Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO FINANCIAL STATEMENTS

Filed with the Securities and Exchange Commission on March 31,April 4, 2014.

Registration Statement No. 333- 333-194919

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Ares Management, L.P.

(Exact name of registrant as specified in its charter)

| Delaware | 6282 | 80-0962035 | ||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

2000 Avenue of the Stars

12th Floor

Los Angeles, California 90067

(310) 201-4100

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Michael D. Weiner

c/o Ares Management, L.P.

2000 Avenue of the Stars

12th Floor

Los Angeles, California 90067

(310) 201-4100

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies of all communications to: | ||||

Michael A. Woronoff Philippa M. Bond Proskauer Rose LLP 2049 Century Park East, Suite 3200 Los Angeles, California 90067 (310) 557-2900/(310) 557-2193 (Facsimile) | Joshua Ford Bonnie Simpson Thacher & Bartlett LLP 425 Lexington Avenue New York, New York 10017-3954 Telephone: (212) 455-2000 Facsimile: (212) 455-2502 | Kirk A. Davenport II Cynthia A. Rotell Latham & Watkins LLP 355 South Grand Avenue Los Angeles, California 90071 (213) 485-1234/(213) 891-8763 (Facsimile) | ||

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) | Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price(1)(2) | Amount of Registration Fee | ||

|---|---|---|---|---|

| Common Units Representing Limited Partner Interests | $100,000,000 | $12,880 | ||

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated March 31,April 4, 2014

PROSPECTUS

Common Units

Representing Limited Partner Interests

Ares Management, L.P.

This is Ares Management, L.P.'s initial public offering. We are selling common units, representing limited partner interests in Ares Management, L.P. The selling unitholder identified in this prospectus is offering an additional common units. We will not receive any of the proceeds from the sale of common units by the selling unitholder.

We expect the public offering price of our common units to be between $ and $ per common unit. Currently, no public market exists for our common units. We intend to apply for our common units to be listed on the New York Stock Exchange under the symbol "ARES."

We are managed by our general partner, which is wholly owned by Ares Partners Holdco LLC, an entity owned and controlled by our Co-Founders. Our common unitholders will have limited voting rights and will have no right to remove our general partner or, except in limited circumstances, elect the directors of our general partner. Moreover, immediately following this offering, our Co-Founders will have sufficient voting power to determine the outcome of those few matters that may be submitted for a vote of our limited partners. In addition, our partnership agreement limits the liability of, and reduces or eliminates the duties (including fiduciary duties) owed by, our general partner to our common unitholders and restricts the remedies available to our common unitholders for actions that might otherwise constitute breaches of our general partner's duties. Moreover, there are certain conflicts of interest inherent in our structure between our Co-Founders on behalf of our general partner respecting our common unitholders and on behalf of our funds respecting investors in our funds.

Investing in our common units involves risks that are described in the section entitled "Risk Factors" beginning on page 25 of this prospectus. These risks include:

| | Per Common Unit | Total | ||

|---|---|---|---|---|

Initial public offering price | $ | $ | ||

Underwriting discount | $ | $ | ||

Proceeds, before expenses, to us | $ | $ | ||

Proceeds, before expenses, to selling unitholder | $ | $ | ||

| ||||

The underwriters may also exercise their option to purchase up to an additional common units from us, at the initial public offering price, less underwriting discounts, for 30 days after the date of this prospectus to cover overallotments, if any.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The common units will be ready for delivery on or about , 2014.

| J.P. Morgan | BofA Merrill Lynch | |||

Goldman, Sachs & Co. | Morgan Stanley | Wells Fargo Securities |

| Barclays | Citigroup | Credit Suisse |

| Deutsche Bank Securities | RBC Capital Markets | UBS Investment Bank |

| BMO Capital Markets | SunTrust Robinson Humphrey |

The date of this prospectus is , 2014.

| Capital Base | Fee Revenue Base | |

|  |

| | Page | |

|---|---|---|

Prospectus Summary | 1 | |

Ares | 1 | |

Business Model | 3 | |

Competitive Strengths | 5 | |

Industry Trends | 7 | |

Growth Strategy | 8 | |

Investment Risks | ||

Organizational Structure | 10 | |

Implications of Being an Emerging Growth Company | 16 | |

Restrictions on Ownership of Our Common Units | 16 | |

The Offering | 18 | |

Summary Historical Financial and Other Data | 22 | |

Risk Factors | 25 | |

Summary of Risks | 25 | |

Risks Related to Our Businesses | 25 | |

Risks Related to Our Funds | ||

Risks Related to Our Organization and Structure | ||

Risks Related to Our Common Units and this Offering | ||

Risks Related to U.S. Taxation | ||

Special Note Regarding Forward-Looking Statements | ||

Market and Industry Data and Forecasts | ||

Organizational Structure | ||

Reorganization | ||

Exchange Agreement | ||

Offering Transactions | ||

Our Organizational Structure Following this Offering and the Offering Transactions | ||

Holding Partnership Structure | ||

Use of Proceeds | ||

Cash Distribution Policy | ||

Distribution Policy for Common Units | ||

Distributions to Our Existing Owners | ||

Capitalization | ||

Dilution | ||

Unaudited Pro Forma Consolidated Financial Data | ||

Selected Financial Data | ||

Management's Discussion and Analysis of Financial Condition and Results of Operations | ||

Our Business | ||

Trends Affecting Our Business | ||

Reorganization and Offering Transactions | ||

Managing Business Performance | ||

Overview of Combined and Consolidated Results of Operations | ||

Results of Operations | ||

Segment Analysis | ||

Results of Operations by Segment | ||

Liquidity and Capital Resources | ||

Critical Accounting Policies | ||

Quantitative and Qualitative Disclosures About Market Risk | ||

Recent Accounting Pronouncements |

i

| | Page | |

|---|---|---|

Off-Balance Sheet Arrangements | ||

Contractual Obligations, Commitments and Contingencies | ||

Implications of Being an Emerging Growth Company | ||

Business | ||

Overview | ||

Investment Groups | ||

Competitive Strengths | ||

Industry Trends | ||

Growth Strategy | ||

Operations Management Groups | ||

Business Development and Investor Relations | ||

Investment Operations and Information Technology | ||

Investment Process | ||

Structure and Operation of our Funds | ||

Fee Structure | ||

Capital Invested In and Through Our Funds | ||

Regulatory and Compliance Matters | ||

Competition | ||

Legal Proceedings | ||

Properties | ||

Employees | ||

Management | ||

Our General Partner | ||

Directors and Executive Officers | ||

Biographical Information | ||

Composition of the Board of Directors After this Offering | ||

Management Approach | ||

Limited Powers of Our Board of Directors | ||

Committees of the Board of Directors | ||

Compensation Committee Interlocks and Insider Participation | ||

Compensation of Our Directors and Executive Officers | ||

Director Compensation | ||

Executive Compensation | ||

Equity Incentive Plan | ||

IPO Awards Under the 2014 Equity Incentive Plan | ||

Vesting; Transfer Restrictions for Senior Professional Owners | ||

Certain Relationships and Related Person Transactions | ||

Reorganization and Offering Transactions | ||

Our General Partner | ||

Tax Receivable Agreement | ||

Investor Rights Agreement | ||

Ares Operating Group Governing Agreements | ||

Exchange Agreement | ||

Firm Use of Our Co-Founders' Private Aircraft | ||

Co-Investments and Other Investment Transactions | ||

Statement of Policy Regarding Transactions with Related Persons | ||

Indemnification | ||

Selling Unitholder | 241 | |

Principal Unitholders | ||

Pricing Sensitivity Analysis | ||

|

ii

| | Page | |

|---|---|---|

Conflicts of Interest and Fiduciary Responsibilities | 245 | |

Conflicts of Interests | ||

Potential Conflicts | ||

Fiduciary Duties | ||

Description of Common Units | ||

Common Units | ||

Restrictions on Ownership and Transfer | ||

Transfer of Common Units | ||

Listing | ||

Transfer Agent and Registrar | ||

Material Provisions Of Ares Management, L.P. Partnership Agreement | ||

General Partner | ||

Organization | ||

Purpose | ||

Power of Attorney | ||

Capital Contributions | ||

Limited Liability | ||

Issuance of Additional Securities | ||

Common Unit Ownership Limitations | ||

Distributions | ||

Amendment of the Partnership Agreement | ||

Corporate Transactions | ||

Election to be Treated as a Corporation | ||

Dissolution | ||

Liquidation and Distribution of Proceeds | ||

Withdrawal or Removal of the General Partner | ||

Limited Call Right | ||

Sinking Funds; Preemptive Rights | ||

Meetings; Voting | ||

Election of Directors of General Partner | ||

Non-Voting Common Unitholders | ||

Status as Limited Partner | ||

Non-Citizen Assignees; Redemption | ||

Indemnification | ||

Forum Selection | ||

Books and Reports | ||

Right to Inspect Our Books and Records | ||

Common Units Eligible for Future Sale | ||

General | ||

Registration Rights | ||

Lock-Up Arrangements | ||

Ares Transfer Restrictions | ||

Material U.S. Federal Tax Considerations | ||

Taxation of Ares Management, L.P. and the Ares Operating Group | ||

Consequences to U.S. Holders of Common Units | ||

Consequences to Non-U.S. Holders of Common Units | ||

Surtax on Unearned Income | ||

Administrative Matters | ||

Underwriting | ||

Commissions and Discounts | ||

|

iii

| | Page | |

|---|---|---|

Option to Purchase Additional Common Units | 294 | |

Lock-Up Restrictions | ||

Indemnification | ||

Listing | ||

Pricing of the Offering | ||

Price Stabilization, Short Positions and Penalty Bids | ||

Electronic Distribution | ||

Other Relationships | ||

FINRA | ||

Legal Matters | ||

Experts | ||

Where You Can Find More Information | ||

Index to Financial Statements | F-1 | |

Report of Independent Registered Public Accounting Firm | F-2 | |

Appendix A—Form of Amended and Restated Agreement of Limited Partnership of Ares Management,L.P. |

This prospectus is solely an offer with respect to our common units, and is not an offer, directly or indirectly, of any securities of any of the funds we advise, manage or sponsor. An investment in our common units is not an investment in any of our funds, and the assets and revenues of our funds are not directly available to us.

This prospectus does not constitute an offer of, or an invitation to purchase, any of our common units in any jurisdiction in which such offer or invitation would be unlawful. We, the selling unitholder and the underwriters are offering to sell, and seeking offers to buy, our common units only in jurisdictions where offers and sales are permitted.

You should rely only on the information contained in this prospectus or in any free writing prospectus we may authorize to be delivered to you. Neither we, the selling unitholder nor the underwriters have authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectus we have prepared. Neither we, the selling unitholder nor the underwriters take any responsibility for, or can provide any assurance as to the reliability of, any other information that others may give you. The information in this prospectus is current only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our common units.

Our business has historically been conducted through operating subsidiaries held directly or indirectly by Ares Holdings LLC and Ares Investments LLC (or "AI"). These two entities have been principally owned by Ares Partners Management Company LLC ("APMC") and entities affiliated with the Abu Dhabi Investment Authority ("ADIA") and Alleghany Corporation (NYSE: Y) ("Alleghany") that own minority interests with limited voting rights in our business. We refer to these owners collectively as our "existing owners." APMC is controlled by our Co-Founders. Ares Management, L.P. was formed on November 15, 2013 to serve as a holding partnership for our businesses. Ares Management, L.P. has not commenced operations and prior to the consummation of this offering will have nominal assets and liabilities. Unless the context suggests otherwise, references in this prospectus to (1) "Ares," "we," "us" and "our" refer to our businesses, both before and after the consummation of our reorganization into a holding partnership structure as described under "Organizational Structure" and (2) "Pre-IPO Ares" refer to Ares Holdings Inc. ("AHI") and Ares Investments LLC, our accounting predecessors, as well as their wholly owned subsidiaries and managed funds, in each case prior to our Reorganization (as defined under "Organizational Structure"), which we will consummate prior to this offering. References in this

iv

prospectus to "our general partner" refer to Ares Management GP LLC, an entity wholly owned by Ares Partners Holdco LLC, which is in turn owned and controlled by our Co-Founders.

iv

Under generally accepted accounting principles in the United States ("GAAP"), we are required to consolidate (a) entities in which we hold a majority voting interest or have majority ownership and control over the operational, financial and investing decisions of that entity, including Ares-affiliates and affiliated funds and co-investment entities, for which we are the general partner and are presumed to have control, and (b) entities that we concluded are variable interest entities ("VIEs"), including limited partnerships in which we have a nominal economic interest and the CLOs, for which we are deemed to be the primary beneficiary. When a fund is consolidated, we reflect the assets, liabilities, revenues, expenses and cash flows of the fund in our combined and consolidated financial statements on a gross basis, subject to eliminations from consolidation, including the elimination of the management fees, performance fees and other fees that we earn from Consolidated Funds. However, the presentation of performance fee compensation and other expenses associated with generating such revenues are not affected by the consolidation process. In addition, as a result of the consolidation process, the net income attributable to third-party investors in Consolidated Funds is presented as net income attributable to non-controlling redeemable interests in Consolidated Funds in our combined and consolidated statements of operations.

In this prospectus, in addition to presenting our results on a consolidated basis in accordance with GAAP, we present revenues, expenses and other results on a (i) "segment basis," which deconsolidates these funds and therefore shows the results of our reportable segments without giving effect to the consolidation of the funds and (ii) "Stand Alone basis," which shows the results of our reportable segments on a combined segment basis together with our Operations Management Group. In addition to our four segments, we have an Operations Management Group (the "OMG") that consists of five independent, shared resource groups to support our reportable segments by providing infrastructure and administrative support in the areas of accounting/finance, operations/information technology, business development, legal/compliance and human resources. The OMG's expenses are not allocated to our four reportable segments but we consider the cost structure of the OMG when evaluating our financial performance. This information constitutes non-GAAP financial information within the meaning of Regulation G, as promulgated by the SEC. Our management uses this information to assess the performance of our reportable segments and our Operations Management Group, and we believe that this information enhances the ability of unitholders to analyze our performance. For more information, see "Management's Discussion and Analysis of Financial Condition and Results of Operation—Reorganization and Offering Transactions—Consolidation and Deconsolidation of Ares Funds," "—Managing Business Performance—Non-GAAP Financial Measures" and "—Segment Analysis—Combined ENI and Other Measures."

When used in this prospectus, unless the context otherwise requires:

v

taxes paid by operating entities, expenses arising from transaction costs associated with acquisitions, placement fees and underwriting costs, expenses incurred in connection with corporate reorganization, depreciation and the items included in the calculation of ENI and also adjusts ENI

v

for unrealized performance fees, unrealized performance fee compensation expenses and unrealized investment income from Consolidated Funds and non-consolidated funds;

vi

Many of the terms used in this prospectus, including AUM, fee earning AUM, ENI, FRE, PRE and distributable earnings, may not be comparable to similarly titled measures used by other companies. In addition, our definitions of AUM and fee earning AUM are not based on any definition of AUM or fee earning AUM that is set forth in the agreements governing the investment funds that we manage and may differ from definitions of AUM set forth in other agreements to which we are a party from time to time. Further, ENI, FRE, PRE and distributable earnings are not measures of performance calculated in accordance with GAAP. We use ENI, FRE, PRE and distributable earnings as measures of operating performance, not as measures of liquidity. ENI, FRE, PRE and distributable earnings should not be considered in isolation or as substitutes for operating income, net income, operating cash flows, or other income or cash flow statement data prepared in accordance with GAAP. The use of ENI, FRE, PRE and distributable earnings without consideration of related GAAP measures is not adequate due to the adjustments described above. Our management compensates for these limitations by using ENI, FRE, PRE and distributable earnings as supplemental measures to our GAAP results, to provide a more complete understanding of our performance as our management measures it. Please see "Management's Discussion and Analysis of Financial Condition and Results of Operations—Managing Business Performance—Non-GAAP Financial Measures" and "—Reconciliation of Certain Non-GAAP Measures to Consolidated GAAP Financial Measures" and Note 16, "Segment Reporting," to our combined and consolidated financial statements appearing elsewhere in this prospectus for more information on AUM, fee earning AUM, ENI, FRE, PRE and distributable earnings. Amounts and percentages throughout this prospectus may reflect rounding adjustments and consequently totals may not appear to sum.

vii

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider before investing in our common units. You should read this entire prospectus carefully, including the more detailed information regarding us and our common units, the sections entitled "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our combined and consolidated financial statements and related notes included elsewhere in this prospectus, before you decide to invest in our common units.

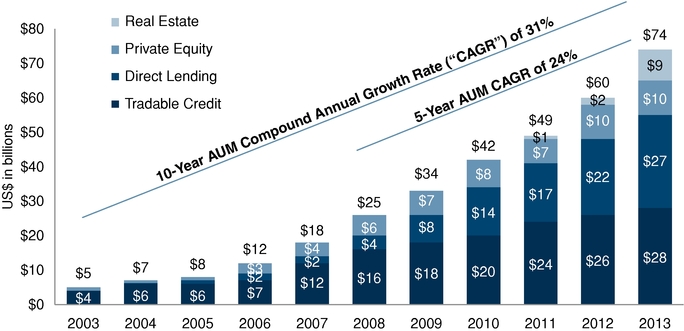

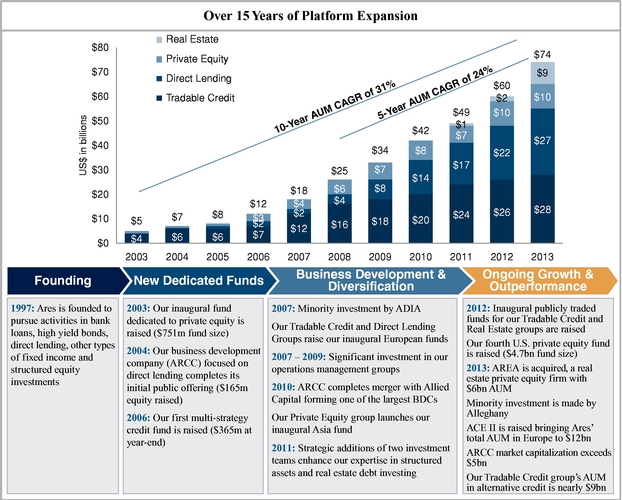

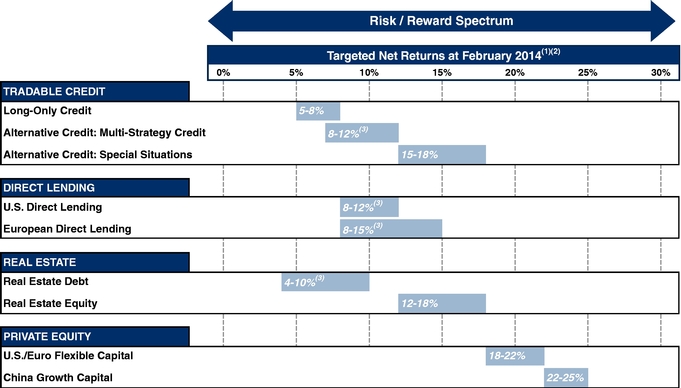

Ares is a leading global alternative asset manager with approximately $74 billion of assets under management and approximately 700 employees in over 15 offices in the United States, Europe and Asia. We provide a range of investment strategies and seek to deliver attractive performance to a growing investor base that includes over 500 direct institutional relationships and a significant retail investor base across our publicly traded and sub-advised funds. Over the past ten years, our assets under management and total management fees, which comprise a significant portion of our total fee revenue, have achieved compound annual growth rates of 31% and 33%, respectively.

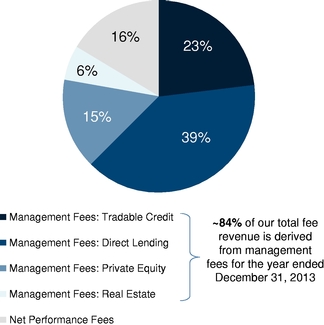

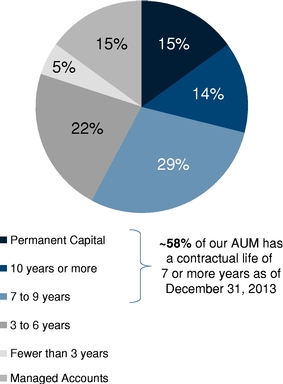

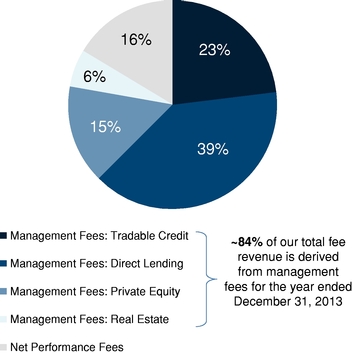

Since our inception in 1997, we have adhered to a disciplined investment philosophy that focuses on delivering strong risk-adjusted investment returns throughout market cycles. We have created value for our stakeholders not only through our investment performance but also by expanding our product offering, enhancing our distribution channels, increasing our global presence, investing in our non-investment functions, securing strategic partnerships and completing accretive acquisitions and portfolio purchases. For the year ended December 31, 2013, we generated total management fees of $517 million and economic net income of $329 million on a Stand Alone basis. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Reconciliation of Certain Non-GAAP Measures to Consolidated GAAP Financial Measures." Our revenues are diversified, with more than 140 active investment funds under management, and stable, with approximately 84% of total fee revenue for the year ended December 31, 2013 derived from management fees. In addition, as of December 31, 2013, approximately 58% of our assets under management was in funds with a contractual life of seven years or more, including 15% that was in our permanent capital vehicles with unlimited duration.

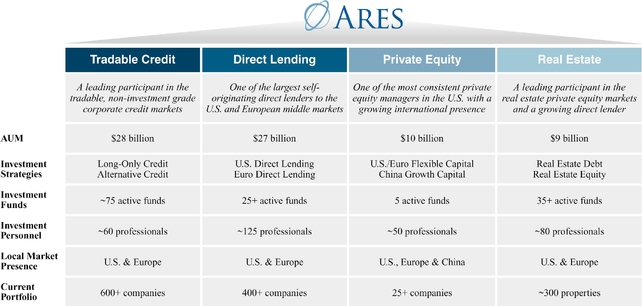

We believe each of our four distinct but complementary investment groups is a market leader based on assets under management and investment performance and has compelling long-term business prospects. Each investment group has demonstrated a consistently strong investment track record, and we believe each is viewed as a top-tier manager by a loyal, high quality investor base.

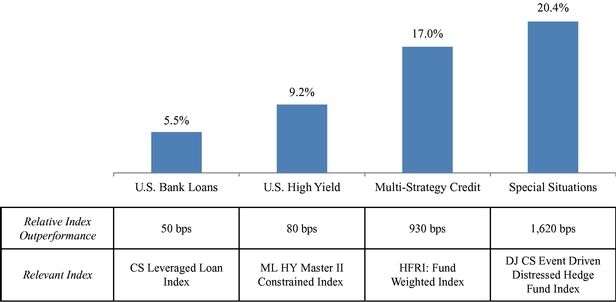

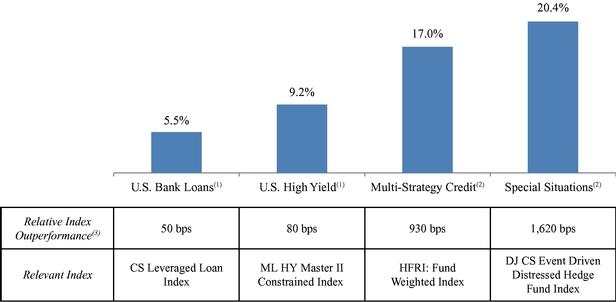

Tradable Credit Group

We are a leading participant in the tradable, non-investment grade corporate credit markets, with approximately $28 billion of assets under management as of December 31, 2013. We have investment track records of over 15 years in both bank loans and high yield bonds, and we hold top quartile rankings in several of our funds within long-only and alternative credit investment strategies. We are one of the top ten bank loan institutional managers, based on reported trading volume, and our broader investing efforts are supported by a large research team dedicated to non-investment grade corporate credit. Our analysts generate proprietary research on over 1,000 companies in over 30 industries, which benefits our investment professionals across the entire firm.

Direct Lending Group

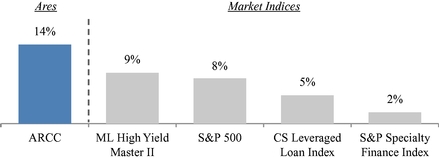

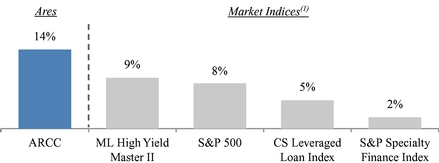

We are one of the largest self-originating direct lenders to the U.S. and European markets, with approximately $27 billion of assets under management across over 25 funds as of December 31, 2013. We provide one-stop financing solutions to small-to-medium sized companies, which we believe are increasingly underserved by traditional lenders. We launched our inaugural vehicle dedicated to direct lending, Ares Capital Corporation (Nasdaq: ARCC) ("ARCC"), nearly ten years ago as a business development company. ARCC has grown to become the largest business development company, by both market capitalization and total assets, and has generated a 14% annualized total shareholder return since its 2004 initial public offering, outperforming the Standard & Poor's 500, Credit Suisse Leveraged Loan and Merrill Lynch U.S. High Yield Master II indices by a range of approximately 550-900 basis points over the same timeframe. In 2007, we extended our direct lending capabilities into Europe and raised our first dedicated fund. Our European team has grown to become a market leader in the region and was named the "Specialty Lender of the Year" by Real Deals in each of 2010, 2011 and 2012 and the co-winner of the "Unitranche Lender of the Year" by Private Debt Investor in 2013.

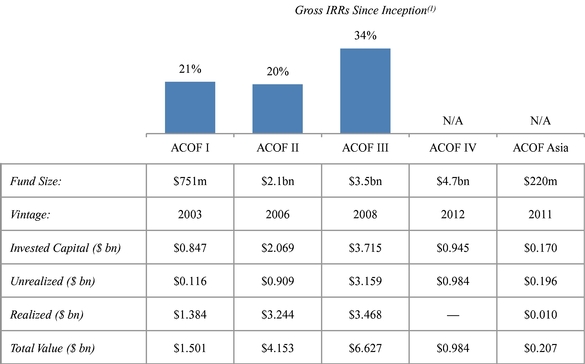

Private Equity Group

We have one of the most consistent performance records in the United States, as measured by our investment results, with a growing presence in Asia and Europe. With approximately $10 billion of assets under management as of December 31, 2013, we focus on majority or shared-control investments, principally in under-capitalized companies. We launched our inaugural fund dedicated to private equity, Ares Corporate Opportunities Fund, L.P., ten years ago. Since that time, we have achieved compelling returns in both traditional private equity sponsorship and distressed balance sheet investing, which we believe enables us to stay active and disciplined in different market environments. In the aggregate, we have generated a 24% gross IRR on more than $7 billion of capital deployed from our five funds. We hold top quartile rankings for our 2006 and 2008 vintage funds, which were deployed at markedly different points in the economic cycle. Our 2008 fund is ranked as a "Top 10 Best Performing Buyout Fund" by Preqin for all funds it tracks across the 2006 to 2010 vintages, and we were named by PEI the "2012 North American Special Situations / Turnaround Firm of the Year."

Real Estate Group

We are a leading participant in the real estate private equity markets and have a growing real estate direct lending business. We have developed a comprehensive real estate product offering, through both fundraising efforts and acquisitions, in a relatively short period of time, and havewith approximately $9 billion of assets under management as of December 31, 2013. We focus on investing in assets that have been under-managed or need repositioning in their markets. Our real estate private equity team has investment track records of over 15 years in both the United States and Europe and, in 2013, PERE ranked our team as a Top 15 real estate manager based on equity raised from January 2008 to April 2013. In 2012, we launched a mortgage real estate investment trust ("REIT"), Ares Commercial Real Estate Corporation (NYSE: ACRE) ("ACRE").

We have an established track record of delivering strong risk-adjusted returns through market cycles. We believe our consistent and strong performance in a broad range of alternative assets has been shaped by several distinguishing features of our platform:

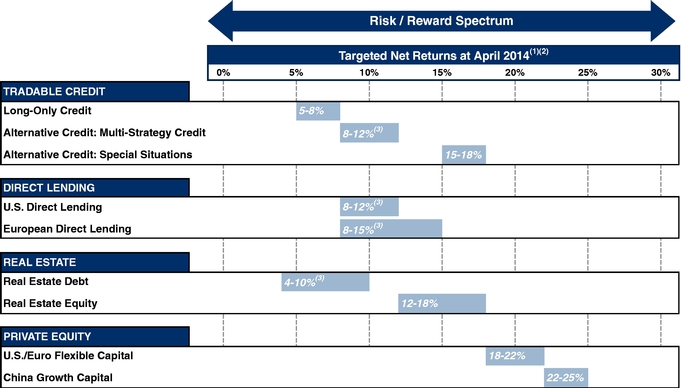

We provide our investment management capabilities through various funds and products that meet the needs of a wide range of institutional and retail investors.

In addition to our four segments, we have an Operations Management Group that consists of five independent, shared resource groups to support our reportable segments by providing infrastructure and administrative support in the areas of accounting/finance, operations/information technology, business development, legal/compliance and human resources. The OMG's expenses are not allocated to our four reportable segments but we do consider the cost structure of the OMG when evaluating our financial performance.

Most of the funds we manage are structured to earn a fixed management fee and performance fees based on investment performance in the form of incentive fees or carried interest. Management fees comprise the significant majority of our total fee revenue, which has resulted in a stable, predictable revenue stream. In addition, we have been able to mitigate some of the volatility that is typically associated with performance fees because a significant portion of our performance fees is based on net interest income from fixed income investments.

The following table sets forth certain combined consolidated financial information and certain Stand Alone financial information for the periods presented. Please see "Management's Discussion and Analysis of Financial Condition and Results of Operations—Reconciliation of Certain Non-GAAP Measures to Consolidated GAAP Financial Measures" for a discussion of segment results.

| | Year Ended December 31, | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | 2013 | 2012 | 2011 | |||||||

| | (Dollars in millions) | |||||||||

Combined consolidated financial data(1) | ||||||||||

Income before taxes | 873 | 1,262 | 953 | |||||||

Net income attributable to AHI, AI and consolidated subsidiaries | 180 | 221 | 97 | |||||||

Stand Alone data(2) | ||||||||||

Management fees | $ | 517 | $ | 415 | $ | 324 | ||||

Net operating expenses(3) | (364 | ) | (277 | ) | (204 | ) | ||||

Fee related earnings | 153 | 138 | 120 | |||||||

Net performance fees | 102 | 157 | 39 | |||||||

Net investment income | 74 | 107 | 34 | |||||||

Performance related earnings | 176 | 265 | 73 | |||||||

Economic net income | $ | 329 | $ | 402 | $ | 194 | ||||

Distributable earnings | $ | 306 | $ | 302 | $ | 203 | ||||

Total fee revenue | $ | 619 | $ | 572 | $ | 363 | ||||

Management fees as % of total fee revenue | 84 | % | 73 | % | 89 | % | ||||

Since our inception in 1997, we have grown to become a leading global alternative asset manager. We believe the following competitive strengths position us well for future growth:

Stable Earnings Model

We believe we have a stable earnings model based on:

Broad Alternative Product Offering with Balanced Growth Across Strategies

To meet investors' growing demand for alternative asset investments, we manage investments in an increasingly comprehensive range of funds across a spectrum of compelling and complementary strategies. We have demonstrated an ability to consistently generate attractive and differentiated investment returns across these investment strategies and through various market environments. As such, we have been able to increase AUM during all phases of an economic cycle. We believe the breadth of our product offering, our expertise in various investment strategies and our proficiency in attracting and satisfying our growing

institutional and retail client base has enabled and will continue to enable us to increase our AUM across each of our investment groups in a balanced manner. Our fundraising efforts historically have been spread across investment strategies and have not been dependent on the success of any one strategy.

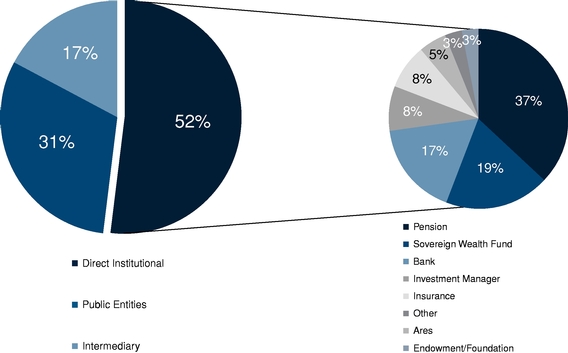

Diverse and Growing Investor Base

Our investor base includes direct institutional relationships and a significant retail investor base across our publicly traded and sub-advised funds. Our high quality institutional investor base includes large pension funds, sovereign wealth funds, banks and insurance companies and we have grown the number of these relationships from approximately 200 in 2011 to over 500 as of December 31, 2013. In many instances, investors have increased their commitments to subsequent funds in a particular investment strategy and deployed capital across our other investment groups. We believe that our deep and longstanding investor relationships, founded on our strong performance, disciplined management of our investors' capital and diverse product offering, have facilitated the growth of our existing businesses and will assist us with the development of additional strategies and products, thereby increasing our fee earning AUM. We have a dedicated in-house Business Development Group that includes approximately 45 investor relations and marketing specialists. We have frequent dialogue with our investors and are committed to providing them with the highest quality service. We believe our service levels, as well as our emphasis on transparency, inspire loyalty and support our efforts to continue to attract investors across our investment platform.

Integrated and Scalable Global Business Platform

We operate our increasingly diversified and global firm as an integrated investment platform with a collaborative culture that emphasizes sharing of knowledge and expertise. We believe the exchange of information enhances our ability to analyze investments, deploy capital and improve the performance of our funds and portfolio companies. Through collaboration, we drive value by leveraging our capital markets relationships and access to deal flow. Within this framework we have established deep and sophisticated independent research capabilities in over 30 industries and insights from active investments in over 1,000 companies, 300 structured assets and approximately 300 properties. Further, our extensive network of investment professionals is comprised primarily of local and geographically positioned individuals with the knowledge, experience and relationships that enable them to identify and take advantage of a wide range of investment opportunities. They are supported by a highly sophisticated operations management team. We believe this broad platform and our operational infrastructure provide us with a scalable foundation to expand our product offering, geographic scope and profitability.

Breadth, Depth and Tenure of our Senior Management

Ares was built upon the fundamental principle that each of our distinct but complementary investment groups benefits from being part of our broader platform. We believe that our strong performance, consistent growth and high talent retention through economic cycles is due largely to the effective application of this principle across our broad organization of over 700 employees. We do not have a centralized investment committee. Our investment committees are structured with overlapping membership to ensure consistency of approach. Each of our four investment groups is led by its own deep leadership team of highly accomplished investment professionals, who average over 22 years of experience managing investments in, advising, underwriting and restructuring leveraged companies. While primarily focused on managing strategies within their own investment group, these senior professionals are integrated within our platform through economic, cultural and structural measures. Our senior professionals have the opportunity to participate in the incentive programs of multiple investment groups to reward collaboration in our investment activities. This collaboration takes place on a daily basis but is formally promoted through sophisticated internal systems and widely attended weekly or monthly meetings.

Alignment of Interests with Stakeholders

The alignment of the interests of our Co-Founders and investment professionals with those of the investors in our funds and our unitholders is fundamental to our business. We and our investment

professionals have committed over $1 billion of capital across our various investment funds, aligning our interests with those of our clients. Moreover, a significant portion of our professionals' compensation is in the form of performance fees, which we believe aligns their interests with those of the investors in our funds. We expect that our senior professional owners will own approximately 70% of Ares after this offering, aligning our interests with those of our common unitholders. In connection with this offering, we are establishing a long-term equity compensation plan that we believe will strengthen this alignment, as well as the motivation and retention of our professionals, through the significant and long-term ownership of our equity by our Co-Founders, senior professionals and other employees.

We are well positioned to capitalize on the following trends in the asset management industry:

Increasing Importance of Alternative Assets

Over the past several years, investor groups of all types have meaningfully increased their capital allocations to alternative investment strategies. McKinsey and Co. estimates that alternative investments (which includes private equity, hedge funds and investments in real estate, infrastructure and commodities in a variety of vehicles) grew at a 14% compound annual growth rate versus non-alternative investments at 2% for the six year period from 2005 to 2011. We expect this current trend will continue as the combination of volatile returns in public equities and low-yields on traditional fixed income investments shifts investor focus to the lower correlated and absolute levels of returns offered by alternative assets.

Increasing Demand for Alternative Assets from Retail Investors

Defined contribution pension plans and retail investors are demanding more exposure to alternative investment products to seek differentiated returns as well as to satisfy a desire for current yield due to changing demographics. According to McKinsey & Co., retail alternative investments will account for 13% of U.S. retail fund assets and 24% of revenues by 2015, up from 6% and 13% as of year-end 2010, respectively. ARCC has benefited from this growing demand, increasing its retail-originated assets under management from approximately $300 million in 2004 to $9.7 billion in 2013. Our Tradable Credit and Real Estate Groups have raised three publicly traded vehicles over the past two years. With an established market presence, we believe we are well positioned to take advantage of the growing opportunity in the retail channel.

Shifting Asset Allocation Policies of Institutional Investors

We believe that the growing pension liability gap is driving investors to seek higher return strategies and that institutional investors, such as insurance companies, are increasingly rotating away from core fixed income products towards more liquid alternative credit and absolute return-oriented products to achieve their return hurdles. According to Bain & Company, public pension funds increased their allocations toward alternative strategies to approximately 10% in 2013, up from approximately 8% in 2012. The increase in allocation has also been accompanied by a change in allocation strategy to a more balanced approach between private equity and non-private equity alternative investments. Our combination of credit expertise, total return and multi-strategy product offerings are particularly well suited to benefit from these asset allocation trends.

De-Leveraging of the Global Banking System

After an extended period of increasing leverage, commercial and investment banks have been de-leveraging since 2008. Bank consolidation, more prudent balance sheet discipline, changing regulatory

capital requirements and the increasing cost and complexity of regulatory compliance have led to material changes in the global banking system and have created significant opportunities for other institutional

market participants. For example, well-capitalized non-bank direct lenders like ARCC and othersome of our other funds have been able to fill the significant and growing need for financing solutions as traditional lenders have withdrawn from certain middle-market and non-investment grade asset classes. At the same time, tradable debt managers have been able to raise vehicles to capitalize on banks' interest in divesting non-core assets and/or reducing their hold commitments in new financings. Citibank estimates that bank divestments of non-core holdings from the higher-risk areas of the lending market will create an investment opportunity of between $1 trillion and $2 trillion over the next decade.

Increasing Benefits of Scale

Many institutional investors are focused on limiting the number of their manager relationships and allocating a greater share of their assets to established and diversified platforms. These investors seek to partner with investment management firms that have not only proven track records across multiple investment products, but also highly sophisticated non-investment group functions in accounting, legal/compliance and operations. Given the advantages of scale and a heightened focus on diligence, transparency and compliance, institutional clients are allocating a greater proportion of assets to established asset managers with whom there is a deep level of comfort. This trend is evidenced by the distribution of net asset flows, as firms with more than $1 billion in assets under management garnered approximately 90% of the net asset flows in the six months ended June 30, 2013, according to Hedge Fund Report. Furthermore, the increasing complexity of the regulatory environment in which alternative investment managers operate and the costs of complying with such regulations serve as barriers to entry in the investment management business.

As we continue to expand our business, we intend to apply the same core principles and strategies to which we have adhered since our inception to:

Organically Grow our Core Business

Alternative assets are experiencing increasing demand from a range of investors, which we and many industry participants believe is part of a long-term trend to enhance portfolio diversification and to meet desired return objectives. We have demonstrated our ability to deliver strong risk-adjusted investment returns in alternative assets throughout market cycles since our inception in 1997, and we believe each of our investment groups is well positioned to benefit from long-term positive industry momentum. By continuing to deliver strong investment and operations management performance, we expect to grow the AUM in our existing products by deepening and broadening relationships with our current high-quality investor base as well as attracting new investors.

Expand our Product Offering

A key to our growth has been pursuing complementary investment strategies and structuring different types of investment funds that address the specific needs of our investor base. We have expanded our product offering to provide increasingly diversified opportunities for investors and a balanced business model that we believe benefits all of our stakeholders. For example, our Tradable Credit Group has grown its AUM in alternative credit investment funds from zero in 2005 to approximately $9 billion as of December 31, 2013. We take advantage of market trends arising out of an increasingly complex regulatory environment to develop products that meet the evolving needs of market participants. We have demonstrated the ability to expand our product offering in a manner that enhances the investing capabilities of our professionals, provides differentiated solutions for our clients and creates a more balanced business model for our unitholders. There are a number of complementary strategies that we are

currently pursuing across our investment groups, such as broadening our capabilities in direct lending and tradable credit to service more end-markets.distribution channels.

Enhance our Distribution Channels

The growing demand for alternative assets provides an opportunity for us to attract new investors across a variety of channels. As we continue to expand our product offering and our global presence, we expect to be able to attract new investors to our funds. In addition to pension funds, sovereign wealth funds, banks and high net worth individuals, which have historically comprised a significant portion of our assets under management, in recent periods we have extended our investment strategies and marketing efforts increasingly to insurance companies, sub-advisory partners and retail investors with the initial public offerings of two closed-end funds, Ares Dynamic Credit Allocation Fund, Inc. (NYSE: ARDC) ("ARDC") and Ares Multi-Strategy Credit Fund, Inc. (NYSE: ARMF) ("ARMF"), and a REIT, ACRE.

Increase our Global Presence

The favorable industry trends for alternative asset managers are global in nature and we believe there are a number of international markets that represent compelling opportunities for our investment strategies. Our European platform has 100 total employees, including approximately 70 investment professionals managing approximately $12 billion in assets under management in eight Western European offices as of December 31, 2013. We believe our strong financial position and existing global operations and network enable us to identify and readily pursue a range of expansion opportunities, including acquisitions of existing businesses or operations, partnering with local operators, establishing our own operations or otherwise. We intend to continue to develop our private equity and real estate direct lending capabilities in Western Europe, while opportunistically pursuing the expansion of our direct lending franchise into attractive new international markets.

Secure Strategic Partnerships

We have established valuable relationships with strategic partners and large institutional investors who, among other things, provide market insights, product advice and relationship introductions. ADIA and Alleghany, minority investors in Ares since May 2007 and July 2013, respectively, have committed significant capital across our investment groups. Our Direct Lending Group has a joint venture with affiliates of General Electric Company that offers U.S. and European middle-market borrowers a differentiated loan product. We also have important relationships with large fund investors, leading commercial and investment banks, global professional services firms, key distribution agents and other market participants that we believe are of significant value. As we expand our product offering and global presence, we intend to pursue opportunities with additional strategic partners.

Complete Accretive Acquisitions and Portfolio Purchases

We continuously evaluate acquisition opportunities that we believe will enable us to expand our product offering, broaden our investor base and increase our global presence. We have a demonstrated ability to acquire companies at accretive valuations and effectively integrate their personnel, assets and investors into our organization. In particular, we believe the unique challenges facing large banks and small boutique asset managers in the current market environment will persist, which we expect will generate compelling opportunities for us to pursue acquisitions of businesses, investment teams and assets.

An investment in our common units involves substantial risks and uncertainties. Some of the most significant challenges and risks relating to an investment in our common units include those associated with:

Please see "Risk Factors" for a discussion of these and other factors you should consider before making an investment in our common units.

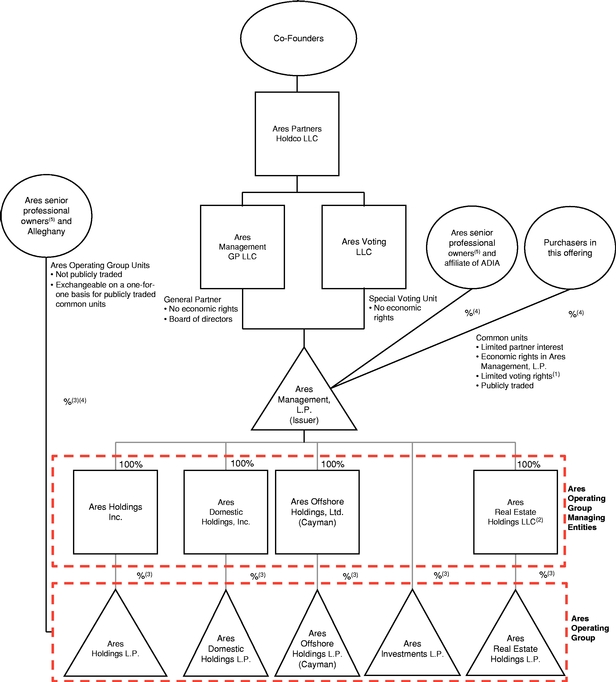

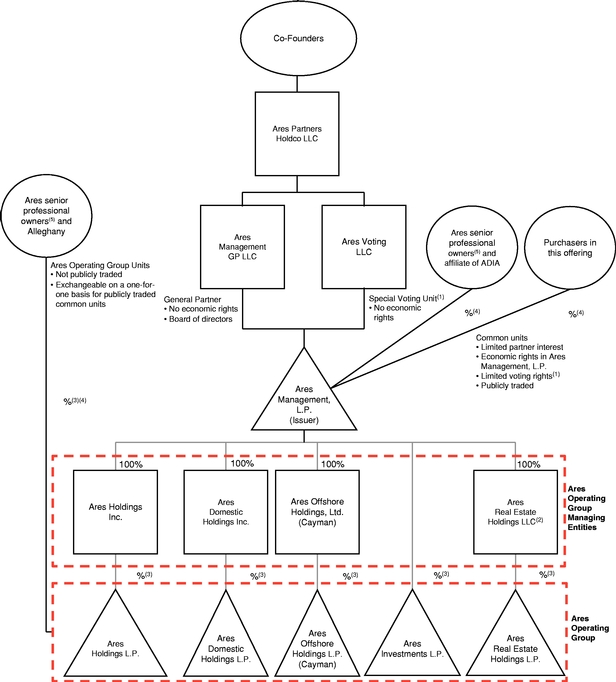

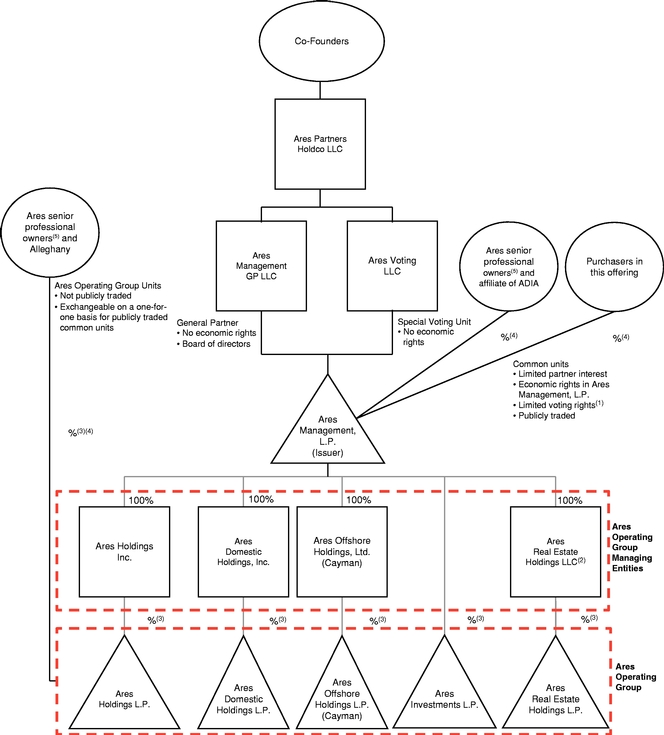

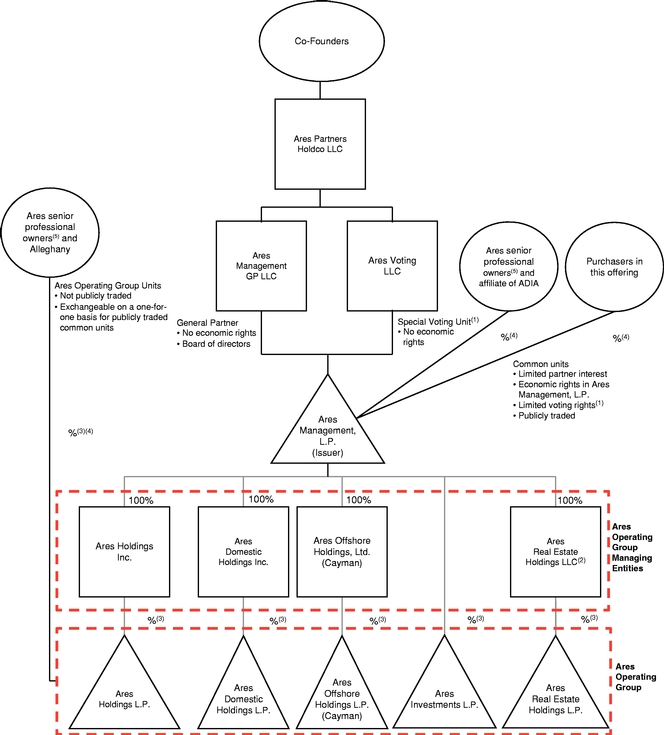

We currently conduct our businesses through operating subsidiaries held directly or indirectly by Ares Holdings LLC and Ares Investments LLC. These two entities are principally owned by APMC and entities affiliated with ADIA and Alleghany that own minority interests with limited voting rights in our business (ADIA and Alleghany together, the "Strategic Investors"). We refer to these owners collectively as our "existing owners." APMC is controlled by our Co-Founders.

To facilitate this offering, we will consummate the transactions described below and in "Organizational Structure" in connection with which Ares Management, L.P. will become the successor to AHI and Ares Investments LLC for financial accounting purposes under GAAP. We refer to these transactions as the "Reorganization."

Reorganization

Historically, Ares Holdings LLC has operated and controlled our U.S. fee-generating and many of our non-U.S. fee-generating businesses, while Ares Investments LLC has held a variety of assets, including our carried interests and co-investments in many of the proprietary investments made by our funds.

In connection with this offering, we will convert Ares Holdings LLC into a limited partnership, Ares Holdings L.P. ("Ares Holdings"), and convert Ares Investments LLC into a limited partnership, Ares Investments L.P. ("Ares Investments"). In addition, we will form Ares Domestic Holdings L.P. ("Ares Domestic"), Ares Offshore Holdings L.P. ("Ares Offshore") and Ares Real Estate Holdings L.P. ("Ares

Real Estate") (as described under "Organizational Structure"). Ares Holdings, Ares Domestic, Ares Offshore, Ares Investments and Ares Real Estate are collectively referred to as the "Ares Operating Group."

Following this offering, the Ares Operating Group will hold:

Prior to this offering, APMC will be converted into a limited partnership and renamed Ares Owners Holdings L.P. In exchange for its interest in Ares Management, L.P., APMCAres Owners Holdings L.P. will transfer to Ares Management, L.P., prior to this offering, its interests in each of AHI, Ares Domestic Holdings Inc., Ares Offshore Holdings, Ltd., Ares Real Estate Holdings LLC and a portion of its interest in Ares Investments. Similarly, in exchange for its interest in Ares Management, L.P., an affiliate of ADIA will transfer to Ares Management, L.P., prior to this offering, its interests in each of AHI, Ares Domestic Holdings Inc., Ares Offshore Holdings, Ltd., Ares Investments and Ares Real Estate Holdings LLC. APMCAres Owners Holdings L.P. will retain a % interest in each of the Ares Operating Group entities. In addition, APMC will be converted into a limited partnership and renamed Ares Owners Holdings L.P.

Offering Transactions

Upon the consummation of this offering, Ares Management, L.P. will (i) loan a portion of the proceeds from this offering to its wholly owned subsidiary, AHI, which will then contribute such amount to Ares Holdings in exchange for limited partnership units of Ares Holdings, (ii) contribute a portion of the proceeds from this offering to Ares Domestic Holdings Inc., which will then contribute such amount to Ares Domestic in exchange for limited partnership units of Ares Domestic, (iii) contribute a portion of the proceeds from this offering to Ares Offshore Holdings, Ltd., which will then contribute such amount to Ares Offshore in exchange for limited partnership units of Ares Offshore, (iv) contribute a portion of the proceeds from this offering to Ares Investments in exchange for limited partnership units of Ares Investments and (v) contribute a portion of the proceeds from this offering to Ares Real Estate Holdings LLC, which will then contribute such amount to Ares Real Estate in exchange for limited partnership units of Ares Real Estate. See "Material U.S. Federal Tax

Considerations—United States Taxes—Taxation of Ares Management, L.P. and the Ares Operating Group" for more information about the expected tax treatment of Ares Management, L.P. and the Ares Operating Group.

Our Organizational Structure Following this Offering and the Offering Transactions

Following the Reorganization, this offering and the Offering Transactions (as such terms are described and defined under "Organizational Structure"), Ares Management, L.P. will be a holding partnership and, either directly or through direct subsidiaries, will control and hold equity interests in each of the Ares

Operating Group entities, which in turn will own the operating entities included in our historical combined and consolidated financial statements. We intend to conduct all of our material business activities through the Ares Operating Group. Ares Management, L.P., either directly or through direct subsidiaries, will be the general partner of each of the Ares Operating Group entities, and will operate and control all of the businesses and affairs of the Ares Operating Group. In addition, Ares Management, L.P. will consolidate the financial results of the Ares Operating Group entities, their consolidated subsidiaries and certain consolidated funds. The ownership interest of the limited partners of the Ares Operating Group entities will be reflected as a non-controlling interest in Consolidated Funds in Ares Management, L.P.'s combined and consolidated financial statements. Following this offering, our senior professional owners will hold their ownership interests in Ares Management, L.P. and in the Ares Operating Group either directly or indirectly through Ares Owners Holdings L.P.

Following the Reorganization, this offering and the Offering Transactions, the Ares Operating Group will generally be entitled to:

See "Business—Incentive Arrangements / Fee Structure."

The diagram below (which omits certain wholly owned intermediate holding companies) depicts our organizational structure as it will exist immediately following this offering. All entities are organized in the state of Delaware unless otherwise indicated.

Holding Partnership Structure

As discussed in "Material U.S. Federal Tax Considerations," Ares Management, L.P. will be treated as a partnership and not as a corporation for U.S. federal income tax purposes. An entity that is treated as a partnership for U.S. federal income tax purposes generally incurs no U.S. federal income tax liability at the entity level. Instead, each partner is required to take into account its allocable share of items of income, gain, loss, deduction and credit of the partnership in computing its U.S. federal, state and local income tax liability each taxable year, whether or not cash distributions are made. Investors who acquire common units in this offering will become limited partners of Ares Management, L.P. Accordingly, holders of common units will be required to report their allocable share of the income, gain, loss, deduction and credit of Ares Management, L.P., even if Ares Management, L.P. does not make cash distributions. We believe that, for U.S. federal income tax purposes, the Ares Operating Group entities generally will be treated as partnerships for U.S. federal income tax purposes. Accordingly, direct subsidiaries of Ares Management, L.P. that are treated as corporations for U.S. federal income tax purposes and that are the holders of Ares Operating Group Units (as defined below) will be (and, in the case of Ares Offshore Holdings, Ltd., may be) subject to U.S. federal, state and local income taxes in respect of their interests in the Ares Operating Group entities. See "Material U.S. Federal Tax Considerations" for more information about the tax treatment of Ares Management, L.P. and the Ares Operating Group.

Each of the Ares Operating Group entities will have an identical number of limited partnership units outstanding. We use the term "Ares Operating Group Unit" to refer, collectively, to a limited partnership unit in each of the Ares Operating Group entities. Ares Management, L.P. will hold, directly or through direct subsidiaries, a number of Ares Operating Group Units equal to the number of common units that Ares Management, L.P. has issued. The Ares Operating Group Units that will be held by Ares Management, L.P. and its direct subsidiaries will be economically identical in all respects to the Ares Operating Group Units that are not held by Ares Management, L.P. and its direct subsidiaries following the Reorganization, this offering and the Offering Transactions. Accordingly, the income of the Ares Operating Group will benefit Ares Management, L.P. to the extent of its equity interest in the Ares Operating Group. Immediately following this offering, Ares Management, L.P. will hold Ares Operating Group Units representing % of the total number of Ares Operating Group Units, or % if the underwriters exercise in full their option to purchase additional common units, and our senior professional owners will hold Ares Operating Group Units representing % of the total number of Ares Operating Group Units, or % if the underwriters exercise in full their option to purchase additional common units.

Following the Reorganization, the Ares Operating Group Units and our common units held directly or indirectly by our senior professional owners will generally be subject to restrictions on transfer and other provisions. See "Compensation of Our Directors and Executive Officers—Vesting; Transfer Restrictions for Senior Professional Owners."

Certain Corporate Governance Considerations

Voting Rights. Unlike the holders of common stock in a corporation, our common unitholders will have limited voting rights and will have no right to remove our general partner or, except in the limited circumstances described below, elect the directors of our general partner. On those few matters that may be submitted for a vote of our common unitholders, Ares Voting LLC, an entity wholly owned by Ares Partners Holdco LLC, which is in turn owned and controlled by our Co-Founders, will hold a special voting unit that provides it with a number of votes, on any matter that may be submitted for a vote of our common unitholders, that is equal to the aggregate number of vested and unvested Ares Operating Group Units held directly or indirectly by the limited partners of the Ares Operating Group entities that do not directly hold a special voting unit. We refer to our common units (other than those held by any person whom our general partner may from time to time, with such person's consent, designate as a non-voting common unitholder) and our special voting units as "voting units." Accordingly, immediately following this

offering, on those few matters that may be submitted for a vote of our common unitholders, investors in this offering will collectively have % of the voting power of Ares Management, L.P., or % if the underwriters exercise in full their option to purchase additional common units, and our senior professional owners will collectively have % of the voting power of Ares Management, L.P., or % if the underwriters exercise in full their option to purchase additional common units. Our common unitholders' voting rights will be further restricted by the provision in our partnership agreement stating that any common units held by a person that beneficially owns 20% or more of any class of our common units then outstanding (other than our general partner, Ares Partners Holdco LLC and their respective affiliates, or a direct or subsequently approved transferee of our general partner or its affiliates) cannot be voted on any matter.

Election of Directors. In general, our common unitholders will have no right to elect the directors of our general partner. However, when our Co-Founders and other then-current or former Ares personnel directly or indirectly hold less than 10% of the limited partner voting power, our common unitholders will have the right to vote in the election of the directors of our general partner. This voting power condition will be measured on January 31 of each year, and will be triggered if the total voting power held by holders of the special voting units in Ares Management, L.P. (including voting units held by our general partner and its affiliates) in their capacity as such, or otherwise directly or indirectly held by then-current or former Ares personnel (treating voting units deliverable to such persons pursuant to outstanding equity awards as being held by them), collectively, constitutes less than 10% of the voting power of the outstanding voting units of Ares Management, L.P. See "Material Provisions of Ares Management, L.P. Partnership Agreement—Election of Directors of General Partner." Unless and until the foregoing voting power condition is satisfied, our general partner's board of directors will be elected in accordance with its limited liability company agreement, which provides that directors generally may be appointed and removed by the member of our general partner, an entity owned and controlled by our Co-Founders. See "Material Provisions of Ares Management, L.P. Partnership Agreement—Election of Directors of General Partner." Unless and until the foregoing voting power condition is satisfied, the board of directors of our general partner will have no authority other than that which its member chooses to delegate to it. In the event that the voting power condition is satisfied, the board of directors of our general partner will be responsible for the oversight of our business and operations. See "Management—Limited Powers of Our Board of Directors."

Conflicts of Interest and Duties of Our General Partner. Although our general partner will not engage in any business activities other than the management and operation of our businesses, conflicts of interest may arise in the future between us and our common unitholders, on the one hand, and our general partner and its affiliates, on the other. The resolutions of these conflicts may not always be in our best interests or that of our common unitholders. In addition, we have fiduciary and contractual obligations to the investors in our funds and we expect to regularly take actions with respect to the purchase or sale of investments in our funds, the structuring of investment transactions for those funds or otherwise that are in the best interests of the investors in those funds but that might at the same time adversely affect our near term results of operations or cash flow.

Our partnership agreement will limit the liability of, and reduce or eliminate the duties (including fiduciary duties) owed by, our general partner to our common unitholders. Our partnership agreement will also restrict the remedies available to common unitholders for actions that might otherwise constitute breaches of our general partner's duties (including fiduciary duties). By purchasing our common units, you are treated as having consented to the provisions set forth in our partnership agreement, including the provisions regarding conflicts of interest situations that, in the absence of such provisions, might be considered a breach of fiduciary or other duties under applicable state law. For a more detailed description

of the conflicts of interest and fiduciary responsibilities of our general partner, see "Conflicts of Interest and Fiduciary Responsibilities."

Ares Management, L.P. was formed as a Delaware limited partnership on November 15, 2013. Our principal executive offices are located at 2000 Avenue of the Stars, 12th Floor, Los Angeles, California 90067, and our telephone number is (310) 201-4100.

Implications of Being an Emerging Growth Company

We are an "emerging growth company," as defined in the Jumpstart Our Business Startups Act of 2012 (the "JOBS Act"), and we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies. These provisions include, among other matters:

We have determined to opt out of the exemption from compliance with new or revised financial accounting standards. Our decision to opt out of this exemption is irrevocable.

We have elected to adopt the reduced disclosure requirements and the exemption from the auditor attestation requirement available to emerging growth companies. As a result of these elections, the information that we provide in this prospectus may be different than the information you may receive from other public companies in which you hold, or may contemplate holding, equity interests. In addition, it is possible that some investors will find our common units less attractive as a result of our elections, which may cause a less active trading market for our common units and more volatility in our the price of common units.

We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year (a) following the fifth anniversary of the completion of this offering, (b) in which we have total annual gross revenue of at least $1.0 billion or (c) in which we are deemed to be a large accelerated filer, which means the market value of our common units that are held by non-affiliates exceeds $700 million as of the prior June 30, and (2) the date on which we have issued more than $1.0 billion in non-convertible debt securities during the prior three-year period.

Restrictions on Ownership of Our Common Units

Our general partner has determined that electing for one of our direct subsidiaries, Ares Real Estate Holdings LLC, to be taxable as a REIT will reduce the administrative burden of filing certain tax returns in certain states in which we hold real property interests and may otherwise enhance our tax position. To assist Ares Real Estate Holdings LLC, in complying with the requirements for qualification as a REIT under the U.S. Internal Revenue Code of 1986, as amended (the "Code"), our partnership agreement

prohibits, with certain exceptions, any common unitholder from beneficially or constructively owning, applying certain attribution rules under the Code, more than the lesser of % of the number of all outstanding common units and the value of all outstanding units.

Our general partner may, in its sole discretion, waive the % ownership limit with respect to a particular common unitholder if it is presented with evidence satisfactory to it that such ownership will not then or in the future jeopardize Ares Real Estate Holdings LLC's qualification as a REIT. Our general partner is expected to establish an excepted holder limit for existing owners who would otherwise exceed the ownership limit.

Our partnership agreement also prohibits any person from, among other things, beneficially or constructively owning common units that would result in Ares Real Estate Holdings LLC being "closely held" under Code Section 856(h), or otherwise cause Ares Real Estate Holdings LLC to fail to qualify as a REIT.

In addition, our partnership agreement provides that any ownership or purported transfer of our common units in violation of the foregoing restrictions will result in the common units so owned or transferred being automatically transferred to a charitable trust for the benefit of a charitable beneficiary, and the purported owner or transferee acquiring no rights in such common units. If a transfer to a charitable trust would be ineffective for any reason to prevent a violation of the restriction, the transfer resulting in such violation will be void from the time of such purported transfer.

Common units offered by Ares Management, L.P. | common units. We have granted the underwriters an option to purchase up to an additional common units. | |

Common units outstanding after this offering | common units ( common units if the underwriters exercise their option to purchase additional common units in full). | |

Common units offered by the selling unitholder | common units. | |

Use of proceeds | We estimate that our net proceeds from this offering will be $ million, assuming an initial public offering price of $ per common unit, which is the midpoint of the price range set forth on the front cover of this prospectus, after deducting underwriting discounts and commissions and estimated offering expenses. If the underwriters exercise in full their option to purchase additional common units, the net proceeds to us will be approximately $ million. We intend to use the net proceeds to purchase newly issued Ares Operating Group Units concurrently with the consummation of this offering, as described under "Organizational Structure—Offering Transactions," to partially repay outstanding balances under our revolving credit facility (the "Credit Facility") and for general corporate purposes and to fund growth initiatives. The Ares Operating Group will also bear or reimburse Ares Management, L.P. for all of the expenses of this offering, which we estimate will be approximately $ million. Affiliates of J.P. Morgan Securities LLC, Merrill Lynch, Pierce, Fenner & Smith Incorporated, | |

We will not receive any proceeds from the sale of common units in this offering by the selling unitholder. | ||

Voting rights | Our general partner, Ares Management GP LLC, will manage all of our operations and activities. Our common unitholders will not hold an interest in our general partner, which is wholly owned by Ares Partners Holdco LLC, an entity owned and controlled by our Co-Founders. Unlike the holders of common stock in a corporation, our common unitholders will have limited voting rights and will have no right to remove our general partner or, except in limited circumstances, elect the directors of our general partner. |

On those few matters that may be submitted for a vote of our common unitholders, Ares Voting LLC, an entity wholly owned by Ares Partners Holdco LLC, which is in turn owned and controlled by our Co-Founders, will hold a special voting unit that provides it with a number of votes, on any matter that may be submitted for a vote of our common unitholders, that is equal to the aggregate number of vested and unvested Ares Operating Group Units held directly or indirectly by the limited partners of the Ares Operating Group entities that do not directly hold a special voting unit. Accordingly, immediately following this offering our Co-Founders will have sufficient voting power to determine the outcome of those few matters that may be submitted for a vote of our common unitholders. Our common unitholders' voting rights will be further restricted by the provision in our partnership agreement stating that any common units held by a person that beneficially owns 20% or more of any class of our common units then outstanding (other than our general partner, Ares Partners Holdco LLC and their respective affiliates, or a direct or subsequently approved transferee of our general partner or its affiliates) cannot be voted on any matter. See "Material Provisions of Ares Management, L.P. Partnership Agreement—Withdrawal or Removal of the General Partner," "—Meetings; Voting" and "—Election of Directors of General Partner." | ||

Cash distribution policy | We expect to distribute to our common unitholders on a quarterly basis substantially all of Ares Management, L.P.'s share of distributable earnings in excess of amounts determined by our general partner to be necessary or appropriate to provide for the conduct of our businesses, to make appropriate investments in our businesses and our funds, to comply with applicable law, any of our debt instruments or other agreements or to provide for future distributions to our common unitholders for any ensuing quarter, subject to a base quarterly distribution target range of 75% to 85% of distributable earnings. We expect that our first quarterly distribution will be paid in the quarter of in respect of the prior quarter. The declaration, payment and determination of the amount of any distributions will be at the sole discretion of our general partner, which may change our distribution policy at any time. We cannot assure you that any distributions, whether quarterly or otherwise, can or will be paid or that any cash distribution will be sufficient to cover taxes on any unitholder's allocable share of gain or income. See "Cash Distribution Policy." |

Exchange agreement | Prior to this offering, we will enter into an exchange agreement with the holders of Ares Operating Group Units so that such holders, subject to any applicable transfer restrictions and other provisions, may up to four times each year from and after the second anniversary of the date of the closing of this offering (subject to the terms of the exchange agreement) exchange their Ares Operating Group Units for our common units on a one-for-one basis, subject to customary conversion rate adjustments for splits, unit distributions and reclassifications, or, at our option, for cash. A holder of Ares Operating Group Units must exchange one Ares Operating Group Unit in each of the five Ares Operating Group entities to effect an exchange for a common unit of Ares Management, L.P. If and when a holder exchanges Ares Operating Group Units for common units of Ares Management, L.P., the relative equity percentage ownership of such holder and of the other equity owners of Ares (whether held at Ares Management, L.P. or at the Ares Operating Group) will not be altered. | |

Tax receivable agreement | Future exchanges of Ares Operating Group Units are expected to result in increases in the tax basis of the tangible and intangible assets of the relevant Ares Operating Group entity. These increases in tax basis generally will increase (for U.S. federal income tax purposes) depreciation and amortization deductions and potentially reduce gain on sales of assets, and therefore reduce the amount of tax that the direct subsidiaries of Ares Management, L.P. that are taxable as corporations for U.S. federal income tax purposes would otherwise be required to pay in the future. These direct subsidiaries that are taxable as corporations will enter into a tax receivable agreement with certain existing direct and indirect holders of Ares Operating Group Units whereby they will agree to pay such holders or entities that will hold such Ares Operating Group Units on their behalf (the "TRA Recipients") 85% of the amount of cash tax savings, if any, in U.S. federal, state, local and foreign income tax or franchise tax that these direct subsidiaries actually realize as a result of these increases in tax basis under the tax receivable agreement. See "Certain Relationships and Related Person Transactions—Tax Receivable Agreement." | |

Risk factors | See "Risk Factors" beginning on page 25 for a discussion of some of the factors you should carefully consider before deciding to invest in our common units. |

Ownership and transfer restrictions | To assist one of our direct subsidiaries, Ares Real Estate Holdings LLC, in complying with the requirements for qualification as a REIT under the Code and for other purposes, which our general partner has determined will potentially benefit our common unitholders, our partnership agreement generally prohibits, among other prohibitions, any common unitholder from beneficially or constructively owning more than the lesser of | |

Proposed New York Stock Exchange symbol | ARES |

The number of common units outstanding after this offering and the other information based thereon in this prospectus, except where otherwise disclosed, excludes:

Unless otherwise indicated, all information in this prospectus assumes no exercise by the underwriters of their right to purchase up to an additional common units from us.

See "Compensation of Our Directors and Executive Officers—Equity Incentive Plan" and "—IPO Awards Under the 2014 Equity Incentive Plan."

Summary Historical Financial and Other Data

The following tables present summary historical financial and other data of Pre-IPO Ares. Ares Management, L.P. was formed on November 15, 2013 to serve as a holding partnership for our businesses. Ares Management, L.P. has not commenced operations and has nominal assets and liabilities. To facilitate this offering, we will consummate the Reorganization in which Ares Management, L.P. will become the successor to AHI and Ares Investments LLC for financial accounting purposes under GAAP. See "Organizational Structure."