As filed with the Securities and Exchange Commission on October 26, 2012July 15, 2013

Registration No. 333-333-189422

|

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1 to

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

MusclePharm Corporation

(Exact name of registrant as specified in its charter)

| Nevada | 2834 | 77-0664193 | ||

(State or other jurisdiction | ||||

of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

4721 Ironton Street, Building A

Denver, Colorado 80239

Telephone: (303) 396-6100

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Brad J. Pyatt

Co-Chairman, Chief Executive Officer and President

MusclePharm Corporation

5348 Vegas Drive

Las Vegas, Nevada 89108

Telephone: (702) 953-1890

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Harvey J. Kesner, Esq.

Arthur S. Marcus, Esq.

Sichenzia Ross Friedman Ference LLP

61 Broadway, 32nd Floor

New York, New York 10006

Telephone: (212) 930-9700

Fax: (212) 930-9725

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: o¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | Accelerated filer |

| Non-accelerated filer | Smaller reporting company x |

CALCULATION OF REGISTRATION FEE

| Proposed Maximum | Amount of | |||||||

| Title of Each Class of Securities to be Registered | Aggregate Offering Price(1) $ | Registration Fee(2) $ | ||||||

| Common Stock, par value $0.001 per share (2)(3) | $ | 19,550,000 | $ | 2,667 | ||||

| Representative’s Common Stock Purchase Warrant | (4 | ) | ||||||

| Shares of Common Stock underlying Representative’s Common Stock Purchase Warrant (2)(5) | $ | 1,062,500 | $ | 145 | ||||

| Total | $ | 20,612,500 | $ | 2,812 | ||||

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Amount to be Registered(1) | Proposed Maximum Offering Price per Share(2) | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee | ||||||||||||

| Shares of Common Stock, par value $0.001 per share | 1,740,691 | (2) | $ | 10.76 | $ | 18,729,835.16 | $ | 2,554.77 | ||||||||

| (1) | Pursuant to Rule 416 under the Securities Act of 1933, as amended, the shares being registered hereunder include such indeterminate number of shares of common stock, as may be issuable with respect to the shares being registered hereunder as a result of stock splits, stock dividends or similar transactions. |

| (2) | Estimated solely for purposes of calculating the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended, using the average of the high and low prices as reported on the OTCBB on June 11, 2013, which was $10.76 per share. |

| The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted. | ||||

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED | ||

|

1,740,691 Shares of Common Stock

We are registering an aggregate of 1,740,691 shares of common stock, $0.001 par value per share (the “Common Stock”) of MusclePharm Corporation is offering shares of its common stock pursuant(referred to this prospectus. We expect to effect a 1-for-650 reverse stock splitherein as “we” ,“us”, “our”, “MusclePharm”, “Registrant”, or the “Company”) for resale by certain of our common stock prior to offering these securities. Informationshareholders identified in this prospectus is provided on(the “Selling Shareholders”), of which 703,236 were issued to them in the March 2013 Private Placement, 100,000 shares were issued in a post-reverse stock split basis giving effectMay 2013 Private Placement, 150,000 were issued in a June 2013 Private Placement and an aggregate of 787,455 of which were issued pursuant to such 1-for-650 reverse stock split as if it had occurred priorthree consulting agreements (the “Resale Shares”). Please see “Selling Shareholders” beginning at page 60.

The Selling Shareholders may offer to sell the Resale Shares at fixed prices, at prevailing market prices at the time of sale, at varying prices or at negotiated prices, and will pay all brokerage commissions and discounts attributable to the date hereof unless otherwise indicated.sale of such shares. The Selling Shareholders will receive all of the net proceeds from the offering of their shares.

The Resale Shares may be sold by the Selling Shareholders to or through underwriters or dealers, directly to purchasers or through agents designated from time to time. For additional information regarding the methods of sale you should refer to the section entitled “Plan of Distribution” in this Prospectus.

Our common stock is presently quoted on the OTCBB under the symbol “MSLP.OB”. We have applied to list our common stock on The NASDAQ Capital Market under the symbol “MSPH”. On October 25, 2012,July 9, 2013, the last reported sale price for our common stock on the OTC QBBB was $3.45$10.85 per share after giving pro forma effect to the 1-for-650 reverse stock split of our common stock.share.

Our business and an investment in our securities involve a high degree of risk. See “Risk Factors” beginning on page 78 of this prospectus for a discussion of information that you should consider before investing in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters may also purchase up to an additional shares of common stock from us at the public offering price, less the underwriting discount, within 45 days from the date of this prospectus to cover over-allotments, if any.

The underwriters expect to deliver the shares against payment therefor on or about , 2012.

The date of this prospectus is , 2012

TABLE OF CONTENTS

| Page | |

| Prospectus Summary | |

| Risk Factors | |

| Cautionary Note Regarding Forward-Looking Statements and Industry Data | |

| Use of Proceeds | |

| Price Range of Common Stock | |

| Dividend Policy | |

| Dilution | |

| Capitalization | |

| Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

| Business | |

| Management | |

| Security Ownership of Certain Beneficial Owners and Management | |

| Certain Relationships and Related Party Transactions | 52 |

| Description of Series D Preferred Stock | 55 |

| Description of Securities | |

| Legal Matters | |

| Experts | |

| Where You Can Find More Information | |

| Index to Financial Statements |

You should rely only on the information contained in this prospectus or in any free writing prospectus that we may specifically authorize to be delivered or made available to you. We have not, and the underwriters have not authorized anyone to provide you with any information other than that contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus may only be used where it is legal to offer and sell shares of our common stock.securities. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our common stock.securities. Our business, financial condition, results of operations and prospects may have changed since that date. We are not and the underwriters are not, making an offer of these securities in any jurisdiction where the offer is not permitted.

For investors outside the United States: We have not and the underwriters have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside the United States.

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock,securities, you should carefully read this entire prospectus, including our financial statements and the related notes and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in each case included elsewhere in this prospectus.

Unless otherwise stated or the context requires otherwise, references in this prospectus to “MusclePharm”, the “Company”, “we”, “us”, or “our” refer to MusclePharm Corporation. Unless otherwise stated or the context requires otherwise,Corporation, and information in this prospectus gives effect to the 1-for-6501-for-850 reverse stock split of our common stock that we intend to effect prior to offering these securities.effected on November 26, 2012.

MusclePharm Corporation

Business Overview

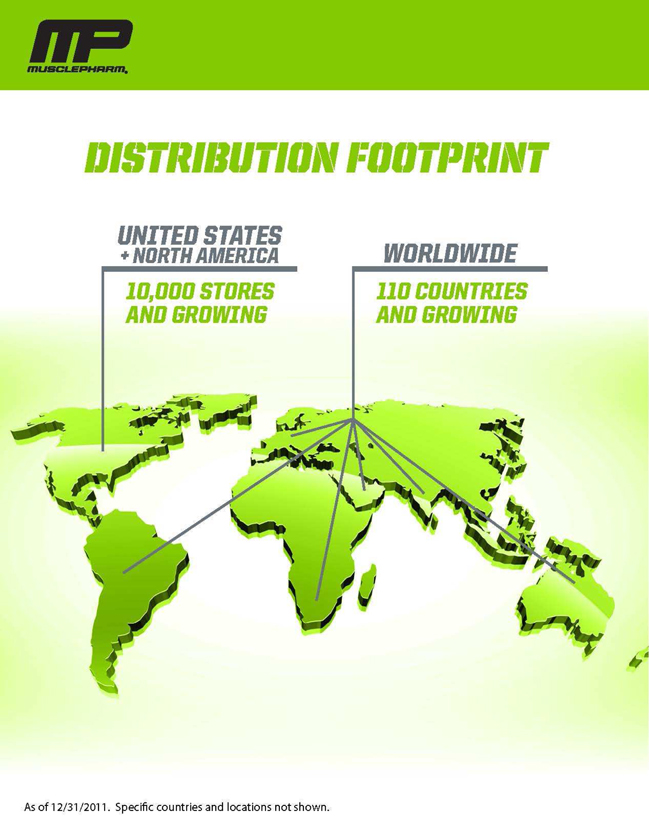

We develop, marketMusclePharm Corporation was initially incorporated in the State of Nevada on August 4, 2006, under the name Tone in Twenty, for the purpose of engaging in the business of providing personal fitness training using isometric techniques (Tone in Twenty”). Tone in Twenty was never able to raise the level of funding necessary to commence operations. On February 18, 2010, the Company acquired all of the issued and sell athlete-focused, high quality nutritional supplements primarilyoutstanding equity and voting interests of Muscle Pharm, LLC, a Colorado limited liability company, in exchange for 26,000,000 pre-split shares of the Company’s common stock. The shares were issued pursuant to specialty resellers. Our products have been formulated to enhance active fitness regimens, including muscle building, weight loss and maintaining general fitness. Our nutritional supplements are available for purchase in over 10,000 U.S. retail outlets, including Dick’s Sporting Goods, GNC, Vitamin Shoppe and Vitamin World. We also sell our products to over 100 online channels, including bodybuilding.com, amazon.com, gnc.com and vitacost.com. Internationally, our nutritional supplements are sold in over 110 countries, and we expect that international sales will becertain Securities Exchange Agreement, dated February 1, 2010 (the Securities Exchange Agreement”). As a significantresult of this transaction, Muscle Pharm, LLC became a wholly owned subsidiary of the Company. The 26,000,000 pre-split shares represented approximately 99.7% of the common stock outstanding following the closing of such transaction. As part of our salessuch transaction, the Company’s former President sold his 366,662 pre-split shares to Muscle Pharm, LLC for the foreseeable future.$25,000 and these shares were then cancelled.

We started formulating our nutritional supplements in 2008 for consumptionAs part of the Securities Exchange Agreement, the Company agreed to seek shareholder approval of an amendment to the Company’s Articles of Incorporation changing the name of the Company to MusclePharm Corporation.” This amendment was approved by active individuals, high performance athletesa majority of the Company’s shareholders and fitness enthusiasts. We launched our sales and marketing programs in late 2008 through our internal sales executives and staff targeting specialty retail distributors.the name change became effective on March 1, 2010.

Our wide-rangeMusclePharm currently manufactures and markets wide-ranging variety of nutritional supplements, include Assault™high-quality sports nutrition products, including: AssaultTM , Battle FuelTM , Bullet ProofTM, Combat Powder™TM, MusclePharm Musclegel®, MusclePharm Shred Matrix®SHRED Matrix®, and Re-Con®Re-con®. These products are comprised of amino acids, herbs,herb, and proteins scientifically tested by our scientistsand proven as safe and effective for the overall health of athletes. We developed theseThese nutritional supplements were created to enhance the effects of workouts, repair muscles, and nourish the body for optimal physical fitness.

Our Growth and Core Marketing Strategy

Our primary growth strategy is to:

| · | increase our product distribution and sales through increased market penetrations both domestically and internationally; |

| · | increase our margins by focusing on streamlining our operations and seeking operating efficiencies in all areas of our operations; |

| · | continue to conduct additional testing of the safety and efficacy of our products and formulate new products; and |

| · | increase awareness of our products by increasing our marketing and branding opportunities through endorsements, sponsorships and brand extensions. |

Our Core Marketing Strategy

Our core marketing strategy is to brand MusclePharm as the “must have” fitness brand for workout enthusiasts and elite athletes. We seek to be known as the athlete’s company,The Athletes Company® , run by athletes who create their products for other athletes, both professional and otherwise. We believe that our marketing mix of endorsers, sponsorships and providing sample products for our retail resellers to use is an optimal strategy to increase sales.

Recent Developments

We have recently experienced significant growth in our product sales. Our net sales for the years ended December 31, 2010 and 2011 were $3.2 million and $17.2 million, respectively. Our net sales for the six months ended June 30, 2011 and 2012 were $6.4 million and $32.0 million, respectively.

Conversion of Warrants into Common Stock

In late September 2012, we issued 670,364 shares of our common stock to several accredited investors pursuant to conversions of warrants to purchase an aggregate of 946,438 shares of common stock of the Company.

As a result of these warrant conversions and other extinguishments of derivative liabilities during the quarter ended September 30, 2012, our pro forma adjusted capitalization as of June 30, 2012 reflects a decrease in stockholders’ deficit from approximately $11,417,000 to approximately $6,815,000 and a reduction in our derivative liabilities as of June 30, 2012 from approximately $7,909,000 to approximately $25,000. All of these stock issuances, warrant conversions and extinguishments of derivative liabilities will be reflected in our financial statements as of and for the three and nine months ended September 30, 2012.

Proportionate Reverse Stock Split and Increase in Number of Authorized Shares of Common Stock

On October 15,November 26, 2012, our board of directors approvedwe (i) effected a 1-for-6501-for-850 reverse stock split of our common stock, including a proportionate reduction in the number of authorized shares of our common stock from 2.52.36 billion shares to 3,846,1532.8 million shares of common stock, which we intend to effect prior to the offering of these securities; and (ii) an amendment toamended our articles of incorporation to increase the number of authorized shares of common stock (post reverse stock-split)stock split) from 3,846,1532,941,177 to 100 million effective November 27, 2012. Unless otherwise indicated, all share and recommended the proposal for approvalper share amounts in this document have been changed to give effect to the holders havingreverse stock split.

Conversion of Warrants into Common Stock

In late September 2012, we issued 512,675 shares of our common stock to several accredited investors pursuant to conversions of warrants to purchase an aggregate of 723,747 shares of our common stock. As a result of these warrant conversions and other extinguishments of derivative liabilities during the powerquarter ended September 30, 2012, our stockholders’ deficit decreased from $11,013,113 at June 30, 2012 to vote with respect$7,297,593 at September 30, 2012 and our derivative liabilities decreased from $7,908,960 at June 30, 2012 to the$24,889 at September 30, 2012. On December 5, 2012, we converted a warrant exercisable for 4,902 shares of common stock into 3,677 shares of our common stock. Thereafter, our derivative liability was reduced to approximately $300 as of December 5, 2012.

Registered Direct Offerings

On October 18, 2012,February 4, 2013, we completed the holdersfinal closing of our registered direct offering of an aggregate of 1,500,000 shares of our Series BD Convertible Preferred Stock, who holdat a public offering price of $8.00 per share pursuant to an offering registered with the SEC. Each share of Series D Convertible Preferred Stock is convertible into two shares of common stock, subject to adjustment. Our net proceeds from the offering were approximately 50.99%$10.8 million after placement agent discounts, and other offering expenses of $1.2 million. Net proceeds from this offering were used to reduce indebtedness and for other corporate purposes.

As of July 9, 2013, 1,355,000 Series D shares have been converted into 2,710,000 shares of the total voting powerCompany’s common stock and 145,000 shares of all issued and outstanding voting capitalSeries D preferred stock remain outstanding.

Private Placements of Common Stock

On March 26, 2013, the Company approvedentered into subscription agreements with non-affiliated accredited investors for the amendmentissuance of 703,236 shares of common stock pursuant to exemptions from registration under federal and state securities laws. The shares of common stock were sold for $8.50 per share. The gross proceeds to the articlesCompany of incorporation$6.0 million were reduced by written consentcommissions and issuance costs of $115,000. These shares of common stock are being registered in lieuthe registration statement of which this prospectus forms a meeting in accordance with Nevada law. See “Description of Securities” beginning on page 57 of this prospectus.part.

On May 3, 2013, the Company entered into a subscription agreement with one non-affiliated accredited investor for the issuance of 100,000 shares of common stock pursuant to exemptions from federal and state securities laws. The shares of common stock were sold for $8.50 per share. These shares of common stock are being registered in this registration statement of which this prospectus forms a part.

On June 3, 2013, the Company entered into a subscription agreement with one non-affiliated accreditor investor for the issuance of 150,000 shares of common stock pursuant to exemptions from registration under federal and state securities laws. The shares of common stock were sold for $10.00 per share. The gross proceeds of $1,500,000 were reduced by commissions and issuance costs of $75,000. Those shares of common stock are being registered in this registration statement of which this prospectus forms a part.

Selected Risks Associated With Our Business

Our business is subject to numerous risks described in the section entitled “Risk Factors” and elsewhere in this prospectus. You should carefully consider these risks before making an investment. Some of these risks include:

| · | Our business and operations are experiencing rapid growth. If we fail to effectively manage our growth, our business and operating results could be harmed; |

| · | Our failure to respond appropriately to competitive challenges, changing consumer preferences and demand for new products could significantly harm our customer relationships and product sales; |

| · | Our management has determined that our disclosure controls and procedures are ineffective which could result in material misstatements in our financial statements; |

| · | If we fail to comply with the rules under the Sarbanes-Oxley Act of 2002 related to disclosure controls and procedures, or, if we discover material weaknesses and other deficiencies in our internal control and accounting procedures, our stock price could decline significantly and raising capital could be more difficult; |

| · | Our industry is highly competitive, and our failure to compete effectively could adversely affect our market share, financial condition and future growth; |

| · | We rely on a limited number of customers for a substantial portion of our sales, and the loss of or material reduction in purchase volume by any of these customers would adversely affect our sales and operating results; |

| · | Adverse publicity or consumer perception of our products and any similar products distributed by others could harm our reputation and adversely affect our sales and revenues; |

| · | We rely on highly skilled personnel and, if we are unable to retain or motivate key personnel, hire qualified personnel, we may not be able to grow effectively; |

| · | If we are unable to retain key personnel, our ability to manage our business effectively and continue our growth could be negatively impacted; |

| · | Our operating results may fluctuate, which makes our results difficult to predict and could cause our results to fall short of expectations; |

| · | We may be exposed to material product liability claims, which could increase our costs and adversely affect our reputation and business; |

| · | Our insurance coverage or third party indemnification rights may not be sufficient to cover our legal claims or other losses that we may incur in the future; |

| · | Our intellectual property rights are valuable, and any inability to protect them could reduce the value of our products and brand; |

| · | We may be subject to intellectual property rights claims, which are costly to defend, could require us to pay damages and could limit our ability to sell some of our products; |

| · | An increase in product returns could negatively impact our operating results and profitability; |

| · | We have no manufacturing capacity and anticipate continued reliance on third-party manufacturers for the development and commercialization of our products; |

| · | A shortage in the supply of key raw materials could increase our costs or adversely affect our sales and revenues; |

| · | A member of our management team has been involved in a bankruptcy proceeding and other failed business ventures that may expose us to assertions that we are not able to effectively manage our business, which could have a material adverse effect on our business and your investment in our securities; |

| · | You may experience substantial dilution in the event we issue common stock in the future at a price below $4.00 per share; |

| · | The conversion reset provision relating to our Series D Preferred Stock could result in difficulty for us to obtain future equity financing; |

| · | We may issue additional shares of preferred stock in the future that may adversely impact your rights as holders of our common stock; |

| · | Our common stock is quoted on the OTCBB which may have an unfavorable impact on our stock price and liquidity; |

| · |

| · | Future financings through debt securities and preferred stock may restrict our operations; |

| · | Our common stock price may be volatile and could fluctuate widely in price, which could result in substantial losses for investors; |

| · | If our common stock |

| · | Because certain of our stockholders control a significant number of shares of our common stock, they may have effective control over actions requiring stockholder approval; |

| · | If securities or industry analysts do not publish research or reports about our business, or if they change their recommendations regarding our stock adversely, our stock price and trading volume could decline; |

| · | A sale of a substantial number of shares of our common stock may cause the price of our common stock to decline and may impair our ability to raise capital in the future; |

Corporate Information

We were incorporated in the state of Nevada on August 4, 2006, under the name “Tone in Twenty” for the purpose of engaging in the business of providing personal fitness training using isometric techniques.. On February 18, 2010, Tone in Twenty acquired all of the issued and outstanding equity and voting interests of Muscle Pharm, LLC, a Colorado limited liability company, in exchange for 26,000,00030,589 shares of its common stock. As a result of this transaction, Muscle Pharm, LLC became a wholly owned subsidiary of Tone in Twenty, and Tone in Twenty changed its name to “MusclePharm Corporation.” Our principal executive offices are located at 4721 Ironton Street, Building A, Denver, Colorado 80239 and our telephone number is (303) 396-6100. Our website address is http://www.musclepharm.com. The information on, or that can be accessed through, our website is not part of this prospectus.

Summary of the Offering

| 1,740,691 Shares of Common Stock of which 703,236 shares were issued in a private placement in March 2013, 100,000 were issued in a private placement in May 2013, 150,000 were issued in a private placement in June 2013 and an aggregate of | ||

| Risk factors | See “Risk Factors” beginning on page | |

| Common stock OTC Bulletin Board trading symbol | MSLP.OB | |

Unless we indicate otherwise, all information in this prospectus:

| · |

| is based on |

| · |

| · | excludes 670 shares of our common stock issuable upon exercise of outstanding options at a weighted average exercise price of $425.00 per share as of July 9, 2013; |

| · | excludes 40,089 shares of our common stock issuable upon exercise of outstanding warrants at a weighted average exercise price of $13.31 per share as of |

| · | excludes 86,276 shares of common stock |

SUMMARY CONSOLIDATED FINANCIAL DATA

The following tables sets forth our (i) summary statement of operations data for the years ended December 31, 2011 and 2010 and the six months ended June 30, 2012 and 2011 (unaudited) and (ii) summary consolidated balance sheet data as of June 30, 2012 (unaudited),selected financial information is derived from our audited and unaudited consolidated financial statements and related notes includedthe Company’s Financial Statements appearing elsewhere in this prospectus. The summary consolidated financial data forProspectus and should be read in conjunction with the six months ended June 30, 2012 and 2011 and as of June 30, 2012 are not indicative of results to be expected forCompany’s Financial Statements, including the full year. Our financial statements are prepared and presentednotes thereto, appearing elsewhere in accordance with generally accepted accounting principles in the United States.this Prospectus. All share amounts and per share amounts reflect the expected 1-for-650completed 1-for-850 reverse stock split that we intend to effect prior to offering these securities.split. The results indicated below are not necessarily indicative of our future performance.

You should read this information together with the sections entitled “Capitalization”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes included elsewhere in this prospectus.

| Six Months Ended June 30, | Year Ended December 31, | |||||||||||||||

| 2012 | 2011 | 2011 | 2010 | |||||||||||||

| (unaudited) | ||||||||||||||||

| Statement of Operations: | ||||||||||||||||

| Sales – net | $ | 31,990,020 | $ | 6,431,678 | $ | 17,212,636 | $ | 3,202,687 | ||||||||

| Loss from operations | (2,391,634 | ) | (2,980,993 | ) | (16,220,160 | ) | (18,251,836 | ) | ||||||||

| Other income (expense) | (7,461,755 | ) | (9,467,552 | ) | (7,060,790 | ) | (1,317,501 | ) | ||||||||

| Net income (loss) | (9,853,389 | ) | (12,448,545 | ) | (23,280,950 | ) | (19,569,337 | ) | ||||||||

| Series C preferred stock dividend | - | - | (293 | ) | - | |||||||||||

| Other comprehensive income | 40,719 | - | - | - | ||||||||||||

| Total comprehensive income (loss) | (9,812,670 | ) | (12,448,545 | ) | (23,280,657 | ) | (19,569,337 | ) | ||||||||

| Net income (loss) per share of common stock – basic and diluted | $ | (4.92 | ) | $ | (46.41 | ) | $ | (53.76 | ) | $ | (309.18 | ) | ||||

| Weighted average number of shares of common stock outstanding – basic and diluted | 2,001,880 | 268,254 | 433,053 | 63,295 | ||||||||||||

Summary of Statements of Operations

| As of June 30, 2012 | ||||||||

| Actual | Pro Forma, As Adjusted(1) | |||||||

| (unaudited) | (unaudited) | |||||||

| Balance Sheet Data: | ||||||||

| Cash | $ | 291,971 | ||||||

| Cash – restricted | 52,744 | |||||||

| Total assets | 4,725,828 | |||||||

| Working Capital (Deficit) | (12,668,017 | ) | ||||||

| Long term debt | 114,682 | |||||||

| Stockholders’ deficit | $ | (11,013,113 | ) | |||||

| Year Ended December 31 | Three Months Ended March 31 | |||||||||||||||

| 2012 | 2011 | 2013 | 2012 | |||||||||||||

| (Unaudited) | ||||||||||||||||

| Sales – Net | $ | 67,055,215 | $ | 17,212,636 | $ | 22,561,227 | $ | 16,560,680 | ||||||||

| Loss from operations | $ | (8,735,811 | ) | $ | (16,220,160 | ) | $ | (721,480 | ) | $ | (727,293 | ) | ||||

| Other expense | $ | (10,216,984 | ) | $ | (7,060,790 | ) | $ | (6,640,501 | ) | $ | (15,308,000 | ) | ||||

| Net loss | $ | (18,952,795 | ) | $ | (23,280,950 | ) | $ | (7,368,049 | ) | $ | (16,035,293 | ) | ||||

| Net loss per common share-basic diluted | $ | (13.00 | ) | $ | (70.30 | ) | $ | (1.78 | ) | $ | (11.23 | ) | ||||

| Weighted average number of common shares outstanding – basic and diluted | 1,458,757 | 331,158 | 4,128,679 | 1,428,024 | ||||||||||||

| Statement of Financial Position | ||||||||||||||||

| As of March 31 | ||||||||||||||||

| 2013 | ||||||||||||||||

| Cash | $ | 8,482,927 | ||||||||||||||

| Total Assets | $ | 20,537,257 | ||||||||||||||

| Current Liabilities | $ | 13,309,425 | ||||||||||||||

| Long-Term Debt | $ | 506 | ||||||||||||||

| Stockholders’ equity | $ | 7,227,326 | ||||||||||||||

| 8 |

RISK FACTORS

Any investment in our common stocksecurities involves a high degree of risk. Investors should carefully consider the risks described below and all of the information contained in this prospectus before deciding whether to purchase our common stock.securities. Our business, financial condition and results of operations could be materially adversely affected by these risks if any of them actually occur. This prospectus also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks we face as described below and elsewhere in this prospectus.

Risks Related to Our Business and Industry

Our independent auditors have expressed substantial doubt about our ability to continue as a going concern, which may hinder our ability to obtain future financing.

As reflected in the accompanying unaudited interim consolidated financial statements, we incurred a net loss of approximately $9.9 million for the six months ended June 30, 2012, and we had a working capital deficit and stockholders’ deficit of approximately $12.7 million and $11.0 million respectively, at June 30, 2012. Also as reflected in the accompanying financial statements we incurred a net loss of approximately $23.3 million and used net cash in operations of approximately $5.8 million for the year ended December 31, 2011, and had a working capital deficit and stockholders’ deficit of approximately $13.7 million and $13.0 million respectively, at December 31, 2011. These factors raise substantial doubt about our ability to continue as a going concern.

In their report dated April 13, 2012, except for note 1 as to which the date is June 28, 2012, our independent auditors stated that our financial statements for the period ended December 31, 2011, were prepared assuming that we would continue as a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. These financial statements do not include any adjustments relating to the recovery of the recorded assets or the classification of the liabilities that might be necessary should we be unable to continue as a going concern.

Our ability to continue operations is dependent on management’s plans to raise more capital, which include this offering, until such time that funds provided by operations are sufficient to fund working capital requirements.

In addition to the net proceeds from this offering, we could require additional funding to finance the growth of our future operations as well as to achieve our strategic objectives. There can be no assurance that future financing will be available in amounts or terms acceptable to us, if at all.

Our business and operations are experiencing rapid growth. If we fail to effectively manage our growth, our business and operating results could be harmed.

We have experienced and expect to continue to experience rapid growth in our operations, which has placed, and will continue to place, significant demands on our management, and our operational and financial infrastructure. If we do not effectively manage our growth, we may fail to attain operational efficiencies we are seeking, timely deliver products to our customers in sufficient volume or the quality of our products could suffer, which could negatively affect our operating results. To effectively manage this growth, we expect we will need to hire additional persons, particularly in sales and marketing, and we will need to continue to improve significantly our operational, financial and management controls and our reporting systems and procedures. These additional employees, systems enhancements and improvements will require significant capital expenditures and management resources. Failure to implement these proposed growth objectives would likely hurt our ability to manage our growth and our financial position.

As of April 10, 2013, management has taken over the shipping of most product, other than drop shipments, to our customers from our 152,000 square foot distribution center in Franklin, Tennessee. We have hired a warehouse manager, and relocated two shipping logistic individuals from our Denver, Colorado office to manage shipping. We also hired several local warehouse individuals to manage this process. We believe this efficiency will improve our shipping time and reduce our overall cost of goods sold.

Additionally, the Company has hired six new sales and marketing individuals to continue the expansion and growth of sales. The finance team has added four new staff members and our board of directors appointed a new Chief Financial Officer on July 1, 2012. New controls and procedures have been implemented over sales orders and discounting as well as new financial controls, budgeting processes, daily and monthly monitoring reports along with dashboard reporting for aiding management in making good decisions.

The Company has appointed a five member Board of Directors, three of which are independent by the board. The Company has also appointed an audit committee, and compensation committee. Regular board meetings are held and task lists are reviewed and checked off with members of outside counsel to mitigate issues and promote further improvements around internal controls and reporting which the Company believes is much improved but not yet complete.

Our failure to respond appropriately to competitive challenges, changing consumer preferences and demand for new products could significantly harm our customer relationships and product sales.

The nutritional sports supplement industry is characterized by intense competition for product offerings and rapid and frequent changes in consumer demand. Our failure to predict accurately product trends could negatively impact our products and cause our revenues to decline.

Our success with any particular product offering (whether new or existing) depends upon a number of factors, including our ability to:

| · | deliver products in a timely manner in sufficient volumes; |

| · | accurately anticipate customer needs and forecast accurately to our manufacturers in an expanding business; |

| · | differentiate our product offerings from those of our competitors; |

| · | competitively price our products; and |

| · | develop new products. |

Products often have to be promoted heavily in stores or in the media to obtain visibility and consumer acceptance. Acquiring distribution for products is difficult and often expensive due to slotting and other promotional charges mandated by retailers. Products can take substantial periods of time to develop consumer awareness, consumer acceptance and sales volume. Accordingly, some products may fail to gain or maintain sufficient sales volume and as a result may have to be discontinued. In a highly competitive marketplace it may be difficult to have retailers open stock-keeping units (sku’s) for new products.

Our management has determined that ourcertain disclosure controls and procedures aremay be ineffective, even though they have been improved upon, which could result in material misstatements in our financial statements.

Our management is responsible for establishing and maintaining adequate internal control over our financial reporting, as defined in Rule 13a-15(f) under the Securities Exchange Act of 1934, as amended, which we refer to as the Exchange Act. As of December 31, 2011,2012, our management determined that some of our disclosure controls and procedures were ineffective due to weaknesses in our financial closing process.

We intend to implement remedial measures designed to address the ineffectiveness of our disclosure controls and procedures.procedures, such as hiring several individuals with significant accounting, auditing and financial reporting experience and segregating our internal and external financial reporting among our larger financing and accounting staff, implementing more specific segregation of our accounting software and providing historical information more timely, such as monthly budgeting analysis and cash reporting. We have also adopted and implemented written procedures to document purchase orders, product discounts and product transition flow as well as analysis of our cost of goods sold. If these remedial measures are insufficient to address the ineffectiveness of our disclosure controls and procedures, or if material weaknesses or significant deficiencies in our internal control are discovered or occur in the future and the ineffectiveness of our disclosure controls and procedures continues, we may fail to meet our future reporting obligations on a timely basis, our consolidated financial statements may contain material misstatements, we could be required to restate our prior period financial results, our operating results may be harmed, we may be subject to class action litigation, and if we gain a listing on The NASDAQ Capital Market,a stock exchange, our common stock could be delisted from that exchange. Any failure to address the ineffectiveness of our disclosure controls and procedures could also adversely affect the results of the periodic management evaluations regarding the effectiveness of our internal control over financial reporting and our disclosure controls and procedures that are required to be included in our annual report on Form 10-K. Internal control deficiencies and ineffective disclosure controls and procedures could also cause investors to lose confidence in our reported financial information. We can give no assurance that the measures we plan to take in the future will remediate the ineffectiveness of our disclosure controls and procedures or that any material weaknesses or restatements of financial results will not arise in the future due to a failure to implement and maintain adequate internal control over financial reporting or adequate disclosure controls and procedures or circumvention of these controls. In addition, even if we are successful in strengthening our controls and procedures, in the future those controls and procedures may not be adequate to prevent or identify irregularities or errors or to facilitate the fair presentation of our consolidated financial statements.

If we fail to comply with the rules under the Sarbanes-Oxley Act of 2002 related to disclosure controls and procedures, or, if we discover material weaknesses and other deficiencies in our internal control and accounting procedures, our stock price could decline significantly and raising capital could be more difficult.

If we fail to comply with the rules under the Sarbanes-Oxley Act of 2002 related to disclosure controls and procedures, or, if we discover additional material weaknesses and other deficiencies in our internal control and accounting procedures, our stock price could decline significantly and raising capital could be more difficult. Moreover, effective internal controls are necessary for us to produce reliable financial reports and are important to helping prevent financial fraud. If we cannot provide reliable financial reports or prevent fraud, our business and operating results could be harmed, investors could lose confidence in our reported financial information, and the trading price of our common stock could drop significantly. In addition, we cannot be certain that additional material weaknesses or significant deficiencies in our internal controls will not be discovered in the future.

Our industry is highly competitive, and our failure to compete effectively could adversely affect our market share, financial condition and future growth.

The nutritional supplement industry is highly competitive with respect to:

| · | price; |

| · | shelf space and store placement; |

| · | brand and product recognition; |

| · | new product introductions; and |

| · | raw materials. |

Most of our competitors are larger more established and possess greater financial, personnel, distribution and other resources than we have. We face competition in the health food channel from a limited number of large nationally known manufacturers, private label brands and many smaller manufacturers of dietary supplements.

We rely on a limited number of customers for a substantial portion of our sales, and the loss of or material reduction in purchase volume by any of these customers would adversely affect our sales and operating results.

For the six monthsyear ended June 30,December 31, 2012, two of our customers accounted for an aggregate of approximately 46%45% of our sales. Our largest customer for the six monthsyear ended June 30,December 31, 2012, accounted for 35%33% of our sales. For the year ended December 31, 2011, two customers accounted for approximately 55% of our sales and our largest customer represented 41% of our sales.

For the yearthree months ended DecemberMarch 31, 2010, three2013, two of our customers accounted for an aggregate of approximately 67% of our sales and the largest customer accounted for 45%46% of our sales. Our largest customer for the three months ended March 31, 2013, accounted for 35% of our sales. For the three months ended March 31, 2012, two of our customers accounted for an aggregate of approximately 56% of our sales. Our largest customer for the three months ended March 31, 2012, accounted for 38% of our sales.

The loss of any of our major customers, a significant reduction in purchases by any major customer, or, any serious financial difficulty of a major customer, could have a material adverse effect on our sales and results of operations.

Adverse publicity or consumer perception of our products and any similar products distributed by others could harm our reputation and adversely affect our sales and revenues.

We believe we are highly dependent upon positive consumer perceptions of the safety and quality of our products as well as similar products distributed by other sports nutrition supplement companies. Consumer perception of sports nutrition supplements and our products in particular can be substantially influenced by scientific research or findings, national media attention and other publicity about product use. Adverse publicity from these sources regarding the safety, quality or efficacy of nutritional supplements and our products could harm our reputation and results of operations. The mere publication of news articles or reports asserting that such products may be harmful or questioning their efficacy could have a material adverse effect on our business, financial condition and results of operations, regardless of whether such news articles or reports are scientifically supported or whether the claimed harmful effects would be present at the dosages recommended for such products.

We rely on highly skilled personnel and, if we are unable to retain or motivate key personnel, hire qualified personnel, we may not be able to grow effectively.

Our performance largely depends on the talents and efforts of highly skilled individuals. Our future success depends on our continuing ability to identify, hire, develop, motivate and retain highly skilled personnel for all areas of our organization, particularly sales and marketing. Competition in our industry for qualified employees is intense. In addition, our compensation arrangements, such as our bonus programs, may not always be successful in attracting new employees or retaining and motivating our existing employees. Our continued ability to compete effectively depends on our ability to attract new employees and to retain and motivate our existing employees.

If we are unable to retain key personnel, our ability to manage our business effectively and continue our growth could be negatively impacted.

Our management employees include Brad J. Pyatt, L. Gary Davis, John H. Bluher, Richard Estalella, Jeremy R. DeLuca and Cory J. Gregory. These key management employees are primarily responsible for our day-to-day operations, and we believe our success depends in large part on our ability to retain them and to continue to attract additional qualified individuals to our management team. Currently, we have executed employment agreements with our key management employees. The loss or limitation of the services of any of our key management employees or the inability to attract additional qualified personnel could have a material adverse effect on our business and results of operations.

Our operating results may fluctuate, which makes our results difficult to predict and could cause our results to fall short of expectations.

Our operating results may fluctuate as a result of a number of factors, many of which may be outside of our control. As a result, comparing our operating results on a period-to-period basis may not be meaningful, and you should not rely on our past results as an indication of our future performance. Our quarterly, year-to-date, and annual expenses as a percentage of our revenues may differ significantly from our historical or projected rates. Our operating results in future quarters may fall below expectations. Each of the following factors may affect our operating results:

| · | our ability to deliver products in a timely manner in sufficient volumes; |

| · | our ability to recognize product trends; |

| · | our loss of one or more significant customers; |

| · | the introduction of successful new products by our competitors; and |

| · | adverse media reports on the use or efficacy of nutritional supplements. |

Because our business is changing and evolving, our historical operating results may not be useful to you in predicting our future operating results.

The continuing effects of the most recent global economic crisis may impact our business, operating results, or financial condition.

The global economic crisis that began in 2008 has caused disruptions and extreme volatility in global financial markets and increased rates of default and bankruptcy, and has impacted levels of consumer spending. These macroeconomic developments could negatively affect our business, operating results, and financial condition. For example, if consumer spending decreases, this may result in lower sales.

We may be exposed to material product liability claims, which could increase our costs and adversely affect our reputation and business.

As a marketer and distributor of products designed for human consumption, we could be subject to product liability claims if the use of our products is alleged to have resulted in injury. Our products consist of vitamins, minerals, herbs and other ingredients that are classified as dietary supplements and in most cases are not subject to pre-market regulatory approval in the United States or internationally. Previously unknown adverse reactions resulting from human consumption of these ingredients could occur.

We have not had any product liability claims filed against us, but in the future we may be subject to various product liability claims, including among others that our products had inadequate instructions for use, or inadequate warnings concerning possible side effects and interactions with other substances. The cost of defense can be substantially higher than the cost of settlement even when claims are without merit. The high cost to defend or settle product liability claims could have a material adverse effect on our business and operating results.

Our insurance coverage or third party indemnification rights may not be sufficient to cover our legal claims or other losses that we may incur in the future.

We maintain insurance, including property, general and product liability, and workers’ compensation to protect ourselves against potential loss exposures. In the future, insurance coverage may not be available at adequate levels or on adequate terms to cover potential losses, including on terms that meet our customer’s requirements. If insurance coverage is inadequate or unavailable, we may face claims that exceed coverage limits or that are not covered, which could increase our costs and adversely affect our operating results.

Our intellectual property rights are valuable, and any inability to protect them could reduce the value of our products and brand.

We have invested significant resources to protect our brands and intellectual property rights. However, we may be unable or unwilling to strictly enforce our intellectual property rights, including our trademarks, from infringement. Our failure to enforce our intellectual property rights could diminish the value of our brands and product offerings and harm our business and future growth prospects.

We may be subject to intellectual property rights claims, which are costly to defend, could require us to pay damages and could limit our ability to sell some of our products.

Our industry is characterized by vigorous pursuit and protection of intellectual property rights, which has resulted in protracted and expensive litigation for several companies. Third parties may assert claims of misappropriation of trade secrets or infringement of intellectual property rights against us or against our end customers or partners for which we may be liable.

As our business expands, the number of products and competitors in our markets increases and product overlaps occur, infringement claims may increase in number and significance. Intellectual property lawsuits are subject to inherent uncertainties due to the complexity of the technical issues involved, and we cannot be certain that we would be successful in defending ourselves against intellectual property claims. Further, many potential litigants have the capability to dedicate substantially greater resources than we can to enforce their intellectual property rights and to defend claims that may be brought against them. Furthermore, a successful claimant could secure a judgment that requires us to pay substantial damages or prevents us from distributing products or performing certain services.

An increase in product returns could negatively impact our operating results and profitability.

We permit the return of damaged or defective products and accept limited amounts of product returns in certain instances. While such returns have historically been nominal and within management’s expectations and the provisions established, future return rates may differ from those experienced in the past. Any significant increase in damaged or defective products or expected returns could have a material adverse effect on our operating results for the period or periods in which such returns materialize.

We have no manufacturing capacity and anticipate continued reliance on third-party manufacturers for the development and commercialization of our products.

We do not currently operate manufacturing facilities for production of our products. We lack the resources and the capabilities to manufacture our products on a commercial scale. We do not intend to develop facilities for the manufacture of products in the foreseeable future. We rely on third-party manufacturers to produce bulk products required to meet our sales needs. We plan to continue to rely upon contract manufacturers to manufacture commercial quantities of our products.

Our contract manufacturers’ failure to achieve and maintain high manufacturing standards, in accordance with applicable regulatory requirements, or the incidence of manufacturing errors, could result in consumer injury or death, product shortages, product recalls or withdrawals, delays or failures in product testing or delivery, cost overruns or other problems that could seriously harm our business. Contract manufacturers often encounter difficulties involving production yields, quality control and quality assurance, as well as shortages of qualified personnel. Our existing manufacturers and any future contract manufacturers may not perform as agreed or may not remain in the contract manufacturing business. In the event of a natural disaster, business failure, strike or other difficulty, we may be unable to replace a third-party manufacturer in a timely manner and the production of our products would be interrupted, resulting in delays, additional costs and reduced revenues.

A shortage in the supply of key raw materials could increase our costs or adversely affect our sales and revenues.

All of our raw materials for our products are obtained from third-party suppliers. Since all of the ingredients in our products are commonly used, we have not experienced any shortages or delays in obtaining raw materials. If circumstances changed, shortages could result in materially higher raw material prices or adversely affect our ability to have a product manufactured. Price increases from a supplier would directly affect our profitability if we are not able to pass price increases on to customers. Our inability to obtain adequate supplies of raw materials in a timely manner or a material increase in the price of our raw materials could have a material adverse effect on our business, financial condition and results of operations.

Because we are subject to numerous laws and regulations, and we may become involved in litigation from time to time, we could incur substantial judgments, fines, legal fees and other costs.

Our industry is highly regulated. The manufacture, labeling and advertising for our products are regulated by various federal, state and local agencies as well as those of each foreign country to which we distribute. These governmental authorities may commence regulatory or legal proceedings, which could restrict the permissible scope of our product claims or the ability to manufacture and sell our products in the future. The U.S. Food and Drug Administration, or FDA, regulates our products to ensure that the products are not adulterated or misbranded. Failure to comply with FDA requirements may result in, among other things, injunctions, product withdrawals, recalls, product seizures, fines and criminal prosecutions. Our advertising is subject to regulation by the Federal Trade Commission, or FTC, under the Federal Trade Commission Act. In recent years the FTC has initiated numerous investigations of dietary supplement and weight loss products and companies. Additionally, some states also permit advertising and labeling laws to be enforced by private attorney generals, who may seek relief for consumers, seek class action certifications, seek class wide damages and product recalls of products sold by us. Any of these types of adverse actions against us by governmental authorities or private litigants could have a material adverse effect on our business, financial condition and results of operations.

Other RisksA member of our management team has been involved in a bankruptcy proceeding and Risks Relatingother failed business ventures that may expose us to this Offeringassertions that we are not able to effectively manage our business, which could have a material adverse effect on our business and your investment in our securities.

Our chief executive officer and co-chairman of our board of directors, Brad J. Pyatt, has been involved in a personal bankruptcy and other failed business ventures. This may expose us to assertions by others that our management team may not know how to effectively run a business. To address this risk, our board of directors has devoted significant time and energy to bolstering our management team with individuals who have public company experience and financial expertise, as well as adding independent board members. Notwithstanding these efforts, if our business partners and investors do not have confidence in our management team, it could have a material adverse effect on our business and your investment in our company.

Because certain of our stockholders control a significant number of shares of our common stock, they may have effective control over actions requiring stockholder approval.

As of July 9, 2013, our directors, executive officers, and their respective affiliates, beneficially own approximately 19.45% of our outstanding shares of common stock. Also, two of our executive officers own 51 shares of our Series B Preferred Stock, which has voting control of the Company. As a result, these stockholders, acting together, would have the ability to control the outcome of matters submitted to our stockholders for approval, including the election of directors and any merger, consolidation or sale of all or substantially all of our assets. In addition, these stockholders, acting together, would have the ability to control the management and affairs of our company. Accordingly, this concentration of ownership might harm the market price of our common stock by:

| · | delaying, deferring or preventing a change in corporate control; |

| · | impeding a merger, consolidation, takeover or other business combination involving us; or |

| · | discouraging a potential acquirer from making a tender offer or otherwise attempting to obtain control of us. |

The conversion reset provision relating to our Series D Preferred Stock could result in difficulty for us to obtain future equity financing.

Because the conversion price reset provisions relating to our Series D Preferred Stock discussed above are so significant and to the potential detriment of common stockholders, it may make it more difficult for us to raise any future equity capital. This potential difficulty should be reviewed in light of our existing levels of little capital and significant working capital deficit. As of July 9, 2013 approximately 90% of the preferred stock issued in the Series D offering has been converted to common stock, greatly reducing this risk.

We may, in the future, issue additional shares of common stock, which would reduce investors’ percent of ownership and may dilute our share value.

Our articles of incorporation, as amended, authorize the issuance of 2,500,000,000100,000,000 shares of common stock and 10,000,000 shares of preferred stock, of which (i) 5,000,000 shares ofhave been designated as Series A Convertible Preferred Stock, (ii) 51 shares ofhave been designated as Series B Preferred Stock, and(iii) 500 shares ofhave been designated as Series C Convertible Preferred Stock and (iv) 1,600,000 shares have been designated as Series D Convertible Preferred Stock. The articles of incorporation authorize our board of directors to prescribe the series and the voting powers, designations, preferences, limitations, restrictions and relative rights of any undesignated shares of our preferred stock. The future issuance of common stock and preferred stock may result in substantial dilution in the percentage of our common stock held by our then existing stockholders. We may value any common stock or preferred stock issued in the future on an arbitrary basis. The issuance of common stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on any trading market for our common stock.

We may issue additional shares of preferred stock in the future that may adversely impact your rights as holders of our common stock.

Our articles of incorporation, as amended, authorize us to issue shares of preferred stock in various classes.series. Currently, we have 51 shares of Series B Preferred Stock issued and outstanding, which hasshares have voting control of the Company. Each share of our Series A Preferred Stock is convertible into 200 shares of our common stock although no shares of this series are outstanding. Each shares of our Series D Convertible Preferred Stock is convertible into two shares of our common stock. In addition, our board of directors will has the authority to fix and determine the relative rights and preferences of our authorized but undesignated preferred stock, as well as the authority to issue additional shares of such preferred stock, without further stockholder approval. As a result, our board of directors could authorize the issuance of a series of preferred stock that would grant to holders preferred rights to our assets upon liquidation, the right to receive dividends before dividends are declared to holders of our common stock, and the right to the redemption of such preferred stock, together with a premium, prior to the redemption of the common stock. To the extent that we do issue such additional shares of preferred stock, your rights as holders of common stock could be impaired thereby, including, without limitation, dilution of your ownership interests in us. In addition, shares of preferred stock could be issued with terms calculated to delay or prevent a change in control or make removal of management more difficult, which may not be in your interest as a holder of common stock.

Our common stock is quoted on the OTCBB which may have an unfavorable impact on our stock price and liquidity.

Our common stock is quoted on the OTCBB. The OTCBB is a significantly more limited market than the New York Stock Exchange or the NASDAQ Stock Market. The quotation of our shares on the OTCBB may result in a less liquid market available for existing and potential stockholders to trade shares of our common stock, could depress the trading price of our common stock and could have a long-term adverse impact on our ability to raise capital in the future.

LiabilityA DTC “Chill” on the electronic clearing of directors for breachtrades in our securities in the future may affect the liquidity of duty of care is limited.our stock and our ability to raise capital.

Under Because our common stock is considered a “penny stock,” there is a risk that the Depository Trust Company (DTC) may place a “chill” on the electronic clearing of trades in our securities. This may lead some brokerage firms to be unwilling to accept certificates and/or electronic deposits of our stock and other securities and also some may not accept trades in our securities altogether. In the past, DTC has placed a deposit chill on our shares, and although the chill is currently removed, no assurance can be given that a chill will not be reinstated in the future. A future DTC chill would affect the liquidity of our securities and make it difficult to purchase or sell our securities in the open market. It may also have an adverse effect on our ability to raise capital because investors may be unable to easily resell our securities into the market. Our inability to raise capital on terms acceptable to us, if at all, could have a material and adverse effect on our business and operations.

Nevada corporations laws limit the personal liability of corporate directors and officers and require indemnification under certain circumstances.

Section 78.138(7) of the Nevada Revised Statutes allprovides that, subject to certain very limited statutory exceptions or unless the articles of incorporation provide for greater individual liability, a director or officer of a Nevada corporations limitcorporation is not individually liable to the corporation or its stockholders for any damages as a result of any act or failure to act in his or her capacity as a director or officer, unless it is proven that the act or failure to act constituted a breach of his or her fiduciary duties as a director or officer and such breach involved intentional misconduct, fraud or a knowing violation of law. We have not included in our articles of incorporation any provision intended to provide for greater liability of directors and officers, including acts not in good faith. Our stockholders’ ability to recover damages for fiduciary breaches may be reducedas contemplated by this statute. statutory provision.

In addition, we are obligated to indemnify our directors and officers regarding stockholder suits which they successfully defend as set forth in Section 78.750278.7502(3) of the Nevada Revised Statutes.Statutes provides that to the extent a director or officer of a Nevada corporation has been successful on the merits or otherwise in the defense of certain actions, suits or proceedings (which may include certain stockholder derivative actions), the corporation shall indemnify such director or officer against expenses (including attorneys’ fees) actually and reasonably incurred by such director or officer in connection therewith.

BecauseYou may experience substantial dilution in the event we issue common stock in the future at a price below $4.00 per share.

The terms of the Series D Preferred Stock require us to increase the conversion rate in the event we issue common stock below $4.00 per share while any shares of Series D Preferred stock are outstanding, resulting in additional shares of common stock issuable upon conversion of shares of Series D Preferred Stock. For example, if we issue shares of common stock for little or no consideration, the certificate of designation for the Series D Preferred Stock provides that such issuance will be deemed to be issued at $0.001 per share of common stock, which would have broad discretiona substantial impact on the conversion rate of the Series D Preferred Stock, and flexibility in howyour ownership percentage of the net proceeds from this offering are used, we may use the net proceeds in ways in which you disagree.Company and likely, its value, would decrease accordingly.

| 14 |

We currently intend to use the net proceeds from this offering to repay $3.5 million of debt due upon completion of this offering, for working capital and other general corporate purposes. See “Use of Proceeds” on page 18 of this prospectus. Other than the debt payments, we have not allocated specific amounts of the net proceeds from this offering for any of the foregoing purposes. Accordingly, our management will have significant discretion and flexibility in applying these proceeds. You will be relying on the judgment of our management with regard to the use of these net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the net proceeds are being used appropriately. It is possible that the net proceeds will be invested in a way that does not yield a favorable, or any, return for us. The failure of our management to use such funds effectively could have a material adverse effect on our business, financial condition, operating results and cash flow.

Future financings through debt securities and preferred stock may restrict our operations.

If additional funds are raised through a credit facility or the issuance of debt securities or preferred stock, lenders under the credit facility or holders of these debt securities or preferred stock would likely have rights that are senior to the rights of holders of our common stock, and any credit facility or additional securities could contain covenants that would restrict our operations.

Our common stock price may be volatile and could fluctuate widely in price, which could result in substantial losses for investors.

The market price of our common stock has historically been and is likely to be highly volatile and could fluctuate widely in price in response to various factors, many of which are beyond our control, including:

| · | new products and services by us or our competitors; |

| · | additions or departures of key personnel; |

| · | intellectual property disputes; |

| · | sales of our common stock; |

| · | our ability to integrate operations, technology, products and services; |

| · | our ability to execute our business plan; |

| · | operating results below expectations; |

| · | loss of any strategic relationship; |

| · | industry developments; |

| · | economic and other external factors; and |

| · | period-to-period fluctuations in our financial results. |

If our common stock remainsbecomes subject to the SEC’s penny stock rules, broker-dealers may experience difficulty in completing customer transactions and trading activity in our securities may be adversely affected.

Unless our securities are listed on a national securities exchange, or we have net tangible assets of $5.0 million or more and our common stock has a market price per share of $5.00 or more, transactions in our common stock will be subject to the SEC’s “penny stock” rules. If our common stock remains subject to the “penny stock” rules promulgated under the Exchange Act, broker-dealers may find it difficult to effectuate customer transactions and trading activity in our securities may be adversely affected.

Under these rules, broker-dealers who recommend such securities to persons other than institutional accredited investors must:

| · | make a special written suitability determination for the purchaser; |

| · | receive the purchaser’s written agreement to the transaction prior to sale; |

| · | provide the purchaser with risk disclosure documents which identify certain risks associated with investing in “penny stocks” and which describe the market for these “penny stocks” as well as a purchaser’s legal remedies; and |

| · | obtain a signed and dated acknowledgment from the purchaser demonstrating that the purchaser has actually received the required risk disclosure document before a transaction in a “penny stock” can be completed. |

As a result, if our common stock becomes or remains subject to the penny stock rules, the market price of our securities may be depressed, and you may find it more difficult to sell our securities.

Because certain of our stockholders control a significant number of shares of our common stock they may have effective control over actions requiring stockholder approval.

Asafter conversion of October 25, 2012, our directors, executive officers and principal stockholders, and their respective affiliates, beneficially own approximately 21.7% of our outstanding shares of common stock. Also, two of our executive officers own 51 shares of our Series BD Preferred Stock, which has voting control of the Company. As a result, these stockholders, acting together, would have the ability to control the outcome of matters submitted to our stockholders for approval, including the election of directors and any merger, consolidation or sale of all or substantially all of our assets. In addition, these stockholders, acting together, would have the ability to control the management and affairs of our company. Accordingly, this concentration of ownership might harm the market price of our common stock by:Stock.

We have not paid dividends on our common stock in the past and do not expect to pay dividends on our common stock for the foreseeable future. Any return on investment may be limited to the value of our common stock.

No cash dividends have been paid on our common stock. We expect that any income received from operations will be devoted to our future operations and growth. We do not expect to pay cash dividends on our common stock in the near future. Payment of dividends would depend upon our profitability at the time, cash available for those dividends, and other factors as our board of directors may consider relevant. If we do not pay dividends, our common stock may be less valuable because a return on an investor’s investment will only occur if our stock price appreciates. Investors in our common stock should not rely on an investment in our company if they require dividend income.

If securities or industry analysts do not publish research or reports about our business, or if they change their recommendations regarding our stock adversely, our stock price and trading volume could decline.

The trading market for our common stock will be influenced by the research and reports that industry or securities analysts publish about us or our business. We do not currently have and may never obtain research coverage by industry or financial analysts. If no or few analysts commence coverage of us, the trading price of our stock would likely decrease. Even if we do obtain analyst coverage, if one or more of the analysts who cover us downgrade our stock, our stock price would likely decline. If one or more of these analysts cease coverage of our company or fail to regularly publish reports on us, we could lose visibility in the financial markets, which in turn could cause our stock price or trading volume to decline.

A sale of a substantial number of shares of our common stock including the Resale Shares registered herein may cause the price of our common stock to decline and may impair our ability to raise capital in the future.

Our common stock is traded on the OTCBB and, despite certain increases of trading volume from time to time, there have been periods when it could be considered “thinly-traded”, meaning that the number of persons interested in purchasing our common stock at or near bid prices at any given time may be relatively small or non-existent. Finance transactions resulting in a large amount of newly issued shares that become readily tradable, or other events that cause current stockholders to sell shares, could place downward pressure on the trading price of our stock. In addition, the lack of a robust resale market may require a stockholder who desires to sell a large number of shares of common stock to sell the shares in increments over time to mitigate any adverse impact of the sales on the market price of our stock.