As filed with the Securities and Exchange Commission on March 8,May 7, 2007

Registration Number 333- 333-141142

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 3 TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

AECOM TECHNOLOGY CORPORATION

(Exact name of Registrant as specified in its charter)

| Delaware | 8711 | 61-1088522 | ||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

555 South Flower Street, Suite 3700

Los Angeles, California 90071

(213) 589-8000593-8000

(Address of principal executive offices, including zip code and telephone number)

John M. Dionisio

President and Chief Executive Officer

AECOM Technology Corporation

555 South Flower Street, Suite 3700

Los Angeles, California 90071

(213) 593-8000

(Name, address and telephone number of agent for service)

Copies to:

| Jonathan K. Layne, Esq. Gibson, Dunn & Crutcher LLP 2029 Century Park East Los Angeles, CA 90067 (310) 552-8500 | Eric Chen, Esq. David Y. Gan, Esq. AECOM Technology Corporation 555 South Flower Street, Suite 3700 Los Angeles, CA 90071 (213) 593-8000 | J. Scott Hodgkins, Esq. Steven B. Stokdyk, Esq. Latham & Watkins LLP 633 West 5th Street, Suite 4000 Los Angeles, CA 90071 (213) 485-1234 |

Approximate date of proposed sale to the public:As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. o

CALCULATION OF REGISTRATION FEE

| Title of Shares to be Registered | Proposed Maximum Aggregate Offering Price(1)(2) | Amount of Registration Fee | ||

|---|---|---|---|---|

| Common Stock, $0.01 par value | $200,000,000 | $6,140 | ||

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933, OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we and the selling stockholders are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, Dated March 8,May 7, 2007

PROSPECTUS

35,150,000 Shares

AECOM TECHNOLOGY CORPORATION

COMMON STOCK

AECOM Technology Corporation is offering 19,888,797 shares of common stock and the selling stockholders are offering 15,261,203 shares of common stock. We will not receive any proceeds from the sale of shares by the selling stockholders. This is our initial public offering and no public market currently exists for our shares. We estimate that the initial public offering price will be between $$18.00 and $$20.00 per share.

We are applying to have ourOur common stock tradedhas been approved for trading on The New York Stock Exchange under the symbol "ACM."ACM," subject to official notice of issuance.

Investing in our common stock involves risks. See "Risk Factors" beginning on page 9.

PRICE $ A SHARE

| | Price to Public | Underwriting Discounts and Commissions | Proceeds to AECOM | Proceeds to Selling Stockholders | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Per Share | $ | $ | $ | $ | ||||||||

| Total | $ | $ | $ | $ | ||||||||

We have granted the underwriters the right to purchase up to an additional 5,272,500 shares of common stock to cover over-allotments.

The Securities and Exchange Commission and state securities regulators have not approved or disapproved these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares to purchasers on May , 2007.

| MORGAN STANLEY | MERRILL LYNCH & CO. | UBS INVESTMENT BANK |

GOLDMAN, SACHS & CO.

CREDIT SUISSE

D.A. DAVIDSON & CO.

, 2007

| | Page | |

|---|---|---|

| Summary | 1 | |

| Risk Factors | 9 | |

| Special Note Regarding Forward-Looking Statements | ||

| Use of Proceeds | ||

| Industry and Market Data | 19 | |

| Dividend Policy | 19 | |

| Capitalization | 20 | |

| Dilution | ||

| Selected Consolidated Financial Data | ||

| Management's Discussion and Analysis of Financial Condition and Results of Operations | ||

| Business | ||

| Management | ||

| Executive Compensation | ||

| Certain Relationships and Related Transactions | ||

| Principal and Selling Stockholders | ||

| Description of Capital Stock | ||

| United States Federal Income Tax Consequences to Non-U.S. Holders | ||

| Shares Eligible for Future Sale | ||

| Underwriters | ||

| Legal Matters | ||

| Experts | ||

| Where You Can Find Additional Information | ||

| Index to Consolidated Financial Statements | F-1 |

You should rely only on the information contained in this prospectus or any related free writing prospectus we may authorize to be delivered to you. We have not, and the underwriters have not, authorized anyone to provide you with information different from, or in addition to, that contained in this prospectus or any related free writing prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We are offering to sell, and are seeking offers to buy, shares of common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus or any related free writing prospectus is accurate only as of its date, regardless of its time of delivery, or of any sale of the common stock. Our business, financial conditions, results of operations and prospects may have changed since that date.

Through and including , 2007 (25 days after the date of this prospectus), all dealers that buy, sell or trade our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to the obligation of dealers to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

For investors outside of the United States: Neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

i

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information you should consider before buying shares in this offering. You should read the entire prospectus carefully, especially the information under "Risk Factors." References in this prospectus to "AECOM," "the Company," "we," "us" or "our" refer to AECOM Technology Corporation and its consolidated subsidiaries, unless we indicate otherwise.

Unless otherwise noted, references to years are for fiscal years. Our fiscal year consists of 52 or 53 weeks, ending on the Friday closest to September 30. Our fiscal quarters end on the Friday closest to December 31, March 31, June 30 and September 30. For clarity of presentation, we refer to all fiscal years and fiscal quarters in this prospectus as ending on September 30, December 31, March 31 or June 30, regardless of the actual date.

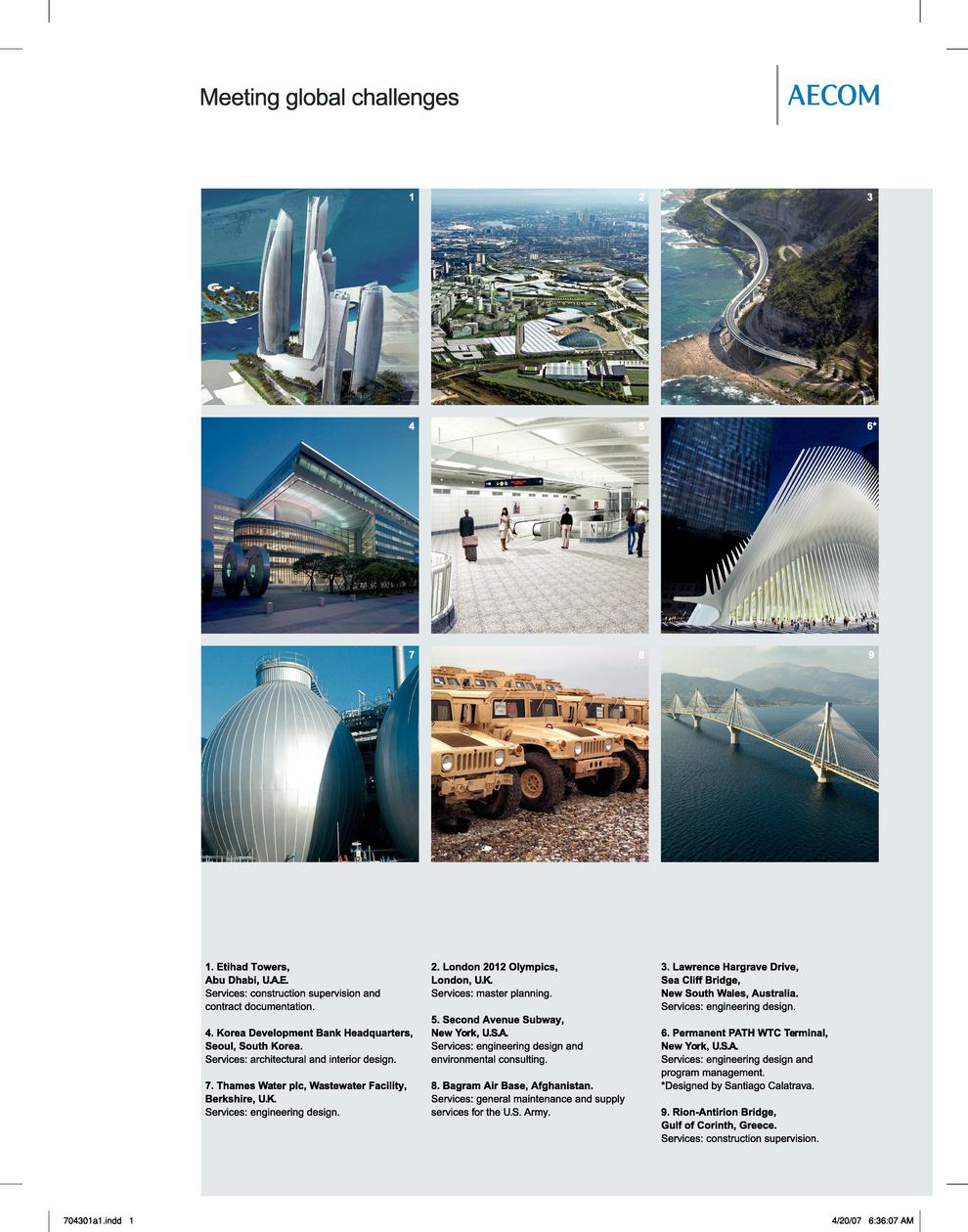

Our Company

We are a leading global provider of professional technical and management support services to government and commercial clients on all seven continents. We provide planning, consulting, architectural and engineering design, and program and construction management services for a broad range of projects, including highways, airports, bridges, mass transit systems, government and commercial buildings, and water and wastewater facilities.facilities and power transmission and distribution. We also provide facilities management, training, logistics and other support services, primarily for agencies of the United States government.

Through our approximately 28,000more than 30,000 employees in over 60 countries, we provide our services to a number of end markets, with particular strength in the transportation, facilities, also referred to as general building, and environmental markets. With over 60% of our employees operating outside the United States, we believe we are well positioned to grow both in the United States and internationally. According toEngineering News-Record's (ENR) 20062007 Design Survey, we are the largest general architectural and engineering design firm in the world, ranked by 20052006 design revenue. In addition, we are ranked by ENR as the leading firm in a number of design end markets, including transportation and general building.

We are led by an experienced management team with a proven record of delivering growth in revenue and profits. Over the last five10 fiscal years, we have grown our revenue from $1.7$0.7 billion to $3.4 billion, reflecting a compound annual growth rate, or CAGR, of 20.0%. Furthermore, over the last five fiscal years, we have doubled our revenue from $1.7 billion to $3.4 billion, reflecting a CAGR of 18.3%. In that same five year period, our net income increased from $23.1 million to $53.7 million, reflecting a CAGR of 23.5%. Our revenue for the first quarter of fiscal 2007 grew 25.7% to $938.5 million, compared to $746.8 million for the same period last year. Over the past 10 years, we have enhanced our organic growth with the successful acquisition and integration of more than 30 complementary businesses. These acquisitions have enabled us to expand our professional service offerings, end market coverage and geographic presence. As of DecemberMarch 31, 2006,2007, we had a total backlog of $2.9$3.1 billion compared to $2.5$2.6 billion at DecemberMarch 31, 2005,2006, a 15.0%21.1% increase.

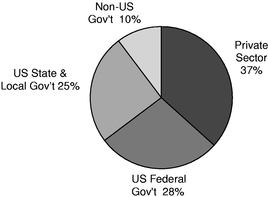

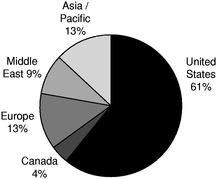

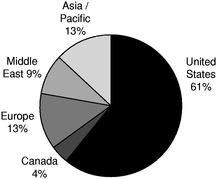

The following two charts illustrate the diversification of our fiscal 2006 revenue by client type and geography.

|  |

We offer our broad range of services through two business segments: Professional Technical Services and Management Support Services.

Professional Technical Services (PTS). Our PTS segment delivers planning, consulting, architectural and engineering design, and program and construction management services to government, institutional and commercial clients worldwide in end markets such as transportation, facilities, environmental—including water, wastewater and environmental management—and energy/power. We provide services in connection with some of the largest and most complex projects in the world. Our PTS segment contributed $2.8 billion, or 81.0%, of our revenue in fiscal 2006, which represents an

increase of 33.1% over fiscal 2005 PTS revenue. The following table highlights our principal PTS end markets along with a list of representative projects:

| End Market | Approximate Percentage of Fiscal 2006 PTS Segment Revenue (%) | Representative Projects | Project Locations | |||

|---|---|---|---|---|---|---|

| Transportation | • Second Avenue Subway • Sydney Orbital Bypass • Sutong Bridge • John F. Kennedy Airport | U.S. Australia China U.S. | ||||

| • 2012 London Olympics • Pentagon Renovation • British Broadcasting Company Headquarters • Los Alamos National Laboratory | U.K. U.S. U.K. U.S. | |||||

| Environmental | • Harbor Area Treatment Scheme • Chicago Calumet and Stickney Wastewater Treatment Plants • New York City Bowery Bay | Hong Kong U.S. U.S. | ||||

| Energy/Power | 4 | • Mutnovsky Independent Power Project • NY Public Schools Coal Conversion Project • Southern Provincial Rural Electrification Project | Russia U.S. Laos | |||

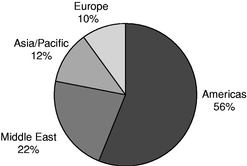

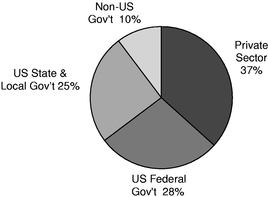

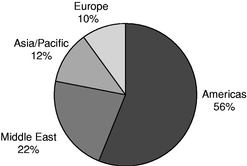

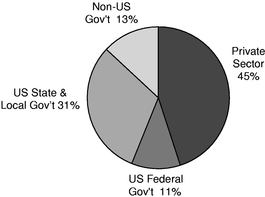

The following two charts illustrate the diversification of our PTS revenue for the first quarter of fiscal 2007, ended December 31, 2006, by client type and geography.

| First Quarter Fiscal 2007 Revenue by Client Type | First Quarter Fiscal 2007 Revenue by Geography | |

|  |

Management Support Services (MSS). Our MSS segment provides facilities management and maintenance, training, logistics, consulting, technical assistance and systems integration services, primarily for agencies of the U.S. government. We have over 9,000 employees managing projects for

over 400 contract-specific job sites for U.S. government clients such as the Department of Defense, Department of Energy and the Department of Homeland Security. Our MSS segment contributed $647 million, or 18.9% of our revenue in fiscal 2006, representing an increase of 109.4% over fiscal 2005 MSS revenue. The following table highlights representative projects in our MSS segment:

| Representative Projects | Project Locations | Clients | ||

|---|---|---|---|---|

| • Nevada Test Site | U.S. | U.S. Dept. of Energy | ||

| • Camp | Kuwait | U.S. Dept. of Defense | ||

| • Fort Polk Training Center | U.S. | U.S. Dept. of Defense | ||

| • International Civilian Police (CIVPOL) | Various worldwide | U.S. Dept. of State |

Our Market Opportunity

According to ENR, the top 500 design firms in the United States, ranked by revenue, generated revenue of approximately $59.8$69.6 billion in 2005, an 11.8%2006, a 17.5% increase over 2004.2005. The top five design firms, which includes us, accounted for 21% of this $69.6 billion market. Our core end markets, namely transportation, facilities, environmental, energy/power and government services, are anticipated to continue to grow, due to the following significant market trends:

The global market for our services is highly fragmented, with thousands of providers. While many of these providers focus on regional niche markets, we believe that clients are increasingly seeking out larger firms such as us that can meet their needs around the world by providing a diverse array of services. This is contributing to a consolidation trend in this market, particularly among mid-size firms without notable technical niche specialties. Furthermore, our client base is becoming increasingly reliant on professional technical services or management support services that are either not readily available from internal resources or are not among their core competencies, or both.

With our broad service offerings, end market coverage and geographic presence, we believe we are well positioned to capitalize on these favorable trends. Furthermore, we believe the industry consolidation trend will allow us to continue to advance our market leadership positions by selectively adding successful firms that are seeking a global platform for their services.

Our Competitive Strengths

We believe we have the experience, relationships, technical expertise and personnel to lead our clients through their most complicated and critical technical undertakings while also delivering the level of consistent, quality service necessary to maintain long-term relationships and secure repeat engagements. Our key competitive strengths include:

We have leadershipLeadership positions in large, growing markets. Based on ENR's rankings of firms by 20052006 revenue, we are ranked number one in two of our core end markets, transportation and general

building. We also have leadership positions based upon ENR's most recent available rankings by 2005 revenue in many key specialty technical areas within our core end markets, including:including being ranked first in mass transit, airports, highways, educational facilities, government offices and transmission and distribution.

| Transportation | General Building | Environmental | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | Ranking | | Ranking | | Ranking | |||||

| Mass Transit and Rail | 1 | Educational Facilities | 1 | Wastewater Treatment | 2 | |||||

| Airports | 1 | Government Offices | 1 | Sanitary and Storm Sewers | 2 | |||||

| Marine and Ports | 1 | Correctional Facilities | 1 | Sewerage and Solid Waste | 2 | |||||

| Highways | 1 | Hotels/Convention Centers | 3 | Water Supply | 4 | |||||

| Bridges | 2 | Commercial Offices | 4 | Clean Air Compliance | 4 | |||||

We are also ranked number one inNew Civil Engineer's 2006 global listing (by 2005 fees) in the areas of water, buildings and roads and number two in waste and rail.

We are diversifiedDiversification across service lines, end markets and geographies. We perform a broad range of services in over 60 countries for our clients, from planning and design to construction and project management and logistics.clients. In addition, our 25 largest projects by gross profit in fiscal 2006 accounted for only 14% of our consolidated gross profit. We believe this diversification enables us, to respond to and take advantage of changing business, technological and economic conditions worldwide, and allows usamong other things, to better manage our business through market cycles. We further believe we are well-positioned in geographic areas with favorable growth prospects such as China/Hong Kong and the United Arab Emirates, where we are among the largest engineering design firms. This diversification has been a key factor in our historical growth and positions us for future growth.

We combine globalGlobal reach with local presence. We combine local market knowledge and relationships with the technical expertise, scale, experience and resources of one of the world's largest global professional technical and support services firms. We believe that our ability to share capabilities and best practices across the firm delivers significant value to our clients and enables us to win and efficiently execute projects worldwide.

We have strongStrong and long-standing client relationships. We have developed strong and long-term relationships with a number of government entities and large corporations worldwide.worldwide that lead to repeat business. For example, we have provided services for over 30 years to clients such as the Illinois State Tollway Authority, U.S. Navy, Massachusetts Water Resources Authority and Port Authority of New York and New Jersey. We believe that these types of long-term relationships enable us to better understand and be more responsive to our clients' needs, which leads to repeat business and opportunities to expand the scope of services we provide to our clients.

We have a successfulSuccessful history of executing and integrating mergers and acquisitions. We believe one of our core competencies is successfully identifying, executing and integrating acquisition opportunities. We have consummated more than 30 mergers and acquisitions since 1998 that have enabled us to expand our end markets, service offerings and geographic reach. This acquisition activity has provided us with access to new markets at lower risk and faster speed relative to our entering the markets as a new participant. We have targeted, and we will continue to target, firms that enable us to add backlog, long-term client relationships and experienced executives who can provide leadership across our company. In addition, we derive our acquisition synergies throughby "cross selling" the capabilities of our newly acquired companies to our existing clients and our global capabilities to the clients of our newly acquired companies.

We benefit from our experiencedExperienced management team and employees. Our Chief Executive Officer and the 10 most senior members of our operating units have an average of more than 20 years of experience with us and more than 25 years in our industry. We also have a large, experienced and skilled workforce. This humanHuman capital is essential in winning the most attractive workcritical to success in our industry.

Risks Affecting Our Business

Our business is subject to numerous risks, as discussed more fully in the section entitled "Risk Factors" beginning on page 9 of this prospectus. In turn,particular:

The foregoing factors, as well as others described in "Risk Factors," could adversely affect the value of your investment in our common stock.

Our Growth Strategy

We intend to grow our business by leveraging our competitive strengths and leadership positions in our core markets while opportunistically entering new markets and geographies. Key elements of our growth strategy include:

Expand our long-standing client relationships and provide our clients with a broad range of services. We have long-standing relationships with a number of governmental agencies, large corporations and public and private institutions worldwide. We will continue to focus on client satisfaction along with opportunities to sell a greater range of services to clients and deliver full-service solutions for their needs. For example, as we have grown our environmental business, we have provided environmental services for transportation and other infrastructure projects in which such services have in the past been subcontracted to third parties.

Capitalize on growth opportunities in our core markets. Our core end markets, including transportation, general buildingfacilities and environmental, are expected to continue to grow. We intend to build on our leading positions in these markets to increase our market share. With our track record and our global resources, we believe we are well positioned to win projects in these core markets. We believe that the need for infrastructure upgrades, environmental management and increased government spending and outsourcing of support services, among other things, will result in continued growth opportunities in our core markets.

Continue to pursue our merger and acquisition strategy. We intend to continue to attract other successful companies whose growth can be enhanced by joining us. This approach has served us well as we have strengthened and diversified our leadership positions both geographically, technically and across end markets. We believe that the trend towards consolidation in our industry will continue to produce attractive candidates that align with our merger and acquisition strategy. For example, we significantly strengthened our presence in the fast-growing market in the United Arab Emirates with the addition of Cansult Limited in September 2006.

Strengthen and support human capital. Our experienced employees and management are our most valued resources. Attracting and retaining key personnel have been and will remain critical to our success. We will continue to focus on providing our personnel with training and other personal and professional growth opportunities, performance-based incentives, opportunities for stock ownership and other competitive benefits in order to strengthen and support our human capital base. During fiscal 2006, we expanded our multi-year employee engagement initiative to focus more intensely on this critical objective.

Corporate Information

We were formed in 1980 as Ashland Technology Corporation, a Delaware corporation and a wholly owned subsidiary of Ashland Inc., an oil and gas refining and distribution company. Since becoming independent of Ashland Inc. in 1990, we have grown by combination of organic growth and strategic mergers and acquisitions from approximately 3,300 employees and $363$387 million in revenue in fiscal 1991, the first full fiscal year of operations, to approximately 27,30030,200 employees at March 31, 2007 and $3.4 billion in revenue for fiscal 2006. Several of the operating companies within AECOM have histories going back more than 50 years. Our principal executive offices are located at 555 South Flower Street, 37th Floor, Los Angeles, California 90071 and our telephone number is (213) 593-8000. Our website is located at www.aecom.com. The information contained on our website is not a part of this prospectus.

The Offering

| Common stock offered | |||

| By AECOM | 19,888,797 shares | ||

| By the selling stockholders | 15,261,203 shares | ||

| Total | 35,150,000 shares | ||

Common stock to be outstanding after this offering | 92,335,201 shares | ||

Over-allotment option | 5,272,500 shares | ||

Net Proceeds | We expect the net proceeds to us from this offering to be $355.2 million ($449.4 million if the underwriters exercise their over-allotment option), after deducting underwriting discounts and commissions payable to the underwriters and our estimated offering expenses, based upon an assumed initial public offering price of $19.00 per share, which is the mid-point of the offering range indicated on the cover of this prospectus, and an assumed $1.14 per share in underwriting discounts and commissions. We will not receive any proceeds from the sale of shares by the selling stockholders. | ||

Use of proceeds | To repay borrowings under our credit facilities and our outstanding 83/8% senior notes due 2012, allow employees under our stock purchase plan to diversify their holdings and use the remaining proceeds for general corporate purposes, including possible future acquisitions. We will not receive any of the proceeds from the sale of shares by the selling stockholders. See "Use of Proceeds" for additional information. | ||

Dividends | We do not anticipate paying any cash dividends in the foreseeable future. | ||

ACM | |||

Common Stock to be outstanding after this offering does not include at December 31, 2006:include:

Except as otherwise indicated, all of the information in this prospectus assumes:

Summary Consolidated Financial Data

You should read the summary consolidated financial data presented below together with "Selected Consolidated Financial Data," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our audited consolidated financial statements, unaudited condensed consolidated financial statements and the related notes included elsewhere in this prospectus. The summary consolidated financial data presented below under "Consolidated Statement of Income Data" for the years ended September 30, 2006, 2005 and 2004 have been derived from our audited consolidated financial statements included elsewhere in this prospectus. We derived the consolidated statement of income data for each of the years ended September 30, 2003 and 2002 and the consolidated balance sheet data as of September 30, 2004, 2003 and 2002 from our audited consolidated financial statements not included in this prospectus.

The summary consolidated financial data presented below under "Consolidated Statement of Income Data" for the threesix months ended DecemberMarch 31, 2006 and 20052007 and "Consolidated Balance Sheet Data" as of DecemberMarch 31, 20062007 have been derived from our unaudited condensed consolidated financial statements that are included elsewhere in this prospectus and have been prepared on the same basis as our audited consolidated financial statements. In the opinion of management, the unaudited condensed consolidated financial statements reflect all adjustments, consisting only of normal and recurring adjustments, necessary to state fairly our results of operations for and as of the periods presented. The results for any interim period are not necessarily indicative of the results that may be expected for a full year.

| | | Year Ended September 30, | Three Months Ended December 31, | | Year Ended September 30, | Six Months Ended March 31, | ||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | 2002 | 2003 | 2004 | 2005 | 2006 | 2005 | 2006 | | 2002 | 2003 | 2004 | 2005 | 2006 | 2006 | 2007 | ||||||||||||||||||||||||||||

| | | (in millions, except share and per share data) | | (in millions, except share and per share data) | ||||||||||||||||||||||||||||||||||||||||

| Consolidated Statement of Income Data: | Consolidated Statement of Income Data: | Consolidated Statement of Income Data: | ||||||||||||||||||||||||||||||||||||||||||

| Revenues | $ | 1,747 | $ | 1,915 | $ | 2,012 | $ | 2,395 | $ | 3,421 | $ | 747 | $ | 939 | ||||||||||||||||||||||||||||||

| Cost of revenues | 1,269 | 1,381 | 1,443 | 1,718 | 2,515 | 547 | 691 | |||||||||||||||||||||||||||||||||||||

| Revenue | Revenue | $ | 1,747 | $ | 1,915 | $ | 2,012 | $ | 2,395 | $ | 3,421 | $ | 1,606 | $ | 2,022 | |||||||||||||||||||||||||||||

| Cost of revenue | Cost of revenue | 1,269 | 1,381 | 1,443 | 1,718 | 2,515 | 1,177 | 1,490 | ||||||||||||||||||||||||||||||||||||

| Gross profit | Gross profit | 478 | 534 | 569 | 677 | 906 | 200 | 248 | Gross profit | 478 | 534 | 569 | 677 | 906 | 429 | 532 | ||||||||||||||||||||||||||||

| Equity in earnings of joint ventures | Equity in earnings of joint ventures | 1 | 2 | 3 | 2 | 7 | 2 | 1 | Equity in earnings of joint ventures | 1 | 2 | 3 | 2 | 7 | 3 | 4 | ||||||||||||||||||||||||||||

| General and administrative expenses | General and administrative expenses | 430 | 467 | 485 | 581 | 810 | 177 | 219 | General and administrative expenses | 430 | 467 | 485 | 581 | 810 | 382 | 468 | ||||||||||||||||||||||||||||

| Income from operations | Income from operations | 49 | 69 | 87 | 98 | 103 | 25 | 30 | Income from operations | 49 | 69 | 87 | 98 | 103 | 50 | 68 | ||||||||||||||||||||||||||||

| Minority interest share of earnings | Minority interest share of earnings | 3 | 3 | 3 | 8 | 14 | 2 | 1 | Minority interest share of earnings | 3 | 3 | 3 | 8 | 14 | 5 | 5 | ||||||||||||||||||||||||||||

| Gain on the sale of equity investment | Gain on the sale of equity investment | — | — | — | — | — | — | 11 | Gain on the sale of equity investment | — | — | — | — | — | — | 11 | ||||||||||||||||||||||||||||

| Interest expense—net | Interest expense—net | 12 | 10 | 8 | 7 | 10 | 4 | 1 | Interest expense—net | 12 | 10 | 8 | 7 | 10 | 8 | 3 | ||||||||||||||||||||||||||||

| Income before income tax expense | Income before income tax expense | 34 | 56 | 76 | 83 | 79 | 19 | 39 | Income before income tax expense | 34 | 56 | 76 | 83 | 79 | 37 | 71 | ||||||||||||||||||||||||||||

| Income tax expense | Income tax expense | 11 | 19 | 26 | 29 | 25 | 6 | 13 | Income tax expense | 11 | 19 | 26 | 29 | 25 | 12 | 24 | ||||||||||||||||||||||||||||

| Net income | Net income | $ | 23 | $ | 37 | $ | 50 | $ | 54 | $ | 54 | $ | 13 | $ | 26 | Net income | $ | 23 | $ | 37 | $ | 50 | $ | 54 | $ | 54 | $ | 25 | $ | 47 | ||||||||||||||

Net income allocation: | Net income allocation: | Net income allocation: | ||||||||||||||||||||||||||||||||||||||||||

| Preferred stock dividend | $ | — | $ | 2 | $ | 5 | $ | 6 | $ | 2 | $ | 1 | $ | — | Preferred stock dividend | $ | — | $ | 2 | $ | 5 | $ | 6 | $ | 2 | $ | 2 | $ | — | |||||||||||||||

| Net income available for common stockholders | 23 | 35 | 45 | 48 | 52 | 12 | 26 | Net income available for common stockholders | 23 | 35 | 45 | 48 | 52 | 23 | 47 | |||||||||||||||||||||||||||||

| Net income | $ | 23 | $ | 37 | $ | 50 | $ | 54 | $ | 54 | $ | 13 | $ | 26 | Net income | $ | 23 | $ | 37 | $ | 50 | $ | 54 | $ | 54 | $ | 25 | $ | 47 | |||||||||||||||

Earnings per share available for common stockholders: | Earnings per share available for common stockholders: | Earnings per share available for common stockholders: | ||||||||||||||||||||||||||||||||||||||||||

| Basic | $ | 0.89 | $ | 1.34 | $ | 1.71 | $ | 1.86 | $ | 1.88 | $ | 0.43 | $ | 0.89 | Basic | $ | 0.45 | $ | 0.67 | $ | 0.86 | $ | 0.93 | $ | 0.94 | $ | 0.43 | $ | 0.82 | |||||||||||||||

| Diluted | $ | 0.86 | $ | 1.29 | $ | 1.57 | $ | 1.68 | $ | 1.48 | $ | 0.40 | $ | 0.65 | Diluted | $ | 0.43 | $ | 0.65 | $ | 0.78 | $ | 0.84 | $ | 0.74 | $ | 0.37 | $ | 0.60 | |||||||||||||||

Weighted average shares outstanding (in thousands): | Weighted average shares outstanding (in thousands): | Weighted average shares outstanding (in thousands): | ||||||||||||||||||||||||||||||||||||||||||

| Basic | 25,815 | 26,429 | 26,300 | 25,940 | 27,428 | 26,644 | 28,800 | Basic | 51,630 | 52,858 | 52,600 | 51,880 | 54,856 | 53,482 | 56,965 | |||||||||||||||||||||||||||||

| Diluted | 27,001 | 28,589 | 32,127 | 31,989 | 36,329 | 32,612 | 39,518 | Diluted | 54,002 | 57,178 | 64,254 | 63,978 | 72,658 | 67,765 | 78,500 | |||||||||||||||||||||||||||||

| | Year Ended or as of September 30, | Three Months Ended or as of December 31, | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2002 | 2003 | 2004 | 2005 | 2006 | 2005 | 2006 | ||||||||||||||

| | (in millions, except employee data) | ||||||||||||||||||||

| Other Data: | |||||||||||||||||||||

| Depreciation and amortization | $ | 23 | $ | 13 | $ | 13 | $ | 20 | $ | 40 | $ | 9 | $ | 7 | |||||||

| Amortization expense of acquired intangible assets | — | — | — | 3 | 15 | 3 | 1 | ||||||||||||||

| Capital expenditures | 20 | 14 | 19 | 31 | 32 | 7 | 10 | ||||||||||||||

| Backlog | 1,710 | 1,660 | 1,620 | 2,000 | 2,500 | 2,480 | 2,851 | ||||||||||||||

| Number of full-time and part-time employees | 15,500 | 16,800 | 17,700 | 22,000 | 27,300 | 24,200 | 28,500 | ||||||||||||||

| | As of September 30, | As of December 31, | ||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2002 | 2003 | 2004 | 2005 | 2006 | 2005 | 2006 | 2006 | ||||||||||||||||

| | (in millions, except employee data) | Actual | Pro Forma, as adjusted | |||||||||||||||||||||

| Consolidated Balance Sheet Data: | ||||||||||||||||||||||||

| Cash and cash equivalents | $ | 28 | $ | 120 | $ | 121 | $ | 54 | $ | 128 | $ | 67 | $ | 138 | ||||||||||

| Working capital | 113 | 213 | 225 | 171 | 201 | 224 | 178 | |||||||||||||||||

| Total assets | 965 | 1,056 | 1,115 | 1,425 | 1,826 | 1,585 | 1,879 | |||||||||||||||||

| Long-term debt excluding current portion | 171 | 122 | 105 | 216 | 123 | 313 | 104 | |||||||||||||||||

| Redeemable preferred and common stock and stock units, net of notes receivable | 378 | 547 | 576 | 661 | 970 | 668 | 1,014 | |||||||||||||||||

| Stockholders' (deficit) equity | (108 | ) | (181 | ) | (159 | ) | (240 | ) | (291 | ) | (237 | ) | (324 | ) | ||||||||||

| | Year Ended or as of September 30, | Six Months Ended or as of March 31, | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2002 | 2003 | 2004 | 2005 | 2006 | 2006 | 2007 | ||||||||||||||

| | (in millions, except employee data) | ||||||||||||||||||||

| Other Data: | |||||||||||||||||||||

| Depreciation and amortization | $ | 23 | $ | 13 | $ | 13 | $ | 20 | $ | 40 | $ | 18 | $ | 19 | |||||||

| Amortization expense of acquired intangible assets(2) | — | — | — | 3 | 15 | 6 | 6 | ||||||||||||||

| Capital expenditures | 20 | 14 | 19 | 31 | 32 | 13 | 19 | ||||||||||||||

| Backlog | 1,710 | 1,660 | 1,620 | 1,980 | 2,480 | 2,585 | 3,131 | ||||||||||||||

| Number of full-time and part-time employees | 15,500 | 16,800 | 17,700 | 22,000 | 27,300 | 24,800 | 30,200 | ||||||||||||||

| | As of September 30, | As of March 31, | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2007 | |||||||||||||||

| | (in millions) | Pro Forma, as adjusted | ||||||||||||||||||||

| | | | | | | Actual | ||||||||||||||||

| Consolidated Balance Sheet Data: | ||||||||||||||||||||||

| Cash and cash equivalents | $ | 28 | $ | 120 | $ | 121 | $ | 54 | $ | 128 | $ | 116 | $ | 326 | ||||||||

| Working capital | 113 | 213 | 225 | 171 | 201 | 185 | 434 | (1) | ||||||||||||||

| Total assets | 965 | 1,056 | 1,115 | 1,425 | 1,826 | 2,076 | 2,088 | |||||||||||||||

| Long-term debt excluding current portion | 171 | 122 | 105 | 216 | 123 | 153 | 11 | |||||||||||||||

| Redeemable preferred and common stock and stock units, net of notes receivable | 378 | 547 | 576 | 661 | 970 | 1,068 | — | |||||||||||||||

| Stockholders' (deficit) equity | (108 | ) | (181 | ) | (159 | ) | (240 | ) | (291 | ) | (298 | ) | 1,116 | |||||||||

Investing in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other information in this prospectus, including our financial statements and the related notes, before making a decision to buy our common stock. If any of the following risks actually occurs, our business could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Relating to Our Business and Industry

We depend on long-term government contracts, some of which are only funded on an annual basis. If appropriations for funding are not made in subsequent years of a multiple-year contract, we may not be able to realize all of our anticipated revenuesrevenue and profits from that project.

A substantial majority of our revenues arerevenue is derived from contracts with agencies and departments of national, state and local governments. During fiscal 2004, 2005 and 2006, approximately 76%, 75% and 63%, respectively, of our revenues wererevenue was derived from contracts with government entities.

Most government contracts are subject to the government's budgetary approval process. Legislatures typically appropriate funds for a given program on a year-by-year basis, even though contract performance may take more than one year. As a result, at the beginning of a program, the related contract is only partially funded, and additional funding is normally committed only as appropriations are made in each subsequent fiscal year. These appropriations, and the timing of payment of appropriated amounts, may be influenced by, among other things, the state of the economy, competing priorities for appropriation, changes in administration or control of legislatures and the timing and amount of tax receipts and the overall level of government expenditures. If appropriations are not made in subsequent years on our government contracts, then we will not realize all of our potential revenue and profit from that contract.

For instance, a significant portion of historical funding for state and local transportation projects has come from the U.S. federal government through its "SAFETEA-LU" infrastructure funding program and predecessor programs. This $286 billion program covers federal fiscal years 2004-2009. Approximately 79% of the SAFETEA-LU funding is for highway programs, 18.5% is for transit programs and 2.5% is for other programs such as motor carrier safety, national highway traffic safety and research. A key uncertainty in the outlook for federal transportation funding in the U.S. is the future viability of the Highway Trust Fund. The Highway Account within the Highway Trust Fund could have a negative balance as soon as 2009, based on the Department of Treasury projections of receipts and Department of Transportation projections of outlays. This raises concerns about whether funding for federal highway programs authorized by SAFETEA-LU will be met in future years.

Governmental agencies may modify, curtail or terminate our contracts at any time prior to their completion and, if we do not replace them, we may suffer a decline in revenues.revenue.

Most government contracts maybe modified, curtailed or terminated by the government either at its convenience or upon the default of the contractor. If the government terminates a contract at its convenience, then we typically are able to recover only costs incurred or committed, settlement expenses and profit on work completed prior to termination, which could prevent us from recognizing all of our potential revenuesrevenue and profits from that contract. If the government terminates the contract due to our default, we could be liable for excess costs incurred by the government in obtaining services from another source.

A delay in the completion of the budget process of the U.S. government could delay procurement of our services and have an adverse effect on our future revenues.revenue.

In years when the U.S. government does not complete its budget process before the end of its fiscal year on September 30, government operations are typically funded pursuant to a "continuing resolution" that authorizes agencies of the U.S. government to continue to operate, but does not authorize new spending initiatives. When the U.S. government operates under a continuing resolution, government agencies may delay the procurement of services, which could reduce our future revenues.revenue.

Our contracts with governmental agencies are subject to audit, which could result in adjustments to reimbursable contract costs or, if we are charged with wrongdoing, possible temporary or permanent suspension from participating in government programs.

Our books and records are subject to audit by the various governmental agencies we serve and their representatives. These audits can result in adjustments to the amount of contract costs we believe are reimbursable by the agencies and the amount of our overhead costs allocated to the agencies. In addition, if one of our subsidiaries is charged with wrongdoing as a result of an audit, that subsidiary, and possibly our company as a whole, could be temporarily suspended or could be prohibited from bidding on and receiving future government contracts for a period of time. Furthermore, as a government contractor, we are subject to an increased risk of investigations, criminal prosecution, civil fraud, whistleblower lawsuits and other legal actions and liabilities to which purely private sector companies are not, the results of which could harm our business.

Our business and operating results could be adversely affected by losses under fixed-price contracts.

Fixed-price contracts require us to either perform all work under the contract for a specified lump-sum or to perform an estimated number of units of work at an agreed price per unit, with the total payment determined by the actual number of units performed. In fiscal 2006, approximately one-third of our revenues wererevenue was recognized under fixed-price contracts. Fixed-price contracts expose us to a number of risks not inherent in cost-plus and time and material contracts, including underestimation of costs, ambiguities in specifications, unforeseen costs or difficulties, problems with new technologies, delays beyond our control, failures of subcontractors to perform and economic or other changes that may occur during the contract period. Losses under fixed-price construction contracts could be substantial and harm our results of operations.

We conduct a portion of our operations through joint venture entities, over which we may have limited control.

Approximately 24% of our fiscal 2006 revenue was derived from our operations through joint ventures or similar partner arrangements, where control may be shared with unaffiliated third parties. As with most joint venture arrangements, differences in views among the joint venture participants may result in delayed decisions or disputes. We also cannot control the actions of our joint venture partners, and we typically have joint and several liability with our joint venture partners under the applicable contracts for joint venture projects. These factors could potentially harm the business and operations of a joint venture and, in turn, our business and operations.

Operating through joint ventures in which we are minority holders results in us having limited control over many decisions made with respect to projects and internal controls relating to projects. Approximately 7% of our fiscal 2006 revenue was derived from our unconsolidated joint ventures where we generally do not have control of the entities. These joint ventures may not be subject to the same requirements regarding internal controls and internal control over financial reporting that we follow. As a result, internal control problems may arise with respect to the joint ventures, which could have a material adverse effect on our financial condition and results of operations.

Misconduct by our employees or consultants or our failure to comply with laws or regulations applicable to our business could cause us to lose customers or lose our ability to contract with government agencies.

As a government contractor, misconduct, fraud or other improper activities by our employees or consultants failure to comply with laws or regulations could have a significant negative impact on our business and reputation. Such misconduct could include the failure to comply with federal procurement regulations, regulations regarding the protection of classified information, legislation regarding the pricing of labor and other costs in government contracts, regulations on lobbying or similar activities, and any other applicable laws or regulations. Our failure to comply with applicable laws or regulations or misconduct by any of our employees or consultants could subject us to fines and penalties, loss of security clearance, cancellation of contracts and suspension or debarment from contracting with government agencies, any of which may adversely affect our business.

Our defined benefit plans currently have significant deficits that could grow in the future and cause us to incur additional costs.

We have defined benefit pension plans for employees in the United States, United Kingdom and Australia. At September 30, 2006, our defined benefit pension plans had an aggregate deficit (the excess of projected benefit obligations over the fair value of plan assets) of $117.2 million. At September 30, 2006, the excess of accumulated benefit obligations over the fair value of plan assets was $84.8 million. In the future, our pension deficits may increase or decrease depending on changes in the levels of interest rates, pension plan performance and other factors. If we are forced or elect to make up all or a portion of the deficit for unfunded benefit plans, our profits could be materially and adversely affected.

Our operations worldwide expose us to legal, political and economic risks in different countries as well as currency exchange rate fluctuations that could harm our business and financial results.

During fiscal 2006, revenuesrevenue attributable to our services provided outside of the United States werewas approximately 44% of our total revenue. Approximately 27% of our total fiscal 2006 revenue was contracted in non-U.S. dollar denominations. We expect the percentage of revenuesrevenue attributable to our non-U.S. operations to increase further as a result of our strategic focus in areas such as Eastern Europe, China and the Middle East. There are risks inherent in doing business internationally, including:

Any of these factors could have a material adverse effect on our business, results of operations or financial condition.

We work in international locations where there are high security risks, which could result in harm to our employees and contractors or material costs to us.

Some of our services are performed in high-risk locations, such as Iraq and Afghanistan, where the country or location is suffering from political, social or economic problems, or war or civil unrest. In those locations where we have employees or operations, we may incur material costs to maintain the safety of our personnel. Despite these precautions, the safety of our personnel in these locations may continue to be at risk, and we may suffer the loss of key employees and contractors, which could harm our business.

Failure to successfully execute our merger and acquisition strategy may inhibit our growth.

We have grown in part as a result of our mergers and acquisitions over the last several years, and we expect continued growth in the form of additional acquisitions and expansion into new markets. We cannot assure you that suitable mergers and acquisitions or investment opportunities will continue to be identified or that any of these transactions can be consummated on favorable terms or at all. Any future mergers and acquisitions will involve various inherent risks, such as:

Furthermore, during the mergers and acquisitions process and thereafter, our management may need to assume significant mergers and acquisitions related responsibilities, which may cause them to divert their attention from our existing operations. If our management is unable to successfully integrate acquired companies or implement our growth strategy, our operating results could be harmed. Moreover, we cannot assure you that we will continue to successfully expand or that growth or expansion will result in profitability.

Our ability to grow and to compete in our industry will be harmed if we do not retain the continued services of our key technical and management personnel and identify, hire and retain additional qualified personnel.

There is strong competition for qualified technical and management personnel in the sectors in which we compete. We may not be able to continue to attract and retain qualified technical and management personnel, such as engineers, architects and project managers, who are necessary for the development of our business or to replace qualified personnel. Our planned growth may place increased demands on our resources and will likely require the addition of technical and management personnel and the development of additional expertise by existing personnel. Also, some of our personnel hold security clearances required to obtain government projects; if we were to lose some or all of these personnel, they would be difficult to replace. Loss of the services of, or failure to recruit, key technical and management personnel could limit our ability to complete existing projects successfully and to compete for new projects.

Additionally, in the past, we have promoted our employee ownership culture as a competitive advantage in recruiting and retaining employees. Although we intend to retain the essential elements of an employee ownership culture and do not intend to change our core values and operating philosophy,

if our employees or recruits perceive that becoming a publicly-traded company will negatively impact our company culture, our ability to recruit and retain employees may be adversely impacted.

Our revenuesrevenue and growth prospects may be harmed if we or our employees are unable to obtain the security clearances or other qualifications we and they need to perform services for our customers.

A number of government programs require contractors to have security clearances. Depending on the level of required clearance, security clearances can be difficult and time-consuming to obtain. If we or our employees are unable to obtain or retain necessary security clearances, we may not be able to win new business, and our existing customers could terminate their contracts with us or decide not to renew them. To the extent we cannot obtain or maintain the required security clearances for our employees working on a particular contract, we may not derive the revenue anticipated from the contract.

Our industry is highly competitive and we may be unable to compete effectively, which could result in reduced revenue, profitability and market share.

We are engaged in a highly competitive business. The extent of competition varies with the types of services provided and the locations of the projects. Generally, we compete on the bases of technical and management capability, personnel qualifications and availability, geographic presence, experience and price. Increased competition may result in our inability to win bids for future projects and loss of revenue, profitability and market share.

Our services expose us to significant risks of liability and our insurance policies may not provide adequate coverage.

Our services involve significant risks of professional and other liabilities that may substantially exceed the fees that we derive from our services. In addition, we sometimes contractually assume liability under indemnification agreements. We cannot predict the magnitude of potential liabilities from the operation of our business.

Our professional liability policies cover only claims made during the term of the policy. Additionally, our insurance policies may not protect us against potential liability due to various exclusions in the policies and self-insured retention amounts. Partially or completely uninsured claims, if successful and of significant magnitude, could have a material adverse affect on our business.

Our backlog of uncompleted projects under contract is subject to unexpected adjustments and cancellations and thus, may not accurately reflect future revenuesrevenue and profits.

At DecemberMarch 31, 2006,2007, our backlog of uncompleted projects under contract was approximately $2.9$3.1 billion. We cannot guarantee that the revenuesrevenue attributed to uncompleted projects under contract will be realized or, if realized, will result in profits. Many projects may remain in our backlog for an extended period of time because of the size or long-term nature of the contract. In addition, from time to time projects are delayed, scaled back or cancelled. These types of backlog reductions adversely affect the revenuesrevenue and profits that we ultimately receive from contracts reflected in our backlog.

We have submitted claims to clients for work we performed beyond the scope of some of our contracts. If these clients do not approve these claims, our results of operations could be adversely impacted.

We typically have pending claims submitted under some of our contracts for payment of work performed beyond the initial contractual requirements for which we have already recorded revenues.revenue. In general, we cannot guarantee that such claims will be approved in whole, in part or at all. If these claims are not approved, our revenuesrevenue may be reduced in future periods.

In conducting our business, we depend on other contractors and subcontractors. If these parties fail to satisfy their obligations to us or other parties, or if we are unable to maintain these relationships, our revenues,revenue, profitability and growth prospects could be adversely affected.

We depend on contractors and subcontractors in conducting our business. There is a risk that we may have disputes with our subcontractors arising from, among other things, the quality and timeliness of work performed by the subcontractor, customer concerns about the subcontractor, or our failure to extend existing task orders or issue new task orders under a subcontract. In addition, if any of our subcontractors fail to deliver on a timely basis the agreed-upon supplies and/or perform the agreed-upon services, our ability to fulfill our obligations as a prime contractor may be jeopardized.

We also rely on relationships with other contractors when we act as their subcontractor or joint venture partner. Our future revenuesrevenue and growth prospects could be adversely affected if other contractors eliminate or reduce their subcontracts or joint venture relationships with us, or if a government agency terminates or reduces these other contractors' programs, does not award them new contracts or refuses to pay under a contract.

Systems and information technology interruption could adversely impact our ability to operate.

We rely heavily on computer, information and communications technology and related systems in order to properly operate. From time to time, we experience occasional system interruptions and delays. If we are unable to continually add software and hardware, effectively upgrade our systems and network infrastructure and take other steps to improve the efficiency of and protect our systems, systems operation could be interrupted or delayed. In addition, our computer and communications systems and operations could be damaged or interrupted by natural disasters, telecommunications failures, acts of war or terrorism, computer viruses, physical or electronic security breaches and similar events or disruptions. Any of these or other events could cause system interruption, delays and loss of critical data, could delay or prevent operations, and could adversely affect our operating results.

Risks Relating to this Offering and Our Common Stock

There has been no prior public market for our shares and an active market may not develop or be maintained, which could limit your ability to sell shares of our common stock.

Before this offering, there has not been a public market for our shares of common stock. Although we are applyingour common stock has been approved for listing on the New York Stock Exchange, an active public market for our shares may not develop or be sustained after this offering. The initial public offering price will be determined by negotiations between the underwriters and our board of directors and may not be representative of the market price at which our shares of common stock will trade after this offering. In particular, we cannot assure you that you will be able to resell our shares at or above the initial public offering price.

The value of our common stock could be volatile.

The overall market and the price of our common stock may fluctuate greatly. The trading price of our common stock may be significantly affected by various factors, including:

Our quarterly operating results may fluctuate significantly, which could have a negative effect on the price of our common stock.

Our quarterly revenues,revenue, expenses and operating results may fluctuate significantly because of a number of factors, including:

Variations in any of these factors could cause significant fluctuations in our operating results from quarter to quarter.quarter and could cause the price of our common stock to fluctuate and decline.

Our charter documents contain provisions that may delay, defer or prevent a change of control.

Provisions of our certificate of incorporation and bylaws could make it more difficult for a third party to acquire control of us, even if the change in control would be beneficial to stockholders. These provisions include the following:

Future sales of our common stock may lower our stock price.

If our existing stockholders sell a large number of shares of our common stock following this offering, the market price of our common stock could decline significantly. In addition, the perception in the public market that our existing stockholders might sell shares of common stock could depress the market price of our common stock, regardless of the actual plans of our existing stockholders. Immediately after this offering, approximately 92,335,201 shares of our common stock will be outstanding, or 97,607,701 if the underwriters' over-allotment option is exercised in full. Of these shares, approximately 40,252,191 shares will be available for immediate resale in the public market, including all of the shares in this offering, and 9,413,842 shares will be available for resale 90 days following completion of this offering, except those held by our "affiliates." Of the remaining shares outstanding, approximately 42,669,167 shares are subject to lock-up agreements restricting the sale of those shares for 180 days from the date of this prospectus. However, the underwriters may waive this restriction and allow the stockholders to sell their shares at any time.

After this offering, we intend to register approximatelyWe have registered 25,637,100 shares of common stock that are reserved for issuance upon exercise of options granted under our stock option plans. Once we registerUpon completion of this offering, these shares they can be sold in the public market upon issuance, subject to restrictions under the securities laws applicable to resales by affiliates.affiliates and applicable lock-up agreements.

Purchasers in this offering will experience immediate and substantial dilution in net tangible book value.

The initial public offering price per share is expected to be substantially higher than the net tangible book value per share of our outstanding common stock. Purchasers of shares in this offering will experience immediate dilution in the net tangible book value of their shares. Based on an assumed initial public offering price of $$19.00 per share, dilution per share in this offering will be $$14.16 per share (or %74.5% of the price). In addition, we have issued options to acquire 8,409,191 shares of our common stock at a weighted average exercise price of $$8.90 per share. To the extent these outstanding options are exercised, there will be further dilution to investors in this offering. Further, if we issue additional equity securities to raise additional capital, your ownership interest in our company may be diluted and the value of your investment may be reduced.

We do not expect to pay any cash dividends for the foreseeable future.

We do not anticipate paying any cash dividends to our stockholders for the foreseeable future. Our credit facilities also restrict our ability to pay dividends. Accordingly, you may have to sell some or all of your common stock in order to generate cash flow from your investment. You may not receive a gain on your investment when you sell our common stock and may lose some or all of the amount of your investment. Any determination to pay dividends in the future will be made at the discretion of our board of directors and will depend on our results of operations, financial conditions, contractual restrictions, restrictions imposed by applicable law and other factors our board of directors deems relevant.

We will incur increased costs as a result of being a publicly-traded company.

As a company with publicly-traded securities, we could incur significant legal, accounting and other expenses not presently incurred. In addition, the Sarbanes-Oxley Act of 2002, as well as rules promulgated by the U.S. Securities and Exchange Commission and the New York Stock Exchange, require us to adopt corporate governance practices applicable to U.S. public companies. These rules and regulations will increase our legal and financial compliance costs.

If we do not timely satisfy the requirements of Section 404 of the Sarbanes-Oxley Act of 2002, the trading price of our common stock could be adversely affected.

Section 404 of the Sarbanes-Oxley Act of 2002 requires us to document and test the effectiveness of our internal controls over financial reporting in accordance with an established internal control framework and to report on our conclusion as to the effectiveness of our internal controls. It also requires our independent registered public accounting firm to test our internal controls over financial reporting and report on the effectiveness of such controls as of September 30, 2008. Our independent registered public accounting firm is also required to test, evaluate and report on management's assessment of internal control. Any delays or difficulty in satisfying these requirements could cause some investors to lose confidence in, or otherwise be unable to rely on, the accuracy of our reported financial information, which could adversely affect the trading price of our common stock.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

(Cautionary Statements Under the Private Securities Litigation Reform Act of 1995)

This prospectus contains statements which, to the extent that they do not recite historical fact, constitute "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. The words "believe," "expect," "estimate," "may," "will," "could," "plan" or "continue" and similar expressions are intended to identify forward-looking statements. Such forward-looking information involves important risks and uncertainties that could materially alter results in the future from those expressed in any forward-looking statements made by us or on our behalf. These risks and uncertainties include, but are not limited to:

In addition, this prospectus contains industry data related to our business and the markets in which we operate. This data includes projections that are based on a number of assumptions. If these assumptions turn out to be incorrect, actual results could differ from the projections.

We caution you that forward-looking statements are only predictions and that actual events or results may differ materially. In evaluating these statements, you should specifically consider the various factors that could cause actual events or results to differ materially from those indicated by the forward-looking statements, including the factors that we discuss in the section entitled "Risk Factors."

We estimate that our net proceeds (after deducting underwriting discounts and commissions payable to the underwriters and our estimated offering expenses) from this offering will be $$355.2 million ($449.4 million if the underwriters exercise their option to acquire additional shares in full), based upon an assumed initial public offering price of $$19.00 per share, which is the mid-point of the offering range indicated on the cover of this prospectus.prospectus, and an assumed $1.14 per share in underwriting discounts and commissions, which is the mid-point of the range of the underwriting discounts and commissions we will pay of $1.09 per share to $1.19 per share, depending on the public offering price and subject to a performance increase payable at the discretion of the Company. We will not receive any proceeds from the sale of shares by the selling stockholders.

We expect to use approximately $$63.0 million (of which $50.0 million was outstanding as of March 31, 2007) of the net proceeds to repay amounts outstanding under our unsecured senior credit facility, which matures March 31, 2011, and currently bears interest at the Interbank Offered Rate plus %, or % per annum, at March 1, 2007.a weighted average interest rate of 6.80%. We also expect to use approximately $$57.0 million of the net proceeds to repay all our outstanding borrowings under our unsecured term credit agreement which matures September 22, 2011 and currently bears interest at a weighted average interest rate of 5.51%. Further, we expect to use approximately $39.0 million to repay all of our outstanding 83/8% senior notes due April 14, 2012 which includes principal, accrued interest and make-whole premiums.

We also expect to use $71.8 million of the net proceeds to fund elections made by employee participants in our stock purchase plan to diversify their holdings of plan units in connection with this offering. The diversification will be effected by our selling a make-whole premium.number of newly issued shares of common stock in this offering equal to the number of common stock units under the stock purchase plan that each employee has elected to diversify. The net proceeds from the sale of such shares will be delivered to a trust for the benefit of such employee's plan account and the plan account will be reduced by the corresponding number of stock units. Such net proceeds will be retained in the trust and will be invested to match the investment elections made by such employee. Since the plan units are currently included in our total shares outstanding and the number of newly issued shares equals the number of plan units deducted from employee plan accounts, this diversification has no net impact on our total shares outstanding.

We expect to use the remaining net proceeds to fund elections made by our employees under our stock purchase plan to diversify their holdings in connection with this offering, in an aggregate amount of approximately $ , and for general corporate purposes, which may include future acquisitions of businesses.acquisitions.

A $1.00 increase (decrease) in the assumed initial public offering price of $$19.00 per share would increase (decrease) the net proceeds to us from this offering by $$18.7 million, assuming the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting the estimated underwriting discounts and commissions and estimated expenses payable by us.

Until we use the net proceeds as described above, we intend to invest the net proceeds in short-term securities.

We obtained the market, demographic, competitive position and similar data used throughout this prospectus from our own research and from surveys or studies conducted by third parties and industry or general publications. We have also derived data regarding our competitors and customers from their press releases and other public filings. This market, demographic, competitive position and similar data include, among other things, statements regarding the global market for engineering, design and support services, our position in the relevant markets, including the transportation, facilities and environmental markets, and the historical and projected growth rate of our industry. While we believe that each of these surveys, studies and publications is reliable, we have not independently verified such data. Similarly, we believe our internal research is reliable, but it has not been verified by any independent sources.

We have not declared or paid any cash dividends on our common stock, and we do not anticipate doing so in the foreseeable future. We currently intend to retain future earnings, if any, to operate our business and finance future growth strategies. Our loan covenants require us to obtain the consent of the banks or the senior noteholders, as the case may be, prior to the payment of any cash dividends.

The following table sets forth our capitalization as of DecemberMarch 31, 20062007 on an actual basis and as adjusted to give effect to our sale of shares of common stock in this offering at an assumed initial offering price of $$19.00 per share and the application of the net proceeds from this offering as described under "Use of Proceeds." A $1.00 increase or decrease in the assumed public offering price of $$19.00 per share would increase or decrease each of additional paid-in capital, total stockholders' (deficit)/equity and total capitalization by approximately $$18.7 million, assuming the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting the estimated underwriting discount and estimated offering expenses payable by us.

| | | As of December 31, 2006 | | As of March 31, 2007 | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | Actual | Pro Forma As Adjusted | | Actual | Pro Forma As Adjusted(3) | |||||||||||

| | | (in thousands, except share data) (unaudited) | | (in thousands, except share data) (unaudited) | |||||||||||||

| Cash and cash equivalents | Cash and cash equivalents | $ | 137,774 | $ | Cash and cash equivalents | $ | 116,264 | $ | 325,729 | ||||||||

| Share purchase liability | Share purchase liability | 56,634 | — | ||||||||||||||

| Debt: | Debt: | Debt: | |||||||||||||||

| Current portion of long-term debt | 23,626 | Current portion of long-term debt | 33,258 | 33,258 | |||||||||||||

| Long-term debt, less current portion | 104,115 | Long-term debt, less current portion | 153,118 | 11,118 | |||||||||||||

| Total debt | 127,741 | Total debt | 186,376 | 44,376 | |||||||||||||

Redeemable common and preferred stock and stock units | 818,901 | ||||||||||||||||

Redeemable common and preferred stock and stock units(1) | Redeemable common and preferred stock and stock units(1) | 832,624 | — | ||||||||||||||

| Notes receivable from stockholders | Notes receivable from stockholders | (36,607 | ) | Notes receivable from stockholders | — | — | |||||||||||

| Redeemable preferred stock, Class F—authorized, 200,000, issued and outstanding, 47,000 as of December 31, 2006, and shares as adjusted | 117,500 | ||||||||||||||||

| Redeemable preferred stock, Class G—authorized, 200,000, issued and outstanding 47,000 as of December 31, 2006, and shares as adjusted | 117,500 | ||||||||||||||||

| Redeemable preferred stock, Class F—47,000 authorized, issued and outstanding as of March 31, 2007, and 0 shares as adjusted(2) | Redeemable preferred stock, Class F—47,000 authorized, issued and outstanding as of March 31, 2007, and 0 shares as adjusted(2) | 117,500 | — | ||||||||||||||

| Redeemable preferred stock, Class G—47,000 authorized, issued and outstanding as of March 31, 2007, and 0 shares as adjusted(2) | Redeemable preferred stock, Class G—47,000 authorized, issued and outstanding as of March 31, 2007, and 0 shares as adjusted(2) | 117,500 | — | ||||||||||||||

Stockholders' (deficit)/equity: | Stockholders' (deficit)/equity: | Stockholders' (deficit)/equity: | |||||||||||||||

| Convertible preferred stock authorized 7,799,780 shares; issued and outstanding, 57,279 shares pro forma as adjusted, $100 liquidation preference value per share | — | 5,728 | |||||||||||||||

| Preferred stock, Class C-authorized 200 shares; issued and outstanding, 111.518 shares pro forma as adjusted, $1.00 liquidation preference value per share | — | — | |||||||||||||||

| Preferred stock, Class E-authorized 20 shares; issued and outstanding, 5.165 shares pro forma as adjusted, $1.00 liquidation preference value per share | — | — | |||||||||||||||

| Common stock, $0.01 par value, and common stock units, no par value, total authorized 150,000,000; issued and outstanding 91,135,704 shares pro forma as adjusted(2) | — | 840 | |||||||||||||||

| Common stock, $0.01 par value, authorized 150,000,000; issued and outstanding shares pro forma as adjusted(1) | — | Additional paid-in capital | (289,790 | ) | 1,121,219 | ||||||||||||

| Additional paid-in capital | (290,797 | ) | Retained earnings | 21,111 | 17,362 | ||||||||||||

| Retained earnings | — | Notes receivable from stockholders | — | — | |||||||||||||

| Accumulated other comprehensive loss | (33,694 | ) | Accumulated other comprehensive loss | (29,495 | ) | (29,495 | ) | ||||||||||

| Total stockholders' (deficit)/equity | (324,491 | ) | Total stockholders' (deficit)/equity | (298,174 | ) | 1,115,654 | |||||||||||

| Total capitalization | Total capitalization | $ | 820,544 | $ | Total capitalization | $ | 1,012,460 | $ | 1,160,030 | ||||||||

Our pro forma net tangible book value at DecemberMarch 31, 20062007 was $$85.5 million, or $$1.20 per share. Net tangible book value per share before the offering has been determined by dividingPro forma net tangible book value (total book valueassumes the conversion, concurrent with the offering, of tangible assets lessall redeemable common and preferred stock and stock units and the related share purchase liability resulting in total liabilities) by the numbercommon shares outstanding of shares71,246,907 as of common stock outstanding at DecemberMarch 31, 2006.2007. After giving effect to the sale of our common stock in this offering at an assumed initial public offering price of $$19.00 per share and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us, our adjusted net tangible book value at DecemberMarch 31, 20062007 would have been $$440.7 million or $$4.84 per share. This represents an immediate increase in net tangible book value per share of $$3.64 to existing stockholders and dilution in net tangible book value per share of $$14.16 to new investors who purchase shares in the offering. The following table illustrates this per share dilution to new investors:

| Assumed initial public offering price per share | $ | 19.00 | |||||

| Pro forma net tangible book value per share at March 31, 2007 | $ | 1.20 | |||||

| Increase in net tangible book value per share attributable to new investors | 3.64 | ||||||

| Adjusted net tangible book value per share | 4.84 | ||||||

| Dilution per share to new investors | $ | 14.16 | |||||

The following table sets forth, on the as adjusted basis described above, at DecemberMarch 31, 2006,2007, the difference between the number of shares of common stock purchased, the total consideration paid, and the average price per share paid by the existing stockholders and by investors purchasing shares in this offering, before deducting estimated underwriting discounts and commissions and estimated offering expenses.

| | Shares Purchased | Total Consideration | | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Average Price Per Share | |||||||||||

| | Number | Percent | Amount | Percent | ||||||||

| Existing stockholders | 71,246,907 | 78 | 655,262,022 | 63 | $ | 9.20 | ||||||

| New investors | 19,888,797 | 22 | 377,887,143 | 37 | $ | 19.00 | ||||||