As filed with the Securities and Exchange Commission on June 13, 2012April 12, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,Washington, D.C. 20549

For the Quarterly Period Ended March 31, 2012FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ORGANOVO HOLDINGS, INC.Organovo Holdings, Inc.

(Exact name of registrant as specified in its charter)

| | | | |

Delaware

|

| 2836 | | 27-1488943

|

Delaware | 2836 | 27-1488943 |

(State or other jurisdiction of

incorporation or organization)

| | (Primary Standard IndustrialClassification Classification Code Number)

| | (I.R.S. Employer

Identification Number)

|

5871 Oberlin Drive, 11555 Sorrento Valley Road, Suite 150,100

San Diego California, CA 92121

Phone: (858) 550-9994(858) 224-1000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Keith Murphy

Chairman, Chief Executive Officer and PresidentChairman

5871 Oberlin Drive, Organovo Holdings, Inc.

11555 Sorrento Valley Road, Suite 150,100

San Diego California , CA92121

Phone: (858) 550-9994(858) 224-1000

(Name, address including zip code, and telephone number, including area code, of agent for service)

Copies to:

Jeff C. Thacker,With copies to:

Jeffrey T. Hartlin, Esq.

DLA PiperSamantha H. Eldredge, Esq.

Paul Hastings LLP (US)

4365 Executive Drive, Suite 11001117 S. California Avenue

San Diego, California 92121Palo Alto, CA 94304

Tel: (858) 677-1400(650) 320-1800

Fax: (858) 677-1401

Approximate date of commencement of proposed sale to public:the public: As soon as practicable after the effectivenesseffective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. x☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”filer,” “smaller reporting company” and “smaller reporting“emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

|

|

|

|

|

|

|

Large accelerated filer |

| ¨☐ |

| Accelerated filer |

| ¨☐ |

|

|

|

|

Non-accelerated filer |

| ¨☒ |

| Smaller reporting company |

| x☒ |

|

|

|

|

|

|

|

| Emerging growth company |

| ☐ |

CalculationIf an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

The Registrant hereby amends this Registration FeeStatement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

| | | | | | | | |

|

Title of Each Class of Securities to be Registered | | Amount to be Registered (1) | | Proposed Maximum Offering Price Per Unit | | Proposed Maximum Aggregate Offering Price | | Amount of Registration Fee |

Common Stock, $0.001 par value per share (2) | | 15,247,987 | | $5.24(3) | | $79,899,452(3) | | $9,157(3) |

Common Stock, $0.001 par value per share (4) | | 15,247,987 | | $1.00(6) | | $15,247,987(6) | | $1,748 (6) |

Common Stock, $0.001 par value per share (5) | | 1,500,000 | | $1.00(6) | | $1,500,000(6) | | $172 (6) |

Total | | 31,995,974 | | N/A | | $96,647,439 | | $11,077 |

|

|

(1) | In the event of a stock split, stock dividend or similar transaction involving our common stock, the number of shares registered shall automatically be increased to cover the additional shares of common stock issuable pursuant to Rule 416 under the Securities Act of 1933, as amended. |

(2) | Represents shares of common stock issued to the selling security holders in the registrant’s private placement (the “Offering”) of units consisting of (i) one share of the registrant’s common stock and (ii) one warrant to purchase one share of the registrant’s common stock at an exercise price of $1.00 per share (the “Units”). Closings of the Offering occurred on each of February 8, 2012 (the “Initial Closing”), February 29, 2012 and March 16, 2012. Also represents shares of common stock issued to certain of the selling security holders on the date of the Initial Closing of the Offering in connection with the conversion of the registrant’s $1,500,000 in principal amount of 6% convertible promissory notes due March 31, 2012 (the “Bridge Notes”) into 1,525,387 Units. |

(3) | Fee calculated in accordance with Rule 457(c) of the Securities Act based on the average of the high and low price for our common stock on the OTCQB as of June 11, 2012. |

(4) | Represents shares of common stock issuable upon the exercise of warrants issued to the selling security holders in the Offering of Units and shares of common stock issuable upon the exercise of warrants issued to certain of the selling security holders on the date of the Initial Closing of the Offering in connection with the conversion of the Bridge Notes into 1,525,387 Units. |

(5) | Represents shares of common stock issuable upon the exercise of warrants issued to certain selling security holders in connection with the original issuance of the registrant’s Bridge Notes that were converted into 1,500,000 new warrants on the date of the Initial Closing, each exercisable at a price of $1.00 per share of the registrant’s common stock. |

(6) | Fee calculated in accordance with Rule 457(g), based upon the highest exercise price of the warrants held by the selling security holders at the time of registration. |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT, OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE SECURITIES AND EXCHANGE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(A), MAY DETERMINE.

The information in this prospectus is not complete and may be changed. The selling security holdersThese securities may not sell these securitiesbe sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offeroffers to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JUNE 13, 2012APRIL 12, 2024

PRELIMINARY PROSPECTUS

ORGANOVO HOLDINGS, INC.

15,247,987 shares

Up to [_______] Shares of Common Stock

16,747,987 sharesUp to [_______] Pre-Funded Warrants to Purchase [_______] Shares of Common Stock issuable upon

Up to [________] Shares of Common Stock Underlying the exercise ofPre-Funded Warrants

This prospectus relates to the resale by certain selling security holders of Organovo Holdings, Inc. ofWe are offering up to 31,995,974 shares of our common stock in connection with the resale of:

up to 15,247,987 shares of our common stock which were issued in our private placement (the “Offering”) of units consisting of (i) one share of our common stock and (ii) one warrant to purchase one share of our common stock at an exercise price of $1.00 per share (the “Units”), with closings of the Offering occurring on each of February 8, 2012 (the “Initial Closing”), February 29, 2012 and March 16, 2012 and[________] shares of common stock, issued to certain of the selling security holdersbased on the date of the Initial Closing of the Offering in connection with the conversion of our $1,500,000 in principal amount of 6% convertible promissory notes due March 31, 2012 (the “Bridge Notes”) into 1,525,387 Units;

up to 15,247,987 shares of our common stock issuable upon the exercise of warrants issued to the selling security holders in our Offering of Units (excluding warrants issued to our placement agents in the Offering) and shares of common stock issuable upon the exercise of warrants issued to certain of the selling security holders on the date of the Initial Closing of the Offering in connection with the conversion of the Bridge Notes into 1,525,387 Units; and

up to 1,500,000 shares of our common stock issuable upon the exercise of warrants issued to certain selling security holders in connection with the original issuance of our Bridge Notes that where converted into 1,500,000 new warrants on the date of the Initial Closing, each exercisable at aan assumed public offering price of $1.00$[___] per share, of our common stock.

The selling security holders may offer to sell the shares of common stock being offered in this prospectus at fixed prices, at prevailing market prices at the time of sale, at varying prices, or at negotiated prices. We do not know when or in what amount the selling security holders may offer the securities for sale. The selling security holders may sell any, all or none of the securities offered by this prospectus.

We will not receive proceeds from the sale of shares by the selling security holders. Any proceeds received by us from the exercise of warrants by the selling security holders will be used for general corporate purposes. The selling security holders and any brokers executing sell orders on behalf of the selling security holders may be deemed to be “underwriters” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”). Commissions received by a broker executing sell orders may be deemed to be underwriting commissions under the Securities Act.

Our common stock is traded on the OTCQB under the symbol “ONVO.” On June 11, 2012, the closinglast reported sale price of our common stock on the OTCQBNasdaq Capital Market on [________], 2024.

We are also offering to certain purchasers whose purchase of shares of common stock in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock immediately following the consummation of this offering, the opportunity to purchase, if any such purchaser so chooses, pre-funded warrants, in lieu of shares of common stock that would otherwise result in such purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock. The public offering price of each pre-funded warrant will be equal to the price at which one share of common stock is sold to the public in this offering, minus $0.001, and the exercise price of each pre-funded warrant will be $0.001 per share. The pre-funded warrants will be immediately exercisable and may be exercised at any time until all of the pre-funded warrants are exercised in full. For each pre-funded warrant we sell, the number of shares of common stock we are offering will be decreased on a one-for-one basis.

This offering will terminate on [________], 2024, unless we decide to terminate the offering (which we may do at any time in our discretion) prior to that date. We will have one closing for all the securities purchased in this offering.

Our common shares are listed on the Nasdaq Capital Market under the symbol “ONVO.” On [________], 2024, the last reported sale price of our common stock was $5.48$[___]. The public offering price per share.share of common stock and per pre-funded warrant will be determined between us and investors based on market conditions at the time of pricing, and may be at a discount to the then current market price of our common stock. The recent market price used throughout this prospectus may not be indicative of the actual offering price. The actual public offering price may be based upon a number of factors, including our history and our prospects, the industry in which we operate, our past and present operating results, the previous experience of our executive officers and the general condition of the securities markets at the time of this offering. There is no established public trading market for the pre-funded warrants and we do not expect a market to develop. Without an active trading market, the liquidity of the pre-funded will be limited. In addition, we do not intend to list the pre-funded warrants on the Nasdaq Capital Market, any other national securities exchange or any other trading system.

We have engaged JonesTrading Institutional Services LLC (the “placement agent”) to act as our exclusive placement agent in connection with this offering. The placement agent has agreed to use its reasonable best efforts to arrange for the sale of the securities offered by this prospectus. The placement agent is not purchasing or selling any of the securities we are offering and the placement agent is not required to arrange the purchase or sale of any specific number of securities or dollar amount. We have agreed to pay to the placement agent the placement agent fees set forth in the table below, which assumes that we sell all of the securities offered by this prospectus. Since we will deliver the securities to be issued in this offering upon our receipt of investor funds, there is no arrangement for funds to be received in escrow, trust or similar arrangement. There is no minimum offering requirement as a condition of closing of this offering. Because there is no minimum offering amount required as a condition to closing this offering, we may sell fewer than all of the securities offered hereby, which may significantly reduce the amount of proceeds received by us, and investors in this offering will not receive a refund in the event that we do not sell an amount of securities sufficient to pursue our business goals described in this prospectus. In addition, because there is no escrow account and no minimum offering amount, investors could be in a position where they have invested in our company, but we are unable to fulfill all of our contemplated objectives due to a lack of interest in this offering. Further, any proceeds from the sale of securities offered by us will be available for our immediate use, despite uncertainty about whether we would be able to use such funds to effectively implement our business plan. See the section entitled “Risk Factors” for more information. We will bear all costs associated with the offering. See “Plan of Distribution” on page 75 of this prospectus for more information regarding these arrangements.

Investing in our securities involves significant risks. Seerisks that are described in the “Risk Factors” section beginning on page 6.10 of this prospectus.

We may amend

| | | | | | | | | | | | |

|

| Per Share |

|

| Per Pre-Funded Warrant |

|

| Total |

|

Public offering price |

| $ |

|

|

| $ |

|

|

| $ |

|

|

Placement agent fees |

| $ |

|

|

| $ |

|

|

| $ |

|

|

Proceeds, before expenses, to us |

| $ |

|

|

| $ |

|

|

| $ |

|

|

The placement agent expects to deliver the securities on or supplement this prospectus from timeabout [_______], 2024, subject to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments or supplements carefully before you make your investment decision.satisfaction of customary closing conditions.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of thethis prospectus is [_______], 2012.

2024

TABLE OF CONTENTS

Organovo Holdings, Inc.

Table of Contents

ORGANOVO HOLDINGS, INC. HAS NOT REGISTERED THE SHARES OF COMMON STOCK THAT MAY BE SOLD BY THE SELLING SECURITY HOLDERS UNDER THE SECURITIES LAWS OF ANY STATE. SELLING SECURITY HOLDERS, AND ANY BROKERS OR DEALERS, EFFECTING TRANSACTIONS IN THE SHARES SHOULD CONFIRM THAT THE SHARES HAVE BEEN REGISTERED UNDER THE SECURITIES LAWS OF THE STATE OR STATES IN WHICH SALES OF THE SHARES OCCUR AS OF THE TIME OF SUCH SALES, OR THAT THERE IS AN AVAILABLE EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE SECURITIES LAWS OF SUCH STATES.

THIS PROSPECTUS IS NOT AN OFFER TO SELL ANY SECURITIES OTHER THAN THE SHARES OF COMMON STOCK FOR SALE BY THE SELLING SECURITY HOLDERS. THIS PROSPECTUS IS NOT AN OFFER TO SELL SECURITIES IN ANY CIRCUMSTANCES IN WHICH SUCH AN OFFER IS UNLAWFUL.

About this Prospectus

You should rely only on the information contained in this prospectus. Neither we nor the selling security holdersWe have not authorized anyone to provide you with information other than the information that is different from that containedwe have provided or incorporated by reference in this prospectus. Weprospectus and the selling security holders take no responsibility for,your reliance on any unauthorized information or representation is at your own risk. This prospectus may be used only in jurisdictions where offers and can provide no assurance as to the reliabilitysales of any other information that others may give you. We. If anyone provides you with different information, you should not rely on it. Neither we nor the selling security holders are making an offer to sell these securities in any jurisdiction where the offer or sale is notare permitted. You should assume that the information containedappearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Neitherprospectus, regardless of the time of delivery of this prospectus, noror any sale madeof our common stock. Our business, financial condition and results of operations may have changed since those dates.

The information appearing in this prospectus and any free writing prospectus that we have authorized for use in connection with this offering is accurate only as of its respective date, regardless of the time of delivery of the respective document or of any sale of securities covered by this prospectus. You should not assume that the information contained in this prospectus, shall, underor in any circumstances, createfree writing prospectus that we have authorized for use in connection with this offering, is accurate as of any implicationdate other than the respective dates thereof.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference herein were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

To the extent there has been no changeis a conflict between the information contained in our affairs sincethis prospectus, on the one hand, and the information contained in any document incorporated by reference filed with the U.S. Securities and Exchange Commission (the “SEC”) before the date of this prospectus, or thaton the other hand, you should rely on the information containedin this prospectus. If any statement in a document incorporated by reference to this prospectus is correct as of any time after its date.

In this prospectus, “Organovo,” “the Company,” “we,” “us,” and “our” refer to Organovo Holdings, Inc.,inconsistent with a Delaware corporation, unlessstatement in another document incorporated by reference having a later date, the context otherwise requires.

FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements as that term is definedstatement in the Private Securities Litigation Reform Act of 1995. These statements relate to anticipated future events, future results of operationsdocument having the later date modifies or future financial performance. These forward-looking statements include, but are not limited to, statements relating to our ability to raise sufficient capital to finance our planned operations, market acceptance of our technology and product offerings, our ability to attract and retain key personnel, our ability to protect our intellectual property, and estimates of our cash expenditures forsupersedes the next 12 to 36 months. In some cases, you can identify forward-looking statements by terminology such as “may,” “might,” “will,” “should,” “intends,” “expects,” “plans,” “goals,” “projects,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,”earlier statement.

Neither we nor the placement agent have done anything that would permit this offering or “continue”possession or the negative of these terms or other comparable terminology.

These forward-looking statements are only predictions, are uncertain and involve substantial known and unknown risks, uncertainties and other factors which may cause our (or our industry’s) actual results, levels of activity or performance to be materially different from any future results, levels of activity or performance expressed or implied by these forward-looking statements. The “Risk Factors” sectiondistribution of this prospectus sets forth detailed risks, uncertainties and cautionary statements regarding our business and these forward-looking statements.

We cannot guarantee future results, levels of activity or performance. You should not place undue reliance on these forward-looking statements, which speak only as of the datein any jurisdiction where action for that they were made. These cautionary statements should be considered with any written or oral forward-looking statements that we may issuepurpose is required, other than in the future. Except as required by applicable law, including the securities lawsUnited States. Persons who come into possession of this prospectus and any free writing prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus and any free writing prospectus applicable to that jurisdiction.

This prospectus includes statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not intendguarantee the accuracy or completeness of such information. Industry publications and third-party research, surveys and studies often indicate that their information has been obtained from sources believed to update anybe reliable, although they do not guarantee the accuracy or completeness of the forward-looking statements to conform these statements to reflect actual results, later events or circumstances or to reflect the occurrence of unanticipated events.such information and such information is inherently imprecise.

PROSPECTUS SUMMARY

The following

This summary highlights selected information contained elsewhere in this prospectus. Because it is aThis summary it does not contain all of the information you should consider before making an investment decision. Before making an investment decision, youinvesting in our common stock. You should read thethis entire prospectus carefully, including the sections of this prospectus titled “Risk Factors” section, theFactors,” “Special Note Regarding Forward-Looking Statements,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and the related notes included elsewhere in this prospectus, before making an investment decision. Unless otherwise indicated, all references in this prospectus to “Organovo,” the financial statements.“company,” “we,” “our,” “us” or similar terms refer to Organovo Holdings, Inc. and its wholly owned subsidiaries, including Organovo, Inc. and Opal Merger Sub, Inc.

Overview

Overview

Organovo Holdings, Inc. (Nasdaq: ONVO), together with its wholly owned subsidiaries (collectively, “Organovo”, “we”, “us” and “our”), is a clinical stage biotechnology company that is focused on developing FXR314 in inflammatory bowel disease (“IBD”), including ulcerative colitis (“UC”), based on demonstration of clinical promise in three-dimensional (“3D”) human tissues as well as strong preclinical data. FXR is a mediator of gastrointestinal and liver diseases. FXR agonism has been tested in a variety of preclinical models of IBD. FXR314 is the lead compound in our established FXR program containing two clinically tested compounds (including FXR314) and over 2,000 discovery or preclinical compounds. FXR314 is a drug with safety and tolerability after daily oral dosing in Phase 1 and Phase 2 trials. Further, FXR314 has FDA clinical trial authorization for a Phase 2 trial in UC.

Our current clinical focus is in advancing FXR314 in IBD, including UC and Crohn’s disease (“CD”). We have developedplan to start a Phase 2a clinical trial in UC in the calendar year 2024. We are exploring the potential for combination therapies using FXR314 and are commercializing a platformcurrently approved mechanisms in preclinical animal studies and our IBD disease models.

Our second focus is building high fidelity, 3D tissues that recapitulate key aspects of human disease. We use our proprietary technology for the generation of three-dimensional (3D)to build functional 3D human tissues that mimic key aspects of native human tissue composition, architecture, function and disease. We believe these attributes can enable critical complex, multicellular disease models that can be employedused to develop clinically effective drugs across multiple therapeutic areas.

As with the clinical development program, we are initially focusing on the intestine and have ongoing 3D tissue development efforts in drug discoveryhuman tissue models of UC and development, biological research,CD. We use these models to identify new molecular targets responsible for driving the disease and as therapeutic implants forto explore the treatmentmechanism of damaged or degenerating tissuesaction of known drugs including FXR314 and organs.related molecules. We intend to introduce a paradigm shiftinitiate drug discovery programs around these new validated targets to identify drug candidates for partnering and/or internal clinical development.

Our current understanding of intestinal tissue models and IBD disease models leads us to believe that we can create models that provide greater insight into the biology of these diseases than are generally currently available. We are creating high fidelity disease models, leveraging our prior work including the work found in our peer-reviewed publication on bioprinted intestinal tissues (Madden et al. Bioprinted 3D Primary Human Intestinal Tissues Model Aspects of Native Physiology and ADME/Tox Functions. iScience. 2018 Apr 27;2:156-167. doi: 10.1016/j.isci.2018.03.015.) Our advances include cell type-specific compartments, prevalent intercellular tight junctions, and the approachformation of microvascular structures.

Using these disease models, we intend to identify and validate novel therapeutic targets. After finding therapeutic drug targets, we intend to focus on developing novel small molecule, antibody, or other therapeutic drug candidates to treat the generationdisease, and advance these novel drug candidates towards an Investigational New Drug filing and potential future clinical trials.

We expect to broaden our work into additional therapeutic areas over time and are currently exploring specific tissues for development. In our work to identify the areas of three-dimensional human tissues, by creation of constructs ininterest, we evaluate areas that might be better served with 3D that havedisease models than currently available models as well as the potential commercial opportunity. In line with these plans, we are building upon both our external and in house scientific expertise, which will be essential to replicate native human biology. We can improve on previous technologies by moving away from monolayer 2D cell cultures and by enabling all or partour drug development effort.

Recent Developments

In February 2024, we formed our Mosaic Cell Sciences division (“Mosaic”) to serve as a key source of certain of the tissuesprimary human cells we create to be constructed solely of cells.utilize in our research and development efforts. We believe Mosaic can help us optimize our expertisesupply chain, reduce operating expenses related to cell sourcing and procurement and ensure that the cellular raw materials we use are of the highest quality and are derived from tissues that are ethically sourced in printing small-diameter, fully cellular human blood vessels in vitro provides a strong foundation upon which other tissues can be built to replicate human biologyfull compliance with state and human disease.federal guidelines. We believe that our broad and exclusive commercial rights to patented and patent-pending 3D bioprinting technology, combined with strengths in engineering and biology, put us in an ideal positionintend for Mosaic to provide a wide array of productsus with qualified human cells for use in our clinical research drug discovery and regenerative medicine therapies.

Our foundational proprietary technology derives from research led by Dr. Gabor Forgacs, a Professor of Biophysics at the University of Missouri. We have a broad portfolio of intellectual property rights covering principles, enabling instrumentation applications and methods of cell based printing, including exclusive licensesdevelopment programs. In addition to certain patented and patent pending technologies from the University of Missouri-Columbia and Clemson University, and outright ownership of six pending patent applications (the patents and patent rights described in this paragraph are sometimes collectively referred to as the “Intellectual Property Rights”). See “Description of Business—Intellectual Property”. We believe that our portfolio of Intellectual Property Rights provides a strong and defensible market position for the commercialization of 3D bioprinting technology.

We believe we have the potential to build and maintain a sustainable business by leveraging our core technology platform across a variety of applications. As part of our business strategysupplying us with primary human cells, we intend for Mosaic to pursue collaboration agreements with drug development companiesoffer human cells for sale to life science customers, both directly and through distribution partners, which we expect to offset costs and over time become a profit center that will allow us to further develop our 3D bioprinting technology and the potential uses of the cellular structures and tissues that can be produced with our technology. We also plan to develop research products with our 3D bioprinting technology that can be offered to third parties involved in drug discovery. We currently have collaborative research agreements currently in effect with Pfizer, Inc. (“Pfizer”) and United Therapeutic Corporation (“Unither”). offsets overall R&D spending by Organovo.

Financial Update (Unaudited)

As of March 31, 2012,2024, we have also secured five federal grants in the aggregate amounthad cash and cash equivalents of approximately $955,000 including Small Business Innovation Research grants$2.9 million.

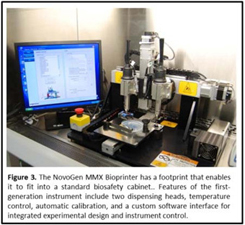

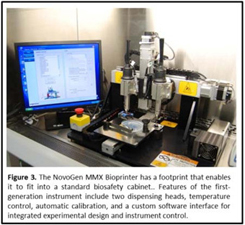

The estimated preliminary cash and developed the NovoGen MMX Bioprinter™ (our first-generation 3D bioprinter) – within two and one half years of opening our first facilities. We believe these corporate achievements provide strong validation for the commercial viability of our technology.

Ascash equivalents number presented above as of March 31, 2012, we had devoted substantially all2024 is preliminary and unaudited and may change, is based on information available to management as of the date of this prospectus, and is subject to the completion of the Company’s financial closing procedures and the audit for the year ended March 31, 2024. There can be no assurance that such financial information as of March 31, 2024 will not differ from these estimates, including as a result of year-end closing and the audit and any such changes could be material. We have not yet completed our normal audit procedures as of and for the year ended March 31, 2024.

The foregoing preliminary financial data has been prepared by, and is the responsibility of, our effortsmanagement. This data has not been audited, is subject to product development, raising capital and building infrastructure. We did not, as of that date, realize significant revenues from our planned principal operations. Accordingly, we are considered to be in the development stage.

The Technology

Our technology is centered around a core 3D bioprinting method, represented by our bioprinting instrument, the NovoGen MMX Bioprinter™. The 3D bioprinting technology enables a wide array of tissue compositions and architectures to be created, using combinations of cellular ‘bio-ink’ (building blocks comprised solely of cells), hydrogel (building blocks comprised of biocompatible gels), or hybrid ‘bio-ink’ (building blocks comprised of a mixture of cells and material such as hydrogel). A key distinguishing featurechange upon completion of our bioprinting platform isongoing audit and could change as a result of further review. Complete annual results will be included in our Annual Report on Form 10-K for the ability to generate three-dimensional constructs that have all or some of their components comprised entirely of cells. The fully-cellular featureyear ended March 31, 2024.

Corporate Information

We were incorporated in Delaware under the name Organovo Holdings, Inc. in January 2012. We are operating the business of our technology enables architecturally- and compositionally-defined 3D human tissues to be generated for in vitro use in drug discovery and development to potentially replicate the functional biology of a solid, fully cellular tissue. Furthermore, fully cellular constructs may offer specific advantages for regenerative medicine applications where bioactive cells are required and three-dimensional configuration is necessary, such as augmenting or replacing functional mass in tissues and organs that have sustained acute or chronic damage.

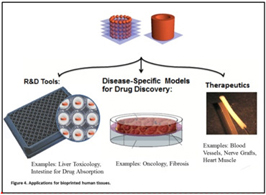

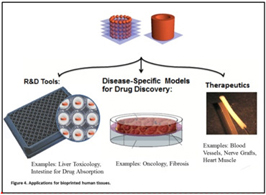

We plan to develop research products with our 3D bioprinting technology that can be offered to third parties involved in drug discovery. We intend to deliver the following products to the market:

Three-dimensional models of human tissue for utilization in traditional absorption, distribution, metabolism, excretion (ADME) / toxicology (TOX) / and drug metabolism and pharmacokinetics (DMPK) testing in drug development.

Specific models of human biology or pathophysiology, in the form of three-dimensional human tissues, and for use in drug discovery, development, and delivery.

Three-dimensional human tissues for use as therapeutic regenerative medicine products, such as blood vessels for bypass grafting, nerve grafts for nerve damage repair and cardiac patches for treatment of heart disease.

3D bioprinters for use in medical research.

A portfolio of consumables for use in 3D bioprinting.

As part of our business strategy we intend to pursue collaboration agreements with drug development companies that will allow us to further develop our 3D bioprinting technology and the potential uses of the cellular structures and tissues that can be produced with our technology. We currently have a collaborative research agreement with Pfizer to develop specific three-dimensional tissue models. We are engaged in the development of specific 3D human tissues to aid Pfizer in discovery of successful therapies in two areas of interest. In addition, in October 2011, we entered into a research agreement with Unither to establish and conduct a research program to discover treatments for pulmonary hypertension using our NovoGen MMX Bioprinter™ technology.

Market Opportunity

We believe that our bioprinting technology is uniquely positioned to provide three-dimensional human tissues for use in drug discovery and development as well as a broad array of tissues suitable for therapeutic use in regenerative medicine applications. While there are rapid-prototyping printers currently available that build three-dimensional structures out of polymers (often used for prototyping of plastic parts for tools or devices), these instruments are not specifically designed or intended for use with purely cellular inks in building biologic tissues and we do not believe that the firms working on these instruments have the required biology expertise to create tissues using these instruments at this time. There are multiple markets addressable by our technology platform:

| 1) | Specialized Models for Drug Discovery and Development: Our NovoGen MMX Bioprinter™ can produce highly specialized three-dimensional human tissues that can be utilized to model a specific tissue physiology or pathophysiology. Our bioprinting technology has demonstrated the ability to create human blood vessel constructs, and to create fully human tissue containing capillary structures. These capabilities are anticipated to broaden the scope and scale of 3D tissues that can be generated, and to facilitate the development of disease models in such areas as cardiovascular disease, oncology, and fibrosis. |

| 2) | Biological Research Tools: Absorption, distribution, metabolism, excretion (ADME) testing is used to determine which factors enhance or inhibit how a potential drug compound reaches the blood stream. Distribution of a compound can be affected by binding to plasma proteins; age, genetics, and other factors can influence metabolism of a compound; and the presence of certain disease states can have effects on excretion of a compound. Many companies perform ADME studies utilizing various cell-based assays or automated bioanalytical techniques. Drug metabolism and pharmacokinetics (DMPK) testing is a subset of ADME. Determining the DMPK properties of a drug helps the drug developer to understand its safety and efficacy. Toxicology (TOX) testing is a further requirement to determine the detrimental effects of a particular drug on specific tissues. We believe that the NovoGen MMX Bioprinter™ is positioned to deliver highly differentiated products for use in traditional cell-based ADME / TOX / DMPK studies. Products in this arena may replace or complement traditional cell-based assays that typically employ primary hepatocytes, intestinal cell lines, renal epithelial cells and cell lines grown in a traditional two-dimensional format. Importantly, the combination of tissue-like three-dimensionality and human cellular components is believed to provide an advantage over non-human animal systems toward predicting in vivo human outcomes. |

| 3) | Regenerative Medicine: The field of regenerative medicine is advancing via multiple strategic approaches in development and practice, including cell therapies and scaffold-based products (+/- cells). The architectural precision and flexibility of our technology may facilitate the optimization, development, and clinical use of three-dimensional tissue constructs. Importantly, our technology offers a next-generation strategy whereby three-dimensional structures can be generated without the use of scaffolding or biomaterial components. The ultimate goal is to enable fully cellular constructs to be generated in a configuration compatible with surgical modes of delivery, thereby enabling restoration of significant functional mass to a damaged tissue or organ. |

We believe that our technology can capitalize, via strategic partnerships, on additional market opportunities in the provision of enabling tools for drug discovery and development as well as the discovery and development of therapeutic implants that augment or replace damaged tissues and organs. There are multiple short- and long-term revenue opportunities for us in these areas,subsidiaries, including direct sales of 3D human tissue constructs for drug screening and development, licensing fees for commercial access to our technology, and royalties from product enablement, particularly in the area of therapeutic products for regenerative medicine.

Corporate Background

Real Estate Restoration and Rental,Organovo, Inc. (“RERR”), our predecessor company,wholly-owned subsidiary, which we acquired in February 2012. Organovo, Inc. was incorporated in 2007Delaware in the state of Nevada. On December 28, 2011, RERR entered into an Agreement and Plan of Merger pursuant to which RERR merged with its newly formed, wholly owned subsidiary, Organovo Holdings, Inc. (“Merger Sub”), a Nevada corporation (the “RERR Merger”). Upon the consummation of the RERR Merger, the separate existence of Merger Sub ceased and RERR, the surviving corporation in the RERR Merger, became known as Organovo Holdings, Inc. (“Holdings-Nevada”).

As permitted by Chapter 92A.180 of Nevada Revised Statutes, the sole purpose of the RERR Merger was to effect a change of RERR’s name. Upon the filing of Articles of Merger with the Secretary of State of Nevada on December 28, 2011 to effect the RERR Merger, RERR’s articles of incorporation were deemed amended to reflect the change in RERR’s corporate name.

On January 30, 2012, Holdings-Nevada entered into an Agreement and Plan of Merger pursuant to which Holdings-Nevada merged with and into its newly formed, wholly owned subsidiary, Organovo Holdings, Inc. (“Holdings-Delaware” or “Pubco”), a Delaware corporation (the “Reincorporation Merger”). Upon the consummation of the Reincorporation Merger, the separate existence of Holdings-Nevada ceased and Holdings-Delaware was the surviving corporation in the Reincorporation Merger. The sole purpose of the Reincorporation Merger was to change the domicile of Pubco from Nevada to Delaware.

On February 8, 2012, Organovo Acquisition Corp. (“Acquisition Corp.”), a wholly-owned subsidiary of Pubco, merged (the “Merger”) with and into Organovo, Inc., a Delaware corporation (“Organovo”). Organovo was the surviving corporation of that Merger. As a result of the Merger, Pubco acquired the business of Organovo, and will continue the existing business operations of Organovo.

Risks Associated withApril 2007. Our Business

Investing in our common stock involves substantial risk. Before participating in this offering, you should carefully consider all ofhas traded on the information in this prospectus, includingNasdaq Capital Market under the risks discussed in “Risk Factors” immediately following this summary. In particular:

We have a limited operating historysymbol “ONVO” since December 27, 2019. Prior to that time, it had traded on the Nasdaq Global Market under the symbol “ONVO” since August 8, 2016 and a history of operating losses, and expect to incur significant additional operating losses;

We need to secure additional financing to support our planned operations;

We are an early-stage company with an unproven business strategy and may never achieve commercialization of our research tools and therapeutic products or profitability;

Our success and our collaborators’ ability to sell therapeutic products will depend to a large extent upon reimbursement from health care insurance companies;

Our research tools are new and unproven and may not allow us or our collaborators to develop successful commercial products;

Our proprietary tissue creation technology, drug discovery and research tools are subject to the risks associated with new and rapidly evolving technologies.

The commercialization of therapeutic or other life science products developed using our research tools is subject to a variety of risks of failure inherent in their development or commercial viability, including the possibility that any such products will (i) fail to be found through the use of research tools; (ii) be found to be toxic or ineffective; (iii) fail to receive necessary regulatory approvals; (iv) be difficult or impossible to manufacture on a large scale; (v) be economically infeasible to market; (vi) fail to be developed prior to that it traded on the successful marketing of similar products by competitors; or (vii) be impossible to market because they infringeNYSE MKT under the proprietary rights of third parties or compete with superior products marketed by third parties;

If we are unable to enter into or maintain strategic collaborations with third parties, we may have difficulty selling our research tools and therapeutic products and we may not generate sufficient revenue to achieve or maintain profitability; and

We cannot control our collaborators’ allocation of resources or the amount of time that our collaborators devote to developing our programs or potential products, which may have a material adverse effect on our business.

We will depend on our patent portfolio, our licensed technology and other trade secrets in the conduct of our business and must ensure that we do not violate the patent or intellectual property rights of others.

Corporate Information

Our principal executive offices are located at 5871 Oberlin Drive,11555 Sorrento Valley Road, Suite 150,100, San Diego, California 92121. OurCA 92121, and our telephone number is (858) 550-9994.224-1000. Our website can be found ataddress is www.organovo.com. TheAny information contained inon, or that can be accessed through, our website is not incorporated by reference into, nor is it in any way part of this prospectus.

The Offering

Key Factsprospectus and should not be relied upon in connection with making any decision with respect to an investment in our securities. We are required to file annual, quarterly and current reports, proxy statements and other information with the SEC. You may obtain any of the Offeringdocuments filed by us with the SEC at no cost from the SEC’s website at http://www.sec.gov.

We are a “smaller reporting company” as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and have elected to take advantage of certain of the scaled disclosure available for smaller reporting companies in this prospectus as well as our filings under the Exchange Act.

The Offering

| | |

Common stock beingSecurities offered by the selling security holders:us

| | 15,247,987 |

| |

TotalUp to [_______] shares of common stock outstanding: (1) | | 43,693,241 |

| |

Numberor pre-funded warrants to purchase shares of common stock. We are also registering [_______] shares of common stock issuable upon the exercise of warrants held by the selling security holders registered on this prospectus: | | 16,747,987pre-funded warrants |

Pre-funded warrants offered by us in this offering | Each purchaser whose purchase of shares in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock immediately following the consummation of this offering, has the opportunity to purchase, if the purchaser so chooses, pre-funded warrants (each pre-funded warrant to purchase one share of our common stock) in lieu of shares that would otherwise result in the purchaser’s beneficial ownership exceeding 4.99% of our outstanding common stock (or, at the election of the purchaser, 9.99%). The purchase price of each pre-funded warrant will equal the price at which one share of common stock is being sold to the public in this offering, minus $0.001, and the exercise price of each pre-funded warrant will be $0.001 per share. The pre-funded warrants will be exercisable immediately and may be exercised at any time until all of the pre-funded warrants are exercised in full. For each pre-funded warrant we sell, the number of shares we are offering will be decreased on a one-for-one basis. |

Term of the offering | This offering will terminate on [_______], 2024, unless we decide to terminate the offering (which we may do at any time in our discretion) prior to that date. |

Common stock to be outstanding immediately after this offering | [_______] shares, assuming no sale of pre-funded warrants, which, if sold, would reduce the number of shares of common stock that we are offering on a one-for-one basis |

Use of Proceeds:proceeds | | We will not receive any ofintend to use the net proceeds from the sale of our shares by the selling security holders. Any proceeds received by us from the exercise of warrants by the selling security holders will be usedthis offering for working capital and general corporate purposes.purposes, which could include capital expenditures, research and development expenditures, regulatory affairs expenditures, clinical trial expenditures, legal expenditures, including intellectual property protection and maintenance expenditures, acquisitions of new technologies and investments, business combinations and the repurchase of capital stock. See “Use of Proceeds” on page 32 for more information. |

Risk factors | |

OTCQB Symbol: | | ONVO |

| |

Risk Factors: | | Investing in our securities involves a high degree of risk and purchasersrisk. As an investor, you should be able to bear a complete loss of our securities may lose their entireyour investment. See “Risk Factors” below and the other information included elsewhere in this prospectus for a discussion of factors youYou should carefully consider before decidingthe information set forth in the “Risk Factors” section beginning on page 10. |

Nasdaq Capital Market trading symbol | Our common stock is listed on the Nasdaq Capital Market under the symbol “ONVO.” There is no established trading market for the pre-funded warrants, and we do not expect a trading market to invest our securities.develop. We do not intend to list the pre-funded warrants on any securities exchange or other trading market. Without a |

| |

| trading market, the liquidity of the pre-funded warrants will be extremely limited. |

(1) | The number of shares of our common stock outstanding is based on the number of shares of our common stock outstanding as of March 31, 2012, including the shares of common stock held by the selling security holders. This number does not include: |

The number of shares immediately outstanding following this offering is based on 9,838,755 shares of common stock outstanding as of December 31, 2023 and also gives effect to 237,712 shares of our common sold and issued through an “at the market” offering”

pursuant to a Sales Agreement that we entered into with H.C. Wainwright & Co., LLC and JonesTrading Institutional Services LLC

on March 16, 2018 (the "Sales Agreement") and excludes:

24,256,932•

695,459 shares of common stock issuable upon the exercise of stock options outstanding warrants at a weighted average exercise price of $1.00approximately $4.35 per share, including the warrants held by the selling security holders;share;

896,256•

123,892 shares of common stock issuable upon exercisethe vesting and settlement of outstanding options, at a weighted average exercise pricerestricted stock units;

•1,000 shares of $0.08 per share, which were issued under our 2008common stock available for issuance pursuant to the 2021 Inducement Equity Plan;

•1,643,798 shares of common stock available for issuance pursuant to the 2022 Equity Incentive Plan prior to this offering;Plan; and

6,553,986•

45,000 shares of our common stock which remain available for grant and possible subsequent issuance under our 2012 Equity Incentivepursuant to the 2023 Employee Stock Purchase Plan.

Unless otherwise indicated, all information in this prospectus assumes that no exercise of options warrants or sharesunder our equity incentive plans and no exercise of common stock were issued afterpre-funded warrants.

Summary Financial Data

The following tables set forth our summary statements of operations and comprehensive loss data for the years ended March 31, 2012,2023 and no outstanding options or warrants were exercised after March 31, 2012. In addition, unless otherwise indicated, all information in this prospectus assumes that2022 and the warrants issued in connection with this offering to the investors in the Units and our placement agents and financial advisor have not been exercised.

Summary Financial Data

The following summary audited financial information for the fiscal yearsnine months ended December 31, 20112023 and 2010, includes2022, and our summary balance sheet and statementdata as of December 31, 2023. The statements of operations and comprehensive loss data for the years ended March 31, 2023 and 2022 have been derived from our audited financial statements included elsewhere in this prospectus. The financial informationWe derived our summary statements of operations and comprehensive loss data for the nine months ended December 31, 2023 and 2022 and the summary balance sheet data as of MarchDecember 31, 2012, and for the three months ended March 31, 2012 and 2011 is derived2023 from our unaudited condensed consolidated financial statements included elsewhere in this prospectus. The information containedprospectus, which have been prepared on a basis consistent with our audited financial statements and, in this tablethe opinion of management, contain all adjustments, consisting only of normal and recurring adjustments, necessary for a fair presentation of such interim financial statements. Our historical results are not necessarily indicative of the results that may be expected for any period in the future, and our interim results are not necessarily indicative of the results that may be expected for the full year or any other period. You should be read in conjunctionthe following summary financial data together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and the related notes included elsewhere in this prospectus. The summary financial data included in this section are not intended to replace the financial statements and accompanyingare qualified in their entirety by our financial statements and the related notes included elsewhere in this prospectus.

Statement of Operations and comprehensive loss for the years ended March 31, 2023 and 2022

| | | | | | | | |

| | Year Ended | | | Year Ended | |

| | March 31, 2023 | | | March 31, 2022 | |

Revenues | | | | | | |

Royalty revenue | | $ | 370 | | | $ | 1,500 | |

Total Revenues | | | 370 | | | | 1,500 | |

Research and development expenses | | | 8,885 | | | | 3,320 | |

Selling, general, and administrative expenses | | | 9,216 | | | | 9,659 | |

Total costs and expenses | | | 18,101 | |

| | 12,979 | |

Loss from Operations | | | (17,731 | ) | | | (11,479 | ) |

Other Income (Expense) | | | | | | |

Loss on fixed asset disposals | | | (9 | ) | | | — | |

Gain on investment in equity securities | | | 29 | | | | — | |

Interest income | | | 454 | | | | 8 | |

Other income | | | — | | | | 25 | |

Total Other Income | | | 474 | | | | 33 | |

Income Tax Expense | | | (2 | ) | | | (2 | ) |

Net Loss | | $ | (17,259 | ) | | $ | (11,448 | ) |

Other comprehensive income: | | | | | | |

Unrealized gain on available-for-sale debt securities | | | 2 | | | | — | |

Comprehensive loss | | $ | (17,257 | ) | | $ | (11,448 | ) |

Net loss per common share—basic and diluted | | $ | (1.98 | ) | | $ | (1.32 | ) |

Weighted average shares used in computing net loss per common share—basic

and diluted | | | 8,713,032 | | | | 8,703,596 | |

Statement of Operations and comprehensive loss for the nine months ended December 31, 2023 and 2022 (unaudited)

| | | | | | | | |

| | Nine Months Ended | | | Nine Months Ended | |

| | December 31, 2023 | | | December 31, 2022 | |

Revenues | | | | | | |

Royalty revenue | | $ | 80 | | | $ | 208 | |

Total Revenues | | | 80 | | | | 208 | |

Research and development expenses | | | 4,435 | | | | 3,436 | |

Selling, general and administrative expenses | | | 7,635 | | | | 6,724 | |

Total costs and expenses | | | 12,070 | | | | 10,160 | |

Loss from Operations | | | (11,990 | ) | | | (9,952 | ) |

Other Income (Expense) | | | | | | |

(Loss) gain on investment in equity securities | | | 12 | | | | (123 | ) |

Interest income | | | 354 | | | | 277 | |

Total Other Income | | | 366 | | | | 154 | |

Income Tax Expense | | | (2 | ) | | | (2 | ) |

Net Loss | | $ | (11,626 | ) | | $ | (9,800 | ) |

Other Comprehensive Loss: | | | | | | |

Unrealized gain (loss) on available-for-sale debt

securities | | $ | (1 | ) | | $ | 3 | |

Comprehensive Loss | | $ | (11,627 | ) | | $ | (9,797 | ) |

Net loss per common share—basic and diluted | | $ | (1.31 | ) | | $ | (1.13 | ) |

Weighted average shares used in computing

net loss per common share—basic and

diluted | | | 8,850,881 | | | | 8,712,294 | |

Balance Sheet as of March 31, 2023 and 2022

| | | | | | | | |

| | March 31, 2023 | | | March 31, 2022 | |

Assets | | | | | | |

Current Assets | | | | | | |

Cash and cash equivalents | | $ | 15,301 | | | $ | 28,675 | |

Accounts receivable | | | 152 | | | | — | |

Investment in equity securities | | | 706 | | | | — | |

Prepaid expenses and other current assets | | | 889 | | | | 858 | |

Total current assets | | | 17,048 | | | | 29,533 | |

Fixed assets, net | | | 902 | | | | 662 | |

Restricted cash | | | 143 | | | | 143 | |

Operating lease right-of-use assets | | | 1,705 | | | | 2,153 | |

Prepaid expenses and other assets, net | | | 515 | | | | 805 | |

Total assets | | $ | 20,313 | | | $ | 33,296 | |

Liabilities and Stockholders' Equity | | | | | | |

Current Liabilities | | | | | | |

Accounts payable | | $ | 331 | | | $ | 415 | |

Accrued expenses | | | 2,848 | | | | 489 | |

Operating lease liability, current portion | | | 492 | | | | 479 | |

Total current liabilities | | | 3,671 | | | | 1,383 | |

Operating lease liability, net of current portion | | | 1,313 | | | | 1,704 | |

Total liabilities | | | 4,984 | | | | 3,087 | |

Commitments and Contingencies | | | | | | |

Stockholders' Equity | | | | | | |

Common stock, $0.001 par value; 200,000,000 shares authorized,

8,716,906 and 8,710,627 shares issued and outstanding at

March 31, 2023 and 2022, respectively | | | 9 | | | | 9 | |

Additional paid-in capital | | | 340,317 | | | | 337,940 | |

Accumulated deficit | | | (324,998 | ) | | | (307,739 | ) |

Accumulated other comprehensive income | | | 2 | | | | — | |

Treasury stock, 46 shares at cost | | | (1 | ) | | | (1 | ) |

Total stockholders' equity | | | 15,329 | | | | 30,209 | |

Total Liabilities and Stockholders' Equity | | $ | 20,313 | | | $ | 33,296 | |

Balance Sheet as of the nine months ended December 31, 2023 and 2022 (unaudited)

| | | | | | | | |

| | December 31, 2023 | | | December 31, 2022 | |

| | (Unaudited) | | | (Unaudited) | |

Assets | | | | | | |

Current Assets | | | | | | |

Cash and cash equivalents | | $ | 5,295 | | | $ | 20,196 | |

Accounts receivable | | | 33 | | | | 76 | |

Investment in equity securities | | | — | | | | 554 | |

Prepaid expenses and other current assets | | | 913 | | | | 788 | |

Total current assets | | | 6,241 | | | | 21,614 | |

Fixed assets, net | | | 739 | | | | 742 | |

Restricted cash | | | 143 | | | | 143 | |

Operating lease right-of-use assets | | | 1,403 | | | | 1,803 | |

Prepaid expenses and other assets, net | | | 355 | | | | 777 | |

Total assets | | $ | 8,881 | | | $ | 25,079 | |

Liabilities and Stockholders’ Equity | | | | | | |

Current Liabilities | | | | | | |

Accounts payable | | $ | 471 | | | $ | 242 | |

Accrued expenses | | | 727 | | | | 646 | |

Operating lease liability, current portion | | | 502 | | | | 488 | |

Total current liabilities | | | 1,700 | | | | 1,376 | |

Operating lease liability, net of current portion | | | 999 | | | | 1,414 | |

Total liabilities | | | 2,699 | | | | 2,790 | |

Commitments and Contingencies (Note 7) | | | | | | |

Stockholders’ Equity | | | | | | |

Common stock, $0.001 par value; 200,000,000 shares authorized, 9,838,755

and 8,714,590 shares issued and outstanding at December 31, 2023 and

December 31, 2022, respectively | | | 10 | | | | 9 | |

Additional paid-in capital | | | 342,796 | | | | 339,817 | |

Accumulated deficit | | | (336,624 | ) | | | (317,539 | ) |

Accumulated other comprehensive income | | | 1 | | | | 3 | |

Treasury stock, 46 shares at cost | | | (1 | ) | | | (1 | ) |

Total stockholders’ equity | | | 6,182 | | | | 22,289 | |

Total Liabilities and Stockholders’ Equity | | $ | 8,881 | | | $ | 25,079 | |

Special Note Regarding Forward-Looking Statements

This prospectus and any accompanying prospectus supplement may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Exchange Act, about Organovo. These forward-looking statements are intended to be covered by the safe harbor for forward-looking statements provided by the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not statements of historical fact, and can be identified by the use of forward-looking terminology such as “believes”, “expects”, “may”, “will”, “could”, “should”, “projects”, “plans”, “goal”, “targets”, “potential”, “estimates”, “pro forma”, “seeks”, “intends” or “anticipates” or the negative thereof or comparable terminology. Forward-looking statements include discussions of strategy, financial projections, guidance and estimates (including their underlying assumptions), statements regarding plans, objectives, expectations or consequences of various transactions, and statements about the future performance, operations, products and services of Organovo. We caution our stockholders and other readers not to place undue reliance on such statements.

You should read this prospectus, any accompanying prospectus supplement and the documents incorporated by reference completely and with the understanding that our actual future results may be materially different from what we currently expect. Our business and operations are and will be subject to a variety of risks, uncertainties and other factors. Consequently, actual results and experience may materially differ from those contained in any forward-looking statements. Such risks, uncertainties and other factors that could cause actual results and experience to differ from those projected include, but are not limited to, the risk factors described in the “Risk Factors” section beginning on page 10 of this prospectus.

You should assume that the information appearing in this prospectus, any accompanying prospectus supplement and any related free writing prospectus is accurate as of its date only. Because the risk factors referred to above could cause actual results or outcomes to differ materially from those expressed in any forward-looking statements made by us or on our behalf, you should not place undue reliance on any forward-looking statements. Further, any forward-looking statement speaks only as of the date on which it is made. New factors emerge from time to time, and it is not possible for us to predict which factors will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. All written or oral forward-looking statements attributable to us or any person acting on our behalf made after the date of this prospectus are expressly qualified in their entirety by the risk factors and cautionary statements contained in and incorporated by reference into this prospectus. Unless legally required, we do not undertake any obligation to release publicly any revisions to such forward-looking statements to reflect events or circumstances after the date of this prospectus or to reflect the occurrence of unanticipated events.

Market, Industry and Other Data

Unless otherwise indicated, we have based the information concerning economic conditions, our industry and our market contained in this prospectus on a variety of sources, including information from third-party industry analysts and publications and our own estimates and research. This information involves a number of assumptions, estimates and limitations. The industry publications, surveys and forecasts and other public information generally indicate or suggest that their information has been obtained from sources believed to be reliable. None of the third-party industry publications used in this prospectus were prepared on our behalf. The industries in which we operate are subject to a high degree of uncertainty and risk due to a variety of factors, and are subject to change based on various factors, including those discussed in the “Risk Factors” section of this prospectus and in the other information contained in this prospectus. InThese and other factors could cause the opinioninformation concerning our industry to differ materially from those expressed in this prospectus and incorporated by reference herein.

Dividend Policy

We have never declared or paid cash dividends on our common stock. We currently intend to retain our future earnings, if any, for use in our business and therefore do not anticipate paying cash dividends in the foreseeable future. Payment of management,future dividends, if any, will be at the unaudited interim financial statements have been prepared on the same basis as the audited financial statements and include all adjustments, consisting of only normal recurring adjustments, necessary for a fair presentationdiscretion of our board of directors after taking into account various factors, including our financial condition, operating results, current and financial positionanticipated cash needs and plans for those periods and as of such dates. The results for any interim period are not necessarily indicative of the results that may be expected for a full year.expansion.

| | | | | | | | | | | | | | | | |

| | | Organovo Holdings, Inc.

For the Three Months Ended

March 31,

(unaudited) | | | Organovo Holdings, Inc.

For the Year Ended

December 31, | |

Statement of Operations Data: | | 2012 | | | 2011 | | | 2011 | | | 2010 | |

Revenues | | $ | 120,000 | | | $ | 200,789 | | | $ | 968,513 | | | $ | 603,412 | |

Research and Development Expense | | | 547,287 | | | | 398,664 | | | | 1,419,718 | | | | 1,203,716 | |

General and Administrative Expense | | | 901,843 | | | | 243,494 | | | | 1,705,171 | | | | 577,914 | |

Income (loss) from Operations | | | (1,329,130 | ) | | | (491,953 | ) | | | (2,289,983 | ) | | | (1,178,218 | ) |

Change in fair value of warrants | | | (13,505,819 | ) | | | — | | | | 6,569 | | | | — | |

Net Income (loss) | | | (37,080,582 | ) | | | (546,585 | ) | | | (4,383,262 | ) | | | (1,338,694 | ) |

Income (loss) per Share | | $ | (1.17 | ) | | $ | (0.04 | ) | | $ | (0.02 | ) | | $ | (0.09 | ) |

| | | | | | | | | | | | |

| | | Organovo Holdings, Inc. For the Three Months Ended March 31, (unaudited) | | | Organovo Holdings, Inc.

For the Year Ended

December 31, | |

Balance Sheet Data: | | 2012 | | | 2011 | | | 2010 | |

Working Capital | | $ | 9,723,755 | | | $ | (945,543 | ) | | $ | (749,142 | ) |

Total Assets | | | 11,240,550 | | | | 1,408,832 | | | | 760,398 | |

Current Liabilities | | | 1,110,948 | | | | 1,975,748 | | | | 1,173,258 | |

| | | |

Total Stockholders’ Equity (Deficit) | | $ | (37,385,108 | ) | | $ | (1,833,785 | ) | | $ | (2,300,360 | ) |

RISK FACTORS

Any investmentInvestment in our common stock involves a highsubstantial degree of risk. Yourisk and should consider carefullybe regarded as speculative. As a result, the following information about these risks, together with the other information contained in this prospectus, before you decide to buypurchase of our common stock. The risksstock should be considered only by persons who can reasonably afford to lose their entire investment. Before you elect to purchase our common stock, you should carefully consider the risk and uncertainties described below are notin addition to the only ones we face.other information incorporated herein by reference. Additional risks and uncertainties not presently known to usof which we are unaware or thatwhich we currently deembelieve are immaterial maycould also impairmaterially adversely affect our business, financial condition or results of operations. If any of the following risks actuallyor uncertainties discussed in this prospectus occur, our business, would likely sufferprospects, liquidity, financial condition and results of operations could be materially and adversely affected, in which case the trading price of our common stock could decline, and you maycould lose all or part of your investment.

Risk factors marked with an asterisk (*) below include a substantive change from or an update to the money you paid to buyrisk factors included in our Annual Report on Form 10-K for the fiscal year ended March 31, 2023, filed with the SEC on July 14, 2023.

Risk Factor Summary

Below is a summary of the principal factors that make an investment in our common stock speculative or risky. This summary does not address all of the risks that we face. Additional discussion of the risks summarized in this risk factor summary, and other risks that we face, can be found below and should be carefully considered, together with other information in this prospectus and our other filings with the Securities and Exchange Commission before making investment decisions regarding our common stock.

Risks related•We will incur substantial additional operating losses over the next several years as our research and development activities increase.

•Using our platform technology to develop human tissues and disease models for drug discovery and development is new and unproven.

•As we pursue drug development through 3D tissues and disease models, we will require access to a constant, steady, reliable supply of human cells to support our development activities.

•We may require substantial additional funding. Raising additional capital would cause dilution to our Businessexisting stockholders and may restrict our Industryoperations or require us to relinquish rights to our technologies or to a product candidate.

•Clinical drug development involves a lengthy and expensive process with uncertain timelines and uncertain outcomes, and results of earlier studies and trials may not be predictive of future results.

•The near and long-term viability of our drug discovery and development efforts will depend on our ability to successfully establish strategic relationships.

•Current and future legislation may increase the difficulty and cost of commercializing our drug candidates and may affect the prices we may obtain if our drug candidates are approved for commercialization.

•Management has performed an analysis and concluded that substantial doubt exists about our ability to continue as a going concern.

•Additional funds may not be available when we need them on terms that are acceptable to us, or at all. If adequate funds are not available to us on a timely basis, we may be required to curtail or cease our operations.

•We have

a limited operating history and a history of operating losses and expect to incur significant additional operating losses.

We were incorporated

•There is no assurance that an active market in 2007, opened our laboratoriescommon stock will continue at present levels or increase in San Diego in January, 2009 and have only a limited operating history. Therefore, there is limited historical financial information upon which to base an evaluationthe future.

•The price of our performance. Our prospects mustcommon stock may continue to be consideredvolatile, which could lead to losses by investors and costly securities litigation.

•Patents covering our products could be found invalid or unenforceable if challenged in lightcourt or before administrative bodies in the United States or abroad.

•We may be involved in lawsuits or other proceedings to protect or enforce our patents or the patents of the uncertainties, risks, expenses,our licensors, which could be expensive, time-consuming and difficulties frequently encountered by companiesunsuccessful.

Risks related to this Offering

*We need to raise capital in their early stages ofthis offering to support our operations. If we are unable to raise capital in this offering, our financial position will be materially adversely impacted.

We have generated operatingincurred substantial losses since our inception, and we beganexpect to continue to incur additional losses for the next several years. For the three months ended December 31, 2023, we had net losses of $3.6 million. From our inception through December 31, 2023, we had an accumulated deficit of $336.6 million. We believe that current cash on hand, prior to the receipt of any proceeds from this offering, is not sufficient to fund operations including $1,338,694, $3,964,610beyond June 2024. If we were to receive net proceeds of $[___] million from this offering, we believe that the net proceeds from this offering, together with our existing cash and $1,329,130cash equivalents, will meet our capital needs into [___]. If we receive the foregoing net proceeds of $[___] million in this offering, and if we raise an additional $[___] million in net proceeds through the sale of securities or otherwise throughout 2024, we believe that we will then meet our capital needs through the end of [___]. If we were to receive net proceeds of $[___] million from this offering, we believe that the net proceeds from this offering, together with our existing cash and cash equivalents, will meet our capital needs through [__]. In addition, the report of our independent registered public accounting firm on our financial statements for the year ended March 31, 2023 contains explanatory language that substantial doubt exists about our ability to continue as a going concern. If we do not have access to sufficient cash and liquidity to finance our business operations as currently contemplated, we would be compelled to reduce general and administrative expenses and delay research and development projects, including the purchase of scientific equipment and supplies, until we are able to obtain sufficient financing. We have no additional committed sources of capital and may find it difficult to raise money on terms favorable to us or at all. The failure to obtain sufficient capital to support our operations would have a material adverse effect on our business, financial condition and results of operations. If such sufficient financing is not received timely, we would then need to pursue a plan to license or sell assets, seek to be acquired by another entity, cease operations and/or seek bankruptcy protection.

*Purchasers who purchase our securities in this offering pursuant to a securities purchase agreement may have rights not available to purchasers that purchase without the benefit of a securities purchase agreement.

In addition to rights and remedies available to all purchasers in this offering under federal securities and state law, the purchasers that enter into a securities purchase agreement will also be able to bring claims of breach of contract against us. The ability to pursue a claim for breach of contract provides those investors with the means to enforce the covenants uniquely available to them under the securities purchase agreement including: (i) timely delivery of shares; (ii) agreement to not enter into variable rate financings for [____] from closing, subject to certain exceptions; (iii) agreement to not enter into any financings for [__] days from closing; and (iv) indemnification for breach of contract.