Executive Vice President and Chief Legal Officer

Bloomin’ Brands, Inc.

2202 North West Shore Boulevard, Suite 500, Tampa, Florida 33607

(813) 282-1225

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Joseph J. Kadow

Executive Vice President and Chief Legal Officer

Bloomin’ Brands, Inc.

2202 North West Shore Boulevard, Suite 500, Tampa, Florida 33607

(813) 282-1225

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

John M. Gherlein Janet A. Spreen Baker & Hostetler LLP PNC Center 1900 East 9th Street Cleveland, Ohio 44114 Telephone: (216) 621-0200 Facsimile: (216) 696-0740 | Keith F. Higgins Marko S. Zatylny Ropes & Gray LLP Prudential Tower 800 Boylston Street Boston, Massachusetts 02199-3600 Telephone: (617) 951-7000 Facsimile: (617) 951-7050 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462 under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer x | Smaller reporting company ¨ |

CALCULATION OF REGISTRATION FEE

| ||||

| Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price (1)(2) | Amount of Registration Fee | ||

Common Stock, $.01 par value per share | $300,000,000 | $34,380 | ||

| ||||

| ||||

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Index to Financial Statements

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated April 6, 2012May 20, 2013

P R O S P E C T U S

17,000,000 Shares

Common Stock

This isThe selling stockholders identified in this prospectus are selling 17,000,000 shares of Bloomin’ Brands Inc.’s initial public offering.common stock. We arewill not receive any proceeds from the sale of shares by the selling sharesstockholders.

Our common stock is listed on the Nasdaq Global Select Market under the symbol “BLMN.” On May 17, 2013, the last sale price of our common stock.

We expectstock as reported on the public offering price to be between $ and $Nasdaq Global Select Market was $21.75 per share. Currently, no public market exists for the shares. After pricing of the offering, we expect that the shares will trade on the under the symbol “BLM.”

Investing in theour common stock involves risks that are described in the “Risk Factors”“Risk Factors” section beginning on page 13 of this prospectus.

Per Share | Total | |||||||||

Public offering price | $ | $ | ||||||||

Underwriting discount (1) | $ | $ | ||||||||

Proceeds, before expenses, to | $ | $ | ||||||||

| (1) | See “Underwriting” for additional compensation details. |

The underwriters may also exercise their option to purchase up to an additional 2,550,000 shares from us,certain of the selling stockholders at the public offering price, on the same terms and conditions as set forth above, for 30 days after the date of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The shares will be ready for delivery on or about , 2012.2013.

| BofA Merrill Lynch | Morgan Stanley | J.P. Morgan |

| Deutsche Bank Securities | Goldman, Sachs & Co. |

Jefferies

William Blair | Raymond James | Wells Fargo Securities | The Williams Capital Group, L.P. |

The date of this prospectus is , 2012.2013.

Index to Financial Statements

Index to Financial Statements

Index to Financial Statements

Index to Financial Statements

| Page No. | ||||

| 1 | ||||

| 9 | ||||

| 13 | ||||

| 34 | ||||

| 35 | ||||

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | ||||

MATERIAL U.S. FEDERAL INCOME AND ESTATE TAX CONSIDERATIONS FOR NON-U.S. HOLDERS | ||||

| F-1 | ||||

You should rely only on the information contained in this prospectus or in any free writing prospectus that we authorize be distributed to you. We have not, and the underwriters have not, authorized anyone to provide you with additional or different information. This document may only be used where it is legal to sell these securities. You should assume that the information contained in this prospectus is accurate only as of the date of this prospectus.

No action is being taken in any jurisdiction outside the United States to permit a public offering of the common stock or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of the prospectus applicable to that jurisdiction.

Until , 2012, all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealer’s obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

i

Index to Financial Statements

MARKET AND OTHER INDUSTRY DATA

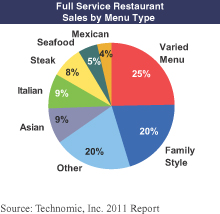

In this prospectus, we rely on and refer to information regarding the restaurant industry, sectors within the restaurant industry, such as full-service restaurants, and categories within the full-service sector that are generally defined by price point (e.g., casual or fine dining) and menu type (e.g., steak or Italian), based on information published by industry research firms Technomic, Inc., The NPD Group, Inc. (which prepares and disseminates Consumer Reported Eating Share Trends (“CREST®”) data), Euromonitor International and Knapp-Track, or compiled from market research reports, analyst reports and other publicly available information.International. Delineations of our competitors by price or menu categories may vary by data source.

Unless otherwise indicated in this prospectus:

market data relating to the U.S. market positions of Outback Steakhouse, Carrabba’s Italian Grill, Bonefish Grill or Fleming’s Prime Steakhouse and Wine Bar was published by, or derived by ustaken from Technomic, Inc.’s 2013 Top 500 Chain Restaurant Report and is based on 20112012 calendar year sales; and

market data relating to the size of the U.S. full-service restaurant sector’s menu categories of steak, Italian and seafood was published by Technomic, Inc. and is based on 2010 calendar year sales, which is the most recent available data;

|

market data relating to a foreign country’s full-service restaurant sector or the market position of Outback Steakhouse restaurants in a particular foreign market was published by, or was derived by us from, Euromonitor International, and such data is as of December 31, 2010, which is the most recent available data.2011.

All other industry and market data included in this prospectus are from internal analyses based upon publicly available data or other proprietary research and analysis. We believe these datathis information to be accurate as of the date of this prospectus. However, this information may prove to be inaccurate becausetrue and accurate; however, this information cannot always be verified with complete certainty because of the limitations on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties. As a result, you should be aware that market and other similar industry data included in this prospectus, and estimates and beliefs based on that data, may not be reliable.

TRADEMARKS, SERVICE MARKS AND COPYRIGHTS

We own or have rights to trademarks, service marks or trade names that we use in connection with the operation of our business, including our corporate names, logos and website names. Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this prospectus are listed without the©,©®,® and ™ symbols, but we will assert, to the fullest extent permissible under applicable law, our rights to our copyrights, trademarks, service marks and trade names. All brand names or other trademarks appearing in this prospectus are the property of their respective owners, and their use or display should not be construed to imply a relationship with, or an endorsement or a sponsorship of us by, these other parties.

ii

Index to Financial Statements

This summary highlights information appearing elsewhere in this prospectus. This summary does not contain all of the information that you should consider before investing in our common stock. You should carefully read the entire prospectus, including the financial data and related notes and the section entitled “Risk Factors”Factors,” before deciding whether to invest in our common stock. Unless otherwise indicated or the context otherwise requires, references in this prospectus to the “company,“Company,” “Bloomin’ Brands,” “we,” “us” and “our” refer to Bloomin’ Brands, Inc. and its consolidated subsidiaries.

Our Company

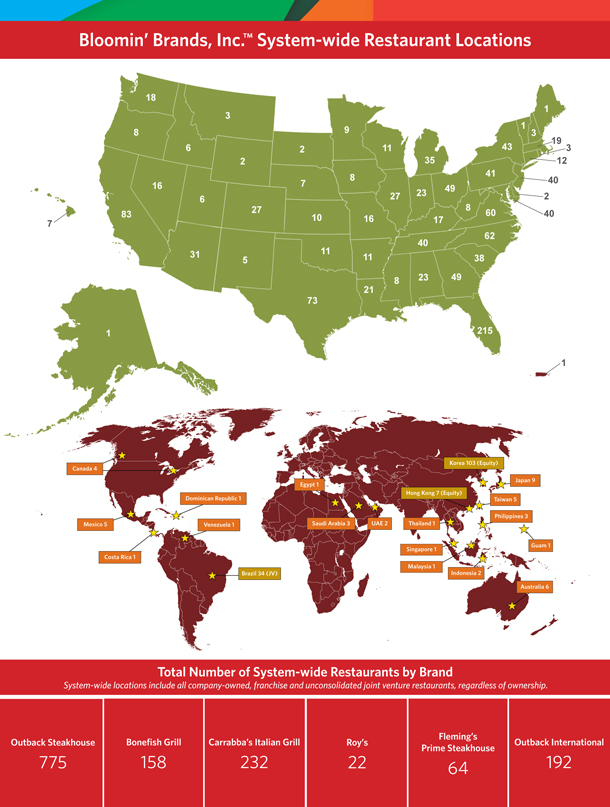

We are one of the largest casual dining restaurant companies in the world, with a portfolio of leading, differentiated restaurant concepts. We own and operate 1,2481,275 restaurants and have 195203 restaurants operating under franchise or joint venture arrangements across 4948 states, Puerto Rico, Guam and 21 countries and territories.19 countries. We have five founder-inspired concepts: Outback Steakhouse, Carrabba’s Italian Grill, Bonefish Grill, Fleming’s Prime Steakhouse and Wine Bar and Roy’s. Outback Steakhouse holds the #1 U.S. market position, and Carrabba’s and Bonefish Grill hold the #2 U.S. market position, in their respective full-service restaurant categories. Fleming’s is the fourth largest fine dining steakhouse brand in the U.S.

In 2010, we launched a new strategic plan and operating model, leveraging beststrengthened our management team and adapted practices from the consumer products and retail industries to complement our restaurant acumen and enhance our brand competitiveness.management, analytics and innovation. This new model keeps the customer at the center of our decision-making and focuses on continuous innovation and productivity to drive sustainable sales and profit growth. We have significantly strengthened our management team and implemented initiatives to accelerate innovation, improve analytics and increase productivity. We have made these changes while preserving our entrepreneurial culture at the operating level. Our restaurant managing partners are a key element of this culture, each of whom shares in the cash flows of his or her restaurant after making a required initial cash investment.

We believe our new strategic plan and operating modelSince 2010, we have driven our recentcontinued to balance near-term growth in market share gainswith investments to achieve sustainable growth. As a result of continued improvements in infrastructure and improved margins while providing a solid foundation for continuing salesorganizational effectiveness, in 2012 we grew average restaurant volumes and profit growth. In 2011, we had $3.8 billion of revenue, $100.0 million of net income and $361.5 million of Adjusted EBITDA. In the U.S., each of our four core concepts generated positive comparable restaurant sales over the last seven consecutive quarters, and in 2010 and 2011, our combined comparable restaurant sales at our core concepts grew 2.7% and 4.9%, respectively. Additionally, over the last two years,existing domestic Company-owned restaurants for our Outback Steakhouse, Carrabba’s andItalian Grill, Bonefish Grill have significantly outperformedand Fleming’s Prime Steakhouse and Wine Bar concepts, which we refer to as our core concepts. In addition, we improved our operating margins at the Knapp-Track Casual Dining Index on traffic growthrestaurant level (calculated as Restaurant sales after deduction of main restaurant-level operating costs, which are comprised of Cost of sales, Labor and other related costs and Other restaurant operating expenses) by 8.5%6.1% in 2012 as compared to 2011. Across our restaurant system, we opened 37 restaurants (22 domestic and 15 international), 11.2% and 20.2%, respectively. Overwe increased Total revenues by 3.8% in 2012.

For the three yearsmonths ended March 31, 2013 and the year ended December 31, 2011, our2012, we had $1.1 billion and $4.0 billion of Total revenues, $63.2 million and $50.0 million of Net income attributable to Bloomin’ Brands, Inc. and $63.2 million and $114.0 million of Adjusted net income increased from a net loss of $64.5 millionattributable to Bloomin’ Brands, Inc., respectively. Adjusted net income attributable to Bloomin’ Brands, Inc. is a non-GAAP measure. See note (5) of $100.0 million,“Summary Consolidated Financial and Adjusted EBITDA increased from $319.9 millionOther Data” for information about our use of this measure and a reconciliation of the differences between this measure and Net income attributable to $361.5 million. Over the same period, our Adjusted EBITDA margins grew from 8.9% to 9.4%.Bloomin’ Brands, Inc.

Our concepts seek to provide a compelling customer experience combining great food, highly attentive service and lively and contemporary ambience at attractive prices. EachOur ingredients are carefully selected to offer a high degree of freshness and quality and maintain the authenticity of our recipes, while keeping costs in line with our

target pricing. We believe each of our concepts maintains a unique, founder-inspired brand identity and entrepreneurial culture, while leveraging our scale and enhanced operating model. Below is an overview of our four core concepts:

| A casual dining steakhouse featuring high quality, freshly prepared food, attentive service and Australian dé |

Index to Financial Statements

| An authentic Italian casual dining restaurant featuring high quality handcrafted dishes, an exhibition kitchen and | ||

| A polished casual seafood restaurant featuring market fresh grilled fish, high-end yet approachable service and a lively bar. Bonefish Grill’s bar provides an energetic setting for drinks, dining and socializing with a | ||

| |||

Recent Evolution of Our Business

In November 2009, we hired Elizabeth A. Smith as Chief Executive Officer. Ms. Smith brought close to 20 years of consumer products experience, including five years as a senior executive at Avon Products, Inc. and 14 years at Kraft Foods Inc. Under Ms. Smith’s leadership, we launched our new strategic plan and operating model. The key initiatives we implemented as part of this plan and model, many of which are ongoing, are summarized below:

|

| |

Evolved our menus by supplementing our classic items with a greater variety of lighter dishes and lower priced items, such as small plates and handhelds, and enhanced bar and happy hour offerings to broaden appeal, improve our value perception and increase traffic.

Shifted our marketing strategy away from principally using brand awareness messages to traffic generating messages focused on quality, value and limited-time offers.

Initiated a remodel program focused on Outback Steakhouse and Carrabba’s to refresh the restaurant base, through which we have remodeled one-third of our domestic Outback Steakhouse restaurants to date; we are testing remodel designs at Carrabba’s.

Refocused our service to improve execution on aspects of the dining experience that matter most to our customers as indicated through ongoing customer surveys.

Index to Financial Statements

|

|

|

|

|

Competitive Strengths

We believe the following competitive strengths, when combined with our strategic plan and operating model, provide a platform to deliver sustainable sales and profit growth:

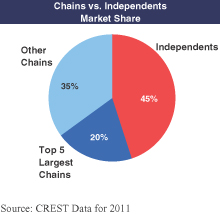

Strong Market Position With Highly Recognizable Brands. We have market leadership positions in each of our core concepts domestically, as well as in our core international markets. Based on 20112012 sales in the U.S., Outback Steakhouse ranked #1 in the full-service steak restaurant category, Carrabba’s Italian Grill ranked #2 in the full-service Italian restaurant category, Bonefish Grill ranked #2 in the full-service seafood restaurant category and Fleming’s Prime Steakhouse and Wine Bar is the fourth largest fine dining steakhouse brand. In 20102011, Outback Steakhouse ranked #1 in market share in Brazil among full-service restaurants and in South Korea among western full-service restaurant concepts. We believe our market leadership positions and scale will allow us to continue to gain market share in the fragmented restaurant industry.

Compelling 360-Degree Customer Experience. We believe we offer a compelling 360-degree customer experience with superioroutstanding value by providing great food, highly attentive service and lively and contemporary ambience at attractive prices. We believe our customer experience and value perception, are differentiating factors thatbased on the following elements, drive strong customer loyalty.loyalty:

| • | Great Food.We deliver consistently executed, freshly prepared meals using high quality ingredients. |

| • |

|

Index to Financial Statements

| • | Lively and Contemporary Ambience. |

| • | Attractive Prices. |

Diversified Portfolio With Global Presence. Our diversified portfolio of distinct concepts and global presence provide us with a broad growth platform to capture additional market share domestically and internationally. We are diversified by concept, category and geography as follows:

| • | By Concept and Category. We believe our concepts are differentiated relative to each other by category and to their respective key competitors. Our core concepts target three separate, large and highly fragmented menu categories of the full-service restaurant sector: steak, |

| • | By Geography. The system-wide sales of our international Outback Steakhouse restaurants |

Business Model Focused on Continuous Innovation and Productivity. Our business model keeps the customer at the center of our decision-making and focuses on innovation and productivity to drive sustainable sales and profit growth. We reinvest a portion of productivity savings in innovation to enable us to respond to continuously evolving consumer trends.

| • | Innovation. We have established an enterprise-wide innovation process to enhance every dimension of the customer experience. Cross-functional innovation teams collaborate |

| • | Productivity.Without compromising the customer experience, we continuously explore opportunities to increase productivity and reduce costs. Our cost-savings allow us to reinvest in innovation initiatives, |

Experienced Executive and Field Management Teams. Our organization maintains deep restaurant experience at the operating level coupled with a functional corporate support team that drives innovation, productivity and scale efficiencies. Our management team is led by our Chairman and Chief Executive Officer, Elizabeth A. Smith, and since she joined us in November 2009, we have further enhancedSmith. The other members of our senior leadership team by addinginclude executives from best-in-class consumer and retail companies. Our senior team possesses strongcompanies with experience in brand management, innovation and innovation expertise, which facilitates our focus on analytics and customer testing.analytics. This complements our field operating and management teams, who have deep experience operating our restaurants and in the restaurant industry. Our core concept presidents have been with us for an average of 20 years and have an average of 30 years of industry experience. Our regional field management team has an average of over 13 years of experience working with us at the managing partner level or above.

Index to Financial Statements

Our Growth Strategy

We believe there are significant opportunities to continuefocused on the following three strategies for continuing to drive sustainable sales and profit growth through the following three strategies:growth:

Grow Comparable Restaurant Sales.Building on the strong momentum of the business, weWe believe we have the following opportunities to continue to grow comparable restaurant sales:

| • | Remodel and Relocate Our Restaurants. In the near term, we are focused on continuing our |

| • | Continue to Improve Promotional Marketing to Drive Traffic. We plan to continue to improve our limited-time offers and multimedia marketing campaigns. By promoting continuously evolving |

| • | Expand Share of Occasions and Increase Frequency. We believe we have a strong market share of weekend dinner occasions and a significant opportunity to grow our share of other dining occasions across all concepts. |

| • | Continue Innovating New Menu Items and Categories. Our research and development, or R&D, team will seek to continue to introduce innovative menu items that we believe match evolving consumer preferences and broaden appeal. In addition to continuous menu enhancements, we periodically evaluate our menus at each of our concepts. For example, we are working on significant menu updates at Bonefish Grill and at Carrabba’s Italian Grill in connection with our revitalization plan. |

Pursue New Domestic and International Development With Strong Unit Level Economics.We believe that a substantial development opportunity remains for our concepts in the U.S. and internationally. We expect to open 30 company-ownedbetween 45 and five joint venture units55 system-wide locations in 20122013 and increase the pace thereafter. We expect that the mix of development thereafter.new units will be weighted approximately 60% to domestic restaurants in 2013, but will shift to a higher weight of international units as we continue to implement our international expansion plans.

| • | Pursue Domestic Development Focused on Bonefish Grill and Carrabba’ |

to six years. Bonefish Grill unit growth |

| • | Accelerate International Growth Focused on Outback Steakhouse.We believe we are well-positioned to continue to expand internationally beyond our |

Index to Financial Statements

Drive Margin Improvement.We believe that we have the opportunity to increase our margins through continued productivity and increased fixed-cost leverage as we grow comparable restaurant sales. We have developed a multi-year productivity plan that focuses on high value initiatives across four categories: labor, food cost, supply chain and restaurant facilities. This strategy is expected to yieldWe set a target for productivity and cost savings of $50.0 million annually for 2012 through 2014 and estimate that these initiatives allowed us to save approximately $50$59.0 million in 2012the aggregate in 2012. Our ability to achieve the targets and additionalour actual savings in future years.will depend on successful execution of identified initiatives, various economic factors, including commodity and labor costs, and other circumstances that impact our supply chain.

Our Challenges and Risk Factors

The restaurant industry continues to face many challenges due to the current economic environment. For example, the ongoing impacts of high unemployment, financial market volatility and unpredictability, the housing crisis, the so-called “sequester” and related governmental spending and budget matters, other national, regional and local regulatory and economic conditions, gasoline prices, reduced disposable consumer income and consumer confidence have had a negative effect on discretionary consumer spending. This has negatively affected customer traffic and comparable restaurant sales for us and throughout our industry thus far in 2013. We believe these factors and conditions, among other items, are creating a challenging sales environment in the casual dining sector for 2013. As these conditions persist, we will face increased pressure with respect to our pricing, traffic levels and commodity costs, which could negatively impact our business and results of operations.

We continue to have a significant amount of debt (approximately $1.5 billion as of March 31, 2013) and have pledged substantially all of our assets under certain of our loan arrangements. We believe that our leverage, as well as competition in our industry and economic conditions that impact customer spending and our costs, are among the challenges we face in continuing to implement our strategic plan.

Before you invest in our common stock, you should carefully consider all of the information in this prospectus, including matters set forth under the heading “Risk Factors.” Risks relating to our business include the following, among others:

we face significant competition for customers, real estate and employees that could affect our profit margins;

general economic factors and changes in consumer preference may adversely affect our performance;performance and growth plans;

our plans depend on initiatives designed to increase sales, reduce costs and improve the efficiency and effectiveness of our operations, and failure to achieve or sustain these plans could affect our performance adversely;

our failure to comply with governmental regulation, and the costs of compliance or non-compliance, could adversely affect our business;

changes in consumer perception of food safety, damage to our reputation or infringement of our intellectual property could harm our business; and

our substantial leverage could adversely affect our ability to raise additional capital to fund our operations.

Our History

Our predecessor, OSI Restaurant Partners, Inc., was incorporated in August 1987, and we opened our first Outback Steakhouse restaurant in 1988. We became a Delaware corporation in 1991 as part of a corporate reorganization completed in connection with our predecessor’s initial public offering.

BloominBloomin’ Brands, Inc., formerly known as Kangaroo Holdings, Inc., was incorporated in Delaware in October 2006 by an investor group comprised of funds advised by Bain Capital Partners, LLC and Catterton Management Company, LLC, who we collectively refer to as our “Sponsors,” and Chris T. Sullivan, Robert D. Basham and J. Timothy Gannon, who we collectively refer to as our Founders,“Founders,” and members of our management. On June 14, 2007, we acquired OSI Restaurant Partners, Inc. by means of a merger and related transactions, referred to in this prospectus as the Merger.“Merger.” At the time of the Merger, OSI Restaurant Partners, Inc. was converted into a Delaware limited liability company named OSI Restaurant Partners, LLC, or OSI.“OSI.” In connection with the Merger, we implemented a new ownership and financing arrangement for our owned restaurant properties, pursuant to which Private Restaurant Properties, LLC, or PRP,“PRP,” our indirect wholly-owned subsidiary, acquired 343 restaurant properties then owned by OSI and leased them back to subsidiaries of OSI. In March 2012, we refinanced the commercial mortgage-backed securities loan that we entered into in 2007 in connection with the Merger with a new $500.0 million commercial mortgage-backed loan. See Note 20 of our Notes to Consolidated Financial Statements. Following the refinancing, OSI remains our primary operating entity and New Private Restaurant Properties, LLC, another indirect wholly-owned subsidiary of ours, continues to lease 261 of our owned restaurant properties to an OSI subsidiaries.subsidiary.

In August and September 2012, we and certain of our stockholders sold a total of 18.4 million shares of our common stock in our initial public offering. Since that time, our shares of common stock have been listed on the Nasdaq Global Select Market under the symbol “BLMN.”

Index to Financial Statements

Our Sponsors and Founders

Upon completion of this offering, Bain Capital, LLCan investor group consisting of investment funds advised by our Sponsors and Catterton Management Company, LLC, which we refer to astwo of our Sponsors,Founders, Robert D. Basham and Chris T. Sullivan, will continue to hold a controlling interest in, us and will continue to have significant influence over, us and decisions made by stockholders, and they may have interests that differ from yours. This investor group is expected to collectively beneficially own an aggregate of 63.7% of our outstanding common stock (or 61.6% if the underwriters exercise their option to purchase additional shares from certain of the selling stockholders in full) upon completion of this offering, and will therefore continue to control a majority of the voting power of our outstanding common stock. See “Principal and Selling Stockholders” and “Risk Factors—Risks Related to this Offering and Our Common Stock.” We are a party to a stockholders agreement (the “Stockholders Agreement”), pursuant to which our Sponsors have the right, subject to certain conditions, to nominate up to three representatives to our Board of Directors and committees of our Board of Directors so long as they collectively own more than 3% of our outstanding common stock. See “Related Party Transactions—Arrangements With Our Investors.”

Certain of our Directors are affiliated with our Sponsors, which could result in conflicts of interest arising from the fiduciary duties owed to these various entities, business opportunities that may arise and the time and attention needed to fulfill these commitments. One of our Founders also serves as a Director and, due to his interests in certain transactions with us and our affiliates, he may also experience conflicts of interest. See “Related Party Transactions—Arrangements With Our Sponsors and Founders” and “Risk Factors—Risks Related to this Offering and Our Common Stock.”

Bain Capital Partners, LLC

Bain Capital LLC, whose affiliates include Bain Capital Partners, LLC (along with its associated investment funds, or Bain Capital,any successor to its investment management business, “Bain Capital”) is a global private investment firm that manages several pools of capital including private equity, venture capital, public equity, credit products and absolute return investments with approximately $60$70 billion in assets under management. Since its inception in 1984, Bain Capital has made private equity investments and add-on acquisitions in more than 300 companies in a variety of industries around the world, including such restaurant concepts as Domino’s Pizza, Dunkin’ Brands, Burger King and Skylark Company (Japan), and retail businesses including Toys “R” Us, AMC Entertainment, Michael’s Stores, Staples and Gymboree. Headquartered in Boston, Bain Capital has offices in New York, Palo Alto, Chicago, London, Melbourne, Munich, Hong Kong, Shanghai, Tokyo, and Mumbai.

Catterton Management Company, LLC

Catterton Management Company, LLC, or Catterton, is a leading private equity firm with a focus on providing equity capital in support of small to middle-market consumer companies that are positioned for attractive growth. Since its founding in 1989, Catterton has invested in approximately 80 companies and led equity investments totaling over $3.6 billion.companies. Presently, Catterton is actively managing more than $2.5 billion of equity capital focused on all sectors of the consumer industry.

Company Information

Our principal executive offices are located at 2202 North West Shore Boulevard, Suite 500, Tampa, Florida 33607, and our telephone number at that address is (813) 282-1225.282-1225 and our website address is www.bloominbrands.com. Our website and the information contained on or accessible through our website are not part of this prospectus.

Index to Financial Statements

The Offering

Common stock offered by | 17,000,000 shares |

|

immediately after completion of this offering

Option to purchase additional shares |

Use of proceeds | We |

Dividend policy | We do not currently pay cash dividends on our common stock and do not anticipate paying any dividends on our common stock in the foreseeable future. Any future determinations relating to our dividend policies will be made at the discretion of our |

Principal stockholders | Upon completion of this offering, an investor group consisting of investment funds |

Risk factors | You should read carefully the “Risk Factors” section of this prospectus for a discussion of factors that you should consider before deciding to invest in shares of our common stock. |

| “ |

The number of shares of our common stock to be outstanding after this offering excludes (1) outstanding options to purchase 11,863,378 shares of our common stock at a weighted average exercise price of $7.52 per share, of which options to purchase 5,673,525 shares were exercisable as of March 15, 2012, and (2) an additional shares of our common stock issuable pursuant to future awards under our 2012 Incentive Award Plan.

Index to Financial Statements

SUMMARY CONSOLIDATED FINANCIAL AND OTHER DATA

The following table sets forth our summary consolidated financial and other data as of the dates and for the periods indicated. The summary consolidated financial data as of December 31, 20102012 and December 31, 2011 and for each of the three years in the period ended December 31, 20112012 presented in this table have been derived from the audited consolidated financial statements included elsewhere in this prospectus. The summary consolidated balance sheet data as of December 31, 20092010 has been derived from our historical audited consolidated financial statements for that year, which are not included in this prospectus. The summary consolidated financial data as of March 31, 2013 and for the three months ended March 31, 2013 and 2012 have been derived from the unaudited interim consolidated financial statements included in this prospectus. The summary consolidated balance sheet data as of March 31, 2012 has been derived from our historical unaudited interim consolidated financial statements for that year, which are not included in this prospectus. The total number of system-wide restaurants in the following table is unaudited for all periods presented. Historical results are not necessarily indicative of the results to be expected for future periods.

This summary consolidated financial and other data should be read in conjunction with the disclosures set forth under “Capitalization,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Unaudited Pro Forma Consolidated Financial Statements” and the consolidated financial statements and the related notes thereto appearing elsewhere in this prospectus.

| Years Ended December 31, | ||||||||||||

| 2009 | 2010 | 2011 | ||||||||||

| ($ in thousands, except per share amounts) | ||||||||||||

Statement of Operations Data: | ||||||||||||

Revenues | ||||||||||||

Restaurant sales | $ | 3,573,760 | $ | 3,594,681 | $ | 3,803,252 | ||||||

Other revenues | 27,896 | 33,606 | 38,012 | |||||||||

|

|

|

|

|

| |||||||

Total revenues | 3,601,656 | 3,628,287 | 3,841,264 | |||||||||

|

|

|

|

|

| |||||||

Costs and expenses | ||||||||||||

Cost of sales | 1,184,074 | 1,152,028 | 1,226,098 | |||||||||

Labor and other related | 1,024,063 | 1,034,393 | 1,094,117 | |||||||||

Other restaurant operating | 849,696 | 864,183 | 890,004 | |||||||||

Depreciation and amortization | 186,074 | 156,267 | 153,689 | |||||||||

General and administrative (1) | 252,298 | 252,793 | 291,124 | |||||||||

Recovery of note receivable from affiliated entity (2) | — | — | (33,150 | ) | ||||||||

Loss on contingent debt guarantee | 24,500 | — | — | |||||||||

Goodwill impairment | 58,149 | — | — | |||||||||

Provision for impaired assets and restaurant closings (3) | 134,285 | 5,204 | 14,039 | |||||||||

Income from operations of unconsolidated affiliates | (2,196 | ) | (5,492 | ) | (8,109 | ) | ||||||

|

|

|

|

|

| |||||||

Total costs and expenses | 3,710,943 | 3,459,376 | 3,627,812 | |||||||||

|

|

|

|

|

| |||||||

Income (loss) from operations | (109,287 | ) | 168,911 | 213,452 | ||||||||

Gain on extinguishment of debt (4) | 158,061 | — | — | |||||||||

Other income (expense), net | (199 | ) | 2,993 | 830 | ||||||||

Interest expense, net | (115,880 | ) | (91,428 | ) | (83,387 | ) | ||||||

|

|

|

|

|

| |||||||

Income (loss) before provision (benefit) for income taxes | (67,305 | ) | 80,476 | 130,895 | ||||||||

Provision (benefit) for income taxes | (2,462 | ) | 21,300 | 21,716 | ||||||||

|

|

|

|

|

| |||||||

Net income (loss) | (64,843 | ) | 59,176 | 109,179 | ||||||||

Less: net income (loss) attributable to noncontrolling interests | (380 | ) | 6,208 | 9,174 | ||||||||

|

|

|

|

|

| |||||||

Net income (loss) attributable to Bloomin’ Brands, Inc. | $ | (64,463 | ) | $ | 52,968 | $ | 100,005 | |||||

|

|

|

|

|

| |||||||

Basic net income (loss) per share (5) | $ | (0.62 | ) | $ | 0.50 | $ | 0.94 | |||||

Diluted net income (loss) per share (5) | $ | (0.62 | ) | $ | 0.50 | $ | 0.94 | |||||

Weighted average shares outstanding | ||||||||||||

Basic | 104,442 | 105,968 | 106,224 | |||||||||

Diluted | 104,442 | 105,968 | 106,689 | |||||||||

| Years Ended December 31, | Three Months Ended March 31, | |||||||||||||||||||

| 2012 | 2011 | 2010 | 2013 | 2012 | ||||||||||||||||

| (unaudited) | (unaudited) | |||||||||||||||||||

| (in thousands) | ||||||||||||||||||||

Statements of Operations Data: | ||||||||||||||||||||

Revenues | ||||||||||||||||||||

Restaurant sales | $ | 3,946,116 | $ | 3,803,252 | $ | 3,594,681 | $ | 1,082,356 | $ | 1,045,466 | ||||||||||

Other revenues | 41,679 | 38,012 | 33,606 | 9,894 | 10,160 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total revenues | 3,987,795 | 3,841,264 | 3,628,287 | 1,092,250 | 1,055,626 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Costs and expenses | ||||||||||||||||||||

Cost of sales | 1,281,002 | 1,226,098 | 1,152,028 | 349,989 | 335,859 | |||||||||||||||

Labor and other related | 1,117,624 | 1,094,117 | 1,034,393 | 299,867 | 293,501 | |||||||||||||||

Other restaurant operating | 918,522 | 890,004 | 864,183 | 233,809 | 218,965 | |||||||||||||||

Depreciation and amortization | 155,482 | 153,689 | 156,267 | 40,196 | 38,860 | |||||||||||||||

General and administrative (1)(2) | 326,473 | 291,124 | 252,793 | 72,491 | 76,002 | |||||||||||||||

Recovery of note receivable from affiliated entity (3) | — | (33,150 | ) | — | — | — | ||||||||||||||

Provision for impaired assets and restaurant closings | 13,005 | 14,039 | 5,204 | 1,896 | 4,435 | |||||||||||||||

Income from operations of unconsolidated affiliates | (5,450 | ) | (8,109 | ) | (5,492 | ) | (2,858 | ) | (2,404 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total costs and expenses | 3,806,658 | 3,627,812 | 3,459,376 | 995,390 | 965,218 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Income from operations | 181,137 | 213,452 | 168,911 | 96,860 | 90,408 | |||||||||||||||

Loss on extinguishment and modification of debt (4) | (20,957 | ) | — | — | — | (2,851 | ) | |||||||||||||

Other (expense) income, net | (128 | ) | 830 | 2,993 | (217 | ) | 54 | |||||||||||||

Interest expense, net (4) | (86,642 | ) | (83,387 | ) | (91,428 | ) | (20,880 | ) | (20,974 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Income before provision for income taxes | 73,410 | 130,895 | 80,476 | 75,763 | 66,637 | |||||||||||||||

Provision for income taxes | 12,106 | 21,716 | 21,300 | 10,707 | 12,805 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net income | 61,304 | 109,179 | 59,176 | 65,056 | 53,832 | |||||||||||||||

Less: net income attributable to noncontrolling interests | 11,333 | 9,174 | 6,208 | 1,833 | 3,833 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net income attributable to Bloomin’ Brands, Inc. | $ | 49,971 | $ | 100,005 | $ | 52,968 | $ | 63,223 | $ | 49,999 | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Index to Financial Statements

| Years Ended December 31, | ||||||||||||

| 2009 | 2010 | 2011 | ||||||||||

| ($ in thousands) | ||||||||||||

Statement of Cash Flows Data: | ||||||||||||

Net cash provided by (used in): | ||||||||||||

Operating activities | $ | 195,537 | $ | 275,154 | $ | 322,450 | ||||||

Investing activities | (39,171 | ) | (71,721 | ) | (113,142 | ) | ||||||

Financing activities | (137,397 | ) | (167,315 | ) | (89,300 | ) | ||||||

Other Financial and Operating Data: | ||||||||||||

Number of system-wide restaurants at end of period | 1,477 | 1,439 | 1,443 | |||||||||

Comparable domestic restaurant sales (6) | (8.6 | )% | 2.7 | % | 4.9 | % | ||||||

Capital expenditures | $ | 57,528 | $ | 60,476 | $ | 120,906 | ||||||

Adjusted EBITDA (7) | 319,925 | 338,898 | 361,478 | |||||||||

Adjusted EBITDA margin (7) | 8.9 | % | 9.3 | % | 9.4 | % | ||||||

Balance Sheet Data (at period end, 2009 unaudited): | ||||||||||||

Cash and cash equivalents | $ | 330,957 | $ | 365,536 | $ | 482,084 | ||||||

Net working capital (deficit) (8) | (187,648 | ) | (120,135 | ) | (248,145 | ) | ||||||

Total assets | 3,340,708 | 3,243,411 | 3,353,936 | |||||||||

Total debt (4)(9) | 2,302,233 | 2,171,524 | 2,109,290 | |||||||||

Total shareholders’ (deficit) equity | (116,625 | ) | (55,911 | ) | 40,297 | |||||||

Pro Forma Balance Sheet Data (9): | ||||||||||||

Cash and cash equivalents | $ | |||||||||||

Net working capital (deficit) | $ | |||||||||||

Total assets | $ | |||||||||||

Total debt | $ | |||||||||||

Total shareholders’ equity | $ | |||||||||||

| Years Ended December 31, | Three Months Ended March 31, | |||||||||||||||||||

| 2012 | 2011 | 2010 | 2013 | 2012 | ||||||||||||||||

| (unaudited) | (unaudited) | |||||||||||||||||||

| (in thousands, except per share amounts) | ||||||||||||||||||||

Basic earnings per share | $ | 0.45 | $ | 0.94 | $ | 0.50 | $ | 0.52 | $ | 0.47 | ||||||||||

Diluted earnings per share | 0.44 | 0.94 | 0.50 | 0.50 | 0.47 | |||||||||||||||

Weighted average shares outstanding | ||||||||||||||||||||

Basic | 111,999 | 106,224 | 105,968 | 121,238 | 106,332 | |||||||||||||||

Diluted | 114,821 | 106,689 | 105,968 | 126,507 | 107,058 | |||||||||||||||

Pro forma diluted weighted average common shares outstanding (5) | 123,505 | 120,886 | 120,165 | 126,507 | 121,255 | |||||||||||||||

Statement of Cash Flows Data: | ||||||||||||||||||||

Net cash provided by (used in): | ||||||||||||||||||||

Operating activities | $ | 340,091 | $ | 322,450 | $ | 275,154 | $ | 18,100 | $ | 2,096 | ||||||||||

Investing activities | 19,944 | (113,142 | ) | (71,721 | ) | (38,394 | ) | 155,820 | ||||||||||||

Financing activities | (586,219 | ) | (89,300 | ) | (167,315 | ) | (21,226 | ) | (306,404 | ) | ||||||||||

Other Financial and Operating Data: | ||||||||||||||||||||

Number of system-wide restaurants at end of period | 1,471 | 1,443 | 1,439 | 1,478 | 1,442 | |||||||||||||||

Comparable domestic restaurant sales (6) | 3.7 | % | 4.9 | % | 2.7 | % | 1.6 | % | 5.2 | % | ||||||||||

Capital expenditures | $ | 178,720 | $ | 120,906 | $ | 60,476 | $ | 40,950 | $ | 34,019 | ||||||||||

Adjusted income from operations (5) | 236,908 | 197,255 | 179,618 | 96,860 | 99,495 | |||||||||||||||

Adjusted net income attributable to Bloomin’ Brands, Inc. (5) | 114,038 | 86,497 | 60,838 | 63,223 | 59,646 | |||||||||||||||

Adjusted diluted earnings per share (5) | 0.99 | 0.81 | 0.57 | 0.50 | 0.56 | |||||||||||||||

Adjusted diluted earnings per pro forma share (5) | 0.92 | 0.72 | 0.51 | 0.50 | 0.49 | |||||||||||||||

Balance Sheet Data: | ||||||||||||||||||||

Cash and cash equivalents (7) | $ | 261,690 | $ | 482,084 | $ | 365,536 | $ | 217,469 | $ | 335,059 | ||||||||||

Net working capital (deficit) (4)(8) | (203,566 | ) | (248,145 | ) | (120,135 | ) | (146,838 | ) | (29,981 | ) | ||||||||||

Total assets | 3,016,553 | 3,353,936 | 3,243,411 | 2,954,393 | 3,037,222 | |||||||||||||||

Total debt, net (4) | 1,494,440 | 2,109,290 | 2,171,524 | 1,464,861 | 1,825,153 | |||||||||||||||

Total stockholders’ equity (deficit) (9) | 220,205 | 40,297 | (55,911 | ) | 298,739 | 95,124 | ||||||||||||||

| (1) | Includes management fees and out-of-pocket and other reimbursable expenses paid to a management company owned by our Sponsors and Founders of |

| (2) |

| (3) | During 2011, we |

During |

| As a result of these transactions, we recorded a loss from the |

| 2012. In March |

Index to Financial Statements

Adjusted EBITDA does not reflect our capital expenditures or future requirements for capital expenditures;

Adjusted EBITDA does not reflect the cost of stock-based compensation;

Adjusted EBITDA does not reflect the interest expense, or the cash requirements necessary to service interest or principal payments, associated with our indebtedness;

Adjusted EBITDA does not reflect depreciation and amortization, which are non-cash charges, although the assets being depreciated and amortized will likely have to be replaced in the future, and it does not reflect cash requirements for such replacements; and

Adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs.

Index to Financial Statements

| Years Ended December 31, | ||||||||||||

| 2009 | 2010 | 2011 | ||||||||||

| (in thousands) | ||||||||||||

Net income (loss) attributable to Bloomin’ Brands, Inc. | $ | (64,463 | ) | $ | 52,968 | $ | 100,005 | |||||

(Benefit) provision for income taxes | (2,462 | ) | 21,300 | 21,716 | ||||||||

Interest expense, net | 115,880 | 91,428 | 83,387 | |||||||||

Depreciation and amortization | 186,074 | 156,267 | 153,689 | |||||||||

|

|

|

|

|

| |||||||

EBITDA | $ | 235,029 | $ | 321,963 | $ | 358,797 | ||||||

|

|

|

|

|

| |||||||

Impairments and disposals | 192,572 | 4,915 | 15,062 | |||||||||

Stock-based compensation expense | 15,215 | 3,146 | 3,907 | |||||||||

Other losses (gains) | 884 | (1,833 | ) | (90 | ) | |||||||

Deal-related expenses (a) | — | 1,157 | 7,582 | |||||||||

Management fees and expenses | 9,786 | 9,550 | 9,370 | |||||||||

Gain on extinguishment of debt | (158,061 | ) | — | — | ||||||||

Unusual loss (gain) (b) | 24,500 | — | (33,150 | ) | ||||||||

|

|

|

|

|

| |||||||

Adjusted EBITDA | $ | 319,925 | $ | 338,898 | $ | 361,478 | ||||||

|

|

|

|

|

| |||||||

| (5) | In addition to the results provided in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”), we have provided non-GAAP measures that present operating results in 2012, 2011 and 2010 and for the three months ended March 31, 2013 and 2012 on an adjusted and/or pro forma basis. These are supplemental measures of performance that are not required by or presented in accordance with U.S. GAAP. They are not measurements of our operating or financial performance under U.S. GAAP and should not be considered as an alternative to Income from operations, Net income attributable to Bloomin’ Brands, Inc., Diluted earnings per share or any other performance measures derived in accordance with U.S. GAAP. |

| We provide these adjusted operating results because we believe they are useful for investors to assess the operating performance of our business without the effect of certain charges. For the periods presented, these charges include transaction-related expenses primarily attributable to costs incurred in connection with the initial public offering, the refinancing of debt and other deal costs, management fees paid to the management company associated with our Sponsors and Founders, loss on the extinguishment and modification of debt, collection of a promissory note and other amounts in connection with the 2009 sale of one of our restaurant concepts and the tax effect of these items. Pro forma amounts give effect to the issuance of the shares in the initial public offering as if they were all outstanding on January 1, 2010. The use of these measures permits a comparative assessment of our operating performance relative to our performance based on U.S. GAAP results, while isolating the effects of certain items that vary from period to period without correlation to core operating performance or that vary widely among similar companies. However, our inclusion of these adjusted measures should not be construed as an inference that our future results will be unaffected by excluded or unusual items or that the items for which we have made adjustments are unusual or infrequent. In the future, we may incur expenses or generate income similar to the adjusted items. We further believe that the disclosure of these non-GAAP measures is useful to investors as they form the basis for how our management team and Board of Directors evaluate our performance including for achievement of objectives under our cash and equity compensation plans. By disclosing these non-GAAP measures, we believe that we provide investors a greater understanding of, and an enhanced level of transparency into, the means by which our management team operates our business. |

| The following table reconciles Adjusted income from operations, Adjusted net income attributable to Bloomin’ Brands, Inc., Adjusted diluted earnings per share and Adjusted diluted earnings per pro forma share for the years ended December 31, 2012, 2011 and 2010 and the three months ended March 31, 2013 and 2012 to their respective most comparable GAAP measures: |

| Years Ended December 31, | Three Months Ended March 31, | |||||||||||||||||||

| 2012 | 2011 | 2010 | 2013 | 2012 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

Income from operations | $ | 181,137 | $ | 213,452 | $ | 168,911 | $ | 96,860 | $ | 90,408 | ||||||||||

Transaction-related expenses (a) | 45,495 | 7,583 | 1,157 | — | 6,761 | |||||||||||||||

Management fees and expenses (b) | 13,776 | 9,370 | 9,550 | — | 2,326 | |||||||||||||||

Other gains (c) | (3,500 | ) | (33,150 | ) | — | — | — | |||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Adjusted income from operations | $ | 236,908 | $ | 197,255 | $ | 179,618 | $ | 96,860 | $ | 99,495 | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net income attributable to Bloomin’ Brands, Inc. | $ | 49,971 | $ | 100,005 | $ | 52,968 | $ | 63,223 | $ | 49,999 | ||||||||||

Transaction-related expenses (a) | 45,495 | 7,583 | 1,157 | — | 6,761 | |||||||||||||||

Management fees and expenses (b) | 13,776 | 9,370 | 9,550 | — | 2,326 | |||||||||||||||

Other gains (c) | (3,500 | ) | (33,150 | ) | — | — | — | |||||||||||||

Loss on extinguishment and modification of debt (d) | 20,956 | — | — | — | 2,851 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total adjustments, before income taxes | 76,727 | (16,197 | ) | 10,707 | — | 11,938 | ||||||||||||||

| Years Ended December 31, | Three Months Ended March 31, | |||||||||||||||||||

| 2012 | 2011 | 2010 | 2013 | 2012 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

Income tax effect of adjustments (e) | (12,660 | ) | 2,689 | (2,837 | ) | — | (2,291 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net adjustments | 64,067 | (13,508 | ) | 7,870 | — | 9,647 | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Adjusted net income attributable to Bloomin’ Brands, Inc. | $ | 114,038 | $ | 86,497 | $ | 60,838 | $ | 63,223 | $ | 59,646 | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Diluted earnings per share | $ | 0.44 | $ | 0.94 | $ | 0.50 | $ | 0.50 | $ | 0.47 | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Adjusted diluted earnings per share | $ | 0.99 | $ | 0.81 | $ | 0.57 | $ | 0.50 | $ | 0.56 | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Adjusted diluted earnings per pro forma share (f) | $ | 0.92 | $ | 0.72 | $ | 0.51 | $ | 0.50 | $ | 0.49 | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Diluted weighted average shares outstanding | 114,821 | 106,689 | 105,968 | 126,507 | 107,058 | |||||||||||||||

Pro forma initial public offering adjustment (f) | 8,684 | 14,197 | 14,197 | — | 14,197 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Pro forma diluted weighted average common shares outstanding (f) | 123,505 | 120,886 | 120,165 | 126,507 | 121,255 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

| (a) | Transaction-related expenses primarily relate to costs incurred in association with the initial public offering, the refinancing of debt and other deal costs. Refer to note (2) above for additional detail regarding 2012 transaction-related expenses. |

| Represents management fees and out-of-pocket and certain other reimbursable expenses paid to |

| (c) | During 2012, we recorded a gain associated with the collection of the promissory note and other amounts in connection with |

| (d) | Loss on extinguishment and modification of debt is related to the refinancing of OSI’s senior secured credit facilities in the fourth quarter of 2012, the CMBS refinancing completed in the first quarter of 2012 and the retirement of OSI’s senior notes in the third quarter of 2012. Refer to note (4) above for additional detail regarding these refinancing transactions. |

| (e) | Income tax effect of adjustments for the years ended December 31, 2012, 2011 and 2010 were calculated using our full-year effective tax rates of 16.5%, 16.6% and 26.5%, respectively. Income tax effect of adjustments for the three months ended March 31, 2012 were calculated using our projected full-year effective tax rate of 19.2%. |

| (f) | Gives pro forma effect to the issuance of shares in our initial public offering as if |

| (6) | Represents combined comparable restaurant sales of our core domestic Company-owned restaurants open 18 months or more. |

| (7) | Excludes restricted cash. |

| (8) | We have, and in the future may continue to have, negative working capital balances (as is common for many restaurant companies). We operate successfully with negative working capital because cash collected on restaurant sales is typically received before payment is due on our current liabilities, and our inventory turnover rates require relatively low investment in inventories. Additionally, ongoing cash flows from restaurant operations and gift card sales are used to service debt obligations and for capital expenditures. |

| (9) | On August 13, 2012, we completed an initial public offering in which (i) we issued and sold an aggregate of 14,196,845 shares of common stock (including 1,196,845 shares sold pursuant to an underwriters’ option to purchase additional shares) at a price to the public of $11.00 per share for aggregate gross offering proceeds of $156.2 million and (ii) certain of our stockholders sold 4,196,845 shares of our common stock (including 1,196,845 shares pursuant to the underwriters’ option to purchase additional shares) at a price to the public of $11.00 per share for aggregate gross offering proceeds of $46.2 million. We received net proceeds in the offering of approximately $142.2 million after deducting underwriting discounts and commissions of approximately $9.4 million on our sale of shares and $4.6 million of offering related expenses payable by us. We did not receive any proceeds from the sale of shares of common stock by the selling stockholders. All of the net proceeds, together with cash on hand, were applied to the retirement of OSI’s outstanding senior notes. |

Index to Financial Statements

An investment in our common stock involves various risks. You should carefully consider the following risks and all of the other information contained in this prospectus before investing in our common stock. The risks described below are those that we believe are the material risks that we face. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment in our common stock.

Risks Related to Our Business and Industry

We face significant competition for customers, real estate and employees and competitive pressure to adapt to changes in conditions driving customer traffic. Our inability to compete effectively may affect our traffic, sales and profit margins, which could adversely affect our business, financial condition and results of operations.

The restaurant industry is intensely competitive with a substantial number of restaurant operators that compete directly and indirectly with us in respect to price, service, location and food quality, and there are other well-established competitors with significant financial and other resources. There is also active competition for management personnel as well as attractive suitable real estate sites. Consumer tastes, nutritional and dietary trends, traffic patterns and the type, number and location of competing restaurants often affect the restaurant business, and our competitors may react more efficiently and effectively to those conditions. Further, we face growing competition from the supermarket industry, with the improvement of their “convenient meals” in the deli section,and prepared food sections, and from quick service and fast casual restaurants, as a result of higher-quality food and beverage offerings by those restaurants. If we are unable to continue to compete effectively, our traffic, sales and margins could decline and our business, financial condition and results of operations would be adversely affected.

Challenging economic conditions may have a negative effect on our cash flowsbusiness and financial results through lower consumer confidence and discretionary spending, availability and cost of credit, foreign currency exchange rates and other items.

Challenging economic conditions may negatively impact consumer confidence and discretionary spending and thus cause a decline in our cash flowflows from operations. For example, during the economic downturn starting in 2008, continuing disruptions in the overall economy, including the ongoing impacts of the housing crisis, high unemployment, and financial market volatility and unpredictability, caused athe housing crisis, the so-called “sequester” and related reduction in consumer confidence, which negatively affected customer trafficgovernmental spending and sales throughout our industry. These factors, as well asbudget matters, other national, regional and local regulatory and economic conditions, gasoline prices, reduced disposable consumer income and consumer confidence affecthave had a negative effect on discretionary consumer spending. This has negatively affected customer traffic and comparable restaurant sales for us and throughout our industry thus far in 2013. We believe these factors and conditions, among other items, are creating a challenging sales environment in the casual dining sector for 2013. If challenging economic conditions persist for an extended period of time or worsen, consumers might make long-lasting changes to their discretionary spending behavior, including dining out less frequently. The ability of the U.S. economy to continue to recover from these challenging economic conditions is likely to be affected by many national and international factors that are beyond our control, including current economic trends in Europe. Continued weakness in or a further worsening of the economy, generally or in a number of our markets, and our customers’ reactions to these trends could adversely affectresult in increased pressure with respect to our pricing, traffic levels and commodity costs and to continue our innovation and productivity initiatives, which could negatively impact our business and results of operations. These factors could also cause us to, among other things, reduce the number and frequency of new restaurant openings, close restaurants or delay remodeling of our existing restaurant locations.

In addition, as noted in our other risk factors, our high degree of leverage could increase our vulnerability to general economic and industry conditions and require that a substantial portion of cash flow from operations be dedicated to the payment of principal and interest on our indebtedness. Further, the availability of

credit already arranged for under our revolving credit facilities and the cost and availability of future credit may be adversely impacted by economic challenges. Foreign currency exchange rates for the countries in which we operate may decline. In addition, we may experience interruptions in supplies and other services from our third-party vendors as a result of market conditions. These disruptions in the economy are beyond our control, and there is no guarantee that any government response will restore consumer confidence, stabilize the economy or increase the availability of credit.

Index to Financial Statements

Loss of key management personnel could hurt our business and inhibit our ability to operate and grow successfully.

Our success will continue to depend, to a significant extent, on our leadership team and other key management personnel. If we are unable to attract and retain sufficiently experienced and capable management personnel, our business and financial results may suffer. If members of our leadership team or other key management personnel leave, we may have difficulty replacing them, and our business may suffer. There can be no assurance that we will be able to successfully attract and retain our leadership team and other key management personnel that we need.

Risks associated with our expansion and relocation plans may have adverse effects on our ability to increase revenues.

As part of our business strategy, we intend to continue to expand our current portfolio of restaurants. Current development schedules call for the construction of between 45 and 55 new system-wide locations in 2013 and we expect to increase the pace thereafter. We also plan to accelerate our restaurant relocation plan, primarily related to our Outback Steakhouse brand, beginning with the relocation of approximately 10 to 20 restaurants in 2013. A variety of factors could cause the actual results and outcome of those expansion and relocation plans to differ from the anticipated results, including among other things:

our ability to generate sufficient funds from operations or to obtain acceptable financing to support our development;

the availability of attractive sites for new restaurants and the ability to acquire or lease appropriate real estate at those sites at acceptable prices;

our ability to obtain all required governmental permits, including zoning approvals and liquor licenses, on a timely basis;

the impact of moratoriums or approval processes of state, local or foreign governments, which could result in significant delays;

our ability to obtain all necessary contractors and sub-contractors;

union activities such as picketing and hand billing, which could delay construction;

our ability to negotiate suitable lease terms;

our ability to recruit and train skilled management and restaurant employees;

our ability to receive the premises from the landlord’s developer without any delays;

weather, natural disasters and disasters beyond our control resulting in construction delays; and

consumer tastes in new geographic regions and acceptance of our restaurant concepts.

Some of our new restaurants may take several months to reach planned operating levels due to lack of market awareness, start-up costs and other factors typically associated with new restaurants. There is also the possibility that new restaurants may attract customers away from other restaurants we own, thereby reducing the revenues of those existing restaurants or that we may lose customers due to relocation.

Development rates for each concept may differ significantly. The development of each concept may not be as successful as our experience in the past. It is difficult to estimate the performance of newly opened or relocated restaurants. Earnings achieved to date by restaurants open for less than two years may not be indicative of future operating results. Should enough of these new restaurants not meet targeted performance, it could have a material adverse effect on our operating results.

We could face labor shortages that could slow our growth and adversely impact our ability to operate our restaurants.

Our success depends in part upon our ability to attract, motivate and retain a sufficient number of qualified employees, including managing partners, restaurant managers, kitchen staff and servers, necessary to keep pace with our anticipated expansion schedule and meet the needs of our existing restaurants. A sufficient number of qualified individuals of the requisite caliber to fill these positions may be in short supply in some communities. Competition in these communities for qualified staff could require us to pay higher wages and provide greater benefits. Any inability to recruit and retain qualified individuals may also delay the planned openings of new restaurants and could adversely impact our existing restaurants. Any such inability to retain or recruit qualified employees, increased costs of attracting qualified employees or delays in restaurant openings could adversely affect our business and results of operations.

Risks associated with our expansion plans may have adverse effects on our ability to increase revenues.

As part of our business strategy, we intend to continue to expand our current portfolio of restaurants. Current development schedules call for the construction of approximately 30 or more new restaurants in 2012. A variety of factors could cause the actual results and outcome of those expansion plans to differ from the anticipated results, including among other things:

the availability of attractive sites for new restaurants and the ability to obtain appropriate real estate at those sites at acceptable prices;

the ability to obtain all required governmental permits, including zoning approvals and liquor licenses, on a timely basis;

the impact of moratoriums or approval processes of state, local or foreign governments, which could result in significant delays;

the ability to obtain all necessary contractors and sub-contractors;

union activities such as picketing and hand billing, which could delay construction;

the ability to negotiate suitable lease terms;

the ability to recruit and train skilled management and restaurant employees;

the ability to receive the premises from the landlord’s developer without any delays; and

weather, natural disasters and disasters beyond our control resulting in construction delays.

Some of our new restaurants may take several months to reach planned operating levels due to lack of market awareness, start-up costs and other factors typically associated with new restaurants. There is also the possibility that new restaurants may attract customers away from other restaurants we own, thereby reducing the revenues of those existing restaurants.

Index to Financial Statements

Development rates for each concept may differ significantly. The development of each concept may not be as successful as our experience in the past. It is difficult to estimate the performance of newly opened restaurants. Earnings achieved to date by restaurants open for less than two years may not be indicative of future operating results. Should enough of these new restaurants not meet targeted performance, it could have a material adverse effect on our operating results.

Our business is subject to seasonal fluctuations and past results are not indicative of future results.

Historically, customer spending patterns for our established restaurants are generally highest in the first quarter of the year and lowest in the third quarter of the year. Additionally, holidays may affect sales volumes seasonally in some of the markets in which we operate. Our quarterly results have been and will continue to be affected by the timing of new restaurant openings and their associated pre-opening costs, as well as restaurant closures and exit-related costs and impairments of goodwill, intangible assets and property, fixtures and equipment. As a result of these and other factors, our financial results for any quarter may not be indicative of the results that may be achieved for a full fiscal year.

Significant adverse weather conditions and other disasters could negatively impact our results of operations.

Adverse weather conditions and natural disasters, such as regional winter storms, floods, major hurricanes and earthquakes, severe thunderstorms and other disasters, such as oil spills, could negatively impact our results of operations. Temporary and prolonged restaurant closures may occur and customer traffic may decline due to the actual or perceived effects from these events.

We may be required to use cash to pay one of our franchisees in connection with a put right under a settlement agreement, which could have an adverse impact on our development plans and operating results.

In connection with the settlement of litigation with T-Bird, which includeincluded the franchisees of 56 Outback Steakhouse restaurants in California, we entered into an agreement with T-Bird pursuant to which T-Bird has the right, referred to as the Put“Put Right,” to require us to purchase for cash all of the equityownership interests in the T-Bird entities (which include general and limited partnership interests in such entities) that own Outback Steakhouse56 restaurants. The Put Right will becomeis exercisable by T-Bird for a one-year period beginning on the date of closing of this offering. The Put Right is also exercisable if we sell our Outback Steakhouse concept.until August 13, 2013. If the Put Right is exercised, we will pay a purchase price equal to a multiple of the T-Bird entities’ adjusted EBITDA, net of liabilities, for the trailing 12 months as of the closing of the purchase from T-Bird. The multiple will be equal to 75% of the multiple of our adjusted EBITDA for the same trailing 12-month period as reflected in our stock price in the case of this offering or, in a sale of our Outback Steakhouse concept, 75% of the multiple of adjusted EBITDA that we are receiving in the sale.price. We have a one-time right to reject the exercise of the Put Right if the transaction would be dilutive to our consolidated

earnings per share. In that event, the Put Right is extended until the first anniversary of our notice to the T-Bird entities of that rejection. We have agreed to waive all rights of first refusal in our franchise arrangements with the T-Bird entities in connection with a sale of all, and not less than all, of the assets, or at least 75% of the ownership, of the T-Bird entities. If the Put Right is exercised, we will have to use cash to pay the purchase price that could have been allocated to more profitable development initiatives or other business needs, and we will then own restaurants that may not fit our current expansion criteria. This could have an adverse impact on our operating results.

We have limited control with respect to the operations of our franchisees and joint venture partners, which could have a negative impact on our business.

Our franchisees and joint venture partners are obligated to operate their restaurants according to the specific guidelines we set forth. We provide training opportunities to these franchisees and joint venture partners to fully integrate them into our operating strategy. However, since we do not have control over these restaurants,

Index to Financial Statements

we cannot give assurance that there will not be differences in product quality or that there will be adherence to all of our guidelines at these restaurants. The failure of these restaurants to operate effectively or in accordance with our guidelines could adversely affect our cash flows from those operations or have a negative impact on our reputation or our business.

Our failure to comply with government regulation, and the costs of compliance or non-compliance, could adversely affect our business.

We are subject to various federal, state, local and foreign laws affecting our business. Each of our restaurants is subject to licensing and regulation by a number of governmental authorities, which may include, among others, alcoholic beverage control, health and safety, nutritional menu labeling, health care, environmental and fire agencies in the state, municipality or country in which the restaurant is located. Difficulty in obtaining or failing to obtain the required licenses or approvals could delay or prevent the development of a new restaurant in a particular area. Additionally, difficulties or inabilities to retain or renew licenses, or increased compliance costs due to changed regulations, could adversely affect operations at existing restaurants.

Approximately 15% of our consolidated restaurant sales are attributable to the sale of alcoholic beverages. Alcoholic beverage control regulations require each of our restaurants to apply to a state authority and, in certain locations, county or municipal authorities for a license or permit to sell alcoholic beverages on the premises and to provide service for extended hours and on Sundays. Typically, licenses must be renewed annually and may be revoked or suspended for cause at any time. Alcoholic beverage control regulations relate to numerous aspects of daily operations of our restaurants, including minimum age of patrons and employees, hours of operation, advertising, training, wholesale purchasing, inventory control and handling and storage and dispensing of alcoholic beverages. The failure of a restaurant to obtain or retain liquor or food service licenses would adversely affect the restaurant’s operations. Additionally, we are subject in certain states to “dramshop”“dram shop” statutes, which generally provide a person injured by an intoxicated person the right to recover damages from an establishment that wrongfully served alcoholic beverages to the intoxicated person.