S‑1

| 1389 | |||

(State or other jurisdiction of | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) | ||

Title of Each Class of Securities Common Stock, par value $0.001 per share This Investing in our common stock involves risks. You should consider the risks we have described in The date of this prospectus is , 2017. ” estimates. of proppant per well. Over 75% of our fleet has been delivered over the past complex hydraulic fracturing jobs, and is largely standardized across units to facilitate efficient maintenance and repair and reduce equipment downtime. strong relationships to keep our fleet fully utilized and selectively expand our platform in response to specific customer demand. Common stock offered by the selling shareholders Common stock outstanding prior to and after this offering Use of proceeds We will not receive any of the proceeds from the sale of shares of our common stock by the selling shareholders Dividend policy Risk factors ($ in thousands except shares and per share amounts) Statement of Operations Data: Revenue Costs and Expenses: Cost of services(1) General and administrative(2) Depreciation and amortization Impairment expense Loss on disposal of assets Total costs and expenses Operating Loss Other Income (Expense): Interest expense Gain on extinguishment of debt Other expense Total other expense Loss before income taxes Income tax benefit Net loss Per share information: Net loss per common share: Basic Diluted Weighted average common shares outstanding: Basic Diluted Balance Sheet Data as of: Cash and cash equivalents Property and equipment — net of accumulated depreciation Total assets Long-term debt — net of deferred loan costs Total shareholders' equity Cash Flow Statement Data: Net cash (used in) provided by operating activities Net cash used in investing activities Net cash used in financing activities Other Data: Adjusted EBITDA Adjusted EBITDA Margin Capital expenditures Net loss Interest expense Income tax benefit Depreciation and amortization EBITDA Impairment expense Loss on disposal of assets Gain on extinguishment of debt Stock-based compensation Other expense Adjusted EBITDA Revenue Adjusted EBITDA margin capacity constraints, market limitations, curtailment of production or interruption of the processing or transportation of oil and natural gas produced from the wells in these areas. In addition, the effect of fluctuations on supply and demand may become more pronounced within specific geographic oil and natural gas producing areas such as the Permian Basin, which may cause these conditions to occur with greater frequency or magnify the effects of these conditions. Due to the concentrated nature of our operations, we could experience any of the same conditions at the same time, resulting in a relatively greater impact on our revenue than they might have on other companies that have more geographically diverse operations. completing their wells using their own hydraulic fracturing equipment and personnel. sources in these areas. Our or our alternative may not be favorable to us. In particular, the terms of any debt financing may include covenants that significantly restrict our operations. Our inability to grow as planned may reduce our chances of maintaining and improving profitability. needs or to expand or pursue our business activities. For example, Facility and Other Financing Arrangements .” imposed for certain risks. In some instances, certain insurance could become unavailable or available only for reduced amounts of coverage. If we were to incur a significant liability for which we are not fully insured, it could have a material adverse effect on our business, results of operations and financial condition. In addition, we may not be able to secure additional insurance or bonding that might be required by new governmental regulations. This may cause us to restrict our operations, which might severely impact our financial position. Certain motor vehicle operators require registration with the Department of Transportation. This registration requires an acceptable operating record. The Department of Transportation periodically conducts compliance reviews and may revoke registration privileges based on certain safety performance criteria that could result in a suspension of operations. separately negotiated agreement are unclear at this time. Conservation measures, commercial development and technological advances could reduce demand for oil and natural gas and our services.688-0012

688‑0012registrant'sregistrant’s principal executive offices)688-0012

688‑0012Copies to:Ryan J. Maierson

Thomas G. Brandt

Latham & Watkins LLP

811 Main Street, Suite 3700

Houston, Texas 77002

(713) 546-5400Alan BeckDouglas E. McWilliamsVinson & Elkins L.L.P.1001 Fannin Street, Suite 2500Houston, Texas 77002(713) 758-2222546‑5400oxpost-effectivepost‑effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. opost-effectivepost‑effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. onon-acceleratednon‑accelerated filer, or a smaller reporting company.company or an emerging growth company . See the definitions of "large“large accelerated filer," "accelerated filer"” “accelerated filer,” “smaller reporting company” and "smaller reporting company"“emerging growth company” in Rule 12b-212b‑2 of the Exchange Act.Non-acceleratedNon‑accelerated filer ý

x

(Do not check if a

smaller reporting company)CALCULATION OF REGISTRATION FEE

to be Registered Proposed Maximum

Aggregate Offering

Price(1)(2) Amount of

Registration Fee Amount to be

Registered(1) Proposed Maximum

Offering Price per

Share(2)

Aggregate Common Stock, par value $0.001 per share Common Stock, par value $0.001 per share 17,355,045 $11.765 $204,182,104 $23,665 (1) (1) (1) $345,000,000 $39,985.50 (2) (1)Includes shares issuable upon exercise of the underwriters' option to purchase additional shares.(2)Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o).isbecomes effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.FEBRUARY 7,SEPTEMBER 8, 2017![]()

is our initial public offering. We are offeringprospectus covers the offer and sale of 17,355,045 shares of our common stock andby the selling shareholders are(which term as used in this prospectus includes pledgees, donees, transferees or other successors‑in‑interest). We will not receive any of the proceeds from the sale of the shares by the selling shares ofshareholders. stock. Prior to this offering, there has been no public market for our common stock. Itstock is currently estimated that the initial public offering price will be between $ and $ per share. We intend to apply to list our common stocklisted on the New York Stock Exchange, or NYSE, under the symbol "PUMP." “PUMP.” The last reported closing sales price of our common stock on September 7, 2017 was $11.76 per share. You are urged to obtain current market quotations for our common stock."emerging“emerging growth company"company” as that term is used in the Jumpstart Our Business Startups Act of 2012, or JOBS Act, and will beare subject to reduced public company reporting requirements."Risk Factors"“Risk Factors” beginning on page 15.8.Per ShareTotal Initial public offering price$ $ Underwriting discounts and commissions(1)$ $ Proceeds, before expenses, to ProPetro Holding Corp. $ $ Proceeds, before expenses, to the selling shareholders$ $ (1)Please read "Underwriting" for a description of all underwriting compensation payable in connection with this offering. The underwriters have the option to purchase up to an additional shares from us and the selling shareholders at the public offering price, less the underwriting discounts. Delivery of the shares of common stock is expected to be made on or about , 2017 through the book-entry facilities of The Depository Trust Company.Goldman, Sachs & Co.BarclaysCredit SuisseJ.P. MorganEvercore ISIRBC Capital MarketsSimmons & Company International Energy Specialists of Piper JaffrayRaymond JamesDeutsche Bank SecuritiesTudor, Pickering, Holt & Co.Johnson Rice & Company L.L.C.

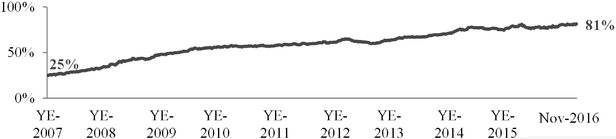

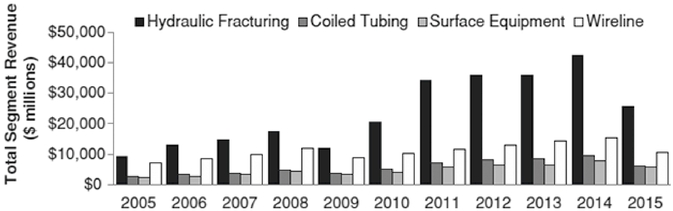

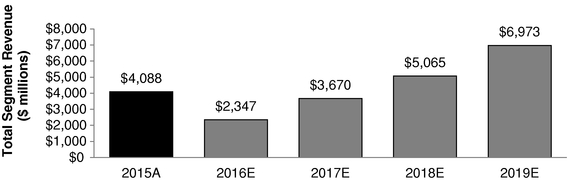

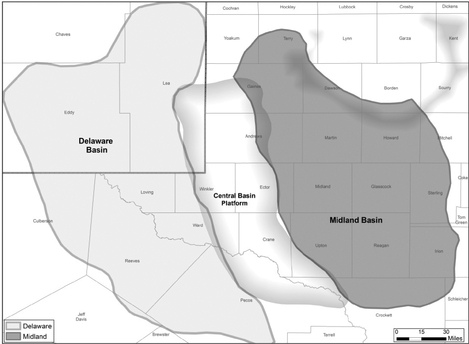

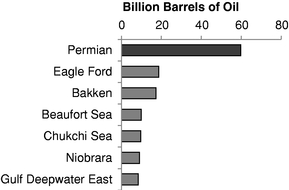

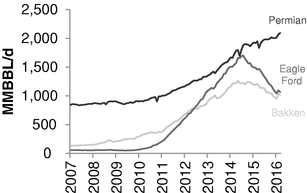

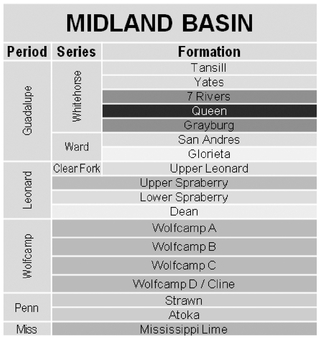

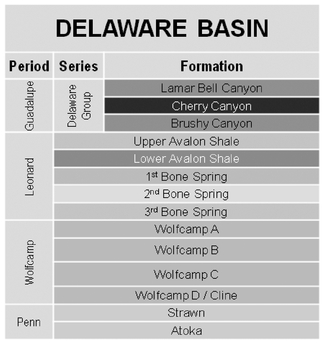

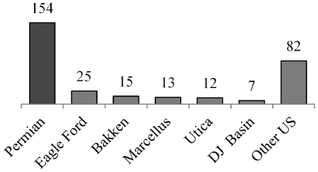

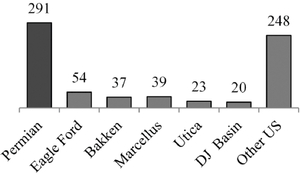

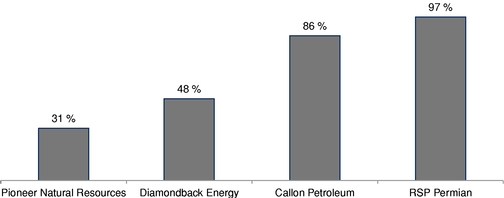

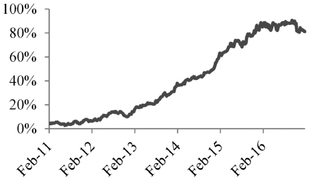

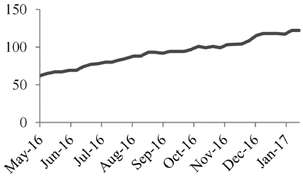

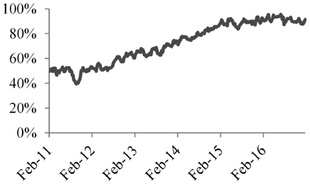

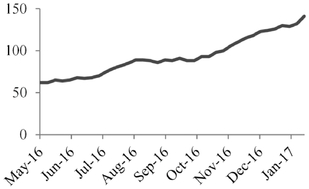

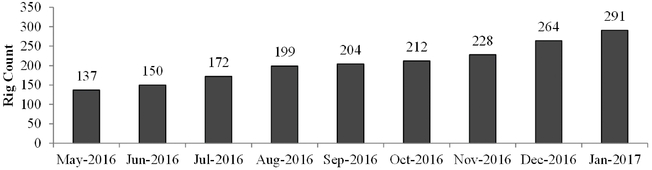

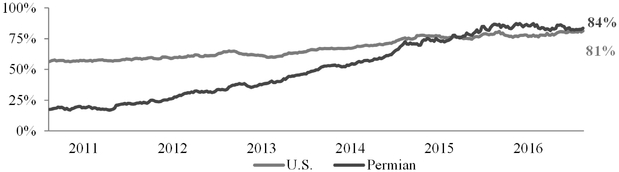

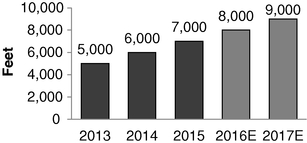

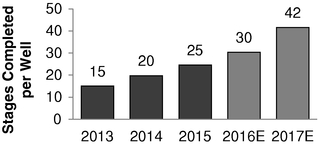

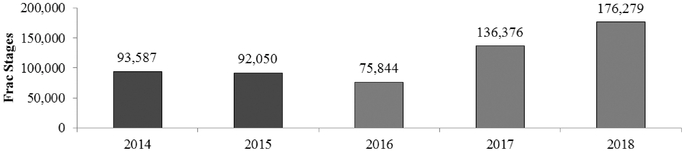

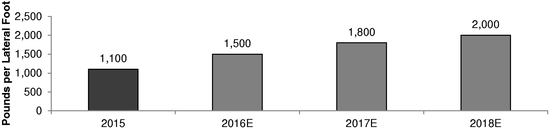

Page SummaryThe OfferingSummary Historical Consolidated Financial DataRisk FactorsUse of ProceedsDividend PolicyDilutionSelected Historical Financial DataManagement's Discussion and Analysis of Financial Condition and Results of OperationsIndustry OverviewManagementExecutive CompensationPrincipal and Selling ShareholdersCertain Relationships and Related Party TransactionsDescription Of Capital StockShares Eligible For Future SaleMaterial U.S. Federal Income Tax Consequences to Non-U.S. HoldersUnderwritingLegal MattersWhere You Can Find Additional InformationForward-Looking StatementsGlossary of Oil and Natural Gas TermsIndex to Financial StatementsF-1underwritersselling shareholders have not, authorized any other person to provide you with information different from that contained in this prospectus and any free writing prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwritersThe selling shareholders are not making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.forward-lookingforward‑looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. Please read "Risk Factors"“Risk Factors” and "Forward-Looking“Forward‑Looking Statements."parties'parties’ trademarks, service marks, trade names or products in this prospectus is not intended to, and does not imply, a relationship with, or endorsement or sponsorship by us. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus may appear without the ®,TM orSM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks, service marks and trade names. Unless the context otherwise requires, the information in this prospectus (other than in the historical financial statements) assumes that the underwriters will not exercise their option to purchase additional shares.is based on a variety of sources, including independent publications, government publications, informationhas been obtained from customers, distributors, suppliers, trade and business organizations and publicly available information and publications as well as our good faith estimates, which have been derived from management's knowledge and experience in the industry in which we operate. The industry data sourced from Spears & Associates is from its publication titled "Hydraulic Fracturing Market 2005-2017," published in the fourth quarter of 2016. The industry data sourced from Rystad Energy is from its "UCube" as of November 2016. We believe that these third-party sources are reliable and that the third-party information included in this prospectus and in our estimates is accurate and complete.prospectus. Unless indicated otherwise, the information presented in this prospectus assumes an initial public offering price of $ per share (the midpoint of the price range on the cover page of this prospectus), that the underwriters do not exercise their option to purchase additional shares and the conversion of all of the outstanding shares of our Series A Convertible Preferred Stock, par value $0.001 per share ("Series A Preferred Shares"), into shares of common stock.documents incorporated by reference herein. You should read "Risk Factors"“Risk Factors” for more information about important risks that you should consider carefully before buying our common stock."ProPetro“ProPetro Holding Corp.," "the” “the Company," "our” “our company," "we," "our"” “we,” “our” and "us,"“us,” or like terms, refer to ProPetro Holding Corp. and its subsidiary. References to (i) "Energy“Energy Capital Partners"Partners” refer to Energy Capital Partners II, LP and its parallel and co-investmentco‑investment funds and related investment vehicles and (ii) the "selling shareholders"“selling shareholders” refer to Energy Capital Partners and the other selling shareholders that are offering shares of common stock as set forth in this offering and have granted the underwriters an option to purchase additional shares.section entitled “Selling Shareholders.” When we refer to the "utilization"“utilization” of our fleet, we are referring to the percentage of our fleet in use by our customers at the applicable time or for the applicable period of determination. We have provided definitions for some of the terms we use to describe our business and industry and other terms used in this prospectus in the "Glossary“Glossary of Oil and Natural Gas Terms"Terms” beginning on page A-1A‑1 of this prospectus.growth-oriented,growth‑oriented, Midland, Texas-basedTexas‑based oilfield services company providing hydraulic fracturing and other complementary services to leading upstream oil and gas companies engaged in the exploration and production, or E&P, of North American unconventional oil and natural gas resources. Our operations are primarily focused in the Permian Basin, where we have cultivated longstanding customer relationships with some of the region'sregion’s most active and well-capitalizedwell‑capitalized E&P companies, including Callon Petroleum, Diamondback Energy, Parsley Energy, Pioneer Natural Resources, Surge Energy and XTO Energy. For the year ended December 31, 2016, no single customer represented greater than 20% of our revenue.companies. The Permian Basin is widely regarded as the most prolific oil-producingoil‑producing area in the United States, and we believe we are currentlyone of the largest private providerproviders of hydraulic fracturing services in the region by hydraulic horsepower, or HHP, with an aggregate deployed capacity of 420,000555,000 HHP. Our fleet which consists of 10 hydraulic fracturing units, has been designed to handle the highest intensity, most complex hydraulic fracturing jobs, and has been 100% utilized since September 2016. We haveIn the quarter ended June 30, 2017, we purchased and put in service two additional hydraulic fracturing units, which areand took delivery and put into service a third unit following the end of quarter, bringing our fleet total to 13 deployed units. In addition, we have contracted to purchase three new hydraulic fracturing units scheduled for delivery and deployment to dedicated customers in Aprilthe second half of 2017, as well as other ancillary equipment such as engines and June 2017, respectively.spare parts. These units will provide us with an additional 90,000135,000 HHP, bringing our totalaggregate capacity to 510,000690,000 HHP. Additionally, we expect to use the proceeds from this offering to purchase two additional units that will be deployed in 2017 to meet specific customer requests, giving us an additional 90,000 HHP, or 600,000 HHP in the aggregate, once all units have been received.region'sregion’s increasingly high-intensityhigh‑intensity well completions, which are characterized by longer horizontal wellbores, more frac stages per lateral and increasing amountsthreefour years, and we have fully maintained our equipment throughout the recent industry downturn to ensure optimal performance and reliability. In contrast, we believe many of our competitors have deferred necessary maintenance capital spending throughout the downturn, which we believe positions us to respond more quickly and reliably to customer needs during the ongoing market recovery.customers'customers’ increasing service needs and spending levels.high-qualityhigh‑quality services that are tailored to our customers'customers’ needs and synchronized with their well development programs. This alignment assists our customers in optimizing the long-termlong‑term development of their unconventional resources. Over the past threefour years, we have leveraged our strong Permian Basin relationships to grow our installed HHP capacity by over 400%four times and organically build our Permian Basin cementing, coiled tubing and acidizing lines of business. Consistent with past performance, we believe our substantial market presence will continue to yield a variety of actionable growth opportunities allowing us to expand both our hydraulic fracturing and complementary services going forward. To this end, we intend to continue our past practice of opportunistically deploying new equipment on a long-term,long‑term, dedicated basis in response to specific customer demand. For the nine months ended September 30, 2016 and the year ended December 31, 2015, we generated net losses of approximately $(35.8) million and $(45.9) million, respectively, and Adjusted EBITDA of approximately $1.6 million and $60.1 million, respectively. Over these same periods, approximately 92.1% and 90.0% of our revenues, respectively, were generated from our pressure pumping segment, which includes our hydraulic fracturing, cementing and acidizing services. For the definition of Adjusted EBITDA and a reconciliation from its most directly comparable financial measure calculated and presented in accordance with generally accepted accounting principles ("GAAP"), please read "Selected Historical Consolidated Financial Data — Non-GAAP Financial Measures."Company'sCompany’s operations on hydraulic fracturing targeting the Permian Basin. As of September 30, 2016,August 1, 2017, we had grown our hydraulic fracturing business to a total of 1013 hydraulic fracturing units with an aggregate of 420,000555,000 HHP, of which 320,000455,000 HHP has been delivered since 2013. We have purchased twoFurther, three additional hydraulic fracturing units which are scheduled for delivery and deployment to dedicated customers in April and Junethe second half of 2017, respectively. These unitswhich will provide us with an additional 90,000 HHP, bringingincrease our total capacity to 510,000an aggregate of 690,000 HHP. Additionally, we expect to use the proceeds from this offering to purchase two additional units that will be deployed in 2017 to meet specific customer requests, giving us an additional 90,000 HHP, or 600,000 HHP in the aggregate, once all units have been received. Our fleet has been designed to handle the highest-intensity,highest‑intensity, mostcustomer'scustomer’s needs. Each unit in our fleet has a designated team of personnel, which allows us to provide responsive and customized services, such as project design, proppant procurement, real-timereal‑time data provision and post-completionpost‑completion analysis for each of our jobs. Many of our hydraulic fracturing units and associated personnel have continuously worked with the same customer for the past several years, promoting deep relationships and a high degree of coordination and visibility into future customer activity levels. Furthermore, in light of our substantial market position and historically high fleet utilization levels, we have established a variety of entrenched relationships with key equipment, sand and other downhole consumable suppliers. These strategic relationships provide us ready access to equipment, parts and materials on a timely and economic basis and allow our dedicated procurement logistics team to ensure consistently reliable operations. In addition to our hydraulic fracturing operations, we offer a range of ancillary services to our customers, including cementing, acidizing, coiled tubing, flowback services and surface air drilling. We believe these services are complementary and synergistic with our hydraulic fracturing operations and have, in large part, grown organically with our customers'customers’ demand for these services. ProPetro is strategically located and focused in the Permian Basin, one of the world's most attractive regions for oil field service operations as a result of its size, geology, and customer activity levels. The Permian Basin consists of mature, legacy, onshore oil and liquids-rich natural gas reservoirs that span approximately 86,000 square miles in West Texas and New Mexico and are characterized by multiple prospective geologic benches for horizontal development. Rystad Energy estimates that, as of November 2016, the Permian Basin contains approximately 58 billion barrels of oil, the largest recoverable crude oil resource base in the United States and the second largest in the world. As a result of its significant size, coupled with the presence of multiple prospective geologic benches and other favorable characteristics, the Permian Basin has become widely recognized as the most attractive and economic oil resource in North America. Since May 2016, Permian Basin rig counts have grown by more than 110% to 291 active rigs as of January 2017. This increase in Permian Basin rig activity has accounted for more than 50% of the total U.S. rig count growth over that time period, more than three times the combined number of rigs added in the Bakken and Eagle Ford shales. The Permian Basin is divided by the Central Basin Platform, creating the Midland and Delaware sub-basins, which have each contributed to the overall growth in the Permian Basin. The Midland Basin is the more delineated and mature resource-play of the Permian Basin's sub-basins and is the current focus of our operations. Operational improvements in the basin have driven heightened oil production in recent years as a result of increasing levels of pad drilling, downspacing, and capital efficiency. Initially delineated with thousands of vertical wells, today its resource potential is further enhanced through horizontal drilling and completion efficiencies. Rystad Energy estimates the Midland Basin's recoverable oil resource to be over 27 billion barrels, second in the United States only to the geographically adjacent Delaware Basin. Accounting for more than 50% of the Permian Basin's growth in rig activity since May 2016, the Delaware Basin has become a premier, complementary resource base to the Midland Basin. Rystad Energy estimates the recoverable crude oil resource in the Delaware Basin to be slightly greater than the Midland Basin, at approximately 28 billion barrels. E&P operators have actively delineated acreage in the Delaware Basin, having successfully targeted nine distinct zones with horizontal penetration. As the less-developed of the two primary Permian Basin sub-basins, theDelaware Basin represents a high-growth opportunity for E&P companies, many of whom have entered the basin through large-scale acquisitions. As activity levels increase in the Delaware Basin, we have begun to expand our presence in the region in tandem with increasing activity levels and demand pull from our core customer base. The Permian Basin's compelling economics for E&P companies, especially in a low commodity price environment, has resulted in a significant increase in acquisition activity across the basin. Since 2016 the Permian Basin leads all other North American basins in acquisition activity, with more than 30 transactions of $100 million or greater and an aggregate transaction volume totaling more than $30 billion. Our customers have accounted for a significant portion of this acquisition activity by both size and volume and are actively scaling their capital budgets to develop their expanding resource bases. In addition to increased drilling activity levels in the Permian Basin, an ongoing shift to larger and more complex well completions has significantly increased per-well demand for the hydraulic fracturing and other completion services we offer. According to Spears & Associates, key drivers of this increasing service intensity include:•Longer horizontal wellbore laterals. Average Permian Basin lateral lengths are expected to grow from an average of 5,000 feet in 2013 to an estimated average of 9,000 feet anticipated in 2017. Management estimates that leading-edge Permian Basin lateral lengths are currently approaching 12,500 feet;•More frac stages per lateral. Frac stages per well are expected to increase from 15 stages per well completed in 2013 to approximately 42 stages per well completed in 2017; and•Increasing amounts of proppant per well. Permian Basin sand use is expected to grow from an average of 1,100 pounds per foot of proppant per well in 2015 to approximately 1,800 pounds per foot of proppant per well anticipated in 2017. Rising producer activity levels, increasing basin service intensity and continued drilling and completion efficiencies have combined to drive the 100% utilization of our fleet and build a sizable backlog of addressable demand for our services. We have seen our competitors defer necessary maintenance spending and cannibalize idle equipment for spare parts. This has resulted in tightening hydraulic fracturing supply and demand fundamentals and is likely to drive continued pricing improvement for our hydraulic fracturing services. Moreover, we believe the other complementary services that we provide are well-positioned to similarly benefit from a continued industry recovery.high-qualityhigh‑quality services that are tailored to our customers'customers’ needs and synchronized with their well development programs. This alignment assists our customers in optimizing the long-termlong‑term development of their unconventional resources. We believe that the following competitive strengths differentiate us from our peers and uniquely position us to achieve our primary business objective.•private hydraulic fracturing providerproviders by HHP in the Permian Basin, which is the most prolific oil producing area in the United States. Our longstanding customer relationships and substantial Permian Basin market presence uniquely position us to continue growing in tandem with the basin'sbasin’s ongoing development. The Permian Basin is a mature, liquids-richliquids‑rich basin with well-knownwell‑known geology and a large, exploitable resource base that delivers attractive E&P producer economics at or below current commodity prices. Rystad Energy estimatesthat, as of November 2016, the Permian Basin contains approximately 58 billion barrels of oil, the largest recoverable crude oil resource base in the United States and the second largest in the world. As a result of its significant size, coupled with the presence of multiple prospective geologic benches and other favorable characteristics, the Permian Basin has become widely recognized as the mostThe recent recovery of oil prices to the low $50 per barrel range has driven a considerable increase in Permian drilling and completion activity and associated demand for our services. Today, the Permian Basin is the most active onshore basin in North America, with over 291 active rigs, and accounts for approximately 51% of all oil-directed rigs in the United States. Current Permian production levels exceed the combined output of both the Bakken and Eagle Ford shale formations, and, given the Permian Basin's superior breakeven economics, which are estimated by Rystad Energy to be as low as $32 per barrel, we expect robust activity levels in the basin for the foreseeable future.

Our operational focus has historically been in the Permian Basin'sBasin’s Midland sub-basinsub‑basin in support of our customers'customers’ core operations. More recently, however, many of our customers (including Callon Petroleum, Diamondback Energy, Parsley Energy, RSP Permian and XTO Energy) have made sizeable acquisitions in the Delaware Basin. We anticipate that many of these customers will request our services in the Delaware Basin to help develop their acreage, and we believe that we are uniquely positioned to capture a large addressable growth opportunity as the basin develops. For the foreseeable future, we expect both the Midland Basin and the Delaware Basin to continue to command a disproportionate share of future North American E&P spending.•in Januaryat the beginning of August 2017. As the horizontal rig count has grown, well completion intensity levels have also increased as a result of longer wellbore lateral lengths, more fracturing stages per foot of lateral and increasing amounts of proppant per stage. Furthermore, the ongoing improvement in drilling and completion efficiencies, driven by innovations such as multi-wellmulti‑well pads and zipper fracs, have further increased the demand for HHP. Taken together, these demand drivers have helped contribute to the full utilization of our fleet and leave us well positioned to capture future organic growth opportunities and enhanced pricing for the services we offer.•high-quality,high‑quality, Permian Basin-focusedBasin‑focused customers.Our deep local roots, operational expertise and commitment to safe and reliable service have allowed us to cultivate longstanding customer relationships with the most active and well-capitalizedwell‑capitalized Permian Basin operators. Our diverse customer base is comprised of market leaders such as Callon Petroleum, Diamondback Energy, Parsley Energy, Pioneer Natural Resources, Surge Energy and XTO Energy, with no single customer representing more than 20% of our revenue for the year ended December 31, 2016. Many of our current customers have worked with us since our inception and have integrated our fleet scheduling with their well development programs. This high degree of operational alignment and their continued support have allowed us to maintain relatively high utilization rates over time. As our customers increase activity levels, we expect to continue to leverage these•well-maintainedwell‑maintained equipment.We have a large, homogenous fleet of modern equipment that is configured to handle the Permian Basin'sBasin’s most complex, highest-intensity,highest‑intensity, hydraulic fracturing jobs. We believe that our fleet design is a key competitive advantage compared to many of our competitors who have fracturing units that are not optimized for Permian Basin conditions. Our fleet is largely standardized across units to facilitate efficient maintenance and repair, reducing equipment downtime and improving labor efficiency. Importantly, we have fully maintained our fleet throughout the recent industry downturn to ensure optimal performance and reliability. In contrast, we believe many of our competitors have deferred necessary maintenance capital spending and cannibalized essential equipment for spare parts during the same period. Furthermore, our entrenched relationships with a variety of key suppliers and vendors provide us with the reliable access to the equipment necessary to support our continued organic growth strategy.•cross-cyclecross‑cycle financial performance.Over the past several years, we have maintained relatively high cross-cyclecross‑cycle fleet utilization rates. Since September 2016, our fleet has been 100% utilized, and for each of the years ended December 31, 2015 and 2016 and the quarter ended June 30, 2017, we operated in excess of 65% utilization. Our consistent track record of steady organic growth, coupled with our ability to immediately deploy new HHP on a dedicated and fully utilized basis, has resulted in revenue growth across industry cycles. We believe that we will be able to grow faster thancustomer-focusedcustomer‑focused approach should result in enhanced financial performance going forward.•theour company with a portion of our original investment capital. We believe their track record of successfully building premier oilfield service companies in the Permian Basin, as well as their deep roots and relationships throughout the West Texas community, provide a meaningful competitive advantage for our business. In addition, our management team has assembled a loyal group of highly-motivatedhighly‑motivated and talented divisional managers and field personnel, and we have had virtually no manager-levelmanager‑level turnover in our core service divisions over the past three years. We employ a balanced decision-makingdecision‑making structure that empowers managerial and field personnel to work directly with customers to develop solutions while leveraging senior management'smanagement’s oversight. This collaborative approach fosters strong customer links at all levels of the organization and effectively institutionalizes customer relationships beyond the executive suite. We promote a "Safety First"“Safety First” culture, which has led to a Total Recordable Incident Rate, or TRIR, well below industry averages. For example, for the year ended December 31, 2016, we had a TRIR of 0.9, compared to a peer average of 2.5 for the year ended December 31, 2014.•Basin-focusedBasin‑focused hydraulic fracturing business, as we believe the Permian Basin hydraulic fracturing market offers supportive long-termlong‑term growth fundamentals. These fundamentals are characterized by increased demand for our HHP, driven by increasing drilling activity and well completion intensity levels, along with underinvestment by our competitors in their equipment. In response to the current commodity price environment, a number of our customers have publicly announced their intention to increase 2017 capital budgets in the Permian Basin in excess of 50% over 2016 levels. We are currently operating at 100% utilization, and several of our customers have requested additional HHP capacity from us. As our customers continue to develop their assets in the Midland Basin and Delaware Basin, we believe we are strategically positioned to deploy additional hydraulic fracturing equipment in support of their ongoing needs. We have purchased twoFurther, three additional hydraulic fracturing units which are scheduled for delivery and deployment to dedicated customers in April and June 2017, respectively.the second half of 2017. These units will provide us with an additional 90,000135,000 HHP, bringing our total capacity to 510,000690,000 HHP. Additionally, we expect to use the proceeds from this offering to purchase two additional units that will be deployed in 2017 to meet specific customer requests, giving us an additional 90,000 HHP, or 600,000 HHP in the aggregate, once all units have been received.•(as(with approximately 90% of our fleet currently operating on such a schedule, as compared to 2014, when the majority of our services were provided during daylight hours) should result in greater revenue opportunity and enhanced margins as fixed costs are spread over a broader revenue base. We believe that any incremental future fleet additions will benefit from these trends and associated economies of scale.•Cross-sellCross‑sell our complementary services.In addition to our hydraulic fracturing services, we offer a broad range of complementary services in support of our customers'customers’ development activities, including cementing, acidizing, coiled tubing, flowback services and surface air drilling. These complementary services create operational efficiencies for our customers, and allow us to capture a greater percentagecross-sellingcross‑selling and growing our complementary service offerings.•long-term,long‑term, dedicated basis in response to inbound customer requests. We will also selectively evaluate potential strategic acquisitions that increase our scale and capabilities or diversify our operations. At the closing of this offering, we will have no outstanding debt and expect to have a net cash position and $ million of available liquidity, in the form of cash on hand and undrawn borrowing capacity under our $ million revolving credit facility, to support our growth ambitions. Our principal shareholder is Energy Capital Partners. Energy Capital Partners, together with its affiliate funds and related persons, is a private equity firm with over $13.5 billion in capital commitments that is focused on investing in North America's energy infrastructure. Energy Capital Partners has significant energy and financial expertise, including investments in the power generation, midstream oil and gas, energy services and environmental infrastructure sectors. Upon completion of this offering, Energy Capital Partners will beneficially own approximately % of our common stock (or approximately % if the underwriters' option to purchase additional shares of common stock is exercised in full). We are also a party to certain other agreements with Energy Capital Partners and certain of its affiliates. For a description of these agreements, please read "Certain Relationships and Related Party Transactions.""Risk Factors"“Risk Factors” beginning on page 158 and the other information in this prospectus for an explanation of these risks before investing in our common stock.688-0012. Following the closing of this offering, our688‑0012. Our website will beis located athttp://www. .com.www.propetroservices.com. We expect to make our periodic reports and other information filed with or furnished to the Securities and Exchange Commission, or the SEC, available, free of charge, through our website, as soon as reasonably practicable after those reports and other information are electronically filed with or furnished to the SEC. Information on our website or any other website is not incorporated by reference into this prospectus and does not constitute a part of this prospectus.$1.0$1.07 billion in revenue during our last fiscal year, we qualify as an "emerging“emerging growth company"company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As an emerging growth company, we may, for up to five years, take advantage of specified exemptions from reporting and other regulatory requirements that are otherwise applicable generally to public companies. These exemptions include:•Management'sManagement’s Discussion and Analysis of Financial Condition and Results of Operations in this prospectus;•••auditor'sauditor’s report in which the auditor would be required to provide additional information about the audit and the financial statements of the issuer; and•thisthe consummation of our initial public offering (“IPO”), (ii) the last day of the fiscal year in which we have more than $1.0$1.07 billion in annual revenue, (iii) the date on which we issue more than $1.0 billion of non-convertiblenon‑convertible debt over a three-year three‑year"large“large accelerated filer,"” as defined in Rule 12b-212b‑2 promulgated under the Securities Exchange Act of 1934, as amended, or the Exchange Act.will electhave elected to opt out of the exemption that allows emerging growth companies to extend the transition period for complying with new or revised financial accounting standards (this election is irrevocable). Accordingly, the information that we provide you may be different than what you may receive from other public companies in which you hold equity interests. IssuerProPetro Holding Corp.Common stock offered by us shares.17,355,045 shares. shares.83,039,854 shares. shares (including shares of common stock issued upon the automatic conversion of our Series A Preferred Shares at the consummation of this offering).Option to purchase additional sharesWe and the selling shareholders have granted the underwriters a 30-day option to purchase up to an aggregate of additional shares of our common stock.Shares held by our selling shareholders after this offering shares (or shares, if the underwriters exercise in full their option to purchase additional shares).We expect to receive approximately $ million of net proceeds from this offering, based upon the assumed initial public offering price of $ per share (the midpoint of the price range set forth on the cover page of this prospectus), after deducting underwriting discounts and estimated offering expenses payable by us.We intend to use the net proceeds from this offering as follows: • approximately $ million will be used to repay borrowings outstanding under our term loan; • approximately $ million will be used to fund the purchase of additional hydraulic fracturing units; and • approximately $ million will be retained for general corporate purposes, including to fund growth capital expenditures. Please read "Use of Proceeds."in this offering, including pursuant to any exercise by the underwriters of their option to purchase additional shares of our common stock from the selling shareholders.Dividend policy We do not anticipate paying any cash dividends on our common stock. In addition, we expect our new revolving credit facility will place certain restrictions on our ability to pay cash dividends. Please read "Dividend“Dividend Policy."” Directed share program At our request, the underwriters have reserved up to % of theTrading symbolOur common stock being offered by this prospectus for sale, at the initial public offering price, to our directors, executive officers, employees and business associates. The sales will be made by the underwriters through a directed share program. We do not know if these persons will choose to purchase all or any portion of these reserved shares, but any purchases they do make will reduce the number of shares available to the general public. Please read "Underwriting — Directed Share Program."Listing and trading symbolWe intend to apply to list our common stockis listed on the NYSE under the symbol "PUMP."Risk factors You should carefully read and consider the information set forth under the heading "Risk Factors"“Risk Factors” and all other information set forth in this prospectus before deciding to invest in our common stock.SUMMARY HISTORICAL CONSOLIDATED FINANCIAL DATA The following table presents summary historical consolidated financial data of ProPetro Holding Corp. as of the dates and for the periods indicated. The summary historical consolidated financial data as of and for the year ended December 31, 2015 are derived from the audited financial statements appearing elsewhere in this prospectus. The summary historical consolidated interim financial data as of September 30, 2016 and 2015, and for the nine months ended September 30, 2016 and 2015, are derived from the unaudited condensed consolidated interim financial statements appearing elsewhere in this prospectus. The unaudited interim condensed consolidated financial statements have been prepared on the same basis as our audited financial statements and, in our opinion, include all adjustments, consisting of normal recurring adjustments, that are considered necessary for a fair presentation of the financial position, results of operations and cash flows for such periods. Historical results are not necessarily indicative of future results. We conduct our business through seven operating segments: hydraulic fracturing, cementing, acidizing, coil tubing, flowback, surface drilling and Permian drilling. For reporting purposes, the hydraulic fracturing, cementing and acidizing operating segments are aggregated into our one reportable segment: pressure pumping. The summary historical consolidated data presented below should be read in conjunction with "Risk Factors," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and the related notes and other financial data included elsewhere in this prospectus. For the Nine For the Year Months Ended Ended September 30, December 31, 2016 2015 2015 $ 272,999 $ 437,752 $ 569,618 255,362 369,411 483,338 17,197 20,248 27,370 32,669 37,636 50,134 — 36,609 36,609 12,859 15,093 21,268 $ 318,087 $ 478,997 $ 618,719 $ (45,088 ) $ (41,245 ) $ (49,101 ) (15,942 ) (16,458 ) (21,641 ) 6,975 — — (419 ) (643 ) (499 ) (9,386 ) (17,101 ) (22,140 ) (54,474 ) (58,346 ) (71,241 ) (18,644 ) (20,763 ) (25,388 ) $ (35,830 ) $ (37,583 ) $ (45,853 ) $ (1.22 ) $ (1.56 ) $ (1.90 ) $ (1.22 ) $ (1.56 ) $ (1.90 ) 29,328,475 24,132,871 24,132,871 29,328,475 24,132,871 24,132,871

$ 5,288 $ $ 34,310 267,239 291,838 384,264 446,454 188,439 236,876 75,297 69,571

$ (5,652 ) $ 64,690 $ 81,231 (18,156 ) (56,911 ) (62,776 ) (5,215 ) (35,789 ) (15,216 )

$ 1,570 $ 49,022 $ 60,149 0.6 % 11.2 % 10.6 % $ 21,894 $ 62,168 $ 71,677 (1)Exclusive of depreciation and amortization.(2)Inclusive of stock-based compensation.Non-GAAP Financial MeasuresEBITDA, Adjusted EBITDA and Adjusted EBITDA margin We view Adjusted EBITDA and Adjusted EBITDA margin as important indicators of performance. We define EBITDA as our net income, before (i) interest expense, (ii) income taxes and (iii) depreciation and amortization. We define Adjusted EBITDA as EBITDA, plus (i) loss on disposal of assets, (ii) gain on extinguishment of debt, (iii) stock based compensation, and (iv) other unusual or non-recurring charges, such as costs related to our initial public offering. Adjusted EBITDA margin reflects our Adjusted EBITDA as a percentage of our revenues. EBITDA, Adjusted EBITDA and Adjusted EBITDA margin are supplemental measures utilized by our management and other users of our financial statements such as investors, commercial banks, research analysts and others, to assess our financial performance because it allows us to compare our operating performance on a consistent basis across periods by removing the effects of our capital structure (such as varying levels of interest expense), asset base (such as depreciation and amortization) and items outside the control of our management team (such as income tax rates). EBITDA, Adjusted EBITDA and Adjusted EBITDA margin have limitations as analytical tools and should not be considered as an alternative to net income, operating income, cash flow from operating activities or any other measure of financial performance presented in accordance with GAAP. We believe that our presentation of EBITDA, Adjusted EBITDA and Adjusted EBITDA margin will provide useful information to investors in assessing our financial condition and results of operations. Net income is the GAAP measure most directly comparable to EBITDA, Adjusted EBITDA and Adjusted EBITDA margin. EBITDA, Adjusted EBITDA and Adjusted EBITDA margin should not be considered alternatives to net income presented in accordance with GAAP. Because EBITDA, Adjusted EBITDA and Adjusted EBITDA margin may be defined differently by other companies in our industry, our definition of EBITDA, Adjusted EBITDA and Adjusted EBITDA margin may not be comparable to similarly titled measures of other companies, thereby diminishing its utility. The following table presents a reconciliation of net loss to EBITDA, Adjusted EBITDA and Adjusted EBITDA margin for each of the periods indicated.Reconciliation of net loss to Adjusted EBITDA For the Nine For the Year Months ended Ended September 30, December 31, 2016 2015 2015 $ (35,830 ) $ (37,583 ) $ (45,853 ) 15,942 16,458 21,641 (18,644 ) (20,763 ) (25,388 ) 32,669 37,636 50,134 $ (5,863 ) $ (4,252 ) $ 534 — 36,609 36,609 12,859 15,093 21,268 (6,975 ) — — 1,130 929 1,239 419 643 499 $ 1,570 $ 49,022 $ 60,149 272,999 437,752 569,618 0.6 % 11.2 % 10.6 % customers'customers’ spending and associated drilling and completion activities, which had an adverse effect on our revenue. If prices were to decline, similar declines in our customers'customers’ spending would have an adverse effect on our revenue. In addition, a worsening of these conditions may result in a material adverse impact on certain of our customers'customers’ liquidity and financial position resulting in further spending reductions, delays in the collection of amounts owing to us and similar impacts.customers'customers’ willingness to explore, develop and produce oil and natural gas, and therefore, influence prices for our services, including:••••••••••••••••••••••••••short-termshort‑term basis, we are exposed to the risks of a rapid reduction in market prices and utilization and resulting volatility in our revenues.ninesix months ended SeptemberJune 30, 2017 and the year ended December 31, 2016, approximately 97% of our revenues were attributable to our operations in the Permian Basin. As a result of this concentration, we may be disproportionately exposed to the impact of regional supply and demand factors, delays or interruptions of production from wells in the Permian Basin caused by significant governmental regulation, processing or transportationre-marketre‑market or otherwise use the production could have a material adverse effect on our business, results of operations and financial condition. The decline and volatility in oil and natural gas prices over the last two years has negatively impacted the financial condition of our customers and further declines, sustained lower prices, or continued volatility could impact their ability to meet their financial obligations to us.competitors'competitors’ greater resources could allow those competitors to compete more effectively than we can. For instance, our larger competitors may offer services at below-marketbelow‑market prices or bundle ancillary services at no additional cost our customers. We compete with large national and multi-nationalmulti‑national companies that have longer operating histories, greater financial, technical and other resources and greater name recognition than we do. Several of our competitors provide a broader array of services and have a stronger presence in more geographic markets. In addition, we compete with several smaller companies capable of competing effectively on a regional or local basis.in-housein‑house fracturing capabilities by our customers could decrease the demand for our services and have a material adverse impact on our business.provider'sprovider’s reputation for safety and quality. We cannot assure that we will be able to maintain our competitive position.third-partythird‑party suppliers, and we may be vulnerable to delayed deliveries and future price increases.customers'customers’ ability to obtain water may have an adverse effect on our financial condition, results of operations and cash flows.customers'customers’ inability to obtain water from local sources or to effectively utilize flowback water could have an adverse effect on our financial condition, results of operations and cash flows."key person"“key person” life insurance policies on any of our employees. As a result, we are not insured against any losses resulting from the death of our key employees.well-establishedwell‑established competitors. A significant increase in the wages paid by competing employers could result in a reduction of our skilled labor force, increases in the wage rates that we must pay, or both. If either of these events were to occur, our capacity and profitability could be diminished and our growth potential could be impaired.$72$46 million for the year ended December 31, 2015.2016. We have historically financed capital expenditures primarily with funding from cash generated by operations, equipment and vendor financing and borrowings under our credit facilities. Following the completion of this offering,our IPO, we intend to finance our capital expenditures primarily with cash on hand, cash flow from operations and borrowings under our new revolving credit facility. We may be unable to generate sufficient cash from operations and other capital resources to maintain planned or future levels of capital expenditures which, among other things, may prevent us from acquiring new equipment or properly maintaining our existing equipment. Further, any disruptions or continuing volatility in the global financial markets may lead to an increase in interest rates or a contraction in credit availability impacting our ability to finance our operations. This could put us at a competitive disadvantage or interfere with our growth plans. Further, our actual capital expenditures for 2017 or future years could exceed our capital expenditure budget. In the event our capital expenditure requirements at any time are greater than the amount we have available, we could be required to seek additional sources of capital, which may include debt financing, joint venture partnerships, sales of assets, offerings of debt or equity securities or other means. We may not be able to obtain any such alternative source of capital. We may be required to curtail or eliminate contemplated activities. If we can obtain alternative sources of capital, the terms of such••••••new revolving credit facility (as defined herein) and any future financing agreements may limit our ability to finance future operations or capital needs or capitalize on potential acquisitions and other business opportunities. We expect to enter into a new revolving credit agreement concurrently with the closing of this offering. new revolving credit facility and any future financing agreements could restrict our ability to finance future operations or capitalwe expect that our new revolving credit facility will restrictrestricts or limitlimits our ability to:••••••conducted at the closing of this offering;currently conducted; and• new revolving credit facility may containcontains certain other operating and financial covenants. Our ability to comply with the covenants and restrictions contained in the new revolving credit facility may be affected by events beyond our control, including prevailing economic, financial and industry conditions. If market or other economic conditions deteriorate, our ability to comply with these covenants may be impaired. If we violate any of the restrictions, covenants, ratios or tests in our new revolving credit facility, a significant portion of our indebtednesslenders'lenders’ commitment to make further loans to us may terminate. We might not have, or be able to obtain, sufficient funds to make these accelerated payments. Any subsequent replacement of our new revolving credit facility or any new indebtedness could have similar or greater restrictions. Please read "Management's“Management’s Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources — Credit Facilities — Our Revolving Credit Facility."clean-upclean‑up responsibilities, regulatory investigations and penalties or other damage resulting in curtailment or suspension of our operations. The cost of managing such risks may be significant. The frequency and severity of such incidents will affect operating costs, insurability and relationships with customers, employees and regulators. In particular, our customers may elect not to purchase our services if they view our environmental or safety record as unacceptable, which could cause us to lose customers and substantial revenues.sub-limitssub‑limits have beenclean-upclean‑up costs stemming from a sudden and accidental pollution event. However, we may not have coverage if we are unaware of the pollution event and unable to report the "occurrence"“occurrence” to our insurance company within the time frame required under our insurance policy. In addition, these policies do not provide coverage for all liabilities, and the insurance coverage may not be adequate to cover claims that may arise, or we may not be able to maintain adequate insurance at rates we consider reasonable. A loss not fully covered by insurance could have a material adverse effect on our financial position, results of operations and cash flows.anti-terroristanti‑terrorist efforts and other armed conflicts involving the United States could adversely affect the U.S. and global economies and could prevent us from meeting financial and other obligations. We could experience loss of business, delays or defaults in payments from payors or disruptions of fuel supplies and markets if pipelines, production facilities, processing plants, refineries or transportation facilities are direct targets or indirect casualties of an act of terror or war. Such activities could reduce the overall demand for oil and natural gas, which, in turn, could also reduce the demand for our services. Terrorist activities and the threat of potential terrorist activities and any resulting economic downturn could adversely affect our results of operations, impair our ability to raise capital or otherwise adversely impact our ability to realize certain business strategies.earth'searth’s atmosphere and other climatic changes. Based on these findings, the EPA has adopted and implemented, and continues to adopt and implement, regulations thatgreenhouse gases ("GHGs")GHGs under existing provisions of the Clean Air Act ("CAA"(“CAA”). The EPA also requires the annual reporting of GHG emissions from certain large sources of GHG emissions in the United States, including certain oil and gas production facilities. The EPA has also taken steps to limit methane emissions from oil and gas production facilities. In addition, the U.S. Congress has from time to time considered adopting legislation to reduce emissions of GHGs and almost one-halfone‑half of the states have already taken legal measures to reduce emissions of GHGs primarily through the planned development of GHG emission inventories and/or regional GHG cap and trade programs. And in December 2015, the United States joined the international community at the 21st Conference of the Parties of the United Nations Framework Convention on Climate Change in Paris, France. The resulting Paris Agreement calls for the parties to undertake "ambitious efforts"“ambitious efforts” to limit the average global temperature, and to conserve and enhance sinks and reservoirs of greenhouse gases. The Paris Agreement entered into force in November 2016. On June 1, 2017, President Trump announced that the United States planned to withdraw from the Paris Agreement and to seek negotiations either to reenter the Paris Agreement on different terms or establish a new framework agreement. The Paris Agreement provides for a four‑year exit process beginning when it took effect in November 2016, which would resulting in an effective exit date of November 2020. The United States’ adherence to the exit process is uncertain and/or the terms on which the United States is one of over 70 nations that has ratifiedmay reenter the Paris Agreement or otherwise indicated that it intends to comply with the agreement. Restrictions on emissions of GHGs that may be imposed could adversely affect the oil and natural gas industry byreducing demand for hydrocarbons and by making it more expensive to develop and produce hydrocarbons, either of which could have a material adverse effect on future demand for our services."underground injection"“underground injection” and require federal permitting and regulatory control of hydraulic fracturing, as well as legislative proposals to require disclosure of the chemical constituents of the fluids used in the fracturing process, have been proposed in recent sessions of Congress. Several states and local jurisdictions in which we or our customers operate also have adopted or are considering adopting regulations that could restrict or prohibit hydraulic fracturing in certain circumstances, impose more stringent operating standards and/or require the disclosure of the composition of hydraulic fracturing fluids."water cycle"“water cycle” activities associated with hydraulic fracturing may impact drinking water resources under certain circumstances such as water withdrawals for fracturing in times or areas of low water availability, surface spills during the management of fracturing fluids, chemicals or produced water, injection of fracturing fluids into wells with inadequate mechanical integrity, injection of fracturing fluids directly into groundwater resources, discharge of inadequately treated fracturing wastewater to surface waters, and disposal or storage of fracturing wastewater in unlined pits. The results of these studies could lead federal and state governments and agencies to develop and implement additional regulations.