As filed with the Securities and Exchange Commission on May 14, 2004March 31, 2017

Registration No. 333- 333-216663

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-1

Amendment No. 1 to

FORMS-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Targacept, Inc.

CATALYST BIOSCIENCES, INC.

(Exact name of registrantRegistrant as specified in its charter)

| Delaware | 2834 | 56-2020050 | ||

(State or other jurisdiction of

| (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

200 East First Street, Suite 300260 Littlefield Avenue

Winston-Salem, North Carolina 27101South San Francisco, California 94080

(650)(336) 480-2100266-8674

(Address, including zip code, and telephone number, including area code, of registrant’sRegistrant’s principal executive offices)

J. Donald deBethizy

Nassim Usman, Ph.D.

Chief Executive Officer

Targacept,Catalyst Biosciences, Inc.

200 East First Street, Suite 300South San Francisco, California 94080

(650)Winston-Salem, North Carolina 27101266-8674

(336) 480-2100

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copies to:

Stephen B. Thau

Alfredo B. D. Silva

Morrison & Foerster LLP

755 Page Mill Road

Palo Alto, CA 94304

(650)813-5600

|

|

|

Approximate date of commencement of proposed sale of the securities to the public: public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”), check the following box. ¨☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, anon-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule¨12b-2 of the Exchange Act.

If delivery of the Prospectus is expected to be made pursuant to Rule 434, please check the following box. ¨

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☒ |

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price(1) | Amount of Registration Fee(2) | ||

Common Stock, par value $0.001 per share | $86,250,000 | $10,927.88 | ||

| ||||

Title of each class of securities to be registered(1) | Proposed maximum aggregate offering price(1)(2) | Amount of registration fee | ||

Class A Units consisting of: | ||||

(i) Shares of common stock, par value $0.001 per share | 5,250,000 | 608.48 | ||

(ii) Warrants to purchase common stock | ||||

Class B Units consisting of: | ||||

(i) Shares of Series A Preferred Stock, par value $0.001 per share | 12,000,000 | 1,390.88 | ||

(ii) Shares of common stock issuable on conversion of Series A Preferred Stock(3) | ||||

(iii) Warrants to purchase common stock | ||||

Common stock issuable upon exercise of warrants | $9,918,750 | 1,149.58 | ||

Total | $27,168,750 | $3,148.86 | ||

| ||||

| (1) | Estimated solely for the purpose of |

| (2) | Includes the price of additional shares of common stock and warrants to purchase shares of common stock that the underwriters have the option to purchase to cover over-allotments, if any. |

| (3) |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. WeThese securities may not sell these securitiesbe sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities, and we areit is not soliciting offersan offer to buy these securities in any statejurisdiction where the offer or sale is not permitted.

PROSPECTUS (Subject to Completion)

Issued May 14, 2004

SharesSubject to completion, dated March 31, 2017

285,714 Class A Units consisting of common stock and warrants and

12,000 Class B Units consisting of shares of Series A Preferred Stock and warrants

(and 1,857,143 shares of common stock underlying shares of

Series A Preferred Stock and warrants)

COMMON STOCK

Targacept, Inc. isWe are offering 285,714 Class A Units, with each Class A Unit consisting of one share of common stock, par value $0.001 per share (the “common stock”) and a warrant to purchase half of one share of our common stock (together with the shares of its common stock. This is our initial public offering and no public market currently exists for our shares. We anticipate thatstock underlying such warrants, the initial“Class A Units”) at a public offering price will be between $ andof $ per share.Class A Unit. Each warrant included in the Class A Units entitles its holder to purchase half of one share of common stock at an exercise price per share of $ .

We have appliedare also offering to havethose purchasers whose purchase of Class A Units in this offering would result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock following the consummation of this offering, the opportunity to purchase, if they so choose, in lieu of the number of Class A Units that would result in ownership in excess of 4.99% (or, at the election of the purchaser, 9.99%), 12,000 Class B Units. Each Class B Unit will consist of one share of Series A Preferred Stock, par value $0.001 per share (the “Series A Preferred Stock”), convertible into 95.24 shares of common stock and warrants to purchase 47.62 shares of our common stock approved(together with the shares of common stock underlying such shares of Series A Preferred Stock and such warrants, the “Class B Units” and, together with the Class A Units, the “units”) at a public offering price of $ per Class B Unit. Each warrant included in the Class B Units entitles its holder to purchase 47.62 shares of common stock at an exercise price per share of $ .

The Class A Units and Class B Units have no stand-alone rights and will not be certificated or issued as stand-alone securities. The shares of common stock, Series A Preferred Stock and warrants comprising such units are immediately separable and will be issued separately in this offering. The underwriters have the option to purchase additional shares of common stock and/or warrants to purchase shares of common stock solely to cover over-allotments, if any, at the price to the public less the underwriting discounts and commissions. The over-allotment option may be used to purchase shares of common stock, or warrants, or any combination thereof, as determined by the underwriters, but such purchases cannot exceed an aggregate of 15% of the number of shares of common stock (including the number of shares of common stock issuable upon conversion of shares of Series A Preferred Stock) and warrants sold in the primary offering. The over-allotment option is exercisable for listing45 days from the date of this prospectus.

Our common stock is listed on the NASDAQ NationalThe Nasdaq Capital Market under the symbol “TRGT.”

Investing in“CBIO”. The closing price of our common stock on March 29, 2017, as reported by The Nasdaq Capital Market, was $10.51 per share. All share and warrant numbers of the securities being offered included in this prospectus are based on an assumed public offering price per share of $10.50. We do not intend to apply for listing of the warrants offered hereby or the shares of Series A Preferred Stock on any securities exchange or trading system.

Investing in the units involves risks. Seea high degree of risk. Before making any investment in these securities, you should consider carefully the risks and uncertainties in the section entitled “Risk Factors” beginning on page 7.13 of this prospectus.

PRICE$ A SHARE

|

|

| Total | |||||||||

| $ | $ | $ | |||||||||

| $ | $ | $ | |||||||||

Proceeds, before expenses, to Catalyst Biosciences, Inc. | $ | $ | $ | |||||||||

| (1) | The public offering price and underwriting discount corresponds to (x) in respect of the Class A Units (i) a public offering price per share of common stock of $ and (ii) a public offering price per share underlying the warrants of $ and (y) in respect of the Class B Units (i) a public offering price per share of Series A Preferred Stock of $ and (ii) a public offering price per share underlying the warrants of $ . |

| (2) | We have also agreed to reimburse for certain expenses. See “Underwriting.” |

| (3) | We have granted a45-day day option to the underwriter to purchase additional shares of common stock and/or warrants to purchase shares of common stock (up to 15% of the number of shares of common stock (including the number of shares of common stock issuable upon conversion of shares of Series A Preferred Stock) and warrants sold in the primary offering) solely to cover over-allotments, if any. |

We have grantedNeither the underwriters the right to purchase up to an additional shares of our common stock to cover over-allotments.

The Securities and Exchange Commission andnor any state securities regulators have notcommission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense. The securities are not being offered in any jurisdiction where the offer is not permitted.

Morgan Stanley & Co. Incorporated expects to deliver the shares to purchasers on

Ladenburg Thalmann

The date of this prospectus is , 2004.

MORGAN STANLEY

DEUTSCHE BANK SECURITIES

CIBC WORLD MARKETS

PACIFIC GROWTH EQUITIES, LLC

, 2004

1 | ||||

| 1 | ||||

| 7 | ||||

| 7 | |||

| 8 | ||||

| 9 | ||||

| 13 | ||||

| 43 | |||

| 45 | ||||

| 46 | ||||

| 47 | ||||

| 48 | ||||

| 49 | ||||

| 53 | ||||

| 61 | ||||

| 65 | ||||

| 65 | ||||

| 66 | ||||

| 67 | ||||

You should rely only on the information contained in this prospectus.prospectus or in any related free writing prospectus filed by us with the Securities and Exchange Commission, or the SEC. We have not, and the underwriters and their affiliates have not, authorized anyone to provide you with any information different from the informationor to make any representation not contained in this prospectus. We are offeringdo not, and the underwriters and their affiliates do not, take any responsibility for, and can provide no assurance as to the reliability of, any information that others may provide to you. This prospectus is not an offer to sell shares of common stock, and seeking offersor an offer to buy shares of common stock, onlyunits in jurisdictionsany jurisdiction where offers and sales are not permitted. The information contained in this prospectus is accurate only as of its date, regardless of the datetime of delivery of this prospectus regardless of when this prospectus is delivered or when any sale of our common stock occurs.units. You should also read and consider the information in the documents to which we have referred you under the caption “Where You Can Find More Information” in the prospectus.

Until , 2004, 25 days after the commencement of this offering, all dealers that buy, sell or trade shares of our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

For investors outside the United States: Neither we nor any of the underwriters have done anything that would permit thisa public offering of the units or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required toPersons outside the United States who come into possession of this prospectus must inform yourselvesthemselves about, and to observe any restrictions relating to, thisthe offering of the units and the distribution of this prospectus.prospectus outside of the United States.

The following summary highlightsis qualified in its entirety by, and should be read together with, the more detailed information and financial statements and related notes thereto appearing elsewhere in this prospectus. It may not contain all of the information that may be important toBefore you in deciding whetherdecide to invest in our common stock. Youstock, you should read the entire prospectus carefully, including the “Risk Factors” sectionrisk factors and the financial statements and related notes appearing at the end ofincluded in this prospectus before making an investment decision.

TARGACEPT, INC.

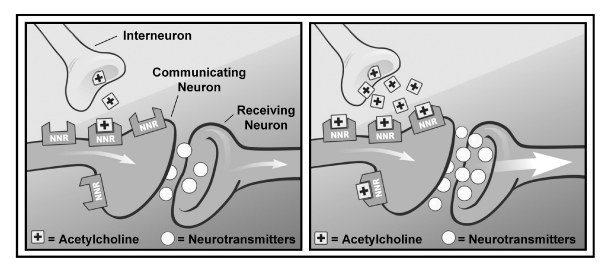

We are a biopharmaceutical company engagedUnless the context requires otherwise, in this prospectus the design, discoveryterms “Catalyst,” the “Company,” “we,” “us” and development of a new class of drugs“our” refer to treat multiple diseases and disorders of the nervous system by selectively targeting neuronal nicotinic acetylcholine receptors, or NNRs. NNRs are found on nerve cells throughout the nervous system and serve as key regulators of nervous system activity. Our product candidates are designed to selectively target specific NNR subtypes to promote therapeutic effects while limiting or eliminating adverse side effects. In addition to a marketed product, Inversine, we have four product candidates in clinical development and multiple ongoing preclinical programs. Our pipeline includes:

We trace our scientific lineage to a research program initiated by R.J. Reynolds Tobacco Company in 1982 to study the activity and effects of nicotine, a compound that interacts non-selectively with all nicotinic acetylcholine receptors. There is a significant amount of published clinical data relating to nicotine, including studies in which individuals with ADHD, cognitive impairment, and ulcerative colitis showed therapeutic improvement when treated with the nicotine patch. We have used this clinical data,Catalyst Biosciences, Inc., together with our deep understanding of the biological characteristics and functions of NNRs that we have built over more than 20 years, to validate NNRs as potential therapeutic targets. We have also developed an expertise in designing small molecules that can selectively interact with specific NNR subtypes, with the objective of eliciting a desired therapeutic effect while limiting or potentially eliminating side effects such as those typically seen with nicotine. We have built an extensive patent estate covering the structure or therapeutic use of small molecules designed to regulate the nervous system by selectively modulating specific NNR subtypes.

We develop product candidates using our proprietary databases and computer-based molecular design technologies, which we refer to collectively as Pentad. Together with our proprietary target validation assays and novel screening methods, Pentad enables us to efficiently identify, prioritize, characterize and optimize novel compounds.

We have entered into two collaboration agreements with Aventis Pharma SA relating to the development of treatments for Alzheimer’s disease and other diseases of the central nervous system. In addition, we have entered into a collaboration agreement with Dr. Falk Pharma GmbH relating to the development of a treatment for ulcerative colitis.

Our Product Pipeline

TC-1734. TC-1734 is a novel small molecule that we are developing as an oral treatment for a range of cognitive impairment in the elderly thatits subsidiary, Catalyst Bio, Inc. This prospectus includes age associated memory impairment, commonly referred to as AAMI, and mild cognitive impairment, commonly referred to as MCI. We are currently conducting a Phase II clinical trial of TC-1734 in 56 elderly persons classified with AAMI and have completed two arms of the trial. We are also currently conducting a Phase II clinical trial in 40 elderly persons classified with MCI. We have previously evaluated TC-1734 in 84 healthy volunteers in four Phase I clinical trials. In our clinical trials to date, TC-1734 was well tolerated at doses at which trial subjects showed signs of improvement in cognitive function. Subject to the results of discussions with the FDA, we anticipate commencing a separate Phase II clinical trial designed to evaluate the efficacy of TC-1734 in the fourth quarter of 2004. We are also evaluating TC-1734 for potential additional clinical development for indications marked by cognitive impairment that are not specific to the elderly, such as ADHD, schizophrenia and various forms of dementia.

TC-5231. TC-5231 is a small molecule that we are developing as an oral treatment for ADHD. TC-5231 is a low-dose reformulation of mecamylamine hydrochloride, the active ingredient in our FDA-approved product, Inversine. Inversine is approved in the United States for the management of moderately severe to severe essential hypertension at average daily doses of 25mg. However, our market research suggests that Inversine is prescribed predominantly for the treatment of Tourette’s syndrome and other neuropsychiatric disorders at doses ranging from 2.5mg to 7.5mg. We are evaluating TC-5231 in doses between 0.2mg and 1.0mg in two Phase II clinical trials, one in ADHD in children and adolescents and the other in ADHD in young adults.

TC-2403. TC-2403 is a small molecule that we are developing for the treatment of ulcerative colitis in collaboration with Dr. Falk Pharma GmbH. We are currently conducting a Phase II clinical trial of an enema formulation of the compound designed to induce remission of acute episodes of a form of ulcerative colitis known as left-sided colitis. In addition, we are developing a delayed release oral formulation of the compound designed to deliver the drug to the entire colon to induce and maintain remission of all forms of ulcerative colitis. We expect to complete the oral formulation of this product candidate in the fourth quarter of 2004.

TC-2696. TC-2696 is a novel small molecule that we are developing as an oral treatment for acute post-operative pain. We are currently conducting a Phase I clinical trial of TC-2696. Depending on clinical trial results, available resources and other considerations, we may pursue development of TC-2696 for other classes of pain as well.

Business Strategy

Our goal is to become a leader in the discovery, development and commercialization of novel drugs that selectively target NNRs in order to treat diseases and disorders where there is significant medical need and commercial potential. To achieve this goal, we are pursuing the following strategies:

Risks Associated with Our Business

Our business is subject to numerous risks, as more fully described in the section entitled “Risk Factors” immediately following this prospectus summary. We have a limited operating history and have incurred substantial net losses since our incorporation in 1997. We expect to continue to incur substantial losses for the foreseeable future. Inversine is the only product that we have available for commercial sale, and it generates limited revenues. All of our other product candidates are undergoing clinical trials or are in early stages of development, and failure is common and can occur at any stage of development. Our ability to generate product revenue in the future will depend heavily on the successful development and commercialization of these product candidates. Even if we succeed in developing and commercializing one or more of our product candidates, we may never generate sufficient sales revenue to achieve and then sustain profitability.

Company History

Our history traces back to 1982 when R.J. Reynolds Tobacco Company initiated a program to study the activity and effects of nicotine in the body. We were incorporated in Delaware as a wholly owned subsidiary of RJR and became an independent company in August 2000. Our executive offices are located at 200 East First Street, Suite 300, Winston-Salem, North Carolina 27101, and our telephone number is (336) 480-2100. Our web site is located at www.targacept.com. Information contained on our web site is not incorporated by reference into, and does not form any part of, this prospectus. We have included our website address in this document as an inactive textual reference only. Our trademarks, include Targacept® and Inversine®. Other service marks trademarks and trade names appearingowned by us or other companies. All trademarks, service marks and trade names included in this prospectus are the property of their respective owners. Unless

We are a clinical-stage biopharmaceutical company focused on developing novel medicines to address serious medical conditions for patients who need new or better treatment options. We have used a scientific approach to engineer several novel protease-based therapeutic candidates. We are focusing our product development efforts in the context requires otherwise, referencesfield of hemostasis (the process that regulates bleeding) and have a mission to develop valuable therapies for individuals with hemophilia.

With drug candidates in this prospectusclinical and advanced preclinical development, we are a leader in the field of prophylactic subcutaneously (SQ) dosed coagulation factor therapies for individuals with hemophilia. We have assembled an experienced management team, scientists and advisors with subject matter expertise, a strategic collaborator, an enabling technology platform, and a leading intellectual property position in the fields of protease therapeutics to advance our clinical and preclinical pipeline.

Our Focus—Hemophilia

Hemophilia is a rare but serious bleeding disorder that results from a genetic or an acquired deficiency of a protein required for normal blood coagulation. There are two major types of hemophilia, A and B, that are caused by alterations in Factor VIII or Factor IX genes, respectively, with a corresponding deficiency in the affected proteins. The disease is X chromosome-linked, meaning that most people who inherit the disorder and suffer from symptoms are male. However, female carriers of mutations in Factor VIII or Factor IX can also have reduced clotting factor levels.

Individuals with hemophilia suffer from spontaneous bleeding episodes and substantially prolonged bleeding times that can become limb- or life-threatening following injury or trauma. In cases of severe hemophilia, spontaneous bleeding into muscles or joints is frequent and often results in permanent, disabling joint damage. Individuals with hemophilia are currently treated with replacement therapy of key coagulation proteins, Factor VIII for hemophilia A or Factor IX for hemophilia B.

Our Pipeline of Product Candidates

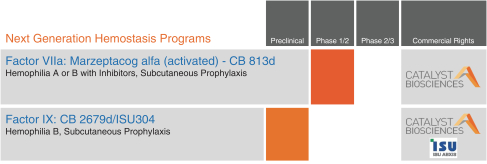

We are currently focused on the clinical development of improved, next-generation subcutaneous prophylaxis using enhanced potency Factor VIIa and Factor IX variants.

The following table summarizes our development programs.

Our Technology

We are applying our substantial expertise in protease engineering and our proprietary product discovery platform to create, engineer and characterize protease drug candidates. Proteases regulate several complex biological cascades, or sequenced biochemical reactions, including the coagulation cascade (a mechanism of blood clotting) in hemophilia andnon-hemophilia settings and the complement cascade that causes inflammation and tissue damage in certain diseases. Our protease expertise allowed us to improve the biochemical and pharmacological properties of currently marketed hemophilia protease drugs, specifically Factors VIIa, IX and Xa and to create completely novel proteases that cleave disease-causing proteins, specifically complement Factor 3 (C3) for the potential treatment of dryage-related macular degeneration (Dry AMD) and renal delayed graft function (DGF).

We estimate the total market for our product candidates is $3.4 billion. Based on industry reports, annual worldwide sales in 2016 for Factor VIIa recombinant products for individuals with hemophilia A or B with an inhibitor were approximately $1.4 billion, and prothrombin complex concentrate products used to treat individuals with hemophilia A or B with an inhibitor were $0.8 billion. Worldwide sales in 2016 for Factor IX products for individuals with hemophilia B were approximately $1.2 billion.

We believe that the shortcomings of currently approved therapies, including a requirement for intravenous infusion, are barriers to prophylactic treatment strategies that, if surmounted, could provide meaningfully improved long-term clinical outcomes for individuals with hemophilia.

The substantially enhanced potency of marzeptacog alfa (activated) and CB 2679d/ISU304 compared with existing treatment options may allow for effective subcutaneous prophylactic treatment of individuals with hemophilia A or B with an inhibitor or individuals with hemophilia B, respectively. Our engineered hemostasis proteases are designed to overcome current treatment limitations by allowing delivery via subcutaneous injection which we believe will facilitate effective prophylactic treatment, especially in children, which represent approximately 40% of individuals with hemophilia, and may ultimately deliver substantially better outcomes for individuals with hemophilia.

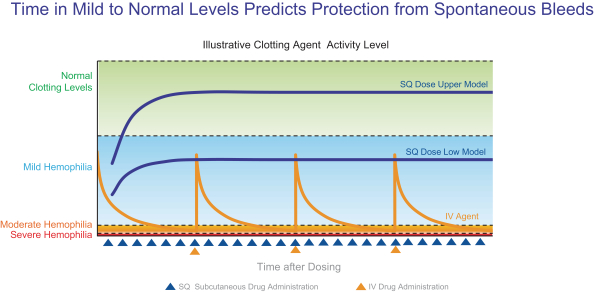

Subcutaneous dosing results in progressive increases in the levels of our protease factors until they reach a stable blood level therapeutic target range (ideally mild hemophilia to normal). Conversely, dosing by intravenous (IV) infusions results in very high factor levels in the blood initially, but the factor level then falls rapidly to a trough level at a range that is measured as moderate or severe hemophilia, triggering the next dose. These results are illustrated in the diagram below.

Stable factor levels could potentially yield a significant improvement in outcomes and have the added benefit of convenience over competing intravenous therapeutics, particularly when administered to children where venous access is challenging.

Factor VIIa

Our most advanced product candidate is marzeptacog alfa (activated) (formerly CB 813d), a next-generation Factor VIIa variant, was tested in an intravenous Phase 1 clinical trial that was completed in February 2015 to evaluate the safety, tolerability, pharmacokinetics, pharmacodynamics and coagulation activity of marzeptacog alfa (activated) in severe hemophilia A and B with and without an inhibitor.

Marzeptacog alfa (activated) is initially being developed for the prophylactic treatment of individuals with severe hemophilia A or B with inhibitors. Pfizer Inc. (“Pfizer”) filed the Investigational New Drug Application (IND) with the FDA for the Phase 1 trial in August 2011 for adult males with hemophilia A or B, with or without an inhibitor to Factor VIII or Factor IX. We have received the IND application filed with the FDA from Pfizer and plan to initiate the Phase 2 portion of a Phase 2/3 clinical subcutaneous prophylaxis efficacy trial in the fourth quarter of 2017. Marzeptacog alfa (activated) has received orphan drug designation in the United States from the FDA.

On June 29, 2009, we entered into a Research and License Agreement with Wyeth Pharmaceuticals, Inc., subsequently acquired by and referred to herein as Pfizer, whereby we and Pfizer collaborated on the development of novel human Factor VIIa products and we granted Pfizer the exclusive rights to develop and commercialize the licensed products on a worldwide basis. On April 2, 2015, Pfizer notified us that it was exercising its right to terminate the research and license agreement, and on December 8, 2016, we signed a definitive agreement related to the “company,” “we,” “us,”termination of the Pfizer agreement. Pursuant to this termination agreement, Pfizer granted us an exclusive license to Pfizer’s proprietary rights for manufacturing materials and “our” referprocesses that apply to Targacept, Inc.

IND application and documentation related to the development, manufacturing and testing of the Factor VIIa products as well as the orphan drug designation. Pursuant to this agreement, we agreed to make contingent cash payments to Pfizer in an aggregate amount equal to up to $17.5 million, payable upon the achievement of clinical, regulatory and commercial milestones. Following commercialization of any of Factor VIIa products, Pfizer would also receive a single-digit royalty on net product sales on aTHE OFFERINGcountry-by-country basis for a predefined royalty term.

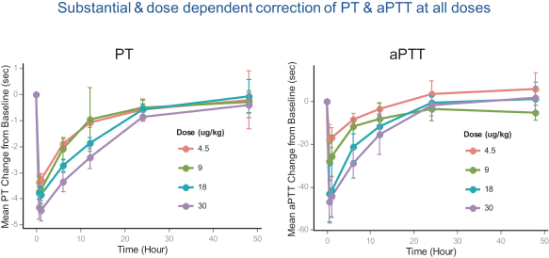

In the Phase 1 clinical trial of intravenous marzeptacog alfa (activated) conducted by Pfizer, 25 individuals with severe hemophilia A or B with and without an inhibitor were enrolled and treated. Clinical endpoints included safety, tolerability, pharmacokinetics and clot-forming activity, such as prothrombin time, or PT, activated partial thromboplastin time, or aPTT, thrombin-antithrombin activity and others. Results showed that single doses of marzeptacog alfa (activated) were well tolerated when administered to individuals with hemophilia A and B, and there were no instances of bleeding or thrombosis. As shown in the graph below, marzeptacog alfa (activated) demonstrated pharmacological efficacy as measured by significant shortening of aPTT (activated partial thromboplastin time) and PT (prothrombin time) for up to24-hours post dosing. The results were presented in a poster session at the International Society on Thrombosis and Haemostasis (ISTH) Meeting held in Toronto, Canada from June 20 to 25, 2015.

We designed marzeptacog alfa (activated) to combine higher clot-generating activity, or potency, at the site of bleeding and improved duration of action in vivo to allow for the effective, long-term, prophylaxis in individuals with hemophilia with an inhibitor. We anticipate that this product candidate, if approved, could be used prophylactically to prevent bleeding episodes with subcutaneous administration that may be superior to intravenous infusions. We have previously demonstrated in several bleeding models that marzeptacog alfa (activated) can treat or prevent bleeding when dosed intravenously. The next step required to develop marzeptacog alfa (activated) for subcutaneous use was to test its ability to correct bleeding times in hemophilia models and to achieve sufficient plasma (blood) levels of activity when dosed subcutaneously.

During the past nine months, we have presented data at scientific conferences demonstrating that daily subcutaneous administration in hemophilia B mice and hemophilia A dogs resulted in steady-state blood levels of marzeptacog alfa (activated) that correct the hemophilia coagulation impairment present at baseline as measured by whole blood clotting time and aPTT.

Factor IX

Our next most advanced product candidate is CB 2679d/ISU304, is a highly potent, next generation coagulation, Factor IX variant that is under development by our collaborator ISU Abxis and has been approved for human clinical trials by the Korean Food and Drug Administration. The National Hemophilia Foundation has recommended chronic, prophylactic treatment as the optimal therapy for individuals with severe hemophilia B. We intend to enter Phase 1/2 clinical development with our collaborator ISU Abxis in the second quarter of 2017, and clinical data is expected in the second half of 2017. We entered into aco-development agreement with ISU Abxis in 2013. Under the ISU Abxis agreement we licensed our proprietary human Factor IX products to ISU Abxis for initial development in South Korea. ISU Abxis is responsible for manufacturing, preclinical development activities and clinical development through aproof-of-concept Phase 1/2 study in individuals with hemophilia B. We have the sole rights and responsibility for worldwide development, manufacture, and commercialization of Factor IX products after Phase 1/2 development. ISU Abxis may exercise its right of first refusal to acquire commercialization rights in South Korea, in which case they would be entitled to profit sharing on worldwide sales.

CB 2679d/ISU304 has demonstrated in a hemophilia B mouse animal study higher potency than BeneFIX®, Pfizer’s currently marketed Factor IX therapeutic, and Alprolix®, Bioverativ’s approved FactorIX-Fc fusion protein, and may allow for subcutaneous prophylactic treatment of individuals with hemophilia B.

Factor Xa

We also have several Factor Xa variants that have demonstrated efficacy in several preclinical models and have the potential to be used as a universalpro-coagulant. We have delayed initiating further work on our Factor Xa therapeutic program at this time to focus our efforts on the Factor VIIa and Factor IX clinical programs.

Our Strategy

Our goal is to build a clinical-stage biopharmaceutical company whose mission is to develop valuable therapies for individuals with hemophilia who need new or better treatment options. Key elements of our strategy to achieve this goal are to:

|

| Advance the Clinical Development of our Lead Product Candidates:Our most advanced drug candidate, marzeptacog alfa (activated), for the treatment of hemophilia and to facilitate surgery in hemophilia, has completed a Phase 1 clinical trial evaluating safety and tolerability as well as pharmacokinetics, pharmacodynamics and coagulation activity. We expect that we will advance marzeptacog alfa (activated) into the Phase 2 portion of a Phase 2/3 subcutaneous dosing clinical efficacy trial in individuals with hemophilia A or B with an inhibitor in the fourth quarter of 2017. In addition, we expect that our collaborator ISU Abxis will initiate a Phase 1/2 subcutaneous dosing clinical trial of CB 2679d/ISU304, our next-generation Factor IX drug candidate in individuals with hemophilia B, in the second quarter of 2017, and clinical data is expected in the second half of 2017. |

| • | Leverage Existing Strategic Factor IX Collaboration:We have established a strategic collaboration with ISU Abxis for its CB 2679d/ISU304 program. We are entitled to up front and milestone payments and have retained worldwide commercialization rights, except for ISU Abxis’ right of first refusal for commercialization rights in South Korea, and subject to a future profit sharing arrangement. We believe our Factor IX collaboration contributes to our ability to advance our Factor IX product candidate through clinical development. |

| • | Build a Hemostasis Franchise:We intend to build on our recent clinical and preclinical success in Factor VIIa and Factor IX by advancing our Factor VIIa program into the Phase 2 portion of a Phase 2/3 subcutaneous dosing clinical efficacy trial in the fourth quarter of 2017. The combination of the wholly owned Factor VIIa product candidate entering a Phase 2/3 clinical efficacy trial and the Factor IX product candidate entering a Phase 1/2 clinical trial may allow us to build a strong hemostasis franchise. |

We continue to explore licensing opportunities for our anti-complement programs in DGF and Dry AMD so that we can focus our efforts and resources on advancing marzeptacog alfa (activated) and CB 2679d/ISU304 through Phase 2/3 and Phase 1/2 clinical trials, respectively.

Market Opportunity

Hemophilia A occurs in approximately 1 in 5,000 male births, and hemophilia B in 1 in 30,000 male births. The prevalence of hemophilia A and B in the United States is approximately 20,000 individuals out of an estimated 400,000 individuals worldwide.

Currently there is no cure for hemophilia. Treatment usually involves management of acute bleeding episodes or prophylactic treatment through factor replacement therapy by infusion of individuals’ missing Factor VIII or IX.

A complication for individuals with hemophilia who are receiving factor replacement therapy is the production of antibodies, also called inhibitors, that inactivate the replacement factor. The overall prevalence of inhibitor formation is up to 30% in individuals with hemophilia A and up to 5% in individuals with hemophilia B. Individuals with an inhibitor are treated with what are known as bypassing agents that initiate coagulation by a pathway that is independent of Factor VIII or Factor IX, the proteins that are deficient or inactivated in individuals with hemophilia A and B respectively. Currently available bypassing agents include recombinant Factor VIIa, NovoSeven® RT produced by Novo Nordisk and activated prothrombin complex concentrates, marketed as FEIBA by Shire. NovoSeven® was first approved in 1999 and is indicated for treatment of bleeding episodes, prevention of bleeding during surgeries in individuals with hemophilia A or B with an inhibitor, and individuals with congenital Factor VII deficiency. In 2006, it was approved for the treatment of acquired hemophilia. NovoSeven® RT was approved in 2014 and is also indicated for treatment of Glanzmann’s thrombasthenia. Sales of NovoSeven® RT in 2016, which we estimate based on our research, were $1.4 billion. FEIBA is approved for use in individuals with hemophilia A or B with an inhibitor, which we estimate, based on our research, had 2016 sales of $0.8 billion. Based on our market research, the treatable Factor VIIa patient population in the world’s seven major markets is approximately 3,000 patients.

Based on our research, we estimate worldwide sales of all FactorIX-containing products for the treatment of hemophilia B in 2016 were approximately $1.2 billion, including approximately $0.7 billion as reported by Pfizer, Inc. for its BeneFIX® product and $0.3 billion as reported by Bioverativ and Swedish Orphan Biovitrum for their Alprolix® product, and we estimate that the worldwide Factor IX patient population is approximately 9,700 patients.

Intellectual Property

We have established a broad intellectual property portfolio including patents and patent applications covering the identification, selection, optimization, and manufacture of human proteases, the composition of matter and methods of use of our product candidates and related technology, and other inventions that are important to our business.

As more fully described below, as of January 8, 2017, our patent portfolio included approximately 112 patents; including 13 issued and allowed U.S. patents and 99 foreign granted and accepted patents, and 4 U.S. patent applications, plus an additional 64 pending foreign patent applications. We also rely on trade secrets and careful monitoring of our proprietary information to protect aspects of our business that are not amenable to, or that we do not consider appropriate for, patent protection.

All of our patents and applications were internally developed and assigned to us, except for one pending South Korean patent application that isco-owned. Our current patents and patent applications include:

59 patents, including 1 issued U.S. patent, and 16 patent applications, including 1 U.S. patent application, covering modified Factor VII polypeptides, such as our lead product candidate, marzeptacog alfa (activated),

|

We commenced operations in 2002 and are a Delaware corporation. On August 20, 2015, we completed our business combination between Targacept, Inc. and Catalyst Bio, Inc. (“Catalyst Bio”), which was incorporated in Delaware in 1997. Following the completion of the merger, the business conducted by the Company became primarily the business conducted by Catalyst Bio prior to the merger. In this prospectus, we refer to the business combination as the “merger” and to the Company prior to the merger as “Targacept.” Discussions of historical results reflect the results of Catalyst Bio prior to the completion of the merger and do not include the historical results of Targacept prior to the completion of the merger.

Our corporate headquarters are in South San Francisco, California, 94080. Our telephone number is (650)871-0761, and our website address iswww.catalystbiosciences.com. The information on or accessible through our website does not constitute part of this prospectus or any accompanying prospectus supplement and should not be relied upon in connection with making any investment in our securities.

On February 10, 2017, we effected a reverse stock split of our shares of common stock at a ratio ofone-for-fifteen (“2017 Reverse Stock Split”). The 2017 Reverse Stock Split was approved by our stockholders at our special meeting of stockholders held on February 2, 2017. As a result of the 2017 Reverse Stock Split, every fifteen (15) shares of our common stock outstanding was automatically changed and reclassified into one (1) new share of common stock. Holders of common stock that would have otherwise received a fractional share of common stock pursuant to the 2017 Reverse Stock Split received cash in lieu of the fractional share. Unless indicated otherwise, the numbers set forth in this prospectus have been adjusted to reflect the 2017 Reverse Stock Split.

After the completion of this offering, we expect that our Board of Directors will approve and recommend to our stockholders an increase to the number of shares of common stock reserved for issuance under our 2015 Stock Incentive Plan, or the creation of a new stock incentive plan with additional shares. Shares reserved for issuance under any such plans, if approved by stockholders to the extent required by applicable laws and regulations, may be issued by the Board of Directors, or a committee of the Board of Directors, to employees, consultants and directors of the Company, including our current officers and directors. The amount of such increase has not been determined, but could equal up to 20% or more of our total number of shares outstanding or issuable after this offering, including shares issuable upon the exercise of options and warrants. The final determination of the amount of such increase will be made by the Board of Directors or a committee thereof and will be subject to stockholder approval to the extent required by applicable laws or regulations. Any issuance of such shares could dilute the ownership of our other stockholders.

During the first quarter of 2017, under our at the market offering program with JonesTrading Institutional Services LLC (“JonesTrading”), we sold an aggregate of 439,880 shares of our common stock for approximately $5.34 million of net proceeds, including the sale of 241,600 shares of common stock on March 29, 2017, to be

issued at settlement on April 3, 2017, for approximately $3.5 million of net proceeds. Without giving effect to the receipt of proceeds from the foregoing March 29, 2017 sale or any other subsequent events, as of March 28, 2017, we had cash and cash equivalents of approximately $15.5 million. The foregoing financial information should not be viewed as a substitute for full interim financial statements as of and four the three months ended March 31, 2017 prepared in accordance with generally accepted accounting principles and reviewed by our auditors, which we will subsequently provide.

Investing in our securities involves substantial risk, and our business is subject to numerous risks and uncertainties. You should carefully consider all of the information set forth in this prospectus and, in particular, the information under the heading “Risk Factors,” prior to making an investment in our securities. Some of these risks include:

We file electronically with the Securities and Exchange Commission, or SEC, our annual reports on Form10-K, quarterly reports on Form10-Q and current reports on Form8-K pursuant to Section 13(a) or 15(d) of the Exchange Act. We make available on our website at www.catalystbiosciences.com, free of charge, copies of these reports, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC.

The public may read or copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street NE, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at1-800-SEC-0330. The SEC maintains a website that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of that website iswww.sec.gov.

The information in or accessible through the websites referred to above are not incorporated into, and are not considered part of, this filing. Further, our references to the URLs for these websites are intended to be inactive textual references only.

The Offering

Class A Units offered by us | We are offering 285,714 Class A Units. Each Class A Unit consists of one share of common stock and a warrant to purchase half of one shares of our common stock (together with the shares of common stock underlying such warrants). | |

Offering price per Class A Unit | $ | |

Class B Units offered by us | We are also offering to those purchasers whose purchase of Class A Units in this offering would result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock following the consummation of this offering, the opportunity to purchase, in lieu of the number of Class A Units that would result in ownership in excess of 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock, 12,000 Class B Units. Each Class B Unit will consist of one share of Series A Preferred Stock, par value $0.001 per share, convertible into 95.24 shares of common stock and a warrant to purchase 47.62 shares of our common stock (together with the shares of our common stock underlying such shares of Series A Preferred Stock and warrants). | |

Offering price per Class B Unit | $ | |

Overallotment option | The underwriters have the option to purchase up to additional shares of common stock, and/or warrants to purchase shares of common stock solely to cover over-allotments, if any, at the price to the public less the underwriting discounts and commissions. The over-allotment option may be used to purchase shares of common stock, or warrants, or any combination thereof, as determined by the underwriters, but such purchases cannot exceed an aggregate of 15% of the number of shares of common stock (including the number of shares of common stock issuable upon conversion of shares of Series A Preferred Stock) and warrants sold in the primary offering. The over-allotment option is exercisable for 45 days from the date of this prospectus. | |

Description of warrants | The warrants will be exercisable beginning on the date of issuance and expire on the five (5) year anniversary of the date of issuance at an initial exercise price per share equal to , subject to appropriate adjustment in the event of recapitalization events, stock dividends, stock splits, stock combinations, reclassifications, reorganizations or similar events affecting our common stock. | |

Description of Series A Preferred Stock | Each share of Series A Preferred Stock is convertible at any time at the holder’s option into 95.24 shares of common stock. | |

| Notwithstanding the foregoing, we shall not effect any conversion of Series A Preferred Stock, with certain exceptions, to the extent that, after giving effect to an attempted conversion, the holder of shares of Series A Preferred Stock (together with such holder’s affiliates, and any persons acting as a group together with such holder or any of such holder’s affiliates) would beneficially own a number of shares of our common stock in excess of 4.99% (or, at the election of the purchaser, 9.99%) of the shares of our common stock then outstanding after giving effect to such exercise. For additional information, see “Description of Securities—Preferred Stock” on page 53 of this prospectus. | ||

Shares of common stock outstanding before this offering | 1,000,036 shares | |

Shares of Series A Preferred Stock outstanding before this offering | None | |

Shares of common stock outstanding after this offering | 1,285,750 shares | |

| 12,000 shares | |

| Use of proceeds |

| We estimate that the net proceeds to us from this offering will be approximately $13,470,000 million, based on an assumed offering price of $10.50 per Class A Unit and |

| Risk factors | You should carefully read and consider the information set forth under “Risk Factors” | |

Nasdaq Capital Market common stock symbol | CBIO | |

No listing of Series A Preferred Stock or | We do not intend to apply for listing of the shares of | |

|

|

The number of shares of common stock to be outstanding before this offering and to be outstanding after this offering in the table above is based on 1,000,036 shares of common stock outstanding as of March 28, 2017 and excludes:

The number of shares of our common stock that will be outstanding immediately after this offering excludes:

Unless otherwise indicated, all information contained in this prospectus assumes:

In addition, unless otherwise noted, all information in this prospectus gives effect to the one-for- reverse stock split of our common stock that will be effective prior to the completion of this offering.

SUMMARY FINANCIAL DATAits overallotment option.

The following tables summarize our financial data. You should read the following summary financial data together with our financial statements and the related notes appearing at the end of this prospectus and the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section and other financial information included in this prospectus.

The pro forma net loss attributable to common stockholders per share information is computed using the weighted average number of common shares outstanding, after giving pro forma effect to the conversion of all outstanding shares of our convertible preferred stock into 73,739,905 shares of common stock concurrently with the completion of this offering, as if the conversion had occurred at the date of the original issuance. This pro forma information does not give effect to the exercise of an outstanding warrant.

| Year ended December 31, | Three months ended March 31, | |||||||||||||||||||

| 2001 | 2002 | 2003 | 2003 | 2004 | ||||||||||||||||

| (unaudited) | ||||||||||||||||||||

| (in thousands, except share and per share data) | ||||||||||||||||||||

Statement of Operations Data: | ||||||||||||||||||||

Net revenue | $ | 1,703 | $ | 2,286 | $ | 2,458 | $ | 691 | $ | 497 | ||||||||||

Operating expenses: | ||||||||||||||||||||

Research and development | 8,152 | 16,244 | 18,179 | 4,069 | 6,050 | |||||||||||||||

General and administrative | 2,302 | 4,135 | 3,600 | 697 | 1,109 | |||||||||||||||

Cost of product sales | — | 244 | 743 | 200 | 182 | |||||||||||||||

Purchased in-process research and development | — | 2,666 | — | — | — | |||||||||||||||

Total operating expenses | 10,454 | 23,289 | 22,522 | 4,966 | 7,341 | |||||||||||||||

Loss from operations | (8,751 | ) | (21,003 | ) | (20,064 | ) | (4,275 | ) | (6,844 | ) | ||||||||||

Interest and dividend income | 1,449 | 88 | 791 | 124 | 231 | |||||||||||||||

Interest expense | — | (103 | ) | (122 | ) | (34 | ) | (25 | ) | |||||||||||

Loss on disposal of fixed assets | — | (54 | ) | — | — | — | ||||||||||||||

Net loss | (7,302 | ) | (21,072 | ) | (19,395 | ) | (4,185 | ) | (6,638 | ) | ||||||||||

Preferred stock accretion | (3,808 | ) | (4,173 | ) | (8,341 | ) | (1,915 | ) | (2,142 | ) | ||||||||||

Net loss attributable to common stockholders | $ | (11,110 | ) | $ | (25,245 | ) | $ | (27,736 | ) | $ | (6,100 | ) | $ | (8,780 | ) | |||||

Basic and diluted net loss per share applicable to common stockholders | $ | (26.80 | ) | $ | (45.28 | ) | $ | (33.91 | ) | $ | (9.48 | ) | $ | (7.89 | ) | |||||

Shares used to compute basic and diluted net loss per share | $ | 414,624 | $ | 557,492 | $ | 817,894 | $ | 643,571 | $ | 1,112,591 | ||||||||||

Pro forma basic and diluted net loss per share applicable to common stockholders (unaudited) | $ | (0.27 | ) | $ | (0.09 | ) | ||||||||||||||

Shares used to compute pro forma basic and diluted net loss per share (unaudited) | 71,118,629 | 74,852,496 | ||||||||||||||||||

The pro forma balance sheet information gives effect to the conversion of all outstanding shares of our convertible preferred stock into 73,739,905 shares of common stock concurrently with the completion of this offering. The pro forma as adjusted balance sheet information gives further effect to:

| As of March 31, 2004 | ||||||||||

| Actual | Pro Forma | Pro Forma As Adjusted | ||||||||

(unaudited) (in thousands) | ||||||||||

Balance Sheet Data: | ||||||||||

Cash, cash equivalents and short-term investments | $ | 36,847 | $ | 36,847 | ||||||

Working capital | 33,663 | 33,663 | ||||||||

Total assets | 40,806 | 40,806 | ||||||||

Long-term debt, net of current portion | 1,298 | 1,298 | ||||||||

Redeemable convertible preferred stock | 132,276 | — | ||||||||

Accumulated deficit | (82,818 | ) | (82,818 | ) | ||||||

Total stockholders’ equity (deficit) | (99,510 | ) | 32,766 | |||||||

InvestingAn investment in our common stocksecurities involves a high degree of risk. You should carefully consider the risks described in our Annual Report on Form10-K for the year ended December 31, 2016, as updated by any other document that we subsequently file with the Securities and uncertaintiesExchange Commission and that is incorporated by reference into this prospectus, the risks described below together withand all of the other information contained in this prospectus and incorporated by reference into this prospectus, including our financial statements and related notes, before deciding to investinvesting in our common stock.securities. If any of these risksthe possible events described in those sections or below actually occurs,occur, our business, business prospects, financial condition,cash flow, results of operations or cash flows would likely suffer, maybe materially. Thisfinancial condition could causebe harmed. In this case, the trading price of our common stock tocould decline, and you couldmight lose partall or allpart of your investment.

The following is a discussion of the risk factors that we believe are material to us at this time. These risks and uncertainties are not the only ones facing us and there may be additional matters that we are unaware of or that we currently consider immaterial. All of these could adversely affect our business, results of operations, financial condition and cash flows.

Risks Relatedrelated to Our Financial Resultsour financial condition and Need for Additional Financingcapital requirements

We have incurred significant losses since our inception, and anticipate that we willare expected to continue to incur substantialsignificant losses for the foreseeable future. We may never achieve or sustain profitability.

We were incorporated in 1997are a clinical-stage biotechnology company, and operated as a wholly owned subsidiary of R.J. Reynolds Tobacco Company until August 2000.we have not yet generated significant revenues. We have a limited operating history and have incurred substantial net losses in each year since our inception.inception in August 2002, including net losses of $16.9 million and $14.8 million for the years ended December 31, 2016 and 2015, respectively. As of MarchDecember 31, 2004,2016, we had an accumulated deficit of $82.8$148.0 million. Our net loss was $6.6 million

We are still in the early stages of development of our product candidates, and have no products approved for the three months ended March 31, 2004, $19.4 million for the fiscal year ended December 31, 2003commercial sale. To date, we have financed our operations primarily from private placements of convertible preferred stock, payments under collaboration agreements, and $21.1 million for the fiscal year ended December 31, 2002. Our lossesto a lesser extent through issuances of shares of common stock.

We have resulted principally from costs incurred in connection withdevoted most of our financial resources to research and development, activities, including clinical trials, and from general and administrative expenses associated with our operations.preclinical development activities. We expect to continue to incur substantialsignificant expenses and operating losses over the next several years. Our operating losses may fluctuate significantly from quarter to quarter and year to year. We are expected to continue to incur significant expenses and increasing operating losses for at least the foreseeablenext several years, and our expenses will increase substantially if and as we:

In addition, in connection with the license granted to us by Pfizer, we agreed to make contingent cash payments to Pfizer in an aggregate amount equal to up to $17.5 million, payable upon the achievement of clinical, regulatory and commercial milestones, the timing of which is uncertain. Following commercialization of any of Factor VIIa products, Pfizer would also receive a single-digit royalty on net product sales on acountry-by-country basis for a predefined royalty term. See “Business Overview—Factor VIIa” in this prospectus.

Further, in connection with an initial statement of work under the Development and Manufacturing Agreement that we have entered into with CMC ICOS Biologics, Inc. (“CMC”), we have agreed to a total of $3.8 million in payments to CMC, subject to the completion of work relating to the manufacturing development of marzeptacog alfa (activated). See “Item 1—Business—Collaborations” in our Annual Report on Form10-K for the year ended December 31, 2016.

To become and remain profitable, we must succeed in developing and eventually commercializing products that generate significant revenue. This will require us to be successful in a range of challenging activities, including completing preclinical testing and clinical trials of product candidates, obtaining regulatory approval for these product candidates and manufacturing, marketing and selling any products for which regulatory approval is obtained. We are only in the preliminary stages of most of these activities. We may never succeed in these activities and, even if we do, we may never generate revenues that are significant enough to achieve profitability.

Because of the numerous risks and uncertainties associated with pharmaceutical product development, we are unable to accurately predict the timing or amount of increased expenses or when, or if, we will be able to achieve profitability. Even if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis. Failure to become and remain profitable would depress the value of the company and could impair our ability to raise capital, expand our business, maintain research and development efforts, diversify product offerings or even continue operations. A decline in the value of the Company could also cause you to lose all or part of your investment.

We will continue to need additional capital in the future. If we are unable to raise sufficient capital in the future, we will be forced to delay, reduce or eliminate product development programs.

Developing pharmaceutical products, including conducting preclinical studies and clinical trials, is expensive. We expect our research and development expenses to increase substantially following completionwith our ongoing activities, particularly activities related to the continued clinical development of this offering asmarzeptacog alfa (activated), including a clinical efficacy trial and, if Phase 1 clinical trials of CB 2679d/ISU304 are successful, an efficacy trial for that compound. Until we expand our clinical trial activity and ascan generate a sufficient revenue from our product candidates, advanceif ever, we expect to finance future cash needs through public or private equity offerings, debt financings, corporate collaborations and/or licensing arrangements. Additional funds may not be available when we need them on terms that are acceptable, or at all. If adequate funds are not available, we may be required to delay, reduce the scope of or eliminate one or more of our research or development cycle. programs.

In August 2015, we issued $37.0 million in aggregate principal amount of redeemable convertible notes to former Targacept stockholders as part of a dividend immediately prior to the completion of the merger (the“Pre-Closing Dividend”), with an amount equal to the total principal deposited in an escrow account for the benefit of the noteholders. The notes may be redeemed for cash or repaid upon maturity, holders may also elect to convert any principal amount of the notes into shares of common stock at a price of $137.85 per share on or before February 19, 2018. As of December 31, 2016, $17.3 million in aggregate principal has been redeemed and $0.3 million had been converted to common stock. Except for this arrangement, we have no commitments or

arrangements for any additional financing to fund our research and development programs. There can be no assurance regarding the amount of the notes that will be redeemed or the portion of the remaining $19.4 million in capital that will become available to us.

We also expectbelieve that our general and administrative costscurrent available cash, together with the proceeds from this offering will be sufficient to increase substantially as we expandfund our infrastructure. As a result,operations for at least 18 months. However, we will need to generate significant revenuesraise substantial additional capital to pay these costscomplete the development and achieve profitability.commercialization of marzeptacog alfa (activated) and CB 2679d/ISU304, and depending on the availability of capital, may need to delay development of some of our product candidates.

InversineBecause successful development of our product candidates is our only current source of product revenue. We acquired the rights to Inversine in August 2002. Sales of Inversine generated revenues of only $188,000 for the three months ended March 31, 2004 and $815,000 for the year ended December 31, 2003. Inversine is approved in the United States for the treatment of moderately severe to severe essential hypertension. However, we believe that the substantial majority of Inversine sales are derived from prescriptions written by a very limited number of physicians for the treatment of Tourette’s syndrome and other neuropsychiatric disorders. If any of these physicians were to change their prescribing habits, Inversine sales would suffer. We do not expect that sales of Inversine will increase substantially in the future.

Ifuncertain, we are unable to develop and commercialize any of our product candidates, if development is delayed or if sales revenue from any of our product candidates that receives marketing approval is insufficient, we may never become profitable. Even if we do become profitable, we may not be ableestimate the actual funds required to sustain or increase our profitability on a quarterly or annual basis.

We will require substantial additional financing and our failure to obtain additional funding when needed could force us to delay, reduce or eliminate our product development programs or commercialization efforts.

We will require substantial future capital in order to continue to conduct thecomplete research and development clinical and regulatory activities necessary to bringcommercialize our product candidates to market and to establish marketing and sales capabilities.products under development. Our future capitalfunding requirements, both near and long-term, will depend on many factors, including:including, but not limited to:

Raising additional funds by issuing securities or through licensing arrangements may cause dilution to stockholders, restrict our general and administrative expenses.

operations or require us to relinquish proprietary rights.

In addition, we may seek additional capital due to market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans. To the extent that we raise additional capital through the sale of equity or convertible debt securities, your ownership intereststockholders will be diluted, and the terms of these new securities may include liquidation or other preferences that adversely affect yourthe rights as a stockholder. of common stockholders.

Debt financing, if available at all, may involve agreements that include covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making capital expenditures or declaring dividends. If we raise additional funds through collaboration andcollaborations, strategic alliances or licensing arrangements with third parties, we may have to relinquish valuable rights to our technologies, or product candidates or future revenue streams or grant licenses on terms that are not favorable to us.

Based on our current operating plan, We may also seek to access the public or private capital markets whenever conditions are favorable, even if we expectdo not have an immediate need for additional capital at that our existing capital resourcestime. There can be no assurance that we will be able to obtain additional funding if, and the net proceeds from this offering will enable uswhen necessary. If we are unable to maintain currently planned operations through the first half of 2006. However, our operating plan may change as a result of many factors including those described above, and we may need additional funds sooner than planned to meet operational needs and capital requirements for product development and commercialization. Other than a modest amount of committed equipmentobtain adequate financing we currently have no credit facility or committed sources of capital. Additional funds may not be available when we need them on terms that are acceptable to us, or at all. If adequate funds are not available on a timely basis, we may:could be required to delay, curtail or eliminate one or more, or all, of our development programs or grant rights to develop and market product candidates that we would otherwise prefer to develop and market ourselves.

Demand™ Sales Agreement with JonesTrading. In accordance with the terms of the sales agreement, as of March 29, 2017, we have sold 479,681 shares of our common stock having an aggregate offering price of $6.5 million through JonesTrading. Any additional sales in the public market of our common stock under the shelf registration statement could adversely affect prevailing market prices for our common stock.

We have no history of clinical development or commercialization of pharmaceutical products, which may make it difficult to evaluate the prospects for the company’s future viability.

We began operations in August 2002. Our operations to date have been limited to financing and staffing the company, developing our technology and product candidates and establishing collaborations. We have not yet demonstrated an ability to successfully conduct a clinical trial, obtain marketing approvals, manufacture a product for clinical trials or at commercial scale, or arrange for a third-party to do so on our behalf, or conduct sales and marketing activities necessary for successful product commercialization. Consequently, predictions about the company’s future success or viability may not be as accurate as they could be if we had a longer operating history or a history of successfully developing and commercializing pharmaceutical products.

Risks related to the discovery, development and commercialization of our product candidates

We are substantially dependent upon the success of marzeptacog alfa (activated) and CB 2679d/ISU304.

The failure of marzeptacog alfa (activated) or CB 2679d/ISU304 to commence anticipated clinical trials or achieve successful clinical trial endpoints, delays in clinical development generally, unanticipated adverse side effects or any other adverse developments or information related to marzeptacog alfa (activated) or CB 2679d/ISU304 would significantly harm our business, its prospects and the value of the company’s common stock. We expect to advance marzeptacog alfa (activated) into a Phase 2 clinical efficacy trial in individuals with hemophilia A or B with an inhibitor and to advance CB 2679d/ISU304 into a Phase 1/2 clinical trial in individuals with hemophilia B. There is no guarantee that the results of these clinical trials, if they occur, will be positive or will not generate unanticipated safety concerns. The Phase 1 clinical trial of marzeptacog alfa (activated) was a single-dose escalation trial that would not, compared to multi-dose trials, be expected to exclude the possibility of an immunological response to marzeptacog alfa (activated) in individuals who received the product candidate. After completion of the dosing portion of the Phase 1 clinical trial, Pfizer observed a positive result in an assay for a potentialnon-neutralizing anti-drug antibody in a single individual at a time point 60 days post-dosing that was not confirmed by testing of a subsequent,follow-up blood draw. Additional confirmatory testing indicated that this was due to a false positive assay result; however, there can be no assurance thatanti-marzeptacog alfa (activated) antibodies will not be observed in subsequent trials. If subsequent multi-dose trials of marzeptacog alfa (activated) or of CB 2679d/ISU304 demonstrate a treatment-related neutralizing immunological response in individuals, development of such product could be halted. Even if the next trials of marzeptacog alfa (activated) are positive, marzeptacog alfa (activated) may require substantial additional trials and other testing before approving marzeptacog alfa (activated) for marketing, and CB 2679d/ISU304 will require additional trials and other testing before receiving approval for marketing.

Marzeptacog alfa (activated) and CB 2679d/ISU304 are not expected to be commercially available in the near term, if at all. Further, the commercial success of each product candidate will depend upon its acceptance by physicians, patients, third-party payors and other key decision-makers as a therapeutic and cost effective alternative to currently available products. If we are unable to successfully develop, obtain regulatory approval for and commercialize marzeptacog alfa (activated) and CB 2679d/ISU304, our ability to generate revenue from product sales will be significantly delayed and our business will be materially and adversely affected, and we may not be able to earn sufficient revenues to continue as a going concern.

Even if the FDA or other regulatory agency approves marzeptacog alfa (activated) or CB 2679d/ISU304, the approval may impose significant restrictions on the indicated uses, conditions for use, labeling, advertising, promotion, marketing and/or production of such product and may impose ongoing commitments or requirements

for post-approval studies, including additional research and development and clinical trials. The FDA and other agencies also may impose various civil or criminal sanctions for failure to comply with regulatory requirements, including withdrawal of product approval. Regulatory approval from authorities in other foreign countries will be needed to market marzeptacog alfa (activated) or CB 2679d/ISU304 in those countries. Approval by one regulatory authority does not ensure approval by regulatory authorities in other jurisdictions. If we fail to obtain approvals from foreign jurisdictions, the geographic market for marzeptacog alfa (activated) or CB 2679d/ISU304 would be limited.

We plan to conduct clinical trials for onesubcutaneous dosing trials of marzeptacog alfa (activated) and CB 2679d/ISU304, which is an untested route of administration for these product candidates in humans.

We expect to commence a subcutaneous prophylaxis clinical trial of marzeptacog alfa (activated) in 2017 and for ISU Abxis to commence a subcutaneous clinical trial of CB 2679d/ISU304 in the second quarter of 2017 and clinical data is expected in the second half of 2017. Neither product candidate has previously been studied in human clinical trials using subcutaneous dosing. There can be no assurance that either product will achieve efficacious levels of biological activity when administered subcutaneously. There can also be no assurance that the clinical trial results will be positive or morethat the clinical trials will not generate unanticipated safety concerns. The failure of either product to achieve successful clinical trial endpoints, delays in clinical trial commencement or in clinical development generally, unanticipated adverse side effects, adverse immunological responses, or any other adverse developments or information related to our product candidates would significantly harm our business, its prospects and the value of our common stock.

Marzeptacog alfa (activated) and CB 2679d/ISU304 may cause the generation of antibodies, which could prevent their further development.

Both marzeptacog alfa (activated) and CB 2679d/ISU304 are protein molecules which may cause the generation of antibodies in individuals who receive them. The Phase 1 clinical trial of marzeptacog alfa (activated) was a single-dose intravenous escalation trial that would not, compared to multi-dose trials or higher dose administered subcutaneously, be expected to exclude the possibility of an immunological response to marzeptacog alfa (activated) in individuals who received the product candidates;

If subsequent multi-dose trials demonstrate a treatment-related neutralizing immunological response in individuals, development of marzeptacog alfa (activated) or of CB 2679d/ISU304 could be halted.

We are transitioning manufacturing and clinical activities related to marzeptacog alfa (activated) from Pfizer to CMC and continuing to optimize the manufacturing process. This process will be lengthy and its outcome uncertain.

Pfizer, through its wholly-owned subsidiary Wyeth, conducted the Phase 1 clinical trial of marzeptacog alfa (activated) pursuant to a research and license agreement. Pfizer terminated this agreement effective June 1, 2015.

In March 2016, we engaged CMC to conduct manufacturing development and, upon successful development of the manufacturing process, manufacture the marzeptacog alfa (activated) that we intend to use in our establishment of salesclinical trials on afee-for-services basis. During 2016, we also worked with Pfizer to transition manufacturing capabilities from Pfizer to CMC, and marketing capabilities or other activitiesin December 2016, Pfizer granted us an exclusive license to its proprietary rights for manufacturing materials and processes that may be necessaryapply to commercialize our product candidates; or

Factor VIIa variants, CB 813a and marzeptacog

alfa (activated). Pfizer also transferred the IND and documentation related to the Risks RelatedDevelopmentdevelopment, manufacturing and Regulatory Approvaltesting of Our Product Candidates

Our success depends substantially onWe are very early in our most advanceddevelopment efforts and have only one product candidate that has completed a Phase 1 clinical trial. All our other product candidates which are still underin preclinical development. If we are unable to bring any or all of theseobtain regulatory clearance and commercialize our product candidates to market, or experience significant delays in doing so, our ability to generate product revenue and our likelihood of successbusiness will be materially harmed.