As filed with the Securities and Exchange Commission on OctoberSeptember 9, 2020.2021

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Virpax Pharmaceuticals, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 2834 | 82-1510982 | ||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer | ||

Identification Number) |

1554 Paoli Pike, #2791055 Westlakes Drive, Suite 300

West Chester,Berwyn, PA 1938019312

(610) 727-4597

(484) 880-4588

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Anthony Mack

Chief Executive Officer

1055 Westlakes Drive, Suite 300

1554 Paoli Pike, #279

West Chester,Berwyn, PA 1938019312

(610) 727-4597

(484) 880-4588

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies to: | ||

| Michael J. Lerner Steven M. Skolnick Lowenstein Sandler LLP 1251 Avenue of the Americas New York, New York 10020 (212) 262-6700 | Jeffrey J. Fessler | |

Sheppard, Mullin, Richter & Hampton LLP | ||

30 Rockefeller Plaza | ||

New York, NY 10112 | ||

(212) 634-3067 | ||

Approximate date of commencement of proposed sale to public:

As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☒ | Smaller reporting company | ☒ | |||

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to Be Registered | Proposed Maximum Aggregate Offering Price(1) | Amount of Registration Fee(2) | ||||||

| Common Stock, $0.00001 par value per share (3) | $ | 17,250,000.00 | $ | 1,881.98 | ||||

| Underwriter’s warrant (4) | — | — | ||||||

| Common Stock underlying underwriter’s warrant (5) | $ | 1,078,125.00 | $ | 117.62 | ||||

| Total | $ | 18,328,125.00 | $ | 1,999.60 | ||||

| Title of Each Class of Securities to Be Registered | Proposed Maximum Aggregate Offering Price(1) | Amount of Registration Fee(2) | ||||||

| Common Stock, $0.00001 par value per share(3) | $ | 57,500,000 | $ | 6,273.25 | ||||

| (1) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended (the “Securities Act”). |

| (2) | Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price. |

| (3) | Includes shares of common stock which may be issued on exercise of a |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information contained in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED |

Shares

Common Stock

Virpax Pharmaceuticals, Inc

This is a firm commitment initial public3,401,360 Shares

Common Stock

| Virpax Pharmaceuticals, Inc. |

We are offering of3,401,360 shares of Virpax Pharmaceuticals, Inc. common stock. Prior to this offering, there has been no public market for our common stock. We anticipate that the initial public offering price of our common stock will be between $ and $ per share.on a firm commitment basis.

We have applied to list our shares ofOur common stock for tradingis listed on the Nasdaq Capital Market under the symbol “VRPX.” IfThe last reported sale price of our common stock is not approved for listing on the NASDAQNasdaq Capital Market we will not consummate this offering. No assurance can be given that our application will be approved.on September 8, 2021 was $14.70 per share.

We are an emerging growth company under the Jumpstart our Business Startups Act of 2012, or JOBS Act, and, as such, may elect to comply with certain reduced public company reporting requirements for this prospectus and future filings.

Investing in our common stock is highly speculative and involves a high degree of risk. See “Risk Factors” beginning on page 1114 of this prospectus for a discussion of information that should be considered in connection with an investment in our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| $ | $ | |||||||

| Underwriting discounts and commissions | $ | $ | ||||||

| Proceeds to us, before expenses | $ | $ | ||||||

The underwriters may also exercise their option to purchase up to 510,204 additional shares from us at the public offering price, less the underwriting discounts and commissions, for 45 days after the date of this prospectus to cover over-allotments, if any.

The underwriters expect to deliver our shares in the offeringof common stock on or about , 2020.2021.

ThinkEquity

a division of Fordham Financial Management, Inc.

The date of this prospectus is , 20202021

TABLE OF CONTENTS

We have not authorized anyone to provide you with different information, and we take no responsibility for any other information others may give you. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front of this prospectus.

No action is being taken in any jurisdiction outside the United States to permit a public offering of our common stock or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus applicable to that jurisdiction.

We and the underwriters are offering to sell, and seeking offers to buy, our common shares only in jurisdictions where offers and sales are permitted. Neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside of the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of our common shares and the distribution of this prospectus outside of the United States.

i

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider before making your investment decision. Before investing in our common stock, you should carefully read this entire prospectus, including our financial statements and the related notes thereto and the information set forth in the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” If any of the risks materialize, our business, financial condition, operating results and prospects could be materially and adversely affected. In that event, the price of our common stock could decline, and you could lose part or all of your investment. Unless the context otherwise requires, we use the terms “Virpax,” “company,” “we,” “us” and “our” in this prospectus to refer to Virpax Pharmaceuticals, Inc.

Our Company

We are a preclinical stage biopharmaceuticalpreclinical-stage pharmaceutical company focused on becoming a global leader in pain management by developing and delivering innovative non-opioid and non-addictive pharmaceutical products using new drug delivery systems and technology. We are developing branded pharmaceutical product candidates forwith a focus on pain management by using advancedcutting-edge technology in an effort to enhance patients’ quality of life.

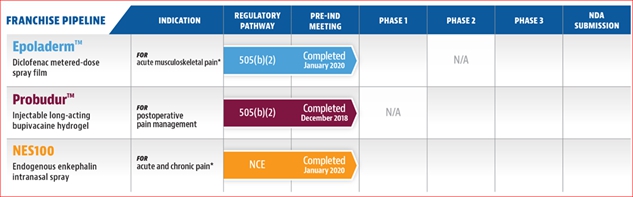

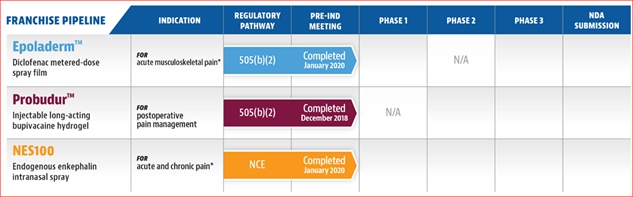

We have exclusive global rights to develop, sell and export (among other rights) a proprietary patented nonsteroidnonsteroidal anti-inflammatory Topical Spray Film Delivery Technology for acute musculoskeletal pain (“DSF100” or “EpoladermTM”) and for chronic osteoarthritis of the knee (“OSF200”). We also have exclusive global rights to a proprietary patented injectable, long-acting, “local anesthetic”local anesthetic Liposomal (Hydro) Gel Technology for postoperative pain management (“LBL100” or “ProbudurTM”“Probudur”). Additionally, we have exclusive global rights to a proprietary patented Molecular Envelope Technology (“MET”) that uses an intranasal device to deliver exogenous enkephalin for the management of acute and chronic pain, including pain associated with cancer (“NES100”Envelta”) and for the management of Post-Traumatic Stress Disorder (“PES200”). Enkephalins are pain-relieving pentapeptides produced in the body, and function to inhibit neurotransmitters in the pathway for pain perception, thereby reducing the physical impact of pain. While the Company is currently focused on the development of its non-opioid and non-addictive pain management pipeline of product candidates, the Company also plans on using its proprietary delivery technologies to develop anti-viral therapies (“AnQlar”) as an anti-viral barrier to potentially prevent or reduce the risk or the intensity of viral infections in humans, including, but not limited to, influenza and SARS-CoV-2 (COVID 19).

We believe the Topical Spray Film Delivery Technology could provide a pathway for additional proprietary spray formulations and could potentially evolve into the preferred therapeutic treatment for topicals and transdermal deliveries due to itswith strong adhesion and accessibility properties, especially around joints and curved body surfaces. Pursuant to a Researchresearch and Option Agreement we have entered into with MedPharm Limitedoption agreement (the “MedPharm Research and Option Agreement”), with MedPharm Limited, (“MedPharm”), MedPharm will conduct certain research and development activities of proprietary formulations incorporating certain MedPharm technologies and certain of our proprietary molecules. These proprietary molecules relate to indications which include, but are not limited to, treatment of estrogen levels, Alzheimer’s disease, dementia, Parkinson’s disease, neuropathic issues, and acute and chronic pain. Under the agreement, we were granted an option to obtain an exclusive, world-wide, sub-licensable, royalty bearing, irrevocable license to research, develop, market, use, commercialize, and sell any product utilizing MedPharm’s spray formulation technology. See “Material Agreements” below for more information concerning this research and option agreement.

We believe NES100 and PES200 would support the current effort among prescribers, regulators, and patients to seek non-addictive treatment options to combat the opioid epidemic. We plan to utilize these delivery technologies to selectively develop a portfolio of patented 505(b)(2) and new chemical entity (“NCE”) product candidates for commercialization.

While we are currently focused on the development of our non-opioid and non-addictive pain management pipeline of product candidates, we also plan on using our proprietary delivery technologies to develop anti-viral therapies as an anti-viral barrier to potentially prevent or reduce the risk or the intensity of viral infections in humans, including, but not limited to, influenza and SARS-CoV-2 (COVID 19). As of the date of this prospectus, activities related to our anti-viral therapies have not commenced. We plan to finance our anti-viral-related activities through the use of grants and do not plan on using any proceeds from this offering.

Our Portfolio

Our portfolio currently consists of sixmultiple preclinical stage product candidates: Epoladerm, OSF200, Probudur, NES100,Envelta, PES200 and MMS019.AnQlar. In the accompanying section we will describe each product candidate, its benefits, and our market strategy for each product candidate. The dates reflected in the below table are estimates only, and there can be no assurances that the events included in the table will be completed on the anticipated timeline presented, or at all.

* We are also developing Epoladerm for a second indication, OSF200, which utilizes the same transdermal delivery system as Epoladerm, as a twice daily topical treatment for chronic osteoarthritis of the knee. OSF200 development plan is pending the approval of Epoladerm. In addition, we are also developing NES100 for a second indication, PES200, which utilizes the same delivery mechanism as NES100. PES200 enables the delivery of a metabolically labile peptide drug (Enkephalin) into the brain for post-traumatic stress disorder. PES200 development plan is pending a grant approval. Further, we recently entered into a Collaboration and License Agreement with Nanomerics Ltd. for the exclusive North American license to develop and commercialize a High-Density Molecular Masking Spray (“MMS019”) as an anti-viral barrier to prevent or reduce the risk or the intensity of viral infections in humans. We plan to develop MMS019 primarily through grants and do not plan on using any proceeds from this offering.

1

| 1,2,3 | We are also developing Envelta for a second indication, PES200, which utilizes the same delivery mechanism as Envelta. PES200 enables the delivery of a metabolically labile peptide drug (Enkephalin) into the brain for the treatment of post-traumatic stress disorder. The Envelta IND enabling studies may be cross-referenced to the PES200 IND. We are also developing Epoladerm for a second indication, OSF200, which utilizes the same transdermal delivery system as Epoladerm, as a twice daily topical treatment for chronic osteoarthritis of the knee. OSF200’s development plan is pending the approval of Epoladerm. AnQlar has completed IND-enabling toxicology studies and ex-vivo studies demonstrated a reduction in infectivity from respiratory viruses like influenza and SARS-CoV-2. AnQlar also reduced nasal and viral load in its animal study. |

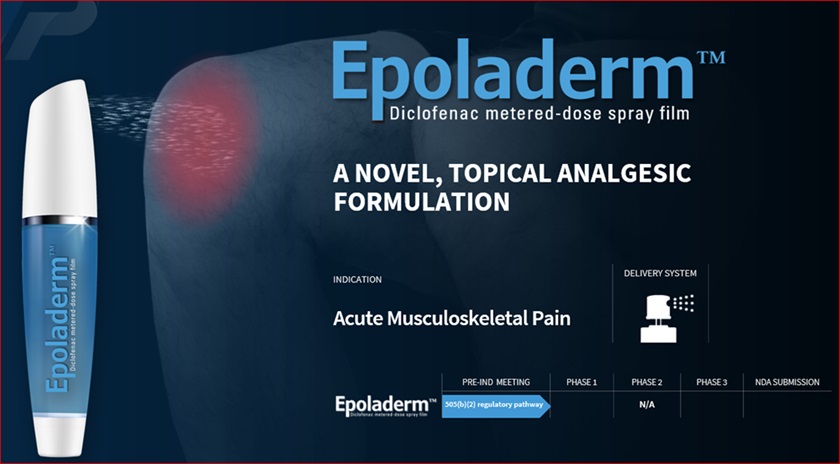

Diclofenac Epolamine Metered-Dose Spray Film (EpoladermTM)

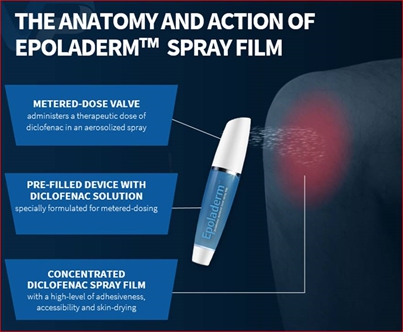

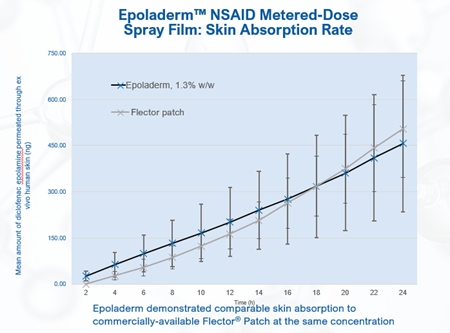

We believe our Diclofenac Epolamine metered-dose spray film technology, which we refer to as Epoladerm, could provide a pathway for additional proprietary spray formulations with strong adhesion and accessibility properties upon application, especially around joints and curved body surfaces. We plan to develop and market Epoladerm as a topical nonsteroidal anti-inflammatory drug (“NSAID”) treatment for acute pain. We believe Epoladerm’s proprietary spray film technology may lead to adhesion capabilities superior to those of transdermal patches (e.g. Epoladerm does not require any tape reinforcement), while maintaining comparable skin absorption capabilities to transdermal patches currently on the market. Specifically, because the Epoladerm technology does not require a patch to deliver the drug through the skin, we believe Epoladerm may have better adhesion to the skin and may have better accessibility, particularly around joints and other curved body surfaces. Additionally, because Epoladerm is a spray, we believe it will be more aesthetically appealing than transdermal patches. As a spray, Epoladerm and OSF200 (as defined below) will bewere studied in non-clinical animal trials to demonstrateex-vivo skin studies (skin from abdominoplasty) and demonstrated drying times of between 60 and 90 seconds. Unlike other topical NSAIDs, Epoladerm does not require physical handling of the actual drug and enables metered dosing that provides an accurate amount of active ingredient per spray application.

When discussing nonopioid treatments for chronic pain, the Centers for Disease Control (“CDC”) notes clinicians should consider topical agents as alternative first-line analgesics, thought to be safer than systemic medications. In an August 18, 2020 article appearing in the Annals of Internal Medicine, the American College of Physicians and the American Academy of Family Physicians announced a joint clinical guideline, “Nonpharmacologic and Pharmacologic Management of Acute Pain from Non-Low Back, Musculoskeletal Injuries in Adults,” whereby they recommend topical NSAIDs as first-line therapy for patients experiencing pain from non-low back, musculoskeletal injuries. The clinical guideline also recommends that clinicians not prescribe opioids for these injuries except in cases of severe injury or if patients cannot tolerate first-line therapeutic options. We believe this creates a unique market opportunity for Epoladerm within the $3.3 billion (as of 2019) transdermal and topical non-opioid pain market. We plan to target our marketing and selling efforts to pain management clinics and high-prescribing healthcare practitioners, including orthopedic surgeons, rheumatologists, physical medicine and rehabilitation specialists and primary care physicians (“PCPs”).

The below image is a concept design for our metered-dose spray canister for the delivery of Epoladerm for the treatment of acute pain:

We believe Epoladerm represents a novel technology that administers a metered dose film based on our proprietary spray formulation. We are not aware of any other metered dose spray film product, on the market or in clinical development, that utilizes the same delivery mechanisms as Epoladerm. We believe that this transdermal delivery system could provide a pathway for additional proprietary spray formulations for us going forward. As a result of the Pre-Investigational New Drug (“IND”) review, the U.S. Food and Drug Administration (“FDA”) has indicated that it is reasonable for us to pursue a 505(b)(2) accelerated New Drug Application (“NDA”) for Epoladerm.Epoladerm to conduct a study to assess bioavailability and bioequivalence, and then move into Phase III clinical trials. A “505(b)(2)” NDA refers to an application for a new drug filed under Section 505(b)(2) of the Federal Food, Drug, and Cosmetic Act (“FDCA”). There can be no assurance that we will be successful in securing regulatory approval under the 505(b)(2) pathway or that we will be successful in mitigating risks associated with the clinical development of this product candidate.

The following is the planned development activity and status to bring Epoladerm to market:

2

We are also developing Epoladerm for a second indication utilizing the same transdermal delivery system as EpoladermEpoladerm. This second indication would be as a twice daily topical treatment for chronic osteoarthritis of the knee (“OSF200”). OSF200 will use the same formulation as Epoladerm; however, OSF200 would be applied twice daily. OSF200 is also covered under the same intellectual property as Epoladerm. As a result of the IND review, the FDA has indicated that it is reasonable for us to pursue a 505(b)(2) accelerated NDA for OSF200. There can be no assurance that we will be successful in securing regulatory approval under the 505(b)(2) pathway or that we will be successful in mitigating risks associated with the clinical development of this product candidate. OSF200 would be marketed as a topical NSAID treatment for chronic osteoarthritis of the knee. We believe OSF200’s adhesion capabilities and other attributes are the same as those listed for Epoladerm above. Our plan would beis to file a supplement for OSF200 to our potential NDA approval of Epoladerm for OSF200.Epoladerm. If we are able to obtain approval of the NDA for Epoladerm, we plan to conduct Phase III clinical trials for OSF200 with an anticipated NDA approval in approximately 18 months following a potential approval for Epoladerm. However, there can be no assurances that Epoladerm receives FDA approval.

Long-acting Bupivacaine Liposomal-gel 3.0% (LBL100 or ProbudurTM)Probudur)

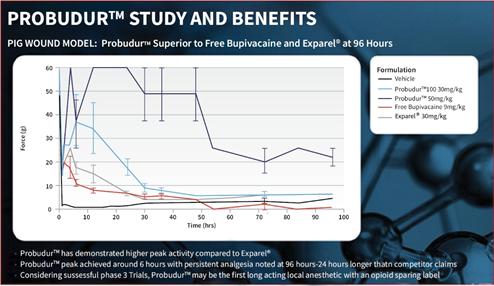

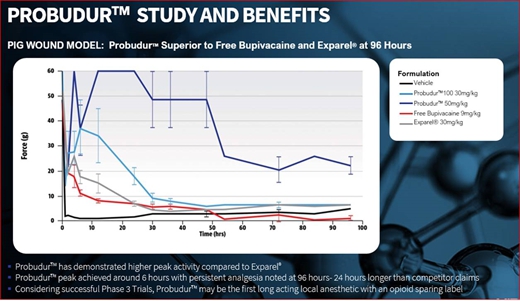

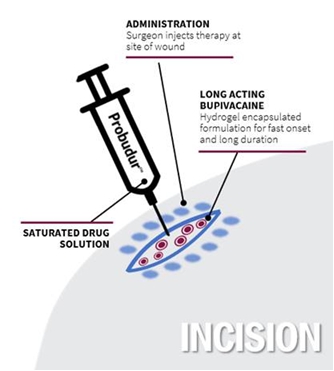

Probudur is a drug product candidate based on a unique liposomal delivery system utilizing large multi-vesicular vesicles (“LMVVs”) encapsulating a high dose of the local anesthetic bupivacaine. These drug-loaded liposomes are composed of lecithin and cholesterol which are generally recognized as safe (“GRAS”) by the FDA. These LMVVs are embedded in hydrogel beads to form a Lipogel. The system delivers a local anesthetic/analgesic medicine from the Lipogel. Early non-clinical animal studies produced data which suggests that Probudur may be able to provide improved onset, duration and peak performance properties as compared to a similar product on the market. Early dataData from these animal studies indicatedemonstrated that after treatment with Probudur may provide pain(50 mg/kg), statistically significant analgesic activity (measured as threshold pressure at the withdrawal of the animal’s treated extremity) was observed in comparison to a control (vehicle), for up toas long as 96 hours.hours post-treatment (22.33±3.67g vs 5.00±0.58g; p<0.05), which is 24 hours longer than the leading product on the market. These animal studies were conducted by administering Probudur by local infiltration of the surgical site, which resulted in keeping the active ingredient localized at the surgical site for a longer period of time. Four trials were conducted using three animal models. The results of the animal studies show initial support for our belief that Probudur may potentially be safely administered to humans in a planned Phase IIA study.

Based on data from early animal studies, Probudur has indicated post-operative control for up to 96 hours, which is 24 hours longer than the leading product on the market. If we are able to demonstrate a successful Phase III clinical trial, we believe Probudur may represent the first long acting local anesthetic with an opioid sparing label. The slow release of the drug from the liposomal depot reduces the peak plasma levels. We believe this property may permit administration of higher bupivacaine doses (3% versus 1.3% in leading market product); however, there can be no assurances, based on these animal studies, that Probudur will be safe or effective. Further, there can be no assurance that Probudur will receive FDA approval.

We plan to market Probudur to general surgeons, anesthesiologists, and orthopedic surgeons within the $577 million (as of 2019) local anesthetic post-surgical market. If the product candidate is used appropriately, we believe this product candidate could potentially eliminate the need for opioids for post-operative pain relief. As a result of our IND review, the FDA has indicated that it is reasonable for us to pursue a 505(b)(2) accelerated NDA for Probudur. There can be no assurance that we will be successful in securing regulatory approval under the 502(b)(2) pathway or that we will be successful in mitigating risks associated with the clinical development of this product candidate.

Probudur has completed IND Enabling studies “in vitro,” “in vivo efficacy” and “in vivo toxicology.” Based upon discussions with the FDA, we intend to move Probudur directly into dose escalation studies in targeted patient populations. We believe the completed IND Enabling studies allow us to transition directly to a Phase II study. The following is the planned activity and status to bring Probudur to market:

| ||

| ||

3

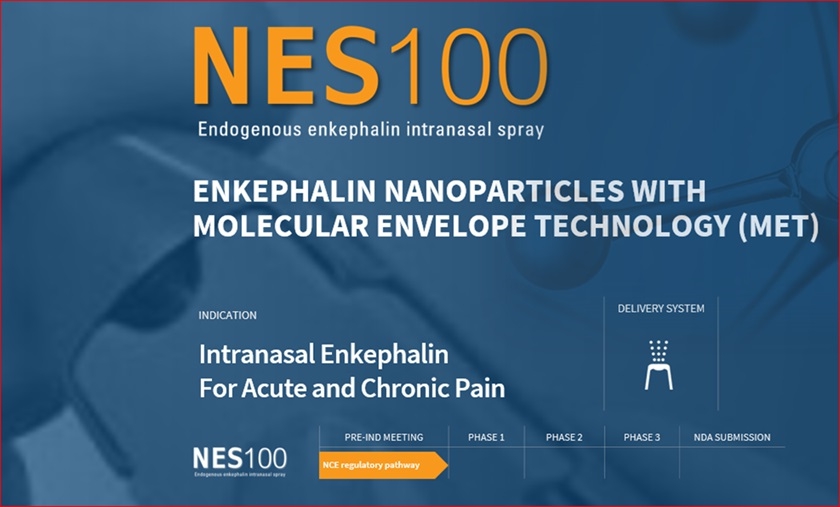

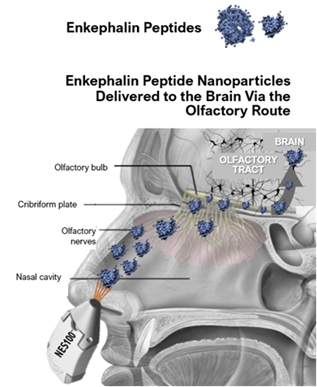

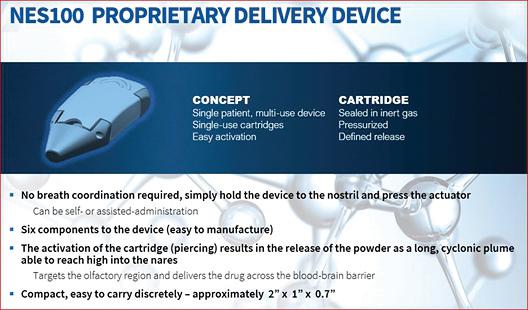

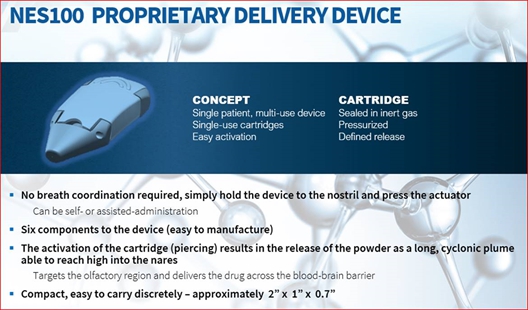

Molecular Envelope Technology Enkephalin Intranasal Spray (NES100)(Envelta)

NES100Envelta is a nanotechnology-based intranasal spray drug product candidate which enables the delivery of a metabolically labile peptide drug (Enkephalin) into the brain. NES100It is manufactured using high pressure homogenization and spray drying. The MET nanoparticles are well tolerated via the nasal route at the dose administered. There is pharmacological evidence of activity of MET enabled enkephalin in morphine-tolerant animals. Preclinical studies were conducted in animals for between 6 and 28 days through intravenous, oral and intranasal dosing.

Twelve studies were conducted using three animal models whereby the animal studies were aimed at determining safety pharmacology and genetic toxicology. We believe theThe preliminary data from these early animal studies of NES100 support our beliefEnvelta have shown that NES100 may have comparable preclinical activity toEnvelta exhibited pain control in morphine in alltolerant animals, without the development of tolerance itself. These animal pain models tested without the drug seeking,anti-hyperalgesic effects in rats against evoked stimuli in a model of chronic inflammatory pain and against ongoing neuropathic pain in a conditioned placement preference model with spinal nerve ligation. Envelta and morphine were compared at the same dose level of 7.5 mg kg-1 in this model and Envelta was determined to have a similar analgesic effect. With respect to respiratory depression, and tolerance associated with opioids.delta opioid receptor agonists actually reverse the respiratory depression caused by morphine agonists, leading to our believe that Envelta will be unlikely to cause respiratory depression. However, there can be no assurances, based on these preclinical animal studies, that NES100Envelta will be safe and effective. Further, there can be no assurance that NES100Envelta will receive FDA approval.

We believe we have identified a large unmet need and market opportunity for current prescribers of opioids, including pain and hospice treatment centers. Currently, these prescribers may be using morphine-like opioids, which target three opioid receptors: mu, delta and kappa. Most analgesics used clinically target mu receptor, however, this receptor is also responsible for the majority of undesirable side effects associated with opioids. Currently, enkephalins are limited in their therapeutic potential by their pharmacokinetic profiles due to their inability to cross the blood-brain barrier to reach opioid receptors located in the central nervous system. However, we believe NES100’sEnvelta’s novel nasally delivered formulation, based on early animal studies, enhances enkephalin transport to the brain by protecting the drug in a molecular envelope (MET), facilitating its crossing of the blood-brain barrier. Enkephalins bind predominantly to the delta-receptor which is typically not associated with the dangers associated with opioids. We believe NES100Envelta may have analgesic potential without opioid tolerance, and Envelta has not exhibited any indications of withdrawal, respiratory depression, euphoria, or addiction in the early animal studies. A new study published in Proceedings of the National Academy of Sciences (PNAS)(“PNAS”) indicates, “Delta opioid receptors have a built-in mechanism for pain relief and can be precisely targeted with drug-delivering nanoparticles, making them a promising target for treating chronic inflammatory pain with fewer side effects.” There can be no assurances, based on these preclinical animal studies, that NES100Envelta will be safe and effective in human trials.

Additionally, we believe NES100Envelta may significantly reduce constipation and early animal clinical trials have not demonstrated any opioid dependence, drug seeking or respiratory depression. We plan to use the endogenous NCE regulatory pathway to bring this product candidate to market. We plan to target our marketing and selling efforts to pain specialists, anesthesiologists, orthopedics, surgeons, PCPs, Nurse Practitioners (“NPs”), oncologists, and neurologists within the $7 billion (as of 2019) analgesic narcotics market.

NES100Envelta is a neuroactive peptide drug product (enkephalin) with a proprietary composition formulated for administration by all routes, except the topical route. A preassembled device and cartridge would be used to propel the enkephalin formulation through the nose to the brain via the olfactory nerve/bulb route of transmission. A MET will encapsulate the drug product, protecting it from degradation, and help to carry the drug across the blood-brain barrier to promptly suppress pain.

NES100Envelta has completed IND enabling studies “in vitro,” “in vivo efficacy” and “in vivo toxicology.” The following is the planned activity and status to bring the product candidate to market:

We are also developing NES100Envelta for a second indication, Post-Traumatic Stress Disorder, utilizing the same delivery mechanism as NES100.Envelta. PES200 enables the delivery of a metabolically labile peptide drug (Enkephalin) into the brain and it is also covered under the same intellectual property listed elsewhere in this prospectus for NES100.Envelta. We believe PES200’s capabilities and attributes are the same as listed for NES100Envelta above. Our plan is to validate proof-of-concept for PES200 followed by IND-enabling studies for the development of a novel enkephalin-based formulation to treat Post-Traumatic Stress Disorder.

On August 25, 2020, we entered into a cooperative research and development agreement (the “CRADA”), with the National Center for Advancing Translational Sciences (NCATS) (the “CRADA”(“NCATS”), an institute/center of the National Institutes of Health (NIH)(“NIH”), U.S. Department of Health and Human Services. This collaboration is for the continued development of Virpax’sour product candidate, NES100,Envelta, an intranasal peptide, for the management of acute and chronic non-cancer pain. The term of the CRADA is for a period of four years from the effective date of the agreement and can be terminated by both parties at any time by mutual written consent. In addition, either party may unilaterally terminate the CRADA at any time by providing written notice of at least sixty (60) days before the desired termination date. The agreement provides for studies that are focused on the pre-clinical characterization of NES100Envelta as a novel analgesic for acute and chronic non-cancer pain, and for studies to further develop NES100Envelta through IND enabling studies.

4

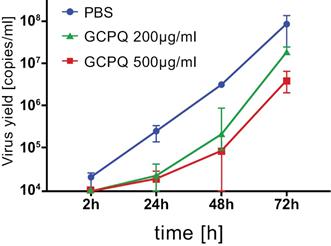

High-Density Molecular Masking Spray Formulation for the Prevention of Respiratory Viruses (MMS019)(AnQlar)

MMS019AnQlar is high-density molecular masking spray we plan to develop as an anti-viral barrier to potentially prevent, or reduce the risk or the intensity of, viral infections in humans. We intend for this formulation to be delivered using a preassembled device and cartridge to propel the High-Density Molecular Sprayhigh-density molecular spray formulation into the nose. MMS019AnQlar will be used as a nasal powder spray to potentially prevent viral binding to epithelial cells in the nasal cavity and the upper respiratory tract, potentially reducing respiratory related infections.

WeAs an addition to standard personal protective equipment, we believe MMS019AnQlar may offer anotheran additional layer of protection, in the form of a Molecular Mask, to be added to standard personal protective equipmentmolecular mask, to protect healthcare workers and those at-riskat risk of serious disease from viral infections. MMS019AnQlar has completed IND-enabling toxicology studies and intends to demonstrate that pre-treatmentex-vivo studies which demonstrated a reduction in infectivity from respiratory viruses like influenza and SARS-CoV-2. During the ex-vivo study, in the presence of nasal mucosal cellsAnQlar, SARS-CoV-2 viral replication inhibition was observed in vitro prevents, or reduces, thea bronchial epithelial model reconstituted from healthy human donor cells. Virus replication was evaluated using RT-qPCR. The data was presented as a number of cells that get infected.viral copies per ml. A lower viral yield was detected in the cultures treated with AnQlar than in the control with phosphate buffered saline (“PBS”) after 72 hours of infection. We intendplan to finance activities relatedmarket AnQlar to MMS019 with grantsfirst responders, healthcare workers, clinics, military forces, transplant and not with any proceeds from this offering.other immune compromised or at risk patients within the $13 billion (as of 2019) anti-viral market.

We continue to seek opportunities to exploit our product portfolio through licensing and other strategic transactions to further develop our drug product candidates. This includes seeking potential partners in further developing our drug product candidates and responding to inquiries of interest we have received concerning our product portfolio.

Recent Developments

Initial Public Offering

On February 19, 2021, we closed our initial public offering (the “IPO”) of 1,800,000 shares of our common stock at a public offering price of $10.00 per share, for gross proceeds of $18.0 million, before deducting underwriting discounts and offering expenses.

Epoladerm

We have initiated a series of IND enabling toxicity studies for Epoladerm which are expected to take between eight months to one year to complete. If the completion of these studies are successful, we intend to submit an IND application to the FDA, including a trial design for a Phase I study.

Probudur

In March 2021, we engaged Charles River Laboratories to perform seven preclinical animal studies during the second half of 2021, including method, dosage, and toxicity as part of the required FDA enabling trials for an IND for Probudur. However, we elected to strategically delay these trials in order to enhance the formulation of Probudur to increase stability for manufacturing purposes and to possibly extend the lifetime of a relevant patent.

On June 29, 2021, we entered into an Agreement for Rendering of Research Services with LipocureRX, Ltd. (“Lipocure,” and the “June 2021 Lipocure Research Agreement”). Under the June 2021 Lipocure Research Agreement, we will provide funding for research and development related to the optimization of the Liposomal Bupivacaine formulation and eventual manufacture of pre-clinical batches including batches for stability testing, animal studies and toxicology work. This will also include work associated with the potential filing of additional provisional patent applications. We may terminate the agreement at any time upon 30 days written notice and will only be responsible to pay Lipocure for work performed through the date of such notice. In consideration for the research services, we agreed to pay research service fees of $200,000 upon execution as prepayment for research services, as well as $400,000 on July, 1 2021, and five quarterly payments of $270,000 initiating on September 1 2021. We also agreed to pay $250,000 to Lipocure upon the successful completion of a Chemistry, Manufacturing and Controls (“CMC”) filing with the FDA. All services to be provided under the June 2021 Lipocure Research Agreement initiated on July 1, 2021 and are anticipated to be completed towards the end 2022.

On June 30, 2021, we entered into an Agreement for Rendering of Research Services (the “June 2021 Yissum Research Agreement”) with Yissum Research Development Company of the Hebrew University of Jerusalem, Ltd. (“Yissum”). Under the June 2021 Yissum Research Agreement, we shall provide funding for research and development studies to be performed by researchers at Hebrew University related to the optimization of the Liposomal Bupivacaine formulation and to increase stability for manufacturing purposes. We may terminate the agreement at any time upon 30 days written notice and shall be only responsible to pay Yissum for work performed through the date of such notice. In consideration for the research services, we agreed to pay research service fees of $337,500 in six equal quarterly installments. Each party will be entitled to terminate the agreement in the event of a breach by the other party of its obligations under the agreement, including, but not limited to, any payment failure, which is not remedied by the breaching party within 30 days of receipt of written notice from the non-breaching party. All services to be provided under the June 2021 Yissum Research Agreement initiated on July 1, 2021 and are anticipated to be completed towards the end of 2022.

Envelta

We plan to utilize the delivery technologies utilized for Envelta to selectively develop a portfolio of patented 505(b)(2) and NCE candidates for commercialization. The IND enabling studies for Envelta are being performed under a CRADA entered into by us and NCATS. To that end, we intend to use these studies as a source for INDs for two additional potential indications, cancer pain and post-traumatic stress disorder. To date, two of the four planned initial in vitro studies have been successfully completed. These pre-clinical studies under the CRADA are expected to be conducted through 2021 and 2022.

AnQlar

We have received a written pre-investigational new drug (“pre-IND”) response from the FDA for AnQlar, our patented and proprietary high-density molecular masking spray under development for use as an anti-viral barrier product. In its pre-IND response, the FDA provided guidance on our pathway to pursue prophylactic treatment against SARS-CoV-2 and influenza for daily use as an over-the-counter (“OTC”) product. We believe the results of the pre-IND response support further research on AnQlar as an intranasal protective that may limit transmission of the viruses to others. If we are able to successfully complete the required clinical trials for this product candidate, we intend to move forward and pursue an NDA for AnQlar as a once daily intranasal treatment. The FDA has indicated that, upon successful completion, we may pursue an NDA drug approval with the Office of Non-Prescription Drugs.

In August 2021, we engaged Syneos Health to assist with the optimal clinical trial design based on an efficient timeline. On August 25, 2021, we entered into a commercial manufacturing and supply agreement with Seqens, an integrated global leader in pharmaceutical solutions with 24 manufacturing sites worldwide and seven research and development facilities throughout the U.S. and Europe. The agreement with Seqens provides for both the supply material for our clinical studies as well as the long-term commercial supply of AnQlar. Seqens will conduct process development and validation of additional large scale commercial quantities of AnQlar at its facilities in Devens and Newburyport, Massachusetts.

Our Strengths

We are working to create and advance novel non-addictive treatments for the management of acute musculoskeletal pain, chronic pain, mononeuropathy, pain associated with cancer, and post-operative pain. Our goal is to develop and commercialize product candidates that improve the clinical outcomes of the treatments currently on the market. There can be no assurance that we will be able to execute on this strategy. With the support of the President, the U.S. Department of Health and Human Health Services (“HHS”), the National Institutes of Health (“NIH”) launched the initiative Helping to End Addiction Long-term (“HEAL”), to provide solutions to the national opioid crisis. Pursuant to this initiative, we have been awarded grantsin kind support related to NES100Envelta and have filed for additional grants that are currently pending. We believe HEAL and recent FDA guidance has made it more efficient to bring novel non-opioid medication to market.

We believe three of the below product candidates (Epoladerm, Probudur, and Envelta) have novel technologies that could improve pain management.management and one product candidate (AnQlar) could inhibit viral replication and decrease levels of virus in brain tissue. We believe these product candidates also have the following individual strengths and differentiators as compared to similar product candidates that we believe could make these product candidates more desirable if approved:

| ● | Epoladerm’s quick-drying spray film technology may permit consistent 12-hour dosing without the messy handling of much slower drying liquids, gels and spray foam formulations that must be rubbed into the skin on application. We believe this may allow for improved patient compliance, which may enhance therapeutic outcomes compared to the inconsistent adhesion of patch technology. |

| ● | Probudur may eliminate the need for opioids and catheters after surgery and may reduce the associated costs and length of stay. |

| ● |

| ● | AnQlar has demonstrated inhibited viral replication and |

Also, three of the sixour product candidates (Epoladerm, Probudur, and OSF200) could potentially be developed using the FDA’s 505(b)(2) regulatory pathway. This type of submission differs from the FDA’s standard 505(b)(1) NDA clinical development pathway typically used for most pharmaceutical new chemical entities (“NCEs”) in that the development candidate contains similar active ingredients to a previously approved drug. Consequently, the data included in the submission can rely, at least partially, on the FDA’s findings of safety and effectiveness related to the prior approved product, and as a result can mitigate many of the drug development risks faced by the drug developer. Companies utilizing the 505(b)(2) accelerated NDA regulatory pathway typically experience a shorter drug development program that requires less resources than the standard regulatory pathway. Under the 505(b)2(2) pathway, the FDA allows the use of data from a prior application that can be referenced by a new sponsor that can include part of the required preclinical or clinical studies for approval. Consequently, this alternative pathway can significantly lower the development cost and shorten the timeline to NDA approval.

We are focused on applying our spray film and liposomal gel technologies to already-approved pharmacological actives. We intend to seek to leverage the 505(b)(2) accelerated NDA pathway to accelerate our development timeline and potentially lower our clinical and regulatory risk for not only our Epoladerm drug candidate, but for the OSF200 and Probudur product candidates as well. However, there can be no assurance that the 505(b)(2) accelerated NDA pathway will lead to a faster development process or a faster regulatory review. While the 502(b)(2) pathway may potentially expedite development or the approval process, it does not change the FDA’s standards of approval or increase the likelihood that a product candidate will receive approval.

5

Our Team

We have assembled a highly experienced management team, board of directors (the “Board of Directors”) and scientific advisory board to execute on our mission to develop product candidates that effectively manage pain in all its complexities, while minimizing risks to patients and society. Our team has a proven track record in developing, launching and marketing multiple pain products.

Our Founder and Chief Executive Officer, Anthony Mack, is a business leader with over 25 years of experience in the pharmaceutical and finance industries. Our Chief Medical Officer, Jeffrey Gudin, M.D., is a Clinical Associate Professor in Anesthesiology at the Rutgers New Jersey Medical School and is Board Certified in Pain Medicine, Anesthesiology, Addiction Medicine and Hospice and Palliative Medicine. Our EVP, Commercial Operations Officer, Gerald W. Bruce, has spent over 30 years, including 20 years in senior leadership roles, in the Pharmaceutical and Medical Nutrition industry. Our Chief Financial Officer, Christopher M. Chipman, CPA, has more than 25 years of industry experience assisting public companies with financial reporting, forecasting, preparation of periodic reports required to be filed with the Securities and Exchange Commission and compliance with Section 404 of the Sarbanes Oxley Act of 2002 including pharmaceutical clients. Gerald W. Bruce EVP, Commercial Operations, has spent over 30 years, including 20 years in senior leadership roles, in the Pharmaceutical industry.

Our Strategy

We are focused on becoming a global leader in pain management by developing and delivering innovative pharmaceutical products to patients. We are developing branded pharmaceutical product candidates for pain management by using cutting-edge technology to enhance patients’ quality of life.

According to data from the CDC, in 2016, approximately 20% of adults in the United States had chronic pain (approximately 50 million people). Further, CDC data indicates that the prescribing of opioids by clinicians has increased threefold in the last 20 years, contributing to the problem of prescription opioid abuse. Accordingly, there is a push among prescribers, regulators, and patients to seek non-opioid and non-addictive treatment options to combat the opioid epidemic. We plan to utilize these delivery technologies to selectively develop a portfolio of patented 505(b)(2) and NCE product candidates for commercialization.

We have developed a marketing and sales strategy tailored to each individual product candidate within our portfolio which will be deployed if each product candidate is approved and brought to market. With a dedicated sales team, and niche non-opioid and non-addictive pain management product candidates, we believe once these strategies are put into place, they can produce products with greater pain management than opioid competitor products, potentially without any of the side effects caused by morphine/opioid related products.

6

Summary of Risks Associated with Our Business

Our business and an investment in our company is subject to numerous risks and uncertainties, including those highlighted in the section titled “Risk Factors” immediately following this prospectus summary. Some of these risks include:

| ● | We are a pre-revenue company with a limited operating history; | |

| ● | We may not be able to successfully develop or commercialize new product candidates or do so on a timely or cost-effective basis; |

| ● | Our business may be negatively affected by the ongoing COVID-19 pandemic; | |

| ● | Our business may be negatively affected by ongoing litigation; |

| ● | We depend on a limited number of product candidates and our business could be materially adversely affected if one or more of our key product candidates do not perform as well as expected and do not receive regulatory approval; |

| ● | Our profitability depends on our major customers, and if our relationships with them do not continue as expected, our business, prospects and results of operations could materially suffer; |

| ● | We are, and will continue to be in the future, a party to legal proceedings that could result in adverse outcomes; |

| ● | Our competitors and other third parties may allege that we are infringing their intellectual property, forcing us to expend substantial resources in resulting litigation, and any unfavorable outcome of such litigation could have a material adverse effect on our business; |

| ● | We may experience failures of or delays in clinical trials which could jeopardize or delay our ability to obtain regulatory approval and commence product sales; |

| ● | We face intense competition from both brand and generic companies which could limit our growth and adversely affect our financial results; |

| ● | We are subject to extensive governmental regulation and we face significant uncertainties and potentially significant costs associated with our efforts to comply with applicable regulations; |

| ● | We may not be able to develop or maintain our sales capabilities or effectively market or sell our products; |

| ● | Manufacturing or quality control problems may damage our reputation, require costly remedial activities or otherwise negatively impact our business; |

| ● | Our profitability depends on coverage and reimbursement by third-party payors, and healthcare reform and other future legislation may lead to reductions in coverage or reimbursement levels; |

| ● | We face risks related to health epidemics and outbreaks, including the COVID-19 pandemic, which could significantly disrupt our preclinical studies and clinical trials, and therefore our receipt of necessary regulatory approvals could be delayed or prevented; |

| ● | We currently, and may in the future need to, license certain intellectual property from third parties, and such licenses may not be available or may not be available on commercially reasonable terms; |

| ● | We may not identify relevant third-party patents or may incorrectly interpret the relevance, scope or expiration of a third-party patent, which might adversely affect our ability to develop, manufacture and market our products and product candidates; |

| ● | If we fail to comply with our obligations under any of our third-party agreements, we could lose license rights that are necessary to develop our product candidates; and |

| ● | After this offering, our directors, executive officers and certain stockholders (one of which is an affiliate of our Chief Executive Officer) will continue to own a significant percentage of our common stock and, if they choose to act together, will be able to exert significant control over matters subject to stockholder approval. |

Our Corporate Information

We were incorporated under the laws of the State of Delaware on May 12, 2017. Our principal executive offices are located at 1554 Paoli Pike, #279, West Chester,1055 Westlakes Drive, Suite 300, Berwyn, PA 19380.19312. Our telephone number is (484) 880-4588.(610) 727-4597.

Our website address is www.virpaxpharma.com. The information contained in, or accessible through, our website does not constitute a part of this prospectus. You should not rely on any such information in making your decision whether to purchase our common stock.

7

Implications of Being an Emerging Growth Company

As a company with less than $1.07 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or JOBS Act, enacted in 2012. An emerging growth company may take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

| ● | being permitted to present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations in this prospectus; |

| ● | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended; |

| ● | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and |

| ● | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

We may take advantage of these provisions until the last day of our fiscal year following the fifth anniversary of the completion of thisour initial public offering. However, if certain events occur prior to the end of such five-year period, including if we become a large accelerated filer, our annual gross revenue exceeds $1.07 billion or we issue more than $1.0 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company prior to the end of such five-year period.

We have elected to take advantage of certain of the reduced disclosure obligations in the registration statement of which this prospectus is a part and may elect to take advantage of other reduced reporting requirements in future filings. As a result, the information that we provide to our stockholders may be different than you might receive from other public reporting companies in which you hold equity interests.

In addition, the JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. This allows an emerging growth company to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We are choosing to “opt in” to this extended transition period, which will ensure us additional time to adopt these new accounting standard updates.

8

THE OFFERING

| Shares being offered | 3,401,360 shares of common stock based on an assumed public offering price of $14.70 per share (the last reported sale price of our common stock on the Nasdaq Capital Market on September 8, 2021) | |

| Number of shares of common stock outstanding immediately before this offering | 5,045,181 shares | |

| Number of shares of common stock to be outstanding after this offering (1) | 8,446,541 shares (or 8,956,745 shares if the underwriters exercise the option to purchase additional shares in full) based on an assumed public offering price of $14.70 per share (the last reported sale price of our common stock on the Nasdaq Capital Market on September 8, 2021). See “Description of Share Capital”. | |

| Use of proceeds | We expect to receive net proceeds, after deducting underwriting discounts and commissions and estimated expenses payable by us, of approximately | |

| We intend to use substantially all of the net proceeds from this offering to fund research and development of our Epoladerm, Probudur, Envelta and | ||

| Underwriters’ over-allotment option | We have granted the underwriters a | |

| Shares of our common stock are listed on the Nasdaq Capital Market under the symbol “VRPX.” | ||

| Risk factors | Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page |

| (1) | The number of shares of our common stock to be outstanding immediately after this offering is based on shares of our common stock outstanding as of |

| ● | 669,067 shares of common stock issuable upon exercise of stock options outstanding as of |

| ● |

| ● | ||

Unless otherwise indicated, this prospectus reflects and assumes the following:

| ● | no exercise of outstanding options or warrants described |

| ● | no exercise by the |

9

SUMMARY SELECTED FINANCIAL DATA

You should read the following summary selected financial data together with our financial statements and the related notes appearing at the end of this prospectus and the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section of this prospectus. We have derived the statement of operations data for the years ended December 31, 20192020 and December 31, 20182019 from our audited financial statements appearing at the end of this prospectus. We have derived the statement of operations data for the six months ended June 30, 20202021 and 20192020 and the balance sheet data as of June 30, 20202021 from our unaudited interim condensed financial statements appearing at the end of this prospectus. Our historical results are not necessarily indicative of results that should be expected in any future period.

| Year Ended December 31, | Six Months Ended June 30, | Year Ended December 31, | Six Months Ended June 30, | |||||||||||||||||||||||||||||

| 2019 | 2018 | 2020 | 2019 | 2020 | 2019 | 2021 | 2020 | |||||||||||||||||||||||||

| Statement of Operations Data: | ||||||||||||||||||||||||||||||||

| Operating expenses: | ||||||||||||||||||||||||||||||||

| General and administrative | $ | 2,559,127 | $ | 1,483,786 | $ | 1,510,835 | $ | 1,364,326 | $ | 2,904,104 | $ | 2,559,127 | $ | 3,262,544 | $ | 1,510,835 | ||||||||||||||||

| Research and development | 622,741 | 1,142,176 | 335,553 | 154,559 | 1,291,615 | 622,741 | 1,391,565 | 335,553 | ||||||||||||||||||||||||

| Total operating expenses | 3,181,868 | 2,625,962 | 1,846,388 | 1,518,885 | 4,195,719 | 3,181,868 | 4,654,109 | 1,846,388 | ||||||||||||||||||||||||

| Loss from operations | (3,181,868 | ) | (2,625,962 | ) | (1,846,388 | ) | (1,518,885 | ) | (4,195,719 | ) | (3,181,868 | ) | (4,654,109 | ) | (1,846,388 | ) | ||||||||||||||||

| Other income (expense): | ||||||||||||||||||||||||||||||||

| Interest expense | (124,644 | ) | (14,976 | ) | (83,891 | ) | (55,637 | ) | (147,934 | ) | (124,644 | ) | (64,748 | ) | (83,891 | ) | ||||||||||||||||

| Other income | - | - | 4,000 | - | 4,000 | — | (3,833 | ) | 4,000 | |||||||||||||||||||||||

| Total other income (expense) | (143,934 | ) | (124,644 | ) | (68,581 | ) | (79,891 | ) | ||||||||||||||||||||||||

| Net loss | $ | (3,306,512 | ) | $ | (2,640,938 | ) | $ | (1,926,279 | ) | $ | (1,574,522 | ) | $ | (4,339,653 | ) | $ | (3,306,512 | ) | $ | (4,722,690 | ) | $ | (1,926,279 | ) | ||||||||

| Net loss per common share—basic and diluted(1) | $ | (0.23 | ) | $ | (0.19 | ) | $ | (0.13 | ) | $ | (0.11 | ) | ||||||||||||||||||||

| Weighted average common shares outstanding—basic and diluted(1) | 14,481,487 | 14,035,316 | 15,152,543 | 14,275,073 | ||||||||||||||||||||||||||||

| Net loss per common share – basic and diluted(1) | $ | (1.40 | ) | $ | (1.13 | ) | $ | (1.06 | ) | $ | (0.63 | ) | ||||||||||||||||||||

| Weighted average common shares outstanding – basic and diluted(1) | 3,107,502 | 2,929,005 | 4,454,877 | 3,065,636 | ||||||||||||||||||||||||||||

| (1) | See Note 2 to our audited and unaudited financial statements appearing at the end of this prospectus for further details on the calculation of basic and diluted net loss per common share. |

| June 30, 2021 | ||||||||||||||||

| Actual | Adjusted (1) | Actual | As Adjusted(1) | |||||||||||||

| (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | |||||||||||||

| Balance Sheet Data: | ||||||||||||||||

| Cash | $ | 416,909 | $ | $ | 10,466,774 | $ | 56,690,274 | |||||||||

| Working capital | $ | (2,714,370 | ) | $ | $ | 8,557,320 | $ | 54,780,820 | ||||||||

| Total assets | $ | 898,152 | $ | $ | 11,387,696 | $ | 57,611,196 | |||||||||

| Notes payable and related party notes payable | $ | 1,463,663 | $ | $ | 1,072,100 | $ | 1,072,100 | |||||||||

| Accumulated deficit | $ | (8,234,470 | ) | $ | $ | (15,370,534 | ) | $ | (15,370,534 | ) | ||||||

| Stockholders’ (deficit) equity | $ | 7,535,730 | $ | 53,759,230 | ||||||||||||

| (1) |

10

RISK FACTORS

An investment in our common stock is speculative, illiquid and involves a high degree of risk including the risk of a loss of your entire investment. You should carefully consider the risks and uncertainties described below and the other information contained in this prospectus. The risks set forth below are not the only ones facing us. Additional unanticipated or unknown risks and uncertainties may exist that could also adversely affect our business, operations and financial condition in ways that are unknown to us or unpredictable. If any of the following risks actually materialize, our business, financial condition and/or operations could suffer. In such event, the value of our common stock could decline, and you could lose all or a substantial portion of the money that you pay for our common stock.

Risks Related to Our Financial Position and Need for Additional Capital

We are a preclinical stage biopharmaceutical company with a limited operating history.

We were established and began operations in 2017. Our operations to date have been limited to financing and staffing our company, licensing product candidates, conducting preclinical and clinical studies of Epoladerm for acute musculoskeletal pain, Probudur for postoperative hip and knee replacement pain management, and NES100Envelta for the management of acute and chronic pain.pain, including pain associated with cancer, and AnQlar as an anti-viral barrier to potentially prevent or reduce the risk or the intensity of viral infections in humans. We have not yet demonstrated the ability to successfully complete a large-scale, pivotal clinical trial, obtain marketing approval, manufacture a commercial scale product, arrange for a third party to do so on our behalf, or conduct sales and marketing activities necessary for successful product commercialization. Consequently, predictions about our future success or viability may not be as accurate as they could be if we had a history of successfully developing and commercializing pharmaceutical products.

Accordingly, you should consider our prospects in light of the costs, uncertainties, delays and difficulties frequently encountered by companies in the early stages of development, especially earlypreclinical stage clinical pharmaceutical companies such as ours. Potential investors should carefully consider the risks and uncertainties that a company with a limited operating history will face. In particular, potential investors should consider that we cannot assure you that we will be able to, among other things:

| ● | successfully implement or execute our current business plan, and we cannot assure you that our business plan is sound; |

| ● | successfully manufacture our clinical product candidates and establish commercial supply; |

| ● | successfully complete the clinical trials necessary to obtain regulatory approval for the marketing of our product candidates; |

| ● | secure market exclusivity and/or adequate intellectual property protection for our product candidates; |

| ● | attract and retain an experienced management and advisory team; |

| ● | secure acceptance of our product candidates in the medical community and with third-party payors and consumers; |

| ● | raise sufficient funds in the capital markets or otherwise to effectuate our business plan; and |

| ● | utilize the funds that we do have and/or raise in this offering or in the future to efficiently execute our business strategy. |

If we cannot successfully execute any one of the foregoing, our business may fail and your investment will be adversely affected.

We have incurred losses since inception and anticipate that we will continue to incur losses for the foreseeable future. We are not currently profitable, and we may never achieve or sustain profitability.

We are a preclinical stage biopharmaceutical company with a limited operating history and have incurred losses since our formation. We incurred net losses of approximately $3.3$4.3 million and approximately $2.6$3.3 million for the years ended December 31, 20192020 and 2018,2019, respectively, and incurred net losses of approximately $1.9$4.7 million and approximately $1.6$1.9 million for the six months ended June 30, 20202021 and 2019,2020, respectively. As of June 30, 2020,2021, we had an accumulated loss of approximately $8.2$15.4 million. We have not commercialized any product candidates and have never generated revenue from the commercialization of any product. To date, we have devoted most of our financial resources to research and development, including our preclinical and clinical work, and to intellectual property.

We expect to incur significant additional operating losses for the next several years, at least, as we advance Epoladerm, Probudur, Envelta and NES100AnQlar through clinical development, complete clinical trials, seek regulatory approval and commercialize Epoladerm, Probudur, Envelta and NES100,AnQlar, if approved. The costs of advancing product candidates into each clinical phase tend to increase substantially over the duration of the clinical development process. Therefore, the total costs to advance any of our product candidates to marketing approval in even a single jurisdiction will be substantial. Because of the numerous risks and uncertainties associated with pharmaceutical product development, we are unable to accurately predict the timing or amount of increased expenses or when, or if, we will be able to begin generating revenue from the commercialization of any products or achieve or maintain profitability. Our expenses will also increase substantially if and as we:

| ● | are required by the FDA, to complete Phase 1 trials in Epoladerm, Envelta and AnQlar and Phase 2 trials to support an NDA for |

| ● | are required by the FDA to complete Phase 3 trials to support NDAs for Epoladerm, Probudur, Envelta and |

| ● | establish a sales, marketing and distribution infrastructure to commercialize our drugs, if approved, and for any other product candidates for which we may obtain marketing approval; |

| ● | maintain, expand and protect our intellectual property portfolio; |

| ● | hire additional clinical, scientific and commercial personnel; |

| ● | add operational, financial and management information systems and personnel, including personnel to support our product development and planned future commercialization efforts, as well as to support our transition to a public reporting company; and |

| ● | acquire or in-license or invent other product candidates or technologies. |

Furthermore, our ability to successfully develop, commercialize and license any product candidates and generate product revenue is subject to substantial additional risks and uncertainties, as described under “Risks Related to Development, Clinical Testing, Manufacturing and Regulatory Approval” and “Risks Related to Commercialization.” As a result, we expect to continue to incur net losses and negative cash flows for the foreseeable future. These net losses and negative cash flows have had, and will continue to have, an adverse effect on our stockholders’ equity and working capital. The amount of our future net losses will depend, in part, on the rate of future growth of our expenses and our ability to generate revenues. If we are unable to develop and commercialize one or more product candidates, either alone or through collaborations, or if revenues from any product that receives marketing approval are insufficient, we will not achieve profitability. Even if we do achieve profitability, we may not be able to sustain profitability or meet outside expectations for our profitability. If we are unable to achieve or sustain profitability or to meet outside expectations for our profitability, the value of our common stock will be materially and adversely affected.

Even if this offering is successful, we will require additional capital to fund our operations, and if we fail to obtain necessary financing, we may not be able to complete the development and commercialization of our drugs.

Our operations have consumed substantial amounts of cash since inception. We expect to continue to spend substantial amounts to advance the clinical development of and launch and commercialize our product candidates if we receive regulatory approval. Following this offering, we will require additional capital for the further development and potential commercialization of Epoladerm, Probudur, Envelta and NES100AnQlar and may also need to raise additional funds sooner to pursue a more accelerated development of Epoladerm, Probudur, Envelta and NES100.AnQlar. If we are unable to raise capital when needed or on attractive terms, we could be forced to delay, reduce or eliminate our research and development programs or any future commercialization efforts.

We believe that the net proceeds from this offering will enable us to fund our operating expense requirements for at least 12 monthsthrough December 2024 following the closing of this offering. We have based this estimate on assumptions that may prove to be wrong, and we could deploy our available capital resources sooner than we currently expect. Our future funding requirements, both near and long-term, will depend on many factors, including, but not limited to the:

| ● | initiation, progress, timing, costs and results of preclinical studies and clinical trials, including patient enrollment in such trials, for Epoladerm, Probudur, Envelta and |

| ● | clinical development plans we establish for Epoladerm, Probudur, Envelta and |

| ● | obligation to make royalty and non-royalty sublicense receipt payments to third-party licensors, if any, under our licensing agreements; |

| ● | number and characteristics of product candidates that we discover or in-license and develop; |

| ● | outcome, timing and cost of regulatory review by the FDA and comparable foreign regulatory authorities, including the potential for the FDA or comparable foreign regulatory authorities to require that we perform more studies than those that we currently expect; |

| ● | costs of filing, prosecuting, defending and enforcing any patent claims and maintaining and enforcing other intellectual property rights; |

| ● | effects of competing technological and market developments; |

| ● | costs and timing of the implementation of commercial-scale manufacturing activities; |

| ● | costs and timing of establishing sales, marketing and distribution capabilities for any product candidates for which we may receive regulatory approval; and |

| ● | cost associated with being a public company. |

If we are unable to expand our operations or otherwise capitalize on our business opportunities due to a lack of capital, our ability to become profitable will be compromised.

Our independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern.

Our recurring losses from operations raise substantial doubt about our ability to continue as a going concern. As a result, our independent registered public accounting firm included an explanatory paragraph in its report on our financial statements for the year ended December 31, 2019 with respect to this uncertainty. Our ability to continue as a going concern will require us to obtain additional funding.

Raising additional capital may cause dilution to our stockholders, including purchasers of common stock in this offering, restrict our operations or require us to relinquish rights to our technologies or product candidates.

Until such time, if ever, as we can generate substantial revenue, we may finance our cash needs through a combination of equity offerings, debt financings, marketing and distribution arrangements and other collaborations, strategic alliances and licensing arrangements or other sources. We do not currently have any committed external source of funds. In addition, we may seek additional capital due to favorable market conditions or strategic considerations, even if we believe that we have sufficient funds for our current or future operating plans.

To the extent that we raise additional capital through the sale of equity or convertible debt securities, your ownership interest will be diluted, and the terms of these securities may include liquidation or other preferences that adversely affect your rights as a common stockholder. Debt financing and preferred equity financing, if available, may involve agreements that include covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making capital expenditures or declaring dividends. If we raise additional funds through collaborations, strategic alliances or marketing, distribution or licensing arrangements with third parties, we may be required to relinquish valuable rights to our technologies, intellectual property, future revenue streams or product candidates or grant licenses on terms that may not be favorable to us. If we are unable to raise additional funds through equity or debt financings when needed, we may be required to delay, limit, reduce or terminate product candidate development or future commercialization efforts.

Changes in U.S. tax law may materially adversely affect our financial condition, results of operations and cash flows.

On March 27, 2020, the Coronavirus Aid, Relief, and Economic Security Act, or the CARES Act, was signed into law to address the COVID-19 crisis. The CARES Act is an approximately $2 trillion emergency economic stimulus package that includes numerous U.S. federal income tax provisions, including the modification of: (i) net operating loss rules (as discussed below), (ii) the alternative minimum tax refund and (iii) business interest deduction limitations under Section 163(j) of the Internal Revenue Code of 1986, as amended, or the Code.

On December 22, 2017, President Trump signed into law federal tax legislation commonly referred to as the TCJA (defined below), which also significantly changed the U.S. federal income taxation of U.S. corporations. TCJA remains unclear in many respects and has been, and may continue to be, subject to amendments and technical corrections, as well as interpretations and implementing regulations by the Treasury and Internal Revenue Service, or the IRS, any of which could lessen or increase certain adverse impacts of TCJA. In addition, it is unclear how these U.S. federal income tax changes will affect state and local taxation, which often uses federal taxable income as a starting point for computing state and local tax liabilities.

While some of these U.S. federal income tax changes may adversely affect us in one or more reporting periods and prospectively, other changes may be beneficial on a going-forward basis. We continue to work with our tax advisors and auditors to determine the full impact TCJA and the CARES Act will have on us. We urge our investors to consult with their legal and tax advisors with respect to both TCJA and the CARES Act and the potential tax consequences of investing in our common stock.

Our ability to use our net operating loss carryforwards to offset future taxable income may be subject to certain limitations.

Our net operating loss carryforwards (“NOLs”), and certain other tax attributes could expire unused and be unavailable to offset future income tax liabilities because of their limited duration or because of restrictions under U.S. tax law. AsFrom the total of our federal NOL of $6,951,000 as of December 31, 2019, we had NOLs of approximately $4.3 million for federal and state income tax purposes. Our federal NOL of2020, $326,000 expireexpires in 2037, (withand the remaining federal NOLs havingNOL has an indefinite expiration date) and ourcarryover period. Our state NOL’s of $4,387,000 begin to$6,951,000 expire afterfrom 2037 through 2039.2040.

Under TCJA (defined below), federal NOLs generated in tax years ending after December 31, 2017 may be carried forward indefinitely. Under the CARES Act, NOL carryforwards arising in tax years beginning after December 31, 2017 and before January 1, 2021 may be carried back to each of the five tax years preceding the tax year of such loss. Due to our cumulative losses through June 30, 2020,2021, we do not anticipate that such provision of the CARES Act will be relevant to us. The deductibility of federal NOLs, particularly for tax years beginning after December 31, 2020, may be limited. It is uncertain if and to what extent various states will conform to TCJA or the CARES Act.

In addition, our NOLs are subject to review and possible adjustment by the U.S. Internal Revenue Service, or IRS, and state tax authorities. In general, under Sections 382 and 383 of the Code, a corporation that undergoes an “ownership change” is subject to limitations on its ability to use its pre-change NOLs to offset future taxable income. Due to previous ownership changes, or if we undergo an ownership change in connection with or after this offering, our ability to use our NOLs could be limited by Section 382 of the Code. Future changes in our stock ownership, inclusive of a public offering and some of which are outside of our control, could result in an ownership change under Sections 382 and 383 of the Code. Furthermore, our ability to use NOLs of companies that we may acquire in the future may be subject to limitations. For these reasons, we may not be able to use a material portion of the NOLs, even if we attain profitability.

Our business, financial condition and results of operations may be adversely affected if we are unsuccessful in our current litigation with Sorrento Therapeutics, Inc. and Scilex Pharmaceuticals, Inc.