Use these links to rapidly review the document

TABLE OF CONTENTS

Acceleron Pharma Inc. Index to Financial Statements

As filed with the Securities and Exchange Commission on August 7,September 6, 2013

Registration No. 333- 333-190417

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ACCELERON PHARMA INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) | 2836 (Primary Standard Industrial Classification Code Number) | 27-0072226 (I.R.S. Employer Identification Number) |

128 Sidney Street

Cambridge, MA 02139

(617) 649-9200

(Address, including zip code, and telephone number, including

area code, of registrant's principal executive offices)

John L. Knopf, Ph.D.

Chief Executive Officer and President

128 Sidney Street

Cambridge, MA 02139

(617) 649-9200

(Name, address, including zip code, and telephone number, including

area code, of agent for service)

| Copies to: | ||||

Marc Rubenstein, Esq. Ropes & Gray LLP Prudential Tower 800 Boylston Street Boston, MA 02199 (617) 951-7000 | John D. Quisel, Ph.D., Esq. Vice President, General Counsel and Secretary Acceleron Pharma Inc. 128 Sidney Street Cambridge, MA 02139 (617) 649-9200 | Jonathan L. Kravetz, Esq. Brian P. Keane, Esq. Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C. One Financial Center Boston, MA 02111 (617) 542-6000 | ||

Approximate date of commencement of proposed sale to public:

As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) | Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

| Title of each class of securities to be registered | Proposed maximum aggregate offering price(1) | Amount of registration fee | ||

|---|---|---|---|---|

Common stock, $0.001 par value | $74,750,000 | $10,196 | ||

| ||||

| Title of Each Class of Securities to be Registered | Amount to be Registered(1) | Proposed Maximum Offering Price Per Share | Proposed Maximum Aggregate Offering Price(2) | Amount of Registration Fee(3) | ||||

|---|---|---|---|---|---|---|---|---|

Common Stock, $0.001 par value per share | 5,347,500 | $15.00 | $80,212,500 | $10,941 | ||||

| ||||||||

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED AUGUST 7,SEPTEMBER 6, 2013

PRELIMINARY PROSPECTUS

4,650,000 Shares

Acceleron Pharma Inc.

Common Stock

$ per share

This is the initial public offering of our common stock. We are selling 4,650,000 shares of our common stock. We currently expect the initial public offering price to be between $$13.00 and $$15.00 per share of common stock.

We have granted the underwriters an option to purchase up to 697,500 additional shares of common stock to cover over-allotments.

We have applied to have our common stock listed on the NASDAQ Global Market under the symbol "XLRN".

We are an "emerging growth company" as that term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings.

Investing in our common stock involves risk. See "Risk Factors" beginning on page 12.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| | Per share | Total | ||

|---|---|---|---|---|

| Initial Public Offering Price | $ | $ | ||

| Underwriting Discounts and | $ | $ | ||

| Proceeds to Acceleron (before expenses) | $ | $ |

Our collaboration partner, Celgene Corporation, has agreed to purchase $$10.0 million of our common stock in a separate private placement concurrent with the completion of this offering at a price per share equal to the initial public offering price. The sale of such shares will not be registered under the Securities Act of 1933, as amended.

The underwriters expect to deliver the shares of common stock to investors on or about , 2013 through the book-entry facilities of The Depositary Trust Company.

| Citigroup | Leerink Swann |

Piper Jaffray

JMP Securities

, 2013

TABLE OF CONTENTS

| | Page | |

|---|---|---|

Summary | 1 | |

The Offering | 8 | |

Summary Financial Data | 10 | |

Risk Factors | 12 | |

Series E Conversion | 37 | |

Use of Proceeds | 38 | |

Dividend Policy | 39 | |

Capitalization | 40 | |

Dilution | 42 | |

Selected Financial Data | 44 | |

Management's Discussion and Analysis of Financial Condition and Results of Operations | 46 | |

Business | ||

Management | ||

Executive and Director Compensation | ||

Certain Relationships and Related Party Transactions | ||

Principal Stockholders | ||

Description of Capital Stock | ||

Shares Eligible for Future Sale | ||

Material United States Federal Income Tax Considerations for Non-U.S. Holders | ||

Underwriting | ||

Legal Matters | ||

Experts | ||

Where You Can Find More Information |

We are responsible for the information contained in this prospectus and in any free-writing prospectus we prepare or authorize. We have not authorized anyone to provide you with different information, and we take no responsibility for any other information others may give you. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the cover of this prospectus.

We own or have rights to trademarks, service marks and trade names that we use in connection with the operation of our business, including our corporate name, logos and website names. Other trademarks, service marks and trade names appearing in this prospectus are the property of their respective owners. The trademarks that we own include Acceleron®. Solely for convenience, some of the trademarks, service marks and trade names referred to in this prospectus are listed without the ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights to our trademarks, service marks and trade names.

This summary highlights information contained in other parts of this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in shares of our common stock and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. You should read the entire prospectus carefully, especially "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations", before deciding to buy shares of our common stock. Unless the context requires otherwise, references in this prospectus to "Acceleron", "we", "us" and "our" refer to Acceleron Pharma Inc.

Overview

We are a clinical stage biopharmaceutical company focused on the discovery, development and commercialization of novel protein therapeutics for cancer and rare diseases. Our research focuses on the biology of the Transforming Growth Factor-Beta (TGF-b) protein superfamily, a large and diverse group of molecules that are key regulators in the growth and repair of tissues throughout the human body. We are leaders in understanding the biology of the TGF-b superfamily and in targeting these pathways to develop important new medicines. By coupling our discovery and development expertise, including our proprietary knowledge of the TGF-b superfamily, with our internal protein engineering and manufacturing capabilities, we have built a highly productive research and development platform that has generated innovative clinical and preclinical protein therapeutic candidates with novel mechanisms of action.

We have three internally discovered protein therapeutic candidates that are currently being studied in 12 ongoing Phase 2 clinical trials, focused on cancer and rare diseases. These differentiated protein therapeutic candidates have the potential to significantly improve clinical outcomes for patients.

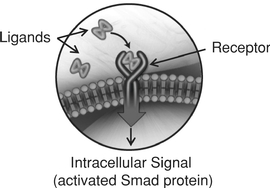

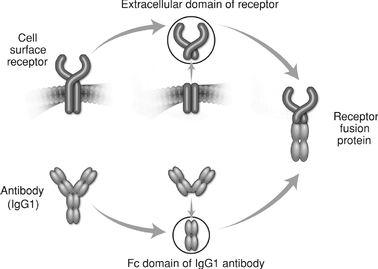

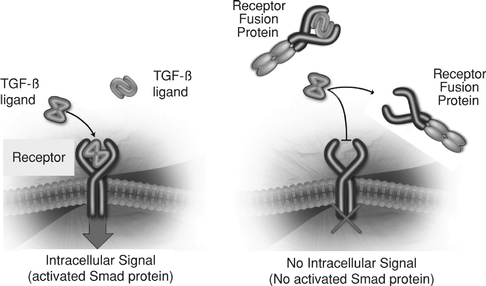

The Acceleron Discovery and Development Platform: Novel Approaches to Potent Biology

We focus on discovering and developing protein therapeutics that target a group of approximately 30 secreted proteins, or ligands, that are collectively referred to as the TGF-b superfamily. These ligands bind to subsets of 12 different receptors on the surface of cells, triggering intracellular changes in gene expression that guide cell growth and differentiation. The TGF-b superfamily ligands and their receptors represent a diverse and under-explored set of drug targets with the potential to yield therapeutics that modulate the growth and repair of diseased cells and tissues.

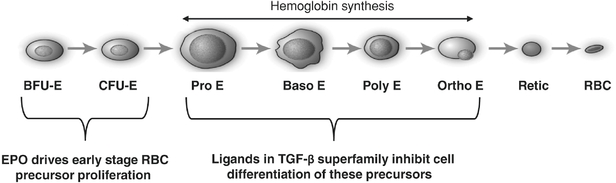

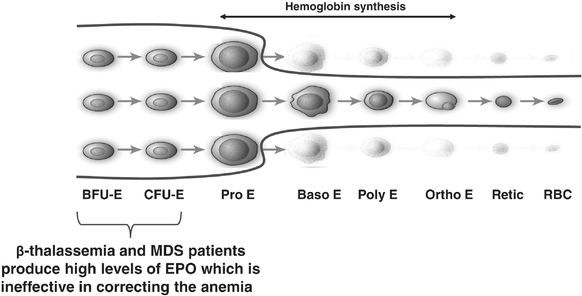

Members of the TGF-b superfamily are now recognized as important regulators of red blood cell formation. We have shown that inhibition of members of the TGF-b superfamily ameliorates anemia in mouse models ofb-thalassemia and myelodysplastic syndromes (MDS). These red blood cell disorders are generally unresponsive to currently approved drugs. Based on our findings, we are developing two protein therapeutic candidates, sotatercept and ACE-536, each of which is currently in Phase 2 clinical trials to treat patients with these diseases.

Members of the TGF-b superfamily also play a significant role in regulating blood vessel formation. We and our academic collaborators have shown that mice with a defect in a particular receptor for members of the TGF-b superfamily are resistant to tumor growth due to reduced blood vessel formation in the tumor. We have used this insight to design our anti-angiogenic agent, dalantercept, which is currently in Phase 2 clinical trials for the treatment of cancer.

Sotatercept and ACE-536: Novel Protein Therapeutic

Candidates in Phase 2 Clinical Trials forb-thalassemia and MDS

Together with our collaboration partner, Celgene Corporation, we are developing sotatercept and ACE-536, our lead protein therapeutic candidates, to treat anemia and associated complications in patients withb-thalassemia and MDS. Clinical trials are underway in other diseases as well.

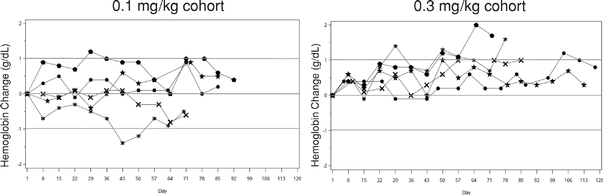

Sotatercept and ACE-536 have already shown promising biological activity in initial clinical trials. We and Celgene have conducted six clinical trials with sotatercept in over 160 healthy volunteers and cancer patients. We have conducted one clinical trial with ACE-536 in healthy volunteers. In these studies, both sotatercept and ACE-536 caused a dose-dependent increase in the number of red blood cells. Based on these results, we and Celgene have initiated Phase 2 clinical trials with each of these protein therapeutic candidates inb-thalassemia and MDS. We and Celgene plan to initiate Phase 3 clinical trials for one or both of these protein therapeutic candidates in one or both ofb-thalassemia and MDS by the end of 2014 or early 2015.

b-thalassemia

b-thalassemia is a hereditary disease arising from defects in genes involved in the production of hemoglobin, the protein responsible for carrying oxygen in red blood cells. During red blood cell formation in the bone marrow, these genetic defects cause most of the cells to die before they mature into fully functional red blood cells. As a consequence, patients withb-thalassemia have anemia, a lower than normal number of red blood cells, and many patients experience a broad array of complications arising from their disease, including an enlarged spleen, skeletal deformities and serious organ damage, such as liver fibrosis and heart failure, resulting from the accumulation of iron. There is no approved drug and no effective drug therapy for the anemia ofb-thalassemia. Frequent blood transfusions are used to manage the treatment of anemia in patients withb-thalassemia, but further contribute to the accumulation of iron and associated organ toxicities.

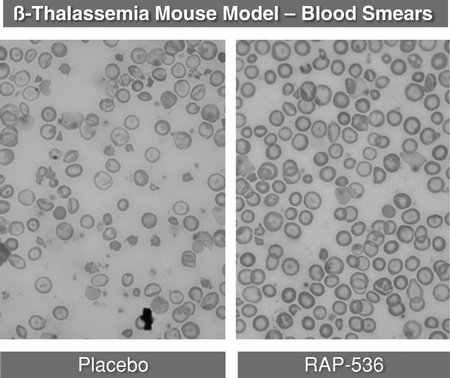

We and Celgene have shown that sotatercept and ACE-536 increase the production of red blood cells by promoting their maturation in the bone marrow. We believe this mechanism of action may be particularly beneficial for patients suffering from diseases, such asb-thalassemia, that are characterized by diminished red blood cell maturation. In a mouse model ofb-thalassemia, the mouse version of ACE-536 demonstrated broad disease modifying effects. In this model, the mouse version of ACE-536 increased red blood cell production, reduced spleen size, increased bone density and reduced levels of iron in the kidney and liver.

The Thalassaemia International Federation estimates that there are approximately 300,000 patients worldwide withb-thalassemia, approximately 20,000 of which are in the United States and Europe, who are dependent on frequent blood transfusions. We estimate that there are at least as manyb-thalassemia patients who do not receive frequent blood transfusions. Many of these patients have hemoglobin levels that are approximately half that of normal individuals and experience significant complications from the disease.

Myelodysplastic Syndromes (MDS)

MDS are a group of heterogeneous hematologic diseases characterized by abnormal proliferation and differentiation of blood precursor cells, including red blood cell precursors, in the bone marrow. This leads to anemia, which is present in the vast majority of MDS patients at the time of diagnosis. Much like the anemia ofb-thalassemia, the anemia of MDS is characterized by an over-abundance of early stage red blood cell precursors, a large proportion of which fails to mature into functional red blood cells during the later phases of the red blood cell formation process. Drugs that stimulate the production of early stage red blood cell precursors, such as recombinant erythropoietin, are often used to treat anemia in MDS patients, yet many do not experience a substantial improvement of their

anemia with these drugs. Although not approved by the United States Food and Drug Administration (FDA) for use in patients with MDS, these products generate an estimated $500 to $700 million in annual U.S. sales from use in these patients, according to our market research.

Additional Opportunities for Sotatercept

Although sotatercept and ACE-536 have similar effects on red blood cells, sotatercept has also been shown to increase bone mass in humans and to inhibit tumor growth in mouse models of multiple myeloma, a cancer of the bone marrow. To take advantage of these additional activities, sotatercept is being studied in an investigator-sponsored Phase 2 trial in multiple myeloma patients. Additionally, many patients with chronic kidney disease suffer from both anemia and bone loss. Celgene is conducting a Phase 2 clinical trial of sotatercept in patients with chronic kidney disease.

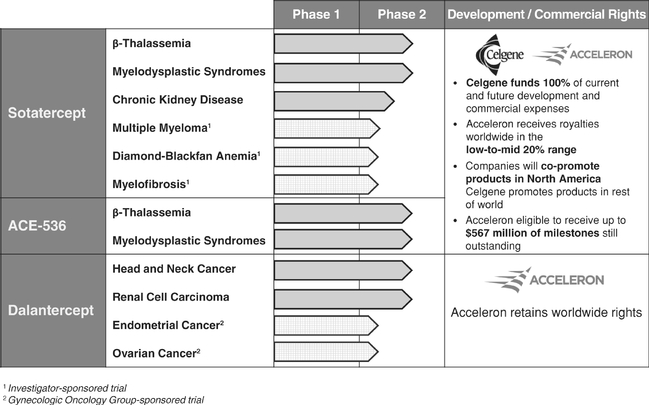

Our Partnership With Celgene

We are developing sotatercept and ACE-536 through our exclusive worldwide collaborations with Celgene. As of January 1, 2013, Celgene became responsible for paying 100% of worldwide development costs for both programs. Additionally, we may receive up to $567.0 million of potential development, regulatory and commercial milestone payments and, if these protein therapeutic candidates are commercialized, we will receive a royalty on net sales in the low-to-mid 20% range. If approved, we also will co-promote sotatercept and ACE-536 in North America, for which our commercialization costs will be entirely funded by Celgene.

Dalantercept: Novel Protein Therapeutic Candidate in Phase 2 Clinical Trials for Cancer

Our third clinical stage protein therapeutic candidate, dalantercept, is designed to inhibit blood vessel formation in tumors through a mechanism that is distinct from, and potentially synergistic with, vascular endothelial growth factor (VEGF) pathway inhibitors, the dominant class of cancer drugs that inhibit blood vessel formation. The VEGF pathway inhibitors collectively generate worldwide sales in excess of $8 billion annually. We are developing dalantercept primarily for use in combination with these successful products to produce better outcomes for cancer patients.

Inhibiting Angiogenesis to Limit Tumor Growth

Angiogenesis is a process by which new blood vessels are formed. Angiogenesis can be simplified to two major stages—the proliferative stage followed by the maturation stage. During the proliferative stage, vascular endothelial cells, the cells lining the inside of the blood vessels, increase in number. This proliferative stage is followed by the maturation stage during which the endothelial cells coalesce to form tubes which are then stabilized through the recruitment of perivascular cells that form an outer layer of the blood vessels resulting in fully formed, functional vessels.

Tumors depend on angiogenesis to form new blood vessels that supply nutrients and oxygen to feed the rapidly growing malignant cells. The principal molecule driving the proliferative stage of angiogenesis in tumors is a protein called VEGF. Inhibiting VEGF-driven angiogenesis to control tumor growth has become an important and widely-used approach to cancer treatment. There are several FDA-approved cancer drugs that inhibit the VEGF pathway. Despite the success of these drugs, many patients fail to respond or develop resistance to VEGF pathway inhibitor therapy, resulting in an unmet need for new therapies to inhibit angiogenesis by a different mechanism.

We are using our knowledge of the TGF-b superfamily to develop dalantercept, a novel protein therapeutic candidate targeting the maturation stage of angiogenesis. Recently, the activin receptor-like kinase 1 (ALK1) has been recognized as an important regulator of the maturation stage of angiogenesis. ALK1 is one of the 12 receptors for ligands in the TGF-b superfamily and is found primarily on endothelial cells. The importance of the ALK1 pathway in angiogenesis was discovered in

part through research into a genetic disease in which patients manifest vascular defects, including a reduced ability to form capillary beds, which are the networks of small blood vessels that connect arteries to veins and are necessary for nutrient and waste exchange in tissues. This research revealed that these patients have only one of two functional copies of the ALK1 gene. The resulting decreased signaling through the ALK1 receptor inhibits blood vessel maturation, leading to the reduced formation of capillary beds.

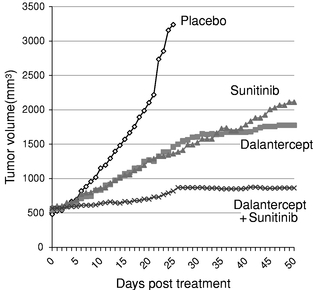

Opportunities for Dalantercept

We reasoned that leveraging the biology of the ALK1 pathway to inhibit maturation of blood vessels could impair the growth of tumors by limiting the development of capillary beds within the tumor. To test this hypothesis, mice with a predisposition to develop tumors were bred to have only one copy, rather than two copies, of the ALK1 gene that normally occur. In response to the loss of half of the ALK1 genes, tumor growth and size and blood vessel density in the tumor were reduced by half. We have also shown in two mouse cancer models that treatment with dalantercept decreases metastases. This is in contrast to VEGF pathway inhibitors, many of which have been shown to increase metastases in mouse cancer models. These results and additional research in the field have established the ALK1 signaling pathway as a promising target for developing a new class of anti-angiogenesis agents, ALK1 pathway inhibitors. We are developing dalantercept to treat cancer by inhibiting the ligands of the TGF-b superfamily that signal through the ALK1 receptor.

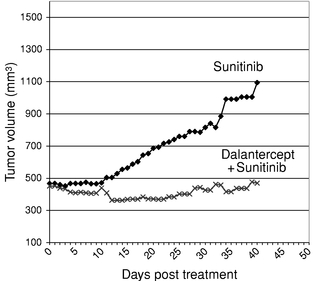

We believe one promising opportunity for dalantercept will be its use in combination with VEGF pathway inhibitors because these agents target distinct sequential steps in tumor angiogenesis. Moreover, we believe that dalantercept sensitizes blood vessels to increase the effects of treatment with VEGF pathway inhibitors. A combination of ALK1 and VEGF pathway inhibitors could have application in a number of different oncology indications where VEGF pathway inhibitors are currently used, such as non-small cell lung cancer, colorectal cancer and renal cell carcinoma and we are considering future trials in these indications.

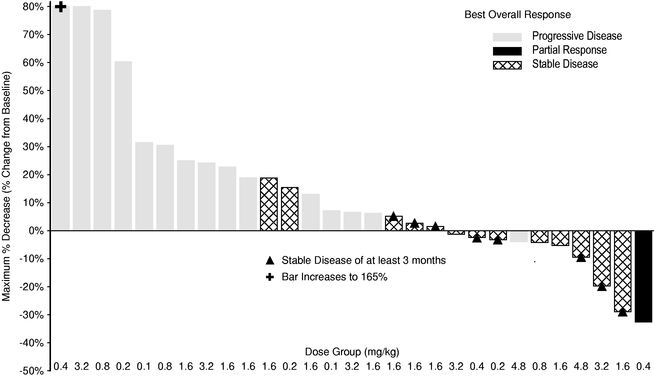

We have completed a Phase 1 trial of dalantercept and are pursuing a program of ongoing and planned Phase 2 trials seeking to demonstrate single agent activity of dalantercept for advanced solid tumors and activity of dalantercept in combination with approved VEGF pathway inhibitors or chemotherapy in advanced solid tumors. We currently are testing dalantercept as a single agent in a Phase 2 clinical trial in patients with squamous cell cancer of the head and neck and in a Phase 2 combination clinical trial with the VEGF pathway inhibitor axitinib in patients with renal cell carcinoma.

We have not entered into a partnership for dalantercept and retain worldwide rights to this program.

Our Clinical Stage Pipeline

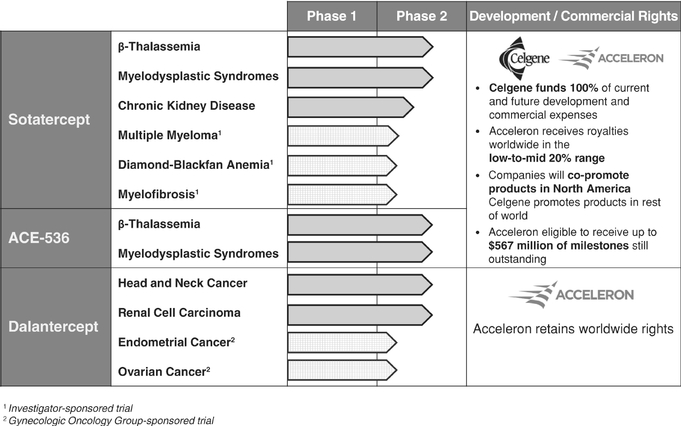

The development status of our three clinical stage protein therapeutic candidates is summarized below:

Our Strategy

Our goal is to be a leader in the discovery, development and commercialization of novel protein therapeutics for cancer and rare diseases. Key components of our strategy are:

additional protein therapeutic candidates for the treatment of cancer and diseases involving fibrosis.

Risk Factors

An investment in our common stock involves a high degree of risk. Any of the factors set forth under "Risk Factors" may limit our ability to successfully execute our business strategy. You should carefully consider all of the information set forth in this prospectus and, in particular, should evaluate the specific factors set forth under "Risk Factors" in deciding whether to invest in our common stock. Among these important risks are the following:

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in revenue during our most recently completed fiscal year, we qualify as an "emerging growth company" as defined in Section 2(a) of the Securities Act of 1933, as amended, which we refer to as the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As an emerging growth company, we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable, in general, to public companies that are not emerging growth companies. These provisions include:

We may take advantage of these exemptions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company if we have more than $1.0 billion in annual revenues as of the end of a fiscal year, if we are deemed to be a large-accelerated filer under the rules of the Securities and Exchange Commission, or if we issue more than $1.0 billion of non-convertible debt over a three-year-period.

The JOBS Act permits an emerging growth company to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies. We are choosing to "opt out" of this provision.

Corporate Information

We were incorporated in the state of Delaware in June 2003 as Phoenix Pharma, Inc., and we subsequently changed our name to Acceleron Pharma Inc. and commenced operations in February 2004. Our principal executive offices are located at 128 Sidney Street, Cambridge, Massachusetts 02139, and our telephone number is (617) 649-9200. Our Internet website iswww.acceleronpharma.com. The information on, or that can be accessed through, our website is not part of this prospectus, and you should not rely on any such information in making the decision whether to purchase our common stock.

Common stock offered by us | 4,650,000 shares | |

Common stock to be outstanding after this offering | 25,705,604 shares | |

Common stock to be outstanding after this offering and the concurrent private placement | 26,419,889 shares | |

Option to purchase additional shares | The underwriters have an option for a period of 30 days to purchase up to 697,500 additional shares of our common stock to cover over-allotments, if any. | |

Use of proceeds | We estimate that the net proceeds from this offering will be approximately | |

Risk factors | You should read the "Risk Factors" section of this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our common stock. | |

Proposed NASDAQ Global Market symbol | XLRN |

The number of shares of common stock to be outstanding after this offering and the concurrent private placement is based on 81,867,37821,055,604 shares of common stock outstanding as of March 31,June 30, 2013 and excludes the following:

Unless otherwise indicated, all information in this prospectus reflects or assumes the following:

The following summary financial data for the years ended December 31, 2011 and 2012 are derived from our audited financial statements included elsewhere in this prospectus. The summary financial data as of March 31,June 30, 2013 and for the threesix months ended March 31,June 30, 2012 and 2013 have been derived from our unaudited financial statements included elsewhere in this prospectus. These unaudited financial statements have been prepared on a basis consistent with our audited financial statements and, in our opinion, contain all adjustments, consisting only of normal and recurring adjustments, necessary for a fair presentation of such financial data. You should read this data together with our audited financial statements and related notes included elsewhere in this prospectus and the information under the captions "Selected Financial Data" and "Management's Discussion and Analysis of Financial Condition and Results of Operations". Our historical results are not necessarily indicative of our future results, and our operating results for the three-monthsix-month period ended March 31,June 30, 2013 are not necessarily indicative of the results that may be expected for the fiscal year ending December 31, 2013 or any other interim periods or any future year or period.

| | Year ended December 31, | Three months ended March 31, | Year Ended December 31, | Six Months Ended June 30, | ||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

(in thousands, except per share data) | 2011 | 2012 | 2012 | 2013 | 2011 | 2012 | 2012 | 2013 | ||||||||||||||||||

Revenue: | ||||||||||||||||||||||||||

Collaboration revenue: | ||||||||||||||||||||||||||

License and milestone | $ | 74,406 | $ | 9,696 | $ | 2,375 | $ | 12,515 | $ | 74,406 | $ | 9,696 | $ | 4,765 | $ | 35,406 | ||||||||||

Cost-sharing, net | 4,760 | 5,558 | 949 | 2,497 | 4,760 | 5,558 | 2,599 | 6,034 | ||||||||||||||||||

Contract manufacturing | 1,745 | — | — | — | 1,745 | — | — | — | ||||||||||||||||||

Total revenue | 80,911 | 15,254 | 3,324 | 15,012 | 80,911 | 15,254 | 7,364 | 41,440 | ||||||||||||||||||

Costs and expenses: | ||||||||||||||||||||||||||

Research and development | 32,713 | 35,319 | 8,212 | 8,780 | 32,713 | 35,319 | 16,925 | 17,691 | ||||||||||||||||||

General and administrative | 8,142 | 8,824 | 2,045 | 3,096 | 8,142 | 8,824 | 4,276 | 6,461 | ||||||||||||||||||

Cost of contract manufacturing revenue | 1,500 | — | — | — | 1,500 | — | — | — | ||||||||||||||||||

Total costs and expenses | 42,355 | 44,143 | 10,257 | 11,876 | 42,355 | 44,143 | 21,201 | 24,152 | ||||||||||||||||||

Income (loss) from operations | 38,556 | (28,889 | ) | (6,933 | ) | 3,136 | 38,556 | (28,889 | ) | (13,837 | ) | 17,288 | ||||||||||||||

Total other expense, net | (2,290 | ) | (3,693 | ) | (655 | ) | (1,489 | ) | (2,290 | ) | (3,693 | ) | (1,151 | ) | (2,563 | ) | ||||||||||

Net income (loss) | $ | 36,266 | $ | (32,582 | ) | $ | (7,588 | ) | $ | 1,647 | $ | 36,266 | $ | (32,582 | ) | $ | (14,988 | ) | $ | 14,725 | ||||||

Comprehensive income (loss) | $ | 36,266 | $ | (32,582 | ) | $ | (7,588 | ) | $ | 1,647 | $ | 36,266 | $ | (32,582 | ) | $ | (14,988 | ) | $ | 14,725 | ||||||

Net income (loss) per share applicable to common stockholders(1) | ||||||||||||||||||||||||||

Basic | $ | 0.20 | $ | (6.21 | ) | $ | (1.50 | ) | $ | (0.24 | ) | $ | 0.80 | $ | (24.84 | ) | $ | (11.91 | ) | $ | 0.19 | |||||

Diluted | $ | 0.19 | $ | (6.21 | ) | $ | (1.50 | ) | $ | (0.24 | ) | $ | 0.78 | $ | (24.84 | ) | $ | (11.91 | ) | $ | 0.17 | |||||

Weighted-average number of common shares used in computing net income (loss) per share applicable to common stockholders | ||||||||||||||||||||||||||

Basic | 9,313 | 9,605 | 9,579 | 9,740 | 2,328 | 2,401 | 2,395 | 2,437 | ||||||||||||||||||

Diluted | 10,863 | 9,605 | 9,579 | 9,740 | 2,716 | 2,401 | 2,395 | 4,434 | ||||||||||||||||||

Pro forma net income (loss) per share applicable to common stockholders(1): | ||||||||||||||||||||||||||

Basic | $ | (0.37 | ) | $ | 0.03 | $ | (1.43 | ) | $ | 0.77 | ||||||||||||||||

Diluted | $ | (0.37 | ) | $ | 0.03 | $ | (1.43 | ) | $ | 0.70 | ||||||||||||||||

Pro forma weighted-average number of common shares used in computing pro forma net income (loss) per share: | ||||||||||||||||||||||||||

Basic | 82,267 | 81,859 | 21,155 | 21,045 | ||||||||||||||||||||||

Diluted | 82,267 | 88,651 | 21,155 | 23,062 | ||||||||||||||||||||||

| | March 31, 2013 | June 30, 2013 | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

(in thousands) | Actual | Pro forma(2) | Pro forma, as adjusted(3)(4) | Actual | Pro forma(2) | Pro forma, as adjusted(3)(4) | ||||||||||||||

Balance Sheet Data: | ||||||||||||||||||||

Cash and cash equivalents | $ | 38,510 | $ | 38,510 | $ | 28,465 | $ | 28,465 | $ | 96,253 | ||||||||||

Total assets | 48,447 | 48,447 | 40,023 | 40,023 | 107,811 | |||||||||||||||

Total current liabilities | 37,279 | 37,279 | 16,786 | 16,786 | 16,786 | |||||||||||||||

Long-term deferred revenue | 6,670 | 6,670 | 6,668 | 6,668 | 6,668 | |||||||||||||||

Long-term notes payable | 14,717 | 14,717 | 12,869 | 12,869 | 12,869 | |||||||||||||||

Warrants to purchase redeemable convertible preferred stock | 1,022 | — | 1,009 | — | — | |||||||||||||||

Warrants to purchase common stock | 5,935 | 5,935 | 6,381 | 6,381 | 6,381 | |||||||||||||||

Redeemable convertible preferred stock | 272,980 | — | 279,823 | — | — | |||||||||||||||

Total stockholders' deficit | (292,868 | ) | (18,866 | ) | ||||||||||||||||

Total stockholders' (deficit) equity | (286,100 | ) | (5,268 | ) | 62,520 | |||||||||||||||

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below together with all of the other information contained in this prospectus, including our financial statements and the related notes appearing at the end of this prospectus, before deciding to invest in our common stock. If any of the following risks actually occurs, our business, prospects, operating results and financial condition could suffer materially, the trading price of our common stock could decline and you could lose all or part of your investment. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may also adversely affect our business.

Risks related to our financial position and need for additional capital

We have incurred net operating losses since our inception and anticipate that we will continue to incur substantial operating losses for the foreseeable future. We may never achieve or sustain profitability.

We have incurred net losses during most fiscal periods since our inception. As of March 31,June 30, 2013, we had an accumulated deficit of $292.9$286.1 million. We do not know whether or when we will become profitable. To date, we have not commercialized any products or generated any revenues from the sale of products, and we do not expect to generate any product revenues in the foreseeable future. Our losses have resulted principally from costs incurred in our discovery and development activities.

We anticipate that our expenses will increase in the future as we expand our discovery, research, development, manufacturing and commercialization activities. However, we also anticipate that these increased expenses will be partially offset by milestone payments we expect to receive under our agreements with Celgene and potentially by payments we may receive under new collaboration arrangements we may enter into with third parties for dalantercept or other protein therapeutic candidates. If we do not receive the anticipated milestone payments or do not enter into partnerships for dalantercept or other protein therapeutic candidates on acceptable terms, our operating losses will substantially increase over the next several years as we execute our plan to expand our discovery, research, development, manufacturing and commercialization activities. There can be no assurance that we will enter into a new collaboration or achieve milestones and, therefore, no assurance our losses will not increase prohibitively in the future.

To become and remain profitable, we or our partners must succeed in developing our protein therapeutic candidates, obtaining regulatory approval for them, and manufacturing, marketing and selling those products for which we or our partners may obtain regulatory approval. We or they may not succeed in these activities, and we may never generate revenue from product sales that is significant enough to achieve profitability. Even if we achieve profitability in the future, we may not be able to sustain profitability in subsequent periods. Our failure to become or remain profitable would depress our market value and could impair our ability to raise capital, expand our business, discover or develop other protein therapeutic candidates or continue our operations. A decline in the value of our company could cause you to lose all or part of your investment.

We will require substantial additional financing to achieve our goals, and a failure to obtain this necessary capital when needed could force us to delay, limit, reduce or terminate our product development or commercialization efforts.

As of March 31,June 30, 2013, our cash and cash equivalents were $38.5$28.5 million. We believe that we will continue to expend substantial resources for the foreseeable future developing dalantercept and new protein therapeutic candidates. These expenditures will include costs associated with research and development, potentially acquiring new technologies, conducting preclinical studies and clinical trials, potentially obtaining regulatory approvals and manufacturing products, as well as marketing and selling

products approved for sale, if any. In addition, other unanticipated costs may arise. Because the outcome of our planned and anticipated clinical trials is highly uncertain, we cannot reasonably estimate the actual amounts necessary to successfully complete the development and commercialization of our protein therapeutic candidates.

Celgene pays development, manufacturing and commercialization and certain patent costs for sotatercept and ACE-536. Other than those costs, our future capital requirements depend on many factors, including:

Based on our current operating plan, we believe that the net proceeds we receive from this offering and the concurrent private placement, together with receipt of anticipated milestone payments and our existing cash and cash equivalents will be sufficient to fund our projected operating requirements through the first half of 2015. However, our operating plan may change as a result of many factors currently unknown to us, and we may need additional funds sooner than planned. In addition, we may seek additional capital due to favorable market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans. Additional funds may not be available when we need them on terms that are acceptable to us, or at all. If adequate funds are not available to us on a timely basis, we may be required to delay, limit, reduce or terminate preclinical studies, clinical trials or other development activities for one or more of our protein therapeutic candidates or delay, limit, reduce or terminate our establishment of sales and marketing capabilities or other activities that may be necessary to commercialize our protein therapeutic candidates.

Raising additional capital may cause dilution to our existing stockholders, restrict our operations or require us to relinquish rights to our technologies or protein therapeutics on unfavorable terms to us.

We may seek additional capital through a variety of means, including through private and public equity offerings and debt financings. To the extent that we raise additional capital through the sale of equity or convertible debt securities, your ownership interest will be diluted, and the terms may include liquidation or other preferences that adversely affect your rights as a stockholder. Debt financing, if available, may involve agreements that include covenants limiting or restricting our ability to take certain actions, such as incurring additional debt, making capital expenditures or declaring dividends. If we raise additional funds through strategic partnerships with third parties, we may have to relinquish valuable rights to our technologies or protein therapeutics, or grant licenses on terms that are not favorable to us. If we are unable to raise additional funds through equity or debt financing when needed, we may be required to delay, limit, reduce or terminate our product development or

commercialization efforts for dalantercept or any protein therapeutics other than sotatercept or ACE-536, or grant rights to develop and market protein therapeutics that we would otherwise prefer to develop and market ourselves.

Risks Related to Regulatory Review and Approval of Our Protein Therapeutic Candidates

If we or our partners do not obtain regulatory approval for our current and future protein therapeutics, our business will be adversely affected.

Our protein therapeutic candidates will be subject to extensive governmental regulations relating to, among other things, development, clinical trials, manufacturing and commercialization. In order to obtain regulatory approval for the commercial sale of any protein therapeutic candidates, we or our partners must demonstrate through extensive preclinical studies and clinical trials that the protein therapeutic candidate is safe and effective for use in each target indication. Clinical testing is expensive, time-consuming and uncertain as to outcome. We or our partners may gain regulatory approval for sotatercept, ACE-536, dalantercept, or any other protein therapeutic candidate in some but not all of the territories available or some but not all of the target indications, resulting in limited commercial opportunity for the approved protein therapeutics, or we or they may never obtain regulatory approval for these protein therapeutic candidates.

Delays in the commencement, enrollment or completion of clinical trials of our protein therapeutic candidates could result in increased costs to us as well as a delay or failure in obtaining regulatory approval, or prevent us from commercializing our protein therapeutic candidates on a timely basis, or at all.

We cannot guarantee that clinical trials will be conducted as planned or completed on schedule, if at all. A failure of one or more clinical trials can occur at any stage of testing. Events that may prevent successful or timely commencement, enrollment or completion of clinical development include:

Delays, including delays caused by the above factors, can be costly and could negatively affect our or Celgene's ability to complete a clinical trial. If we or Celgene are not able to successfully complete clinical trials, we will not be able to obtain regulatory approval and will not be able to commercialize our protein therapeutic candidates.

Clinical failure may occur at any stage of clinical development, and because our protein therapeutic candidates are in an early stage of development, there is a high risk of failure, and we may never succeed in developing marketable products or generating product revenue.

Our early encouraging preclinical and clinical results for sotatercept, ACE-536 and dalantercept are not necessarily predictive of the results of our ongoing or future clinical trials. Promising results in preclinical studies of a drug candidate may not be predictive of similar results in humans during clinical trials, and successful results from early clinical trials of a drug candidate may not be replicated in later and larger clinical trials or in clinical trials for different indications. If the results of our or our partners' ongoing or future clinical trials are inconclusive with respect to the efficacy of our protein therapeutic candidates or if we or they do not meet the clinical endpoints with statistical significance or if there are safety concerns or adverse events associated with our protein therapeutic candidates, we or our partner may be prevented or delayed in obtaining marketing approval for our protein therapeutic candidates. In addition, data obtained from trials and studies are susceptible to varying interpretations, and regulators may not interpret our data as favorably as we do, which may delay or prevent regulatory approval. Alternatively, even if we or our partners obtain regulatory approval, that approval may be for indications or patient populations that are not as broad as intended or desired or may require labeling that includes significant use or distribution restrictions or safety warnings. We or our partners may also be required to perform additional or unanticipated clinical trials to obtain approval or be subject to additional post-marketing testing requirements to maintain regulatory approval. In addition, regulatory authorities may withdraw their approval of a product or impose restrictions on its distribution, such as in the form of a modified risk evaluation and mitigation strategy.

If we or any of our partners violate the guidelines pertaining to promotion and advertising of any of our protein therapeutics, if approved, we or they may be subject to disciplinary action by the FDA's Office of Prescription Drug Promotion (OPDP) or other regulatory authorities.

The FDA's Office of Prescription Drug Promotion, or OPDP, is responsible for reviewing prescription drug advertising and promotional labeling to ensure that the information contained in these materials is not false or misleading. There are specific disclosure requirements, and the applicable regulations mandate that advertisements cannot be false or misleading or omit material facts about the product. Prescription drug promotional materials must present a fair balance between the drug's effectiveness and the risks associated with its use. Most warning letters from OPDP cite inadequate disclosure of risk information.

OPDP prioritizes its actions based on the degree of risk to the public health, and often focuses on newly introduced drugs and those associated with significant health risks. There are two types of letters that OPDP typically sends to companies that violate its drug advertising and promotional guidelines: notice of violation letters, or untitled letters, and warning letters. In the case of an untitled letter, OPDP typically alerts the drug company of the violation and issues a directive to refrain from future violations, but does not typically demand other corrective action. A warning letter is typically issued in cases that are more serious or where the company is a repeat offender. Although we have not received

any such letters from OPDP, we or any partner may inadvertently violate OPDP's guidelines in the future and be subject to a OPDP untitled letter or warning letter, which may have a negative impact on our business.

If we or our partners fail to obtain regulatory approval in jurisdictions outside the United States, we and they will not be able to market our products in those jurisdictions.

We and our partners intend to market our protein therapeutic candidates, if approved, in international markets. Such marketing will require separate regulatory approvals in each market and compliance with numerous and varying regulatory requirements. The approval procedures vary from country-to-country and may require additional testing. Moreover, the time required to obtain approval may differ from that required to obtain FDA approval. In addition, in many countries outside the United States, a protein therapeutic must be approved for reimbursement before it can be approved for sale in that country. Approval by the FDA does not ensure approval by regulatory authorities in other countries or jurisdictions, and approval by one foreign regulatory authority does not ensure approval by regulatory authorities in other foreign countries or by the FDA. The foreign regulatory approval process may include all of the risks associated with obtaining FDA approval. We or our partners may not obtain foreign regulatory approvals on a timely basis, if at all. We or our partners may not be able to file for regulatory approvals and may not receive necessary approvals to commercialize our products in any market.

Even if we or our partners receive regulatory approval for our protein therapeutic candidates, such products will be subject to ongoing regulatory review, which may result in significant additional expense. Additionally, our protein therapeutic candidates, if approved, could be subject to labeling and other restrictions, and we or our partners may be subject to penalties if we fail to comply with regulatory requirements or experience unanticipated problems with our products.

Any regulatory approvals that we or our partners receive for our protein therapeutic candidates may also be subject to limitations on the approved indicated uses for which the product may be marketed or to conditions of approval, or contain requirements for potentially costly post-marketing testing, including Phase 4 clinical trials, and surveillance to monitor safety and efficacy. In addition, if the FDA approves any of our protein therapeutic candidates, the manufacturing processes, labeling, packaging, distribution, adverse event reporting, storage, advertising, promotion and recordkeeping for the product will be subject to extensive and ongoing regulatory requirements. These requirements include submissions of safety and other post-marketing information and reports, registration, as well as continued compliance with current good manufacturing practice, or cGMP, and GCP, for any clinical trials that we or our partners conduct post-approval.

Later discovery of previously unknown problems with an approved protein therapeutic, including adverse events of unanticipated severity or frequency, or with manufacturing operations or processes, or failure to comply with regulatory requirements, may result in, among other things:

The FDA's policies may change and additional government regulations may be enacted that could prevent, limit or delay regulatory approval of our protein therapeutic candidates. We cannot predict the likelihood, nature or extent of government regulation that may arise from future legislation or administrative action, either in the United States or abroad. If we or our partners are slow or unable to adapt to changes in existing requirements or the adoption of new requirements or policies, or not able to maintain regulatory compliance, we or our partners may lose any marketing approval that may have been obtained and we may not achieve or sustain profitability, which would adversely affect our business.

Risks Related to Our Reliance on Third Parties

We are dependent on Celgene for the successful development and commercialization of two of our three clinical stage protein therapeutic candidates, sotatercept and ACE-536. If Celgene does not devote sufficient resources to the development of these candidates, is unsuccessful in its efforts, or chooses to terminate its agreements with us, our business will be materially harmed.

We have entered into collaboration agreements with Celgene to develop and commercialize sotatercept and ACE-536. Pursuant to the sotatercept agreement, responsibility for all clinical and other product development activities and for manufacturing sotatercept has been transferred to Celgene. For ACE-536, we are responsible for conducting the two ongoing Phase 2 clinical trials, and we are also responsible for manufacturing supplies for Phase 1 and Phase 2 studies. Celgene will be responsible for all clinical development and manufacturing activities after such studies are completed. As of January 1, 2013, Celgene became responsible for paying 100% of worldwide development costs for sotatercept and ACE-536. We will co-promote sotatercept and ACE-536, if approved by the FDA and its counterparties, in North America. Celgene will be responsible for all commercialization costs, including the cost of our promotion activities.

Celgene is obligated to use commercially reasonable efforts to develop and commercialize sotatercept and ACE-536. Celgene may determine that it is commercially reasonable to develop and commercialize only sotatercept or ACE-536 and discontinue the development or commercialization of the other protein therapeutic candidate, or Celgene may determine that it is not commercially reasonable to continue development of one or both of sotatercept and ACE-536. In the event of any such decision, we may be unable to progress the discontinued candidate or candidates ourselves. In addition, under our collaboration agreements, once Celgene takes over development activities of a protein therapeutic candidate, it may determine the development plan and activities for that protein therapeutic candidate. We may disagree with Celgene about the development strategy it employs, but we will have no rights to impose our development strategy on Celgene. Similarly, Celgene may decide to seek regulatory approval for, and limit commercialization of, either or both of sotatercept and ACE-536 to narrower indications than we would pursue. We would be prevented from developing or commercializing a candidate in an indication that Celgene has chosen not to pursue.

This partnership may not be scientifically or commercially successful due to a number of important factors, including the following:

existing products, lenalidomide and azacitidine, for certain MDS patients for which sotatercept and ACE-536 are also being developed.

We and Celgene rely on third parties to conduct preclinical studies and clinical trials for our protein therapeutic candidates, and if they do not properly and successfully perform their obligations to us, we may not be able to obtain regulatory approvals for our protein therapeutic candidates.

We design the clinical trials for dalantercept and will do so for any future unpartnered protein therapeutic candidates, and we will continue to work with Celgene on trials for sotatercept and ACE-536. However, we and Celgene rely on CROs and other third parties to assist in managing, monitoring and otherwise carrying out many of these trials. We and Celgene compete with many other companies for the resources of these third parties. The third parties on whom we and Celgene rely generally may terminate their engagements at any time, and having to enter into alternative arrangements would delay development and commercialization of our protein therapeutic candidates.

The FDA and foreign regulatory authorities require compliance with regulations and standards, including GCP, for designing, conducting, monitoring, recording, analyzing, and reporting the results of clinical trials to assure that the data and results are credible and accurate and that the rights, integrity and confidentiality of trial participants are protected. Although we and Celgene rely on third parties to conduct many of our and their clinical trials, we and Celgene are responsible for ensuring that each of these clinical trials is conducted in accordance with its general investigational plan, protocol and other requirements.

If these third parties do not successfully carry out their duties under their agreements, if the quality or accuracy of the data they obtain is compromised due to their failure to adhere to clinical trial protocols or to regulatory requirements, or if they otherwise fail to comply with clinical trial protocols or meet expected deadlines, the clinical trials of our protein therapeutic candidates may not

meet regulatory requirements. If clinical trials do not meet regulatory requirements or if these third parties need to be replaced, preclinical development activities or clinical trials may be extended, delayed, suspended or terminated. If any of these events occur, we or Celgene may not be able to obtain regulatory approval of our protein therapeutic candidates on a timely basis or at all.

We and Celgene intend to rely on third-party manufacturers to make our protein therapeutics, and any failure by a third-party manufacturer may delay or impair our and Celgene's ability to complete clinical trials or commercialize our protein therapeutic candidates.

Manufacturing biologic drugs is complicated and is tightly regulated by the FDA, the European Medicines Agency, or EMA, and comparable regulatory authorities around the world. We currently manufacture drug substance for our preclinical studies, Phase 1 clinical trials and Phase 2 clinical trials of ACE-536 and dalantercept. For Phase 3 and commercial supply of our products that we have not partnered, we expect to use contract manufacturing organizations. Successfully transferring complicated manufacturing techniques to contract manufacturing organizations and scaling up these techniques for commercial quantities will be time consuming and we may not be able to achieve such transfer. Moreover, the market for contract manufacturing services for protein therapeutics is highly cyclical, with periods of relatively abundant capacity alternating with periods in which there is little available capacity. If any need we or Celgene have for contract manufacturing services increases during a period of industry-wide tight capacity, we or Celgene may not be able to access the required capacity on a timely basis or on commercially viable terms.

In addition, we contract with fill & finishing providers with the appropriate expertise, facilities and scale to meet our needs. Failure to maintain cGMP can result in a contractor receiving FDA sanctions, which can impact our and Celgene's contractors' ability to operate or lead to delays in our clinical development programs. We believe that our current fill & finish contractors are operating in accordance with cGMP, but we can give no assurance that FDA or other regulatory agencies will not conclude that a lack of compliance exists. In addition, any delay in contracting for fill & finish services, or failure of the contract manufacturer to perform the services as needed, may delay clinical trials, registration and launches. Any such issues may have a substantial negative effect on our business.

For our two lead products, sotatercept and ACE-536, we rely on our collaboration partner Celgene to produce, or contract for the production of, bulk drug substance and finished drug product for late stage clinical trials and for commercial supplies of any approved candidates. Any failure by Celgene or by third-parties with which Celgene contracts may delay or impair the ability to complete late stage clinical trials or commercialize either or both of sotatercept and ACE-536, if approved.

We produced drug substance for preclinical and Phase 1 and 2 clinical trials for sotatercept and ACE-536. Celgene is now responsible for manufacturing sotatercept and will be responsible for manufacturing ACE-536 for future late-stage clinical trials. Celgene generally does not perform the manufacture of the drug substance or drug product for either sotatercept or ACE-536 itself. Celgene has used and may continue to use contract manufacturers for the manufacture of drug substance and drug product for sotatercept and we have no expectation that Celgene plans to perform the manufacture of bulk drug substance or drug product for either sotatercept or ACE-536 in the future. However, Celgene would have the right to manufacture sotatercept or ACE-536, itself or through the use of contract manufacturers. We understand that they have entered into a manufacturing arrangement for Phase 2 supplies of sotatercept bulk drug substance with contract manufacturers with considerable biotherapeutics manufacturing experience, including manufacturing monoclonal antibodies through processes similar to those used for sotatercept. To date they have not entered into an arrangement with a third party to manufacture supplies of sotatercept or ACE-536 for Phase 3 trials or commercial sales. If they are unable to contract at the appropriate time with a manufacturer willing and able to manufacture sufficient quantities of sotatercept and ACE-536 to meet Phase 3 and

commercial demand, either for technical or business reasons, the development and commercialization of sotatercept and ACE-536 may be delayed.

We may not be successful in establishing and maintaining additional strategic partnerships, which could adversely affect our ability to develop and commercialize products, negatively impacting our operating results.

In addition to our current collaborations with Celgene, a part of our strategy is to strategically evaluate and, as deemed appropriate, enter into additional partnerships in the future when strategically attractive, including potentially with major biotechnology or pharmaceutical companies. We face significant competition in seeking appropriate partners for our protein therapeutic candidates, and the negotiation process is time-consuming and complex. In order for us to successfully partner our protein therapeutic candidates, potential partners must view these protein therapeutic candidates as economically valuable in markets they determine to be attractive in light of the terms that we are seeking and other available products for licensing by other companies. Even if we are successful in our efforts to establish new strategic partnerships, the terms that we agree upon may not be favorable to us, and we may not be able to maintain such strategic partnerships if, for example, development or approval of a protein therapeutic is delayed or sales of an approved product are disappointing. Any delay in entering into new strategic partnership agreements related to our protein therapeutic candidates could delay the development and commercialization of our protein therapeutic candidates and reduce their competitiveness even if they reach the market.

If we fail to establish and maintain additional strategic partnerships related to our protein therapeutic candidates, we will bear all of the risk and costs related to the development of any such protein therapeutic candidate, and we may need to seek additional financing, hire additional employees and otherwise develop expertise for which we have not budgeted. This could negatively affect the development of any unpartnered protein therapeutic candidate.

Risks Related to Our Intellectual Property

If we are unable to obtain or protect intellectual property rights related to our protein therapeutic candidates, we may not be able to compete effectively.

We rely upon a combination of patents, trade secret protection and confidentiality agreements to protect the intellectual property related to our platform technology and protein therapeutic candidates. The patent position of biotechnology companies is generally uncertain because it involves complex legal and factual considerations. The standards applied by the United States Patent and Trademark Office, or USPTO, and foreign patent offices in granting patents are not always applied uniformly or predictably. For example, there is no uniform worldwide policy regarding patentable subject matter or the scope of claims allowable in biotechnology patents. The patent applications that we own or in-license may fail to result in issued patents with claims that cover our protein therapeutic candidates in the United States or in other countries. There is no assurance that all potentially relevant prior art relating to our patents and patent applications has been found. We may be unaware of prior art that could be used to invalidate an issued patent or prevent our pending patent applications from issuing as patents. Even if patents do successfully issue and even if such patents cover our protein therapeutic candidates, third parties may challenge their validity, enforceability or scope, which may result in such patents being narrowed or invalidated. Furthermore, even if they are unchallenged, our patents and patent applications may not adequately protect our intellectual property, provide exclusivity for our protein therapeutic candidates or prevent others from designing around our claims. Any of these outcomes could impair our ability to prevent competition from third parties, which may have an adverse impact on our business.

If patent applications we hold or have in-licensed with respect to our platform or protein therapeutic candidates fail to issue, if their breadth or strength of protection is threatened, or if they

fail to provide meaningful exclusivity for our protein therapeutic candidates, it could dissuade companies from collaborating with us. Several patent applications covering our protein therapeutic candidates have been filed recently. We cannot offer any assurances about which, if any, patents will issue, the breadth of any such patents or whether any issued patents will be found invalid and unenforceable or will be threatened by third parties. Any successful challenge to these patents or any other patents owned by or licensed to us could deprive us of rights necessary for the successful commercialization of any protein therapeutic candidate that we or our partners may develop. Since patent applications in the United States and most other countries are confidential for a period of time after filing, and some remain so until issued, we cannot be certain that we were the first to file any patent application related to a protein therapeutic candidate. Furthermore, if third parties have filed such patent applications, an interference proceeding in the United States can be initiated by the USPTO or a third party to determine who was the first to invent any of the subject matter covered by the patent claims of our applications. In addition, patents have a limited lifespan. In the United States, the natural expiration of a patent is generally 20 years after it is filed. Various extensions may be available; however, the life of a patent and the protection it affords is limited. If we encounter delays in obtaining regulatory approvals, the period of time during which we could market a protein therapeutic under patent protection could be reduced. Even if patents covering our protein therapeutic candidates are obtained, once the patent life has expired for a product, we may be open to competition from biosimilar products.

Any loss of patent protection could have a material adverse impact on our business. We and our partner may be unable to prevent competitors from entering the market with a product that is similar to or the same as our protein therapeutics. In addition, the royalty we would receive under our collaboration agreements with Celgene for sotatercept and ACE-536 would be reduced by 50% if such product ceases to be covered by a valid claim of our patents even if no competitor with a similar product has entered the market.

Third-party claims of intellectual property infringement or misappropriation may prevent or delay our development and commercialization efforts.

Our commercial success depends in part on us and our partners not infringing the patents and proprietary rights of third parties. There is a substantial amount of litigation, both within and outside the United States, involving patent and other intellectual property rights in the biotechnology and pharmaceutical industries, including patent infringement lawsuits, interferences, oppositions and inter partes reexamination proceedings before the USPTO and corresponding foreign patent offices. Numerous U.S. and foreign issued patents and pending patent applications owned by third parties exist in the fields in which we and our partners are developing and may develop our protein therapeutic candidates. As the biotechnology and pharmaceutical industries expand and more patents are issued, the risk increases that our protein therapeutic candidates may be subject to claims of infringement of the patent rights of third parties.

Third parties may assert that we are employing their proprietary technology without authorization. There may be third-party patents or patent applications with claims to materials, formulations, methods of manufacture or methods for treatment related to the use or manufacture of our protein therapeutic candidates, that we failed to identify. For example, applications filed before November 29, 2000 and certain applications filed after that date that will not be filed outside the United States remain confidential until issued as patents. Except for the preceding exceptions, patent applications in the United States and elsewhere are generally published only after a waiting period of approximately 18 months after the earliest filing. Therefore, patent applications covering our platform technology or our protein therapeutic candidates could have been filed by others without our knowledge. Additionally, pending patent applications which have been published can, subject to certain limitations, be later amended in a manner that could cover our platform technologies, our protein therapeutic candidates or the use or manufacture of our protein therapeutic candidates.

If any third-party patents were held by a court of competent jurisdiction to cover aspects of our materials, formulations, methods of manufacture or methods for treatment, the holders of any such patents would be able to block our ability to develop and commercialize the applicable protein therapeutic candidate until such patent expired or unless we or our partners obtain a license. These licenses may not be available on acceptable terms, if at all. Even if we or our partners were able to obtain a license, the rights may be nonexclusive, which could result in our competitors gaining access to the same intellectual property. Ultimately, we or our partners could be prevented from commercializing a product, or be forced to cease some aspect of our business operations, if, as a result of actual or threatened patent infringement claims, we or our partners are unable to enter into licenses on acceptable terms. If Celgene is required to enter a license agreement with a third party in order to import, develop, manufacture or commercialize sotatercept or ACE-536, the royalty rate and sales milestone payments that we could receive may be reduced by up to 50%. This could harm our business significantly.

Parties making claims against us or our partners may obtain injunctive or other equitable relief, which could effectively block our or our partners' ability to further develop and commercialize one or more of our protein therapeutic candidates. Defending against claims of patent infringement or misappropriation of trade secrets could be costly and time consuming, regardless of the outcome. Thus, even if we were to ultimately prevail, or to settle at an early stage, such litigation could burden us with substantial unanticipated costs. In addition, litigation or threatened litigation could result in significant demands on the time and attention of our management team, distracting them from the pursuit of other company business. In the event of a successful claim of infringement against us or our partners, we may have to pay substantial damages, including treble damages and attorneys' fees for willful infringement, pay royalties, redesign our infringing products or obtain one or more licenses from third parties, which may be impossible or require substantial time and monetary expenditure.

We may face a claim of misappropriation if a third party believes that we inappropriately obtained and used trade secrets of such third party. If we are found to have misappropriated a third party's trade secrets, we may be prevented from further using such trade secrets, limiting our ability to develop our protein therapeutic candidates, and we may be required to pay damages.

During the course of any patent or other intellectual property litigation, there could be public announcements of the results of hearings, rulings on motions, and other interim proceedings in the litigation. If securities analysts or investors regard these announcements as negative, the perceived value of our protein therapeutics, programs, or intellectual property could be diminished. Accordingly, the market price of our common stock may decline.

We have in-licensed a portion of our intellectual property, and, if we fail to comply with our obligations under these arrangements, we could lose such intellectual property rights or owe damages to the licensor of such intellectual property.

We are a party to a number of license agreements that are important to our business, and we may enter into additional license agreements in the future. Our discovery and development platform is built, in part, around patents exclusively in-licensed from academic or research institutions. Certain of our in-licensed intellectual property also covers sotatercept and dalantercept. See "Business—Intellectual Property—In-Licenses" for a description of our license agreements with the Beth Israel Deaconess Medical Center, the Ludwig Institute for Cancer Research and the Salk Institute for Biological Studies.

Our existing license agreements impose, and we expect that future license agreements will impose, various diligence, milestone payment, royalty and other obligations on us. If there is any conflict, dispute, disagreement or issue of non-performance between us and our licensing partners regarding our rights or obligations under the license agreements, including any such conflict, dispute or disagreement arising from our failure to satisfy payment obligations under any such agreement, we may owe damages, our licensor may have a right to terminate the affected license, and our and our partners'

ability to utilize the affected intellectual property in our drug discovery and development efforts, and our ability to enter into collaboration or marketing agreements for an affected protein therapeutic candidate, may be adversely affected.

For example, the Salk Institute for Biological Studies recently filed a lawsuit against us alleging under one of our license agreements with them, which pertains to ActRIIB, its entitlement to a further share of certain payments received by us under our now-terminated agreement with Shire AG and a share of certain payments received by us under our on-going collaboration agreement with Celgene in connection with ACE-536. Although we and Salk have agreed that ACE-536 is not covered by any patent rights licensed from Salk, an unfavorable outcome in this litigation may lead to us owing significant damages to Salk and higher-than-anticipated future payments under this license in connection with development milestone payments that we may receive from Celgene. It is possible that Salk may seek to terminate the license covering the receptor. We do not believe that such a termination would have a material impact on our business or the development of any of our products. The patents under this license covered only one of our protein therapeutic candidates, ACE-031, the development of which has been discontinued. See "Business—Legal Proceedings" for a description of this proceeding.

Confidentiality agreements with employees and third parties may not prevent unauthorized disclosure of trade secrets and other proprietary information.

In addition to the protection afforded by patents, we rely on trade secret protection and confidentiality agreements to protect proprietary know-how that is not patentable or that we elect not to patent, processes for which patents are difficult to enforce and any other elements of our platform technology and discovery and development processes that involve proprietary know-how, information or technology that is not covered by patents. However, trade secrets can be difficult to protect. We seek to protect our proprietary technology and processes, in part, by entering into confidentiality agreements with our employees, consultants, and outside scientific advisors, contractors and collaborators. Although we use reasonable efforts to protect our trade secrets, our employees, consultants, contractors, or outside scientific advisors might intentionally or inadvertently disclose our trade secret information to competitors. In addition, competitors may otherwise gain access to our trade secrets or independently develop substantially equivalent information and techniques.

Enforcing a claim that a third party illegally obtained and is using any of our trade secrets is expensive and time consuming, and the outcome is unpredictable. In addition, courts outside the United States sometimes are less willing than U.S. courts to protect trade secrets. Misappropriation or unauthorized disclosure of our trade secrets could impair our competitive position and may have a material adverse effect on our business

Risks Related to Commercialization of Our Protein Therapeutic Candidates

Our future commercial success depends upon attaining significant market acceptance of our protein therapeutic candidates, if approved, among physicians, patients, health care payers and, in cancer markets, acceptance by the operators of major cancer clinics.

Even if we or our partners obtain regulatory approval for sotatercept, ACE-536, dalantercept or any other protein therapeutics that we may develop or acquire in the future, the product may not gain market acceptance among physicians, health care payors, patients and the medical community. Market acceptance of any approved products depends on a number of factors, including:

Market acceptance is critical to our ability to generate significant revenue. Any protein therapeutic candidate, if approved and commercialized, may be accepted in only limited capacities or not at all. If any approved products are not accepted by the market to the extent that we expect, we may not be able to generate significant revenue and our business would suffer.

Reimbursement may be limited or unavailable in certain market segments for our protein therapeutic candidates, which could make it difficult for us to sell our products profitably.

Market acceptance and sales of any approved protein therapeutics will depend significantly on the availability of adequate coverage and reimbursement from third-party payers and may be affected by existing and future health care reform measures. Government authorities and third-party payors, such as private health insurers and health maintenance organizations, decide which drugs they will pay for and establish reimbursement levels. Reimbursement by a third-party payer may depend upon a number of factors, including the third-party payor's determination that use of a product is: