and marketing assets.

Critical Accounting Policies and Estimates

Our critical accounting policies are discussed in Note 2 to the Consolidated Financial Statements. The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities, as well as the disclosure of contingent assets and liabilities, at the date of the financial statements. Such estimates and assumptions also affect the reported amounts of revenues and expenses during the reporting period. Although we believe these estimates are reasonable, actual results could differ from these estimates. The critical accounting policies that we have identified are discussed below.

Purchase and Sales Accruals. We routinely make accruals based on estimates for certain components of our revenues and cost of sales due to the timing of compiling billing information, receiving third-party information and reconciling our records with those of third parties. Where applicable, these accruals are based on nominated volumes expected to be purchased, transported and subsequently sold. Uncertainties involved in these estimates include levels of production at the wellhead, access to certain qualities of crude oil, pipeline capacities and delivery times, utilization of truck fleets to transport volumes to their destinations, weather, market conditions and other forces beyond our control. These estimates are generally associated with a portion of the last month of each reporting period. We currently estimate that less than 2% of total annual revenues and cost of sales are recorded using estimates and less than 5% of total quarterly revenues and cost of sales are recorded using estimates. Accordingly, a variance from this estimate of 10% would impact the respective line items by less than 1% on both an annual and quarterly basis. Although the resolution of these uncertainties has not historically had a material impact on our reported results of operations or financial condition, because of the high volume, low margin nature of our business, we cannot provide assurance that actual amounts will not vary significantly from estimated amounts. Variances from estimates are reflected in the period actual results become known, typically in the month following the estimate.

Mark-to-Market Accrual. In situations where we are required to make mark-to-market estimates pursuant to SFAS 133, the estimates of gains or losses at a particular period end do not reflect the end results of particular transactions, and will most likely not reflect the actual gain or loss at the conclusion of a transaction. We reflect estimates for these items based on our internal records and information from third parties. A portion of the estimates we use are based on internal models or models of third parties because they are not quoted on a national market. Additionally, values may vary among different models due to a difference in assumptions applied such as the estimate of prevailing market prices, volatility, correlations and other factors and may not be reflective of the price at which they can be settled due to the lack of a liquid market. Less than 1% of total revenues are based on

estimates derived from these models. Although the resolution of these uncertainties has not historically had a material impact on our results of operations or financial condition, we cannot provide assurance that actual amounts will not vary significantly from estimated amounts.

Contingent Liability Accruals. We accrue reserves for contingent liabilities including, but not limited to, environmental remediation, insurance claims, asset retirement obligations and potential legal claims. Accruals are made when our assessment indicates that it is probable that a liability has occurred and the amount of liability can be reasonably estimated. Our estimates are based on all known facts at the time and our assessment of the ultimate outcome. Among the many uncertainties that impact our estimates are the necessary regulatory approvals for, and potential modification of, our remediation plans, the limited amount of data available upon initial assessment of the impact of soil or water contamination, changes in costs associated with environmental remediation services and equipment, costs of medical care associated with worker's compensation and employee health insurance claims, and the possibility of existing legal claims giving rise to additional claims. Our estimates for contingent liability accruals are increased or decreased as additional information is obtained or resolution is achieved. A variance of 10% in our aggregate estimate for the contingent liabilities discussed above would have an approximate $2.3 million impact on earnings. Although the resolution of these uncertainties has not historically had a material impact on our results of operations or financial condition, we cannot provide assurance that actual amounts will not vary significantly from estimated amounts.

Fair Value of Assets and Liabilities Acquired and Identification of Associated Goodwill and Intangible Assets. In conjunction with each acquisition, we must allocate the cost of the acquired entity to the assets and liabilities assumed based on their estimated fair values at the date of acquisition. We also estimate the amount of transaction costs that will be incurred in connection with each acquisition. As additional information becomes available, we may adjust the original estimates within a short time period subsequent to the acquisition. In addition, in conjunction with the adoption of SFAS 141, we are required to recognize intangible assets separately from goodwill. Goodwill and intangible assets with indefinite lives are not amortized but instead are periodically assessed for impairment. The impairment testing entails estimating future net cash flows relating to the asset, based on management's estimate of market conditions including pricing, demand, competition, operating costs and other factors. Intangible assets with finite lives are amortized over the estimated useful life determined by management. Determining the fair value of assets and liabilities acquired, as well as intangible assets that relate to such items as customer relationships, contracts, and industry expertise involves professional judgment and is ultimately based on acquisition models and management's assessment of the value of the assets acquired and, to the extent available, third party assessments. Uncertainties associated with these estimates include changes in production decline rates, production interruptions, fluctuations in refinery capacity or product slates, economic obsolescence factors in the area and potential future sources of cash flow. Although the resolution of these uncertainties has not historically had a material impact on our results of operations or financial condition, we cannot provide assurance that actual amounts will not vary significantly from estimated amounts.

Recent Accounting Pronouncements and Change in Accounting Principle

Recent Accounting Pronouncements

Buy/sell transactions. The Emerging Issues Task Force ("EITF") is currently considering Issue No. 04-13, "Accounting for Purchases and Sales of Inventory with the Same Counterparty," ("EITF No. 04-13"), which relates to buy/sell transactions. The issues to be addressed by the EITF are i) under what circumstances should two or more transactions with the same counterparty be viewed as a single nonmonetary transaction within the scope of APB No. 29; and ii) if nonmonetary transactions within the scope of APB No. 29 involve inventory, are there any circumstances under which the transactions should be recognized at fair value.

Buy/sell transactions are contractual arrangements in which we agree to buy a specific quantity and quality of crude oil or LPG to be delivered at a specific location while simultaneously agreeing to sell a specified quantity and quality of crude oil or LPG at a different location, usually with the same counterparty. These arrangements are generally designed to increase our margin through a variety of methods, including reducing our transportation or storage costs or acquiring a grade of crude oil that more closely matches our physical delivery requirement to one of our other customers. The value difference between purchases and sales is referred to as margin and is primarily due to grade, quality or location differentials. All buy/sell transactions result in us making or receiving physical delivery of the product, involve the attendant risks and rewards of ownership, including title transfer, assumption of environmental risk, transportation scheduling, credit risk and counterparty nonperformance risk, and such transactions are settled in cash similar to all other purchases and sales. Accordingly, such transactions are recorded in both revenues and purchases as separate sales and purchase transactions on a "gross" basis.

We believe that buy/sell transactions are monetary in nature and thus outside the scope of APB Opinion No. 29, "Accounting for Nonmonetary Transactions" ("APB No. 29"). Additionally, we have evaluated EITF No. 99-19, "Reporting Revenue Gross as a Principal versus Net as an Agent" ("EITF No. 99-19") and, based on that evaluation, we believe that recording these transactions on a gross basis is appropriate. If the EITF were to determine that these transactions should be accounted for as monetary transactions on a gross basis, no change in our accounting policy for buy/sell transactions would be necessary. If the EITF were to determine that these transactions should be accounted for as nonmonetary transactions qualifying for fair value recognition and require a net presentation of such transactions, the amounts of revenues and purchases associated with buy/sell transactions would be netted in our consolidated statement of operations, but there would be no effect on operating income, net income or cash flows from operating activities. If the EITF were to determine that these transactions should be accounted for as nonmonetary transactions not qualifying for fair value recognition, these amounts of revenues and purchases would be netted in our consolidated statement of operations and there could be an impact on operating income and net income related to the timing of the ultimate sale of product purchased in the "buy" side of the buy/sell transaction. However, we do not believe any impact on operating income, net income or cash flows from operating activities would be material.

Earnings per Unit. In March 2004, the Emerging Issues Task Force issued Issue No. 03-06 ("EITF 03-06"), "Participating Securities and the Two-Class Method under FASB Statement No. 128." EITF 03-06 addresses a number of questions regarding the computation of earnings per share by companies that have issued securities, other than common stock, that contractually entitle the holder to participate in dividends and earnings of the company when, and if, it declares dividends on its common stock. The issue also provides further guidance in applying the two-class method of calculating earnings per share, clarifying what constitutes a participating security and how to apply the two-class method of computing earnings per share once it is determined that a security is participating, including how to allocate undistributed earnings to such a security. EITF 03-06 was effective for fiscal periods beginning after March 31, 2004. The adoption of EITF 03-06 may have an impact on earnings per limited partner unit in future periods if net income exceeds distributions or if other participating securities are issued. The effect of applying EITF 03-06 on prior periods was not material except for the year ended December 31, 2000, which has been restated as shown below.

Basic and Diluted Income Before Extraordinary Item and Cumulative Effect of Change in Accounting Principle per Limited Partner Unit:

| | For the Year Ended December 31, 2000 | ||

|---|---|---|---|

| Prior to the adoption of SFAS 145(1) or EITF 03-06 | $ | 2.64 | |

| After the adoption of SFAS 145 but prior to the adoption of EITF 03-06 | $ | 2.20 | |

| After the adoption of both SFAS 145 and EITF 03-06 | $ | 2.13 | |

Change in Accounting Principle

During the second quarter of 2004, we changed our method of accounting for pipeline linefill in third party assets. Historically, we have viewed pipeline linefill, whether in our assets or third party assets, as having long-term characteristics rather than characteristics typically associated with the short-term classification of operating inventory. Therefore, previously we have not included linefill barrels in the same average costing calculation as our operating inventory, but instead have carried linefill at historical cost. Following this change in accounting principle, the linefill in third party assets that we have historically classified as a portion of "Pipeline Linefill" on the face of the balance sheet (a long-term asset) and carried at historical cost, is included in "Inventory" (a current asset) in determining the average cost of operating inventory and applying the lower of cost or market analysis. At the end of each period, we reclassify the linefill in third party assets not expected to be liquidated within the succeeding twelve months out of "Inventory" (a current asset), at average cost, and into "Inventory in Third Party Assets" (a long-term asset), which is now reflected as a separate line item within other assets on the consolidated balance sheet.

This change in accounting principle was effective January 1, 2004 and is reflected in our consolidated statement of operations for the year ended December 31, 2004 and our consolidated balance sheet as of December 31, 2004. The cumulative effect of this change in accounting principle as of January 1, 2004, is a charge of approximately $3.1 million, representing a reduction in Inventory of approximately $1.7 million, a reduction in Pipeline Linefill of approximately $30.3 million and an increase in Inventory in Third Party Assets of $28.9 million. The pro forma impact for the periods ended December 31, 2003 and 2002 is detailed below:

| | Reported Year Ended December 31, | Impact of Change in Accounting Principle Year Ended December 31, | Pro Forma Year Ended December 31, | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2003 | 2002 | 2003 | 2002 | 2003 | 2002 | ||||||||||||

| Net income | $ | 59.5 | $ | 65.3 | $ | 2.0 | $ | (0.1 | ) | $ | 61.5 | $ | 65.2 | |||||

| Basic income per limited partner unit | $ | 1.01 | $ | 1.34 | $ | 0.04 | $ | — | $ | 1.05 | $ | 1.34 | ||||||

| Diluted income per limited partner unit | $ | 1.00 | $ | 1.34 | $ | 0.04 | $ | — | $ | 1.04 | $ | 1.34 | ||||||

In conjunction with this change in accounting principle, we have classified cash flows associated with purchases and sales of linefill on assets that we own as cash flows from investing activities instead of the historical classification of cash flows from operating activities. Accordingly, our statement of cash flows for the years ended December 31, 2003 and 2002 has been revised to reclassify the cash paid for linefill in assets owned from operating activities to investing activities. As a result of this change in classification, net cash provided by operating activities for the years ended December 31, 2003 and 2002 increased to $115.3 million from $68.5 million and to $185.0 million from $173.9 million, respectively.

Net cash used in investing activities for the years ended December 31, 2003 and 2002 increased to $272.1 million from $225.3 million and $374.8 million from $363.8 million, respectively.

Analysis of Operating Segments