may be liable for damages.

Our research and development activities involve the controlled use of potentially hazardous substances, including chemical and biological materials by our third-party manufacturers. Our manufacturers are subject to federal, state and local laws and regulations in the United States governing the use, manufacture, storage, handling and disposal of medical, radioactive and hazardous materials. Although we believe that our manufacturers’ procedures for using, handling, storing and disposing of these materials comply with legally prescribed standards, we cannot completely eliminate the risk of contamination or injury resulting from medical, radioactive or hazardous materials. As a result of any such contamination or injury we may incur liability or local, city, state or federal authorities may curtail the use of these materials and interrupt our business operations. In the event of an accident, we could be held liable for damages or penalized with fines, and the liability could

exceed our resources. We do not have any insurance for liabilities arising from medical radioactive or hazardous materials. Compliance with applicable environmental laws and regulations is expensive, and current or future environmental regulations may impair our research, development and production efforts, which could harm our business, prospects, financial condition or results of operations.

Risks Related to Our Financial Position and Capital Requirements

We have a limited operating history, have incurred significant operating losses since our inception and anticipate that we will continue to incur losses for the foreseeable future.

Our operations began in 2005 and we have only a limited operating history upon which you can evaluate our business and prospects. Our operations to date have been limited to conducting product development activities for emricasan and performing research and development with respect to our clinical and preclinical programs. In addition, as an early stage company, we have limited experience and have not yet demonstrated an ability to successfully overcome many of the risks and uncertainties frequently encountered by companies in new and rapidly evolving fields, particularly in the pharmaceutical area. Nor have we demonstrated an ability to obtain regulatory approval for or to commercialize a drug candidate. Consequently, any predictions about our future performance may not be as accurate as they would be if we had a history of successfully developing and commercializing pharmaceutical products.

To date, we have financed our operations primarily through private placements of convertible debt and preferred stock, and we have incurred significant operating losses since our inception, including consolidated net losses of $12.0 million and $8.7 million for the years ended December 31, 2011 and 2012, respectively, and $2.3 million for the three months ended March 31, 2013. As of March 31, 2013, we had an accumulated deficit of $61.1 million. Our prior losses, combined with expected future losses, have had and will continue to have an adverse effect on our stockholders’ equity and working capital. Our losses have resulted principally from costs incurred in our research and development activities. We anticipate that our operating losses will substantially increase over the next several years as we execute our plan to expand our research, development and commercialization activities, including the clinical development and planned commercialization of our drug candidate, emricasan, and incur the additional costs of operating as a public company. In addition, if we obtain regulatory approval of emricasan, we may incur significant sales and marketing expenses. Because of the numerous risks and uncertainties associated with developing pharmaceutical products, we are unable to predict the extent of any future losses or whether or when we will become profitable, if ever.

Our independent registered public accounting firm has included an explanatory paragraph relating to our ability to continue as a going concern in its report on our audited financial statements included in this prospectus.

Our report from our independent registered public accounting firm for the year ended December 31, 2012 includes an explanatory paragraph stating that our recurring losses from operations and negative cash flows raise substantial doubt about our ability to continue as a going concern. If we are unable to obtain sufficient funding, our business, prospects, financial condition and results of operations will be materially and adversely affected and we may be unable to continue as a going concern. If we are unable to continue as a going concern, we may have to liquidate our assets and may receive less than the value at which those assets are carried on our audited consolidated financial statements, and it is likely that investors will lose all or a part of their investment. After this offering, future reports from our independent registered public accounting firm may also contain statements expressing doubt about our ability to continue as a going concern. If we seek additional financing to fund our business activities in the future and there remains doubt about our ability to continue as a going concern, investors or other financing sources may be unwilling to provide additional funding on commercially reasonable terms or at all.

We have not generated any revenues to date from product sales. We may never achieve or sustain profitability, which could depressnegatively affect the market price of our common stock, and could cause you to lose all orregardless of our actual operating performance. Further, a part of your investment.

Our ability to become profitable depends on our ability to develop and commercialize emricasan. To date, we have no products approved for commercial sale and have not generated any revenues from sales of any drug

candidate, and we do not know when, or if, we will generate revenuesdecline in the future. We do not anticipate generating revenues, if any, from sales of emricasan for at least the next several yearsfinancial markets and we will never generate revenues from emricasan if we do not obtain regulatory approval for emricasan. Our ability to generate future revenues depends heavily onrelated factors beyond our success in:

developing and securing U.S. and/or foreign regulatory approvals for emricasan;

manufacturing commercial quantities of emricasan at acceptable cost;

achieving broad market acceptance of emricasan in the medical community and with third-party payors and patients;

commercializing emricasan, assuming we receive regulatory approval; and

pursuing clinical development of emricasan in additional indications.

Even if we do generate product sales, we may never achieve or sustain profitability. Our failure to become and remain profitable would depress the market price of our common stock and could impair our ability to raise capital, expand our business, diversify our product offerings or continue our operations.

If we fail to obtain additional financing, we may be unable to complete the development and commercialization of emricasan.

Our operations have consumed substantial amounts of cash since inception. We expect to continue to spend substantial amounts to continue the clinical development of emricasan, including our planned Phase 2 and Phase 3 clinical trials. If approved, we will require significant additional amounts in order to launch and commercialize emricasan, including building our own commercial capabilities to sell, market, and distribute emricasan in the United States and the EU.

We estimate that our net proceeds from this offering will be approximately $ million, based upon an assumed initial public offering price of $ per share (the midpoint of the price range set forth on the cover page of this prospectus), after deducting the estimated underwriting discounts and commissions and offering expenses payable by us. We believe that such proceeds together with our existing cash and cash equivalents will be sufficient to fund our operations for at least the next 18 months. In particular, we expect that the net proceeds from this offering will allow us to complete our planned Phase 2b ACLF trial, Phase 2b/3 HCV-POLT trial and Phase 2b CLF trial. However, changing circumstancescontrol may cause usour stock price to consume capital significantly faster than we currently anticipate,decline rapidly and we may need to spend more money than currently expected because of circumstances beyond our control. We will require additional capital for the further development and commercialization of emricasan and may need to raise additional funds sooner if we choose to expand more rapidly than we presently anticipate.

We cannot be certain that additional funding will be available on acceptable terms, or at all. If we are unable to raise additional capital in sufficient amounts or on terms acceptable to us, we may have to significantly delay, scale back or discontinue the development or commercialization of emricasan or other research and development initiatives. We also could be required to seek collaborators for emricasan at an earlier stage than otherwise would be desirable or on terms that are less favorable than might otherwise be available or relinquish or license on unfavorable terms our rights to emricasan in markets where we otherwise would seek to pursue development or commercialization ourselves.

Any of the above events could significantly harm our business, prospects, financial condition and results of operations and cause the price of our common stock to decline.unexpectedly.

Raising additional capital may cause dilution to our existing stockholders, restrict our operations or require us to relinquish rights to our technologies or drugproduct candidate.

We may seek additional capital through a combination of public and private equity offerings, debt financings, strategic partnerships and alliances and licensing arrangements. ToWe have a purchase agreement in place with Lincoln Park to sell up to $10.0 million worth of shares of our common stock, from time to time, to Lincoln Park, under which $8.5 million remains available for future sale as of September 30, 2020. Any sales under the Lincoln Park arrangement, and to the extent that we raise additional capital through the sale of equity or convertible debt securities, yourthe ownership interestinterests of our stockholders will be diluted, and the terms may include liquidation or other preferences that adversely affect yourthe rights as a stockholder.of our stockholders. The incurrence of

indebtedness would result in increased fixed payment obligations and could involve certain restrictive covenants, such as limitations on our ability to incur additional debt, limitations on our ability to acquire or license intellectual property rights and other operating restrictions that could adversely impact our ability to conduct our business. If we raise additional funds through strategic partnerships and alliances and licensing arrangements with third parties, we may have to relinquish valuable rights to our technologies or drugproduct candidate, or grant licenses on terms unfavorable to us.

Our ability to utilize our net operating loss carryforwards and certain other tax attributes may be limited.

Under Section 382 of the Internal Revenue Code of 1986, as amended, if a corporation undergoes an “ownership change” (generally defined as a greater than 50% change (by value) in its equity ownership over a three year period), the corporation’s ability to use its pre-change net operating loss carryforwards and other pre-change tax attributes to offset its post-change income may be limited. As a result of our most recent private placements and other transactions that have occurred over the past three years, we may have experienced, and, upon completion of this offering, may experience, an “ownership change.” We may also experience ownership changes in the future as a result of subsequent shifts in our stock ownership. As of December 31, 2012, we had federal and state net operating loss carryforwards of approximately $52.3 million and $51.2 million, respectively, and federal and state research and development credits of $1.3 million and $745,000, respectively, which could be limited if we experience an “ownership change.”

Unstable market and economic conditions may have serious adverse consequences on our business, financial condition and stock price.

As widely reported, global credit and financial markets have experienced extreme disruptions in the past several years, including severely diminished liquidity and credit availability, declines in consumer confidence, declines in economic growth, increases in unemployment rates, and uncertainty about economic stability. There can be no assurance that further deterioration in credit and financial markets and confidence in economic conditions will not occur. Our general business strategy may be adversely affected by any such economic downturn, volatile business environment or continued unpredictable and unstable market conditions. If the current equity and credit markets deteriorate, or do not improve, it may make any necessary debt or equity financing more difficult, more costly, and more dilutive. Failure to secure any necessary financing in a timely manner and on favorable terms could have a material adverse effect on our growth strategy, financial performance and stock price and could require us to delay or abandon clinical development plans. In addition, there is a risk that one or more of our current service providers, manufacturers and other partners may not survive these difficult economic times, which could directly affect our ability to attain our operating goals on schedule and on budget.

At March 31, 2013, we had approximately $5.1 million of cash, cash equivalents and short-term investments. While we are not aware of any downgrades, material losses, or other significant deterioration in the fair value of our cash equivalents since March 31, 2013, no assurance can be given that further deterioration of the global credit and financial markets would not negatively impact our current portfolio of cash equivalents or marketable securities or our ability to meet our financing objectives. Furthermore, our stock price may decline due in part to the volatility of the stock market and the general economic downturn.

Risks Related to Our Intellectual Property

If our efforts to protect the proprietary nature of the intellectual property related to our technologies are not adequate, we may not be able to compete effectively in our market.

We rely upon a combination of patents, trade secret protection and confidentiality agreements to protect the intellectual property related to our technologies. Any disclosure to or misappropriation by third parties of our confidential proprietary information could enable competitors to quickly duplicate or surpass our technological achievements, thus eroding our competitive position in our market.

Composition-of-matter patents on the active pharmaceutical ingredient and crystalline forms are generally considered to be the strongest form of intellectual property protection for pharmaceutical products, as such

patents provide protection without regard to any method of use. We cannot be certain that the claims in our patent applications covering composition-of-matter and crystalline forms of emricasan will be considered patentable by the United States Patent and Trademark Office, or the U.S. PTO, courts in the United States, or by the patent offices and courts in foreign countries. Method-of-use patents protect the use of a product for the specified method. This type of patent does not prevent a competitor from making and marketing a product that is identical to our product for an indication that is outside the scope of the patented method. Moreover, even if competitors do not actively promote their product for our targeted indications, physicians may prescribe these products “off-label.” Although off-label prescriptions may infringe or contribute to the infringement of method-of-use patents, the practice is common and such infringement is difficult to prevent or prosecute.

The strength of patents in the biotechnology and pharmaceutical field involves complex legal and scientific questions and can be uncertain. Some of our patents related to emricasan were acquired from a predecessor owner and were therefore not written by us or our attorneys, and we did not have control over the drafting and prosecution of these patents. Further, the former patent owners might not have given the same attention to the drafting and early prosecution of these patents and applications as we would have if we had been the owners of the patents and applications and had control over the drafting and prosecution. In addition, the former patent owners may not have been completely familiar with U.S. patent law, possibly resulting in inadequate disclosure and/or claims. This could result in findings of invalidity or unenforceability of the patents we own or patents issuing with reduced claim scope.

In addition, the patent applications that we own or that we may license may fail to result in issued patents in the United States or in other foreign countries. Even if the patents do successfully issue, third parties may challenge the validity, enforceability or scope thereof, which may result in such patents being narrowed, invalidated or held unenforceable. Furthermore, even if they are unchallenged, our patents and patent applications may not adequately protect our intellectual property or prevent others from designing around our claims. If the breadth or strength of protection provided by the patent applications we hold with respect to emricasan is threatened, it could dissuade companies from collaborating with us to develop, and threaten our ability to commercialize, emricasan. Further, if we encounter delays in our clinical trials, the period of time during which we could market emricasan under patent protection would be reduced. Since patent applications in the United States and most other countries are confidential for a period of time after filing, we cannot be certain that we were the first to file any patent application related to emricasan. Furthermore, for applications in which all claims are entitled to a priority date before March 16, 2013, an interference proceeding can be provoked by a third-party or instituted by the U.S. PTO, to determine who was the first to invent any of the subject matter covered by the patent claims of our applications. For applications containing a claim not entitled to priority before March 16, 2013, there is greater level of uncertainty in the patent law with the passage of the America Invents Act (2012) which brings into effect significant changes to the U.S. patent laws that are yet untried and untested, and which introduces new procedures for challenging pending patent applications and issued patents. A primary change under this reform is creating a “first to file” system in the U.S. This will require us to be cognizant going forward of the time from invention to filing of a patent application.

In addition to the protection afforded by patents, we seek to rely on trade secret protection and confidentiality agreements to protect proprietary know-how that is not patentable, processes for which patents are difficult to enforce and any other elements of our drug discovery and development processes that involve proprietary know-how, information or technology that is not covered by patents. Although we require all of our employees to assign their inventions to us, and require all of our employees, consultants, advisors and any third parties who have access to our proprietary know-how, information or technology to enter into confidentiality agreements, we cannot be certain that our trade secrets and other confidential proprietary information will not be disclosed or that competitors will not otherwise gain access to our trade secrets or independently develop substantially equivalent information and techniques. Furthermore, the laws of some foreign countries do not protect proprietary rights to the same extent or in the same manner as the laws of the United States. As a result, we may encounter significant problems in protecting and defending our intellectual property both in the United States and abroad. If we are unable to prevent unauthorized material disclosure of our intellectual property to third parties, we will not be able to establish or maintain a competitive advantage in our market, which could materially adversely affect our business, operating results and financial condition.

Third-party claims of intellectual property infringement may prevent or delay our drug discovery and development efforts.

Our commercial success depends in part on our avoiding infringement of the patents and proprietary rights of third parties. There is a substantial amount of litigation involving patents and other intellectual property rights in the biotechnology and pharmaceutical industries, as well as administrative proceedings for challenging patents, including interference and reexamination proceedings before the U.S. PTO or oppositions and other comparable proceedings in foreign jurisdictions. Recently, under U.S. patent reform, new procedures includinginter partes review and post grant review have been implemented. As stated above, this reform is untried and untested and will bring uncertainty to the possibility of challenge to our patents in the future. Numerous U.S. and foreign issued patents and pending patent applications, which are owned by third parties, exist in the fields in which we are developing emricasan. As the biotechnology and pharmaceutical industries expand and more patents are issued, the risk increases that emricasan may give rise to claims of infringement of the patent rights of others.

Third parties may assert that we are employing their proprietary technology without authorization. There may be third-party patents of which we are currently unaware with claims to materials, formulations, methods of manufacture or methods for treatment related to the use or manufacture of emricasan. Because patent applications can take many years to issue, there may be currently pending patent applications which may later result in issued patents that emricasan may infringe. In addition, third parties may obtain patents in the future and claim that use of our technologies infringes upon these patents. If any third-party patents were held by a court of competent jurisdiction to cover the manufacturing process of emricasan, any molecules formed during the manufacturing process or any final product itself, the holders of any such patents may be able to block our ability to commercialize the drug candidate unless we obtained a license under the applicable patents, or until such patents expire or they are finally determined to be held invalid or unenforceable. Similarly, if any third-party patent were held by a court of competent jurisdiction to cover aspects of our formulations, processes for manufacture or methods of use, including combination therapy or patient selection methods, the holders of any such patent may be able to block our ability to develop and commercialize the drug candidate unless we obtained a license or until such patent expires or is finally determined to be held invalid or unenforceable. In either case, such a license may not be available on commercially reasonable terms or at all. If we are unable to obtain a necessary license to a third-party patent on commercially reasonable terms, or at all, our ability to commercialize emricasan may be impaired or delayed, which could in turn significantly harm our business.

Parties making claims against us may seek and obtain injunctive or other equitable relief, which could effectively block our ability to further develop and commercialize emricasan. Defense of these claims, regardless of their merit, would involve substantial litigation expense and would be a substantial diversion of employee resources from our business. In the event of a successful claim of infringement against us, we may have to pay substantial damages, including treble damages and attorneys’ fees for willful infringement, obtain one or more licenses from third parties, pay royalties or redesign our infringing products, which may be impossible or require substantial time and monetary expenditure. We cannot predict whether any such license would be available at all or whether it would be available on commercially reasonable terms. Furthermore, even in the absence of litigation, we may need to obtain licenses from third parties to advance our research or allow commercialization of emricasan. We may fail to obtain any of these licenses at a reasonable cost or on reasonable terms, if at all. In that event, we would be unable to further develop and commercialize emricasan, which could harm our business significantly.

We may be involved in lawsuits to protect or enforce our patents, which could be expensive, time-consuming and unsuccessful.

Competitors may infringe our patents. To counter infringement or unauthorized use, we may be required to file infringement claims, which can be expensive and time-consuming. In addition, in an infringement proceeding, a court may decide that one or more of our patents is not valid or is unenforceable, or may refuse to stop the other party from using the technology at issue on the grounds that our patents do not cover the technology in question. An adverse result in any litigation or defense proceedings could put one or more of our patents at risk of being invalidated, held unenforceable, or interpreted narrowly and could put our patent applications at risk of not

issuing. Defense of these claims, regardless of their merit, would involve substantial litigation expense and would be a substantial diversion of employee resources from our business. In the event of a successful claim of infringement against us, we may have to pay substantial damages, including treble damages and attorneys’ fees for willful infringement, obtain one or more licenses from third parties, pay royalties or redesign our infringing products, which may be impossible or require substantial time and monetary expenditure.

Interference proceedings provoked by third parties or brought by the U.S. PTO may be necessary to determine the priority of inventions with respect to our patents or patent applications. An unfavorable outcome could require us to cease using the related technology or to attempt to license rights to it from the prevailing party. Our business could be harmed if the prevailing party does not offer us a license on commercially reasonable terms. Litigation or interference proceedings may fail and, even if successful, may result in substantial costs and distract our management and other employees. We may not be able to prevent misappropriation of our trade secrets or confidential information, particularly in countries where the laws may not protect those rights as fully as in the United States.

Furthermore, because of the substantial amount of discovery required in connection with intellectual property litigation, there is a risk that some of our confidential information could be compromised by disclosure during this type of litigation. In addition, there could be public announcements of the results of hearings, motions or other interim proceedings or developments. If securities analysts or investors perceive these results to be negative, it could have a substantial adverse effect on the price of our common stock.

Obtaining and maintaining our patent protection depends on compliance with various procedural, document submission, fee payment and other requirements imposed by governmental patent agencies, and our patent protection could be reduced or eliminated for non-compliance with these requirements.

Periodic maintenance fees on any issued patent are due to be paid to the U.S. PTO and foreign patent agencies in several stages over the lifetime of the patent. The U.S. PTO and various foreign governmental patent agencies require compliance with a number of procedural, documentary, fee payment and other similar provisions during the patent application process. While an inadvertent lapse can in many cases be cured by payment of a late fee or by other means in accordance with the applicable rules, there are situations in which noncompliance can result in abandonment or lapse of the patent or patent application, resulting in partial or complete loss of patent rights in the relevant jurisdiction. Non-compliance events that could result in abandonment or lapse of a patent or patent application include, but are not limited to, failure to respond to official actions within prescribed time limits, non-payment of fees and failure to properly legalize and submit formal documents. In such an event, our competitors might be able to enter the market, which would have a material adverse effect on our business.

We may be subject to claims that our employees, consultants or independent contractors have wrongfully used or disclosed confidential information of third parties.

We have received confidential and proprietary information from third parties. In addition, we employ individuals who were previously employed at other biotechnology or pharmaceutical companies. We may be subject to claims that we or our employees, consultants or independent contractors have inadvertently or otherwise used or disclosed confidential information of these third parties or our employees’ former employers. Litigation may be necessary to defend against these claims. Even if we are successful in defending against these claims, litigation could result in substantial cost and be a distraction to our management and employees.

Risks Related to This Offering and Ownership of our Common Stock

We do not know whether an active, liquid and orderly trading market will develop for our common stock or what the market price of our common stock will be and as a result it may be difficult for you to sell your shares of our common stock.

Prior to this offering there has been no public market for shares of our common stock. Although we expect that our common stock will be approved for listing on The NASDAQ Global Market, an active trading market for our shares may never develop or be sustained following this offering. You may not be able to sell your shares quickly or at the market price if trading in shares of our common stock is not active. The initial public offering price for our common stock will be determined through negotiations with the underwriters, and the negotiated price may

not be indicative of the market price of the common stock after the offering. As a result of these and other factors, you may be unable to resell your shares of our common stock at or above the initial public offering price. Further, an inactive market may also impair our ability to raise capital by selling shares of our common stock and may impair our ability to enter into strategic partnerships or acquire companies or products by using our shares of common stock as consideration.

The price of our stock may be volatile, and you could lose all or part of your investment.

The trading price of our common stock following this offering is likely to be highly volatile and could be subject to wide fluctuations in response to various factors, some of which are beyond our control, including limited trading volume. In addition to the factors discussed in this “Risk Factors” section and elsewhere in this prospectus, these factors include:

the commencement, enrollment or results of our planned Phase 2 and Phase 3 clinical trials of emricasan or any future clinical trials we may conduct, or changes in the development status of emricasan;

any delay in our regulatory filings for emricasan and any adverse development or perceived adverse development with respect to the applicable regulatory authority’s review of such filings, including without limitation the FDA’s issuance of a “refusal to file” letter or a request for additional information;

adverse results or delays in clinical trials;

our decision to initiate a clinical trial, not to initiate a clinical trial or to terminate an existing clinical trial;

adverse regulatory decisions, including failure to receive regulatory approval for emricasan;

changes in laws or regulations applicable to our products, including but not limited to clinical trial requirements for approvals;

adverse developments concerning our manufacturers;

our inability to obtain adequate product supply for any approved drug product or inability to do so at acceptable prices;

our inability to establish collaborations if needed;

our failure to commercialize emricasan;

additions or departures of key scientific or management personnel;

unanticipated serious safety concerns related to the use of emricasan;

introduction of new products or services offered by us or our competitors;

announcements of significant acquisitions, strategic partnerships, joint ventures or capital commitments by us or our competitors;

our ability to effectively manage our growth;

the size and growth, if any, of the ACLF, CLF and HCV-POLT markets and other targeted markets;

our ability to successfully enter new markets;

actual or anticipated variations in quarterly operating results;

our failure to meet the estimates and projections of the investment community or that we may otherwise provide to the public;

publication of research reports about us or our industry or positive or negative recommendations or withdrawal of research coverage by securities analysts;

changes in the market valuations of similar companies;

overall performance of the equity markets;

sales of our common stock by us or our stockholders in the future;

trading volume of our common stock;

changes in accounting practices;

ineffectiveness of our internal controls;

disputes or other developments relating to proprietary rights, including patents, litigation matters and our ability to obtain patent protection for our technologies;

significant lawsuits, including patent or stockholder litigation;

general political and economic conditions; and

other events or factors, many of which are beyond our control.

In addition, the stock market in general, and The NASDAQ Global Market and biotechnology companies in particular, have experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of these companies. Broad market and industry factors may negatively affect the market price of our common stock, regardless of our actual operating performance. If the market price of our common stock after this offering does not exceed the initial public offering price, you may not realize any return on your investment in us and may lose some or all of your investment. In the past, securities class action litigation has often been instituted against companies following periods of volatility in the market price of a company’s securities. This type of litigation, if instituted, could result in substantial costs and a diversion of management’s attention and resources, which would harm our business, operating results or financial condition.

We do not intend to pay dividends on our common stock so any returns will be limited to the value of our stock.

We have never declared or paid any cash dividend on our common stock. We currently anticipate that we will retain future earnings for the development, operation and expansion of our business and do not anticipate declaring or paying any cash dividends for the foreseeable future. In addition, our ability to pay cash dividends is currently prohibited by the terms of a promissory note in the principal amount of $1.0 million issued by us to Pfizer Inc. in July 2010. Any return to stockholders will therefore be limited to the appreciation of their stock.

Our principal stockholders and management own a significant percentage of our stock and will be able to exert significant control over matters subject to stockholder approval.

Prior to this offering, our executive officers, directors, 5% stockholders and their affiliates owned approximately % of our voting stock and, upon the closing of this offering, that same group will hold approximately % of our outstanding voting stock (assuming no exercise of the underwriters’ over-allotment option) in each case assuming an initial public offering price of $ per share (the midpoint of the price range set forth on the cover page of this prospectus). Therefore, even after this offering, these stockholders will have the ability to influence us through this ownership position. These stockholders may be able to determine all matters requiring stockholder approval. For example, these stockholders may be able to control elections of directors, amendments of our organizational documents, or approval of any merger, sale of assets, or other major corporate transaction. This may prevent or discourage unsolicited acquisition proposals or offers for our common stock that you may feel are in your best interest as one of our stockholders. In addition, entities affiliated with Aberdare Ventures, Advent Private Equity, Coöperative Gilde Healthcare II U.A., MPM Capital, Roche Finance Ltd, AgeChem Venture Fund L.P., Hale BioPharma Ventures LLC and our chief executive officer, each of which is a current stockholder, have indicated an interest in purchasing an aggregate of approximately $10.0 million of shares of our common stock in this offering. The above discussed ownership percentage upon completion of this offering does not reflect the potential purchase of any shares in this offering by such entities. If these entities purchase shares of our common stock in this offering, assuming an initial public offering price of $ per share (the midpoint of the price range set forth on the cover page of this prospectus), upon completion of this offering, our executive officers, directors, 5% stockholders and their affiliates will hold approximately % of our voting stock (assuming no exercise of the underwriters’ over-allotment option).

If you purchase our common stock in this offering, you will incur immediate and substantial dilution in the book value of your shares.

The initial public offering price is substantially higher than the net tangible book value per share of our common stock. Investors purchasing common stock in this offering will pay a price per share that substantially exceeds the book value of our tangible assets after subtracting our liabilities. As a result, investors purchasing common stock in this offering will incur immediate dilution of $ per share, based upon an assumed initial public offering price of $ per share (the midpoint of the price range set forth on the cover page of this prospectus). Further, investors purchasing common stock in this offering will contribute approximately % of the total amount invested by stockholders since our inception, but will own only approximately % of the shares of common stock outstanding after giving effect to this offering.

This dilution is due to our investors who purchased shares prior to this offering having paid substantially less when they purchased their shares than the price offered to the public in this offering and the exercise of stock options granted to our employees. To the extent outstanding options or warrants are exercised, there will be further dilution to new investors. As a result of the dilution to investors purchasing shares in this offering, investors may receive significantly less than the purchase price paid in this offering, if anything, in the event of our liquidation. For a further description of the dilution that you will experience immediately after this offering, see “Dilution.”

We are an emerging growth company, and we cannot be certain if the reduced reporting requirements applicable to emerging growth companies will make our common stock less attractive to investors.

We are an emerging growth company, as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. For as long as we continue to be an emerging growth company, we may take advantage of exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies, including not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in this prospectus and our periodic reports and proxy statements and exemptions from the requirements of holding nonbinding advisory votes on executive compensation and stockholder approval of any golden parachute payments not previously approved. We could be an emerging growth company for up to five years following the year in which we complete this offering, although circumstances could cause us to lose that status earlier, including if the market value of our common stock held by non-affiliates exceeds $700.0 million as of any June 30 before that time or if we have total annual gross revenue of $1.0 billion or more during any fiscal year before that time, in which cases we would no longer be an emerging growth company as of the following December 31 or, if we issue more than $1.0 billion in non-convertible debt during any three year period before that time, we would cease to be an emerging growth company immediately. Even after we no longer qualify as an emerging growth company, we may still qualify as a “smaller reporting company” which would allow us to take advantage of many of the same exemptions from disclosure requirements including not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act and reduced disclosure obligations regarding executive compensation in this prospectus and our periodic reports and proxy statements. We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

Under the JOBS Act, emerging growth companies can also delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have irrevocably elected not to avail ourselves of this exemption from new or revised accounting standards and, therefore, will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies. As a result, changes in rules of U.S. generally accepted accounting principles or their interpretation, the adoption of new guidance or the application of existing guidance to changes in our business could significantly affect our financial position and results of operations.

We will incur significant increased costs as a result of operating as a public company, and our management will be required to devote substantial time to new compliance initiatives.

As a public company, we will incur significant legal, accounting and other expenses that we did not incur as a private company. We will be subject to the reporting requirements of the Securities Exchange Act of 1934, as amended, which will require, among other things, that we file with the Securities and Exchange Commission, or the SEC, annual, quarterly and current reports with respect to our business and financial condition. In addition, the Sarbanes-Oxley Act, as well as rules subsequently adopted by the SEC and The NASDAQ Global Market to implement provisions of the Sarbanes-Oxley Act, impose significant requirements on public companies, including requiring establishment and maintenance of effective disclosure and financial controls and changes in corporate governance practices. Further, in July 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act, or the Dodd-Frank Act, was enacted. There are significant corporate governance and executive compensation relatedAnti-takeover provisions in the Dodd-Frank Act that require the SEC to adopt additional rules and regulations in these areas such as “say on pay” and proxy access. Recent legislation permits emerging growth

companies to implement many of these requirements over a longer period and up to five years from the pricing of this offering. We intend to take advantage of this new legislation but cannot guarantee that we will not be required to implement these requirements sooner than budgeted or planned and thereby incur unexpected expenses. Stockholder activism, the current political environment and the current high level of government intervention and regulatory reform may lead to substantial new regulations and disclosure obligations, which may lead to additional compliance costs and impact the manner in which we operate our business in ways we cannot currently anticipate.

We expect the rules and regulations applicable to public companies to substantially increase our legal and financial compliance costs and to make some activities more time-consuming and costly. If these requirements divert the attention of our management and personnel from other business concerns, they could have a material adverse effect on our business, financial condition and results of operations. The increased costs will decrease our net income or increase our consolidated net loss, and may require us to reduce costs in other areas of our business or increase the prices of our products or services. For example, we expect these rules and regulations to make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to incur substantial costs to maintain the same or similar coverage. We cannot predict or estimate the amount or timing of additional costs we may incur to respond to these requirements. The impact of these requirements could also make it more difficult for us to attract and retain qualified persons to serve on our board of directors, our board committees or as executive officers.

Sales of a substantial number of shares of our common stock by our existing stockholders in the public market could cause our stock price to fall.

If our existing stockholders sell, or indicate an intention to sell, substantial amounts of our common stock in the public market after the lock-up and other legal restrictions on resale discussed in this prospectus lapse, the trading price of our common stock could decline. Based on shares of common stock outstanding as of March 31, 2013, upon the closing of this offering we will have outstanding a total of shares of common stock, assuming net exercises of all outstanding warrants, no exercise of the underwriters’ over-allotment option and no exercise of outstanding options. Of these shares, only the shares of common stock sold in this offering by us, plus any shares sold upon exercise of the underwriters’ over-allotment option, will be freely tradable without restriction in the public market immediately following this offering. Stifel, Nicolaus & Company, Incorporated and Piper Jaffray & Co., however, may, in their sole discretion, permit our officers, directors and other stockholders who are subject to these lock-up agreements to sell shares prior to the expiration of the lock-up agreements.

We expect that the lock-up agreements pertaining to this offering will expire 180 days from the date of this prospectus. After the lock-up agreements expire, up to an additional shares of common stock will be eligible for sale in the public market, of which shares are held by directors, executive officers and other affiliates and will be subject to volume limitations under Rule 144 under the Securities Act, assuming an initial public offering price of $ per share (the midpoint of the price range set forth on the cover page of this prospectus). In addition, shares of common stock that are either subject to outstanding options or reserved for future issuance under our employee benefit plans will become eligible for sale in the public market to the extent permitted by the provisions of various vesting schedules, the lock-up agreements and Rule 144 and Rule 701 under the Securities Act. If these additional shares of common stock are sold, or if it is perceived that they will be sold, in the public market, the trading price of our common stock could decline.

After this offering, the holders of shares of our common stock, or % of our total outstanding common stock as of March 31, 2013, will be entitled to rights with respect to the registration of their shares under the Securities Act, subject to the 180-day lock-up agreements described above and assuming an initial public offering price of $ per share (the midpoint of the price range set forth on the cover page of this prospectus). See “Description of Capital Stock—Registration Rights.” Registration of these shares under the Securities Act would result in the shares becoming freely tradable without restriction under the Securities Act, except for shares held by affiliates, as defined in Rule 144 under the Securities Act. Any sales of securities by these stockholders could have a material adverse effect on the trading price of our common stock.

Future sales and issuances of our common stock or rights to purchase common stock, including pursuant to our equity incentive plans, could result in additional dilution of the percentage ownership of our stockholders and could cause our stock price to fall.

We expect that significant additional capital may be needed in the future to continue our planned operations, including conducting clinical trials, commercialization efforts, expanded research and development activities and costs associated with operating a public company. To raise capital, we may sell common stock, convertible securities or other equity securities in one or more transactions at prices and in a manner we determine from time to time. If we sell common stock, convertible securities or other equity securities, investors may be materially diluted by subsequent sales. Such sales may also result in material dilution to our existing stockholders, and new investors could gain rights, preferences and privileges senior to the holders of our common stock, including shares of common stock sold in this offering.

Pursuant to our 2013 equity incentive plan, or the 2013 plan, which will become effective immediately prior to the closing of this offering, our management is authorized to grant stock options to our employees, directors and consultants. The number of shares available for future grant under the 2013 plan will automatically increase each year by an amount equal to 4% of all shares of our capital stock outstanding as of January 1stof each year, subject to the ability of our board of directors to take action to reduce the size of such increase in any given year. Unless our board of directors elects not to increase the number of shares available for future grant each year, our stockholders may experience additional dilution, which could cause our stock price to fall.

We could be subject to securities class action litigation.

In the past, securities class action litigation has often been brought against a company following a decline in the market price of its securities. This risk is especially relevant for us because pharmaceutical companies have experienced significant stock price volatility in recent years. If we face such litigation, it could result in substantial costs and a diversion of management’s attention and resources, which could harm our business.

We have broad discretion in the use of the net proceeds from this offering and may not use them effectively.

Our management will have broad discretion in the application of the net proceeds from this offering, including for any of the purposes described in the section entitled “Use of Proceeds,” and you will not have the opportunity as part of your investment decision to assess whether the net proceeds are being used appropriately. Because of the number and variability of factors that will determine our use of the net proceeds from this offering, their ultimate use may vary substantially from their currently intended use. Our management might not apply our net proceeds in ways that ultimately increase the value of your investment. We expect to use the net proceeds from this offering to fund the clinical development of emricasan and to fund working capital and for general corporate purposes. The failure by our management to apply these funds effectively could harm our business. Pending their use, we may invest the net proceeds from this offering in short-term, investment-grade, interest-bearing securities. These investments may not yield a favorable return to our stockholders. If we do not invest or apply the net proceeds from this offering in ways that enhance stockholder value, we may fail to achieve expected financial results, which could cause our stock price to decline.

Anti-takeover provisions under our charter documents and under Delaware law could delay or prevent a changemake an acquisition of control which could limit the market price of our common stockus more difficult and may prevent or frustrate attempts by our stockholders to replace or remove our current management.

Our amended and restatedProvisions in our certificate of incorporation and amended and restated bylaws which are to become effective at or prior to the closing of this offering, contain provisions that couldmay delay or prevent an acquisition or a change of control of our company or changes in ourmanagement. These provisions include a classified board of directors, that our stockholders might consider favorable. Some of these provisions include:

a board of directors divided into three classes serving staggered three-year terms, such that not all members of the board will be elected at one time;

a prohibition on stockholder action throughactions by written consent which requires that all stockholder actions be taken at a meeting of our stockholders;

a requirement that special meetings of stockholders be called only by the chairman of the board of directors,combined organization’s stockholders and the chief executive officer, the president or by a majority of the total number of authorized directors;

advance notice requirements for stockholder proposals and nominations for election to our board of directors;

| • | | a requirement that no member of our board of directors may be removed from office by our stockholders except for cause and, in addition to any other vote required by law, upon the approval of not less than 66 2⁄3% of all outstanding shares of our voting stock then entitled to vote in the election of directors;

|

| • | | a requirement of approval of not less than 66 2⁄3% of all outstanding shares of our voting stock to amend any bylaws by stockholder action or to amend specific provisions of our certificate of incorporation; and

|

the authorityability of the board of directors to issue preferred stock on terms determined by the board of directors without stockholder approval and which preferred stock may include rights superior to the rights of the holders of common stock.

approval. In addition, because we are incorporated in Delaware, we are governed by the provisions of Section 203 of the Delaware General Corporate Law,DGCL, which may prohibit certain business combinations withprohibits stockholders owning in excess of 15% or more of our outstanding voting stock from merging or combining with us. Although we believe these provisions collectively will provide for an opportunity to receive higher bids by requiring potential acquirers to negotiate with our board of directors, they would apply even if the offer may be considered beneficial by some stockholders. In addition, these provisions may frustrate or prevent any attempts by our stockholders to replace or remove then current management by making it more difficult for stockholders to replace members of the board of directors, which is responsible for appointing the members of management.

Our pre-Merger net operating loss carryforwards and certain other tax attributes may be subject to limitations. The pre-Merger net operating loss carryforwards and certain other tax attributes of us may also be subject to limitations as a result of ownership changes resulting from the Merger.

In general, a corporation that undergoes an “ownership change” as defined in Section 382 of the Code, is subject to limitations on our ability to utilize our pre-change net operating loss carryforwards to offset future taxable income. In general, an ownership change occurs if the aggregate stock ownership of certain stockholders, generally stockholders beneficially owning five percent or more of a corporation’s common stock, applying certain look-through and aggregation rules, increases by more than 50 percentage points over such stockholders’ lowest percentage ownership during the testing period, generally three years. We may have experienced ownership changes in the past and we may experience ownership changes in the future. In addition, the closing of the merger may result in an ownership change for us, which could result in limitations on the use of our federal and state net

The PPACA established the Center for Medicare and its proper function is indispensable for many critical metabolic functions,Medicaid Innovation within CMS to test innovative payment and service delivery models to lower Medicare and Medicaid spending, potentially including prescription drug spending. Funding has been allocated to support the regulation of lipid and sugar metabolism, the production of important proteins, including those involved in blood clotting, and purification of blood. There are over 100 described diseasesmission of the liver,Center for Medicare and becauseMedicaid Innovation from 2011 to 2019.

Many of its many functions, thesethe details regarding the implementation of the PPACA are yet to be determined, and, at this time, the full effect of the PPACA on our business remains unclear. Further, there have been recent public announcements by members of the U.S. Congress, President Trump and his administration regarding their plans to repeal and replace the PPACA. For example, on December 22, 2017, President Trump signed into law the Tax Cuts and Jobs Act of 2017, which, among other things, eliminated the individual mandate requiring most Americans (other than those who qualify for a hardship exemption) to carry a minimum level of health coverage, effective January 1, 2019. We cannot predict the ultimate form or timing of any repeal or replacement of the PPACA or the effect such a repeal or replacement would have on our business.

Chemistry, Manufacturing, and Controls

We have successfully developed production processes that are scalable and economically viable. All of the derivatives of the manufacturing process can be highly debilitating and life-threatening unless effectively treated. Common causesused, creating a spectrum of liver disease include viral infections, such as HCV and HBV, obesity, chronic excessive alcohol use or autoimmune diseases. Many people with active liver disease remain undiagnosed largely because liver disease patients are often asymptomaticproducts for many years. The NIH estimates that 5.5 million Americans have chronic liver disease or cirrhosis, and liver disease is the twelfth leading cause of death in the United States. According to the EASL, 29 million Europeans have chronic liver disease and liver disease represents approximately two percent of deaths annually.

Liver disease is often first detected as active hepatitis, which is defined as inflammation of the liver. Hepatitis is easily detected by a routine laboratory test to measure blood levels of the liver enzyme ALT. ALT is elevated in almost all liver diseases and represents an overall measure of liver inflammation and liver cell death. As liver disease progresses, fibrotic scar tissue will begin to replace healthy liver tissue and over time will reduce the liver’s ability to function properly. A liver biopsy is used to diagnose fibrosis and determine how much liver scarring has developed. If fibrosis is allowed to progress, it will lead to cirrhosis. As liver cirrhosis becomes progressively worse, all aspects of liver function will dramatically decline.

Some patients with liver cirrhosis have a partially functioning liver, which is referred to as compensated liver disease, and may appear asymptomatic for long periods of time. When the liver is unable to perform its normal functions this is referred to as decompensated liver disease. ACLF occurs in patients who are in relatively stable condition until an acute event sets off a rapid deterioration of liver function. The morbidity and mortality of the patient population with ACLF we plan to study is high, with approximately 45% of patients dying or progressing to multi-organ failure or requiring transplant within 28 days of hospitalization as a result of the acute decompensating episode. If the patient survives the acute decompensating event, they may return to a stable state. Patients with CLF suffer from continual disease progression which may eventually lead them to require liver transplantation. Despite advances in liver transplantation, morbidity and mortality in the CLF patient population remains high with some patients ineligible for a liver transplant and others unable to be matched with a suitable donor liver.

Patients who receive liver transplants as a result of HCV infection are at risk of accelerated fibrosis of the transplanted liver. This occurs because residual HCV is still present in the patient’s blood and can immediately infect the new liver, thus increasing the risk of accelerated inflammation and fibrosis. This patient population is referred to as HCV-POLT. Liver fibrosis can be scored using the standard Ishak Fibrosis Score, which stages the

severity of fibrosis and/or cirrhosis on a 0-6 scale. Approximately 55% of the patient population we plan to study will progress more than one stage in fibrosis score within two years of transplant and 50% of these HCV-POLT patients will have stage 3 fibrosis within five years after their transplants. If emricasan demonstrates the ability to halt the progression of fibrosis in the HCV-POLT population, we believe that this could serve as a basis to evaluate emricasan for additional indications in patients at earlier stages of liver fibrosis resulting from HCV, HBV, obesity, chronic excessive alcohol use or autoimmune diseases.

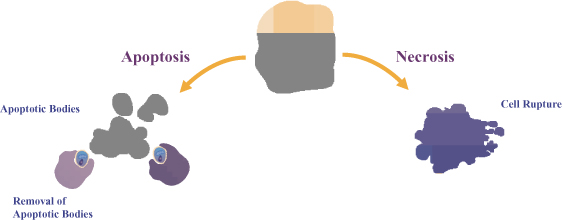

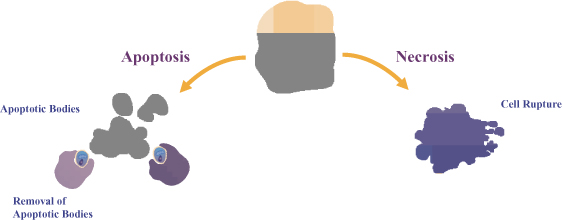

The Role of Apoptosis, Necrosis and Inflammation in Liver Disease

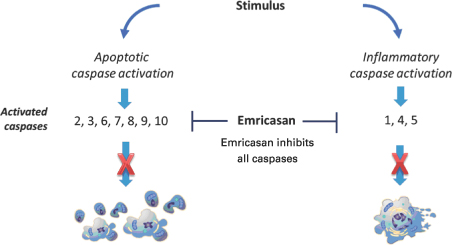

The death of cells and resulting inflammation play an important role in the progression of many liver diseases. In general, cells can die by either of two major mechanisms, apoptosis, a form of programmed cell death, or necrosis. Both of these mechanisms can produce a state of acute and/or chronic inflammation as shown in Figure 1.

Figure 1. Apoptosis and Necrosis: The Two Main Pathways of Liver Cell Death

High levels of noxious stimuli can rapidly overwhelm the cell’s natural protective mechanisms, leading to a rupture of the cell and subsequent release of its contents into the surrounding tissue. This process is known as necrosis and results in a highly pro-inflammatory response, further damaging the surrounding tissue. In contrast, the programmed cell death mechanism, termed apoptosis, is a highly controlled and tightly regulated process that involves the orderly condensation and dismantling of the cell leading to its subsequent rapid and specific removal from the surrounding tissue by specialized cells. However, under conditions of excessive stress as often observed in disease, the production of apoptotic cells outpaces the body’s ability to effectively remove them from the surrounding tissue. This results in an accumulation of shed cell fragments known as apoptotic bodies which are taken up by surrounding cells and can stimulate additional cell death. Disease-driven excessive apoptosis results in the development of scar tissue or fibrosis which can lead to tissue destruction and eventually reduce the capacity of an organ to function normally.

Markers of Liver Cell Death

ALT is an enzyme that is produced in liver cells and is naturally found in the blood of healthy individuals. In liver disease, liver cells are damaged and as a consequence, ALT is released into the blood increasing ALT levels above the normal range. Physicians routinely test blood levels of ALT to monitor the health of a patient’s liver. ALT level is a clinically important biochemical marker of the severity of liver inflammation and ongoing liver disease. Elevated levels of ALT represent general markers of liver cell death and inflammation without regard to any specific mechanism. Aspartate aminotransferase, or AST, is a second enzyme found in the blood that is produced in the liver and routinely measured by physicians along with ALT. As with ALT, AST is often elevated in liver disease and, like ALT, is considered an overall marker of liver inflammation. We have measured both ALT and AST levels in our clinical studies, and have observed similar effects of emricasan on both enzymes. However, because ALT is considered more liver specific and the pattern of changes we have observed in AST levels has been similar to those seen in ALT levels, our discussion will focus primarily on ALT.

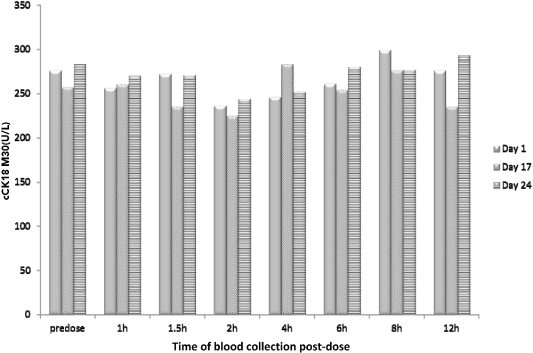

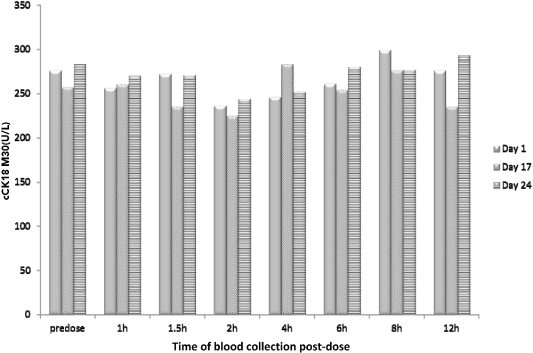

Another important marker of liver cell death is a protein fragment called cCK18. During apoptosis, a key structural protein within the cell called Cytokeratin 18, or CK18, is specifically cleaved by caspases which results in the release of cCK18 into the blood stream. cCK18 is easily detected in the blood with a commercially-available test and is a mechanism-specific biomarker of apoptosis and caspase activity. Importantly, cCK18 is also present in healthy subjects and multiple studies have demonstrated an approximate basal level in healthy subjects.

Numerous independent clinical trials and published studies have demonstrated the utility of cCK18 for detecting and gauging the severity of ongoing liver disease across a variety of disease etiologies. These studiesmarkets from one core technology.

We have demonstrated correlations between diseaseestablished in-house research, development and cCK18 levelsmanufacturing capabilities in patientsour corporate headquarters, however, we do not intend to continue manufacturing commercial or clinical material in-house moving forward. We intend to secure manufacturing agreements with ACLF, CLF, HCV, NASHa contract research organization for our own clinical and various other liver disease indications. For example, it has been shown that in HCV patients,commercial supply. Currently, we are not a party to any manufacturing agreements.

We currently manufacture commercial quantities of our CCM skin care ingredient for Allergan, who formulates the severity of liver disease was correlated with cCK18 levels and apoptosis, such that the more severe the disease, the higher the serum level of cCK18. In ACLF patients, studies have shown that blood levels of cCK18 were higher in non-surviving patients than in patients that survived. In CLF patients, studies have shown that cCK18 levelsingredient into their skin care product lines. However, we are elevated and correlate with liver inflammation and cholestasis. In patients with recurrent HCV-POLT, it has been shown that cCK18 levels and apoptosis were significantly elevated in liver biopsies as determined by immunohistochemical analysis. We believe these studies demonstrate the relationship between elevated cCK18 levels and severity of liver disease and that cCK18 is a valid and important biomarker of excessive apoptosis in liver disease.

The Model for End-Stage Liver Disease, or MELD, is a scoring system for assessing the severity of chronic liver disease. MELD is a composite score that is calculated using bilirubin levels, creatinine levels and International Normalized Ratio, or INR, which is a tool for assessing blood clotting times. MELD scores, which range from 6-40, are considered to be a valuable predictor of three-month survival. MELD score is also generally used to prioritize patients on the liver transplant list, with the average MELD score of 20 in patients undergoing liver transplant. In our planned clinical trials, we will study a subset of patients with ACLF and CLF who have MELD scores ranging from 20 to 30.

Emricasan

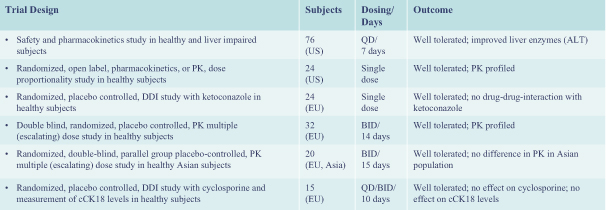

Emricasan is a first-in-class, proprietary and orally active caspase protease inhibitor designed to slow or halt the progression of chronic liver disease caused by fibrosis and cirrhosis. To date, emricasan has been administered to over 500 subjects in six Phase 1 and four Phase 2 clinical trials, and has been generally well-tolerated in both healthy volunteers and patients with liver disease. Emricasan has also been extensively profiled inin vitro tests and studied in many preclinical models of human disease.

Mechanism of Action

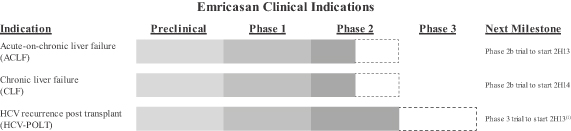

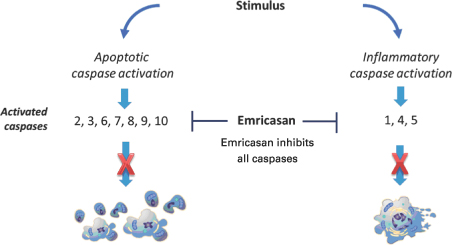

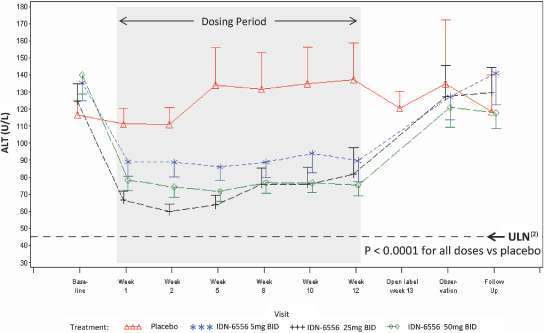

Emricasan works by inhibiting caspases, which are a family of related enzymes that play an important role as modulators of critical cellular functions, including functions that result in apoptosis and inflammation. Caspase activation and regulation is tightly controlled through a number of mechanisms. All caspases are expressed as enzymatically inactive forms known as pro-caspases which can be activated following a variety of cellular insults or stimuli. Seven caspases are specifically involved in the process of apoptosis while three caspases specifically activate pro-inflammatory cytokines and are not directly involvedconducting a technology transfer to Allergan, which will enable our commercial partner to utilize their own or third-party facilities. We anticipate exiting the commercial manufacturing business in apoptosis as shown in Figure 2.

Figure 2. Emricasan is a Potent Inhibitor of Apoptotic and Inflammatory Caspases

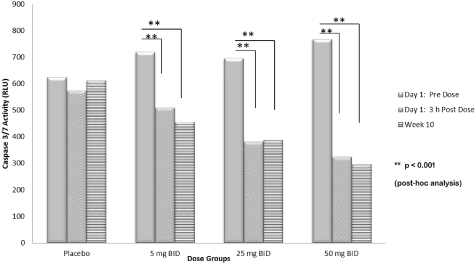

Caspase mediated apoptosis is driven primarily by the activity of caspases 3 and 7 which, by virtue of their enzymatic activity, cleave a wide variety of cellular proteins and result in dismantling of the cell. Other apoptotic caspase family members are principally involved in sensing and transmitting signals from either outside or inside the cell. These signals converge to activate pro-caspases 3 and 7, enabling them to carry out the process of apoptosis.

CK18 is one key structural protein that is cleaved by caspases 3 and 7 in a highly specific manner. The product of this cleavage is a small protein fragment, cCK18. This fragment is contained within the apoptotic cell fragments and is easily detected in serum using a commercially available monoclonal antibody assay. This monoclonal antibody, M30, is used routinely in clinical studies as a measure of apoptosis.

While healthy individuals have normal levels of apoptosis, excessive levels of apoptosis associated with disease can overwhelm the body’s normal clearance mechanisms. Reducing excessive levels of apoptosis reestablishes balance between apoptotic activity and normal clearance mechanisms and brings inflammation and other drivers of disease progression under control. As a result, we believe targeting caspases that drive both apoptosis and inflammation in disease offers a unique and potentially powerful therapeutic approach for the treatment of both acute and chronic liver disease.

Testing inin vitroenzyme assays demonstrated that emricasan efficiently inhibits all human caspases at low nanomolar concentrations. Preclinical studies have demonstrated that emricasan is highly selective for the caspase family of enzymes with little to no activity against other enzyme systems. These studies have also shown that emricasan potently inhibits the apoptosis of cells regardless of the apoptotic stimuli and that it is a potent inhibitor of caspase-mediated pro-inflammatory cytokines. Emricasan has been examined in various preclinical models of liver disease. In these models, caspase activity was demonstrated to be inhibited, as determined by histological examination, in liver tissue. Based on our evaluation of emricasan inin vitro systems, cellular assays and disease models, we believe emricasan’s mechanism of action has been well characterized.

Clinical Data

2021. To date, emricasan has been studied in over 500 subjects in six Phase 1 clinical trialswe have successfully transferred our process with two third-party contract manufacturing organizations (CMOs) and four Phase 2 clinical trials. This includes a total of 153 healthy volunteers, 306 subjects with elevated ALT levels and 53 liver transplant subjects receiving single or multiple doses of emricasan ranging from 1 to 500 mg per day orally or 0.1 to 10 mg/kg per day intravenously for up to 12 weeks. Emricasan has demonstrated evidence of a beneficial effect on serological biomarkers in patients with chronic liver disease independent of the cause of disease. Favorable changes have been observed in functional biomarkers of liver damage and inflammation, such as ALT and AST, and mechanistic biomarkers, such as cCK18 and caspase activity, indicating that emricasan works by the presumed mechanism of action of inhibiting apoptosis of liver cells. Importantly, clinical trials have also

demonstrated that emricasan does not inhibit normal levels of caspase activity in healthy individuals. Emricasan has been generally well-tolerated in clinical trials completed to date.

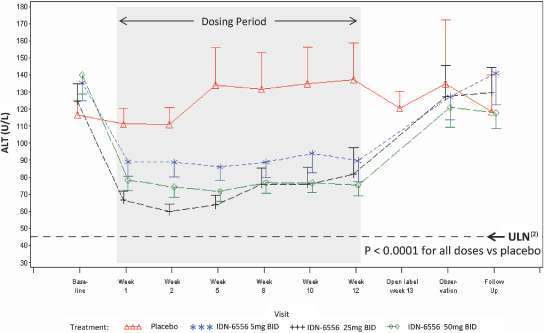

Phase 2b Dose Response Study in HCV Patients (Study A8491003)

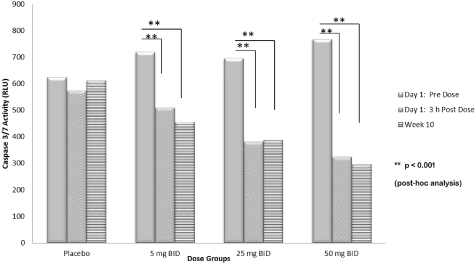

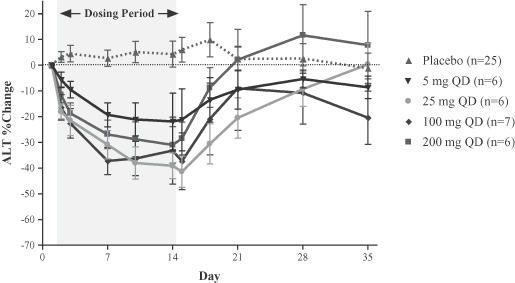

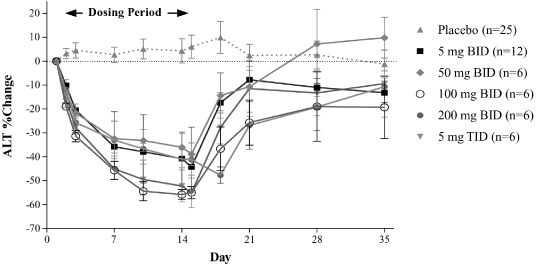

Study A8491003, or the 003 trial, was a Phase 2b, randomized, multicenter, placebo-controlled, double-blind, parallel group, dose response trial. The trial was designed to evaluate the safety and efficacy of emricasan in patients with chronic HCV infection who were unresponsive to antiviral therapy and who had compensated liver disease with or without fibrosis. Patients with cirrhosis or hepatocellular carcinoma were excluded from the trial. The trial enrolled 204 HCV patients across three oral emricasan dose arms of twice-daily, or BID, 5 mg, 25 mg and 50 mg and one placebo arm. The primary endpoint in the study was changes from Baseline in ALT and AST levels over a period of 12 weeks. This study also measured cCK18 levels, and caspase 3 and 7 activity as exploratory biomarkers. In this trial, emricasan treatment resulted in statistically significant reductions in the primary endpoints of ALT and AST levels as well as statistically significant reductions in cCK18 levels and caspase 3 and 7 activity.

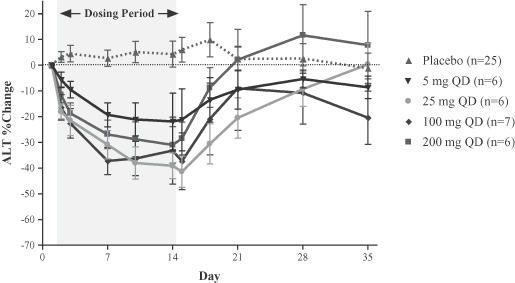

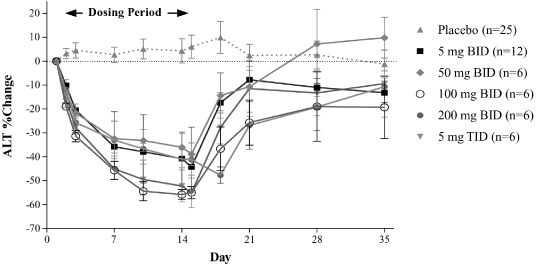

As shown in Figure 3 below, the changes in ALT demonstrated in the 003 trial were statistically significant in each of the emricasan treatment groups compared with the placebo group. The decreases in ALT were seen by day 7, the first time post-dosing that ALT was measured, and the decreases were maintained throughout the treatment period (up to 12 weeks) in all emricasan treatment groups. Discontinuation of emricasan at the end of the treatment period was followed by a gradual return of ALT towards baseline levels.

Figure 3. Change in ALT (Mean ± SEM(1)) from Baseline Following BID Dosing in Subjects with HCV

(1) | Standard Error of the Mean.

|

(2) | Upper limit of normal for males.

|

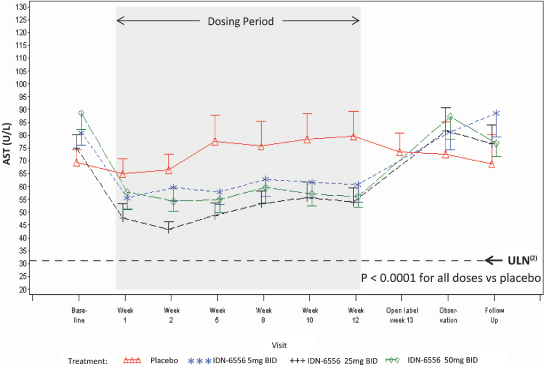

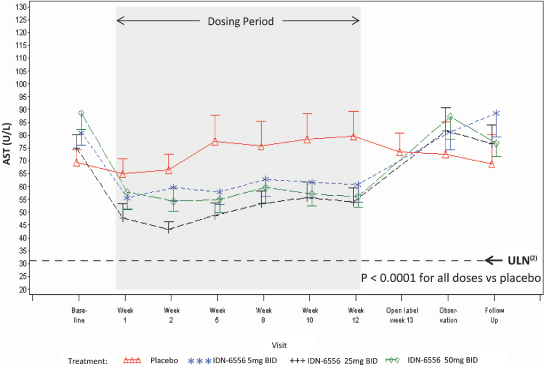

In addition to ALT levels, the 003 trial also examined changes in AST levels. As shown in Figure 4 below, the reductions in AST levels demonstrated in the 003 trial were also statistically significant in each of the emricasan treatment groups compared with the placebo group. Consistent with the ALT results, reductions in AST levels were seen as early as seven days and were maintained throughout the treatment period. At the end of treatment

AST levels gradually returned to baseline levels. During the 003 trial, biochemical flare, which is defined as ALT or AST values twice as high as the baseline value while on emricasan treatment, or overshoot, which is defined as ALT or AST values twice as high as the baseline value after stopping emricasan treatment, occurred in patients randomized to both placebo and emricasan. Twenty-one patients in the trial experienced flare and/or overshoot; six of these patients had both flare and overshoot; six of these patients had flare only; and nine of these patients had overshoot only. Of the six patients with flare and overshoot, four were in the placebo group, one was in the 5 mg group, and one was in the 25 mg group. Of the six patients with flare only, two were in the placebo group, one was in the 5 mg group, and three were in the 50 mg group. Of the nine patients with overshoot only, one was in the placebo group, five were in the 5 mg group, two were in the 25 mg group, and one was in the 50 mg group. These data suggest that the occurrence may be part of the natural variability of ALT or AST levels in the patient population under study. All subjects were followed up until levels had returned to baseline levels and there were no reports by the investigator of any clinical concern.

Figure 4. Change in AST (Mean ± SEM(1)) from Baseline Following BID Dosing in Subjects with HCV

(1) | Standard Error of the Mean.

|

(2) | Upper limit of normal for males.

|

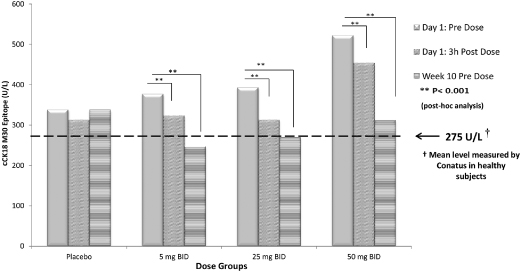

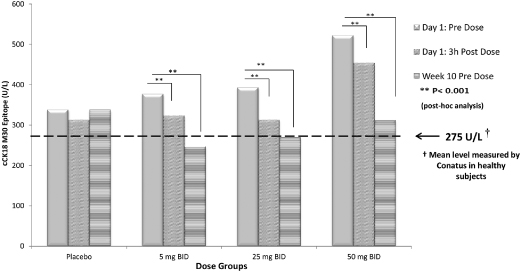

The 003 trial data also provide evidence that emricasan reduces cCK18 levels from baseline in patients with elevated cCK18 levels, as shown in Figure 5 below. Statistically significant reductions in cCK18 levels were reported as early as three hours after dosing and were still evident following ten weeks of treatment, within each of the 5 mg, 25 mg and 50 mg dose arms compared to baseline values in the relevant dose group. Importantly, in the 003 trial, after ten weeks of dosing, cCK18 levels in all emricasan treatment groups were similar to the baseline level of cCK18 in healthy volunteers as established in our Phase 1 trial (see the description of study IDN-6556-03 below) and as generally reported from independent trials. We believe this observation suggests that normal levels of caspase activity remain intact. We also believe that by returning apoptosis to normalized levels, emricasan may enable the balance between apoptosis and the body’s normal clearance mechanism for apoptosis to be restored.

Figure 5. Change in cCK18 from Baseline Following BID Dosing in Subjects with HCV