Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on March 10, 2014April 6, 2015

Registration No. 333-333-194473

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 4

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Virtu Financial, Inc.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) | 6200 (Primary Standard Industrial Classification Code Number) | 32-0420206 (I.R.S. Employer Identification Number) |

645 Madison900 Third Avenue

New York, New York 10022-1010

(212) 418-0100

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Douglas A. Cifu

Chief Executive Officer645 Madison900 Third Avenue

New York, New York 10022-1010

(212) 418-0100

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| John C. Kennedy, Esq. Paul, Weiss, Rifkind, Wharton & Garrison LLP 1285 Avenue of the Americas New York, New York 10019-6064 (212) 373-3000 | Michael Kaplan, Esq. Davis Polk & Wardwell LLP 450 Lexington Avenue New York, New York 10017 (212) 450-4000 |

Approximate date of commencement of proposed sale to the public:As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) | Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price(1)(2) | Amount of Registration Fee(3) | Amount to be Registered(1)(2) | Proposed Maximum Offering Price per Share | Proposed Maximum Aggregate Offering Price(1)(2) | Amount of Registration Fee(3) | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Class A common stock, par value $0.00001 per share | $ | 100,000,000 | $ | 12,880 | 19,012,112 | $19.00 | $361,230,128 | $43,320 | |||||||

|

|

| |||||||||||||

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any state or jurisdiction where the offer or sale is not permitted.

Subject to Completion. Dated March 10, 2014.April 6, 2015.

16,532,272 Shares

Virtu Financial, Inc.

Class A Common Stock

This is an initial public offering of shares of Class A common stock of Virtu Financial, Inc. All of the 16,532,272 shares of Class A common stock being offered are being sold by the Company.

Prior to this offering, there has been no public market for the Class A common stock. It is currently estimated that the initial public offering price per share will be between $$17.00 and $ .$19.00.

Following this offering, Virtu Financial, Inc. will have four classes of authorized common stock. The Class A common stock offered hereby and the Class C common stock will have one vote per share. The Class B common stock and the Class D common stock will have 10 votes per share. TJMT Holdings LLC, an affiliate of Mr. Vincent Viola, our Founder and Executive Chairman, and certain trusts for the benefit of the Viola family and others will hold all of our issued and outstanding Class D common stock after this offering and will control more than a majority of the combined voting power of our common stock. As a result, TJMT Holdings LLCthe Viola family will be able to control any action requiring the general approval of our stockholders, including the election of our board of directors, the adoption of amendments to our certificate of incorporation and by-laws and the approval of any merger or sale of substantially all of our assets.

We intend to list the Class A common stock on The NASDAQ Stock Market LLC ("NASDAQ") under the symbol "VIRT."

We will be a "controlled company" under the corporate governance rules for NASDAQ-listed companies, and therefore we will be permitted to, and we intend to, elect not to comply with certain NASDAQ corporate governance requirements. See "Management — Controlled Company."

We are an "emerging growth company" under the federal securities laws. Investing in our Class A common stock involves risks. See "Risk Factors" on page 2528 to read about factors you should consider before buying shares of our Class A common stock.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | ||||||

Initial public offering price | $ | $ | |||||

Underwriting discount | $ | $ | |||||

Proceeds, before expenses, to us(1) | $ | $ |

The shares of Class A common stock are being offered through the underwriters on a firm commitment basis, subject to the terms and conditions of an underwriting agreement. To the extent that the underwriters sell more than 16,532,272 shares of Class A common stock, the underwriters have the option to purchase up to an additional 2,479,840 shares from us at the initial price to the public less the underwriting discount within 30 days from the date of this prospectus.

The underwriters expect to deliver the shares against payment in New York, New York on , 2014.2015.

| Goldman, Sachs & Co. | J.P. Morgan | Sandler O'Neill + Partners, L.P. |

| BMO Capital Markets | Citigroup | Credit Suisse | Evercore ISI | UBS Investment Bank |

| Academy Securities | CIBC | Rosenblatt Securities |

Prospectus dated , 2014.2015.

We have not, and the underwriters have not, authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give to you. This prospectus is an offer to sell only the shares offered hereby, and only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of the date hereof.

TABLE OF CONTENTS

| | Page | |

|---|---|---|

Prospectus Summary | 1 | |

Risk Factors | ||

Forward-Looking Statements | ||

Organizational Structure | ||

Use of Proceeds | ||

Dividend Policy | ||

Capitalization | ||

Dilution | ||

Unaudited Pro Forma Financial Information | ||

Selected Consolidated Financial Data | ||

Management's Discussion and Analysis of Financial Condition and Results of Operations | ||

Business | ||

Management | ||

Executive Compensation | ||

Principal Stockholders | ||

Certain Relationships and Related Party Transactions | ||

Description of Capital Stock | ||

Shares Available for Future Sale | ||

Material U.S. Federal Tax Considerations | ||

Underwriting | ||

Legal Matters | ||

Experts | ||

Where You Can Find More Information | ||

Index to Consolidated Financial Statements | F-1 |

Through and including , 20142015 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer's obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

Industry and market data used throughout this prospectus were obtained through company research, surveys and studies conducted by third parties and industry and general publications. Certain information contained in "Business" is based on studies, analyses and surveys prepared by the Bank for International Settlements, Bloomberg, BATS Global Markets, Inc., the Futures Industry Association, the Investment Industry Regulatory Organization of Canada and the World Federation of Exchanges. While we are not aware of any misstatements regarding the industry data presented herein, estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading "Risk Factors."

i

This prospectus contains references to our trademarks and service marks and to those belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies' trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

ii

This summary highlights selected information about us and this offering but does not contain all of the information that you should consider before investing in our Class A common stock. Before making an investment decision, you should read this entire prospectus carefully, including the discussion under the heading "Risk Factors" and the consolidated financial statements and related notes thereto contained elsewhere in this prospectus. This prospectus includes forward looking-statements that involve risks and uncertainties. See "Forward-Looking Statements" for more information.

Unless we state otherwise or the context otherwise requires, the terms "we," "us," "our," "Virtu" and the "Company" refer to Virtu Financial, Inc., a Delaware corporation, and its consolidated subsidiaries after giving effect to the reorganization transactions described under " — Corporate History and Organizational Structure" below. Also, unless we state otherwise or the context otherwise requires, all information in this prospectus gives effect to the reorganization transactions described below. "Virtu Financial" refers to Virtu Financial LLC, a Delaware limited liability company and a consolidated subsidiary of ours following the reorganization transactions.

Overview

Virtu is a leading technology-enabled market maker and liquidity provider to the global financial markets. We stand ready, at any time, to buy or sell a broad range of securities and other financial instruments, and we generate revenue by buying and selling large volumes of securities and other financial instruments and earning small amounts of money on individual transactions based on the difference between what buyers are willing to pay and what sellers are willing to accept, which we refer to as "bid/ask spreads.spreads," across a large volume of transactions. We make markets by providing quotations to buyers and sellers in more than 10,00011,000 securities and other financial instruments on more than 210225 unique exchanges, markets and liquidity pools in 3034 countries around the world. We believe that our broad diversification, in combination with our proprietary technology platform and low-cost structure, enables us to facilitate risk transfer between global capital markets participants by supplying liquidity and competitive pricing while at the same time earning attractive margins and returns.

We believe that market makers like us serve an important role in maintaining and improving the overall health and efficiency of the global capital markets by continuously posting bids and offers for securities and other financial instruments and thereby providing to market participants an efficient means to transfer risk. All marketMarket participants benefit from the increased liquidity, lower overall trading costs and enhanced execution certainty that we provide. While in most cases we do not have customers in a traditional sense, we make markets for global banks, brokers and other intermediaries, in addition to retail and institutional investors, including corporations, individuals, hedge funds, mutual funds, pension funds and other investors, all of whom desirecan access our liquidity on exchanges or venues in order to transfer risk in multiple securities and asset classes for their own accounts and/or on behalf of their customers. The following table illustrates our diversification and scale:

Asset Classes | Selected Venues in Which We Make Markets | |

|---|---|---|

North, Central and South America | NYSE, NASDAQ, DirectEdge, NYSE Arca, NYSE MKT, | |

Europe, Middle East and Africa | LSE, Deutsche Boerse, NASDAQ OMX, NYSE Euronext, Eurex, Chi-X, BME, XETRA, NYSE Liffe, Turquoise, Borsa Italiana, SIX Swiss Exchange, Johannesburg Stock Exchange | |

Asia and Pacific ("APAC") Equities | TSE, SGX, OSE, SBI Japannext, TOCOM | |

Global Commodities (including energy, | CME, ICE, TOCOM, SGX, NYSE Liffe, EBS | |

Global Currencies (including futures | CME, ICE, Currenex, EBS, HotSpot, Reuters, FXall, LMAX | |

Options, Fixed Income and | CBOE, PHLX, NYSE Arca Options, eSpeed, BOX, BrokerTec |

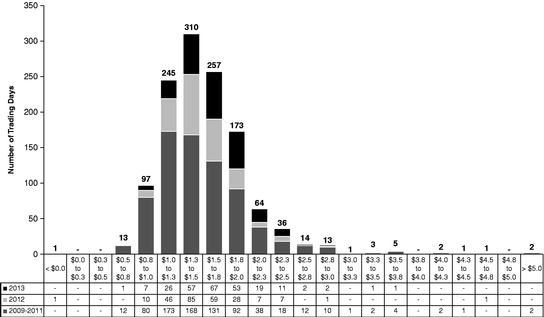

We refer to our market making activities as being "market neutral," which means that we are not dependent on the direction of aany particular market and we do not speculate. Our market making activities are designed to minimize capital at risk at any given time by limiting the notional size of our positions. Our strategies are also designed to lock in returns through precise and nearly instantaneous hedging in the primary instrument or in one or more economically equivalent instruments, as we seek to eliminate the price risk in any positions held. See "Business — Overview" for more information regarding our strategies. Our revenue generation is driven primarily by transaction volume across a broad range of securities and other financial instruments, asset classes and geographies. We avoid the risk of long or short positions in favor of earningseeking to earn small bid/ask spreads on large trading volumes across thousands of securities and other financial instruments. The overall breadth and diversity of our market making activities, together with our real-time risk management strategy and technology, have enabled us to have only one overall losing trading day during a period of 1,485 trading days. While we seek to eliminate the price risk of long or short positions, a significant percentage of our trades are not profitable. For example, for the 252 trading days of 2014, we averaged approximately 5.3 million trades per day globally across all asset classes, and we profitably exited 49% of our overall positions.

We do not engage in the types of principal investing and predictive, momentum and signal trading in which many other broker-dealers and trading firms engage. In fact, in order to minimize the likelihood of unintended activities by our market making strategies, if our risk management system detects a trading strategy generating revenues outside of our preset limits, it will freeze, or "lockdown," that strategy and alert risk management personnel and management. Although this approach may prevent us from maximizing potential returns in times of extreme market volatility, we believe the reduction in risk is an appropriate trade-off that is in keeping with our aim of generating consistently strong revenue from trading.

For the years ended December 31, 20132014 and 2012,2013, our total revenues were approximately $664.5$723.1 million and $615.6$664.5 million, respectively, our trading income, net, was approximately $623.7$685.2 million and $581.5$623.7 million, respectively, our Adjusted Net Trading Income was approximately $414.5$435.0 million and $366.3$414.5 million, respectively, our net income was approximately $182.2$190.1 million and $87.6$182.2 million, respectively, and our Adjusted Net Income was approximately $215.4$226.5 million and $188.3$215.4 million, respectively. For the year ended December 31, 2013,2014, we earned approximately 27%26% of our Adjusted Net Trading Income from Americas equities 11%(of which approximately 20% was attributable to U.S. equities and approximately 6% was attributable to Canadian and Latin American equities), 12% from EMEA equities, 11%7% from APAC equities, 23%21% from global commodities, 20%25% from global currencies and 9%10% from options, fixed income and other securities. For a reconciliation of Adjusted Net Trading Income to trading income, net, and Adjusted Net Income to net income,

see " — Summary Historical and Pro Forma Consolidated Financial and Other Data." Since our inception, we have sought to broadly diversify our market making across securities, asset classes and geographies, and as a result, for the year ended December 31, 2013,2014, we achieved a diverse mix of Adjusted Net Trading Income results, with no one geography or asset class constituting more than 30%26% of our total Adjusted Net Trading Income.

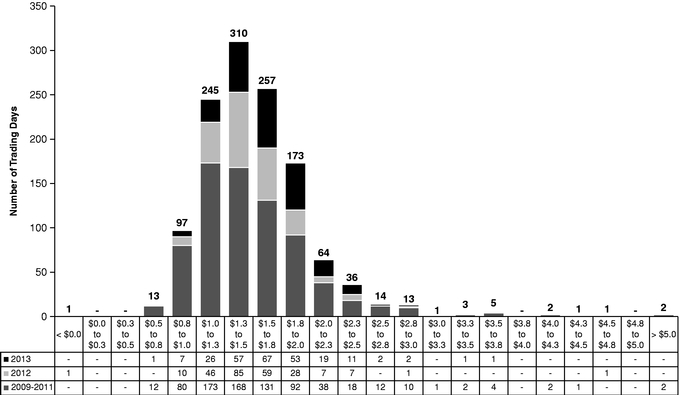

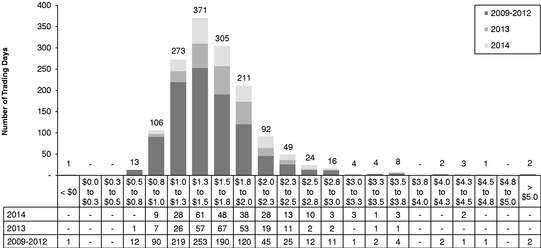

The chart below illustrates our daily Adjusted Net Trading Income from January 1, 2009 through December 31, 2013. As a result of our real-time risk management strategy and technology, we had only one losing trading day during the period depicted, a total of 1,238 trading days.

Daily Adjusted Net Trading Income Distribution*(in millions)

Technology and operational efficiency are at the core of our business, and our focus on market making technology is a key element of our success. We have developed a proprietary, multi-asset, multi-currency technology platform that is highly reliable, scalable and modular, and we integrate directly with exchanges and other liquidity centers. Our market data, order routing, transaction processing, risk management and market surveillance technology modules manage our market making activities in an efficient manner and enable us to scale our market making activities globally and across additional securities and other financial instruments and asset classes without significant incremental costs or third-party licensing or processing fees.

Industry and Market Overview

A "market maker" or "liquidity provider" is commonly defined by stock exchanges, futures exchanges and regulatory authorities around the world as a person or entity who provides continuous, two-sided quotes at multiple price levels at or near the best bid or offer, taking market risk, through a variety of exchanges and markets, which are accessible broadly and continuously for immediate execution. Market makers, like us, serve a critical role in the functioning of all financial markets by providing bids and offers for securities and other financial instruments. Market makers enhance liquidity and execution certainty for all market participants, enabling buyers and sellers to efficiently transfer risk, and are compensated for this service by earning a small amount of money on the bid/ask spread.spread on individual transactions. A market maker's success depends on it posting the best availablecompetitive prices and accurately and efficiently responding to relevant market data in similar and correlated instruments.data.

Historically, market making activities occurred on the physical floor of exchanges, where human traders would execute buy and sell orders for securities. Over the last 20 years, however, the global trading markets have been characterized by the electronification of trading, development of new asset classes, volume growth and improving technology and speed of communication. The advent of electronic trading venues has changed the traditional trading process for many types of securities in the equity, bond and currency markets. The practice of physical, "open outcry" trading has largely been replaced by electronic trading platforms. This shift, and the resulting increase in

automation and speed and reduction in trading costs, has led to significant growth in electronic trading volumes, as implied by growth in the aggregate notional value and number of trades on exchanges around the world.

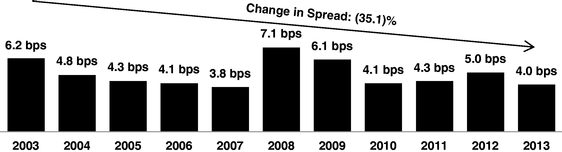

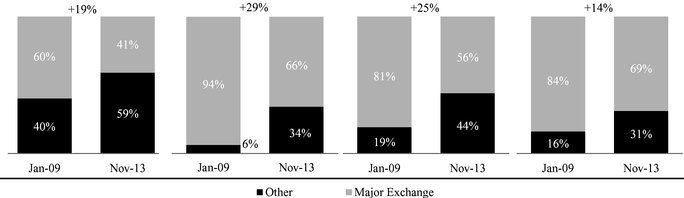

Market structure hasstructures have become increasingly complex.complex and diverse. Although in some geographies and asset classes trading continues to occur through a single exchange, many markets for many asset classes, such as U.S. and European equities, have become increasingly fragmented. While we believe this fragmentation and related competition have been beneficial to all market participants, leading to more compressed bid/ask spreads and creating deeper liquidity, they have also created greater complexity and hashave required electronic market makers to expand their infrastructure to connect with more venues, which wevenues. We believe this trend will enable larger firms with scalable infrastructure, like us, to capture more of these opportunities.

Our Competitive Strengths

Critical Component of an Efficient Market Eco-System. As a leading, low-cost market maker dedicated to providing improved efficiency and liquidity across multiple securities, asset classes and geographies, we aim to provide critical market functionality and robust price competition, leading to reduced trading costs and more efficient pricing in the securities and other financial instruments in which we provide liquidity. This contribution to the financial markets, and the scale and diversity of our market making activities, provides added liquidity and transparency, which

we believe are necessary and valued components to the efficient functioning of market infrastructure and benefit all market participants. We support transparent and efficient, technologically advanced marketplaces and advocate for legislation and regulation that promotes fair and transparent access to markets.

Cutting Edge, Proprietary Technology. Technology is at the core of our business. Our team of software engineers develops all of our core software internally, and we utilize customizedoptimized infrastructure to integrate directly with the exchanges and other trading venues on which we provide liquidity. Wherever possible, we lease co-locationcommercially available rack space atthat is co-located with, or near, and utilize customized network infrastructure to connectin close proximity to, the exchanges and other venues where we provide liquidity. We do not pay any licensing or per-trade processing fees to any third parties, and the engineering cycles for enhancements or new technologies are entirely within our control. Our focus on technology and our ability to leverage our technology enables us to be one of the lowest cost providers of liquidity to the global electronic trading marketplace.

Consistent, Diversified and Growing Revenue Base. We makegenerate revenues by making markets and earning small bid/ask spreads in more than 10,00011,000 listed securities and other financial instruments on more than 210225 unique exchanges, markets and liquidity pools in 3034 countries around the world, and we generate revenue by earning small bid/ask spreads on large trading volumes.world. The reliability and scalability of our technology platform also allow us to capitalize on higher transaction volumes during periods of extraordinary market volatility and are the drivers of our large trading volumes, enablingenable us to constantly diversify our Adjusted Net Trading Income through asset class and geographic expansion and to deliver consistent profitability.expansion. As a result, during the year ended December 31, 2013,2014, no single asset class or geography constituted more than 30%26% of our total Adjusted Net Trading Income. Our diversification, together with our revenue generation strategy of earning small bid/ask spreads on large trading volumes across thousands of securities, enables us to deliver consistent Adjusted Net Trading Income under a wide range of market conditions.

Low Costs and Large Economies of Scale. Our high degree of automation, together with our ability to reduce external costs by internalizing certain trade processing functions, enables us to leverage our low market making costs over large trading volumes. Our market making costs are low due to several factors. As a self-clearing member of the Depository Trust Company ("DTC"), we avoid paying clearing fees to third parties in our U.S. equities market making business. In addition,

because of our significant scale, we are able to obtain favorablecompetitive pricing for trade processing functions and other costs that we do not internalize. Our significant volumes generallyfrequently place us in the toplowest cost tiers of favorable brokerage, clearing and exchange fees for venues that provide tiered pricing structures. Our low-cost structure allows us to maintain a marginal cost per trade that we believe is favorable compared to our competitors. Our scale is further demonstrated by our headcount — as of December 31, 2013,2014, we had only 151148 employees. Our business efficiency is also reflected in our operating margins and our Adjusted EBITDA margins.

Real-Time Risk Management. Our trading is designed to be non-directional, non-speculative and market neutral. Our market making strategies are designed to put minimal capital at risk at any given time by limiting the notional size of our positions. Our strategies are also designed to lock in returns through precise and nearly instantaneous hedging in the primary instrument or in one or more economically equivalent instruments, as we seek to eliminate the price risk in any positions held. Our real-time risk management system is built into our trading platform and is an integral part of our order life-cycle, analyzing real-time pricing data and ensuring that our order activity is conducted within strict pre-determined trading and position limits. If our risk management system detects that a trading strategy is generating revenues outsideor losses in excess of our preset limits, it will lockdown that strategy and alert management. In addition, our risk management system continuously reconciles our internal transaction records against the records of the exchanges and other liquidity centers with which we interact. As a result of our successful real-time risk management strategy, we have had only one losing trading day since January 1, 2008.

Proven and Talented Management Team. Our management team, with an average of more thanapproximately 20 years of industry experience, is led by individuals with diverse backgrounds and deep knowledge and experience in the development and application of technology to the electronic trading industry. Mr. Vincent Viola, our Founder and Executive Chairman, is the former Chairman of the NYMEX and has been a market maker his entire career since leaving active duty in the U.S. Army and joining the NYMEX in 1982. Mr. Viola is widely recognized as an innovator and pioneer in market making and electronic trading over his 30-plus year career. Our Chief Executive Officer, Mr. Douglas A. Cifu, has been with us since our founding in 2008 and previously was a Partner with the international law firm of Paul, Weiss, Rifkind, Wharton & Garrison LLP. Mr. Christopher Concannon, our President andOur Chief OperatingFinancial Officer, Joseph Molluso, has been with us since 2009. Mr. Concannon's experience includes six years as Executive Vice President of NASDAQ OMX Group, where he2013 and previously was responsible for overseeing all of NASDAQ OMX's U.S. exchanges.a Managing Director in the Investment Banking division at J.P. Morgan.

Our Key Growth Strategies

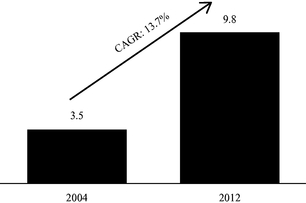

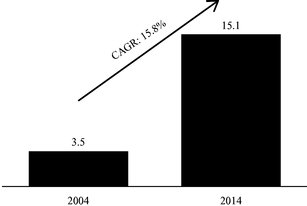

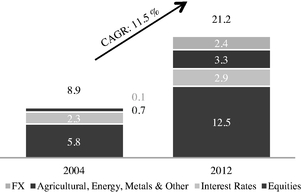

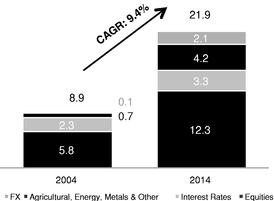

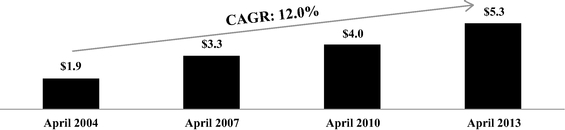

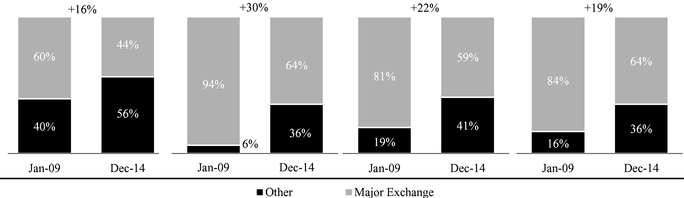

Capitalize on secular growth in electronic trading of global listed securities markets and continue to increase market penetration. We expect that global electronic trading volumes will continue to grow, driven by various factors, including technology, globalization, convergence of exchange and non-exchange markets and the evolving regulatory environment. According to the World Federation of Exchanges, the number of equity shares traded through an electronic order book grew at a compound annual rate of 13.7%15.8% since 2004, from approximately 3.5 billion shares in 2004 to approximately 9.815.1 billion shares in 2012.2014. In addition, according to the Futures Industry Association, trading of futures and options on exchanges has grown at a compound annual rate of 11.5%9.4% since 2004, from 8.9 billion contracts in 2004 to 21.221.9 billion contracts in 2012,2014, and we believe that a significant portion of this growth has come from the electronification of trading. Our ability to offer competitive bid and offer quotes, facilitated by our proprietary, scalable technology platform and our low-cost structure, has enabled us to grow our business and add trading volume at little incremental cost, and ascost. As a result, we expect to be well positioned to capitalize on future growth in the global electronic trading markets, particularly in certain asset classes in which we have lower Adjusted Net Trading Income or are not yet a participant.

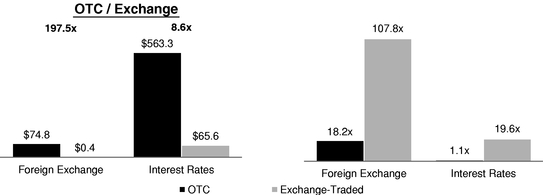

Provide increasing liquidity across a wider range of new securities and other financial instruments. We believe that the full implementation of the European Markets Infrastructure Regulation and the Dodd-Frank Wall Street Reform and Consumer Protection Act (the "Dodd-Frank Act") in the U.S. will increase transparency, liquidity and efficiency in global trading markets and encourage the further development of trading opportunities in certain asset classes in which highly liquid electronic markets remain limited or nonexistent due to historical reliance on bilateral voice trading and other inefficient processes. The migration of these products to electronic tradingmarkets will provide us with an opportunity to deploy our technologymarket making strategies in asset classes that are not accessible to us currently including, for example, interest rate swaps, interest rate swap futures, credit default swap ("CDS") index futures and over-the-counter ("OTC") energy swaps.

Grow geographically. We trade on over 210225 unique exchanges, markets and liquidity pools around the world, located in 3034 countries. We look to expand into new geographies when access is available to us and the applicable regulatory scheme permits us to deploy our strategy. Given the scalability of our platform, we believe we will be able to expand into new geographies and begin generating revenues quickly with little incremental cost. We intend to continue to expand our market making business into new geographic locations, including locations in the EMEA and APAC markets, where we began making markets in 2008 and 2010, respectively. We entered the Japanese, Australian and certain other Asian markets beginning in late 2011, and we expect those markets to be growth areas for us.

Leverage our technology to offer additional technology services to market participants. We believe that our order management, market data, order routing, processing, risk management and market surveillance technology modules offer a key value proposition to market participants

and that sharing our technological capabilities with market participants in a manner that expands electronic trading will create more opportunities for market making as trading volumes increase. Recently,For example, we adapted our existing technology to provide a customized automated trading platform for foreign exchange products to a major financial institution. We believe this platform will increase transparency, liquidity and efficiency for that financial institution and will provide us with a unique opportunity to provide liquidity and market making services directly to other financial institutions as well. In 2014, we also entered into an order routing agreement with a registered broker-dealer in order to assist it in its execution of institutional order flow.

Expand customized liquidity solutions. We also provide liquidity and competitive pricing in foreign currency markets directly to market participants on our own trading platform called "VFX" and through other customized liquidity arrangements. We offered more than 75 different pairs of currency products as of December 31, 2013.2014. We intend to offer this same type of customized liquidity in other asset classes globally.

Pursue strategic partnerships and acquisitions. We intend to selectively consider opportunities to grow through strategic partnerships or acquisitions that enhance our existing capabilities or enable us to enter new markets or provide new products and services. For example, the Madison Tyler Transactions described below created economies of scale with substantial synergy opportunities realized to date and allowed us to enhance our international presence. In addition, with our acquisition of the ETF market making assets of Nyenburgh Holding B.V. ("Nyenburgh") in the third quarter of 2012, we became an OTC market maker in ETFs and currentlyfrom time to time provide two-sided liquidity to over 70a significant number of counterparties throughout Europe.

Recent Developments

The following table presents ranges for our expected total revenues, Adjusted Net Trading Income, Trading income, net, Adjusted EBITDA, net income and Adjusted Net Income for the three months ended March 31, 2015.

| | Three Months Ended March 31, 2015 | Three Months Ended March 31, 2014 | % Change | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (In millions, except percentage) | Low | High | Actual | Low | High | |||||||||||

Unaudited Financial Data | ||||||||||||||||

Total revenues | $ | 210 | $ | 225 | $ | 173 | 21 | % | 30 | % | ||||||

Adjusted Net Trading Income | $ | 140 | $ | 150 | $ | 106 | 32 | % | 42 | % | ||||||

Trading income, net | $ | 205 | $ | 218 | $ | 165 | 24 | % | 32 | % | ||||||

Adjusted EBITDA | $ | 99 | $ | 105 | $ | 71 | 40 | % | 48 | % | ||||||

Net income | $ | 70 | $ | 76 | $ | 49 | 44 | % | 55 | % | ||||||

Adjusted Net Income | $ | 81 | $ | 87 | $ | 56 | 45 | % | 56 | % | ||||||

We expect total revenues for the three months ended March 31, 2015 to be between $210 million and $225 million, representing an increase of between 21% and 30% compared to the same period in 2014.

We anticipate our Adjusted Net Trading Income for the three months ended March 31, 2015 to be between $140 million and $150 million, representing an increase of between 32% and 42% compared to the same period in 2014. The increase in total revenues as well as the increase in Adjusted Net Trading Income was attributable to an increase in volumes and overall volatility in the majority of the markets in which we participate. Trading income, net, is expected to be between $205 million and $218 million, representing an increase of between 24% and 32% compared to the same period in 2014.

We expect our Adjusted EBITDA for the three months ended March 31, 2015 to be between $99 million and $105 million, representing an increase of between 40% and 48% compared to the same period in 2014.

For the three months ended March 31, 2015, our net income is estimated to be between $70 million and $76 million, representing an increase of between 44% and 55% compared to the same period in 2014 and our Adjusted Net Income is estimated to be between $81 million and $87 million, representing an increase of between 45% and 56% compared to the same period in 2014.

The preliminary financial and other data set forth above has been prepared by, and is the responsibility of, our management. The foregoing information and estimates have not been compiled or examined by our independent registered public accounting firm nor have our independent registered public accounting firm performed any procedures with respect to this information or expressed any opinion or any form of assurance on such information. In addition, the foregoing information and estimates are subject to revision as we prepare our consolidated financial statements and other disclosures as of and for the three months ended March 31, 2015, including all disclosures required by U.S. GAAP. Because we have not completed our normal quarterly closing and review procedures for the three months ended March 31, 2015, and subsequent events may occur that require material adjustments to these results, the final results and other disclosures for the three months ended March 31, 2015 may differ materially from these estimates. These estimates should not be viewed as a substitute for full financial statements prepared in accordance with U.S. GAAP or as a measure of performance. In addition, these estimated results of operations for the three months ended March 31, 2015 are not necessarily indicative of the results to be achieved for any future period. See "Special Note Regarding Forward-looking Statements." These estimated results of operations should be read together with "Selected Consolidated Financial Data," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our and Virtu Financial's audited consolidated financial statements and related notes included elsewhere in this prospectus.

Adjusted Net Trading Income, Adjusted EBITDA and Adjusted Net Income are non-GAAP financial measures. For a description of these measures and their limitations, see footnotes 6 and 7 in "—Summary Historical and Pro Forma Consolidated Financial and Other Data."

The following table reconciles trading income, net, to Adjusted Net Trading Income:

| | Three Months Ended March 31, 2015 | Three Months Ended March 31, 2014 | % Change | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (In millions, except percentages) | Low | High | Actual | Low | High | |||||||||||

Unaudited Financial Data | ||||||||||||||||

Trading income, net | $ | 205 | $ | 218 | $ | 165 | 24 | % | 32 | % | ||||||

Interest and dividends income | 5 | 6 | 6 | |||||||||||||

Interest and dividends expense | (10 | ) | (11 | ) | (10 | ) | ||||||||||

Brokerage, exchange, clearance fees | (60 | ) | (63 | ) | (55 | ) | ||||||||||

Adjusted Net Trading Income | $ | 140 | $ | 150 | $ | 106 | 32 | % | 42 | % | ||||||

The following table reconciles net income to EBITDA and Adjusted EBITDA:

| | Three Months Ended March 31, 2015 | Three Months Ended March 31, 2014 | % Change | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (In millions, except percentages) | Low | High | Actual | Low | High | |||||||||||

Unaudited Financial Data | ||||||||||||||||

Net income | $ | 70 | $ | 76 | $ | 49 | 45 | % | 56 | % | ||||||

Financing interest expense on senior secured credit facility | 8 | 8 | 8 | |||||||||||||

Depreciation and amortization | 10 | 10 | 6 | |||||||||||||

Provision for Income Taxes | 2 | 2 | 1 | |||||||||||||

EBITDA | $ | 90 | $ | 96 | $ | 64 | 41 | % | 50 | % | ||||||

Termination of office leases | 3 | 3 | — | |||||||||||||

Acquisition related retention bonus | — | — | 1 | |||||||||||||

Stock-based compensation | 6 | 6 | 6 | |||||||||||||

Adjusted EBITDA | $ | 99 | $ | 105 | $ | 71 | 40 | % | 48 | % | ||||||

The following table reconciles net income to Adjusted Net Income:

| | Three Months Ended March 31, 2015 | Three Months Ended March 31, 2014 | % Change | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (In millions, except percentages) | Low | High | Actual | Low | High | |||||||||||

Unaudited Financial Data | ||||||||||||||||

Net Income | $ | 70 | $ | 76 | $ | 49 | 44 | % | 55 | % | ||||||

Termination of office leases | 3 | 3 | — | |||||||||||||

Equipment write-off | 2 | 2 | — | |||||||||||||

Acquisition related retention bonus | — | — | 1 | |||||||||||||

Stock-based compensation | 6 | 6 | 6 | |||||||||||||

Adjusted Net Income | $ | 81 | $ | 87 | $ | 56 | 45 | % | 56 | % | ||||||

Risks Associated with Our Business

While we have set forth our competitive strengths and our key growth strategies above, we face numerous risks and uncertainties in operating our business, which may negatively impact our competitive strengths, prevent us from implementing our key growth strategies or have a material adverse effect on our business, financial condition or results of operations. Below is a summary of certain risk factors associated with our business that you should consider in evaluating an investment in shares of our Class A common stock.

The above list is not exhaustive. See "Risk Factors" on page 2527 for a more thorough discussion of these and other risks and uncertainties we face.

Corporate History and Organizational Structure

We and our predecessors have been in the electronic trading and market making business for approximately 12 years. We currently conduct our business through Virtu Financial and its subsidiaries. On July 8, 2011, we completed our acquisition of Madison Tyler Holdings, LLC ("Madison Tyler Holdings"), which was co-founded in 2002 by Mr. Vincent Viola, our Founder and Executive Chairman. In connection with the acquisition, Virtu Financial paid approximately $536.5 million in cash and issued membership interests in Virtu Financial to the members of Madison Tyler Holdings and Virtu Financial Operating LLC ("Virtu East"). We refer to the acquisition of Madison Tyler Holdings and the related transactions as the "Madison Tyler Transactions." To finance the Madison Tyler Transactions, (i) an affiliate of Silver Lake Partners invested approximately $250.0 million in Virtu Financial, (ii) an affiliate of Mr. Viola invested approximately $19.6 million in Virtu Financial and (iii) Virtu Financial borrowed approximately $304.4 million, net of fees and expenses, under a term loan facility, as amended to date, which we refer to (as amended to date) as our "senior secured

credit facility." The business that comprises Virtu Financial today is the result of the Madison Tyler Transactions, which combined Virtu East, our historical business, with Madison Tyler Holdings.

On December 31, 2014, through a series of transactions, Temasek Holdings (Private) Limited, whom we refer to as "Temasek," acting through two indirect wholly owned subsidiaries, acquired (i) direct interests in Virtu Financial from affiliates of Silver Lake Partners, Virtu Financial and a member of management (other than Messrs. Viola and Cifu and their affiliates) and (ii) indirect interests in Virtu Financial by acquiring an interest in an affiliate of Silver Lake Partners. For more information, see "Organizational Structure — The Temasek Transaction."

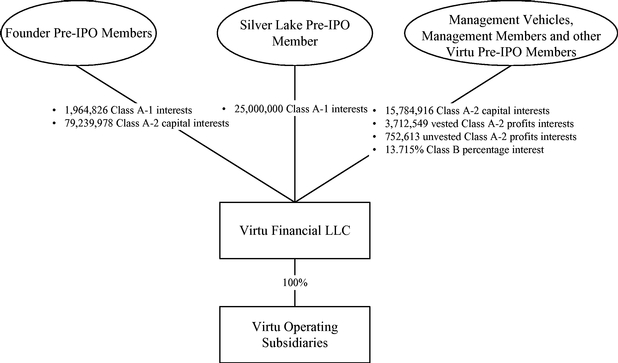

The Reorganization Transactions

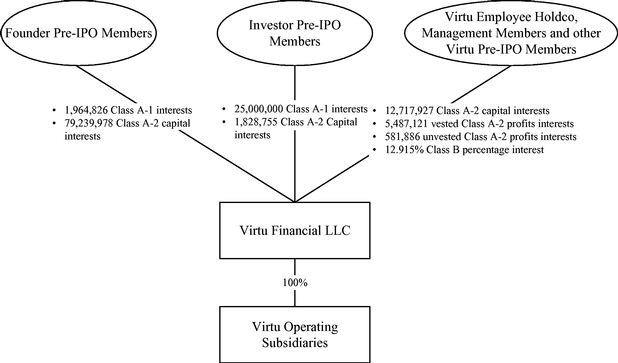

Prior to the consummation of the reorganization transactions described below and this offering, all of Virtu Financial's outstanding equity interests, including its Class A-1 interests, Class A-2 capital interests, Class A-2 profits interests and Class B interests, are owned by the following persons, whom we refer to collectively as the "Virtu Pre-IPO Members":

Prior to the completion of this offering, we intend to commence an internal reorganization, which we refer to as the "reorganization transactions." In connection with the reorganization transactions, the following steps will occur:

Table of ours, and in Contents

exchange we will issue to SLP III EW Feeder I, L.P., anotheran affiliate of Silver Lake Partners, whom we refer to as the "Silver Lake Post-IPO Stockholder," and an affiliate of Temasek, whom we refer to as the "Temasek Post-IPO Stockholder" and whom we refer to together with the Silver Lake Post-IPO Stockholder as the "Investor Post-IPO Stockholders," shares of our Class A common stock and rights to receive payments under a tax receivable agreement

described below. The number of shares of Class A common stock to be issued to the Silver LakeInvestor Post-IPO StockholderStockholders will be based on the value of the Virtu Financial equity interests that we acquire, which will be determined based on a hypothetical liquidation of Virtu Financial and the initial public offering price per share of our Class A common stock in this offering;

Class of Common Stock | Votes | Economic Rights | |||

|---|---|---|---|---|---|

Class A common stock | 1 | Yes | |||

Class B common stock | 10 | Yes | |||

Class C common stock | 1 | No | |||

Class D common stock | 10 | No | |||

Shares of our common stock will generally vote together as a single class on all matters submitted to a vote of our stockholders;

right to exchange their Virtu Financial Units, together with a corresponding number of shares of our Class C common stock, for shares of our Class A common stock. Each share of our Class B common stock and Class D common stock is convertible at any time, at the option of the holder, into one share of Class A common stock or Class C common stock, respectively.

See "Organizational Structure" for further details.

After the completion of this offering, based on an assumed initial public offering price of $$18.00 per share (the midpoint of the estimated public offering price range set forth on the cover page of this prospectus), we intend to use the net proceeds from this offering as follows:

We estimate that the offering expenses (other than the underwriting discounts) will be approximately $10.2 million. All of such offering expenses will be paid for or otherwise borne by Virtu Financial.

See "Use of Proceeds" and "Certain Relationships and Related Party Transactions — Purchases from Equityholders" for further details.

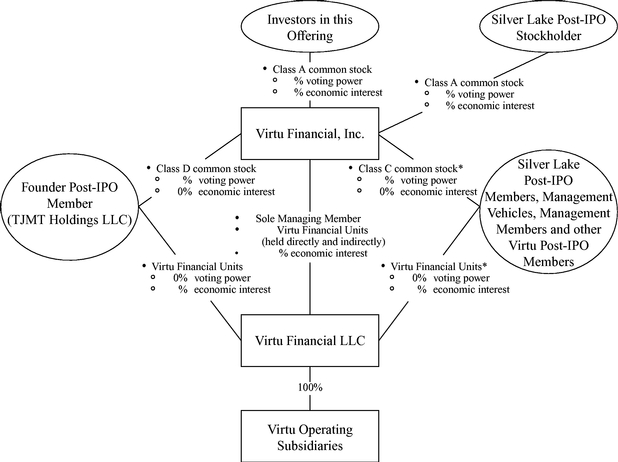

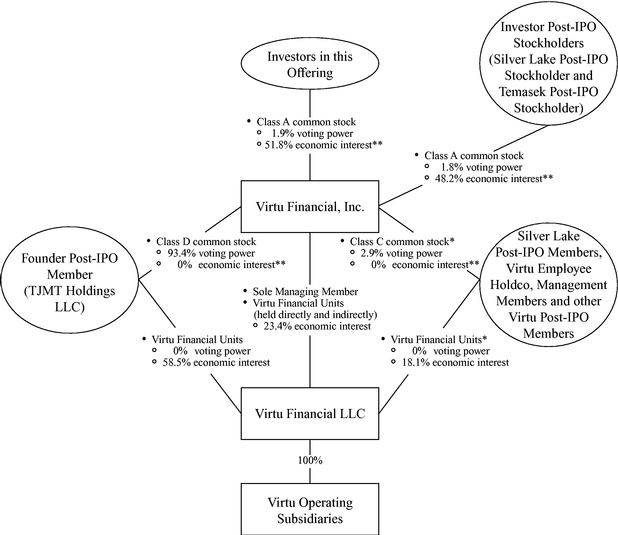

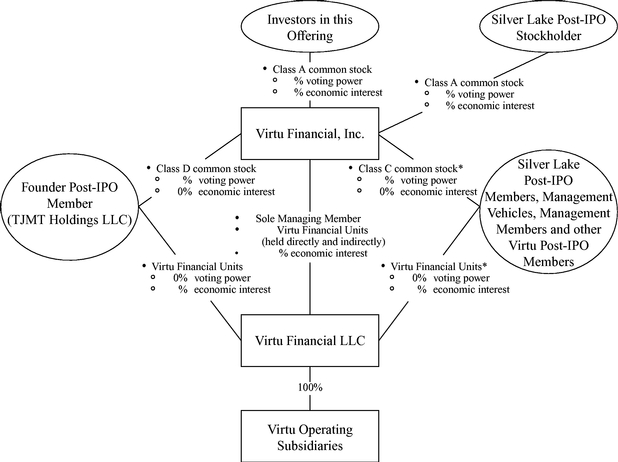

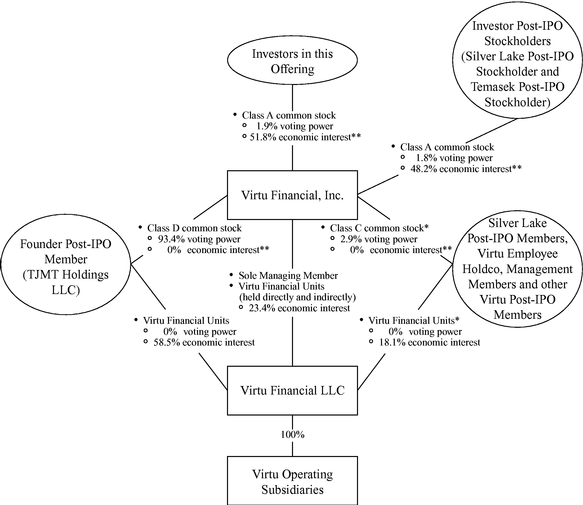

The following diagram depicts our organizational structure following the reorganization transactions, this offering and the application of the net proceeds from this offering, including all of the transactions described above (assuming an initial public offering price of $$18.00 per share (the midpoint of the estimated public offering price range set forth on the cover page of this prospectus) and no exercise of the underwriters' option to purchase additional shares). This chart is provided for illustrative purposes only and does not purport to represent all legal entities within our organization:organizational structure:

In connection with the reorganization transactions, we will be appointed as the sole managing member of Virtu Financial pursuant to Virtu Financial's limited liability company agreement. Because we will manage and operate the business and control the strategic decisions and day-to-day operations of Virtu Financial and will also have a substantial financial interest in Virtu Financial, we will consolidate the financial results of Virtu Financial, and a portion of our net income (loss) will be allocated to the non-controlling interest to reflect the entitlement of the Virtu Post-IPO Members to a portion of Virtu Financial's net income (loss). In addition, because Virtu Financial will be under the common control of Mr. Viola and his affiliates before and after the reorganization transactions, we will account for the reorganization transactions as a reorganization of entities under common control and will initially measure the interests of the Virtu Pre-IPO Members in the assets and

liabilities of Virtu Financial at their carrying amounts as of the date of the completion of this reorganization transactions.

Upon the completion of this offering and the application of the net proceeds from this offering, based on an assumed initial public offering price of $$18.00 per share (the midpoint of the estimated public offering price range set forth on the cover page of this prospectus) and assuming no exercise of the underwriters' option to purchase additional shares, we will hold approximately

%23.4% of the outstanding Virtu Financial Units, the Virtu Post-IPO Members will hold approximately %76.6% of the outstanding Virtu Financial Units and approximately %96.3% of the combined voting power of our outstanding common stock, the Silver LakeInvestor Post-IPO StockholderStockholders will indirectly own (through us) a % equity interest in Virtu Financial and hold approximately %1.8% of the combined voting power of our common stock and the investors in this offering will indirectly own (through us) a % equity interest in Virtu Financial and hold approximately %1.9% of the combined voting power of our common stock. See "Organizational Structure," "Certain Relationships and Related Party Transactions" and "Description of Capital Stock" for more information on the rights associated with our capital stock and the Virtu Financial Units.

In connection with the reorganization transactions, we will acquire existing equity interests in Virtu Financial from an affiliate of Silver Lake Partners.Partners and Temasek, and the Temasek Pre-IPO Member in the Mergers described under "Organizational Structure — The Reorganization Transactions." In addition, as described above, we intend to use a portion of the net proceeds from this offering to repurchase (i) Class A common stock from the Silver Lake Post-IPO Stockholder and (ii)purchase Virtu Financial Units and corresponding shares of Class C common stock from certain Virtu Post-IPO Members, including the Silver Lake Post-IPO Members and certain members of management.employees. These acquisitions of interests in Virtu Financial will result in tax basis adjustments to the assets of Virtu Financial that will be allocated to us and our subsidiaries. In addition, future exchanges by the Virtu Post-IPO Members of Virtu Financial Units and corresponding shares of Class C common stock or Class D common stock, as the case may be, for shares of our Class A common stock or Class B common stock, respectively, are expected to produce favorable tax attributes. These tax attributes would not be available to us in the absence of those transactions. In connection with the reorganization transactions, we will enter into tax receivable agreements that will obligate us to make payments to the Virtu Post-IPO Members and the Silver LakeInvestor Post-IPO StockholderStockholders generally equal to 85% of the applicable cash savings that we actually realize as a result of these tax attributes and tax attributes resulting from payments made under the tax receivable agreement. We will retain the benefit of the remaining 15% of these tax savings. See "Organizational Structure — Holding Company Structure and Tax Receivable Agreements" and "Certain Relationships and Related Party Transactions — Tax Receivable Agreements."

New Revolving Credit Facility

We have obtained commitments from a syndicate of lenders, subject to customary conditions in addition to the consummation of this offering, to fundprovide us with a new $100 million revolving credit facility in the proceedsamount of which will be available$100 million for general corporate purposes. This new revolving credit facility, which we refer to as the "new revolving credit facility," will be implemented pursuant to an amendment to our senior secured credit facility, will be secured on a pari passu basis with the existing term loan under our senior secured credit facility and will be subject to the same financial covenants and negative covenants. Although we have obtained commitments for the new revolving credit facility, the commitments are subject to conditions and there can be no assurance that we will successfully enter into the new revolving credit facility. See "Management's Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources — Credit Facilities."

Our Principal Equityholders

Following the reorganization transactions and this offering, the Founder Post-IPO Member will control approximately %93.4% of the combined voting power of our outstanding common stock (or %93.2% if the underwriters exercise their option to purchase additional shares in full) based on an

assumed initial public offering price of $$18.00 per share (the midpoint of the estimated public offering price range set forth on the cover page of this prospectus). As a result, the Founder Post-IPO Member will control any action requiring the general approval of our stockholders, including the election of our board of directors, the adoption of amendments to our certificate of

incorporation and by-laws and the approval of any merger or sale of substantially all of our assets. Because the Founder Post-IPO Member will hold more than 50% of the combined voting power of our outstanding common stock, we will be a "controlled company" under the corporate governance rules for NASDAQ-listed companies. Therefore we will be permitted to, and we intend to, elect not to comply with certain NASDAQ corporate governance requirements. See "Management — Controlled Company."

In addition, we will enter into a stockholders agreement that will provide affiliates of Silver Lake Partners with the right to nominate one Class III director for election to our board of directors so long as affiliates of Silver Lake Partners continue to own at least 30% of the Class A common stock held by affiliates of Silver Lake Partners immediately prior to this offering (calculated assuming that all of their Virtu Financial Units and corresponding shares of Class C common stock are exchanged for Class A common stock). Mr. Viola and the Founder Post-IPO Member will agree to take all necessary action, including voting their respective shares of common stock, to cause the election of the nominee. See "Principal Stockholders" and "Certain Relationships and Related Party Transactions — Stockholders Agreement" for additional information. We refer to affiliates of Silver Lake Partners that own equity interests in our Company from time to time as the "Silver Lake Equityholders."

The Founder Post-IPO Member is controlled by family members of Mr. Viola, our Founder and Executive Chairman. Mr. Viola has successfully led our Company since our inception and is one of the nation's foremost leaders in electronic trading. He was the founder of Virtu East in 2008, a founder of Madison Tyler Holdings in 2002 and the former Chairman of the New York Mercantile Exchange ("NYMEX"). None of the Founder Pre-IPO Members, the Founder Post-IPO Member, nor Mr. Viola or any of his family members intends to sell any equity interests in the Company in connection with the reorganization transactions or this offering.

Silver Lake is a global investment firm focused on the technology, technology-enabled and related growth industries with offices in Silicon Valley,Menlo Park, New York, London, Hong Kong, Shanghai and Tokyo. Silver Lake was founded in 1999 and has over $20$23 billion in combined assets under management and committed capital across its large-cap private equity, middle-market private equity, growth equity and credit investment strategies.

Incorporated in 1974, Temasek is an investment company based in Singapore, with a S$223 billion (US$177 billion) portfolio as of March 31, 2014. Temasek's portfolio encompasses companies across a broad spectrum of sectors, financial services; transportation, logistics and industrials; telecommunications, media and technology; life sciences, consumer and real estate; and energy and resources. In addition to Singapore, Temasek has offices in 10 other cities around the world, including Beijing, Shanghai, Mumbai, São Paulo, Mexico City, London and New York. We refer to Temasek entities that own equity interests in our Company prior to this offering, namely Wilbur Investments LLC and Havelock Fund Investments Pte Ltd., as the "Temasek Equityholders."

Corporate Information

We were formed as a Delaware corporation on October 16, 2013. We are a newly formed corporation, have no material assets and have not engaged in any business or other activities except in connection with the reorganization transactions described under "Organizational Structure." Our corporate headquarters are located at 645 Madison900 Third Avenue, New York, New York 10022, and our telephone number is (212) 418-0100. Our website address iswww.virtu.com. Information contained on our website does not constitute a part of this prospectus.

| Class A common stock outstanding before this offering | 18,837,464 shares. | |

Class A common stock offered by us | 16,532,272 shares. | |

Option to purchase additional shares | We have granted the underwriters the right to purchase an additional 2,479,840 shares of Class A common stock from us within 30 days from the date of this prospectus. | |

Class A common stock to be outstanding immediately after this offering | 31,899,012 shares | |

Class B common stock to be outstanding immediately after this offering | None. |

Class C common stock to be outstanding immediately after this offering | 24,708,063 shares (or 24,152,507 shares if the underwriters exercise their option to purchase additional shares in |

Class D common stock to be outstanding immediately after this offering | 79,902,009 shares based on an assumed initial public offering price of | |

Voting rights | Each share of our Class A common stock entitles its holder to one vote per share, representing an aggregate of | |

Each share of our Class B common stock entitles its holder to 10 votes per share. Because no shares of Class B common stock will be issued and outstanding upon the completion of this offering and the application of the net proceeds from this offering, our Class B common stock will initially represent none of the combined voting power of our issued and outstanding common stock. | ||

Each share of our Class C common stock entitles its holder to one vote per share, representing an aggregate of |

Each share of our Class D common stock entitles its holder to 10 votes per share, representing an aggregate of | ||

All classes of our common stock generally vote together as a single class on all matters submitted to a vote of our stockholders. Upon the completion of this offering, our Class D common stock will be held exclusively by the Founder Post-IPO Member and our Class C common stock will be held by the Virtu Post-IPO Members other than the Founder Post-IPO Member. See "Description of Capital Stock." |

| Exchange/conversion | Virtu Financial Units held by the Founder Post-IPO Member, together with a corresponding number of shares of our Class D common stock, may be exchanged for shares of our Class B common stock on a one-for-one basis. | |

Virtu Financial Units held by the Virtu Post-IPO Members other than the Founder Post-IPO Member, together with a corresponding number of shares of our Class C common stock, may be exchanged for shares of our Class A common stock on a one-for-one basis. | ||

Each share of our Class B common stock and Class D common stock is convertible at any time, at the option of the holder, into one share of Class A common stock or Class C common stock, respectively. | ||

Each share of our Class B common stock will automatically convert into one share of Class A common stock and each share of our Class D common stock will automatically convert into one share of our Class C common stock (a) immediately prior to any sale or other transfer of such share by | ||

Use of proceeds | We estimate that our net proceeds from this offering will be approximately | |

• we intend to contribute $23.3 million of the net proceeds from this offering to Virtu Financial (or $55.5 million if the underwriters exercise their option to purchase additional shares in full) in exchange for a number of Virtu Financial Units equal to the contribution amount divided by the price paid by the underwriters for shares of our Class A common stock in this offering (1,388,889 Virtu Financial Units at the midpoint of the estimated public offering price range set forth on the cover page of this prospectus or, if the underwriters exercise their option to purchase additional shares in full, 3,313,174 Virtu Financial Units), and such contribution amount will be used by Virtu Financial for working capital and general corporate purposes, which may include financing growth; and |

• we intend to | ||

| ||

Virtu Financial will contribute such net proceeds to its subsidiaries. We have broad discretion as to the application of such net proceeds to be used for working capital and general corporate purposes. We may use such net proceeds to finance growth through the acquisition of, or investment in, businesses, products, services or technologies that are complementary to our current business, through mergers, acquisitions or other strategic transactions. | ||

We estimate that the offering expenses (other than the underwriting discounts) will be approximately $10.2 million. All of such offering expenses will be paid for or otherwise borne by Virtu Financial. | ||

See "Use of Proceeds" and "Certain Relationships and Related Party Transactions — Purchases from Equityholders" for further details. |

| Dividend policy | Commencing with the fiscal quarter ending | |

Because we will be a holding company and our principal asset after the consummation of this offering will be our direct and indirect equity interests in Virtu Financial, we will fund dividends by causing Virtu Financial to make distributions to its equityholders, including the Founder Post-IPO Member, the Silver Lake Post-IPO Members, |

| Following the consummation of this offering, before any other distributions are made to us and the Virtu Post-IPO Members by Virtu Financial, Virtu Financial will distribute to certain Virtu Pre-IPO Members as of | ||

See "Dividend Policy." | ||

Proposed NASDAQ symbol | "VIRT." | |

Risk factors | You should read the "Risk Factors" section of this prospectus for a discussion of factors that you should consider carefully before deciding to invest in shares of our Class A common stock. |

Unless we indicate otherwise throughout this prospectus, the number of shares of our Class A common stock and Class B common stock outstanding after this offering excludes:

Incentive Plan following the completion of this offering. See "Executive Compensation—2014Compensation — 2015 Management Incentive Plan";

Unless we indicate otherwise, all information in this prospectus assumes (i) that the underwriters do not exercise their option to purchase up to 2,479,840 additional shares from us and (ii) an initial public offering price of $$18.00 per share (the midpoint of the estimated public offering price range set forth on the cover page of this prospectus).

Summary Historical and Pro Forma Consolidated Financial and Other Data

The following tables set forth summary historical consolidated financial and other data of Virtu Financial for the periods presented. We were formed as a Delaware corporation on October 16, 2013 and have not, to date, conducted any activities other than those incident to our formation and the preparation of this prospectus and the registration statement of which this prospectus forms a part.

The consolidated statements of comprehensive income data for the years ended December 31, 2014, 2013 2012 and 20112012 and statements of financial condition data as of December 31, 20132014 and 20122013 have been derived from Virtu Financial's audited financial statements included elsewhere in this prospectus.

The pro forma consolidated statements of comprehensive income for the year ended December 31, 20132014 give effect to (i) the reorganization transactions described under "Organizational Structure" and (ii) the creation or acquisition of certain tax assets in connection with this offering and the reorganization transactions and the creation of related liabilities in connection with entering into the tax receivable agreements with the Virtu Post-IPO Members and the Silver LakeInvestor Post-IPO Stockholder,Stockholders, as if each had occurred on January 1, 2012.2014. The pro forma consolidated statement of financial condition data as of December 31, 20132014 give effect to (i) the reorganization transactions described under "Organizational Structure," (ii) the creation or acquisition of certain tax assets in connection with this offering and the reorganization transactions and the creation of related liabilities in connection with entering into the tax receivable agreements with the Virtu Post-IPO Members and the Silver LakeInvestor Post-IPO Stockholder,Stockholders, (iii) this offering and the application of the net proceeds from this offering and (iv) a one-time distributioncash distributions by Virtu Financial to occurthe Virtu Pre-IPO Members in an aggregate amount of $50.0 million in January 2015, $20.0 million in February 2015 and $10.0 million in March 2015 and anticipated cash distributions by Virtu Financial to the Virtu Pre-IPO Members in an aggregate amount of $50.0 million prior to the consummation of this offering and $50.0 million following the consummation of this offering, described under "Dividend Policy," as if each had occurred on December 31, 2013.2014. We expect that the anticipated cash distributions to the pre-IPO equityholders following the consummation of this offering will be funded from cash on hand and excess cash held at clearing deposits from broker-dealers and clearing organizations. See "Unaudited Pro Forma Financial Information."

The summary historical and pro forma consolidated financial and other data presented below do not purport to be indicative of the results that can be expected for any future period and should be read together with "Capitalization," "Unaudited Pro Forma Financial Information," "Selected Consolidated Financial Data," "Management's Discussion and Analysis of Financial Condition and

Results of Operations" and our and Virtu Financial's audited consolidated financial statements and related notes thereto included elsewhere in this prospectus.

| | | Years Ended Dec. 31, | | Years Ended Dec. 31, | ||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Pro Forma Year Ended Dec. 31, 2013 | Pro Forma Year Ended Dec. 31, 2014 | ||||||||||||||||||||||||

(In thousands) | 2013 | 2012 | 2011 | 2014 | 2013 | 2012 | ||||||||||||||||||||

Consolidated Statements of Comprehensive Income Data(1): | ||||||||||||||||||||||||||

Consolidated Statements of Comprehensive Income Data: | ||||||||||||||||||||||||||

Revenues | ||||||||||||||||||||||||||

Trading income, net | $ | $ | 623,733 | $ | 581,476 | $ | 449,360 | $ | 685,150 | $ | 685,150 | $ | 623,733 | $ | 581,476 | |||||||||||

Interest and dividends income | 31,090 | 34,152 | 11,851 | 27,923 | 27,923 | 31,090 | 34,152 | |||||||||||||||||||

Technology services | 9,682 | — | — | 9,980 | 9,980 | 9,682 | — | |||||||||||||||||||

Total revenues | 664,505 | 615,628 | 461,211 | 723,053 | 723,053 | 664,505 | 615,628 | |||||||||||||||||||

Operating Expenses | ||||||||||||||||||||||||||

Brokerage, exchange and clearance fees, net | 195,146 | 200,587 | 148,020 | 230,965 | 230,965 | 195,146 | 200,587 | |||||||||||||||||||

Communication and data processing | 64,689 | 55,384 | 46,109 | 68,847 | 68,847 | 64,689 | 55,384 | |||||||||||||||||||

Employee compensation and payroll taxes | 78,353 | 63,836 | 46,344 | 103,036 | 84,531 | 78,353 | 63,836 | |||||||||||||||||||

Interest and dividends expense | 45,196 | 48,735 | 24,093 | 47,083 | 47,083 | 45,196 | 48,735 | |||||||||||||||||||

Operations and administrative | 27,215 | 27,826 | 7,986 | 21,923 | 21,923 | 27,215 | 27,826 | |||||||||||||||||||

Depreciation and amortization | 23,922 | 17,975 | 12,074 | 30,441 | 30,441 | 23,922 | 17,975 | |||||||||||||||||||

Amortization of purchased intangibles and acquired capitalized software | 1,011 | 71,654 | 37,820 | 211 | 211 | 1,011 | 71,654 | |||||||||||||||||||

Acquisition cost | — | 69 | 18,843 | — | — | — | 69 | |||||||||||||||||||

Acquisition related retention bonus | 6,705 | 6,151 | 4,325 | 2,639 | 2,639 | 6,705 | 6,151 | |||||||||||||||||||

Impairment of intangible assets | — | 1,489 | — | — | — | — | 1,489 | |||||||||||||||||||

Lease abandonment | — | 6,134 | — | — | — | — | 6,134 | |||||||||||||||||||

Debt issue cost related to debt refinancing(2) | 10,022 | — | — | — | — | 10,022 | — | |||||||||||||||||||

Initial public offering fees and expenses(3) | 8,961 | 8,961 | — | — | ||||||||||||||||||||||

Transaction advisory fees and expenses(4) | 3,000 | 3,000 | — | — | ||||||||||||||||||||||

Financing interest expense on senior secured credit facility | 24,646 | 26,460 | 14,608 | 28,322 | 30,894 | 24,646 | 26,460 | |||||||||||||||||||

Total operating expenses | 476,905 | 526,300 | 360,222 | 545,428 | 529,495 | 476,905 | 526,300 | |||||||||||||||||||

Income before income taxes | 187,600 | 89,328 | 100,989 | 177,625 | 193,558 | 187,600 | 89,328 | |||||||||||||||||||

Provision for income taxes | (5,397 | ) | (1,768 | ) | (11,697 | ) | 18,256 | 3,501 | 5,397 | 1,768 | ||||||||||||||||

Net income | $ | $ | 182,203 | $ | 87,560 | $ | 89,292 | $ | 159,369 | $ | 190,057 | $ | 182,203 | $ | 87,560 | |||||||||||

Net income attributable to non-controlling interest | — | — | — | (133,379 | ) | — | — | — | ||||||||||||||||||

Net income attributable to Virtu Financial, Inc. | — | — | — | 25,990 | — | — | — | |||||||||||||||||||

Basic and diluted earnings per share to Class A common stockholders: | ||||||||||||||||||||||||||

Basic | — | — | — | $ | 0.81 | — | — | — | ||||||||||||||||||

Diluted | — | — | — | $ | 0.81 | — | — | — | ||||||||||||||||||

Weighted average number of shares used in computing earnings per share: | ||||||||||||||||||||||||||

Basic | — | — | — | 31,899,012 | — | — | — | |||||||||||||||||||

Diluted | — | — | — | 31,899,012 | — | — | — | |||||||||||||||||||

Other Comprehensive Income, net of taxes | ||||||||||||||||||||||||||

Foreign exchange translation adjustment | 1,382 | 548 | (488 | ) | ||||||||||||||||||||||

Comprehensive income | $ | $ | 183,585 | $ | 88,108 | $ | 88,804 | |||||||||||||||||||

| | Pro Forma as of Dec. 31, 2013 | As of Dec. 31, | Pro Forma as of Dec. 31, 2014 | As of Dec. 31, | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

(In thousands) | 2013 | 2012 | 2014 | 2013 | ||||||||||||||||

Consolidated Statements of Financial Condition Data: | ||||||||||||||||||||

Cash and cash equivalents | $ | $ | 66,010 | $ | 39,978 | $ | 29,114 | $ | 75,864 | $ | 66,010 | |||||||||

Total assets | 3,963,570 | 3,208,947 | 3,309,887 | 3,324,561 | 3,963,570 | |||||||||||||||

Senior secured credit facility | 507,725 | 256,309 | 500,827 | 500,827 | 507,725 | |||||||||||||||

Total liabilities | 3,510,282 | 2,518,712 | 2,993,531 | 2,817,863 | 3,510,282 | |||||||||||||||

Class A-1 redeemable membership interest(3) | — | 250,000 | 250,000 | |||||||||||||||||

Class A-1 redeemable interest(4) | — | 294,433 | 250,000 | |||||||||||||||||

Total members'/stockholders' equity | 203,288 | 440,235 | 55,975 | 212,265 | 203,288 | |||||||||||||||

| | | Years Ended Dec. 31, | | Years Ended Dec. 31, | ||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Pro Forma Year Ended Dec. 31, 2013 | Pro Forma Year Ended Dec. 31, 2014 | ||||||||||||||||||||||||

(In thousands) | 2013 | 2012 | 2011 | 2014 | 2013 | 2012 | ||||||||||||||||||||

Unaudited Financial Data: | ||||||||||||||||||||||||||

Adjusted Net Income | $ | $ | 215,372 | $ | 188,305 | $ | 157,700 | $ | 214,353 | $ | 226,536 | $ | 215,372 | $ | 188,305 | |||||||||||

EBITDA | 247,201 | 205,417 | 165,491 | 236,599 | 255,104 | 247,201 | 205,417 | |||||||||||||||||||

Adjusted EBITDA | 269,337 | 234,508 | 196,079 | 291,372 | 291,372 | 269,337 | 234,508 | |||||||||||||||||||

Adjusted Net Trading Income | 414,481 | 366,306 | 289,098 | 435,025 | 435,025 | 414,481 | 366,306 | |||||||||||||||||||

Operating margin | 52 | % | 51 | % | 55 | % | 49 | % | 52 | % | 52 | % | 51 | % | ||||||||||||

Adjusted EBITDA margin | 65 | % | 64 | % | 68 | % | 67 | % | 67 | % | 65 | % | 64 | % | ||||||||||||

net income in accordance with U.S. GAAP as a measure of performance. Our presentation of Adjusted Net Income, EBITDA and Adjusted EBITDA should not be construed as an indication that our future results will be unaffected by unusual or nonrecurring items. Adjusted Net Income and our EBITDA-based measures have limitations as analytical tools, and you should not consider them in isolation or as substitutes for analysis of our results as reported under U.S. GAAP. Some of these limitations are:

The following table reconciles net income to Adjusted Net Income:

| | | Years Ended Dec. 31, | | Years Ended Dec. 31, | ||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Pro Forma Year Ended Dec. 31, 2013 | Pro Forma Year Ended Dec. 31, 2014 | ||||||||||||||||||||||||

(In thousands) | 2013 | 2012 | 2011 | 2014 | 2013 | 2012 | ||||||||||||||||||||

Net income | $ | $ | 182,203 | $ | 87,560 | $ | 89,292 | $ | 159,369 | $ | 190,057 | $ | 182,203 | $ | 87,560 | |||||||||||

Amortization of purchased intangibles and acquired capitalized software | 1,011 | 71,654 | 37,820 | 211 | 211 | 1,011 | 71,654 | |||||||||||||||||||

Debt issue cost related to debt refinancing | 10,022 | — | — | — | — | 10,022 | — | |||||||||||||||||||

Impairment of intangible assets | — | 1,489 | — | — | — | — | 1,489 | |||||||||||||||||||

Lease abandonment | — | 6,134 | — | — | — | — | 6,134 | |||||||||||||||||||

Acquisition cost | — | 69 | 18,843 | — | — | — | 69 | |||||||||||||||||||

Terminated transaction fees and expenses(a) | — | 4,727 | — | — | — | — | 4,727 | |||||||||||||||||||

Severance(b) | 1,990 | 2,123 | — | |||||||||||||||||||||||

Initial public offering fees and expenses | 8,961 | 8,961 | — | — | ||||||||||||||||||||||

Transaction advisory fees and expenses | 3,000 | 3,000 | — | — | ||||||||||||||||||||||

Expenses associated with termination of London leases(b) | 849 | 849 | — | — | ||||||||||||||||||||||

Severance(c) | 4,786 | 4,786 | 1,990 | 2,123 | ||||||||||||||||||||||

Acquisition related retention bonus | 6,705 | 6,151 | 4,325 | 2,639 | 2,639 | 6,705 | 6,151 | |||||||||||||||||||

Stock-based compensation | 13,441 | 8,398 | 7,420 | 34,538 | 16,033 | 13,441 | 8,398 | |||||||||||||||||||

Adjusted Net Income | $ | $ | 215,372 | $ | 188,305 | $ | 157,700 | $ | 214,353 | $ | 226,536 | $ | 215,372 | $ | 188,305 | |||||||||||

| | | Years Ended Dec. 31, | | Years Ended Dec. 31, | ||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Pro Forma Year Ended Dec. 31, 2013 | Pro Forma Year Ended Dec. 31, 2014 | ||||||||||||||||||||||||

(In thousands) | 2013 | 2012 | 2011 | 2014 | 2013 | 2012 | ||||||||||||||||||||

Net income | $ | $ | 182,203 | $ | 87,560 | $ | 89,292 | $ | 159,369 | $ | 190,057 | $ | 182,203 | $ | 87,560 | |||||||||||

Financing interest expense on senior secured credit facility | 24,646 | 26,460 | 14,608 | 28,322 | 30,894 | 24,646 | 26,460 | |||||||||||||||||||

Debt issue cost related to debt refinancing | 10,022 | — | — | — | — | 10,022 | — | |||||||||||||||||||

Depreciation and amortization | 23,922 | 17,975 | 12,074 | 30,441 | 30,441 | 23,922 | 17,975 | |||||||||||||||||||

Amortization of purchased intangibles and acquired capitalized software | 1,011 | 71,654 | 37,820 | 211 | 211 | 1,011 | 71,654 | |||||||||||||||||||

Income tax expense | 5,397 | 1,768 | 11,697 | 18,256 | 3,501 | 5,397 | 1,768 | |||||||||||||||||||

EBITDA | $ | $ | 247,201 | $ | 205,417 | $ | 165,491 | $ | 236,599 | $ | 255,104 | $ | 247,201 | $ | 205,417 | |||||||||||

Impairment of intangible assets | — | 1,489 | — | — | — | — | 1,489 | |||||||||||||||||||

Lease abandonment | — | 6,134 | — | — | — | — | 6,134 | |||||||||||||||||||

Acquisition cost | — | 69 | 18,843 | — | — | — | 69 | |||||||||||||||||||

Terminated transaction fees and expenses(a) | — | 4,727 | — | — | — | — | 4,727 | |||||||||||||||||||

Severance(b) | 1,990 | 2,123 | — | |||||||||||||||||||||||

Initial public offering fees and expenses | 8,961 | 8,961 | — | — | ||||||||||||||||||||||

Transaction advisory fees and expenses | 3,000 | 3,000 | — | — | ||||||||||||||||||||||

Expenses associated with termination of London leases(b) | 849 | 849 | — | — | ||||||||||||||||||||||