As filed with the Securities and Exchange Commission on December 20, 2013.July 14, 2015.

Registration No. 333- 333-_______

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

MEDICAL TRANSCRIPTION BILLING, CORP.

(Exact name of registrant as specified in its charter)

| 7389 | ||||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

7 Clyde Road

Somerset, New Jersey 08873

(732) 873-5133

(Address, including zip code, and telephone number, including area code, ofregistrant’s principal executive offices)

Mahmud Haq

Chief Executive Officer

7 Clyde Road

Somerset, New Jersey 08873

(732) 873-5133

(Name, address, including zip code, and telephone number, including area code,of agent for service)

Copies of Communicationscommunications to:

Joel Mayersohn, Esq. Roetzel & Andress, LPA 350 East Las Olas Boulevard Las Olas Centre II, Suite 1150 Fort Lauderdale, FL 33301 (954) 759-2763 | ||

Joseph Smith, Esq. Ellenoff Grossman & 1345 Avenue New York, New York |

Approximate date of commencement of proposed sale to thepublic:As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box.o¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.o¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.o¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.o¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check

(Check one):

| Large accelerated filero | Accelerated filer | |

| Non-Accelerated filero | Smaller reporting company |

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price(1)(2) | Amount of Registration Fee | ||||||

| common stock, par value $0.001 per share | $ | 35,000,000 | $ | 4,508.00 | ||||

| Proposed Maximum | Amount of | |||||||

| Title of Each Class of | Aggregate | Registration | ||||||

| Securities to be Registered | Offering Price(1)(2) | Fee | ||||||

| Series A Preferred Stock, par value $0.001 per share | $ | 17,250,000 | $ | 2,004.45 | ||||

| (1) | Includes shares of |

| (2) | Estimated solely for purposes of calculating the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended. |

The Registrant hereby amends this Registration Statement on such date or datesas may be necessary to delay its effective date until the Registrant shall file afurther amendment which specifically states that this Registration Statement shallthereafter become effective in accordance with Section 8(a) of the Securities Actof 1933, as amended, or until this Registration Statement shall become effective onsuch date as the Securities and Exchange Commission, acting pursuant toSection 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED DECEMBER , 2013

Shares_____, 2015

![[GRAPHIC MISSING]](https://capedge.com/proxy/S-1/0001144204-13-068422/logo_mtbc.jpg)

Common Stock________, 2015

This is an initial public offering of shares of common stock of

Medical Transcription Billing, Corp.

Prior600,000 Shares of 11% Series A Cumulative Redeemable Perpetual Preferred Stock

$25.00 Per Share

Liquidation Preference $25.00 Per Share

We are offering600,000 shares of our11% Series A Cumulative Redeemable Perpetual Preferred Stock, which we refer to this offering thereas the Series A Preferred Stock.

Dividends on the Series A Preferred Stock are cumulative from the date of original issue and will be payable on the fifteenth day of each calendar month commencing ________, 2015 when, as and if declared by our board of directors. Dividends will be payable out of amounts legally available therefor at a rate equal to11% per annum per$25.00 of stated liquidation preference per share, or$2.75 per share of Series A Preferred Stock per year.

Commencing on ________, 2020, we may redeem, at our option, the Series A Preferred Stock, in whole or in part, at a cash redemption price of$25.00 per share, plus all accrued and unpaid dividends to, but not including, the redemption date. The Series A Preferred Stock has been no publicstated maturity, will not be subject to any sinking fund or other mandatory redemption, and will not be convertible into or exchangeable for any of our other securities.

Holders of the Series A Preferred Stock generally will have no voting rights except for limited voting rights if dividends payable on the outstanding Series A Preferred Stock are in arrears for eighteen or more consecutive or non-consecutive monthly dividend periods, or if we fail to maintain the listing of the Series A Preferred Stock on a national securities exchange for a period continuing for more than 180 days.

There is no established trading market for our common stock. It is currently estimatedthe Series A Preferred Stock. Subject to issuance of the offered shares, we anticipate that the initial public offering price per shareoutstanding shares of Series A Preferred Stock will be between $ and $ . We intend to apply to list our common stocklisted on the NASDAQ GlobalCapital Market, underand we anticipate that the trading symbol “MTBC”.will be “MTBC.PRA.”

Ladenburg Thalmann & Co. Inc. is acting as our underwriter in the public offering on a firm commitment basis. We are an “emerging growth company” under federal securities lawswill receive a maximum of$15.0 million in gross proceeds and are subjectapproximately$13.1 million in net proceeds, after deducting the underwriting discount and estimated offering expenses payable by us.

See “Use of Proceeds” in this prospectus. There is no arrangement for funds to reduced public company reporting requirements.be received in escrow, trust or similar arrangement. We expect the Series A Preferred Stock will be ready for delivery in book- entry form through The Depositary Trust Company on or about ________, 2015.

Investing in our common stockSeries A Preferred Stock involves significant risks. See “Risk Factors”You should carefully consider the risk factors beginning on page 10 to read about factors you should consider before buying shares of our common stock.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the adequacy or accuracy13 of this prospectus. Any representation toprospectus before purchasing any of the contrary is a criminal offense.Series A Preferred Stock offered by this prospectus.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY OTHER REGULATORY BODY HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

| Per Share | Total | |||||||

| Public offering price | $ | 25.00 | $ | 15,000,000 | ||||

| Underwriting discount (1) | $ | 2.125 | $ | 1,275,000 | ||||

| Proceeds, before expenses, to MTBC | $ | 22.875 | $ | 13,725,000 | ||||

| (1) | See “Underwriting” for a description of the compensation payable to the underwriters; including reimbursable expenses. |

The underwriters may also exercise their option to purchase up to an additional 90,000 shares of common stockSeries A Preferred Stock from us, at the initial public offering price, less the underwriting discount.discount, for a period of 45 days after closing of the offering.

The underwriters expect to deliver the shares against payment in New York, New York on , 2014.________, 2015.

Summer Street Research Partners

Ladenburg Thalmann

Prospectus dated , 2014.________, 2015.

TABLE OF CONTENTS

Dealer Prospectus Delivery Obligation

Through and including , 2014 (the 25th day after

You should rely only on the date ofinformation contained or incorporated into this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

The market data and certain other statistical information used throughout this prospectus are based on independent industry publications, governmental publications, reports by market research firms or other independent sources. Some data are also based on our good faith estimates.

Neither we nor the underwriters have authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

i

IMPORTANT INTRODUCTORY INFORMATION

In You should also read this prospectus unlesstogether with the additional information described under “Where You Can Find More Information” and “Incorporation of Information by Reference.”

Unless the context otherwise requires, we use the terms “MTBC,” “we,” “us,” “the company” and “our” to refer to Medical Transcription Billing, Corp. and its wholly-owned subsidiary, Medical Transcription Billing Company (Private) Limited,subsidiaries.

| i |

INCORPORATION OF INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” into this prospectus information we file with the SEC in other documents. This means that we can disclose important information to you by referring to another document we filed with the SEC. The information relating to us contained in this prospectus should be read together with the information in the documents incorporated by reference.

We incorporate by reference, as of their respective dates of filing, the documents listed below, excluding any portions of such documents that have been “furnished” but not “filed” for purposes of the Securities Exchange Act of 1934, as amended (the “Exchange Act”):

| · | our Annual Report on Form 10-K for the year ended December 31, 2014 filed with the SEC on March 31, 2015; |

| · | our Quarterly Report on Form 10-Q for the quarter ended March 31, 2015 filed with the SEC on May 13, 2015; |

| · | our Definitive Proxy Statement onSchedule 14A filed with the SEC on April 30, 2015; and |

| · | our Current Reports on Form 8-K, filed with the SEC on each of August 28, 2014, January 12, 2015, February 25, 2015, March 12, 2015, March 27, 2015, May 13, 2015, May 21, 2105, June 11, 2015, June 12, 2015 and two filed on July 14, 2015. |

Any statement incorporated by reference in this prospectus from an earlier dated document that is inconsistent with a private limited company organized understatement contained in this prospectus or in any other document filed after the lawsdate of Pakistan,the earlier dated document, but prior to the date hereof, which also is incorporated by reference into this prospectus, shall be deemed to be modified or superseded for purposes of this prospectus by such statement contained in this prospectus or in any other document filed after the date of the earlier dated document, but prior to the date hereof, which also is incorporated by reference into this prospectus.

Any person, including any beneficial owner, to whom this prospectus is delivered may request copies of this prospectus and does not include any of the followingdocuments incorporated by reference into this prospectus, without charge, by written or oral request directed to MTBC, 7 Clyde Road, Somerset, New Jersey, Telephone: (732) 873-5133 or from the SEC through the SEC's Internet website at the address provided under “Where You Can Find More Information.” Documents incorporated by reference into this prospectus are available without charge, excluding any exhibits to those documents unless the exhibit is specifically incorporated by reference into those documents.

Special Note Regarding Forward-Looking Statements

This prospectus, including the sections entitled “Prospectus Summary,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” contains forward-looking statements within the meaning of the federal securities laws. These statements relate to anticipated future events, future results of operations or future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may,” “might,” “will,” “should,” “intends,” “expects,” “plans,” “goals,” “projects,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” or “continue” or the negative of these terms or other comparable terminology. These forward-looking statements include, but are not limited to:

| · | our ability to manage our growth, including acquiring and effectively integrating other businesses into our infrastructure; |

| · | our ability to retain our customers, including effectively migrating and keeping new customers acquired through business acquisitions; |

| · | our ability to attract and retain key officers and employees, including Mahmud Haq and personnel critical to the transitioning and integration of our newly acquired businesses; |

| · | our ability to compete with other companies developing products and selling services competitive with ours, and who may have greater resources and name recognition than we have; |

| · | our ability to maintain operations in Pakistan and Poland in a manner that continues to enable us to offer competitively-priced products and services; |

| · | our ability to keep and increase market acceptance of our products and services; |

| · | our ability to keep pace with a changing healthcare industry and its rapidly evolving regulatory environment; |

| · | our ability to protect and enforce intellectual property rights; and |

| · | our ability to maintain and protect the privacy of customer and patient information. |

These forward-looking statements are only predictions, are uncertain and involve substantial known and unknown risks, uncertainties and other factors which we refermay cause our (or our industry’s) actual results, levels of activity or performance to as the “Target Sellers,” whose businesses we will acquire upon the closebe materially different from any future results, levels of activity or performance expressed or implied by these forward-looking statements. The “Risk Factors” section of this offering:

Concurrently with the consummationpredict all of the offering made byrisks and uncertainties that could have an impact on the forward-looking statements contained in this prospectus, through a seriesprospectus.

We cannot guarantee future results, levels of asset purchases, we will acquire the businessesactivity or performance. You should not place undue reliance on these forward-looking statements, which speak only as of the Target Sellers. The aggregate purchase price will amount to approximately $33 million (assuming an initial public offering pricedate of $ per share,this prospectus. These cautionary statements should be considered with any written or oral forward-looking statements that we may issue in the midpointfuture. Except as required by applicable law, including the securities laws of the estimated offering price range set forth on the cover page of this prospectus)U.S., consisting of cash in the amount of approximately $23 million, and shares of our common stock with a market value of $10 million based on the initial public offering pricewe do not intend to update any of the shares sold inforward-looking statements to conform these statements to reflect actual results, later events or circumstances or to reflect the occurrence of unanticipated events. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or other investments or strategic transactions we may engage in.

The following summary contains basic terms about this offering. Pursuantoffering and the Series A Preferred Stock and is not intended to be complete. It may not contain all of the information that is important to you. For a more complete description of the terms of the respective purchase agreements, the aggregate purchase price we will pay for the assets of eachSeries A Preferred Stock, see “Description of the Target Sellers will be calculated as a multiple of either 1.5 or 2.0 of the revenue generated by such Target Seller in the most recent four quarters included in this prospectus from its customers that are in good standing as of the closing date.Series A Preferred Stock.”

All of the shares to be issued to the Target Sellers will be deposited into escrow to secure our rights (i) to be indemnified under the purchase agreements, and (ii) to cancel a portion of the shares in the event our revenues from the Target Sellers’ customers in the 12 months following the closing are below specified thresholds. With respect to each Target Seller, 15% of the escrowed shares will be eligible for release six months following the closing and the remaining shares will be eligible for release following the determination of such Target Seller’s revenue in the 12 months following the closing. In addition, 10% of the cash consideration payable for the acquisition of Practicare and 15% of the cash consideration payable for the acquisition of CastleRock will be held in escrow for 120 days following the closing to satisfy indemnification claims we may have during that period.

| Issuer | Medical Transcription Billing, Corp. |

| Securities Offered | 600,000 shares of 11% Series A Cumulative Redeemable Perpetual Preferred Stock (or “Series A Preferred Stock”) |

| Offering Price | $25.00 per share of Series A Preferred Stock |

| Dividends | Holders of the Series A Preferred Stock will be entitled to receive cumulative cash dividends at a rate of 11% per annum of the $25.00 per share liquidation preference (equivalent to $2.75 per annum per share). Dividends will be payable monthly on the 15th day of each month (each, a “dividend payment date”), provided that if any dividend payment date is not a business day, then the dividend that would otherwise have been payable on that dividend payment date may be paid on the next succeeding business day without adjustment in the amount of the dividend. Dividends will be payable to holders of record as they appear in our stock records for the Series A Preferred Stock at the close of business on the corresponding record date, which shall be the last day of the calendar month, whether or not a business day, in which the applicable dividend payment date falls (each, a “dividend record date”). As a result, holders of shares of Series A Preferred Stock will not be entitled to receive dividends on a dividend payment date if such shares were not issued and outstanding on the applicable dividend record date. |

| No Maturity, Sinking Fund or Mandatory Redemption | The Series A Preferred Stock has no stated maturity and will not be subject to any sinking fund or mandatory redemption. Shares of the Series A Preferred Stock will remain outstanding indefinitely unless we decide to redeem or otherwise repurchase them. We are not required to set aside funds to redeem the Series A Preferred Stock. |

| Optional Redemption | The Series A Preferred Stock is not redeemable by us prior to ________, 2020. On and after ________, 2020, we may, at our option, redeem the Series A Preferred Stock, in whole or in part, at any time or from time to time, for cash at a redemption price equal to $25.00per share, plus any accumulated and unpaid dividends to, but not including, the redemption date. Please see the section entitled “Description of the Series A Preferred Stock—Redemption—Optional Redemption.” |

| Special Optional Redemption | Upon the occurrence of a Change of Control, we may, at our option, redeem the Series A Preferred Stock, in whole or in part, within 120 days after the first date on which such Change of Control occurred, for cash at a redemption price of$25.00per share, plus any accumulated and unpaid dividends to, but not including, the redemption date. |

Unless we close the acquisition of all of the Target Sellers, we will not close any of those acquisitions and we will not close this offering. See “Business — Acquisitions” for further information on our acquisition of the Target Sellers.

Unless otherwise indicated, all share, per share and financial data set forth in this prospectus have not been adjusted to give effect to the closing of the acquisition of the Target Sellers.

A "Change of Control" is deemed to occur when, after the original issuance of the Series A Preferred Stock, the following have occurred and are continuing: the acquisition by any person, including any syndicate or group deemed to be a "person" under Section 13(d)(3) of the "Exchange Act (other than Mahmud Haq, the chairman of our board of directors and our principal shareholder, any member of his immediate family, and any "person" or "group" under Section 13(d)(3) of the Exchange Act, that is controlled by Mr. Haq or any member of his immediate family, any beneficiary of the estate of Mr. Haq, or any trust, partnership, corporate or other entity controlled by any of the foregoing), of beneficial ownership, directly or indirectly, through a purchase, merger or other acquisition transaction or series of purchases, mergers or other acquisition transactions of our stock entitling that person to exercise more than 50% of the total voting power of all our stock entitled to vote generally in the election of our directors (except that such person will be deemed to have beneficial ownership of all securities that such person has the right to acquire, whether such right is currently exercisable or is exercisable only upon the occurrence of a subsequent condition); and following the closing of any transaction referred to in the bullet point above, neither we nor the acquiring or surviving entity has a class of common securities (or American Depositary Receipts representing such securities) listed on the NYSE, the NYSE MKT or the NASDAQ Stock Market ("NASDAQ"), or listed or quoted on an exchange or quotation system that is a successor to the NYSE, the NYSE MKT or NASDAQ. | |

| Liquidation Preference | If we liquidate, dissolve or wind up, holders of the Series A Preferred Stock will have the right to receive$25.00 per share, plus any accumulated and unpaid dividends to, but not including, the date of payment, before any payment is made to the holders of our common stock. Please see the section entitled "Description of the Series A Preferred Stock- Liquidation Preference." |

| Ranking | The Series A Preferred Stock will rank, with respect to rights to the payment of dividends and the distribution of assets upon our liquidation, dissolution or winding up, (1) senior to all classes or series of our common stock and to all other equity securities issued by us other than equity securities referred to in clauses (2) and (3); (2) on a parity with all equity securities issued by us with terms specifically providing that those equity securities rank on a parity with the Series A Preferred Stock with respect to rights to the payment of dividends and the distribution of assets upon our liquidation, dissolution or winding up; (3) junior to all equity securities issued by us with terms specifically providing that those equity securities rank senior to the Series A Preferred Stock with respect to rights to the payment of dividends and the distribution of assets upon our liquidation, dissolution or winding up; and (4) effectively junior to all of our existing and future indebtedness (including indebtedness convertible into our common stock or preferred stock) and to the indebtedness and other liabilities of (as well as any preferred equity interests held by others in) our existing subsidiaries and any future subsidiaries. Please see the section entitled "Description of the Series A Preferred Stock–Ranking." |

| 4 |

| Limited Voting Rights | Holders of Series A Preferred Stock will generally have no voting rights. However, if we do not pay dividends on the Series A Preferred Stock for eighteen or more monthly dividend periods (whether or not consecutive), the holders of the Series A Preferred Stock (voting separately as a class with the holders of all other classes or series of our preferred stock we may issue upon which like voting rights have been conferred and are exercisable and which are entitled to vote as a class with the Series A Preferred Stock in the election referred to below) will be entitled to vote for the election of two additional directors to serve on our board of directors until we pay, or declare and set aside funds for the payment of, all dividends that we owe on the Series A Preferred Stock, subject to certain limitations described in the section entitled “Description of the Series A Preferred Stock—Voting Rights.” In addition, the affirmative vote of the holders of at least two-thirds of the outstanding shares of Series A Preferred Stock is required at any time for us to authorize or issue any class or series of our capital stock ranking senior to the Series A Preferred Stock with respect to the payment of dividends or the distribution of assets on liquidation, dissolution or winding up, to amend any provision of our articles of incorporation so as to materially and adversely affect any rights of the Series A Preferred Stock or to take certain other actions. If any such amendments to our articles of incorporation would be material and adverse to holders of the Series A Preferred Stock and any other series of parity preferred stock upon which similar voting rights have been conferred and are exercisable, a vote of at least two-thirds of the outstanding shares of Series A Preferred Stock and the shares of the other applicable series materially and adversely affected, voting together as a class, would be required. Please see the section entitled “Description of the Series A Preferred Stock—Voting Rights.” |

| Information Rights | During any period in which we are not subject to Section 13 or 15(d) of the Exchange Act and any shares of Series A Preferred Stock are outstanding, we will use our best efforts to (i) transmit by mail (or other permissible means under the Exchange Act) to all holders of Series A Preferred Stock, as their names and addresses appear on our record books and without cost to such holders, copies of the Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q that we would have been required to file with the SEC pursuant to Section 13 or 15(d) of the Exchange Act if we were subject thereto (other than any exhibits that would have been required) and (ii) promptly, upon request, supply copies of such reports to any holders or prospective holder of Series A Preferred Stock, subject to certain exceptions described in this prospectus. We will use our best efforts to mail (or otherwise provide) the information to the holders of the Series A Preferred Stock within 15 days after the respective dates by which a periodic report on Form 10-K or Form 10-Q, as the case may be, in respect of such information would have been required to be filed with the SEC, if we were subject to Section 13 or 15(d) of the Exchange Act, in each case, based on the dates on which we would be required to file such periodic reports if we were a “non-accelerated filer” within the meaning of the Exchange Act. |

| 5 |

| Listing | Our common stock is listed on the NASDAQ Capital Market under the symbol “MTBC.” We have filed an application to list the Series A Preferred Stock on the NASDAQ. If approved for listing, we expect that trading on the NASDAQ will commence immediately after the date of initial issuance of the Series A Preferred Stock with the trading symbol “MTBC.PRA”. The underwriters have advised us that they intend to make a market in the Series A Preferred Stock prior to the commencement of any trading on the NASDAQ, but they are not obligated to do so and market making may be discontinued at any time without notice. |

| Use of Proceeds | We plan to use the net proceeds from this offering for acquisitions (we have not entered into any agreement or commitment with respect to any acquisitions or investments at this time) and general corporate purposes, including the repayment of indebtedness. Please see the section entitled “Use of Proceeds.” |

| Risk Factors | Please read the section entitled “Risk Factors” beginning on page 13 for a discussion of some of the factors you should carefully consider before deciding to invest in our Series A Preferred Stock. |

| Transfer Agent | The registrar, transfer agent and dividend and redemption price disbursing agent in respect of the Series A Preferred Stock will beVStock Transfer, LLC. |

| Material U.S. Federal Income Tax Considerations | For a discussion of the federal income tax consequences of purchasing, owning and disposing of the Series A Preferred Stock, please see the section entitled "Material U.S. Federal Income Tax Consequences." You should consult your tax advisor with respect to the U.S. federal income tax consequences of owning the Series A Preferred Stock in light of your own particular situation and with respect to any tax consequences arising under the laws of any state, local, foreign or other taxing jurisdiction. |

| Book Entry and Form | The Series A Preferred Stock will be represented by one or more global certificates in definitive, fully registered form deposited with a custodian for, and registered in the name of, a nominee of The Depository Trust Company ("DTC"). |

| 6 |

PROSPECTUS SUMMARYProspectus Summary

The following summary highlights selected information contained in this prospectus. This summary does not contain all the information that may be important to you. You should read the more detailed information contained in this prospectus, including but not limited to, the risk factors beginning on page 10.13.

Medical Transcription Billing, Corp. (“MTBC”) is a healthcare information technology company that provides a fully integrated suite of proprietary web-based solutions, together with related business services, to healthcare providers practicing in ambulatory care settings. Our integrated Software-as-a-Service (or SaaS) platform is designed to helphelps our customers increase revenues, streamline workflows and make better business and clinical decisions, while reducing administrative burdens and operating costs. WeIn addition to our experienced team in the United States, we employ a highly educated offshore workforce of more than 1,000 people in Pakistan, where1,900 employees, who we believe labor costs areearn approximately one-halfone-tenth the costsalary of comparable India-basedU.S.-based employees, thus enabling us to deliver our solutions at competitive prices.

Our flagship offering, PracticePro, empowers healthcare practices with the core software and business services they need to address industry challenges, including the Patient Protection and Affordable Care Act (“Affordable Care Act”), on one unified SaaS platform,platform. We deliver powerful, integrated and easy-to-use ‘big practice solutions’ to small and medium practices, which enable them to efficiently operate their businesses, manage clinical workflows and receive timely payment for their services. PracticePro consists of:includes:

| · | Practice management solutions and related tools, which facilitate the day-to-day operation of a medical practice; |

| · | Electronic health records (or EHR), which is easy to use, highly ranked by KLAS in a study of our users, and allows our customers to reduce paperwork, earn governmental and private payer incentives and avoid governmental penalties that begin this year for those providers who are not using a certified EHR like the one we offer; |

| · | Revenue cycle management (or RCM) services, which include end-to-end medical billing, analytics, and related services; and |

| · | Mobile Health (or mHealth) solutions, including smartphone applications that assist patients and healthcare providers in the provision of healthcare services. |

On July 23, 2014, the Company completed its initial public offering (“IPO”) of common stock, and related tools and applications, which facilitateon July 28, 2014, the day-to-day operationCompany completed the acquisition of a medical practice;

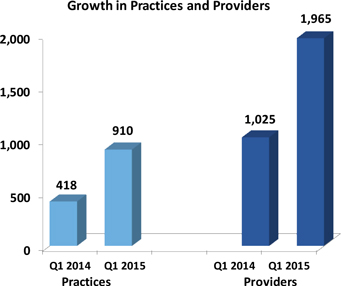

As of September 30, 2013,December 31, 2014, we served approximately 475980 practices representing approximately 1,1902,200 providers (which we define as physicians, nurses, nurse practitioners, physician assistants and other clinical staff that render bills for their services), practicing in 50approximately 60 specialties and subspecialties, in 3743 states. Pro forma for the acquisitionAs of the Target Sellers, as of September 30, 2013,March 31, 2015, we served approximately 970910 practices representing approximately 2,1801,965 providers, practicing in approximately 5060 specialties and subspecialties, in 40 states. As of December 31, 2011, we served approximately 355 practices representing approximately 1,280 providers, approximately 55 specialties and subspecialties, in 38 states, and as of December 31, 2012, we served approximately 400 practices representing approximately 1,320 providers, practicing in approximately 55 specialties and subspecialties, in 3943 states. Approximately 98% of the practices we serve consist of one to ten providers, with the majority of the practices we serve being primary care providers. However, our solutions are scalable and are appropriate for larger healthcare practices across a wide range of specialty areas. In fact, our largest customer is a hospital-based group with more thanapproximately 120 providers.

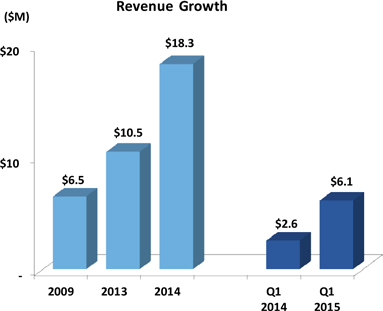

For the year ended December 31, 2014 our total revenue was $18.3 million, an increase of 75% over our revenue of $10.5 million for the year ended December 31, 2013. For the three months ended March 31, 2015 our total revenue was $6.1 million, an increase of 139% over our revenue of $2.6 million for the three months ended March 31, 2014. Much of the growth in revenue was due to the acquisition of the Acquired Businesses in July 2014.

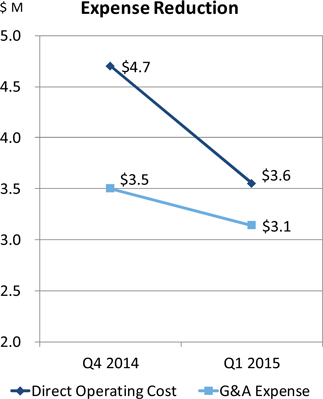

For the year ended December 31, 2014 and the three months ended March 31, 2015 our net loss was $4.5 million and $1.2 million, respectively. The losses include $2.5 million and $1.1 million of non-cash amortization expenses related to purchased intangible assets from the acquisition of the Acquired Businesses.

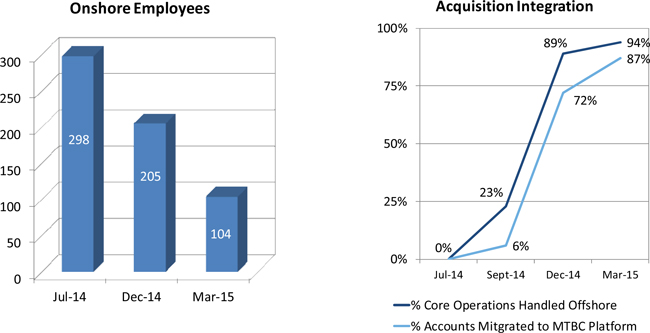

For the year ended December 31, 2014 and the three months ended March 31, 2015 our Adjusted EBITDA was ($1.7 million) and ($710,000), respectively. The negative Adjusted EBITDA is a result of a significant overlap in expenses, paying for new employees offshore while retaining many employees from the Acquired Businesses, which will diminish as a result of cost reductions during the first quarter. We had 205 employees in the U.S. on January 1, 2015 and 104 employees on March 31, 2015, so the full effect of this savings will be realized during the second quarter of 2015. Because Adjusted EBITDA is closely related to our cash flow from operations, management uses Adjusted EBITDA as a financial measure to evaluate the profitability and efficiency of our business model. For information on how we define and calculate Adjusted EBITDA, and a reconciliation of net income to Adjusted EBITDA, see the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Including the employees of our subsidiaries, as of March 2015 we employed approximately 2,200 people worldwide on a full-time basis. We also use the services of a number of part time employees. In addition, all officers work on a full-time basis.

Our growth strategy includes acquiring or partnering with smaller revenue cycle management companies and then migrating the customers of those companies to our solutions. The revenue cycle management service industry is highly fragmented, with many local and regional revenue cycle management companies serving small medical practices. We believe that the industry is ripe for consolidation and that we can achieve significant growth through acquisitions. Likewise, we see significant opportunities to pursue partnerships with other billing companies whereby we provide services and our technology directly to their customers and then share a portion of the revenue generated from these customers with our partner billing company; in fact, we have entered into two such arrangements over the last nine months. We estimate that there are more than 1,500 companies in the United States providing revenue cycle management services and that no one company has more than a 5% share of the market. We further believe that it is becoming increasingly difficult for traditional revenue cycle management companies to meet the growing technology and business service needs of healthcare providers without a significant investment in information technology infrastructure.

In addition, uponour growth strategy includes strategic partnerships with other industry participants, including electronic health records vendors, in which the completion of this offering, we intend to hire sales and marketing executives to spearhead our customer acquisition initiative and enhance our team of marketing and communications professionals. We believe that these new team members will also be able to successfully leverage the Target Sellers’ network of relationships and our existing infrastructure. By devoting greater resources to sales and marketing, we expect that our organic growth will increase more rapidly, as our current organic growth is driven primarily by customer referrals and internet search engine optimization techniques.

For the years ended December 31, 2011 and December 31, 2012, and the nine months ended September 30, 2013, without giving effect to the acquisition of the assets of the Target Sellers, our total

revenue was $10.1 million, $10.0 million and $7.5 million, respectively. For the years ended December 31, 2011 and December 31, 2012, our net income was $470,000 and $117,000, respectively, and for the nine months ended September 30, 2013, our net loss was ($268,000). For the years ended December 31, 2011 and December 31, 2012, and the nine months ended September 30, 2013, our EBITDA was $1.3 million, $870,000 and $526,000, respectively. Because EBITDA is closely relatedvendors refer customers to our cash flow from operations,services. While we offer our own electronic health records, our strategy includes providing integrated offerings utilizing third party electronic health records while offering customers MTBC’s revenue cycle management, uses EBITDA as a financial measure to evaluate the profitabilitypractice management and efficiency of our business model. For information on how we define and calculate EBITDA, and a reconciliation of net income to EBITDA, see the section titled “— Summary Consolidated Financial — Other Financial Data.”mobile health capabilities.

For the twelve months ended September 30, 2013, without giving effect to the acquisition of the assets of the Target Sellers, our total revenue was $9.9 million, our net loss was ($207,000), and our EBITDA was $792,000. Pro forma for the acquisition of the Target Sellers, our total revenue for the twelve months ended September 30, 2013 was $33.4 million, our net loss was ($5.0 million), and our EBITDA was $1.3 million.

Industry Overview

The modern American healthcare industry is characterized by inefficiencies, waste, complexity, an underutilization of technology and a lack of transparency. According to a report issued by the Centers for Medicare & Medicaid Services, approximately $2.9 trillion was spent in a statethe United States on healthcare in 2013, which is 17.4% of transformation.Gross Domestic Product (GDP). Two 2014 studies, by the Harvard School of Public Health and PricewaterhouseCoopers, estimated that 30%-33% of that spending was wasteful, not improving the quality of care that patients receive. According to the Centers for Medicare and Medicaid Services Health, spending is projected to grow at an average rate of 5.7% for 2013-2023, 1.1 percentage points faster than expected average annual growth in the GDP. Healthcare spending in the United States is widely viewed as growing at an unsustainable rate, and policymakers and payers are continuously seeking ways to reduce that growth.

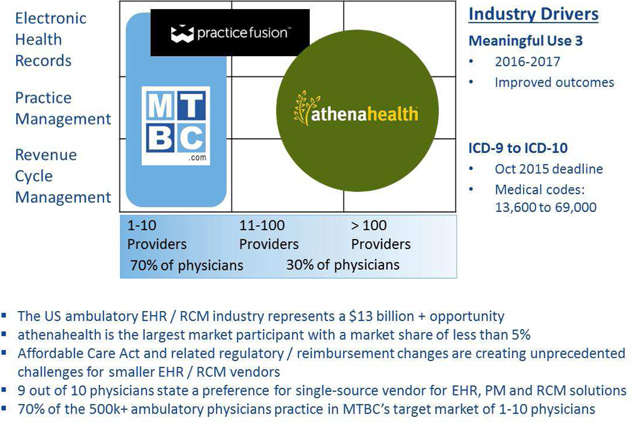

The Affordable Care Act and other recent legislative, regulatory and industry drivers are directed toward addressing many of these challenges. For decades, the U.S. healthcare delivery system has been characterized by a vast cottage industry of small, independent practices functioning in a low-technology fee-for-service environment. During 2013, there were more than 500,000 U.S. physicians practicing in ambulatory care settings and it is estimated that approximately 70% of these providers are practicing in groups with 10 or fewer physicians. Recent changes in the industry, including legislative reform and increasing reimbursement complexity, have created significant opportunities for MTBC, as traditional practice tools are not well-suited for the modern medical practice.

Increasingly Complex Reimbursement Processes. New laws and payer requirements have further complicated insurance reimbursement processes. For example, Medicare, Medicaid and commercial insurances are increasingly requiring proof of adherence to best practices and improved patient health outcomes to support full reimbursement. Moreover, an upcoming shift to a new generation of insurance codes will dramatically increase the complexity associated with selecting appropriate procedure and diagnosis codes needed to support proper claim reimbursement.

Movement Toward Healthcare Information Technology.Since 2011, the federal government has offered financial incentives to eligible healthcare providers who adopt and meaningfully use electronic health records technology. Beginning this year, providers who are not meaningfully using this technology incur penalties and these penalties will increase every year through 2019. While these incentives and looming penalties have encouraged many providers to adopt and meaningfully use electronic health records software, we believe that most providers are not utilizing an integrated platform that combines practice management, business intelligence, and revenue cycle management. The lack of an integrated platform leaves them ill-equipped to address the multitude of rapidly growing industry challenges.

Shift in Focus to Preventive Care.In an effort to avoid the negative health effects and increased costs associated with undetected and untreated chronic conditions, the Affordable Care Act requires most health insurance plans to provide co-payment and deductible-free coverage for preventive health services, such as annual well visits. Many believe that this shift in focus will, in the long-term, reduce costs and improve patient health.

Inaccessibility of Critical Data.To thrive in the emerging healthcare landscape, healthcare practices need timely information, such as health insurance plan eligibility and coverage details, provider performance and productivity data and clinical and reimbursement benchmarking. However, we believe that most small and medium size practices do not have access to this type of real-time data, business intelligence and analytical tools and thus struggle to efficiently operate their practices and make optimal decisions.

Competition

The market for practice management, EHR and RCM information solutions and related services is highly competitive, and we expect competition to increase in the future. We face competition from other providers of both integrated and stand-alone practice management, EHR and RCM solutions, including competitors who utilize a web-based platform and providers of locally installed software systems. Our competitors include larger healthcare IT companies, such as athenahealth, Inc., Allscripts Healthcare Solutions, Inc. and Greenway Medical Technologies, Inc.

Our Solution

We believe that our fully integrated solutions uniquely address the challenges in the industry, including those presented by the Affordable Care Act. Our solutions dramatically simplify the complexities inherent in the reimbursement process and thereby deliver objectively superior results, such as reduced claim denial rates, improved customer days in accounts receivable, reduced patient no-shows, increased well visit encounters and reimbursement. Our solutions empower our customers with the real-time data they need to be efficient and make better decisions, such as real-time insurance eligibility and deductible details, provider productivity details and payer benchmarking.

Our fully integrated suite of technology and business service solutions is designed to enable healthcare practices to thrive in the midst of a rapidly changing environment in which managing reimbursement, clinical workflows and day-to-day administrative tasks is becoming increasingly complex, costly and time-consuming. Our end-to-end solution combines clinical and practice management solutions with critical business services and knowledge driven tools. TheMoreover, the standard offering fee for our complete, integrated, end-to-end solution is 5% of a practice’s healthcare-related revenues plus a nominal one-time setup fee, and is among the lowest in the industry.industry and it is based on a percentage of our clients’ revenues, thereby aligning our interest.

Our Business Strategy

PracticePro empowers healthcare practices with the core software and business services, on one unified SaaS platform, to efficiently operate their businesses, manage clinical workflows and receive timely payment for their services. PracticePro customers are able to leverage our revenue cycle management services, electronic health record solutions, practice management solutions and related services. For an additional fee, our customers can access additional services we provide, such as transcription, document indexing, coding, coding audit support, and consulting services.

Our Strategy

Our objective is to become athe leading provider of integrated, end-to-end software and business service solutions to healthcare providers practicing in an ambulatory setting. To achieve this objective, we employ the following strategies:

| Provide comprehensive practice management, electronic health |

| Provide exceptional customer | ||

| Leverage significant cost advantages provided by our skilled offshore |

| Pursue strategic |

| · | Leverage strategic partnerships.A portion of our current customers were initially referred to MTBC by one of our existing or former channel partners. We recently entered into new channel partnership agreements with various industry-leading vendors, including another leading electronic health records vendor. We have also signed two revenue sharing arrangements with small medical billing companies, where we take over servicing their clients and pay the |

Our Service Offerings

We offer a suite of fully-integrated, web-based SaaS platform and business services designed for healthcare providers. Our products and services offer healthcare providers a unified solution designed to meet the healthcare industry’s demand for the delivery of cost-efficient, quality care with measureable outcomes. The threefour primary components of our proprietary web-based suite of services are: (i) practice management applications, (ii) a certified electronic health recordrecords solution, and (iii) revenue cycle management services.services and (iv) mobile health applications.

Our flagship product, PracticePro, offers all three components in oneprovides our clients with a seamlessly-integrated, end-to-end solution. Our web-based electronic health record solution isrecords are also available to customers as a stand-alonestandalone product. We regularly update our software platform with the goal of staying on the leading edge of industry developments, payer reimbursements trends and new regulations.

Web-based Practice Management Application

Our proprietary, web-based practice management application automates the labor-intensive workflow of a medical office in a unified and streamlined SaaS platform. The various functions of the platform collectively support the entire workflow of the day-to-day operations of a medical office in an intuitive and user-friendly format. For example, our platform provides office staff with real-time insurance details to allow them to more efficiently collect patient payments; its automated appointment reminders reduce patient no-show rates, and scheduling functionality results in increased reimbursable patient well visit appointments. A simple, individual and secure login to our web-based platform gives physicians, other healthcare providers and staff membersmembers’ access to a vast array of real time practice management data which they can access at the office or from any other location where they can access the Internet. Users can customize the “Practice Dashboard” to display only the most useful and relevant information needed to carry out their particular functions. We believe that this streamlined and centralized automated workflow allows providers to focus on delivering quality patient care rather than office administration.

Web-based Electronic Health Records

Our web-based electronic health records solution is one of the approximately 300 unique ambulatory electronic health record products that, as of February 2015, has received 2014 Edition ONC-ACB certification as a Complete Ambulatory electronic health records solution. Moreover, in a previous study, KLAS, a leading independent industry assessor of healthcare information technology products, issued its annual electronic health records ranking and MTBC placed number five in our target market, which is healthcare practices with one to ten providers, outperforming most leading electronic health records. A healthcare provider can use our solution allowsto demonstrate “meaningful use” under federal law to earn incentives and avoid penalties. Our web-based electronic health records allow a provider to view all patient information in one online location, thus avoiding the need for numerous paper-based charts and records for each patient. Utilizing our web-based electronic health recordrecords solution, providers can track patients from their initial appointments; chart clinical data, history, and other personal information; enter and submit claims for medical services; and review and respond to queries for additional information regarding the billing process. Additionally, the electronic health record software delivers a robust document management system to enable providers to transition to paperless environments. The document management function makes available electronic connectivity between practitioners and patients, thereby streamlining patient care coordination and communications.

Revenue Cycle Management and other Technology-driven Business Services

Our proprietary revenue cycle management offering is designed to improve the medical billing reimbursement process, allowing healthcare providers to accelerate and increase collections, reduce errors in claim submission and streamline workflow to free up practitioners to focus on patient care. Customers using PracticePro will generally see an improvement in their collections, as illustrated by the following:

| · | Our first pass acceptance rate is 97%. |

| · | Our first pass resolution rate is 95%. |

| · | Our clients’ median days in accounts receivable is 36 days for primary care and 39 days for combined specialties. |

These rates are among the most competitive in the industry and compare favorably with the published performance of our largest competitor, among others. Our revenue cycle management service employs a proprietary rules-based system designed and constantly updated by our knowledgeable workforce, whichwho screens and scrubs claims prior to submission for payment.

Risk Relating to our Acquisition Strategy

Following our past acquisitions, some acquired customers terminated their relationships with us. These terminations occurred for a variety of reasons, including because

Mobile Health Solutions

The functionality of our transitioncloud-based platform is extended to mobile devices through our integrated suite of workflow from local employees previously assigned to their account to our offshore team members; actual or perceived disruptions to customers’ businesses; our migrationmobile health applications. These mobile health applications include physician end-user tools that support, among other things, electronic prescribing, the capture of customers from their existing practice management software platform to our solution;billing charges in the current medical coding formats, and the exacerbationcreation and secure transfer of clinical audio notes that are converted into text and billing charges. We also offer iCheckIn, a patient check-in app for iOS and Android-based tablet devices. Our patient applications allow patients to access their medical information, securely communicate with their doctors’ office, schedule appointments, request prescription refills, pay balances and check-in for office appointments.

Clearinghouse

In conjunction with an acquisition, we recently launched a standalone insurance clearinghouse service, which includes electronic claim submissions and payment remittances, insurance eligibility verification, electronic data interchange (EDI) services and related solutions for healthcare providers and industry vendors throughout the straincountry. Our clearinghouse division presently serves more than 2,000 healthcare providers. We expect that already existed in some of the customers’ relationships with the acquired companies. For example, following our 2010 acquisition of the customers of Medical Accounting Billing Company, we retainedclearinghouse division client base will present a key employee of the seller to assist us in transitioning the acquired customers to our solution. However, that employee became disabled by an illness soon after closing, becoming incapable of effectively guiding the accounts through the transition. As a result, we eventually lost all of the acquired customers and were required to write-off intangible assets in the amount $126,000 in 2012. In addition, of the eight practices we acquired in our June 2011 acquisition of a small New Jersey-based revenue cycle management company, only three are current customers of ours.

During 2012, we acquired four revenue cycle management companies and successfully migrated a majority of their customerssignificant opportunity for potential cross-selling to PracticePro within 120 daysand similar solutions.

| 11 |

Voting Rights of closing. One year after acquisition,Our Directors, Executive Officers, and Principal Stockholders

The directors and executive officers currently hold 44.4% of both the average quarterly revenue generated from the customers acquired in our 2012 acquisitions was 85% of the quarterly revenue generated from these customers in the quarter preceding the respective acquisitions. Approximately two-thirds of the practices we acquired in those transactions remained our customers as of September 30, 2013. In addition, following our most recent acquisition in June 30, 2013, we successfully migrated 50% of the acquired customers to PracticePro within 90 days of closing, and retained 96% of acquired customers and 99% of the revenue as of September 30, 2013, 90 days after the closing. Notwithstanding the recent improvement in our migration and retention of acquired customers, we expect to experience customer loss following our acquisition of the Target Sellers and any other future acquisitions for a variety of reasons, including our inability to transition the existing workflow to our off shore infrastructure and the existing strain on customer relationships at the time of acquisition.

We will seek to address the challenges we have experienced in prior acquisitions by working more closely with acquired customers in the future to understand which combination of software and services is best for their practice. To that end, we plan on retaining a larger portion of the Target Sellers’ existing workforce for a longer period of time than in previous acquisitions, as well as developing integrations with existing software solutions to ensure customer satisfaction and retention.

Other Risks Relating to Our Business

Investing in our common stock involves a high degree of risk. You should carefully consider the risks described in “Risk Factors” beginning on page 10 of this prospectus before making a decision to invest in our common stock. If any of these risks actually occurs, our business financial condition and results of operations would likely be negatively affected. In such case, the trading priceshares of our common stock would likely decline, and you may lose part, or all,voting power of your investment. Below is a summaryour common stock and have the ability to control the outcome of somematters submitted to our stockholders for approval, including the election of our directors, as well as the overall management and direction of our company. In addition, 9.5% of the principal risks we believe we face:

Acquired Businesses.

Corporate Information

We were incorporated in Delaware on September 28, 2001 under the name Medical Transcription Billing, Corp. Our principal executive offices are located at 7 Clyde Road, Somerset, New Jersey 08873, and our telephone number is (732) 873-5133. Our website address iswww.mtbc.com. Information contained on, or that can be accessed through, our website is not incorporated by reference into this prospectus, and you should not consider information on our website to be part of this prospectus.

MTBC, MTBC.com and A Unique Healthcare IT Company, and other trademarks and service marks of MTBC appearing in this prospectus are the property of MTBC. Trade names, trademarks and service marks of other companies appearing in this prospectus are the property of their respective holders.

We are an emerging growth company as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. We will remain an emerging growth company until the earlier of the last day of the fiscal year following the fifth anniversary of the completion of this offering, the last day of the fiscal year in which we have total annual gross revenue of at least $1.0 billion, the date on which we are deemed to be a large accelerated filer (this means the market value of our common stock that is held by non-affiliates exceeds $700 million as of the end of the second quarter of that fiscal year), or the date on which we have issued more than $1.0 billion in non-convertible debt securities during the prior three-year period. An emerging growth company may take advantage of specified reduced reporting requirements and is relieved of certain other significant requirements that are otherwise generally applicable to public companies. As an emerging growth company:

However, we are choosingchose to “opt out” of the extended transition periods available under the JOBS Act for complying with new or revised accounting standards.

TABLE OF CONTENTSRisk Factors

An investment in our securities involves a high degree of risk. You should carefully consider the risks and uncertainties described in this prospectus and the documents incorporated by reference into this prospectus. The risks and uncertainties described in this prospectus are not the only ones we face. Additional risks and uncertainties that we do not presently know about or that we currently believe are not material may also adversely affect our business, business prospects, results of operations or financial condition. If any of the risks and uncertainties described in this prospectus or the documents incorporated by reference into this prospectus actually occurs, then our business, results of operations and financial condition could be adversely affected in a material way. This could cause the market price of the Series A Preferred Stock to decline, perhaps significantly, and you may lose part or all of your investment.

Risks Related to this Offering and Ownership of Shares of Our Series A Preferred Stock

The Series A Preferred Stock ranks junior to all of our indebtedness and other liabilities.

In the event of our bankruptcy, liquidation, dissolution or winding-up of our affairs, our assets will be available to pay obligations on the Series A Preferred Stock only after all of our indebtedness and other liabilities have been paid. The rights of holders of the Series A Preferred Stock to participate in the distribution of our assets will rank junior to the prior claims of our current and future creditors and any future series or class of preferred stock we may issue that ranks senior to the Series A Preferred Stock. Also, the Series A Preferred Stock effectively ranks junior to all existing and future indebtedness and to the indebtedness and other liabilities of our existing subsidiaries and any future subsidiaries. Our existing subsidiaries are, and future subsidiaries would be, separate legal entities and have no legal obligation to pay any amounts to us in respect of dividends due on the Series A Preferred Stock. If we are forced to liquidate our assets to pay our creditors, we may not have sufficient assets to pay amounts due on any or all of the Series A Preferred Stock then outstanding. We have incurred and may in the future incur substantial amounts of debt and other obligations that will rank senior to the Series A Preferred Stock. At March 31, 2015, our total liabilities (excluding contingent consideration, which is not payable in cash) equaled approximately $7.2 million.

Certain of our existing or future debt instruments may restrict the authorization, payment or setting apart of dividends on the Series A Preferred Stock. Also, future offerings of debt or senior equity securities may adversely affect the market price of the Series A Preferred Stock. If we decide to issue debt or senior equity securities in the future, it is possible that these securities will be governed by an indenture or other instruments containing covenants restricting our operating flexibility. Additionally, any convertible or exchangeable securities that we issue in the future may have rights, preferences and privileges more favorable than those of the Series A Preferred Stock and may result in dilution to owners of the Series A Preferred Stock. We and, indirectly, our shareholders, will bear the cost of issuing and servicing such securities. Because our decision to issue debt or equity securities in any future offering will depend on market conditions and other factors beyond our control, we cannot predict or estimate the amount, timing or nature of our future offerings. The holders of the Series A Preferred Stock will bear the risk of our future offerings, which may reduce the market price of the Series A Preferred Stock and will dilute the value of their holdings in us.

There is no existing market for our Series A Preferred Stock and a trading market that will provide you with adequate liquidity may not develop for our Series A Preferred Stock.

The Series A Preferred Stock is a new issue of securities and currently no market exists for the Series A Preferred Stock. We have filed an application to list the Series A Preferred Stock on the NASDAQ. However, we cannot assure you that the Series A Preferred Stock will be approved for listing on the NASDAQ. Even if so approved, a trading market for the Series A Preferred Stock may never develop or, even if one develops, may not be maintained and may not provide you with adequate liquidity. The liquidity of any market for the Series A Preferred Stock that may develop will depend on a number of factors, including prevailing interest rates, our financial condition and operating results, the number of holders of the Series A Preferred Stock, the market for similar securities and the interest of securities dealers in making a market in the Series A Preferred Stock. We cannot predict the extent to which investor interest in our company will lead to the development of a trading market in our Series A Preferred Stock, or how liquid that market might be. If an active market does not develop, you may have difficulty selling your shares of our Series A Preferred Stock. The price of our Series A Preferred Stock was determined by the negotiations between us and the representatives of the underwriters and may not be indicative of prices that will prevail in the open market following the completion of this offering.

We may issue additional shares of Series A Preferred Stock and additional series of preferred stock that rank on parity with the Series A Preferred Stock as to dividend rights, rights upon liquidation or voting rights.

We are allowed to issue additional shares of Series A Preferred Stock and additional series of preferred stock that would rank equally to or above the Series A Preferred Stock as to dividend payments and rights upon our liquidation, dissolution or winding up of our affairs pursuant to our articles of incorporation and the articles of amendment relating to the Series A Preferred Stock without any vote of the holders of the Series A Preferred Stock. The issuance of additional shares of Series A Preferred Stock and additional series of preferred stock could have the effect of reducing the amounts available to the Series A Preferred Stock issued in this offering upon our liquidation or dissolution or the winding up of our affairs. It also may reduce dividend payments on the Series A Preferred Stock issued in this offering if we do not have sufficient funds to pay dividends on all Series A Preferred Stock outstanding and other classes or series of stock with equal priority with respect to dividends.

Also, although holders of Series A Preferred Stock are entitled to limited voting rights, as described in “Description of the Series A Preferred Stock—Voting Rights,” with respect to the circumstances under which the holders of Series A Preferred Stock are entitled to vote, the Series A Preferred Stock will vote separately as a class along with all other series of our preferred stock that we may issue upon which like voting rights have been conferred and are exercisable. As a result, the voting rights of holders of Series A Preferred Stock may be significantly diluted, and the holders of such other series of preferred stock that we may issue may be able to control or significantly influence the outcome of any vote.

Future issuances and sales of senior or pari passu preferred stock, or the perception that such issuances and sales could occur, may cause prevailing market prices for the Series A Preferred Stock and our common stock to decline and may adversely affect our ability to raise additional capital in the financial markets at times and prices favorable to us.

Market interest rates may materially and adversely affect the value of the Series A Preferred Stock.

One of the factors that will influence the price of the Series A Preferred Stock will be the dividend yield on the Series A Preferred Stock (as a percentage of the market price of the Series A Preferred Stock) relative to market interest rates. An increase in market interest rates, which are currently at low levels relative to historical rates, may lead prospective purchasers of the Series A Preferred Stock to expect a higher dividend yield (and higher interest rates would likely increase our borrowing costs and potentially decrease funds available for dividend payments). Thus, higher market interest rates could cause the market price of the Series A Preferred Stock to materially decrease.

We may not be able to pay dividends on the Series A Preferred Stock.

Our ability to pay cash dividends on the Series A Preferred Stock will require us to have either net profits or positive net assets (total assets less total liabilities) over our capital, and to be able to pay our debts as they become due in the usual course of business.

Further, notwithstanding these factors, we may not have sufficient cash to pay dividends on the Series A Preferred Stock. Our ability to pay dividends may be impaired if any of the risks described in this prospectus or documents incorporated by reference in this prospectus, were to occur. Also, payment of our dividends depends upon our financial condition and other factors as our board of directors may deem relevant from time to time. We cannot assure you that our businesses will generate sufficient cash flow from operations or that future borrowings will be available to us in an amount sufficient to enable us to make distributions on our common stock, if any, and preferred stock, including the Series A Preferred Stock to pay our indebtedness or to fund our other liquidity needs.

Holders of the Series A Preferred Stock may be unable to use the dividends-received deduction and may not be eligible for the preferential tax rates applicable to “qualified dividend income.”

Distributions paid to corporate U.S. holders of the Series A Preferred Stock may be eligible for the dividends-received deduction, and distributions paid to non-corporate U.S. holders of the Series A Preferred Stock may be subject to tax at the preferential tax rates applicable to “qualified dividend income,” if we have current or accumulated earnings and profits, as determined for U.S. federal income tax purposes. We do not currently have accumulated earnings and profits. Additionally, we may not have sufficient current earnings and profits during future fiscal years for the distributions on the Series A Preferred Stock to qualify as dividends for U.S. federal income tax purposes. If the distributions fail to qualify as dividends, U.S. holders would be unable to use the dividends-received deduction and may not be eligible for the preferential tax rates applicable to “qualified dividend income.” If any distributions on the Series A Preferred Stock with respect to any fiscal year are not eligible for the dividends-received deduction or preferential tax rates applicable to “qualified dividend income” because of insufficient current or accumulated earnings and profits, it is possible that the market value of the Series A Preferred Stock might decline.

Our revenues, operating results and cash flows may fluctuate in future periods and we may fail to meet investor expectations, which may cause the price of our Series A Preferred Stock to decline.

Variations in our quarterly and year-end operating results are difficult to predict and our income and cash flow may fluctuate significantly from period to period, which may impact our board of directors’ willingness or legal ability to declare a monthly dividend. If our operating results fall below the expectations of investors or securities analysts, the price of our Series A Preferred Stock could decline substantially. Specific factors that may cause fluctuations in our operating results include:

| · | demand and pricing for our products and services; |

| · | government or commercial healthcare reimbursement policies; |

| · | physician and patient acceptance of any of our current or future products; |

| · | introduction of competing products; |

| · |

| · | timing and size of any new product or technology acquisitions we may complete; and |

| · | variable sales cycle and implementation periods for our products and services. |

Our Series A Preferred Stock has not been rated.

We have not sought to obtain a rating for the Series A Preferred Stock. No assurance can be given, however, that one or more rating agencies might not independently determine to issue such a rating or that such a rating, if issued, would not adversely affect the market price of the Series A Preferred Stock. Also, we may elect in the future to obtain a rating for the Series A Preferred Stock, which could adversely affect the market price of the Series A Preferred Stock. Ratings only reflect the views of the rating agency or agencies issuing the ratings and such ratings could be revised downward, placed on a watch list or withdrawn entirely at the discretion of the issuing rating agency if in its judgment circumstances so warrant. Any such downward revision, placing on a watch list or withdrawal of a rating could have an adverse effect on the market price of the Series A Preferred Stock.

We may redeem the Series A Preferred Stock.

On or after ________, 2020, we may, at our option, redeem the Series A Preferred Stock, in whole or in part, at any time or from time to time. Also, upon the occurrence of a Change of Control, we may, at our option, redeem the Series A Preferred Stock, in whole or in part, within 120 days after the first date on which such Change of Control occurred. We may have an incentive to redeem the Series A Preferred Stock voluntarily if market conditions allow us to issue other preferred stock or debt securities at a rate that is lower than the dividend on the Series A Preferred Stock. If we redeem the Series A Preferred Stock, then from and after the redemption date, your dividends will cease to accrue on your shares of Series A Preferred Stock, your shares of Series A Preferred Stock shall no longer be deemed outstanding and all your rights as a holder of those shares will terminate, except the right to receive the redemption price plus accumulated and unpaid dividends, if any, payable upon redemption.

The market price of the Series A Preferred Stock could be substantially affected by various factors.

The market price of the Series A Preferred Stock depends on many factors, which may change from time to time, including:

| · | prevailing interest rates, increases in which may have an adverse effect on the market price of the Series A Preferred Stock; |

| · | trading prices of similar securities; |

| · | our history of timely dividend payments; |

| · | the annual yield from dividends on the Series A Preferred Stock as compared to |

| · | general economic and financial market conditions; |

| · | government action or regulation; |

| · | the financial condition, performance and prospects of us and our competitors; |

| · | changes in financial estimates or recommendations by securities analysts with respect to |

| · | our issuance of additional preferred equity or debt securities; and |

| · | actual or anticipated variations in quarterly operating results of us and our competitors. |

As a result of these and other factors, investors who purchase the Series A Preferred Stock in this offering may experience a decrease, which could be substantial and rapid, in the market price of the Series A Preferred Stock, including decreases unrelated to our operating performance or prospects.

| 15 |

As a holder of Series A Preferred Stock, you will have extremely limited voting rights. Your voting rights as a holder of Series A Preferred Stock will be limited. Our shares of common stock are the only class of our securities that carry full voting rights, and Mahmud Haq, our Chief Executive Officer, beneficially owns 43.6% of our outstanding shares of common stock. As a result, Mr. Haq exercises a significant level of control over all matters requiring stockholder approval, including the election of directors, amendment of |

In connection with this offering we will amend and restate our certificate of incorporation, and effectuateapproval of significant corporate transactions. This control could have the effect of delaying or preventing a [ ]change of control of our company or changes in management, and will make the approval of certain transactions difficult or impossible without his support, which in turn could reduce the price of our Series A Preferred Stock.