AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON JUNE 24, 2008FEBRUARY 10, 2009

REGISTRATION NO. 333-142238333-151893

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 3 TO

FORM S-1

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

_____________________________

CICERO INC.

(Exact Name of Registrant as Specified in Its Charter)

| DELAWARE | 11-2920559 | |

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification Number) |

7372 Services, Prepackaged Software

_____________________________

(Primary Standard Industrial Classification Code)

8000 Regency Parkway

Suite 542

Cary, NC 27518

(919) 380-5000

(Address, Including Zip Code, and Telephone Number, Including

Area Code, of Registrant’s Principal Executive Offices)

_____________________________

John P. Broderick

Chief Financial Officer

Cicero Inc.

8000 Regency Parkway

Suite 542

Cary, NC 27518

(919) 380-5000

_____________________________

(Name, Address, Including Zip Code, and Telephone Number,

Including Area Code, of Agent for Service)

Copies to:

Lawrence M. Bell, Esq.

Golenbock Eiseman Assor Bell & Peskoe LLP

437 Madison Ave

New York, NY 10022

(212) 907-7300

_____________________________

Approximate Date of Commencement of Proposed Sale to the Public: From time to time or at one time after the effective date of this registration statement as determined by the selling stockholders.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. T

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check One):

Large accelerated filer £ | Accelerated filer £ | Non-accelerated filer £ | Smaller reporting company T |

CALCULATION OF REGISTRATION FEE

TITLE OF EACH CLASS OF SECURITIES TO BE REGISTERED | AMOUNT TO BE REGISTERED | PROPOSED MAXIMUM OFFERING PRICE PER SHARE(1) | PROPOSED MAXIMUM AGGREGATE OFFERING PRICE | AMOUNT OF REGISTRATION FEE | AMOUNT TO BE REGISTERED | PROPOSED MAXIMUM OFFERING PRICE PER SHARE(1) | PROPOSED MAXIMUM AGGREGATE OFFERING PRICE | AMOUNT OF REGISTRATION FEE | ||||||||||||||||||||||||

Common Stock, par value $.001 per share | 7,492,348 | (1) | $ | 0.17 | $ | 1,273,699.16 | $ | 51.39 | 7,492,348 | $ | 0.17 | $ | 1,273,699.16 | $ | 51.39 | (3) | ||||||||||||||||

Warrants for Common Stock, par value $.001 per share | 188,285 | $ | 0.18 | $ | 33,891,.30 | |||||||||||||||||||||||||||

Common Stock, par value $.001 per share | 188,285 | (2) | $ | 0.18 | $ | 33,891.30 | ||||||||||||||||||||||||||

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(c ) under the Securities Act of 1933 and based upon the average high and low prices of the registrant’s common stock on the Over the Counter Bulletin Board on June 5, 2008. |

| (2) | Represents shares of common stock issuable upon exercise of warrants held by a selling stockholder. |

| (3) | Previously paid. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JUNE 24, 2008FEBRUARY 10, 2009

PROSPECTUS

7,680,633 Shares of Common Stock

CICERO INC.

This prospectus relates to the resale of up to 7,680,633 shares of our common stock, $.001 par value, which are being offered for resale from time to time by the stockholders named in the section entitled “Selling Stockholders” on page 10. The number of shares the selling stockholders may offer and sell under this prospectus includes shares of common stock:

| · | the selling stockholders currently hold; |

| · | issuable to them upon the exercise of warrants previously issued. |

We are registering these shares to satisfy registration rights of the selling stockholders.

We are not offering or selling any shares under this prospectus and we will not receive any of the proceeds from any resales by the selling stockholders. We may, however, receive the proceeds from the exercise of the warrants issued to the selling stockholders. The selling stockholders may sell the shares of common stock from time to time in various types of transactions, including on the Over-the-Counter Bulletin Board and in privately negotiated transactions. For additional information on methods of sale, you should refer to the section entitled “Plan of Distribution” on page 13.14.

On June 18, 2008,February 3, 2009, the last sales price of the common stock quoted on the Over-the-Counter Bulletin Board was $0.17$0.12 per share. Our common stock is quoted on the Over-the-Counter Bulletin Board under the symbol “CICN.”

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 3.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this Prospectus is ____________

TATABLE BLE OF CONTENTS

| i | ||

| 1 | ||

| 3 | ||

| 8 | ||

| 8 | ||

| 9 | ||

| 10 | ||

| F-1 |

_____________________________

AABOUT BOUT THIS PROSPECTUS

You should read this prospectus and any accompanying prospectus supplement, as well as any post-effective amendments to the registration statement of which this prospectus is a part, together with the additional information described under “Available Information” before you make any investment decision.

The terms “Cicero,” “we,” “our” and “us” refer to Cicero Inc. and its consolidated subsidiaries unless the context suggests otherwise. The term “you” refers to a prospective purchaser of our common stock.

You should not rely on any information other than contained in this prospectus or any accompanying prospectus supplement. We have not authorized anyone to provide you with information different from that contained in this prospectus or any accompanying prospectus supplement. These securities are being offered for sale and offers to buy these securities are only being solicited in jurisdictions where offers and sales are permitted. The information contained in this prospectus and any accompanying prospectus supplement is accurate only as of the date on their respective covers, regardless of the time of delivery of this prospectus or any accompanying prospectus supplement or any sale of the securities.

PPROSPECTUS ROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read the entire prospectus carefully, including “Risk Factors” and the financial statements, before making an investment decision. References to “we,” “our,” “Cicero” and the “Company” generally refer to Cicero Inc., a Delaware corporation.

We provide business integration software, which enables organizations to integrate new and existing information and processes at the desktop. Our business integration software addresses the emerging need for companies’ information systems to deliver enterprise-wide views of their business information processes. In addition to software products, the Company also provides technical support, training and consulting services as part of its commitment to providing its customers with industry-leading integration solutions. The Company’s consulting team has in-depth experience in developing successful enterprise-class solutions as well as valuable insight into the business information needs of customers in the largest 5000 corporations worldwide (the “Global 5000”).

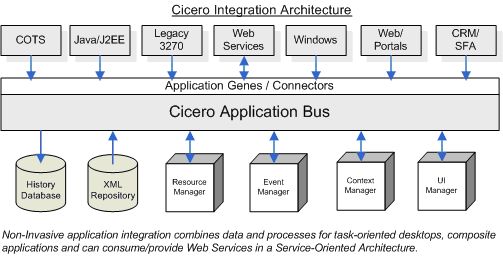

Our focus is on the growing desktop integration and business process automation market with our Cicero® product. Cicero® is a business application integration platform that enhances end-user productivity, streamlines business operations and integrates systems and applications that would not otherwise work together. Cicero® software offers a proven, innovative departure from traditional, costly and labor-intensive enterprise application integration, which occurs at the server level. Cicero® provides non-invasive application integration at the desktop level. Desktop level integration provides the user with a single environment with a consistent look and feel for diverse applications across multiple operating environments, reduces enterprise integration implementation cost and time, and supports a Service-Oriented Architecture (SOA).

By using Cicero® software, we believe companies can decrease their customer management costs, improve their customer service and more efficiently cross-sell the full range of their products and services resulting in an overall increase in return on their information technology investments. In addition, we believe Cicero® software enables organizations to reduce the business risks inherent in replacement or re-engineering of mission-critical applications and extend the productive life and functional reach of their application portfolio.

Cicero® software is engineered to integrate diverse business applications and shape them to more effectively serve the people who use them. Cicero® provides an intuitive integration and development environment, which simplifies the integration of complex multi-platform applications. Cicero® can streamline end-user tasks by providing a single, seamless user interface for simple access to multiple systems or be configured to display one or more composite applications to enhance productivity. Our software enables automatic information sharing among line-of-business applications and tools.

Cicero® software is ideal for deployment in contact centers where its highly productive, task-oriented user interface promotes user efficiency. By integrating diverse applications across multiple operating systems, Cicero® software is also ideal for the financial services, for which Cicero® was initially developed, insurance, telecommunications, intelligence, security, law enforcement, governmental and other industries requiring a cost-effective, proven application integration solution.

Recent Developments

In March 2008, the Company was notified that a group of investors including two members of the Board of Directors acquired a short term promissory note due SDS Merchant Fund in the principal amount of $250,000. The note is unsecured and bears interest at 10% per annum. In March, our Board of Directors approved a resolution to convert this debt plus accrued interest into common stock of the Company. The total principal and interest amounted to $361,827 and was converted into 1,417,264 shares of common stock. Mr. John Steffens, the Company’s Chairman, acquired 472,516 shares and Mr. Bruce Miller, also a member of our Board of Directors, acquired 472,374 shares.

In October 2007, we agreed to restructure a promissory note payable to Bank Hapoalim and guaranty by BluePhoenix Solutions. Under a new agreement with BluePhoenix, we made a principal reduction payment to Bank Hapoalim in the amount of $300,000. Simultaneously, BluePhoenix paid $1,671,000 to Bank Hapoalim, thereby discharging that indebtedness. The Company and BluePhoenix entered into a new promissory note (which we refer to as the Note) in the amount of $1,021,000, bearing interest at LIBOR plus 1.0% and maturing on December 31, 2011. In addition, BluePhoenix acquired 2,546,149 shares of our common stock in exchange for $650,000 paid to Bank Hapoalim to retire that indebtedness. In March 2008, we amended the terms of the Note with BluePhoenix Solutions. Under the terms of the original Note, the Company was to make a principal reduction payment in the amount of $350,000 on January 30, 2009. The Company and BluePhoenix agreed to accelerate that principal payment to March and April 2008 in return for a conversion of $50,000 into 195,848 shares of the Company’s common stock. In March, the Company paid $200,000 plus accrued interest and in April, the Company paid $100,000 plus accrued interest.

In October 2007, we completed a private sale of shares of itsour common stock to a group of investors, four of which are members of our Board of Directors. Under the terms of that agreement, we sold 2,169,311 shares of our common stock for $0.2457 per share for a total of $533,000. Participating in this consortium were Mr. John L. (Launny) Steffens, the Company’s Chairman, and Messrs. Bruce Miller, Don Peppers, and Bruce Percelay, members of the Board. Mr. Steffens converted the principal amount of his short term notes with the Company of $250,000 for 1,017,501 shares of common stock. Mr. Miller invested $20,000 for 81,400 shares of common stock, Mr. Peppers acquired 101,750 shares for a $25,000 investment and Mr. Bruce Percelay acquired 40,700 shares for a $10,000 investment.

The Offering

Common stock offered by selling stockholders: 7,680,633 shares.

Use of proceeds: The selling stockholders will receive all net proceeds from sale of our common stock covered by this prospectus. We will not receive any proceeds from this offering other than from the exercise of warrants to purchase shares of common stock.

Risk Factors: See “Risk Factors” beginning on page 3 and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in the shares.

We were incorporated as Level 8 Systems, Inc. in New York in 1988 and re-incorporated in Delaware in 1999. In November 2006, our stockholders approved the change of our name to Cicero Inc. Our principal executive offices are located at 8000 Regency Parkway, Suite 542, Cary, North Carolina 27518. Our telephone number is (919) 380-5000 and our web site is www.ciceroinc.com. Information contained on our web site is not a part of this prospectus.

RRISK ISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the specific risk factors listed below together with the other information included in this prospectus before you decide whether to purchase shares of our common stock. Additional risks and uncertainties not presently known to us, including those that are not yet identified or that we currently think are immaterial, may also adversely affect our business, results of operations and financial condition. The market price of our common stock could decline due to any of these risks, and you could lose all or part of your investment.

There is substantial doubt as to whether we can continue as a going concern.

Because we incurred net operating losses of approximately $2.0 million for the year ended December 31, 2007 and $0.5 million$609,000 for the threenine months ended March 31,September 30, 2008, and losses from continuing operations of approximately $6.7 million for the previous two fiscal years we experienced negative cash flows from operations, had significant working capital deficiencies at March 31,September 30, 2008, and because we are relying on acceptance of a newly developed and marketed product, there is substantial doubt that we can continue to operate as a going concern. While we have attracted some additional capital to continue to fund operations, there can be no assurance that we can obtain additional financing and if we do obtain financing that it will be on terms that are favorable to us or our stockholders.

We have a history of losses and expect that we will continue to experience losses at least through thirdsecond quarter of 20082009.

We experienced operating losses and net losses for each of the years from 1998 through 2007. We incurred a net loss of $3.68 million in 2005, $3.0 million in 2006, $2.0 million for 2007 and $0.5 million$609,000 for the threenine months ended March 31,September 30, 2008. As of March 31,September 30, 2008, we had a working capital deficit of $6.3$6.0 million and an accumulated deficit of $237$236.9 million. Our ability to generate positive cash flow is dependent upon sustaining certain cost reductions and generating sufficient revenues.

Therefore, due to these and other factors, we expect that we will continue to experience net losses through the thirdsecond quarter of 2008.2009. We have not generated sufficient revenues to pay for all of our operating costs or other expenses and have relied on financing transactions over the last several fiscal years to pay our operating costs and other expenses. We cannot predict with accuracy our future results of operations and believe that any period-to-period comparisons of our results of operations are not meaningful. Furthermore, there can be no assurance that if we are unable to generate sufficient revenue from operations that we will be able to continue to access the capital markets to fund our operations, or that if we are able to do so that it will be on satisfactory terms.

We develop new and unproven technology and products.

To date, our products have not been widely accepted in the market place and therefore may be considered unproven. The markets for our products are characterized by rapidly changing technologies, evolving industry standards, frequent new product introductions and short product life cycles. Our future success will depend to a substantial degree upon our ability to market and enhance our existing products and to develop and introduce, on a timely and cost-effective basis, new products and features that meet changing customer requirements and emerging and evolving industry standards.

We depend on an unproven strategy for ongoing revenue.

Our future revenues are entirely dependent on acceptance of Cicero® which had limited success in commercial markets to date. We have experienced negative cash flows from operations for the past three years. At March 31,September 30, 2008, we had a working capital deficiency of approximately $6,330,000.$6.0 million. Accordingly, there is substantial doubt that we can continue as a going concern, and the independent auditor’s report accompanying our financial statements raises doubt about our ability to continue as a going concern. In order to address these issues and to obtain adequate financing for our operations for the next twelve months, we are actively promoting and expanding our product line and continue to negotiate with significant customers who have demonstrated interest in the Cicero® technology. We are experiencing difficulty increasing sales revenue largely because of the inimitable nature of the product as well as customer concerns about our financial viability. Cicero® software is a new “category defining” product in that most Enterprise Application Integration or EAI projects are performed at the server level and Cicero®’s integration occurs at the desktop level without the need to open and modify the underlying code for those applications being integrated. Many companies are not aware of this new technology or tend to look toward more traditional and accepted approaches although emerging competition has increased the public awareness of this new form of technology. We are attempting to solve the former problem by improving the market’s knowledge and understanding of Cicero® through increased marketing and leveraging its limited number of reference accounts while enhancing its list of resellers and system integrators to assist in the sales and marketing process. Additionally, we are seeking additional equity capital or other strategic transactions in the near term to provide additional liquidity, however, there is no assurance that we will be able to obtain any additional funding.

Our new strategy is subject to the following specialized risks that may adversely affect our long-term revenue and profitability prospects:

| · | Cicero® was originally developed internally by Merrill Lynch and has no track record of successful sales to organizations within the financial services industry and may not gain market acceptance; |

| · | We are approaching a different segment of the financial services industry, the customer contact center, compared to our sales and marketing efforts in the past and there can be no assurance that we can successfully sell and market into this industry; and |

| · | We have had very limited success because the financial condition of the Company has caused concern for enterprise customers that would be dependent on Cicero® for their long-term needs. |

Economic conditions could adversely affect our revenue growth and cause us not to achieve desired revenue.

Our ability to generate revenue depends on the overall demand for desktop integration software and services. Our business depends on overall economic conditions, the economic and business conditions in our target markets and the spending environment for information technology projects, and specifically for desktop integration in those markets. A weakening of the economy in one or more of our geographic regions, unanticipated major events and economic uncertainties may make more challenging the spending environment for our software and services, reduce capital spending on information technology projects by our customers and prospective customers, result in longer sales cycles for our software and services or cause customers or prospective customers to be more cautious in undertaking larger transactions. Those situations may cause a decrease in our revenue. A decrease in demand for our software and services caused, in part, by an actual or anticipated weakening of the economy, may result in a decrease in our revenue rates.

The “penny stock” rule will limit brokers and dealers ability to trade in our common stock, making the market for our common stock less liquid which could cause the price of our stock to decline.

Our common stock is quoted on the Over-the-Counter Bulletin Board.

Trading of our common stock on the OTCBB may be subject to certain provisions of the Securities Exchange Act of 1934, as amended, commonly referred to as the "penny stock" rule. A penny stock is generally defined to be any equity security that has a market price less than $5.00 per share, subject to certain exceptions. If our stock is deemed to be a penny stock, trading in our stock will be subject to additional sales practice requirements on broker-

dealers. These may require a broker-dealer to:

| · | make a special suitability determination for purchasers of our shares; |

| · | receive the purchaser's written consent to the transaction prior to the purchase; and |

| · | deliver to a prospective purchaser of our stock, prior to the first transaction, a risk disclosure document relating to the penny stock market. |

Consequently, penny stock rules may restrict the ability of broker-dealers to trade and/or maintain a market in our common stock. Also, prospective investors may not want to get involved with the additional administrative requirements, which may have a material adverse effect on the trading of our shares.

Because we cannot accurately predict the amount and timing of individual sales, our quarterly operating results may vary significantly, which could adversely impact our stock price.

Our quarterly operating results have varied significantly in the past, and we expect they will continue to do so in the future. We have derived, and expect to continue to derive in the near term, a significant portion of our revenue from relatively large customer contracts or arrangements. The timing of revenue recognition from those contracts and arrangements has caused and may continue to cause fluctuations in our operating results, particularly on a quarterly basis. Our quarterly revenues and operating results typically depend upon the volume and timing of customer contracts received during a given quarter and the percentage of each contract, which we are able to recognize as revenue during the quarter. Each of these factors is difficult to forecast. As is common in the software industry, the largest portion of software license revenues are typically recognized in the last month of each fiscal quarter and the third and fourth quarters of each fiscal year. We believe these patterns are partly attributable to budgeting and purchasing cycles of our customers and our sales commission policies, which compensate sales personnel for meeting or exceeding periodic quotas.

Furthermore, individual Cicero® sales are large and each sale can or will account for a large percentage of our revenue and a single sale may have a significant impact on the results of a quarter. The sales of both our historical products and Cicero® can be classified as generally large in size to a small discrete number of customers. In addition, the substantial commitment of executive time and financial resources that have historically been required in connection with a customer’s decision to purchase Cicero® and our historical products increases the risk of quarter-to-quarter fluctuations. Cicero® sales require a significant commitment of time and financial resources because it is an enterprise product. Typically, the purchase of our products involves a significant technical evaluation by the customer and the delays frequently associated with customers’ internal procedures to approve large capital expenditures and to test, implement and accept new technologies that affect key operations. This evaluation process frequently results in a lengthy sales process of several months. It also subjects the sales cycle for our products to a number of significant risks, including our customers’ budgetary constraints and internal acceptance reviews. The length of our sales cycle may vary substantially from customer to customer.

Our product revenue may fluctuate from quarter to quarter due to the completion or commencement of significant assignments, the number of working days in a quarter and the utilization rate of services personnel. As a result of these factors, we believe that a period-to-period comparison of our historical results of operations is not necessarily meaningful and should not be relied upon as indications of future performance. In particular, our revenues in the third and fourth quarters of our fiscal years may not be indicative of the revenues for the first and second quarters. Moreover, if our quarterly results do not meet the expectations of our securities analysts and investors, the trading price of our common stock would likely decline.

Loss of key personnel associated with Cicero® development could adversely affect our business.

Loss of key executive personnel or the software engineers we have hired with specialized knowledge of the Cicero® technology could have a significant impact on our execution of our new strategy given that they have specialized knowledge developed over a long period of time with respect to the Cicero® technology. Furthermore, because of our restructuring and reduction in the number of employees, we may find it difficult to recruit new employees in the future.

Different competitive approaches or internally developed solutions to the same business problem could delay or prevent adoption of Cicero®.

Cicero® is designed to address in a novel way the problems that large companies face integrating the functionality of different software applications by integrating these applications at the desktop. To effectively penetrate the market for solutions to this disparate application problem, Cicero® will compete with traditional Enterprise Application Integration, or EAI, solutions that attempt to solve this business problem at the server or back-office level. Server level EAI solutions are currently sold and marketed by companies such as NEON, Mercator, Vitria, and BEA. There can be no assurance that our potential customers will determine that Cicero®’s desktop integration methodology is superior to traditional middleware EAI solutions provided by the competitors described above in addressing this business problem. Moreover, the information systems departments of our target customers, large financial institutions, are large and may elect to attempt to internally develop an internal solution to this business problem rather than to purchase the Cicero® product. Cicero® itself was originally developed internally by Merrill Lynch to solve these integration needs.

Accordingly, we may not be able to provide products and services that compare favorably with the products and services of our competitors or the internally developed solutions of our customers. These competitive pressures could delay or prevent adoption of Cicero® or require us to reduce the price of our products, either of which could have a material adverse effect on our business, operating results and financial condition.

Our ability to compete may be subject to factors outside our control.

We believe that our ability to compete depends in part on a number of competitive factors outside our control, including the ability of our competitors to hire, retain and motivate senior project managers, the ownership by competitors of software used by potential clients, the development by others of software that is competitive with our products and services, the price at which others offer comparable services and the extent of our competitors’ responsiveness to customer needs.

The markets for our products are characterized by rapidly changing technologies, evolving industry standards, frequent new product introductions.

Our future success will depend to a substantial degree upon our ability to enhance our existing products and to develop and introduce, on a timely and cost-effective basis, new products and features that meet changing customer requirements and emerging and evolving industry standards.

The introduction of new or enhanced products also requires us to manage the transition from older products in order to minimize disruption in customer ordering patterns, as well as ensure that adequate supplies of new products can be delivered to meet customer demand. There can be no assurance that we will successfully develop, introduce or manage the transition to new products.

We have in the past, and may in the future, experience delays in the introduction of our products, due to factors internal and external to our business. Any future delays in the introduction or shipment of new or enhanced products, the inability of such products to gain market acceptance or problems associated with new product transitions could adversely affect our results of operations, particularly on a quarterly basis.

We may face damage to the reputation of our software and/or a loss of revenue if our software products fail to perform as intended or contain significant defects.

Our software products are complex, and significant defects may be found following introduction of new software or enhancements to existing software or in product implementations in varied information technology environments. Internal quality assurance testing and customer testing may reveal product performance issues or desirable feature enhancements that could lead us to reallocate product development resources or postpone the release of new versions of our software. The reallocation of resources or any postponement could cause delays in the development and release of future enhancements to our currently available software, require significant additional professional services work to address operational issues, damage the reputation of our software in the marketplace and result in potential loss of revenue. Although we attempt to resolve all errors that we believe would be considered serious by our partners and customers, our software is not error-free. Undetected errors or performance problems may be discovered in the future, and known errors that we consider minor may be considered serious by our partners and customers. This could result in lost revenue, delays in customer deployment or legal claims and would be detrimental to our reputation. If our software experiences performance problems or ceases to demonstrate technology leadership, we may have to increase our product development costs and divert our product development resources to address the problems.

We may be unable to enforce or defend our ownership and use of proprietary and licensed technology.

We originally licensed the Cicero® technology and related patents on a worldwide basis from Merrill Lynch, Pierce, Fenner & Smith Incorporated in August of 2000 under a license agreement containing standard provisions and a two-year exclusivity period. On January 3, 2002, the license agreement was amended to extend our exclusive worldwide marketing, sales and development rights to Cicero® in perpetuity (subject to Merrill Lynch's rights to terminate in the event of bankruptcy or a change in control of the Company) and to grant ownership rights in the Cicero® trademark. Merrill Lynch indemnifies us with regard to the rights granted to us by them. Consideration for the original Cicero® license consisted of 10,000 shares of our common stock. In exchange for the amendment, we granted an additional 2,500 shares of common stock to MLBC, Inc., a Merrill Lynch affiliate and entered into a royalty sharing agreement. Under the royalty sharing agreement, we pay a royalty of 3% of the sales price for each sale of Cicero® or related maintenance services. The royalties over the life of the agreement are not payable in excess of $20 million. We have completely re-engineered the Cicero® software to provide increased functionality and much more powerful integration capabilities.

Our success depends to a significant degree upon our proprietary and licensed technology. We rely on a combination of patent, trademark, trade secret and copyright law, contractual restrictions and passwords to protect our proprietary technology. However, these measures provide only limited protection, and there is no guarantee that our protection of our proprietary rights will be adequate. Furthermore, the laws of some jurisdictions outside the United States do not protect proprietary rights as fully as in the United States. In addition, our competitors may independently develop similar technology; duplicate our products or design around our patents or our other intellectual property rights. We may not be able to detect or police the unauthorized use of our products or technology, and litigation may be required in the future to enforce our intellectual property rights, to protect our trade secrets or to determine the validity and scope of our proprietary rights. Additionally, with respect to the Cicero® line of products, there can be no assurance that Merrill Lynch will protect its patents or that we will have the resources to successfully pursue infringers. Any litigation to enforce our intellectual property rights would be expensive and time-consuming, would divert management resources and may not be adequate to protect our business.

We do not believe that any of our products infringe the proprietary rights of third parties. However, as the number of software products in the industry increases and the functionality of these products further overlaps, we believe that software developers and licensors may become increasingly subject to infringement claims. In addition, we may be required to indemnify our distribution partners and end- usersend-users for similar claims made against them. Any claims against us, with or without merit, would be time consuming, divert management resources, and could require us to spend significant time and money in litigation, pay damages, develop new intellectual property or acquire licenses to intellectual property that is the subject of the infringement claims. These licenses, if required, may not be available on acceptable terms. As a result, intellectual property claims against us could have a material adverse effect on our business, operating results and financial condition.

Our business may be adversely impacted if we do not provide professional services to implement our solutions.

Customers that license our software typically engage our professional services staff or third-party consultants to assist with product implementation, training and other professional consulting services. We believe that many of our software sales depend, in part, on our ability to provide our customers with these services and to attract and educate third-party consultants to provide similar services. New professional services personnel and service providers require training and education and take time and significant resources to reach full productivity. Competition for qualified personnel and service providers is intense within our industry. Our business may be harmed if we are unable to provide professional services to our customers to effectively implement our solutions of if we are unable to establish and maintain relationships with third-party implementation providers.

Because our software could interfere with the operations of customers, we may be subject to potential product liability and warranty claims by these customers.

Our software enables customers’ software applications to integrate and is often used for mission critical functions or applications. Errors, defects or other performance problems in our software or failure to provide technical support could result in financial or other damages to our customers. Customers could seek damages for losses from us. In addition, the failure of our software and solutions to perform to customers’ expectations could give rise to warranty claims. The integration of our software with our customer’s applications, increase the risk that a customer may bring a lawsuit us. Even if our software is not at fault, a product liability claim brought against us, even if not successful, could be time consuming and costly to defend and could harm our reputation.

We have not paid any cash dividends on our common stock and it is likely that no cash dividends will be paid in the future.

We have never declared or paid cash dividends on our common stock and we do not anticipate paying any cash dividends on our common stock in the foreseeable future.

Provisions of our Charter and Bylaws could deter takeover attempts.

Our certificate of incorporation authorizes the issuance, without stockholder approval, of preferred stock, with such designations, rights and preferences as the board of directors may determine preferences as from time to time. Such designations, rights and preferences established by the board may adversely affect our stockholders. In the event of issuance, the preferred stock could be used, under certain circumstances, as a means of discouraging, delaying or preventing a change of control of the Company. Although we have no present intention to issue any shares of preferred stock in addition to the currently outstanding preferred stock, we may issue preferred stock in the future.

Some of the rights granted to the holders of our Series A-1 Preferred Stock could prevent a potential acquirer from buying our company.

Holders of our Series A-1 Preferred Stock have the right to block the company from consummating a merger, sale of all or substantially all of its assets or recapitalization. Accordingly, the holder of our Series A-1 Preferred Stock could prevent the consummation of a transaction in which our stockholders could receive a substantial premium over the current market price for their shares.

We will not receive any proceeds from the sale of shares by the selling stockholders in this offering but may receive proceeds from the exercise of warrants held by certain of the selling stockholders. We expect to use any proceeds we receive for working capital and for other general corporate purposes, including research and product development.

PPRICE RICE RANGE OF OUR COMMON STOCK

Our common is currently quoted on the Over-The-Counter Bulletin Board. In January 2007 we formally changed our name to Cicero Inc. and now trade under the ticker CICN. The chart below sets forth the high and low stock prices for the quarters of the fiscal years ended December 31, 2008, 2007, and 2006 and for the first two quartersquarter of 20082009 (through May 31),February 3, 2009) as retroactively adjusted for the 100:1 reverse stock split. As of MayDecember 31, 2008, we had 226220 registered stockholders of record.

| 2007 | 2006 | |||||||||||||||

| Quarter | High | Low | High | Low | ||||||||||||

| First | $ | 2.60 | $ | 1.02 | $ | 3.00 | $ | 1.80 | ||||||||

| Second | $ | 1.13 | $ | 0.16 | $ | 2.50 | $ | 1.00 | ||||||||

| Third | $ | 0.75 | $ | 0.24 | $ | 2.10 | $ | 1.10 | ||||||||

| Fourth | $ | 0.29 | $ | 0.15 | $ | 4.50 | $ | 1.30 | ||||||||

| 2008 | 2007 | |||||||||||||||

| Quarter | High | Low | High | Low | ||||||||||||

| First | $ | 0.25 | $ | 0.14 | $ | 2.60 | $ | 1.02 | ||||||||

| Second | $ | 0.19 | $ | 0.14 | $ | 1.13 | $ | 0.16 | ||||||||

| Third | $ | 0.27 | $ | 0.17 | $ | 0.75 | $ | 0.24 | ||||||||

| Fourth | $ | 0.20 | $ | 0.09 | $ | 0.29 | $ | 0.15 | ||||||||

| 2008 | ||||||||

| Quarter | High | Low | ||||||

| First | $ | 0.25 | $ | 0.14 | ||||

| Second | $ | 0.19 | $ | 0.14 | ||||

| 2009 | ||||||||

| Quarter | High | Low | ||||||

| First | $ | 0.12 | $ | 0.12 | ||||

The closing price of the common stock on May 30, 2008,February 3, 2009, was $0.17$0.12 per share.

Our common stock is designated as “penny stock” and thus may be illiquid. The SEC has adopted rules (Rules 15g-2 through l5g-6 of the Exchange Act), which regulate broker-dealer practices in connection with transactions in “penny stocks.” Penny stocks generally are any non-NASDAQ or non-exchange equity securities with a price of less than $5.00, subject to certain exceptions. The penny stock rules require a broker-dealer to deliver a standardized risk disclosure document to provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, monthly account statements showing the market value of each penny stock held in the customers account, to make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity, if any, in the secondary market for a stock that is subject to the penny stock rules. Since our common stock is subject to the penny stock rules, persons holding or receiving such stock may find it more difficult to sell their shares. The market liquidity for the stock could be severely and adversely affected by limiting the ability of broker-dealers to sell the shares and the ability of stockholders to sell their stock in any secondary market.

The trading volume in our common stock has been and is extremely limited. The limited nature of the trading market can create the potential for significant changes in the trading price for the common stock as a result of relatively minor changes in the supply and demand for our common stock and perhaps without regard to our business activities.

The market price of our common stock may be subject to significant fluctuations in response to numerous factors, including: variations in our annual or quarterly financial results or those of our competitors; conditions in the economy in general; announcements of key developments by competitors; loss of key personnel; unfavorable publicity affecting our industry or us; adverse legal events affecting us; and sales of our common stock by existing stockholders.

DDIVIDEND IVIDEND POLICY

We have never declared or paid any cash dividends on our common stock. The payment of cash dividends on our common stock in the future will depend on our earnings, capital requirements, and operating and financial condition and on such other factors as our board of directors may consider appropriate. We currently expect to use all available funds to finance the future development and expansion of our business and for working capital and do not anticipate paying dividends on our common stock in the foreseeable future

SSELLING ELLING STOCKHOLDERS

Our shares of common stock to which this prospectus relates are being registered for resale by the selling stockholders. The following shows the name and number of shares of our common stock owned by the selling stockholders who may sell shares covered by this prospectus.

In March 2008, the Company was notified that a group of investors including two members of the Board of Directors acquired a short term promissory note due SDS Merchant Fund in the principal amount of $250,000. The note is unsecured and bears interest at 10% per annum. In March, our Board of Directors approved a resolution to convert this debt plus accrued interest into common stock of the Company. The total principal and interest amounted to $361,827$363,167 and was converted into 1,417,2641,425,137 shares of common stock. We refer to this issuance as the SDS Loan refinancing. Mr. John Steffens, the Company’s Chairman, acquired 472,516475,141 shares and Mr. Bruce Miller, also a member of our Board of Directors, acquired 472,374474,998 shares.

In October 2007, we agreed to restructure a promissory note (which we refer to as the Note) payable to Bank Hapoalim and guaranty by BluePhoenix Solutions. In connection with the restructuring, we entered into a long term loan with Mr. John Steffens, the Company’s Chairman, for $300,000 at an interest rate of 3.0 % and issued 188,285 warrants at $0.18 per share. Under a new agreement with BluePhoenix, we made a principal reduction payment to Bank Hapoalim in the amount of $300,000. Simultaneously, BluePhoenix paid $1,671,000 to Bank Hapoalim, thereby discharging that indebtedness. The Company and BluePhoenix entered into a new Note in the amount of $1,021,000, bearing interest at LIBOR plus 1.0% and maturing on December 31, 2011. In addition, BluePhoenix acquired 2,546,149 shares of our common stock in exchange for $650,000 paid to Bank Hapoalim to retire that indebtedness. In March 2008, we amended the terms of the Note with BluePhoenix Solutions. Under the terms of the original Note, the Company was to make a principal reduction payment in the amount of $350,000 on January 30, 2009. The Company and BluePhoenix agreed to accelerate that principal payment to March and AprilJuly 2008 in return for a conversion of $50,000 into 195,848 shares of the Company’s common stock. In March, the Company paid $200,000 plus accrued interest and in April,July the Company paid $100,000 plus accrued interest. Simultaneously in July 2008, we converted $100,000 of promissory notes payable to Mr. John Steffens, the Company’s Chairman, into 391,696 shares of the Company’s common stock. Per the securities agreement between the Company and BluePhoenix, an additional 60,000 shares were issued due to delays in filing a registration statement covering the shares held by BluePhoenix. We refer to these issuances as the BluePhoenix Loan conversion.

In October 2007, we completed a private sale of shares of our common stock to a group of investors, four of which are members of our Board of Directors. Under the terms of that agreement, we sold 2,169,311 shares of our common stock for $0.2457 per share for a total of $533,000. We refer to this private placement as our August 2007 offering. Participating in this consortium were Mr. John L. (Launny) Steffens, the Company’s Chairman, and Messrs. Bruce Miller, Don Peppers, and Bruce Percelay, members of the Board. Mr. Steffens converted the principal amount of his short term notes with the Company of $250,000 for 1,017,501 shares of common stock. Mr. Miller invested $20,000 for 81,400 shares of common stock, Mr. Peppers acquired 101,750 shares for a $25,000 investment and Mr. Bruce Percelay acquired 40,700 shares for a $10,000 investment.

The selling stockholders may resell all, a portion or none of such shares of common stock from time to time. The table below sets forth, as of the date of this prospectus, with respect to each selling stockholder, based upon information made available to us by each selling stockholder, the number of shares of common stock beneficially owned, the number of shares of common stock registered by this prospectus and the number and percent of outstanding common stock that will be owned after the sale of the registered shares of common stock assuming the sale of all of the registered shares of common stock under this prospectus.

| Name | Number of Shares of Common Stock Beneficially Owned Prior to Offering (1) | Number of Shares of Common Stock Offered | Shares Owned After Offering | Percent of Common Stock Beneficially Owned After Offering | ||||||||||||

| Steffens, John L. + | 5,382,668 | (2) | 2,072,623 | (3) | 3,310,045 | 7.2 | % | |||||||||

| Ahab International, Ltd.(a) | 4,813,698 | (4) | 323,661 | 4,490,037 | 9.8 | % | ||||||||||

| Ahab Partners, LP (a) | 4,101,688 | (5) | 354,837 | 3,746,851 | 8.2 | % | ||||||||||

| BluePhoenix Solutions, Ltd. (b) | 2,801,997 | 2,801,997 | - | - | ||||||||||||

| Miller, Bruce + | 1,982,244 | (6) | 556,398 | 1,425,846 | 3.1 | % | ||||||||||

| Paneyko, Steve | 1,638,559 | 81,400 | 1,557,159 | 3.4 | % | |||||||||||

| Percelay, Bruce + | 1,073,486 | 40,700 | 1,032,786 | 2.3 | % | |||||||||||

| Lucas, Scott | 979,734 | 40,700 | 939,034 | 2.1 | % | |||||||||||

| Name | Number of Shares of Common Stock Beneficially Owned Prior to Offering (1) | Number of Shares of Common Stock Offered | Shares Owned After Offering | Percent of Common Stock Beneficially Owned After Offering | ||||||||||||

| Casey, Kenneth | 819,164 | 40,700 | 778,464 | 1.7 | % | |||||||||||

| Lustgarten, Scott | 722,893 | (7) | 40,700 | 682,193 | 1.5 | % | ||||||||||

| Haines Family Assoc LP (c) | 716,315 | (8) | 623,214 | 93,101 | - | |||||||||||

| Keates, Richard M.D. | 672,925 | (9) | 122,100 | 550,825 | 1.2 | % | ||||||||||

| Stevens, Jim | 497,399 | (10) | 40,700 | 456,699 | - | |||||||||||

| Weitzman, Hervey | 270,283 | (11) | 20,350 | 249,933 | - | |||||||||||

| Wittenbach, Roger | 180,593 | 20,350 | 160,243 | - | ||||||||||||

| Howard, Joan | 165,130 | 28,490 | 136,640 | - | ||||||||||||

| Corwin, Leonard | 130,450 | (12) | 10,175 | 120,275 | - | |||||||||||

| Robinson, Jonathon | 125,732 | 20,350 | 105,382 | - | ||||||||||||

| Grodko, Steven | 124,385 | (13) | 124,135 | 250 | - | |||||||||||

| Blanck, Richard | 107,461 | 12,210 | 95,251 | - | ||||||||||||

| Peppers, Don + | 101,750 | 101,750 | - | - | ||||||||||||

| Whalen, Chris | 80,993 | 80,993 | - | - | ||||||||||||

| Grodko, Sandra | 43,700 | (14) | 40,700 | 3,000 | - | |||||||||||

| Sweet, Christine | 40,700 | 40,700 | - | - | ||||||||||||

| Sutro, Peter | 40,192 | 12,210 | 27,982 | - | ||||||||||||

| Miller, Douglas & Anita E. | 28,490 | 28,490 | - | - | ||||||||||||

| Total | 27,642,629 | 7,680,633 | 19,961,996 | |||||||||||||

| Name | Number of Shares of Common Stock Beneficially Owned Prior to Offering (1) | Number of Shares of Common Stock Offered | Shares Owned After Offering | Percent of Common Stock Beneficially Owned After Offering | ||||||||||||

| Steffens, John L. + | 5,382,668 | (2) | 2,072,623 | (3) | 3,310,045 | 7.2 | % | |||||||||

| Ahab International, Ltd.(a) | 4,813,698 | (4) | 323,661 | (5) | 4,490,037 | 9.8 | % | |||||||||

| Ahab Partners, LP (a) | 4,101,688 | (6) | 354,837 | (7) | 3,746,851 | 8.2 | % | |||||||||

| BluePhoenix Solutions, Ltd. (b) | 2,801,997 | 2,801,997 | (8) | - | - | |||||||||||

| Miller, Bruce + | 1,982,244 | (9) | 556,398 | (10) | 1,425,846 | 3.1 | % | |||||||||

| Paneyko, Steve | 1,638,559 | 81,400 | (11) | 1,557,159 | 3.4 | % | ||||||||||

| Percelay, Bruce + | 1,073,486 | 40,700 | (12) | 1,032,786 | 2.3 | % | ||||||||||

| Lucas, Scott | 979,734 | 40,700 | (13) | 939,034 | 2.1 | % | ||||||||||

| Casey, Kenneth | 819,164 | 40,700 | (14) | 778,464 | 1.7 | % | ||||||||||

| Lustgarten, Scott | 722,893 | (15) | 40,700 | (16) | 682,193 | 1.5 | % | |||||||||

| Haines Family Assoc LP (c) | 716,315 | (17) | 623,214 | (18) | 93,101 | - | ||||||||||

| Keates, Richard M.D. | 672,925 | (19) | 122,100 | (20) | 550,825 | 1.2 | % | |||||||||

| Stevens, Jim | 497,399 | (21) | 40,700 | (22) | 456,699 | - | ||||||||||

| Weitzman, Hervey | 270,283 | (23) | 20,350 | (24) | 249,933 | - | ||||||||||

| Wittenbach, Roger | 180,593 | 20,350 | (25) | 160,243 | - | |||||||||||

| Howard, Joan | 165,130 | 28,490 | (26) | 136,640 | - | |||||||||||

| Corwin, Leonard | 130,450 | (27) | 10,175 | (28) | 120,275 | - | ||||||||||

| Robinson, Jonathon | 125,732 | 20,350 | (29) | 105,382 | - | |||||||||||

| Grodko, Steven | 124,385 | (30) | 124,135 | (31) | 250 | - | ||||||||||

| Blanck, Richard | 107,461 | 12,210 | (32) | 95,251 | - | |||||||||||

| Peppers, Don + | 101,750 | 101,750 | (33) | - | - | |||||||||||

| Whalen, Chris | 80,993 | 80,993 | (34) | - | - | |||||||||||

| Grodko, Sandra | 43,700 | (35) | 40,700 | (36) | 3,000 | - | ||||||||||

| Sweet, Christine | 40,700 | 40,700 | (37) | - | - | |||||||||||

| Sutro, Peter | 40,192 | 12,210 | (38) | 27,982 | - | |||||||||||

| Miller, Douglas & Anita E. | 28,490 | 28,490 | (39) | - | - | |||||||||||

| Total | 27,642,629 | 7,680,633 | 19,961,996 | |||||||||||||

| + | Member of the Board of Directors of the Company |

| (a) | Jonathan Gallen is an investment adviser for, and exercises sole voting and investment authority with respect to the securities held by, each of (i) Ahab Partners, L.P., (ii) Ahab International, Ltd. |

| (b) | Yael Peretz, |

| (c) | John Haines, representative of Haines Family Associates, LP, exercises sole |

| (1) | The number of shares of common stock owned by each selling stockholder includes the aggregate number of shares of common stock which may be obtained by each stockholder upon conversion of all of the Series A1 Preferred Stock owned by the stockholder. It also includes the aggregate number of shares of common stock that may be obtained upon exercise of warrants to purchase common stock owned by such stockholder. The informtation in this table assumes that all shares offered are sold. |

| (2) | Includes 14,832 shares of common stock issuable upon conversion of Series A-1 Preferred Stock, and 207,529 shares of common stock issuable upon exercise of warrants. The exercise price of 4,912 warrants at $40 per share, the exercise price of 14,332 warrants at $10 per share, and the exercise price of 188,285 warrants at $0.18 per share. Also includes 5,160,307 shares of common stock. Mr. Steffens is a member of the Company’s Board of Directors. |

| (3) | Includes |

| (4) | Owns 4,801,186 shares of common stock and 12,512 shares issuable upon the exercise of warrants. The exercise prices of the warrants are as follows: 3,194 at $40.00 per share, and 9,318 at $10.00 per share. |

| (5) | Includes 109,890 shares of common stock issued in connection with the August 2007 offering and 213,771 shares of common stock in connection with the SDS Loan refinancing. |

| (6) | Owns 4,094,950 shares of common stock and 6,738 shares issuable upon the exercise of warrants. The exercise prices of the warrants are as follows: 1,720 at $40.00 per share, and 5,018 at $10.00 per share. |

| Includes 93,610 shares of common stock issued in connection with the August 2007 offering and 261,227 shares of common stock in connection with the SDS Loan refinancing. |

| (8) | Includes 2,801,997 shares of common stock issued in connection with the BluePhoenix Loan conversion. |

| (9) | Owns 19,166 shares of common stock issuable upon exercise of warrants. The exercise price of 2,457 warrants at $40 per share, and the exercise price of 16,709 warrants at $10 per share. Also includes 1,963,078 shares of common stock. Mr. Miller is a member of the Company’s Board of Directors. |

| Includes 81,400 shares of common stock issued in connection with the August 2007 offering and 474,998 shares of common stock in connection with the SDS Loan refinancing. |

| (11) | Includes 81,400 shares of common stock issued in connection with the August 2007 offering. |

| (12) | Includes 40,700 shares of common stock issued in connection with the August 2007 offering. |

| (13) | Includes 40,700 shares of common stock issued in connection with the August 2007 offering. |

| (14) | Includes 40,700 shares of common stock issued in connection with the August 2007 offering. |

| (15) | Owns 1,000 shares of common stock issuable upon conversion of Series A-1 Preferred Stock. Also owns |

| Includes 40,700 shares of common stock issued in connection with the August 2007 offering. |

| (17) | Owns 2,000 shares of common |

| In April 2008, the Company issued 623,214 shares of the Company’s common stock to Haines Family Trust to satisfy the obligation of $159,106 for rent payable. |

| (19) | Owns 18,778 shares of common stock issuable upon exercise of warrants. The exercise price of 1,982 warrants is $20 per share, and the exercise price of 16,796 warrants is $10 per share. Also includes 654,147 shares of common stock. |

| Includes 122,100 shares of common stock issued in connection with the August 2007 offering. |

| (21) | Owns 6,031 shares of common stock issuable upon exercise of warrants exercisable at $10 per share. Also owns 491,368 shares of common stock. |

| Includes 40,700 shares of common stock issued in connection with the August 2007 offering. |

| (23) | Owns 278 shares of common stock issuable upon exercise of warrants exercisable at $10 per share. Also includes 270,005 shares of common stock. |

| Includes 20,350 shares of common stock issued in connection with the August 2007 offering. |

| (25) | Includes 20,350 shares of common stock issued in connection with the August 2007 offering. |

| (26) | Includes 28,490 shares of common stock issued in connection with the August 2007 offering. |

| (27) | Owns 222 shares of common stock issuable upon exercise of warrants exercisable at $10 per share. Also includes 130,228 shares of common stock. |

| Includes 10,175 shares of common stock issued in connection with the August 2007 offering. |

| (29) | Includes 20,350 shares of common stock issued in connection with the August 2007 offering. |

| (30) | Owns 250 shares of common stock issuable upon exercise of warrants exercisable at $10 per share. Also includes 124,135 shares of common stock. |

| Includes 124,135 shares of common stock issued in connection with the August 2007 offering. |

| (32) | Includes 12,210 shares of common stock issued in connection with the August 2007 offering. |

| (33) | Includes 101,750 shares of common stock issued in connection with the August 2007 offering. |

| (34) | In June 2008, the Company entered into an agreement to issue 80,993 shares of the Company’s common stock to Chris Whelan to satisfy the obligation of $20,678 for consulting fees payable. These shares were issued in July 2008. |

| (35) | Owns 3,000 shares of common stock issuable upon exercise of warrants exercisable at $10 per share. Also includes 40,700 shares of common stock. |

| (36) | Includes 40,700 shares of common stock issued in connection with the August 2007 offering. |

| (37) | Includes 40,700 shares of common stock issued in connection with the August 2007 offering. |

| (38) | Includes 12,210 shares of common stock issued in connection with the August 2007 offering. |

| (39) | Includes 28,490 shares of common stock issued in connection with the August 2007 offering. |

PPLAN LAN OF DISTRIBUTION

We are registering the shares of common stock on behalf of the selling stockholders. All costs, expenses and fees in connection with the registration of the shares offered by this prospectus will be borne by us, other than brokerage commissions and similar selling expenses, if any, attributable to the sale of shares which will be borne by the selling stockholders. We have agreed to indemnify the selling stockholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act. Sales of shares may be effected by selling stockholders in one or more types of transactions (which may include block transactions), in the over-the-counter market, any exchange or quotation system, in negotiated transactions, through put or call options transactions relating to the shares, through short sales of shares, or a combination of any such methods of sale, and any other method permitted pursuant to applicable law, at market prices prevailing at the time of sale, or at negotiated prices. Such transactions may or may not involve brokers or dealers.

The selling stockholders may enter into hedging transactions with broker-dealers or other financial institutions. In connection with such transactions, broker-dealers or other financial institutions may engage in short sales of the shares or of securities convertible into or exchangeable for the shares in the course of hedging positions they assume with selling stockholders. The selling stockholders may also enter into options or other transactions with broker-dealers or other financial institutions which require the delivery to such broker-dealers or other financial institutions of shares offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as amended or supplemented to reflect such transaction). The selling stockholders may pledge and/or loan these shares to broker-dealers who may borrow the shares against their hedging short position and in turn sell these shares under the prospectus to cover such short position.

The selling stockholders may make these transactions by selling shares directly to purchasers or to or through broker-dealers, which may act as agents or principals. Such broker-dealers may receive compensation in the form of discounts, concessions or commissions from selling stockholders and/or the purchasers of shares for whom such broker-dealers may act as agents or to whom they sell as principal, or both (which compensation as to a particular broker-dealer is not expected to be in excess of customary commissions).

The selling stockholders and any broker-dealers that act in connection with the sale of shares may be deemed to be “underwriters” within the meaning of Section 2(11) of the Securities Act, and any commissions received by such broker-dealers or any profit on the resale of the shares sold by them while acting as principals might be deemed to be underwriting discounts or commissions under the Securities Act. The selling stockholders may agree to indemnify any agent, dealer or broker-dealer that participates in transactions involving sales of the shares against certain liabilities, including liabilities arising under the Securities Act.

Because selling stockholders may be deemed “underwriters” within the meaning of Section 2(11) of the Securities Act, the selling stockholders may be subject to the prospectus delivery requirements of the Securities Act. We have informed the selling stockholders that the anti-manipulative provisions of Regulation M promulgated under the Exchange Act may apply to their sales in the market.

Selling stockholders also may resell all or a portion of the shares in open market transactions in reliance upon Rule 144 under the Securities Act provided they meet the criteria and conform to the requirements of Rule 144.

Upon our being notified by a selling stockholder that any material arrangement has been entered into with a broker-dealer for the sale of shares through a block trade, special offering, exchange distribution or secondary distribution or a purchase by a broker or dealer, a supplement to this prospectus will be filed, if required, pursuant to Rule 424(b) under the Securities Act, disclosing:

| · | the name of each such selling stockholder and of the participating broker-dealer(s); |

| · | the number of shares involved; |

| · | the initial price at which such shares were sold; |

| · | the commissions paid or discounts or concessions allowed to such broker-dealer(s), where applicable; |

| · | that such broker-dealer(s) did not conduct any investigation to verify the information set out or incorporated by reference in this prospectus; and |

| · | other facts material to the transactions. |

In addition, upon our being notified by a selling stockholder that a donee or pledgee intends to sell more than 500 shares, a supplement to this prospectus will be filed. The selling stockholder may from time to time pledge or grant a security interest in some or all of the shares or common stock or warrants owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares of common stock from time to time under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act of 1933 amending the list of selling stockholders to include the pledgee, transferee or other successors in interest as selling stockholders under this prospectus.

The selling stockholders also may transfer the shares of common stock in other circumstances, in which case the transferees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

SELSELECTED ECTED CONSOLIDATED FINANCIAL DATA

The following selected financial data is derived from the consolidated financial statements of the Company. The data should be read in conjunction with the consolidated financial statements, related notes, and other financial information included herein.

Year Ended December 31, (in thousands, except per share data) | Three Months Ended March 31, | Year Ended December 31, (in thousands, except per share data) | Nine Months Ended September 30, | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2003 | 2004 | 2005 | 2006 | 2007 | 2007 | 2008 | 2003 | 2004 | 2005 | 2006 | 2007 | 2007 | 2008 | |||||||||||||||||||||||||||||||||||||||||||

| SELECTED STATEMENT OF OPERATIONS DATA | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Revenue | $ | 530 | $ | 775 | $ | 785 | $ | 972 | $ | 1,808 | $ | 232 | $ | 470 | $ | 530 | $ | 775 | $ | 785 | $ | 972 | $ | 1,808 | $ | 935 | $ | 2,475 | ||||||||||||||||||||||||||||

| Loss from continuing operations | $ | (9,874 | ) | $ | (9,731 | ) | $ | (3,681 | ) | $ | (2,997 | ) | $ | (1,975 | ) | $ | (529 | ) | $ | (485 | ) | $ | (9,874 | ) | $ | (9,731 | ) | $ | (3,681 | ) | $ | (2,997 | ) | $ | (1,975 | ) | $ | (1,809 | ) | $ | (463 | ) | ||||||||||||||

| Loss from continuing operations per common share – basic and diluted | $ | (54.00 | ) | $ | (27.05 | ) | $ | (8.27 | ) | $ | (0.25 | ) | $ | (0.05 | ) | $ | (0.01 | ) | $ | (0.01 | ) | $ | (54.00 | ) | $ | (27.05 | ) | $ | (8.27 | ) | $ | (0.25 | ) | $ | (0.05 | ) | $ | (0.06 | ) | $ | (0.01 | ) | ||||||||||||||

| Weighted average common and common equivalent shares outstanding– basic and diluted | 215 | 360 | 445 | 35,182 | 36,771 | 38,930 | 43,879 | 215 | 360 | 445 | 35,182 | 36,771 | 34,785 | 45,682 | ||||||||||||||||||||||||||||||||||||||||||

| December 31, | March 31, | December 31, | September 30, | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2003 | 2004 | 2005 | 2006 | 2007 | 2007 | 2008 | 2003 | 2004 | 2005 | 2006 | 2007 | 2007 | 2008 | |||||||||||||||||||||||||||||||||||||||||||

| SELECTED BALANCE SHEET DATA | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Working capital (deficiency) | $ | (6,555 | ) | $ | (10,255 | ) | $ | (13,894 | ) | $ | (7,894 | ) | $ | (6,132 | ) | $ | (7,870 | ) | $ | (6,330 | ) | $ | (6,555 | ) | $ | (10,255 | ) | $ | (13,894 | ) | $ | (7,894 | ) | $ | (6,132 | ) | $ | (6,252 | ) | $ | (6,039 | ) | ||||||||||||||

| Total assets | 5,362 | 530 | 241 | 597 | 1,251 | 739 | 620 | 5,362 | 530 | 241 | 597 | 1,251 | 448 | 871 | ||||||||||||||||||||||||||||||||||||||||||

| Long-term debt, including current maturities | 2,756 | 5,444 | 7,931 | 2,932 | 2,558 | 33 | 1,122 | 2,756 | 5,444 | 7,931 | 2,932 | 2,558 | 1,323 | 971 | ||||||||||||||||||||||||||||||||||||||||||

| Senior convertible redeemable preferred stock | 3,355 | 1,367 | 1,061 | -- | -- | -- | -- | 3,355 | 1,367 | 1,061 | -- | -- | -- | -- | ||||||||||||||||||||||||||||||||||||||||||

| Stockholders' deficiency | (6,103 | ) | (11,857 | ) | (15,076 | ) | (7,912 | ) | (7,433 | ) | (7,884 | ) | (7,431 | ) | (6,103 | ) | (11,857 | ) | (15,076 | ) | (7,912 | ) | (7,433 | ) | (8,203 | ) | (6,962 | ) | ||||||||||||||||||||||||||||

BBUSINESSUSINESS

Overview

Cicero Inc, formerly known as Level 8 Systems, Inc. (“we”, “us” or the “Company”) is a provider of business integration software, which enables organizations to integrate new and existing information and processes at the desktop. Our business integration software addresses the emerging need for companies’ information systems to deliver enterprise-wide views of their business information processes. In addition to software products, we also provide technical support, training and consulting services as part of itsour commitment to providing itsour customers with industry-leading integration solutions. Our consulting team has in-depth experience in developing successful enterprise-class solutions as well as valuable insight into the business information needs of customers in the largest 500 corporations worldwide (the “Global 500”).

Our focus is on the desktop integration and business process automation market with our Cicero® product. Cicero® is a business application integration platform that enhances end-user productivity, streamlines business operations and integrates systems and applications that would not otherwise work together. Cicero® software offers a proven, innovative departure from traditional, costly and labor-intensive enterprise application integration, which occurs at the server level. Cicero® provides non-invasive application integration at the desktop level. Desktop level integration provides the user with a single environment with a consistent look and feel for diverse applications across multiple operating environments, reduces enterprise integration implementation cost and time, and supports a Service-Oriented Architecture (“SOA”). Cicero®’s desktop level integration also enables clients to transform applications, business processes and human expertise into a seamless, cost effective business solution that provides a cohesive, task-oriented and role-centric interface that works the way people think.

By using Cicero® software, we believe companies can decrease their customer management costs, improve their customer service and more efficiently cross-sell the full range of their products and services resulting in an overall increase in return on their information technology investments. In addition, we believe Cicero® software enables organizations to reduce the business risks inherent in replacement or re-engineering of mission-critical applications and extend the productive life and functional reach of their application portfolio.

Cicero® software is engineered to integrate diverse business applications and shape them to more effectively serve the people who use them. Cicero® provides an intuitive integration and development environment, which simplifies the integration of complex multi-platform applications. Cicero® provides a unique approach that allows companies to organize components of their existing applications to better align them with tasks and operational processes. In addition, Cicero® can streamline end-user tasks by providing a single, seamless user interface for simple access to multiple systems or be configured to display one or more composite applications to enhance productivity. Cicero® software enables automatic information sharing among line-of-business applications and tools. It is ideal for deployment in contact centers where its highly productive, task-oriented user interface promotes user efficiency. Finally, Cicero® software, by integrating diverse applications across multiple operating systems, is ideal for the financial services, for which Cicero® was initially developed, insurance, telecommunications, intelligence, security, law enforcement, governmental and other industries requiring a cost-effective, proven application integration solution. Cicero® is also an integration solution for merger and acquisition events where the sharing of data and combining of systems is imperative.

Some of the companies and other users that have implemented or are implementing our Cicero® software product include Merrill Lynch Pierce Fenner & Smith Incorporated, Nationwide Financial Services, IBM and N.E.W. Customer Service Companies. We have also sold to intelligence, security, law enforcement and other government users.

Cicero Inc. was incorporated in New York in 1988 as Level 8 Systems, Inc. and re-incorporated in Delaware in 1999. Our principal executive offices are located at 8000 Regency Parkway, Suite 542, Cary, NC 27518 and our telephone number is (919) 380-5000. Our web site is www.ciceroinc.com. Information contained on our website is not part of this prospectus.

Strategic Realignment

Historically, we have been a global provider of software solutions designed to help companies integrate new and existing applications as well as extend those applications to the Internet. This market segment is commonly known as Enterprise Application Integration or EAI. Historically, EAI solutions work directly at the server or back-office level allowing disparate applications to communicate with each other.

Until early 2001, we focused primarily on the development, sale and support of EAI solutions through our Geneva product suite. After extensive strategic consultation with outside advisors and an internal analysis of our products and services, we recognized that a new market opportunity had emerged. This opportunity was represented by the increasing need to integrate applications that are physically resident on different platforms, a typical situation in larger companies. In most cases, companies with large customer bases utilize numerous different, or "disparate," applications that were not designed to effectively communicate and pass information. In addition, traditional EAI is often times too costly and time-consuming to implement. It also requires a group of programmers with the necessary skills and ongoing invasive changes to application software code throughout the enterprise. With Cicero® software, which non-invasively integrates the functionality of these disparate applications at the desktop, we believe that we have found a unique solution to this disparate application problem. We believe that our existing experience in and understanding of the EAI marketplace coupled with the unique Cicero® software solution, which approaches traditional EAI needs in a more effective manner, position us to be a competitive provider of business integration solutions to the financial services and other industries with large deployed contact centers, as well as our other target markets.

We originally licensed the Cicero® technology and related patents on a worldwide basis from Merrill Lynch, Pierce, Fenner & Smith Incorporated in August of 2000 under a license agreement containing standard provisions and a two-year exclusivity period. On January 3, 2002, the license agreement was amended to extend our exclusive worldwide marketing, sales and development rights to Cicero® in perpetuity (subject to Merrill Lynch's rights to terminate in the event of bankruptcy or a change in control of the Company) and to grant ownership rights in the Cicero® trademark. Merrill Lynch indemnifies us with regard to the rights granted to us by them. Consideration for the original Cicero® license we issued to Merrill Lynch consisted of 10,000 shares of our common stock. In consideration for the amendment, we issued an additional 2,500 shares of common stock to MLBC, Inc., a Merrill Lynch affiliate and entered into a royalty sharing agreement. Under the royalty sharing agreement, we pay a royalty of 3% of the sales price for each sale of Cicero® or related maintenance services. The royalties over the life of the agreement are not payable in excess of $20 million. We have completely re-engineered the Cicero® software to provide increased functionality and much more powerful integration capabilities.