Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on July 7, 2011October 13, 2020.

Registration No. 333- 333-249224

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REGISTRATION STATEMENTAmendment No. 3 to

UNDERFORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

GATOS SILVER, INC.†

(Exact Name of Registrant as Specified in Its Charter)

Delaware | ||||

(State or Other Jurisdiction of Incorporation or Organization) | 1040 (Primary Standard Industrial Classification Code Number) | 27-2654848 (I.R.S. Employer Identification Number) |

370 17th Street,8400 E. Crescent Parkway, Suite 3800

Denver,600

Greenwood Village, CO 80202

80111

(303) 784-5350

(Address, Including Zip Code, and Telephone Number, Including

Area Code, of Registrant’sRegistrant's Principal Executive Offices)

Executive Chairman and Acting Stephen Orr

Chief Executive Officer

and Director

Sunshine Silver MinesMining & Refining Corporation

370 17th Street,

8400 E. Crescent Parkway, Suite 3800

Denver,600

Greenwood Village, CO 80202

80111

(303) 784-5350

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies to: | ||||

Richard D. Truesdell, Jr.

|

10001 | |||

Approximate date of commencement of proposed sale to the public: public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this formForm are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨o

If this formForm is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨o

If this formForm is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨o

If this formForm is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of “large"large accelerated filer,” “accelerated filer”" "accelerated filer," "smaller reporting company," and “smaller reporting company”"emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | Accelerated filer | |||||

| Non-accelerated filer | Smaller reporting company Emerging growth company ý |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ý

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities To Be Registered | Proposed Maximum Aggregate Offering Price(1)(2) | Amount of Registration Fee(3) | ||

|---|---|---|---|---|

Common Stock, par value $0.001 per share | $100,000,000 | $10,910 | ||

| ||||

Title Of Each Class Of Securities To Be Registered | Proposed Maximum Aggregate Offering Price(1)(2) | Amount Of Registration Fee | ||

Common Stock, par value $0.001 per share | $250,000,000 | $29,025 | ||

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information contained in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we areit is not soliciting offersan offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JULY 7, 2011OCTOBER 13, 2020

PRELIMINARY PROSPECTUS

SHARES

SUNSHINE

GATOS SILVER, MINES CORPORATIONINC.

COMMON STOCK

We are selling shares of common stock.stock to the underwriters in a firm commitment offering.

Prior to this offering, there has been no public market for our common stock. We currently estimate that the initial public offering price will be between $ and $ per share. We intend to applyhave applied to list our common stock on the New York Stock Exchange ("NYSE") and the Toronto Stock Exchange ("TSX") under the symbol “AGS.”"GATO."

The underwriters have an option to purchase a maximum of additional shares of common stock from us to cover over-allotments. The underwriters can exercise this rightoption at any time within 30 days from the date of this prospectus.

We are an "emerging growth company" as defined in the Jumpstart Our Business Startups Act of 2012 (the "JOBS Act") and will therefore be subject to reduced reporting requirements.

Investing in our common stock involves risks. See “Risk Factors”"Risk Factors" beginning on page 1128 of this prospectus.

| ||||||||

| Per Share | Total | |||||||

|---|---|---|---|---|---|---|---|---|

| $ | $ | ||||||

Underwriting discounts and commissions(1) | $ | $ | ||||||

Proceeds, before expenses, to | $ | $ | ||||||

Delivery of the shares of common stock will be made on or about , 2011.2020 through the book-entry facilities of The Depositary Trust Company.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| RBC Capital Markets |

The date of this prospectus is , 2011.2020.

SUNSHINE SILVER MINES CORPORATION PRINCIPAL PROJECTS

Sunshine Mine PropertyTable of Contents

Silver Valley

Idaho, U.S.A.

Chihuahua, Mexico

| Page | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| 1 | ||||||||

| |||||||||

| |||||||||

| |||||||||

| |||||||||

| |||||||||

| |||||||||

| |||||||||

| |||||||||

| |||||||||

| |||||||||

| |||||||||

| |||||||||

| |||||||||

| |||||||||

| |||||||||

| |||||||||

| |||||||||

| |||||||||

| |||||||||

| |||||||||

| |||||||||

| |||||||||

| |||||||||

| 174 | ||||||||

GLOSSARY OF TECHNICAL TERMS | 175 | ||||||||

INDEX TO FINANCIAL STATEMENTS | F-1 | ||||||||

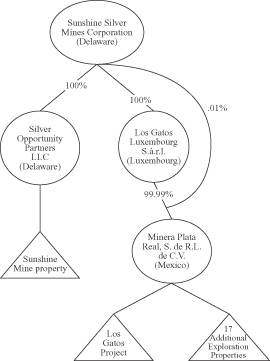

In this prospectus, “Sunshine Silver,” the “Company,” “we,” “us” and “our” refer to Sunshine Silver Mines Corporation and its subsidiaries. We and the underwriters have not authorized anyone to provide any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We and the underwriters take no responsibility for, and can provide no assurance and make no representation as to the reliability of, any other information that others may give you. We are offering to sell and are seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of theour common stock.

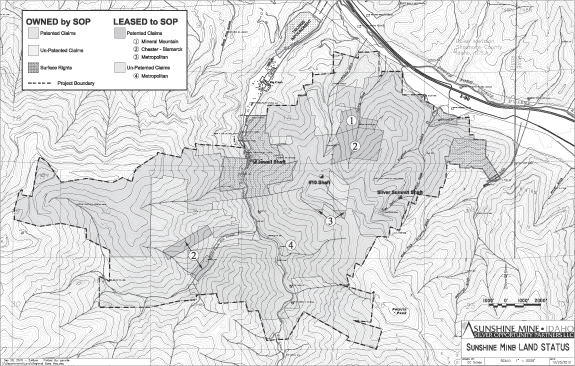

Immediately prior to the closing of this offering, we intend to effect a reorganization (the "Reorganization") in which (i) Silver Opportunity Partners LLC ("SOP") will become a wholly owned subsidiary of a newly created Delaware corporation named Silver Opportunity Partners Corporation ("SOP Corporation"), (ii) each shares of our common stock outstanding immediately prior to the Reorganization will be exchanged for (A) shares of our common stock (subject to rounding

i

to eliminate fractional shares) and (B) shares of common stock of SOP Corporation (subject to rounding to eliminate fractional shares) and (iii) we will change our name from Sunshine Silver Mining & Refining Corporation to Gatos Silver, Inc. SOP currently holds our interest in the Sunshine Complex, which is located in the Coeur d'Alene Mining District in Idaho and is comprised of the Sunshine Mine and the Sunshine Big Creek Refinery. Through the Reorganization, we expect to distribute all of our equity interest in SOP to our shareholders immediately prior to the completion of this offering. See "Prospectus Summary—Corporate Information and Reorganization." As used in this prospectus, SOP refers to (i) SOP prior to the Reorganization and (ii) SOP Corporation from and after the Reorganization. Unless otherwise indicated, all information in this prospectus assumes the completion of the Reorganization.

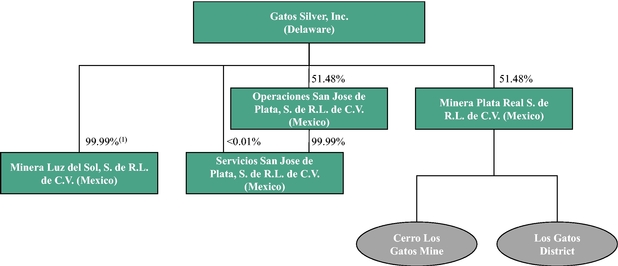

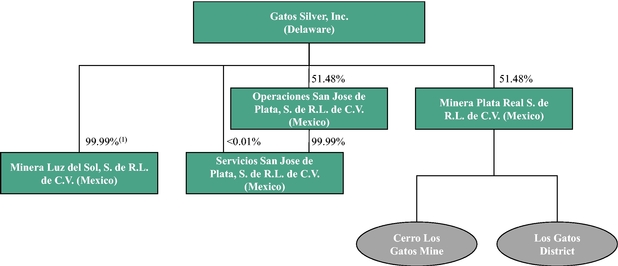

Where information relates to our company before the Reorganization and where the context otherwise requires, the "Company," "SSMRC," "we," "us" and "our" refer to Sunshine Silver Mining & Refining Corporation and its consolidated subsidiaries, and, unless the context otherwise requires, to its affiliate entities, Minera Plata Real S. de R.L. de C.V. ("MPR"), Operaciones San Jose de Plata S. de R.L. de C.V. ("OSJ") and Servicios San Jose de Plata S. de R.L. de C.V. ("SSJ"). We also refer to these entities collectively as the "Los Gatos Joint Venture" or "LGJV" where applicable. Where information relates to our company following the Reorganization and where the context otherwise requires, "Gatos," the "Company," "we," "us" and "our" refer to Gatos Silver, Inc. and its consolidated subsidiaries, and, unless the context otherwise requires, to its affiliate entities that are part of the Los Gatos Joint Venture. We own approximately 51.5% of the LGJV. Despite owning the majority interest in the LGJV, we do not exercise control over the LGJV due to certain provisions contained in the Unanimous Omnibus Partner Agreement (as defined herein) that currently require unanimous partner approval of all major operating decisions (such as certain approvals, the creation of security interests on property, any initial public offering of the joint venture, and litigation settlements). We intend to exercise our right to repurchase an 18.5% interest in the LGJV from Dowa, increasing our ownership to approximately 70.0%. Following this increase in our ownership interest in the LGJV, we will continue to not exercise control over the LGJV due to the provisions contained in the Unanimous Omnibus Partner Agreement that currently require unanimous partner approval of all major operating decisions. See "Business—The Los Gatos District—Unanimous Omnibus Partner Agreement."

MARKET AND INDUSTRY DATA AND FORECASTS

This prospectus includes market and industry data and forecasts that we have developed from independent research reports, publicly available information, various industry publications, other published industry sources or our internal data and estimates. Independent research reports, industry publications and other published industry sources generally indicate that the information contained therein was obtained from sources believed to be reliable, but do not guarantee the accuracy and completeness of such information. Although we believe that the publications and reports are reliable, neither we nor the underwriters have independently verified the data. Our internal data, estimates and forecasts are based on information obtained from trade and business organizations and other contacts in the markets in which we operate and our management’smanagement's understanding of industry conditions. Although we believe that such information is reliable, we have not had such information verified by any independent sources.

i

PROSPECTUS SUMMARY

NOTICE REGARDING MINERAL DISCLOSURE

In October 2018, the Securities and Exchange Commission (the "SEC") adopted amendments to its current disclosure rules to modernize the mineral property disclosure requirements for mining registrants. The amendments include the adoption of a new subpart 1300 of Regulation S-K, which will govern disclosure for mining registrants (the "SEC Mining Modernization Rules"). The SEC Mining

ii

Modernization Rules replace the historical property disclosure requirements for mining registrants that were included in the SEC's Industry Guide 7 and better align disclosure with international industry and regulatory practices, including the Canadian National Instrument 43-101—Standards of Disclosure for Mineral Projects ("NI 43-101"). Although compliance with the SEC Mining Modernization Rules is not required until January 1, 2021, we have chosen to voluntarily comply with the SEC Mining Modernization Rules in this prospectus.

The technical report summary for our material properties, the Los Gatos District and the Cerro Los Gatos Mine, has been prepared in accordance with the SEC Mining Modernization Rules and NI 43-101 and is included as Exhibit 96.1 to the registration statement of which this prospectus forms a part.

"Inferred mineral resources" are subject to uncertainty as to their existence and as to their economic and legal feasibility. The level of geological uncertainty associated with an inferred mineral resource is too high to apply relevant technical and economic factors likely to influence the prospects of economic extraction in a manner useful for evaluation of economic viability. Because we have elected to voluntarily comply with the SEC Mining Modernization Rules, the mineral property disclosure included in this prospectus may not be comparable to similar information provided by other issuers that have not elected to early adopt such rules. For the meanings of certain technical terms used in this prospectus, see "Glossary of Technical Terms."

iii

This summary highlights the more detailed information and financial data and statements contained elsewhere in this prospectus. This summary maydoes not contain all of the information that you should consider before deciding to invest in our common stock. You should read this entire prospectus carefully, including the “Risk Factors”"Risk Factors" section and theour consolidated financial statements and therelated notes to those statements. included elsewhere in this prospectus.

As used herein, references to NI 43-101the "Los Gatos Technical Report" are to National Instrumentthe "NI 43-101 Technical Report: Los Gatos Project, Chihuahua, Mexico," prepared by Tetra Tech Inc. ("Tetra Tech"), dated July 1, 2020, which was prepared in accordance with the requirements of the SEC Mining Modernization Rules and NI 43-101. The Los Gatos Technical Report is filed as Exhibit 96.1 to the registration statement of which this prospectus forms a part. The mineral resource classification system used forestimates contained in the public disclosureLos Gatos Technical Report have an effective date of information relating toSeptember 6, 2019 and have not been updated since that time. The mineral propertiesreserve estimates and the economic analysis contained in Canada,the Los Gatos Technical Report have an effective date of July 1, 2020 and references to Industry Guide 7 are to Industry Guide 7 under the Securities Acthave not been updated since that time and exclude 655,746 tonnes of 1933, as amended, or the Securities Act. material that has been mined through June 30, 2020. See "Business—The Los Gatos District."

As used herein, references to “$”"$" or “dollars”"dollars" are to United States dollars.

SUNSHINE SILVER MINES CORPORATIONAll mineral reserves and mineral resources contained herein for the Cerro Los Gatos Mine, the Esther deposit and the Amapola deposit are presented on both a 100% basis as well as on a 51.5% basis to reflect our current ownership interest in the LGJV.

Sunshine Silver Mines Corporation is We are a U.S.-based precious metals explorationproduction, development and developmentexploration company with the objective of becoming a premier silver producer. The Company isWe are currently focused on the advancement of its two principal projects: (i) the Sunshine Mine in Idaho, oneproduction and continued development of the highest-grade known remaining primary-silver discoveries worldwide, which is estimated to have produced a totalCerro Los Gatos Mine and the further exploration and development of over 365 million ounces of silver, and (ii) the Los Gatos ProjectDistrict:

basis) and 3.3 million diluted tonnes of probable mineral reserves (or 1.7 million diluted tonnes of probable mineral reserves on a 51.5% basis). Average proven and probable mineral reserve grades are 306 g/t silver, 0.35 g/t gold, 2.76% lead and 5.65% zinc.

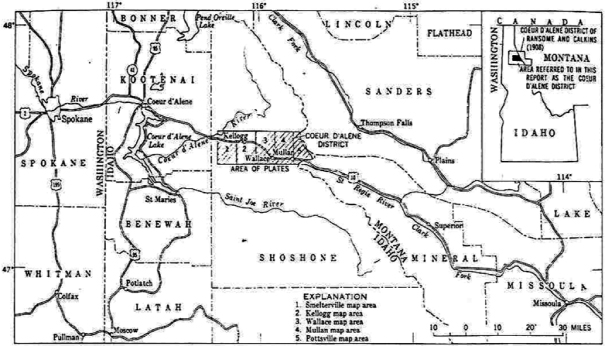

Principal Projects

Sunshine Mine

The Sunshine Mine, acquired by the Company in the first half of 2010, is located within the Coeur d’Alene Mining District in Idaho. It is a past-producing mine, which is estimated to have produced a total of over 365 million ounces of silver from 1904 to 2008. In 1990, the last year the Sunshine Mine operated at full capacity, silver production from the Sunshine Mine was approximately 5.4 million ounces. The Sunshine Mine has significant existing on-site infrastructure, including a primary shaft, which is operational and being upgraded and refurbished, and a secondary shaft, which is being refurbished. The Company’s consolidated land position at the Sunshine Mine property consists of approximately 2,247 hectares. The property has an abundant water supply, is connected to the electricity grid and is accessible by paved roads.

The underground workings at the Sunshine Mine consist of multiple levels developed off the primary shaft, extending from the surface to a depth of over 1,825 meters. The Company estimates that the Sunshine Mine contains more than 160 kilometers of underground workings.

Though a significant historical producing mine, the Company believes that the Sunshine Mine property remains highly prospective. As a result, the Company is undertaking significant exploration and re-development of the property. An independent technical report prepared by Behre Dolbear & Company from July 2011 estimated 1,991,169 tons of mineralized material at an average silver grade of 21.2 ounces per ton at the Sunshine Mine property. Sunshine Silver’s objectives are to: (i) increase the confidence of this mineralized material into the proven and probable reserve categories; (ii) define additional mineralized material through extensive surface and underground exploration; (iii) complete a pre-feasibility study within 24 months from the consummation of the offering to determine the costs to re-commission and operate the Sunshine Mine as a sustainable and efficient silver producer; and (iv) upgrade existing infrastructure and re-establish access to developed portions of the resource. See “Business—The Sunshine Mine Property” beginning on page 57.

Los Gatos Project

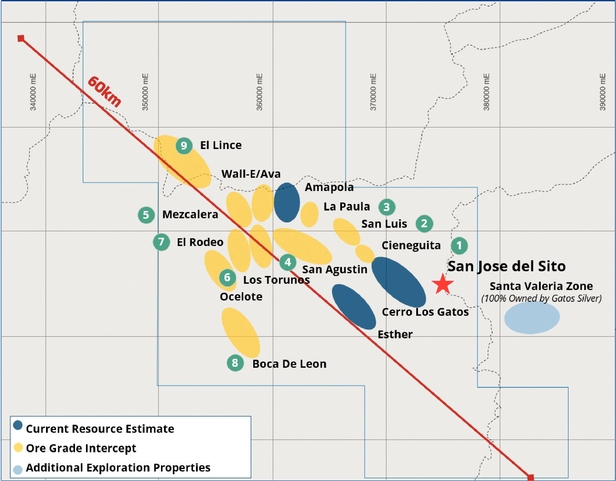

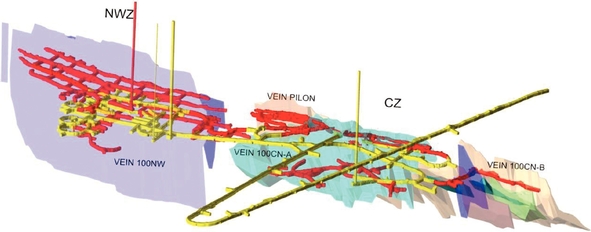

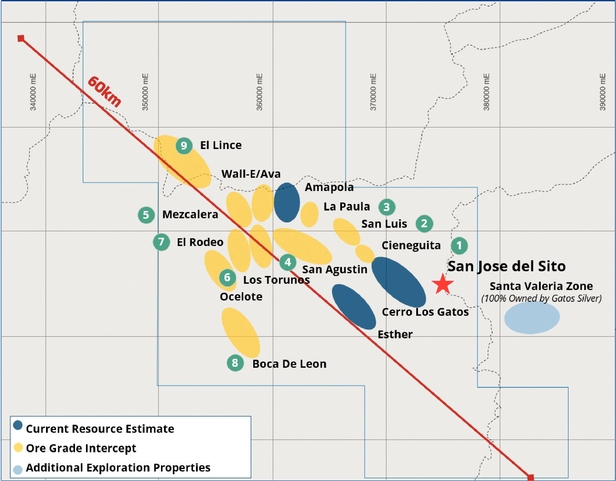

district. The Los Gatos Project is located approximately 128 kilometers south of the state capital of Chihuahua City, in Northern Mexico andDistrict consists of two14 mineralized zones, which include three identified silver discoveries, silver-lead-zinc deposits that contain mineral resources—the Cerro Los Gatos zoneMine, the Esther deposit and the Esther zone,Amapola deposit—as well as 11 additional high-priority targets defined by high-grade drill intersections and 14 other priority targets with over 100150 kilometers of outcropping quartz and calcite veins. The area is characterized by a predominant silver-lead-zinc epithermal mineralization. On September 1, 2019, the LGJV commenced production at the Cerro Los Gatos Mine. A core component of the LGJV's business plan is to explore the highly prospective, underexplored Los Gatos District with the objective of identifying additional mineral deposits that can be mined and processed, possibly utilizing the Cerro Los Gatos Mine plant infrastructure.

Prior to Sunshine Silver’sour initial acquisition of exploration concession rights in April 2006, only very limited historical prospecting and exploration activities had been conducted atin the Los Gatos Project. As a result, the Company wasDistrict. We were able to acquire concessions covering approximately 81,607103,087 hectares and, through itsour exploration, has identifieddiscovered a virgin silver region containing high-grade vein styleepithermal vein-style mineralization throughout itsthe Los Gatos District concession package.

In 2008, the Companywe negotiated surface access rights with local ranchesranch owners and obtained the necessary environmental permits for drilling.drilling and road construction. Through 2015, we purchased all the surface lands required for the Cerro Los Gatos Mine development. Environmental baseline data collection began in May 2010 and was completed in 2016 and approved in 2017 to prepare for the development of future environmental studies required for the Cerro Los Gatos Project. Mine. In 2014, we partnered with Dowa Metals and Mining Co., Ltd. ("Dowa"), which manufactures and distributes metals products and owns Japan's largest zinc refinery, to finance and develop the Cerro Los Gatos Mine and to pursue exploration in the Los Gatos District. We and Dowa formed a Mexico-incorporated co-owned operating company, MPR, which owns certain surface and mineral rights associated with the Los Gatos District. In connection with the formation of the LGJV, we entered into the Unanimous Omnibus Partner Agreement with Dowa, MPR, OSJ, SSJ and Los Gatos Luxembourg S.a.r.l. on January 1, 2015 (as amended on April 10, 2017, June 30, 2017, March 10, 2018, May 20, 2019, April 29, 2020, May 25, 2020 and June 16, 2020, the "Unanimous Omnibus Partner Agreement"), which governs our and Dowa's respective rights over the LGJV. We own approximately 51.5% of the LGJV, with Dowa owning the remainder. Despite owning the majority interest in the LGJV, we do not exercise control over the LGJV due to certain provisions contained in the Unanimous Omnibus Partner Agreement that currently require unanimous partner approval of all major operating decisions (such as certain

approvals, the creation of security interests on property, any initial public offering of the joint venture, and litigation settlements). We intend to exercise our right to repurchase an 18.5% interest in the LGJV from Dowa, increasing our ownership to approximately 70.0%. Following this increase in our ownership interest in the LGJV, we will continue to not exercise control over the LGJV due to the provisions contained in the Unanimous Omnibus Partner Agreement that currently require unanimous partner approval of all major operating decisions. See "Business—The present field camp is located in aLos Gatos District—Unanimous Omnibus Partner Agreement."

We believe that we have strong support from the local community, with over 130 employees from the local community working across multiple areas involving the continued underground development, construction of approximately 200 persons, with electricalthe surface facilities and water services, an elementary school and basic health services.operation of the Cerro Los Gatos Mine. Over 99% of the approximate 540 employees at the Cerro Los Gatos Mine hail from Mexico, highlighting our commitment to the local workforce.

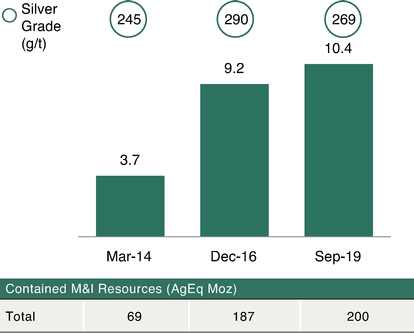

To date, Sunshine Silver’s Our primary areas of focus have been definingconstructing and extending mineralization alongcommissioning the Cerro Los Gatos Mine and Esther zones that currently extend more than 2,500 meters along strikedefining and remain open at depth and toexpanding the southeast. Through November 2010, Sunshine Silver has completed 154 drill holes inmineral resources associated with the Cerro Los Gatos Mine, the Esther deposit and Esther zones,the Amapola deposit. As of July 1, 2020, 739 exploration drill holes have been completed in the Los Gatos District, totaling 69,745259,060 meters. The Los Gatos Project has a known strike distance of over 100 kilometers, of which only 15 kilometers has been explored by drilling. In addition toTechnical Report estimates that the Cerro Los Gatos Mine contains 10.4 million tonnes of measured and Esther zones,indicated resources (or 5.4 million tonnes of measured and indicated resources on a 51.5% basis) inclusive of mineral reserves, at average grades of 269 g/t silver, 2.7% lead, 5.5% zinc, 0.34 g/t gold and 0.11% copper, or 3.5 million tonnes of measured and indicated resources (or 1.8 million tonnes of measured and indicated resources on a 51.5% basis) exclusive of mineral reserves, at average grades of 154 g/t silver, 2.2% lead, 4.3% zinc and 0.29 g/t gold, and 3.7 million tonnes of inferred resources (or 1.9 million tonnes of inferred resources on a 51.5% basis), at average grades of 107 g/t silver, 2.8% lead, 4.0% zinc and 0.28 g/t gold. The mineral resource estimates for the Cerro Los Gatos Mine have an effective date of September 6, 2019 and have not been updated since that time. The mineral resource estimates contained in the Los Gatos Project has 14Technical Report are presented on an undiluted basis without adjustment for mining recovery.

The Los Gatos Technical Report estimates that the Esther deposit contains 0.46 million tonnes of indicated resources (or 0.24 million tonnes of indicated resources on a 51.5% basis) at average grades of 133 g/t silver, 0.04 g/t gold, 0.02% copper, 0.70% lead and 2.10% zinc, and 2.29 million tonnes of inferred resources (or 1.18 million tonnes of inferred resources on a 51.5% basis) at average grades of 98 g/t silver, 0.12 g/t gold, 0.05% copper, 1.60% lead and 3.00% zinc; and the Amapola deposit contains 0.25 million tonnes of indicated resources (or 0.13 million tonnes of indicated resources on a 51.5% basis) at average grades of 135 g/t silver, 0.10 g/t gold, 0.02% copper, 0.10% lead and 0.30% zinc, and 3.44 million tonnes of inferred resources (or 1.77 million tonnes of inferred resources on a 51.5% basis) at average grades of 140 g/t silver, 0.10 g/t gold, 0.03% copper, 0.20% lead and 0.30% zinc. The mineral resource estimates for the Esther and Amapola deposits have an effective date of December 21, 2012 and have not been updated since that time. The mineral resource estimates contained in the Los Gatos Technical Report are presented on an undiluted basis without adjustment for mining recovery.

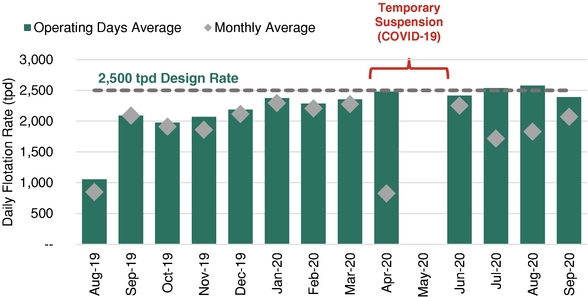

Since the acquisition of the Los Gatos District concession package, we, Dowa and the LGJV have invested approximately $500 million in the development of the Cerro Los Gatos Mine. The Cerro Los Gatos Mine is currently in production. The first lead concentrate was shipped on September 3, 2019, and the first zinc concentrate was shipped on September 4, 2019. We anticipate increasing production to the designed 2,500 tpd rate by the end of the first quarter of 2021.

Our objectives at the Cerro Los Gatos Mine are to, among other priority targets.things:

The Company’s

Our objectives at the Los Gatos ProjectDistrict are to: (i) increaseto, among other things:

See “Business—The Los Gatos Project” beginning on page 64."Business—Our Company—Our Principal Projects."

Overview

Silver occursdeposits occur naturally in itstheir solid metallic state and isare commonly associated with deposits of gold, copper, lead and zinc. According to GFMS Limited, or GFMS, 2010 global supplyzinc as a secondary metal. Silver is a precious metal and demand totaled approximately 1.1 billion ouncesis widely used in the manufacturing of silver; approximately 70% of 2010 global supply camejewelry and silverware and as an investment. Silver is distinct from mine production.other precious metals in that it is both used in industrial applications and as an investment asset.

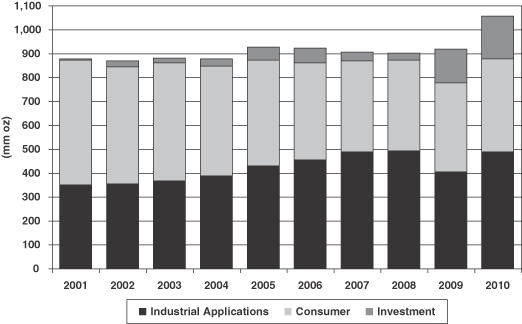

Silver has strong supply and demand fundamentals with significant demand rooted in diverse sectors. The demand for silver is driven primarily by three uses: industrial, consumer and investment. According to GFMS, in 2010, industrial, consumer and investment represented 46.1%, 37.0% and 16.8% of silver demand, respectively.

Industrial—Silver has a number of distinctive physical and chemical properties that make it an essential component in severalnumerous industrial applications, including its strength, malleability, conductivity and ductility, its electrical and thermal conductivity, its sensitivity to and high reflectance of light and its ability to endure extreme temperature ranges. These properties restrict its substitution in most applications. In addition to traditional industrial uses,Silver is one of the world's best conductors of electricity and is used in electronic components of common items such as batteries, bearings, catalystssolar panel photovoltaic cells, computers, televisions and electronics, increases in emerging applications for silver are expected to continue to augment industrial demand. Emerging applications include utilizing silver’s reflectivitycell phones.

Silver has also been used as a component in solar cells to produce “green” electricity, and utilizing silver’s antimicrobial properties in medical applications and in the preventionmedium of algae build-up in water purification systems.

Consumer—Consumer use ofexchange since earliest recorded history. While it is no longer widely used as circulating currency, silver is primarilystill widely sought by investors for the fabricationits store of jewelry, silverware and coins, which rely on silver’s lustre, resistance to tarnishing and malleability. For these usesvalue attributes. In particular, silver is often alloyed to a small proportion of other metals, such as copper, to harden it. Sterling silver, for example, is 92.5% silver and 7.5% copper and has been the standard in many countries for silver jewelry since the 14th century.

Investment—Investment demand for silver has increased significantly in the last 10 years, with the most significant investment demand coming from silver exchange traded funds, or ETFs, and bullion funds. Historically, the price of silver has shown a high correlation to the price of gold as a result of investment demand, and has been viewed as an attractive hedge against a decrease in the value of currency and inflation during times of economic uncertainty.

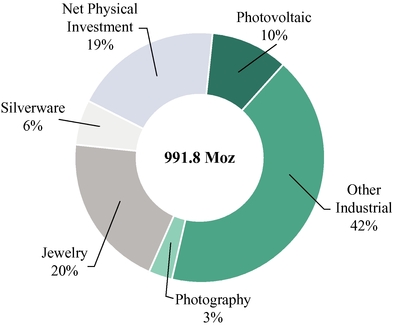

Demand

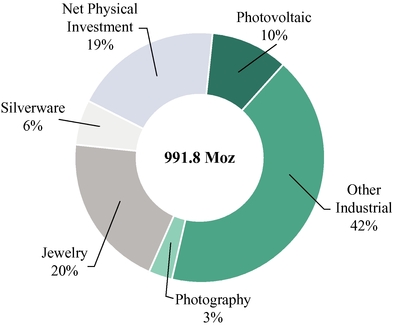

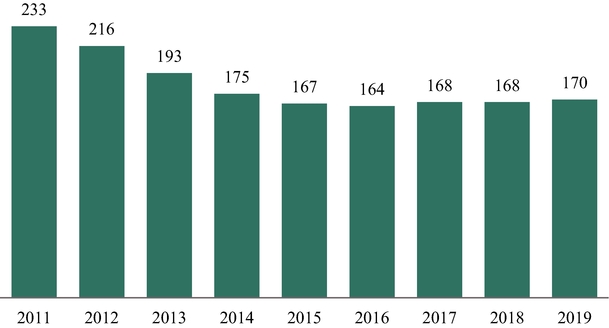

The three principal drivers of silver demand are industrial applications, consumer use and investment. According to The Silver Institute's World Silver Survey 2020, demand for industrial applications is mainly driven by electrical and electronics uses, which accounted for 58.3% of industrial demand and 30.0% of total demand in 2019. Jewelry accounted for 20.3% of total demand and net physical investment represented 18.8% of total demand.

Silver demand grew 0.4% in 2019 to a three-year high of 991.8 million ounces, from 988.3 million ounces the previous year, driven by a 12.3% surge in demand for net physical investment. This was offset by declines in silverware and other industrials. Silver remains difficult to substitute in many areas, and outside of a dip in 2009, demand for industrial applications has remained broadly flat since 2007.

There was healthy photovoltaic demand in 2019, with support from structural changes in demand, such as vehicle electrification.

World Physical Silver Demand in 2019 (%)

Source: The Silver Institute, World Silver Survey 2020

Supply

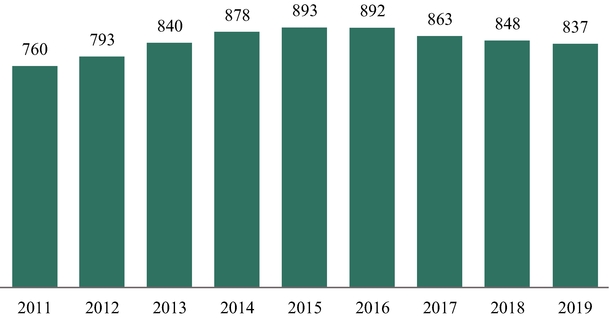

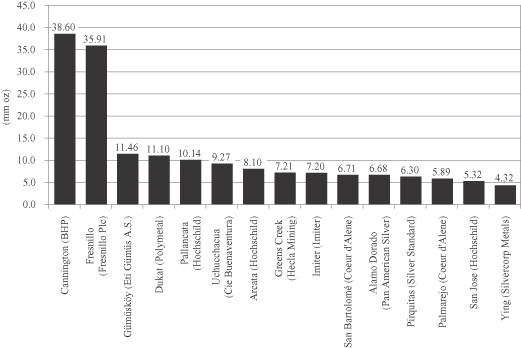

Silver supply is primarily driven by mined silver production, which, according to The Silver Institute's World Silver Survey 2020, accounted for 81.7% of supply in 2019. Recycling largely accounted for the remainder of silver supply. Global silver supply increased 0.6% year-over-year in 2019 to 1,023 million ounces compared to 1,016.8 million ounces in 2018.

Mine silver output in 2019 declined for the fourth consecutive year, falling 1.3% to 836.5 million ounces from 847.8 million ounces in 2018. These recent production declines follow 13 consecutive years of growth. The decrease in silver supply was largely driven by lower grades at primary silver mines, lower silver production from copper mines and losses from production disruptions. In Peru, Compañía de Minas Buenaventura's Uchucchacua Mine saw silver production decrease from a 27% decline in grades and experienced a 21-day strike; Hochschild Mining's Arcata Mine was placed into care and maintenance early in the year; and declining silver grades were a factor at large primary copper mines. In Mexico, Fresnillo plc achieved lower grades at several of its mines; First Majestic Silver Corp.'s San Martin Mine and Endeavour Silver's El Cubo Mine were placed on care and maintenance; and blockades resulted in Newmont Corporation's Peñasquito Mino being suspended for 90 days.

Pricing and Outlook

A combination of a slightly higher demand and a slightly higher supply in 2019 compared to 2018 resulted in a surplus of 31.3 million ounces, or 3.1% of silver demand, according to The Silver Institute's World Silver Survey 2020. Net investment in exchange traded products of 81.7 million ounces helped to propel the net silver balance to a 50 million ounce deficit, or approximately 5% of demand.

In 2019, the average London Bullion Market Association ("LBMA") silver price increased 3.4% year-over-year to $16.21/oz. In 2019, the price of silver reached a high of $19.31/oz, a low of $14.38/oz

and ended the year at $18.05/oz. The largest contributor to silver price movements is believed to be the ongoing trade dispute between the U.S. and China, which has had the impact of strengthening the U.S. dollar and inflation, attracting investors during timesweighing on the price of uncertainty.silver and other precious metals. The U.S. Federal Reserve took a dovish stance through 2019, as it lowered the federal funds rate three times.

Business Strengths and Competitive AdvantagesKey Investment Highlights

AttractiveHigh Quality and Long Life Assets in Two of the World’s Premier Silver Regions

Sunshine Silver’s principal assets are located in two of the world’s premier silver regions. The Sunshine Mine property is located in the Coeur d’Alene Mining District in Idaho, which district is estimated to have produced over one billion ounces of silver over the Mine’s 107-year history, and the Los Gatos Project is located in the Mexican Silver Belt, the world’s largest silver producing region in 2010. In addition to being located in premier silver regions, both assets possess characteristics that differentiate them from other silver projects:

Sunshine Mine Property

A prolific past-producing mine, once one of the largest silver producers in the United States, which is estimated to have produced a total of over 365 million ounces of silver

One of the highest-grade known remaining primary-silver discoveries worldwide, estimated to contain 1,991,169 tons of mineralized material at an average silver grade of 21.2 ounces per ton

Consolidated land position of approximately 2,247 hectares

Significant existing infrastructure, including a primary shaft that is Once fully operational, and being upgraded and refurbished, and a secondary shaft that is being refurbished and access to roads, power and water

Strong community support coupled with an experienced and skilled workforce

Los Gatos Project

Control over an emerging silver region; land position of 81,607 hectares

The identified Cerro Los Gatos and Esther zones, high-grade mineralization occurrences that currently extend more than 2,500 meters along strike, remain open at depth and to the southeast

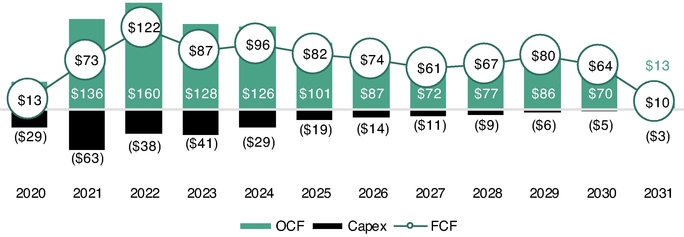

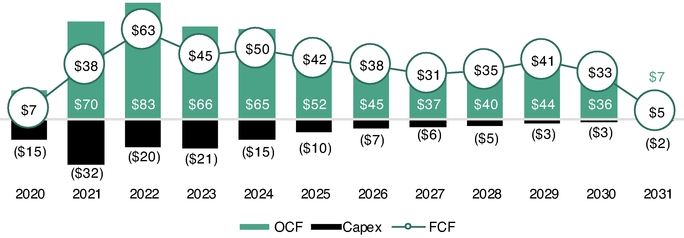

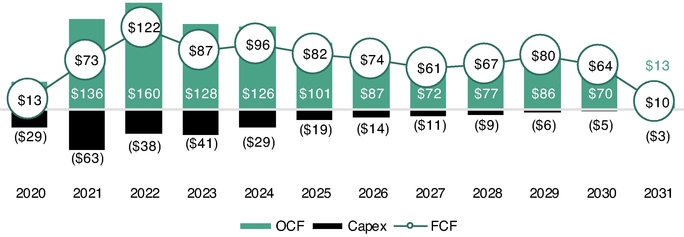

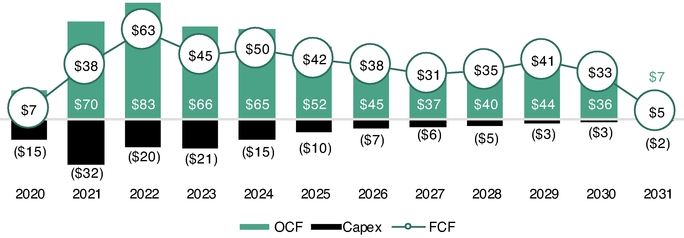

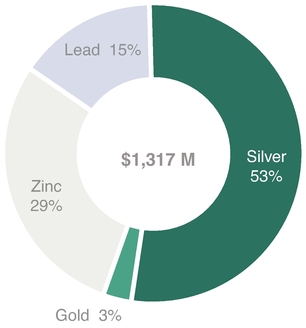

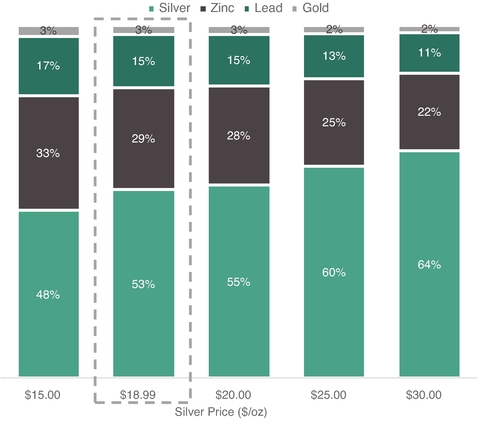

Widespread mineralization beyond the Cerro Los Gatos Mine is expected to generate average life-of-mine ("LOM") unlevered, after-tax free cash flow of approximately $76 million per year on a 100% basis (or approximately $39 million per year on a 51.5% basis). Projected attributable net revenue and Esther zones, with 14 other priority targetsunlevered free cash flow, as set forth in the Los Gatos Technical Report, are presented below:

Projected Net Revenue (in millions)

Reduced Operating Risks at Sunshine Mine Given Historical Production

Sunshine Silver believes that

Projected Unlevered Free Cash Flow (in millions)

Net revenue is defined as net smelter return (revenue per tonne mined less the significant historical production at the Sunshine Mine, combined with the recentsum of concentrate refining, treatment and planned mine improvements, reduces the risktransportation costs per tonne mined), less royalties. Unlevered cash flow is defined as unlevered operating cash flow less capital expenditures and changes in working capital. See also Section 22 of the project relative to other silver development projects.

Los Gatos Technical Report. The Sunshine Mine covers 171 hectaresLos Gatos Technical Report has an effective date of surface rights,July 1, 2020. The mineral resource estimates contained in the Los Gatos Technical Report have an effective date of September 6, 2019. The mineral reserve estimates and the Companyeconomic analysis contained in the Los Gatos Technical Report have an effective date of July 1, 2020 and exclude 655,746 tonnes of material that has been mined through June 30, 2020. For a discussion of the mineral resource estimates thatand mineral reserve estimates contained in the Los Gatos Technical Report, see "Business—The Los Gatos District—Mineral Resource Estimates—Cerro Los Gatos Mine, contains more than 160 kilometersEsther and Amapola Deposits" and "Business—The Los Gatos District—Mineral Reserve Estimates—Cerro Los Gatos Mine." For a

Table of underground workings. Contents

discussion of the assumed capital and operating costs in the Los Gatos Technical Report, see "Business—The underground workings consistLos Gatos District—Capital and Operating Costs." This information does not constitute guidance and you should not rely on it as an estimate or forecast of multiple levels developed offfuture performance. The Cerro Los Gatos net revenue and unlevered free cash flow are shown on a 51.5% ownership basis to reflect our current ownership interest in the mainLGJV. The 18.5% option represents our right to repurchase an 18.5% interest in the LGJV from Dowa. See "Business—Business Strategy." The level of geological uncertainty associated with an inferred mineral resource is too high to apply relevant technical and economic factors likely to influence the prospects of economic extraction in a manner useful for evaluation of economic viability. Inferred mineral resources are subject to uncertainty as to their existence and as to their economic legal feasibility.

Cerro Los Gatos Mine Successfully Commissioned with Significant Near-Term Production Growth

The Cerro Los Gatos Mine is currently in production, shaft, extending fromwith final construction completed in the surface to a depthsecond quarter of over 1,825 meters.

Since acquiring the Sunshine Mine, the Company has acquired additional surface rights and improved the existing infrastructure, repaired surface facilities and equipment and completed2019. Commissioning was successful, having achieved a number of environmental, healthkey milestones, including:

Aerial View of the Cerro Los Gatos Mine

Significant Exploration Potential for Additional Silver Resources

Sunshine Silver believes it has substantial opportunities to define additional mineral resources through continued explorationTable of its properties:Contents

Sunshine Mine: Sunshine Silver has rights to approximately 2,247 hectares of exploration ground at the Sunshine Mine property.Concentrate production is currently achieving quality specifications and expected grades. The property has numerous well-defined exploration targets, many of which

|

Cerro Los Gatos Project: Sunshine Silver expectsMine is expected to produce, on average, 12.2 million payable silver equivalent ounces annually through the existing mine life (or 6.3 million payable silver equivalent ounces annually on a 51.5% basis), with an attractive, low-cost all-in sustaining cost ("AISC") profile. In addition to the goal of achieving the plant's 2,500 tpd design capacity, we intend to use a portion of the proceeds from this offering to complete a feasibility study, prepared in accordance with the SEC Mining Modernization Rules and NI 43-101, to expand the Cerro Los Gatos Mine production rate to 3,000 tpd. If feasible, we expect the LGJV to complete the expansion within the next three to four years.

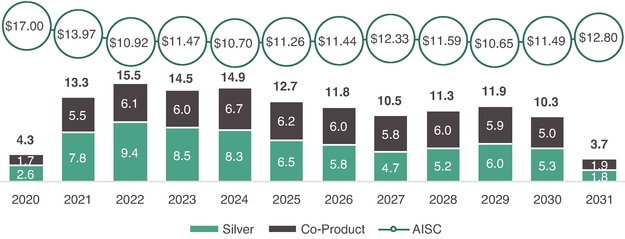

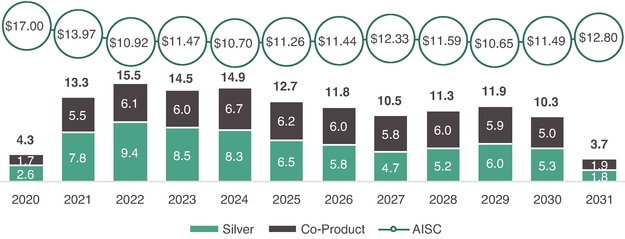

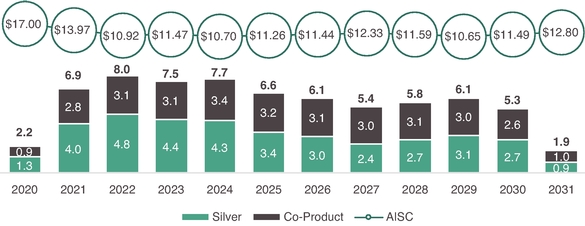

The below graphs show our estimated payable silver equivalent production levels at the Cerro Los Gatos Mine in the coming years:

2020—2031 Cerro Los Gatos Mine Payable AgEq Production Estimate (Moz) and AISC ($/oz AgEq) on a 100% Basis

2020—2031 Cerro Los Gatos Mine Payable AgEq Production Estimate (Moz) and AISC ($/oz AgEq) on a 51.5% Basis

Payable silver equivalent calculated using feasibility study LOM average prices of $18.99/oz silver, $1,472/oz gold, $0.87/lb lead and $1.09/lb zinc. AISC calculated as sum of total operating costs, treatment and refining charges, penalties, transportation and freight, royalties and capital costs for each year. See Section 22 of the Los Gatos Technical Report. The Los Gatos Technical Report has an effective date of July 1, 2020. The mineral resource estimates contained in the Los Gatos Technical Report have an effective date of September 6, 2019. The mineral reserve estimates and the economic analysis contained in the Los Gatos

Technical Report have an effective date of July 1, 2020 and exclude 655,746 tonnes of material that has been mined through June 30, 2020. For a discussion of the mineral resource estimates and mineral reserve estimates contained in the Los Gatos Technical Report, see "Business—The Los Gatos District—Mineral Resource Estimates—Cerro Los Gatos Mine, Esther and Amapola Deposits" and "Business—The Los Gatos District—Mineral Reserve Estimates—Cerro Los Gatos Mine." For a discussion of the assumed capital and operating costs in the Los Gatos Technical Report, see "Business—The Los Gatos District—Capital and Operating Costs." Based on production to date, we believe that the Cerro Los Gatos Mine has the potential to produce up to 7.2 million ounces of silver equivalent on a 100% basis (3.7 million ounces of silver equivalent on a 51.5% basis) in fiscal year 2020.

Estimated mineral reserves at the Cerro Los Gatos Mine are summarized below:

Cerro Los Gatos Mineral Reserve Estimates as of the Effective Date of the Los Gatos Technical Report

Zone | Category | Tonnes (millions; 100% basis) | Tonnes (millions; 51.5% basis) | Ag (g/t) | Au (g/t) | Pb (%) | Zn (%) | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Northwest Zone | Proven | 2.6 | 1.3 | 359 | 0.43 | 3.09 | 5.88 | ||||||||||||||

| Probable | 0.5 | 0.3 | 333 | 0.34 | 2.86 | 5.88 | |||||||||||||||

Central Zone | Proven | 3.8 | 1.9 | 314 | 0.31 | 2.55 | 5.32 | ||||||||||||||

| Probable | 1.8 | 0.9 | 299 | 0.44 | �� | 2.32 | 5.82 | ||||||||||||||

Southeast Zone | Proven | 0.0 | 0.0 | 148 | 0.16 | 3.69 | 7.23 | ||||||||||||||

| Probable | 0.6 | 0.3 | 148 | 0.16 | 3.69 | 7.23 | |||||||||||||||

Southeast Zone Block 2 | Probable | 0.4 | 0.2 | 118 | 0.17 | 3.11 | 4.16 | ||||||||||||||

Total (Proven) | 6.4 | 3.3 | 332 | 0.36 | 2.77 | 5.55 | |||||||||||||||

Total (Probable) | 3.3 | 1.7 | 254 | 0.34 | 2.74 | 5.86 | |||||||||||||||

Total (Proven & Probable) | 9.6 | 5.0 | 306 | 0.35 | 2.76 | 5.65 | |||||||||||||||

Reserves based on a $75 Net Smelter Return ("NSR") cut-off value. NSR is defined as revenue per tonne mined less the sum of concentrate refining, treatment and transportation costs per tonne mined. The mineral reserve estimates for the Cerro Los Gatos Mine reflect diluted grades with adjustment for metallurgical recovery. The mineral reserve estimates contained in the Los Gatos Technical Report have an effective date of July 1, 2020 and exclude 655,746 tonnes of material that has been mined through June 30, 2020. Mineral reserve estimates and mineral resource estimates contained in the Los Gatos Technical Report have different effective dates and are based on different dilution and recovery factors and cut-off grades. For a discussion of the mineral reserve estimates contained in the Los Gatos Technical Report, see "Business—The Los Gatos District—Mineral Reserve Estimates—Cerro Los Gatos Mine."

Estimated mineral resources at the Cerro Los Gatos Mine are summarized below:

Cerro Los Gatos Mine Mineral Resource Estimates Inclusive of Mineral Reserves as of the Effective Date of the Los Gatos Technical Report

Category | Tonnes (millions; 100% basis) | Tonnes (millions; 51.5% basis) | Ag (g/t) | Au (g/t) | Pb (%) | Zn (%) | Cu (%) | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Measured | 5.8 | 3.0 | 324 | 0.39 | 2.9 | 5.8 | 0.11 | |||||||||||||||

Indicated | 4.6 | 2.4 | 202 | 0.28 | 2.5 | 5.2 | 0.11 | |||||||||||||||

Measured & Indicated | 10.4 | 5.4 | 269 | 0.34 | 2.7 | 5.5 | 0.11 | |||||||||||||||

Inferred | 3.7 | 1.9 | 107 | 0.28 | 2.8 | 4.0 | 0.14 | |||||||||||||||

Based on a cut-off grade of 150 grams silver equivalent/tonne at assumed metal prices of $18.00/toz silver, $0.92/lb lead and $1.01/lb zinc; gold was not considered in silver equivalent calculation. The mineral resource estimates contained in the Los Gatos Technical Report have an effective date of September 6, 2019. The mineral resource estimates contained in the Los Gatos Technical Report are presented on an undiluted basis without adjustment for mining recovery. Mineral reserve estimates and mineral resource estimates contained in the Los Gatos Technical Report have different effective dates and are based on different dilution and recovery factors and cut-off grades. For a discussion of the mineral resource estimates contained in the Los Gatos Technical Report, see "Business—The Los Gatos District—Mineral Resource Estimates—Cerro Los Gatos Mine, Esther and Amapola Deposits."

Cerro Los Gatos Mine Mineral Resource Estimates Exclusive of Mineral Reserves as of the Effective Date of the Los Gatos Technical Report

Category | Tonnes (million; 100% basis) | Tonnes (million; 51.5% basis) | AgEq (g/t) | Ag (g/t) | Au (g/t) | Pb (%) | Zn (%) | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Measured | 1.3 | 0.7 | 442 | 181 | 0.39 | 2.4 | 4.5 | |||||||||||||||

Indicated | 2.2 | 1.1 | 368 | 139 | 0.23 | 2.1 | 4.2 | |||||||||||||||

Measured & Indicated | 3.5 | 1.8 | 395 | 154 | 0.29 | 2.2 | 4.3 | |||||||||||||||

Inferred | 3.7 | 1.9 | 361 | 107 | 0.28 | 2.8 | 4.0 | |||||||||||||||

Resources based on a cut-off grade of 150 grams silver equivalent/tonne at assumed metal prices of $18.00/toz silver, $0.92/lb lead and $1.01/lb zinc; gold was not considered in silver equivalent calculation. The mineral resource estimates contained in the Los Gatos Technical Report have an effective date of September 6, 2019. The mineral resource estimates contained in the Los Gatos Technical Report are presented on an undiluted basis without adjustment for mining recovery. Reserves based on a $75 NSR cut -off value. NSR is defined as revenue per tonne mined less the sum of concentrate refining, treatment and transportation costs per tonne mined. The mineral reserve estimates for the Cerro Los Gatos Mine reflect diluted grades with adjustment for metallurgical recovery. The mineral reserve estimates contained in the Los Gatos Technical Report have an effective date of July 1, 2020 and exclude 655,746 tonnes of material that has been mined through June 30, 2020. Mineral reserve estimates and mineral resource estimates contained in the Los Gatos Technical Report have different effective dates and are based on different dilution and recovery factors and cut-off grades. For a discussion of the mineral resource estimates contained in the Los Gatos Technical Report, see "Business—The Los Gatos District—Mineral Resource Estimates—Cerro Los Gatos Mine, Esther and Amapola Deposits."

The economic analysis contained in the Los Gatos Technical Report is presented on an unlevered, post-tax, present value basis and has an effective date of July 1, 2020. The results of the economic analysis are summarized below:

Mine Life | years | 11 | ||||

Ore Tonnage | kt | 9,618 |

| Life-of-Mine Payable Production | Avg. Annual Payable Production | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Average Grade | ||||||||||

| (51.5% basis) | (51.5% basis) | |||||||||

| Processed | (100% basis) | (100% basis) | ||||||||

Production Statistics | ||||||||||

Silver | 305 g/t | 72.0 Moz | 37.1 Moz | 6.5 Moz | 3.4 Moz | |||||

Zinc | 5.7% | 679 Mlb | 350 Mlb | 62 Mlb | 32 Mlb | |||||

Lead | 2.8% | 442 Mlb | 228 Mlb | 40 Mlb | 21 Mlb | |||||

Gold | 0.35 g/t | 45.5 Koz | 23.4 Koz | 4.1 Koz | 2.1 Koz | |||||

Silver Equivalent | 642 g/t | 134.7 Moz | 69.4 Moz | 12.2 Moz | 6.3 Moz | |||||

Life-of-Mine Cost Metrics | ||||||||||

Total Sustaining Capital Costs | $ millions | $267 | ||||||||

Operating Costs | $/t-milled | $83.58 | ||||||||

TC / RC, Penalties and Freight Costs | $/mt | $51.90 | ||||||||

Royalties | $/mt | $1.50 | ||||||||

Life-of-Mine By-Product Costs | ||||||||||

AISC | $/oz Ag | $5.47 | ||||||||

Life-of-Mine Co-Product Costs | ||||||||||

AISC | $/oz AgEq | $11.77 | ||||||||

Project Economics | ||||||||||

NPV (post-tax; 5.0%) | $ millions | $653 | ||||||||

Silver equivalent and by-product credits calculated using LOM average prices of $18.99/oz silver, $1,472/oz gold, $0.87/lb lead and $1.09/lb zinc. The economic analysis contained in the Los Gatos Technical Report has an effective date of July 1, 2020 and

excludes 655,746 tonnes of material that has been mined through June 30, 2020. For a discussion of the mineral resource estimates and mineral reserve estimates contained in the Los Gatos Technical Report, see "Business—The Los Gatos District—Mineral Resource Estimates—Cerro Los Gatos Mine, Esther and Amapola Deposits" and "Business—The Los Gatos District—Mineral Reserve Estimates—Cerro Los Gatos Mine." For a discussion of the assumed capital and operating costs in the Los Gatos Technical Report, see "Business—The Los Gatos District—Capital and Operating Costs."

Cerro Los Gatos Mine Unlevered Free Cash Flow Profile on a 100% Basis (in millions)

Cerro Los Gatos Mine Unlevered Free Cash Flow Profile on a 51.5% Basis (in millions)

See Section 22 of the Los Gatos Technical Report. The economic analysis contained in the Los Gatos Technical Report has an effective date of July 1, 2020 and excludes 655,746 tonnes of material that has been mined through June 30, 2020. For a discussion of the mineral resource estimates and mineral reserve estimates contained in the Los Gatos Technical Report, see "Business—The Los Gatos District—Mineral Resource Estimates—Cerro Los Gatos Mine, Esther and Amapola Deposits" and "Business—The Los Gatos District—Mineral Reserve Estimates—Cerro Los Gatos Mine." For a discussion of the assumed capital and operating costs in the Los Gatos Technical Report, see "Business—The Los Gatos District—Capital and Operating Costs."

Additional Resource Growth Potential from Exploration of the Los Gatos District

In addition to the significant existing resources at the Cerro Los Gatos Mine, the Los Gatos District also contains the Esther and Amapola deposits and 11 other mineralized zones. With control of the concessions, the ability to develop the entire 103,087-hectare land position and more than 85% of the land position yet to be explored, we expect that we will stand to benefit from mineralization beyond those already identified in the 14 mineralized zones, which remain open to extensions. Sunshine Silver also has identified 14 other priority targets.include the Cerro Los Gatos Mine, the

Other opportunities: Sunshine Silver owns 17 other exploration propertiesEsther deposit and the Amapola deposit. The mineral resource estimates for the Esther and Amapola deposits are set forth below:

Esther and Amapola Deposit Mineral Resource Estimates as of the Effective Date of the Los Gatos Technical Report

| | Category | Tonnes (millions; 100% basis) | Tonnes (millions; 51.5% basis) | Ag (g/t) | Au (g/t) | Pb (%) | Zn (%) | Cu (%) | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Esther Deposit | Indicated | 0.46 | 0.24 | 133 | 0.04 | 0.70 | 2.10 | 0.02 | ||||||||||||||||

| Inferred | 2.29 | 1.18 | 98 | 0.12 | 1.60 | 3.00 | 0.05 | |||||||||||||||||

Amapola Deposit | Indicated | 0.25 | 0.13 | 135 | 0.10 | 0.10 | 0.30 | 0.02 | ||||||||||||||||

| Inferred | 3.44 | 1.77 | 140 | 0.10 | 0.20 | 0.30 | 0.03 | |||||||||||||||||

Based on a cut-off grade of 100 grams silver equivalent/tonne using metal prices of $22.30/toz silver, $0.97/lb lead, and $0.91/lb zinc. The mineral resource estimates for the Esther and Amapola deposits have an effective date of December 21, 2012. The mineral resource estimates contained in Mexico, which could provide additional opportunitiesthe Los Gatos Technical Report are presented on an undiluted basis without adjustment for mining recovery. Mineral reserve estimates and mineral resource growth.estimates contained in the Los Gatos Technical Report have different effective dates and are based on different dilution and recovery factors and cut-off grades. For a discussion of the mineral resource estimates contained in the Los Gatos Technical Report, see "Business—The Los Gatos District—Mineral Resource Estimates—Cerro Los Gatos Mine, Esther and Amapola Deposits."

Politically StableAssets Located in Geopolitically Safe and Mining-Friendly JurisdictionsEstablished Mining Regions

Both Idaho and The Los Gatos District is located in one of the world's premier silver mining regions: the Mexican Silver Belt, which was the world's largest silver producing region in 2019. Based on a survey published in 2019 by the Fraser Institute, an independent research organization, Mexico areis highly ranked among silver mining jurisdictions withworldwide in terms of the attractiveness of investment. Mexico also has a long history of successful mineral development and operations. Both are consideredoperations, which we believe makes it a desirable jurisdictionsjurisdiction in which to conduct mining operations due to stable political, tax and regulatory policies.

Mexico is the largest producer of silver in the world, in addition to being a top-10 producer of gold, lead and zinc, among other major commodities. According to the 2019 Fraser Institute survey, Mexico ranks ahead of many countries in terms of investment attractiveness for mining, but behind certain areas in the U.S., Canada and Australia. In the mining sector, foreign ownership of Mexican companies is not subject to significant restrictions. The Mexican government is focused on improving infrastructure, primarily in the power grid and road networks.

Mine Site Exploration Potential Provides Opportunity for Significant Resource Conversion Beyond Existing Mine Plan

We believe that our properties have significant exploration upside with numerous opportunities to define additional mineral resources through continued exploration.

Los Gatos District

The Los Gatos District is located in the Mexican Silver Belt, near several other silver assets owned by large public companies. The Mexican Silver Belt has experienced significant exploration success, and the Los Gatos District represents an underexplored property where there has been little historical workings or previous exploration.

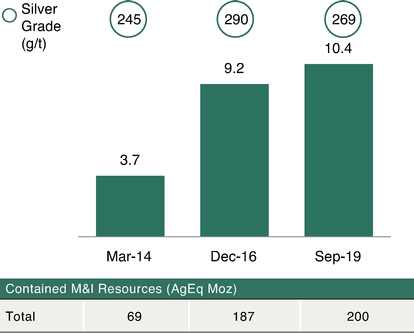

The Los Gatos District contains numerous significant high-grade targets throughout. Previous work done has resulted in a 190% increase in measured and indicated silver equivalent resources from March 2014 to September 2019, with additional exploration planned using proceeds from this offering.

Cerro Los Gatos Mine Measured & Indicated Ore Tonnage (Mt) and Silver Grade (g/t) (100% Basis)

Mineral resource estimates presented include mineral reserves. Based on a survey publishedcut-off grade of 150 grams silver equivalent/tonne at assumed metal prices of $18.00/toz silver, $0.92/lb lead and $1.01/lb zinc; gold was not considered in March 2011 bysilver equivalent calculation. The mineral resource estimates contained in the Fraser Institute,Los Gatos Technical Report have an independent research organization, Idahoeffective date of September 6, 2019. The mineral resource estimates contained in the Los Gatos Technical Report are presented on an undiluted basis without adjustment for mining recovery. Mineral reserve estimates and Mexico rank amongmineral resource estimates contained in the top silver mining jurisdictions worldwide in termsLos Gatos Technical Report have different effective dates and are based on different dilution and recovery factors and cut-off grades. For a discussion of the attractivenessmineral resource estimates contained in the Los Gatos Technical Report, including mineral resource estimates exclusive of government policies, accessmineral reserves, see "Business—The Los Gatos District—Mineral Resource Estimates—Cerro Los Gatos Mine, Esther and Amapola Deposits."

The LGJV owns the surface rights to infrastructure5,479 hectares covering the Cerro Los Gatos Mine and qualified labor availability.the Esther and Amapola deposits and the Gavilana (Paula) and San Luis zones, and has been granted mineral concessions for all 103,087 hectares, with 17 contiguous concessions in the Los Gatos District. We have identified 14 mineralized zones within the concessions. Of the 14 mineralized zones, the LGJV has established mineral resource estimates only at the Cerro Los Gatos Mine, the Esther deposit and the Amapola deposit and has conducted drilling on only 15 kilometers out of a strike length of over 150 kilometers of quartz veining along the Los Gatos District.

Location of the Cerro Los Gatos District

Mineralized Zones Grade Intercepts

Mineralized Zones | Length (m) | Ag (g/t) | Pb (%) | Zn (%) | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Boca de Leon | 2.2 | 90.6 | 5.0 | 0.8 | |||||||||

Cieneguita | 1.3 | 62.4 | 5.4 | 0.9 | |||||||||

El Lince | 4.0 | 62.2 | 0.0 | 0.1 | |||||||||

El Rodeo | 0.8 | 61.5 | 3.4 | 4.0 | |||||||||

La Paula | 4.0 | 180.0 | 0.1 | 0.1 | |||||||||

Los Torunos | 1.8 | 34.2 | 2.6 | 0.9 | |||||||||

Mezcalera | 2.0 | 59.4 | 0.1 | 0.1 | |||||||||

San Agustin | 1.3 | 148.0 | 1.2 | 2.3 | |||||||||

San Luis | 2.0 | 271.0 | 0.3 | 0.1 | |||||||||

The table above does not include Ocelote and Wall-E/Ava zones, as they do not have sufficient drilling.

The current resources are significant, but we believe that additional resource potential remains in the immediate area. Drill testing of other high-priority targets within the Los Gatos District has been relatively limited given our focus on delineation of reserves at, and construction of, the Cerro Los Gatos Mine. As a result, the highly prospective Los Gatos District remains underexplored. Drilling at the Esther deposit to date has demonstrated good grade continuity along the system and characteristics similar to that identified during preliminary work at the Cerro Los Gatos Mine. Following potentially positive results from infill drilling at the Esther and Amapola deposits, we expect to update the

resources and perform a scoping study to determine if these two deposit areas could generate economic production, representing further upside potential for the broader Los Gatos District.

We expect to perform additional definition drilling to expand the Southeast and Northwest zones of the Cerro Los Gatos Mine and to perform additional drilling to expand the Esther and Amapola deposits, which remain open to extensions at depth. In addition to the Cerro Los Gatos Mine, the Esther deposit and the Amapola deposit, we have identified 11 other mineralized zones defined by high-grade drill intersections in the Los Gatos District.

Other Exploration Opportunities

In addition to the Los Gatos District, we have 100% control of the Santa Valeria property, located in Chihuahua, Mexico, which is comprised of 1,543 hectares and could provide further opportunities for resource growth.

Attractive Market DynamicsExposure to Rapidly Improving Silver Fundamentals

Investment demand for The value of silver exposure remains strong,is driven by two main factors: first, silver has a number of distinctive physical and chemical properties that make it an essential and difficult-to-substitute component in part by continued U.S. dollar weakness, ongoingseveral industrial applications; and second, in times of economic uncertainty, in Europe and political unrest in the Middle East. Historically, silver has beenis viewed as an effectiveattractive hedge against inflation and a decrease in the value of the U.S. dollar and inflation, attracting investors during times of uncertainty. In addition, industrialdollar.

Industrial demand for silver continues to increase, driven by newelectrical and electronics applications as well as emerging applications for silver such as solar energy, medical applications and water purification, which the Company believes willwe believe enhance the strong supply and demand fundamentals of silver. Moreover, investment demand for silver exposure has strengthened, driven in part by accommodative monetary policy, aggressive stimulus measures and an uncertain economic environment in connection with the COVID-19 pandemic. In 2019, the silver market posted a net deficit (including the impact of exchange-traded products) representing approximately 5% of demand.

Despite this strong investment and industrial demand, the universe of primary silver companies is small, which limitshas created a scarcity of investor options for silver exposure. Sunshine Silver represents anWe believe we represent a highly attractive opportunity for investors to gain exposure to a primary silver company with two attractive assets.a world-class asset.

Experienced Management Team and Board of Directors

Sunshine Silver has We have an experienced and growing management team with a track record of successfully identifying and developing mineral discoveries. The Company’s Executive Chairman & Acting

Stephen Orr, Chief Executive Officer Stephen Orr,and Director, who joined the Company in 2011, has 34more than 40 years of experience in the mineralsmining industry, principally with Homestake Mining Company, where he ultimatelyincluding international commercial experience at both executive and operational levels. Previously, Mr. Orr served as Presidentpresident, director and chief executive officer at Ventana Gold Corp., a Vancouver-based mineral exploration and development company, as director and chief executive officer at OceanaGold Corporation ("OceanaGold"), where under his leadership OceanaGold built and commissioned two new mines in New Zealand, as vice president of Homestake Canada Inc.;North American operations and then managing director of Australia and Africa operations at Barrick Gold Corporation whereand as president and chief executive officer at Homestake Canada Inc. Mr. Orr has notified the Board of Directors that he was Managing Director of Australia & Africa operations; OceanaGold Limited, where he servedintends to retire as Chief Executive Officer;Officer within one to two years following the completion of this offering. Accordingly, the Board of Directors has initiated efforts to recruit an experienced executive as President, who will work closely with Mr. Orr and Ventana Gold Corp., where he was President &be considered to succeed Mr. Orr as Chief Executive Officer. The Company’sWe intend for Mr. Orr to continue to serve on our Board of Directors after his retirement as Chief Executive Officer.

Roger Johnson, Chief Financial Officer, Roger Johnson,who joined the Company in 2011, has 32more than 40 years of experience in financial management ofin the minerals industrymining industry. Previously, Mr. Johnson served as vice president and chief accounting officer at Newmont Mining Corporation (now Newmont Corp.), as senior vice president, finance and administration at Pasminco Zinc, Inc., and as vice president, controller at Kennecott Utah Copper LLC and practiced public accounting with Coopers & Lybrand (now PricewaterhouseCoopers LLP).

Philip Pyle, Vice President of Exploration and Chief Geologist, who joined the Company in 2011, has more than 40 years of experience in the mining industry. Previously, Mr. Pyle served as vice president—exploration at Los Gatos Ltd., as exploration manager at Linear Gold Corp. (now Fortune Bay Corp.), as exploration manager at MIM Exploration Pty Ltd., as exploration manager at BHP Minerals International Exploration Inc. and as a public accountant; Kennecott Utah Copper Corporation, asgeologist at AMAX Exploration Inc.

John Kinyon, Vice President Controller; Pasmincoof Operations, who joined the Company in 2012, has more than 40 years of U.S. and international operations and construction experience, including experience in various mining positions in the U.S., Canada, Tanzania, Australia, and New Zealand. Previously, Mr. Kinyon served as vice president and general manager at Coeur Mining Inc.'s Kensington Mine in Juneau, Alaska, as vice president of operations at OceanaGold, as general manager at Yukon Zinc Corporation ("Yukon Zinc") and as general manager at Eskay Creek at Barrick Gold Corporation.

Luis Felipe Huerta, Project Director of the Cerro Los Gatos Mine, who joined the Company in 2015, has more than 20 years of project management experience in the mining industry. Previously, Mr. Huerta served as project manager at Continental Gold Inc., as Senior Vice President, Financeproject manager at Fortuna Silver Mines Inc., and Administration; and Newmont Mining Corporation,as project superintendent at Compañía Minera Milpo.

Adam Dubas, Chief Administrative Officer, who joined the Company in 2011, has more than 20 years of experience in financial management. Previously, Mr. Dubas served as our Corporate Controller, as a senior manager at KPMG LLP, where he was Chief Accounting Officer.focused on the energy industry, and as an international financial analyst at Sprint Corporation.

The Our Board will beof Directors is comprised of senior mining and financial executives who have broad domestic and international experience in mineral exploration, development and mining. The Company’s senior management andOur Board of Directors has been established with individuals who have in excess of 300 years of combinedcareer backgrounds at notable mining experience. Sunshine Silver believescompanies. We believe that the specialized skills and knowledge of the management team and of the Board of Directors will significantly enhance Sunshine Silver’sour ability to explore and develop the Sunshine Mine property and the Los Gatos ProjectDistrict and to pursue other regional growth opportunities.

Thomas S. Kaplan, Chairman of the Board of Directors, is chairman and chief executive officer of The Electrum Group LLC, a privately-held global natural resources investment management company. Dr. Kaplan has over 25 years of experience in the resources sector. Dr. Kaplan served as chairman of Leor Exploration & Production LLC, a natural gas exploration and development company, which he founded in 2003 and sold in 2007 to EnCana Corporation. Dr. Kaplan intends to resign from the Board of Directors contingent upon and effective immediately prior to the effectiveness of the registration statement of which this prospectus forms a part.

Janice Stairs, Lead Director, was general counsel and corporate secretary at Namibia Critical Metals Inc., general counsel at Endeavour Mining Corporation, and vice president and general counsel at Etruscan Resources Inc. Ms. Stairs has more than 30 years of experience in the resources sector, including service on the board of directors of Gabriel Resources Ltd., Trilogy Metals Inc., and Marathon Gold Corporation. Ms. Stairs will become the Chair of the Board of Directors immediately prior to the effectiveness of the registration statement of which this prospectus forms a part.

Jeb Burns, Director, is the chief investment officer of the Municipal Employees' Retirement System of Michigan and serves on the investment committee of Western Michigan University Foundation, the board of directors of Pacific Pension & Investment Institute, the board of directors of

the Michigan History Foundation, the board of trustees of Mackinac Associates, and the board of directors of Venture Michigan Fund. Mr. Burns has nearly 20 years of investment and asset management experience. Mr. Burns intends to resign from the Board of Directors contingent upon and effective immediately prior to the effectiveness of the registration statement of which this prospectus forms a part.

Ali Erfan, Director, is vice chairman of The Electrum Group LLC, a privately-held global natural resources investment management company. Mr. Erfan is a founding board member of Leor Energy. Mr. Erfan has more than 20 years of experience in senior roles in the venture capital and private equity industry.

Igor Gonzales, Director, is the chief operating officer at Appian Capital Advisory, a leading investment advisor in the metals and mining industry. Mr. Gonzales has more than 30 years of experience in the mining industry.

Karl Hanneman, Director, is chief executive officer of International Tower Hill Mines, Ltd., where he leads a team advancing a 10-million-ounce gold resource in Alaska through project optimization. Mr. Hanneman has more than 35 years of mining industry management and technical experience as an executive, manager, mining engineer, mine operator and entrepreneur.

Charles Hansard, Director Nominee, has over 25 years of experience in corporate governance at the board of directors level, including as chairman of African Platinum Plc.

Igor Levental, Director, is president of The Electrum Group LLC, a privately-held global natural resources investment management company. Mr. Levental has held senior executive positions with major mining companies, including Homestake Mining Company and International Corona Corp. Mr. Levental has more than 30 years of experience across a broad cross-section of the international mining industry.

David Peat, Director, was vice president and chief financial officer at Frontera Copper Corporation, vice president and global controller at Newmont Mining Corporation and vice president of finance and chief financial officer at Homestake Mining Company. Mr. Peat has more than 30 years of experience in financial leadership in support of mining corporations.

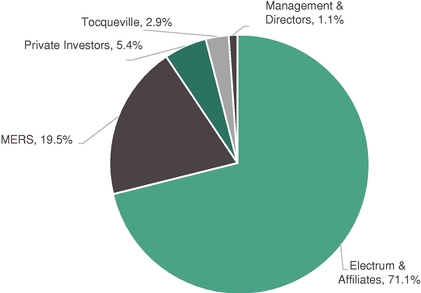

Shareholder Support and Sponsorship

We were founded by The Electrum Group LLC and certain of Companies, orits affiliates. We refer to The Electrum Group LLC and its affiliates in this prospectus, individually and collectively, as "Electrum." Electrum is a leading private equityan investment firm engagedadvisor whose team has historically focused on making strategic investments in mining explorationprecious metals resources and development. Led by Dr. Thomas S. Kaplan, a highly-respected natural resources investor, Electrum brings together decades of combined investment and operating experience, proven execution abilities and capabilities, a broad and diverse background and a deep knowledge of the natural resources sector and mining disciplines. By maintaining a disciplined and professional approach to acquisition and value enhancement, Electrum has developed a strong track record and a multi-billion dollar asset base in the natural resource sector. Electrum holds significant stakes in public and private metals and mining companies, including NovaGold Resources Inc., Gabriel Resources Ltd., Taung Gold Limited, Tintina Resources Inc., Niocan Inc. and Sunward Resources Ltd. The Company believeshydrocarbons. We believe that access to the specialized skills and knowledge within Electrum will significantly enhance Sunshine Silver’sour ability to execute itsour business strategy. When we refer

The Municipal Employees' Retirement System of Michigan ("MERS") is an independent, professional retirement services company that was created to “Electrum” in this prospectus, we are including Electrum Silver Holdings LLC, Tigris Financial (International) L.P., Tigris Financial Group Ltd. and CGT Management Ltd., alladminister the retirement plans for Michigan's local units of which are our stockholders.government on a not-for-profit basis.

Liberty Metals & Mining Holdings, LLC, or Liberty Metals & Mining, is a wholly-owned subsidiary of Boston-headquartered, Liberty Mutual Group. As of March 31, 2011, Liberty Mutual Group had more than $71 billion of total invested assets. As a subsidiary of Liberty Mutual Group, Liberty Metals & Mining makes investments in Following the metals and mining sector for Liberty Mutual Group.

Following completion of thethis offering, Electrum and Liberty Metals & MiningMERS will beneficially own approximately % and % of the Company’sour outstanding common stock, respectively, after giving effect to (i) the Reorganization, (ii) the issuance of an aggregate of shares of common stock to our executive officers in connection with this offering, as described in "Certain Relationships and Related Party Transactions—Grants to Certain Executive Officers in Connection with This Offering," (iii) the conversion of our outstanding convertible notes into an aggregate of shares of common stock in connection with this offering, and (iv) the issuance and sale of shares of common stock in this offering, assuming the over-allotment option is not exercised by the underwriters.underwriters, and Electrum will continue to have a presence on the Board of Directors.

See "Business—Key Investment Highlights—Shareholder Support."

Sunshine Silver’s Our business strategy is focused on creating value for stakeholders through the ownership and advancement of its two principal projects, projects—the SunshineCerro Los Gatos Mine property and the Los Gatos Project, District—and through the pursuit of similarly attractive silver-focused projects. Sunshine Silver plans to:

Continue Exploration and DevelopmentThe LGJV commenced production at the Sunshine Mine property to Convert Existing Mineralized Material to Reserves and Expand the Resource Base

Sunshine Silver intends to complete a pre-feasibility study at the Sunshine Mine property to determine the costs to re-commission and operate the Sunshine Mine as a sustainable and efficient silver producer. Sunshine Silver expects this study will be completed within 24 months from the completion of this offering. In addition, the Company intends to continue with its surface and underground exploration drilling program to provide sufficient sampling to estimate grade, tonnage and location of additional potentially economic veins and deposits for future production and to upgrade mineralized material to reserves.

Re-Commission the Sunshine Mine to Long-Term Sustainable Production

Sunshine Silver intends to refurbish or replace existing infrastructure at the Sunshine Mine in connection with its modernization and rehabilitation efforts and to review process optimization alternatives. The re-commissioning of the Sunshine Mine will be designed to allow the Company to reach a safe and sustainable production rate utilizing its newly optimized facilities.

Accelerate Exploration at the Los Gatos Region and Advance the Los Gatos Project

The Company plans to accelerate its exploration program at the Los Gatos region through additional drilling with the intent of identifying mineralized material. In the near term, the Company also intends to progress the most advanced exploration sites, the Cerro Los Gatos Mine in the third quarter of 2019. We intend to achieve these objectives through the following value-enhancing near-term and Esther zones, through to pre-feasibility study.long-term initiatives:

Sunshine Silver plans The Los Gatos Working Capital Facility provided by Dowa to expand its exploration programs at its Mexican properties outsidethe LGJV carries an annual interest rate of LIBOR plus 3%. In addition, we are required to pay an arrangement fee on the borrowing, calculated as 15.0% per annum of 70.0% of the average daily principal amount outstanding during the relevant fiscal quarter. Retiring a portion of the Los Gatos region and continue to grow its land position. The Company owns or controls a portfolio of 17 other exploration propertiesWorking Capital Facility will reduce our borrowing costs.

Identify and Pursue Other Growth Opportunities that Add Value to Stockholders

Given the management and Board’s strong track record in exploration, development and asset integration, the Company may pursue acquisitions and joint ventures that are value accretive to its stockholders through the pursuit of similarly attractive silver-focused projects.

Recent Developments

Philip Pyle, Vice President Exploration, who is a Qualified Person as set out in NI 43-101, has supervised the preparation of the technical information that forms the basis of the information contained in this section “—Recent Developments.”

Exploration drilling at the Los Gatos Project has recently detectedJoint Venture to increase our ownership to 70.0%:

Hole | From (meters) | To (meters) | Thickness (meters) | Ag (g/t) | Pb (%) | Zn (%) | ||||||||||||||||||

AM22 | 651 | 651.85 | 0.85 | 588.0 | 13.70 | 0.70 | ||||||||||||||||||

AM25 | 533 | 560 | 27.0 | 81.8 | 0.53 | 1.33 | ||||||||||||||||||