| Large accelerated filer | Accelerated filer | ||

| Non-accelerated filer | Smaller reporting company | ☒ | |

| (do not check if a smaller reporting company) | Emerging Growth Company | ☐ | |

________________________

| Title of Each Class of Securities to be Registered (1) | Proposed Maximum Aggregate Offering Price (2) | Amount of Registration Fee (3) | |||||

| Series D preferred stock, par value $0.001 | $ | $ | |||||

| Warrants to purchase shares of common stock (4) | $ | $ | |||||

| Shares of common stock issuable upon conversion of Series D preferred stock | $ | $ | |||||

| Shares of common stock issuable upon exercise of the Warrants | $ | $ | |||||

| Total: | $ | 5,000,000 | $ | 503.50 | |||

Title of Each Class of securities to be registered | Numbert of shares of common stock to be registered (1) | Proposed Maximum Offering Price Per Share (2) | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee (3) |

| Common Stock | 70,000,000 | $0.0075 | $525,000 | $65.36 |

| (1) | In |

| (2) | Based on the average of the lowest two (2) volume weighted average trading prices of the Company’s common stock during the fifteen (15) consecutive trading day period immediately preceding the filing of this Registration Statement of approximately $0.0075. The shares offered, hereunder, may be sold by the selling stockholder from time to time in the open market, through privately negotiated transactions, or a combination of these methods at market prices prevailing at the time of sale or at negotiated prices. |

| (3) | The fee is calculated by multiplying the aggregate offering amount by ..00012450, pursuant to Section 6(b) of the Securities Act of 1933. |

The registrant

PRELIMINARY PROSPECTUS

Subject to completion, dated July 1, 2016

$5,000,000

5,000

Warrants to Purchaseshares of its common stock, which will consist of up to _________ Shares of Common Stock

_________ Shares of Common Stock Underlying the Series D Preferred Stock

_________ Shares of Common Stock Underlying the Warrants

________________________

We are offering up to 5,000 shares of our Series D convertible preferred stock, together with warrants to purchase __________70,000,000 shares of common stock atto be sold by GHS Investments LLC (“GHS”) pursuant to an Equity Financing Agreement (the “Financing Agreement”) dated March 1, 2018. If issued presently, the 70,000,000 of common stock registered for resale by GHS would represent 24.89% of our issued and outstanding shares of common stock as of June 1, 2018.

Subject to certain ownership limitations, the Series D preferred stock will be convertible at any timeprevailing market prices at the holder’s option intotime of sale, at varying prices, or at negotiated prices.

be underwriting commissions or discounts under the Securities Act of 1933.

| Per Share/Warrant | Total | ||||||

| Offering Price | $ | 1,000 | $ | 5,000,000 | |||

| Placement Agent’s Fees (1) | $ | 90 | $ | 450,000 | |||

| Offering Proceeds, Before Expenses | $ | 910 | $ | 4,550,000 | |||

_____________________________

We have retained Ladenburg Thalmann & Co., Inc. to act as our exclusive placement agent in connection with this offering, and to use its “best efforts” to solicit offers to purchase thethere has been a very limited market for our securities. The placement agent is not required to sell any specific number or dollar amount of securities but will use its best efforts to sell the securities offered. This best-efforts offering does not have a minimum purchase requirement and therefore is not certain to raise any specific amount.

Investing inWhile our common stock involvesis on the OTC Markets, there has been negligible trading volume. There is no guarantee that an active trading market will develop in our securities.

5. Neither the Securities and Exchange Commission or SEC, nor any state securities commission has approved or disapproved of these securities or passed upon the securities that may be offered underaccuracy or adequacy of this prospectus, nor have any of these organizations determined if this prospectus is truthful or complete.prospectus. Any representation to the contrary is a criminal offense.

Ladenburg Thalmann

TABLE OF CONTENTS

| 5 | |

| 22 | |

| | |

| Item 6. Dilution | 22 |

| Item 7. Selling Security Holder | 22 |

| Item 8. Plan of Distribution | 24 |

| Item 9. Description of Securities to be Registered | 25 |

| Item 10. Interests of Named Experts and Counsel | 27 |

| Item 11. Information with Respect to the Registrant | 27 |

| Item 12. Incorporation of Certain Information by Reference. | 43 |

| Item 13. Other Expenses of Issuance and Distribution | 99 |

| Item 14. Indemnification of Officers and Directors | 99 |

| Item 15. Recent Sales of Unregistered Securities | 99 |

| Item 16. Exhibits and Financial Statement Schedules. | 100 |

| Item 17. Undertakings. | 103 |

| Financial Statements | 46 |

ABOUT THIS PROSPECTUS

changed since those dates. The termsselling stockholders are offering to sell and seeking offers to buy shares of our common stock only in jurisdictions where offers and sales are permitted.

FORWARD-LOOKING STATEMENTS

Statements in this prospectus, which express “belief,” “anticipation” or “expectation,” as well as other statements that are not historical facts, are forward-looking statements. These forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from historical results or anticipated results, including those identified, a Delaware corporation.

Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by which, such performance or results will be achieved. Forward-looking information is based on information available at the time and/or management’s good faith belief with respect to future events, and is subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the statements.

Forward-looking statements speak only as of the date the statements are made. We assume no obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information except to the extent required by applicable securities laws. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect thereto or with respect to other forward-looking statements.

SUMMARY

This summary highlights information contained elsewhere in this prospectus. This summary is not complete and may not contain all of the information that may be important to you. We urge you to read the entire prospectus, carefully, including the ‘‘Risk Factors’’ section, beforefinancial statements and their explanatory notes under the Financial Statements prior to making an investment decision. Unless otherwise noted, all share and per share data in this prospectus give effect to the 1:___ reverse stock split of our common stock implemented on ___________, 2016, and is based on 67,901,547 pre-reverse split shares outstanding as of June 15, 2016. For more information about our reverse stock split, see “Recent Developments.”

Our Company

Our single-use cervical guides are manufactured by a vendor that specializes in injection molding of plastic medical products. On January 22, 2017, we entered into a license agreement with Shandong Yaohua Medical Instrument Corporation (“SMI”) pursuant to which we granted SMI an exclusive global license to manufacture the LuViva device and related disposables (subject to a carve-out for manufacture in Turkey).

2016, respectively.

Since our inception, we have raised capital through the public and private sale of debt and equity, funding from collaborative arrangements, and grants.

Our prospects must be considered in light of the substantial risks, expenses and difficulties encountered by entrants into the medical device industry. This industry is characterized by an increasing number of participants, intense competition and a high failure rate. We have experienced operating losses since our inception and, as of March 31, 2016 we have an accumulated deficit of about $122.9 million. To date, we have engaged primarily in research and development efforts and the early stages of marketing our products. We do not have significant experience in manufacturing, marketing or selling our products. We may not be successful in growing sales for our products. Moreover, required regulatory clearances or approvals may not be obtained in a timely manner, or at all. Our products may not ever gain market acceptance and we may not ever generate significant revenues or achieve profitability. The development and commercialization of our products requires substantial development, regulatory, sales and marketing, manufacturing and other expenditures. We expect our operating losses to continue through at least the end of 2016 as we continue to expend substantial resources to complete commercialization of our products, obtain regulatory clearances or approvals, build our marketing, sales, manufacturing and finance capabilities, and conduct further research and development.

Our product revenues to date have been limited. In 2015 and 2014, the majority of our revenues were from the sale of LuViva devices and disposables, as well as some revenue from grants from the NIH and licensing agreement fees received. We expect that the majority of our revenue in 2016 will be derived from revenue from the sale of LuViva devices and disposables.

Recent Developments

Reverse Stock Split. On May 18, 2016, our board determined to recommend that at our 2016 annual stockholders’ meeting, our stockholders grant the board the authority, in its discretion, to effect a reverse stock split by a ratio of not less than 1:10

Warrant Restructuring.Between June 13, 2016 and June 14, 2016, we entered into various agreements with holders of certain warrants (including John Imhoff, the chairman of our board of directors) originally issued in May 2013, and with GPB Debt Holdings II LLC, holder of a warrant issued February 12, 2016, pursuant to which each holder separately agreed to exchange warrants for either (1) shares of common stock equal to 166% of the number of shares of common stock underlying the surrendered warrants, or (2) new warrants exercisable for 200% of the number of shares underlying the surrendered warrants, but without certain anti-dilution protections included with the surrendered warrants. As a result of the exchanges, we effectively eliminate any potential exponential increase in the number of underlying shares issuable upon exercise of our outstanding warrants. In total, for surrendered warrants then-exercisable for an aggregate of 115,237,788 shares of common stock (but subject to exponential increase upon operation of certain anti-dilution provisions), we issued or are obligated to issue 13,517,342 shares of common stock and new warrants that, if exercised as of June 14, 2016, would be exercisable for an aggregate of 214,189,622 shares of common stock.

In certain circumstances, in lieu of presently issuing all of the shares (for each holder that opted for shares of common stock), we and the holder further agreed that we will, subject to the terms and conditions set forth in the applicable warrant exchange agreement, from time to time, be obligated to issue the remaining shares to the holder. No additional consideration will be payable in connection with the issuance of the remaining shares.

The holders that elected to receive shares for their surrendered warrants have agreed that they will not sell shares on any trading day in an amount, in the aggregate, exceeding 20% of the composite aggregate trading volume of the common stock for that trading day. The holders that elected to receive new warrants will be required to surrender their old warrants upon consummation of this offering. The new warrants will have an initial exercise price equal to the exercise price of the surrendered warrants as of immediately prior to consummation of this offering, subject to customary “downside price protection” for as long as our common stock is not listed on a national securities exchange, and will expire five years from the date of issuance.

| Shares currently outstanding: | 211,291,990 | |

| |

Shenghuo License Agreement.On June 5, 2016, we entered into a license agreement with Shenghuo Medical, LLC pursuant to which we granted Shenghuo an exclusive license to manufacture, sell and distribute LuViva in Taiwan, Brunei Darussalam, Cambodia, Laos, Myanmar, Philippines, Singapore, Thailand, and Vietnam. Shenghuo was already our exclusive distributor in China, Macau and Hong Kong, and the license extends to manufacturing in those countries as well. Under the terms of the license agreement, once Shenghuo is capable of manufacturing LuViva in accordance with ISO 13485 for medical devices, Shenghuo will pay us a royalty equal to $2.00 or 20% of the distributor price (subject to a discount under certain circumstances), whichever is higher, per disposable distributed within Shenghuo’s exclusive territories.

In connection with the license grant, Shenghuo will underwrite the cost of securing approval of LuViva with Chinese Food and Drug Administration. At its option, Shenghuo also will provide up to $1.0 million in furtherance of our efforts to secure regulatory approval for LuViva from the U.S. Food and Drug Administration, in exchange for the right to receive payments equal to 2% of our future sales in the United States, up to an aggregate of $4.0 million.

Pursuant to the license agreement, Shenghuo has the option, after our next annual meeting of stockholders, to have a designee appointed to our board of directors.

As partial consideration for, and as a condition to, the license, and to further align the strategic interests of the parties, we have agreed to issue a convertible note to Shenghuo, in exchange for an aggregate cash investment of $200,000. The note will provide for a payment to Shenghuo of $240,000, due upon consummation of any capital raising transaction by us within 90 days and with net cash proceeds of at least $1.0 million. Absent such a transaction, the payment will increase to $300,000 and will be payable by December 31, 2016. The note will accrue interest at 20% per year on any unpaid amounts due after that date. The note will be convertible into shares of our common stock at a conversion price per share of $0.017402, subject to customary anti-dilution adjustment. The note will be unsecured, and is expected to provide for customary events of default. We will also issue Shenghuo a five-year warrant exercisable immediately for approximately 13.8 million shares of common stock at an exercise price equal to the conversion price of the note, subject to customary anti-dilution adjustment.

Short Term Promissory Notes.On May 4, 2016 and May 26, 2016, Aquarius Opportunity Fund advanced us a total of $87,500 for 2% simple interest notes due the earlier of December 31, 2016 or consummation of this offering. Also on May 26, 2016, GPB Debt Holdings II LLC, holder of our outstanding senior secured convertible note, advanced as an additional $87,500, on the same terms as their note. We intend to offer each of them the opportunity to participate in the offering at least up to the extent of the outstanding principal and interest on these cash advances, by extinguishing all or a portion of the debt on a dollar-for-dollar basis.

Series C Exchanges.Between April 27, 2016 and May 3, 2016, we entered into various agreements with certain holders of our Series C preferred stock, including John Imhoff, one of our directors, pursuant to which those holders separately agreed to exchange each share of Series C preferred stock held for 2.25 shares of our newly created Series C1 preferred stock and 9,600 shares of our common stock. In connection with these exchanges, each holder also agreed to exchange the $1,000 stated value per share of the holder’s shares of Series C1 preferred stock for new securities that we issue in the next qualifying financing we undertake on a dollar-for-dollar basis. We expect this offering will be a qualifying financing. Finally, each holder agreed, except in the event of an additional $50,000 cash investment in the financing by the holder, to execute a customary “lockup” agreement in connection with the qualifying financing. In total, for 1,916 shares of Series C preferred stock surrendered, we issued 4,311 shares of Series C1 preferred stock and 18,396,800 shares of common stock.

The Series C1 preferred stock has terms that are substantially the same as the Series C preferred stock, except that the Series C1 preferred stock does not pay dividends (unless and to the extent declared on the common stock) or at-the-market “make-whole payments.” See “Description of Securities” for a description of the material terms of the Series C1 preferred stock.

Separately, on April 27, 2016, we entered into a rollover and amendment agreement with another holder of Series C preferred stock, Aquarius Opportunity Fund, pursuant to which Aquarius agreed to exchange any shares of Series C preferred stock (stated value plus make-whole dividend), as well as any remaining principal and accrued interest on our convertible promissory note Aquarius holds, for new securities that we issue in our next financing, all on a dollar-for-dollar basis, as long as the next financing involves at least $1 million in cash from investors unaffiliated with Aquarius. We expect this offering will be a qualifying financing. Aquarius also agreed to return to us for cancelation warrants exercisable for 722,211 shares of our common stock that it held. Except in the event of an additional $50,000 cash investment by Aquarius in the qualifying financing, Aquarius has agreed to execute a customary “lockup” agreement in connection with the financing. Finally, Aquarius, as the holder of a majority of the outstanding Series C preferred stock, agreed to amend the Series C stock purchase agreement to eliminate any participation rights held by the Series C shareholders and to waive operation of certain anti-dilution provisions of the Series C that would otherwise be triggered by the transactions described in “—Recent Developments.”

| Shares being offered: | 70,000,000 | |

| |

The Offering

| Offering | The selling stockholders may sell all or a portion of | |

| Use of | We will not receive any proceeds from the | |

| OTC Markets Symbol: | GTHP | |

| Risk | See “Risk Factors” beginning on page |

| stock. |

Year Ended March 31, 2018 | Year Ended December 31, 2017 | Year Ended December 31, 2016 | |

| Cash | $76 | $1 | $14 |

| Total Assets | 527 | 489 | 1,492 |

| Total Liabilities | 18,465 | 19,891 | 10,758 |

| Total Stockholder’s Equity (Deficit) | (17,938) | (19,402) | (9,266) |

Three Months Ended March 31, 2018 | Three Months Ended March 31, 2017 | Year Ended December 31, 2017 | Year Ended December 31, 2016 | |

| Revenue | 4 | 21 | 244 | 605 |

| Total Expenses | 380 | 535 | 3,365 | 4,425 |

| Total Other income (expense) | 1,458 | 407 | (7,575) | (150) |

| Net Income (Loss) for the Period | 1,082 | (107) | (10,696) | (3,970) |

| Net Loss per Share | 0.012 | (0.22) | (1.29) | (24.62) |

Your

Risks RelatedPrivate Securities Litigation Reform Act of 1995 is not available to this Offering

As a new investor, you will incur substantial dilutionus as a result of this offering and future equity issuances.

Our net tangible book value deficiency as of March 31, 2016 was approximately $7.3 million, or $1.37 per share of common stock. Net tangible book value per share represents total tangible assets less total liabilities, divided by the number of shares of common stock outstanding. On a pro form basis after giving effect to the assumed sale of 5,000 shares of Series D preferred stock in this offering at a public offering price of $1,000 per share, and assuming the conversion of all the shares of Series D preferred stock sold in the offering at an assumed conversion price of $0.01 per share, which was the last reported sale price of our common stock on June 15, 2016 (and excluding shares of common stock issuable upon exercisenon- reporting issuer. Further, Section 27A(b)(2)(D) of the warrants),Securities Act and after deducting estimated placement agent fees and estimated offering expenses payable by us, if you purchase securities in this offering, you will suffer immediate and substantial dilution of approximately $0.006 per share in the net tangible book valueSection 21E(b)(2)(D) of the common stock underlyingSecurities Exchange Act expressly state that the Series D preferred stock that you acquire. See “Dilution”safe harbor for a more detailed discussion of the dilution you will incur if you participateforward looking statements does not apply to statements made in thisconnection with an initial public offering. In addition to this offering, subject to market conditions and other factors, it is likely that we will pursue additional capital to finance our operations. Accordingly, we may conduct substantial future offerings of equity securities. The exercise of outstanding options and warrants and future equity issuances, including future public offerings or future private placements of equity securities, would result in further dilution to investors.

The actual offering amount, the offering price and the net proceeds to us, if any, in this offering may be substantially less than the amounts set forth above.

Because there is no minimum offering amount or offering price required as a condition to closing in this offering, the actual public offering amount, offering price and net proceeds to us, if any, in this offering are not presently determinable and may be substantially less than the amounts set forth above. We are not required to sell any specific number or dollar amount of the securities offered in this offering, but the placement agent will use its best efforts to sell the securities offered.

Sales of a significant number of shares of our common stock in the public markets, or the perception that such sales could occur, could depress the market price of our common stock.

If our stockholders (including those persons who may become stockholders upon conversion of outstanding convertible securities or exercise of outstanding warrants or options) sell substantial amounts of our common stock, or the public market perceives that stockholders might sell substantial amounts of our common stock, the market price of our common stock could decline significantly. Such sales also might make it more difficult for us to sell equity or equity-related securities in the future at a time and price that our management deems appropriate.

We will have broad discretion over the use of the proceeds of this offering and may not realize a return.

We will have considerable discretion in the application of the net cash proceeds of this offering. We intend to use the net cash proceeds to increase inventory of LuViva to meet current demand for the product, and to support general working capital and operations. However, we will retain broad discretion over the use of the net proceeds and may use the money for other corporate purposes. We may use the net cash proceeds for purposes that do not yield a significant return, if any, for our stockholders.

There is no public market for the Series D preferred stock or warrants being offered in this offering.

There is no established public trading market for the Series D preferred stock or warrants being offered in this offering. We do not expect a market to develop for the Series D preferred stock or the warrants. In addition, we do not intend to apply for listing of the Series D preferred stock or warrants on any securities exchange or expect the Series D preferred stock to trade on the OTCQB marketplace, although we will use our best efforts to have the warrants quoted on the OTCQB marketplace on or before the closing. Without an active market, the liquidity of the Series D preferred stock and warrants will be limited.

If we cannot obtain additional funds or achieve profitability, we may not be able to continue as a going concern.

| Accumulated deficit, from inception to 12/31/ | $ | |

| Preferred dividends | $ | |

| Net Loss for fiscal year | $ | |

| Accumulated deficit, from inception to 12/31/ | $ | |

| Preferred dividends | $ | |

| Net Loss for | $ | |

| Accumulated deficit, from inception to 12/31/ | $138.5 million | |

| Preferred dividends | ||

| Net Income for | $ | |

| Accumulated deficit, from inception to 3/31/ | $ |

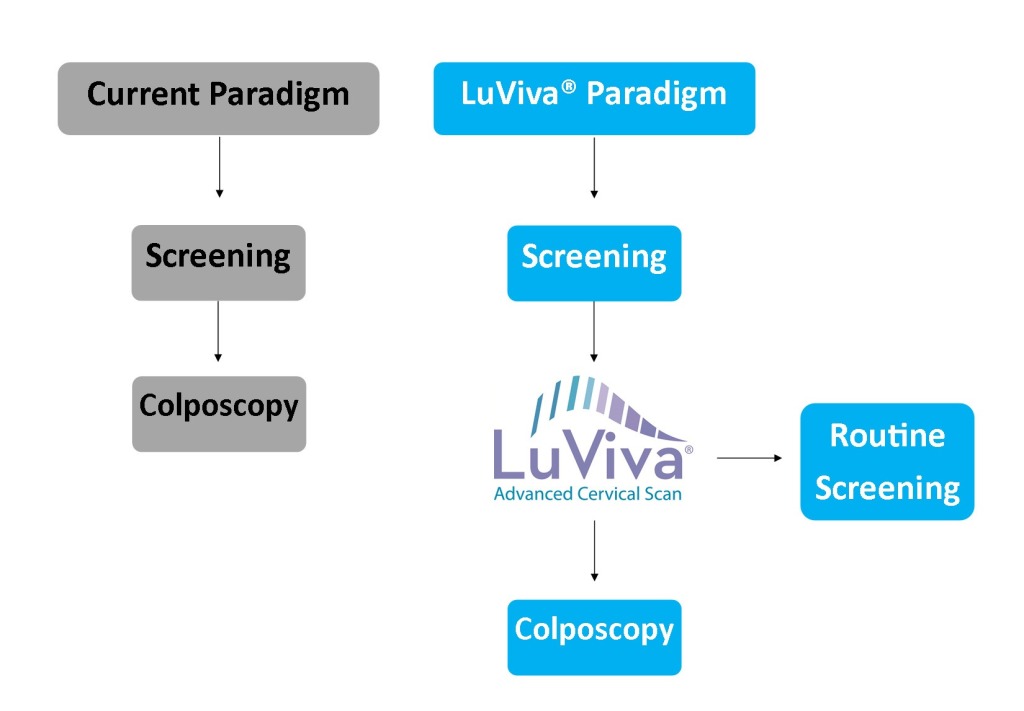

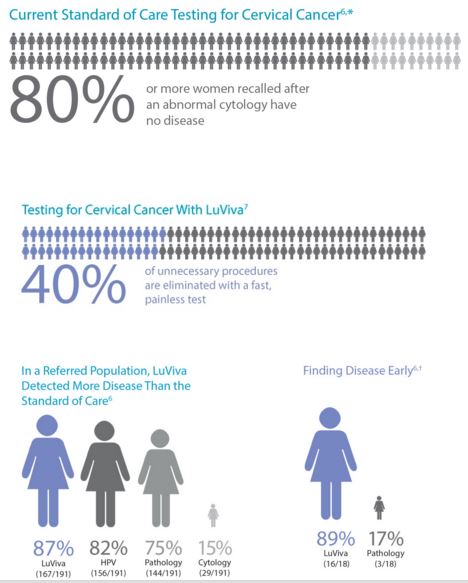

2018. 2018. split. However, please refer to Footnote 11 - CONVERTIBLE DEBT IN DEFAULT in the paragraph: Debt Restructuring for more information regarding our warrants. common stock, which consists of shares of common stock to be sold by GHS pursuant to the Financing Agreement. If issued presently, the shares of common stock registered for resale by GHS would represent 24.89% of our issued and outstanding shares of common stock as of June 1, 2018. Expected % of Net Cash Proceeds Warrants Exercise Price Per Share Expiration Date We are a medical technology company focused on developing innovative medical devices that have the potential to improve healthcare. Our primary focus is the sales and marketing of our LuViva® Advanced Cervical Scan non-invasive cervical cancer detection device. The underlying technology of LuViva primarily relates to the use of biophotonics for the non-invasive detection of cancers. LuViva is designed to identify cervical cancers and precancers painlessly, non-invasively and at the point of care by scanning the cervix with light, then analyzing the reflected and fluorescent light. London in 2015 and at the Indonesian National Obstetrics and Gynecology (POGI) Meeting in Solo in 2016. 2018. On January 22, 2017, we entered into a license agreement with Shandong Yaohua Medical Instrument Corporation (“SMI”) pursuant to which we granted SMI an exclusive global license to manufacture the LuViva device and related disposables (subject to a carve-out for manufacture in Turkey). CFDA. questions. 30092. 1, 2018 was 148. The actual number of stockholders is greater than this number of record holders and includes stockholders who are beneficial owners but whose shares are held in street name by brokers and other nominees. Plan category Number of securities to be issued upon exercise of outstanding options, warrants and rights Weighted-average exercise price of outstanding options, warrants and rights Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) 104,356 $45.00 26,616 - - - Capital Resources 2017. $5,214, unamortized and debt issuance costs of $11,160 for the period ended December 31, 2017. the period ended December 31, 2017. 2018, we had a net debt of $76,626, including unamortized debt issuance costs of $11,672 and unamortized discount of $6,890. Based on discussions with our distributors, we expect to generate purchase orders for approximately $2 million in LuViva devices and disposables in 2018, and expect those purchase orders to result in actual sales of $1.5 million in 2018, representing what we view as current demand for our products. We cannot be assured that we will generate all or any of these additional purchase orders, or that existing orders will not be canceled by the distributors or that parts to build product will be available to meet demand, such that existing orders will result in actual sales. Because we have a short history of sales of our products, we cannot confidently predict future sales of our products beyond this time frame, and cannot be assured of any particular amount of sales. Accordingly, we have not identified any particular trends with regard to sales of our products. statements contained in our annual report on Form 10-K for the year ended December 31, 2017. PROMOTERS, AND CONTROL PERSONS If we amend our code of ethics, other than a technical, administrative or non-substantive amendment, or we grant any waiver, including any implicit waiver, from a provision of the code that applies to our principal executive officer, principal financial officer, principal accounting officer or controller, we will disclose the nature of the amendment or waiver on our website, www.guidedinc.com, under the “Investor Relations” tab under the tab “About Us.” Also, we may elect to disclose the amendment or waiver in a report on Form 8-K filed with the Securities and Exchange Commission. Name and Principal Position Year Salary ($) Bonus ($) Option Awards ($)(1) Total ($) Gene S. Cartwright, Ph.D. President, CEO, Acting CFO and Director (2) Mark Faupel, Ph.D. Former President, CEO and Acting CFO(3) Richard Fowler, Senior Vice President of Engineering 2015 2014 243,000 203,000 - - $30,880 17,000 273,880 220,000 Name and Principal Position Number of Securities Underlying Options Exercisable (#)(1) Number of Securities Underlying Options Un-exercisable (#) Equity Incentive Plan Awards: Number of Securities Under- lying Unexercised Unearned Options (#) Option Exercise Price ($)(2) Option Expiration Date Gene S. Cartwright, Ph.D. President, CEO, Acting CFO and Director Mark Faupel, Ph.D. Former President, CEO & Acting CFO Richard Fowler Senior Vice President of Engineering Option Awards (#) Exercise Price ($) Name and Address of Beneficial Owner Percent of Class(2) PERSONS Based on the definition of independence of the NASDAQ Stock Market, the board has determined that Mr. James and directors. We BASIC AND DILUTED NET LOSS PER SHARE ATTRIBUTABLE TO COMMON STOCKHOLDERS (post 1:100 reverse stock split) Preferred Stock Series B Preferred Stock Series C Common Stock Additional Paid-In Treasury Accumulated Preferred Stock Series B Preferred Stock Series C Common Stock Additional Paid-In Treasury Accumulated BASIS OF PRESENTATION 2017. 2018. SIGNIFICANT ACCOUNTING POLICIES The Company uses the Monte Carlo simulations and binomial calculations in the calculation of the fair value of the warrant liabilities and the valuation of embedded conversion options and freestanding warrants. All intercompany transactions are eliminated. guidance. the balance sheet as a direct deduction from the carrying amount of the debt liability consistent with the debt discount. As of December 31, presented under the new revenue standard, while prior period amounts are not adjusted and continue to be reported in accordance with our historic accounting under Topic 605. 2018. During the three months ended March 31, 2017, there were revenues from one distributor, that totaled approximately $21,000. As of March 31, 2018, and December 31, 2017, the Company has received prepayments for devices and disposables recorded as deferred revenue in the amount of $28,000 and $21,000, respectively. 2017: December 31, 2015 December 31, 2014 December 31, 2014 Fair Value Measurements Using Significant Unobservable Inputs (Level 3) December 2014 Public Offering ExchangedWarrants Series C Warrants STOCKHOLDERS’ DEFICIT respectively. Between June 13, 2016 and June 14, 2016, the Company entered into various agreements with holders of the Company’s “Series B Tranche B” warrants, pursuant to which each holder separately agreed to exchange the warrants for either (1) shares of common stock equal to 166% of the number of shares of common stock underlying the surrendered warrants, or (2) new warrants exercisable for 200% of the number of shares underlying the surrendered warrants, but without certain anti-dilution protections included with the surrendered warrants. $640. issued during the period ended March 31, 2018. Weighted Average Exercise Warrants (Underlying Shares) Exercise Price Per Share Expiration Date customary anti-dilution adjustment. On Year Ended December 31, Year Ended December 31, promissory note for an aggregate purchase price of $135,000 (representing a $15,000 original issue discount). On March 20, 2018, the Company issued the note to Auctus. Pursuant to the purchase agreement, the Company also issued to Auctus a warrant exercisable to purchase an aggregate of 3,409,090 shares of the Company’s common stock. The warrant is exercisable at any time, at an exercise price per share equal to $0.00228 (110% of the closing price of the common stock on the day prior to issuance), subject to certain customary adjustments and price-protection provisions contained in the warrant. The warrant has a five-year term. The note matures nine months from the date of issuance and, in addition to the original issue discount, accrues interest at a rate of 12% per year. The Company could have prepaid the note, in whole or in part, for 115% of outstanding principal and interest until 30 days from issuance, for 125% of outstanding principal and interest at any time from 31 to 60 days from issuance, and for 130% of outstanding principal and interest at any time from 61 days from issuance to 180 days from issuance. After six months from the date of issuance, Auctus may convert the note, at any time, in whole or in part, into shares of the Company’s common stock, at a conversion price equal to the lower of the price offered in the Company’s next public offering or a 40% discount to the average of the two lowest trading prices of the common stock during the 20 trading days prior to the conversion, subject to certain customary adjustments and price-protection provisions contained in the note. The note includes customary events of default provisions and a default interest rate of 24% per year. Upon the occurrence of an event of default, Auctus may require the Company to redeem the note (or convert it into shares of common stock) at 150% of the outstanding principal balance plus accrued and unpaid interest. As of March 31, 2018, the Company has net debt of $99,000 including unamortized debt issuance costs of $31,500 and reduction related to the allocated value of the warrants of $19,500. GUIDED THERAPEUTICS INC. AND SUBSIDIARY FOR THE THREE MONTHS ENDED MARCH 31, PREFERRED STOCK DIVIDENDS NET LOSS ATTRIBUTABLE TO COMMON STOCKHOLDERS GUIDED THERAPEUTICS INC. AND SUBSIDIARY FOR THE THREE MONTHS ENDED MARCH 31, March 31, 2016 Fair Value at December 31, 2015 Fair Value Measurements Using Significant Unobservable Inputs (Level 3) $22,000. As of March 31, Warrants Exercise Price Expiration Date Weighted Average Exercise IN DEFAULT accredited investors of its portion of the note of to a third accredited investor. The balance was reduced by $306,863 as part of a debt restructuring on December 7, 2016. GPB. year. At December 31, 2017, there were 4,312 shares outstanding with a conversion price of $0.017 per share, such that each share of Series C preferred stock would convert into approximately 58,824 shares of the Company’s common stock. As of December 31, 2017, the Company had issued 14,766 shares of common stock and rights to common stock shares for 2,131. In certain circumstances, in lieu of presently issuing all of the shares (for each holder that opted for shares of common stock), The holders that elected to receive shares for their surrendered warrants have agreed that they will not sell shares on any trading day in an amount, in the aggregate, exceeding 20% of the composite aggregate trading volume of the common stock for that trading day. The holders that elected to receive new warrants will be required to surrender their old warrants upon consummation of case. EXHIBIT NO. DESCRIPTION June Chairman of the Board and Director June Directorapprovals,approvals; build our marketing, sales, manufacturing and finance capabilities, and conduct further research and development. The further development and commercialization of our products will require substantial development, regulatory, sales and marketing, manufacturing and other expenditures. We have only generated limited revenues from product sales. Our accumulated deficit was approximately $122.9$137.5 million at March 31, 2016.maintainundergo an inspection and re-file for ISO 13485:2003 certification and the CE mark certification,Mark, which is an international symbol of quality and compliance with applicable European medical device directives. Failure to maintain ISO 13485:2003 certification or CE mark certification or other international regulatory approvals would prevent us from selling in some countries in the European Union.our ability to sellus from selling our products domestically.·we, or any collaborative partner, will make timely filings with the FDA;·the FDA will act favorably or quickly on these submissions;·we will not be required to submit additional information or perform additional clinical studies; or·we will not face other significant difficulties and costs necessary to obtain FDA clearance or approval. 7customersdistributors and any reduction, delay or cancellation of an order from these customersdistributors or the loss of any of these customersdistributors could cause our revenue to decline.customersdistributors that have accounted for substantially all of our limited revenues. As a result, the termination of a purchase order with any one of these customersdistributors may result in the loss of substantially all of our revenues. We are constantly working to develop new relationships with existing or new customers,distributors, but despite these efforts we may not be successful at generating new orders to maintain similar revenues as current purchase orders are filled. In addition, since a significant portion of our revenues is derived from a relatively few customers,distributors, any financial difficulties experienced by any one of these customers,distributors, or any delay in receiving payments from any one of these customers,distributors, could have a material adverse effect on our business, results of operations, financial condition and cash flows.customersdistributors outside of the United States. We expect that substantially all of our business will continue to come from sales in foreign markets, through increased penetration in countries where we currently sell LuViva, combined with expansion into new international markets. However, international sales are subject to a number of risks, including:customers,distributors, and if these distributors terminate their relationships with us or under-perform, we may be unable to maintain or increase our level of international revenue. We will also need to engage additional international distributors to grow our business and expand the territories in which we sell LuViva. Distributors may not commit the necessary resources to market, sell and service LuViva to the level of our expectations. If current or future distributors do not perform adequately, or if we are unable to engage distributors in particular geographic areas, our revenue from international operations will be adversely affected 82016,2018, we have been issued, or have rights to, 24 U.S. patents (including those under license). In addition, we have filed for, or have rights to, six U.S. patents (including those under license) that are still pending. There are additional international patents and pending applications. One or more of the patents we hold directly or license from third parties, including those for our cervical cancer detection products, may be successfully challenged, invalidated or circumvented, or we may otherwise be unable to rely on these patents. These risks are also present for the process we use or will use for manufacturing our products. In addition, our competitors, many of whom have substantial resources and have made substantial investments in competing technologies, may apply for and obtain patents that prevent, limit or interfere with our ability to make, use and sell our products, either in the United States or in international markets. 9 10includingwhich is considered ordinary course accounts payablepayables and accrued payroll liabilities, was $4.0$5.1 million at March 31, 2016. We currently are required to make approximately $21,000 in monthly payments of interest and, beginning August 2016, $239,583 in quarterly payments of principal on our outstanding senior secured convertible note. The outstanding principal and accrued interest on our secured promissory note is due on August 31, 2016. In connection with the Shenghuo license agreement, we have agreed to issue Shenghuo a convertible note in principal amount of $240,000, due upon consummation of any capital raising transaction by us within 90 days and with net cash proceeds of at least $1.0 million. Absent such a transaction, the payment will increase to $300,000 and will be payable by December 31, 2016.·we may be unable to obtain additional financing to fund working capital, operating losses, capital expenditures or acquisitions on terms acceptable to us, or at all;·the amount of our interest expense may increase if we are unable to make payments when due;·our assets might be subject to foreclosure if we default on our secured debt (see “—We have outstanding debt that is collateralized by a general security interest in all of our assets, including our intellectual property. If we were to fail to repay the debt when due, the holders would have the right to foreclose on these assets.”);·our vendors or employees may, and some have, instituted proceedings to collect on amounts owed them;·we have to use a substantial portion of our cash flows from operations to repay our indebtedness, including ordinary course accounts payable and accrued payroll liabilities, which reduces the amount of money we have for future operations, working capital, inventory, expansion, or general corporate or other business activities; and·we may be unable to refinance our indebtedness on terms acceptable to us, or at all.15, 2016,1, 2018, we had notes outstanding that are collateralized by a security interest in our current and future inventory and accounts receivable. We also had a note outstanding that is collateralized by a security interest in all of our assets, including our intellectual property. When the debt is repaid, the holders’ security interests on our assets will be extinguished. However, if an event of default occurs under the notes prior to their repayment, the holders may exercise their rights to foreclose on these secured assets for the payment of these obligations. Under “cross-default” provisions in each of the notes, an event of default under one note is automatically an event of default under the other notes. Any such default and resulting foreclosure would have a material adverse effect on our business, financial condition and results of operations.Only our Chief Executive Officer and our Senior Vice President of Engineering have employment contracts with us, and none of our employees are covered by key person or similar insurance. In addition, if we are able to successfully develop and commercialize our products, we will need to hire additional scientific, technical, marketing, managerial and finance personnel. We face intense competition for qualified personnel in these areas, many of whom are often subject to competing employment offers. 11We are significantly influenced by our directors, executive officers and their affiliated entities.Our directors, executive officers and entities affiliated with them controlled 15.31 %, of the voting power of our outstanding common stock as of June 15, 2016. These stockholders, acting together, would be able to exert significant influence on substantially all matters requiring approval by our stockholders, including the election of directors and the approval of mergers and other business combination transactions.9.05.0 million shares of preferred stock. Our undesignated shares of preferred stock may be issued in one or more series, the terms of which may be determined by the board without further stockholder action. These terms may include, among other terms, voting rights, including the right to vote as a series on particular matters, preferences as to liquidation and dividends, repurchase rights, conversion rights, redemption rights and sinking fund provisions. The issuance of any preferred stock could diminish the rights of holders of our common stock, and therefore could reduce the value of our common stock. In addition, specific rights granted to future holders of preferred stock could be used to restrict our ability to merge with or sell assets to a third party. The ability of our board to issue preferred stock could make it more difficult, delay, discourage, prevent or make it more costly to acquire or effect a change in control, which in turn could prevent our stockholders from recognizing a gain in the event that a favorable offer is extended and could materially and negatively affect the market price of our common stock.Our board of directors has asked our stockholders to approveproposal to authorize our board to effect a1:800 reverse stock split of all of our issued and outstanding common stock.stock was implemented. There are risks associated with a reverse stock split, if it is effected.May 18,November 7, 2016, our board determined to recommend that at our 2016 annual stockholders’ meeting, our stockholders grant the board the authority, in its discretion, to effect a 1:800 reverse stock split byof all of our issued and outstanding common stock was implemented. As a ratioresult of not less than 1:10 and not more than 1:400, with no change in the number of authorizedreverse stock split, every 800 shares of ourissued and outstanding common stock and allwere converted into 1 share of common stock. All fractional shares created by the reverse stock split to bewere rounded to the nearest whole share. On May 26, 2016, our largest stockholder, John Imhoff, who is also oneThe number of our directors, agreed to vote hisauthorized shares of common stock in favor of the reverse stock split. As of the record date for the 2016 annual meeting, Dr. Imhoff held 10,361,179 shares, or 19.26%, of the outstanding shares of common stock.We intend to effect the reverse stock split prior to the consummation of this offering; however, there are no assurances that the reverse stock split will be implemented. If the reverse stock split is effected, theredid not change.·We would have additional authorized shares of common stock that the board could issue in future without stockholder approval, and such additional shares could be issued, among other purposes, in financing transactions or to resist or frustrate a third-party transaction that is favored by a majority of the independent stockholders. This could have an anti-takeover effect, in that additional shares could be issued, within the limits imposed by applicable law, in one or more transactions that could make a change in control or takeover of us more difficult.·There can be no assurance that the reverse stock split, if completed, will achieve the benefits that we hope it will achieve. The total market capitalization of our common stock after the reverse stock split may be lower than the total market capitalization before the reverse stock split.will bewere outstanding immediately following the reverse stock split, especially if the market price of our common stock does not increase as a result of the reverse stock split. In addition, the reverse stock split may increasehave increased the number of stockholders who own odd lots of our common stock, creating the potential for such stockholders to experience an increase in the cost of selling their shares and greater difficulty effecting such sales. 12(excluding the convertible stock or warrants in this offering) is substantial.15, 2016,1, 2018, our outstanding convertible debt was convertible into an aggregate of 151,583,8431,240,341,381 shares of our common stock, and the outstanding shares of our Series C and Series C1 preferred stock were convertible into an aggregate of 433,385,611747,804,361 shares of common stock. Also, as of that date we had warrants outstanding that were exercisable for an aggregate of 233,615,051667,513,881 shares, contractual obligations to issue 5,205,1012,132 shares, and outstanding options to purchase 104,356116 shares. The shares of common stock issuable upon conversion or exercise of these securities would have constituted approximately 91.8 %92.6% of the total number of shares of common stock then issued and outstanding.(including the convertible stock and warrants in this offering), will dilute the ownership interests of our existing stockholders.”for a portion of our convertible debt orand preferred stock, and the exercise price for certain of our Series C preferred stockwarrants, will dilute the ownership interests of our existing stockholders. and the preferred stock part of this offering, any dividends we choose to pay in shares of our common stock will be calculated based on the then-current market price of our common stock. Accordingly, if the market price of our common stock decreases, the number of shares of our common stock issuable upon conversion of the convertible debt or upon payment of dividends on our outstanding Series C preferred stock and preferred stock part of this offering will increase, and may result in the issuance of a significant number of additional shares of our common stock.(including the preferred stock part of this offering) and certain of our convertible notes and outstanding warrants, the conversion price or exercise price will be lowered if we issue common stock at a per share price below the then conversionthen-conversion price or then-exercise price for those securities. Reductions in the conversion price or exercise price would result in the issuance of a significant number of additional shares of our common stock upon conversion or exercise, which would result in dilution in the value of the shares of our outstanding common stock and the voting power represented thereby.·we are a small company that is relatively unknown to stock analysts, stock brokers, institutional investors and others in the investment community that generate or influence sales volume; and·stock analysts, stock brokers and institutional investors may be risk-averse and be reluctant to follow a company such as ours that faces substantial doubt about its ability to continue as a going concern or to purchase or recommend the purchase of our shares until such time as we became more viable. 13customersdistributors or accredited investors. Penny stocks are generally defined to be an equity security that has a market price of less than $5.00 per share. For transactions covered by the rule, the broker-dealer must make a special suitability determination for the purchaser and receive the purchaser’s written agreement to the transaction prior to the sale. Consequently, the rule may affect the ability of broker-dealers to sell our securities and also may affect the ability of our stockholders to sell their securities in any market that might develop.·control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer;·manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases;·“boiler room” practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons;·excessive and undisclosed bid-ask differentials and markups by selling broker-dealers; and·the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequent investor losses. 14We estimate thatnet cash proceeds to us from the sale of the securities offered by this prospectus, excludingShares for general corporate and working capital purposes and acquisitions or assets, businesses or operations or for other purposes that the proceeds, if any, fromBoard of Directors, in good faith deem to be in the exercisebest interest of the warrants included in the offering, will be approximately $4.26 million, assuming the sale by us of 5,000 shares of Series D preferred stock and warrants atCompany. assumed public offering price of $1,000 per share and after deductingfor the estimated placement agent fees and estimated offering expenses payable by us. However, this is a best efforts offering with no minimum, and weshares registered hereunder, as the only shares being registered are those sold pursuant to the GHS Financing Agreement. GHS may not sell all or anya portion of the securities; as a result, weshares being offered pursuant to this prospectus at fixed prices and prevailing market prices at the time of sale, at varying prices or at negotiated prices.receive significantly less in net cash proceeds,offer and the net cash proceeds received may not be sufficient to continue to operate our business. In addition, expected net proceeds include a non-cash benefit for the extinguishment ofsell up to $175,000 in outstanding principal and interest on simple interest notes from certain70,000,000 shares of our investors.intendmay require the selling stockholder to apply any proceeds received in connection withsuspend the offering to increase inventory of LuViva to meet current demand for the product, and to support general working capital and operations. However, we will retain broad discretion over the usesales of the net proceeds and may useshares of our common stock being offered pursuant to this prospectus upon the money for other corporate purposes.The following table summarizes our currently estimated and intended useoccurrence of net cash proceeds if we receive the maximum amount of proceeds to be potentially obtainedany event that makes any statement in this offering, which we expect would provide funding for our operations for approximately 24 months. prospectus or the related registration statement untrue in any material respect or that requires the changing of statements in those documents in order to make statements in those documents not misleading.dataselling stockholder identified in the table set forth below excludesmay from time to time offer and sell under this prospectus any proceeds we could receive from the exerciseor all of the warrantsshares of common stock described under the column “Shares of Common Stock Being Offered” in the table below.issued in this offering.Expected Use for Net Cash Proceeds Expected Amount of Net Cash Proceeds

($ in 000s) Increase inventory of LuViva advanced cervical device $1,750,000 41% General working capital and operations 2,510,000 59% Total $4,260,000 100% Ifan underwriter within the net cash proceeds of this offering are less than the maximum, we except to divide the proceeds for purposes listed above on a similar percentage basis.If a warrant holder elects to exercise the warrants issued in this offering, we may also receive proceeds from the exercisemeaning of the warrants.Securities Act. Any profits realized by such selling stockholder may be deemed to be underwriting commissions.predict when or ifgive an estimate as to the warrants will be exercised. It is possible that the warrants may expire and may never be exercised.DILUTIONOur net tangible book value deficiency as of March 31, 2016 was approximately $7.3 million, or $1.37 per share of common stock. “Net tangible book value” represents total tangible assets less total liabilities. “Net tangible book value per share” represents net tangible book value divided by the total number of shares of common stock outstanding.After giving effect tothat will actually be held by the assumed saleselling stockholder upon termination of 5,000this offering, because the selling stockholders may offer some or all of the common stock under the offering contemplated by this prospectus or acquire additional shares of Series D preferred stock and accompanying warrantscommon stock. The total number of shares that may be sold, hereunder, will not exceed the number of shares offered, hereby. Please read the section entitled “Plan of Distribution” in this offering at a public offering price of $1,000 per share, and assumingprospectus.conversion of all theselling stockholder acquired or will acquire shares of Series D preferred stock sold in the offering at an assumed conversion price of $0.01, which was the last reported sale price of our common stock on June 15, 2016 (and excluding shares of common stock issuable upon exercise of warrants), and after deducting estimated placement agent fees and estimated offering expenses payable by us, our pro forma net tangible book value deficiency as of March 31, 2016 would have been approximately $5.8 million, or $0.01 per share of common stock. This represents an immediate increase in net tangible book value of $1.36 per share to our existing stockholders and an immediate dilution in net tangible book value of $(0.02) per share to investors participating in this offering. is discussed below under “The Offering.”illustrates this dilution per share to investors participating in this offering:Assumed Series D Conversion Price $ 0.01 Net tangible book value per share as of March 31, 2016 $ (1.37 ) Increase in net tangible book value per share attributable to this offering $ 1.36 Pro forma net tangible book value per share after giving effect to the offering $ (0.01 ) Dilution per share to new investors in this offering $ 0.02 The above discussion and table are based on 5,322,003 sharessets forth the name of common stock outstanding as of March 31, 2016, which does not include the following, all as of June 15, 2016: 15·104,356 shares of common stock reserved for future issuance under our 1995 Stock Plan;·433,385,611 shares of common stock reserved for issuance upon conversion of, or issuance as dividends on, our Series C and Series C1 convertible preferred stock, which we assume will be exchanged for shares of Series D preferred stock and warrants as part of this offering;·151,583,843 shares reserved for issuance upon conversion of our outstanding convertible debt;·233,615,051 shares of common stock issuable upon the exercise of outstanding warrants or warrants to be exchanged for outstanding warrants·5,205,101 shares reserved for issuance pursuant to contractual obligations; and·up to ______ shares of common stock issuable upon exercise of warrants sold as part of this offering, including up to ______ shares of common stock issuable upon exercise of warrants to be issued to the placement agentA $0.001 increase (decrease) in the assumed Series D preferred stock conversion price of $0.01 per share would not change the pro forma as adjusted net tangible book value deficiency resulting from the offering ($5.8 million), and our as adjusted net tangible book value deficiency per share by approximately $0.01, but would increase (decrease) the dilution per share to new investors by approximately $0.001, assuming the assumed number of shares of Series D preferred stock sold remains the same. A 10% increase (decrease) in the number of shares sold would would not change the pro forma as adjusted net tangible book value deficiency resulting from the offering ($5.8 million), and our as adjusted net tangible book value deficiency per share by approximately $0.01, but would increase (decrease) the dilution per share to new investors by approximately $0.001, assuming the assumed number of shares of Series D preferred stock sold remains the same.Certain of our outstanding indebtedness and our outstanding warrants are subject to customary “downside price protection” provisions in the event we sell any common stock at a price lower than the then-conversion price of these securities. The Series D preferred stock offered pursuant to this prospectus will also be subject to similar adjustment. These provisions are further described under the captions “Description of Securities” and “Description of Securities We Are Offering.” 16CAPITALIZATIONThe following table shows our cash and cash equivalents and our capitalization as of March 31, 2016:·on an actual basis;·as adjusted to give effect to transactions described in “Summary—Recent Developments”; and·as further adjusted to give effect to this offering.You should read this table together with the information under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our audited annual consolidated financial statements and the related notes and other financial information incorporated by reference into this prospectus from our annual report on Form 10-K for the fiscal year ended December 31, 2015 and our quarterly report on Form 10-Q for the quarterly period ended March 31, 2016. As of March 31, 2016 Actual As Adjusted(a) As Further Adjusted(b) (in thousands) Cash and cash equivalents $ 56 431 4,691 Short-term debt 259 434 434 Short-term convertible note 591 677 86 Convertible notes payable – current portion 479 479 479 Long-term convertible notes payable, net 197 197 197 Outstanding warrants, at fair value 1,588 1,310 185 Total liabilities 3,114 3,097 1,381 Series C preferred stock 1,817 1,116 — Series C1 preferred stock — 701 — Series D preferred stock — — 6,668 Common stock 297 329 329 Additional paid-in capital 115,471 115,831 116,956 Treasury stock, at cost (132 ) (132 ) (132 ) Accumulated deficit (122,903 ) (122,903 ) (122,903 ) Total stockholders’ surplus (deficit) (5,450 ) (5,058 ) 918 Total capitalization $ (8,564 ) (8,155 ) (463 ) (a)Reflects the following, each further described under “Summary—Recent Developments”:·the April-May 2016 issuances of an aggregate 4,311 shares of Series C1 preferred stock and 18,396,800 shares common stock in exchange for 1,916 then-outstanding shares of Series C preferred stock;·the cancelation of warrants held by Aquarius Opportunity Fund that were exercisable for an aggregate of 7,148,813 shares of common stock;·the May 2016 cash advances of $175,000 by Aquarius Opportunity Fund and GPB Debt Holdings II LLC;·the June 2016 obligation to issue a convertible note and warrant in connection with the Shenghuo license agreement; and·the June 2016 issuances of an aggregate of 13,517,342 shares of common stock and rights, which includes 8,312,241 common stock shares that were issued and 5,205,101 rights, in exchange for warrants previously exercisable for 8,142,977 shares of common stock.(b)Assumes sale of all of the securities offered, except (i) shares of common stock that could be issued upon conversion of the Series D preferred stock or upon exercise of the warrants sold (or issued to the placement agent) as part of this offering. Reflects receipt of the net cash proceeds from this offering prior to the application thereof. Also reflects the following, each of which is contingent upon consummation of the offering, as further described under “Summary—Recent Developments”:·the extinguishment of indebtedness represented by the May 2016 short-term cash advances as a result of the participation by Aquarius Opportunity Fund and GPB Debt Holdings II LLC in this offering at least to the extent of the principal and interest on the cash advances;·the exchange, on a dollar-for-dollar basis, of all outstanding shares Series C and Series C1 preferred stock, as well as any remaining principal and accrued interest on our convertible promissory note held by Aquarius Opportunity Fund, for shares of Series D preferred stock and warrants;·the exchange of certain warrants, exercisable for 115,237,788 shares of common stock, for new warrants, exercisable for 214,189,622 shares of common stock. 17PLAN OF DISTRIBUTIONWe are offering up to 5,000 shares of our Series D convertible preferred stock, together with warrants to purchase __________ shares of common stock, at a purchase price of $1,000 (and the shares issuable from time to time upon conversion of the Series D preferred stock and the exercise of the warrants) pursuant to this prospectus. The shares of Series D preferred stock and warrants are immediately separable and will be separately issued. There is no minimum offering amount required as a condition to closing and we may sell significantly fewer securities in the offering. The offering will terminate on ___________, unless the offering is fully subscribed before that date or we decide to terminate the offering prior to that date.In determining the offering price of the securities offered hereby, we will consider a number of factors including, but not limited to, the current market price of our common stock, trading prices of our common stock over time, the illiquidity and volatility of our common stock, our current financial condition and the prospects for our future cash flows and earnings, and market and economic conditions at the time of the offering. Once the offering price is determined, the offering price for the securities will remain fixed for the duration of the offering.Ladenburg Thalmann & Co. Inc. has agreed to act as our exclusive placement agent in connection with this offering, subject to the terms and conditions of the placement agent agreement dated _______________. Ladenburg is not purchasing or selling any securities offered by this prospectus, nor is it required to arrange the purchase or sale of any specific number or dollar amount of securities, but has agreed to use its best efforts to arrange for the sale of all of the shares of Series D preferred stock and warrants offered hereby. Therefore, we will enter into purchase agreements directly with investors in connection with this offering. Ladenburg may retain other brokers or dealers to act as sub-agents or selected-dealers on its behalf in connection with the offering. Offers will only be made to, and subscriptions accepted from, institutional investors within the meaning of state securities laws of the state in which such investor is domiciled.All cash funds received in payment for securities sold in this offering will be required to be submitted by subscribers to a non-interest bearing escrow account, and will be held by the escrow agent for such account until we and the placement agent notify the escrow agent that the offering has closed. The closing will occur, as to all subscriptions duly received and accepted by us, in one closing; we do not intend to hold multiple closings in the offering. In the event we do not accept the subscriptions and do not close the offering, escrowed funds will be promptly returned to subscribers without interest or offset.We have agreed to pay Ladenburg a placement agent’s fee of 9% of the aggregate cash purchase price of the securities sold in this offering. We will also reimburse Ladenburg for its reasonable out-of-pocket expenses, including, without limitation, fees and expenses of its counsel.The following table shows the per share and total placement agent’s fees that we will pay to Ladenburg in connection with the sale of the securities offered pursuant to this prospectus, assuming the purchase of all of the shares of Series D preferred stock and accompanying warrants offered hereby.Per share placement agent’s fees . . . . .$90Maximum offering total placement agent’s fees . . . . .$450,000Because there is no minimum amount required as a condition to the closing in this offering, the actual total offering commissions, if any, are not presently determinable and may be substantially less than the maximum amount set forth above.We have also agreed to issue warrants to Ladenburg or it designees (as permitted by FINRA Rule 5110(g)) to purchasestockholder, the number of shares of our common stock equivalentbeneficially owned by such stockholder before this offering, the number of shares to 5%be offered for such stockholder’s account and the number and (if one percent or more) the percentage of the class to be beneficially owned by such stockholder after completion of the offering. The number of shares owned are those beneficially owned, as determined under the rules of the SEC, and such information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares of our common stock as to which a person has sole or shared voting power or investment power and any shares of common stock which the person has the right to acquire within 60 days, through the exercise of any option, warrant or right, through conversion of any security or pursuant to the automatic termination of a power of attorney or revocation of a trust, discretionary account or similar arrangement, and such shares are deemed to be beneficially owned and outstanding for computing the share ownership and percentage of the person holding such options, warrants or other rights, but are not deemed outstanding for computing the percentage of any other person. Beneficial ownership percentages are calculated based on 211,291,990 shares of our common stock outstanding as of June 1, 2018.issuable upon conversionshown as beneficially owned before the offering is based on information furnished to us or otherwise based on information available to us at the timing of the Series D preferred stock (subject to reduction if required by FINRA Rule 5110), at an exercise price equal to 125% of the conversion price per share at the offering. The placement agent warrants will contain a cashless exercise provision, and a piggyback registration rights provision for the life of the warrants, but shall not contain any price-based anti-dilution provisions. The placement agent warrants will have a term expiring five years from the effective datefiling of the registration statement of which this prospectus forms a part. Pursuant Name of Selling Stockholder GHS Investments LLC (3) FINRA Rule 5110(g), the placement agentshares of common stock. Shares of common stock subject to options, warrants and anyconvertible debentures currently exercisable or convertible, or exercisable or convertible within 60 days, are counted as outstanding. The actual number of shares issuedof common stock issuable upon exercisethe conversion of the placement agent warrantsconvertible debentures is subject to adjustment depending on, among other factors, the future market price of our common stock, and could be materially less or more than the number estimated in the table.sold, transferred, assigned, pledged, or hypothecated, orsufficient, dependent upon the share price, to allow us to access the full amount contemplated under the Financing Agreement. If the bid/ask spread remains the same we will not be able to place a put for the subject of any hedging, short sale, derivative, put, or call transaction that would result infull commitment under the effective economic dispositionFinancing Agreement. Based on the average of the securities by any person for atwo (2) lowest volume weighted average prices of our common stock during the fifteen (15) consecutive trading day period preceding June 1, 2018 of 180 daysapproximately $0.0056, the registration statement covers the offer and possible sale of $392,000 worth of our shares.followingpreceding the date on which the Company delivers a put notice to GHS. In addition, there is an ownership limit for GHS of effectiveness or commencement9.99%.this offering, except the transferour common stock by GHS after delivery of any security:·by operation of law or by reason of our reorganization;·to any FINRA member firm participating in the offering and the officers or partners thereof, as long as all securities so transferred remain subject to the lock-up restriction set forth above for the remainder of the time period;