PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION DATED _____________.

PROSPECTUS18,333,450 SharesCARDO MEDICAL, INC.Common StockOTC Bulletin Board Trading Symbol: CDOM.OB

The selling stockholders may offer and sell from time to time up to an aggregate of 18,333,450 shares of Cardo Medical, Inc. (the "Company") common stock that they own or that they may acquire from us upon exercise of warrants. For information concerning the selling stockholders and the manner in which they may offer and sell shares of our common stock, see "Selling Stockholders" and "Plan of Distribution" in this prospectus.

We will not receive any proceeds from the sale by the selling stockholders of their shares of common stock other than the exercise price of the warrants if and when the warrants are exercised unless the warrants are exercised on a cashless basis.

On December 17, 2009, the last reported sale price for our common stock on the OTC Bulletin Board was $1.01 per share.

Investing in shares of our common stock involves a high degree of risk. You should purchase our common stock only if you can afford to lose your entire investment. See "Risk Factors," which begins on page 3.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The selling stockholders have not engaged any underwriter in connection with the sale of their shares of common stock. The selling stockholders may sell their shares of common stock in the public market based on the market price at the time of sale or at negotiated prices. The selling stockholders may also sell their shares in transactions that are not in the public market in the manner set forth under "Plan of Distribution."

You should rely only on the information contained in this prospectus. We have not authorized any dealer, salesperson or other person to provide you with information concerning us, except for the information contained in this prospectus. The information contained in this prospectus is complete and accurate only as of the date on the front cover page of this prospectus, regardless of the time of delivery of this prospectus or the sale of any common stock. This prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The date of this prospectus is December [ ], 2009.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it iswe are not soliciting an offeroffers to buy these securities in any statejurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JULY 15, 2019

BioCardia, Inc.

1,500,000 Units, Each Unit Consisting of

One Share of Common Stock and

a Warrant to Purchase One Share of Common Stock

We are offering 1,500,000 units, with each unit consisting of one share of common stock, $0.001 par value per share, and a warrant to purchase one share of common stock at an exercise price of $ per share (together with the shares of common stock underlying such warrants, the “Units”), of BioCardia, Inc., a Delaware corporation (the “Company”), in a firm commitment underwritten public offering at a public offering price of $ per Unit (this “Offering”).

The warrants offered hereby may be exercised from time to time beginning on the date of issuance and expire on 2022. Our Units have no stand-alone rights and will not be certificated or issued as stand-alone securities. The shares of our common stock and the warrants comprising our Units are immediately separable and will be issued separately in this Offering.

Our common stock is currently quoted on the OTCQB Marketplace (“OTCQB”) under the symbol “BCDA.” On July 12, 2019, the last reported price for our common stock as reported on the OTCQB was $10.00 per share, which gives effect to our one-for-nine reverse split of our issued and outstanding shares of common stock which began trading on a post-split basis on OTCQB on June 6, 2019. There is currently no public market for the offered warrants. We have applied to list our common stock and our warrants on the Nasdaq Capital Market under the symbols “BCDA” and “BCDAW.” There can be no assurance that we will be successful in listing our common stock or our warrants on the Nasdaq Capital Market.

Investing in our securities involves significant risks. You should review carefully the “Risk Factors” beginning on page 14 of this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

The Securities and Exchange Commission and state securities regulators have not approved or disapproved of these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Per Unit | Total | |||||||

Public offering price(1) | $ | |||||||

Underwriting discounts and commissions(2) | $ | |||||||

Proceeds, before expenses, to us(3) | $ | |||||||

(1) | The public offering price and underwriting discount corresponds to (i) a public offering price per share of common stock of $ and (ii) a public offering price per warrant of $ . |

(2) | We have also agreed to reimburse the underwriters for certain expenses. See “Underwriting” for additional information regarding total underwriter compensation. |

(3) | The amount of offering proceeds to us presented in this table does not give effect to any exercise of the warrants being issued in this Offering, if any. |

We have granted a 45-day option to the underwriters to purchase up to additional shares of common stock at a price of $ per share and/or additional warrants at a price of $ per warrant less, in each case, the underwriting discount solely to cover overallotments, if any. If the underwriters exercise the option in full, the total underwriting discounts and commissions payable to us will be $ and the total proceeds to us, before expenses, will be $ .

The underwriters expect to deliver the units against payment in New York, New York on , 2019.

Sole Book-Running Manager

Maxim Group LLC

Co-Managers

| Arcadia Securities | Dawson James Securities, Inc. |

The date of this prospectus is , 2019

TABLE OF CONTENTS

Page | |

About this Prospectus | i |

Prospectus Summary | 1 |

The Offering | 10 |

Risk Factors | 14 |

Special Note Regarding Forward-Looking Statements | 53 |

Use of Proceeds | 55 |

Dividend Policy | 56 |

Capitalization | 57 |

Dilution | 59 |

Business | 61 |

Properties | 89 |

Legal Proceedings | 89 |

Management’s Discussion | 90 |

Directors, Executive Officers and | 99 |

Executive | 108 |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 111 |

Certain Relationships and Related Transactions, | 114 |

Description of the Securities We Are Offering | 116 |

Material | 121 |

Shares Available for Future Sales | 127 |

Underwriting | 128 |

Legal Matters | 132 |

Experts | 132 |

Where You Can Find More Information | 132 |

Index to Consolidated Financial Statements | F-1 |

ABOUT THIS PROSPECTUS

The registration statement of which this prospectus forms a part that we have filed with the Securities and Exchange Commission, or SEC, includes exhibits that provide more detail of the matters discussed in this prospectus. You should read this prospectus and the related exhibits filed with the SEC, together with the additional information described under the heading “Where You Can Find More Information.”

You should rely only on the information contained in this prospectus and in any free writing prospectus prepared by or on behalf of us. We have not, and the underwriters have not, authorized anyone to provide you with information different from, or in addition to, that contained in this prospectus or any related free writing prospectus. This prospectus is an offer to sell only the securities offered hereby but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date. Our business, financial condition, results of operations and prospects may have changed since that date.

We are not offering to sell or seeking offers to purchase these securities in any jurisdiction where the offer or sale is not permitted. We have not done anything that would permit this Offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States Persons outside the United States who come into possession of this prospectus and any free writing prospectus related to this Offering in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions relating to this Offering and the distribution of this prospectus and any such free writing prospectus applicable to that jurisdiction.

Unless the context otherwise requires, the terms “BioCardia,” the “Company,” “we,” “us” and “our” refer to BioCardia, Inc. We have registered our name, logo and the trademarks “BioCardia,” “CardiAMP,” “CardiALLO,” and “Morph” in the United States. We have registered the trademarks “CardiAMP” and “CardiALLO” for use in connection with a biologic product, namely, a cell-based therapy product composed of bone marrow derived cells for medical use. We also have rights to use the “Helix” trademark in the United States. Other service marks, trademarks and trade names referred to in this prospectus are the property of their respective owners. Except as set forth above and solely for convenience, the trademarks and trade names in this prospectus are referred to without the ®, © and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto.

PROSPECTUS SUMMARY

This summary highlights information contained in greater detail elsewhere in this prospectus. This summary does not contain all of the information that is important to you.you should consider before investing. You should read the entire prospectus carefully, including the Risk Factorssections titled “Risk Factors” and our consolidated financial statements“Management’s Discussion and related notes appearing elsewhereAnalysis of Financial Condition and Results of Operations.”

Unless otherwise indicated, all information in this prospectus before making an investment decision.

Our Business

Cardo Medical, Inc. ("Cardo" or the "Company"),reflects a Delaware corporation, is an orthopedic medical device company specializing in designing, developing and marketing reconstructive joint devices and spinal surgical devices. Reconstructive joint devices are used to replace knee, hip and other joints that have deteriorated through disease or injury. Spinal surgical devices involve products to stabilize the spine for fusion and reconstructive procedures. Within these areas, Cardo intends to focus on the higher-growth sectorsone-for-nine reverse stock split of the orthopedic industry, such as advanced minimally invasive instrumentation and bone-conserving high-performance implants. Cardo is focused on developing surgical devices that will enable surgeons to bridge the gap between soft tissue-driven sports medicine techniques and classical reconstructive surgical procedures. Cardo commercializes its reconstructive joint devices through its Cardo Orthopedics division and its spine devices through its Cardo Spine division.

GENERAL

On June 18, 2008, Cardo Medical, LLC, a California limited liability company, entered into a Merger Agreement and Plan of Reorganization with clickNsettle.com, Inc. ("CKST") and Cardo Acquisition, LLC, a California limited liability company and wholly-owned subsidiary of CKST. Upon the consummation of the transactions contemplated by the Merger Agreement, CKST acquired Cardo Medical, LLC through a merger of Cardo Medical, LLC with Cardo Acquisition, with Cardo Medical, LLC continuing as the surviving entity in the Merger and a wholly-owned subsidiary of CKST. Pursuant to the Merger Agreement, all of theour issued and outstanding units of Cardo Medical, LLC's membership interests were converted into the right to receive shares of the common stock of CKST. In connection with the consummation of the Merger, CKST approved through its stockholders an amendment to its Amended and Restated Certificate of Incorporation to change its name from "clickNsettle.com, Inc." to "Cardo Medical, Inc."

Our executive offices are located at 9701 Wilshire Blvd., Suite 1100, Beverly Hills, California 90212. Our telephone number is (310) 274-2036. Our website is www.cardomedical.com. Information on our website or any other website is not part of this prospectus. References to "we," "us," "our" and similar words in this prospectus refer to Cardo Medical, Inc. and its consolidated subsidiaries.

Sale of Securities to the Selling Stockholders

On October 27, 2009, we sold, in the first tranche of a private placement, 9,949,276 shares of common stock, options, restricted stock units and warrants, and the corresponding adjustment of all common stock and restricted stock unit prices per share and stock option and warrant exercise prices per share and conversion ratios. Our common stock began trading on a reverse stock split-adjusted basis on The OTC Market on the opening of trading on June 6, 2019.

Overview

We are a clinical-stage regenerative medicine company developing novel therapeutics for cardiovascular diseases with large unmet medical needs. Our lead therapeutic candidate is the investigational CardiAMP Cell Therapy System, which provides an autologous bone marrow derived cell therapy (using a patient’s own cells) for the treatment of two clinical indications: heart failure that develops after a heart attack and chronic myocardial ischemia. Chronic myocardial ischemia involves sustained poor blood perfusion to the heart muscle often at $0.35 per share. On November 13, 2009, we sold,the microvascular level. The CardiAMP Cell Therapy System is being developed to provide a comprehensive biotherapeutic solution, incorporating a proprietary molecular diagnostic to characterize the potency of a patient’s own bone marrow cells and determine if they are an optimal candidate for therapy, a proprietary point of care processing platform to prepare cells at the patient’s bedside, an optimized therapeutic formulation that builds on the total experience in the cardiac stem cell field to-date, and a proprietary interventional delivery system that easily navigates a patient’s vasculature to securely deliver cells in a routine cardiac catheterization procedure. Our second tranchetherapeutic candidate is the CardiALLO Cell Therapy System, an investigational culture expanded bone marrow derived allogenic “off the shelf” cell therapy from a donor that meets specified criteria, which has potential to be advanced for many clinical indications including heart failure.

We are committed to applying our expertise in the fields of autologous and allogeneic cell-based therapies to improve the lives of patients with cardiovascular conditions.

Market Overview

Adult bone marrow contains a large reservoir of stem and progenitor cells capable of differentiating into blood cells, blood vessel cells, and connective tissue cells. In addition, numerous pre-clinical cardiac studies have shown that cell-to-cell communication in which bone marrow-derived stem cells promotes microcirculatory adaptation, immune modulation and cell protection, facilitating cardiac recovery, in part via recruitment of other reparative cell types.

Bone marrow cell homing to the heart is believed to be part of the body’s natural repair process. After a heart attack or an acute injury to the heart, cells from bone marrow are known to home to the heart. For example, a population of bone marrow cells that express the surface marker CD34 has certain receptors, including CXC-4 and CXC-7 receptors, that home to the SDF-1 ligand in injured heart tissue. In heart failure, the heart may have fewer of these homing signals and a decreased ability to stimulate or recreate this signaling process, leading to a lower likelihood of heart tissue repair. A number of other bone marrow derived cells with unique cell surface markers have also been shown to have beneficial effects in animal models of heart failure and chronic myocardial ischemia disease when delivered directly to the heart.

Bone marrow derived cell-based therapy has been shown to have the potential to provide therapeutic benefit for patients with heart failure and chronic myocardial ischemia. In the past decade, intramyocardial delivery of bone marrow derived cell-based therapies in preclinical and clinical studies of heart failure and chronic myocardial ischemia has predominantly resulted in benefits, such as improvement in ventricular function, reduction in the area of dead heart tissue and increase in heart muscle blood flow, reduction in pain symptoms, reduced major adverse event rates, and reduced mortality.

Recent systematic review and meta-analysis of the scientific literature from 23 randomized controlled trials prior to 2013, covering more than 1,200 participants, was published by Fisher in Circulation Research in January 2015. The review found evidence that bone marrow cell treatment, including intramyocardial delivery of bone marrow cells, has improved left ventricle ejection fraction, or LVEF, and chronic ischemic heart disease. The authors of the review found evidence for a potential beneficial clinical effect in terms of mortality and performance status after at least one year post-treatment in people who suffer from chronic ischemic heart disease and heart failure. Results in heart failure trials indicate that bone marrow derived cell-based therapy leads to a reduction in deaths and readmission to hospital and improvements over standard treatment as measured by tests of heart function. This review concluded that further research is required to confirm the results. Published scientific papers provide clinical support for efficacy from randomized controlled clinical trials of intramyocardial delivery of bone marrow derived cells in closely related clinical conditions of chronic myocardial ischemia, diastolic heart failure, and subacute myocardial infarction.

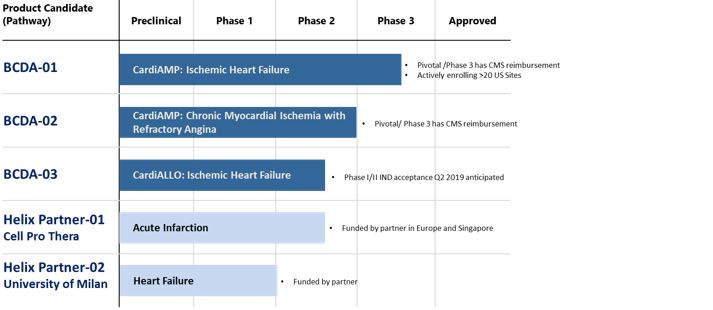

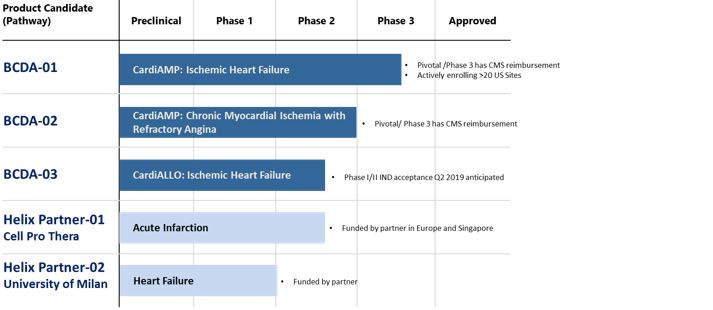

Product Pipeline and Development Status

CardiAMP Cell Therapy System

The CardiAMP Cell Therapy System, or CardiAMP, is our lead therapeutic program being advanced for two clinical indications. This investigational cell therapy system is comprised of (i) a cell potency screening test, (ii) a point of care cell processing platform, and (iii) a biotherapeutic delivery system. In the screening process, the physician extracts a small sample of the patient’s bone marrow in an outpatient procedure performed under local anesthesia. The clinic sends the sample to a centralized diagnostic lab, which tests for identified biomarkers from which we generate a potency assay score for the patient. During the treatment for patients who are assessed as meeting the indication specific CardiAMP cell potency assay score, a doctor harvests and then prepares the patient’s own bone marrow mononuclear cells, or autologous cells, using our point of care cell processing platform, which a cardiologist then delivers into the heart using our proprietary biotherapeutic delivery system. We designed the entire procedure to be performed in approximately 60 to 90 minutes, which we believe is substantially faster than alternative cell-based therapies in development. The patient then leaves the hospital the same or next day.

CardiAMP Cells Phase I Heart Failure Study: Transendocardial Autologous Marrow Cells in Myocardial Infarction

The CardiAMP Phase I Transendocardial Autologous Marrow Cells in Myocardial Infarction or TABMMI trial enrolled 20 patients with ischemic systolic heart failure in an open label safety trial of bone marrow cells delivered with the Helix™ biotherapeutic delivery system at a dosage of 100 million cells. Results showed improvement in cardiac function as measured by left ventricular ejection fraction, improved exercise tolerance, and superior survival as compared to historical controls. The Phase I TABMMI study was submitted to the Argentine Administración Nacional de Medicamentos, Alimentos y Technología Médica.

In our TABMMI Phase I trial of CardiAMP cells, we enrolled 20 patients with previous evidence of having had a heart attack and who presented with a low ejection fraction of less than or equal to 40% and greater than or equal to 20%. Baseline evaluations included informed consent, history and physical examination, electrocardiogram, 24-hour Holter monitoring, echocardiography, routine blood tests and exercise tolerance testing. Reduced regional heart wall motion was coincident with the diseased coronary vessel in each patient. A total of 20 patients with heart failure (NYHA Class I, II and III) each received three to ten transendocardial infusions of cells using our Helix™ biotherapeutic delivery system in an open-label dose-escalation two cohort trial. Dosage administration ranged from 30 million to 130 million autologous bone marrow derived mononuclear cells, with an average of 96 million cells.

Bone marrow cells delivered in TABMMI demonstrated an excellent safety profile in this heart failure population, with no treatment related toxicities observed. The 20 patients who received CardiAMP cells, demonstrated improvements from baseline to both six-month and 12-month follow-up across a number of parameters important in heart failure, including statistically and clinically significant improvements in left ventricular, or LV, function (ejection fraction). The difference of average ejection fraction was statistically significant over baseline at all follow-up time points of 6 months, 12 months, and 24 months. Average exercise tolerance time showed an increase at all follow-up time points, but was only statistically significant at 12 months and 24 months.

A total of 12 adverse events were observed in six patients, although none were related to the investigational delivery or cell transplantation procedure. The complete results of the 20 patients at two-year follow-up have been published in the journal Eurointervention in 2011.

CardiAMP Cells Phase II Heart Failure Trial: Transendocardial Autologous Cells in Heart Failure Trial (TAC-HFT)

In our co-sponsored Phase II Transendocardial Autologous Cells in Heart Failure Trial, patients with ischemic systolic heart failure were randomized on a one to one basis into two double-blind, placebo-controlled trials: TACHFT-BMC and TACHFT-MSC. The IND for the TACHFT trial was filed with the U.S. Food and Drug Administration, or FDA Center for Biologics Evaluation and Research in 2008 by the University of Miami, the co-sponsor of the trial.

In the safety dose escalation roll-in cohort stage of the study, eight patients received treatment with either CardiAMP cells, or autologous bone marrow mesenchymal cells, or MSC, at dosages of 100 million or 200 million cells. In the randomized, placebo-controlled efficacy stage of the study, 29 patients received treatment with either CardiAMP cells or placebo and 30 patients received treatment with either MSCs or placebo. The mode of administration was 10 intramyocardial infusions per patient using our Helix™ biotherapeutic delivery system into the myocardium adjacent to and into the infarcted tissue. All subjects had ischemic systolic heart failure (NYHA Class I, II or III).

TACHFT-BMC met its primary safety endpoint at both dosages (100 million and 200 million cells) and treated patients had increased functional capacity, improved quality of life, symptoms and key markers of cardiac function predictive of survival, such as end systolic volume, or ESV. The TACHFT-BMC trial included a single dose of CardiAMP cells with a follow up observation period of 12 months. The Phase II, randomized, placebo-controlled study met its primary safety endpoint and demonstrated statistically significant and clinically meaningful improvements in secondary efficacy endpoints of functional capacity, as measured by the six minute walk distance (6MW), and in quality of life, as measured by the Minnesota Living with Heart Failure Questionnaire score. Phase II results were published in the journal of the American Medical Association in 2014 and were presented at the World Congress of Regenerative Medicine in 2015.

By way of comparison, previous investigational device exemption (IDE) pivotal clinical trials that led to FDA approval of Cardiac Resynchronization Therapy, in which a pacemaker stimulates both sides of a private placement, 7,808,561 sharespatient’s heart for the treatment of common stockheart failure followed the same IDE regulatory pathway and have had similar endpoints to the CardiAMP Heart Failure Trial. Pacemakers that pace both sides of the heart are intended for patients that are NYHA III and IV versus the CardiAMP Heart Failure Trial indication of NYHA II and III. Results from 5 out of 6 randomized pivotal trials for pacemakers that pace both sides of the heart have showed both smaller improvements in functional capacity as measured by the six minute walk test and smaller improvement in quality of life than the CardiAMP Phase II results. Although the benefits with pacemakers that pace both sides of the heart were less than observed in CardiAMP placebo controlled Phase II trial, these results for the permanently implantable pacemaker devices were sufficient to obtain FDA approval.

CardiAMP Cell Phase III Heart Failure Trial

The CardiAMP Heart Failure Trial is a Phase III, multi-center, randomized, double-blinded, sham-controlled study of up to 260 patients at $0.35 per share. 40 centers nationwide, which includes a 10-patient roll-in cohort.

The Phase III pivotal trial is designed to provide the primary support for the safety and efficacy of the CardiAMP Cell Therapy System. The primary endpoint is a clinical composite of six minute walk distance and major adverse cardiac and cerebrovascular events. Based on the results achieved in the Phase II trial, our Phase III pivotal trial is designed to have more than 95% probability of achieving a positive result with statistical significance. Statistical significance denotes the mathematical likelihood that the results observed are real and not due to chance.

Particularly novel aspects of this trial include a cell potency assay to screen subjects who are most likely to respond favorably to treatment, a point of care treatment method, use of a high target dose of 200 million cells and an efficient transcatheter delivery method that is associated with high cell retention. Success in the primary endpoint of the trial may lead to a new treatment for those suffering from heart failure in the aftermath of a heart attack. The trial design was published in the peer reviewed American Heart Journal in 2018.

The Department of Health & Human Services Centers for Medicare & Medicaid Services, or CMS, has designated the CardiAMP Heart Failure Trial as a qualifying trial for Medicare national coverage determination that routine costs of care will be covered for Medicare beneficiaries. Private insurance plans covering 50 million insured Americans follow this CMS reimbursement policy and are also anticipated to pay for these costs in the CardiAMP Heart Failure Trial. Covered costs today for both the treatment and control arms of the trial include patient screening, the CardiAMP Cell Therapy System and procedure, and clinical follow-up at one and two years after the procedure.

The Phase III CardiAMP Heart Failure Trial was initiated in the fourth quarter of 2016, and the first patient treated in Q1 2017. The Data Safety Monitoring Board (DSMB) safety review of the 10 patient roll in cohort treated at three clinical sites was completed successfully in the third quarter of 2017, and the trial is actively enrolling today at 22 clinical sites. Efficacy data from the primary endpoint in the open label roll in cohort were presented at the American Heart Association Scientific Sessions in 2018.

At the primary endpoint of exercise capacity at 12 months, the 10-patient roll-in cohort of the trial showed clinically meaningful improvement, walking an average of 46.4 meters more than baseline, although the improvement was not considered statistically significant (p=0.06). Eight of the 10 patients experienced improvement in their exercise capacity. This improvement is more than triple the average improvement over baseline reported in the CardiAMP-treated arm of the Phase II TAC-HFT-MNC trial, and greater than the average improvement seen in a number of pivotal trials for implantable pacemakers to treat heart failure.

In the private placement, we issued an aggregatesecondary efficacy endpoint of 17,757,837 sharesquality of common stocklife, patients showed a clinically meaningful improvement of 9.8 points relative to baseline, which was not statistically significant (p=0.33) in the small cohort. Seven of the 10 patients reported better quality of life after CardiAMP treatment. This was a greater improvement over baseline than was seen in the Phase II TAC-HFT-MNC trial of CardiAMP therapy.

The secondary efficacy endpoints of superiority relative to major adverse cardiac events (MACE) and survival were not possible to assess in this roll-in cohort as there is no control arm specific to this cohort. There were no treatment emergent major adverse cardiac events in this group at $0.35 per share,30 days, while there was one MACE event due to 74 accredited investors. In conjunction witha hospitalization at nine months. All MACE have not been adjudicated at this time. All patients from this cohort were alive and out of the private placement, Cardo Medical, Inc. issuedhospital at 12 months.

Echocardiographic core lab measures of cardiac function in the roll-in cohort at 12 months showed improvement in left ventricular ejection fraction of 4.1 percent (N=10, p=0.181), left ventricular end systolic volume (2.5 ml, p=0.502), neither of which were statistically significant in this small cohort relative to baseline. However, statistically significant improvement in total wall motion score (5.9 points, p=0.014) were observed.

We have enrolled 45 patients in the trial to date and enrollment is anticipated to begin accelerating due to additional compelling data presented from the roll in cohort, the addition of world class centers to the placement agent warrants to purchase 575,613 sharestrial, and the completion of competitive clinical programs. We anticipate a first interim readout from the trial in Q3 2019, a second interim readout in Q3 2020, that trial enrollment will be completed in Q3 2020 and that top line data will be available in Q3 2021.

Although clinical trial results show support for safety and efficacy in our Phase I TABMMI trial, Phase II TACHFT-BMC trial, and Phase III CardiAMP Heart Failure trial, the CardiAMP Cell Therapy System still remains investigational, and no claims regarding safety or efficacy can be made until the products are approved by the FDA.

We believe the remaining clinical efficacy risk is modest in light of the Company's common stock,Phase I, II, and III data available, and broader literature which supports CardiAMP Cell Therapy System as a number thattherapeutic candidate for heart failure secondary to having had a heart attack. The CardiAMP Cell Therapy System has the potential to significantly benefit patients who have limited options and provide a cost-effective therapy to help reduce the substantial heart failure hospitalization and care costs. Unlike other autologous cell therapies, the CardiAMP Cell Therapy System, is equivalentexpected to six percent (6%)have elegantly straightforward and low cost manufacturing and distribution, significantly enhancing its probability of commercial success.

CardiAMP Chronic Myocardial IschemiaPhase III PivotalTrial

In 2017, we submitted for approval of an investigational device exemption for the CardiAMP Cell Therapy System in a second related clinical indication of chronic myocardial ischemia based on the strength of our Phase I and II heart failure trial data, and the strength of the numberclinical data showing support for the efficacy of sharesone component of common stock soldour cell therapy (the CD34+ cells) in chronic myocardial ischemia. In January 2018, the FDA approved the IDE for the randomized controlled pivotal trial of autologous bone marrow mononuclear cells using the CardiAMP Cell Therapy System in patients with refractory chronic myocardial ischemia for up to 343 patients at up to 40 clinical sites in the private placement transaction to investors that were solicited byUnited States. This therapeutic approach uses the placement agent ("Approved Investors"), at an exercise price of $0.44 per share. The warrants issuedsame novel aspects as the CardiAMP Heart Failure Trial. An update to the placement agentstatistical analysis plan to enable an adaptive trial design is anticipated. Success in the private placement are sometimesprimary endpoint of the trial, which is exercise tolerance, may lead to a new treatment for those suffering from chronic myocardial ischemia and having sustained debilitating heart pain, referred to as refractory angina.

In 2018, CMS approved BioCardia’s request for the "Placement Agent Warrants"designation of the CardiAMP Chronic Myocardial Ischemia Trial as a qualifying trial for Medicare national coverage determination similar to the designation received for the CardiAMP Heart Failure Trial. It is anticipated that this second pivotal trial will build on and benefit from the experience and infrastructure from the CardiAMP Heart Failure Trial. With additional modest funding to support this program, there is potential for this trial to be activated in 2019.

CardiAMP Cell Therapy System - Other Indications

In the future, we may also explore the continued development of CardiAMP for use immediately after a heart attack and for treatment of heart failure with preserved ejection fraction, a form of heart failure wherein the amount of blood pumped from the heart’s left ventricle with each beat (ejection fraction) is greater than 50%.

CardiALLO Cell Therapy System

Our second therapeutic candidate is the CardiALLO Cell Therapy System, an investigational culture expanded bone marrow derived “off the shelf” mesenchymal stem cell therapy. CardiALLO cell therapy cells are expanded from Neurokinin-1 receptor positive bone marrow cells. These cells are being advanced to treat heart failure, but have potential for numerous therapeutic applications as these are anticipated to be the cells that respond to the release of Substance P. Substance P (“SP”) is a neuropeptide released from sensory nerves and is associated with the inflammatory processes and pain. The Placement Agent Warrants expireendogenous receptor for SP is the neurokinin-1 receptor (“NK1-receptor” or “NK1R”), which is distributed over cytoplasmic membranes of many cell types (for example neurons, glia, endothelia of capillaries and lymphatics, fibroblasts, stem cells, and white blood cells) in many tissues and organs. SP amplifies or excites most cellular processes. Elevation of serum, plasma, or tissue SP and/or its receptor NK1R has been associated with many diseases: sickle cell crisis, inflammatory bowel disease, major depression and related disorders, fibromyalgia rheumatological, and infections such as HIV/AIDS and respiratory syncytial virus, as well as in cancer. Our CardiALLO NK1R positive derived cells are believed to be an important subset of the cells that we have delivered in our previous preclinical and clinical mesenchymal stem cell studies. We believe this therapy presents the advantages of an "off the shelf" therapy that does not require tissue harvesting or cell processing. We have completed manufacturing validation runs of these cells at BioCardia to support future clinical studies. We are working to obtain FDA acceptance of an Investigational New Drug (“IND”) application for a Phase I/II trial for CardiALLO Cell Therapy System for the treatment of ischemic systolic heart failure in the fourth quarter of 2019.

The subset of patients we are targeting initially for the CardiALLO Heart Failure Trial are those that have been excluded from the CardiAMP Heart Failure Trial due to their lower cell potency assay scores. CardiALLO trial activation would likely enhance enrollment in the CardiAMP Heart Failure Trial. And if the CardiAMP trial is successful, as anticipated, there is the potential for the CardiALLO therapy indication to be designated as an orphan indication.

CardiALLO related Phase I /II Studies: POSEIDON, TAC-HFT-MSC, and TRIDENT

We have co-sponsored three clinical trials for MSCs for the treatment of ischemic systolic heart failure. In substantially similar trial designs, the POSEIDON Phase I/II trial compared autologous MSCs to allogeneic MSCs, the TACHFT-MSC Phase II trial compared autologous MSCs to placebo, and the TRIDENT Phase II compared allogenic MSCs at different doses. The first two trials shared common arms of autologous MSCs, enabling a bridge to placebo, leading us to conclude that allogeneic MSC therapy has potential to be superior to placebo. The IND for the TACHFT trial was filed with the FDA Center for Biologics Evaluation and Research in 2008 by the University of Miami, our co-sponsor for the trial. The POSEIDON trial and the TRIDENT trials were submitted by amendment under the same IND filed for the TACHFT study, and was co-sponsored by the University of Miami, the National Institutes of Health and us. The results from all three of these studies can be submitted to the FDA in support of an IND for the CardiALLO Cell Therapy System.

CardiALLO Development

CardiALLO is being advanced with an anticipated improved cell production strategy to be detailed in the Chemistry Manufacturing and Controls (CMC) of the IND in development. We believe the new CMC will reduce the likelihood of immune response to transplanted allogenic cells further, may enhance efficacy, and will enable commercial scale up and global distribution. CardiALLO will require more extensive clinical development than the CardiAMP Cell Therapy System, beginning with a Phase I/II trial that follows previous work, to confirm the results with the modified cell culture and dosage strategy.

We are performing our own CMC development work in BioCardia laboratories to accelerate the effort and secure additional intellectual property, and have taken steps to build the capacity at BioCardia to culture and supply the MSC cells for CardiALLO clinical development. Our development tissue culture laboratory is fully operational and our clinical manufacturing controlled environment room has been built. We expect to demonstrate support for the safety and efficacy of MSCs in our target patient population in a Phase I/II randomized controlled study. We expect the CardiALLO Phase II Heart Failure Trial will enroll patients with control, low dose and high dose groups using the Helix™ biotherapeutic delivery system and a similar inclusion criterion as the CardiAMP Heart Failure Trial. In the United States, CardiALLO Cell Therapy System is expected to be regulated by the FDA as a biologic product with a dedicated delivery system, our own Helix™ biotherapeutic delivery system.

The completed clinical studies show support for the safety and efficacy of both the CardiAMP Cell Therapy System and CardiALLO Cell Therapy System development programs; however, both product candidates remain investigational, and no claims regarding safety or efficacy can be made until the constituent products are approved by the FDA. As we engage in clinical trials of our therapeutic candidates, we have compensated and intend to compensate all parties performing the trials or studies (including all the parties identified in our Annual Report on November 13, 2014Form 10-K) only on terms that are standard and customary in clinical study arrangements.

These two therapeutic candidates provide compelling and synergistic approaches to replicating the natural response of bone marrow cells to cardiac injury. CardiAMP harnesses the potential of autologous minimally processed bone marrow cells, using an anticipated companion diagnostic to identify patients most likely to benefit from the therapy. CardiALLO utilizes mesenchymal stem cells from a donor that meets specified criteria and may be exercised on a cashless basis.

We paidappropriate for patients who are not optimal candidates for the placement agent for this offering a commission equal to eight percent (8%) of the gross proceeds from the offering that was received from Approved Investors. Additionally, the placement agent received (i) a cash non-accountable expense allowance equal to one percent (1%) of the gross proceeds of the offering received from Approved Investors; (ii) reimbursement of the placement agent's out-of-pocket expenses related to the offering, including its legal fees and expenses up to $40,000; and (iii) warrants to purchase 575,613 shares of common stock equal to six percent (6%) of the number of shares sold in the offering to Approved Investors at a exercise price of $0.44 per share.

1

The registration rights agreement entered into with subscribers in the offering requires us to use commercially reasonable efforts to have this registration statement declared effective by the Securities and Exchange Commission ("SEC") as soon as practicable, but in no event later than the one hundred twenty (120) calendar days after the final closing date or one hundred fifty (150) calendar days if the SEC reviews the registration statement.CardiAMP therapy.

Cell Processing and Cell Delivery Product Platforms

BioCardia has developed and secured exclusive rights to enabling cell processing and cell delivery products, which are used as part of our CardiAMP and CardiALLO therapies, and which we believe validate our approach and development expertise: (i) the CardiAMP cell processing platform, (ii) the CardiALLO cell processing platform, (iii) the Helix™ transendocardial biotherapeutic delivery system, and (iv) our Morph vascular access products.

• | CardiAMP cell processing platform - processes bone marrow aspirate at the point of care to concentrate mononuclear cells and prepare the dosage form. We expect the CardiAMP cell processing platform to be approved in the United States for ischemic systolic heart failure and/or chronic myocardial ischemia as part of the CardiAMP Cell Therapy System clinical development. The platform is currently cleared for use in the United States and in European Union for the preparation of a cell concentrate from bone marrow. The platform is approved in Japan with a broad regenerative medicine indication. The platform is under investigational use for the treatment of heart failure and chronic myocardial ischemia under BioCardia investigational device exemptions in the United States. | |

• | CardiALLO cell processing platform - processes young qualified donor marrow at BioCardia cell manufacturing facility to expand the cell subpopulation that is NK1R positive to produce a cryopreserved “off the shelf” cell dosage that may be shipped to hospitals for therapeutic delivery. This manufacturing facility is believed to be suitable and sufficient for the planned Phase I and Phase II clinical trials for a number of clinical indications including heart failure. |

2

| Helix™biotherapeutic delivery system - delivers therapeutics into the heart muscle with a penetrating helical needle from within the heart. This is a leading delivery platform in the field, which has increased safety and performance. We expect Helix™ to be approved in the United States as part of CardiAMP Cell Therapy System. The | |

|

| |

|

On April 1, 2019, CE Mark certification expired due to delays in certifying to the new ISO 13485:2016 standard, which defines new requirements in the quality management system required for medical devices. We anticipate being in compliance within calendar year 2019. Until we receive renewal of our EC certificate for CE marking, we will not be able to sell our delivery system in Europe. This is not expected to have a material impact on the Company because we have planned for such delay with our Biotherapeutic partners that use Helix™ in Europe. |

| • | Morph vascular access products - provides enhanced control for Helix™ in biotherapeutic delivery and for other common interventions. We have secured all necessary approvals in the United States and Europe. Currently there are seven Morph product model numbers approved for commercial sale in the United States via a 510(k) clearance. The Morph products are valued by physicians performing difficult vascular procedures worldwide and they have been used in more than 12,000 clinical procedures to date. We are working to receive FDA clearance for market release of new Morph product family members, which include the AVANCE bidirectional steerable introducers for use in transseptal procedures. These transseptal procedures may include atrial fibrillation ablation, patent foramen ovale and atrial septal defect repair, percutaneous mitral valve repair, and left atrial appendage closure, among others. FDA clearance of the AVANCE 510(k) submitted to the FDA during the first quarter of 2019 was received in May 2019. |

Business Strategy

We are committed to applying our expertise in the fields of autologous and allogeneic cell-based therapies to improve the lives of patients with cardiovascular conditions. We are pursuing the following business strategies:

● | Complete the ongoing 260 patient, 40 center Phase III pivotal IDE trial of CardiAMP Cell Therapy System for patients with ischemic systolic heart failure. |

● | Complete the FDA approved, CMS reimbursed, 343 patient, 40 center Phase III pivotal IDE trial of CardiAMP Cell Therapy System for patients with chronic myocardial ischemia. |

● | Obtain FDA approval and commercialize CardiAMP Cell Therapy System using a highly-targeted cardiology sales force in the United States. |

● | Advance our CardiALLO Cell Therapy System for the treatment of ischemic systolic heart failure. CardiALLO has the potential to benefit patients for whom the CardiAMP Cell Therapy System is not optimal due to the lower potency of their bone marrow cells. This therapy may present advantages for patients or physicians who wish to avoid bone marrow aspiration, and our development work builds on our clinical development capabilities established through our CardiAMP program. This program positions us to provide therapy to patients ineligible for CardiAMP. |

● | Expand CardiAMP and CardiALLO Cell Therapy Systems into additional cardiac indications. CardiAMP and CardiALLO Cell Therapy Systems have potential therapeutic benefits for multiple cardiovascular indications in addition to ischemic systolic heart failure and ischemic heart disease. |

● | Continue to develop and partner our Helix™biotherapeutic delivery system for use with other biotherapeutics. We plan to continue to make our Helix™ biotherapeutic delivery system available for use by qualified partners seeking to advance their own biotherapeutic candidates for similar indications. |

● | Continue to develop and commercialize Morph catheter products. We plan to continue to enhance the performance of our Morph catheter products to benefit the CardiAMP and CardiALLO Cell Therapy Systems, to enhance Helix™ partnering, and to grow revenues. |

Risks Associated With Our Business

Our business is subject to numerous risks, as more fully described in the “Risk Factors” section immediately following this prospectus summary. These risks include, among other:

We have a history of net losses and may not be able to achieve or sustain profitability, which raises substantial doubt about our ability to continue as a going concern.

Our success depends in large part on our ability to obtain FDA approval for, and successfully commercialize, CardiAMP. This therapeutic candidate is still in clinical trials, has been used in only a limited number of procedures and there is no long-term data on its safety and efficacy.

Our limited commercialization experience and number of approved products makes it difficult to evaluate our current business, predict our future prospects and forecast our financial performance and growth.

We may not be able to secure additional financing on favorable terms, or at all, to meet our future capital needs and our failure to obtain additional financing when needed could force us to delay, reduce or eliminate our therapeutic candidate development programs and commercialization efforts.

We may in the future be a party to intellectual property litigation or administrative proceedings that could be costly and could interfere with our ability to sell our products and therapeutic candidates, if approved.

Recent Developments

On July 5, 2019, we entered into a note purchase agreement pursuant to which we issued on such date $0.625 million in aggregate principal amount of convertible promissory notes, a portion of which was issued to certain of our officers and directors and a principal stockholder (or their respective affiliates). Interest on the convertible notes accrues at the rate of 14.0% per year. The unpaid principal amount of the convertible notes, together with all interest accrued but unpaid thereon, will be automatically converted into units (the “Private Placement Units”), each Private Placement Unit consisting of one share of common stock and a warrant to purchase one share of common stock (the “Private Placement Warrants”), upon the closing of this Offering at a conversion price equal to 50% of the price to the public in this Offering.

On July 11, 2019, we signed an extension to a 2017 development agreement with a global biotherapeutics leader for BioCardia’s Helix™ biotherapeutic delivery catheter system. The agreement is exclusive with respect to a class of biotherapeutic agents that BioCardia is not currently developing on its own or with any other party and is time limited. Under the terms of the initial pre-clinical phase of the relationship, BioCardia will receive an upfront payment of $1,000,000, a portion of which will be creditable to BioCardia biotherapeutic delivery systems, support and training.

Corporate Information

We were incorporated in Delaware in March 2002 as BioCardia DeviceCo, Inc. and changed our name to BioCardia, Inc. in August 2002. Our principal executive offices are located at 125 Shoreway Road, Suite B, San Carlos, CA 94070. Our telephone number is (650) 226-0120. Our website address is www.biocardia.com. Information contained in our website is not incorporated by reference into this prospectus, and should not be considered to be a part of this prospectus. You should not rely on our website or any such information in making your decision whether or not to purchase our common stock.

THE OFFERING

Issuer | BioCardia, Inc. |

|

|

| We |

___________

|

|

Offering price per Unit | $ |

Over-allotment option | We have granted |

|

|

Common stock to be outstanding immediately after this Offering | shares. |

Use of proceeds | We estimate the net proceeds to us from this Offering, after deducting underwriting discounts and commissions and estimated offering expenses payable by us, will be approximately $ million. We intend to use the |

Current Market for the common stock and warrants | Our common stock is currently quoted on the OTCQB under the symbol “BCDA.” There is currently no public market for the offered warrants. |

Proposed Nasdaq Capital Market Trading Symbols and Listings | We have applied to list our common stock and offered warrants on the Nasdaq Capital Market under the symbols “BCDA” and “BCDAW,” respectively. No assurance can be given that such listings will be approved or that a trading market will develop for our common stock or warrants. |

Underwriters’ warrants | We will issue to Maxim Group LLC, as the representative of the underwriters, upon closing of this Offering compensation warrants entitling the underwriters or their designees to purchase up to 3.5% of the aggregate number of shares of our Common Stock that we issue to retail investors in this Offering. The warrants will be exercisable for a five-year period, commencing six months following the effective date of this Offering at an exercise price per share equal to 110% of the public offering price of our Units offered hereby. See “Underwriting.” |

Lock-up | Our directors, executive officers, and stockholders who own 5% or more of the outstanding shares of our common stock have agreed with the underwriters not to offer for sale, issue, sell, contract to sell, pledge or otherwise dispose of any of our common stock or securities convertible into common stock for a period of 180 days commencing on the date of this prospectus. See “Underwriting.” |

Risk factors | You should read the “Risk Factors” section of this prospectus and the documents incorporated herein for a discussion of certain factors to consider carefully before deciding to purchase any of our securities. |

Outstanding Shares

The number of shares of common stock to be outstanding immediately following this Offering is based on 4,847,471 shares issued and outstanding at March 31, 2019. The number of shares of common stock to be outstanding immediately following this Offering does not take into account:

● | 606,249 shares of our common stock issuable upon the exercise of options outstanding as of March 31, 2019, with a weighted-average exercise price of $24.39 per share; |

● | 27,435 shares of our common stock issuable upon the vesting of restricted stock units outstanding as of March 31, 2019; |

● | 296,295 shares of our common stock issuable upon the exercise of the warrants outstanding as of March 31, 2019 with a weighted-average exercise price of $6.75 per share; |

● | 410,596 shares of our common stock reserved for future issuance under our equity compensation plans; |

● | the shares issuable upon the exercise of warrants to be issued with the Units in this Offering (or shares if the underwriters exercise their over-allotment option in full); |

● | the shares of our common stock that may be issued upon exercise of the underwriter warrants; and |

| ● | the shares of our common stock that may be issued upon exercise of the Private Placement Warrants. |

The number of shares of common stock to be outstanding immediately following this Offering includes:

● | the shares to be issued upon automatic conversion of our convertible notes into Private Placement Units upon completion of this Offering. |

Unless otherwise indicated, all information in this prospectus assumes no exercise of the outstanding options or the warrants being offered in this Offering or the underwriter warrants.

Unless otherwise indicated, all information in this prospectus reflects a one-for-nine reverse stock split of our issued and outstanding shares of common stock, options, restricted stock units and warrants, and the corresponding adjustment of all common stock and restricted stock unit prices per share and stock option and warrant exercise prices per share and conversion ratios. Our common stock began trading on a reverse stock split-adjusted basis on The OTC Market on the opening of trading on June 6, 2019.

RISK FACTORS

This registration statement includes "forward-looking statements" within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended ("Exchange Act"), including, in particular, certain statements about our plans, strategies and prospects. Although we believe that our plans, intentions and expectations reflected in or suggested by such forward-looking statements are reasonable, we cannot assure you that such plans, intentions or expectations will be achieved. Important factors that could cause our actual results to differ materially from our forward-looking statements include those set forth in this Risk Factors section.

An investment in theour securities is speculative and involves a high degree of risk. YouIn addition to the other information included in this prospectus, including the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” you should carefully consider the risk factorsrisks described below, togetherbefore making an investment decision with respect to the securities. We expect to update these Risk Factors from time to time in the periodic and current reports that we file with the otherSEC after the date of this prospectus. Please refer to these subsequent reports for additional information containedrelating to the risks associated with investing in this prospectus before making a decision to purchase our securities.common stock and the accompanying warrant. If any of thesuch risks described below occur, or if other risks not identified below occur,and uncertainties actually occurs, our business, business prospects, cash flow, financial condition, stock price and results of operations could be materially adversely affected. Under these circumstances,severely harmed. This could cause the trading price of our common stock couldand our warrants to decline, and you maycould lose all or part of your investment. Additional risksinvestment.

Risks Relating to Our Business

We will require additional financing in 2019 in order to continue the trial and uncertaintiesto continue operations at the current level.

Our current cash resources are not presently knownsufficient to us or thatfund operations at the expected level of activity through the third quarter of 2019. We will need additional capital to continue operations at the current level and to continue the Phase III trial. While we currently deem immaterial also may impair our financial condition and operations. Furthermore, referencesplan to "we," "us" and "our" are referencesraise additional capital to fund operations, including the trials, there can be no assurances as to the Company.availability of capital or the terms on which capital will be available.

We have a history of operating losses, and we may not be able to achieve or sustain profitability. In addition, we may be unable to the risk factors related to the offering set forth below, the risk factors set forth in the SEC filings, including the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2008,continue as a going concern.

We are a clinical-stage regenerative medicine company and future filings with the SEC are incorporated by reference into this prospectus.

You understand that, certain unique factors make an investment in the Company subject to a high degree of risk. You have been cautioned that an investment in the Company is speculative and involves significant risks, and that it is probably not possible to foresee and describe all of the business, economic and financial risk factors which may affect the Company.

3

This document contains "forward-looking statements," as that term is defined under the Private Securities Litigation Reform Act of 1995, or the PSLRA. Forward-looking statements include statements about our expectations, beliefs or intentions regarding our product development efforts, business, financial condition, results of operations, strategies or prospects. You can identify forward-looking statements by the fact that these statements do not relate strictly to historical or current matters. Rather, forward-looking statements relate to anticipated or expected events, activities, trends or results as of the date they are made. Because forward-looking statements relate to matters thatwe have not yet occurred, these statements are inherently subject to risks and uncertainties that could cause our actual results to differ materially from any future results expressed or implied by the forward-looking statements.

Any or allgenerated a profit. We have incurred net losses during each of our forward-looking statements in this document may turn out to be wrong. They can be affected by inaccurate assumptions we might make or by known or unknown risksfiscal years since our inception. Our net loss for the three months ended March 31, 2019 was $3.7 million and uncertainties. Many factors mentioned in our discussion in this document will be important in determining future results. Consequently, no forward-looking statement can be guaranteed. Actual future results may vary materially. While we may elect to update these forward-looking statements at some point in the future, we specifically disclaim any obligation to do so to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking statements. We intend that all forward-looking statements be subject to the safe-harbor provisions of the PSLRA. These forward-looking statements are only predictions and reflect our viewsaccumulated deficit totaled approximately $90.0 million as of the date they are made with respectMarch 31, 2019. We do not know whether or when we will become profitable, if ever. We currently expect operating losses and negative cash flows to future events and financial performance.

Risks and uncertainties, the occurrence of which could adversely affect our business, include the following:

Risks Related to Our Business, Industry and Regulatory Matters

We expect to incur significant losses, either directly or indirectly through the companies in which we develop our products,continue for at least the next several years.

To date, our only approved or cleared products are our Morph universal deflectable guide catheters and Morph AccessPro sheaths, or Morph, in the United States and Europe and our HelixTM biotherapeutic delivery system, or Helix, in Europe. Our limited commercialization experience and number of approved products makes it difficult to evaluate our current business and predict our future prospects. Our short commercialization experience and limited number of approved products also makes it difficult for us to forecast our future financial performance and growth and such forecasts are limited and subject to a number of uncertainties, including our ability to successfully complete our Phase III pivotal trials in heart failure and chronic myocardial ischemia and obtain FDA approval for, and then successfully commercialize, the CardiAMP Cell Therapy System.

Our ability to generate sufficient revenue to achieve profitability depends on our ability, either alone or with strategic collaboration partners, to successfully complete the development of, and obtain the regulatory approvals necessary to commercialize our therapeutic candidates. We do not anticipate generating revenues from sales of the CardiAMP Cell Therapy System, the CardiALLO Cell Therapy System or any other biotherapeutic candidates within the next few years, and we cannot assure youmay never generate sales of these products.

Our unaudited consolidated financial statements as of and for the three months ended March 31, 2019 and the year ended December 31, 2018 have been prepared on the basis that we will ever be profitable.

continue as a going concern, which contemplates the realization of assets and satisfaction of liabilities in the normal course of business. We expect to incurhave incurred significant losses over the next several years, either directly or indirectly through the companies in whichsince our inception and we develop our products, as we expand our research and development activities, apply for regulatory approvals, develop additional technology and expand our operations. We cannot assure youexpect that we will continue to incur losses as we aim to successfully execute our business plan and will be successful in sellingdependent on additional public or private financings, collaborations or licensing any of the products we might developarrangements with strategic partners, or predict the terms we may be ableadditional credit lines or other debt financing sources to obtain in any sales or licensing transaction.

We havefund continuing operations. Based on our cash balances, recurring losses since inception and our existing capital resources to fund our planned operations for a limited number of products currently available for sale andtwelve-month period, there is substantial doubt about our ability to continue as a high risk that our research and development efforts might not successfully generate any viable product candidates in the future.

We currently have nine products available for sale, all of which are in the early stages of distribution. Other than those nine products,going concern. As noted below, we are in the preliminary stages of product identification and development, and have identified only a few potential additional products. We have not yet conducted preclinical studies or clinical testing on these potential additional products. It is statistically unlikely that the few products that we have identified as potential candidates will actually lead to successful development efforts, and we do not expect any additional products resulting from our research to be commercially available for several years, if at all. Our leads for potential products will be subject to the risks and failures inherent in developing medical devices and products, including, but not limited to, the unanticipated problems relating to research and development, product testing, confirming intellectual property rights and non-infringement, regulatory compliance, manufacturing, marketing and competition. Additional expenses may exceed current estimates and, therefore, adversely affect our profitability.

We will need to raiseobtain additional funds in the future to fund our operations and research, and these funds may not be available on acceptable terms, if at all.

We anticipate spending significant amounts of cash on expanding our research and development, sales and marketing efforts, and product commercialization. We expect proceedsfunding from the recent private placement will be sufficient to provide working capital requirements for the next nine months. However, actual capital requirements may change as a result of various factors, including:

the success of our research and development efforts, and any changes in the breadth of our research and development programs;

4

results from preclinical studies and clinical trials conducted by us or our collaborative partners or licensees, if any;the number and timing of acquisitions and other strategic transactions;our ability to maintain and establish corporate relationships and research collaborations;our ability to manage growth and costs associated with this growth, and the costs associated with increased capital expenditures;the time and costs involved in filing, prosecuting, defending and enforcing patent and intellectual property claims;the cost and timing of obtaining and maintaining regulatory approval or clearance for our products and products in development;the expenses we incur in manufacturing and selling our products;the revenues generated by sales of our products;expenses that may be incurred in pursuing or defending any potential litigation; andthe costs associated with our employee retention programs and related benefits.

Our primary goal as it relates to liquidity and capital resources is to attain the appropriate level of debt and equity and the resultant cash to implement our business plan. We may need to raise additional funds, which may not be available to us on favorable terms, if at all. If we raise capital by issuing equity or debt securities,financings, which may require us to agree to burdensome covenants, grant security interests in our existing stockholders may experience dilutionassets, enter into collaboration and the new equity or debt securities may have rights, preferences and privileges senior to those of our existing stockholders. Further, if we raise additional funds through collaboration, licensing or other similar arrangements it may be necessarythat require us to relinquish commercial rights, to our existing or potential products or proprietary technologies, or to grant licenses on terms that are not favorablefavorable. No assurance can be given at this time as to us.whether we will be able to achieve our fundraising objectives, regardless of the terms. If adequate funds are not available, the Company may be required to reduce operating expenses, delay or reduce the scope of its product development programs, obtain funds through arrangements with others that may require the Company to relinquish rights to certain of its technologies or products that the Company would otherwise seek to develop or commercialize itself, or cease operations.

Our success depends in large part on our ability to obtain approval for, and successfully commercialize, the CardiAMP Cell Therapy System.

The long-term viability of our company is largely dependent on the successful development and commercialization of the CardiAMP Cell Therapy System. We are currently enrolling patients in a Phase III pivotal trial that will be used to support regulatory approval, and we do not have significant long-term data on the CardiAMP Cell Therapy System’s safety and efficacy in either heart failure or chronic myocardial ischemia. While we expect to successfully complete our ongoing Phase III pivotal trial of the CardiAMP Cell Therapy System in heart failure, there can be no guarantee that the study will be completed, that the primary endpoints will be achieved, or that we will receive regulatory approval for the sale and marketing in the United States. A number of companies in similar fields have suffered significant setbacks during clinical trials due to lack of efficacy or unacceptable safety issues, notwithstanding promising preliminary results. Because we are depending heavily on sales of the CardiAMP Cell Therapy System to achieve our revenue goals, failure to successfully complete the study and receive U.S. Food and Drug Administration, or FDA, approval, in a timely manner or at all, will harm our financial results and ability to become profitable. Even if we obtain regulatory approval, our ability to successfully market this product will be limited due to a number of factors, including regulatory restrictions in our labeling or requirements to obtain additional post-approval data, if any. In addition, there can be no guarantee that the CardiAMP Cell Therapy System will be accepted by the medical community as a valid alternative to currently available products. If we are unablecannot sell the CardiAMP Cell Therapy System as planned, our financial results will be harmed.

FDA acceptance of a Phase III pivotal trial is not a guarantee of an approval of a product candidate or any permissible claims about the product candidate. Failure to raise needed capital on terms acceptablesuccessfully complete our ongoing Phase III trial of CardiAMP in heart failure would significantly impair our financial results. Such a failure could (i) delay or prevent the CardiAMP Cell Therapy System from obtaining regulatory approval, (ii) require us to us, weperform another clinical trial, which will be expensive, may not be able to develop new products, enhance our existing products, execute our business plan, take advantage of future opportunities, respond to competitive pressures or unanticipated customer requirements or continue to operate our business. Any of these events could have a material adverse effect on our business, financial conditionsuccessful and results of operations.

Cost containment measures, pressure from our competitors and availability of medical reimbursement may impactwill significantly delay our ability to sellcommercialize the CardiAMP Cell Therapy System and (iii) impair our products at prices necessaryability to expandconvince hospitals and physicians of the benefits of our operationsCardiAMP Cell Therapy System product. Furthermore, even if we are granted regulatory clearances or approvals, they may include significant limitations on the indicated uses for CardiAMP, which may limit the market for this product.

Because the CardiAMP Cell Therapy System is, to our knowledge, the first cardiac cell-based therapy with an accepted pivotal trial that is to be regulated by the FDA via the premarket approval pathway, the approval process for the CardiAMP Cell Therapy System is uncertain.

Although we have obtained FDA acceptance of Phase III pivotal trials of the CardiAMP Cell Therapy System for the treatment of ischemic systolic heart failure and reach profitability.

Healthcare costs have risen significantly overchronic myocardial ischemia, this does not guarantee any particular outcome from regulatory review. To the past decadebest of our knowledge, the CardiAMP Cell Therapy System for the treatment of ischemic systolic heart failure is the first cardiac cell-based therapy with an accepted pivotal trial that is to be regulated by the FDA Center for Biologics Evaluation and numerous initiatives and reforms initiatedResearch, or CBER, via the premarket approval, or PMA, pathway requiring a single trial. The CardiAMP Cell Therapy System for the treatment of chronic myocardial ischemia is also to be regulated under the same IDE/PMA pathway. All other cardiac cell-based therapies in clinical trials are believed to be regulated by legislators, regulators and third-party payorsthe same agency, but as biologics which generally require two separate pivotal trials. There is no guarantee that the FDA will grant us regulatory clearance or approval to curb these costs have resulted inmarket the CardiAMP Cell Therapy System on the basis of a consolidation trend insingle pivotal trial, or that the healthcare industry, including hospitals. This has resulted in greater pricing and other competitive pressures and the exclusion of certain suppliers from important market segments as group purchasing organizations, independent delivery networks and large single accounts continue to consolidate purchasing decisions for some hospital customers. We expect that market demand, government regulation, third-party reimbursement policies and societal pressuresFDA will continue to changeallow us to develop the national and worldwide healthcare industry, resulting in further business consolidations and alliances among customers and competitors. This consolidation may reduce competition, exert downward pressure onCardiAMP Cell Therapy System via the pricesPMA pathway. Two well-controlled pivotal studies could be necessary to provide FDA assurance of our products and adversely impact our business, financial conditionsafety or results of operations.

Further, third-party payors ineffectiveness. If the United States and abroad continue to work to contain healthcare costs. The introduction of cost containment incentives, along with closer scrutiny of healthcare expenditures by both private health insurers and employers, has resulted in increased discounts and contractual adjustments to hospital charges for services performed and has shifted services between inpatient and outpatient settings. HospitalsFDA approval process does not occur as we anticipate or physicians may respond to these cost-containment pressures by substituting lower-cost products or other therapies for our products, the occurrence of which may adversely impact our business, financial condition and results of operation.

The market for orthopedic, knee and hip surgery devices is large and growing at a significant rate. Numerous new companies and technologies, as well as more established companies, have entered this market. New entrants to our markets include numerous niche companies with a singular product focus, as well as companies owned partially by surgeons, who may have greater access than we do to the surgeons who may use our products. As a result of this intensified competition, we believe there will be increasing pressure to reduce pricing of our medical devices. If we are unablerequired to price our products appropriately dueconduct more than one pivotal study to these competitive pressures or for other reasons, our profit margins will shrink and our ability to invest in and grow our business and achieve profitability will decrease.

5

Sales of our products will depend on the availability of adequate reimbursement from third-party payors (such as governmental programs, for example, Medicare and Medicaid, private insurance plans and managed care programs), both in terms of the sales volumes and prices of our products.

Healthcare providers, such as hospitals that purchase medical devices for treating their patients, generally rely on third-party payors to reimburse all or part of theobtain approval, we may incur substantial additional costs and fees associated with the procedures performed with these devices. These third-party payors may deny reimbursementdelays to obtain approval, if they feel that a device is not the most cost-effective treatment available, or was used for an unapproved indication. As such, surgeons are unlikely to use our products if they do not receive reimbursement adequate to cover the cost of their involvement in the surgical procedures. The failure of surgeons to use our products, or the diminished use by surgeons, mayat all, which would have a material adverse impact on our business, financial condition and resultsprospects.

Our CardiAMP and CardiALLO cell therapy system therapeutic candidates are based on novel technology, which makes it difficult to accurately and reliably predict the time and cost of operations.product development and subsequently obtaining regulatory approval. At the moment, no cell-based therapies have been approved in the United States for a cardiac indication.