As filed with the Securities and Exchange Commission on June 9, 2011May 31, 2013

Registration No. 333- 333-174801

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 5

to

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

AVAYA HOLDINGS CORP.

(Exact name of registrant as specified in its charter)

| Delaware | 3661 | 26-1119726 | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

211 Mount Airy Road4655 Great America Parkway

Basking Ridge, New Jersey 07920Santa Clara, California 95054

(908) 953-6000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Pamela F. Craven, Esq.

Chief Administrative Officer

Avaya Holdings Corp.

211 Mount Airy Road

Basking Ridge, New Jersey 07920

(908) 953-6000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

Julie H. Jones, Esq.

| Daniel J. Zubkoff, Esq. Douglas S. Horowitz, Esq. Cahill Gordon & ReindelLLP 80 Pine Street New York, NY 10005 Telephone (212) 701-3000 Fax (212) 269-5420 |

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||||||

| Non-accelerated filer | x | (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | ||||||

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering | Amount of Registration Fee | ||

Common Stock, $0.001 par value per share | $1,000,000,000 | $116,100 | ||

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PROSPECTUS (Subject to Completion)

Issued June 9, 2011May 31, 2013

Shares

COMMON STOCK

Avaya Holdings Corp. is offering shares of its common stock. This is the initial public offering of shares of our common stock and no public market currently exists for our shares. We expect the initial public offering price of our common stock to be between $ and $ per share.

After the completion of this offering, funds affiliated with our Sponsors (as defined herein) will continue to own a majority of the voting power of our outstanding common stock. As a result, we expect to be a “controlled company” within the meaning of the corporate governance standards of .the New York Stock Exchange. See “Principal Stockholders.”

We have applied to list our common stock on the New York Stock Exchange under the symbol “ .”“AVYA.”

Investing in our common stock involves a high degree of risk. See “Risk Factors”“Risk Factors” beginning on page 17.18.

PRICE $ A SHARE

| Public Offering Price | Underwriting | Proceeds to Avaya | ||||

Per Share | $ | $ | $ | |||

Total | $ | $ | $ |

We have granted the underwriters the right to purchase up to an additional shares of common stock for a period of 30 days.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares to purchasers on , 2011.2013.

| MORGAN STANLEY | GOLDMAN, SACHS & CO. | J.P. MORGAN |

| CITI | DEUTSCHE BANK SECURITIES | |

BofA MERRILL LYNCH | BARCLAYS | CREDIT SUISSE | ||

, 20112013

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| Page | ||||

| 1 | ||||

| 31 | ||||

| 33 | ||||

| 34 | ||||

| 35 | ||||

| 37 | ||||

| 39 | ||||

Management’s Discussion and Analysis of Financial Condition and Results of Operations | ||||

| 134 | ||||

| 135 | ||||

| 145 | ||||

| Page | ||||

| ||||

| F-1 | ||||

We have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we file with the Securities and Exchange Commission, or the SEC. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

Until , 20112013 (25 days after the commencement of this offering), all dealers that buy, sell or trade shares of our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to the obligation of dealers to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

For investors outside the United States: we have not and the underwriters have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside the United States.

When we use the terms “we,” “us,” “our,” “Avaya” or the “Company,” we mean Avaya Holdings Corp., a Delaware corporation, and its consolidated subsidiaries, including Avaya Inc., our principal U.S. operating subsidiary, taken as a whole, unless the context otherwise indicates.

Avaya Aura®, Avaya Flare® and Avaya web.alive, AvayaLive™®, Radvision Scopia® and other trademarks or service marks of Avaya are the property of Avaya Holdings Corp. and/or its affiliates. This prospectus also contains additional tradenames, trademarks or service marks belonging to us and to other companies. We do not intend our use or display of other parties’ trademarks, tradenames or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties.

i

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully, especially the “Risk Factors” section of this prospectus and our consolidated financial statementsConsolidated Financial Statements and related notes appearing at the end of this prospectus, before making an investment decision. This summary contains forward-looking statements that involve risks and uncertainties. Our actual results may differ significantly from the results discussed in the forward-looking statements as a result of certain factors, including those set forth in “Risk Factors” and “Special Note Regarding Forward-Looking Statements.”

Our Company

We are a leading global provider of next-generationreal-time business collaboration and communications solutions that bring people together with the right information at the right time in the right context, enabling business usersbusinesses to improve their efficiency and quickly solve critical business challenges. Our solutions are designed to enable business users to work together more effectively as a team internally orand with their customers and suppliers, increasing innovation, improving productivity and acceleratingto accelerate decision-making and achieve business outcomes. We have a long track record of innovation and our customers historically have relied on us to deliver mission critical communications solutions. The markets for areas associated with our business collaboration and communicationsThese industry leading solutions are expectedalso designed to representbe flexible, reliable and secure, enabling simplified management and cost reduction while providing a $77 billion market in 2011 in the aggregate.platform for next-generation collaboration from Avaya.

We are highly focused on and structured to serveserving our core business collaboration and communications markets with open and unifying, fit-for-purpose products, targeted sales coveragesolutions and distributed software services and support models. We targetshape our portfolio to meet the demands of customers today and in the future.

Our solutions and services are aimed at large enterprises, small- and medium-sizedmid-sized businesses and government organizationsorganizations. We offer solutions in fivethree key business collaboration and communications product categories:

Real-Time Collaboration, Video and Unified Communications Software, Infrastructure and Endpoints for an increasingly mobile workforce

Real Time Video CollaborationCustomer Experience Management, including Contact Center applications

Contact Center

Data Communications

Applications, including their IntegrationNetworking for data center, campus, branch, and Enablementwireless access to complement our business collaboration, unified communications and contact center portfolios

Our next-generationThese three categories are supported by Avaya’s portfolio of services including product support, integration, and professional and managed services. These services enable customers to optimize and manage their communications networks worldwide and achieve enhanced business collaborationresults.

Our solutions are architecteddesigned to be highly scalable, reliable, secure, flexible and easy to manage,manage. They can be deployed in numerous ways including on a customer’s own premise, in the cloud and supportin a varietyvirtualized environment. We believe that delivering solutions in a cloud environment, either private or public, will be the deployment mode of deployment models, including on-premise, public and private cloud, virtualized and mobile delivery. Ourchoice for many customers in the near future. Further, our research and development investments are focused on software atsolutions across the user experience and business application layers, and software and hardware at the infrastructure layer, and endpoints. In addition, we are investing in software for monitoring, troubleshooting and managing distributed communications architectures that we believe will reduce the total cost of ownership and improve end-to-end serviceability of our solutions versus our competitors.

WeSignificant industry trends, such as the Bring Your Own Device (BYOD) and the blurring of consumer and enterprise, called the “Consumerization of IT,” are executingdriving the overall move toward enterprise mobility. Enterprises seek 24x7 device and location agnostic collaboration and communications solutions to increase employee effectiveness, reduce costs and gain competitive advantages in the marketplace. In addition, we believe

many businesses today have grown through acquisition or lack central controls on two critical strategic initiatives relatedinfrastructure and are left with inefficient, disparate communications infrastructure that may benefit financially from consolidation. As a result of these trends, we believe that enterprises require a holistic, flexible business solution that is designed to facilitate collaboration, and incorporates enterprise-class stability, scalability and security. Additionally, we believe that the transition ofmarket will evolve to require secure collaboration between enterprises including video, desktop sharing, presence and directory updates.

Through our innovative collaboration and communications solutions, we are reshaping our product portfolio to address these trends and the enhancement of our sales coverage model in order to continue to grow our business. Our product portfolio has been reshaped to drive revenue growthThe foundation for our ongoing innovation is our Avaya Aura platform, our Session Initiation Protocol (SIP) standards-based software suite that brings together voice, video and business model cash cycle time. In addition, ourdata into a single, integrated communications and collaboration platform.

Our portfolio of business collaboration and communications solutions is designed to deliver ana simple and intuitive and personalized user experience, seamlessly integrating various modes of communications and collaboration, including real-time voice, video, instant messaging, presence, and conferencing, and non real-timenon-real-time email, voicemail and social networking. In addition, we have decoupled solutions from the user’s location and allowed consolidation of infrastructure in the data center. Our solutions take the critical step of replacing voice-centric call control used by traditional Voice over Internet Protocol (VoIP) solutions with standards-based SIP session management. This allows communications applications to operate freely from the underlying infrastructure and supports both multiple media (voice, video, text) and modes (call, conference, instant messaging/chat, and email) of communication over the same session. Our Avaya Aura Contact Center also leverages our session management architecture and applies these collaboration principles to customer interactions.

These solutions target high growth market segments and we believe expand our addressable markets and accelerate our sales cycle as customers more frequently upgradeaugment their solutions to take advantage of our ongoing product innovation and to deploy our user experience across an array of endpoints, including our own and those of other vendors. Detailed information on the trends impacting our industry can be found in the next section, Our Industry.

We have further enhanced our business through acquisitions that have amplified our innovation and growth strategy. A key example of this is Radvision Ltd., which we acquired in June 2012 and which enhances Avaya’s position with industry leading video collaboration and communications solutions.

With our product portfolio poised for the future, we are now seeking toWe leverage our sales and distribution channels to speed new solutions to market and accelerate customer adoption and generate an increasing percentage ofadoption. We have strategic initiatives in place to grow our revenue from these new high value software solutions and user experience-centric applications. We are expanding our sales coverage model, including both partners and direct sales,partner community while supporting our customers’ channel preference. In December 2009, we acquiredpartners’ profitability and success. We also fully leverage the enterprise solutions businessdiversity of Nortel Networks Corporation, or NES, which expanded our customer base, broadenedthe partner community for the Avaya portfolio, engaging with value added resellers, systems integrators, service providers, and strengthened our indirect sales channel, enhanced our technology portfolio, established our leading presence in data communicationsapplication developers. Please see the section titled, Customers; Sales, Partners and enhanced our ability to compete globally.

Over the past several years, we have invested significantly in research and development, introducing more than 60 new product offerings to the market since the beginning of fiscal year 2010. For example, we recently released our Avaya Flare Experience, a real-time, enterprise video communications and collaboration solution helping to break down the barriers commonly seen in today’s communications and collaboration tools with a distinctive user interface for quick, easy access to voice and video, social media, presence, instant messaging, audio/video/web conferencing, a consolidated view of multiple directories and context history. In addition, we have further enhanced our business through acquisitions and by restructuring or divesting businesses that dilute our focus from our principal markets.

Our market leadership in next-generation business collaboration is due in part to our long-standing heritage of delivering mission critical unified communications, contact center and voice communications solutions. As a market leader in enterprise voice telephony and messagingDistribution for more than 10 years and in unified communications for the past four years, we believe that our Voice over Internet Protocol, or VoIP, solutions have enabled customers to centralize communications applications and hardware to serve geographically dispersed users, significantly reducing management cost, complexity, and annual spend to telecommunication service providers. Leveraging this experience, we have now developed innovative, next-generation unified communications and contact center solutions that focus on business collaboration, and, unlike earlier solutions, are designed from the ground up to support multiple media and modes of communication, reducing cost and complexity while improving collaboration effectiveness. At the core of our next-generation collaboration solutions is Avaya Aura, our Session Initiation Protocol, or SIP, based architecture, which enables multiple people, media and resources to be brought together into an integrated communications session with the ability to access the communication context across different media and modes. The Avaya Aura architecture makes software applications easier to develop, deploy and manage than traditional Computer Telephone Integration, or CTI, based unified communications and contact center applications. Since our SIP-based architecture requires much less specialized communications programming skill than traditional solutions, we expect it to attract a broader community of developers and accelerate innovation and application development.details.

Our solutions address the needs of a diverse range of customers, including large multinational enterprises, small-small and medium-sized businesses and government organizations. As of March 31, 2011,September 30, 2012, we had over 400,000300,000 customers, including more than 85%95% of the Fortune 500 companies, andwith installations in over one million customer locations worldwide. Our customers operate in a broad range of industries, including financial services, manufacturing, retail, transportation, energy, media and communications, health care,healthcare, education and government, and include, among others, Morgan Stanley & Co. LLC, Progressive Casualty Insurance Company, Whirlpool Corporation, The Hewlett-Packard Company, or HP, Home Depot, Inc., United Air Lines, Inc., Marriott International, Inc., the Blue Cross and Blue Shield Association, Australia National University and the Federal Deposit Insurance Corporation, or the FDIC. We employ a flexible go-to-market strategy with direct and indirect presence in over 100170 countries. As of March 31, 2011,2013, we had approximately 9,90010,800 channel partners and for the six months ended March 31, 2011,fiscal 2012, our product revenue from indirect sales represented approximately 77%75% of our total product revenue.

For the twelve months ended September 30, 2010fiscal 2012 and the six months ended March 31, 2011, we generated revenue of $5,060$5,171 million and $2,756$5,547 million, respectively. For the twelve months ended September 30, 2010,fiscal 2012, product revenue represented 51%52% of our total revenue and services revenue represented 49%48%. For the six months

ended March 31,fiscal 2011, product revenue represented 54% of our total revenue and services revenue represented 46%. For the twelve months ended September 30, 2010, approximately 55% of our revenue wasRevenue generated in the United States.States for fiscal 2012 and 2011 represented 54% of our total revenue. For the twelve months ended September 30, 2010fiscal 2012 we had operating income of $115 million as opposed to an operating loss of $94 million in fiscal 2011. For fiscal 2012 and the six months ended March 31, 2011, we had a net losslosses of $871$354 million and $612$863 million, respectively,respectively. For each of fiscal 2012 and 2011, we had Adjusted EBITDA of $795 million and $442 million, respectively.$971 million. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Financial Measures and Supplemental Disclosure—Operations: EBITDA and Adjusted EBITDA” for a definition and explanation of Adjusted EBITDA and a reconciliation of net loss to Adjusted EBITDA.

Our Industry

Trends Driving Business Collaboration Spending

Enterprises are increasingly focused on deploying collaboration solutions in order to increase productivity, reduce costs and complexity and gain competitive advantages. The requirements of enterprises have evolved over the past few years in response to the following trends:

Increasingly Mobile and Always-ConnectedConnected Workforce Needs Anytime/Anywhere Collaboration Tools.As enterprises move toward a more geographically dispersed, 24x7 connected workforce, they need tools to quickly solve business challenges while improving their efficiency. To do this, enterprises need collaboration technology that can bring people together with the right information at the right time in the right context to make critical business decisions, enabling business users to improve their efficiency and quickly solve critical business challenges.decisions.

Proliferation of Devices and ApplicationsExpanding the Number of Points of Integration.The number and types of endpoints are growing rapidly. Whereas in the past, business users communicated primarily via desk-phones, today they continue to use desk-based devices, but also various mobile devices such as laptops, smartphones and tablets. In order to communicate seamlessly and securely across these devices, applications and applications, collaboration solutionsendpoints must integrate thembe integrated into the communications infrastructure and allowprovide a way for IT professionals to manage themhave a consolidated view of these devices and applications so that the environment can be managed effectively and reliably.

Consumerization of the Enterprise has Changed Expectations of Business Users and Put More Pressure on IT Departments.BusinessWith the proliferation of consumer devices such as the Apple iPhone and Apple iPad, Google Android smartphones and tablets and business and social networking applications, business users are increasingly using consumer-focused products and applications for business tasks, particularly in the areas of collaboration and communication. This has put a significant strain onBusiness users expect their enterprise IT departmentssolutions to support and secure these devices and mimic these applications within the enterprise.and expect enterprise vendors to design their products so that they are easier to use.

Customer Expectations of Contact Centers and Customer Service Areare Changing. Customer expectationsinteractions are changing as interactions with contact centers evolveevolving from voice-centric, point-in-time, contact center transactions to multimediapersistent customer conversations over multiple interactions and multi-modal communications.across multiple media and modes of communication. Customers increasingly expect enterprises to know about the history of the interaction regardlesstheir interactions, even when they occur across a mix of the method of communication.self-service and agent assisted communications methods including voice, video, email and chat.

Business Leaders are Increasingly Challenged to Deliver New Business Capabilities to Support Growth While Facing Tight IT Budgets. Business leaders continue to manage their overall spending closely dueDue to continued macro-economic uncertainty. Atuncertainty, businesses are closely managing overall spending while at the same time business leaders are focused onmaking strategic IT investments to gain competitive advantageadvantage. As a result, they are seeking solutions that cost-effectively scale with their businesses. Increasingly, to help manage costs and improve productivity, while expecting acceptable levels of return on their investment.efficiencies businesses are exploring a shift to operating expense models, where they pay a fee for business collaboration and communications services but the underlying solutions, infrastructure and headcount are owned and managed by the vendor, as opposed to capital expenditure models that require them to invest in and own the solutions, infrastructure and headcount.

Competitors’ Solutions are Inadequate

Together these trends add to the complexityThe Benefits of enabling business collaboration, and drive business leaders to seek a more simple, holistic solution that is easy-to-use, scalable and cost-effective. We believe that competitors’ solutions fall short of delivering a seamless real-time collaboration experience due to the following limitations:

Most Collaboration Solutions Today are One-size-fits-all and Often Cannot Accommodate Customers’ Specific Needs.Competitors’ collaboration solutions are not designed for the demands of unified communications. Many collaboration vendors see the demand for unified communications as an opportunity to sell more of their core products by bundling their products with other communication systems and loosely tying the systems together with a single user interface. The resulting solutions are poorly architected, difficult to deploy and manage and do not deliver a seamless, real-time business collaboration experience.

Competitors’ Solutions Were Built from an Email or Data Networking Focus, Not for Real-time Collaboration. Many traditional collaboration tools simply aggregate different modes of communication around their core competency (email or data) with a single interface without integrating the underlying architectures. As a result, users have a disjointed experience and do not realize the many benefits of next-generation business collaboration solutions such as simultaneous conversations across different media or the ability to access the context of their conversations across various modes and media.

Traditional Solutions are Closed and Proprietary, Forcing Customers to Use a Single Vendor and Abandon Existing IT Investments.Many of our competitors’ collaboration solutions use proprietary, closed architectures, which do not integrate well with those of other vendors. This forces customers to choose a platform that does not offer all of the desired features and functionality and makes it difficult to integrate third party applications to address broader enterprise requirements. As a result, customers either have to abandon their existing infrastructure investments or accept additional complexity and costs in order to deploy new infrastructure equipment or applications.

Limited Consumer Device Support.We believe that because of their proprietary nature, competitors’ solutions do not easily lend themselves to enabling the integration of new consumer devices with seamless, real-time collaborations applications. These solutions lack the infrastructure to reliably integrate, support and secure these consumer devices and therefore inhibit the potential benefits these devices can bring to the enterprise.

Most Collaboration Solutions Vendors Lack an In-house Global Services Organization to Support Customers and Partners Through Implementation and Maintenance. Most collaboration vendors lack a full scale in-house services organization to help customers and partners deploy business collaboration solutions or the integration expertise to help customers migrate from their current communications environment. As a result, customers are forced to contract with third-party service providers, which adds to the overall cost and complexity of deployment.

High Total Cost of Ownership. Traditional solutions require a significant investment in new infrastructure and customized integration. In addition, they are difficult to deploy and manage and require significant professional services support upfront and ongoing IT costs to manage and maintain.

Addressable Market for Business Collaboration Solutions is Large and Growing

We believe that the trend toward a more mobile workforce and the proliferation of devices and applications creates a significant market opportunity for business collaboration. In addition, we believe that the limitations of traditional collaboration solutions present an opportunity for differentiated vendors to gain market share. We believe that the business collaboration market includes spending on unified communications, contact center applications and data networking equipment, as well as spending on support and maintenance services to support these tools. Industry analysts project that in 2011, these markets will grow to $77 billion in aggregate.

Our Solutions

We are a leader in the business collaboration market and have created next-generation solutions that offer an innovative approach, delivering our customers fit-for-purpose, open solutions that we believe enable them to experience enhanced levels of productivity at a lower total cost of ownership than our competitors. The key benefits of our solutions include:

Innovative Real-Time, Multimedia, Multi-Platform Collaboration Tools that Unleash the Power of Teamwork.Promote Business Collaboration.We help Our next-generation business collaboration and communications solutions are designed to provide our customers unleash the power of collaboration by providing them with the software and infrastructure needed to bring together the right people together with the right information at the right time in the right context regardless of the communications technology, devices or location.

Fit-for-Purpose Solutions that Offer Anan Enhanced User Experience, Productivity Benefits and Lower Total Cost of Ownership.OurWe deliver comprehensive, fit-for-purpose solutions that are designed for the needs of today’s distributed, collaborative workforce, while addressing what we believe are the three key performance challenges for an enterprise-class communications environment: resiliency, efficiency and scalability. We believe our solutions are specifically designed to address thethese needs, of today’s unified communications environment. As a result, we believe our solutions require less hardware and perform better than our competitors.

Open Standards-Based Architecture that Enables Flexible and Extensible Collaboration.Our next-generationopen standards-based solutions, are based on an open SIP architecture, accommodatingincluding our Avaya Aura platform, accommodate customers with multi-vendor environments seeking to leverage their existing investments and supplement their existing solutionswhat they have with the specific collaboration products thatand/or services they need, as well asand rapidly create and deploy applications. Providing enterprises with strong integration capabilities gives them the flexibility to take advantage of new collaboration and contact center tools and devices as they are introduced, rather than being confined to a single vendor and having to compromise on functionality.

Enterprise-Class Solutions that are Scalable, Secure, Reliable and Reliable.Backed by Our Award-Winning Services.Enterprises and governments across the world depend on us for their collaboration needs, knowing that we can deliver mission critical dependability. Our product portfolio has been designed to be highly reliable, secure and scalable, and is backed by anour award-winning global services. Avaya Global Services, or AGS, is a leading provider of support services organization withrelating to business collaboration and communications solutions, offering services support tools to help our customers monitor, troubleshoot and manage their infrastructure. In addition, AGS delivers managed and professional services, providing the integration expertise necessary to help customers migrate from their current communications environment to next-generation business collaboration and communications environments.

Centralized Application Integration and Management that Makes it Easier to Integrate, Deploy and Manage. Our solutions provide enterprises with the ability to perform integration and management tasks as part of a central service rather than from individual platforms, reducing the amount of time required to perform integration activities and to support and manage unified communications services.

Our Competitive Strengths

In addition to the strengths of our solutions, we believe the following competitive strengths position us well to capitalize on the opportunities presentedcreated by the market trends impactingaffecting our industry.

Leading Position Across Our Key End Markets.We are a leader in business collaboration and communications, with leading market share in worldwide unified communications, contact center infrastructure, voice maintenancesupport services and enterprise messaging.

Large, Diverse and Global Customer Installed Base.Our solutions address the needs of a diverse range of customers from large multinational enterprises to small- and medium-sized businesses in a number ofvarious industries. We believe our large and diverse customer base provides us with recurring revenue and a continuing growththe opportunity to further expand within our customer base.

History of Innovation with Large Pipeline of New Products and UniqueDifferentiated Approach to Commercialization.We continue to innovate rapidly. As of March 31, 2011,September 30, 2012, we had over 5,700approximately 5,900 patents and pending patent applications, including foreign counterparts.counterparts that cover a wide range of products and services. Since the beginning of fiscal year 2010, we have introduced more than 60130 new offerings across our portfolio.portfolio, the largest product pipeline in our history. These new offerings include our Avaya Aura platform, Avaya Aura Contact Center, Avaya Flare Experience and Avaya Virtual Enterprise Network Architecture. We have a uniquebelieve that our approach to commercialization approach which we believe results in new products with broad appeal and accelerates the timeline for development and adoption.

Acquisitions Have Further Amplified Our Innovation and Growth Strategy. Key examples of this include Radvision Ltd., acquired in June 2012, and Sipera Systems, Inc., acquired in October 2011. Radvision enhances Avaya’s position with industry leading video collaboration and communications solutions. The Sipera portfolio brings best-in-class Session Border Controller (SBC) security and management solutions.

Flexible Go-to-Market Strategy Expands Reach of Our Products and Services.We sell our solutions both directly and through an indirect sales channel, enabling ustailoring our go-to-market strategy to reach customers across industries and globally.our target market. With the acquisition of the enterprise solutions business of Nortel Networks Corporation, or NES, we significantly expanded our channel coverage and deepened our vertical expertise.

Global End-to-End Services OrganizationCapability Provides Large Recurring Revenue Stream. We maintain an award-winning, global, in-house services organization that provides us withAvaya Global Services is uniquely positioned to deploy, support and manage Avaya solutions as a key advantage over manyresult of joint planning between R&D and service planning in advance of new products being released. Avaya Global Services has direct access to our competitors who lack such an organization. Our services contracts tendresearch and development teams necessary to be multi-year arrangements, have high renewal rates and have provided us with a large recurring revenue base and significant visibility into our customers’ future collaboration needs.quickly resolve customer issues. This allows Avaya to provide quality service for Avaya products.

Experienced Management Team with Track Record of Execution. We have an experienced team of senior executives that has demonstrated an ability to identify critical trends in the technology and communications sectors and develop a comprehensive strategic vision to enable businesses to capitalize on those trends.

Our Growth Strategy

We intendbelieve we are well-positioned worldwide and have a multi-faceted strategy that builds upon our brand, strong client relationships and ability to continue to be on the cutting edge of innovation. Our vision is to be the preeminent provider of business collaboration and communications solutions with a commitment to open standards and innovative products, services and solutions. Key elements of our strategy include:

Leverage our Leading Market Positions to Drive the Adoption of our Next-Generation Collaboration Solutions.We believe that our market leadership, global scale and extensive customer interaction and credibility with customers and prospects creates a strong platform from which to drive and shape the evolution of enterprise communications toward greater business collaboration.

Capture Additional Market Share Across our Portfolio of Products and Services. MostWhile we have leading market presence in the majority of the markets we serve, most of our markets still have numerous competitors of varying size, whosize. Changes in business communications needs will find it challengingchallenge many of these competitors to keep paceinnovate and allow us to gain share with our broader portfolio of products and services. We also believe that scale and service capability become increasingly important as the changing business collaboration needs. Ourcomplexity and importance of communications grows within the enterprise. As potential customers look to migrate to our solutions, our open architecture integratescan integrate with competitor systems and providesprovide a path for gradual transition while still achieving cost savings and improved functionality. In addition, weWe also believe there is significant opportunity to further monetize the NES installed base by increasing the services attach rate forsell support contracts to customers acquired in the NES acquisition.

Grow Avaya Managed Services. With Communications Outsourcing Solutions, Avaya provides custom managed services for multi-vendor applications and infrastructure. Avaya offers end-to-end management for any stage of the network lifecycle to help extend the potential of aging communications environments and enable customers to adopt new technology easily. Avaya takes a vendor-agnostic approach to managing communications and day-to-day operations. We help design, implement, and manage technology upgrades, working in existing environments and offering flexible financial models to meet budget and business needs.

Expand Margins and Profitability. Drive profitable growth worldwide andWe have multiple initiatives to further increase our profit margins worldwide, including increasingexpanding gross profits and reducing operating expenses. From fiscal 2007 to fiscal 2012 we increased our focus on higher-margin software revenue, optimizinggross margin, excluding the amortization of technology intangible assets and the impact of purchase accounting adjustments, from 47% to 54% and we are pursuing the following initiatives to further expand our gross profits:

Driving lower material cost through our increased scale as a result of the NES acquisition, improved supplier mix and increased component commonality.

Greater use of low cost regions for supplier sourcing, contract manufacturing and provisioning of some support services.

Optimizing design of products and services productivity to drive efficiencies, executing on certain cost-savingsmaterial and supply chain efficiencies.

Increasing the percentage of our revenue represented by higher-margin software.

Generating service productivity improvements through methodology and diagnostic tools as well as promoting greater web-based self-service tools.

We also have the following initiatives to reduce operating expenses as a percentage of revenues:

Cost savings initiatives associated with the integration of NES and achieving greater economies of scale.other acquisitions.

Other restructuring activities including exiting facilities and reducing the workforce or relocating positions to lower cost geographies.

Sales productivity improvements and distribution channel optimization.

Continue to Develop Innovative Products and Services Around Our Next Generation Business Collaboration Solutions.Solutions to Drive Revenue and Shorten Sales Cycles. ExtendWe intend to extend our industry-leading position through continued focus on product innovation and substantial investment in research and development for new products and services in high growth areas.services. Evidence of this focus is our 130 new product offerings since the beginning of fiscal 2010. We believe our abilityalso plan to develop innovative solutions is advancedcontinue to embrace the opportunity presented by feedback gathered from our extensive customer relationshipscloud computing and our customer focus, which allow usseek new ways to better meet our customers’ needs and anticipate market demand.leverage the Virtual Desktop Integration (VDI) trend to securely deliver business collaboration to users.

Continue to Invest in and Expand our Sales and Distribution Capabilities to Attack New Markets and Better Penetrate Existing Markets. Continue to investOur continued investment in our channel partners and sales force is designed to help optimize their market focus, improve segmentation, enter new geographies and provide our channel partners with compelling business incentives and discounts, along with training, marketing programs and technical support through our Avaya Connect, our business partner program. We also plan to leverage our sales and distribution channels to accelerate customer adoption and generate an increasing percentage of our revenue from our new high value software solutions and user experience-centric applications.

Pursue Strategic Relationships, Alliances and Acquisitions. ContinueWe plan to continue to establish relationships and alliances and selectively acquire capability-enhancing businesses as key elements in our strategy going forward. We believe we have one of the largest communications-focused developer and technology partner ecosystems. This is evidenced by the Avaya DevConnect program, which promotes the development, compliance-testing and co-marketing of innovative third-party products that are compatible with Avaya’s standards-based solutions and has more than 20,000 registered companies as of September 30, 2012. We also maintain key relationships with large technology vendors such as International Business Machines Corporation (IBM), HP, and Oracle. Additionally, we will continue to continue our global growth.make acquisitions when we find opportunities with compelling strategic and financial rationales.

Retain, Recruit and Develop Talent Globally.Globally Develop. We are focused on developing a workforce that has both exceptional technical capabilities and the leadership skills that are required to support our technological and geographical growth. Building and nurturing a committed, diverse and engaged workforce with the highest levels of ethics and integrity is at the heart of our strategy. We have dramatically reshaped our workforce throughout our entire organization and have an executive team with significant experience in operating leading technology companies. Our transformation to being the leader in business collaboration and communications will be fueled by developing new workforce capabilities and building upon our talented team in place today.

Risks Associated with Our Company

Our business is subject to a number of risks of which you should be aware before making an investment decision. These risks are discussed more fully in the “Risk Factors” section of this prospectus immediately following this prospectus summary. These risks include, but are not limited to, the following:

Our revenues are dependent on general economic conditions and the willingness of enterprises to make capital investments;

| • | Our revenues are dependent on general economic conditions and the willingness of enterprises to make capital investments. The impact of economic conditions on the willingness of enterprises to make capital investments, particularly in business collaboration technology and related services can significantly affect our operating results and we believe that enterprises continue to be cautious about sustained economic growth. |

The market opportunity for advanced communications products and services, including our next-generation business collaboration solutions may not develop in the ways that we anticipate;

| • | The market opportunity for advanced communications products and services, including our next-generation business collaboration solutions may not develop in the ways that we anticipate. The demand for our offerings can change quickly and in ways that we may not anticipate because the market in which we operate is characterized by rapid, and sometimes disruptive, technological developments, evolving industry standards, frequent new product introductions and enhancements, changes in customer requirements and a limited ability to accurately forecast future customer demand. |

We depend on third-party providers to manufacture, warehouse and distribute our products;

| • | We are dependent on our intellectual property. As a leader in technology and innovation in business collaboration and communications, we are dependent on the maintenance of our current intellectual property rights and the establishment of new intellectual property rights. If we are not able to protect our intellectual property rights or if those rights are invalidated or circumvented, our business may be adversely affected. |

If we are not able to protect our intellectual property rights or if those rights are invalidated or circumvented, our business may be adversely affected;

| • | Our degree of leverage could adversely affect our ability to raise additional capital to fund our operations and limit our ability to react to changes in the economy or our industry. Our degree of leverage could have important consequences, including making it more difficult for us to make payments on our indebtedness and increasing our vulnerability to general economic and industry conditions. |

Our degree of leverage could adversely affect our ability to raise additional capital to fund our operations and limit our ability to react to changes in the economy or our industry;

| • | We face formidable competition from providers of unified communications, contact center and networking solutions and related services; as these markets evolve, we expect competition to intensify. In addition to the competition we face from traditional enterprise voice communications |

We face formidable competition from numerous established firms that provide both traditional enterprise voice communications solutions as well as providers of technology related to business collaboration and contact center solutions; as these markets evolve, we expect competition to intensify and expand to include companies that do not currently compete directly against us;

solutions and providers of technology related to business collaboration and contact center solutions, we expect competition to intensify and expand to include companies that do not currently compete directly against us. |

Following the completion of this offering, funds affiliated with TPG Capital, or TPG, and Silver Lake, which are collectively referred to as our Sponsors, will have the ability to control the outcome of matters submitted for stockholder approval and may have interests that differ from those of our other stockholders; and

| • | The Sponsors have significant influence over corporate transactions. Following the completion of this offering, funds affiliated with TPG Global LLC, or, together with its affiliates, TPG, and Silver Lake Partners, or Silver Lake, which are collectively referred to as our Sponsors, will have the ability to control the outcome of matters submitted for stockholder approval and may have interests that differ from those of our other stockholders. |

We expect to be a “controlled company” within the meaning of the rules of the and, as a result, will qualify for, and intend to rely on, exemptions from certain corporate governance requirements.

| • | We expect to be a “controlled company” within the meaning of the rules of the New York Stock Exchange. After completion of this offering, the Sponsors will continue to control a majority of the voting power of our outstanding common stock. As a result, we will qualify for, and intend to rely on, exemptions from certain corporate governance requirements. |

Company Information and Corporate Structure

Our principal executive offices are located at 211 Mt. Airy Road, Basking Ridge, NJ 07920.4655 Great America Parkway, Santa Clara, CA 95054. Our telephone number is (908) 953-6000. Our website address is www.avaya.com. Information contained in, and that can be accessed through, our website is not incorporated into and does not form a part of this prospectus.

Avaya Holdings Corp., formerly known as Sierra Holdings Corp., was incorporated under the laws of the State of Delaware on June 1, 2007 by affiliates of the Sponsors. The Sponsors, through a subsidiary holding company, acquired Avaya Inc., our principal U.S. operating subsidiary, and each of its subsidiaries in a merger transaction that was completed on October 26, 2007, which we refer to in this prospectus as the Merger. SinceDespite the fact that Avaya Inc.’s obligation to file periodic and current reports with the SEC ended on October 1, 2010, it has voluntarily filedfiles such reports with the SEC to comply with the terms of the indenturesindenture governing its senior secured and unsecured notes. Avaya Holdings Corp. is a holding company with no stand-alone operations and has no material assets other than its ownership interest in Avaya Inc. and its subsidiaries. All of Avaya Holdings Corp.’s operations are conducted through its various subsidiaries, which are organized and operated according to the laws of their jurisdiction of incorporation, and consolidated by Avaya Holdings Corp.

As of March 31, 2013, our total outstanding indebtedness was $6,103 million (excluding capital lease obligations and $18 million of debt discount due upon settlement of our indebtedness), of which $5,094 million was attributable to financing associated with the Merger and $1,009 million was attributable to financing associated with the acquisition of NES. For a complete discussion of our financing see Note 7, “Financing Arrangements,” to our unaudited Consolidated Financial Statements included elsewhere in this prospectus.

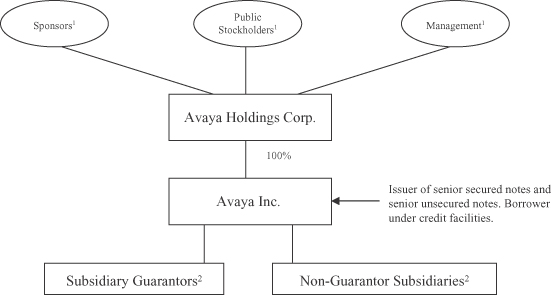

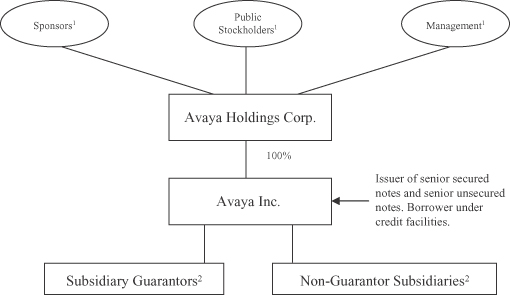

The following chart shows our organizational structure immediately following the consummation of this offering:

| (1) | Represents %, % and % of the total voting power in our company, respectively. |

| (2) | Substantially all of our domestic 100% owned subsidiaries as of |

THE OFFERING

Common stock we are offering | Shares | |

Common stock to be outstanding after this offering | Shares | |

Option to purchase additional shares offered to underwriters | Shares | |

Use of proceeds | We intend to use the net proceeds received by us in connection with this offering for the following purposes: | |

• to repay a portion of our long-term indebtedness; | ||

• to redeem all of our outstanding Series A Preferred Stock; and | ||

• to pay certain amounts in connection with the termination of our management services agreement with affiliates of our Sponsors pursuant to its terms. | ||

See “Use of Proceeds.” | ||

Risk factors | You should carefully read the “Risk Factors” section of this prospectus beginning on page 17 for a discussion of factors to consider carefully before deciding whether to purchase shares of our common stock. | |

Proposed NYSE symbol | “ | |

As of March 31, 2011,2013, we had 487,389,017488,662,389 shares of common stock outstanding. This excludes the following numbers of shares of our common stock issuable in connection with the exercise of warrants outstanding as of March 31, 20112013, the conversion of our Series B Convertible Preferred Stock and equity awards under our Amended and Restated 2007 Equity Incentive Plan, or the 2007 Plan:

100,000,000 shares of common stock issuable upon the exercise of warrants held by affiliates of our Sponsors, which warrants are subject to the lock-up agreements described under “Underwriters” and exercisable at any time prior to December 18, 2019 at an exercise price of $3.25 per share see(see “Description of Capital Stock—Warrants”);

24,500,000 shares of common stock issuable upon the exercise of warrants held by affiliates of our Sponsors, which warrants are subject to the lock-up agreements described under “Underwriters” and “Principal Stockholders”exercisable at any time prior to May 29, 2022 at an exercise price of $4.00 per share (see “Description of Capital Stock—Warrants”);

429,761 shares of common stock issuable on the exercise of optionsContinuation Options that were awarded by the Company to executive officers prior to the Merger andthat were permitted to be rolled over into equity awards issued by us upon consummation of the Merger, or Continuation Options, each with an exercise price of $1.25 per share;

972,341 shares of common stock issuable onupon conversion of the distributionSeries B Convertible Preferred Stock held by affiliates of units that were awarded to executive officers priorour Sponsors, and convertible at any time as such Series B Convertible Preferred Stock is outstanding at a conversion price equal to the Merger and were permittedlesser of (1) $4.00 per share (subject to be rolled over into equity awards issued by us upon consummationcertain anti-dilution provisions) or (2) the offering price per share in this offering, which such shares if converted are subject to the lock-up agreements described under “Underwriters” (see “Description of the Merger, or Continuation Units;Capital Stock—Preferred Stock—Series B Convertible Preferred Stock”);

44,072,95636,262,394 shares of common stock issuable upon the exercise of options with exercise prices ranging from $3.00 to $5.00 per share and a weighted average exercise price of $3.03$3.28 per share;

1,370,0001,719,808 shares of common stock issuable on the vesting and distribution of restricted stock units, or RSUs; and

4,405,2019,748,283 additional shares of common stock as of March 31, 20112013 reserved for future grants under the 2007 Plan.

This also excludes additional shares of common stock reserved for future equity incentive plans to be effective upon the occurrencecompletion of this offering.

Unless otherwise indicated, all information in this prospectus:

assumes the adoption of our amended and restated certificate of incorporation and our amended and restated bylaws to be effective upon the closing of this offering;

assumes no exercise by the underwriters of their option to purchase up to additional shares of our common stock in this offering; and

reflects, for all prior periods, a for of our common stock to be effected prior to the consummation of this offering.

SUMMARY HISTORICAL FINANCIAL DATA

The following table sets forth our summary historical consolidated financial data at the dates and for the periods indicated. Avaya Holdings Corp. was incorporated on June 1, 2007 by affiliates of the Sponsors. Avaya Holdings Corp., through a subsidiary holding company, entered into a merger agreement with Avaya Inc., or the Predecessor, pursuant to which the holding company merged with and into Avaya Inc., with Avaya Inc. continuing as the surviving entity and a wholly owned subsidiary of Avaya Holdings Corp., in a transaction that was completed on October 26, 2007. Avaya Holdings Corp. is a holding company and has no material assets or stand-alone operations other than its ownership in Avaya Inc. and its subsidiaries. The summary historical consolidated financial data set forth below are those of Avaya Holdings Corp. and its consolidated subsidiaries, or the Successor, from its inception on June 1, 2007 through March 31, 20112013 and those of its predecessor, Avaya Inc., for all prior periodsthe period October 1, 2007 through October 26, 2007, the closing date of the Merger.

The Predecessor summary historical consolidated financial data set forth below as of and for the years ended September 30, 2006 and September 30, 2007 have been derived from our Predecessor’s audited consolidated financial statements and related notes, which are not included in this prospectus. The Predecessor summary historical consolidated financial data set forth below for the period October 1, 2007 through October 26, 2007 hashave been derived from our Predecessor’s audited Consolidated Financial Statements and related notes, which are not included in this prospectus. The Successor summary historical consolidated financial statementsdata set forth below as of September 30, 2011 and 2012 and for the years ended September 30,2010, 2011 and 2012 have been derived from our audited Consolidated Financial Statements and related notes included elsewhere in this prospectus. The Successor summary historical consolidated financial data set forth below as of and for the yearsyear ended September 30, 2008 and 2009 and 2010 havehas been derived from our audited consolidated financial statementsConsolidated Financial Statements and related notes, which are not included elsewhere in this prospectus. The Successor summary historical consolidated financial data set forth below as of and for the period June 1, 2007 through September 30, 2007 has been derived from our unaudited consolidated financial statements,Consolidated Financial Statements, which are not included in this prospectus. The Successor had no operations prior to the Merger. The Successor summary historical consolidated financial data set forth below as of and for the six months ended March 31, 2011 and 2010 have been derived from our unaudited consolidated financial statements included elsewhere in this prospectus. Our unaudited consolidated financial statements for the six months ended March 31, 2011 and 2010 have been prepared on the same basis as the annual consolidated financial statements and, in the opinion of our management, include all adjustments, which include only normal recurring adjustments, necessary for a fair statement of this data. As part of the Merger on October 26, 2007, we entered into various financing arrangements and, as a result, had a different capital structure following the Merger. Accordingly, the results of operations for periods subsequent to the Merger will not necessarily be comparable to the prior period.

The data for the six months ended March 31, 2013 and 2012 has been derived from unaudited financial statements also appearing herein and which, in the opinion of management, include all adjustments consisting only of normal recurring adjustments, necessary for a fair statement of the financial condition, results of operations and cash flows for the unaudited interim periods.

The following summary should be read together with our consolidated financial statementsConsolidated Financial Statements and the related notes appearing elsewhere in this prospectus and the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section of this prospectus.

| Predecessor | Successor | Predecessor | Successor | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fiscal year ended September 30, | Period from October 1, 2007 through October 26, 2007 | Period from June 1, 2007 through September 30, 2007(1) | Fiscal year ended September 30, | For the Six Months Ended March 31, | Period from October 1, 2007 through October 26, 2007 | Period from June 1, 2007 through September 30, 2007 | Fiscal year ended September 30, | Six months ended March 31, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2006 | 2007 | 2008(2) | 2009 | 2010 | 2010 | 2011 | 2008(1) | 2009 | 2010 | 2011 | 2012 | 2012 | 2013 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (in millions, except per share amounts) | (in millions, except per share amounts) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

STATEMENT OF OPERATIONS DATA: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

REVENUE | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Products | $ | 2,790 | $ | 2,875 | $ | 96 | $ | — | $ | 2,595 | $ | 1,923 | $ | 2,602 | $ | 1,193 | $ | 1,479 | $ | 96 | $ | — | $ | 2,595 | $ | 1,923 | $ | 2,602 | $ | 2,976 | $ | 2,672 | $ | 1,386 | $ | 1,160 | ||||||||||||||||||||||||||||||||||||||||||

Services | 2,358 | 2,403 | 150 | — | 2,328 | 2,227 | 2,458 | 1,187 | 1,277 | 150 | — | 2,328 | 2,227 | 2,458 | 2,571 | 2,499 | 1,258 | 1,198 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 246 | — | 4,923 | 4,150 | 5,060 | 5,547 | 5,171 | 2,644 | 2,358 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5,148 | 5,278 | 246 | — | 4,923 | 4,150 | 5,060 | 2,380 | 2,756 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

COSTS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Products: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Costs (exclusive of amortization of intangible assets) | 1,224 | 1,295 | 56 | — | 1,256 | 872 | 1,243 | 548 | 675 | 56 | — | 1,256 | 872 | 1,243 | 1,314 | 1,145 | 591 | 497 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Amortization of technology intangible assets | 15 | 20 | 1 | — | 231 | 248 | 291 | 142 | 133 | 1 | — | 231 | 248 | 291 | 257 | 192 | 99 | 36 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Services | 1,534 | 1,512 | 100 | — | 1,403 | 1,164 | 1,354 | 644 | 687 | 100 | — | 1,403 | 1,164 | 1,354 | 1,344 | 1,248 | 637 | 573 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2,773 | 2,827 | 157 | — | 2,890 | 2,284 | 2,888 | 1,334 | 1,495 | 157 | — | 2,890 | 2,284 | 2,888 | 2,915 | 2,585 | 1,327 | 1,106 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

GROSS MARGIN | 2,375 | 2,451 | 89 | — | 2,033 | 1,866 | 2,172 | 1,046 | 1,261 | 89 | — | 2,033 | 1,866 | 2,172 | 2,632 | 2,586 | 1,317 | 1,252 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

OPERATING EXPENSES | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Selling, general and administrative | 1,532 | 1,552 | 111 | — | 1,456 | 1,272 | 1,721 | 833 | 931 | 111 | — | 1,456 | 1,272 | 1,721 | 1,845 | 1,630 | 847 | 765 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Research and development | 428 | 444 | 29 | — | 376 | 309 | 407 | 197 | 236 | 29 | — | 376 | 309 | 407 | 461 | 464 | 228 | 231 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Amortization of intangible assets | 48 | 48 | 4 | — | 187 | 207 | 218 | 107 | 112 | 4 | — | �� | 187 | 207 | 218 | 226 | 226 | 112 | 114 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Impairment of long-lived assets | — | — | — | — | 10 | 2 | 16 | 16 | — | — | — | 10 | 2 | 16 | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Impairment of indefinite-lived intangible assets | — | — | — | — | 130 | 60 | — | — | — | — | — | 130 | 60 | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Goodwill impairment | — | — | — | — | 899 | 235 | — | — | — | — | — | 899 | 235 | — | — | — | — | 89 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Restructuring charges, net | 104 | 36 | 1 | — | — | 160 | 171 | 83 | 64 | 1 | — | — | 160 | 171 | 189 | 147 | 111 | 102 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

In-process research and development charge | — | — | — | — | 112 | 12 | — | — | — | — | — | 112 | 12 | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Acquisition-related costs | — | — | — | — | — | 29 | 20 | 19 | 4 | — | — | — | 29 | 20 | 5 | 4 | 3 | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Merger-related costs | — | 105 | 57 | — | 1 | — | — | — | — | 57 | — | 1 | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2,112 | 2,185 | 202 | — | 3,171 | 2,286 | 2,553 | 1,255 | 1,347 | 202 | — | 3,171 | 2,286 | 2,553 | 2,726 | 2,471 | 1,301 | 1,301 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

OPERATING INCOME (LOSS) | 263 | 266 | (113 | ) | — | (1,138 | ) | (420 | ) | (381 | ) | (209 | ) | (86 | ) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

OPERATING (LOSS) INCOME | (113 | ) | — | (1,138 | ) | (420 | ) | (381 | ) | (94 | ) | 115 | 16 | (49 | ) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Interest expense | (3 | ) | (1 | ) | — | — | (377 | ) | (409 | ) | (487 | ) | (229 | ) | (240 | ) | — | — | (377 | ) | (409 | ) | (487 | ) | (460 | ) | (432 | ) | (217 | ) | (224 | ) | ||||||||||||||||||||||||||||||||||||||||||||||

Loss on extinguishment of debt | — | — | — | — | — | — | — | — | (246 | ) | — | — | — | — | — | (246 | ) | — | — | (6 | ) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Other income, net | 24 | 43 | 1 | — | 27 | 14 | 15 | 5 | 1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Other income (expense), net | 1 | — | 27 | 14 | 15 | 5 | (29 | ) | (16 | ) | 4 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

INCOME (LOSS) BEFORE INCOME TAXES | 284 | 308 | (112 | ) | — | (1,488 | ) | (815 | ) | (853 | ) | (433 | ) | (571 | ) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Provision for (benefit from) income taxes | 83 | 93 | (24 | ) | — | (183 | ) | 30 | 18 | (16 | ) | 41 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

LOSS BEFORE INCOME TAXES | (112 | ) | — | (1,488 | ) | (815 | ) | (853 | ) | (795 | ) | (346 | ) | (217 | ) | (275 | ) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

NET INCOME (LOSS) | 201 | 215 | (88 | ) | — | (1,305 | ) | (845 | ) | (871 | ) | (417 | ) | (612 | ) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Benefit from (provision for) income taxes | 24 | — | 183 | (30 | ) | (18 | ) | (68 | ) | (8 | ) | 26 | 6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

NET LOSS | (88 | ) | — | (1,305 | ) | (845 | ) | (871 | ) | (863 | ) | (354 | ) | (191 | ) | (269 | ) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Less net income attributable to noncontrolling interests | — | 3 | — | — | 2 | 2 | 3 | 2 | — | — | — | 2 | 2 | 3 | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

NET INCOME (LOSS) ATTRIBUTABLE TO AVAYA HOLDINGS CORP. | 201 | 212 | (88 | ) | — | (1,307 | ) | (847 | ) | (874 | ) | (419 | ) | (612 | ) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Less: Accretion and accrued dividends on Series A preferred stock | — | — | — | — | — | — | (62 | ) | (2 | ) | (3 | ) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

NET LOSS ATTRIBUTABLE TO AVAYA HOLDINGS CORP. | (88 | ) | — | (1,307 | ) | (847 | ) | (874 | ) | (863 | ) | (354 | ) | (191 | ) | (269 | ) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

NET INCOME (LOSS) ATTRIBUTABLE TO AVAYA HOLDINGS CORP. COMMON STOCKHOLDERS | $ | 201 | $ | 212 | $ | (88 | ) | $ | — | $ | (1,307 | ) | $ | (847 | ) | $ | (936 | ) | $ | (421 | ) | $ | (615 | ) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

Less: Accretion and accrued dividends on Series A and Series B preferred stock | — | — | — | — | (62 | ) | (7 | ) | (71 | ) | (3 | ) | (21 | ) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

NET LOSS ATTRIBUTABLE TO AVAYA HOLDINGS CORP. COMMON STOCKHOLDERS | $ | (88 | ) | $ | — | $ | (1,307 | ) | $ | (847 | ) | $ | (936 | ) | $ | (870 | ) | $ | (425 | ) | $ | (194 | ) | $ | (290 | ) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

SHARE DATA: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Net income (loss) per share attributable to common stockholders—basic | $ | 0.43 | $ | 0.47 | $ | (0.19 | ) | $ | — | $ | (2.87 | ) | $ | (1.74 | ) | $ | (1.92 | ) | $ | (0.86 | ) | $ | (1.26 | ) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

Net loss per share attributable to common stockholders—basic | $ | (0.19 | ) | $ | — | $ | (2.87 | ) | $ | (1.74 | ) | $ | (1.92 | ) | $ | (1.78 | ) | $ | (0.87 | ) | $ | (0.40 | ) | $ | (0.59 | ) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Weighted average shares outstanding—basic | 462.6 | 454.2 | 462.9 | — | 455.9 | 488.1 | 488.6 | 488.5 | 488.9 | 462.9 | — | 455.9 | 488.1 | 488.6 | 489.0 | 489.6 | 489.3 | 489.3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Net income (loss) per share attributable to common stockholders—diluted | $ | 0.43 | $ | 0.46 | $ | (0.19 | ) | $ | — | $ | (2.87 | ) | $ | (1.74 | ) | $ | (1.92 | ) | $ | (0.86 | ) | $ | (1.26 | ) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

Net loss per share attributable to common stockholders—diluted | $ | (0.19 | ) | $ | — | $ | (2.87 | ) | $ | (1.74 | ) | $ | (1.92 | ) | $ | (1.78 | ) | $ | (0.87 | ) | $ | (0.40 | ) | $ | (0.59 | ) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Weighted average shares outstanding—diluted | 468.6 | 461.3 | 462.9 | — | 455.9 | 488.1 | 488.6 | 488.5 | 488.9 | 462.9 | — | 455.9 | 488.1 | 488.6 | 489.0 | 489.6 | 489.3 | 489.3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Predecessor | Successor | Predecessor | Successor | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fiscal year ended September 30, | Period from October 1, 2007 through October 26, 2007 | Period from June 1, 2007 through September 30, 2007(1) | Fiscal year ended September 30, | Six months ended March 31, | Period from October 1, 2007 through October 26, 2007 | Period from June 1, 2007 through September 30, 2007 | Fiscal year ended September 30, | Six months ended March 31, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2006 | 2007 | 2008(2) | 2009 | 2010 | 2010 | 2011 | 2008(1) | 2009 | 2010 | 2011 | 2012 | 2012 | 2013 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (in millions) | (in millions) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

BALANCE SHEET DATA (at end of period): | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Cash and cash equivalents | $ | 899 | $ | 1,270 | $ | — | $ | 594 | $ | 582 | $ | 594 | $ | 591 | $ | 468 | $ | — | $ | 594 | $ | 582 | $ | 594 | $ | 415 | $ | 338 | $ | 356 | $ | 303 | ||||||||||||||||||||||||||||||||||||||||||||||

Intangible assets, net | 263 | 248 | — | 3,154 | 2,636 | 2,603 | 2,878 | 2,367 | — | 3,154 | 2,636 | 2,603 | 2,129 | 1,775 | 1,939 | 1,625 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Goodwill | 941 | 1,157 | — | 3,956 | 3,695 | 4,075 | 4,113 | 4,080 | — | 3,956 | 3,695 | 4,075 | 4,079 | 4,188 | 4,093 | 4,093 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Total assets | 5,200 | 5,933 | — | 10,010 | 8,665 | 9,276 | 9,691 | 8,920 | — | 10,010 | 8,665 | 9,276 | 8,561 | 8,184 | 8,321 | 7,830 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Total debt (excluding capital lease obligations) | — | — | — | 5,222 | 5,150 | 5,928 | 5,887 | 6,176 | — | 5,222 | 5,150 | 5,928 | 6,157 | 6,121 | 6,139 | 6,103 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Preferred stock, Series B | — | — | — | — | — | 227 | — | 245 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Preferred stock, Series A | — | — | — | — | — | 130 | 127 | 133 | — | — | — | 130 | 137 | 144 | 140 | 147 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Total Avaya Holdings Corp. stockholders’ equity (deficiency) | 2,086 | 2,586 | — | 1,063 | (682 | ) | (1,543 | ) | (907 | ) | (2,136 | ) | — | 1,063 | (682 | ) | (1,543 | ) | (2,500 | ) | (2,843 | ) | (2,637 | ) | (3,133 | ) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

STATEMENT OF CASH FLOWS DATA: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Net cash provided by (used in) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Operating activities | $ | 647 | $ | 637 | $ | 133 | $ | — | $ | 304 | $ | 242 | $ | 42 | $ | (2 | ) | $ | (349 | ) | $ | 133 | $ | — | $ | 304 | $ | 242 | $ | 42 | $ | (300 | ) | $ | 44 | $ | 31 | $ | 88 | |||||||||||||||||||||||||||||||||||||||

Investing activities | (189 | ) | (360 | ) | (16 | ) | — | (7,205 | ) | (155 | ) | (864 | ) | (850 | ) | (30 | ) | (16 | ) | — | (7,205 | ) | (155 | ) | (864 | ) | (101 | ) | (283 | ) | (75 | ) | (59 | ) | ||||||||||||||||||||||||||||||||||||||||||||

Financing activities | (315 | ) | 54 | 11 | — | 7,512 | (101 | ) | 853 | 878 | 248 | 11 | — | 7,512 | (101 | ) | 853 | 228 | 155 | (22 | ) | (59 | ) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

OTHER FINANCIAL DATA: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

EBITDA | $ | 520 | $ | 557 | $ | (94 | ) | $ | — | $ | (515 | ) | $ | 240 | $ | 320 | $ | 135 | $ | 2 | $ | (94 | ) | $ | — | $ | (515 | ) | $ | 240 | $ | 320 | $ | 313 | $ | 647 | $ | 284 | $ | 169 | ||||||||||||||||||||||||||||||||||||||

Adjusted EBITDA(3) | 654 | 832 | (27 | ) | — | 859 | 753 | 795 | 367 | 442 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||