As filed with the Securities and Exchange Commission on June 21,July 29, 2013

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

STERLING CONSOLIDATED CORP.

(Exact Name of Registrant in its Charter)

| Nevada | 3050 | 45-1840913 |

(State or other Jurisdiction of Incorporation) | (Primary Standard Industrial Classification Code) | (IRS Employer Identification No.)

|

1105 Green Grove Road

Neptune, New Jersey 07753

Tel.: 732-918-8004

(Address and Telephone Number of Registrant’s Principal

Executive Offices and Principal Place of Business)

INCORP SERVICES, INC.

2360 Corporate Circle, Suite 400

Henderson, Nevada 89074-7722

Tel: (702) 866-2500

(Name, Address and Telephone Number of Agent for Service)

Copies of communications to:

Gregg E. Jaclin, Esq.

Anslow & Jaclin, LLP

195 Route 9 South, Suite 204

Manalapan, NJ 07726

Tel. No.: (732) 409-1212

Fax No.: (732) 577-1188

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective. If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ | Smaller reporting company | x |

| (Do not check if a smaller reporting company) | |||

CALCULATION OF REGISTRATION FEE

| Proposed | Proposed | Proposed | Proposed | |||||||||||||||||||||||||||||

| Maximum | Maximum | Amount of | Maximum | Maximum | Amount of | |||||||||||||||||||||||||||

| Title of Each Class of Securities | Amount to be | Offering Price | Aggregate | Registration | Amount to be | Offering Price | Aggregate | Registration | ||||||||||||||||||||||||

| to be Registered | Registered (1) | Per Share (2) | Offering Price | Fee | Registered (1) | Per Share (2) | Offering Price | Fee(3) | ||||||||||||||||||||||||

| Common Stock, par value $0.001 per share, issuable pursuant to the SurePoint Investment Agreement | 4,398,504 | $ | 0.26 | $ | 1,143,611 | $ | 155.99 | 4,398,504 | $ | 0.26 | $ | 1,143,611 | $ | 155.99 | ||||||||||||||||||

| Total | 4,398,504 | $ | 0.26 | $ | 1,143,611 | $ | 155.99 | 4,398,504 | $ | 0.26 | $ | 1,143,611 | $ | 155.99 | ||||||||||||||||||

| (1) | We are registering 4,398,504 shares of our common stock, including (i) 125,000 commitment shares in exchange for SurePoint Capital Management LLC(“SurePoint”) entering into the investment agreement (the “SurePoint Investment Agreement”) and (ii) 4,273,504 shares that we will put to SurePoint pursuant to the SurePoint Investment Agreement. The investment agreement was entered into between SurePoint Capital Management LLC(“SurePoint”) and the registrant on |

| (2) | The offering price has been estimated solely for the purpose of computing the amount of the registration fee in accordance with Rule 457(o) of the Securities Act on the basis of the closing bid price of the common stock of the registrant as reported on the OTCBB on June 10, 2013. |

| (3) | Offset pursuant to Rule 457(p) under the Securities Act by the registration fee of $155.99 paid on June 21, 2013 pursuant to the Registrant’s S-1 Registration Statement, File No. 333-189537. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the commission, acting pursuant to said section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION, DATED |

4,398,504 Shares of Common Stock

STERLING CONSOLIDATED CORP.

This prospectus relates to the resale of up to 4,398,504shares of common stock of Sterling Consolidated Corp. (“we” or the “Company”), par value $0.001 per share, including (i) 125,000 commitment shares issued to SurePoint in connection with the execution of the Surepoint Investment Agreement, and (ii) 4,273,504 shares issuable to SurePoint pursuant to that SurePoint Investment Agreement. The SurePoint Investment Agreement permits us to “put” up to $1,000,000 in shares of our common stock to SurePoint over a period of up to twenty-four (24) months. We will not receive any proceeds from the resale of these shares of common stock. However, we will receive proceeds from the sale of securities pursuant to our exercise of the put right offered by SurePoint. SurePoint is deemed an underwriter for our common stock.

The selling stockholder may offer all or part of the shares for resale from time to time through public or private transactions, at either prevailing market prices or at privately negotiated prices. SurePoint is paying all of the registration expenses incurred in connection with the registration of the shares except for accounting fees and expenses and we will not pay any of the selling commissions, brokerage fees and related expenses.

Our common stock is quoted on the Over-the-Counter Bulletin Board (“OTCBB”) under the ticker symbol “STCC.” On June 10, 2013, the closing price of our common stock was $0.26 per share.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 3 to read about factors you should consider before investing in shares of our common stock.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The Date of This Prospectus Is: _______, 2013

TABLE OF CONTENTS

| Page | |

| Prospectus Summary | 1 |

| The Offering | 3 |

| Risk Factors | 3 |

| Special Note Regarding Forward-Looking Statements | 13 |

| Use of Proceeds | 14 |

| Market For Common Equity and Related Stockholder Matters | 14 |

| Management’s Discussion and Analysis of Financial Condition and Results Of Operations | 14 |

| Description of Business | 21 |

| Directors and Executive Officers | 27 |

| Executive Compensation | 29 |

| Security Ownership of Certain Beneficial Owners and Management | 30 |

| Certain Relationships and Related Transactions | 31 |

| Changes In and Disagreement With Accountants On Accounting and Financial Disclosure | 32 |

| The Selling Stockholder | 32 |

| Plan of Distribution | 33 |

| Description of Securities | 34 |

| Legal Matters | 34 |

| Experts | 34 |

| Available Information | 35 |

| Index To Consolidated Financial Statements |

PROSPECTUS SUMMARY

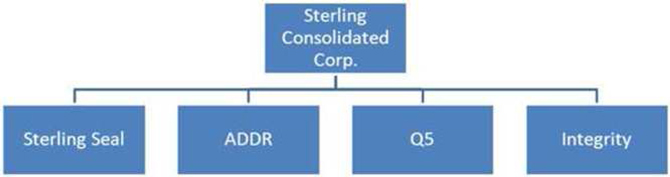

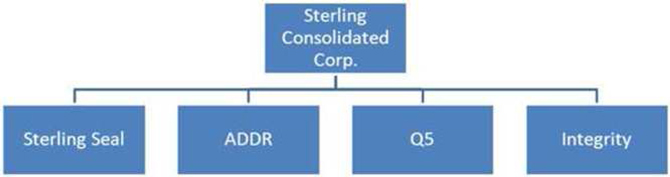

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all the information that you should consider before investing in the common stock. You should carefully read the entire prospectus, including “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Financial Statements, before making an investment decision. In this prospectus, the terms “Sterling Consolidated,” the “Company,” “we,” “us” and “our” refer to Sterling Consolidated Corp. Sterling Seal refers to our wholly-owned subsidiary Sterling Seal & Supply, Inc., a New Jersey corporation. ADDR refers to our wholly-owned subsidiary ADDR Properties, LLC. Q5 refers to our wholly-owned subsidiary Q5 Ventures, LLC.

Overview

We were incorporated in the State of Nevada as Oceanview Acquisition Corp. on January 31, 2011. On May 18, 2012, we amended our Articles of Incorporation to change our name to Sterling Consolidated Corp.

Our largest subsidiary is Sterling Seal & Supply, Inc. (“Sterling Seal”), a New Jersey corporation which was incorporated in 1997. Its predecessor was Sterling Plastic & Rubber Products, Inc., incorporated in New Jersey and was founded in 1970. Sterling Seal engages primarily in the distribution and sale of O-rings, rubber seals, oil seals, custom molded rubber parts, custom Teflon parts, Teflon rods, O-ring cord, bonded seals, O-ring kits, and stuffing box sealant.

We also own real property through our subsidiaries ADDR Properties, LLC (“ADDR”) and Q5 Ventures, LLC (“Q5”). ADDR owns a 28,000 square foot facility in Neptune, New Jersey, that is primarily used by Sterling Seal for its operations. ADDR also owns another property in Cliffwood Beach, New Jersey, that was previously occupied by Sterling Seal and is now rented out to tenants. Q5 owns a 5,000 square foot facility that is used by Sterling Seal in Florida.On April 29, 2013, the Company entered into a sales agreement to sell the Cliffwood Beach property. The sale price is for $650,000 and contains various contingencies. The property has a book value of $644,435 as of March 31, 2013.

In addition, our subsidiary Integrity Cargo Freight Corporation (“Integrity”) is a freight forwarding business. Integrity shares a facility with Sterling Seal and manages the importation of Sterling Seal’s products and exports products on behalf of Sterling Seal to various countries.

Risk Factors

Our ability to successfully operate our business and achieve our goals and strategies is subject to numerous risks as discussed in the section titled “Risk Factors,” beginning on page 3.

Emerging Growth Company Status

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act of 1933, or the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As such, we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We have decided to take advantage of these exemptions. As a result, some investors may find our common stock less attractive as a result. The result may be a less active trading market for our common stock and our stock price may be more volatile.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We intend to take advantage of the benefits of this extended transition period.

We could remain an “emerging growth company” for up to five years, or until the earliest of (a) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (b) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (c) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three-year period.

Investment Agreement with SurePoint

On May 28,,July 25, 2013, we entered into an investment agreement, (the “SurePoint Investment Agreement”) with SurePoint Capital, a Delaware limited liability company (“SurePoint”). Pursuant to the terms of the SurePoint Investment Agreement, SurePoint committed to purchase up to $1,000,000 of our common stock over a period of up to twenty-four (24) months. From time to time during the twenty-four (24) month period commencing from the effectiveness of the registration statement, we may deliver a put notice to SurePoint which states the dollar amount that we intend to sell to SurePoint on a date specified in the put notice. The maximum investment amount per notice shall be no more than $50,000 worth of common stock so long sas such amount does not exceed 4.99% of the outstanding shares of the Company. The purchase price per share to be paid by SurePoint shall be calculated at a ten percent (10%) discount to the average of the three lowest closing bids during the five (5) consecutive trading days immediately prior to the receipt by SurePoint of the put notice. We have reserved 4,273,504shares of our common stock for issuance under the SurePoint Investment Agreement. Additionally, we agreed to issue SurePoint 125,000 shares of our common stock..stock. The SurePoint Investment Agreement and SurePoint’s obligations thereunder are not transferable and cannot be assigned.

The SurePoint Investment Agreement shall terminate upon any of the following events: (i) an aggregate of One Million Dollars is purchased under this SurePoint Investment Agreement; (ii) the date date which is twenty four months following the date of the SurePoint Investment Agreement; or (iii) the date that this Registration Statement is no longer effective. The SurePoint Investment Agreement will be suspended and shall remain suspended if any of the following occurs and is not rectified: (i) the trading of the Company’s stock is suspended by the Securities and Exchange Commission; or (ii) the Common Stock ceases to be quoted, listed or traded on the Principal Market. If our securities are only registered under Section 15(d) of the Securities Act, it is possible that we will no longer be eligible for quotation on the Over-the-Counter Bulletin Board and would be subject to de-listing from the Over-the-Counter Bulletin Board. If this occurs, the SurePoint Investment Agreement would be suspended and we would no longer be able to access this capital until the issue was rectified.

In connection with the SurePoint Investment Agreement, we also entered into a registration rights agreement with SurePoint, pursuant to which we are obligated to file a registration statement with the Securities and Exchange Commission (the “SEC”) covering [4,398,5044,398,504 shares of our common stock underlying the SurePoint Investment Agreement within 21 days after the closing of the transaction. In addition, we are obligated to use all commercially reasonable efforts to have the registration statement declared effective by the SEC after the closing of the transaction and maintain the effectiveness of such registration statement until termination of the SurePoint Investment Agreement.

The 4,398,504 shares to be registered herein represent 11.9% of the shares issued and outstanding, assuming that the selling stockholder will sell all of the shares offered for sale.

At an assumed purchase price of $0.234 (equal to 90% of the closing price of our common stock of $0.26 on June 10, 2013,2013), we will be able to receive up to $1,000,000 in gross proceeds, assuming the sale of the entire 4,273,504 shares being registered hereunder pursuant to the SurePoint Investment Agreement.,Agreement, excluding the 125,000 commitment shares Accordingly, we will not be required to register additional shares under the SurePoint Investment Agreement. We are currently authorized to issue 200,000,000 shares of our common stock. SurePoint has agreed to refrain from holding an amount of shares, which would result in SurePoint owning more than 4.99% of the then-outstanding shares of our common stock at any one time.

There are substantial risks to investors as a result of the issuance of shares of our common stock under the SurePoint Investment Agreement. These risks include dilution of stockholders’ percentage ownership, significant decline in our stock price and our inability to draw sufficient funds when needed.

SurePoint will periodically purchase our common stock under the SurePoint Investment Agreement and will, in turn, sell such shares to investors in the market at the market price. This may cause our stock price to decline, which will require us to issue increasing numbers of common shares to SurePoint to raise the same amount of funds, as our stock price declines.

The aggregate investment amount of $1 million was determined based on numerous factors, including the following: it is a quantity sufficient to execute our stated strategy of acquiring other companies in our industry. While it is difficult to estimate the likelihood that the Company will need the full investment amount, we believe that the Company may need the full amount of $1 million funding under the SurePoint Investment Agreement.

Where You Can Find Us

Our principal executive office is located at 1105 Green Grove Road, Neptune, NJ 07753 and our telephone number is (732) 918-8004.

THE OFFERING

| Common stock offered by Selling Stockholder | 4,398,504 shares of common stock. |

| Common stock outstanding before the offering | 37,074,040 shares of common stock as of the date hereof. |

| Common stock outstanding after the offering | 41,472,544 shares of common stock. |

| Use of proceeds | We will not receive any proceeds from the sale of shares by the selling stockholder. However, we will receive proceeds from the sale of securities pursuant to the SurePoint Investment Agreement. The proceeds received under the SurePoint Investment Agreement will be used for general corporate and working capital purposes and acquisitions or assets, businesses or operations or for other purposes that the Board of Directors, in its good faith deem to be in the best interest of the Company. |

| Trading Symbol | STCC |

| Risk Factors | The common stock offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment. See “Risk Factors”. |

RISK FACTORS

The shares of our common stock being offered for resale by the selling security holder are highly speculative in nature, involve a high degree of risk and should be purchased only by persons who can afford to lose the entire amount invested in the common stock. Before purchasing any of the shares of common stock, you should carefully consider the following factors relating to our business and prospects. If any of the following risks actually occurs, our business, financial condition or operating results could be materially adversely affected. In such case, you may lose all or part of your investment. You should carefully consider the risks described below and the other information in this process before investing in our common stock.

Risks Related to Our Business and Industry

THE PRICES WE PAY AND CHARGE FOR THE PRODUCTS THAT WE SUPPLY, AND THE AVAILABILITY OF SUCH PRODUCTS GENERALLY, MAY FLUCTUATE DUE TO A NUMBER OF FACTORS BEYOND OUR CONTROL.

We purchase large quantities of O-rings and other rubber seals from our suppliers for distribution to our customers. At times pricing and availability of these products change depending on many factors outside of our control, such as general global economic conditions, competition, consolidation of seal producers, cost and availability of raw materials necessary to produce rubber and other materials found in the products we carry, production levels, labor costs, freight and shipping costs, natural disasters, political instability, import duties, tariffs and other trade restrictions, currency fluctuations and surcharges imposed by our suppliers.

We seek to maintain our profit margins by attempting to increase the prices we charge for the products we supply in response to increases in the prices we pay for them. However, demand for the products we supply, the actions of our competitors, our contracts with certain of our customers and other factors largely out of our control will influence whether, and to what extent, we can pass any such cost increases and surcharges on to our customers. If we are unable to pass on higher costs and surcharges to our customers, or if we are unable to do so in a timely manner, our business, financial condition, results of operations and liquidity could be materially and adversely affected.

Alternatively, if the price of the raw materials decreases significantly or if demand for the products we supply decreases because of increased customer, manufacturer or distributor inventory levels of O-rings and other seals, we may be required to reduce the prices we charge for the products we supply to remain competitive. These factors may affect our gross profit and cash flow and may also require us to write-down the value of inventory on hand that we purchased prior to the steel price decreases, which could materially and adversely affect our business, financial condition, results of operations and liquidity.

Our business could also be negatively impacted by the importation of lower-cost seals into the U.S. market. An increase in the level of imported lower-cost products could adversely affect our business to the extent that we then have higher-cost products in inventory or if prices and margins are driven down by increased supplies of such products. These events could also have a material adverse effect on our profit margins and results of operations.

In addition, the domestic and international O-ring industry has experienced consolidation in recent years. Further consolidation could result in a decrease in the number of our major suppliers or a decrease in the number of alternative supply sources available to us, which could make it more likely that termination of one or more of our relationships with major suppliers would result in a material adverse effect on our business, financial condition, results of operations or cash flows. Consolidation could also result in price increases for the products that we purchase. Such price increases could have a material adverse effect on our business, financial condition, results of operations or cash flows if we were not able to pass these price increases on to our customers.

WE MAY EXPERIENCE UNEXPECTED SUPPLY SHORTAGES.

We supply products from a wide variety of vendors and suppliers. In the future we may have difficulty obtaining the products we need from suppliers and manufacturers as a result of unexpected demand or production difficulties. Also, products may not be available to us in quantities sufficient to meet customer demand. Failure to fulfill customer orders in a timely manner could have an adverse effect on our relationships with these customers. Our inability to obtain products from suppliers and manufacturers in sufficient quantities to meet demand could have a material adverse effect on our business, results of operations and financial condition.

WE MAINTAIN AN INVENTORY OF PRODUCTS FOR WHICH WE DO NOT HAVE FIRM CUSTOMER ORDERS. AS A RESULT, IF PRICES OR SALES VOLUMES DECLINE, OUR PROFIT MARGINS AND RESULTS OF OPERATIONS COULD BE ADVERSELY AFFECTED.

Our profitability, margins and cash flows may be negatively affected if we are unable to sell our inventory in a timely manner. Because we maintain substantial inventories of specialty seal products for which we do not have firm customer orders, there is a risk that we will be unable to sell our existing inventory at the volumes and prices we expect.

OUR BUSINESS IS SENSITIVE TO ECONOMIC DOWNTURNS AND ADVERSE CREDIT MARKET CONDITIONS, WHICH COULD ADVERSELY AFFECT OUR BUSINESS, FINANCIAL CONDITION, RESULTS OF OPERATIONS AND LIQUIDITY.

Aspects of our business, including demand for and availability of the products we supply, are dependent on, among other things, the state of the global economy and adverse conditions in the global credit markets. Our business has been affected in the past and may be affected in the future by the following:

| · | our customers reducing or eliminating capital expenditures as a result of reduced demand from their customers; |

| · | our customers not being able to obtain sufficient funding at a reasonable cost or at all as a result of tightening credit markets, which may result in delayed or cancelled projects or maintenance expenditures; |

| · | our customers not being able to pay us in a timely manner, or at all, as a result of declines in their cash flows or available credit; |

| · | experiencing supply shortages for certain products if our suppliers reduce production as a result of reduced demand for their products or as a result of limitations on their ability to access credit for their operations; |

| · | experiencing tighter credit terms from our suppliers, which could increase our working capital needs and potentially reduce our liquidity; and |

| · | the value of our inventory declining if the sales prices we are able to charge our customers decline. |

As a result of these and other effects, economic downturns such as the one we recently experienced have, and could in the future, materially and adversely affect our business, financial condition, results of operations and liquidity.

In addition, market disruptions, such as the recent global economic recession, could adversely affect the creditworthiness of lenders under our debt facilities. Any reduced credit availability under our credit facilities could require us to seek other forms of liquidity through financing in the future and the availability of such financing will depend on market conditions prevailing at that time.

WE RELY ON OUR SUPPLIERS TO MEET THE REQUIRED SPECIFICATIONS FOR THE PRODUCTS WE PURCHASE FROM THEM, AND WE MAY HAVE UNREIMBURSED LOSSES ARISING FROM OUR SUPPLIERS’ FAILURE TO MEET SUCH SPECIFICATIONS.

We rely on our suppliers to provide mill certifications that attest to the specifications and physical and chemical properties of the seals that we purchase from them for resale. We generally do not undertake independent testing of any such seals but rely on our customers or assigned third-party inspection services to notify us of any products that do not conform to the specifications certified by the manufacturers. We may be subject to customer claims and other damages if products purchased from our suppliers are deemed to not meet customer specifications. These damages could exceed any amounts that we are able to recover from our suppliers or under our insurance policies. Failure to provide products that meet our customer’s specifications would adversely affect our relationship with such customer, which could negatively impact our business and results of operations.

LOSS OF KEY SUPPLIERS COULD DECREASE OUR SALES VOLUMES AND OVERALL PROFITABILITY.

For the year ended December 31, 2012, two suppliers accounted for 41% of our accounts payable and accrued expenses and our single largest supplier accounted for approximately 27% of our accounts payable and accrued expenses. Consistent with industry practice, we do not have long-term contracts with any of our suppliers. Therefore, all of our suppliers have the ability to terminate their relationships with us or reduce their planned allocations of product to us at any time. The loss of any of these suppliers due to merger or acquisition, business failure, bankruptcy or other reason could put us at a competitive disadvantage by decreasing the availability or increasing the prices, or both, of products we supply, which in turn could result in a decrease in our sales volumes and overall profitability.

LOSS OF THIRD-PARTY TRANSPORTATION PROVIDERS UPON WHICH WE DEPEND, FAILURE OF SUCH THIRD-PARTY TRANSPORTATION PROVIDERS TO DELIVER HIGH QUALITY SERVICE OR CONDITIONS NEGATIVELY AFFECTING THE TRANSPORTATION INDUSTRY COULD INCREASE OUR COSTS AND DISRUPT OUR OPERATIONS.

We depend upon third-party transportation providers for delivery of products to our customers. Shortages of transportation vessels, transportation disruptions or other adverse conditions in the transportation industry due to shortages of truck drivers, strikes, slowdowns, piracy, terrorism, disruptions in rail service, closures of shipping routes, unavailability of ports and port service for other reasons, increases in fuel prices and adverse weather conditions could increase our costs and disrupt our operations and our ability to deliver products to our customers on a timely basis. We cannot predict whether or to what extent any of these factors would affect our costs or otherwise harm our business. In addition, the failure of our third-party transportation providers to provide high quality customer service when delivering product to our customers would adversely affect our reputation and our relationship with our customers and could negatively impact our business and results of operations.

SIGNIFICANT COMPETITION FROM A NUMBER OF COMPANIES COULD REDUCE OUR MARKET SHARE AND HAVE AN ADVERSE EFFECT ON OUR SELLING PRICES, SALES VOLUMES AND RESULTS OF OPERATIONS.

We operate in a highly competitive industry and compete against a number of other market participants, some of which have significantly greater financial, technological and marketing resources than we do. We compete primarily on the basis of pricing, availability of specialty products and customer service. We may be unable to compete successfully with respect to these or other competitive factors. If we fail to compete effectively, we could lose market share to our competitors. Moreover, our competitors’ actions could have an adverse effect on our selling prices and sales volume. To compete for customers, we may elect to lower selling prices or offer increased services at a higher cost to us, each of which could reduce our sales, margins and earnings. There can be no assurance that we will be able to compete successfully in the future, and our failure to do so could adversely affect our business, results of operations and financial condition.

THE DEVELOPMENT OF ALTERNATIVES TO SEAL PRODUCT DISTRIBUTORS IN THE SUPPLY CHAIN IN THE INDUSTRIES IN WHICH WE OPERATE COULD CAUSE A DECREASE IN OUR SALES AND RESULTS OF OPERATIONS AND LIMIT OUR ABILITY TO GROW OUR BUSINESS.

If our customers were to acquire or develop the capability and desire to purchase products directly from our suppliers in a competitive fashion, it would likely reduce our sales volume and overall profitability. Our suppliers also could expand their own local sales forces, marketing capabilities and inventory stocking capabilities and sell more products directly to our customers. Likewise, customers could purchase from our suppliers directly in situations where large orders are being placed and where inventory and logistics support planning are not necessary in connection with the delivery of the products. These and other actions that remove us from, limit our role in, or reduce the value that our services provide in the distribution chain could materially and adversely affect our business, financial condition and results of operations.

CHANGES IN THE PAYMENT TERMS WE RECEIVE FROM OUR SUPPLIERS COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR LIQUIDITY.

The payment terms we receive from our suppliers are dependent on several factors, including, but not limited to, our payment history with the supplier, the supplier’s credit granting policies, contractual provisions, our credit profile, industry conditions, global economic conditions, our recent operating results, financial position and cash flows and the supplier’s ability to obtain credit insurance on amounts that we owe them. Adverse changes in any of these factors, many of which may not be wholly in our control, may induce our suppliers to shorten the payment terms of their invoices. Given the large amounts and volume of our purchases from suppliers, a change in payment terms may have a material adverse effect on our liquidity and our ability to make payments to our suppliers, and consequently may have a material adverse effect on our business, results of operations and financial condition.

| 6 |

WE ARE A HOLDING COMPANY WITH NO REVENUE GENERATING OPERATIONS OF OUR OWN. WE DEPEND ON THE PERFORMANCE OF OUR SUBSIDIARIES AND THEIR ABILITY TO MAKE DISTRIBUTIONS TO US.

We are a holding company with no business operations, sources of income or assets of our own other than our ownership interests in our subsidiaries. Because all of our operations are conducted by our subsidiaries, our cash flow and our ability to repay debt that we currently have and that we may incur after this offering and our ability to pay dividends to our stockholders are dependent upon cash dividends and distributions or other transfers from our subsidiaries.

Our subsidiaries are separate and distinct legal entities. Any right that we have to receive any assets of or distributions from any of our subsidiaries upon the bankruptcy, dissolution, liquidation or reorganization of any such subsidiary, or to realize proceeds from the sale of their assets, will be junior to the claims of that subsidiary’s creditors, including trade creditors and holders of debt issued by that subsidiary.

Shortages or interruptions in the supply or delivery of our products could adversely affect our operating results.

We are dependent on frequent deliveries of products that meet our specifications. Shortages or interruptions in the supply of products caused by unanticipated demand, problems in production or distribution, inclement weather or other conditions could adversely affect the availability, quality and cost of supplies, which would adversely affect our operating results.

FAILURE TO COMPLY WITH THE LAWS ADMINISTERED BY THE U.S. FEDERAL MARITIME COMMISSION COULD SUBJECT US TO PENALTIES AND OTHER ADVERSE CONSEQUENCES.

Integrity Cargo is regulated by the Federal Maritime Commission. The Federal Maritime Commission (FMC) is an independent regulatory agency responsible for the regulation of ocean-borne transportation in the foreign commerce of the U.S. The principal statutes or statutory provisions administered by the Commission are: the Shipping Act of 1984, the Foreign Shipping Practices Act of 1988, section 19 of the Merchant Marine Act, 1920, and Public Law 89-777. Failure to comply with these laws could subject us to penalties and other adverse consequences.

OUR REAL ESTATE HOLDING COMPANIES AND FREIGHT FORWARDING BUSINESS RELY UPON STERLING SEAL FOR A MAJORITY OF THEIR REVENUE. LOSS OF CUSTOMERS BY STERLING SEAL WILL ADVERSELY AFFECT THE BUSINESS PERFORMANCE OF OUR OTHER CONSOLIDATING ENTITIES.

ADDR and Q5 rely on generating a majority of their respective revenues from Sterling Seal. In addition, 52% of the revenues of our freight forwarding business, Integrity Cargo, are derived from Sterling Seal. In the event that Sterling Seal has any material disruptions in business or its revenues or profits decrease substantially, our other subsidiaries may not be able to sustain operations.

DUE TO THE GLOBAL NATURE OF OUR BUSINESS, WE COULD BE ADVERSELY AFFECTED BY VIOLATIONS OF THE FCPA AND VARIOUS INTERNATIONAL TRADE AND EXPORT LAWS.

The global nature of our business creates various domestic and local regulatory challenges. The Foreign Corrupt Practices Act (“FCPA”) generally prohibits U.S.-based companies and their intermediaries from making improper payments to non-U.S. officials for the purpose of obtaining or retaining business. Our policies mandate compliance with these and other anti-bribery laws. We operate in parts of the world that experience corruption by government officials to some degree and, in certain circumstances, compliance with anti-bribery laws may conflict with local customs and practices. Our global operations require us to import from various countries, which geographically stretches our compliance obligations. To help ensure compliance, our anti-bribery policy and training on a global basis provide our employees with procedures, guidelines and information about anti-bribery obligations and compliance. However, such anti-bribery policies will not always protect us from reckless, criminal or unintentional acts committed by our employees, agents or other persons associated with us. If we are found to be in violation of the FCPA or other anti-bribery laws (either due to acts or inadvertence of our employees, or due to the acts or inadvertence of others), we could suffer criminal or civil penalties or other sanctions, which could have a material adverse effect on our business.

| 7 |

WE RELY ON OUR INFORMATION TECHNOLOGY SYSTEMS TO MANAGE NUMEROUS ASPECTS OF OUR BUSINESS AND CUSTOMER AND SUPPLIER RELATIONSHIPS, AND A DISRUPTION OF THESE SYSTEMS COULD ADVERSELY AFFECT OUR BUSINESS, FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

We depend on our information technology, or IT, systems to manage numerous aspects of our business transactions and provide analytical information to management. Our IT systems are an essential component of our business and growth strategies, and a disruption to our IT systems could significantly limit our ability to manage and operate our business efficiently. These systems are vulnerable to, among other things, damage and interruption from power loss, including as a result of natural disasters, computer system and network failures, loss of telecommunications services, operator negligence, loss of data, security breaches and computer viruses. Any such disruption could adversely affect our competitive position and thereby our business, financial condition and results of operations.

WE COULD BE SUBJECT TO PERSONAL INJURY, PROPERTY DAMAGE, PRODUCT LIABILITY, WARRANTY, ENVIRONMENTAL AND OTHER CLAIMS INVOLVING ALLEGEDLY DEFECTIVE PRODUCTS THAT WE SUPPLY.

The products we supply are often used in potentially hazardous applications that could result in death, personal injury, property damage, environmental damage, loss of production, punitive damages and consequential damages. Actual or claimed defects in the products we supply may result in our being named as a defendant in lawsuits asserting potentially large claims despite our not having manufactured the products alleged to have been defective. We may offer warranty terms that exceed those of the supplier, or we and the supplier may be financially unable to cover the losses and damages caused by any defective products that it manufactured and we supplied. Finally, the third-party supplier may be in a jurisdiction where it is impossible or very difficult to enforce our rights to obtain contribution in the event of a claim against us.

WE MAY NOT HAVE ADEQUATE INSURANCE FOR POTENTIAL LIABILITIES.

In the ordinary course of business, we may be subject to various product and non-product related claims, laws and administrative proceedings seeking damages or other remedies arising out of our commercial operations. We maintain insurance to cover our potential exposure for most claims and losses. However, our insurance coverage is subject to various exclusions, self-retentions and deductibles, may be inadequate or unavailable to protect us fully, and may be canceled or otherwise terminated by the insurer. Furthermore, we face the following additional risks under our insurance coverage:

| · | we may not be able to continue to obtain insurance coverage on commercially reasonable terms, or at all; |

| · | we may be faced with types of liabilities that are not covered under our insurance policies, such as damage from environmental contamination or terrorist attacks, and that exceed any amounts we may have reserved for such liabilities; |

| · | the amount of any liabilities that we may face may exceed our policy limits and any amounts we may have reserved for such liabilities; and |

| · | we may incur losses resulting from interruption of our business that may not be fully covered under our insurance policies. |

Even a partially uninsured claim of significant size, if successful, could materially and adversely affect our business, financial condition, results of operations and liquidity. However, even if we successfully defend ourselves against any such claim, we could be forced to spend a substantial amount of money in litigation expenses, our management could be required to spend valuable time in the defense against these claims and our reputation could suffer, any of which could harm our business and financial condition.

OUR FUTURE GROWTH MAY REQUIRE RECRUITMENT OF ADDITIONAL QUALIFIED EMPLOYEES.

In the event of our future growth in administration, marketing, and customer service, we may have to increase the depth and experience of our management team by adding new members. Our future success will depend to a large degree upon the active participation of our key officers and employees. There is no assurance that we will be able to employ qualified persons on acceptable terms. Lack of qualified employees may adversely affect our business development.

Risks Related To This Offering

WE MAY INCUR SIGNIFICANT COSTS TO BE A PUBLIC COMPANY TO ENSURE COMPLIANCE WITH U.S. CORPORATE GOVERNANCE AND ACCOUNTING REQUIREMENTS AND WE MAY NOT BE ABLE TO ABSORB SUCH COSTS.

We may incur significant costs associated with our public company reporting requirements, costs associated with newly applicable corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002 and other rules implemented by the Securities and Exchange Commission. We expect all of these applicable rules and regulations to significantly increase our legal and financial compliance costs and to make some activities more time consuming and costly. We also expect that these applicable rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors or as executive officers. We are currently evaluating and monitoring developments with respect to these newly applicable rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs. In addition, we may not be able to absorb these costs of being a public company which will negatively affect our business operations.

THE LACK OF PUBLIC COMPANY EXPERIENCE OF OUR MANAGEMENT TEAM COULD ADVERSELY IMPACT OUR ABILITY TO COMPLY WITH THE REPORTING REQUIREMENTS OF U.S. SECURITIES LAWS.

Our Chief Executive Officer (“CEO”) lacks public company experience, which could impair our ability to comply with legal and regulatory requirements such as those imposed by Sarbanes-Oxley Act of 2002. Our CEO has never been responsible for managing a publicly traded company. Such responsibilities include complying with federal securities laws and making required disclosures on a timely basis. Our management may not be able to implement programs and policies in an effective and timely manner that adequately respond to such increased legal, regulatory compliance and reporting requirements, including establishing and maintaining internal controls over financial reporting. Any such deficiencies, weaknesses or lack of compliance could have a materially adverse effect on our ability to comply with the reporting requirements of the Securities Exchange Act of 1934 which is necessary to maintain our public company status. If we were to fail to fulfill those obligations, our ability to continue as a U.S. public company would be in jeopardy in which event you could lose your entire investment in our company.

OUR FUTURE SUCCESS IS DEPENDENT, IN PART, ON THE PERFORMANCE AND CONTINUED SERVICE OF ANGELO AND DARREN DEROSA, OUR OFFICERS AND DIRECTORS.

We are presently dependent to a great extent upon the experience, abilities and continued services of Angelo DeRosa, our Chairman of the Board, and Darren DeRosa, our Chief Executive Officer. The loss of services of any of the management staff could have a material adverse effect on our business, financial condition or results of operation.

SurePoint will pay less than the then-prevailing market price for our common stock.

The common stock to be issued to SurePoint pursuant to the SurePoint Investment Agreement will be purchased at a 10% discount to the average of the three lowest closing bids of our common stock during the five (5) consecutive trading days immediately before SurePoint receives our notice of sale. SurePoint has a financial incentive to sell our common stock immediately upon receiving the shares to realize the profit equal to the difference between the discounted price and the market price. If SurePoint sells the shares, the price of our common stock could decrease. If our stock price decreases, SurePoint may have a further incentive to sell the shares of our common stock that it holds. These sales may have a further impact on our stock price.

Your ownership interest may be diluted and the value of our common stock may decline by exercising the put right pursuant to the SurePoint Investment Agreement.

Pursuant to the SurePoint Investment Agreement, when we deem it necessary, we may raise capital through the private sale of our common stock to SurePoint at a price equal to a 10% discount to the three lowest closing bid prices of our stock for the five (5) consecutive trading days before SurePoint receives our notice of sale. Because the put price is lower than the prevailing market price of our common stock, to the extent that the put right is exercised, your ownership interest may be diluted.

We are registering an aggregate of 4,398,504 shares of common stock to be issued under the SurePoint Investment Agreement. The sales of such shares could depress the market price of our common stock.

We are registering an aggregate of 4,398,504 shares of common stock under this prospectus pursuant to the SurePoint Investment Agreement. Notwithstanding SurePoint’ ownership limitation, the 4,398,504 shares would represent approximately 11.9% of our shares of common stock outstanding immediately after our exercise of the put right under the Investment Agreement. The sale of these shares into the public market by SurePoint could depress the market price of our common stock.

At an assumed purchase price of $0.234 (equal to 90% of the closing price of our common stock of $0.26 on June 10, 2013), we will be able to receive up to $1,000,000 in gross proceeds, assuming the sale of the entire 1,000,000 shares being registered hereunder pursuant to the SurePoint Investment Agreement, excluding the 125,000 commitment shares. However, due to the floating offering price, we are not able to determine the exact number of shares that we will issue under the SurePoint Investment Agreement.

We may not have access to the full amount available under theSurePoint Investment Agreement.

We have not drawn down funds and have not issued shares of our common stock under the SurePoint Investment Agreement. Our ability to draw down funds and sell shares under the SurePoint Investment Agreement requires that the registration statement, of which this prospectus is a part, be declared effective by the SEC, and that this registration statement continue to be effective. In addition, the registration statement of which this prospectus is a part registers 4,398,504 shares issuable under the SurePoint Investment Agreement. Our ability to sell the shares issuable under the SurePoint Investment Agreement is subject to the floating offering price and whether the shares registered under this prospectus allows for us to receive the total gross proceeds of $1,000,000. If this prospectus does not cover all of the shares issuable under the SurePoint Investment Agreement, then we will have file one or more additional registration statements registering the resale of these shares. These registration statements may be subject to review and comment by the staff of the SEC, and will require the consent of our independent registered public accounting firm. Therefore, the timing of effectiveness of these registration statements cannot be assured. The effectiveness of these registration statements is a condition precedent to our ability to sell the shares of common stock to SurePoint under the SurePoint Investment Agreement. Even if we are successful in causing one or more registration statements registering the resale of some or all of the shares issuable under the SurePoint Investment Agreement to be declared effective by the SEC in a timely manner, we may not be able to sell the shares unless certain other conditions are met. Accordingly, because our ability to draw down any amounts under the SurePoint Investment Agreement is subject to a number of conditions, there is no guarantee that we will be able to draw down any portion or all of the proceeds of $1,000,000 under the SurePoint Investment Agreement.

Certain restrictions on the extent of puts and the delivery of advance notices may have little, if any, effect on the adverse impact of our issuance of shares in connection with the SurePoint Investment Agreement, and as such, SurePoint may sell a large number of shares, resulting in substantial dilution to the value of shares held by existing shareholders.

SurePoint has agreed, subject to certain exceptions listed in the SurePoint Investment Agreement, to refrain from holding an amount of shares which would result in SurePoint or its affiliates owning more than 4.99% of the then-outstanding shares of our common stock at any one time. These restrictions, however, do not prevent SurePoint from selling shares of common stock received in connection with a put, and then receiving additional shares of common stock in connection with a subsequent put. In this way, SurePoint could sell more than 4.99% of the outstanding common stock in a relatively short time frame while never holding more than 4.99% at one time.

Risk Related To Our Capital Stock

WE MAY NEVER PAY ANY DIVIDENDS TO SHAREHOLDERS.

We have never declared or paid any cash dividends or distributions on our capital stock. We currently intend to retain our future earnings, if any, to support operations and to finance expansion and therefore we do not anticipate paying any cash dividends on our common stock in the foreseeable future.

The declaration, payment and amount of any future dividends will be made at the discretion of the board of directors, and will depend upon, among other things, the results of our operations, cash flows and financial condition, operating and capital requirements, and other factors as the board of directors considers relevant. There is no assurance that future dividends will be paid, and, if dividends are paid, there is no assurance with respect to the amount of any such dividend.

YOU WILL EXPERIENCE DILUTION OF YOUR OWNERSHIP INTEREST BECAUSE OF THE FUTURE ISSUANCE OF ADDITIONAL SHARES OF OUR COMMON STOCK AND OUR PREFERRED STOCK.

In the future, we may issue our authorized but previously unissued equity securities, resulting in the dilution of the ownership interests of our present stockholders. We are currently authorized to issue 200,000,000 shares of common stock, par value $0.001 per share, and 10,000,000 shares of preferred stock, par value $0.001 per share. We may also issue additional shares of our common stock or other securities that are convertible into or exercisable for common stock in connection with hiring or retaining employees or consultants, future acquisitions, future sales of our securities for capital raising purposes, or for other business purposes. The future issuance of any such additional shares of our common stock or other securities may create downward pressure on the trading price of our common stock. There can be no assurance that we will not be required to issue additional shares, warrants or other convertible securities in the future in conjunction with hiring or retaining employees or consultants, future acquisitions, future sales of our securities for capital raising purposes or for other business purposes, including at a price (or exercise prices) below the price at which shares of our common stock will be quoted on the OTCBB.

IN THE EVENT THAT THE COMPANY’S SHARES ARE TRADED, THEY WILL MOST LIKELY TRADE UNDER $5.00 PER SHARE AND THUS WILL BE A PENNY STOCK. TRADING IN PENNY STOCKS HAS MANY RESTRICTIONS AND THESE RESTRICTIONS COULD SEVERELY AFFECT THE PRICE AND LIQUIDITY OF THE COMPANY’S SHARES.

In the event that our shares are traded, our stock will most likely trade below $5.00 per share, and our stock will therefore be known as a “penny stock”, which is subject to various regulations involving disclosures to be given to you prior to the purchase of any penny stock. The U.S. Securities and Exchange Commission (the “SEC”) has adopted regulations which generally define a “penny stock” to be any equity security that has a market price of less than $5.00 per share, subject to certain exceptions. Our common stock will probably be considered to be a “penny stock” and will subject to the additional regulations and risks of such a security. A penny stock is subject to rules that impose additional sales practice requirements on broker/dealers who sell these securities to persons other than established customers and accredited investors. For transactions covered by these rules, the broker/dealer must make a special suitability determination for the purchase of these securities. In addition, he must receive the purchaser’s written consent to the transaction prior to the purchase. He must also provide certain written disclosures to the purchaser. Consequently, the “penny stock” rules may restrict the ability of broker/dealers to sell our securities, and may negatively affect the ability of holders of shares of our common stock to resell them. These disclosures require you to acknowledge that you understand the risks associated with buying penny stocks and that you can absorb the loss of your entire investment. Penny stocks are low priced securities that do not have a very high trading volume. Consequently, the price of the stock is often volatile and you may not be able to buy or sell the stock when you want to.

INVESTING IN THE COMPANY IS A HIGHLY SPECULATIVE INVESTMENT AND COULD RESULT IN THE LOSS OF YOUR ENTIRE INVESTMENT.

A purchase of the offered shares is significantly speculative and involves significant risks. The offered shares should not be purchased by any person who cannot afford the loss of his or her entire purchase price. The business objectives of the Company are also speculative, and we may be unable to satisfy those objectives. The shareholders of the Company may be unable to realize a substantial return on their purchase of the offered shares, or any return whatsoever, and may lose their entire investment in the Company. For this reason, each prospective purchaser of the offered shares should read this prospectus and all of its exhibits carefully and consult with their attorney, business advisor and/or investment advisor.

THERE IS NO ASSURANCE OF A PUBLIC MARKET OR THAT OUR COMMON STOCK WILL EVER TRADE ON A RECOGNIZED EXCHANGE. THEREFORE, YOU MAY BE UNABLE TO LIQUIDATE YOUR INVESTMENT IN OUR STOCK.

There is no established public trading market for our common stock. Our shares have not been listed or quoted on any exchange or quotation system. There can be no assurance that a market maker will agree to file the necessary documents with FINRA, which operates the OTCBB, nor can there be any assurance that such an application for quotation will be approved or that a regular trading market will develop or that if developed, will be sustained. In the absence of a trading market, an investor may be unable to liquidate their investment.

WE ARE AN “EMERGING GROWTH COMPANY,” AND ANY DECISION ON OUR PART TO COMPLY ONLY WITH CERTAIN REDUCED DISCLOSURE REQUIREMENTS APPLICABLE TO “EMERGING GROWTH COMPANIES” COULD MAKE OUR COMMON STOCK LESS ATTRACTIVE TO INVESTORS.

We are an “emerging growth company,” as defined in the JOBS Act, and, for as long as we continue to be an “emerging growth company,” we may choose to take advantage of exemptions from various reporting requirements applicable to other public companies but not to “emerging growth companies,” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We could be an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to opt in to the extended transition period for complying with the revised accounting standards.

BECAUSE WE HAVE ELECTED TO DEFER COMPLIANCE WITH NEW OR REVISED ACCOUNTING STANDARDS, OUR FINANCIAL STATEMENT DISCLOSURE MAY NOT BE COMPARABLE TO SIMILAR COMPANIES.

We have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1) of the JOBS Act. This allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. As a result of our election, our financial statements may not be comparable to companies that comply with public company effective dates.

OUR STATUS AS AN “EMERGING GROWTH COMPANY” UNDER THE JOBS ACT OF 2012 MAY MAKE IT MORE DIFFICULT TO RAISE CAPITAL AS AND WHEN WE NEED IT.

Because of the exemptions from various reporting requirements provided to us as an “emerging growth company” and because we will have an extended transition period for complying with new or revised financial accounting standards, we may be less attractive to investors and it may be difficult for us to raise additional capital as and when we need it. Investors may be unable to compare our business with other companies in our industry if they believe that our financial accounting is not as transparent as other companies in our industry. If we are unable to raise additional capital as and when we need it, our financial condition and results of operations may be materially and adversely affected.

WE MAY BE EXEMPT FROM THE REPORTING OBLIGATIONS PURSUANT TO SECTION 15(d)15(D) OF THE SECURITIES EXCHANGE ACT AND THEREFORE MAY NOT HAVE TO PROVIDE INVESTORS WITH PERIODIC REPORTS AS MAY BE REQUIRED PURSUANT TO SECTION 13 OF THE SECURITIES EXCHANGE ACT, FOLLOWING THE FORM 10K REQUIRED FOR THE FISCAL YEAR IN WHICH OUR REGISTRATION STATEMENT IS EFFECTIVE.

The requirement for an issuer that has filed a registration statement to file pursuant to Section 15(d) of the Securities Exchange Act is suspended for any fiscal year, except for the fiscal year in which such registration statement becomes effective, if, at the beginning of the fiscal year, the issuer has fewer than 300 shareholders. We currently have fewer than 300 shareholders and expect to maintain a base of fewer than 300 shareholder base.shareholders. If we do continue to have fewer than 300 shareholders, we will be exempt from the filing requirements as required pursuant to Section 13 of the Securities Exchange Act and will not be required to file any periodic reports, including Form 10Q and 10K filings, with the SEC subsequent to the Form 10K required for the fiscal year in which our registration statement is effective. Further, disclosures in our Form 10K that we will be required to file for the fiscal year in which our registration statement is effective, is less extensive than the disclosures required of fully reporting companies. Specifically, we are not subject to disclose in our Form 10K risk factors, unresolved staff comments, or selected financial data, pursuant to Items 1A, 1B, 6, respectively.

UNTIL WE REGISTER A CLASS OF OUR SECURITIES UNDER SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934 (“EXCHANGE ACT”), WE WILL ONLY BE SUBJECT TO THE PERIODIC REPORTING OBLIGATIONS IMPOSED BY SECTION 15(D) OF THE EXCHANGE ACT.

Until such time as we register a class of our securities under Section 12 of the Securities Exchange Act of 1934, we will only be subject to the periodic reporting obligations imposed by Section 15(d) of the Exchange Act. Accordingly, we will not be subject to the proxy rules, Section 16 short-swing profit provisions, beneficial ownership reporting, the bulk of the tender offer rules and the reporting requirements of Section 13 of the Exchange Act.

IF WE ARE EXEMPT FROM REPORTING OBLIGATIONS AND DO NOT HAVE AN OBLIGATION TO REPORT UNDER SECTION 13(A) OR 15(D), OUR SECURITIES MAY BE INELIGIBLE FOR QUOTATION ON THE OVER-THE-COUNTER BULLETIN AND OUR COMMON STOCK MAY NOT BE QUOTED.

Our common stock is currently quoted on the Over-the-Counter Bulletin Board (OTCBB) and we are subject to the reporting requirements pursuant to Section 15(d). If, however, we do not make the required reporting filings or we are exempt from the reporting obligations pursuant to Section 15(d) of the Securities Exchange Act, the Over-the-Counter Bulletin Board may no longer deem us eligible for quotation and would de-list our common stock. In that instance, our Common Stock would not be quoted and there may be no available platform to trade our common stock.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains certain forward-looking statements. When used in this prospectus or in any other presentation, statements which are not historical in nature, including the words “anticipate,” “estimate,” “should,” “expect,” “believe,” “intend,” “may,” “project,” “plan” or “continue,” and similar expressions are intended to identify forward-looking statements. They also include statements containing a projection of revenues, earnings or losses, capital expenditures, dividends, capital structure or other financial terms.

The forward-looking statements in this prospectus are based upon our management’s beliefs, assumptions and expectations of our future operations and economic performance, taking into account the information currently available to them. These statements are not statements of historical fact. Forward-looking statements involve risks and uncertainties, some of which are not currently known to us that may cause our actual results, performance or financial condition to be materially different from the expectations of future results, performance or financial condition we express or imply in any forward-looking statements. These forward-looking statements are based on our current plans and expectations and are subject to a number of uncertainties and risks that could significantly affect current plans and expectations and our future financial condition and results.

We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this prospectus might not occur. We qualify any and all of our forward-looking statements entirely by these cautionary factors. As a consequence, current plans, anticipated actions and future financial conditions and results may differ from those expressed in any forward-looking statements made by or on our behalf. You are cautioned not to unduly rely on such forward-looking statements when evaluating the information presented herein.

USE OF PROCEEDS

We will not receive any proceeds from the sale of shares by the selling stockholder. However, we will receive proceeds from the sale of securities pursuant to the SurePoint Investment Agreement. The proceeds received from any “Puts” tendered to SurePoint under the SurePoint Investment Agreement will be used for general corporate and working capital purposes or for other purposes that the Board of Directors, in its good faith deem to be in the best interest of the Company.

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Public Market for Common Stock

On April 30, 2013, shares of our common stock began to be quoted on the OTCBB and OTCQB under the symbol “STCC”. Accordingly, there are no high and low bids for the common stock before the second quarter 2013.

The following table summarizes the high and low historical closing prices reported by the OTCBB Historical Data Service for the periods indicated. OTCBB quotations reflect inter-dealer prices, without retail mark-up, mark down or commissions, so those quotes may not represent actual transactions.

| High | Low | |||||||

| Second Quarter 2013 (until June 10, 2013) | $ | 0.27 | $ | 0.20 | ||||

Holders

We had approximately 65 record holders of our common stock as of June10, 2013, according to the books of our transfer agent. The number of our stockholders of record excludes any estimate by us of the number of beneficial owners of shares held in street name, the accuracy of which cannot be guaranteed.

Dividends

Holders of our common stock are entitled to receive dividends if, as and when declared by the Board of Directors out of funds legally available therefore. We have never declared or paid any dividends on our common stock. We intend to retain any future earnings for use in the operation and expansion of our business. Consequently, we do not anticipate paying any cash dividends on our common stock to our stockholders for the foreseeable future.

Securities Authorized for Issuance under Equity Compensation Plans

We do not have in effect any compensation plans under which our equity securities are authorized for issuance.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Our discussion includes forward-looking statements based upon current expectations that involve risks and uncertainties, such as our plans, objectives, expectations and intentions. Actual results and the timing of events could differ materially from those anticipated in these forward-looking statements as a result of a number of factors, including those set forth under the Risk Factors, Cautionary Notice Regarding Forward-Looking Statements and Business sections in this Prospectus. We use words such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “believe,” “intend,” “may,” “will,” “should,” “could,” and similar expressions to identify forward-looking statements.

Overview

We were incorporated in the State of Nevada as Oceanview Acquisition Corp. on January 31, 2011. On May 18, 2012, we amended our Articles of Incorporation to change our name to Sterling Consolidated Corp.

Our largest subsidiary is Sterling Seal & Supply, Inc. (“Sterling Seal”), a New Jersey corporation which was incorporated in 1997. Its predecessor was Sterling Plastic & Rubber Products, Inc., incorporated in New Jersey and was founded in 1970. Sterling Seal engages primarily in the distribution and sale of O-rings, rubber seals, oil seals, custom molded rubber parts, custom Teflon parts, Teflon rods, O-ring cord, bonded seals, O-ring kits, and stuffing box sealant.

We also own real property through our subsidiaries ADDR Properties, LLC (“ADDR”) and Q5 Ventures, LLC (“Q5”). ADDR owns a 28,000 square foot facility in Neptune, New Jersey, that is primarily used by Sterling Seal for its operations. ADDR also owns another property in Cliffwood Beach, New Jersey, that was previously occupied by Sterling Seal and is now rented out to tenants. Q5 owns a 5,000 square foot facility that is used by Sterling Seal in Florida.On April 29, 2013, the Company entered into a sales agreement to sell the Cliffwood Beach property. The sale price is for $650,000 and contains various contingencies. The property has a book value of $644,435 as of March 31, 2013.

In addition, our subsidiary Integrity Cargo Freight Corporation (“Integrity”) is a freight forwarding business. Integrity shares a facility with Sterling Seal and manages the importation of Sterling Seal’s products and exports products on behalf of Sterling Seal to various countries.

Recent Financings

Private Placements

In January of 2012, Sterling Seal and Supply, Inc. conducted a private placement under Rule 506 of Regulation D. In the offering, Sterling Seal and Supply, Inc. sold a total of 697,040 shares of common stock at $0.30 per share to 36 investors prior to the June 8, 2012 share exchange agreement for total proceeds of $209,112.

In June 2012, Sterling Consolidated Corp. conducted a private placement selling an additional 100,333 shares to 2 investors for a total investment of $30,100.

In December of 2012, Sterling Consolidated Corp. obtained an equity investment of $35,000 in exchange for 116,667 shares from one investor.

| 15 |

This decrease can be explained by decreased revenues coupled with non-recurring costs related to the Company’s public offering.

Recent Developments

Sale of Cliffwood Beach Property

As previously disclosed on the Current Report on Form 8-K filed with the SEC on May 23, 2013, on April 29, 2013, the Company entered into a sales agreement to sell the Cliffwood Beach property. The sale price is for $650,000 and contains various contingencies. The property has a book value of $644,435 as of March 31, 2013.

SurePoint Investment Agreement

On May 28,July 25, 2013, we entered into the SurePoint Investment Agreement with SurePoint, pursuant to which SurePoint agreed to purchase shares of our common stock for an aggregate purchase price of up to $1,000,000.

The SurePoint Investment Agreement provides that we may, from time to time during the twenty-four (24) months period commencing from the effectiveness of the registration statement, in our sole discretion, deliver a put notice to SurePoint which states the dollar amount that we intend to sell to SurePoint on a date specified in the put notice. The maximum investment amount per notice shall be no more than $50,000 worth of our common stock so long as such amount does not exceed 4.99% of the outstanding shares of the Company. The purchase price per share to be paid by SurePoint shall be calculated at a 10 percent (10%) discount to the average of the three lowest closing bid prices of the common stock during the five (5) consecutive trading days immediately prior to the receipt by SurePoint of the put notice. We have reserved 4,273,504shares of our common stock for issuance under the SurePoint Investment Agreement.

We plan to use the proceeds from the sale of the common stock under the SurePoint Investment Agreement for general corporate and working capital purposes and acquisitions or assets, businesses or operations or for other purposes that the Board of Directors, in its good faith deem to be in the best interest of the Company.

Results of Operations

Comparison for the three months ended March 31, 2013 and 2012

Net Revenue

Net revenue decreased by approximately $78,282 or approximately 4.5%, from $1,741,432 for the three months ended March 31, 2012 to $1,663,150 for the three months ended March 31, 2013. This decrease is due primarily to a customer that placed large stocking orders in the first quarter of 2012 and is still liquidating that stock.

Total Cost of Sales

Cost of sales decreased by $115,005 or approximately 9.73%, from $1,181,737 for the three months ended March 31, 2013 to $1,066,732 for the three months ended March 31, 2012. The decrease in cost of sales was attributed to a corresponding decrease in sales coupled with a decrease in o-ring prices.

Gross profit

Gross profit increased approximately $36,723, or approximately 6.6%, from $559,695 for the three months ended March 31, 2012 to $596,418 for the three months ended March 31, 2013. This increase can be attributed to the above described decrease in cost of sales mitigated by a lesser decrease in net revenue.

Net Income

As a result of the above factors, net income was $110,922 for the three months ended March 31, 2013, as compared to net income of $92,639 for the three months ended March 31, 2012. This increase of $18,283 or approximately 19.7% is attributed to the above described increase in gross profit against relatively unchanged operating expenses.

Comparison of the year ended December 31, 2012 and 2011

Revenues

For the years ended December 31, 2012 and 2011 we generated revenues of $5,859,637 and $6,734,673, respectively. This represents a decrease by approximately $875,036 or approximately 12.99%.

The decrease in revenue was primarily attributed to a $679,420 decrease in o-ring sales and a $196,615 decrease in freight sales, offset by a $49,056 increase in rental services income. The decrease in o-rings is explained by reduced purchasing of 2 larger customers due to competitive market forces. The decrease in freight sales is explained by loss of shipping customers and reduced shipping activity by our remaining freight customers.

Total Cost of Sales

For the years ended December 31, 2012 and 2011 our overall cost of sales was $4,155,378 and $4,106,293, respectively. This represents an increase of $49,085 or 1.19%.

The increase in cost of sales is primarily attributed to increased allocation of existing labor resources to Cost of Goods.

Gross profit

For the years ended December 31, 2012 and 2011 our gross profit was $1,704,259 and $2,628,380, respectively. This represents a decrease of $924,121, or 35.2%.

This decrease can be explained by a corresponding decrease in revenue and increase in cost of sales.

Other Income and Expense

Losses from Other Income and Expense increased $31,969 from a loss of $48,599 for the year ended December 31, 2011 to a loss of $80,568 for the year ended December 31, 2012 primarily due to increased interest expense on related party notes payable.

Net Income

As a result of the above factors, overall net income was $59,800 for the year ended December 31, 2012, as compared to net income of $247,313 for the year ended December 31, 2011, a decrease of approximately $187,513 or 75.8%.

This decrease can be explained by decreased revenues coupled with non-recurring costs related to the Company’s public offering.

Liquidity and Capital Resources

Cash requirements for, but not limited to, working capital, capital expenditures, and debt repayments have been funded from cash balances on hand, revolver borrowings, loans from officers, notes payable and cash generated from operations.

At March 31, 2013, we had cash and cash equivalents of approximately $74,541 as compared to approximately $115,489 as of December 31, 2012, representing a decrease of $40,948. This decrease can be explained by net cash used from financing activities of $32,675, primarily attributed to paydown of notes payable of $38,402; and net cash used in operating activities of $8,273 primarily attributed to an increase of accounts payable of $242,331 offset by a decrease of other liabilities of $148,428. At March 31, 2013, our working capital was approximately $1,199,369.

The cash flow from operating activities decreased from $154,003 for the quarter ended March 31, 2012 to ($8,273) for the quarter ended March 31, 2013. This decrease of $162,276 is primarily attributed to a significant paydown of accounts payable of $297,388 offset by an increase of other liabilities of $131,436.

The cash flow from financing activities decreased from net cash provided of $59,503 for the quarter ended March 31, 2012 to net cash used of $32,675 for the quarter ended March 31, 2013. This decrease is primarily attributed to a reduction of proceeds of common stock due to closing of the securities offering executed in the first quarter of 2012.

Bank Loans