As filed with the Securities and Exchange Commission on July 2, 2020.

Registration Statement No. 333-[●]333-238514

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1AMENDMENT NO. 1 TO:

FORM S-1

REGISTRATION STATEMENT UNDER

THE

SECURITIES ACT OF 1933

JERRICK MEDIA HOLDINGS, INC.

(Exact name of Registrant as specified in its charter)

| Nevada | 7819 | 87-0645394 | ||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification |

2050 Center Avenue Suite 640

Fort Lee, NJ 07024

Tel:Telephone: (201) 258-3770

Fax: (201)-608-7536

(Address including zip code, and telephone number including area code, of Registrant’s principal executive offices)

Copies to:

Jeremy Frommer

Chief Executive Officer

2050 Center Avenue Suite 640

Fort Lee, NJ 07024

Tel:Telephone: (201) 308-8060258-3770

(Name, address including zip code, and telephone number including area code, of agent for service)

Copies to:

Andrea Cataneo, Esq. Richard A. Friedman, Esq. Sheppard, Mullin, Richter & Hampton LLP 30 Rockefeller Plaza New York, NY 10112 (212) 653-8700 | Joseph M. Lucosky, Esq. Lawrence Metelitsa, Esq. Scott E. Linsky, Esq. Lucosky Brookman LLP 101 Wood Avenue South, 5th Floor Woodbridge, NJ 08830 (732) 395-4400 |

Approximate dateDate of commencementCommencement of proposed saleProposed Sale to the public:Public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”filer,” “smaller reporting company” and “smaller reporting“emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| Non-accelerated filer | Smaller reporting company | ☒ | ||

| Emerging | ☐ | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.Act ☐

CALCULATION OF REGISTRATION FEE

| Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price (1)(2) | Amount of Registration Fee | ||||||

| Common stock, par value $0.001 per share | $ | 9,200,000 | $ | 1,194.16 | * | |||

Warrants to purchase common stock, par value $0.001 per share(3) | ||||||||

Shares of common stock issuable upon exercise of the Warrants | $ | 9,200,000 | $ | 1,194.16 | ||||

Total | $ | 18,400,000 | $ | 2,388.32 | ||||

| Securities to be Registered | Amount to be Registered(1) | Proposed Maximum Offering Price per Security | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee | ||||||||||||

| Common Stock | 13,745,160 | $ | 0.15 | (2) | $ | 2,061,774 | (2) | $ | 249.89 | |||||||

| Common Stock underlying Warrants(3) | 13,745,160 | $ | 0.30 | (3) | $ | 4,123,548 | $ | 499.78 | ||||||||

| Total | 27,490,320 | $ | 6,185,322 | $ | 749.67 | |||||||||||

| (1) |

|

| (2) | Pursuant to Rule 416, the securities being registered hereunder include such indeterminate number of |

| (3) | No fee is required pursuant to |

The registrantRegistrant hereby amends this registration statementRegistration Statement on such date or dates as may be necessary to delay its effective date until the registrantRegistrant shall file a further amendment which specifically states that this registration statementRegistration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until the registration statementRegistration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.determine.

The information in this preliminary prospectus is not complete and may be changed. WeThese securities may not sell these securitiesbe sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state or jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION, DATEDOCTOBER 24, 2018 JULY 2, 2020

PRELIMINARY PROSPECTUS

13,745,160 Shares of Common Stock Issuable upon Exercise of Warrants

13,745,160 Shares of Common StockJERRICK MEDIA HOLDINGS, INC.

Units

Common Stock and Warrants

This prospectus relates to the offering and resalesale by the selling security holders (the “Selling Security Holders”) identified herein of up to 27,490,320 shares of Common Stock, of Jerrick Media Holdings, Inc. (the “Company” or “Jerrick”) of $8,000,000 of units of securities (the “Units”). These shares include 13,745,160

Each Unit consists of (a) one share of our common stock, and (b) one warrant to purchase one share of our common stock at an exercise price equal to $ until the fifth anniversary of the issuance date. The shares of Common Stockour common stock and 13,745,160 shares of Common Stock Issuable upon Exercise of Warrants.

The Selling Security Holders may sell the shares of Common Stock on the OTCQB, in one or more transactions otherwise than on the OTCQB, such as privately negotiated transactions, or using a combination of these methods,warrants are immediately separable and at fixed prices, at prevailing market prices at the time of the sale, at varying prices determined at the time of sale, or at negotiated prices. See the disclosure under the heading “Plan of Distribution” elsewherewill be issued separately but will be purchased together in this prospectus for more information about how the Selling Security Holders may sell or otherwise dispose of their shares of Common Stock hereunder.

The Selling Security Holders may sell any, all or none of the securities offered by this prospectus and we do not know when or in what amount the Selling Security Holders may sell their shares of Common Stock hereunder following the effective date of this registration statement.offering.

We have applied to list our common stock and the warrants on the Nasdaq Capital Market upon our satisfaction of the exchange’s initial listing criteria. If our common stock and warrants are not approved for listing on the Nasdaq Capital Market, we will not receive any proceeds from the sale ofconsummate this offering. No assurance can be given that our Common Stock by the Selling Security Holders in the offering described in this prospectus.application will be approved.

Our Common Stockcommon stock is currently quoted for trading on theThe OTCQB Marketplace (OTCQB)Venture Market (the “OTCQB”), operated by OTC Markets Group, under the symbol “JMDA”. AsOn July 1, 2020, the last reported sale price of October 19, 2018, the closing bid price for our Common Stock as reportedcommon stock on the OTCQB was $0.175$4.45 per share. Quotes of our common stock trading prices on the OTCQB may not be indicative of the market price of our common stock or warrants if listed on the Nasdaq Capital Market. Upon the securities comprising the Units becoming separately traded, we expect that our common stock and warrants will be listed on the Nasdaq Capital Market under the symbols “JMDA” and “JMDAW,” respectively.

Investing in our Common Stock should be consideredcommon stock is highly speculative and involves a high degree of risk, includingrisk. You should carefully consider the risk of losing your entire investment. Seerisks and uncertainties described under the heading “Risk Factors” beginning on page 56 of this prospectus before making a decision to read aboutpurchase our securities.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

| Per Share | Total | |||||||

| Public offering price | $ | $ | ||||||

| Underwriting discounts and commissions(1) | ||||||||

| Proceeds to Jerrick Media Holdings, Inc. before expenses | ||||||||

| (1) | The Company has also agreed to issue to the underwriters warrants to purchase up to shares of the Company’s common stock. See “Underwriting” beginning on page 64 of this prospectus for a description of the Company’s arrangements with the underwriters. |

The Company has granted a 45 day option to the risks you should consider before buyingrepresentative of the underwriters to purchase up to an additional shares of our Common Stock.common stock to cover over-allotments, if any.

We may amendThe underwriters expect to deliver the shares to purchasers in the offering on or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments or supplements carefully before you make your investment decision.about , 2020.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.Book-Running Manager

We have retained no underwriter in connection with this offering.THE BENCHMARK COMPANY

The date of this prospectus is October 24, 2018, 2020.

You may only rely on the information contained in this prospectus or that we have referred you to. We have not authorized anyone to provide you with different information. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities other than the Common Stock offered by this prospectus. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any Common Stock in any circumstances in which such offer or solicitation is unlawful. Neither the delivery of this prospectus nor any sale made in connection with this prospectus shall, under any circumstances, create any implication that there has been no change in our affairs since the date of this prospectus is correct as of any time after its date.

i

ABOUT THIS PROSPECTUS

Neither we, nor the Selling Security Holders, have authorized anyone to provide any information or to make any representations other than those contained inIn this prospectus, orunless the context suggests otherwise, references to “the Company,” “Jerrick,” “JMDA,” “we,” “us,” and “our” refer to Jerrick Media Holdings, Inc. and its consolidated subsidiaries.

This prospectus describes the specific details regarding this offering, the terms and conditions of the common stock being offered hereby and the risks of investing in the Company’s common stock. You should read this prospectus, any free writing prospectuses we have prepared. We take no responsibility for,prospectus and can provide no assurance asthe additional information about the Company described in the section entitled “Where You Can Find More Information’’ before making your investment decision.

Neither the Company, nor any of its officers, directors, agents, representatives or underwriters, make any representation to you about the reliabilitylegality of any other information that others may give you. The Selling Security Holders are offering to sell, and seeking offers to buy, shares of our Common Stock onlyan investment in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless ofCompany’s common stock. You should not interpret the time of deliverycontents of this prospectus or any salefree writing prospectus to be legal, business, investment or tax advice. You should consult with your own advisors for that type of shares of our Common Stock. Ouradvice and consult with them about the legal, tax, business, financial condition, results of operations, and prospects may have changed sinceother issues that date.you should consider before investing in the Company’s common stock.

ADDITIONAL INFORMATION

The information in this preliminary prospectus is not complete and is subject to change. No person

You should rely only on the information contained in this document forprospectus and in any purpose other than participating in this offering, and only the preliminaryaccompanying prospectus dated October 24, 2018, is authorized by us to be used in connection with this offering. The preliminary prospectus will only be distributed by us and the Selling Security Holders and no other personsupplement. No one has been authorized by us to use this document toprovide you with different or additional information. The shares of common stock are not being offered in any jurisdiction where the offer or sell any of our securities.

Referencesis not permitted. You should not assume that the information in this prospectus to “we,” “us,” “our,”or any prospectus supplement is accurate as of any date other than the “Company” and “Jerrick” refer to Jerrick Media Holdings, Inc., together with its consolidated subsidiaries, unless we specify otherwise or unlessdate on the context requires otherwise. front of such documents.

TRADEMARKS AND TRADE NAMES

This prospectus contains summariesincludes trademarks that are protected under applicable intellectual property laws and are the Company’s property or the property of certain other documents, which summaries contain all material termsone of the relevant documentsCompany’s subsidiaries. This prospectus also contains trademarks, service marks, trade names and/or copyrights of other companies, which are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that the Company will not assert, to the fullest extent under applicable law, its rights or the right of the applicable licensor to these trademarks and trade names.

INDUSTRY AND MARKET DATA

Unless otherwise indicated, information contained in this prospectus concerning the Company’s industry and the markets in which it operates, including market position and market opportunity, is based on information from management’s estimates, as well as from industry publications and research, surveys and studies conducted by third parties. The third-party sources from which the Company has obtained information generally state that the information contained therein has been obtained from sources believed to be reliable, but the Company cannot assure you that this information is accurate but reference is hereby made to the full textor complete. The Company has not independently verified any of the actual documents for complete information concerningdata from third-party sources nor has it verified the rightsunderlying economic assumptions relied upon by those third parties. Similarly, internal company surveys, industry forecasts and obligationsmarket research, which the Company believes to be reliable, based upon management’s knowledge of the parties thereto.industry, have not been verified by any independent sources. The Company’s internal surveys are based on data it has collected over the past several years, which it believes to be reliable. Management estimates are derived from publicly available information, its knowledge of the industry, and assumptions based on such information and knowledge, which management believes to be reasonable and appropriate. However, assumptions and estimates of the Company’s future performance, and the future performance of its industry, are subject to numerous known and unknown risks and uncertainties, including those described under the heading “Risk Factors” in this prospectus and those described elsewhere in this prospectus, and the other documents the Company files with the Securities and Exchange Commission, or SEC, from time to time. These and other important factors could result in its estimates and assumptions being materially different from future results. You should read the information contained in this prospectus completely and with the understanding that future results may be materially different and worse from what the Company expects. See the information included under the heading “Forward-Looking Statements.”

ii

TABLE OF CONTENTS

-i-

ThisThe following summary highlights some of the information contained elsewhere in this prospectus. It is not complete andThis summary may not contain all of the information that you may be important to you. You should read this entire prospectus carefully, including the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Company’s historical financial statements and related notes included elsewhere in this prospectus. In this prospectus, unless otherwise noted, the terms “the Company,” “Jerrick,” “we,” “us,” and “our” refer to Jerrick Media Holdings, Inc. and its consolidated subsidiaries.

Overview

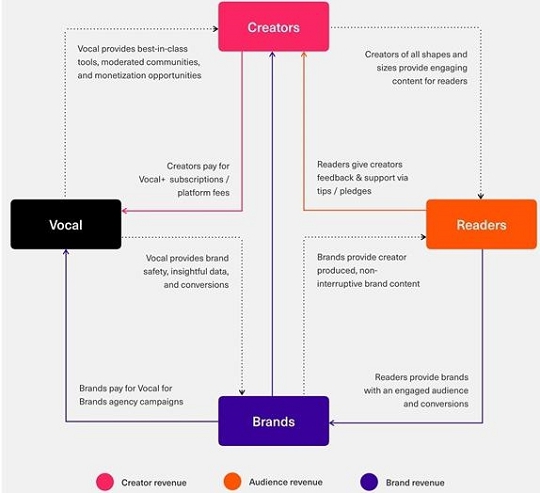

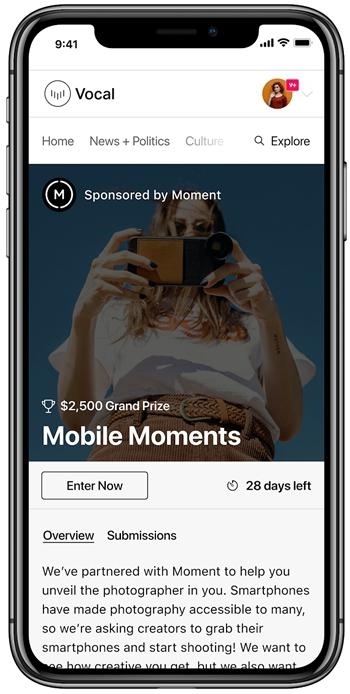

Jerrick Media Holdings, Inc. (“JMDA” or “the Company”) is the parent company and creator of the Vocal platform. The Company develops technology-based solutions to solve problems for the creator community, connecting creators with their ideal audiences and with the brands that want to consider. To understand this offering fully,access those audiences. Through a combination of data analysis, design, and development, the Company conceptualizes, creates, and maintains a suite of technology products and provides services that influence a global audience.

Jerrick is committed to identifying and leveraging opportunities within the digital platform and content monetization space. Our proprietary flagship technology platform is Vocal, which provides creators with storytelling tools, engaged communities, and opportunities to monetize their content. Vocal’s architecture was engineered to support a scalable and easy-to-update platform that could adapt its capacity to meet the current and growing demand for digital resources and technologies that foster virtual connection and community.

We maintain a capital-light infrastructure by, among other things, using third party cloud based service providers. As a result, we are able to focus on platform and revenue growth rather than building and maintaining a costly internal infrastructure. Similarly, while our users can embed rich media, such as video, audio, and product links, into their Vocal stories, the rich media content is hosted elsewhere (such as YouTube, Vimeo, Shopify, Spotify, etc.). As a result, our platform can accommodate rich media content of all kinds without bearing the financial or operational costs associated with hosting the rich media itself.

Vocal’s technology was built to organically sustain and scale multiple lines of revenue, as well as to assimilate external technology platforms and media assets into its existing infrastructure. The Company anticipates continuing to make targeted acquisitions of technologies and public and private companies. The Vocal technology platform, trademark, and related intellectual property are wholly owned and operated by Jerrick.

Risks Associated with Our Business

Our business is subject to a number of risks of which you should carefully read the entire prospectus, specifically including the section entitled “Risk Factors,”be aware before making a decision to invest in our Common Stock. common shares. The following, and other risks, are discussed more fully in the “Risk Factors” section of this prospectus.

Our Company

| ● | The Company is a development stage business and subject to the many risks associated with new businesses. |

General

| ● | Our financial situation creates doubt whether we will continue as a going concern. |

Jerrick Media is a technology company focused on the development of digital platforms that are designed to support content creation and distribution. Jerrick’s flagship platform Vocal (https://vocal.media/) is a publishing platform that supports and discovers new generations of content creators and their stories. It provides an ecosystem that connects creators to diverse audiences within the Vocal network. Creators have access to a suite of powerful publishing tools that help creators get their voice heard and monetize their work, support communities, and the targeted marketing of branded digital content, and e-commerce opportunities algorithmically derived in relevance for each community. Content creators reach engaged audiences through a growing portfolio of genre-specific branded websites. Vocal is a unique platform as it can incorporate most forms of content and therefore can serve as a master platform for versatile content creators. Content creators can include, but are not limited to: videos, imagery, articles, e-books, film, podcasts, and television projects.

| ● | Our operating expenses exceed our revenues and will likely continue to do so for the foreseeable future. |

Vocal also represents a unique ecosystem for advertisers and marketers to access innovative ways to target and engage customers. Vocal for Brands is the in-house agency with a dedicated team focused on creating authentic creative content campaigns to be leverage both through Vocal and other digital venues. Vocal for Brands provides branding clients with: built-in genre specific audiences through the Vocal communities, SEO optimization, social first assets, research & analytics.

| ● | We will need additional capital, which may be difficult to raise as a result of our limited operating history or any number of other reasons. |

| ● | We face intense competition. If we do not provide digital content that is useful to users, we may not remain competitive, and our potential revenues and operating results could be adversely affected. |

Revenue is generated in a variety of ways, including: (i) the sale of advertising and marketing services related to our content, including but not limited to pre-roll videos, text and image advertisements, native advertisements, and affiliate marketing; (ii) the sale of genre-specific products related to our brands and, licensing of our content for download-to-own services; and (iii) royalties and production fees for original content, created for either film, television, or digital end-markets. Future revenue is expected to include subscriptions from creators for upgraded services. Subscription revenue is also expected to be derived from branding clients based on unique self-serve access to the platform. The value-add features that will be offered on a subscription basis are currently in development. Demand and pricing for our advertising depends on our user base and overall market conditions. We also drive additional demand through integrated sales of digital advertising inventory, through our marketing services, and by providing unique branded entertainment and custom sponsorship opportunities to our advertisers. Our advertising and e-commerce revenues may be affected by the strength of advertising markets and general economic conditions and may fluctuate depending on the success of our content, as measured by the number of people visiting our websites at any given time.-1-

Our Market

According to Forrest Research’s “Using eCommerce To Monetize Digital Content In The Media Industry” report, content driven e-commerce proves to be one of the most profitable options for media companies to create a new revenue channel, enhance engagement with their audience base, and differentiate themselves from other media companies without a digital e-commerce platform. Forrester Research estimates that online consumers will increase their spending to $327 billion by 2016 from $202 billion in 2011. In addition, 52% of U.S. consumers buy directly from brands online. We believe we can capitalize on a content to commerce model as advances in technology and declining barriers to entry have allowed for cost effective construction of commerce infrastructure outside of the traditional Amazon and eBay models.

| If we fail to retain existing users or add new users, or if our users decrease their level of engagement with our products, our revenue, financial results, and business may be significantly harmed. |

| ● | We face competition from traditional media companies, and we may not be included in the advertising budgets of large advertisers, which could harm our operating results. |

| ● | Market and economic conditions may negatively impact our business, financial condition and share price. |

| ● | Future sales and issuances of our securities could result in additional dilution of the percentage ownership of our shareholders and could cause our share price to fall. |

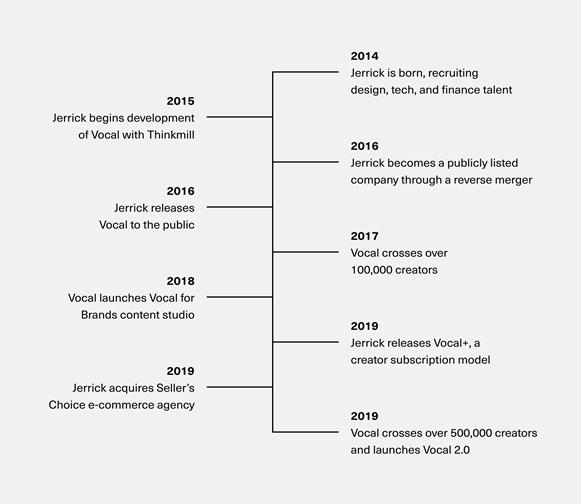

Our StrategyCorporate History and Information

We have developedwere originally incorporated under the laws of the State of Nevada on December 30, 1999 under the name LILM, Inc. The Company changed its name on December 3, 2013 to Great Plains Holdings, Inc.

On February 5, 2016 (the “Merger Closing Date”), we entered into an Agreement and Plan of Merger (the “Merger Agreement”) with GPH Merger Sub, Inc., a proprietary patent-pending technology platform, Vocal, designedNevada corporation and our wholly-owned subsidiary (“Merger Sub”), and Jerrick Ventures, Inc., a privately-held Nevada corporation headquartered in New Jersey (“Jerrick”), pursuant to developwhich the Merger Sub was merged with and cost-effectively acquire content that reaches audiencesinto Jerrick, with Jerrick surviving as our wholly-owned subsidiary (the “Merger”). Pursuant to the terms of the Merger Agreement, we acquired, through a reverse triangular merger, all of the outstanding capital stock of Jerrick in exchange for issuing Jerrick’s shareholders (the “Jerrick Shareholders”), pro-rata, a total of 28,500,000 shares of our portfoliocommon stock. Additionally, we assumed 33,415 shares of genre-specific communities, as well as through other socialJerrick’s Series A Convertible Preferred Stock (the “Jerrick Series A Preferred”) and digital distribution channels.8,064 shares of Series B Convertible Preferred Stock (the “Jerrick Series B Preferred”).

Upon closing of the Merger on February 5, 2016, the Company changed its business plan to our current plan.

In connection with the Merger, on the Merger Closing Date, we entered into a Spin-Off Agreement with Kent Campbell (the “Spin-Off Agreement”), pursuant to which Mr. Campbell purchased (i) all of our interest in Ashland Holdings, LLC, a Florida limited liability company, and (ii) all of our interest in Lil Marc, Inc., a Utah corporation, in exchange for the cancellation of 781,818 shares of our common stock held by Mr. Campbell. In addition, Mr. Campbell assumed all of our debts, obligations and liabilities, including any existing prior to providing relevantthe Merger, pursuant to the terms and refreshing content,conditions of the Spin-Off Agreement.

Effective February 28, 2016, we entered into an Agreement and Plan of Merger (the “Statutory Merger Agreement”), pursuant to which we became the parent company of Jerrick Ventures, LLC, our technology is centeredwholly-owned operating subsidiary (the “Statutory Merger”).

On February 28, 2016, we changed our name to Jerrick Media Holdings, Inc. to better reflect our new business strategy.

On July 25, 2019, we filed a certificate of amendment to our articles of incorporation, as amended (the “Amendment”), with the Secretary of State of the State of Nevada to effectuate a one-for-twenty (1:20) reverse stock split (the “Reverse Stock Split”) of our common stock without any change to its par value. The Amendment became effective on efficiency and scalability in both input of content across a growing variety of topics, and output through a growingJuly 30, 2019. The number of distribution methods. We believeshares of authorized common stock was proportionately reduced as a result of the Reverse Stock Split. The number of shares of authorized preferred stock was not affected by the Reverse Stock Split. No fractional shares were issued in connection with the Reverse Stock Split as all fractional shares were “rounded up” to the next whole share.

All share and per share amounts for the common stock indicated in this prospectus have been retroactively restated to give effect to the Reverse Stock Split.

Subsequent to the consummation of this offering and our content-to-commerce modellisting on The Nasdaq Capital Market, we intend to change our name to “Creatd, Inc.” subject to necessary approvals.

The Company’s address is an integral2050 Center Avenue Suite 640 Fort Lee, NJ 07024. The Company’s telephone number is (201) 258-3770. Our website is: https://jerrick.media/. The information on, or that can be accessed through, this website is not part of digital monetization. We focusthis prospectus, and you should not rely on distribution of content throughany such information in making the Vocal platform that optimizes user-generated content through an algorithmically derived moderation process. Throughdecision whether to purchase the moderation process, we reduce manpower costs, and simultaneously increase our ability to publish content and rapidly produce genre-specific websites driven by usage data. Through these genre-specific websites, we are able to provide advertisers with a more transparent and targeted community for their brands, which we believe offers a very high value proposition. The Vocal platform and its proprietary technology can be white-labeled or licensed, to provide seamless integration to independent media companies and brands. We also use the Vocal platform for distribution and monetization of a substantial inventory of content featuring unpublished photographs, negatives, trademarks, videos, scripts, short stories, and articles across various genres. We believe we have a competitive advantage in the ownership of merchandising rights of such content which allows us to sell or license these properties.Company’s common stock.

Employees

As partof July 2, 2020, we had 21 full-time employees. None of our strategy,employees are subject to a collective bargaining agreement, and we develop transmedia assets internally, in collaboration with other production and media companies, as well asbelieve that relationship with our expanding user base.employees to be good.

-2-

THE OFFERING

| Securities offered by us | Each Unit consists of (a) one share of our common stock, par value $0.001 per share, and (b) one warrant to purchase one share of our common stock, at an exercise price equal to $ , exercisable until the fifth anniversary of the issuance date. | |

| Shares of common stock outstanding before this offering(1) | 10,127,420 | |

| Over-allotment option | The underwriters have an option for a period of 45 days to acquire up to an additional shares of common stock from the Company at the public offering price, less the underwriting discount, solely for the purpose of covering over-allotments, if any. | |

| Shares of common stock to be outstanding after this offering(1) | shares (or shares if the underwriters exercise their over-allotment option in full). | |

| Use of Proceeds | We estimate that the net proceeds from this offering will be approximately $ million, or approximately $ million if the underwriters exercise their over-allotment option in full, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us. The Company intends to use the net proceeds from this offering to conduct operations, increase marketing efforts, repay certain indebtedness, increase investment in the Company’s existing business initiatives and products and for general working capital. See “Use of Proceeds” for a more complete description of the intended use of proceeds from this offering. | |

| Dividend Policy | The Company has never declared any cash dividends on its common stock. The Company currently intends to use all available funds and any future earnings for use in financing the growth of its business and does not anticipate paying any cash dividends for the foreseeable future. See “Dividend Policy.” | |

| Trading Symbol | Our common stock is currently quoted on the OTCQB under the trading symbol “JMDA”. We have applied to list our common stock on the Nasdaq Capital Market upon our satisfaction of the exchange’s initial listing criteria. We anticipate that the shares of common stock and warrants underlying the Units (once the warrants have begun to trade separately), will be listed on the Nasdaq Capital Market under the symbols “JMDA” and “JMDAW”, respectively. No assurance can be given that its application will be approved. | |

| Risk Factors | You should carefully consider the information set forth in this prospectus and, in particular, the specific factors set forth in the “Risk Factors” section beginning on page 6 of this prospectus before deciding whether or not to invest in the Company’s common stock. | |

| Lock-up | We and our directors, officers and principal stockholders have agreed with the underwriters not to offer for sale, issue, sell, contract to sell, pledge or otherwise dispose of any of our common stock or securities convertible into common stock for a period of days after the date of this prospectus, in the case of our directors and officers, and days after the date of this prospectus, in the case of our principal stockholders. See “Underwriting” section on page 64. |

(1) The transmedia assets we produce, suchnumber of shares of common stock outstanding is based on 10,127,420 shares of common stock issued and outstanding as film, television, digital shorts, books,of July 2, 2020 and comic series can be leveraged beyond digital media and can be distributed across multiple platforms and formats.excludes the following:

| ● | 452,523 shares of common stock issuable upon the exercise of outstanding stock options having a weighted average exercise price of $7.89 per share; | |

| ● | 954,389 shares of common stock issuable upon the exercise of outstanding warrants having a weighted average exercise price of $5.09 per share; | |

| ● | shares of the Company’s common stock underlying the warrants to be issued to the representative of the underwriters in connection with this offering. |

Except as otherwise indicated herein, all information in this prospectus reflects or assumes:

| ● | a one-for-twenty reverse stock split of our common stock effected on July 30, 2019; | |

| ● | no exercise of the outstanding options or warrants described above; and | |

| ● | no exercise of the underwriters’ option to purchase up to an additional shares of common stock to cover over-allotments, if any. |

-3-

Our Website CommunitiesThe following summary financial and operating data set forth below should be read in conjunction with the Company’s financial statements, the notes thereto and the other information contained in this prospectus. The summary statement of operations data for the years ended December 31, 2019 and 2018 have been derived from the Company’s audited financial statements appearing elsewhere in this prospectus. The historical results presented below are not necessarily indicative of financial results to be achieved in future periods. The financial data as of March 31, 2020 and 2019 has been derived from our unaudited financial statements and the related notes thereto, which are included elsewhere in this prospectus.

Statement of Operations Data:

The following information should be read in conjunction with “Capitalization,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Business” and our consolidated financial statements and related notes included elsewhere in this prospectus.

| Year Ended December 31, | Three Months Ended March 31, | |||||||||||||||

| Statement of operations data: | 2019 | 2018 | 2020 | 2019 | ||||||||||||

| Revenue | $ | 453,006 | $ | 80,898 | $ | 293,142 | $ | 34,334 | ||||||||

| Operating expenses | $ | (7,669,984 | ) | $ | (5,767,153 | ) | $ | (2,119,091 | ) | $ | (1,739,328 | ) | ||||

| (Loss) income from operations | $ | (7,216,978 | ) | $ | (5,686,255 | ) | $ | (1,825,949 | ) | $ | (1,704,994 | ) | ||||

| Other expenses | $ | (818,394 | ) | $ | (6,327,287 | ) | $ | (1,160,048 | ) | $ | (1,884,441 | ) | ||||

| Net income (loss) | $ | (8,035,372 | ) | $ | (12,013,542 | ) | $ | (2,985,997 | ) | $ | (1,884,441 | ) | ||||

| Income (loss) per common share – basic and diluted(1) | $ | (0.98 | ) | $ | (4.16 | ) | $ | (0.32 | ) | $ | (0.28 | ) | ||||

| December 31, | March 31, | |||||||||||||||

| Balance sheet data: | 2019 | 2018 | 2020 | 2019 | ||||||||||||

| Cash | $ | 11,637 | $ | - | $ | 118,361 | $ | 262,707 | ||||||||

| Total assets | $ | 2,572,046 | $ | 208,925 | $ | 2,836,270 | $ | 583,974 | ||||||||

| Current liabilities | $ | 10,928,830 | $ | 2,569,584 | $ | 12,809,118 | $ | 3,869,128 | ||||||||

| Total liabilities | $ | 11,130,774 | $ | 2,699,529 | $ | 13,027,333 | $ | 4,135,603 | ||||||||

| Year Ended December 31, | Three Months Ended March 31, | |||||||||||||||

| Cash flows from operating activities data: | 2019 | 2018 | 2020 | 2019 | ||||||||||||

| Net cash used in operating activities | $ | (5,957,027 | ) | $ | (4,972,814 | ) | $ | (1,314,863 | ) | $ | (1,461,053 | ) | ||||

| Net cash used in investing activities | $ | (363,288 | ) | $ | (27,605 | ) | $ | - | $ | (2,801 | ) | |||||

| Net cash provided by financing activities | $ | 6,337,947 | $ | 4,889,368 | $ | 1,430,826 | $ | 1,726,561 | ||||||||

| Net change in cash and cash equivalents | $ | 11,637 | $(111,051 | ) | $ | 106,724 | $ | 262,707 | ||||||||

| Year Ended December 31, | Three Months Ended March 31, | |||||||||||||||

| Other financial data (unaudited): | 2019 | 2018 | 2020 | 2019 | ||||||||||||

| Adjusted EBITDA(2) | $ | (6,927,944 | ) | $ | (10,701,362 | ) | $ | (2,180,078 | ) | $ | (1,508,103 | ) | ||||

| (1) | Reflects the 1-for-20 reverse stock split of our common stock that occurred on July 25, 2019. |

-4-

| (2) | In addition to net income (loss) presented in accordance with GAAP, we use Adjusted EBITDA to measure our financial performance. Adjusted EBITDA is a supplemental non-GAAP financial measure of operating performance and is not based on any standardized methodology prescribed by GAAP. Adjusted EBITDA should not be considered in isolation or as alternatives to net income (loss), cash flows from operating activities or other measures determined in accordance with GAAP. Also, Adjusted EBITDA is not necessarily comparable to similarly titled measures presented by other companies. |

| We define Adjusted EBITDA as net income (loss) before (i) interest expense, (ii) depreciation and amortization, (iii) stock-based compensation, and (iv) items that management believes are not part of our core operations. We present Adjusted EBITDA because we believe its assists investors and analysts in comparing our operating performance across reporting periods on a consistent basis by excluding items that we do not believe are indicative of our core operating performance. Management and our board of directors has begun to use Adjusted EBITDA to assess our financial performance and believe it is helpful in highlighting trends because it excludes the results of decisions that are outside the control of management, while other measures can differ significantly depending on long-term strategic decisions regarding capital structure, the tax jurisdictions in which we operate and capital investments. We have begun to reference Adjusted EBITDA in our decision-making because it provides supplemental information that facilitates internal comparisons to the historical operating performance of prior periods. In addition, we have based certain of our forward-looking estimates and budgets on Adjusted EBITDA. Adjusted EBITDA has limitations as an analytical tool, and you should not consider such measure either in isolation or as a substitute for analyzing our results as reported under GAAP. |

| Year Ended December 31, | Three Months Ended March 31, | |||||||||||||||

| Reconciliation of Adjusted EBITDA: | 2019 | 2018 | 2020 | 2019 | ||||||||||||

| Net loss: | $ | (8,035,372 | ) | $ | (12,013,542 | ) | $ | (2,985,997 | ) | $ | (1,884,441 | ) | ||||

| Add (deduct): | ||||||||||||||||

| Interest expense | $ | 612,830 | $ | 923,008 | $ | 375,530 | $ | 54,569 | ||||||||

| Depreciation | $ | 57,492 | $ | 42,218 | $ | 38,246 | $ | 3,133 | ||||||||

| Stock-based compensation | $ | 437,106 | $ | 346,954 | $ | 392,143 | $ | 318,636 | ||||||||

| Adjusted EBITDA | $ | (6,927,944 | ) | $ | (10,701,362 | ) | $ | (2,180,078 | ) | $ | (1,508.103 | ) | ||||

-5-

Investing in our common stock involves a high degree of risk. Prospective investors should carefully consider the risks described below, together with all of the other information included or referred to in this prospectus, before purchasing shares of our common stock. There are developing an ever-increasing number of genre-specific websites, designed to create self-sustaining communities, with each revolving around a specific topic or theme. The creationnumerous and varied risks that may prevent the Company from achieving its goals. If any of these websites is driven by two factors: (i)risks actually occurs, the potential for monetization opportunities,Company’s business, financial condition or results of operations may be materially adversely affected. In such case, the trading price of our common stock could decline and (ii) by the topical content provided by our users. Allinvestors could lose all or part of these sites are powered by Vocal, our proprietary long-form digital publishing and content distribution platform.their investment.

Risks Related to our Business

Recent DevelopmentsThe Company is a development stage business and subject to the many risks associated with new businesses.

The August 2018 OfferingOur current line of business has a limited operating history and Conversionsour business is subject to all of Debt / Preferred Securities

Effective August 31, 2018 (the “Effective Date”), Jerrick Media Holdings, Inc. (the “Company”) consummated the initial closing (the “Initial Closing”)risks inherent in the establishment of a private placement offeringnew business enterprise. Our likelihood of its securitiessuccess must be considered in light of up to $5,000,000 (the “Offering”). Inthe problems, expenses, difficulties, complications and delays frequently encountered in connection with development and expansion of a new business enterprise. We have incurred losses and may continue to operate at a net loss for at least the Initial Closing,next several years as we execute our business plan. We had a net loss of approximately $8.0 million for the Company entered into definitive securities purchase agreements (the “Purchase Agreements”) with 37 accredited investors (the “Purchasers”) year ended December 31, 2019, and a working capital deficit and accumulated deficit of approximately $10.7 million and approximately $44.6 million, respectively. Our net lossfor aggregate gross proceedsthe three months ended March 31, 2020 and 2019 was $2,985,997 and $1,884,441, respectively, and our accumulated deficit as of $1,002,832. Pursuant to the Purchase Agreement, the Purchasers purchased an aggregate of 4,011,328 shares of common stock at $0.25 per share and received warrants to purchase 4,011,328 shares of common stock at an exercise price of $0.30 per share (the “Purchaser Warrants”, collectively, the “Securities”)March 31, 2020 was $47,566,434. Additionally, the Purchasers may participate in a subsequent offering of the Company’s securities in an aggregate amount of up to 50% of the subsequent offering on the twenty-four (24) month anniversary of the close of the Third Closing (as defined in the Securities Purchase Agreement) of the Private Offering.

The Purchaser Warrants are exercisable forOur financial situation creates doubt whether we will continue as a term of five years from the Initial Exercise Date (as defined in the Purchaser Warrants). The Purchase Agreements contain customary representations, warranties, agreements and conditions to completing future sale transactions, indemnification rights and obligations of the parties.going concern.

In connection with the Private Offering, the CompanyThere can be no assurances that we will issue Chardan Capital Markets, LLC (the “Placement Agent”) 2,000,000 sharesbe able to achieve a level of Common Stock for services rendered as the Company’s placement agent in the Private Offering.

In connection with the Private Offering, the Company entered into those certain letter agreements (the “Debt Conversion Agreements”) with certain holders of its debt securities (the “Debt Holders”), for the conversion of an aggregate amount of $7,745,027 of the Company’s debt obligations into 38,725,151 shares of Common Stock at a conversion price equalrevenues adequate to $0.20 per share. Additionally, as inducementgenerate sufficient cash flow from operations or obtain funding from this offering or additional financing through private placements, public offerings and/or bank financing necessary to enter into the Debt Conversion Agreement, the Debt Holders were issued warrants to purchase 19,362,600 shares of Common Stock at an exercise price equal to $0.30 per share, expiring five years from the date of issuance (the “Incentive Debt Warrants”).

Concurrently with its entrance in the Debt Conversion Agreements, the Company entered into those letter agreements (the “Preferred Stock Conversion Agreements”) with certain holders (the “Preferred Holders”) of its Series A Cumulative Convertible Preferred Stock and Series B Cumulative Convertible Preferred Stock (the “collectively, the Preferred Stock”) whereby the Preferred Holders converted 37,234 shares of the Preferred Stock and $713,078 in dividends into an aggregate of 25,924,625 shares of Common Stock at conversion prices equal to $0.19683 per share and $0.164 per share. As in an inducement to enter into the Preferred Stock Conversion Agreements, the Preferred Holders were issued warrants to purchase 12,962,326 shares of Common Stock at an exercise price equal to $0.30 per share, expiring five years from the date of issuance (the “Incentive Preferred Warrants”, and together with the Incentive Debt Warrants, the “Incentive Warrants”).

Commencing on the Effective Date, the Company’s officers, directors and 10% shareholders entered into Lock-Up Agreements for a period of 365 days from the date the Registration Statement is declared effective by the SEC, prohibiting the sale or other transfer of all securities of the Company owned by them.

Corporate Organization

We were incorporated in Nevada in 1999. Our corporate headquarters are located at 2050 Center Avenue, Suite 640, Fort Lee, NJ 07024. As described above, in February 2016, we engaged in a reverse triangular merger through which we acquired the business of Jerrick Ventures, Inc., a Nevada corporation, and changedsupport our corporate name to “Jerrick Media Holdings, Inc.” Prior to the merger, our corporate name was “Great Plains Holdings, Inc.” Our telephone number is (201) 258-3770. Our website address iswww.jerrick.media. The information on or accessible through our website is not part of this prospectus.

The Offering

Effective August 31, 2018 (the “Effective Date”), the Company consummated the initial closing (the “Initial Closing”) of a private placement offering of its securities (the “Offering”). In connection with the Initial Closing, the Company entered into definitive securities purchase agreements (the “Purchase Agreements”) with 37 accredited investors (the “Purchasers”) for aggregate gross proceeds of $1,002,832. Pursuant to the Purchase Agreement, the Purchasers purchased an aggregate of 4,011,328 shares of common stock at $0.25 per share and received warrants to purchase 4,011,328 shares of common stock at an exercise price of $0.30 per share (the “Purchaser Warrants”, collectively, the “Securities”).

The Purchaser Warrants are five year warrants to purchase shares of Common Stock at an exercise price of $0.30 per share, subject to adjustment (the “Exercise Price”), exercisable immediately after issuance thereof. The Purchaser Warrants provide for cashless exercise toworking capital requirements. To the extent that there isfunds generated from any private placements, public offerings and/or bank financing are insufficient, we will have to raise additional working capital and no registration statementassurance can be given that additional financing will be available, for the underlying shares of Common Stock. The Exercise Price shallor if available, will be reduced and only reduced to equal the Base Share Price (as defined in the Purchaser Warrants) and the number of shares of Common Stock issuable under the Purchaser Warrants shall be increased such that the aggregate Exercise Price payable under the Purchaser Warrants, after taking into account the decrease in the Exercise Price, shall be equal to the aggregate Exercise Price prior to such adjustment.

In connection with the Purchase Agreements, the Company and the Purchasers entered into Registration Rights Agreements (the “Registration Rights Agreements”) with the Purchasers. Pursuant to the Registration Rights Agreements, the Company agreed to register the Securities and the Commitment Shares (as defined below) in a Registration Statement with the SEC. The Registration Rights Agreement contains customary representations, warranties, agreements and indemnification rights and obligations of the parties.

The Purchasers committed to purchase an additional $2,004,458 in Securities (the “Commitment Shares”) pursuant to the Purchase Agreements, bringing the total dollar amount committed to the Offering $3,007,290.

The Company will sell to the Selling Security Holders and the Selling Security Holders will purchase from the Company $1,002,832 of Securities within five (5) Trading Days (as defined in the Purchase Agreements) of, the date on which the Registration Statement registering all of the Registrable Securities (as defined in the Registration Rights Agreement) is filed with the SEC.

Further, the Company will sell to the Selling Security Holders and the Selling Security Holders will purchase from the Company $1,002,832 of Securities within five (5) Trading Days of the date on which the Registration Statement registering all of the Registrable Securities is declared effective by the Commission.

| ||

| ||

(1) Assumes the exercise of all shares underlying the warrants being registered hereunder.

An investment in our Common Stock involves a high degree of risk. Before deciding whether to invest in our Common Stock, you should consider carefully the risks described below, together with all of the other information set forth in this prospectus and the documents incorporated by reference herein, and in any free writing prospectus that we have authorized for use in connection with this offering. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be harmed. This could cause the trading price of our Common Stock to decline, resulting in a loss of all or part of your investment. The risks described below and in the documents referenced above are not the only ones that we face. Additional risks not presently known to us or that we currently deem immaterial may also affect our business.

RISKS RELATED TO OUR BUSINESS

Our independent auditors have expressedacceptable terms. These conditions raise substantial doubt about our ability to continue as a going concern,concern. If adequate working capital is not available, we may be forced to discontinue operations, which may hinder our abilitywould cause investors to obtain future financing.lose their entire investment.

As reflected inBased on the accompanying audited consolidated financial statements, the Company had a net loss of approximately $8.8 million for the year ended December 31, 2017, and a working capital deficit and accumulated deficit of approximately $4.0 million and approximately $22.2 respectively, at December 31, 2017. These factors raise substantial doubt about the Company’s ability to continue as a going concern.

The ability of the Company to continue its operations is dependent on management’s plans, which include the raising of capital through debt and/or equity markets with some additional fundingreport from other traditional financing sources, including term notes, until such time that funds provided by operations are sufficient to fund working capital requirements. The Company may need to incur liabilities with certain related parties to sustain the Company’s existence.

The Company will require additional funding to finance the growth of its current and expected future operations as well as to achieve its strategic objectives. The Company believes its current available cash, along with anticipated revenues, may be insufficient to meet its cash needs for the near future. There can be no assurance that financing will be available in amounts or terms acceptable to the Company, if at all.

In response to these problems, management has taken the following actions:

In their report dated May 17, 2018, our independent auditors dated March 30, 2020, management stated that our financial statements for the periodyear ended December 31, 2017,2019, were prepared assuming that we would continue as a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. TheseThe accompanying financial statements do not include any adjustments relating to the recovery of the recorded assets or the classification of the liabilities that might be necessary should the Company be unable to continue as a going concern.

We are not profitable and may never be profitable.

Since inception through the present, we have been dependent on raising capital to support our working capital needs. During this same period, we have recorded net accumulated losses and are yet to achieve profitability. Our ability to achieve profitability depends upon many factors, including itsour ability to develop and commercialize our websites. There can be no assurance that we will ever achieve any significant revenues or profitable operations.

Our operating expenses exceed our revenues and will likely continue to do so for the foreseeable future.

We are in an early stage of our development and we have not generated sufficient revenues to offset our operating expenses. Our operating expenses will likely continue to exceed our operating income for the foreseeable future, until such time as we are able to monetize our brands and generate substantial revenues, particularly as we undertake payment of the increased costs of operating as a public company.

Our Operating subsidiary has a limited operating history.

-6-

Our operating subsidiary has been in existence for approximately two years. Our limited operating history means that there is a high degree of uncertainty in our ability to: (i) develop and commercialize our products; (ii) achieve market acceptance; or (iii) respond to competition. Additionally, even if we do implement our business plan, we may not be successful. No assurances can be given as to exactly when, if at all, we will be able to recognize profits high enough to sustain our business. We face all the risks inherent in a new business, including the expenses, difficulties, complications, and delays frequently encountered in connection with conducting operations, including capital requirements. Given our limited operating history, we may be unable to effectively implement our business plan, which would result in a loss of your investment.

WE have assumed Aa significant amount of debt and our operations may not be able to generate sufficient cash flows to meet our debt obligations, which could reduce our financial flexibility and adversely impact our operations.

Currently the Company has considerable convertibleobligations under notes, related party notes and lines of credit outstanding with various debtors. Our ability to make payments on such indebtedness will depend on our ability to generate cash flow. The Company may not generate sufficient cash flow from operations to enable us to repay this indebtedness and to fund other liquidity needs, including capital expenditure requirements. Such indebtedness could affect our operations in several ways, including the following:

| ● | a significant portion of our cash flows could be required to be used to service such indebtedness; |

| ● | a high level of debt could increase our vulnerability to general adverse economic and industry conditions; |

| ● | any covenants contained in the agreements governing such outstanding indebtedness could limit our ability to borrow additional funds, dispose of assets, pay dividends and make certain investments; |

| ● | a high level of debt may place us at a competitive disadvantage compared to our competitors that are less leveraged and, therefore, our competitors may be able to take advantage of opportunities that our indebtedness may prevent us from pursuing; and |

| ● | debt covenants to which we may agree may affect our flexibility in planning for, and reacting to, changes in the economy and in our industry. |

A high level of indebtedness increases the risk that we may default on our debt obligations. We may not be able to generate sufficient cash flows to pay the principal or interest on our debt. If we cannot service or refinance our indebtedness, we may have to take actions such as selling significant assets, seeking additional equity financing (which will result in additional dilution to stockholders) or reducing or delaying capital expenditures, any of which could have a material adverse effect on our operations and financial condition. If we do not have sufficient funds and are otherwise unable to arrange financing, our assets may be foreclosed upon which could have a material adverse effect on our business, financial condition and results of operations.

We will need additional capital, which may be difficult to raise as a result of our limited operating history or any number of other reasons.

We expect that we will have adequate financing for the next 96 months. However, in the event that we exceed our expected growth, we would need to raise additional capital. There is no assurance that additional equity or debt financing will be available to us when needed, on acceptable terms, or even at all. Our limited operating history makes investor evaluation and an estimation of our future performance substantially more difficult. As a result, investors may be unwilling to invest in us or such investment may be offered on terms or conditions whichthat are not acceptable. In the event that we are not able to secure financing, we may have to scale back our growth plans or cease operations.

We face intense competition. If we do not provide digital content that is useful to users, we may not remain competitive, and our potential revenues and operating results could be adversely affected.

Our business is rapidly evolving and intensely competitive, and is subject to changing technologies, shifting user needs, and frequent introductions of new products and services. Our ability to compete successfully depends heavily on providing digital content that is useful and enjoyable for our users and delivering our content through innovative technologies in the marketplace.

We face competition from others in the digital content creation industry and media companies. Our current and potential competitors range from large and established companies to emerging start-ups. Established companies have longer operating histories and more established relationships with customers and users, and they can use their experience and resources in ways that could affect our competitive position, including by making acquisitions, investing aggressively in research and development, aggressively initiating intellectual property claims (whether or not meritorious) and competing aggressively for advertisers and websites. Emerging start-ups may be able to innovate and provide products and services faster than we can.

-7-

Additionally, our operating results would suffer if our digital content is not appropriately timed with market opportunities, or if our digital content is not effectively brought to market. As technology continues to develop, our competitors may be able to offer user experiences that are, or that are seen to be, substantially similar to or better than, ours. This may force us to compete in different ways and expend significant resources in order to remain competitive. If our competitors are more successful than we are in developing compelling content or in attracting and retaining users and advertisers, our revenues and operating results could be adversely affected.

If we fail to retain existing users or add new users, or if our users decrease their level of engagement with our products, our revenue, financial results, and business may be significantly harmed.

The size of our user base and our user’s level of engagement are critical to our success. Our financial performance will be significantly determined by our success in adding, retaining, and engaging active users of our products, particularly Vocal. We anticipate that our active user growth rate will generally decline over time as the size of our active user base increases, and it is possible that the size of our active user base may fluctuate or decline in one or more markets, particularly in markets where we have achieved higher penetration rates. If people do not perceive Vocal to be useful, reliable, and trustworthy, we may not be able to attract or retain users or otherwise maintain or increase the frequency and duration of their engagement. A number of other content management systems and publishing platforms that achieved early popularity have since seen their active user bases or levels of engagement decline, in some cases precipitously. There is no guarantee that we will not experience a similar erosion of our active user base or engagement levels. Our user engagement patterns have changed over time, and user engagement can be difficult to measure, particularly as we introduce new and different products and services. Any number of factors could potentially negatively affect user retention, growth, and engagement, including if:

| ● | users increasingly engage with other competitive products or services; |

| ● | we fail to introduce new features, products or services that users find engaging or if we introduce new products or services, or make changes to existing products and services, that are not favorably received; |

| ● | user behavior on any of our products changes, including decreases in the quality and frequency of content shared on our products and services; |

| ● | there are decreases in user sentiment due to questions about the quality or usefulness of our products or our user data practices, or concerns related to privacy and sharing, safety, security, well-being, or other factors; |

| ● | we are unable to manage and prioritize information to ensure users are presented with content that is appropriate, interesting, useful, and relevant to them; |

| ● | we are unable to obtain or attract engaging third-party content; |

| ● | users adopt new technologies where our products may be displaced in favor of other products or services, or may not be featured or otherwise available; |

| ● | there are changes mandated by legislation, regulatory authorities, or litigation that adversely affect our products or users; |

| ● | technical or other problems prevent us from delivering our products in a rapid and reliable manner or otherwise affect the user experience, such as security breaches or failure to prevent or limit spam or similar content; |

| ● | we adopt terms, policies, or procedures related to areas such as sharing, content, user data, or advertising that are perceived negatively by our users or the general public; |

| ● | we elect to focus our product decisions on longer-term initiatives that do not prioritize near-term user growth and engagement; |

| ● | we make changes in how we promote different products and services across our family of apps; |

| ● | initiatives designed to attract and retain users and engagement are unsuccessful or discontinued, whether as a result of actions by us, third parties, or otherwise; |

| ● | we fail to provide adequate customer service to users, marketers, developers, or other partners; |

-8-

| ● | we, developers whose products are integrated with our products, or other partners and companies in our industry are the subject of adverse media reports or other negative publicity, including as a result of our or their user data practices; or |

| ● | our current or future products, such as our development tools and application programming interfaces that enable developers to build, grow, and monetize mobile and web applications, reduce user activity on our products by making it easier for our users to interact and share on third-party mobile and web applications. |

If we are unable to maintain or increase our user base and user engagement, our revenue and financial results may be adversely affected. Any decrease in user retention, growth, or engagement could render our products less attractive to users, marketers, and developers, which is likely to have a material and adverse impact on our revenue, business, financial condition, and results of operations. If our active user growth rate continues to slow, we will become increasingly dependent on our ability to maintain or increase levels of user engagement and monetization in order to drive revenue growth.

We face competition from traditional media companies, and we may not be included in the advertising budgets of large advertisers, which could harm our operating results.

In addition to internet companies, we face competition from companies that offer traditional media advertising opportunities. Most large advertisers have set advertising budgets, a very small portion of which is allocated to Internet advertising. We expect that large advertisers will continue to focus most of their advertising efforts on traditional media. If we fail to convince these companies to spend a portion of their advertising budgets with us, or if our existing advertisers reduce the amount they spend on our programs, our operating results would be harmed.

Acquisitions may disrupt growth.

We may pursue strategic acquisitions in the future. Risks in acquisition transactions include difficulties in the integration of acquired businesses into our operations and control environment, difficulties in assimilating and retaining employees and intermediaries, difficulties in retaining the existing clients of the acquired entities, assumed or unforeseen liabilities that arise in connection with the acquired businesses, the failure of counterparties to satisfy any obligations to indemnify us against liabilities arising from the acquired businesses, and unfavorable market conditions that could negatively impact our growth expectations for the acquired businesses. Fully integrating an acquired company or business into our operations may take a significant amount of time. We cannot assure you that we will be successful in overcoming these risks or any other problems encountered with acquisitions and other strategic transactions. These risks may prevent us from realizing the expected benefits from acquisitions and could result in the failure to realize the full economic value of a strategic transaction or the impairment of goodwill and/or intangible assets recognized at the time of an acquisition. These risks could be heightened if we complete a large acquisition or multiple acquisitions within a short period of time.

Our business depends on strong brands and relationships, and if we are not able to maintain our relationships and enhance our brands, our ability to expand our base of users, advertisers and affiliates will be impaired and our business and operating results could be harmed.

Maintaining and enhancing our brands’ profiles may require us to make substantial investments and these investments may not be successful. If we fail to promote and maintain the brands’ profiles, or if we incur excessive expenses in this effort, our business and operating results could be harmed. We anticipate that, as our market becomes increasingly competitive, maintaining and enhancing our brands’ profiles may become increasingly difficult and expensive. Maintaining and enhancing our brands will depend largely on our ability to be a technology leader and to continue to provide attractive products and services, which we may not do successfully.

We depend on our key management personnel and the loss of their services could adversely affect our business.

We place substantial reliance upon the efforts and abilities of Jeremy Frommer, our Chief Executive Officer, and our other executive officers and directors. Though no individual is indispensable, the loss of the services of these executive officers could have a material adverse effect on our business, operations, revenues or prospects. We do not currently maintain key man life insurance on the lives of these individuals.

We have not adopted various corporate governance measures, and, as a result, stockholders may have limited protections against interested director transactions, conflicts of interest and similar matters.

Recent Federal legislation, including the Sarbanes-Oxley Act of 2002, has resulted in the adoption of various corporate governance measures designed to promote the integrity of corporate management and the securities markets. Because our securities are not yet listed on a national securities exchange, we are not required to adopt these corporate governance measures and have not done so voluntarily in order to avoid incurring the additional costs associated with such measures. Among these measures is the establishment of independent committees of the Board of Directors. However, to the extent a public market develops for our securities, such legislation will require us to make changes to our current corporate governance practices. Those changes may be costly and time-consuming. Furthermore, the absence of the governance measures referred to above with respect to our Company may leave our shareholders with more limited protection in connection with interested director transactions, conflicts of interest and similar matters.

-9-

We face intense competition. If we do not provide digital content that is usefulare unable to users, weprotect our intellectual property, the value of our brands and other intangible assets may not remain competitive,be diminished, and our potential revenues and operating results couldbusiness may be adversely affected.

Our business is rapidly evolving and intensely competitive, and is subject to changing technologies, shifting user needs, and frequent introductions of new products and services. Our ability to compete successfully depends heavily on providing digital content that is useful and enjoyable for our users and delivering our content through innovative technologies in the marketplace.

We rely and expect to continue to rely on a combination of confidentiality, assignment, and license agreements with our employees, consultants, and third parties with whom we have many competitors inrelationships, as well as trademark, copyright, patent, trade secret, and domain name protection laws, to protect our proprietary rights. In the digital content creation industryUnited States and media companies. Our current and potential competitors range from large and established companies to emerging start-ups. Established companiesinternationally, we have longer operating histories and more established relationships with customers and users, and they can use their experience and resources in ways that could affectfiled various applications for protection of certain aspects of our competitive position, including by making acquisitions, investing aggressively in research and development, aggressively initiating intellectual property, claims (whetherand we currently hold a number of registered trademarks and issued patents in multiple jurisdictions and have acquired patents and patent applications from third parties. Third parties may knowingly or unknowingly infringe our proprietary rights, third parties may challenge proprietary rights held by us, and pending and future trademark and patent applications may not meritorious) and competing aggressively for advertisers and websites. Emerging start-upsbe approved. In addition, effective intellectual property protection may not be available in every country in which we operate or intend to operate our business. In any or all of these cases, we may be ablerequired to innovateexpend significant time and provideexpense in order to prevent infringement or to enforce our rights. Although we have generally taken measures to protect our proprietary rights, there can be no assurance that others will not offer products or concepts that are substantially similar to ours and services faster thancompete with our business. In addition, we can.

Additionally,regularly contribute software source code under open source licenses and have made other technology we developed available under other open licenses, and we include open source software in our operating results would suffer ifproducts. If the protection of our digital contentproprietary rights is not appropriately timed with market opportunities,inadequate to prevent unauthorized use or ifappropriation by third parties, the value of our digital content is not effectively brought to market. As technology continues to develop, ourbrands and other intangible assets may be diminished and competitors may be able to offer user experiencesmore effectively mimic our products, services, and methods of operations. Any of these events could have an adverse effect on our business and financial results.

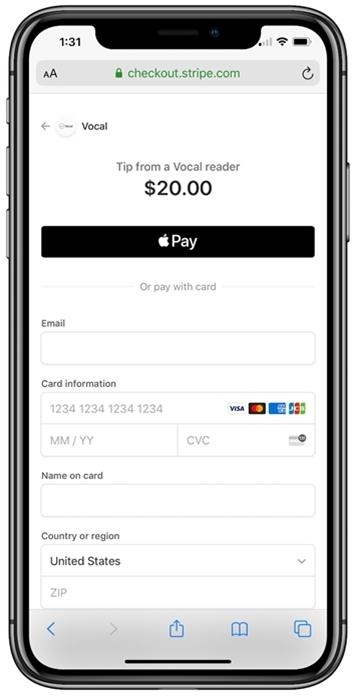

We are subject to payment processing risk.

We accept payments using a variety of different payment methods, including credit and debit cards and direct debit. We rely on third parties to process payments. Acceptance and processing of these payment methods are subject to certain certifications, rules and regulations. To the extent there are disruptions in our or third-party payment processing systems, material changes in the payment ecosystem, failure to recertify and/or changes to rules or regulations concerning payment processing, we could be subject to fines and/or civil liability, or lose our ability to accept credit and debit card payments, which would harm our reputation and adversely impact our results of operations.

We are subject to risk as it relates to software that we license from third parties.

We license software from third parties, much of which is integral to our systems and our business. The licenses are generally terminable if we breach our obligations under the license agreements. If any of these relationships were terminated or that are seenif any of these parties were to cease doing business or cease to support the applications we currently utilize, we may be forced to spend significant time and money to replace the licensed software.

Failures or reduced accessibility of third-party software on which we rely could impair the availability of our platform and applications and adversely affect our business.

We license software from third parties for integration into our Vocal platform, including open source software. These licenses might not continue to be substantially similaravailable to us on acceptable terms, or better than ours. This may force us to compete in different ways and expend significant resources in order to remain competitive. If our competitors are more successful thanat all. While we are not substantially dependent upon any third-party software, the loss of the right to use all or a significant portion of our third-party software required for the development, maintenance and delivery of our applications could result in developing compelling content or in attracting and retaining users and advertisers, our revenues and operating results could be adversely affected.

We face competition from traditional media companies, and we may not be includeddelays in the advertising budgetsprovision of large advertisers,our applications until we develop or identify, obtain and integrate equivalent technology, which could harm our operating results.business.