As filed with the Securities and Exchange Commission on May 15,August 23, 2006

Registration No. 333- 333-134145

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2 to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ALLEGIANT TRAVEL COMPANY

(Exact name of registrant as specified in charter)

| NEVADA (State or other jurisdiction of incorporation or organization) | 4512 (Primary Standard Industrial Classification Code Number) | 20-4745737 (I.R.S. Employer Identification Number) | ||

3301 N. Buffalo Drive, Suite B-9 Las Vegas, Nevada 89129 (702) 851-7300 (Address, including zip code, and telephone number, including area code, of registrant's principal executive offices) | ||||

Andrew C. Levy Managing Director and Secretary 3301 N. Buffalo Drive, Suite B-9 Las Vegas, Nevada 89129 (702) 851-7300 | ||||

(Name, address, including zip code, and telephone number, including area code, of agent for service of process) | ||||

With copies to: | ||

| Robert B. Goldberg Ellis Funk, P.C. 3490 Piedmont Road, Suite 400 Atlanta, Georgia 30305 (404) 233-2800 | Mark C. Smith Skadden, Arps, Slate, Meagher & Flom LLP Four Times Square New York, New York 10036 (212) 735-3000 | |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

CALCULATION OF REGISTRATION FEE

| Title of each class of Securities to be Registered | Amount to be Registered | Proposed Maximum Offering Price Per Share | Proposed Maximum Aggregate Offering Price(1) | Amount of Registration Fee | Amount to be Registered | Proposed Maximum Offering Price Per Share | Proposed Maximum Aggregate Offering Price(1) | Amount of Registration Fee | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock, $0.001 par value | $ | $100,000,000 | $10,700 | $ | $100,000,000 | $10,700(2) |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective time until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Subject to Completion

Preliminary Prospectus dated May 15,August 23, 2006

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is declared effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

P R O S P E C T U S

Shares

Common Stock

This is Allegiant Travel Company's initial public offering. Allegiant is selling shares, and the selling stockholders are selling shares.

We expect the public offering price to be between $ and $ per share. Currently, no public market exists for the shares. After pricing of the offering, we expect that the shares will be quoted on the Nasdaq National Market under the symbol "ALGT."

Investing in our common stock involves risks that are described in the "Risk Factors" section beginning on page 1211 of this prospectus.

| | Per Share | Total | ||||

|---|---|---|---|---|---|---|

| Public offering price | $ | $ | ||||

| Underwriting discount | $ | $ | ||||

| Proceeds, before expenses, to Allegiant | $ | $ | ||||

| Proceeds, before expenses, to selling stockholders | $ | $ | ||||

The underwriters may also purchase up to an additional shares from Allegiant, and up to an additional shares from the selling stockholders, at the public offering price, less the underwriting discount, within 30 days from the date of this prospectus to cover overallotments.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The shares will be ready for delivery on or about , 2006.

| Merrill Lynch & Co. | ||

Bear, Stearns & Co. Inc. | ||

Raymond James | ||

The date of this prospectus is , 2006.

| | Page | |

|---|---|---|

| Special Note About Forward-Looking Statements | 1 | |

| Summary | 2 | |

| Risk Factors | ||

| Company History and Reorganization | ||

| Use of Proceeds | ||

| Dividend Policy | ||

| Capitalization | ||

| Dilution | ||

| Selected Financial and Operating Data | ||

| Unaudited Pro Forma Condensed Consolidated Financial Information | ||

| Management's Discussion and Analysis of Financial Condition and Results of Operations | ||

| Industry | ||

| Business | ||

| Management | ||

| Principal and Selling Stockholders | ||

| Related Party Transactions | ||

| Description of Capital Stock | ||

| Shares Eligible for Future Sale | ||

| Material United States Federal Tax Considerations for Non-U.S. Holders of Common Stock | ||

| Underwriting | ||

| Legal Matters | ||

| Experts | ||

| Where You Can Find Additional Information | ||

| Index to Consolidated Financial Statements | F-1 |

You should rely only on the information contained in this prospectus. We have not, and the underwriters have not, authorized any other person to provide you with information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell those securities in any jurisdiction where the offer and sale is not permitted. The information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

i

SPECIAL NOTE ABOUT FORWARD-LOOKING STATEMENTS

We have made forward-looking statements in this prospectus, including the sections entitled "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Business," that are based on our management's beliefs and assumptions and on information currently available to our management. Forward-looking statements include the information concerning our possible or assumed future results of operations, business strategies, financing plans, competitive position, industry environment, potential growth opportunities, the effects of future regulation and the effects of competition. Forward-looking statements include all statements that are not historical facts and can be identified by the use of forward-looking terminology such as the words "believe," "expect," "anticipate," "intend," "plan," "estimate" or similar expressions.

Forward-looking statements involve risks, uncertainties and assumptions. Actual results may differ materially from those expressed in the forward-looking statements. We do not have any intention or obligation to update forward-looking statements after we distribute this prospectus.

You should understand that many important factors, in addition to those discussed elsewhere in this prospectus, could cause our results to differ materially from those expressed in the forward-looking statements. These factors include, without limitation, increases in fuel prices, terrorist attacks, risks inherent to airlines, demand for air services to Las Vegas and Orlando from the markets served by us, our ability to implement our growth strategy, our fixed obligations, our dependence on the Las Vegas and Orlando markets, our ability to add, renew or replace gate leases, our competitive environment, problems with our aircraft, dependence on fixed fee customers, economic and other conditions in markets in which we operate, governmental regulation, increases in maintenance costs and insurance premiums and cyclical and seasonal fluctuations in our operating results.

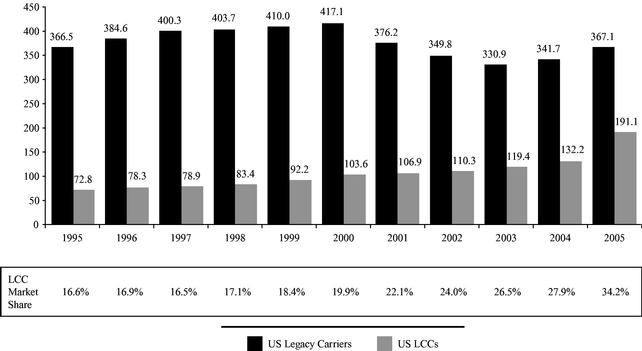

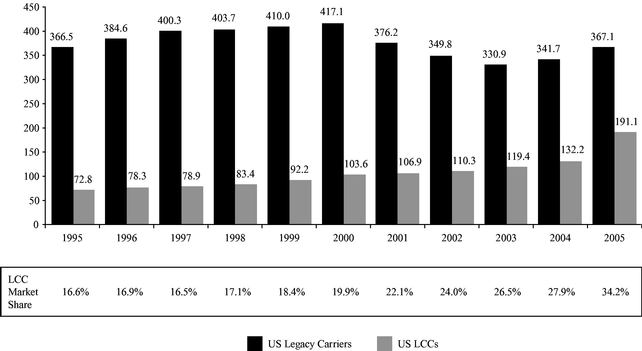

This section summarizes material information that appears later in this prospectus and is qualified in its entirety by the more detailed information and financial statements included elsewhere in this prospectus. In this prospectus, we consider Alaska Airlines, Inc., American Airlines, Inc., Continental Airlines, Inc., Delta Air Lines, Inc., Northwest Airlines, Inc., United Air Lines Inc., Trans World Airlines, Inc. (prior to its acquisition by AMR Corp.) and US Airways, Inc. (prior to 2005) as U.S. legacy carriers, and we consider AirTran Airways, Inc., America West Airlines, Inc., Frontier Airlines, Inc., JetBlue Airways Corporation, Southwest Airlines Co., and US Airways, Inc. (starting in 2005) as U.S. low cost carriers. This summary may not contain all of the information that may be important to you. As an investor or prospective investor, you should carefully review the entire prospectus, including the risk factors and the more detailed information that appears later.

In this prospectus, we use the terms "Allegiant," "we," "us" and "our" to refer to Allegiant Travel Company and its subsidiaries.

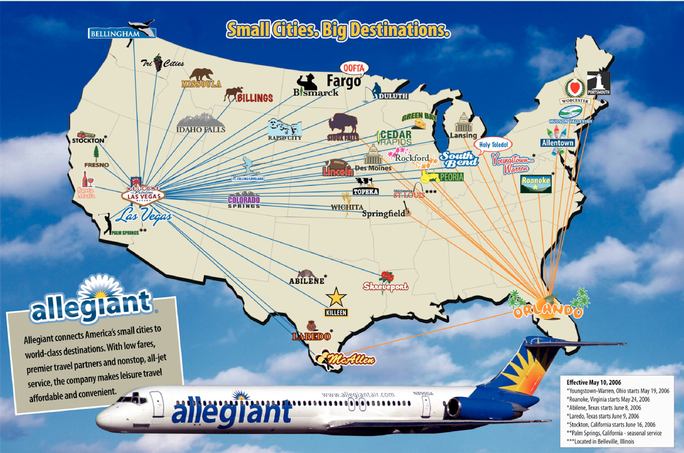

We are a leisure travel company focused on linking travelers in small cities to world-class leisure destinations such as Las Vegas, Nevada and Orlando, Florida. We operate a low-cost passenger airline marketed to leisure travelers in small cities, allowing us to sell air travel both on a stand-alone basis orand bundled with hotel rooms, rental cars and other travel related services. Our route network, pricing philosophy, advertising and diversified product offering built around relationships with premier leisure companies are all intended to appeal to leisure travelers and make it attractive for them to purchase air travel and related services from us.

Our business model provides for diversified revenue streams, which we believe distinguishes us from other U.S. airlines and other travel companies.

Our business strategy has evolved as our experienced management team has taken a different approach to the traditional way business has been conducted in the airline industry. In contrast to the traditional airline strategy, we focus primarily on the leisure traveler, provide low frequency nonstop service from small cities in larger jet aircraft, sell direct to travelers, do not offer connections, do not code share,code-share, and provide amenities at a small charge to our passengers. We have developed relationships with many premier leisure companies to generate revenue beyond just air fares. In 2005, weWe generated $11.55 of ancillary revenue per scheduled service passenger.passenger in 2005 and $13.58 per scheduled service passenger in the first six months of 2006.

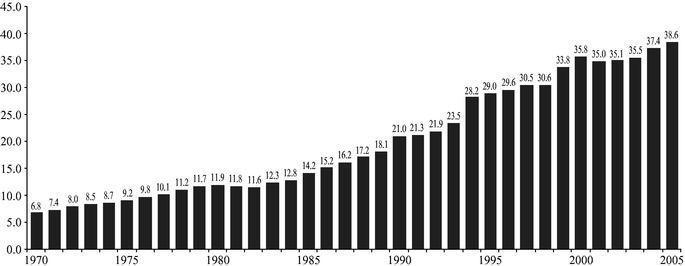

We provide scheduled air service to customers in 3540 small cities, with an aggregate population of over 4045 million within a 50-mile radius of the airports in those cities. We have identified anat least 60 additional 65 cities in the United States and Canada with similar characteristics representingand where we do not presently have any arrangements for service. These cities represent an estimated population of over 6055 million people we could potentially serve to our existing Las Vegas and Orlando destinations.

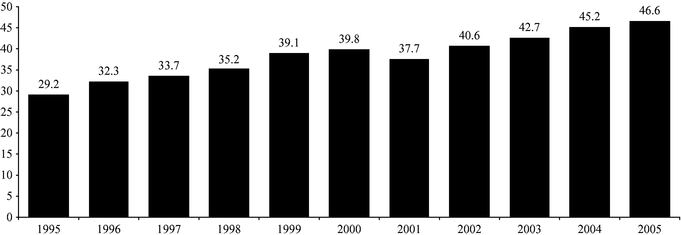

Our business model has allowed us to grow rapidly and to achieve attractive rates of profitability, even during the present climate of record high fuel costs. For the year ended December 31, 2005, we

had revenue of $132.5 million, representing substantial growth of 46.6% over the year ended December 31, 2004, while maintaining an operating margin of 6.4% which was higher than the U.S. legacy carriers and U.S. low cost carriers other than Southwest Airlines Co. Further,We had operating income of $6.1 million in 2004 and $8.5 million in 2005. Our net income was $9.1 million in 2004 and $7.3 million in 2005, the decline attributable to a substantially higher gain on fuel derivatives in 2004. In the first six months of 2006, we had revenue of $119.3 million, and net income of $7.3$11.5 million, in 2005.which was 99.1% and 73.2% higher than the first six months of 2005, respectively.

We have developed a unique business model that focuses on leisure travelers in small cities. We believe the following strengths allow us to maintain a competitive advantage in the markets we serve:

Focus on Linking Small Cities to World-Class Leisure Destinations. We provide nonstop low fare scheduled air service from 3540 small cities to the world-class leisure destinations of Las Vegas, Nevada and Orlando, Florida. Frequently, when we enter a new market, we introduce nonstop service to Las Vegas or Orlando which previously did not exist. We believe this nonstop service, combined with our pricing philosophy and premier leisure company relationships, makes it attractive for leisure travelers to purchase air travel and related services from us. As a result, we believe we stimulate new traffic. By focusing on underserved small cities, we believe we avoid the overcapacity and intense competition presently seen in high traffic domestic air corridors. On 3744 of our 4349 routes, we are the only carrier providing nonstop service to Las Vegas or Orlando.

We believe it would be difficult for potential competitors to profitably contest our market positions with nonstop service as our markets are generally too small to support either two carriers or the high frequency service provided by most U.S. legacy carriers and U.S. low cost carriers ("LCCs"). In addition, leisure routes from small cities are generally too low-yielding for most carriers to prioritize. Moreover, while some of these markets may be suitable for service with regional jet equipment, we believe our unit costs are significantly less than the unit costs for most regional jets, making it difficult for the regional jet to effectively compete.

Low Operating Costs. We believe low costs are essential to competitive success in the airline industry today. Our cost per available seat mile, or "CASM," was 6.82¢6.92¢ and 7.41¢ for the years ended December 31, 2004 and 2005, respectively. We believe our CASM for the year ended December 31, 2005 was approximately 31.2% lower than the average of the U.S. legacy carriers, and was approximately 18.3% lower than the average of the LCCs. Our CASM for the first six months of 2006 increased slightly to 7.43¢ despite significantly higher fuel costs. Excluding the cost of fuel, our CASM was 4.63¢ for the year ended December 31, 2004, 4.27¢ for the year ended December 31, 2005 was 4.27¢.and 3.90¢ for the first six months of 2006.

Our low operating costs are the result of our focus on the following factors:

comparably sized new Airbus A320 and Boeing 737 aircraft. While used MD80 aircraft are less fuel and maintenance efficient than new aircraft, we believe the ownership cost advantages of the MD80 currently outweigh the operating cost savings of new equipment for our type of operation.

full-time equivalent employees per aircraft, based on publicly available information. Our high level of employee productivity is created by fleet commonality, fewer unproductive labor work rules, cost-driven scheduling, and the effective use of automation and part-time employees.

Growing Ancillary Revenues. Ancillary revenues are earned in conjunction with our sale of scheduled air service and represent a significant, growing revenue stream. OurOn a per scheduled service passenger basis, our ancillary revenues have grownincreased by 96.8% from $3.1 million, or 3.5% of total revenue$5.87 per scheduled service passenger in 2004, to $11.2 million, or 8.4%$11.55 in 2005 and increased further to $13.58 in the first six months of total revenue in 2005. In the fourth quarter of 2005, ancillary revenues were $4.5 million, or 11.3% of our total revenue.2006. Ancillary revenue is derived from the sale of vacation packages including hotels, rental cars, show tickets, night club packages and other attractions; the sale of advance seat assignments; the sale of beverages, snacks and other products on board the aircraft; charging a fee for using our reservation center or website to purchase air travel; the collection of excess checked bag and overweight bag charges; and several smallerother revenue streams. The largest component of our ancillary revenue is from the sale of hotel rooms packaged with air travel. We have agreements with 3537 hotels in Las Vegas, including hotels managed by MGM MIRAGE, Harrah's Entertainment Inc., Boyd's Gaming Corp., Wynn Resorts, Limited, and Las Vegas Sands Corp. and 22 hotels in Orlando. For the month of MarchJune 2006, we generated revenue from the sale of more than 27,00030,000 hotel room nights in the Las Vegas market.

Strong Financial Position. We have a strong financial position with significant cash balances. On December 31, 2005,June 30, 2006, we had $53.3$58.3 million of unrestricted cash and investments. On a pro forma as adjusted basis as of December 31, 2005,June 30, 2006, to give effect to the receipt of approximately $ million in net proceeds from the sale of shares of our common stock in this offering at an initial public offering price of $ per share, the midpoint of the range set forth on the cover page of this prospectus, and the conversion of our preferred shares in the reorganization, our unrestricted cash would have been $ million and our debt to total capitalization ratio would have been %. We also have a history of growing profitably, having generated 12 consecutive quartersnet income in 13 of profits.the last 14 quarters. We believe our strong financial position allows us to have greater financial flexibility to grow the business and weather sudden industry disruptions.

Proven Management Team and Financial Sponsors. We have a strong management team comprised of experienced and motivated individuals. Our management team is led by Maurice J. Gallagher, Jr., who has an extensive background in the airline industry. Mr. Gallagher was the president of WestAir Holdings, Inc. and built WestAir into one of the largest regional airlines in the U.S., prior to its sale in 1992 to Mesa Air Group. He was also one of the founders of ValuJet, Inc., known today as AirTran Holdings, Inc., which we believe was one of the most successful start-ups of a low-cost airlinecarrier in industry history. Three of our other executive officers are former managers of ValuJet or WestAir. Our investors also have significant experience in the airline industry and were intimately involved in several airline successes. These include Robert L. Priddy, a founder and former chairman and chief executive

officer of ValuJet, Inc. and Declan F. Ryan, a co-founder and former chief executive officer of Ryanair, the successful European low-cost carrier.

To continue the growth of our business and increase our profitability, our strategy will be to continue to offer a single class of air travel service at low fares, while maintaining high-qualityhigh quality standards, keeping our operating costs low and pursuing ways to make our operations more efficient. We intend to grow by adding flights on existing routes, entering additional small cities, expanding our relationships with premier leisure companies, and providing service to more world-class leisure destinations.

The following are the key elements of our strategy:

Capitalize on Significant Growth Opportunities in Linking Small Cities to Leisure Destinations. We believe small cities represent a large untapped market, especially for leisure travel. We believe small city travelers have limited options to world-class leisure destinations as existing carriers are generally focused on connecting small city "spokes" to their business hubs. We aim to become the premier travel brand for leisure travelers in small cities. We have identified at least 6560 additional small cities in the U.S. and Canada where we cancould potentially offer our low fare nonstop service to Las Vegas or Orlando. We also believe there are several other world-class leisure destinations we could serve that share many of the same characteristics as Las Vegas and Orlando. These potential markets include several popular vacation destinations in the U.S., Mexico and the Caribbean.

Develop New Sources of Revenue. We have identified three key areas where we believe we can grow our ancillary revenues:

multiple opportunities to market products and services, including: at the time they purchase their travel, between the time they purchase their flights and when they initiate their travel, and after they have completed their travel. In addition, we market products and services to our customers during the flight. We believe the breadth of options we can offer them allows us to provide a "one-stop" shopping solution.

Continue to Reduce Our Operating Costs. We intend to continue to focus on lowering our costs to remain one of the lowest cost airlines in the world, which we believe is instrumental to increasing profitability. We will drive operational efficiency and lower costs principally by growing our network.

We will expand our network by increasing the frequency of our flights in existing markets, expanding the number of small cities we serve, and serving additional world-class leisure destinations, all of which permits us to increase the utilization of our employees and assets, spreading our fixed costs over a larger number of available seat miles. In 2005 we averaged only 183.7184.7 block hours per aircraft per month while in the first six months of 2006, we averaged 209.1 block hours per aircraft per month.

Minimize Fixed Costs to Increase Strategic Flexibility. We believe our low aircraft ownership costs and the lower fixed costs associated with our small city market strategy provide us with a lower level of fixed costs than other U.S. airlines. We believe minimizing our level of fixed costs will provide us with added flexibility in scheduling our services and controlling our profitability. For example, with lower fixed costs we are better able to enter or exit markets as well as match the size and utilization of our fleet to limit unprofitable flying and maximize profitability. We match our frequency with the market demand on a daily and seasonal basis.

Our principal executive offices are located at 3301 N. Buffalo Drive, Suite B-9 Las Vegas, Nevada 89129. Our telephone number is (702) 851-7300. Our website's address is http://www.allegiantair.com. We have not incorporated by reference into this prospectus the information on our website and you should not consider it to be a part of this document. Our website address is included in this document for reference only.

Allegiant Travel Company, Allegiant Air and Allegiant Vacations are service marks of Allegiant Travel Company in the U.S. This prospectus also contains trademarks and tradenames of other companies.

In May 2005, we completed a private placement under which ComVest Allegiant Holdings, Inc., Viva Air Limited and Timothy P. Flynn invested $34.5 million in preferred shares of our limited liability company predecessor. Simultaneously, Maurice J. Gallagher, Jr., our chief executive officer, converted $5.0 million of debt owed to him into preferred shares. All of our current directors were selected by these shareholders. The representation of these shareholders on our board of directors and the ownership by these shareholders of approximately % of our stock after this offering will allow these shareholders to exert significant control over our business in the future.

We currently conduct our business through a limited liability company, Allegiant Travel Company, LLC, and its consolidated subsidiaries. At or immediately prior to the closing of this offering, we will complete a merger in order to have Allegiant Travel Company (a Nevada corporation) succeed to the business of Allegiant Travel Company, LLC and its consolidated subsidiaries and to have our members become stockholders of Allegiant Travel Company, a Nevada corporation. For further details on these transactions, see "Company History and Reorganization" and "Related Party Transactions—Reorganization Transactions" in this prospectus.

| Common stock offered by: | |||||

Allegiant | shares | ||||

Selling stockholders | shares | ||||

Total | shares | ||||

Shares outstanding after the offering | shares | ||||

Use of proceeds | We estimate our net proceeds from this offering without exercise of the overallotment will be approximately $ . We intend to use these net proceeds to: | ||||

• | retire $1.1 million of our secured debt owed to our chief executive officer; | ||||

• | purchase additional aircraft consistent with our growth strategy and acquisition criteria; and | ||||

• | fund general corporate purposes, including working capital. | ||||

Risk Factors | See "Risk Factors" and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in shares of our common stock. | ||||

Proposed Nasdaq National Market Symbol | "ALGT" | ||||

The number of shares outstanding after this offering:

Summary Consolidated Financial Information

| | | | | | | | | | Six Months Ended June 30, | |||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | Year Ended December 31, | | | | | Year Ended December 31, | ||||||||||||||||||||||||||

| | | Predecessor January 1- June 30, 2001(2) | | Successor July 1- December 31, 2001(2) | | Predecessor January 1- June 30, 2001(2) | | Successor July 1- December 31, 2001(2) | Six Months Ended June 30, | |||||||||||||||||||||||||||

| | | | 2002 | 2003 | 2004 | 2005 | | | 2002 | 2003 | 2004 | 2005 | 2005 | 2006 | ||||||||||||||||||||||

| | | (unaudited) | | (unaudited) | (unaudited) | | | | | (unaudited) | | (unaudited) | (unaudited) | | | | (unaudited) | |||||||||||||||||||

| | | (in thousands, except share and per share data) | | (in thousands, except share and per share data) | ||||||||||||||||||||||||||||||||

| Statement of Operations Data: | Statement of Operations Data: | Statement of Operations Data: | ||||||||||||||||||||||||||||||||||

| Operating revenue: | Operating revenue: | Operating revenue: | ||||||||||||||||||||||||||||||||||

| Scheduled service revenues | $1,254 | $1,244 | $6,007 | $22,515 | $46,236 | $90,664 | Scheduled service revenues | $1,254 | $1,244 | $6,007 | $22,515 | $46,236 | $90,664 | $37,362 | $87,509 | |||||||||||||||||||||

| Fixed fee contract revenues | 1,688 | 1,922 | 16,081 | 26,569 | 40,987 | 30,642 | Fixed fee contract revenues | 1,688 | 1,922 | 16,081 | 26,569 | 40,987 | 30,642 | 19,001 | 19,173 | |||||||||||||||||||||

| Ancillary revenues | 62 | 43 | 89 | 886 | 3,142 | 11,194 | Ancillary revenues | 62 | 43 | 89 | 886 | 3,142 | 11,194 | 3,567 | 12,621 | |||||||||||||||||||||

| Total operating revenue | Total operating revenue | 3,004 | 3,209 | 22,177 | 49,970 | 90,365 | 132,500 | Total operating revenue | 3,004 | 3,209 | 22,177 | 49,970 | 90,365 | 132,500 | 59,930 | 119,303 | ||||||||||||||||||||

| Operating expenses: | Operating expenses: | Operating expenses: | ||||||||||||||||||||||||||||||||||

| Aircraft fuel | 727 | 699 | 4,761 | 11,755 | 27,914 | 52,568 | Aircraft fuel | 727 | 699 | 4,761 | 11,755 | 27,914 | 52,568 | 19,964 | 50,882 | |||||||||||||||||||||

| Salary and benefits | 1,071 | 1,225 | 4,320 | 8,176 | 15,379 | 21,718 | Salary and benefits | 1,071 | 1,225 | 4,320 | 8,176 | 15,379 | 21,718 | 9,769 | 16,008 | |||||||||||||||||||||

| Station operations | 286 | 314 | 2,852 | 8,042 | 13,608 | 14,090 | Station operations | 286 | 314 | 2,852 | 8,042 | 13,608 | 14,090 | 6,999 | 12,369 | |||||||||||||||||||||

| Maintenance and repairs | 729 | 766 | 2,275 | 5,140 | 8,220 | 9,022 | Maintenance and repairs | 729 | 766 | 2,589 | 6,136 | 9,367 | 9,022 | 3,823 | 7,477 | |||||||||||||||||||||

| Sales and marketing | 28 | 73 | 632 | 2,385 | 3,548 | 5,625 | Sales and marketing | 28 | 73 | 632 | 2,385 | 3,548 | 5,625 | 2,441 | 4,753 | |||||||||||||||||||||

| Aircraft lease rentals | 885 | 459 | 3,033 | 3,137 | 3,847 | 4,987 | Aircraft lease rentals | 885 | 459 | 3,033 | 3,137 | 3,847 | 4,987 | 1,921 | 3,173 | |||||||||||||||||||||

| Depreciation and amortization | 240 | 125 | 260 | 1,181 | 2,183 | 5,088 | Depreciation and amortization | 240 | 125 | 260 | 1,181 | 2,183 | 5,088 | 2,297 | 4,745 | |||||||||||||||||||||

| Other | 1,484 | 1,060 | 4,661 | 6,258 | 8,441 | 10,901 | Other | 1,484 | 1,060 | 4,661 | 6,258 | 8,441 | 10,901 | 5,781 | 7,604 | |||||||||||||||||||||

| Total operating expense | Total operating expense | 5,450 | 4,721 | 22,794 | 46,074 | 83,140 | 123,999 | Total operating expense | 5,450 | 4,721 | 23,108 | 47,070 | 84,287 | 123,999 | 52,995 | 107,011 | ||||||||||||||||||||

| Operating income (loss) | Operating income (loss) | (2,446 | ) | (1,512 | ) | (617 | ) | 3,896 | 7,225 | 8,501 | Operating income (loss) | (2,446 | ) | (1,512 | ) | (931 | ) | 2,900 | 6,078 | 8,501 | 6,935 | 12,292 | ||||||||||||||

| Other (income) expense: | Other (income) expense: | Other (income) expense: | ||||||||||||||||||||||||||||||||||

| Gain on fuel derivatives, net | — | — | — | (314 | ) | (4,438 | ) | (612 | ) | Gain on fuel derivatives, net | — | — | — | (314 | ) | (4,438 | ) | (612 | ) | (928 | ) | (578 | ) | |||||||||||||

| Other (income) expense, net | 489 | 609 | (9 | ) | (913 | ) | — | — | Other (income) expense, net | 489 | 609 | (9 | ) | (913 | ) | — | — | — | — | |||||||||||||||||

| Interest income | (1 | ) | (1 | ) | — | (9 | ) | (30 | ) | (1,225 | ) | Interest income | (1 | ) | (1 | ) | — | (9 | ) | (30 | ) | (1,225 | ) | (162 | ) | (1,309 | ) | |||||||||

| Interest expense | 13 | 127 | 367 | 831 | 1,399 | 3,009 | Interest expense | 13 | 127 | 367 | 831 | 1,399 | 3,009 | 1,327 | 2,601 | |||||||||||||||||||||

| Total other (income) expense | Total other (income) expense | 501 | 735 | 358 | (405 | ) | (3,069 | ) | 1,172 | Total other (income) expense | 501 | 735 | 358 | (405 | ) | (3,069 | ) | 1,172 | 237 | 714 | ||||||||||||||||

| Income (loss) before income taxes | Income (loss) before income taxes | (2,947 | ) | (2,247 | ) | (975 | ) | 4,301 | 10,294 | 7,329 | Income (loss) before income taxes | (2,947 | ) | (2,247 | ) | (1,289 | ) | 3,305 | 9,147 | 7,329 | 6,698 | 11,578 | ||||||||||||||

| Provision for state income taxes | Provision for state income taxes | 1 | 0 | 1 | 1 | 12 | 37 | Provision for state income taxes | 1 | 0 | 1 | 1 | 12 | 37 | 38 | 42 | ||||||||||||||||||||

| Net income (loss) | Net income (loss) | ($2,948 | ) | ($2,247 | ) | ($976 | ) | $4,300 | $10,282 | $7,292 | Net income (loss) | ($2,948 | ) | ($2,247 | ) | ($1,290 | ) | $3,304 | $9,135 | $7,292 | $6,660 | $11,536 | ||||||||||||||

| Earnings (loss) per share: | Earnings (loss) per share: | Earnings (loss) per share: | ||||||||||||||||||||||||||||||||||

| Basic | ($0.44 | ) | ($0.33 | ) | ($0.14 | ) | $0.64 | $1.53 | $1.11 | Basic | ($0.44 | ) | ($0.33 | ) | ($0.14 | ) | $0.49 | $1.36 | $1.11 | $1.00 | $1.79 | |||||||||||||||

| Diluted(1) | ($0.44 | ) | ($0.33 | ) | ($0.14 | ) | $0.64 | $1.53 | $0.56 | Diluted(1) | ($0.44 | ) | ($0.33 | ) | ($0.14 | ) | $0.49 | $1.36 | $0.56 | $0.68 | $0.69 | |||||||||||||||

| Other Financial Data: | |||||||||||||||||

| Operating margin | ($2,446 | ) | ($1,512 | ) | ($617 | ) | $3,896 | $7,225 | $8,501 | ||||||||

| Operating margin % | (81.4 | %) | (47.1 | %) | (2.8 | %) | 7.8 | % | 8.0 | % | 6.4 | % | |||||

| EBITDA (unaudited) | ($2,695 | ) | ($1,996 | ) | ($348 | ) | $6,304 | $13,846 | $14,201 | ||||||||

| EBITDAR (unaudited) | ($1,810 | ) | ($1,537 | ) | $2,685 | $9,441 | $17,693 | $19,188 | |||||||||

Net cash from: | |||||||||||||||||

| Operating activities | $4,172 | $10,484 | $44,027 | ||||||||||||||

| Investing activities | (7,380 | ) | (9,675 | ) | (47,706 | ) | |||||||||||

| Financing activities | 3,380 | 480 | 23,369 | ||||||||||||||

| Other Financial Data: | |||||||||||||||||||||

| Operating margin | ($2,446 | ) | ($1,512 | ) | ($931 | ) | $2,900 | $6,078 | $8,501 | $6,935 | $12,292 | ||||||||||

| Operating margin % | (81.4 | %) | (47.1 | %) | (4.2 | %) | 5.8 | % | 6.7 | % | 6.4 | % | 11.6 | % | 10.3 | % | |||||

| EBITDA (unaudited) | ($2,695 | ) | ($1,996 | ) | ($662 | ) | $5,308 | $12,699 | $14,201 | $10,160 | $17,615 | ||||||||||

Net cash from: | |||||||||||||||||||||

| Operating activities | ($5,521 | ) | ($1,418 | ) | $1,686 | $4,172 | $10,484 | $44,027 | $8,799 | $30,226 | |||||||||||

| Investing activities | (728 | ) | (693 | ) | (1,844 | ) | (7,380 | ) | (9,675 | ) | (47,706 | ) | (28,711 | ) | (27,335 | ) | |||||

| Financing activities | 6,719 | 240 | 201 | 3,380 | 480 | 23,369 | 26,594 | (9,623 | ) | ||||||||||||

| | As of December 31, | | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | As of June 30, 2006 | ||||||||||||

| | 2001 | 2002 | 2003 | 2004 | 2005 | ||||||||

| | (unaudited) | (unaudited) | | | | (unaudited) | |||||||

| | (in thousands) | ||||||||||||

| Balance Sheet Data: | |||||||||||||

| Cash, cash equivalents and short-term investments | $66 | $108 | $280 | $1,569 | $53,325 | $58,318 | |||||||

| Total assets | 2,936 | 5,840 | 32,689 | 65,474 | 170,083 | 196,845 | |||||||

| Long-term debt (including capital leases) | 3,715 | 3,915 | 18,981 | 31,992 | 59,747 | 63,050 | |||||||

| Redeemable convertible preferred shares | — | — | — | — | 39,540 | 39,540 | |||||||

| Shareholders'/members' equity (deficit) | (2,253 | ) | (2,951 | ) | 355 | 9,493 | 14,607 | 22,064 | |||||

| | | | | | | | | Six Months Ended June 30, | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Predecessor January 1- June 30, 2001 | | | Year Ended December 31, | ||||||||||||||||

| | | Successor July 1- December 31, 2001 | ||||||||||||||||||

| | | 2002 | 2003 | 2004 | 2005 | 2005 | 2006 | |||||||||||||

| Operating Statistics (unaudited): | ||||||||||||||||||||

| Total system statistics: | ||||||||||||||||||||

| Passengers | 27,027 | 32,931 | 200,872 | 472,078 | 840,939 | 1,199,574 | 526,065 | 1,056,823 | ||||||||||||

| Revenue passenger miles (RPMs) (thousands) | 9,555 | 11,151 | 149,158 | 436,740 | 914,897 | 1,295,633 | 571,345 | 1,146,761 | ||||||||||||

| Available seat miles (ASMs) (thousands) | 22,807 | 26,550 | 222,216 | 614,280 | 1,218,560 | 1,674,376 | 716,477 | 1,439,964 | ||||||||||||

| Load factor | 41.9 | % | 42.0 | % | 67.1 | % | 71.1 | % | 75.1 | % | 77.4 | % | 79.7 | % | 79.6 | % | ||||

| Operating revenue per ASM (cents) | 13.17 | 12.09 | 9.98 | 8.13 | 7.42 | 7.91 | 8.36 | 8.29 | ||||||||||||

| Operating expense per ASM (cents) | 23.90 | 17.78 | 10.40 | 7.66 | 6.92 | 7.41 | 7.40 | 7.43 | ||||||||||||

| Operating expense per ASM, excluding fuel (cents) | 20.71 | 15.15 | 8.26 | 5.75 | 4.63 | 4.27 | 4.61 | 3.90 | ||||||||||||

| Departures | 552 | 794 | 3,308 | 5,307 | 8,369 | 11,646 | 5,117 | 9,584 | ||||||||||||

| Block hours | 688 | 917 | 5,486 | 11,160 | 20,784 | 29,472 | 12,800 | 25,223 | ||||||||||||

| Average stage length (miles) | 369 | 332 | 564 | 779 | 948 | 977 | 958 | 1,015 | ||||||||||||

| Average number of operating aircraft during period | 1.0 | 1.7 | 2.8 | 4.8 | 8.0 | 13.3 | 11.8 | 20.1 | ||||||||||||

| Total aircraft in service end of period | 1 | 1 | 3 | 7 | 9 | 17 | 14 | 21 | ||||||||||||

| Full-time equivalent employees end of period | 59 | 52 | 107 | 282 | 391 | 596 | 456 | 739 | ||||||||||||

| Fuel gallons consumed (thousands) | 563 | 556 | 4,548 | 10,490 | 19,789 | 28,172 | 12,256 | 23,953 | ||||||||||||

| Average fuel cost per gallon | $1.29 | $1.26 | $1.05 | $1.12 | $1.41 | $1.87 | $1.63 | $2.12 | ||||||||||||

Scheduled service statistics: | ||||||||||||||||||||

| Passengers | 16,631 | 16,310 | 83,779 | 260,850 | 535,602 | 969,393 | 392,085 | 929,653 | ||||||||||||

| Revenue passenger miles (RPMs) (thousands) | 4,291 | 4,192 | 33,687 | 202,997 | 517,301 | 1,029,625 | 408,209 | 1,000,708 | ||||||||||||

| Available seat miles (ASMs) (thousands) | 8,553 | 7,668 | 57,566 | 274,036 | 694,949 | 1,294,064 | 482,120 | 1,217,847 | ||||||||||||

| Load factor | 50.2 | % | 54.7 | % | 58.5 | % | 74.1 | % | 74.4 | % | 79.6 | % | 84.7 | % | 82.2 | % | ||||

| Departures | 298 | 308 | 1,433 | 2,553 | 4,803 | 8,388 | 3,211 | 7,814 | ||||||||||||

| Block hours | 302 | 310 | 1,897 | 5,141 | 11,827 | 22,465 | 8,432 | 21,246 | ||||||||||||

| Yield (cents) | 29.22 | 29.68 | 17.83 | 11.09 | 8.94 | 8.81 | 9.15 | 8.74 | ||||||||||||

| Scheduled service revenue per ASM (cents) | 14.66 | 16.22 | 10.43 | 8.22 | 6.65 | 7.01 | 7.75 | 7.19 | ||||||||||||

| Ancillary revenue per ASM (cents) | 0.72 | 0.56 | 0.15 | 0.32 | 0.45 | 0.87 | 0.74 | 1.04 | ||||||||||||

| Total revenue per ASM (cents) | 15.39 | 16.78 | 10.59 | 8.54 | 7.11 | 7.87 | 8.49 | 8.22 | ||||||||||||

| Average fare—scheduled service | $75.40 | $76.27 | $71.70 | $86.31 | $86.33 | $93.53 | $95.29 | $94.13 | ||||||||||||

| Average fare—ancillary | $3.73 | $2.64 | $1.06 | $3.40 | $5.87 | $11.55 | $9.10 | $13.58 | ||||||||||||

| Average fare—total | $79.13 | $78.91 | $72.76 | $89.71 | $92.19 | $105.07 | $104.39 | $107.71 | ||||||||||||

| Average stage length (miles) | 258 | 258 | 403 | 725 | 913 | 1,045 | 1,017 | 1,054 | ||||||||||||

| Percent of sales through website during period | — | — | — | 53.2 | % | 68.4 | % | 81.0 | % | 80.0 | % | 84.0 | % | |||||||

As of December 31, | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2001 | 2002 | 2003 | 2004 | 2005 | ||||||

| | (unaudited) | (unaudited) | | | | ||||||

| | (in thousands) | ||||||||||

| Balance Sheet Data: | |||||||||||

| Cash, cash equivalents and short-term investments | $66 | $108 | $280 | $1,569 | $53,325 | ||||||

| Total assets | 2,936 | 5,800 | 31,621 | 67,931 | 172,540 | ||||||

| Long-term debt (including capital leases) | 3,715 | 3,915 | 18,981 | 31,992 | 59,747 | ||||||

| Redeemable convertible preferred shares | — | — | — | — | 39,540 | ||||||

| Shareholders'/members' equity (deficit) | (2,253 | ) | (4,308 | ) | (713 | ) | 11,950 | 17,064 | |||

Year Ended December 31, | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2001 | 2002 | 2003 | 2004 | 2005 | |||||||

| Operating Statistics (unaudited): | ||||||||||||

| Total system statistics: | ||||||||||||

| Passengers | 59,958 | 200,872 | 472,078 | 840,939 | 1,199,574 | |||||||

| Revenue passenger miles (RPMs) (thousands) | 20,706 | 149,158 | 436,740 | 914,897 | 1,295,633 | |||||||

| Available seat miles (ASMs) (thousands) | 49,357 | 222,216 | 614,280 | 1,218,560 | 1,674,376 | |||||||

| Load factor | 42.0 | % | 67.1 | % | 71.1 | % | 75.1 | % | 77.4 | % | ||

| Operating revenue per ASM (cents) | 12.59 | 9.98 | 8.13 | 7.42 | 7.91 | |||||||

| Operating expense per ASM (cents) | 20.61 | 10.26 | 7.50 | 6.82 | 7.41 | |||||||

| Operating expense per ASM, excluding fuel (cents) | 17.72 | 8.12 | 5.59 | 4.53 | 4.27 | |||||||

| Departures | 1,346 | 3,308 | 5,307 | 8,369 | 11,646 | |||||||

| Block hours | 1,605 | 5,486 | 11,160 | 20,784 | 29,472 | |||||||

| Average stage length (miles) | 347 | 564 | 779 | 948 | 977 | |||||||

| Average number of operating aircraft during period | 1.4 | 2.8 | 4.8 | 8.0 | 13.3 | |||||||

| Total aircraft in service end of period | 1 | 3 | 7 | 9 | 17 | |||||||

| Full-time equivalent employees at period end | 52 | 107 | 282 | 391 | 596 | |||||||

| Fuel gallons consumed (thousands) | 1,391 | 4,548 | 10,490 | 19,789 | 28,172 | |||||||

| Average fuel cost per gallon | $1.03 | $1.05 | $1.12 | $1.41 | $1.87 | |||||||

Scheduled service statistics: | ||||||||||||

| Passengers | 32,941 | 83,779 | 260,850 | 535,602 | 969,393 | |||||||

| Revenue passenger miles (RPMs) (thousands) | 8,483 | 33,687 | 202,997 | 517,301 | 1,029,625 | |||||||

| Available seat miles (ASMs) (thousands) | 16,221 | 57,566 | 274,036 | 694,949 | 1,294,064 | |||||||

| Load factor | 52.3 | % | 58.5 | % | 74.1 | % | 74.4 | % | 79.6 | % | ||

| Departures | 606 | 1,433 | 2,553 | 4,803 | 8,388 | |||||||

| Block hours | 612 | 1,897 | 5,141 | 11,827 | 22,465 | |||||||

| Yield (cents) | 29.45 | 17.83 | 11.09 | 8.94 | 8.81 | |||||||

| Scheduled service revenue per ASM (cents) | 15.40 | 10.43 | 8.22 | 6.65 | 7.01 | |||||||

| Ancillary revenue per ASM (cents) | 0.65 | 0.15 | 0.32 | 0.45 | 0.87 | |||||||

| Total revenue per ASM (cents) | 16.05 | 10.59 | 8.54 | 7.11 | 7.87 | |||||||

| Average fare—scheduled service | $75.83 | $71.70 | $86.31 | $86.33 | $93.53 | |||||||

| Average fare—ancillary | $3.19 | $1.06 | $3.40 | $5.87 | $11.55 | |||||||

| Average fare—total | $79.02 | $72.76 | $89.71 | $92.19 | $105.07 | |||||||

| Average stage length (miles) | 258 | 403 | 725 | 913 | 1,045 | |||||||

| Percent of sales through website during period | — | — | 53.2 | % | 68.4 | % | 81.0 | % | ||||

The following terms used in this section and elsewhere in this prospectus have the meanings indicated below:

"Available seat miles" or "ASMs" represents the number of seats available for passengers multiplied by the number of miles the seats are flown.

"Average fuel cost per gallon" represents total aircraft fuel costs including taxes divided by the total number of fuel gallons consumed.

"Average stage length" represents the average number of miles flown per flight.

"EBITDA" represents earnings before interest expense, income taxes, depreciation and amortization. EBITDA is not a calculation based on generally accepted accounting principles and should not be considered as an alternative to net income (loss) or operating income (loss) as indicators of our financial performance or to cash flow as a measure of liquidity. In addition, our calculation may not be comparable to other similarly titled measures of other companies. EBITDA is included as a supplemental disclosure because we believe it may provideis a useful information regardingindicator of our ability to service debt payments and to fund capital expenditures. Our ability to service debt payments and to fund capital expendituresoperating performance. Further, EBITDA is a well recognized performance measurement in the future, however,airline industry that is frequently used by securities analysts, investors and other interested parties in comparing the operating performance of companies in our industry. We believe EBITDA is useful in evaluating our operating performance compared to our competitors because its calculation generally eliminates the effects of financing and income taxes and the accounting effects of capital spending and acquisitions, which items may be affected by othervary between periods and for different companies for reasons unrelated to overall operating or legal requirements or uncertainties.performance. The following represents the reconciliation of EBITDA to net income (loss) to EBITDA for the periods indicated below.

| | | | | | | | | Six Months Ended June 30, | ||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | Year Ended December 31, | | | | Year Ended December 31, | |||||||||||||||||||||||||

| | | Predecessor January 1- June 30, 2001 | | Successor July 1- December 31, 2001 | Predecessor January 1- June 30, 2001 | | Successor July 1- December 31, 2001 | Six Months Ended June 30, | ||||||||||||||||||||||||||

| | | | 2002 | 2003 | 2004 | 2005 | | 2002 | 2003 | 2004 | 2005 | 2005 | 2006 | |||||||||||||||||||||

| | | (unaudited) | | (unaudited) | (unaudited) | | | | (unaudited) | | (unaudited) | (unaudited) | | | | (unaudited) | ||||||||||||||||||

| | | (in thousands, except share and per share data) | (in thousands, except share and per share data) | |||||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | |||||||||||||||||

| EBITDA Reconciliation: | EBITDA Reconciliation: | |||||||||||||||||||||||||||||||||

| Net income (loss) | Net income (loss) | ($2,948 | ) | ($2,247 | ) | ($976 | ) | $4,300 | $10,282 | $7,292 | $(2,948 | ) | $(2,247 | ) | $(1,290 | ) | $3,304 | $9,135 | $7,292 | $6,660 | $11,536 | |||||||||||||

| Plus (minus): | Plus (minus): | |||||||||||||||||||||||||||||||||

| Interest, net | 12 | 126 | 367 | 822 | 1,369 | 1,784 | ||||||||||||||||||||||||||||

| Income tax expense | 1 | — | 1 | 1 | 12 | 37 | ||||||||||||||||||||||||||||

| Depreciation and amortization | 240 | 125 | 260 | 1,181 | 2,183 | 5,088 | ||||||||||||||||||||||||||||

| Interest income | (1 | ) | (1 | ) | — | (9 | ) | (30 | ) | (1,225 | ) | (162 | ) | (1,309 | ) | |||||||||||||||||||

| Interest expense | 13 | 127 | 367 | 831 | 1,399 | 3,009 | 1,327 | 2,601 | ||||||||||||||||||||||||||

| Provision for state income taxes | 1 | — | 1 | 1 | 12 | 37 | 38 | 42 | ||||||||||||||||||||||||||

| Depreciation and amortization | 240 | 125 | 260 | 1,181 | 2,183 | 5,088 | 2,297 | 4,745 | ||||||||||||||||||||||||||

| EBITDA | EBITDA | ($2,695 | ) | ($1,996 | ) | ($348 | ) | $6,304 | $13,846 | $14,201 | $(2,695 | ) | $(1,996 | ) | $(662 | ) | $5,308 | $12,699 | $14,201 | $10,160 | $17,615 | |||||||||||||

"EBITDAR"Aircraft lease rentals expense represents earnings before interesta significant operating expense income taxes, depreciation, amortization andof our business. Because we leased aircraft during the periods presented, we believe that when assessing EBITDA you should also consider the impact of our aircraft lease rental expense. EBITDAR is not a calculation based on generally accepted accounting principles and should not be considered as an alternative to net income (loss) or operating income (loss) as indicators of our financial performance or to cash flow as a measure of liquidity. In addition, our calculation may not be comparable to other similarly titled measures of other companies. EBITDAR is included as a supplemental disclosure because it may provide useful information regarding our ability to service debt and lease payments and to fund capital expenditures. Our ability to service debt and lease payments and to fund capital expendituresrentals expense, which was $885 from January 1 - June 30, 2001, $459 from July 1 - December 31, 2001, $3,033 in 2002, $3,137 in 2003, $3,847 in 2004, $4,987 in 2005, $1,921 in the future, however, may be

affected by other operating or legal requirements or uncertainties. The following representsfirst six months of 2005 and $3,173 in the reconciliationfirst six months of net income (loss) to EBITDAR for the periods indicated below.2006.

| | | | | Year Ended December 31, | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Predecessor January 1- June 30, 2001 | | Successor July 1- December 31, 2001 | ||||||||||||

| | | 2002 | 2003 | 2004 | 2005 | ||||||||||

| | (unaudited) | | (unaudited) | (unaudited) | | | | ||||||||

| | (in thousands, except share and per share data) | ||||||||||||||

| EBITDAR Reconciliation | |||||||||||||||

| Net income (loss) | ($2,948 | ) | ($2,247 | ) | ($976 | ) | $4,300 | $10,282 | $7,292 | ||||||

| Plus (minus): | |||||||||||||||

| Interest, net | 12 | 126 | 367 | 822 | 1,369 | 1,784 | |||||||||

| Income tax expense | 1 | — | 1 | 1 | 12 | 37 | |||||||||

| Depreciation and amortization | 240 | 125 | 260 | 1,181 | 2,183 | 5,088 | |||||||||

| Aircraft lease rentals | 885 | 459 | 3,033 | 3,137 | 3,847 | 4,987 | |||||||||

| EBITDAR | ($1,810 | ) | ($1,537 | ) | $2,685 | $9,441 | $17,693 | $19,188 | |||||||

"Load factor" represents the percentage of aircraft seating capacity that is actually utilized (revenue passenger miles divided by available seat miles).

"Operating expense per ASM" represents operating expenses divided by available seat miles.

"Operating expense per ASM, excluding fuel" represents operating expenses, less aircraft fuel, divided by available seat miles.

"Operating revenue per ASM" represents operating revenue divided by available seat miles.

"Revenue passengers" represents the total number of passengers flown on all flight segments.

"Revenue passenger miles" or"RPMs" represents the number of miles flown by revenue passengers.

"Yield" represents scheduled service revenue divided by scheduled service revenue passenger miles.

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below before making an investment decision. The risks described below are not the only ones facing our company. Additional risks not presently known to us or that we currently deem immaterial may also impair our business and operations. Our business, financial condition or results of operations could be materially and adversely affected by any of these risks. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

Risks Related to Allegiant

Increases in fuel prices or unavailability of fuel would harm our business and profitability.

Fuel costs constitute a significant portion of our total operating expenses (42.4%(47.5% for the yearsix months ended December 31, 2005)June 30, 2006). Significant increases in fuel costs would harm our financial condition and results of operations.

Our MD80 series aircraft are relativelyless fuel inefficient compared toefficient than new aircraft. An increase in the price of aircraft fuel would therefore result in a disproportionately higher increase in our average total costs than our competitors using more fuel efficient aircraft.

Historically, fuel costs have been subject to wide price fluctuations. Aircraft fuel availability is also subject to periods of market surplus and shortage and is affected by demand for heating oil, gasoline and other petroleum products. Because of the effect of these events on the price and availability of aircraft fuel, the cost and future availability of fuel cannot be predicted with any degree of certainty. A fuel supply shortage or higher fuel prices could result in the curtailment of our service. Some of our competitors may be better positioned to obtain fuel in the event of a shortage. We cannot assure you increases in the price of fuel can be offset by higher revenue.

In addition, although we implemented a fuel derivatives program in 2003 to partially protect against fuel price volatility, our hedging program does not protect us against ordinary course price increases and is limited in fuel volume and duration. We cannot assure you our fuel hedging program is sufficient to protect us against increases in the price of fuel.

We carry limited fuel inventory and we rely heavily on our fuel suppliers. We cannot assure you we will always have access to adequate supplies of fuel in the event of shortages or other disruptions in the fuel supply.

We may be subject to unionization, work stoppages, slowdowns or increased labor costs.

Unlike most airlines, we have a non-union workforce. If our employees unionize, it could result in demands that may increase our operating expenses and adversely affect our profitability. Our pilots have formed an in-house pilot association and have recently requested pay increases. Our costs will be affected by the results of discussions with our pilot group and any other employee groups in the future. Each of our different employee groups could unionize at any time and would require separate collective bargaining agreements. If any group of our employees were to unionize and we were unable to agree on the terms of their collective bargaining agreement or we were to experience widespread employee dissatisfaction, we could be subject to work slowdowns or stoppages. In addition, we may be subject to disruptions by organized labor groups protesting our non-union status. Any of these events would be disruptive to our operations and could harm our business.

If our credit card processing company were to require significant holdbacks for processing credit card transactions for the purchase of air travel and other services, our cash flow would be adversely affected.

Credit card companies frequently require significant holdbacks when future air travel and other future services are purchased through credit card transactions. We rely on a single credit card

processing company at this time, and our agreement is terminable on 30 days notice. As virtually all of our scheduled service and ancillary revenue is paid with credit card transactionscards and our credit card processing agreement does not require a

significant holdback, our cash flow would suffer in the event the terms of our current agreement were changed.changed or terminated. Although we believe that we would be able to secure a replacement credit card processing agreement if our current agreement is terminated, the terms of any new agreement may not be as favorable to us. These cash flow issues could be exacerbated during periods of rapid growth as we would be incurring additional costs associated with our growth, but our receipt of these revenues would be delayed.

Our failure to successfully implement our growth strategy and generate demand for our services could harm our business.

Successfully implementing our growth strategy is critical for our business to achieve economies of scale and to sustain or increase our profitability. Increasing the number of small city markets we serve depends on our ability to identify and effectively evaluate new target markets and then access suitable airports located in these markets in a manner consistent with our cost strategy.

Most of our scheduled air service is sold to customers traveling from our small city markets to either Las Vegas or Orlando. While we seek to generate demand for our services in these markets, the smaller size of these markets makes it more difficult to create this demand. If we are unable to do so in a particular market, our revenues could be negatively affected and our ability to grow could be constrained. Under those circumstances, we may decide to reduce or terminate service to that market, which could result in additional costs.

We will also need to obtain additional gates in Las Vegas and Orlando, and obtain access to markets we seek to serve in the future. Any condition that would deny, limit or delay our access to airports we seek to serve in the future willwould constrain our ability to grow. Opening new markets may require us to commit a substantial amount of resources, even before the new services commence, including additional skilled personnel, equipment and facilities. An inability to hire and retain skilled personnel or to secure the required equipment and facilities efficiently and cost-effectively may affect our ability to implement our growth strategy. We cannot assure you we will be able to successfully establish new markets and our failure to do so could harm our business.

Over time weWe expect to serve other leisure destinations, in addition to Las Vegas and Orlando, which we believe are attractive to small city markets. However, if we fail to successfully implement service to additional leisure destinations, our growth prospects will be limited and our profitability could be adversely impacted.

Expansion of our markets and services may also strain our existing management resources and operational, financial and management information systems to the point they may no longer be adequate to support our operations, requiring us to make significant expenditures in these areas. We expect we will need to develop further financial, operational and management controls, reporting systems and procedures to accommodate future growth. We cannot assure you we will be able to develop these controls, systems or procedures on a timely basis and the failure to do so could harm our business.

Additionally, we are subject to regulation by the Federal Aviation Administration ("FAA") and must receive its approval to add aircraft to our operating certificate. If the FAA does not grant us approval to add aircraft to our fleet as quickly as we desire, our growth may be limited and our profitability could be adversely impacted.

Any inability to acquire and maintain additional compatible aircraft, engines or parts on favorable terms or at all would increase our operating costs and could harm our profitability.

Our fleet currently consists of MD80 series aircraft equipped with Pratt & Whitney JT8D-200 series engines. Although our management believes there is currently an adequate supply of suitable MD80 series aircraft available at favorable prices and terms, we are unable to predict how long these conditions will continue. Any increase in demand for the MD80 aircraft or the Pratt & Whitney JT8D-200 series engine could restrict our ability to obtain additional MD80 aircraft, engines and spare

parts. Because the aircraft and the engine are no longer being manufactured, we may be unable to obtain additional suitable aircraft, engines or spare parts on satisfactory terms or at the time needed for our operations or for our implementation of our growth plan.

In April 2006, the FAA indicated it intends to issue regulations limiting the age of aircraft that may be flown in the U.S. The announcement did not indicate the maximum age that would be allowed, the effective date of the regulation or any grandfathering provisions. These regulations, if and when implemented, may have a material effect on our future operations.

We cannot assure you we will be able to purchase additional MD80s on favorable terms, or at all. Instead, we may be required to lease MD80s from current owners. Because, in our experience, the cost of leasing generally exceeds the ownership costs associated with the purchase of the MD80, our operating costs would increase if we are required to lease, instead of purchase, additional MD80 aircraft, and this could harm our profitability.

If the available MD80 series aircraft, whether by purchase or lease, are not compatible with the rest of our fleet in terms of takeoff weight, avionics, engine type or other factors, the costs of operating and maintaining our fleet willwould likely increase. Similarly, our aircraft ownership costs will likely increase if we decide to acquire aircraft which are not MD80 series aircraft.

There is also a greater risk with acquiring used aircraft because we may incur additional costs to remedy any mechanical issues not found in our inspection and acceptance process and, generally, the cost to maintain used aircraft exceeds the cost to maintain newernew aircraft.

Any inability to obtain financing for additional aircraft could harm our growth plan.

We typically finance our aircraft through either mortgage debt or lease financing. Although we believe debt and/or lease financing will be available for the aircraft we will acquire, we cannot assure you we will be able to secure such financing on terms attractive to us or at all. To the extent we cannot secure such financing on acceptable terms or at all, we may be required to modify our aircraft acquisition plans, incur higher than anticipated financing costs or use more of our cash balances for aircraft acquisitions than we currently expect.

Aircraft lenders often require that they receive the benefit of Section 1110 protection under the U.S. Bankruptcy Code. It is more difficult to provide lenders Section 1110 protection for aircraft manufactured before 1994. Most MD80s, and almost all of our MD80s, were manufactured before 1994. As a result, we may face difficulty obtaining financing for aircraft transactions.

Our maintenance costs will increase as our fleet ages.

Our aircraft range from 10 to 20 years old, with an average age of 16 years. The average age of aircraft fleets among U.S. legacy carriers and LCCs ranges from 2.6 years old to 13.3 years old. In general, the cost to maintain aircraft increases as they age and exceeds the cost to maintain new aircraft. FAA regulations require additional maintenance inspections for older aircraft. For example, a repair assessment program must be implemented for each of our aircraft once they reach 60,000 cycles. A cycle is defined as one take-off and landing. The average cycles on our fleet is approximately 25,000 cycles and the highest number of cycles on any of our aircraft is approximately 43,000. Based on our current and expected aircraft utilization rates of approximately 1,000 cycles per year, we will not have

to comply with the repair assessment program for several years. We will also need to comply with other programs which require enhanced inspections of aircraft including Aging Aircraft Airworthiness Directives, which typically increase as an aircraft ages and vary by aircraft or engine type depending on the unique characteristics of each aircraft and/or engine.

In addition, we may be required to comply with any future aging aircraft issues, law changes, regulations or airworthiness directives. We cannot assure you our maintenance costs will not exceed our expectations.

We believe our aircraft are and will be mechanically reliable based on the percentage of scheduled flights completed. We cannot assure you our aircraft will continue to be sufficiently reliable over longer periods of time. Furthermore, given the age of our fleet, any public perception that our aircraft are less than completely reliable could have an adverse effect on our profitability.

Our reputation and financial results could be harmed in the event of an accident or incident involving our aircraft or other MD80 aircraft.

AnAlthough we have not had any accidents or material incidents to date, an accident or incident involving one of our aircraft could involve repair or replacement of a damaged aircraft and its consequential temporary or permanent loss from service, and significant

potential claims of injured passengers and others. Although we believe we currently maintain liability insurance in amounts and of the type generally consistent with industry practice, the amount of such coverage may not be adequate and we may be forced to bear substantial losses from an accident. Substantial claims resulting from an accident in excess of our related insurance coverage would harm our business and financial results. Moreover, any aircraft accident or incident, even if fully insured, could cause a public perception that we are less safe or reliable than other airlines, which would harm our business. Because we are a relatively new company and because we are smaller than most airlines, an accident would be likely to adversely affect us to a greater degree than a larger, more established airline.

Additionally, our dependence on this single type of aircraft and engine for all of our flights makes us particularly vulnerable to any problems that might be associated with this aircraft type or these engines. Our business would be significantly harmed if a mechanical problem with the MD80 series aircraft or the Pratt & Whitney JT8D-200 series engine were discovered causing our aircraft to be grounded while any such problem is being corrected, assuming it could be corrected at all. The FAA could also suspend or restrict the use of our aircraft in the event of any actual or perceived mechanical problems, whether involving our aircraft or another U.S. or foreign airline's aircraft, while it conducts its own investigation. Our business would also be significantly harmed if the public avoids flying our aircraft due to an adverse perception of the MD80 series aircraft or the Pratt & Whitney JT8D-200 series engine because of safety concerns or other problems, whether real or perceived, or in the event of an accident involving an MD80 aircraft.

We depend on our ability to maintain existing and develop new relationships with hotels and other providers of travel related services. Any adverse changes in these relationships could adversely affect our business, financial condition and results of operations, as well as our ability to provide air-hotel packages in our leisure destination markets.

An important component of our business success depends on our ability to maintain our existing, as well as build new, relationships with hotels and other travel suppliers in our leisure destination markets. We do not currently have long-term contracts with any of our hotel room suppliers, nor do we anticipate entering into long-term contracts with them in the future. Adverse changes in or the failure to renew existing relationships, or our inability to enter into arrangements with new hotel suppliers on favorable terms, if at all, could reduce the amount, quality and breadth of attractively priced travel products and services we are able to offer, which could adversely affect our business, financial condition and results of operations. Our ability to continue to grow and enter new markets also depends on our

ability to obtain a sufficient supply of suitable hotel rooms on favorable terms in our existing and new leisure destinations.

Hotels and other travel suppliers are increasingly seeking to lower their distribution costs by promoting direct online bookings through their own websites, and we expect this trend to continue. Hotels and travel suppliers may choose not to make their travel products and services available through our distribution channels. To the extent consumers increase the percentage of their travel purchases through supplier direct websites and/or if travel suppliers choose not to make their products and services available to us, our business may suffer.

We have a significant amount of fixed obligations and we expect to incur significantly more fixed obligations which could hurt our ability to meet our strategic goals.

As of December 31, 2005, maturities of our long-term debt (including capital leases) were $10.6 million in 2006, $11.2 million in 2007, $10.4 million in 2008, $12.5 million in 2009, $9.6 million in 2010 and an aggregate of $5.4 million for years thereafter. All of our long-term and short-term debt has fixed interest rates. In addition to long-term debt, we have a significant amount of other fixed obligations under operating leases related to our aircraft, airport terminal space, other airport facilities

and office space. As of December 31, 2005, future minimum lease payments under noncancelable operating leases with initial or remaining terms in excess of one year were approximately $6.7 million in 2006, $6.6 million in 2007, $2.9 million in 2008, $0.8 million in 2009 and $0.6 million in 2010. We expect to incur additional debt and other fixed obligations as we take delivery of additional aircraft and other equipment and continue to expand into new markets.

The amount of our debt and other fixed obligations could:

Our ability to make scheduled payments on our debt and other fixed obligations will depend upon our future operating performance and cash flow, which in turn will depend upon prevailing economic and political conditions and financial, competitive, regulatory, business and other factors, many of which are beyond our control. We cannot assure you we will be able to generate sufficient cash flow from our operations to pay our debt and other fixed obligations as they become due, and our failure to do so could harm our business. If we are unable to make payments on our debt and other fixed obligations, we could be forced to renegotiate those obligations or obtain additional equity or debt financing. To the extent we finance our activities or future aircraft acquisitions with additional debt, we may become subject to financial and other covenants that may restrict our ability to pursue our growth strategy. We cannot assure you any renegotiation efforts would be successful or timely or that we could refinance our obligations on acceptable terms, if at all.

Our lack of an established line of credit or borrowing facility makes us highly dependent upon our operating cash flows.

We have no lines of credit and rely on operating cash flows to provide working capital. Unless we secure a line of credit or borrowing facility, we will be dependent upon our operating cash flows and cash balances to fund our operations and to make scheduled payments on our debt and other fixed obligations. If we fail to generate sufficient funds from operations to meet these cash requirements or

do not secure a line of credit, other borrowing facility or equity financing, we could default on our debt and other fixed obligations. Our inability to meet our obligations as they become due would materially restrict our ability to grow and seriously harm our business and financial results.

Our business is heavily dependent on the Las Vegas and Orlando markets and a reduction in demand for air travel to these markets would harm our business.

All of our scheduled flights have Las Vegas or Orlando as either their destination or origin. Our business would be harmed by any circumstances causing a reduction in demand for air transportation to the Las Vegas or Orlando markets, such as adverse changes in local economic conditions, negative public perception of the particular city, significant price increases, or the impact of past or future terrorist attacks. We serve Orlando Sanford International Airport, which is not the principal airport in the Orlando market. A refusal by passengers to view Orlando Sanford International Airport as a reasonable alternative to Orlando International Airport, the main airport serving Orlando, could harm our business.

We may face increased competition in our markets which could harm our business.

The small cities we serve on a scheduled basis have traditionally attracted considerably less attention from our potential competitors than larger markets, and in most of our markets, we are the only provider of nonstop service to Las Vegas or Orlando. It is possible other airlines will begin to provide nonstop services to and from these markets or otherwise target these markets. An increase in the amount of direct or indirect competition could harm our business.

We may be unable to renew our lease or increase our facilities at Las Vegas' McCarran International Airport.

McCarran International Airport iswas the 9th busiest airport in the world in 2005 and its gate space, terminal space, aircraft parking space and facilities in general are constrained. To meet our growth plan, we will require additional facilities at McCarran. However, we may not be able to maintain sufficient or obtain additional facilities at McCarran on favorable terms, or at all. In addition, our present agreement can be terminated at any time upon 30 days' notice. Since Las Vegas is one of our principal destinations, our inability to maintain sufficient facilities or to obtain additional facilities as needed would harm our business by limiting our ability to grow and increasing our costs.

We also currently rely on the availability of overnight aircraft parking space at McCarran. However, due to anticipated airport growth, we may find it difficult to obtain sufficient overnight aircraft parking space in the future. Over time, this may result in our having to overnight aircraft in other cities, which would increase our costs and could adversely impact our business and results of operations.

Our business could be harmed if we lose the services of our key personnel.

Our business depends upon the efforts of our chief executive officer, Maurice J. Gallagher, Jr., and a small number of management and operating personnel. We do not currently have an employment agreementsagreement with or maintain key-man life insurance on Mr. Gallagher or our other executive officers.Gallagher. We may have difficulty replacing management or other key personnel who leave and, therefore, the loss of the services of any of these individuals could harm our business.

Our results of operations will fluctuate.

We expect our quarterly operating results to fluctuate in the future based on a variety of factors, including:

In addition, seasonal variations in traffic, the timing of significant repair events and weather affect our operating results from quarter to quarter. Quarter-to-quarter comparisons of our operating results may not be good indicators of our future performance. In addition, it is possible our operating results in any future quarter could be below the expectations of investors and any published reports or analyses regarding Allegiant. In that event, the price of our common stock could decline, perhaps substantially.

Due to our limited fleet size, if any of our aircraft becomes unavailable, we may suffer greater damage to our service, reputation and profitability than airlines with larger fleets.

We operate a fleet of 21 aircraft. Given the limited number of aircraft we operate, if an aircraft becomes unavailable due to unscheduled maintenance, repairs or other reasons, we could suffer greater adverse financial and reputational impacts than larger airlines if our flights are delayed or cancelled due to the absence of replacement aircraft. Our business strategy involves concentrating our aircraft overnight at our destination airports. If we are unable to operate those aircraft for a prolonged period of time for reasons outside of our control, for example, a catastrophic event or a terrorist act, our results of operations and business could be disproportionately harmed.

We rely heavily on automated systems to operate our business and any failure of these systems could harm our business.

We depend on automated systems to operate our business, including our computerized airline reservation system, our telecommunication systems, our website and other automated systems. We rely on a single vendor to support many of these systems.systems and it would be difficult to readily replace this vendor on whom we have relied since our inception. A failure of this vendor to satisfactorily service our automation needs could negatively affect our Internet sales and customer service and result in increased costs.

Unlike many other airlines, which issue traditional paper tickets to some or all of their passengers, we issue only electronic tickets. Our website and reservation system must be able to accommodate a high volume of traffic and deliver important flight information. Substantial or repeated website, reservations system or telecommunication systems failures or a failure by our vendor could reduce the attractiveness of our services. Any disruption in these systems could result in the loss of important data, increase our expenses and generally harm our business.

Currently, our fixed fee flying business is substantially dependent on a single customer and the loss of this business could have a material adverse effect on our continuing fixed fee contract revenue.

During 2005, 64.4% of our fixed fee contract revenue was derived from Harrah's Entertainment Inc. We provide these services under contracts which expire in December 2008. If Harrah's suffers a decline in business, decides to change its strategy or otherwise decides to reduce or terminate the fixed fee flying services provided by us, our revenues from fixed fee flying operations could be adversely affected.

If we are unable to attract and retain qualified personnel at reasonable costs or fail to maintain our company culture, our business could be harmed.

Our business is labor intensive, with labor costs representing 17.5%15.0% of our operating expenses for the yearsix months ended December 31, 2005.June 30, 2006. We expect wages and benefits to increase on a gross basis; these costs could also increase as a percentage of our overall costs, which could harm our business. Our expansion plans will require us to hire, train and retain a significant number of new employees in the

future. From time to time, the airline industry has experienced a shortage of personnel licensed by the FAA, especially pilots and mechanics. We compete against other U.S. airlines for labor in these highly skilled positions. Many U.S. airlines offer wage and benefit packages that exceed our wage and benefit packages. As a result, in the future, we may have to significantly increase wages and benefits in order to attract and retain qualified personnel or risk considerable employee turnover. If we are unable to hire, train and retain qualified employees at a reasonable cost, we may be unable to complete our expansion plans and our business could be harmed.