As filed with the Securities and Exchange Commission on July 3, 2013January 17, 2014

Registration No. 333- 333-189807

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 6

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SANTANDER CONSUMER USA HOLDINGS INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 6141 | 32-0414408 | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

8585 North Stemmons Freeway Suite 1100-N

Dallas, Texas 75247

(214) 634-1110

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Jason Kulas

President and Chief Financial Officer

8585 North Stemmons Freeway, Suite 1100-N

Dallas, Texas 75247

(214) 634-1110

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Richard K. Kim, Esq. Benjamin M. Roth, Esq. Mark F. Veblen, Esq. Wachtell, Lipton, Rosen & Katz 51 West 52nd Street New York, New York 10019 Telephone: (212) 403-1000 Facsimile: (212) 403-2000 | Jeffrey D. Karpf, Esq. Cleary Gottlieb Steen & Hamilton LLP One Liberty Plaza New York, New York 10006 Telephone: (212) 225-2000 Facsimile: (212) 225-3999 |

Approximate date of commencement of proposed sale to the public:As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

CALCULATION OF REGISTRATION FEE

| ||||

| Title of Each Class of Securities to Be Registered | Proposed Maximum Aggregate Offering Price(1)(2) | Amount of Registration Fee | ||

Common stock, par value $0.01 per share | $50,000,000 | $6,820 | ||

| ||||

|

|

The Registrant hereby amends this Registration Statement on such date as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, Dated July 3, 2013.January 17, 2014.

PROSPECTUS

65,217,391 Shares

Santander Consumer USA Holdings Inc.

Common Stock

This is the initial public offering of our common stock. We are selling shares of our common stock and theThe selling stockholders named in this prospectus are selling shares.65,217,391 shares of our common stock. We are not selling any shares of our common stock under this prospectus and will not receive any proceeds from the sale of the shares by the selling stockholders. We currently expect the initial public offering price to be between $$22.00 and $$24.00 per share of common stock.

We and someSome of the selling stockholders have granted the underwriters an option to purchase up to 9,782,608 additional shares of common stock to cover over-allotments.stock.

We have applied to have the common stock listed on the New York Stock Exchange under the symbol “ .”“SC.”

Investing in our common stock involves risks. See “Risk Factors” beginning on page 12.13.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||

Public offering price | ||||

Underwriting discounts | ||||

| ||||

Proceeds, to the selling stockholders (before expenses) |

| (1) | See “Underwriting.” |

The underwriters expect to deliver the shares to purchasers on or about , 20132014 through the book-entry facilities of The Depository Trust Company.Company, New York.

Global Coordinators and Joint Book-Running Managers

| Citigroup | J.P. Morgan |

Joint Book-Running Managers

| BofA Merrill Lynch | Deutsche Bank Securities | Santander |

| Barclays | Goldman, Sachs & Co. | Morgan Stanley | RBC Capital Markets |

| BMO Capital Markets | Credit Suisse | UBS Investment Bank | Wells Fargo Securities | |||||

Co-Managers

| KKR | Sandler O’Neill + Partners, L.P. | Stephens Inc. | LOYAL3 Securities | |||

Prospectus dated , 20132014

We are responsible for the information contained in this prospectus and in any free writing prospectus we prepare or authorize. We have not authorized anyone to provide you with different information, and we take no responsibility for any other information others may give you. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than its date.

| Page | ||||

| 1 | ||||

| 38 | ||||

Management’s Discussion and Analysis of Financial Condition and Results | 41 | |||

Security Ownership of Certain Beneficial Owners, Management and Selling Stockholders | ||||

| 159 | ||||

| F-1 | ||||

Unless otherwise indicated, the information presented in this prospectus assumes (i) an initial public offering price of $$23.00 per share, which represents the midpoint of the range set forth on the cover page of this prospectus, and (ii) that the underwriters’ over-allotment option is not exercised.

Santander Consumer USA Holdings Inc. is a newly-formed Delaware corporation that has not, to date, conducted any activities other than those incident to its formation, and the preparation of this registration statement.statement and the reorganization transactions described in the section entitled “Reorganization.” Unless we state otherwise or the context otherwise requires, references in this prospectus to “SCUSA,” “we,” “our,” “us,” and the “Company” for all periods after the reorganization transactions described in the section entitled “Reorganization” (which will bewere completed on January 16, 2014 in connection with this offering) refer to Santander Consumer USA Holdings Inc. and its consolidated subsidiaries after giving effect to such reorganization transactions. For all periods before the completion of such reorganization transactions, these terms refer to Santander Consumer USA Inc., an Illinois corporation, and its predecessors and their respective consolidated subsidiaries.

i

About this Prospectus

Market Data

Market data used in this prospectus has been obtained from independent industry sources and publications, such as the Federal Reserve Bank of New York; the Federal Reserve Bank of Philadelphia; the Board of Governors of the Federal Reserve System; The Conference Board; the Consumer Financial Protection Bureau; Equifax Inc.; Experian Automotive; Chrysler Group LLC; Fair Isaac Corporation; FICO® Banking Analytics Blog; Polk Automotive; the United States Department of Commerce: Bureau of Economic Analysis; J.D. Power; and Ward’s Automotive Reports. We have not independently verified the data obtained from these sources. Forward-looking information obtained from these sources is subject to the same qualifications and the additional uncertainties regarding the other forward-looking statements in this prospectus.

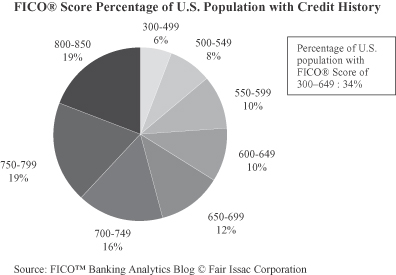

For purposes of this prospectus, we categorize the prime segment as borrowers with FICO® scores of 660 and above, the super prime segment as a portion of borrowers within the prime segment with FICO® scores of 720 and above, and the nonprime segment as borrowers with FICO® scores below 660. FICO® is a registered trademark of Fair Isaac Corporation. FICO® scores are provided by Fair Isaac Corporation and are designed to measure the likelihood that a consumer will pay his or her credit obligations as agreed.

Certain TerminologyGlossary of Selected Terms

Below is a list of additional terms and their respective meanings which we use throughout this prospectus.

Advance Rate

The maximum percentage of the value of collateral that a lender is willing to extend for a loan. The advance rate helps a borrower determine what kind of collateral to provide in order to secure the desired loan amount, and helps minimize a lender’s loss exposure when accepting collateral that can fluctuate in value.

Clean-Up Call

The action of an issuer of a debt instrument (such as a bond) requiring early redemption of the instrument before it is fully amortized.

Credit/Warehouse Facility (Line of Credit)

Any credit source extended to a business by a bank or other financial institution. A line of credit is effectively a source of funds that can readily be tapped at the borrower’s discretion. Interest is paid only on money actually withdrawn. However, the borrower may be required to pay an unused line fee, often an annualized percentage fee on the money not withdrawn. Lines of credit can be secured by collateral, or may be unsecured.

Credit Enhancement

Through credit enhancement, the lender is provided with reassurance that the borrower will honor the obligation through additional collateral, insurance, or a third-party guarantee. Credit enhancement reduces credit/default risk of a debt, thereby increasing the overall credit rating and lowering interest rates.

Dealer Loans

Floorplan lines of credit, real estate loans, and working capital loans to automotive dealers.

FICO®

A type of credit score that makes up a substantial portion of the credit report that lenders use to assess an applicant’s credit risk and whether to extend a loan.

ii

FICO® is an acronym for the Fair Isaac Corporation, the creator of the FICO® score.

Using mathematical models, the FICO® score takes into account various factors in each of these five areas to determine credit risk: payment history, current level of indebtedness, types of credit used, length of credit history, and new credit. A person’s FICO® score will range between 300 and 850.

Floorplan Lines of Credit

A revolving line of credit that allows the borrower to obtain financing for retail goods. These loans are made against a specific piece of collateral (e.g., auto, recreational vehicle, manufactured home). When we refereach piece of collateral is sold by the dealer, the loan advance against that piece of collateral is repaid.

Impairment Reserves

Loan loss reserves recorded on a portfolio of loans acquired with credit deterioration to “loans”cover losses incremental to those expected at the time of acquisition.

Loans That We Acquired and/or Convert

Loans that are included in this prospectus, we mean credit exposure to third parties. When we refer to “loanspools of loans that we originate,” we mean loansacquired as a portfolio from a third party.

Loans That We Originate

(i) Loans that we originate directly, (ii) individual retail installment contracts that we acquire from dealers immediately after origination by a dealer, and (iii) unsecured consumer loans, which includes point-of-sale financing, personal loans, and private label credit cards. When we refer

Nonaccretable Difference

The difference between the undiscounted contractual cash flows and the undiscounted expected cash. The nonaccretable difference represents an estimate of the credit risk in the loan portfolio at the acquisition date.

Non-captive Vehicle Lender

A lender that is not owned by a vehicle manufacturing company.

Off-Lease

A vehicle which was once leased, but now has been returned to “loans that we acquired,” we mean loans that are included in poolsthe lessor due to contractual or early lease termination.

Origination Channels

The specific business relationship or channel through which a loan is made to a customer.

Overcollateralization

The process of loans that we acquiredposting more collateral than is needed to obtain or secure financing. Overcollateralization is often used as a portfolio from a third party. When we use the term “dealer loans,” we mean floorplan linesmethod of credit real estate loans,enhancement by lowering the creditor’s exposure to default risk.

Perfected Security Interest

Security interest in an asset protected from claims by other parties. A lien is perfected by registering it with appropriate statutory authority so that it is made legally enforceable and working capital loans to automotive dealers. When we use the term “prime,” we mean prime and super prime.any subsequent claim on that asset is given a junior status. Also called a perfected lien.

iiiii

Private-Label Loans/Leases

Financings branded in the name of the product manufacturer rather than in the name of the finance company.

Remarketing

Vehicle remarketing is the controlled disposal of fleet and leasing vehicles that have reached the end of their fixed term or the process to resell repossessed vehicles.

Residual Values

Residual value describes the future value of a good at the end of the lease term based upon the percentage of depreciation of its initial value.

Subordinate Financing

Debt financing that is ranked behind that held by secured lenders in terms of the order in which the debt is repaid.

Subvention Program

Reimbursement to the finance company by a manufacturer for the difference between a market loan or lease rate and the below-market rate granted to the customer.

iv

The following is a summary of selected information contained elsewhere in this prospectus. It does not contain all of the information that you should consider before deciding to purchase shares of common stock. You should read this entire prospectus carefully, particularly the section entitled “Risk Factors” immediately following this summary, the historical financial statements, and the related notes thereto and management’s discussion and analysis thereof included elsewhere in this prospectus, before making an investment decision to purchase our common stock.

Background

Overview

We are a full-service, technology-driven consumer finance company focused on vehicle finance and unsecured consumer lending products. SinceWe believe that, since our founding in 1995, we have developed into a leaderachieved strong brand recognition in the nonprime vehicle finance space and have recently increased our presence in the prime space. We leverage our knowledge of consumer behavior via our sophisticated, proprietary software, which allows us to effectively price, manage, and monitor risk. As a result of our deep understanding of the market, we have consistently produced controlled growth and robust profitability in both economic expansions and downturns.

OurWe believe our extensive data and advanced analytics tools enhance our proprietary loan origination, servicing and servicingrisk management platforms. TheseWe believe that these platforms are technologically sophisticated, readily expandable, and easily adaptable to a diverse set of consumer finance products. Led by our experienced and disciplined management team, we have significantly increased our origination volume and our portfolio over the past three years, demonstrating our ability to rapidly growgrown our asset base since 2008 through originations and acquisitions without having to significantly invest in new infrastructure or compromise our credit performance. In addition,Our originations are sourced through many different channels, and we have acquired and/or convertedcontinue to grow our network of relationships in order to maximize our opportunities for growth. Our technologically-driven platform has enabled us to add over $34 billion of assets to our lending platform since 2008. We also2008, and we continue to evaluate opportunities for additional acquisitions. Moreover, we service loans for others, which provides us with an additional and stable fee income stream.

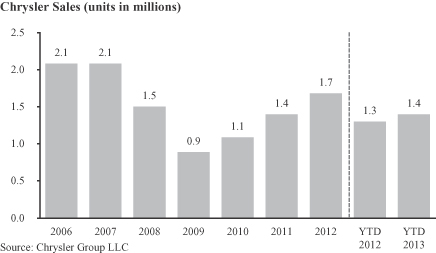

Historically, we have originated loans primarily through franchised automotive dealers for manufacturers such as Chrysler, Ford, General Motors, and Toyota in connection with the sale of new and used vehicles to retail consumers. We currently have active relationships with over 14,000 such dealers throughout the United States. In February 2013, we entered into a ten-year agreement with Chrysler Group LLC (“Chrysler”) whereby we originate private-label loans and leases under the Chrysler Capital brand (“Chrysler Capital”) to facilitate Chrysler vehicle retail sales. We also originate loans through selected independent automobile dealers, such as CarMax, through national and regional banks as well as through relationships with other original equipment manufacturers (“OEMs”). Additionally, we directly originate and refinance vehicle loans via our branded online platform, Roadloans.com,RoadLoans.com, which is available through major online affiliates including Cars.com, AutoTrader.com, Kelley Blue Book, and eBay Motors. Moreover, we periodically purchase retail vehicle loan portfolios from other lenders.

We also provide unsecured consumer loans. WeRecently, we have recently entered into relationships with Bluestem Brands (“Bluestem”), a retailer, and LendingClub Corporation (“LendingClub”), a peer-to-peer lending platform, to acquire and, in certain circumstances, service unsecured consumer loans. In addition, we are actively seeking to utilizeutilizing our deep understanding of consumer finance to expand into private label credit cards and other unsecured consumer finance products.

We derive significant benefits from our relationship with Banco Santander, S.A. (“Santander”), a leader in the banking and consumer finance industries and, as of May 31,September 30, 2013, the largest bank in the Eurozone by

market capitalization. Santander has demonstrated its continuing commitment to us by extending $4.5 billion in credit

facilities with terms of three and five years, and annual renewal mechanisms, as well as a $0.5 billion letter of credit facility. Santander also provided us with financing to opportunistically acquire and/or convert several large portfolios of loans and certain operations from CitiFinancial Auto, Triad Financial, HSBC Auto, and GE Capital (recreational vehicle/marine portfolio), among others.

We have significant access to the capital markets: we have issued and sold over $21$26 billion in securitization transactions since 2010, obtained approximately $12$13.7 billion in committed credit lines and privately issued amortizing notes from large commercial banks, and entered into material flow agreements with large commercial banks. In 2011, funds managed by three of the world’s leading private equity investment firms, Centerbridge Partners, L.P., Kohlberg Kravis Roberts & Co. L.P., and Warburg Pincus LLC, purchased $1.0 billion of newly issued common stock.

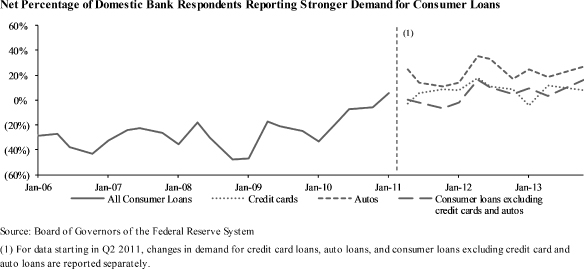

Our Markets

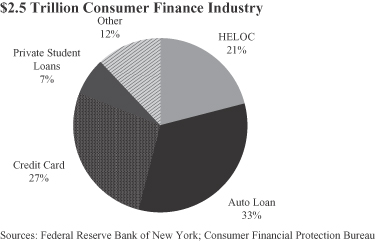

The consumer finance industry in the United States has approximately $2.5 trillion of outstanding borrowings and includes vehicle loans and leases, credit cards, home equity lines of credit, private student loans, and personal loans. As economic conditions continue to recover from the 2008-2009 downturn, there has been significant demand from consumers for loans and leases, particularly to finance the purchase of vehicles.

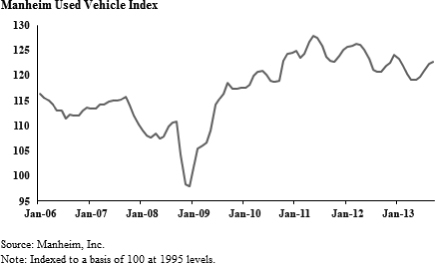

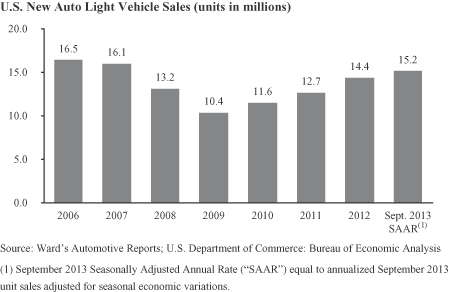

Our primary focus is the vehicle finance segment of the U.S. consumer finance industry. Vehicle finance includes loans and leases taken out by consumers to fund the purchase of new and used automobiles, motorcycles, recreational vehicles (“RVs”), and watercraft. The automobile finance segment comprises the significant majority of the vehicle finance market in the United States. ThereAs of September 30, 2013, there were approximately $800$850 billion of such loans and leases outstanding at the end of 2012.outstanding. Most new and used car purchases in the U.S. are financed with either loans or leases. Historically, used car financing has made up a majority of our business. Most loans in the used car space, which is substantially fragmented, are made to nonprime borrowers and we believe we are a leader in nonprime auto loan originations. We compete with large national and regional banks, which are the biggest lenders in the used car finance space. Through Chrysler Capital and other relationships, we have been increasing, and expect to continue to increase, the proportion of loans and leases that we originate to finance consumer purchases of new automobiles and, by extension, to prime consumers.

We also participate in the unsecured consumer lending market, which includes credit cards, private student loans, point-of-sale financing, and personal loans. This market continues to represent an attractive opportunity for us. Consumers have faced declining access to traditional sources of consumer credit such as credit cards and home equity lines of credit over the past several years, while improving economic conditions have increased consumer demand for access to new sources of financing. We have recently entered into several agreements with other participants in the unsecured consumer lending space to originate point-of-sale financing and personal loans.

In both the vehicle finance and unsecured consumer lending markets, we generate originations indirectly and directly. The indirect model requires relationships with third parties who are generally active in the market, are looking for an additional source of financing for their customers, and agree to direct certain customers to SCUSA. The direct model requires an internally managed platform through which consumers are able to make requests for credit directly to SCUSA. While we have historically focused on the indirect model, we are broadening our presence in the direct vehicle finance market through our RoadLoans.com platform and we are currently building out our direct unsecured consumer lending platform. Additionally, we continue to develop new relationships with third parties to further broaden our origination channels within these markets.

Our Strengths

Technology-Driven Platforms.Platforms Drive Superior Credit and Operational Performance.We have internally developed highly effective, proprietary software applications that we believe are highly effective and leverage our knowledgenearly 20 years of consumer behavior across the full credit spectrum andspectrum. These systems enable us to effectively monitor, price and manage risk on a real-time basis and monitor risk.at a highly granular level, including by vintage, origination channel, brand, and location where the loan or lease was originated. This technology also allows us to expand our existing relationships and explore new relationships at a low marginal cost. Our internally generated data, acquired historical credit data, and extensive third-party data are utilized to continuously adapt our origination, servicing and servicing operationsrisk management platforms to evolving consumer behavior and product performance. The strength of our platforms is demonstrated by our proactive decision to reduce origination volumetighten credit standards prior to the recent economic downturn and by our successful acquisition and/or conversion of over $34 billion of assets onto our platform since 2008. Another benefit of our technology-driven platform is that it allows us to move quickly. For example, in 2010 we onboarded a portfolio of $14.4 billion in assets in just four months.

Growth-Oriented Business ModelModel.. We have demonstrated anthe ability to grow and diversify within the consumer finance industry, havingindustry. We have successfully built mutually beneficial relationships with Chrysler, CarMax, other national automotive dealer groups, national and regional banks, and others. With Chrysler Capital, we expect to significantly grow our vehicle finance portfolio, which we expectbelieve will more than offset the run-off of previously acquired portfolios, diversify our vehicle finance products, and continue to increase the volume of new vehicle financings. As of the month ended May 31,September 30, 2013, new vehicle financings as a percentage of our originations increased from approximately 10%-20% historically to approximatelyover 40%. Additionally, our wide range of origination channels complements our granular risk management, allowing us to reduce growth in channels with pricing or risk concerns and supplement that volume with more attractive channels at that time. We have also entered into committed flow agreements with leading commercial banks under which we retain certain servicing rights that will provide us with additional and stable fee income. We believe we can quickly and efficiently provide similar or expanded offerings for others, including OEMs and consumer lenders, and we are actively working ondeveloping these offerings. Further, our platforms will continue to facilitate our expansion into unsecured consumer lending and servicing.

Robust Financial Performance. We have been profitable every year for the last ten years, including throughout the most recent economic downturn. We believe this consistent profitability can be attributed to our credit analysis, pricing discipline, and efficient low-cost structure. In addition, while portions of our nonprime customer base produce relatively high losses, we structure and apply risk-adjusted pricing to these loans to produce attractive risk-adjusted yields that result in a consistent return on capital. As evidence of this, we delivered an average return on assets of 3.9% from 2009 to 2012 and a return on total common equity of more than 30% in each of those years.years and have continued to deliver similar levels of return on assets and equity year-to-date in 2013, which we believe provides us with the ability to support our growth organically and return capital to our shareholders.

Deep Access to Committed FundingFunding.. We have access to diverse and stable financing sources, including in the broader capital markets. We have issued and sold over $21$26 billion of asset-backed securities (“ABS”) since 2010, were the largest U.S. issuer of retail auto ABS in 2011, and 2012, and are the largest issuer year-to-date in 2013. We have significant bank funding relationships, with third-party banks and Santander currently providing approximately $12$13.7 billion and $4.5 billion, respectively, in committed financing. We also have a $17 billion retail flow agreement in place with Bank of America and a dealer lending flow agreement in place with Santander Bank N.A. (“SBNA,” formerly Sovereign Bank (“Sovereign”)Bank), which is wholly owned by Santander. We will provide servicing, for a fee, on all loans originated under these arrangements. Further, we have been able to attract a substantial amount of third-party capital from our private equity sponsors.

Strong Relationship with SantanderSantander.. Santander, operating through Santander Consumer Finance’s pan-European platform, is one of the top three consumer lending companies and is a leading non-captive vehicle lender in twelve European countries. Santander Consumer Finance��sFinance’s eleven global OEM relationships and large vehicle loan portfolio provide future opportunities for us. Santander, a deposit-funded lender, also has provided us with significant funding support, both through existing committed liquidity and opportunistic extensions of credit. Because of our relationship with Santander, we are subject to the regulatory oversight of the Federal Reserve System (the “Federal Reserve”). This oversight has led us to develop and maintain extensive risk management and reporting procedures and has helped us to continually adapt to the evolving regulatory requirements for consumer finance in the United States.

Experienced Management TeamTeam.. Our management team has ably steered the company through economic expansions as well as downturns, as evidenced by our strong financial performance in 2008 and 2009. Thomas G. Dundon, our President and Chief Executive Officer and one of our founders, has approximately twenty20 years of experience in the consumer finance industry. In addition, Jason Kulas, our President and Chief Financial Officer, has approximately 18 years of experience in the financial services industry and seven years of experience as our Chief Financial Officer. Further, our senior management team has an average of over sixteen16 years of experience across the financial services and consumer industries. Our management will also hold meaningful stakes in the company after giving effect to the offering. Mr. Dundon will own approximately %10.46% of our outstanding common stock as well as options to purchase an additional %,3.29%, and the remainder of our senior management team in aggregate will own approximately %0.10% of our common stock and options to purchase an additional %.0.82%.

Our Business Strategy

Our primary goal is to create stockholder value by leveraging our systems, data, liquidity and management. Our growth strategy is to increase market penetration in the consumer finance industry either by increasing share in existing channels or by broadening the number of origination channels while deploying our capital and funding efficiently.

Expand Our Vehicle Finance Franchise

Organic Growth in Indirect Auto FinanceFinance.. We have a deep knowledge of consumer behavior across the full credit spectrum and are a key player in the U.S. vehicle finance market. We have the ability to continue to increase our market penetration in the vehicle finance market, subject to attractive market conditions, via the number and depth of our relationships. We plan to achieve this in part through rolling out alliance programs with national vehicle dealer groups and financial institutions, including banks, credit unions, and other lenders, in both the prime and nonprime vehicle finance markets. Our technology-based platform enables us to integrate seamlessly with other originators and thereby benefit from their channels and brands.

Strategic Alliances with OEMs.We plan to expand our existing OEM relationships and develop future relationships with other OEMs to drive incremental origination volume. The loans and leases originated through Chrysler Capital should provide us with the majority of our near-term expected growth. In addition, the experience gained in lease and dealer financing can be applied to improve origination volume through the rest of our dealer base. Our relationship with Chrysler has accelerated our transformation into a full-service vehicle finance company that provides financial products and services to consumers and automotive dealers.

Growth in Direct-to-Consumer ExposureExposure.. We are working to further diversify our vehicle finance product offerings by expanding our web-based, direct-to-consumer offerings. Our RoadLoans.com program is a preferred finance resource for many major vehicle shopping websites, including Cars.com, AutoTrader.com, Kelley Blue Book, and eBay Motors. In addition, we are working to integrate our direct-to-consumer offerings with many of the major vehicle brands in the United States, including Chrysler, Jeep, Dodge, Ram, and Fiat. We will continue to focus on securing relationships with additional vehicle-related websites.

Expansion of Fee-Based Income Opportunities.We seek out opportunities to leverage our sophisticated and adaptable servicing platform for both prime and nonprime loans, as well as other vehicle finance and unsecured consumer lending products. We collect fees to originate and service loan portfolios for third parties, and we handle both secured and unsecured loan products across the full credit spectrum. Loans sold to or sourced to third-party banks through flow agreements also provide additional opportunities to service large vehicle loan pools. We believe our loan servicing business is scalable and provides an attractive return on equity, and we intend to continue to develop new third-party relationships to increase its size. In 2013, as of September 30, we have added over $1 billion of assets to our portfolio of assets serviced for others.

Continue to Grow Our Unsecured Consumer Lending Platform

We are further diversifying our business through our strategic relationships in the unsecured consumer lending space, which is a rapidly growing segment of the consumer finance market in the United States. Our ability to offer these products is derived from our expertise in originating nonprime vehicle retail loans, our data on consumers across the credit spectrum, and Santander’s expertise in the unsecured consumer lending industry. One of our principal strategic consumer finance relationships is with Bluestem. Bluestem’s customers rely on Bluestem proprietary credit products at point of sale to make purchases, and we have the option to purchase certain credit receivablesloans through April 2020. We also have a strategic relationship with LendingClub, pursuant to which we invest in or purchase personal loans. Furthermore, we have a pipeline of private label credit card initiatives we expect to pursue, including several through our relationship with a point-of-sale lending technology company.

Risks Associated with Our Business and Growth Strategy

Participating in this offering involves substantial risk. Although we have set forth our competitive strengths and growth strategy above, our ability to execute our strategy and grow our business is subject to certain challenges and risks. The vehicle finance industry is a competitive and highly fragmented industry, with no individual lender capturing more than 10% of the market. We may be at a competitive disadvantage with regard to certain of our competitors who are able to provide financing on more favorable terms or who have more beneficial relationships with automobile manufacturers and dealerships. This competition could reduce our market share or cause us to be unable to successfully execute all or part of our strategy. Some of the more significant challenges and risks include the following:

Adverse economic conditions in the United States and worldwide may negatively impact our results. We are subject to changes in general economic conditions that are beyond our control, such as periods of economic slowdown, increased unemployment rates and disruptions in the global financial markets, which could decrease consumer demand for automobiles and other consumer products and increase our delinquencies, defaults, repossessions and losses.

Our business could be negatively impacted if our access to funding is reduced. We rely upon our ability to sell securities in the ABS market and upon our ability to access various credit facilities to fund our operations, and the continued availability of these funding sources depends, in part, on factors outside of our control. If these sources of funding become unavailable to us, we may have to curtail our loan acquisition and organization activities.

We face significant risks implementing our growth strategy, some of which are outside our control. Our ability to execute a growth strategy of expanding our vehicle finance franchise and growing our unsecured consumer lending platform is subject to risks such as the inherent uncertainty regarding general economic conditions, our ability to obtain adequate financing for our expansion plans, changes in the applicable laws and regulatory environment, the degree of competition in new markets and our ability to recruit qualified personnel.

Our recent agreement with Chrysler may not result in currently anticipated levels of growth and is subject to certain performance conditions that could result in termination of the agreement.The loans and leases originated through Chrysler Capital are expected to provide us with the majority of our projected growth over the next several years. If we are unable to realize the expected benefits of our relationship with Chrysler, or if our agreement with Chrysler were to terminate for failure to meet certain milestones and performance metrics, our future growth would be negatively impacted.

Our business could be negatively impacted if we are unsuccessful in developing and maintaining relationships with automobile dealerships. Our ability to acquire loans and automotive leases is reliant on our relationships with reputable automotive dealers that direct consumers to our offices or originate loans at the point-of-sale, which we subsequently purchase. None of our relationships are exclusive, and they may be terminated at any time.

Our financial condition, liquidity, and results of operations depend on the credit performance of our loans. Nonprime receivables, which comprise more than 80% of our consumer loans, experience higher default rates than prime receivables, which subjects us to a higher risk of losses on those receivables. In addition, our prime portfolio, for which we have less ability to make risk adjustments to pricing compared to our nonprime loan portfolio, is rapidly growing. As a result, a larger proportion of our business will consist of loans with respect to which we have less flexibility to adjust pricing to absorb losses.

The above list is not exhaustive, and we face additional challenges and risks. Before you participate in this offering, you should carefully consider all of the information in this prospectus, including matters set forth under the section entitled “Risk Factors.”

Reorganization

In July 2013, Santander Consumer USA Inc., an Illinois corporation (“SCUSA Illinois”), formed Santander Consumer USA Holdings Inc., a Delaware corporation (“SCUSA Delaware”), and SCUSA Merger Sub Inc., an Illinois corporation and a wholly owned subsidiary of SCUSA Delaware (“SCUSA Merger Sub”). BothOn January 16, 2014, pursuant to an Agreement and Plan of Merger by and among SCUSA Illinois, SCUSA Delaware and SCUSA Merger Sub, were formed solely for the purpose of effecting this offering. Neither SCUSA Delaware nor SCUSA Merger Sub has engaged in any business or other activities except in connection with their respective formations and effecting this offering, and, except for SCUSA Delaware holding the stock of SCUSA Merger Sub, neither holds any assets and, except for SCUSA Merger Sub being a wholly owned subsidiary of SCUSA Delaware, neither has any subsidiaries. Prior to the consummation of this offering, SCUSA Merger Sub will mergemerged with and into SCUSA Illinois, with SCUSA Illinois surviving the merger as a wholly owned subsidiary of SCUSA Delaware, the registrant. In the merger, all of the outstanding shares of common stock of SCUSA Illinois will be converted intowere exchanged for shares of SCUSA Delaware common stock on a 2.6665 for 1.00 basis. We refer to these transactions as the “Reorganization.” Both SCUSA Delaware and SCUSA Merger Sub were formed solely for the purpose of effecting this offering and the Reorganization. Neither SCUSA Delaware nor SCUSA Merger Sub has engaged in any business or other activities except in connection with their respective formations and effecting this offering and the Reorganization, and prior to the Reorganization, except for SCUSA Delaware holding the common stock of SCUSA Merger Sub, neither held any assets and, except for SCUSA Merger Sub being a wholly owned subsidiary of SCUSA Delaware, neither had any subsidiaries.

Principal Stockholders

The majority of our common stock is held collectively by (1) SHUSA,Santander Holdings USA, Inc. (“SHUSA”), a wholly owned subsidiary of Santander; (2) Sponsor Auto Finance Holdings Series LP (“Auto Finance Holdings”), an investment vehicle owned by (i) funds managed by Centerbridge Partners, L.P., Kohlberg Kravis Roberts & Co. L.P., and Warburg Pincus LLC; (ii) DFS Sponsor Investments LLC, an entity affiliated with Mr. Dundon; and (iii) our President and Chief Financial Officer; and (3) DDFS LLC, an entity owned by Mr. Dundon. We refer to these three stockholders, collectively, as our “Principal Stockholders.”

SHUSA is a bank holding company with total assets of $82.7$77 billion as of March 31,September 30, 2013. SHUSA’s primary assets include our common stock and all of the stock of Sovereign,SBNA, whose primary business consists of attracting deposits from its network of over 700 retail branches and originating small business loans, middle market commercial loans, multi-family loans, residential mortgage loans, home equity loans and lines of credit, and vehicle and other consumer loans in the communities served by its branches.

Centerbridge Partners, L.P. is a private investment firm based in New York City and has approximately $19$20 billion in capital under management as of MarchSeptember 2013. The firm focuses on private equity and credit investments. The firm is dedicated to partnering with world-class management teams across targeted industry sectors to help companies achieve their operating and financial objectives.

Kohlberg Kravis Roberts & Co. L.P., together with its affiliates (“KKR”), is a leading global investment firm with approximately $78$90 billion in assets under management as of March 31,September 30, 2013. KKR offers a broad range of investment management services to fund investors and provides capital markets services for the firm, its portfolio companies, and third parties. KKR has over 80 portfolio companies in its private equity funds.

Warburg Pincus is a leading global private equity firm withfocused on growth investing. Founded more than $4040 years ago, the firm has remained true to a unique and enduring strategy of investing in growth businesses in partnership with entrepreneurs and superior management teams. As of September 30, 2013, the firm has more than $35 billion inof assets under management and as of June 30, 2013 an active private equity portfolio of more than 125 companies globally.

Our management will also hold meaningful stakes in the company after giving effect to the offering. Mr. Dundon will own approximately %10.46% of our common stock as well as options to purchase an additional %,3.29%, and the remainder of our senior management team in aggregate will own approximately %0.10% of our common stock and options to purchase an additional %.0.82%. See “Certain Relationships and Related Party Transactions” and “Security Ownership of Certain Beneficial Owners, Management and Selling Stockholders” and the documents referred to herein for more information with respect to our relationship with our Principal Stockholders.

The December 2011 equity transaction whereby Auto Finance Holdings became a stockholder in SCUSA is referred to in this document as the “Equity Transaction.”

Risk Factors

Participating in this offering involves substantial risk. Our ability to execute our strategy and grow our business also is subject to certain risks. The risks described under the heading “Risk Factors” immediately following this summary may cause us not to realize the full benefits of our strengths or may cause us to be unable to successfully execute all or part of our strategy. Some of the more significant challenges and risks include the following:

adverse economic conditions in the United States and worldwide may negatively impact our results;

our business could suffer if our access to funding is reduced;

we face significant risks implementing our growth strategy, some of which are outside our control;

our recent agreement with Chrysler may not result in currently anticipated levels of growth and is subject to certain performance conditions that could result in termination of the agreement;

our business could suffer if we are unsuccessful in developing and maintaining relationships with automobile dealerships;

our financial condition, liquidity and results of operations depend on the credit performance of our loans;

loss of our key management or other personnel, or an inability to attract such management and personnel, could negatively impact our business;

future changes in our relationship with Santander could adversely affect our operations; and

we operate in a highly regulated industry and continually changing federal, state, and local laws and regulations could materially adversely affect our business.

Before you participate in this offering, you should carefully consider all of the information in this prospectus, including matters set forth under the section entitled “Risk Factors.”

Additional Information

Our principal executive offices are located at 8585 North Stemmons Freeway, Suite 1100-N, Dallas, Texas 75247, and our telephone number is (214) 634-1110. Our Internet address is www.santanderconsumerusa.com. Information on, or accessible through, our website is not part of this prospectus.

The Offering

Issuer | Santander Consumer USA Holdings Inc. |

| ||

| Common stock offered by the selling stockholders | 65,217,391 shares of common stock. | |

Underwriters’ over-allotment option to purchase additional shares | ||

9,782,608 shares of common stock from the selling stockholders. | ||

Common stock to be outstanding immediately after this offering | 347,363,230 shares of common stock.(1) | |

Use of proceeds | ||

| We will not receive any proceeds from the sale of shares of common stock by the selling stockholders. | ||

Voting rights | One vote per share. | |

Dividend policy | It has been our policy to pay a dividend to all common stockholders. Following the completion of this offering, we currently intend to pay dividends on a quarterly | |

Listing | We have applied to list our common stock on the New York Stock Exchange (which we refer to as | |

Risk factors | Please read the section entitled “Risk Factors” beginning on page | |

| (1) | Based on 347,363,230 shares of common stock issued and outstanding as of |

up to shares of common stock which may be issued by us upon exercise in full of the underwriters’ option to purchase additional shares of our common stock;

23,907,684 shares of common stock issuable upon exercise of outstanding stock options with a weighted average exercise price of $$10.51 per share, of which 17,292,089 shares were vested as of ;January 17, 2014; and

1,036,360 shares of common stock reserved for issuance under our 2011 Management Equity Plan.

Directed Share Program | At our request, the underwriters have reserved up to 3% of the shares of common stock being offered by this prospectus for sale at the initial public offering price to our directors, officers, employees and other individuals associated with us and members of their families. See “Underwriting.” |

LOYAL3 Platform | At our request, the underwriters have reserved up to 2% of the shares of common stock offered by this prospectus to be offered through the LOYAL3 platform at the initial public offering price. See “Underwriting.” |

Conflict of Interest | Because Santander Investment Securities Inc. and KKR Capital Markets LLC, underwriters for this offering, are under common control with us and certain of the selling stockholders and because affiliates of each of these underwriters will receive at least 5% of the proceeds of this offering, a conflict of interest under Financial Industry Regulatory Authority (“FINRA”) Rule 5121 is deemed to exist. Accordingly, this offering will be conducted in accordance with that rule. See “Underwriting — Conflict of Interest.” |

Summary Historical Consolidated Financial Data

The following summary consolidated financial data should be read in conjunction with, and are qualified by reference to, “Selected Historical Consolidated Financial Information,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and the consolidated financial statements and notes thereto included elsewhere in this prospectus. The summary consolidated statement of income data for the years ended December 31, 2012, 2011, and 2010 and the summary consolidated balance sheet data at December 31, 2012 and 2011 has been derived from, and is qualified by reference to, our audited consolidated financial statements included elsewhere in this prospectus and should be read in conjunction with those consolidated financial statements and notes thereto. The summary consolidated statement of income data for the years ended December 31, 2009 and 2008 and the summary consolidated balance sheet data at December 31, 2010, 2009, and 2008 has been derived from audited consolidated financial statements that are not included in this prospectus. The summary consolidated statement of income data for the quarterly and year-to-date periods ended March 31,September 30, 2013 and 2012 and the summary consolidated balance sheet data at March 31,September 30, 2013 are derived from, and qualified by reference to, our unaudited interim consolidated financial statements included elsewhere in this prospectus and should be read in conjunction with those consolidated financial statements and notes thereto.

Santander Consumer USA Holdings Inc. has not engaged in any operations or conducted any activities other than those incidental to its formation and to preparations for the Reorganization and this offering. It will have only nominal assets and no liabilities prior to the consummation of the Reorganization and this offering. Upon closing, its assets will include shares in Santander Consumer USA Inc., its wholly owned subsidiary and operating company, and the cash proceeds of this offering. See “Reorganization.” Accordingly, this prospectus includes, and the discussion below is based solely on, the historical financial statements of Santander Consumer USA Inc.

| Three Months Ended | Year Ended | Three Months Ended | Nine Months Ended | Year Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| March 31, 2013 | March 31, 2012 | December 31, 2012 | December 31, 2011 | December 31, 2010 | December 31, 2009 | December 31, 2008 | September 30, 2013 | September 30, 2012 | September 30, 2013 | September 30, 2012 | December 31, 2012 | December 31, 2011 | December 31, 2010 | December 31, 2009 | December 31, 2008 | |||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollar amounts in thousands, except per share data) | (Dollar amounts in thousands, except per share data) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Income Statement Data | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Finance and other interest income | $ | 814,592 | $ | 700,902 | $ | 2,948,502 | $ | 2,594,513 | $ | 2,076,578 | $ | 1,510,240 | $ | 1,507,172 | ||||||||||||||||||||||||||||||||||||||||||||||||||

Income from individually acquired retail installment contracts | $ | 879,628 | $ | 580,360 | $ | 2,333,857 | $ | 1,600,054 | $ | 2,223,833 | $ | 1,695,538 | $ | 1,308,728 | $ | 1,281,515 | $ | 1,396,610 | ||||||||||||||||||||||||||||||||||||||||||||||

Income from purchased receivables portfolios | 87,237 | 161,753 | 327,712 | 545,819 | 704,770 | 870,257 | 734,634 | 218,240 | 105,229 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

Other financing income | 44,627 | 2,845 | 62,205 | 7,416 | 19,899 | 28,718 | 33,216 | 10,485 | 5,333 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Interest and fees on finance receivables and loans | 1,011,492 | 744,958 | 2,723,774 | 2,153,289 | 2,948,502 | 2,594,513 | 2,076,578 | 1,510,240 | 1,507,172 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

Interest expense | 82,997 | 98,685 | 374,027 | 418,526 | 316,486 | 235,031 | 256,356 | 120,589 | 98,774 | 291,062 | 293,238 | 374,027 | 418,526 | 316,486 | 235,031 | 256,356 | ||||||||||||||||||||||||||||||||||||||||||||||||

Net other finance and interest income | 9,643 | 2,950 | 17,486 | 9,423 | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

Net interest margin | 731,595 | 602,217 | 2,574,475 | 2,175,987 | 1,760,092 | 1,275,209 | 1,250,816 | 900,546 | 649,134 | 2,450,198 | 1,869,474 | 2,574,475 | 2,175,987 | 1,760,092 | 1,275,209 | 1,250,816 | ||||||||||||||||||||||||||||||||||||||||||||||||

Provision for loan losses on retail installment contracts | 217,193 | 112,188 | 1,122,452 | 819,221 | 888,225 | 720,938 | 823,024 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Provision for loan losses on individually acquired retail installment contracts | 447,565 | 243,698 | 1,074,487 | 683,000 | 1,119,074 | 741,559 | 750,625 | 720,938 | 823,024 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

Incremental increase (decrease) in allowance related to purchased receivables portfolios | 93,718 | (57,823 | ) | 51,654 | (22,798 | ) | 3,378 | 77,662 | 137,600 | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Other provisions for loan losses | 56,918 | — | 97,664 | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Provision for loan losses | 598,201 | 185,875 | 1,223,805 | 660,202 | 1,122,452 | 819,221 | 888,225 | 720,938 | 823,024 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

Profit sharing | 27,238 | — | 34,802 | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

Other income | 76,129 | 70,390 | 295,689 | 452,529 | 249,028 | 48,096 | 43,120 | 78,340 | 74,291 | 208,878 | 238,890 | 295,689 | 452,529 | 249,028 | 48,096 | 43,120 | ||||||||||||||||||||||||||||||||||||||||||||||||

Costs and expenses | 148,874 | 151,324 | 559,163 | 557,083 | 404,840 | 249,012 | 209,315 | 176,140 | 183,730 | 496,312 | 464,192 | 559,163 | 557,083 | 404,840 | 249,012 | 209,315 | ||||||||||||||||||||||||||||||||||||||||||||||||

Income tax expense | 152,798 | 152,662 | 453,615 | 464,034 | 277,944 | 143,834 | 87,472 | 65,486 | 141,261 | 322,413 | 372,266 | 453,615 | 464,034 | 277,944 | 143,834 | 87,472 | ||||||||||||||||||||||||||||||||||||||||||||||||

Net income | 288,859 | 256,433 | 734,934 | 788,178 | 438,111 | 209,521 | 174,125 | 111,821 | 212,559 | 581,744 | 611,704 | 734,934 | 788,178 | 438,111 | 209,521 | 174,125 | ||||||||||||||||||||||||||||||||||||||||||||||||

Net income attributable to Santander Consumer USA Inc. shareholders | 290,402 | 254,192 | 715,003 | 768,197 | 438,111 | 209,521 | 174,125 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Net income attributable to Santander Consumer USA Holdings Inc shareholders | 111,245 | 168,467 | 583,565 | 595,846 | 715,003 | 768,197 | 438,111 | 209,521 | 174,125 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

Share Data | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Weighted-average common shares outstanding | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Basic | 129,819,900 | 129,819,883 | 129,819,883 | 92,277,053 | 92,173,913 | 92,173,913 | 92,173,913 | 346,172,443 | 346,164,717 | 346,169,595 | | 346,164,717 | | 346,164,717 | 246,056,761 | 245,781,739 | 245,781,739 | 245,781,739 | ||||||||||||||||||||||||||||||||||||||||||||||

Diluted | 129,819,900 | 129,819,883 | 129,819,883 | 92,277,053 | 92,173,913 | 92,173,913 | 92,173,913 | 346,172,443 | 346,164,717 | 346,169,595 | 346,164,717 | 346,164,717 | 246,056,761 | 245,781,739 | 245,781,739 | 245,781,739 | ||||||||||||||||||||||||||||||||||||||||||||||||

Earnings per share attributable to Santander Consumer USA Inc. shareholders | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Earnings per share attributable to Santander Consumer USA Holdings Inc shareholders | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Basic | $ | 2.24 | $ | 1.96 | $ | 5.51 | $ | 8.32 | $ | 4.75 | $ | 2.27 | $ | 1.89 | $ | 0.32 | $ | 0.49 | $ | 1.69 | $ | 1.72 | $ | 2.07 | $ | 3.12 | $ | 1.78 | $ | 0.85 | $ | 0.71 | ||||||||||||||||||||||||||||||||

Diluted | 2.24 | 1.96 | 5.51 | 8.32 | 4.75 | 2.27 | 1.89 | $ | 0.32 | $ | 0.49 | $ | 1.69 | $ | 1.72 | $ | 2.07 | $ | 3.12 | $ | 1.78 | $ | 0.85 | $ | 0.71 | |||||||||||||||||||||||||||||||||||||||

| Three Months Ended | Year Ended | Three Months Ended | Nine Months Ended | Year Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| March 31, 2013 | March 31, 2012 | December 31, 2012 | December 31, 2011 | December 31, 2010 | December 31, 2009 | December 31, 2008 | September 30, 2013 | September 30, 2012 | September 30, 2013 | September 30, 2012 | December 31, 2012 | December 31, 2011 | December 31, 2010 | December 31, 2009 | December 31, 2008 | |||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollar amounts in thousands, except per share data) | (Dollar amounts in thousands, except per share data) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Net tangible book value per common share at period end | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Excluding other comprehensive income (loss) | $ | 18.64 | $ | 18.15 | $ | 16.04 | $ | 16.20 | $ | 6.95 | $ | 6.37 | $ | 4.49 | $ | 7.07 | $ | 7.07 | $ | 6.01 | $ | 6.07 | $ | 2.61 | $ | 2.39 | $ | 1.68 | ||||||||||||||||||||||||||||||||||||

Including other comprehensive income (loss) | 18.58 | 18.05 | 15.97 | 16.11 | 6.95 | 6.24 | 4.06 | $ | 7.05 | $ | 7.05 | $ | 5.99 | $ | 6.04 | $ | 2.61 | $ | 2.34 | $ | 1.52 | |||||||||||||||||||||||||||||||||||||||||||

Dividends declared per share of common stock | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Basic | — | — | 5.66 | 5.05 | 4.34 | — | — | $ | — | $ | 0.42 | $ | 0.84 | $ | 1.37 | $ | 2.12 | $ | 1.89 | $ | 1.63 | — | — | |||||||||||||||||||||||||||||||||||||||||

Diluted | — | — | 5.66 | 5.05 | 4.34 | — | — | $ | — | $ | 0.42 | $ | 0.84 | $ | 1.37 | $ | 2.12 | $ | 1.89 | $ | 1.63 | — | — | |||||||||||||||||||||||||||||||||||||||||

Balance Sheet Data(1) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Retail installment contracts, net | 16,589,110 | 16,203,926 | 16,581,565 | 14,802,046 | 6,681,306 | 5,452,678 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Finance receivables and loans | $ | 21,238,684 | $ | 21,238,684 | $ | 16,265,820 | $ | 16,715,703 | $ | 15,032,046 | $ | 7,466,267 | $ | 5,600,102 | ||||||||||||||||||||||||||||||||||||||||||||||||||

Goodwill and intangible assets | 127,508 | 126,700 | 125,427 | 126,767 | 142,198 | 105,643 | 128,573 | 128,573 | 126,700 | 125,427 | 126,767 | 142,198 | 105,643 | |||||||||||||||||||||||||||||||||||||||||||||||||||

Total assets | 19,594,411 | 18,741,644 | 19,404,371 | 16,773,021 | 8,556,177 | 6,044,454 | 25,608,280 | 25,608,280 | 18,741,644 | 19,404,371 | 16,773,021 | 8,556,177 | 6,044,454 | |||||||||||||||||||||||||||||||||||||||||||||||||||

Total debt | 16,529,180 | 16,227,995 | 16,790,518 | 15,065,635 | 7,525,930 | 5,432,338 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Total borrowings | 22,683,397 | 22,683,397 | 16,227,995 | 16,790,518 | 15,065,635 | 7,525,930 | 5,432,338 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Total liabilities | 17,015,845 | 16,502,178 | 17,167,686 | 16,005,404 | 7,838,862 | 5,564,986 | 23,039,122 | 23,039,122 | 16,502,178 | 17,167,686 | 16,005,404 | 7,838,862 | 5,564,986 | |||||||||||||||||||||||||||||||||||||||||||||||||||

Total equity | 2,578,566 | 2,239,466 | 2,236,685 | 767,617 | 717,315 | 479,468 | 2,569,158 | 2,569,158 | 2,239,466 | 2,236,685 | 767,617 | 717,315 | 479,468 | |||||||||||||||||||||||||||||||||||||||||||||||||||

Allowance for loan losses | 1,844,804 | 1,774,002 | 1,208,475 | 840,599 | 384,396 | 347,302 | 2,355,087 | 2,355,087 | 1,774,002 | 1,208,475 | 840,599 | 384,396 | 347,302 | |||||||||||||||||||||||||||||||||||||||||||||||||||

Other Information | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Charge-offs, net of recoveries | 182,885 | 222,709 | 1,008,454 | 1,025,133 | 709,367 | 683,844 | 679,172 | $ | 371,396 | $ | 272,692 | $ | 772,187 | $ | 710,002 | $ | 1,008,454 | $ | 1,025,133 | $ | 709,367 | $ | 683,844 | $ | 679,172 | |||||||||||||||||||||||||||||||||||||||

Delinquent principal over 60 days, end of period | 643,023 | 865,917 | 767,838 | 579,627 | 502,254 | 477,141 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Gross retail installment contracts, end of period | 19,078,620 | 18,593,603 | 18,620,800 | 16,613,774 | 7,524,192 | 6,213,558 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Average gross retail installment contracts | 18,763,805 | 18,313,234 | 18,391,523 | 16,113,117 | 11,609,958 | 6,665,913 | 5,717,258 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Average total assets | 19,094,885 | 18,215,180 | 18,411,012 | 16,067,623 | 11,984,997 | 6,930,260 | 5,520,652 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Average debt | 16,296,712 | 15,378,248 | 15,677,522 | 14,557,370 | 10,672,331 | 6,083,953 | 4,989,280 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Average total equity | 2,417,704 | 2,354,306 | 2,312,781 | 916,219 | 850,219 | 594,097 | 406,680 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

End of period Delinquent principal over 60 days | 969,886 | 969,886 | 865,917 | 767,838 | 579,627 | 502,254 | 477,141 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

End of period Gross finance receivables and loans | 24,201,063 | 24,201,063 | 18,655,497 | 18,754,938 | 16,843,774 | 8,309,153 | 6,360,982 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Average gross individually acquired retail installment contracts | 19,790,033 | 12,704,563 | 17,180,908 | 11,527,698 | 12,082,026 | 8,843,036 | 6,631,231 | 5,690,833 | 5,396,355 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

Average gross purchased receivables portfolios | 2,676,906 | 5,706,495 | 3,325,260 | 6,798,200 | 6,309,497 | 7,270,080 | 4,978,727 | 975,080 | 320,903 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Average Gross finance receivables and loans | 23,246,772 | 18,539,064 | 21,396,754 | 18,454,847 | 18,501,710 | 16,282,215 | 12,111,969 | 7,266,079 | 5,728,599 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

Average Total assets | 24,352,346 | 18,530,771 | 21,514,270 | 18,300,123 | 18,411,012 | 16,067,623 | 11,984,997 | 6,930,260 | 5,520,652 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

Average Debt | 21,451,420 | 15,781,659 | 18,681,703 | 15,528,709 | 15,677,522 | 14,557,370 | 10,672,331 | 6,083,953 | 4,989,280 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

Average Total equity | 2,525,997 | 2,365,722 | 2,453,782 | 2,334,008 | 2,312,781 | 916,219 | 850,219 | 594,097 | 406,680 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

Ratios(2) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Yield on individually acquired retail installment contracts | 17.8 | % | 18.3 | % | 18.1 | % | 18.5 | % | 18.4 | % | 19.2 | % | 19.7 | % | 22.5 | % | 25.9 | % | ||||||||||||||||||||||||||||||||||||||||||||||

Yield on purchased receivables portfolios | 13.0 | 11.3 | 13.1 | 10.7 | 11.2 | 12.0 | 14.8 | 22.4 | 32.8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

Yield on interest-earning assets | 17.4 | % | 15.3 | % | 16.0 | % | 16.1 | % | 17.9 | % | 22.7 | % | 26.4 | % | 17.4 | 16.1 | 17.0 | 15.6 | 15.9 | 15.9 | 17.1 | 20.8 | 26.3 | |||||||||||||||||||||||||||||||||||||||||

Cost of interest-bearing liabilities | 2.0 | 2.6 | 2.4 | 2.9 | 3.0 | 3.9 | 5.1 | 2.2 | 2.5 | 2.1 | 2.5 | 2.4 | 2.9 | 3.0 | 3.9 | 5.1 | ||||||||||||||||||||||||||||||||||||||||||||||||

Efficiency ratio | 18.4 | 22.5 | 19.5 | 21.2 | 20.2 | 18.8 | 16.2 | 18.0 | 25.4 | 18.7 | 22.0 | 19.5 | 21.2 | 20.2 | 18.8 | 16.2 | ||||||||||||||||||||||||||||||||||||||||||||||||

Return on average assets | 6.1 | 5.6 | 4.0 | 4.9 | 3.7 | 3.0 | 3.2 | 1.8 | 4.6 | 3.6 | 4.5 | 4.0 | 4.9 | 3.7 | 3.0 | 3.2 | ||||||||||||||||||||||||||||||||||||||||||||||||

Return on average equity | 47.8 | 43.6 | 31.8 | 86.0 | 51.5 | 35.3 | 42.8 | 17.7 | 35.9 | 31.6 | 34.9 | 31.8 | 86.0 | 51.5 | 35.3 | 42.8 | ||||||||||||||||||||||||||||||||||||||||||||||||

Net charge-off ratio | 3.9 | 4.9 | 5.5 | 6.4 | 6.1 | 10.3 | 11.9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Delinquency ratio, end of period | 3.4 | 4.7 | 4.1 | 3.5 | 6.7 | 7.7 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Tangible common equity to total tangible assets ratio, end of period | 12.6 | 11.3 | 11.0 | 3.8 | 6.8 | 6.3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Common stock dividend ratio | 0.0 | 0.0 | 102.8 | 60.6 | 91.3 | 0.0 | 0.0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Net chargeoff ratio | 6.4 | 5.9 | 4.6 | 5.1 | 5.5 | 6.3 | 5.9 | 9.4 | 11.9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

Delinquency ratio | 4.0 | 4.0 | 4.6 | 4.1 | 3.4 | 6.0 | 7.5 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Tangible common equity to tangible assets | 9.6 | 9.6 | 11.3 | 11.0 | 3.8 | 6.8 | 6.3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Common stock dividend payout ratio | 0.0 | 86.3 | 49.8 | 80.0 | 102.8 | 60.6 | 91.3 | 0.0 | 0.0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (1) | Balance sheet data as of |

| (2) | “Yield on interest-earning assets” is defined as the ratio of |

| “Cost of interest-bearing liabilities” is defined as the ratio of Interest expense to Average debt during the period. |

| “Efficiency ratio” is defined as the ratio of Costs and expenses to the sum of Net interest margin and Other income. |

| “Return on average assets” is defined as the ratio of Net income to Average |

“Cost of interest-bearing liabilities” is defined as the ratio of Interest expense to Average debt during the period.

| “Return on average equity” is defined as the ratio of Net income to Average total equity. |

“Efficiency ratio” is defined as the ratio of Costs and expenses to the sum of Net interest margin and Other income.

“Return on average assets” is defined as the ratio of Net income to Average total assets.

| “Net charge-off ratio” is defined as the ratio of Charge offs, net of recoveries, to Average gross finance receivables and loans. |

| “Delinquency ratio” is defined as the ratio of Delinquent principal over 60 days, end of period to Gross finance receivables and loans, end of period. |

“Return on average equity” is defined as the ratio of Net income to Average total equity.

| “Tangible common equity to total tangible assets ratio” is defined as the ratio of Total equity, excluding Goodwill and intangible assets, to Total assets excluding Goodwill and intangible assets. |

“Net charge-off ratio” is defined as the ratio of Charge offs, net of recoveries, to Average gross retail installment contracts.

| “Common stock dividend ratio” is defined as the ratio of Dividends declared per share of common stock during the period to Net income attributable to Santander Consumer USA Holdings Inc. shareholders. |

“Delinquency ratio” is defined as the ratio of Delinquent principal over 60 days, end of period to Gross retail installment contracts, end of period.

“Tangible common equity to total tangible assets ratio” is defined as the ratio of Total equity, excluding Other income and deducting the value of Goodwill and intangible assets, to Total assets excluding Goodwill and intangible assets.

“Common stock dividend ratio” is defined as the ratio of Dividends declared per share of common stock during the period to Net income attributable to Santander Consumer USA Inc. shareholders.

Activity-based ratios for the periods ending March 31, 2013 and 2012 are presented on an annualized basis.

| Activity-based ratios for the periods ending September 30, 2013 and 2012 are presented on an annualized basis. |

Investing in our common stock involves a high degree of risk. You should carefully consider the following risk factors, as well as all of the other information contained in this prospectus including our consolidated financial statements, and the related notes thereto, before deciding to invest in our common stock. The occurrence of any of the following risks could materially and adversely affect our business, prospects, financial condition, results of operations, and cash flow. In such case, the trading price of our common stock could decline and you could lose all or part of your investment.

Risks Relating to Our Business

Adverse economic conditions in the United States and worldwide may negatively impact our results.

We are subject to changes in general economic conditions that are beyond our control. During periods of economic slowdown such as the recent economic downturn, delinquencies, defaults, repossessions, and losses generally increase while proceeds from auction sales decrease. These periods may also be accompanied by increased unemployment rates, decreased consumer demand for automobiles and other consumer products, and declining values of automobiles and other consumer products securing outstanding accounts, which weaken collateral coverage and increase the amount of a loss in the event of default. Additionally, higher gasoline prices, unstable real estate values, reset of adjustable rate mortgages to higher interest rates, general availability of consumer credit, or other factors that impact consumer confidence or disposable income could increase loss frequency and decrease consumer demand for automobiles and other consumer products as well as weaken collateral values on certain types of automobiles and other consumer products. Because our historical focus has been predominantly on nonprime consumers, the actual rates of delinquencies, defaults, repossessions, and losses on these loans could be more dramatically affected by a general economic downturn. In addition, during an economic slowdown or recession, our servicing costs may increase without a corresponding increase in our finance charge income. Furthermore, our business is significantly affected by monetary and regulatory policies of the U.S. federal government and its agencies. Changes in any of these policies are influenced by macroeconomic conditions and other factors that are beyond our control and could have a material adverse effect on us through interest rate changes, costs of compliance with increased regulation, and other factors.

Although market conditions have improved, unemployment in the United States continues to remain at elevated levels, and conditions remain challenging for financial institutions. Furthermore, certain Eurozone member countries have fiscal outlays that exceed their fiscal revenue, which has raised concerns about such countries’ abilities to continue to service their debt and foster economic growth. A weakened European economy could undermine investor confidence in European financial institutions and the stability of European member economies. Notwithstanding its geographic diversification, this could adversely impact Santander, with whom we have a significant relationship. Such events could also negatively affect U.S.-based financial institutions, counterparties with which we do business, and the stability of the global financial markets. Disruptions in the global financial markets have also adversely affected the corporate bond markets, debt and equity underwriting, and other elements of the financial markets. In recent years, downgrades of the sovereign debt of some European countries have resulted in increased volatility in capital markets and have caused some lenders and institutional investors to reduce and, in some cases, cease to provide funding to certain borrowers, including other financial institutions. The impact on available credit, increased volatility in the financial markets, and reduced business activity has adversely affected, and may continue to adversely affect, our businesses, capital, liquidity, or other financial conditions and results of operations, and access to credit.

The process we use to estimate losses inherent in our credit exposure requires complex judgments, including forecasts of economic conditions and how those economic conditions might impair the ability of our borrowers to repay their loans. The degree of uncertainty concerning economic conditions may adversely affect the accuracy of our estimates, which may, in turn, impact the reliability of the process and the quality of our assets.

Our business could be negatively impacted if our access to funding is reduced.

We rely upon our ability to sell securities in the ABS market and upon our ability to access various credit facilities to fund our operations. The ABS market, along with credit markets in general, experienced unprecedented disruptions during the recent economic downturn. Although market conditions have improved since 2009, for a number of years following the economic downturn, certain issuers experienced increased risk premiums while there was a relatively lower level of investor demand for certain ABS (particularly those securities backed by nonprime collateral). In addition, the risk of volatility surrounding the global economic system and uncertainty surrounding regulatory reforms such as the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) continue to create uncertainty around access to the capital markets. As a result, there can be no assurance that we will continue to be successful in selling securities in the ABS market. Adverse changes in our ABS program or in the ABS market generally could materially adversely affect our ability to securitize loans on a timely basis or upon terms acceptable to us. This could increase our cost of funding, reduce our margins or cause us to hold assets until investor demand improves.

We also depend on various credit facilities and flow agreements to fund our future liquidity needs. We cannot guarantee that these financing sources will continue to be available beyond the current maturity dates, on reasonable terms, or at all. As our volume of loan acquisitions and originations increases, especially due to our recent relationship with Chrysler, we will require the expansion of our borrowing capacity on our existing credit facilities and flow agreements or the addition of new credit facilities and flow agreements. The availability of these financing sources depends, in part, on factors outside of our control, including regulatory capital treatment for unfunded bank lines of credit, the financial strength and strategic objectives of Santander and the other banks that participate in our credit facilities and flow agreements, and the availability of bank liquidity in general. We may also experience the occurrence of events of default or breach of financial covenants, which could reduce our access to bank funding. In the event of a sudden or unexpected shortage of funds in the banking system, we cannot be sure that we will be able to maintain necessary levels of funding without incurring high funding costs, a reduction in the term of funding instruments, or the liquidation of certain assets.

If theseWe have not experienced a significant increase in risk premiums or cost of funding to date, but we are not isolated from general market conditions that may affect issuers of ABS and other borrowers and we could experience increased risk premiums or funding costs in the future. In addition, if the sources of funding described above are not available to us on a regular basis for any reason, we may have to curtail or suspend our loan acquisition and origination activities. Downsizing the scale of our business would have a material adverse effect on our financial position, liquidity, and results of operations.

We face significant risks in implementing our growth strategy, some of which are outside our control.

We intend to continue our growth strategy to (i) expand our vehicle finance franchise by increasing market penetration via the number and depth of our relationships in the vehicle finance market, pursuing additional relationships with OEMs, and expanding our direct-to-consumer footprint and (ii) grow our unsecured consumer lending platform. Our ability to execute this growth strategy is subject to significant risks, some of which are beyond our control, including:

the inherent uncertainty regarding general economic conditions;