As filed with the Securities and Exchange Commission on April 15, 2022

Registration No.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

AMERICAN REBEL HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 7372 | 47-3892903 | ||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

(State or other jurisdiction of incorporation or organization) | ||||

| ||||

(Primary Standard Industrial Classification Code Number) | ||||

| ||||

(I.R.S. Employer Identification Number) | ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

718 Thompson Lane, Suite 108-199

Nashville, Tennessee, 37204

(833)267-3235

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Charles A. Ross, Jr.

Chief Executive Officer

718 Thompson Lane, Suite 108-199

Nashville, Tennessee, 37204

(833) 267-3235

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Joseph Lucosky, Esq.

Adele Hogan, Esq.

Lucosky Brookman LLP

101 Wood Avenue South

Woodbridge, New Jersey 08830

Telephone: (732) 395-4400

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box:.box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. .☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. .☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. .

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Securities Exchange Act (Check One):of 1934.

Large accelerated filer ☐ |

| Accelerated filer |

|

Non-accelerated filer ☒ |

| Smaller reporting company |

|

| Emerging growth company ☐ |

CALCULATION OF REGISTRATION FEE

Title of Each Class Of Securities To Be Registered |

| Amount To Be Registered |

| Proposed Maximum Offering Price Per Share1 |

| Proposed Maximum Aggregate Offering Price1 |

| Amount of Registration Fee |

|

|

|

|

|

|

|

|

|

Common stock, $ .001 par value per share |

| 6,000,000 shares |

| $0.01 |

| $ 60,000 |

| $ 6.97* |

1Estimated solelyIf an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for purposed of calculating the registration fee under Rule 457(a) and (o)complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. This☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall also cover any additional shares of common stock whichthereafter become issuable by reason of any stock split, stock dividend, anti-dilution provisions or similar transaction effected without the receipt of consideration which resultseffective in an increase in the numberaccordance with Section 8(a) of the outstanding shares of common stock ofSecurities Act or until the registrant.

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE SECURITIES AND EXCHANGE COMMISSION, ACTING, PURSUANT TO SECTIONregistration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said section 8(a), MAY DETERMINE.may determine.

The information contained in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it iswe are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion August 4, 2015

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION, DATED APRIL 15, 2022 |

6,000,000 SHARES

COMMON STOCK

CUBESCAPE,AMERICAN REBEL HOLDINGS, INC.

CubeScape, Inc. (“CSI” or

377,484 Shares of Common Stock Underlying 377,484 Pre-funded Warrants and

377,484 Shares of Common Stock Underlying Warrants to Purchase Common Stock

This prospectus relates to the “Company”) is offering for sale a maximumand resale by the Selling Security Holders identified herein of 6,000,000up to an aggregate of 754,968 shares of its common stock at a fixedthe Company’s Common Stock, par value $0.001 per share (the “Common Stock”). The 754,968 shares of Common Stock consist of 377,484 shares of Common Stock underlying the Pre-funded Warrants issued in connection with the Company’s Public Offering (the “Pre-funded Warrants”) and 377,484 shares of Common Stock underlying warrants to purchase Common Stock (the “Warrants”). The Pre-funded Warrants and Warrants were issued upon the conversion of the senior secured convertible promissory notes (the “Notes”) held by the Security Selling Holders. The Pre-funded Warrants have an exercise price of $0.01 per share of Common Stock and the Warrants have an exercise price of $5.1875 per share of Common Stock.

Our Common Stock are traded on the Nasdaq Capital Market under the symbols “AREB”. On April 13, 2022, the closing price of our Common Stock as reported on the Nasdaq Capital Market was $1.75 per share. There is no minimum numberThis price will fluctuate based on the demand for our Common Stock. However, the Common Stock offered by this prospectus may also be offered by the Selling Security Holders to or through underwriters, dealers, or other agents, directly to investors, or through any other manner permitted by law, on a continued or delayed basis. Please see “Plan of Distribution” beginning on page 28 of this prospectus.

We are not selling any shares that must be sold by us for theof Common Stock in this offering, to close, and we will retain allnot receive any proceeds from the sale of shares by the Selling Security Holders. The registration of the securities covered by this prospectus does not necessarily mean that any of the securities will be offered sharesor sold by the Selling Security Holders. The timing and amount of any sale is within the respective Selling Security Holders’ sole discretion, subject to certain restrictions.

Investing in our securities involves a high degree of risk. See “Risk Factors” in the section entitled “Risk Factors” on page 13 of this prospectus for a discussion of certain risk factors that are sold. The offering is being conductedshould be considered by prospective purchasers of the Common Stock offered under this prospectus.

You should rely only on the information contained in this prospectus or any prospectus supplement or amendment hereto. We have not authorized anyone to provide you with different information.

Investing in our securities involves a self-underwritten, best efforts basis, which means our founder, and CEO, Mr. David Estus, will attempt to sell the shares. This prospectus will permit our founder and CEO to sell the shares directly to the public, with no commission or other remuneration payable to him for any the shares he may sell. Mr. Estus will sell the shares and intends to offer them to friends, family membershigh degree of risk. See “Risk Factors” beginning on page 13 of this prospectus. You should carefully consider these risk factors, as well as business acquaintances. In offering the securities on our behalf, Mr. Estus will rely on the safe harbor from broker-dealer registration set forthinformation contained in Rule 3a4-1 under the Securities and Exchange Act of 1934. The intended methods of communication include, without limitation, telephone and personal contacts. For more information, see the section of this prospectus, entitled “Plan of Distribution”.

The proceeds from the sale of the shares in this offering will be payable to The Krueger Group, LLP - Attorney-Client Trust Account. All subscription funds will be held in a non-interest-bearing account pending the completion of the offering. The offering will be completed 180 days from the effective date of this prospectus, unless extended by our board of directors (the “Board of Directors”) for an additional 180 days. There is no minimum number of shares that must be sold. All subscription agreements and checks for payment of shares are irrevocable (except as to any state that requires a statutory cooling-off period or provide for rescission rights). For more information, see the section of this prospectus entitled “Plan of Distribution”.

There is currently no public or established market for our shares. Consequently, our shareholders will not be able to sell their shares in an organized market place and may be limited to selling their shares privately. Accordingly, an investment in our common stock is considered an illiquid investment.

We are an “emerging growth company” under applicable federal securities laws and are subject to reduced public company reporting requirements.See “Risk Factors” beginning on page 8.

THIS INVESTMENT INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD PURCHASE ONLY IF YOU CAN AFFORD A COMPLETE LOSS OF YOUR INVESTMENT. SEE “RISK FACTORS” BEGINNING ON PAGE 8 | NUMBER OF SHARES | OFFERING PRICE | UNDERWRITING DISCOUNTS & COMMISSIONS | PROCEEDS TO THE COMPANY |

|

|

|

|

|

Per Share | 1 | $0.01 | $0.00 | $0.01 |

Total | 6,000,000 | $60,000 | $0.00 | $60,000 |

This prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

INVESTING IN OUR SECURITIES INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD PURCHASE ONLY IF YOU CAN AFFORD A COMPLETE LOSS OF YOUR INVESTMENT. SEE “RISK FACTORS” BEGINNING AT PAGE 8.

We are selling the shares without an underwriter and may not be able to sell all or evenbefore purchasing any of the sharessecurities offered herein.by this prospectus.

NEITHER THE SECURTIESSECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITES COMMISIONSECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITEISSECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. WE MAY NOT SELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES, AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

The date of this prospectus is ____________, 2015.April 15, 2022.

TABLE OF CONTENTS

PROSPECTUS SUMMARY

About CubeScape, Inc.

You may only rely on the information contained in this prospectus or that we have referred you to. We arehave not authorized anyone to provide you with different information. This prospectus does not constitute an internet portal based software driven, cubicle panel and wall covering business. CubeScape, Inc. was incorporatedoffer to sell or a solicitation of an offer to buy any securities other than the Common Stock offered by this prospectus. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any Common Stock in any circumstances in which such offer or solicitation is unlawful. Neither the delivery of this prospectus nor any sale made in connection with this prospectus shall, under the laws of the State of Nevada on December 15, 2014. On January 15, 2015 we entered into an agreement with our founder, at which time we acquired a comprehensive business plan, certain tangible assets and intangible assets with which we started CubeScape’s business operations. Mr. David Estus, our founder,any circumstances, create any implication that there has been working on the CubeScape business model for many yearsno change in our affairs since obtaining the ‘CUBESCAPES’ trademark from the United States Patent and Trademark Office on April 17, 2007. As of August 4, 2015, we had one employee, our founder and executive officer, Mr. Estus. Through the date of this report,prospectus is correct as of any time after its date.

Unless the context otherwise requires, we use the terms “we,” “us,” “the Company”, “American Rebel” and “our” to refer to American Rebel Holdings, Inc. and its consolidated subsidiaries.

| i |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements that reflect our foundercurrent expectations and CEO has devoted between 10views of future events, all of which are subject to risks and 20 hours per weekuncertainties. Forward-looking statements give our current expectations or forecasts of future events. You can identify these statements by the fact that they do not relate strictly to historical or current facts. In some cases, you can identify forward-looking statements by terminology such as “may,” “might,” “should,” “intends,” “expects,” “plans,” “goals,” “projects,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” or “continue” or the negative of these terms or other comparable terminology. These forward-looking statements should be evaluated with consideration given to the risks and uncertainties inherent in our business that could cause actual results and events to differ materially from those in the forward-looking statements.

Such forward-looking statements are based on a series of expectations, assumptions, estimates and projections about our Company, are not guarantees of future results or performance, and involve significant risks, uncertainties and other factors, including assumptions and projections, for all future periods. Our actual results may differ materially from any future results expressed or implied by such forward-looking statements. Such factors include, among others:

| ● | our ability to achieve positive cash flow from operations and new business opportunities; |

| ● | our current reliance on a sole manufacturer and supplier for the production of our safes; |

| ● | our new manufacturing partner’s ability to meet production demands, both quantitively and qualitatively; |

| ● | our ability to expand our sales organization to address effectively existing and new markets that we intend to target; |

| ● | impact from future regulatory, judicial, and legislative changes or developments in the U.S. and foreign countries; |

| ● | our ability to compete effectively in a competitive industry; |

| ● | our ability to identify suitable acquisition candidates to consummate acquisitions on acceptable terms, or to successfully integrate acquisitions in connection with the execution of our growth strategy, the failure of which could disrupt our operations and adversely impact our business and operating results; |

| ● | our ability to obtain funding for our operations; |

| ● | our creditors not accelerating debt obligations; |

| ● | our ability to satisfy debt obligations going forward; |

| ● | our ability to attract collaborators and strategic arrangements; |

| ● | our ability to meet the Nasdaq Capital Market continued listing requirements; | |

| ● | our sole manufacturer’s ability to find adequate replacement in events of shortages of components and materials, and manage chain disruptions; | |

| ● | our current reliance on our founder and Chief Executive Officer, Charles A, Ross; |

| ● | general business and economic conditions, including macroeconomic conditions resulting from the continuing global COVID-19 pandemic; |

| ● | our ability to meet our financial obligations as they become due; and |

| ● | the rate and degree of market acceptance and demand of our products. |

The forward-looking statements contained in this prospectus are based on our current expectations and beliefs concerning future developments and their potential effects on us. There can be no assurance that future developments affecting us will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. The foregoing list of important factors does not include all such factors, nor necessarily present them in order of importance. For additional information regarding risk factors that could affect the Company’s, business operations.see “Risk Factors” beginning on page 13 of this prospectus, and as may be included from time-to-time in our reports filed with the Securities and Exchange Commission (the “SEC”).

| ii |

The Company intends the forward-looking statements to speak only as of the time of such statements and does not undertake or plan to update or revise such forward-looking statements as more information becomes available or to reflect changes in expectations, assumptions or results. The Company can give no assurance that such expectations or forward-looking statements will prove to be correct. An occurrence of, or any material adverse change in, one or more of the risk factors or risks and uncertainties referred to in this prospectus, could materially and adversely affect our results of operations, financial condition, and liquidity, and our future performance. We doundertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

Industry Data and Forecasts

This prospectus contains data related to the permanent and temporary safes and concealed self-defense products industry in the United States. This industry data includes projections that are based on a number of assumptions which have been derived from industry and government sources which we believe to be reasonable. We have not independently verified such third-party information. Industry and market data could be inaccurate because of the method by which sources obtained their data and because information cannot be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties. Industry and market data are often forecasts by industry experts best equipped to make forecasts, but all forecasts bear a certain degree of uncertainty and should not be relied upon as facts. Such data and estimates are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” The permanent and temporary safes and concealed self-defense products industries may not grow at the rate projected by industry data, or at all. The failure of the industries to grow as anticipated is likely to have a compensatory agreementmaterial adverse effect on our business and the market price of our Common Stock. In addition, the rapidly changing nature of the permanent and temporary safes and concealed self-defense industries subjects any projections or estimates relating to the growth prospects or future condition of our industries to significant uncertainties. Furthermore, if any one or more of the assumptions underlying the industry data turns out to be incorrect, actual results may, and are likely to, differ from the projections based on these assumptions.

| iii |

PROSPECTUS SUMMARY

The following highlights certain information contained elsewhere in place with Mr. Estus. Forthis prospectus. It does not contain all the remainder of 2015, Mr. Estus has agreeddetails concerning this offering, including information that may be important to continueyou. You should carefully review this entire prospectus including the section entitled “Risk Factors” and the consolidated historical and consolidated pro forma financial statements and accompanying notes contained herein. See “Where You Can Find More Information.” Unless the context otherwise requires, we use the terms “we,” “us,” “the Company,” “American Rebel” and “our” to provide these services without an agreement with us. Therefer to American Rebel Holdings, Inc. and its wholly-owned subsidiary American Rebel, Inc.

Our Company has agreed to revisit this compensation arrangement in December 2015. Mr. Estus provides his creative energies to another business entity in the computer and video gaming industry from which he derives his primary income.

The Company issued 6,000,000 sharesoperates primarily as a marketer and designer of its common stock to Mr. Estus on December 15, 2014 (inception) in exchange for organizational services. These services were valued at $6,000. As described above, in January 2015 Mr. Estus sold tobranded safes and personal security and self-defense products. Additionally, the Company designs and produces branded apparel and accessories.

We believe that when it comes to their homes, consumers place a comprehensivepremium on their security and extensive business plan packedprivacy. Our products are designed to offer our customers convenient, efficient and secure home and personal safes from a provider that they can trust. We are committed to offering products of enduring quality that allow customers to keep their valuable belongings protected and to express their patriotism and style, which is synonymous with over ten yearsthe American Rebel brand.

Our safes and personal security products are constructed primarily of research and development efforts, software development costs relatedU.S.-made steel. We believe our products are designed to our design portal, along with certain office furnishings and computing equipment. The Company issued to Mr. Estus 3,000,000 shares of common stock with a stated value of $24,000 or $0.008 per share. Mr. Estus incurred and/or paid in excess of $36,000 over the previous 24 months in the advancement, refinement and development of the CubeScape business plan,safely store firearms, as well as equipmentstore our customers’ priceless keepsakes, family heirlooms and treasured memories, and aim to be used in its business operations. The Company believes $24,000 representsmake our products accessible at various price points for home use. We believe our products are designed for safety, quality, reliability, features and performance.

To enhance the fair valuestrength of the tangibleour brand and intangible assets purchased. Total costs incurred by Mr. Estus during the prior ten years could very well be in excess of $50,000, not taking into account Mr. Estus’ services, which valued at $0 for purposes of Topic 5-Gdrive product demand, we work with our sole supplier and in accordance with generally accepted accounting principles (“GAAP”).

We are an early stage business enterprise (“development stage entity”)manufacturer to emphasize product quality and have limited financial resources. We have not established or attempted to establish a source of equity or debt financing. We intend on open having discussions with advisors and other financial resources regarding the financing or securing of working capital for business operations and growth. Our auditors included an explanatory paragraph in their report on our financial statements that states that “the Company’s losses from operations raise substantial doubt about its ability to continue as a going concern”. We continue to improve upon our business plan and operations. We intend to hire consultants, graphic designers and other artists to assist with themechanical development and writing of software code for our design portal and smartphone apps, along with progressive graphics for our intended product. To date, we incurred significant quantifiable and unquantifiable costs related to this development. We have a significant amount of work that needs to be done and working capital that needs to be secured in order to bringimprove the performance and affordability of our productproducts while providing support to market. To date,our distribution channel and consumers. We seek to sell products that offer features and benefits of higher-end safes at mid-line price ranges.

We believe that safes are becoming a ‘must-have appliance’ in a significant portion of households. We believe our current safes provide safety, security, style and peace of mind at competitive prices. We are in the process of developing a newly designed model safe, which is expected to be produced in the U.S. We anticipate our new model safe will offer and be equipped with technologically advanced features, such as independent bolt works operation, double-steel door-jamb framing, and a standardized geared locking mechanism.

In addition to branded safes, we have not developed any saleable productoffer an assortment of personal security products as well as apparel and cannot predict whenaccessories for men and women under the Company’s American Rebel brand. Our backpacks utilize what we believe is a saleable product will be developed. distinctive sandwich-method concealment pocket, which we refer to as Personal Protection Pocket, to hold firearms in place securely and safely. The concealment pockets on our Freedom 2.0 Concealed Carry Jackets incorporate a silent operation opening and closing with the use of a magnetic closure.

We believe that we have an advantagethe potential to continue to create a brand community presence around the core ideals and beliefs of America, in part through our Chief Executive Officer, Charles A. “Andy” Ross, who has written, recorded and performs a number of songs about the American spirit of independence. We believe our customers identify with the values expressed by our founderChief Executive Officer through the “American Rebel” brand.

Through our growing network of dealers, we promote and CEO’s business, video gamesell our products in select regional retailers and software development relationships in executinglocal specialty safe, sporting goods, hunting and improving uponfirearms stores, as well as online, including our core business operations.website and e-commerce platforms such as Amazon.com

The Company has no current intentions, plans, arrangements, commitments or understandings to engage

| 1 |

Our Products

Safes

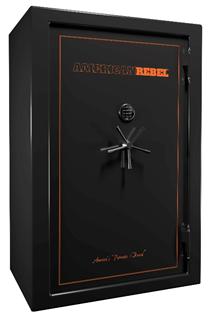

We offer a wide range of home, office and personal safe models, in a mergerbroad assortment of sizes, features and styles, which are constructed with U.S.-made steel. Demand for our safes is growing moderately across all segments of our customers, including individuals and families seeking to protect their valuables, businesses seeking to protect valuables and irreplaceable items such as artifacts and jewelry, and dispensaries servicing the community that seek to protect their inventory and cashflow. Traditionally, our safes have particularly appealed to responsible gun owners, sportsmen, competitive shooters and hunters seeking a premium and responsible solution to secure valuables and firearms, to prevent theft and to protect loved ones. We expect to benefit from increasing awareness of and need for safe storage of firearms in future periods.

Below is a summary of the different safes we offer:

| i. | Large Safes – our current large model safe collection consists of six premium safes. All of our large safes share the same high-quality workmanship, are constructed out of 11-gauge U.S.-made steel and feature a double plate steel door, double-steel door casements and reinforced door edges. Each of these safes provide up to 75 minutes of fire protection at 1200 degrees Fahrenheit. Our safes offer a fully adjustable interior to fit our customers’ needs. Depending on the model, one side of the interior may have shelves and the other side set up to accommodate long guns. There are optional additions such as Rifle Rod Kits and Handgun Hangers to increase the storage capacity of the safe. These large safes offer greater capacity for secure storage and protection, and our safes are designed to prevent unauthorized access, including in the event of an attempted theft, natural disaster or fire. We believe that a large, highly visible safe also acts as a deterrent to any prospective thief. |

| ii. | Personal Safes – the safes in our compact safe collection are easy to operate and carry as they fit into briefcases, desks or under vehicle seats. These personal safes meet Transportation Security Administration (“TSA”) airline firearm guidelinesand fit comfortably in luggage when required by travel regulations. |

| iii. | Vault Doors – our U.S.-made vault doors combine style theft and fire protection for a look that fits any decor. Newly-built, higher-end homes often add vault rooms and we believe our vault doors, which we designed to facilitate secure access to such vault rooms, provide ideal solutions for the protection of valuables and shelter from either storms or intruders. Whether it’s in the context of a safe room, a shelter, or a place to consolidate valuables, our American Rebel in- and out-swinging vault doors provide maximum functionality to facilitate a secure vault room. American Rebel vault doors are constructed of 4 ½” double steel plate thickness, A36 carbon steel panels with sandwiched fire insulation, a design that provides greater rigidity, security and fire protection. Active boltworks, which is the locking mechanism that bolts the safe door closed so that it cannot be pried open and three external hinges that support the weight of the door, are some of the features of the vault door. For safety and when the door is used for a panic or safe room, a quick release lever is installed inside the door. |

| iv. | Dispensary Safes - our HG-INV Inventory Safe, a safe tailor-made for the cannabis community, provides cannabis and horticultural plant home growers a reliable and safe solution to protect their inventory. Designed with medical marijuana or recreational cannabis dispensaries in mind, and increasing governmental and insurance industry regulation to lock inventory after hours, we believe our HG-INV Inventory Safe delivers a high-level of user experience. |

Personal Security

In addition to home, office and personal safes, we offer certain other security products, such as our concealed carry backpack selection. Our backpacks consist of an assortment of sizes, features and styles. Our XL, Large, and Medium concealed carry backpacks feature our proprietary “Personal Protection Pocket” which utilizes a sandwich method to keep handguns secure and in the desired and easily accessible position. The sandwich method is comprised of two foam pads that surround or acquisitionsandwich the firearm in place. The user can access the isolated Protection Pocket from either side of the backpack. These concealed carry backpacks are designed for everyday use while keeping firearms concealed, safe and easily accessible.

| 2 |

| i. | The Extra-Large Freedom and Cartwright CCW Backpack – our largest concealed carry backpack. This backpack offers ample storage, including a dedicated top loading laptop pouch and additional tablet sleeve. Both compartments are padded to protect your devices. Two large open compartments make this backpack practical for carrying items such as laptops or documents from one place to another, and the multiple interior compartments offer space to store other personal items. Our proprietary “Personal Protection Pocket” allows quick and easy access to your handgun from either side. Our Extra-Large Freedom and Cartwright CCW Backpack is available in a variety of designs and trim color options. |

| ii. | Large Freedom and Cartwright CCW Backpack - our most popular concealed carry backpack. This backpack offers ample storage, including a dedicated top loading laptop pouch and an additional tablet sleeve. Both compartments are padded to protect your items. The size of the compartment opening makes this backpack practical for carrying documents, folders or whatever you need to tote from one place to another. Our Large Freedom and Cartwright CCW Backpack includes our proprietary “Personal Protection Pocket” and is available in the Freedom and Cartwright style as well as a variety of designs and trim color options. |

| iii. | Medium Freedom CCW Backpack - this backpack offers ample storage, including a dedicated top loading laptop/tablet compartment and two liquid container pouches. The laptop/tablet compartment is padded to protect your devices. The opening is practical for carrying personal items while on the go. Our Medium Freedom CCW Backpack includes our proprietary “Personal Protection Pocket” and is available in a variety of trim color options. |

| iv. | Small Plus CCW Backpack – our small one-strap concealed carry backpack is designed for those on the go and is suitable for use while running, jogging biking. Our concealment pocket contains a holster and attaches to the interior with hook and loop material. Soft fleece-lined pockets for your tablet, glasses case and accessories are also included. Our Small Plus CCW Backpack is available in dark blue or in our signature patriotic “We The People” design. |

| v. | Small Freedom CCW Backpack – this one strap pack contains a holster and attaches to the interior with hook and loop material. There is also plenty of room for a small tablet, cell phone, chargers and other necessities. Available in a variety of trim color options. |

Apparel and Accessories

We offer a wide range of concealed carry jackets, vests and coats for men and women. We also offer patriotic apparel for the whole family, with another company nor does the American Rebel imprint. Our apparel line serves as “point man” for the brand, often acting as the first point of exposure that people have to all things American Rebel. Our apparel line is designed and branded to be stylish, patriotic and bold. We emphasize styling that complements our enthusiasts’ and customers’ lifestyle, representing the values of our community and quintessential American character. The American Rebel clothing line style is not only a fashion statement; we seek to cultivate a sense of pride of belonging to our patriotic family, in your adventures and in life.

| i. | Cartwright Winter Coats and Jackets – engineered for comfort, warmth, versatility and mobility, our Cartwright winter collection lends textural warmth to these performance-ready, cold-weather essentials. Our Concealed Carry Coats are designed with purpose and informed by the rugged demands of the everyday hard worker. Its quality construction and workmanship are designed to keep you warm and shielded from the elements. Left-hand and right-hand concealed pocket access provides for secure and safe concealment of your firearm with easy access on either side. |

| 3 |

| ii. | Freedom 2.0 CCW Jackets and Vests for Men and Women - our lightweight jackets collection is designed with magnetic pocket closures for silent, secure and safe concealment. Our lightweight jackets are crafted to facilitate easy firearm access for both right-handed and left-handed carriers. |

| iii. | American Rebel T-Shirts Collection - American Rebel’s T-shirts collection is created for those who embrace patriotism and the spirit of an endless summer. |

In addition to our apparel line, we also offer select supplemental accessories for our products, including space savings items for our safes such as hangers, lights kits, moisture guard, and rifle rod kits.

Upcoming Product Offerings

To further complement our diverse product offerings, we intend to introduce additional products in the year of 2022. Below is a summary of our upcoming product offerings:

| i. | Biometrics Safes – we will be introducing our line of wall safes and handgun boxes with biometrics, WiFi and Bluetooth technologies. These Biometric Safes have been designed, engineered and are ready for production. | |

| ii. | Personal Security Device – we are developing a non-lethal device that deters an attacker with an audible siren, which would draw attention to the attacker, as well as notifying the user’s support network that help is needed and providing the location of the attack. | |

| iii. | Wall Safes – the upcoming wall safes can be easily hidden and provide “free” storage space since they are able to be tucked into the space between your wall and studs. | |

| iv. | Youth Protection Backpack – with the objective of keeping kids safe at school, we are designing the Youth Protection Backpack, which will incorporate a light-weight ballistic shield to provide protection when needed for our children as they go through their school day activities. |

Our Competitive Strengths

We believe we are progressing toward long-term, sustainable growth, and our business has, and our future success will be driven by, the following competitive strengths:

| ● | Powerful Brand Identity – we believe we have developed a distinctive brand that sets us apart from our competitors. This has contributed significantly to the success of our business. Our brand is predicated on patriotism and quintessential American character: protecting our loved ones. We strive to equip our safes with technologically advanced features that offer customers advanced security to provide the peace of mind they need. Maintaining, protecting and enhancing the “American Rebel” brand is critical to expanding our loyal enthusiasts base, network of dealers and other partners. Through our branded apparel and accessories, we seek to further enhance our connection with the American Rebel community and share the values of patriotism and safety for which our Company stands for. We strive to continue to meet their need for our premium safes and will depend largely on our ability to maintain customer trust, become a gun safe storage leader and continue to provide high-quality safes. |

| ● | Product Design and Development – our current safe model relies on time-tested features, such as Four-Way Active Boltworks, pinning the door shut on all four sides (compared to Three-Way Bolt works, which is prevalent in our competitors’ safes), and benefits that would not often be available in our price point, including 11-gauge US-made steel. The sleek exterior of our safes has garnered attention and earned the moniker from our dealers as the “safe with an attitude.” When we set out to enter the safe market, we wanted to offer a safe that we would want to buy, one that would get our attention and provide excellent value for the cost. |

| ● | Focus on Product Performance - since the introduction of our first safes, we have maintained a singular focus on creating a full range of safe, quality, reliable safes that were designed to help our customers keep their family and valuables safe at all times. We incorporate advanced features into our safes that are designed to improve strength and durability. Key elements of our current model safes’ performance include: |

Double Plate Steel Door - 4 ½” Thick

Reinforced Door Edge – 7/16” Thick

Double-Steel Door Casement

Steel Walls – 11-Gauge

Diameter Door Bolts – 1 ¼” Thick

Four-Way Active Boltworks – AR-50(14), AR-40(12), AR-30(10), AR-20(10), AR-15(8), AR-12(8)

Diamond-Embedded Armor Plate

* Double Plate Steel Door is formed from two U.S.-made steel plates with fire insulation sandwiched inside. Thicker steel is placed on the outside of the door while the inner steel provides additional door rigidity and attachment for the locking mechanism and bolt works. The door edge is reinforced with up to four layers of laminated steel. Pursuant to industry-standard strength tests performed, this exclusive design offers up to 16 times greater door strength and rigidity than the “thin metal bent to look thick” doors.

* Double-Steel Door Casement is formed from two or anymore layers of its shareholderssteel and is welded around the perimeter of the door opening. Pursuant to industry-standard strength tests performed, it more than quadruples the strength of the door opening and provides a more secure and pry-resistant door mounting. Our manufacturer installs a Double-Steel Door Casement™ on our safes. We believe the reinforced door casement feature provides important security as the safe door is often a target for break-in attempts.

* Diamond-Embedded Armor Plate Industrial diamond is bonded to a tungsten steel alloy hard plate. Diamond is harder than either a cobalt or carbide drill. If drilling is attempted the diamond removes the cutting edge from the drill, thus dulling the drill bit to where it will not cut.

| 4 |

| ● | Trusted Brand - we believe that we have developed a trusted brand with both retailers and consumers for delivering reliable, secure safes solutions. |

| ● | Customer Satisfaction - we believe we have established a reputation for delivering high-quality safes and personal security products in a timely manner, in accordance with regulatory requirements and our retailers’ delivery requirements and supporting our products with a consistent merchandising and marketing message. We also believe that our high level of service, combined with strong consumer demand for our products and our focused distribution strategy, produces substantial customer satisfaction and loyalty. We also believe we have cultivated an emotional connection with the brand which symbolizes a lifestyle of freedom, rugged individualism, excitement and a sense of bad boy rebellion. |

| ● | Proven Management Team - our founder and Chief Executive Officer, Charles A. Ross, Jr., has led the expansion and focus on the select product line we offer today. We believe that Mr. Ross had an immediate and positive impact on our brand, products, team members, and customers. Under Mr. Ross’s leadership, we believe that we have built a strong brand and strengthened the management team. We are refocusing on the profitability of our products, reinforcing the quality of safes to engage customers and drive sales. We believe our management team possess an appropriate mix of skills, broad range of professional experience, and leadership designed to drive board performance and properly oversee the interests of the Company, including our long-term corporate strategy. Our management team also reflects a balanced approach to tenure that will allow the Board to benefit from a mix of newer members who bring fresh perspectives and seasoned directors who bring continuity and a deep understanding of our complex business. |

Our Growth Strategy

Our goal is to enhance our position as a designer, producer and marketer of premium safes and personal security products. We have anyestablished plans to enter into a changegrow our business by focusing on three key areas: (1) organic growth and expansion in existing markets; (2) strategic acquisitions, and (3) expanding the scope of control or similar type of transaction.our operation activities to the dispensaries U.S. community.

CubeScape is a progressive cubicle panel/wall covering business. CubeScape’s coverings are designed to be a wrap-around one-piece with a panoramic presentation of media/art chosen by the user. These coverings can be made for many uses besides office cubicles, currently our primary focus. Our product offering, wrap-around coverings run the gamut from scenes from nature, sports and action-oriented themes, to fantasy based, to game related, and even current and historical pop-art/popular culture themes. Our wrap-around coverings will be made of non-permanent high quality decorative materials designed to be easily applied and removed with little or no damage to walls or other surfaces for which they may be used on. Besides our vast array of stock-photo art, customers can create custom wrap-around coverings using a proprietary design website or portal (currently under development).

CubeScape maintains a vast library of contemporary images that are both hip and cutting edge. Contemporary themesWe have developed primarily by our founder that became our specialty; rock concerts, club scenes, inner-city, urban themes to fascinating industrial settings. Our wrap-around covers are intended to be produced by a quality-focused manufacturer (made in America) specializing in vinyl, durable coverings, drop shipped by selected US partners, where the finished product, a unique wrap-around covering (much like a poster, but superior in quality and durability), arrives in a convenient cardboard tube, ready to apply to your cubicle wall or other surface. Our strategy is to exploit what we believe is a multi-pronged growth strategy, as described below, to behelp us capitalize on a growing market for non-permanent decal-based décor, targetingsizable opportunity. Through methodical sales and marketing efforts, we believe we have implemented several key initiatives we can use to grow our business more effectively. We believe we have made significant progress in 2021 in the office cubicle environmentform of nearly $200,000 in sales to first-time buyers. We also intend to opportunistically pursue the strategies described below to continue our upward trajectory and other work space environments. New materials and adhesives reach the marketplace each and every month which may stimulate new product-lines for us, such as automobile (graphic) wraps, life-size (or larger than life) wall (vinyl posters) of sports figures, semi-permanent or other-use wraps that provide protection from theenhance stockholder value. Key elements of natureour strategy to achieve this goal are as follows:

Organic Growth and provide a unique personalityExpansion in Existing Markets - Build our Core Business

The cornerstone of our business has historically been our safes product offering. We are focused on continuing to otherwise yet inanimate objects. CubeScape, through its developmentdevelop our home, office and recent growth has identified an untapped market that may contain more than 100 million cubicle-bound workers (or “cube jockeys”)personal safes product lines. We are investing in the United States alone. adding what we believe are distinctive technology solutions to our safes.

We believe cube jockeys are ready for a change.

also working to increase floor space dedicated to our safes and strengthen our online presence in order to expand our reach to new enthusiasts and build our devoted American Rebel community. We intend to develop the brand “CubeScape” for durable quality made panoramic vinyl wall graphics using an interactive design portal allcontinue to be made in America. Our design portal will provide the users the abilityendeavor to create unique wall and cubicle panel art that enhances officeprovide retailers and cubicle space with a new approach to work space aesthetics. These products intended to be high resolution wall graphics depicting professional art, stock photos, or user provided images blended in a unique and personal format, constructed of vinyl and low-tack adhesive.

We believe our design portal will enable the creation of custom designs, providing an environment reducing stress and fatigue of toiling in the modern work-place environment, the “cubicle”. Corporate logos may be integrated in wall graphics providing corporate sponsorship for uses in decorating work space at no cost. In order to attract large user customers (employers with 49 or more employees), we will seek to identify cost-saving opportunities, define economic return for employers through increased employee productivity because of our products. We believe our design portal will become an integral part of an office design and layout with unique and lasting upgrades to what are utter drab work space environments. Our design portal and graphics printing service is intended to provide a three-step process providing customers with what we believe are responsible, safe, reliable and stylish products, and we expect to concentrate on tailoring our supply and distribution logistics in response to the specific demands of our customers.

| 5 |

We are currently developing a new model of our home and office safes. Our new safe model, which we expect to introduce at industry trade shows in early 2022, is to be built in the U.S. through our collaboration with Industrial Maintenance Incorporated (“IMI”). The new “Made in the USA” safe model is expected to be manufactured in Topeka, Kansas, and is ready to begin production. We believe IMI’s location is very advantageous, as it is located near our sales office in Lenexa, Kansas.

We expect the new planned model to include additional features, such as a reinforced door and upgraded locking mechanism, and increased fire rating, among others. We are focused on developing best in class, compelling combination of functionality, convenience and style without compromising performance of our safes. We intend to use our designing and developing processes to enhance technological and time to market advantages over incumbent safes manufacturers.

While we currently rely on third-party manufactures for the production of our current line of safes, apparel and accessories, we believe that the expected addition of manufacturing capabilities following the signing of the contract with the aforementioned manufacturer, which we anticipate to work exclusively with us, would allow us, among other benefits, to ramp up our production levels to meet expected demand for our products, provide us greater autonomy over the manufacturing process, and add what we believe are distinctive features.

Additionally, our Concealed Carry Product line and Safe line serve a large and growing market segment. We believe that interest in safes increase, as well as in our complimentary concealed carry backpacks and apparel as a byproduct, when interest of the general population in firearms increase. To this extent, the FBI’s National Instant Criminal Background Check System (NICS), which we believe serves as a proxy for gun sales since a background check is generally needed to purchase a firearm, reported a record number of background checks in 2020, 39,695,315. The prior annual record for background checks was 2019’s 28,369,750. In 2021, there were 38,876,673 background checks conducted, similar to that of 2020’s annual record which was 40% higher than the previous annual record in 2019. While we do not expect this increase in background checks to necessarily translate to an equivalent number of additional safes purchased, we do believe it might be an indicator of the increased demand in the safe market. In addition, certain states (such as Massachusetts, California, New York and Connecticut) are starting to legislate new storage requirements in respect of firearms, which is expected to have positive impact on the sale of safes.

We continue to strive to strengthen our relationships with our current distributors, dealers, manufacturers and specialty retailers and to attract other distributors, dealers, and retailers. We believe that the success of our efforts depends on the distinctive features, quality, and performance of our products; continued manufacturing capabilities and meeting demand for our safes; the effectiveness of our marketing and merchandising programs; and the dedicated customer support.

In addition, we seek to improve customer satisfaction and loyalty by offering distinctive, high-quality products on a timely and cost-attractive basis and by offering efficient customer service. We regard the features, quality, and performance of our products as the most important components of our customer satisfaction and loyalty efforts, but we also rely on customer service and support for growing our business.

Furthermore, we intend to continue improving our business operations, including research and development, component sourcing, production processes, marketing programs, and customer support. Thus, we are continuing our efforts to enhance our production by increasing daily production quantities through equipment acquisitions, expanded shifts and process improvements, increased operational availability of our equipment, reduced equipment down times, and increased overall efficiency.

We believe that by enhancing our brand recognition, our market share might grow correspondingly. Industry sources estimate that 70 million to 80 million people in the United States own an aggregate of more than 400 million firearms, creating a large potential market for our safes and personal security products. We are focusing on the premium segment of the market through the quality, distinctiveness, and performance of our products; the effectiveness of our marketing and merchandising efforts; and the attractiveness of our competitive pricing strategies.

Targeted Strategic Acquisitions for Long-term Growth

We are consistently evaluating and considering acquisitions opportunities that fit our overall growth strategy as part of our corporate mission to accelerate long-term value for our stockholders and create integrated value chains.

Along these lines, in March of 2022 we entered into a letter of intent (“LOI”) to purchase a safe manufacturer. The final structure of the acquisition will be determined by the parties following the receipt of tax, corporate and securities law advice. The acquisition will be structured as an arm’s length transaction and pursuant to the terms of the LOI the parties intend to sign a definitive agreement in respect of the acquisition on or before April 30, 2022. Under the terms of the LOI, we would acquire all of the outstanding shares of capital stock of the acquisition target, free and clear of all encumbrances for a combination of cash and stock. As part of the LOI, we gave the target a $250,000 non-refundable deposit, which will be credited to us at closing. Completion of the acquisition is subject to a number of conditions, including but not limited to the following key conditions: the target obtaining an audit of its financial statements; execution of the definitive and ancillary agreements; completion of mutually satisfactory due diligence; us obtaining sufficient financing to complete the acquisition; and receipt of all required regulatory, corporate and third-party approvals, and the fulfillment of all applicable regulatory requirements and conditions necessary to complete the acquisition.

Expanding Scope of Operations Activities by Offering Servicing Dispensaries and Brand Licensing

We continually seek to target new consumer segments for our safes. As we believe that safes are becoming a must-have household appliance, we strive to establish authenticity by selling our products to additional groups, and to expand our direct-to-consumer presence through our website and our showroom in Lenexa, Kansas.

Further, we expect the cannabis dispensary industry to be a unique approachmaterial growth segment for our business. Several cannabis dispensary operators have expressed interest in the opportunity to integrating corporate office work spacehelp them with art.their inventory locking needs. Cannabis dispensaries have various insurance requirements and local ordinances requiring them to secure their inventory when the dispensary is closed. Dispensary operators have been purchasing gun safes and independently taking out the inside themselves to allow them to store cannabis inventory. Recognizing what seems to be a growing need for cannabis dispensary operators, we have designed a safe tailor-made for the cannabis industry. With the legal cannabis hyper-growth market expected to exceed $43 billion by 2025, and an increasing number of states where the growth and cultivation of cannabis is legal (California, Colorado, Hawaii, Maine, Maryland, Michigan, Montana, New Mexico, Oregon, Rhode Island, Vermont and Washington), we believe we are well positioned to address the need of dispensaries. American Rebel has a long list of dispensary operators, growers, and processors interested in the Company’s inventory control solutions. We believe this approachthat dispensary operators, growers, and processors are another fertile new growth market for our Vault Doors products, as many in the cannabis space have chosen to install entire vault rooms instead of individual inventory control safes—the American Rebel Vault Door has been the choice for that purpose.

Further, we believe that American Rebel has significant potential for branded products as a lifestyle brand. As the American Rebel Brand continues to grow in popularity, we anticipate generating additional revenues from licensing fees earned from third parties who wish to engage the American Rebel community. While the Company does not generate material revenues from licensing fees, our management believes the American Rebel brand name may in the future have significant licensing value to third parties that seek the American Rebel name to brand their products to market to the American Rebel target demographic. For example, a tool manufacturer that wants to pursue an alternative marketing plan for a different look and feel could license the American Rebel brand name for their line of tools and market their tools under our distinct brand. This licensee would benefit from the strong American Rebel brand with their second line of American Rebel branded tools as they would continue to sell both of the lines of tools. Conversely, American Rebel could potentially also benefit as a licensee of products. If American Rebel determines a third party has designed, engineered, and manufactured a product that would be a strong addition to the American Rebel catalog of products, American Rebel could license that product from the third-party and sell the licensed product under the American Rebel brand.

| 6 |

Competition

The safe industry is necessary for breakingdominated by a small number of companies. We compete primarily on the quality, safety, reliability, features, performance, brand awareness, and price of our products. Our primary competitors Superior Safe, Champion Safe as well as certain other domestic and international safe manufacturers. We believe that given the current office work space decisions, creating a long-lasting consumer relationshipsubstantial uncertainty related to the supply chain and happy, productive cube jockeys.

Through the assistancedelivery of a software development firm (which international goods, we have solicited their services since early 2011)a competitive advantage because of what we believe is our affinity marketing with the American Rebel brand and the fact our safes are not manufactured overseas.

Financing Arrangements

We currently have one promissory note outstanding effortsthat we utilize to finance our operation. The note is dated July 1, 2021, and is in the amount of $600,000. The note matures on June 30, 2022, and interest on the note is 12% annually, paid quarterly.

For a complete description of our founder, Mr. Estuscredit facilities and the financial and restrictive covenants contained therein, please see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Financing Arrangements.”

Please see our risk factors in connection therewith, including “Our substantial level of indebtedness and our current liquidity constraints could adversely affect our financial condition and our ability to service our indebtedness, which could negatively impact your ability to recover your investment in the Common Stock,” “Our indebtedness could adversely affect our business and limit our ability to plan for or respond to changes in our business, and we may be unable to generate sufficient cash flow to satisfy significant debt service obligations,” and “Despite the Company’s indebtedness levels, we are able to incur substantially more debt. This could further increase the risks associated with its leverage.”

Intellectual Property

We believe our commercial success depends in part on our ability to obtain and maintain intellectual property protection for our brand and technology, defend and enforce our intellectual property rights, preserve the confidentiality of our trade secrets, operate our business without infringing, misappropriating or otherwise violating the intellectual property or proprietary rights of third parties and prevent third parties from infringing, misappropriating or otherwise violating our intellectual property rights. We rely on a combination of patent, copyright and trade secret laws in the United States to protect our proprietary technology. We also rely on a number of United States registered, pending and common law trademarks to protect our brand “American Rebel”.

On May 29, 2018, US Patent No. 9,984,552, Firearm Detecting Luggage, was issued to us. The term of the patent is 20 years from the issuance date. In addition to our patent, we rely upon unpatented trade secrets and know-how and continuing technological development and maintain our competitive position. Trade secrets and know-how, however, can be difficult to protect. We seek to protect our proprietary information, in part, by entering into confidentiality and proprietary rights agreements with our employees and independent contractors.

| 7 |

Regulation

The storage of firearms and ammunition is subject to increasing federal, state and local governmental laws. While the current legislative climate does not appear to seek to limit possession of firearms, there is apparent momentum to require safe storage of firearms and ammunition. Although our safes, which are the primary driver of our sales and revenues, are designed to protect any valuables, a significant number of our safes’ end users have traditionally been gun enthusiasts, collectors, hunters, sportsmen and competitive shooters. Therefore, we expect the increases to federal, state and local governmental regulation of gun storage to have a positive effect on our business.

Effects of COVID-19

Coronavirus (“COVID-19”) and Related Market Impact. The COVID-19 outbreak has presented evolving risks and developments domestically and internationally, as well as new opportunities for our business. Although the pandemic has not materially impacted our results and operations adversely, our ability to satisfy demand for our products could be negatively impacted by mandatory forced production disruptions of our safes’ sole third-party manufacturer and strategic partners. Any significant disruption to communications and travel, including travel restrictions and other potential protective quarantine measures against COVID-19 by governmental agencies, could make it difficult for us to deliver goods and services to our customers. Further, travel restrictions and protective measures against COVID-19 could cause the Company to incur additional unexpected labor costs and expenses or could restrain the Company’s ability to retain the highly skilled personnel the Company needs for its operations. The extent to which COVID-19 impacts the Company’s business, sales and results of operations will depend on future developments, which are uncertain and cannot be currently predicted.

Additionally, as a result of COVID-19, at any time we may be subject to increased operating costs, supply interruptions, and difficulties in obtaining raw materials and components. To address these challenges, we continue to monitor our supply chain. We have recently entered into a contract with a third-party manufacturer to exclusively assemble our upcoming new line of safes. We believe that this vertical integration would allow us, among other benefits, to ramp up our production levels to meet expected demand for our products, provide us greater autonomy over the manufacturing process, and add what we believe are distinctive features to our design portal is taking shapesafes.

We expect that the demand for home, office and product design method is near completion.personal safety and security products would remain stable, in part due to customers spending more time working remotely, increasing regulation mandating safe storage, and substantial uncertainty related to the supply chain and delivery of international goods, which in turn translate into, we believe, growth in demand for our home and personal safes as a U.S. company. We, developed a durablehowever, cannot guarantee, that demand for our safes and technical frameworkpersonal security products will keep growing through the end of the 2021 calendar year and program design along with a sticky (GUI) interface that has been successfulbeyond.

Further, due to the effects of COVID-19, our management have reduced unnecessary marketing expenditures as part of continued efforts to adjust the Company’s operations to address changes in the computersafes and video game industry. Wevault industry, and particularly to improve staff and human capital expenditures, while maintaining overall workforce levels.

Due to the substantial uncertainty related to the effects of the pandemic, its duration and the related market impacts, including the economic stimulus activity, we are unable to predict the specific impact the pandemic and related restrictions (including the lifting or re-imposing of restrictions due to any current or future variants of the COVID-19 virus or otherwise) will have not formed any meaningful industry relationshipson our results of operations, liquidity or long-term financial results.

Risks Affecting Us

Our business is subject to numerous risks and uncertainties, including those discussed in the office furniture industry, but we intend to. The Company will seeksection titled “Risk Factors” beginning on page 13 and elsewhere in this prospectus. These risks include the assistance of established sales and marketing consultants that focus on office furniture and design in order to develop a sales and marketing strategy that capitalize on our product.following:

We intend to staff our organization and its management team (besides Mr. Estus) with various skills such as product design, engineering, software development along with a strong emphasis on graphics design and media/art.

| ● | we currently do not own a manufacturing facility, and future acquisition and operation of new manufacturing facilities might prove unsuccessful and could fail; | |

| ● | as we currently rely on a sole third-party manufacturer for our safes production, our compromised operational capacity may affect our ability to meet the demand for our safes, which in turn may affect our generation of revenue; | |

| ● | our success depends, in part, on our ability to introduce new products that track customer preferences; | |

| ● | maintaining and strengthening our brand to generate and maintain ongoing demand for our products; |

| ● | as a significant portion of our revenues is derived by demand for our safes and personal security products for firearms storage purposes, we depend on the regulation of firearms and ammunition storage, as well as various economic, social and political factors; |

| ● | shortages of components and materials, as well as supply chain disruptions, may delay or reduce our sales and increase our costs, thereby harming our results of operations; |

| 8 |

| ● | we do not have long-term purchase commitments from our customers, and their ability to cancel, reduce, or delay orders could reduce our revenue and increase our costs; | |

| ● | we face a high degree of market competition that could result in our losing or failing to gain market share; | |

| ● | the inability to efficiently manage our operations; | |

| ● | the inability to achieve future operating results; | |

| ● | the inability of management to effectively implement our strategies and business plans; | |

| ● | given our limited corporate history it is difficult to evaluate our business and future prospects and increases the risks associated with an investment in our securities; | |

| ● | the loss of our founder and Chief Executive Officer, Charles A, Ross, could harm our business; | |

| ● | our inability to service our existing and future indebtedness or other liabilities, the failure of which could result in insolvency proceedings and result in a total loss of your equity investment; | |

| ● | our inability to raise additional financing for working capital; | |

| ● | the unavailability of funds for capital expenditures; | |

| ● | our inability to access lending, capital markets and other sources of liquidity, if needed, on reasonable terms, or at all, or obtain amendments, extensions and waivers of financial maintenance covenants, among other material terms; | |

| ● | our ability to continue as a going concern absent obtaining adequate new debt or equity financing, raising additional funds and achieving sufficient sales levels; | |

| ● | our ability to expand our e-commerce business and sales organization to effectively address existing and new markets that we intend to target, and to generate sufficient revenue in those targeted markets to support operations; | |

| ● | our inability to generate significant cash flow from sales of our products, which could lead to a substantial increase in indebtedness and negatively impact our ability to comply with the financial covenants, as applicable, in our debt agreements; | |

| ● | War, terrorism, other acts of violence or natural or manmade disasters such as a pandemic, epidemic, outbreak of an infectious disease or other public health crisis – such as COVID-19 – may affect the markets in which the Company operates, as well as global economic, market and political conditions; | |

| ● | our ability to identify suitable acquisition candidates to consummate acquisitions on acceptable terms, or to successfully integrate acquisitions in connection with the execution of our growth strategy, the failure of which could disrupt our operations and adversely impact our business and operating results; |

| ● | applicable laws and changing legal and regulatory requirements, including U.S. GAAP changes, could harm our business and financial results; | |

| ● | if we are unable to protect our intellectual property, we may lose a competitive advantage or incur substantial litigation costs to protect our rights; | |

| ● | the fact that our accounting policies and methods are fundamental to how we report our financial condition and results of operations, and they may require management to make estimates about matters that are inherently uncertain; |

| ● | significant dilution resulting from our financing activities; | |

| ● | our Management has control over key decision-making matters as a result of their control of a majority of our voting stock; |

| ● | the actions and initiatives taken by both current and potential competitors; and | |

| ● | the other risks and uncertainties detailed in this report. |

Corporate Information

Our principal executive offices are located at 1854 Oxford Avenue, Cardiff-by-the-Sea, California 92007, and our718 Thompson Lane, Suite 108-199, Nashville, Tennessee. Our telephone number is (760) 613-6257.We may refer (833) 267-3235. Our website address is www.americanrebel.com. The information contained on, or that can be accessed through, our website is not a part of this prospectus. Investors should not rely on any such information in deciding whether to ourselves in thispurchase our securities.

Recent Developments

| 9 |

THE OFFERING

This prospectus as “CSI,”relates to the “Company,” “we,” or “us”.

We are offering foroffer and sale a maximumfrom time to time of 6,000,000up to an aggregate of 754,968 shares of common stock at a fixed pricethe Common Stock, consisting of $0.01 per share (this “Offering”). There is no minimum377,484 shares of Common Stock underlying 377,484 Pre-funded Warrants and 377,484 shares of Common Stock underlying the Warrants.

The number of shares that must be soldof Common Stock ultimately offered for resale by us for this Offering to close, and we retain all the proceeds from the saleSelling Security Holders depends upon how much of the offered shares we sell. This Offering is being conducted on a self-underwritten, best efforts basis, which means our founder,Pre-funded Warrants the Selling Security Holders elect to exercise and CEO, Mr. Estus, will attempt to sell all the shares himself. This prospectus permits our founder and CEO to sell the shares directly to the public, with no commission or remuneration. Mr. Estus will sell allhow much of the shares himselfWarrants the Selling Security Holders elect to exercise and intends to offer them to friends, familythe liquidity and business acquaintances. In offering the securities on our behalf, Mr. Estus will rely on the safe harbor from broker-dealer registration set out in Rule 3a4-1 under the Securities and Exchange Act of 1934 (the “Exchange Act”). The intended methods of communication include, without limitation, telephone and personal contacts.

The proceeds from the sale of shares in this Offering will be made payable to The Krueger Group, LLP – Attorney-Client Trust Account, who acts as CSI’s escrow agent. The Krueger Group, LLP, also acts as legal counsel for CSI and, therefore, may not be considered an independent third party. All subscription agreements and checks are irrevocable and will be delivered to The Krueger Group, LLP at the address provided in the Subscription Agreement (see Exhibit 99.1).

All subscribed-to funds will be held in a non-interest-bearing account pending the completion of this Offering. The Offering ordinarily will be completed 180 days from the effective date of this prospectus, unless extended by our Board of Directors for an additional 180 days. There is no minimum number of shares that must be sold. All subscription agreements and checks for payment of shares are irrevocable (except for states that require a statutory cooling-off period or provide for rescission rights to the prospective investor).

The Company will deliver stock certificates for the shares of common stock purchased within 30 days of the close of this Offering or as soon thereafter as practicable.

The offeringmarket price of the common stock has been determined arbitrarily and bears no relationship to any objective criterion or value. The price does not bear any relationship to our assets, book value, historical earnings (if any), or net worth.Common Stock.

| Issuer | American Rebel Holdings, Inc. | |

|

| |

| Securities Offered by the Selling Security Holders | 377,484 shares of Common Stock issuable upon the exercise of the Pre-funded Warrants and 377,484 shares of Common Stock issuable upon the exercise of the Warrants. |

| Common Stock outstanding prior to this offering | 4,741,321 shares of Common Stock outstanding as of March 31, 2022, which includes 251,698 shares of Common Stock converted from Series B Preferred. | |

| Common Stock to be outstanding after this offering | 5,496,289 shares, assuming Selling Security Holders exercise all Pre-funded Warrants and Warrants. | |

| Use of proceeds | We will not receive any proceeds from the sale of Common Stock by the Selling Security Holders. We will, however, receive proceeds from any exercise of the Pre-Funded Warrants. All of the net proceeds from the sale of our Common Stock will go to the Selling Security Holders as described below in the sections entitled “Selling Security Holders” and “Plan of Distribution”. We have agreed to bear the expenses relating to the registration of the Common Stock for the Selling Security Holders. The Company |

| 10 |

SUMMARY FINANCIAL DATA

The following financial information should be read in conjunction with the financial statements and the notes contained elsewhere in this prospectus.

Balance Sheet Data: |

|

|

|

|

|

| As of June 30, 2015 |

| As of December 31, 2014 |

|

| (unaudited) |

| (audited) |

Current assets | $ | 1,000 | $ | − |

|

|

|

|

|

Other assets | $ | 28,500 | $ | − |

|

|

|

|

|

Current liabilities | $ | 42,410 | $ | 610 |

|

|

|

|

|

Stockholders’ equity (deficit) | $ | (12,910) | $ | (610) |

Operating: |

|

|

|

|

|

| For the Six Month Period Ended June 30, 2015 |

| For the Period December 15, 2014 (inception) to December 31, 2014 |

|

| (unaudited) |

| (audited) |

Net revenues | $ | − | $ | − |

Operating expenses | $ | 36,300 | $ | 6,610 |

Net (loss) | $ | (36,300) | $ | (6,610) |

Net (loss) per common share basic and diluted | $ | (0.00) | $ | (0.00) |

Weighted average number of shares outstanding - basic and diluted |

| 8,750,000 |

| 6,000,000 |

AMERICAN REBEL HOLDINGS, INC.

AUDITED CONSOLIDATED STATEMENTS OF OPERATIONS

For the year ended December 31, 2021 | For the year ended December 31, 2020 | |||||||

| Revenue | $ | 986,826 | $ | 1,255,703 | ||||

| Cost of goods sold | 812,130 | 952,511 | ||||||