As filed with the Securities and Exchange Commission on September 22, 2011March 29, 2012

Registration No. 333- 333-176958

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 6 to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Fulcrum BioEnergy, Inc.

(Exact name of Registrant as specified in its charter)

| Delaware | 2860 | 33-1173733 | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

4900 Hopyard Road, Suite 220

Pleasanton, CA 94588

(925) 730-0150

(Address, including zip code, and telephone number, including area

code, of registrant’s principal executive offices)

E. James Macias

President and Chief Executive Officer

Fulcrum BioEnergy, Inc.

4900 Hopyard Road, Suite 220

Pleasanton, CA 94588

(925) 730-0150

(Name, address including zip code, and telephone number including area code, of agent for service)

Copies to:

| Alan Talkington, Esq. | Jeffrey D. Saper, Esq. | |

| Karen Dempsey, Esq. | Allison B. Spinner, Esq. | |

| Orrick, Herrington & Sutcliffe LLP | Wilson Sonsini Goodrich & Rosati, P.C. | |

| 405 Howard Street | 650 Page Mill Road | |

| San Francisco, CA 94105 | Palo Alto, CA 94304 | |

| (415) 773-5700 | (650) 493-9300 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b2 of the Exchange Act.

Large accelerated filer ¨ | Accelerated filer ¨ | |

Non-accelerated filer þ (Do not check if a smaller reporting company) | Smaller reporting company ¨ |

CALCULATION OF REGISTRATION FEE

|

|

| ||||||

| Title Of Each Class Of Securities To Be Registered | Proposed Maximum Aggregate Offering Price(1)(2) | Amount Of Registration Fee | Proposed Maximum Aggregate Offering Price(1)(2) | Amount Of Registration Fee(3) | ||||

Common Stock, par value $0.001 per share | $115,000,000.00 | $13,351.50 | $115,000,000.00 | $13,351.50 | ||||

|

|

| ||||||

|

|

| ||||||

| (1) | Includes shares of Common Stock issuable upon exercise of the Underwriters’ overallotment option. |

| (2) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act. |

| (3) | Previously paid. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | Subject to Completion |

Shares

Common Stock

This is the initial public offering of our common stock. No public market currently exists for our common stock. We are offering all of the shares of common stock offered by this prospectus. We expect the public offering price to be between $ and $ per share.

We have applied to list our common stock on theThe NASDAQ Global Market under the symbol “FLCM.”

Investing in our common stock involves a high degree of risk. Before buying any shares, you should carefully read the discussion of material risks of investing in our common stock in “Risk factors” beginning on page 1112 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Per Share | Total | |||

Public offering price | $ | $ | ||

Underwriting discounts and commissions | $ | $ | ||

| Proceeds, before expenses, to us | $ | $ |

The underwriters may also purchase up to an additional shares of our common stock at the public offering price, less the underwriting discounts and commissions payable by us, to cover over-allotments, if any, within 30 days from the date of this prospectus. If the underwriters exercise this option in full, the total underwriting discounts and commissions will be $ and our total proceeds, after underwriting discounts and commissions but before expenses, will be $ .

The underwriters are offering the common stock as set forth under “Underwriting.” Delivery of the shares will be made on or about , 2011.2012.

| UBS Investment Bank | BofA Merrill Lynch | Citigroup |

Raymond James

, 20112012

You should rely only on the information contained in this prospectus. We and the underwriters have not authorized anyone to provide you with additional information or information different from that contained in this prospectus. We are offering to sell, and seeking offers to buy, shares of common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date on the front cover of this prospectus, or such other dates as are stated in this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock.

| 1 | ||||

| | ||||

Management’s Discussion and Analysis of Financial Condition and Results of Operations | ||||

Material U.S. Federal Tax Considerations for Non-U.S. Holders of Common Stock | ||||

| F-1 |

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should carefully read this entire prospectus, including our consolidated financial statements and the related notes included elsewhere in this prospectus and the information set forth under the headings “Risk factors” and “Management’s discussion and analysis of financial condition and results of operations.”

OUR BUSINESS

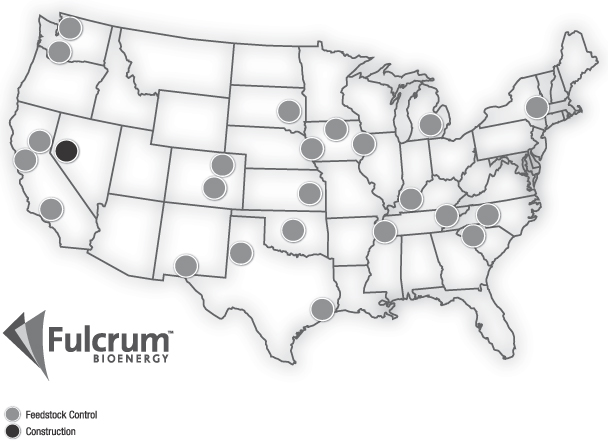

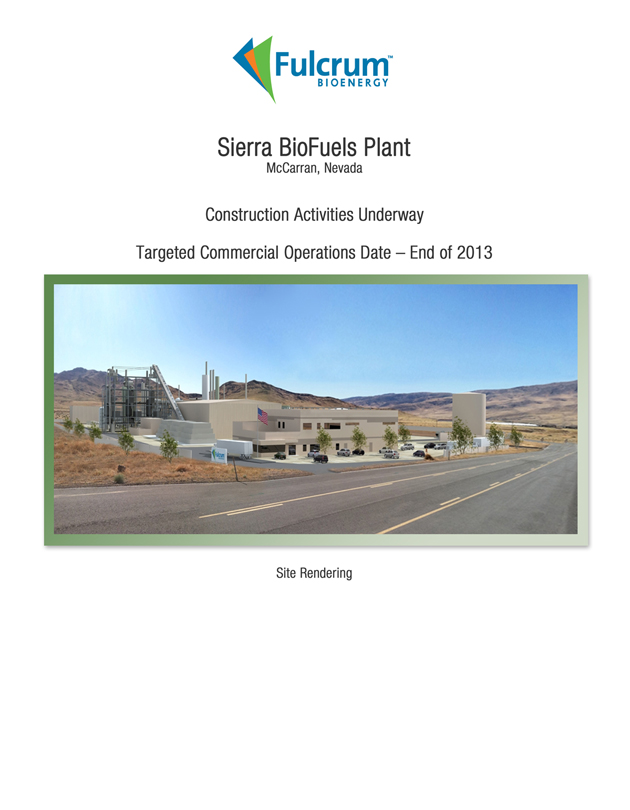

We produce advanced biofuel from garbage.have developed a process to convert garbage to ethanol. Our disruptiveinnovative business model combines our proprietary process and zero-cost municipal solid waste, or MSW, feedstock to provide us with a significant competitive advantage over companies using alternative feedstocks such as corn, sugarcane and other sources of biomass in the production of renewable fuel, which are subject to commodity and other pricing risks. We have entered into a long-term zero-cost contracts for enoughagreement with Waste Connections, Inc. to procure MSW locatedat zero cost throughout the United States in quantities sufficient to produce more than 700 million gallons of ethanol per year. The core element of our technology has been demonstrated at full scale. At our first commercial-scale facility,year, assuming that we expect to producehad approximately 10 million gallons of ethanol per year at an unsubsidized cash operating cost of less than $1.30 per gallon, net of the sale of co-products such as renewable energy credits. This estimate does not require any improvement15 commercial production facilities in MSW-to-ethanol yields or process efficiencies and is a substantially lower cost per gallon than traditional fuels and other renewable biofuels.operation. Our stable cost structure, based on long-term zero-costagreements to procure MSW feedstock arrangements,at zero cost, will allow us to enter into fixed-price offtake contracts or hedges to secure attractive unit economics. We expect our first commercial-scale facility, the Sierra BioFuels Plant, or Sierra, to begin production inby the second halfend of 2013 and to be at full capacity, producing approximately 10 million gallons of ethanol per year, within three years after commencement of ethanol production.

At Sierra, we expect to produce approximately 10 million gallons of ethanol per year at an estimated production cost of less than $1.25 per gallon, net of revenue from the sale of co-products, such as renewable energy credits and recyclables, of approximately $0.45 per gallon. We entered into an agreement with a third party entitling it to up to 80 million renewable energy credits per calendar year generated during the first 15 years of Sierra’s operation in exchange for an upfront contribution of $10 million to help fund the construction of Sierra. The expected revenue from those credits is included in the amount netted against our estimated production costs. These production costs also include plant labor, materials, maintenance, catalyst, utilities and other plant-related costs associated with producing ethanol from MSW. Our estimated production costs at Sierra and other facilities do not require any improvement in MSW-to-ethanol yields or process efficiencies and we believe reflect a substantially lower cost per gallon than production costs for traditional transportation fuels, primarily due to our zero-cost feedstock. In addition, we will benefit from certain federal and state incentives that are available for the production of renewable biofuels, but such incentives are not reflected in our estimated production costs.

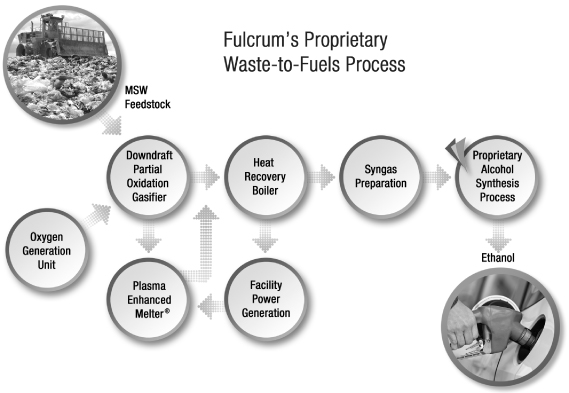

Our proprietary process converts MSW into ethanol. This process, built around numerous commercial systems available today, has been tested, demonstrated and will be deployed on a commercial scale at facilities that we will build, own and operate. We utilize sorted, post-recycled MSW and convert it into ethanol using a two-step process that consists of gasification followed by alcohol synthesis. In the first step, the gasification process converts the MSW into a synthesis gas, or syngas. We have licensed and purchased the gasification system from a third party. In the second step, the syngas is catalytically converted into ethanol using our proprietary alcohol synthesis process. Our alcohol synthesis process demonstration unit has operated at full scale for more than 8,000 hours.hours utilizing a full-scale reactor tube of the same size that will be deployed in our systems at Sierra and future production facilities. We have filed patent applications for the integration of the MSW-to-ethanol process. We believe this may provide us with a significant advantage over competitors looking to replicate our process.

1

In addition, we will generate electricity to power our plants and reduce our reliance on external electricity sources. By taking this approach to power production, we believe many of our future facilities will qualify for state-level renewable energy credits that may provide additional revenue opportunities. Taking into account the feedstock used for electricity generation, we believe our process will produce ethanol at net yields of approximately 70 gallons per ton of MSW, which is sufficient for us to operate profitably in the absence of economic subsidies. Furthermore, an August 2009 independent analysis prepared by Life Cycle Associates, LLC concluded that our process is projected to provide a more than 75% reduction in greenhouse gas, or GHG, emissions compared to traditional gasoline production.

We expect to beginrecently began construction of Sierra, located approximately 20 miles east of Reno, in Storey County, Nevada, by the endwhere we have acquired approximately 17 acres of 2011.vacant property. The construction cost of this facility is estimated at $180 million, which we

1

expect to be financedfinance through existing equity capital, and net proceeds from this offering. We are also pursuingoffering and a U.S. Department of Energy, or DOE,federal loan guarantee to fundthat we are pursuing or, if we do not obtain a portion of the cost and may also seekfederal loan guarantee, a project financing from other sources. We have acquired approximately 17 acres of vacant propertyloan facility for Sierra and permits are in place to begin construction.Sierra. We expect to produce approximately 10 million gallons of ethanol per year from Sierra using zero-cost MSW feedstock contractually procured from affiliates of Waste Management, Inc. and Waste Connections, Inc. We have entered into a contract with Tenaska BioFuels, LLC, or Tenaska, to market and sell all ethanol produced at Sierra for three years commencing on the date of the first ethanol delivery. The modular design ofWe have designed our technology willto allow us to replicate the design of Sierra and more efficiently construct future facilities with up to six times the production capacity of Sierra. We believe we can lower our unsubsidized cash operatingestimated production costs from less than $1.25 per gallon at Sierra to less than $0.70 per gallon at our full-scale commercial facilities, net of revenue from the sale of co-products, such as renewable energy credits from less than $1.30and recyclables, of approximately $0.45 per gallon, at Sierra to less than $0.90 per gallon at our full-scale commercial facilities, assuming economies of scale and a 60 million gallon per year facility. These estimates do not require any improvement in MSW-to-ethanol yields or process efficiencies.

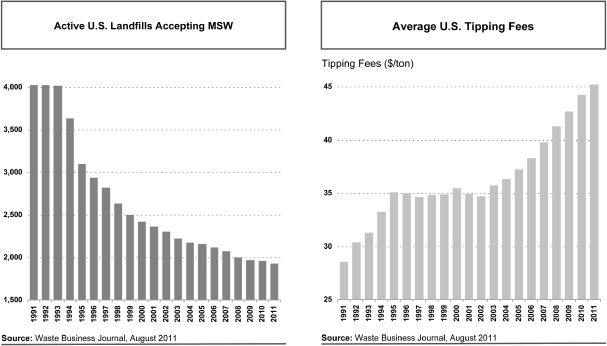

Our production facilities will provide numerous social and environmental benefits. By providing a reliable source of domestic renewable transportation fuels, our facilities will help the United States reduce its dependence on foreign oil. In addition, we expect our process will reduce GHG emissions by more than 75% compared to traditional gasoline production. Our process does not compete with recycling programs available today. We use MSW feedstock after it has been processed for conventional recyclables, such as cans, bottles, plastic containers, paper and cardboard, that would otherwise be landfilled. By diverting MSW from landfills, our facilities will help mitigate the need for new landfills and extend the life of existing landfills. Lastly, our MSW feedstock does not have the land-use issues or adverse impact on food prices generally associated with other feedstocks used to produce ethanol, such as corn and sugarcane.

We are a development stage company and have not yet generated any revenue. As of December 31, 2011, we had a deficit accumulated during development stage of $101.7 million and expect our losses to continue at least through the end of 2013, when Sierra is expected to commence production.

RECENT DEVELOPMENTS

In November 2011, we closed our Series C preferred stock financing, pursuant to which we raised an aggregate of approximately $93.0 million from both existing and new investors, including affiliates of USRG Management Company, LLC and Rustic Canyon Partners, as well as a subsidiary of Waste Management, Inc., or Waste Management, the largest waste management company in the United States. We also entered into a credit agreement with a subsidiary Waste Management to provide a project loan facility of up to $70 million to be available to fund a portion of the construction costs of Sierra, which will be secured by a first priority security interest in all assets of Sierra and a pledge of our equity interest in Sierra. We will utilize this project loan facility only if we do not enter into a federal loan guarantee that we are pursuing. If we utilize this project loan facility, we will be subject to a requirement that

2

100% of the net operating cash flows of Sierra BioFuels will be used to prepay the outstanding loan balance in addition to scheduled amortization until the outstanding loan balance is reduced to $45 million, which we expect would continue for approximately two years from commencement of commercial operations of Sierra. After that, the amount of this cash sweep is reduced in steps to 50% of net operating cash flows when the loan balance has been reduced to $15 million. We expect these cash sweeps would continue for an aggregate of approximately five years from commencement of commercial operations at Sierra. We also entered into a master project development agreement with a subsidiary of Waste Management to cooperate to jointly develop Fulcrum projects in various locations throughout the United States using MSW supplied by subsidiaries of Waste Management under long-term feedstock agreements.

OUR MARKET OPPORTUNITY

According to the National Renewable Energy Laboratory, the global market for transportation fuels was overapproximately $4 trillion in 2010. According to the U.S. Energy Information Administration, in 20092010 there was a 138 billion gallon market for gasoline and a 52 billion gallon market for diesel in the United States alone.

The most common biofuel used in the global transportation sector is ethanol, which has been blended into gasoline since the 1970s, when it was used primarily to increase fuel performance as an octane booster. Today, its primary use is to accelerate the displacement of petroleum gasoline with a domestic, renewable alternative. Federal law established the Renewable Fuel Standards program, or RFS2, and the Clean Air Act Amendments of 1990, which require that gasoline used in the United States have additives that oxygenate the fuel.

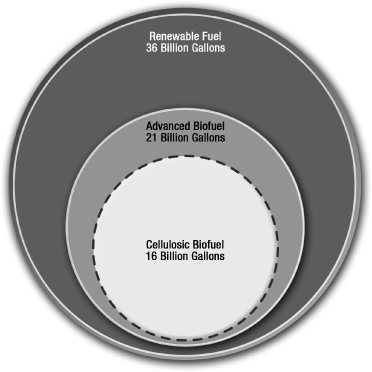

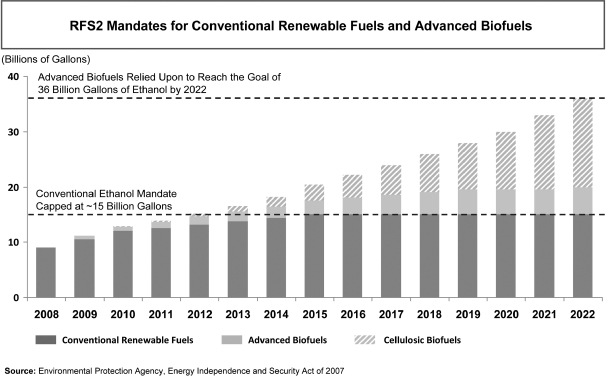

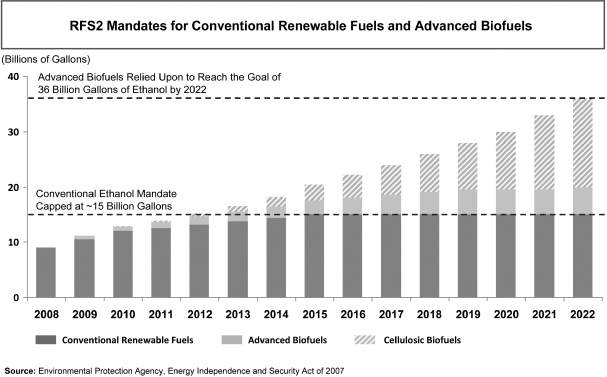

In 2010, approximately 13 billion gallons of ethanol was blended into the gasoline supply of the United States, virtually allmost of which was produced from corn. Ethanol derived from corn does not satisfy RFS2 advanced biofuel requirements. Under RFS2, any refiner or importer of gasoline or diesel fuel in the U.S. mainland or Hawaii must comply on an annual basis with volume requirements for both renewable fuels as a whole, as well as those for each renewable fuel category, including advanced biofuel, which includeis a subset of renewable fuels that reduces lifecycle GHG emissions by at least 50%, and cellulosic biofuel, which is a 50% reduction insubset of advanced biofuel that reduces lifecycle GHG emissions.emissions by at least 60% and is derived from any cellulose, hemicelluloses or lignin. The RFS2 requirement for the volume of all renewable fuel wasis 13.95 billion gallons in 2011, 15.2 billion gallons in 2012, increasing to 20.5 billion gallons in 2015 and reaching 36 billion gallons in 2022, 21 billion gallons of which must be advanced biofuel. We believe our ethanol will qualify as advanced biofuel under RFS2 for purposes of meeting such advanced biofuel targets.

Outside of RFS2, there are also various state and local programs and incentives have mandatedintended to promote the use of renewable fuels. The most notable state program is the California Low Carbon Fuel Standard, or LCFS, which was enacted in January 2007. The LCFS directive calls for a reduction of at least 10%energy and fuels in the carbon intensityUnited States. We intend to review such financial incentives in connection with the selection of California’s transportation fuels by 2020, placing a high demand on low-carbon fuels such as ours. This required reduction is applicable across 100% of California’s transportation fuel volume. As a result, the

2

continued use of traditional gasolinelocations for a significant portion of California’s transportation fuel would lead to greater demand for lower carbon intensity blendstock. For example, the 10% ethanol component of E10 would require approximately 100% carbon intensity reduction to allow for LCFS compliance in the event the remaining 90% fuel volume remained unchanged. Thus, blendstocks with significant carbon intensity reductions will be very attractive in meeting these standards.our future facilities.

OUR SOLUTION

Our business strategy is based on securing long-term, zero-cost MSW feedstock and employing our proprietary process to efficiently convert the MSW into an advanced biofuel. We believe our product will be markedly superior to traditional and other advanced biofuels from both an economic and an environmental perspective.

3

Our competitive strengths

We believe our business model benefits from a number of competitive strengths, including the following:

| Ø | Attractive feedstock. The use of MSW affords us numerous benefits: |

| ¡ | Contracted at zero cost. We have executed a feedstock |

| ¡ | Transportation advantage. Significant volumes of MSW are generated near metropolitan areas, providing us with a transportation advantage compared to feedstocks harvested or grown in rural areas that must ultimately transport either the feedstock or the fuel to metropolitan areas. |

| ¡ | Reliable supply. The United States generates more than 243 million tons of MSW annually, the majority of which is rich in organic |

| ¡ | Established infrastructure. By using MSW, we benefit from existing infrastructure for collection, hauling and handling. No new logistical networks would be required to transport the feedstock to our facilities. |

| ¡ | No competing use. We have developed a process to produce |

| Ø | Clear path to commercialization. Our first commercial-scale ethanol production facility is expected to begin production |

| Ø | Proprietary process not dependent on yield improvement. Our process integrates a catalyst that converts syngas into ethanol, and at our demonstration facility we have demonstrated the success of this process at full scale utilizing a full-scale reactor tube of the same size that will be deployed in our systems at |

3

| Ø | Business model built for long-term and sustainable profitability. We do not rely on government subsidies to make our product commercially viable. While we benefit from policies such as RFS2 and |

| Ø | Flexible production process. We have designed our proprietary alcohol synthesis process to give us the flexibility to produce alcohols other than ethanol and take advantage of opportunities in other renewable fuels and chemical markets. |

4

Benefits for our customers

The key benefits we intend to provide to our customers include:

| Ø | Zero-cost feedstock; stable cost structure. With our long-term, zero-cost MSW feedstock, we will be able to sustain strong margins with very little production cost volatility. This enables our customers to have greater certainty relating to their ongoing access to a stable and reliable supply of ethanol. |

| Ø | Access to domestically-produced advanced biofuel. We will produce our ethanol domestically, offering customers a pricing advantage over those relying on Brazilian ethanol, which is subject to higher feedstock and transportation costs, |

| Ø | Large-scale development program. We have a robust project development pipeline based on the existing MSW under contract across 19 states that will support more than 700 million gallons of annual ethanol |

Benefits for our suppliers

The key benefits we provide to MSW suppliers that work with us include:

| Ø | Cost savings. We provide a cheaper source of waste diversion than traditional landfill disposal. In addition, our ability to site closer to where waste is collected than landfills allows us to pass on a portion of transportation and disposal cost savings to our suppliers. |

| Ø | Extend landfill life at existing capacity levels. Landfills are increasingly expensive and politically contentious assets to permit, expand and maintain. By offering our suppliers the ability to divert large volumes of waste to us, we help them extend the future life of their existing landfills, reduce the need for new landfills and save on the day-to-day costs of managing a landfill. |

| Ø | Avoidance of methane gas emissions. We provide an alternative to traditional decomposition of organic materials that creates methane gas, allowing integrated waste service companies the ability to lessen their GHG emissions footprint. |

OUR STRATEGY

Our objective is to become a leading producer of renewable transportation fuels in the United States by building, owning and operating commercial production facilities. The principal elements of our strategy include:

| Ø | Commence production at Sierra. We |

4

|

| Ø | Expand production capacity. We |

5

| Ø | Execute fixed-price offtake and hedging contracts. For each facility, we intend to enter into physical and/or financial fixed-price arrangements to lock in sufficient economics to cover a substantial portion of our fixed costs, including debt service. |

| Ø | Secure additional MSW contracts. Longer term, we intend to expand our business by entering into additional MSW feedstock agreements to increase the amount of resources we have available to supply our commercial facilities. |

| Ø | Explore new market opportunities. We believe significant opportunities for value creation exist outside of our base model to build, own, and operate facilities within the United States. Our process will be attractive to international markets with heavy reliance on oil, poor access to alternative fuels and expensive MSW disposal options. We may license our technology to third parties and/or partner with large strategic players, such as major oil, refinery and chemical companies. |

RISKS AFFECTING US

Our business is subject to a number of risks and uncertainties including those highlighted in the section entitled “Risk factors” immediately following this prospectus summary. These risks include the following:

| Ø | we |

| Ø | we have not yet generated any revenue, have incurred losses to date, anticipate continuing to incur losses in the future and may never achieve or sustain profitability; |

| Ø | our proprietary process has not been demonstrated on a fully-integrated basis as a single, complete system at a single location, and may perform below expectations when implemented on a commercial scale; |

| Ø | there are significant risks associated with the construction and completion of Sierra, which may cost more to build, maintain or operate than we have currently budgeted or estimated, or there may be delays in the completion of the facility; |

| Ø | we will need substantial additional capital in the future in order to finance the construction of our planned future facilities and to expand our business and we may be unable to draw down from a project loan facility or obtain such capital on terms acceptable to us or at all; |

| Ø | the growth of our business depends on locating and obtaining control of suitable sites for our additional facilities and the continuing supply of MSW as a feedstock; |

| Ø | we may be unable to obtain patent or other protection for our proprietary technologies and, even if we obtain such protection, we may be unable to prevent third parties from infringing on any issued patents and other proprietary rights; |

5

| Ø |

|

| Ø | fluctuations in the price of and demand for ethanol and petroleum will impact our results of operations; |

| Ø | changes in government regulations, including subsidies and economic incentives, could have a material adverse effect on demand for our ethanol, and negatively impact our results of |

| Ø | we are a development stage company with limited headcount and accounting resources, which was identified as a significant deficiency in our internal controls, and will need to hire additional personnel to successfully execute our business strategy. |

6

CORPORATE INFORMATION

We were incorporated in the State of Delaware on July 19, 2007. Our principal executive offices are located at 4900 Hopyard Road, Suite 220, Pleasanton, California 94588, and our telephone number at this location is (925) 730-0150. Our website address is www.fulcrum-bioenergy.com. Information contained on our website is not a part of this prospectus and the inclusion of our website address in this prospectus is an inactive textual reference only. Unless the context requires otherwise, the words “Fulcrum,” “we,” “Company,” “us” and “our” refer to Fulcrum BioEnergy, Inc., Fulcrum Sierra Finance Company, LLC, Fulcrum Sierra BioFuels, LLC and our other wholly-owned subsidiaries and affiliates.

The Fulcrum logo and other trademarks or service marks of Fulcrum appearing in this prospectus are the property of Fulcrum. Trade names, trademarks and service marks of other companies appearing in this prospectus are the property of the respective holders.

67

The offering

Common stock offered by us | shares |

Common stock to be outstanding after this offering | shares |

Overallotment option to be offered by us | shares |

Use of proceeds | We intend to use a substantial portion of the net proceeds from this offering to fund the construction of our first commercial-scale ethanol production facility, the Sierra BioFuels Plant. We intend to use any remaining net proceeds for general corporate purposes and working capital. See “Use of proceeds” for additional information. |

Risk factors | See “Risk factors” and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in shares of our common stock. |

Proposed NASDAQ Global Market symbol | “FLCM” |

The number of shares of our common stock to be outstanding after this offering is based on 66,720,52684,664,845 shares outstanding as of June 30,December 31, 2011, and excludes:

| Ø | as of |

| Ø | 6,500,000 shares of common stock, subject to increase on an annual basis, reserved for future issuance under our |

Unless otherwise indicated, this prospectus reflects or assumes the following:

| Ø | a -for- reverse stock split of our common stock to be effected prior to the effectiveness of the registration statement of which this prospectus forms a part and the resulting -for- conversion ratio applicable to our preferred stock, both of which are reflected in all share and per share amounts with respect to our common stock and preferred stock in this prospectus; |

| Ø | no exercise of options outstanding at |

| Ø | the conversion of our outstanding |

| Ø | the |

78

| Ø | no exercise of the over-allotment option by the underwriters; and |

| Ø | that our amended and restated certificate of incorporation, which we will file in connection with the completion of this offering, is in effect. |

89

Summary consolidated financial data

The following table presents our summary consolidated financial data for the periods indicated. You should read this data together with our consolidated financial statements and related notes, “Selected consolidated financial data,” and “Management’s discussion and analysis of financial condition and results of operations” included elsewhere in this prospectus.

The consolidated statements of operations data for each of the years ended December 31, 2008, 2009, 2010 and 2010,2011, are derived from our audited consolidated financial statements included elsewhere in this prospectus. The consolidated statements of operations data for each of the six months ended June 30, 2010 and 2011, and the consolidated balance sheet data as of June 30, 2011, are derived from our unaudited consolidated financial statements included elsewhere in this prospectus. We have prepared the unaudited financial information on the same basis as the audited consolidated financial statements and have included, in our opinion, all adjustments, consisting of normally recurring adjustments that we consider necessary for a fair presentation of the financial information set forth in those statements. Our historical results for any prior period are not necessarily indicative of results to be expected in any future period, and our results for any interim period are not necessarily indicative of results for a full fiscal year.period.

| Year ended December 31, | Six months ended June 30, | Year ended December 31, | ||||||||||||||||||||||||||||||

| Consolidated statements of operations data: | 2008 | 2009 | 2010 | 2010 | 2011 | 2009 | 2010 | 2011 | ||||||||||||||||||||||||

| (in thousands, except per share data) | (in thousands, except per share data) | |||||||||||||||||||||||||||||||

Operating expenses(1): | ||||||||||||||||||||||||||||||||

Project development expenses | $ | 4,271 | $ | 6,087 | $ | 14,965 | ||||||||||||||||||||||||||

Research and development expenses | $ | 8,041 | $ | 8,939 | $ | 12,015 | $ | 5,304 | $ | 8,929 | 4,668 | 5,928 | 5,906 | |||||||||||||||||||

General and administrative expenses | 4,206 | 6,327 | 4,570 | 2,136 | 4,221 | 6,327 | 4,570 | 5,682 | ||||||||||||||||||||||||

Loss on sale of Series C preferred stock | — | — | 14,259 | |||||||||||||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

Total operating expenses | 12,247 | 15,266 | 16,585 | 7,440 | 13,150 | 15,266 | 16,585 | 40,812 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

Loss from operations | (12,247 | ) | (15,266 | ) | (16,585 | ) | (7,440 | ) | (13,150 | ) | (15,266 | ) | (16,585 | ) | (40,812 | ) | ||||||||||||||||

|

|

| ||||||||||||||||||||||||||||||

Other income (expense): | ||||||||||||||||||||||||||||||||

Interest (expense) | (288 | ) | (1,278 | ) | (1,638 | ) | (1,123 | ) | (958 | ) | (1,278 | ) | (1,638 | ) | (1,436 | ) | ||||||||||||||||

Interest income | 148 | 24 | 8 | 4 | 2 | 24 | 8 | 86 | ||||||||||||||||||||||||

Change in fair value of financial instruments | — | — | (10,360 | ) | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

Total other income (expense) | (140 | ) | (1,254 | ) | (1,630 | ) | (1,119 | ) | (956 | ) | (1,254 | ) | (1,630 | ) | (11,710 | ) | ||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

Net loss | (12,387 | ) | (16,520 | ) | (18,215 | ) | (8,559 | ) | (14,106 | ) | (16,520 | ) | (18,215 | ) | (52,522 | ) | ||||||||||||||||

Less net loss attributable to non-controlling interest in subsidiary | — | 2 | 187 | 38 | 299 | 2 | 187 | 756 | ||||||||||||||||||||||||

|

|

| ||||||||||||||||||||||||||||||

Subtotal | (16,518 | ) | (18,028 | ) | (51,766 | ) | ||||||||||||||||||||||||||

Preferred stock accretion | — | — | (155 | ) | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

Net loss attributable to common stockholders | $ | (12,387 | ) | $ | (16,518 | ) | $ | (18,028 | ) | $ | (8,521 | ) | $ | (13,807 | ) | $ | (16,518 | ) | $ | (18,028 | ) | $ | (51,921 | ) | ||||||||

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

Net loss per share—basic and diluted(2) | $ | (23.04 | ) | $ | (15.08 | ) | $ | (14.46 | ) | $ | (7.01 | ) | $ | (10.32 | ) | $ | (15.08 | ) | $ | (14.46 | ) | $ | (32.52 | ) | ||||||||

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

Weighted-average shares used in EPS calculation—basic and diluted(2) | 538 | 1,095 | 1,247 | 1,216 | 1,338 | 1,095 | 1,247 | 1,596 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

Pro forma loss per share—basic and diluted (unaudited)(2) | $ | (0.43 | ) | $ | (0.30 | ) | $ | (0.68 | ) | |||||||||||||||||||||||

|

|

| ||||||||||||||||||||||||||||||

Pro forma weighted-average shares used in EPS calculation—basic and diluted (unaudited)(2) | 42,409 | 46,604 | 82,945 | |||||||||||||||||||||||||||||

|

|

| ||||||||||||||||||||||||||||||

910

| As of June 30, 2011 | As of December 31, 2011 | |||||||||||||||||||||||

| Consolidated balance sheet data: | Actual | Pro forma adjusted(3) | Pro forma as further adjusted(4) | Actual | Pro forma adjusted(3) | Pro forma as further adjusted(4) | ||||||||||||||||||

| (in thousands) | ||||||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||||||

Current assets | $ | 1,007 | $ | 49,007 | $ | $ | 49,995 | $ | 59,995 | $ | ||||||||||||||

Property and equipment, net | 2,901 | 2,901 | 2,878 | 2,878 | ||||||||||||||||||||

Intangible assets, net | 6,550 | 6,550 | 6,550 | 6,550 | ||||||||||||||||||||

Deposits | 831 | 831 | 832 | 832 | ||||||||||||||||||||

Capitalized offering costs | 436 | 436 | ||||||||||||||||||||||

Deferred offering costs | 1,690 | — | ||||||||||||||||||||||

Deferred debt issuance costs | 2,823 | 2,823 | ||||||||||||||||||||||

Total assets | 64,767 | 73,078 | ||||||||||||||||||||||

Current liabilities | 33,299 | 3,731 | 2,385 | 2,385 | ||||||||||||||||||||

Long-term liabilities | 8 | 8 | ||||||||||||||||||||||

Warrant liabilities | 12,989 | — | ||||||||||||||||||||||

Long term debt | — | 10,000 | ||||||||||||||||||||||

Redeemable convertible preferred stock | 41,902 | — | 143,132 | — | ||||||||||||||||||||

Total stockholders’ equity (deficit) | (63,794 | ) | 55,675 | (94,079 | ) | 60,352 | ||||||||||||||||||

| (1) | Includes stock-based compensation expense as follows: |

| Year ended December 31, | Six months ended June 30, | Year ended December 31, | ||||||||||||||||||||||||||||||

| 2008 | 2009 | 2010 | 2010 | 2011 | 2009 | 2010 | 2011 | |||||||||||||||||||||||||

| (in thousands) | (in thousands) | |||||||||||||||||||||||||||||||

Project development expenses | $ | — | $ | — | $ | 42 | ||||||||||||||||||||||||||

Research and development expenses | $ | — | $ | — | $ | — | $ | — | $ | 3 | — | — | 14 | |||||||||||||||||||

General and administrative expenses | 57 | 151 | 105 | 53 | 48 | 151 | 105 | 397 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

Total | $ | 57 | $ | 151 | $ | 105 | $ | 53 | $ | 51 | $ | 151 | $ | 105 | $ | 453 | ||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

| (2) | See Note 2 to our annual |

| (3) | Reflects on a pro forma as adjusted basis the (i) conversion of all of our outstanding preferred stock as of |

| (4) | Reflects on a pro forma as further adjusted basis the conversion and issuance described in note (3) above and, on an adjusted basis, the receipt by us of the estimated net proceeds from the sale of shares of common stock by us in this offering at an assumed initial public offering price of $ per share, which is the mid-point of the price range set forth on the cover of this prospectus, after deducting estimated underwriting discounts, commissions and estimated offering expenses payable by us. A $1.00 increase or decrease in the assumed public offering price of $ per share would increase or decrease current assets and total stockholders’ deficit by $ million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting estimated underwriting discounts and commissions and estimated offering costs payable by us. |

1011

Investing in our common stock involves a high degree of risk. You should carefully consider the risks described below and all other information contained in this prospectus before making an investment decision. Our business could be harmed by any of these risks. In that event, the trading price of our common stock could decline, and you may lose all or part of your investment. In assessing these risks, you should also refer to the other information contained in this prospectus, including our consolidated financial statements and related notes.

RISKS RELATED TO OUR BUSINESS AND INDUSTRY

We are a development stage company with a limited operating history and have not yet achieved commercial-scale production.production, and our business will not succeed if we are unable to successfully commercialize our process.

We are a development stage company with a limited operating history, and we have not yet generated any revenue. We currently expect to beginrecently began constructing our first commercial ethanol production facility, the Sierra BioFuels Plant, or Sierra, by the end of 2011, and expect to begin production inby the second halfend of 2013. To date, the components of our process have been demonstrated or used separately, but we have not previously demonstrated the processes on a fully-integrated basis as a single, complete system at a single location or on a commercial scale. Certain factors that could, alone, or in combination, delay or prevent us from successfully commercializing our proprietary process, and thus generating revenue or otherwise impact our financial results, include:

| Ø | our ability to achieve commercial-scale production of ethanol on a cost-effective basis; |

| Ø | our ability to successfully integrate our gasification and alcohol synthesis processes; |

| Ø | our process, including the integrated gasification and alcohol synthesis processes, does not produce sufficient quantities of ethanol on a commercial scale; |

| Ø | the manufacturer of our gasification system does not deliver the system on a timely basis or at all; |

| Ø | increased capital costs, including construction costs, of developing Sierra and subsequent facilities; |

| Ø | construction of Sierra or subsequent facilities takes longer than expected to achieve commercial results; |

| Ø | our ability to obtain sufficient quantities of high-quality feedstock on a timely and cost-efficient basis; |

| Ø | ethanol prices and/or demand are lower than expected; |

| Ø | changes to, or elimination of, federal and/or state subsidies or other programs promoting renewable biofuels or ethanol; and |

| Ø | actions of direct and indirect competitors that may seek to enter the renewable biofuels market in competition with us. |

We have not yet generated any revenue, have incurred losses to date, anticipate continuing to incur losses in the future and may never achieve or sustain profitability.

We have not yet generated any revenue and have incurred substantial net losses since our inception, including net losses attributable to common stockholders of $12.4 million, $16.5 million, $18.0 million and $18.0$51.9 million for the years ended December 31, 2008, 2009, 2010 and 2010, respectively and $13.8 million for the six months ended June 30, 2011.2011, respectively. We expect these losses to continue. As of June 30,December 31, 2011, we had a deficit accumulated during development stage of $63.8 $101.7

12

Risk factors

million. We expect to incur significant additional costs and expenses related to the development and construction of Sierra, as well as the expansion of our

11

Risk factors

business, including the development of additional facilities. There can be no assurance that we will ever generate any revenue or achieve or sustain profitability on a quarterly or annual basis.

Our project loan facility for Sierra requires us to meet certain conditions precedent to borrowing which we may be unable to do, and if we utilize this project loan facility for Sierra, we will be subject to certain cash sweeps that require Sierra BioFuels to pay all or a portion of its net operating cash flows for approximately five years and other covenants that may restrict our operations.

If we utilize our project loan facility for Sierra with an affiliate of Waste Management Inc., or Waste Management, because we are unable to obtain a federal loan guarantee, our ability to draw down funds from such facility is subject to certain conditions precedent to borrowing, including confirmation of the Sierra budget, schedule and projections prior to initial funding, as well as a requirement that this offering be completed with proceeds of at least $100 million. The conditions precedent to borrowing also include the requirement that we receive a minimum credit rating of our senior secured debt prior to initial funding and continue to have such rating with no statement of negative credit watch at each draw down. In February 2012, we received a credit rating of our senior secured debt that satisfies the initial requirement. However, there can be no assurances that we will be able to maintain such credit rating in the future, and failure to maintain such rating will limit our ability to utilize this project loan facility. The loan will also be secured by a first priority security interest in all assets of Sierra and a pledge of our equity interests in Sierra.

Furthermore, if we utilize our project loan facility for Sierra and draw down funds from such loan, we will be subject to certain additional affirmative and negative covenants in the loan facility, including limits on distributions, as well as covenants limiting leverage and requiring the maintenance of certain debt service coverage ratios. The loan facility also includes a requirement that 100% of the net operating cash flows of Sierra BioFuels will be used to prepay the outstanding loan balance in addition to scheduled amortization until the outstanding loan balance is reduced to $45 million, which we expect would continue for approximately two years from commencement of commercial operations at Sierra. After that, the amount of this cash sweep is reduced in steps to 50% of net operating cash flows when the loan balance has been reduced to $15 million. We expect these cash sweeps would continue for an aggregate of approximately five years from commencement of commercial operations at Sierra. In addition, the loan facility requires that the full amount of any cash grant in lieu of investment tax credit that we receive be used to prepay a portion of the loan. These restrictions will limit the amount of cash from operations available to us, which may limit our ability to use such cash to fund additional facilities and development programs and may prevent us from taking actions we believe are necessary from a competitive standpoint or that we otherwise believe are necessary to grow our business.

Our process has not been demonstrated on a fully-integrated basis, and may perform below our current expectations when implemented on a commercial scale.

Our proprietary process for converting municipal solid waste, or MSW, into ethanol is comprised of two core components, one involving the gasification of the MSW into synthesis gas, or syngas, and the second involving the alcohol synthesis process to convert the syngas into ethanol. To date, thethese core components have been demonstrated or used separately, but we have not previously demonstrated the process on a fully-integrated basis as a single, complete system at a single location or on a commercial scale, and we have not tested the equipment to be used to clean the syngas. Although we conducted extensive testing of the gasification system at a process demonstration unit, or PDU, of a third party, which converted the feedstock into syngas, that PDU is no longer in operation. In addition, we have designed, constructed and have been operating an alcohol synthesis PDU to test our alcohol synthesis process and proprietary catalyst. However, we have not established a fully integratedfully-integrated PDU for the entire process. As a result, we may experience technological problems that neither we nor any of the third-party engineers

13

Risk factors

that have reviewed the project are able to foresee.

We cannot assure you that Sierra will be completed at the estimated construction cost or on the schedule that we intend or at all. If the fully-integrated, commercial-scale implementation of our proprietary process is unsuccessful, or does not achieve acceptable yields or full expected capacity, we will be unable to generate sufficient revenue and our business will be harmed.

We are currently negotiating with the U.S. Department of Energy for a loan guarantee for the construction of Sierra, and the process for finalizing the terms of such loan guarantee and entering into definitive documentation for loans from the Federal Financing Bank may take longer than expected or may not happen at all.

We are currently in the process of negotiating a term sheet with the U.S. Department of Energy, or DOE, for a loan guarantee to fund a portion of the construction costs associated with Sierra. As a part of the loan guarantee process, the DOE and its independent consultants conduct due diligence on projects which includes a rigorous investigation and analysis of the technical, financial, contractual, market and legal strengths and weaknesses of each project. The DOE’s due diligence of our Sierra project is ongoing and we are negotiating the terms of the loan guarantee with the DOE, and we cannot assure you that the DOE ultimately will issue the loan guarantee on terms that are acceptable to us or at all.

We will need substantial additional capital in order to fund the construction of Sierra and to expand our business in the future.future, and we may be unable to raise sufficient additional funds or obtain sufficient financing on acceptable terms or at all.

We will require substantial additional capital to construct Sierra and grow our business, particularly as we build additional facilities following the completion of Sierra. We will need to raise substantial additional funds to construct Sierra, which we currently expect to finance the cost of construction of Sierra through existing equity capital, net proceeds from this offering and the DOEa federal loan guarantee that we are pursuing or, if we do not obtain a federal loan guarantee, a project loan facility for Sierra. Such federal loan guarantees may not be obtained on terms that are acceptable to us or additional project financing.at all.

We will also need to raise substantial additional funds to construct, own and operate additional commercial-scale production facilities and to continue the development of our technology and process. The extent of our need for additional capital to grow our business will depend on many factors, including the amount of net proceeds we receive from this offering, whether we obtain additional project financing or loan commitments or guarantees, whether we succeed in producing ethanol on a commercial scale, our ability to control costs, the progress and scope of our development projects, the effect of any acquisitions

12

Risk factors

of other technologies that we may make in the future and the filing, prosecution and enforcement of patent claims. Future financings that involve the issuance of equity securities would cause our existing stockholders to suffer dilution. In addition, debt financing sources, including government loan guarantee programs, may be unavailable to us and any debt financing may subject us to restrictive covenants that limit our ability to conduct our business. If we are unable to raise sufficient funds, our ability to fund our operations, take advantage of strategic opportunities, develop products or technologies, or otherwise respond to competitive pressures could be significantly limited. If this happens, we may be forced to delay the construction of new facilities, delay, scale back or terminate research or development activities, curtail or cease operations or obtain funds through collaborative and licensing arrangements that may require us to relinquish commercial rights or grant licenses on terms that are unfavorable to us. We may be unable to raise sufficient additional funds on acceptable terms or at all. If adequate funds are unavailable, we will be unable to execute successfully our business plan or to continue to grow our business.

If we are unable to obtain a federal loan guarantee that we are pursuing or we obtain a federal loan guarantee with terms that are less favorable than the project loan facility from a subsidiary of Waste Management, then we will be subject to the restrictive covenants of that loan which may negatively impact our ability to pursue additional development projects or raise additional financing.

We are currently pursuing a federal loan guarantee to fund a portion of the construction costs associated with Sierra which may include terms that are more favorable than those in our project loan facility with a subsidiary of Waste Management. As part of the federal loan guarantee process, the applicable federal agency and its independent consultants conduct due diligence on projects, which includes a rigorous investigation and analysis of the technical, financial, contractual, market and legal strengths and weaknesses of each project. We cannot assure you that we will obtain a federal loan guarantee on terms that are acceptable to us or at all, or that such terms will be more favorable than our project loan facility with a subsidiary of Waste Management. If we do not obtain a federal loan guarantee, we expect to utilize our project loan facility for Sierra with a subsidiary of Waste Management, which, as described above, would subject us to certain cash sweeps and other covenants that may restrict our operations.

14

Risk factors

If we are unable to obtain a federal loan guarantee, or our project loan facility with a subsidiary of Waste Management is unavailable to us or we are otherwise unable to obtain other sources of project financing for Sierra, we may need to obtain additional or alternative financing to complete construction of Sierra. Such additional or alternative financing may not be available on attractive terms, if at all, and could be more costly for us to obtain. As a result, our plans for constructing Sierra could be significantly delayed which would materially adversely affect our business, prospects, financial condition and operating results.

There are significant risks associated with the construction and completion of Sierra, which may cause budget overruns or delays in the completion of the facility.facility, which in turn may harm our financial condition and results of operations.

The scheduled completion date for Sierra, and the budgeted costs necessary to construct Sierra, assumes that there are no material unforeseen or unexpected difficulties or delays. Construction, equipment or staffing problems or difficulties in obtaining or maintaining any of the requisite licenses, permits or authorizations from regulatory authorities could delay the commencement or completion of construction or commencement of operations or otherwise affect the design and features of Sierra. Furthermore, given that third-party contractors will be assembling first-of-its kind systems using new technologies and processes, there may be potential construction delays and unforeseen cost overruns. Such delays or other unexpected difficulties could involve additional costs and result in a delay in the commencement of commercial operations at Sierra. Significant delays or cost overruns in completing Sierra will delay our development of additional facilities. Failure to complete Sierra within our estimated construction budget or on schedule may harm our financial condition and results of operations.

We are dependent on third parties to manufacture and deliver the main components of our process. If the delivery of such components for Sierra or future facilities are delayed, if the components do not meet our quality standards or specifications, or if our suppliers are unable to meet our demand for Sierra or future facilities, our business would be harmed.

We are depending on third parties to manufacture and deliver the gasification system we currently intend to use at our facilities, including Sierra, and the catalyst needed for our alcohol synthesis process. We currently haveIn April 2008, we entered into an agreement with a single third party to manufacture the gasification system.system, and in May 2009 we entered into our first purchase order under that agreement for Sierra. As the more detailed development and engineering work for Sierra has progressed over the past several years, and advancements and improvements have been made in the development of the underlying gasification technology by the manufacturer during that time, our contractual arrangements with the manufacturer have not kept pace. As a result, we recently entered into discussions with this third party to conform our existing purchasing and licensing arrangements to reflect such technology advancements, and to include additional project finance related provisions to provide greater flexibility for future project financing for Sierra. If such gasification systems are delayed or do not initially meet our quality specifications or expectations, the completion and commencement of operations at the facility would also be delayed, which would delay our ability to generate revenue and our business would be harmed. Furthermore, if we are unable to revise our existing arrangements, if our current manufacturer is delayed or unable to deliver the gasification systems, locating a new manufacturer for the gasification systems would require a significant amount of time, which would result in further delays to the completion and commencement of operations at the facility. In addition, if a third party fails to manufacture and deliver gasification systems to meet our demand and timing for future facilities, we may be unable to grow our business and our financial condition and results of operations may be harmed.

15

Risk factors

We will rely on contract manufacturers to manufacture substantially all of the catalyst needed for Sierra. The failure of these manufacturers, or any manufacturer we use for future facilities, to manufacture and supply the catalyst on a timely basis or at all, in compliance with our quality specifications or expectations, or in volumes sufficient to meet demand for Sierra or future facilities, would adversely

13

Risk factors

affect our ability to produce ethanol and our business would be harmed. If we require additional manufacturing capacity and are unable to obtain it in sufficient quantity, we may not be able to increase our production of ethanol, and we may be forced to contract with other manufacturers on terms that may be less favorable than the terms we currently have. We do not currently have any long-term supply contracts with catalyst manufacturers, but are seeking to enter into such arrangements. However, we cannot guarantee that we will be able to enter into long-term supply contracts on commercially reasonable terms or at all.

If theour estimated production and operating costs of our plants are higher than expected or our plant availability is lower than expected, our business and results of operations may be harmed.

We have not yet built and operated a commercial-scale facility employing our integrated process, and theas a result, our production costs are based on certain assumptions and costs estimates, including certain operating costs of suchour facilities. The operating costs of our facilities may be higher than we currently expect, due to labor costs, labor shortages or delays, costs of equipment, materials and supplies, maintenance costs, weather delays, inflation or other factors, which could be material. Significant unexpected increases in such costs will result in the need to obtain higher selling prices for our ethanol in order to be profitable. If the price of ethanol is below such levels, our results of operations would be harmed.

Other operating and maintenance costs, including fuel costs and downtime, may be significantly higher than we anticipate and plant availability will significantly impact our estimated operating costs per gallon. We currently expect that our process will generate enough electricity to fully supply each facility’s electrical usage requirements. If we are not able to generate sufficient electricity through our process, we will be required to purchase additional natural gas to generate electricity or additional electricity in order to operate our facilities, which could increase our operating costs and harm our results of operations. In addition, our facilities may not operate as efficiently asat the yields we expect and may experience unplanned downtime, which may be significant and could adversely affect our business and results of operations.

We are dependent on third parties to deliver MSW feedstock for use in our projects, and if the supply of feedstock is disrupted or delayed or does not meet our quality standards, or we are required to pay for our feedstock, our business may suffer.

In order to produce sufficient yields of ethanol to make our facilities economically viable, we will require large volumes of MSW feedstock. Though we have entered into long-term MSW feedstock supply agreements with waste companies to provide enough feedstock at zero cost to produce more than 700 million gallons of ethanol annually, at zero cost, deliveries by such companies may be disrupted due to weather, transportation or labor issues or other reasons outside of our control. If we do not have sufficient supplies of feedstock on hand, the volume of ethanol we can produce will be decreased. In addition, the MSW we require must meet certain quality standards with respect to the type of materials included in the MSW. If the MSW delivered by the waste companies regularly contains a high portion of unusable materials, we may not have sufficient supplies of usable feedstock on hand and the volume of ethanol we can produce will be decreased. Further, one of our supply agreements for Sierra provides that we are responsible for the transportation costs of delivering the feedstock to the facility, but that the supplier will pay us a tipping fee for the MSW feedstock that we accept. If transportation costs increase faster

16

Risk factors

than the tipping fees and we are not able to obtain zero-cost feedstock from another source, our production costs would increase and our results of operations may be harmed. In the future, we may also be required to pay for MSW feedstock, transportation fees and related costs. In addition, there can be no assurance that our current zero-cost providers will not breach their agreements with us if they are able to sell the MSW to another party, and we may not be able to find a suitable replacement for a given facility on a timely basis or at all. Our business may suffer as a result of any decreases in the volume of ethanol we can produce due to shortages of feedstock or an increase in the cost of our feedstock.

14

Risk factors

The growth of our business depends on locatingIf we are unable to locate and obtainingobtain site control of suitable locations for additional facilities.facilities, we may be unable to grow our business and our operating results may be harmed.

We seek sites for our facilities based on a number of factors, including the cost to obtain land for the facility, local permitting process, distance to waste processing facilities, distance to oil and gas refinery and blending facilities, access to utilities and existing infrastructure, available work force and local and state development incentives. Once we have identified a suitable site for a facility, purchasing or leasing the land requires us to negotiate with landowners and local government officials. These negotiations can take place over a long period of time, are not always successful and sometimes require economic concessions not in our original plans. In addition, our ability to obtain the site may be subject to competition from other industrial developers. If a competitor or other party obtains the site, or if we are unable to obtain adequate permits for the site, we could incur losses as a result of development costs for sites we do not develop, which we would have to write off. If we are unable to locate sites that meet our criteria, we may have to select sites that are less advantageous to us, and we may be unable to grow our business and our operating results may be harmed.

Our business model depends on our abilityIf we are unable to successfully scale up production capabilitycapacity at future facilities and develop, own and operate additional production facilities.facilities, we may not be able to decrease the cost of production per gallon, which could harm our results of operations and growth prospects.

Our long-term growth and business plan is dependent upon ourcontemplates that we will be able to significantly decreasingdecrease the cost of production per gallon of ethanol from what we expect to achieve at Sierra, based on achieving certain economies of scale by increasing the production capabilitycapacity at our future facilities. Sierra is expected to produce approximately 10 million gallons of ethanol per year and we expect that future facilities will be built at three times and eventually six times the scale of Sierra utilizingSierra. We expect to utilize the modular designimproved profitability and cash flows contemplated for such larger-scale facilities to help fund our future growth and development plans. In addition, though we have sufficient MSW feedstock currently under contract to produce more than 700 million gallons of our integrated process.advanced biofuel per year, to achieve such volumes, we will need to construct and operate approximately 15 production facilities, in addition to Sierra. Our ability to construct and operate such additional facilities will be dependent upon, among other things, the timing, amount and availability of equity capital and project financing for such additional facilities, as well as the timing of site control, permitting and construction of such facilities, and may not occur in a timely manner or at all. If the modular scale-up of our process and technology is unsuccessful or we are otherwise unable to increase our production capabilitiescapacity through the build-outconstruction and operation of additional facilities, we may not be able to decrease the cost of production per gallon, which willcould harm our results of operations and growth prospects.

Fluctuations in the price of and demand for ethanol and petroleum will impact our results of operations.

The market price of ethanol is volatile and can fluctuate significantly. The market price of ethanol is dependent upon many factors, including the supply of ethanol and the price of gasoline, which is in turn

17

Risk factors

dependent on the price of petroleum, which is highly volatile and difficult to forecast. In addition, there has been a substantial increase in ethanol production in recent years, and increases in the demand for ethanol may not be commensurate with increases in the supply of ethanol, thus leading to lower ethanol prices. Demand for ethanol could be impaired due to a number of factors, including regulatory developments and reduced U.S. gasoline consumption. Reduced gasoline consumption has occurred in the past and could occur in the future as a result of increased gasoline or oil prices. Fluctuations in the price of ethanol may cause our financial results to fluctuate significantly.

Changes in government regulations, including mandates, tax credits, subsidies and economicother incentives, could have a material adverse effect on demand for our ethanol,products, business and results of operations.

The market for renewable biofuels and energy is heavily influenced by foreign and U.S. federal, state and local government regulations and policies. ChangesAny reduction in, phasing out or elimination of existing tax credits, subsidies, mandates and other incentives in the United States and foreign markets for renewable fuels and renewable energy, or any inability of our customers to existingaccess such credits, subsidies, mandates and incentives, may adversely affect demand for or adoptionvalue of new domestic or foreign federal, state or local legislative initiatives that impact the production, distribution, sale or importour products, which would adversely affect our business and exportresults of renewable biofuels may harm our business.

15

Risk factors

operations.

For example, the Energy Independence and Security Act of 2007, or EISA, set targets for alternative sourced liquid transportation fuels (approximately 14 billion gallons in 2011, increasing to 36 billion gallons by 2022) as part of the Renewable Fuel Standards program.program, or RFS2. Of the 2022 target amount, a minimum of 21 billion gallons must be advanced biofuels which, as defined in EISA, is any renewable fuel, other than ethanol derived from cornstarch, having lifecycle greenhouse gas emissions that are at least 50 percent less than baseline greenhouse gas emissions.

Ethanol produced from The EPA recently set the mandated volumes for cellulosic components of separated MSW has been approved bybiofuel, advanced biofuel and total renewable fuel for 2012 as required under RFS2. Although the Environmental Protection Agency or, EPA, as an eligible form of ethanol for meetingtotal renewable fuel target, set at 15.2 billion gallons, and the advanced biofuel target, set at 2.0 billion gallons, match the targets set under the EISA in 2007, the cellulosic biofuel targets under EISA. Cellulosic biofuelstandard is one kind of advanced biofuel, and in 2022, a minimum of 16 billionset at 10.45 million gallons of cellulosic ethanol, a much lower target than the 21 billion500 million gallons of advanced biofuels blended into gasoline or diesel fuel must be cellulosic biofuels.

In addition, we and other companiesrequired in 2012 as mandated under the industry are petitioning the EPA for separate and additional confirmation that ethanol produced from any separated MSW (not just the cellulosic components) qualifies as an advanced biofuel for the purpose of meeting the advanced biofuel targets. There is no assurance at this time that we will obtain that confirmationEISA in a timely manner or at all, or that our facilities will be certified, however it is not necessary to be qualified as an advanced biofuel in order for the cellulosic fraction of our ethanol to earn cellulosic biofuel credits. We will need to register and receive producer and facility identification numbers, the receipt of which may be delayed.

We will also apply to the State of California to have our ethanol certified under California’s Low Carbon Fuel Standard, or LCFS, which would make our ethanol eligible for the carbon intensity reduction credits that will be available under this program for reducing the carbon intensity of California’s transportation fuels.

In the United States and in a number of other countries, these2007. The RFS2 regulations and policies have been modified in the past and may be modified again in the future. The elimination of or any reduction in mandated requirements for alternative fuels and additives to gasoline may cause demand for renewable biofuels to decline. However,decline, which would adversely affect our business and results of operations, and there is no assurance that this or any other favorable legislation will remain in place. For example,

In addition, certain state mandates require utilities to utilize specific amounts of renewable energy. Utilities can satisfy such requirements by producing renewable energy or by purchasing renewable energy credits, which represent the biodiesel tax credit expired in December 2009,property rights to the environmental, social, and its extension was not approved until March 2010other nonpower qualities of renewable electricity generation. Such mandates typically vary on a state by state basis, and only through December 31, 2011. The failuremay be subject to legislative and other governmental policy changes. Any elimination of our ethanol to qualify as advanced biofuel or to be certified under LCFS, any reduction in phasing out or elimination of existing tax credits, subsidies, mandates and other incentivesmandated requirements for renewable energy generation in the United Statesstates in which we have production facilities would reduce the value of the renewable energy credits generated by our facilities and foreign markets for renewable fuels, or any inabilitydecrease revenue from the sale of our customers to access such credits, subsidies, mandates and incentives, may adversely affect demand for our product, which would adversely affect our business. Any inability to address these requirements and any regulatory or policy changes could have a material adverse effect on our business financial condition and results of operations.

Conversely, government programs could increase investment and competition in the market for our ethanol. For example, various governments have recently announced a number of spending programs focused on the development of clean technology, including alternatives to petroleum-based fuels and the reduction of GHG emissions, which could lead to increased funding for our competitors or the rapid increase in the number of competitors within our market.

18

Risk factors

If our ethanol does not qualify as advanced biofuel, demand for our ethanol may be adversely affected, which would adversely affect our business.

We believe that our ethanol will qualify as advanced biofuel for purposes of meeting the advanced biofuel targets under RFS2. In order to qualify as advanced biofuel for such purposes, a company’s renewable fuel must use a feedstock that is deemed a renewable biomass by the Environmental Protection Agency, or EPA, it must not be derived from cornstarch (it is not corn-based ethanol) and it must reduce lifecycle GHG emissions by 50%. The EPA has determined that MSW, after reasonably practicable efforts to remove recyclable materials, qualifies as a renewable biomass. As we use MSW as our feedstock, our ethanol is not derived from cornstarch. Though we have obtained an independent analysis stating that our process is projected to provide a more than 75% reduction in GHG emissions compared to traditional gasoline production, thereby qualifying our ethanol as an advanced biofuel, we must petition the EPA for confirmation that ethanol produced from MSW, and our process for producing ethanol from MSW, qualifies as advanced biofuel. In addition, once such confirmation is obtained, we must also register with the EPA to obtain producer and facility identification numbers. There can be no assurances at this time that we will obtain that confirmation in a timely manner or at all. The failure of our ethanol to qualify as advanced biofuel may reduce the demand for or the price that we are able to obtain for our ethanol, which would adversely affect our business.

We intend to take advantage of state and local incentives for renewable biofuels, which may not be available.

We will also seek to take advantage of state and local incentives for renewable biofuels, including applying to the State of California to have our ethanol certified under California’s Low Carbon Fuel Standard, or LCFS, which would make our ethanol eligible for the carbon intensity reduction credits that will be available under this program for reducing the carbon intensity of California’s transportation fuels. The failure of our ethanol to be certified under LCFS may adversely affect demand for our ethanol in California, which would adversely affect our business and results of operations. In addition, this program has been challenged and a federal judge in California recently ruled that LCFS violates the U.S. constitution’s commerce clause and issued an injunction against its enforcement. It is too early to tell whether this California program, as well as other similar state programs intended to reduce carbon emissions and increase demand for renewable biofuels, will be upheld.

The price of renewable fuel credits may decline, reducingwhich could adversely affect our revenues.future results of operations.

The Renewable Fuel Standards program, or RFS2 assigns renewable fuel credits to each gallon of qualifying renewable fuel that is produced, including our products. Refiners and importers are required

16

Risk factors