As filed with the Securities and Exchange Commission on November 21, 2016December 1, 2021

Registration No. 333-259834

United States

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,Washington, D.C. 20549

_______________________

FORM S-1Amendment No. 2 to

Form S-1/A

REGISTRATION STATEMENT

UNDER THE

SECURITIES ACT OF 1933

CREATIVE MEDICAL TECHNOLOGY HOLDINGS, INC.

(Exact name of Registrant as Specified in Its Charter)_______________________

CREATIVE MEDICAL TECHNOLOGY HOLDINGS, INC. | ||||

(Exact name of registrant as specified in its charter) |

Nevada | 2836 | 87-0622284 | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification |

2017 W Peoria Avenue

211 E Osborn Road

Phoenix, AZ 8502985012

(833) 336-7636

(602) 680-7439

(Address, including zip code, and telephone number, including area code,

of registrant'sregistrant’s principal executive offices)

Timothy Warbington CEO

Chief Executive Officer

2017 W Peoria Avenue

Creative Medical Technology Holdings, Inc.

211 E Osborn Road

Phoenix, AZ 85029

(602) 680-7439

timwarbington@yahoo.com

Arizona 85012

(833) 336-7636

(Name, address, including zip code, and telephone number,

including area code,of agent for service)

Copies of Communications to:

Copies to:

Ronald N. Vance

Vance, Higley & Associates, P.C.

Attorneys at Law

1656 Reunion Avenue

Suite 250

South Jordan, UT 84095

(801) 446-8802

(801) 446-8803 (fax)

ron@vancelaw.us

Zev M. Bomrind, Esq. Fox Rothschild LLP 101 Park Avenue New York, New York 10178 (212) 878-7951 | Robert F. Charron, Esq. Charles Phillips, Esq. Ellenoff Grossman & Schole LLP 1345 Avenue of Americas, 11th Floor New York, NY 10105 (212) 370-1300 |

Approximate date of commencement of proposed sale to thepublic: From time to timeAs soon as practicable after the effective date of this Registration Statement becomes effective.registration statement.

If any of the securities being registered on this formForm are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box.x ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨ ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨ ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨ ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

Emerging growth company | ☒ |

| Calculation of Registration Fee | ||||||||||||||||

| Title of Each Class of Securities to be Registered | Amount to be Registered | Proposed Maximum Offering Price Per Share (1) | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee | ||||||||||||

| Common Stock, $.001 par value | 23,732,669 | $ | 0.49 | $ | 11,629,008 | $ | 1,347.80 | |||||||||

| TOTAL | 23,732,669 | $ | 11,629,008 | $ | 1,347.80 | |||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Exchange Act. ☐

(1) CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered |

| Proposed Price (1) |

|

| Amount of |

| ||

Common stock, par value $0.0001 per share (2) |

| $ | 23,000,000 |

|

| $ | 2,132.10 |

|

Warrants to purchase shares of common stock |

| ________ |

|

| (3 | ) | ||

Common stock issuable upon exercise of warrants (2) |

| $ | 23,000,000 |

|

| $ | 2,132.10 |

|

Pre-funded warrants to purchase shares of common Stock |

| (4 | ) |

| ________ |

| ||

Common stock issuable upon exercise of pre-funded warrants |

| (4 | ) |

| ________ |

| ||

Representative’s Warrants to purchase common stock (3) |

| ________ |

|

| ________ |

| ||

Shares of common stock issuable upon exercise of Representative’s Warrants (5)(6) |

| $ | 2,875,000 |

|

| $ | 266.51 |

|

TOTAL |

| $ | 48,875,000 |

|

| $ | 4,530.71 | (7) |

(1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended. |

(2) | Includes stock and/or warrants that may be issued upon exercise of a 45-day option granted to the underwriters to cover over-allotments, if any. |

(3) | In accordance with Rule 457(g) under the Securities Act, because the shares of the common stock underlying the Warrants and Representative’s warrants are registered hereby, no separate registration fee is required with respect to the warrants registered hereby. |

(4) | The proposed maximum aggregate offering price of the common stock will be reduced on a dollar-for-dollar basis based on the offering price of any pre-funded warrants sold in the offering, and the proposed maximum aggregate offering price of the pre-funded warrants to be sold in the offering will be reduced on a dollar-for-dollar basis based on the offering price of any common stock sold in the offering. Accordingly, the proposed maximum aggregate offering price of the common stock and pre-funded warrants (including the common stock issuable upon exercise of the pre-funded warrants), if any, is $23,000,000, including the underwriter’s option to purchase additional shares of common stock. |

(5) | Includes shares of common stock which may be issued upon exercise of additional warrants which may be issued upon exercise of 45-day option granted to the underwriters to cover over-allotment, if any. |

(6) | These warrants are exercisable at a per share exercise price equal to 125% of the public offering price. As estimated solely for the purpose of recalculating the registration fee pursuant to Rule 457(g) under the Securities Act, the proposed maximum aggregate offering price of the Representative Warrants is $2,875,000, which is equal to 125% of $2,300,000 (5% of $46,000,000). |

(7) | The fee was previously paid. |

In the event of a stock split, stock dividend, or similar transaction involving our common stock, the number of shares registered shall automatically be increased to cover the additional shares of common stock issuable pursuant to Rule 457(c) solely for416 under the purpose of calculating the amount of the registration fee.Securities Act.

The registrantRegistrant hereby amends this registration statementRegistration Statement on such date or dates as may be necessary to delay its effective date until the registrantRegistrant shall file a further amendment which specifically states that this registration statementRegistration Statement shall thereafterhereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statementRegistration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

SUBJECT TO COMPLETION, DATED NOVEMBER 21, 2016

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

SUBJECT TO COMPLETION, DATED DECEMBER __, 2021

Creative Medical Technology Holdings, Inc.

23,732,6694,842,615 Shares of Common Stock

Warrants to Purchase up to 4,842,615 Shares of Common Stock

Pre-Funded Warrants to Purchase up to 4,842,615 Shares of Common Stock

This prospectus relates to the resale by the selling stockholdersis a firm commitment public offering of up to 23,732,669 shares of our common stock. The selling stockholders acquired the shares being offered in this prospectus pursuant to the reverse merger transaction with our operating subsidiary completed on May 18, 2016.

The selling stockholders, or their pledgees, donees, transferees or other successors-in-interest, may offer the4,842,615 shares of our common stock and warrants to purchase up to 4,842,615 shares of our common stock (which we refer to as “Public Warrants”) at a combined public offering price of $4.13 per shares of common stock and accompanying Public Warrant. Each Public Warrant is immediately exercisable for resaleone share of common stock at an exercise price of $4.13 share (or 100% of the price of each share of common stock sold in the over-the-counter market,offering) and will expire five years from the date of issuance.

We are also offering to those purchasers, if any, whose purchase of common stock in isolated transactions, orthis offering would otherwise result in a combinationany such purchaser, together with its affiliates, beneficially owning more than 4.99% (or, at the election of such methodspurchaser, 9.99%) of sale. The selling stockholders will sell their shares at prevailing market prices or privately negotiated prices. There will be no underwriter’s discounts or commissions, except forour outstanding common stock immediately following the chargesconsummation of this offering, the opportunity to a selling shareholder for sales through a broker-dealer. All net proceeds from a sale will go to the selling shareholder and not to us. We will pay the expenses of registering these shares.

Our stock is quoted on OTCQB under the symbol “CELZ.” On November 10, 2016, the last reported sale pricepurchase pre-funded warrants in lieu of shares of our common stock onthat would otherwise result in such purchaser’s beneficial ownership exceeding 4.99% (or, at the OTCQB Marketplace was $0.51.election of such purchaser, 9.99%) of our outstanding common stock. The purchase price for each pre-funded warrant will equal the per share public offering price for the common stock in this offering less the $0.0001 per share exercise price of each such pre-funded warrant. Each pre-funded warrant will be exercisable upon issuance and will not expire prior to exercise.

We are an “emerging growth company”Our common stock is quoted for trading on the Pink Market maintained by OTC Markets Group (the “OTC Pink”) under the federal securities laws andsymbol “CELZ.” We have applied to have our common stock listed on the Nasdaq Capital Market under the symbol “CELZ”, which listing is a condition to this offering. No assurance can be given that our application will be subjectapproved. On November 29, 2021, the last reported sales price for our common stock as quoted on the OTC Pink was $4.75 per share.

The share and per share information in this prospectus give retroactive effect to reduced public company reporting requirements. Investingthe 1-for-500 reverse split of our outstanding common stock effected on November 10, 2021.

__________________________

An investment in our common stock and warrants involves risks. Youa high degree of risk. Before buying any securities you should carefully considerread the Risk Factorsdiscussion of the material risks of investing in our common stock and warrants in “Risk Factors” beginning on page 46 of this prospectus.

__________________________

Neither the Securities and Exchange Commission nor any other state securities commission has approved or disapproved of these securities or passed upon the adequacyaccuracy or accuracyadequacy of this prospectus. Any representation to the contrary is a criminal offense.

Per Share and related Public Warrant (2) | Per Pre-Funded Warrant and related Public Warrant (2) | Total | ||||||||||

Public offering price | $ | $ | $ | |||||||||

Underwriting discounts and commissions (1) | $ | $ | $ | |||||||||

Proceeds to us before offering expenses (3) | $ | $ | $ | |||||||||

________________

(1) | Does not reflect additional compensation to the representative in the form of warrants to purchase up to 484,262 shares of common stock (assuming the over-allotment option is fully exercised) at an exercise price equal to 125% of the public offering price. We have also agreed to reimburse the representative for certain expenses. See “Underwriting” on page 67 of this prospectus for a description of these arrangements. |

(2) | The public offering price and underwriting discount corresponds to (x)(i) a public offering price per share of $ and (ii) a public offering price per Public Warrant of $ , and (y)(i) a public offering price per pre-funded warrant of $ and (ii) a public offering price per Public Warrant of $ . |

| (3) | We estimate the total expenses of this offering will be approximately $380,000. Assumes no exercise of the over-allotment option we have granted to the underwriters as described below. |

We have granted the underwriters a 45-day option to purchase up to 726,393 additional shares of common stock and/or Public Warrants to purchase up to 726,393 additional shares of common stock.

The date of this prospectus is ____________, 2016underwriters expect to deliver our shares, Public Warrants and pre-funded warrants, if any, to purchasers in the offering on or about , 2021.

Roth Capital Partners

TABLE OF CONTENTSProspectus dated [●], 2021.

TABLE OF CONTENTS

1 | |||

6 | |||

17 | |||

18 | |||

19 | |||

20 | |||

21 | |||

22 | |||

Management’s Discussion And Analysis Of Financial Condition And Results Of Operation | 35 | ||

39 | |||

42 | |||

43 | |||

Security Ownership Of Certain Beneficial Owners And Management | 45 | ||

46 | |||

47 | |||

51 | |||

52 | |||

57 | |||

64 | |||

64 | |||

64 | |||

64 | |||

F-1 |

________________________________________

MARKET AND INDUSTRY DATA

The market data and certain other statistical information used throughout this prospectus are based on independent industry publications, governmental publications, reports by market research firms or other independent sources. Some data are also based on our good faith estimates.

BASIS OF PRESENTATION

References herein to the “Company,” “Registrant,” “we,” “us,” “our” and “our company” refer to Creative Medical Technology Holdings, Inc., a Nevada corporation and its subsidiaries.

Certain monetary amounts, percentages and other figures included in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables or charts and figures expressed as percentages in the text may not total 100% or, as applicable, when aggregated may not be the arithmetic aggregation of the percentages that precede them.

________________________________________

YOU SHOULD RELY ONLY ON THE INFORMATION CONTAINED IN THIS PROSPECTUS OR IN ANY FREE WRITING PROSPECTUS WE MAY AUTHORIZE TO BE DELIVERED OR MADE AVAILABLE TO YOU. WE HAVE NOT, AND THE UNDERWRITERS HAVE NOT, AUTHORIZED ANYONE TO PROVIDE YOU WITH DIFFERENT INFORMATION. WE ARE NOT MAKING AN OFFER OF THESE SECURITIES IN ANY STATE WHERE THE OFFER IS NOT PERMITTED. YOU SHOULD NOT ASSUME THAT THE INFORMATION PROVIDED IN THIS PROSPECTUS IS ACCURATE AS OF ANY DATE OTHER THAN THE DATE ON THE FRONT OF THIS PROSPECTUS.

No person is authorized in connection with this prospectus to give any information or to make any representations about us, the securities offered hereby or any matter discussed in this prospectus, other than the information and representations contained in this prospectus. If any other information or representation is given or made, such information or representation may not be relied upon as having been authorized by us.

v | |

| Table of Contents |

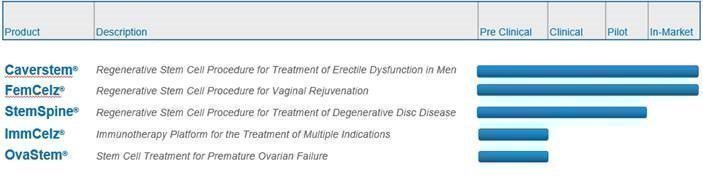

PROSPECTUS SUMMARY This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before investing in our securities. You should carefully read the entire prospectus, including “Risk Factors” and the financial statements and notes thereto, before making an investment decision. Corporate Overview We are a commercial stage biotechnology company focused on immunology, urology, neurology and orthopedics using adult stem cell treatments and interrelated regenerative technologies for the treatment of multiple indications. Our existing and pipeline of therapies and products include of the following:

Our subsidiary, Creative Medical Technologies, Inc. (“CMT”), was originally created to monetize U.S. Patent No. 8,372,797 and related intellectual property related to the treatment of erectile dysfunction (“ED”), which it acquired in February 2016. Subsequently, we have expanded our development and acquisition of intellectual property beyond urology to include therapeutic treatments utilizing “re-programmed” stem cells, and the treatment of neurologic disorders, lower back pain, type I diabetes, and heart, liver, kidney and other diseases using various types of stem cells through our ImmCelz, Inc., StemSpine, Inc. and AmnioStem LLC subsidiaries. However, neither ImmCelz Inc., StemSpine Inc. nor AmnioStem LLC have commenced commercial activities. We currently conduct substantially all of our commercial operations through CMT, which markets and sells our CaverStem® and FemCelz® disposable kits utilized by physicians to perform autologous procedures that treat erectile dysfunction and female sexual dysfunction, respectively. Our CaverStem® and FemCelz® kits are currently available through physicians at eight locations in the United States. In addition to our CaverStem® and FemCelz®products, we are currently in the process of recruiting clinical sites for our StemSpine® Regenerative Stem Cell Procedure for the Treatment of Degenerative Disc Disease. Our StemSpine® treatment is an autologous procedure that utilizes a patient’s own stem cells to treat lower back pain. In 2020, through our ImmCelz Inc. subsidiary, we began exploring the development of treatments that utilize a patient’s own extracted immune cells that are then “reprogrammed” by culturing them outside the patient’s body with optimized stem cells. The immune cells are then re-injected into the patient from whom they were extracted. We believe this process endows the immune cells with regenerative properties that may be suitable for the treatment of stroke victims, among other indications. In contrast to other stem cell-based approaches, the immune cells are significantly smaller in size than stem cells and are believed to more effectively penetrate areas of the damaged tissues and induce regeneration. We are currently primarily focused on expanding the commercial sale and use of our CaverStem® and FemCelz® products by physicians in the United States and Europe, and commercializing our StemSpine® treatment for lower back pain. We also recently filed an Investigational New Drug (IND) application with the FDA to treat stroke utilizing our ImmCelzTM technology. In the future, subject to the availability of capital, we will seek to further develop additional therapeutic products that utilize our proprietary intellectual property. Listing on the Nasdaq Capital Market Our common stock is currently quoted on the Pink Market maintained by OTC Markets Group (the “OTC Pink”). In connection with this offering, we have applied to list our common stock on the Nasdaq Capital Market (“Nasdaq”) under the symbol “CELZ”. We do not intend to apply to list the Public Warrants or the pre-funded warrants on Nasdaq or any nationally recognized trading system. If our listing application is approved, we expect to list our common stock on Nasdaq upon consummation of the offering, at which point our common stock will cease to be traded on the OTC Pink. No assurance can be given that our listing application will be approved. Nasdaq listing requirements include, among other things, a stock price threshold. As a result, in order to meet such requirement, on November 10, 2021, we effected a 1-for-500 reverse split of our common stock. There can be no assurance that our common stock will be listed on the Nasdaq. However, we will not complete this offering if we are not so listed. |

| 1 |

Risks Associated With our Business Our ability to execute our business strategy is subject to numerous risks, as more fully described in the section captioned “Risk Factors” immediately following this prospectus summary. You should read these risks before you invest in our common stock and warrants. In particular, risks associated with our business include, but are not limited to, the following: | ||

· | We have incurred substantial losses and our future profitability is uncertain. | |

· | Even with the proceeds from this offering, we will need additional capital to fund our operations as planned. | |

· | Our future success is dependent on significantly increasing sales of our CaverStem® and FemCelz® products, and the timely and successful development and commercialization of our StemSpine® treatment for lower back pain and/or our ImmCelzTM technology for the treatment of multiple indications; if we are not successful in increasing sales of our existing products or commercializing our proposed new products, our business prospects would be significantly harmed. | |

· | We will need to obtain regulatory approval for our ImmCelzTM therapy. | |

· | The results of our clinical trials may not support our product claims or may result in the discovery of adverse side effects. | |

· | Clinical trials involve a lengthy and expensive process with an uncertain outcome, and results of earlier studies and trials may not be predictive of future trial results. | |

· | Later discovery of previously unknown problems could limit our ability to market or sell our products and therapies even those that have been approved, and can expose us to product liability claims. | |

· | We rely in part on third parties for research and clinical trials for our products. | |

· | We currently have a very limited marketing and sales organization and may have to invest significant resources to develop these capabilities. If we are unable to establish marketing and sales capabilities or enter into agreements with third parties to market and sell our product candidates, we may not be able to generate product revenue. | |

· | We rely upon third parties for the manufacture of our CaverStem® and FemCelz® disposable kits and are dependent on their quality and effectiveness. | |

· | We face competition from well-funded companies. | |

· | We may not be able to maintain the patent rights we rely upon to protect our intellectual property, they may not be sufficient, and we may be subject to claims that we infringe the intellectual property of others; | |

· | We are subject to increasing government regulations, price controls and other restrictions on pricing, reimbursement and access to therapies and drugs, which could adversely affect our future revenues and profitability. | |

· | We are dependent on our executive officers and consultants, and we may not be able to pursue our current business strategy effectively if we lose them. | |

| Bridge Financing In August 2021, we completed the sale of 15% Original Issue Discount Senior Notes (or “Bridge Notes”) in the aggregate principal amount of $4,456,176. In connection with the sale of the Bridge Notes, holders of shares of our preferred stock exchanged such preferred stock for additional Bridge Notes in the aggregate principal amount of $690,000. The Bridge Notes mature on February 11, 2022, subject to the requirement that we redeem the Bridge Notes prior to such date with the net proceeds of any future offering of our securities, including this public offering. Accordingly, we will use a portion of the proceeds of the offering to redeem the Bridge Notes. Pursuant to the Purchase Agreement, the Company also issued to the purchasers of the Bridge Notes five-year warrants to purchase an aggregate of 363,046 shares of our common stock at an initial exercise price of $14.175 per share, subject to anti-dilution adjustment in the event of future sales of our equity below the then exercise price, stock dividends, stock splits and other specified events. | ||

Corporate and other Information We were incorporated on December 3, 1998, in the State of Nevada under the name Jolley Marketing, Inc. On May 18, 2016, we completed a reverse merger transaction under which Creative Medical Technologies, Inc. became our wholly-owned subsidiary. In connection with this merger, we changed our name to Creative Medical Technologies Holdings, Inc. to reflect our current business. Our principal offices are located at 211 E Osborn Road, Phoenix, AZ, 85012, and our telephone number is (833) 336-7636. We maintain a website at https://creativemedicaltechnology.com. Information contained on our website does not constitute part of this prospectus. Implications of Being an Emerging Growth Company We currently qualify as an “emerging growth company” under Jumpstart Our Business Act of 2012, as amended, or the JOBS Act. As a result, we rely on exemptions from certain disclosure requirements, and are not required to: | |||

· | have an auditor report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act; | ||

· | comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis); | ||

· | submit certain executive compensation matters to stockholder advisory votes, such as “say-on-pay” and “say-on-frequency;” and | ||

· | disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the chief executive officer’s compensation to median employee compensation. | ||

We may take advantage of these provisions through 2021. For example, we have taken advantage of the reduced reporting requirements with respect to disclosure regarding our executive compensation arrangements, have presented only two years of audited financial statements, have presented reduced “Management’s Discussion and Analysis of Financial Condition and Results of | In addition, under the JOBS Act, emerging growth companies can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have irrevocably elected not to avail ourselves of this exemption from new or revised accounting standards and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies. Additionally, we are a “smaller reporting company” as defined in Item 10(f)(1) of Regulation S-K. Smaller reporting companies may take advantage of certain reduced disclosure obligations, including, among other things, providing only two years of audited financial statements. We will remain a smaller reporting company until the last day of any fiscal year for so long as either (1) the market value of our shares of common stock held by non-affiliates does not equal or exceed $250 million as of the prior June 30th, or (2) our annual revenues did not equal or exceed $100 million during such completed fiscal year and the market value of our shares of common stock held by non-affiliates did not equal or exceed $700.0 million as of the prior June 30th. To the extent we take advantage of any reduced disclosure obligations, it may also make it difficult to compare our financial statements with other public companies. | ||

| Table of Contents |

The Offering | ||

Common Stock Offered by Us | 4,842,615 shares. | |

Public Warrants Offered by Us | Warrants to purchase up to 4,842,615 shares of our common stock, which will be exercisable during the period commencing on the date of their issuance and ending five years from such date at an exercise price per share of common stock equal to 100% of the combined public offering price per share of common stock and Public Warrant in this offering. | |

Pre-funded Warrants Offered by Us | We are also offering to certain purchasers whose purchase of our common stock in this offering would otherwise result in the purchaser, together with its affiliates, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of common stock immediately following the consummation of this offering, the opportunity to purchase pre-funded warrants in lieu of common stock that would otherwise result in any such purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of common stock. Each pre-funded warrant will be exercisable for one share of common stock. The purchase price of each pre-funded warrant and the accompanying Public Warrant will equal the price at which the common stock and the accompanying Public Warrant are being sold to the public in this offering, minus $0.0001, and the exercise price of each pre-funded warrant will be $0.0001 per share. The pre-funded warrants will be exercisable immediately and may be exercised at any time until exercised in full. For each pre-funded warrant we sell, the number of shares of common stock we are offering will be decreased on a one-for-one basis. Because we will issue one Public Warrant for each share of common stock and for each pre-funded warrant to purchase one share of common stock sold in this offering, the number of Public Warrants sold in this offering will not change as a result of a change in the mix of the shares of our common stock and pre-funded warrants sold. | |

Common stock outstanding prior to this offering (1) | 2,452,348 shares | |

Number of shares of common stock offered by us: | 4,842,615 shares | |

Public offering price: | $4.13 per share of Common Stock and accompanying Public Warrant, or pre-funded warrant and accompanying Public Warrant, as applicable. | |

Common stock outstanding after this offering (1) | 7,294,963 shares (assuming we sell only shares of common stock and no pre-funded warrants, and none of the warrants issued in this offering are exercised). | |

Use of proceeds | We estimate that we will receive net proceeds from this offering of approximately $18,220,000 (or $20,550,000 if the overallotment option is exercised in full) based upon an offering price of $4.13 per Unit, after deducting underwriting discounts and estimated offering expenses payable by us. We currently intend to use the net proceeds we receive from this offering to (i) redeem our Bridge Notes in the outstanding amount of $5,146,176, (ii) repurchase our Series A Preferred Stock from our Chief Executive Officer for an aggregate purchase price of approximately $195,000, (iii) hire marketing and sales personnel to support sales of our CaverStem® and FemCelz® products, (iv) proceed with a clinical study of 100 patients intended to support the safety and efficacy of our StemSpine® Regenerative Stem Cell Procedure for Treatment of Degenerative Disc Disease, (v) conduct, a Phase I clinical trial for the treatment of stroke utilizing our ImmCelzTM technology, (vi) continue to develop other products and therapies, and (vii) fund working capital and general corporate purposes using any remaining amounts. See “Use of Proceeds” on page 18. | |

Representative’s Warrants | The registration statement of which this prospectus is a part also registers for sale warrants (the “Representative’s Warrants”) to purchase 484,262 shares of our common stock (556,901 shares of common stock if the over-allotment option is exercised in full) to Roth Capital Partners (the “Representative”), as the representative of the several underwriters, as a portion of the underwriting compensation payable to the underwriters in connection with this offering. The Representative’s Warrants will be immediately exercisable at an exercise price of $5.1625 (125% of the price which shares of common stock are offered to the public pursuant to this offering) and expire on the fifth anniversary of the commencement of sales of this offering. Please see “Underwriting — Representative’s Warrants” for a description of these warrants. | |

| Table of Contents |

Over-allotment option: | The Underwriting Agreement provides that we will grant to the underwriters an option, exercisable within 45 days after the date of this prospectus, to acquire up to 726,393 additional shares of common stock and/or Public Warrants to purchase up to 726,393 additional shares of common stock, solely for the purpose of covering over-allotments. | |||

Lock-Up | Our directors, executive officers, and certain stockholders have agreed with the Representative not to offer for sale, issue, sell, contract to sell, pledge or otherwise dispose of any of our common stock or securities convertible into common stock for a period of 6 months commencing on the date of this prospectus. | |||

Risk Factors | You should carefully read the “Risk Factors” section of this prospectus beginning on page 6 for a discussion of factors that you should consider before deciding to invest in our securities. | |||

Trading Symbol and Listing | Our common stock is presently quoted on the OTC Pink under the symbol “CELZ”. We have applied to have our common stock listed on the NASDAQ Capital Market under the symbol “CELZ”. If our listing application is not approved, we will not complete this offering. We do not intend to apply for listing of the Public Warrants or pre-funded warrants on any national securities exchange or trading system. | |||

(1) Unless we indicate otherwise, the number of shares of our common stock outstanding after this offering is based on 2,452,348 shares of common stock outstanding on November 15, 2021, and excludes the following: | ||||

· | 600,000 shares of our common stock reserved for issuance under our 2021 Equity Incentive Plan; and | |||

· | 481,351 shares of our common stock issuable upon the exercise of warrants, with a weighted-average exercise price of $13.28 per share. | |||

Unless otherwise noted, the information in this prospectus assumes: | ||||

· | no exercise of the outstanding warrants described above; | |||

· | no exercise of Public Warrants; | |||

· | no exercise of the Representative’s Warrants; and | |||

· | no exercise of the underwriters’ option to purchase additional shares and/or warrants from us in this offering. | |||

RISK FACTORS

An investment in our securities involves a high degree of risk. You should carefully consider the following risk factors in addition to other information in this prospectus before purchasing our securities. The risks and uncertainties described below are those that we currently deem to be material and that we believe are specific to our company, our industry and our securities. In addition to these risks, our business may be subject to risks currently unknown to us. If any of these or other risks actually occurs, our business may be adversely affected, the trading price of our securities may decline and you may lose all or part of your investment.

Risks Related to our Financial Position and Capital Needs

We have incurred recent losses and our future profitability is uncertain.

We have incurred net losses of approximately $36.3 million and $8.4 million for the years ended December 31, 2020 and December 31, 2019, respectively, and 1,844,000 for the nine months ended September 30, 2021. While our recent losses have predominantly resulted from non-cash charges relating to the change in the fair value of derivative liabilities on our balance sheets, and these derivative liabilities were subsequently substantially extinguished, we expect our operating losses to continue until such time, if ever, that product sales, licensing fees, royalties and other sources generate sufficient revenue to fund our operations. We cannot predict when, if ever, we might achieve profitability and cannot be certain that we will be able to sustain profitability, if achieved.

Even with the proceeds from this offering, we will need additional capital to fund our operations as planned.

For the year ended December 31, 2020, our operations used approximately $435,000 in cash, and for the nine months ended September 31, 2021, our operations used approximately $1,054,000 in cash. Cash used in operations consisted primarily of cash on hand and cash raised through private placements of our securities. At September 30, 2021, we had a cash balance of approximately $2,337,930 and current liabilities exceeded current assets by $917,327. Although we expect to raise additional funds from the offering, we will need additional capital to maintain our operations, continue our research and development programs, conduct clinical trials, seek regulatory approvals and manufacture and market our products. We will seek such additional funds through public or private equity or debt financings and other sources. We cannot be certain that adequate additional funding will be available to us on acceptable terms, if at all. If we cannot raise the additional funds required for our anticipated operations, we may be required to reduce the scope of or eliminate our research and development programs, delay our clinical trials and the ability to seek regulatory approvals, downsize our general and administrative infrastructure, or seek alternative measures to avoid insolvency. If we raise additional funds through future offerings of shares of our common stock or other securities, such offerings would cause dilution of current stockholders’ percentage ownership in the Company, which could be substantial. Future offerings also could have a material and adverse effect on the price of our common stock.

We have generated minimal revenues from our products. We will not achieve profitability unless we generate increased revenues from our current or proposed products or therapies.

Revenues generated from sales of our CaverStem® and FemCelz® kits were only $164,500 and $165,500 for the years ended December 31, 2020 and December 31, 2019, respectively, and $20,000 for the nine months ended September 30, 2021. To sustain our operating costs and generate profits, we will need to significantly increase revenues from our CaverStem® and FemCelz® products or from our other products or therapies that have not yet been commercialized.

We expect to continue to incur significant financial losses in the future as we seek regulatory approval for ourImmCelzTM immunotherapy platform and conduct clinical trials of our StemSpine® Regenerative Stem Cell Procedure for Treatment of Degenerative Disc Disease.

We have not authorized anyoneyet received the necessary regulatory approvals for our ImmCelzTM immunotherapy platform. In addition, we are recruiting patients for a clinical trial of StemSpine® Regenerative Stem Cell Procedure for Treatment of Degenerative Disc Disease in an effort to provide you with information differentdemonstrate the efficacy of our procedure to the medical community in order to generate demand for this procedure. We anticipate that our expenses will increase substantially as we:

● | initiate, conduct and complete ongoing, anticipated or future preclinical studies and clinical trials for our current and future product candidates; | |

● | seek marketing approvals for product candidates that successfully complete clinical trials; and | |

● | establish a sales, marketing and distribution infrastructure to commercialize products for which we may obtain marketing approval. |

| 6 |

| Table of Contents |

The report of our independent registered public accounting firm expresses substantial doubt about our ability to continue as a going concern.

Our auditors, Haynie & Company, have indicated in their report on our consolidated financial statements for the fiscal year ended December 31, 2020, that conditions exist that raise substantial doubt about our ability to continue as a going concern due to our recurring losses from that containedoperations and significant accumulated deficit. In addition, we continue to experience negative cash flows from operations. Notwithstanding the funds we expect to raise in this prospectus.offering, our auditors may again provide a “going concern” opinion with respect to our future audited financial statements. A going concern opinion could impair our ability to finance our operations through the sale of equity. Our ability to continue as a going concern will depend upon the availability of equity financing which represents the primary source of cash flows that will permit us to meet our financial obligations as they come due and continue our research and development efforts.

Risks Related to Product Development, Regulatory Approval and Commercialization

Our product candidates’ commercial viability remain subject to current and future preclinical studies, clinical trials, regulatory approvals, and the risks generally inherent in the development of biopharmaceutical products. If we are unable to successfully advance or develop our product candidates, our business will be materially harmed.

In the near-term, failure to successfully advance the development of our proposed products may have a material adverse effect on us. To date, other than limited sales generated from our CaverStem® and FemCelz® products, we have not successfully developed or commercially marketed, distributed, or sold any product candidate. The selling stockholderssuccess of our business may depend upon our ability to successfully advance the development of our current and future product candidates through preclinical studies and clinical trials, where applicable, have the product candidates approved for sale by the FDA or regulatory authorities in other countries, and ultimately have the product candidates successfully commercialized by us or a commercial partner. We cannot assure you that the results of our ongoing preclinical studies or clinical trials will support or justify the continued development of our product candidates, or that we will receive the necessary approvals from the FDA, or similar regulatory authorities in other countries, to advance the development of our product candidates.

We may not be successful in our commercialization efforts for our proposed products and therapies, which may fail to achieve the degree of market acceptance by physicians, patients, healthcare payors and others in the medical community necessary for commercial success.

To the extent we possess or obtain the necessary regulatory approval for our proposed products and therapies, we still may not be successful in our commercialization efforts or in gaining sufficient market acceptance by physicians, patients, third-party payors and others in the medical community. Market acceptance will require us to build and maintain strong relationships with healthcare professionals that treat the indications our therapies are offeringintended to address. A failure to build or maintain these important relationships with these healthcare professionals and treatment centers could result in lower market acceptance. Our efforts to educate physicians, patients, third-party payors and others in the medical community on the benefits of our products and therapies may require significant resources and may never be successful. The degree of market acceptance of our products and therapies will depend on a number of factors, including:

● | their efficacy; | |

● | limitations or warnings or any restrictions on use, and the prevalence and severity of any side effects; | |

● | the availability and efficacy of alternative treatments; | |

● | the effectiveness of sales and marketing efforts and the strength of marketing and distribution support; | |

● | their cost-effectiveness compared to alternative therapies; and | |

● | availability and amount of coverage and reimbursement from government payors, managed care plans and other third-party payors. |

| 7 |

| Table of Contents |

The results of our clinical trials may not support our product claims or may result in the discovery of adverse side effects.

Even if our clinical trials are completed as planned, we cannot be certain that their results will support our product claims or that any regulatory authority whose approval we will require in order to market and sell our products in any territory will agree with our conclusions regarding them. Success in pre-clinical studies and early clinical trials does not ensure that later clinical trials will be successful, and we cannot be sure that clinical trials will replicate the results of prior trials and pre-clinical studies. The clinical trial process may fail to demonstrate that our product candidates are safe and effective for the proposed indicated uses, which could cause us to abandon a product and may delay development of others. Any delay or termination of our clinical trials will delay the filing of our regulatory submissions and, ultimately, our ability to commercialize our product candidates and generate revenues. It is also possible that patients enrolled in clinical trials will experience adverse side effects that are not currently part of the product candidate’s profile.

We have limited experience in conducting and managing the clinical trials necessary to obtain regulatory approvals.

We have limited experience in conducting and managing the clinical trials necessary to obtain regulatory approvals, including FDA approval. Our CaverStem®, FemCelz® and StemSpine®products are exempt from the FDA premarket review and approval process as these autologous therapies involve treating the patient with his or her own cells. However, we will require FDA approval of ImmCelzTM for the treatment of stroke and other indications. We have only limited experience in filing the applications necessary to gain regulatory approvals and have relied, and expect to continue to rely, in part, on consultants and third-party contract research organizations, or CROs, with expertise in this area to assist us in this process. Securing FDA approval requires the submission of extensive non-clinical and clinical data and supporting information to the FDA for each therapeutic indication to establish a product candidate’s safety and efficacy for each indication. If third parties upon whom we rely fail to perform satisfactorily, or do not adequately fulfill their obligations under the terms of our agreements with them, our efforts to secure regulatory approval of our product candidates may be delayed or prove unsuccessful.

Clinical trials involve a lengthy and expensive process with an uncertain outcome, and results of earlier studies and trials may not be predictive of future trial results.

Clinical trials are expensive and complex, can take many years and have uncertain outcomes. We cannot predict whether we will encounter problems with any of our completed, ongoing or planned clinical trials that will cause us or regulatory authorities to delay or suspend clinical trials, or delay the analysis of data from completed or ongoing clinical trials. We estimate that clinical trials of ImmCelzTM for the treatment of stroke will continue for several years, but they may take significantly longer to complete. Failure can occur at any stage of the testing and we may experience numerous unforeseen events during, or as a result of, the clinical trial process that could delay or prevent commercialization of our current or future therapeutic candidates, including but not limited to:

· | delays in securing clinical investigators or trial sites for the clinical trials; | |

· | delays in obtaining institutional review board and other regulatory approvals to commence a clinical trial; | |

· | slower than anticipated patient recruitment and enrollment; | |

· | negative or inconclusive results from clinical trials; | |

· | unforeseen safety issues; | |

· | uncertain dosing issues; | |

· | an inability to monitor patients adequately during or after treatment; and | |

· | problems with investigator or patient compliance with the trial protocols. |

A number of companies in the pharmaceutical and biotechnology industries have suffered significant setbacks in advanced clinical trials, even after seeing promising results in earlier clinical trials. We do not know whether any clinical trials we conduct will demonstrate adequate efficacy and safety to result in regulatory approval to market ImmCelzTM.

| 8 |

| Table of Contents |

Our autologous products are currently not eligible for reimbursement from public or private insurers.

Currently, our CaverStem® and FemCelz® products and related medical procedures are paid for by patients and not eligible for reimbursement from public or private insurers. As a general rule, reimbursement is available only for products and therapies that have been approved of by the FDA. Our CaverStem® and FemCelz® products were exempt from the FDA premarket review and approval process as these autologous therapies involve treating the patient with his or her own cells. While we believe that the requirement that patients directly pay the cost for our CaverStem® and FemCelz® products and procedures make these procedures more attractive to doctors, these treatments are only available to patients that can afford to pay for them. Our success and extent of our growth will depend in part on the extent to which reimbursement for the costs of our products and related treatments will be available from third party payers, such as public and private insurers and health systems.

The pharmaceutical business is subject to increasing government regulation and reform, including with respect to price controls, reimbursement and access to therapies, which could adversely affect our future revenues and profitability.

Our existing and proposed products may not be considered cost-effective, and third-party or government reimbursement might not be available or sufficient. Globally, governmental and other third-party payors are becoming increasingly aggressive in attempting to contain health care costs by strictly controlling, directly or indirectly, pricing and reimbursement and, in some cases, limiting or denying coverage altogether on the basis of a variety of justifications, and we expect pressures on pricing and reimbursement from both governments and private payors inside and outside the U.S. to continue.

Our existing and proposed products are and will be subject to substantial pricing, reimbursement, and access pressures from state Medicaid programs, private insurance programs and pharmacy benefit managers, and the implementation of U.S. health care reform legislation that is increasing these pricing pressures. The Patient Protection and Affordable Care Act, as amended by the Health Care and Education Affordability Reconciliation Act, instituted comprehensive health care reform, and includes provisions that, among other things, reduce and/or limit Medicare reimbursement, and impose new and/or increased taxes. The future of the Affordable Care Act and its constituent parts are uncertain at this time.

The continuing efforts of government and insurance companies, health maintenance organizations, and other payors of health care costs to contain or reduce costs of health care may affect our future revenues and profitability or those of our potential customers, suppliers, and collaborative partners, as well as the availability of capital.

United States federal and state privacy laws, and equivalent laws of other nations, may increase our costs of operation and expose us to civil and criminal sanctions.

Regulation of data processing is evolving, as federal, state, and foreign governments continue to adopt new, or modify existing, laws and regulations addressing data privacy and security, and the collection, processing, storage, transfer, and use of data. These new or proposed laws and regulations are subject to differing interpretations and may be inconsistent among jurisdictions, and guidance on implementation and compliance practices are often updated or otherwise revised, which adds to the complexity of processing personal data. These and other requirements could require us or our collaborators to incur additional costs to achieve compliance, limit our competitiveness, necessitate the acceptance of more onerous obligations in our contracts, restrict our ability to use, store, transfer, and process data, impact our or our collaborators’ ability to process or use data in order to support the provision of our products, affect our or our collaborators’ ability to offer our products in certain locations, or cause regulators to reject, limit or disrupt our clinical trial activities.

We and our collaborators may be subject to federal, state and foreign data protection laws and regulations (i.e., laws and regulations that address privacy and data security). In the United States, numerous federal and state laws and regulations, including federal health information privacy laws, state personal information laws, state data breach notification laws, state health information privacy laws and federal and state consumer protection laws and regulations that govern the collection, use, disclosure and protection of health-related and other personal information could apply to our operations or the operations of our collaborators. In addition, we may obtain health information from third parties (including research institutions from which we obtain clinical trial data) that are subject to privacy and security requirements under the federal Health Insurance Portability and Accountability Act of 1996, or HIPAA, as amended by the Health Information Technology for Economic and Clinical Health Act of 2009, or HITECH. Depending on the facts and circumstances, we could be subject to civil or criminal penalties if we knowingly use or disclose individually identifiable health information maintained by a HIPAA-covered entity in a manner that is not authorized or permitted by HIPAA.

| 9 |

| Table of Contents |

Later discovery of previously unknown problems could limit our ability to market or sell our products or therapies, and can expose us to product liability claims.

Later discovery of previously unknown problems with a product, including adverse events of unanticipated severity or frequency, or with any third-party manufacturers or manufacturing processes, or failure to comply with regulatory requirements, may result in, among other things:

● | refusals or delays in the approval of applications or supplements to approved applications; | |

● | refusal of a regulatory authority to review pending market approval applications or supplements to approved applications; | |

● | restrictions on the marketing or manufacturing of the product, withdrawal of the product from the market or voluntary or mandatory product recalls or seizures; | |

● | fines, warning letters, or holds on clinical trials; | |

● | injunctions or the imposition of civil or criminal penalties; | |

● | restrictions on product administration, requirements for additional clinical trials, or changes to product labeling requirements; or | |

● | recommendations by regulatory authorities against entering into governmental contracts with us. |

Discovery of previously unknown problems or risks relating to our product could also subject us to potential liabilities through product liability claims.

If we do not obtain required approvals in other countries in which we aim to market our products, we will be limited in our ability to export or sell the products in those markets.

Our lack of experience in conducting clinical trials in foreign jurisdictions may negatively impact the approval process in those jurisdictions. If we are unable to obtain and maintain required approval from one or more foreign jurisdictions where we would like to sell our products or therapies, we will be unable to market products as intended, our international market opportunity will be limited and our results of operations will be harmed.

We rely in part on third parties for research and clinical trials for our products and therapies.

We rely on contract research organizations (“CROs”), academic institutions, corporate partners, and other third parties to assist us in managing, monitoring, and otherwise carrying out clinical trials and research activities. We rely or will rely heavily on these parties for the execution of our clinical studies and control only certain aspects of their activities. Accordingly, we may have less control over the timing and other aspects of these clinical trials than if we conducted them entirely on our own. Although we rely on these third parties to manage the data from clinical trials, we will be responsible for confirming that each of our clinical trials is conducted in accordance with its general investigational plan and protocol. Our failure, or the failure of third parties on which we rely, to comply with the strict requirements relating to conducting, recording, and reporting the results of clinical trials, or to follow good clinical practices, may delay the regulatory approval process or cause us to fail to obtain regulatory approval for our proposed products and therapies.

| 10 |

| Table of Contents |

We currently have a very limited marketing and sales organization and may have to invest significant resources to develop these capabilities. If we are unable to establish marketing and sales capabilities or enter into agreements with third parties to market and sell our products and therapies, we may not be able to generate sufficient revenues to support our operations.

Our current sales, marketing and distribution capabilities consist of one independent contractor who promotes the sale our CaverStem® and FemCelz® products to medical doctors. To generate sufficient revenues to support our operations, we will have to seek collaborators, especially for marketing and sales outside of the United States, or invest significant amounts of financial and management resources to develop internal sales, distribution and marketing capabilities. We may not be able to enter into collaborations or hire consultants or external service providers to assist us in sales, marketing and distribution functions on acceptable financial terms, or at all. In addition, our product revenues and our profitability, if any, may be lower if we rely on third parties for these functions than if we were to market, sell and distribute products that we develop ourselves. We likely will have little control over such third parties, and any of them may fail to devote the necessary resources and attention to sell and seeking offersmarket our products effectively. Even if we determine to buy,perform sales, marketing and distribution functions ourselves, we could face a number of additional related risks, including:

● | we may not be able to attract and build an effective marketing department or sales force; | |

● | the cost of establishing a marketing department or sales force may exceed our available financial resources and the revenue generated by our product candidates that we may develop, in-license or acquire; and | |

● | our direct sales and marketing efforts may not be successful. |

We rely upon third parties for the manufacture of our CaverStem® and FemCelz®disposable kits and are dependent on their quality and effectiveness.

We rely upon third parties for the manufacture of our CaverStem® and FemCelz® disposable kits. The failure to achieve and maintain high manufacturing standards, or to detect or control anticipated or unanticipated manufacturing errors or the frequent occurrence of such errors, could result in cost overruns, product recalls or withdrawals, patient injury or death, and other problems that could seriously hurt our business.

We may be unable to compete effectively with marketed therapies or drugs targeting similar indications to our products and therapies.

We face competition generally from established pharmaceutical and biotechnology companies, as well as from academic institutions, government agencies and private and public research institutions. Many of our competitors have significantly greater financial resources and expertise in research and development, manufacturing, preclinical testing, conducting clinical trials, obtaining regulatory approvals and marketing approved products than we do. Small or early-stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large, established companies. Our commercial opportunity will be reduced or eliminated if our competitors develop and commercialize any products that are safer, more effective, have fewer side effects or are less expensive than our products and therapies. These potential competitors may also compete with us in establishing clinical trial sites, and patient enrollment for clinical trials.

Our business and operations would suffer in the event of computer system failures or security breaches.

In the ordinary course of our business, we collect, store and transmit confidential information, including intellectual property, and proprietary business information. Despite the implementation of security measures, our internal computer systems, and those of our contract research organizations, or CROs, and other third parties on which we rely, are vulnerable to damage from computer viruses, unauthorized access, cyberattacks, natural disasters, fire, terrorism, war and telecommunication and electrical failures. Cyberattacks are increasing in their frequency, sophistication and intensity. Cyberattacks could include the deployment of harmful malware, denial-of-service attacks, social engineering and other means to affect service reliability and threaten the confidentiality, integrity and availability of information. Significant disruptions of our information technology systems or security breaches could adversely affect our business operations and/or result in the loss, misappropriation, and/or unauthorized access, use or disclosure of, or the prevention of access to, confidential information (including trade secrets or other intellectual property and proprietary business information and personal information), and could result in financial, legal, business and reputational harm to us. If such disruptions were to occur and cause interruptions in our operations, it could result in a material disruption of our product development programs. For example, the loss of clinical trial data from completed, ongoing or planned clinical trials could result in delays in our regulatory approval efforts and significantly increase our costs to recover or reproduce the data. Further, the COVID-19 pandemic has resulted in a significant number of our employees and partners working remotely, which increases the risk of a data breach or issues with data and cybersecurity. To the extent that any disruption or security breach results in a loss of, or damage to, our data or applications, or inappropriate disclosure of confidential or proprietary information, we could incur liability and the further development of our future product candidates could be delayed.

| 11 |

| Table of Contents |

We are subject to risks arising from the recent global outbreak of the COVID-19 coronavirus.

The recent outbreak of the COVID-19 coronavirus has spread across the globe and is impacting worldwide economic activity. A pandemic, including COVID-19 or other public health epidemic, poses the risk that we or our employees, CROs, suppliers, manufacturers and other partners may be prevented from conducting business activities for an indefinite period of time, including due to the spread of the disease or shutdowns that may be requested or mandated by governmental authorities. During 2020 and 2021, COVID-19 has resulted in significantly reduced revenues from our CaverStem® and FemCelz® products, as elective procedures in general have been greatly reduced throughout the United States during the pandemic. In addition, the continued spread of COVID-19 could disrupt our clinical trials, supply chain and the manufacture or shipment of our products, and other related activities, which could have a material adverse effect on our business, financial condition and results of operations. COVID-19 has also had an adverse impact on global economic conditions which could impair our ability to raise capital when needed.

Risks Related to Our Intellectual Property

We may not be able to protect our proprietary rights.

Our commercial success will depend in large part upon our ability to protect our proprietary rights. There is no assurance, for example, that any additional patents will be issued based on our or our pending applications or, if issued, that such patents will not become the subject of a re-examination, will provide us with competitive advantages, will not be challenged by any third parties, or that the patents of others will not prevent the commercialization of products and services incorporating our technology. Furthermore, there can be no guarantee that others will not independently develop similar products and services, duplicate any of our products and services, or design around any patents we obtain.

Our commercial success will also depend upon our ability to avoid infringing patents issued to others. If we were judicially determined to be infringing on any third-party patent, we could be required to pay damages, alter our products, services or processes, obtain licenses, or cease certain activities. If we are required in the future to obtain any licenses from third parties for some of our products and/or services, there can be no guarantee that we would be able to do so on commercially favorable terms, if at all. United States and foreign patent applications are not immediately made public, so we might be surprised by the grant to someone else of a patent on a technology we are actively using.

In addition to patents, we rely on unpatented trade secrets and proprietary technological expertise, and confidentiality agreements with our partners, employees, advisors, vendors, and consultants to protect our trade secrets and proprietary technological expertise. There can be no guarantee that these agreements will not be breached, or that we will have adequate remedies for any breach, or that our unpatented trade secrets and proprietary technological expertise will not otherwise become known or be independently discovered by competitors.

Failure to obtain or maintain patent protection or to protect our trade secrets could have a substantial negative effect on our results of operations and financial condition.

We are susceptible to intellectual property suits that could cause us to incur substantial costs or pay substantial damages or prohibit us from selling our product candidates.

There is a substantial amount of litigation over patent and other intellectual property rights in the biotechnology industry. Whether or not a product infringes a patent involves complex legal and factual considerations, the determination of which is often uncertain. Our competitors or other parties may assert that our product candidates and the methods employed may be covered by patents held by them. If any of our products infringes a valid patent, we could be prevented from manufacturing or selling such product unless we are able to obtain a license or able to redesign the product in such a manner as to avoid infringement. A license may not always be available or may require us to pay substantial royalties. We also may not be successful in any attempt to redesign our product to avoid infringement, nor does a later redesign protect the Company from prior infringement.

We may need to initiate lawsuits to protect or enforce our intellectual property rights, which could be expensive and, if we lose, could cause us to lose some of our intellectual property rights, which would harm our ability to compete in the market.

In order to protect or enforce our intellectual property rights, we may need to initiate patent, trademark and related litigation against third parties, such as infringement suits or requests for injunctive relief. Our ability to establish and maintain a competitive position may be achieved in part by prosecuting claims against others who we believe to be infringing its rights. Any lawsuits or administrative proceedings in patent offices that we initiate or that are initiated against us could be expensive, take significant time and divert our management’s attention from other business concerns and the outcome of litigation to enforce our intellectual property rights in patents, trade secrets or trademarks is highly unpredictable. Litigation also puts our patents at risk of being invalidated or interpreted narrowly and our patent applications at risk of not issuing, or adversely affect our ability to distribute any products that are subject to such litigation. In addition, we may provoke third parties to assert claims against us. We may not prevail in any lawsuits or administrative proceedings that we initiate, and the damages or other remedies awarded, including attorney fees, if any, may not be commercially valuable.

| 12 |

| Table of Contents |

Risks Related to Employee Matters

We are dependent on our executive officers, and we may not be able to pursue our current business strategy effectively if we lose them.

Our success to date has largely depended on the efforts and abilities of Timothy Warbington, our Chief Executive Officer, and Drs. Thomas Ichim and Amit Patel, who were our founders and who currently serve as directors and/or consultants to us. Our ability to manage our operations and meet our business objectives could be adversely affected if, for any reason, such officers do not remain with us.

Our employees, clinical trial investigators, CROs, consultants, vendors and any potential commercial partners may engage in misconduct or other improper activities, including non-compliance with regulatory standards.

We are exposed to the risk of fraud or other misconduct by our employees, clinical trial investigators, CROs, consultants, vendors and any potential commercial partners. Misconduct by these parties could include intentional, reckless and/or negligent conduct or disclosure of unauthorized activities to us that violates: (i) U.S. laws and regulations or those of foreign jurisdictions, including those laws that require the reporting of true, complete and accurate information, (ii) manufacturing standards, (iii) federal and state health and data privacy, security, fraud and abuse, government price reporting, transparency reporting requirements, and other healthcare laws and regulations in the United States and abroad or (iv) laws that require the true, complete and accurate reporting of financial information or data. Such misconduct could also involve the improper use of information obtained in the course of clinical trials, which could result in regulatory sanctions and cause serious harm to our reputation. We have adopted a code of conduct applicable to our employees, but it is not always possible to identify and deter employee misconduct, and the precautions we take to detect and prevent this activity may not be effective in controlling unknown or unmanaged risks or losses or in protecting us from governmental investigations or other actions or lawsuits stemming from a failure to comply with these laws or regulations. If any such actions are instituted against us, and we are not successful in defending ourselves or asserting our rights, those actions could have a significant impact on our business, including the imposition of significant civil, criminal and administrative penalties, damages, fines, disgorgement, individual imprisonment, exclusion from government funded healthcare programs, such as Medicare, Medicaid and other federal healthcare programs, contractual damages, reputational harm, diminished profits and future earnings, additional integrity reporting and oversight obligations, and the curtailment or restructuring of our operations, any of which could adversely affect our ability to operate our business and our results of operations.

If we fail to comply with the U.S. federal Anti-Kickback Statute and similar state and foreign country laws, we could be subject to criminal and civil penalties and exclusion from federally funded healthcare programs including the Medicare and Medicaid programs and equivalent third country programs, which would have a material adverse effect on our business and results of operations.

A provision of the Social Security Act, commonly referred to as the federal Anti-Kickback Statute, prohibits the knowing and willful offer, payment, solicitation or receipt of any form of remuneration, directly or indirectly, in cash or in kind, to induce or reward the referring, ordering, leasing, purchasing or arranging for, or recommending the ordering, purchasing or leasing of, items or services payable, in whole or in part, by Medicare, Medicaid or any other federal healthcare program. The federal Anti-Kickback Statute is very broad in scope and many of its provisions have not been uniformly or definitively interpreted by existing case law or regulations. In addition, many states have adopted laws similar to the federal Anti-Kickback Statute that apply to activity in those states, and some of these laws are even broader than the federal Anti-Kickback Statute in that their prohibitions may apply to items or services reimbursed under Medicaid and other state programs or, in several states, apply regardless of the source of payment. Violations of the federal Anti-Kickback Statute may result in substantial criminal, civil or administrative penalties, damages, fines and exclusion from participation in federal healthcare programs.

While we believe our operations will be in compliance with the federal Anti-Kickback Statute and similar state laws, we cannot be certain that we will not be subject to investigations or litigation alleging violations of these laws, which could be time-consuming and costly to us and could divert management’s attention from operating our business, which in turn could have a material adverse effect on our business. In addition, if our arrangements were found to violate the federal Anti-Kickback Statute or similar state laws, the consequences of such violations would likely have a material adverse effect on our business, results of operations and financial condition.

| 13 |

| Table of Contents |

Risks Related To Our Common Stock and This Offering

Our management has broad discretion as to the use of the net proceeds from this offering.

We currently intend to use the net proceeds that we receive from this offering to (i) redeem our Bridge Notes in the outstanding amount of $5,146,176, (ii) repurchase our Series A Preferred Stock from our Chief Executive Officer for an aggregate purchase price of approximately $195,000, (iii) hire marketing and sales personnel to support sales of our CaverStem® and FemCelz® products, (iv) proceed with a clinical study of 100 patients intended to support the safety and efficacy of our StemSpine® Regenerative Stem Cell Procedure for Treatment of Degenerative Disc Disease, (v) conduct a Phase I clinical trial for the treatment of stroke utilizing our ImmCelzTM technology, (vi) continue to develop other products and therapies, and (vii) fund working capital and general corporate purposes using any remaining amounts. Our management will have broad discretion in the application of the net proceeds, including for any of the purposes described in “Use of Proceeds.” Accordingly, you will have to rely upon the judgment of our management with respect to the use of the proceeds. Our management may spend a portion or all of the net proceeds from this offering in ways that holders of our common stock may not desire or that may not yield a significant return or any return at all. The failure by our management to apply these funds effectively could harm our business. Pending their use, we may also invest the net proceeds from this offering in a manner that does not produce income or that loses value.

There is no assurance that an active trading market for our common stock will be sustained, and there is no market for our Public Warrants or pre-funded warrants.

The public offering price for the securities will be determined by negotiations between us and the representatives of the underwriters and may not be indicative of prices that will prevail in the trading market. Upon closing of this offering, our common stock will be listed on the Nasdaq Capital Market, however, we cannot ensure that an active public market for our common stock will develop after this offering, or that if it does develop, it will be sustained. In addition, we do not intend to apply to list the Public Warrants or pre-funded warrants on the Nasdaq Capital Market or any nationally recognized trading system, and accordingly, there will be no trading market for such warrants. In the absence of an active public trading market:

● | you may not be able to resell your securities at or above the public offering price; | |