As filed with the Securities and Exchange Commission on April 21, 2016October 11, 2019

RegistrationFile No. 333-____________

333-233066

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,Washington, D.C. 20549

FORM S-1S-1/A

AMENDMENT NO. 3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

KIBUSH CAPITAL CORP.

(Exact name of registrant as specified in its charter)

| Nevada | ||||

(State or Incorporation or organization) | (Primary Standard Industrial Classification | (I.R.S. Employer Identification No.) |

7 Sarah Crescent

Templestowe, VIC 3106

Australia

+61 3 9846 42882215-B Renaissance Drive

Las Vegas, NV 89119

(61) 398464288

(Address, including zip code, and telephone number, including area code,

of registrant’s principalprinciple executive offices)

CSC Services of Nevada, Inc.Matheau J. W. Stout, Esq.

201 International Circle, Suite 230

2215-B Renaissance Dr.Hunt Valley, Maryland 21030

Las Vegas, NV 89119

(410) 429-7076

(Name, address, including zip code, and telephone number,

including area code,

of agent for service)

with copies to:

Jonathan McGee, Esq.

McGee Law Firm, LLC

5635 N. Scottsdale Road, Suite 170

Scottsdale, Arizona 85250

(480) 729-6208

Approximate date of commencement of proposed sale to the public:As soon as practicable after the effective date hereof.this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: [X][ ]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | [ ] | Accelerated filer | [ ] | |

| Non-accelerated filer | [ ] | Smaller reporting company | [X] | |

| Emerging growth company | [X] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. [ ]

CALCULATION OF REGISTRATION FEECalculation of Registration Fee

| Title of each class of securities to be registered | Amount to be registered (1) (2) | Proposed maximum offering price per share (2) (3) | Proposed maximum aggregate offering price (2) (3) | Amount of registration fee (2) (3) | ||||||||||||

| Common Stock, $0.001 par value per share | 50,000,000 | $ | 0.0299 | $ | 1,495,000 | $ | 150.55 | |||||||||

| Title of each Class of Securities To be Registered | Amount to be registered (1) | Proposed maximum Offering price per share (2)(3)(4)(5) | Proposed maximum aggregate Offering price | Amount of registration fee | ||||||||||||

| Common Stock, $0.001 par value per share, to be offered by the issuer | 1,666,666,666 | $ | 0.0003 | $ | 500,000 | $ | 60.60 | |||||||||

| Total | 1,666,666,666 | 0.0003 | $ | 500,000 | $ | 60.60 | ||||||||||

| (1) | |

| (2) | |

| (3) | |

| (4) | The offering price has been estimated solely for |

| (5) | The offering price has been calculated as the |

The Registrant hereby amends this Registration Statementregistration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statementregistration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statementregistration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

PRELIMINARY PROSPECTUS

KIBUSH CAPITAL CORP.

1,666,666,666Shares of Common Stock Offered by the Company

$0.0003per share

This is the initial public offering of our common stock, par value $0.001 per share. We are selling up to 1,666,666,666 shares of our common stock.

This offering will terminate on the date which is 180 days from the effective date of this prospectus, although we may close the offering on any date prior if the offering is fully subscribed or upon the vote of our board of directors.

We currently expect the initial public offering price of the shares we are offering to be $0.0003 per share of our common stock.As of September 30, 2019, we do not have enough authorized shares of common stock to sell all 1,666,666,666 shares, and we expect to file for an increase of our authorized shares of common stock by filing Articles of Amendment in Nevada at such time as this becomes needed. Prior to offering our shares for sale, the Company intends to comply with the requirements of filing Schedule 14A with the SEC, which will detail the proposed increase in authorized shares of common stock, and which will detail the approval of the majority of shareholders of that proposal through the vote in favor of our CEO, Warren Sheppard.

The informationCompany is quoted on the OTC Pink market there is a limited established market for our stock. The offering price of the shares has been determined arbitrarily by us. The price does not bear any relationship to our assets, book value, earnings, or other established criteria for valuing a privately held company. In determining the number of shares to be offered and the offering price, we took into consideration our capital structure and the amount of money we would need to implement our business plans. Accordingly, the offering price should not be considered an indication of the actual value of our securities.

Investing in our common stock involves a high degree of risk. See “Risk Factors” for certain risks you should consider before purchasing any shares in this prospectus is not complete and may be changed. The selling stockholders shall not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective.offering. This prospectus is not an offer to sell these securities and it is not solicitingthe solicitation of an offer to buy these securities in any state or other jurisdiction where the offer orofferor sale is not permitted.

The offering is being conducted on a self-underwritten, best efforts basis, which means our management will attempt to sell the shares being offered hereby on behalf of the Company. There is no underwriter for this offering.

KIBUSH CAPITAL CORP.Completion of this offering is not subject to us raising a minimum offering amount. We do not have an arrangement to place the proceeds from this offering in an escrow, trust or similar account. Any funds raised from the offering will be immediately available to us for our immediate use.

50,000,000SHARES OF COMMON STOCK

This prospectus relates to the offer and sale, from time to time, of up to 50,000,000 shares of the common stock of Kibush Capital Corp., a Nevada corporation (the “Company”, “Kibush,” “we,” “us,” and “our”), by Blackbridge Capital, LLC, whom we refer to in this document as “Blackbridge Capital” or the “selling stockholder.” The shares being registered herein are comprised of an aggregate of 50,000,000 sharesAny purchaser of common stock that are issuable pursuant to a securities equity purchase agreement (the “Purchase Agreement”) that we entered into with Blackbridge Capital on December 4, 2014.

Pursuant toin the Purchase Agreement, from the date that the Securities and Exchange Commission has declared the Registration Statement of which this prospectus forms a part effective (the “Effective Date”) until the two-year anniversary thereof, we have the right to sell, from time to time, up to an aggregate of $3,000,000 in shares of common stock to Blackbridge Capital. The Company will control the timing and amount of future sales, if any, but we would be unable to sell shares to Blackbridge Capital if such purchase would result in its beneficial ownership equaling more than 9.99% of our outstanding common stock. The purchase price of the shares thatoffering may be sold to Blackbridge Capital under the Purchase Agreement will be equal toonly purchaser, given the lack of a 15% discount to market. The draw down request may be limited to the lesser of $250,000 or the 200% of the 10-day average daily trading volume multiplied by the lowest trading price during that 10-day period. Additional draw down requests may be made once Blackbridge Capital has liquidated any remaining shares from the prior draw down by the Company. For a more detailed description, see “Description of Purchase Agreement” below.minimum offering amount.

Because the actual date and price per share for the Company’s draw down right under the Purchase Agreement is unknown, the actual purchase price for the shares is unknown and there is no maximum amount of our shares that may be issued by the Company pursuant to the Purchase Agreement. Accordingly, we caution readers that, although we are registering 50,000,000 shares, the number of shares actually issued under the Purchase Agreement may be substantially greater than the number registered. Please refer to the section of this prospectus titled “Description of Purchase Agreement” for a more complete discussion of the Purchase Agreement and the terms by which we may issue additional shares of our common stock. Please refer to the section of this prospectus titled “Selling Stockholders” for additional information regarding the selling stockholder.

Our auditors have expressed substantial doubt as to our ability to continue as a going concern. We expect that we will need approximately $1,000,000 in capital to continue as a going concern for the next twelve months from the date of this prospectus. We intend to raise capital to fund our operations through sale of our common stock to Blackbridge Capital under the Purchase Agreement and through other private placements of our common stock.

We are not selling any shares of common stock in this offering. We, therefore, will not receive any proceeds from the sale of the shares by the selling stockholder. We will, however, receive proceeds from the sale, if any, of securities to the selling stockholder pursuant to our exercise of the draw down right under the Purchase Agreement.

The selling stockholder may sell common stock from time to timean “emerging growth company” as defined in the principal market on which the stock will be traded at the prevailing market price or in negotiated transactions. See “Plan of Distribution” for more information about how the selling stockholder may sell the shares of common stock being registered pursuant to this prospectus. Any participating broker-dealers may be deemed to be “underwriters” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”), and any commissions or discounts given to any such broker-dealer or affiliates of a broker-dealer may be regarded as underwriting commissions or discounts under the SecuritiesJumpstart Our Business Startups Act. The selling stockholder has informed us that it is not a broker-dealer, is not an affiliate of a broker dealer, and does not have any agreement or understanding, directly or indirectly, with any person to distribute our common stock. We have paid and will pay the expenses incurred in registering the shares, including legal and accounting fees.

Our common stock is currently quoted on the OTC Markets (OTC Pink) under the symbol “DLCR”. On April 19, 2016, the last quoted sale price of our common stock as reported on the OTC Markets was $0.0299 per share.

Investing in our securities involves significant risks, including those set forth in the “Risk Factors” section of this prospectus beginning on page 6.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or passed upon the adequacydetermined if this prospectus is truthful or accuracy of this prospectus.complete. Any representation to the contrary is a criminal offense.

The date ofCompany does not plan to use this offering prospectus is ____________, 2016before the effective date.

Proceeds to Company in Offering

Number of Shares | Offering Price (1) | Underwriting Discounts & Commissions | Gross Proceeds | |||||||||||||

| Per Share | ||||||||||||||||

| 25% of Offering Sold | 416,666,666 | $ | 0.0003 | $ | 0 | $ | 125,000 | |||||||||

| 50% of Offering sold | 833,333,333 | $ | 0.0003 | $ | 0 | $ | 250,000 | |||||||||

| 75% of Offering Sold | 1,249,999,999 | $ | 0.0003 | $ | 0 | $ | 375,000 | |||||||||

| Maximum Offering sold | 1,666,666,666 | $ | 0.0003 | $ | 0 | $ | 500,000 | |||||||||

| (1) | Assuming an initial public offering price of $0.0003 per share, as set forth on the cover page of this prospectus. |

Table of ContentsTABLE OF CONTENTS

| -3- |

You

ABOUT THIS PROSPECTUS

In making your investment decision, you should only rely only on the information contained or incorporated by reference in this prospectus. We have not authorized anyone to provide you with any other or different information.

If anyone provides you with information that is different from, or inconsistent with, the information in this prospectus, you should not rely on it. We have not authorizedbelieve the placement agent or any underwriters, brokers or dealers to make an offerinformation in this prospectus is materially complete and correct as of the securities in any jurisdiction wheredate on the offer is not permitted.

Youfront cover. We cannot, however, guarantee that the information will remain correct after that date. For that reason, you should not assume that the information in this prospectus is accurate only as of any date other than the date on the front cover and that it may not still be accurate on a later date. This document may only be used where it is legal to sell these securities. The information contained in this prospectus is current only as of its date, regardless of the time of delivery of this prospectus or of any sales of our shares of common stock.

You should not interpret the contents of this prospectus to be legal, business, investment or tax advice. You should consult with your own advisors for that type of advice and consult with them about the legal, tax, business, financial and other issues that you should consider before investing in our common stock.

This prospectus does not offer to sell, or ask for offers to buy, any shares of our common stock in any state or other jurisdiction in which such offer or solicitation would be unlawful or where the person making the offer is not qualified to do so.

No action is being taken in any jurisdictions outside the United States to permit a public offering of our common stock or possession or distribution of this prospectus in those jurisdictions. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about, and to observe, any restrictions that apply in those jurisdictions to this offering or the distribution of this prospectus. In this prospectus, unless the context otherwise denotes, references to “we,” “us,” “our,” and the “Company” refer to Kibush Capital Corp.

| -4- |

OFFERING SUMMARY, PERKS AND RISK FACTORS

| Type of Stock Offering: | Common Stock |

| Price Per Share: | $0.0003 |

| Minimum Investment: | $750.00per investor (2,500,000 Share of Common Stock) |

| Maximum Offering: | $500,000.00.The Company will not accept investments greater than the Maximum Offering amount. |

| Maximum Shares Offered: | 1,666,666,666 Shares of Common Stock,As of September 30, 2019, we do not have enough authorized shares of common stock to sell all 1,666,666,666 shares, and we expect to file for an increase of our authorized shares of common stock by filing a Schedule 14A with the SEC and Articles of Amendment in Nevada at such time as this becomes needed. |

| Use of Proceeds: | See the description in section entitled “USE OF PROCEEDS TO ISSUER” on page 19 herein. |

| Voting Rights: | The Shares have full voting rights. |

| Length of Offering: | Shares will be offered on a continuous basis until either (1) the maximum number of Shares or sold; (2) 180 days from the date of registration by the Commission, (3) if Company in its sole discretion extends the offering beyond 180 days from the date of registration by the Commission, or (4) the Company in its sole discretion withdraws this Offering. |

| Common Stock Outstanding | 443,354,541 Shares | |||

| Common Stock in this Offering | 1,666,666,666Shares | |||

| Stock to be outstanding after the offering (1)(2) | 2,110,021,207Shares |

| (1) | The total number of Shares of Common Stock assumes that the maximum number of Shares are sold in this offering. |

| (2) | As of September 30, 2019, we do not have enough authorized shares of common stock to sell all 1,666,666,666 shares, and we expect to file for an increase of our authorized shares of common stock by filing a Schedule 14A with the SEC and Articles of Amendment in Nevada at such time as this becomes needed. |

| -5- |

The Company may not be able to sell the Maximum Offering Amount.

The net proceeds of the Offering will be the gross proceeds of the Shares sold minus the expenses of the offering.

Our common stock is quoted on OTCMarkets.com under trading symbol “DLCR.” We are not listed on any trading market or stock exchange, and our ability to list our stock in the future is uncertain. Investors should not assume that the Offered Shares will be listed. A consistent public trading market for the shares may not develop.

There is no assurance Kibush Capital Corp. will be profitable, or that management’s opinion of the Company’s future prospects will not be outweighed in the by unanticipated losses, adverse regulatory developments and other risks. Investors should carefully consider the various risk factors below before investing in the Shares.

The purchase of the Company’s Common Stock involves substantial risks. You should carefully consider the following risk factors in addition to any other risks associated with this investment. The Shares offered by the Company constitute a highly speculative investment and you should be in an economic position to lose your entire investment. The risks listed do not necessarily comprise all those associated with an investment in the Shares and are not set out in any particular order of priority. Additional risks and uncertainties may also have an adverse effect on the Company’s business and your investment in the Shares. An investment in the Company may not be suitable for all recipients of this Prospectus. You are advised to consult an independent professional adviser or attorney who specializes in investments of this kind before making any decision to invest. You should consider carefully whether an investment in the Company is suitable in the light of your personal circumstances and the financial resources available to you.

The discussions and information in this Prospectus may contain both historical and forward- looking statements. To the extent that the Prospectus contains forward-looking statements regarding the financial condition, operating results, business prospects, or any other aspect of the Company’s business, please be advised that the Company’s actual financial condition, operating results, and business performance may differ materially from that projected or estimated by the Company in forward-looking statements. The Company has attempted to identify, in context, certain of the factors it currently believes may cause actual future experience and results may differ from the Company’s current expectations.

Before investing, you should carefully read and carefully consider the following risk factors:

CAUTIONARY NOTE REGARDING EXPLORATION STAGE STATUSRisks Relating to the Company and Its Business

The risks of Logging and Timber operations are

The Weather, the Rainy Season in PNG are intense and can cause major disruption and damage.

The Landowners whilst the company does everything possible to cover agreements with all Landowners, the risk is that those agreements need management to ensure parties meet their responsibilities.

The Equipment we are currently using is aged and susceptible to breakdowns during heavy usage.

The Company Has A History of Losses

The Company has suffered losses since its inception and there can be no assurance that the Company’s proposed plan of business can be realized in the manner contemplated and, if it cannot be, shareholders may lose all or a substantial part of their investment. There is no guarantee that it will ever realize any significant operating revenues or that its operations will ever be profitable.

| -6- |

The Company Is Dependent Upon Its Management, Key Personnel and Consultants to Execute the Business Plan

The Company’s success is heavily dependent upon the continued active participation of the Company’s current executive officers as well as other key personnel and consultants. Loss of the services of one or more of these individuals could have a material adverse effect upon the Company’s business, financial condition or results of operations. Further, the Company’s success and achievement of the Company’s growth plans depend on the Company’s ability to recruit, hire, train and retain other highly qualified technical and managerial personnel. Competition for qualified employees among companies in the healthy living, healthcare and online industries is intense, and the loss of any of such persons, or an inability to attract, retain and motivate any additional highly skilled employees required for the expansion of the Company’s activities, could have a materially adverse effect on it. The inability to attract and retain the necessary personnel, consultants and advisors could have a material adverse effect on the Company’s business, financial condition or results of operations.

Although Dependent Upon Certain Key Personnel, The Company Does Not Have Any Key Man Life Insurance Policies On Any Such People

The Company is dependent upon management in order to conduct its operations and execute its business plan; however, the Company has not purchased any insurance policies with respect to those individuals in the event of their death or disability. Therefore, should any of these key personnel, management or founders die or become disabled, the Company will not receive any compensation that would assist with such person’s absence. The loss of such person could negatively affect the Company and its operations.

The Company Is Subject To Income Taxes As Well As Non-Income Based Taxes, Such As Payroll, Sales, Use, Value-Added, Net Worth, Property And Goods And Services Taxes.

Significant judgment is required in determining our provision for income taxes and other tax liabilities. In the ordinary course of our business, there are many transactions and calculations where the ultimate tax determination is uncertain. Although the Company believes that our tax estimates will be reasonable: (i) there is no assurance that the final determination of tax audits or tax disputes will not be different from what is reflected in our income tax provisions, expense amounts for non-income based taxes and accruals and (ii) any material differences could have an adverse effect on our consolidated financial position and results of operations in the period or periods for which determination is made.

The Company Is Not Subject To Sarbanes-Oxley Regulations And Lack The Financial Controls And Safeguards Required Of Public Companies.

The Company does not have the internal infrastructure necessary, and is not required, to complete an attestation about our financial controls that would be required under Section 404 of the Sarbanes-Oxley Act of 2002. There can be no assurances that there are no significant deficiencies or material weaknesses in the quality of our financial controls. The Company expects to incur additional expenses and diversion of management’s time if and when it becomes necessary to perform the system and process evaluation, testing and remediation required in order to comply with the management certification and auditor attestation requirements.

The Company Has Engaged In Certain Transactions With Related Persons.

Please see the section of this Prospectus entitled “Interest of Management and Others in Certain Related-Party Transactions and Agreements”

Changes In Employment Laws Or Regulation Could Harm The Company’s Performance.

Various federal and state labor laws govern the Company’s relationship with our employees and affect operating costs. These laws may include minimum wage requirements, overtime pay, healthcare reform and the implementation of various federal and state healthcare laws, unemployment tax rates, workers’ compensation rates, citizenship requirements, union membership and sales taxes. A number of factors could adversely affect our operating results, including additional government-imposed increases in minimum wages, overtime pay, paid leaves of absence and mandated health benefits, mandated training for employees, changing regulations from the National Labor Relations Board and increased employee litigation including claims relating to the Fair Labor Standards Act.

| -7- |

The Company’s Bank Accounts Will Not Be Fully Insured

The Company’s regular bank accounts and the checking account used for this Offering each have federal insurance that is limited to a certain amount of coverage. It is anticipated that the account balances in each account may exceed those limits at times. In the event that any of Company’s banks should fail, the Company may not be able to recover all amounts deposited in these bank accounts.

The Company’s Business Plan Is Speculative

The Company’s present business and planned business are speculative and subject to numerous risks and uncertainties. There is no assurance that the Company will generate significant revenues or profits.

The Company Will Likely Incur Debt

The Company has incurred debt and expects to incur future debt in order to fund operations. Complying with obligations under such indebtedness may have a material adverse effect on the Company and on your investment.

The Company’s Expenses Could Increase Without a Corresponding Increase in Revenues

The Company’s operating and other expenses could increase without a corresponding increase in revenues, which could have a material adverse effect on the Company’s consolidated financial results and on your investment. Factors which could increase operating and other expenses include, but are not limited to (1) increases in the rate of inflation, (2) increases in taxes and other statutory charges, (3) changes in laws, regulations or government policies which increase the costs of compliance with such laws, regulations or policies, (4) significant increases in insurance premiums, and (5) increases in borrowing costs.

The Company Will Be Reliant On Key Suppliers

The Company intends to enter into agreements with key suppliers and will be reliant on positive and continuing relationships with such suppliers. Termination of those agreements, variations in their terms or the failure of a key supplier to comply with its obligations under these agreements (including if a key supplier were to become insolvent) could have a material adverse effect on the Company’s consolidated financial results and on your investment.

Increased Costs Could Affect The Company

An increase in the cost of raw materials or energy could affect the Company’s profitability. Commodity and other price changes may result in unexpected increases in the cost of raw materials, glass bottles and other packaging materials used by the Company. The Company may also be adversely affected by shortages of raw materials or packaging materials. In addition, energy cost increases could result in higher transportation, freight and other operating costs. The Company may not be able to increase its prices to offset these increased costs without suffering reduced volume, sales and operating profit, and this could have an adverse effect on your investment.

| -8- |

Inability to Maintain and Enhance Product Image

It is important that the Company maintains and enhances the image of its existing and new products. The image and reputation of the Company’s products may be impacted for various reasons including litigation, complaints from regulatory bodies resulting from quality failure, illness or other health concerns. Such concerns, even when unsubstantiated, could be harmful to the Company’s image and the reputation of its products. From time to time, the Company may receive complaints from customers regarding products purchased from the Company. The Company may in the future receive correspondence from customers requesting reimbursement. Certain dissatisfied customers may threaten legal action against the Company if no reimbursement is made. The Company may become subject to product liability lawsuits from customers alleging injury because of a purported defect in products or sold by the Company, claiming substantial damages and demanding payments from the Company. The Company is in the chain of title when it manufactures, supplies or distributes products, and therefore is subject to the risk of being held legally responsible for them. These claims may not be covered by the Company’s insurance policies. Any resulting litigation could be costly for the Company, divert management attention, and could result in increased costs of doing business, or otherwise have a material adverse effect on the Company’s business, results of operations, and financial condition. Any negative publicity generated as a result of customer complaints about the Company’s products could damage the Company’s reputation and diminish the value of the Company’s brand, which could have a material adverse effect on the Company’s business, results of operations, and financial condition, as well as your investment. Deterioration in the Company’s brand equity (brand image, reputation and product quality) may have a material adverse effect on its consolidated financial results as well as your investment.

If We Are Unable To Protect Effectively Our Intellectual Property, We May Not Be Able To Operate Our Business, Which Would Impair Our Ability To Compete

Our success will depend on our ability to obtain and maintain meaningful intellectual property protection for any such intellectual property. The names and/or logos of Company brands (whether owned by the Company or licensed to us) may be challenged by holders of trademarks who file opposition notices, or otherwise contest trademark applications by the Company for its brands. Similarly, domains owned and used by the Company may be challenged by others who contest the ability of the Company to use the domain name or URL. Such challenges could have a material adverse effect on the Company’s consolidated financial results as well as your investment.

Computer, Website or Information System Breakdown Could Affect The Company’s Business

Computer, website and/or information system breakdowns as well as cyber security attacks could impair the Company’s ability to service its customers leading to reduced revenue from sales and/or reputational damage, which could have a material adverse effect on the Company’s consolidated financial results as well as your investment.

Changes In The Economy Could Have a Detrimental Impact On The Company

Changes in the general economic climate could have a detrimental impact on consumer expenditure and therefore on the Company’s revenue. It is possible that recessionary pressures and other economic factors (such as declining incomes, future potential rising interest rates, higher unemployment and tax increases) may adversely affect customers’ confidence and willingness to spend. Any of such events or occurrences could have a material adverse effect on the Company’s consolidated financial results and on your investment.

The Amount Of Capital The Company Is Attempting To Raise In This Offering Is Not Enough To Sustain The Company’s Current Business Plan

In order to achieve the Company’s near and long-term goals, the Company will need to procure funds in addition to the amount raised in the Offering. There is no guarantee the Company will be able to raise such funds on acceptable terms or at all. If we are not able to raise sufficient capital in the future, we will not be able to execute our business plan, our continued operations will be in jeopardy and we may be forced to cease operations and sell or otherwise transfer all or substantially all of our remaining assets, which could cause you to lose all or a portion of your investment.

| -9- |

Additional Financing May Be Necessary For The Implementation Of Our Growth Strategy

The Company may require additional debt and/or equity financing to pursue our growth and business strategies. These include, but are not limited to enhancing our operating infrastructure and otherwise respond to competitive pressures. Given our limited operating history and existing losses, there can be no assurance that additional financing will be available, or, if available, that the terms will be acceptable to us. Lack of additional funding could force us to curtail substantially our growth plans. Furthermore, the issuance by us of any additional securities pursuant to any future fundraising activities undertaken by us would dilute the ownership of existing shareholders and may reduce the price of our Shares.

Our Employees, Executive Officers, Directors And Insider Shareholders Beneficially Own Or Control A Substantial Portion Of Our Outstanding Shares

Our employees, executive officers, directors and insider shareholders beneficially own or control a substantial portion of our outstanding type of stock, which may limit your ability and the ability of our other shareholders, whether acting alone or together, to propose or direct the management or overall direction of our Company. Additionally, this concentration of ownership could discourage or prevent a potential takeover of our Company that might otherwise result in an investor receiving a premium over the market price for his Shares. The majority of our currently outstanding Shares of stock is beneficially owned and controlled by a group of insiders, including our employees, directors, executive officers and inside shareholders. Accordingly, our employees, directors, executive officers and insider shareholders may have the power to control the election of our directors and the approval of actions for which the approval of our shareholders is required. If you acquire our Shares, you will have no effective voice in the management of our Company. Such concentrated control of our Company may adversely affect the price of our Shares. Our principal shareholders may be able to control matters requiring approval by our shareholders, including the election of directors, mergers or other business combinations. Such concentrated control may also make it difficult for our shareholders to receive a premium for their Shares in the event that we merge with a third party or enter into different transactions, which require shareholder approval. These provisions could also limit the price that investors might be willing to pay in the future for our Shares.

Our Operating Plan Relies In Large Part Upon Assumptions And Analyses Developed By The Company. If These Assumptions Or Analyses Prove To Be Incorrect, The Company’s Actual Operating Results May Be Materially Different From Our Forecasted Results

Whether actual operating results and business developments will be consistent with the Company’s expectations and assumptions as reflected in its forecast depends on a number of factors, many of which are outside the Company’s control, including, but not limited to:

| ● | whether the Company can obtain sufficient capital to sustain and grow its business |

| ● | our ability to manage the Company’s growth |

| ● | whether the Company can manage relationships with key vendors and advertisers |

| ● | demand for the Company’s products and services |

| ● | the timing and costs of new and existing marketing and promotional efforts |

| ● | competition |

| ● | the Company’s ability to retain existing key management, to integrate recent hires and to attract, retain and motivate qualified personnel |

| ● | the overall strength and stability of domestic and international economies |

| ● | consumer spending habits |

Unfavorable changes in any of these or other factors, most of which are beyond the Company’s control, could materially and adversely affect its business, consolidated results of operations and consolidated financial condition.

| -10- |

To Date, The Company Has Had Operating Losses And May Not Be Initially Profitable For At Least The Foreseeable Future, And Cannot Accurately Predict When It Might Become Profitable

The Company has been operating at a loss since the Company’s inception, but has recently operated at a profit. The Company may not be able to generate significant revenues in the future. In addition, the Company expects to incur substantial operating expenses in order to fund the expansion of the Company’s business. As a result, the Company expects to continue to experience substantial negative cash flow for at least the foreseeable future and cannot predict when, or even if, the Company might become profitable.

The Company May Be Unable To Manage Their Growth Or Implement Their Expansion Strategy

The Company may not be able to expand the Company’s product and service offerings, the Company’s markets, or implement the other features of the Company’s business strategy at the rate or to the extent presently planned. The Company’s projected growth will place a significant strain on the Company’s administrative, operational and financial resources. If the Company is unable to successfully manage the Company’s future growth, establish and continue to upgrade the Company’s operating and financial control systems, recruit and hire necessary personnel or effectively manage unexpected expansion difficulties, the Company’s consolidated financial condition and consolidated results of operations could be materially and adversely affected.

The Company Relies Upon Trade Secret Protection To Protect Its Intellectual Property; It May Be Difficult And Costly To Protect The Company’s Proprietary Rights And The Company May Not Be Able To Ensure Their Protection

The Company currently relies on trade secrets. While the Company uses reasonable efforts to protect these trade secrets, the Company cannot assure that its employees, consultants, contractors or advisors will not, unintentionally or willfully, disclose the Company’s trade secrets to competitors or other third parties. In addition, courts outside the United States are sometimes less willing to protect trade secrets. Moreover, the Company’s competitors may independently develop equivalent knowledge, methods and know-how. If the Company is unable to defend the Company’s trade secrets from others use, or if the Company’s competitors develop equivalent knowledge, it could have a material adverse effect on the Company’s business. Any infringement of the Company’s proprietary rights could result in significant litigation costs, and any failure to adequately protect the Company’s proprietary rights could result in the Company’s competitors offering similar products, potentially resulting in loss of a competitive advantage and decreased revenue. Existing patent, copyright, trademark and trade secret laws afford only limited protection. In addition, the laws of some foreign countries do not protect the Company’s proprietary rights to the same extent as do the laws of the United States. Therefore, the Company may not be able to protect the Company’s proprietary rights against unauthorized third-party use. Enforcing a claim that a third party illegally obtained and is using the Company’s trade secrets could be expensive and time consuming, and the outcome of such a claim is unpredictable. Litigation may be necessary in the future to enforce the Company’s intellectual property rights, to protect the Company’s trade secrets or to determine the validity and scope of the proprietary rights of others. This litigation could result in substantial costs and diversion of resources and could materially adversely affect the Company’s future operating results.

The Company’s Business Model Is Evolving

The Company’s business model is unproven and is likely to continue to evolve. Accordingly, the Company’s initial business model may not be successful and may need to be changed. The Company’s ability to generate significant revenues will depend, in large part, on the Company’s ability to successfully market the Company’s products to potential users who may not be convinced of the need for the Company’s products and services or who may be reluctant to rely upon third parties to develop and provide these products. The Company intends to continue to develop the Company’s business model as the Company’s market continues to evolve.

| -11- |

The Company Needs to Increase Brand Awareness

Due to a variety of factors, the Company’s opportunity to achieve and maintain a significant market share may be limited. Developing and maintaining awareness of the Company’s brand name, among other factors, is critical. Further, the importance of brand recognition will increase as competition in the Company’s market increases. Successfully promoting and positioning the Company’s brand, products and services will depend largely on the effectiveness of the Company’s marketing efforts. Therefore, the Company may need to increase the Company’s financial commitment to creating and maintaining brand awareness. If the Company fails to successfully promote the Company’s brand name or if the Company incurs significant expenses promoting and maintaining the Company’s brand name, it would have a material adverse effect on the Company’s consolidated results of operations.

The Company Faces Competition In The Company’s Markets From A Number Of Large And Small Companies, Some Of Which Have Greater Financial, Research And Development, Production And Other Resources Than Does The Company

In many cases, the Company’s competitors have longer operating histories, established ties to the market and consumers, greater brand awareness, and greater financial, technical and marketing resources. The Company’s ability to compete depends, in part, upon a number of factors outside the Company’s control, including the ability of the Company’s competitors to develop alternatives that are superior. If the Company fails to successfully compete in its markets, or if the Company incurs significant expenses in order to compete, it would have a material adverse effect on the Company’s consolidated results of operations.

A Data Security Breach Could Expose The Company To Liability And Protracted And Costly Litigation, And Could Adversely Affect The Company’s Reputation And Operating Revenues

To the extent that the Company’s activities involve the storage and transmission of confidential information, the Company and/or third-party processors will receive, transmit and store confidential customer and other information. Encryption software and the other technologies used to provide security for storage, processing and transmission of confidential customer and other information may not be effective to protect against data security breaches by third parties. The risk of unauthorized circumvention of such security measures has been heightened by advances in computer capabilities and the increasing sophistication of hackers. Improper access to the Company’s or these third parties’ systems or databases could result in the theft, publication, deletion or modification of confidential customer and other information. A data security breach of the systems on which sensitive account information is stored could lead to fraudulent activity involving the Company’s products and services, reputational damage, and claims or regulatory actions against us. If the Company is sued in connection with any data security breach, the Company could be involved in protracted and costly litigation. If unsuccessful in defending that litigation, the Company might be forced to pay damages and/or change the Company’s business practices or pricing structure, any of which could have a material adverse effect on the Company’s operating revenues and profitability. The Company would also likely have to pay fines, penalties and/or other assessments imposed as a result of any data security breach.

The Company Depends On Third-Party Providers For A Reliable Internet Infrastructure And The Failure Of These Third Parties, Or The Internet In General, For Any Reason Would Significantly Impair The Company’s Ability To Conduct Its Business

The Company will outsource some or all of its online presence and data management to third parties who host the actual servers and provide power and security in multiple data centers in each geographic location. These third-party facilities require uninterrupted access to the Internet. If the operation of the servers is interrupted for any reason, including natural disaster, financial insolvency of a third-party provider, or malicious electronic intrusion into the data center, its business would be significantly damaged. As has occurred with many Internet-based businesses, the Company may be subject to ‘denial-of-service’ attacks in which unknown individuals bombard its computer servers with requests for data, thereby degrading the servers’ performance. The Company cannot be certain it will be successful in quickly identifying and neutralizing these attacks. If either a third-party facility failed, or the Company’s ability to access the Internet was interfered with because of the failure of Internet equipment in general or if the Company becomes subject to malicious attacks of computer intruders, its business and operating results will be materially adversely affected.

| -12- |

The Company’s Employees May Engage In Misconduct Or Improper Activities

The Company, like any business, is exposed to the risk of employee fraud or other misconduct. Misconduct by employees could include intentional failures to comply with laws or regulations, provide accurate information to regulators, comply with applicable standards, report financial information or data accurately or disclose unauthorized activities to the Company. In particular, sales, marketing and business arrangements are subject to extensive laws and regulations intended to prevent fraud, misconduct, kickbacks, self-dealing and other abusive practices. These laws and regulations may restrict or prohibit a wide range of pricing, discounting, marketing and promotion, sales commission, customer incentive programs and other business arrangements. Employee misconduct could also involve improper or illegal activities which could result in regulatory sanctions and serious harm to the Company’s reputation.

Limitation On Director Liability

The Company may provide for the indemnification of directors to the fullest extent permitted by law and, to the extent permitted by such law, eliminate or limit the personal liability of directors to the Company and its shareholders for monetary damages for certain breaches of fiduciary duty. Such indemnification may be available for liabilities arising in connection with this Offering. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling the Company pursuant to the foregoing provisions, the Company has been informed that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

Risks Relating to This Offering and Investment

The Company May Undertake Additional Equity or Debt Financing That May Dilute The Shares In This Offering

The Company may undertake further equity or debt financing, which may be dilutive to existing shareholders, including you, or result in an issuance of securities whose rights, preferences and privileges are senior to those of existing shareholders, including you, and also reducing the value of Shares subscribed for under this Offering.

An Investment In The Shares Is Speculative And There Can Be No Assurance Of Any Return On Any Such Investment

An investment in the Company’s Shares is speculative, and there is no assurance that investors will obtain any return on their investment. Investors will be subject to substantial risks involved in an investment in the Company, including the risk of losing their entire investment.

The Shares Are Offered On A “Best Efforts” Basis And The Company May Not Raise The Maximum Amount Being Offered

Since the Company is offering the Shares on a “best efforts” basis, there is no assurance that the Company will sell enough Shares to meet its capital needs. If you purchase Shares in this Offering, you will do so without any assurance that the Company will raise enough money to satisfy the full Use Of Proceeds To Issuer which the Company has outlined in this Prospectus or to meet the Company’s working capital needs.

| -13- |

If The Maximum Offering Is Not Raised, It May Increase The Amount Of Long-Term Debt Or The Amount Of Additional Equity It Needs To Raise

There is no assurance that the maximum amount of Shares in this offering will be sold. If the maximum Offering amount is not sold, we may need to incur additional debt or raise additional equity in order to finance our operations. Increasing the amount of debt will increase our debt service obligations and make less cash available for distribution to our shareholders. Increasing the amount of additional equity that we will have to seek in the future will further dilute those investors participating in this Offering.

We Have Not Paid Dividends In The Past And Do Not Expect To Pay Dividends In The Future, So Any Return On Investment May Be Limited To The Value Of Our Shares

We have never paid cash dividends on our Shares and do not anticipate paying cash dividends in the foreseeable future. The payment of dividends on our Shares will depend on earnings, financial condition and other business and economic factors affecting it at such time that management may consider relevant. If we do not pay dividends, our Shares may be less valuable because a return on your investment will only occur if its stock price appreciates.

The Company May Not Be Able To Obtain Additional Financing

Even if the Company is successful in selling the maximum number of Shares in the Offering, the Company may require additional funds to continue and grow its business. The Company may not be able to obtain additional financing as needed, on acceptable terms, or at all, which would force the Company to delay its plans for growth and implementation of its strategy which could seriously harm its business, financial condition and results of operations. If the Company needs additional funds, the Company may seek to obtain them primarily through additional equity or debt financings. Those additional financings could result in dilution to the Company’s current shareholders and to you if you invest in this Offering.

The Offering Price Has Been Arbitrary Determined

The offering price of the Shares has been arbitrarily established by the Company based upon its present and anticipated financing needs and bears no relationship to the Company’s present financial condition, assets, book value, projected earnings, or any other generally accepted valuation criteria. The offering price of the Shares may not be indicative of the value of the Shares or the Company, now or in the future.

The Management Of The Company Has Broad Discretion In Application of Proceeds

The management of the Company has broad discretion to adjust the application and allocation of the net proceeds of this offering in order to address changed circumstances and opportunities. As a result of the foregoing, the success of the Company will be substantially dependent upon the discretion and judgment of the management of the Company with respect to the application and allocation of the net proceeds hereof.

| -14- |

An Investment in the Company’s Shares Could Result In A Loss of Your Entire Investment

An investment in the Company’s Shares offered in this Offering involves a high degree of risk and you should not purchase the Shares if you cannot afford the loss of your entire investment. You may not be able to liquidate your investment for any reason in the near future.

There Is No Assurance The Company Will Be Able To Pay Distributions To Shareholders

While the Company may choose to pay distributions at some point in the future to its shareholders, there can be no assurance that cash flow and profits will allow such distributions to ever be made.

There a Limited Public Trading Market for the Company’s Shares

At present, the Company’s common stock is quoted on OTCMarkets.com under the trading symbol “DLCR.” Our common stock experiences fluctuation in volume and trading prices. There is no consistent and active trading market for the Company’s securities and the Company cannot assure that a consistent trading market will develop. OTCMarkets.com provides significantly less liquidity than a securities exchange such as the NASDAQ Stock Market. Prices for securities traded solely on OTCMarkets.com may be difficult to obtain and holders of the Shares and the Company’s securities may be unable to resell their securities at or near their original price or at any price. In any event, except to the extent that investors’ Shares may be registered on a Form S-1 Registration Statement with the Securities and Exchange Commission in the future, there is absolutely no assurance that Shares could be sold under Rule 144 or otherwise until the Company becomes a current public reporting company with the Securities and Exchange Commission and otherwise is current in the Company’s business, financial and management information reporting, and applicable holding periods have been satisfied.

Sales Of A Substantial Number Of Shares Of Our Type Of Stock May Cause The Price Of Our Type Of Stock To Decline

If our shareholders sell substantial amounts of our Shares in the public market, Shares sold may cause the price to decrease below the current offering price. These sales may also make it more difficult for us to sell equity or equity-related securities at a time and price that we deem reasonable or appropriate.

The Company Has Made Assumptions In Its Projections and In Forward-Looking Statements That May Not Be Accurate

The discussions and information in this Prospectus may contain both historical and “forward- looking statements” which can be identified by the use of forward-looking terminology including the terms “believes,” “anticipates,” “continues,” “expects,” “intends,” “may,” “will,” “would,” “should,” or, in each case, their negative or other variations or comparable terminology. You should not place undue reliance on forward-looking statements. These forward-looking statements include matters that are not historical facts. Forward-looking statements involve risk and uncertainty because they relate to future events and circumstances. Forward-looking statements contained in this Prospectus, based on past trends or activities, should not be taken as a representation that such trends or activities will continue in the future. To the extent that the Prospectus contains forward-looking statements regarding the financial condition, operating results, business prospects, or any other aspect of the Company’s business, please be advised that the Company’s actual financial condition, operating results, and business performance may differ materially from that projected or estimated by the Company. The Company has attempted to identify, in context, certain of the factors it currently believes may cause actual future experience and results to differ from its current expectations. The differences may be caused by a variety of factors, including but not limited to adverse economic conditions, lack of market acceptance, reduction of consumer demand, unexpected costs and operating deficits, lower sales and revenues than forecast, default on leases or other indebtedness, loss of suppliers, loss of supply, loss of distribution and service contracts, price increases for capital, supplies and materials, inadequate capital, inability to raise capital or financing, failure to obtain customers, loss of customers and failure to obtain new customers, the risk of litigation and administrative proceedings involving the Company or its employees, loss of government licenses and permits or failure to obtain them, higher than anticipated labor costs, the possible acquisition of new businesses or products that result in operating losses or that do not perform as anticipated, resulting in unanticipated losses, the possible fluctuation and volatility of the Company’s operating results and financial condition, adverse publicity and news coverage, inability to carry out marketing and sales plans, loss of key executives, changes in interest rates, inflationary factors, and other specific risks that may be referred to in this Prospectus or in other reports issued by us or by third-party publishers.

| -15- |

You Should Be Aware Of The Long-Term Nature Of This Investment

Because the Shares have not been registered under the Securities Act or under the securities laws of any state or non-United States jurisdiction, the Shares may have certain transfer restrictions. It is not currently contemplated that registration under the Securities Act or other securities laws will be effected. Limitations on the transfer of the Shares may also adversely affect the price that you might be able to obtain for the Shares in a private sale. You should be aware of the long-term nature of your investment in the Company. You will be required to represent that you are purchasing the Securities for your own account, for investment purposes and not with a view to resale or distribution thereof.

Neither The Offering Nor The Securities Have Been Registered Under Federal Or State Securities Laws, Leading To An Absence Of Certain S-1pplicable To The Company

The Company also has relied on exemptions from securities registration requirements under applicable state and federal securities laws. Investors in the Company, therefore, will not receive any of the benefits that such registration would otherwise provide. Prospective investors must therefore assess the adequacy of disclosure and the fairness of the terms of this Offering on their own or in conjunction with their personal advisors.

The Shares In This Offering Have No Protective Provisions.

The Shares in this Offering have no protective provisions. As such, you will not be afforded protection, by any provision of the Shares or as a Shareholder in the event of a transaction that may adversely affect you, including a reorganization, restructuring, merger or other similar transaction involving the Company. If there is a ‘liquidation event’ or ‘change of control’ the Shares being offered do not provide you with any protection. In addition, there are no provisions attached to the Shares in the Offering that would permit you to require the Company to repurchase the Shares in the event of a takeover, recapitalization or similar transaction.

You Will Not Have Significant Influence On The Management Of The Company

Substantially all decisions with respect to the management of the Company will be made exclusively by the officers, directors, managers or employees of the Company. You will have a very limited ability, if at all, to vote on issues of Company management and will not have the right or power to take part in the management of the Company and will not be represented on the board of directors or by managers of the Company. Accordingly, no person should purchase Shares unless he or she is willing to entrust all aspects of management to the Company.

No Guarantee of Return on Investment

There is no assurance that you will realize a return on your investment or that you will not lose your entire investment. For this reason, you should read this Form S-1, Prospectus and all exhibits and referenced materials carefully and should consult with your own attorney and business advisor prior to making any investment decision.

IN ADDITION TO THE RISKS LISTED ABOVE, BUSINESSES ARE OFTEN SUBJECT TO RISKS NOT FORESEEN OR FULLY APPRECIATED BY THE MANAGEMENT. IT IS NOT POSSIBLE TO FORESEE ALL RISKS THAT MAY AFFECT THE COMPANY. MOREOVER, THE COMPANY CANNOT PREDICT WHETHER THE COMPANY WILL SUCCESSFULLY EFFECTUATE THE COMPANY’S CURRENT BUSINESS PLAN. EACH PROSPECTIVE PURCHASER IS ENCOURAGED TO CAREFULLY ANALYZE THE RISKS AND MERITS OF AN INVESTMENT IN THE SECURITIES AND SHOULD TAKE INTO CONSIDERATION WHEN MAKING SUCH ANALYSIS, AMONG OTHER FACTORS, THE RISK FACTORS DISCUSSED ABOVE.

| -16- |

The term ‘dilution’ refers to the reduction (as a percentage of the aggregate Shares outstanding) that occurs for any given share of stock when additional Shares are issued. If all of the Shares in this offering are fully subscribed and sold, the Shares offered herein will constitute approximately 36.36 % of the total Shares of stock of the Company. The Company anticipates that subsequent to this offering the Company may require additional capital and such capital may take the form of Common Stock, other stock or securities or debt convertible into stock. Such future fund raising will further dilute the percentage ownership of the Shares sold herein in the Company.

If you invest in our Common Stock, your interest will be diluted immediately to the extent of the difference between the offering price per share of our Common Stock and the pro forma net tangible book value per share of our Common Stock after this offering. As of the date of this Offering, the net tangible book value of the Company was approximately $-3,252,130, based on the number of Shares of Common Stock [i/o common] issued and outstanding. as of the date of this Prospectus, that equates to a net tangible book value of approximately $-.0073per share of Common Stock on a pro forma basis. Net tangible book value per share consists of shareholders’ equity adjusted for the retained earnings (deficit), divided by the total number of Shares of Common Stock outstanding. The pro forma net tangible book value, assuming full subscription in this Offering, would be $.0046 per share of Common Stock.

Thus, if the Offering is fully subscribed, the net tangible book value per share of Common Stock owned by our current shareholders will have immediately increased by approximately $0.0027 without any additional investment on their part and the net tangible book value per Share for new investors will be immediately diluted to $-.0046 per Share. These calculations do not include the costs of the offering, and such expenses will cause further dilution.

The following table illustrates this per Share dilution:

| Offering price per Share* | $ | 0.0003 | ||

| Net Tangible Book Value per Share before Offering (based on 443,354,541 | $ | -.0073 | ||

| Decrease in Net Tangible Book Value per Share Attributable to Shares Offered Hereby (based on 250,000,000 Shares) | $ | (.-013 | ) | |

| Net Tangible Book Value per Share after Offering (based on 693,354,541 Shares) | $ | -.0046 | ||

| Dilution of Net Tangible Book Value per Share to Purchasers in this Offering | $ | -.013 |

*Before deduction of offering expenses

There is no material disparity between the price of the Shares in this Offering and the effective cash cost to officers, directors, promoters and affiliated persons for shares acquired by them in a transaction during the past year, or that they have a right to acquire.

PLAN OF DISTRIBUTION

We are considered an “exploration stage” company under the U.S. Securities and Exchange Commission (“SEC”) Industry Guide 7, Descriptionoffering a Maximum Offering of Property by Issuers Engagedup to 1,666,666,666 in Shares of our Common Stock. The offering is being conducted on a best-efforts basis without any minimum number of shares or amount of proceeds required to be Engaged in Significant Mining Operations (“Industry Guide 7”), because wesold. There is no minimum subscription amount required. The Company will not initially sell the Shares through commissioned broker-dealers, but may do not have reserves as defined under Industry Guide 7. Reserves are defined in Guide 7 as that part of a mineral deposit which can be economically and legally extracted or produced atso after the timecommencement of the reserve determination.offering. Any such arrangement will add to our expenses in connection with the offering. If we engage one or more commissioned sales agents or underwriters, we will supplement this Form S-1 to describe the arrangement. The establishment of reserves under Guide 7 requires, among other things, certain spacing of exploratory drill holesCompany will undertake one or more closings on a rolling basis as funds are received from investors. Funds tendered by investors will be deposited in the Company’s checking account. All subscribers will be instructed by the Company or its agents to establishtransfer funds by wire, credit or debit cards or ACH transfer directly to the required continuity of mineralization and the completion of a detailed cost or feasibility study.

Because weCompany. Except as stated above, subscribers have no reserves as definedright to a return of their funds. The Company may terminate the offering at any time for any reason at its sole discretion, and may extend the Offering past the termination date of 180 days from the date of registration by the Commission in Industry Guide 7, we have not exited the exploration stageabsolute discretion of the Company and continue to report our financial information as an exploration stage entity as required under Generally Accepted Accounting Principles (“GAAP”). Although for purposes of FASB Accounting Standards Codification Topic 915, Development Stage Entities, we have exited the development stage and no longer report inception to date results of operations, cash flows and other financial information, we will remain an exploration stage company under Industry Guide 7 until such time as we demonstrate reserves in accordance with the criteria in Industry Guide 7.rules and provisions of the JOBS Act.

Because we have no reserves, we have and will continue to expense all mine construction costs, even though these expendituresNone of the Shares being sold in this offering are expected to have a future economic benefit in excess of one year. We also expense our reclamation and remediation costs at the time the obligation is incurred. Companies that have reserves and have exited the exploration stage typically capitalize these costs, and subsequently amortize them on a units-of-production basis as reserves are mined, with the resulting depletion charge allocated to inventory, and then to cost of sales as the inventory is sold. As a result of these and other differences, our financial statements will not be comparable to the financial statements of mining companies that have established reserves and have exited the exploration stage.being sold by existing securities holders.

| -17- |

After the Registration Statement has been declared effective by the Securities and Exchange Commission (the “SEC”), the Company will accept tenders of funds to purchase the Shares. No escrow agent is involved and the Company will receive the proceeds directly from any subscription.

You will be required to complete a subscription agreement in order to invest.

No broker-dealer registered with the SEC and a member of the Financial Industry Regulatory Authority (“FINRA”), is being engaged as an underwriter or for any other purpose in connection with this Offering.

This offering will commence on the registration of this Prospectus, as determined by the Securities and Exchange Commission and continue for a period of 180 days. The Company may extend the Offering for an additional time period unless the Offering is completed or otherwise terminated by us, or unless we are required to terminate by application of the JOBS Act. Funds received from investors will be counted towards the Offering only if the form of payment, such as a check, clears the banking system and represents immediately available funds held by us prior to the termination of the subscription period, or prior to the termination of the extended subscription period if extended by the Company.

If you decide to subscribe for any Common Stock in this offering, you must deliver a funds for acceptance or rejection. The minimum investment amount for a single investor is 2,500,000 Shares of Common Stock in the principal amount of $750.00. All subscription checks should be sent to the following address:

In such case, subscription checks should be made payable to Kibush Capital Corp. If a subscription is rejected, all funds will be returned to subscribers within ten days of such rejection without deduction or interest. Upon acceptance by the Company of a subscription, a confirmation of such acceptance will be sent to the investor.

The Company maintains the right to accept or reject subscriptions in whole or in part, for any reason or for no reason. The Company maintains the right to accept subscriptions below the minimum investment amount or minimum per share investment amount in its discretion. All monies from rejected subscriptions will be returned by the Company to the investor, without interest or deductions.

Each investor must represent in writing that he/she/it meets the applicable requirements set forth above and in the Subscription Agreement, including, among other things, that (i) he/she/it is purchasing the shares for his/her/its own account and (ii) he/she/it has such knowledge and experience in financial and business matters that he/she/it is capable of evaluating without outside assistance the merits and risks of investing in the shares, or he/she/it and his/her/its purchaser representative together have such knowledge and experience that they are capable of evaluating the merits and risks of investing in the shares. Broker-dealers and other persons participating in the offering must make a reasonable inquiry in order to verify an investor’s suitability for an investment in the Company. Transferees of the shares will be required to meet the above suitability standards.

The shares may not be offered, sold, transferred, or delivered, directly or indirectly, to any person who (i) is named on the list of “specially designated nationals” or “blocked persons” maintained by the U.S. Office of Foreign Assets Control (“OFAC”) at www.ustreas.gov/offices/enforcement/ofac/sdn or as otherwise published from time to time, (ii) an agency of the government of a Sanctioned Country, (iii) an organization controlled by a Sanctioned Country, or (iv) is a person residing in a Sanctioned Country, to the extent subject to a sanctions program administered by OFAC. A “Sanctioned Country” means a country subject to a sanctions program identified on the list maintained by OFAC and available at www.ustreas.gov/offices/enforcement/ofac/sdn or as otherwise published from time to time. Furthermore, the shares may not be offered, sold, transferred, or delivered, directly or indirectly, to any person who (i) has more than fifteen percent (15%) of its assets in Sanctioned Countries or (ii) derives more than fifteen percent (15%) of its operating income from investments in, or transactions with, sanctioned persons or Sanctioned Countries.

The sale of other securities of the same class as those to be offered for the period of distribution will be limited and restricted to those sold through this Offering. Because the Shares being sold are not publicly or otherwise traded, the market for the securities offered is presently stabilized.

| -18- |

The Use of Proceeds is an estimate based on the Company’s current business plan. We may find it necessary or advisable to reallocate portions of the net proceeds reserved for one category to another, or to add additional categories, and we will have broad discretion in doing so.

The maximum gross proceeds from the sale of the Shares in this Offering are $500,000.00. The net proceeds from the offering, assuming it is fully subscribed, are expected to be approximately $475,000.00 after the payment of offering costs including broker-dealer and selling commissions, but before printing, mailing, marketing, legal and accounting costs, and other compliance and professional fees that may be incurred. The estimate of the budget for offering costs is an estimate only and the actual offering costs may differ from those expected by management.

Management of the Company has wide latitude and discretion in the use of proceeds from this Offering. Ultimately, management of the Company intends to use a substantial portion of the net proceeds for general working capital. At present, management’s best estimate of the use of proceeds, at various funding milestones, is set out in the chart below. However, potential investors should note that this chart contains only the best estimates of the Company’s management based upon information available to them at the present time, and that the actual use of proceeds is likely to vary from this chart based upon circumstances as they exist in the future, various needs of the Company at different times in the future, and the discretion of the Company’s management at all times.

A portion of the proceeds from this Offering may be used to compensate or otherwise make payments to officers or directors of the issuer. The officers and directors of the Company may be paid salaries and receive benefits that are commensurate with similar companies, and a portion of the proceeds may be used to pay these ongoing business expenses.

USE OF PROCEEDS

| 10% | 25% | 50% | 75% | 100% | ||||||||||||||||

| Fees | 10,000 | 10,000 | 10,000 | 10,000 | 10,000 | |||||||||||||||

| Equipment | 40,000 | 115,000 | 240,000 | 365,000 | 490,000 | |||||||||||||||

| TOTAL | $ | 50,000 | $ | 125,000 | $ | 250,000 | $ | 375,000 | $ | 500,000 |

The Company reserves the right to change the use of proceeds set out herein based on the needs of the ongoing business of the Company and the discretion of the Company’s management. The Company may reallocate the estimated use of proceeds among the various categories or for other uses if management deems such a reallocation to be appropriate.

| -19- |

PROSPECTUS SUMMARYMANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

This summary highlights certain information appearing elsewhere in this prospectus. For a more complete understanding of this offering, you should read the entire prospectus carefully, including the risk factors and the financial statements. References in this prospectus to “we,” “us,” “our,” and “DLCR” refer to Kibush Capital Corp. References in this prospectus to “Aqua Mining” or “Angel Jade” refer to our majority owned subsidiaries, Aqua Mining Ltd. and Angel Jade Pty, respectively. You should read both this prospectus together with additional information described below under the heading “Where You Can Find More Information.”Forward-Looking Statements

OurCertain statements, other than purely historical information, including estimates, projections, statements relating to our business consists of a jade exploration venture in Australia, a gold exploration venture in Papua, New Guineaplans, objectives, and operation of a timber processing company in Papua, New Guinea.expected operating results, and the assumptions upon which those statements are based, are forward-looking statements. These business activitiesforward-looking statements generally are conducted through our subsidiaries, Aqua Mining Ltd. (“Aqua Mining”) and Angel Jade Pty. Ltd. (“Angel Jade”).

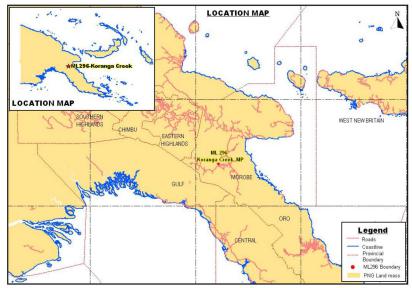

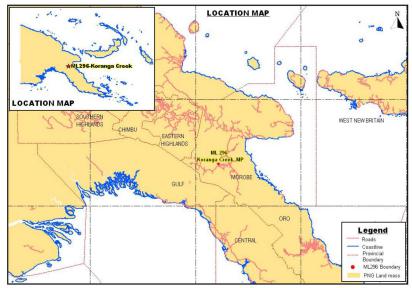

Aqua Mining was created to undertake certain opportunities that exist within the mining sector of the economy of Papua New Guinea. The Director Mr. Vincent Appo, has extensive experience and knowledge in this sector and has over the years assembled a vast network of contacts and contractors that will assist the company in their managerial and operational endeavors. Aqua Mining is in the exploration stage and holds a license for gold exploration in Papua New Guinea.