As filed with the Securities and Exchange Commission on April 18, 2019March 2, 2023

Registration No. 333- 333-269409

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1/A

FORM S-1(Amendment No. 2)

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

ADDENTAX GROUP CORP.

(Exact name of registrant as specified in its charter)

| Nevada | 3990 | 35-2521028 | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

Kingkey 100, Block A, Room 54034805

Luohu District, Shenzhen City, China 518000

+(86) 755 8233 0336

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Business Filings Incorporated

701 S Carson Street, Suite 200

Carson City, Nevada 89701

Tel: (608) 827-5300

(Name, address, including zip code, and telephone number,

including area code, of agent for service of process)

Copies To:

Lawrence Venick, Esq. Loeb & Loeb LLP 345 Park Avenue New York, NY 10154 Telephone: (212) 407-4000

|

|

Approximate date of commencement of proposed sale to the public:As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: [X]☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | Accelerated filer |

Non-accelerated filer

| Smaller reporting company |

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. [ ]☐

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Security Being Registered | Amount to be Registered | Proposed Maximum Offering Price | Proposed Maximum Aggregate Offering Price (1) | Amount of Registration Fee | ||||||||||||

| Common Stock, $0.001 par value (2) | — | — | $ | 20,000,000 | $ | 2,424.00 | ||||||||||

| Common Stock, $0.001 par value (3) | 2,364,837 | $ | 89.75 | $ | 212,244,121 | $ | 25,723.99 | |||||||||

| Placement Agent Warrants (4) | — | — | — | — | ||||||||||||

| Common Stock Underlying Placement Agent Warrants (5) | — | — | $ | 2,000,000 | $ | 242.40 | ||||||||||

| Total | — | — | $ | 234,244,121 | $ | 28,390.39 | ||||||||||

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This Registration Statement contains two prospectuses, as set forth below.

The Resale Prospectus is substantively identical to the Public Offering Prospectus, except for the following principal points:

The Registrant has included in this Registration Statement a set of alternate pages after the back cover page of the Public Offering Prospectus (the “Alternate Pages”) to reflect the foregoing differences in the Resale Prospectus as compared to the Public Offering Prospectus. The Public Offering Prospectus will exclude the Alternate Pages and will be used for the public offering by the Registrant. The Resale Prospectus will be substantively identical to the Public Offering Prospectus except for the addition or substitution of the Alternate Pages and will be used for the resale offering by the selling stockholders.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED APRIL 18, 2019MARCH 2, 2023

PRELIMINARY PROSPECTUS

Addentax Group Corp.

MINIMUM OFFERING: [●]197,227,433 Shares of Common Stock

MAXIMUM OFFERING: [●] Shares of Common Stock

Addentax Group Corp. is offering a minimumThis prospectus relates to the resale by the selling stockholders named in this prospectus from time to time of [●]up to 197,227,433 shares of our common stock, par value $0.001 per share, and a maximum of [●]share. These 197,227,433 shares of our common stock . consist of:

| ● | Up to 164,373,089 shares of common stock (the “PIPE Stocks”), consisting of (i) 82,186,544 shares of common stock issuable upon the conversion of our senior secured convertible notes (the “Notes”) issued to the selling stockholders pursuant to the securities purchase agreement, dated as of January 4, 2023, by and between us and the selling stockholders (the “PIPE Securities Purchase Agreement”), and (ii) 82,186,544 additional shares of common stock that we are required to register pursuant to a registration rights agreement between us and certain selling stockholders obligating us to register 200% of the maximum number of shares of common stock issuable upon conversion of the Notes; | |

| ● | Up to 32,154,344 shares of common stock (the “PIPE Warrant Stocks”), consisting of (i) 16,077,172 shares of our common stock issued or issuable upon the exercise of warrants (the “PIPE Warrants”) that were issued pursuant to the PIPE Securities Purchase Agreement, and (ii) 16,077,172 additional shares of common stock that we are required to register pursuant to a registration rights agreement between us and certain selling stockholders obligating us to register 200% of the maximum number of shares of common stock issuable upon exercise of the PIPE Warrant Stocks; and | |

| ● | Up to 700,000 shares of common stock (the “Placement Agent Warrant Stocks”) issued or issuable upon the exercise of placement agent warrants (the “Placement Agent Warrants”) that were issued to the placement agent pursuant to the PIPE placement agency agreement (the “PIPE Placement Agency Agreement”), dated as of January 4, 2023. |

Among other things, (i) the PIPE Warrant is exercisable for $1.25 per common stock and has a term of 5 years from the issuance date and (ii) the and Placement Agent Warrant is exercisable for $1.25 per common stock and has a term of 5 years from the issuance date. If at the time of exercise there is no effective registration statement registering, or the prospectus contained therein is not available for the issuance of the common stocks underlying the PIPE Warrants and the Placement Agent Warrants to the respective holder, the holder may, in their respective sole discretion, elect to exercise the PIPE Warrants and the Placement Agent Warrants through a cashless exercise, in which case the respective holder would receive upon such exercise the net number of common stocks determined according to the respective formula set forth in the PIPE Warrant and the Placement Agent Warrant, as applicable. If the Company does not issue the common stocks in a timely fashion, the PIPE Warrants and Placement Agent Warrants Warrant each contain certain damages provisions. A holder will not have the right to exercise any portion of the Warrant if the holder (together with its affiliates) would beneficially own in excess of 4.99% of the number of the Company’s common stocks outstanding immediately after giving effect to the exercise. However, any holder may increase or decrease such percentage, but not in excess of 9.99%, provided that any increase will not be effective until the 61st day after such election. The exercise price of the Warrants is subject to appropriate adjustment in the event of certain share dividends and distributions, share splits, reclassifications or similar events affecting our common stocks and also upon any distributions of assets, including cash, stock or other property to our stockholders. If a fundamental transaction occurs, then the successor entity will succeed to, and be substituted for us, and may exercise every right and power that we may exercise and will assume all of our obligations under the PIPE Warrants and the Placement Agent Warrants with the same effect as if such successor entity had been named in the PIPE Warrants and the Placement Agent Warrants itself.

We currently expectare not selling any shares of our common stock in this offering and we will not receive any of the public offering price to be $[●] per share. The offering is being made on a “best efforts” basis without a firm commitmentproceeds from the sale of shares of our common stock by the placement agent who has no obligationselling stockholders. The selling stockholders will receive all of the proceeds from any sales of the shares of our common stock offered hereby. However, we will receive proceeds from the exercise of the PIPE Warrants and Placement Agent Warrants, if such securities are exercised for cash. We intend to use those proceeds, if any, for general corporate purposes. We will also incur expenses in connection with the registration of the shares of our common stock offered hereby

Our registration of the common stocks covered by this prospectus does not mean that the selling stockholders will offer or commitment to purchasesell any of our shares.such common stocks. The placement agent must sellselling stockholders named in this prospectus, or their donees, pledgees, transferees or other successors-in-interest, may resell the minimum numbercommon stocks covered by this prospectus through public or private transactions at prevailing market prices, at prices related to prevailing market prices or at privately negotiated prices. For additional information on the possible methods of shares offered ([●] sharessale that may be used by the selling stockholders, you should refer to the section of common stock), if any are sold, and are only required to use their best efforts to sell the shares offered. Seethis prospectus entitled “Plan of Distribution.”

This offeringAny common stocks subject to resale hereunder will terminate 180 days fromhave been issued by us and acquired by the date of this prospectus (the “Termination Date”), unless extended by our board of directors for an additional 90 days, although we may close the offering on any dateselling stockholders prior to any resale of such shares pursuant to this prospectus.

No underwriter or other person has been engaged to facilitate the Termination Date, if the offering is fully subscribed or upon the votesale of the boardcommon stocks in this offering. We will bear all costs, expenses and fees in connection with the registration of directors. Reasons the board may consider in determining whethercommon stocks. The selling stockholders will bear all commissions and discounts, if any, attributable to extend or terminate the offering may include, but are not limited to, the amounttheir respective sales of funds raised, the potential to raise additional capital, and the response to the offering as of that date.our common stocks.

We are a reporting company under Section 15(d) of the Securities Exchange Act of 1934, as amended. Our common stockstocks is currently quotedtraded on the OTCQB Marketplace (the “OTCQB”) under the symbol “ATXG.” The closing price for our common stock on April 17, 2019, was $89.75 per share. There is a limited public trading market for our common stock. We are applying to list our common stock on the Nasdaq Capital Market under the symbol “ATXG.” On March 1, 2023, the reported sales price of our common stocks on The Nasdaq Capital Market was $1.32 per share.

Throughout this prospectus, unless the context requires otherwise, all references to “Addentax” refer to Addentax Group Corp., a holding company and references to “we,” “us,” “our,” the “Registrant,” the “Company” or “our company” are to Addentax and/or its consolidated subsidiaries.

Investing in our securities involves risks. You should carefully consider the risk factors beginning on page 8 of this prospectus and set forth in the documents incorporated by reference herein before making any decision to invest in our securities.

|

| |||||||||||

In addition to the placement agent commissions listed above and the non-accountable expense allowance described in the footnote, we have agreed to issue share purchase warrants, exercisable commencing 180 days immediately following the date of effectiveness of the registration statement of which this prospectus forms a part or the commencement of sales in this offering for a period of five years after the effective date of the offering, to purchaseOur shares of common stock equal to 10% of the total number of shares soldresold in this offeringprospectus are shares of Addentax, our Nevada holding company, which has no material operations of its own and may be exercisable atconducts substantially all of its operations through the operating companies established in the People’s Republic of China, or the PRC, primarily Shenzhen Qianhai Yingxi Industrial Chain Service Co., Ltd. (“YX”), our wholly owned subsidiary and its subsidiaries. We are not a per share price equal to 120% ofChinese operating company. We are a holding company and do not directly own any substantive business operations in the public offering price (the “Placement Agent Warrants”). The registration statement of which this prospectusChina and Hong Kong. This is a part also covers the Placement Agent. Warrants and the sharesresale of common stock issuableof our Nevada holding company, instead of shares of our operating companies in China. Therefore, investors will not directly hold any equity interests in our Chinese operating companies. Our holding company structure involves unique risks to investors. Chinese regulatory authorities could disallow our operating structure, which would likely result in a material change in our operations and/or the value of our common stock, including that it could cause the value of such securities to significantly decline or become worthless.

Additionally, as we conduct substantially all of our operations through the operating companies established in the PRC, we are subject to certain legal and operational risks associated with our business operations in China and Hong Kong. PRC laws and regulations governing our current business operations are sometimes vague and uncertain, and we face the risk that changes in the policies of the PRC government could have a significant impact upon the exercise thereof. For additionalbusiness we may be able to conduct in the PRC and the profitability of such business. Therefore, these risks associated being based in or having substantially all of our operations through the operating companies established in China and Hong Kong could cause the value of our securities to significantly decline or be worthless. Furthermore, these risks may result in a material change in our business operations or a complete hinderance of our ability to offer or continue to offer our securities to investors.

Recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. As at the date of this prospectus, the business of our subsidiaries in the PRC and Hong Kong until now are not subject to cybersecurity review with the Cyberspace Administration of China, or CAC, given that: (i) our products and services are offered not directly to individual users but through our institutional customers; (ii) we do not possess a large amount of personal information in our business operations; and (iii) data processed in our business does not have a bearing on national security and thus may not be classified as core or important data by the authorities. In addition, as at the date of this prospectus , we (including our Hong Kong subsidiary) are not subject to merger control review by China’s anti-monopoly enforcement agency due to the level of our revenues which provided from us and audited by our auditor BF Borgers CPA PC, and the fact that we currently do not expect to propose or implement any acquisition of control of, or decisive influence over, any company with revenues within China of more than RMB400 million. Currently, these statements and regulatory actions have had no impact on our daily business operation, the ability to accept foreign investments and list our securities on an U.S. or other foreign exchange. As of the date of this prospectus, no effective laws or regulations in the PRC explicitly require us to seek approval from the China Securities Regulatory Commission (the “CSRC”) or any other PRC governmental authorities for our overseas listing, nor has our company or any of our subsidiaries received any inquiry, notice, warning or sanctions regarding our arrangementoverseas listing from the CSRC or any other PRC governmental authorities. However, since these statements and regulatory actions are new, it is highly uncertain how soon legislative or administrative regulation making bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any, and the potential impact such modified or new laws and regulations will have on our daily business operation, the ability to accept foreign investments and list our securities on an U.S. or other foreign exchange. Any change in foreign investment regulations, and other policies in China or related enforcement actions by China government could result in a material change in our operations and/or the value of the securities we are registering for sale and could significantly limit or completely hinder our ability to offer or continue to offer our securities to investors or cause the value of our Shares to significantly decline or be worthless. See “Risk Factors - General Risks Associated with Business Operations in China” in our Annual Report on Form 10-K for the fiscal year ended March 31, 2022 as well as any amendment or update to our risk factors reflected in subsequent filings with the placement agent, pleaseSEC for risks associated with business operations in jurisdictions where our operating subsidiaries operate, and “Risk Factors - Risks Related to This Offering and our Common Stock” for risks associated with this offering in this registration statement.

As a holding company, our ability to pay dividends to our stockholders and to service any debt we may incur may depend upon dividends paid by our PRC Subsidiaries. Current PRC regulations permit our PRC Subsidiaries to pay dividends to us through Yingxi Industrial Chain Investment Co., Ltd. (“Yingxi HK”), our intermediate holding subsidiary in Hong Kong, only out of their accumulated profits, if any, determined in accordance with Chinese accounting standards and regulations. In addition, each of our PRC Subsidiaries is required to set aside at least 10% of its after-tax profits each year, if any, to fund a statutory reserve until such reserve reaches 50% of its registered capital. As of the date hereof, we have had no transactions that involved the transfer of cash or assets throughout our corporate structure. The PRC Subsidiaries have not transferred cash or other assets to Addentax, including by way of dividends. However, to the extent cash in the business is in the PRC/Hong Kong or is in our PRC or Hong Kong subsidiaries, there can be no assurance that the PRC government will not intervene or impose restrictions or limitations on the ability of Addentax or Addentax’s subsidiaries to transfer cash. As a result, such funds may not be available to fund operations or for other use outside of the PRC or Hong Kong. Addentax does not currently plan or anticipate transferring cash or other assets from our operations in China to any non-Chinese entity. We intend to retain most, if not all, of available funds and any future earnings after this offering to the development and growth of our business in China. As of the date hereof, no transfers, dividends, or distributions have been made to our investors. Further, our management is directly supervising cash management. Our finance department is responsible for establishing the cash management policies and procedures among our departments and the operating entities. Each department or operating entity initiates a cash request by putting forward a cash demand plan, which explains the specific amount and timing of cash requested, and submitting it to designated management members of our Company, based on the amount and the use of cash requested. The designated management member examines and approves the allocation of cash based on the sources of cash and the priorities of the needs, and submit it to the cashier specialists of our finance department for a second review. Other than the above, we currently do not have other cash management policies or procedures that dictate how funds are transferred nor a written policy that addresses how we will handle any limitations on cash transfers due to PRC law. For a detailed description of how cash is transferred through our corporate structure, see “Plan“Prospectus Summary - Transfers of Distribution”Cash to and from our Subsidiaries.”

Pursuant to the Holding Foreign Companies Accountable Act (“HFCAA”), the Public Company Accounting Oversight Board (United States) (the “PCAOB”) issued a Determination Report on December 16, 2021 which found that the PCAOB is unable to inspect or investigate completely registered public accounting firms headquartered in: (1) mainland China of the People’s Republic of China because of a position taken by one or more authorities in mainland China; and (2) Hong Kong, a Special Administrative Region and dependency of the PRC, because of a position taken by one or more authorities in Hong Kong. In addition, the PCAOB’s report identified the specific registered public accounting firms which are subject to these determinations. Our registered public accounting firm, BF Borgers CPA PC, is not headquartered in mainland China or Hong Kong and was not identified in this report as a firm subject to the PCAOB’s determinations. BF Borgers CPA PC is registered with the PCAOB and is subject to laws in the United States pursuant to which the PCAOB conducts regular inspections to assess BF Borgers CPA PC’s compliance with applicable professional standards. BF Borgers CPA PC has been inspected by the PCAOB on a regular basis, with the last inspection in November and December of 2021. Notwithstanding the foregoing, if the PCAOB is not able to fully conduct inspections of our auditor’s work papers in China, you may be deprived of the benefits of such inspection which could result in limitation or restriction to our access to the U.S. capital markets and trading of our securities may be prohibited under the HFCAA. Furthermore, on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act (“AHFCAA”) and on December 29, 2022, a legislation entitled “Consolidated Appropriations Act, 2023” (the “Consolidated Appropriations Act”) was signed into law by President Biden, which contained, among other things, an identical provision to AHFCAA and amended the HFCAA by requiring the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three, thus reducing the time before your securities may be prohibited from trading or delisted. The delisting or the cessation of trading of our Common Stocks, or the threat of their being delisted or prohibited from being traded, may materially and adversely affect the value of your investment. On August 26, 2022, the PCAOB announced that it had signed a Statement of Protocol (the “Protocol”) with the CSRC and the Ministry of Finance (“MOF”) of the People’s Republic of China, which governs inspections and investigations of audit firms based in mainland China and Hong Kong. Pursuant to the fact sheet with respect to the Protocol released by the SEC, the PCAOB shall have independent discretion to select any issuer audits for inspection or investigation and the unfettered ability to transfer information to the SEC. According to the PCAOB, its December 2021 determinations under the HFCAA remain in effect. On December 15, 2022, the PCAOB secures complete access to inspect, investigate audit firms based in mainland China and Hong Kong. It is possible when the PCAOB may reassess its determinations in the future, and it could determine that it is still unable to inspect or investigate completely registered public accounting firms in mainland China and Hong Kong. The Holding Foreign Companies Accountable Act and related regulations currently previously did not affect the Company as the Company’s auditor is subject to PCAOB’s inspections and investigations. See “Risk Factors - General Risks Associated with Business Operations in China - Our independent registered public accounting firm’s audit documentation related to their audit reports included in this prospectus include audit documentation located in the PRC. Our Common Stocks may be delisted or prohibited from being traded over-the-counter under the HFCAA if the PCAOB is unable to inspect our audit documentation located in mainland China and, as such, you may be deprived of the benefits of such inspection which could result in limitations or restrictions to our access to the U.S. capital markets. The delisting or the cessation of trading of our Common Stocks, or the threat of their being delisted or prohibited from being traded, may materially and adversely affect the value of your investment” in this registration statement.

We are an “emerging growth company”, as that term is used in the Jumpstart Our Business Startups Act of 2012, and will be subject to reduced public company reporting requirements.

Investment in our common stocks involves a high degree of risk. See “Risk Factors” beginning on page 56.

Until11, in our periodic reports filed from time to time with the Securities and Exchange Commission, which are incorporated by reference in this prospectus and in any applicable prospectus supplement. You should carefully read this prospectus and the accompanying prospectus supplement, together with the documents we sell at least [●] shares of common stock, all investor funds will be held in an escrow account at _________________, as agent, for the benefit of the investors. If we do not sell at least [●] shares of common stockincorporate by ___________________, all funds will be returned to investors without interest or deduction promptly after the Termination Date. If we complete this offering, net proceeds will be promptly delivered to us on the closing date. Affiliates of the company and affiliates and associated persons of the placement agent mayreference, before you invest in this offering on the same terms and conditions as the public investors participating in this offering, and any shares ofour common stock purchased will make up a portion of the minimum offering needed to complete this offering.stocks..

Neither the U.S. Securities and Exchange Commission nor any state securities commissionother regulatory body has approved or disapproved of these securities or determined ifpassed upon the accuracy or adequacy of this prospectus is truthful or complete.registration statement. Any representation to the contrary is a criminal offense.

The placement agent expects to deliver the shares of common stock to purchasers on , 2019.

The date of this prospectus is , 20192023

TABLE OF CONTENTS

This prospectus is part of athe registration statement that we filed with the Securities and Exchange Commission (the “SEC”“SEC”) pursuant to which the selling stockholders named herein may, from time to time, offer and sell or otherwise dispose of the “Commission”). You should rely only oncommon stocks covered by this prospectus. As permitted by the rules and regulations of the SEC, the registration statement filed by us includes additional information not contained in this prospectus.

This prospectus or any supplement or amendment hereto. We and the placement agent have not authorized any person to providedocuments incorporated by reference into this prospectus include important information about us, the securities being offered and other information you with different information. We and the placement agent are not offering to sell, or seeking an offer to buy,should know before investing in our common stock in any jurisdiction where such offer or sale is not permitted.securities. You should not assume that the information contained in this prospectus is accurate on any date subsequent to the date set forth on the front cover of this prospectus or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus is delivered or shares of common stocks are sold or otherwise disposed of on a later date. It is important for you to read and consider all information contained in this prospectus, including the documents incorporated by reference therein, in making your investment decision. You should also read and consider the information in the documents to which we have referred you under “Where You Can Find More Information” and “Incorporation of Certain Information by Reference” in this prospectus.

You should rely only on this prospectus and the information incorporated or deemed to be incorporated by reference in this prospectus. We have not, and the selling stockholders have not, authorized anyone to give any supplementinformation or amendment heretoto make any representation to you other than those contained or incorporated by reference in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus does not constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in this prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of their respective dates, regardlessthe date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

Unless otherwise indicated, information contained or incorporated by reference in this prospectus concerning our industry, including our general expectations and market opportunity, is based on information from our own management estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Management estimates are derived from publicly available information, our knowledge of our industry and assumptions based on such information and knowledge, which we believe to be reasonable. In addition, assumptions and estimates of our and our industry’s future performance are necessarily uncertain due to a variety of factors, including those described in “Risk Factors” beginning on page 11 of this prospectus. These and other factors could cause our future performance to differ materially from our assumptions and estimates.

For investors outside the time of deliveryUnited States: We have not done anything that would permit the offering or possession or distribution of this prospectus orin any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any salerestrictions relating to, the offering of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date. On March 5, 2019, we effected a 1-for-20 reverse split on our shares of common stockthe securities described herein and the proportional reductiondistribution of our total authorized shares of common stock from 506,920,000 shares to 25,346,004 shares.

You should read this prospectus together with additional information described under “Where You Can Find More Information”, beginning on page 61, before making an investment decision.outside the United States.

The market data and certain other statistical information used throughout this prospectus is based on independent industry publications, reports by market research firms or other independent sources that we believe to be reliable sources. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. We are responsible for all of the disclosure contained in this prospectus, and we believe these industry publications and third-party research, surveys and studies are reliable. While we are not aware of any misstatements regarding any third-party information presented in this prospectus, their estimates, in particular, as they relate to projections, involve numerous assumptions, are subject to risks and uncertainties, and are subject to change based on various factors. Some market and other data included herein, as well as the data of competitors as they relate to Addentax Group Corp., is also based on our good faith estimates.

Unless the context otherwise requires, all references in this prospectus to:

| ● | “Addentax” refer to Addentax Group Corp.; | |

| ● | “ | |

| ● | “Exchange Act” refers to the Securities Exchange Act of 1934, as amended; | |

| ● | “SEC” or the “Commission” refers to the United States Securities and Exchange Commission; | |

| ● | “Securities Act” refers to the Securities Act of 1933, as amended; | |

| ● | “China,” “Chinese” or the “PRC” refers to the People’s Republic of China, excluding, for the purposes of this prospectus only, | |

| ● | “Hong Kong” refers to refers to the Hong Kong Special Administrative Region of the People’s Republic of China; | |

| ● | all references to “RMB” or “Chinese Yuan” is to the legal currency of the People’s Republic of China; and | |

| ● | all references to “U.S. dollars,” “dollars,” “USD” or “$” are to the legal currency of the United States; |

Unless otherwise noted, all translations from Chinese Yuan toThe Company’s reporting currency is the U.S. dollars usingdollar. The functional currency of the exchange rate refers toparent company is the exchange rate quoted on http://www.oanda.com on December 31, 2018, which was RMB 6.8761 to USD$1.00. We make no representation thatU.S. dollar and the functional currency of the Company’s operating subsidiaries is the Chinese Yuan amounts referred to in this prospectus could have been or could be converted into U.S. dollars at any particular rate or at all.

Renminbi (“RMB”).

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our securities, you should carefully read this entire prospectus, especially the risks of investing in our securities as discussed under “Risk Factors” and the financial statements and notes thereto herein. The following summary is qualified in its entirety by the detailed information appearing elsewhere in this prospectus.

Overview

Our Business

We (Addentax Group Corp.) are a garment manufacturerNevada holding company with no material operations of our own. We conduct substantially all of our operations through our operating companies established in the PRC, primarily Shenzhen Qianhai Yingxi Industrial Chain Service Co., Ltd. (“YX”), our wholly owned subsidiary and logistics service provider basedits subsidiaries. We are not a Chinese operating company. We are a holding company and do not directly own any substantive business operations in China and Hong Kong. This is an offering of common stock of our Nevada holding company, instead of shares of our operating companies in China. Therefore, you will not directly hold any equity interests in our operating companies. Our holding company structure involves unique risks to investors. Chinese regulatory authorities could disallow our operating structure, which would likely result in a material change in our operations and/or the value of our common stock, including that it could cause the value of such securities to significantly decline or become worthless. We classify our businesses into four segments: garment manufacturing, logistics services, property management and subleasing, and epidemic prevention supplies.

Unless the context otherwise requires, all references in this prospectus to “Addentax” refer to Addentax Group Corp., a holding company, and references to “we,” “us,” “our,” the “Registrant”, the “Company,” or “our company” refer to Addentax and/or its consolidated subsidiaries. Addentax Group Corp., our Nevada holding company, is the entity in which investors are purchasing their interest from this offering.

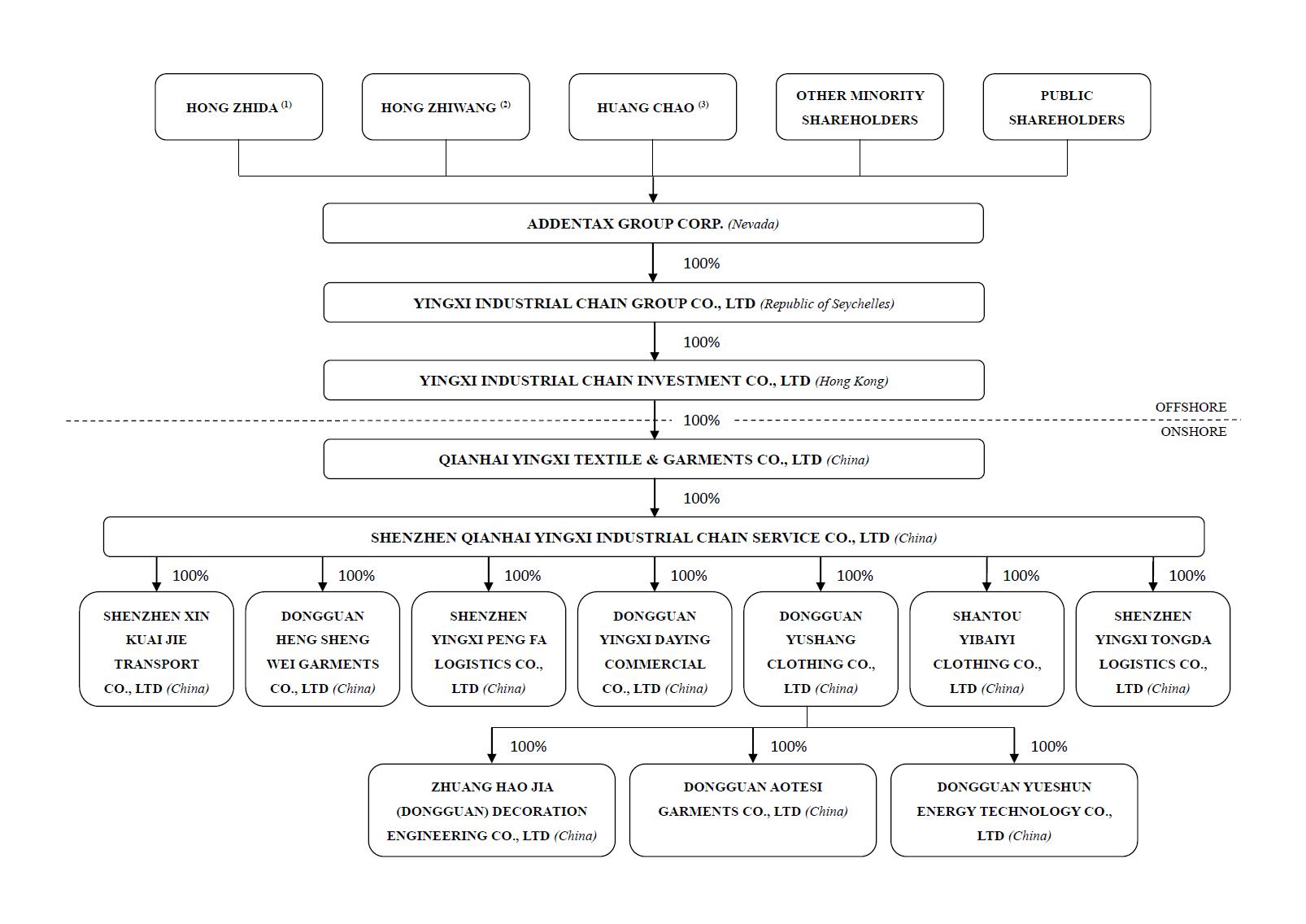

Our subsidiaries include (i) Yingxi Industrial Chain Group Co., Ltd., a Republic of Seychelles company; (ii) Yingxi Industrial Chain Investment Co., Ltd., a Hong Kong company (“Yingxi HK”); (iii) Qianhai Yingxi Textile & Garments Co., Ltd., a PRC company; (iv) Shenzhen Qianhai Yingxi Industrial Chain Services Co., Ltd, a PRC company (“YX”), (v) Dongguan Heng Sheng Wei Garments Co., Ltd, a PRC company (“HSW”), (vi) Dongguan Yushang Clothing Co., Ltd, a PRC company (“YS”), (vii) Shantou Yi Bai Yi Garment Co., Ltd, a PRC company (“YBY”), (viii) Shantou Chenghai Dai Tou Garments Co., Ltd, a PRC company (“DT”); (ix) Shenzhen Xin Kuai Jie Transportation Co., Ltd, a PRC company (“XKJ”), (x) Shenzhen Hua Peng Fa Logistic Co., Ltd, a PRC company (“HPF”), (xi) Shenzhen Yingxi Peng Fa Logistic Co., Ltd., a PRC company (“PF”), (xii) Shenzhen Yingxi Tongda Logistic Co., Ltd, a PRC company (“TD”) and (xiii) Dongguan Yingxi Daying Commercial Co., Ltd., a PRC company (“DY”).

“PRC Subsidiaries” refer to, collectively, (i) Qianhai Yingxi Textile & Garments Co., Ltd.; (ii) Shenzhen Qianhai Yingxi Industrial Chain Services Co., Ltd (“YX”), (iii) Dongguan Heng Sheng Wei Garments Co., Ltd (“HSW”), (iv) Dongguan Yushang Clothing Co., Ltd (“YS”); (v) Shantou Yi Bai Yi Garment Co., Ltd (“YBY”); (vi) Shantou Chenghai Dai Tou Garments Co., Ltd (“DT”); (vii) Shenzhen Xin Kuai Jie Transportation Co., Ltd (“XKJ”); (viii) Shenzhen Hua Peng Fa Logistic Co., Ltd (“HPF”); (ix) Shenzhen Yingxi Peng Fa Logistic Co., Ltd (“PF”).; (x) Shenzhen Yingxi Tongda Logistic Co., Ltd (“TD”); and (xi) Dongguan Yingxi Daying Commercial Co., Ltd (“DY”). In 2020, the Company disposed DT and HFP to a third party respectively.

“WFOE” refers to Qianhai Yingxi Textile & Garments Co., Ltd, a wholly foreign owned enterprise in China, which is indirectly wholly owned by Addentax Group Corp.

Our garment manufacturing business consists of sales made principally to wholesalerswholesaler located in the PRC. We have our own manufacturing facilities, with sufficient production capacity and skilled workers on production lines which we believe ensuresto ensure that we meet our high quality control standards and timely meet the delivery requirements for our customers. We conduct our garment manufacturing operations through two wholly-ownedfour wholly owned subsidiaries, namely Dongguan Heng Sheng Wei Garments Co., Ltd (“HSW”), Dongguan Yushang Clothing Co., Ltd (“YS”), Shantou Yi Bai Yi Garment Co., Ltd (“YBY”), and Shantou Chenghai Dai Tou Garments Co., Ltd (“DT”), which are located in the Guangdong province, China.

In October 2020, the Company disposed of DT to a third party at fair value, which was also its carrying value as of September 30, 2020.

Our logisticlogistics business consists of delivery and courier services covering approximately79 cities in seven provinces and two municipalities in China. Although we have our own motor vehicles and drivers, we currently outsource some of the business to our contractors. We believe outsourcing allows us to maximize our capacity and maintain flexibility while reducing capital expenditures and the costs of keeping drivers during slow seasons. We conduct our logistic operations through two wholly-ownedfour wholly owned subsidiaries, namely Shenzhen Xin Kuai Jie Transportation Co., Ltd (“XKJ”), and Shenzhen Hua Peng Fa Logistic Co., Ltd (“HPF”), Shenzhen Yingxi Peng Fa Logistic Co., Ltd (“PF”) and Shenzhen Yingxi Tongda Logistic Co., Ltd (“TD”), which are located in the Guangdong province, China. In November 2020, the Company disposed of HPF to a third party at fair value, which was also its carrying value as of November 30, 2020.

The business operations, customers and suppliers of DT and HPF were retained by the Company; therefore, the disposition of the two subsidiaries did not qualify as discontinued operations.

Our property management and subleasing business provides shops subleasing and property management services for garment wholesalers and retailers in garment market. We conduct our property management and subleasing operation through a wholly owned subsidiary, namely Dongguan Yingxi Daying Commercial Co., Ltd. (“DY”), which is located in the Guangdong province, China.

Competitive Strengths

Our epidemic prevention supplies business consists of manufacturing and distribution of epidemic prevention products and resale of epidemic prevention supplies purchased from third parties in both domestic and overseas markets. We believe we haveconduct our manufacturing of the following competitive strengths:epidemic prevention products in Dongguan Yushang Clothing Co., Ltd (“YS”). We conduct the trading of epidemic prevention suppliers through Addentax and Shenzhen Qianhai Yingxi Industrial Chain Services Co., Ltd (“YX”), a wholly owned subsidiary of the Company, which is located in the Guangdong province in China.

Cost-effective production. We have adopted a vertical integration production process. We produce garments in our own production facilities and employ our in-house transport teams to deliver garments to our customers. This one-stop service optimizes production efficiency and saves costs by lowering the cost per unit, thereby achieving economies of scale.Recent Developments

Stringent quality control process.Initial Public Offering As of March 31, 2019, we had 15 employees in the production department that are responsible for conducting our quality control process. We implement a stringent quality control process which monitors various stages of our garment manufacturing business, including sampling checks of semi-finished products and finished products. We prepare inspection reports to address the quality problems and make recommendations to improve the quality of our products. During final product inspection, we pay special attention to the measurements, workmanship, ironing and packaging of our products to help best ensure that the quality of our products comply with the specifications, standards and requirements of our customers.

Strong design capabilities. Our design team works closelyOn August 30, 2022, Addentax entered into an underwriting agreement with our customersNetwork 1 Financial Securities, Inc., as representative of the underwriters (the “Representative”), in connection with its initial public offering (“IPO”) of 5,000,000 common stocks, at a price of $5.00 per share, before deducting underwriting discounts, commissions, and other related expenses. The shares began trading on the Nasdaq Capital Market on August 31, 2022. The Company issued Representative’s Warrant to understand their needspurchase up to 500,000 common stocks at $6.50 per share, to Network 1 Financial Securities, Inc. On September 2, 2022, the Company consummated its IPO generating net proceeds of approximately $23.25 million, after deducting underwriting discounts and make recommendations to them. Our design team also conducts market research and attend industry exhibitions to understand the latest market trends. As of March 31, 2019, our design team consisted of 4 members.other related expenses.

PIPE Financing

Extensive delivery network. Our logistics business has nine routesOn January 4, 2023, Addentax entered into a Securities Purchase Agreement (the “PIPE Securities Purchase Agreement”) with certain accredited investors (the “Purchasers”) and covers 66 citiesa PIPE Placement Agency Agreement with the placement agent for a private placement offering (“PIPE Offering”), pursuant to which the Company received gross proceeds of approximately $15 million , before deducting placement agent fees and other offering expenses, in seven provincesconsideration of (i) up to 82,186,544 shares of common stock upon the conversion of certain convertible notes held by the selling stockholders and two municipalities(ii) up to 16,077,172 PIPE Warrants were issued (the “PIPE Offering”). Further, up to 700,000 Placement Agent Warrants were issued to the placement agent in connection to the PRC.

Our Strategies

Key elementsPIPE Offering. The PIPE Warrants and the Placement Agent Warrants have an exercise price of our business$1.25 per share, and growth strategies includewill become exercisable on the following:

Salesdate of raw materials. We intendissuance and six months after their date of issuance, respectively, and will expire five years from their initial date of exercise. The PIPE Securities Purchase Agreement contains customary representations and warranties and agreements of the Company and the Purchasers and customary indemnification rights and obligations of the parties. The PIPE Offering closed on January 4, 2023. Concurrently with the signing of the PIPE Securities Purchase Agreement, we entered into a Registration Rights Agreement (the “Registration Rights Agreement”) to enter into exclusive agreementsfile with textilethe Securities and garment suppliers in Southeast China to be their exclusive agent and supply their textiles and garments to our customers. To execute this plan, we intend to set up several retailers forExchange Commission a Registration Statement covering the salesresale of textiles and garments to retail customers and supplyall of the textiles and garments exclusively to various high-end fashion brands.

Develop our own brands.We intend to develop our own brands that focus on fast fashion with teenagers being our primary target customers. We plan to adopt a low cost strategy atregistrable securities under the early stage and improve the quality of our products after increasing our market share. We are in the process of registering a trademark for our own brand and intend to start our advertising campaign after the registration of this trademark. We plan to distribute our products in different channels, including our own retailers, co-operative retailers and franchisees.

Expand our delivery network. As of March 31, 2019, we provided logistics services to over 66 cities in seven provinces and two municipalities in the PRC. We plan to open our logistic points in 20 more cities in the PRC in the third and fourth quarters of 2019.

Develop international logistics services and warehousing services.We intend to develop international logistics services for customers located all over the world and international warehousing services.

Registration Rights Agreement.

Our Corporate Structure

Notes:

| (1) | Represents 1,507,950 Ordinary Shares held by Hong Zhida as of the date of this prospectus. |

| (2) | Represents 501,171 Ordinary Shares held by Hong Zhiwang as of the date of this prospectus. |

| (3) | Represents 25,720 Ordinary Shares held by Huang Chao as of the date of this prospectus. |

PRC Limitation on Overseas Listing and Share Issuances

Neither we nor our subsidiaries are currently required to obtain approval from Chinese authorities, including the China Securities Regulatory Commission, or CSRC, or Cybersecurity Administration Committee, or CAC, to list on U.S. exchanges or issue securities to foreign investors, however, if our subsidiaries or the holding company were required to obtain approval in the future and were denied permission from Chinese authorities to list on U.S. exchanges, we will not be able to continue listing on U.S. exchange, which would materially affect the interest of the investors. It is uncertain when and whether the Company will be required to obtain permission from the PRC government to list on U.S. exchanges in the future, and even when such permission is obtained, whether it will be denied or rescinded. Although the Company is currently not required to obtain permission from any of the PRC central or local government to obtain such permission and has not received any denial to list on the U.S. exchange, our operations could be adversely affected, directly or indirectly, by existing or future laws and regulations relating to its business or industry; if we inadvertently conclude that such approvals are not required when they are, or applicable laws, regulations, or interpretations change and we are required to obtain approval in the future.

Risks RelatedOn December 24, 2021, the China Securities Regulatory Commission, or the CSRC, issued Provisions of the State Council on the Administration of Overseas Securities Offering and Listing by Domestic Companies (Draft for Comments) (the “Administration Provisions”), and the Administrative Measures for the Filing of Overseas Securities Offering and Listing by Domestic Companies (the “Measures”), which were open for public comments by January 23, 2022. The Administration Provisions and Measures for overseas listings lay out specific requirements for filing documents and include unified regulation management, strengthening regulatory coordination, and cross-border regulatory cooperation. Domestic companies seeking to Our Businesslist abroad must carry out relevant security screening procedures if their businesses involve supervisions such as foreign investment security and cyber security reviews. Companies endangering national security are among those off-limits for overseas listings. As the Administration Provisions and Measures have not yet come into effect, we are currently unaffected by them. However, it is uncertain when the Administration Provision and the Measures will take effect or if they will take effect as currently drafted.

OurAs of the date of this prospectus, other than the response we recently received from the CSRC confirming that our offering under this prospectus does not require the examination and approval of the CSRC in accordance with the existing PRC legislation and regulations (for more details about this response from the CSRC, we have not received any inquiry, notice, warning, sanctions or regulatory objection to this offering from the CSRC, CAC or any other PRC governmental authorities, and we believe our PRC Subsidiaries have obtained all requisite permissions and approvals from PRC governmental authorities to operate our business as currently conducted under relevant PRC laws and regulations.

Currently, each of our PRC Subsidiaries holds and maintains a business license issued by the local market supervision and administration bureau, and has received all requisite permissions and approvals in order to conduct and operate our business. Based on our understanding of the PRC laws and regulations, our PRC businesses only require business licenses issued and approved from the relevant local authorities and do not require any other permissions or approvals to operate their PRC business operations. Further, we have not relied upon an opinion of a PRC counsel in drawing such conclusion in the current registration statement for the following reasons: (i) during our IPO process which was closed on September 2, 2022, we previously engaged a local PRC counsel, Hiways Law Firm (Shenzhen), to assist with the PRC disclosures in the IPO registration statement on Form S-1 and Hiways Law Firm (Shenzhen) confirmed such conclusion; (ii) the time period between the IPO and the submission of the current registration statement on January 25, 2023 is not substantial; (iii) no material changes occurred with respect to our PRC business operations since the IPO; and (iv) the expenses of engaging Hiway Law Firm or another PRC counsel for the current registration statement will be unduly burdensome on the Company; and thus, the Company has not sought out to engage a PRC counsel to obtain an additional opinion for the current registration statement. As of the date of this prospectus, none of our PRC Subsidiaries has been denied or punished by relevant governmental authorities due to its business qualifications. In addition, we (Addentax Group Corp.) and our non-PRC subsidiaries have also received all requisite permissions and approvals in order to conduct and operate our business.

Transfers of Cash to and from our Subsidiaries

We (Addentax Group Corp.) are a Nevada holding company with no material operations of our own. We conduct substantially all of our operations through the operating companies established in the PRC, primarily Shenzhen Qianhai Yingxi Industrial Chain Service Co., Ltd. (“YX”), our wholly owned subsidiary and its subsidiaries. We are not a Chinese operating company. We are a holding company and do not directly own any substantive business operations in China and Hong Kong. As a result, although other means are available for us to obtain financing at the holding company level, Addentax’s ability to implementpay dividends to its stockholders and to service any debt it may incur may depend upon dividends paid by our PRC Subsidiaries. If any of our subsidiaries incurs debt on its own in the future, the instruments governing such debt may restrict its ability to pay dividends to Addentax. In addition, our PRC Subsidiaries are required to make appropriations to certain statutory reserve funds, which are not distributable as cash dividends except in the event of a solvent liquidation of the companies.

Current PRC regulations permit our PRC Subsidiaries to pay dividends to us through Yingxi HK, our intermediate holding subsidiary in Hong Kong, only out of their accumulated profits, if any, determined in accordance with Chinese accounting standards and regulations. In addition, each of our PRC Subsidiaries is required to set aside at least 10% of its after-tax profits each year, if any, to fund a statutory reserve until such reserve reaches 50% of its registered capital. Each of such entity in China is also required to further set aside a portion of its after-tax profits to fund the employee welfare fund, although the amount to be set aside, if any, is determined at the discretion of its board of directors. Although the statutory reserves can be used, among other ways, to increase the registered capital and eliminate future losses in excess of retained earnings of the respective companies, the reserve funds are not distributable as cash dividends except in the event of liquidation.

The PRC government also imposes controls on the conversion of RMB into foreign currencies and the remittance of currencies out of the PRC. Therefore, we may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency for the payment of dividends from our profits, if any. Furthermore, if our PRC Subsidiaries incur debt on their own in the future, the instruments governing the debt may restrict their ability to pay dividends or make other payments.

Cash dividends, if any, on our common stock will be paid in U.S. dollars. If we are considered a PRC tax resident enterprise for tax purposes, any dividends we pay to our overseas stockholders may be regarded as China-sourced income and as a result may be subject to PRC withholding tax at a rate of up to 10.0%.

In order for us to pay dividends to our stockholders, we will rely on the distribution of dividends, through the WFOE, to Yingxi HK from our PRC Subsidiaries. As of the date hereof, none of our PRC Subsidiaries has distributed any dividends to Yingxi HK.

Pursuant to the Arrangement between Mainland China and the Hong Kong Special Administrative Region for the Avoidance of Double Taxation and Tax Evasion on Income, or the Double Tax Avoidance Arrangement, the 10% withholding tax rate may be lowered to 5% if a Hong Kong resident enterprise owns no less than 25% of a PRC project. However, the 5% withholding tax rate does not automatically apply and certain requirements must be satisfied, including without limitation that (a) the Hong Kong project must be the beneficial owner of the relevant dividends; and (b) the Hong Kong project must directly hold no less than 25% share ownership in the PRC project during the 12 consecutive months preceding its receipt of the dividends. In current practice, a Hong Kong project must obtain a tax resident certificate from the Hong Kong tax authority to apply for the 5% lower PRC withholding tax rate. As the Hong Kong tax authority will issue such a tax resident certificate on a case-by-case basis, we cannot assure you that we will be able to obtain the tax resident certificate from the relevant Hong Kong tax authority and enjoy the preferential withholding tax rate of 5% under the Double Taxation Arrangement with respect to dividends to be paid by our WFOE to its immediate holding company, Yingxi HK. As of the date of this prospectus, we have not applied for the tax resident certificate from the relevant Hong Kong tax authority. Yingxi HK intends to apply for the tax resident certificate when WFOE plans to declare and pay dividends to Yingxi HK.

As of the date hereof, we have had no transactions that involved the transfer of cash or assets throughout our corporate structure. The PRC Subsidiaries have not transferred cash or other assets to Addentax, including by way of dividends. However, to the extent cash in the business is in the PRC/Hong Kong or is in our PRC or Hong Kong subsidiaries, there can be no assurance that the PRC government will not intervene or impose restrictions or limitations on the ability of Addentax or Addentax’s subsidiaries to transfer cash. As a result, such funds may not be available to fund operations or for other use outside of the PRC or Hong Kong. Addentax does not currently plan or anticipate transferring cash or other assets from our operations in China to any non-Chinese entity. We intend to retain most, if not all, of available funds and any future earnings after this offering to the development and growth of our business strategyin China. As of the date hereof, no transfers, dividends, or distributions have been made to our investors. Further, our management is directly supervising cash management. Our finance department is responsible for establishing the cash management policies and procedures among our departments and the operating entities. Each department or operating entity initiates a cash request by putting forward a cash demand plan, which explains the specific amount and timing of cash requested, and submitting it to designated management members of our Company, based on the amount and the use of cash requested. The designated management member examines and approves the allocation of cash based on the sources of cash and the priorities of the needs, and submit it to the cashier specialists of our finance department for a second review. Other than the above, we currently do not have other cash management policies or procedures that dictate how funds are transferred nor a written policy that addresses how we will handle any limitations on cash transfers due to PRC law.

Holding Foreign Company Accountable Act

Trading in our securities may be prohibited under the Holding Foreign Companies Accountable Act, or the HFCAA, if the Public Company Accounting Oversight Board (United States) (the “PCAOB”) determines that it cannot inspect or investigate completely our auditor.

Pursuant to the HFCAA, the PCAOB issued a Determination Report on December 16, 2021 which found that the PCAOB is unable to inspect or investigate completely registered public accounting firms headquartered in: (1) mainland China of the People’s Republic of China because of a position taken by one or more authorities in mainland China; and (2) Hong Kong, a Special Administrative Region and dependency of the PRC, because of a position taken by one or more authorities in Hong Kong. In addition, the PCAOB’s report identified the specific registered public accounting firms which are subject to these determinations.

The PCAOB is currently unable to conduct inspections in China without the approval of Chinese government authorities. If it is later determined that the PCAOB is unable to inspect or investigate our auditor completely, investors may be deprived of the benefits of such inspection. Any audit reports not issued by auditors that are completely inspected by the PCAOB, or a lack of PCAOB inspections of audit work undertaken in China that prevents the PCAOB from regularly evaluating our auditors’ audits and their quality control procedures, could result in a lack of assurance that our financial statements and disclosures are adequate and accurate.

Our auditor, BF Borgers CPA PC, is an independent registered public accounting firm with the PCAOB, and as an auditor of publicly traded companies in the U.S., is subject to numerous riskslaws in the U.S. pursuant to which the PCAOB conducts regular inspections to assess its compliance with the applicable professional standards. BF Borgers CPA PC is based in the United States and uncertainties that you shouldhas been inspected by the PCAOB on a regular basis, with the last inspection in November and December of 2021. BF Borgers CPA PC, is not headquartered in mainland China or Hong Kong and was not identified as a firm subject to the determinations announced by the PCAOB on December 16, 2021. Should the PCAOB be awareunable to fully conduct inspection of before making an investment decision. We face many risks inherentour auditor’s work papers in China, it will make it difficult to evaluate the effectiveness of our auditor’s audit procedures or equity control procedures. Investors may consequently lose confidence in our businessreported financial information and procedures or quality of the financial statements, which would adversely affect us and our industry generally. You should carefully consider allsecurities.

On August 26, 2022, the PCAOB announced that it had signed the “Protocol” with the CSRC and the MOF, which governs inspections and investigations of audit firms based in mainland China and Hong Kong. The Protocol remains unpublished and is subject to further explanation and implementation. Pursuant to the fact sheet with respect to the Protocol released by the SEC, the PCAOB shall have independent discretion to select any issuer audits for inspection or investigation and the unfettered ability to transfer information set forth in this prospectus and, in particular,to the informationSEC. According to the PCAOB, its December 2021 determinations under the heading “Risk Factors,” priorHFCAA remain in effect. On December 15, 2022, the PCAOB secures complete access to making an investmentinspect, investigate audit firms based in mainland China and Hong Kong. It is possible when the PCAOB may reassess its determinations in the future, and it could determine that it is still unable to inspect or investigate completely registered public accounting firms in mainland China and Hong Kong. The Holding Foreign Companies Accountable Act and related regulations currently previously did not affect the Company as the Company’s auditor is subject to PCAOB’s inspections and investigations.

Moreover, if trading in our common stock. These risks include,securities is prohibited under the HFCAA in the future because the PCAOB determines that it cannot inspect or fully investigate our auditor at such future time, an exchange may determine to delist our securities.

Furthermore, on June 22, 2021, the U.S. Senate passed AHFCAA and on December 29, 2022, the Consolidated Appropriations Act was signed into law by President Biden, which contained, among others,other things, an identical provision to AHFCAA and amended the following:Holding Foreign Companies Accountable Act by requiring the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three, thus reducing the time before your securities may be prohibited from trading or delisted. The delisting or the cessation of trading of our Ordinary Shares, or the threat of their being delisted or prohibited from being traded, may materially and adversely affect the value of your investment.

On December 15, 2022, the PCAOB announced that it has completed a test inspection of two selected auditing firms in mainland China and Hong Kong and has voted to vacate its previous Determination Report, which concluded in December 2021 that the PCAOB could not inspect or investigate completely registered public accounting firms based in mainland China or Hong Kong. On December 23, 2022 the AHFCAA was enacted, which amended the HFCAA by requiring the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three and such act was signed into law on December 29, 2022.

Implications of Being an Emerging Growth Company

Emerging Growth Company

As a company with less than US$1.235 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An “emerging growth company” may take advantage of reduced reporting requirements that are otherwise applicable to larger public companies. In particular, as an emerging growth company, we:

| ● |

| ● | are not required to provide a detailed narrative disclosure discussing our | |

| ● | ||

| ● | ||

| ● | ||

| ● |

We intend to take advantage of all of these reduced reporting requirements and exemptions, with the exception of the longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act.

Under the JOBS Act, we may take advantage of the above-described reduced reporting requirements and exemptions until we no longer meet the definition of an emerging growth company. The JOBS Act provides that we would cease to be an “emerging growth company” at the end of the fiscal year in which the fifth anniversary of our initial sale of common equity pursuant to a registration statement declared effective under the Securities Act of 1933, as amended, herein referred to as the Securities Act, occurred, if we have more than US$1.235 billion in annual revenues, have more than US$700 million in market value of the common stocks held by non-affiliates, or issue more than US$1 billion in principal amount of non-convertible debt over a three-year period.

Corporate Information

Addentax Group Corp. was incorporated in the State of Nevada on October 28, 2014. We have a fiscal year-end of March 31. Our principal executive offices are located at Kingkey 100, Block A, Room 5403 ,4805, Luohu District, Shenzhen City, China 518000 and our telephone number is + (86)+(86) 755 8233 0336. We maintain a website at www.addentax.com. The information contained on our website is not, and should not be interpreted to be, a part of this prospectus.

The offering is being made on a “best efforts, minimum/maximum” basis. The offering is being made without a firm commitment by the placement agent, who has no obligation or commitment to purchase any of our shares. The closing of the offering and delivery of the shares is expected to occur no later than ___________________. See “Plan of Distribution.” The placement agent must sell the minimum number of shares offered ([●] shares of common stock), if any are sold, and are only required to use their best efforts to sell the shares offered. If the placement agents did not sell the minimum number of shares, the offering will be terminated at____________________.

| Common |

| |

Common this | ||

| ||

Common stock outstanding immediately after this offering | ||

| ||

|

| |

|

| |

|

| |

|

The number of shares of our common stock to be outstanding after this offering is based on the number of shares outstanding as of , 2019.

Unless otherwise indicated, all information in this prospectus gives effect to a 1-for-20 reverse stock split of our common stock effected on February 27, 2019.

SUMMARY FINANCIAL AND OTHER DATA

The following tables set forth our summary historical financial data for the periods presented. The following summary financial data for the years ended March 31, 2018 and 2017 are derived from our audited financial statements appearing elsewhere in this prospectus. The following summary financial data for the nine-month periods ended December 31, 2018 and 2017 and the selected balance sheet data as of December 31, 2018 are derived from our unaudited financial statements appearing elsewhere in this prospectus.

This summary financial data should be read together with the historical financial statements and related notes to those statements, as well as “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” which are included elsewhere in this prospectus.

| As of March 31, | ||||||||

| 2018 | 2017 | |||||||

| Balance Sheet Data: | ||||||||

| Cash and cash equivalents | $ | 264,806 | $ | 176,905 | ||||

| Prepayments, Deposits and Other Receivable | 6,129,762 | 6,777,748 | ||||||

| Total Assets | 7,518,111 | 8,547,518 | ||||||

| Total Current Liabilities | 8,623,045 | 8,791,500 | ||||||

| Total Liabilities | 8,623,045 | 8,791,500 | ||||||

| Total Stockholders’ equity (deficit) | (1,104,934 | ) | (243,983 | ) | ||||

| Years Ended March 31, | ||||||||

| 2018 | 2017 | |||||||

| Statements of Operations Data: | ||||||||

| Revenues | $ | 13,437,569 | $ | 5,335,501 | ||||

| Operating expenses | ||||||||

| Selling, General and Administrative Expenses | (1,585,836 | ) | (595,334 | ) | ||||

| Depreciation | (111,740 | ) | (34,905 | ) | ||||

| Total operating expenses | (1,697,576 | ) | (630,239 | ) | ||||

| Loss from Operations | (255,954 | ) | (374,221 | ) | ||||

| Loss before provision for income taxes | (690,054 | ) | (358,225 | ) | ||||

| Net Loss | $ | (709,396 | ) | $ | (371,802 | ) | ||

| Net income per common share | ||||||||

| Basic* | $ | 0.00 | $ | 0.00 | ||||

| Diluted* | $ | 0.00 | $ | 0.00 | ||||

| As of December 31, | ||||||||

| 2018 | 2017 | |||||||

| Balance Sheet Data: | ||||||||

| Cash and cash equivalents | $ | 356,969 | $ | 146,365 | ||||

| Prepayments, Deposits and Other Receivable | 2,777,080 | 8,248,026 | ||||||

| Total Assets | 4,260,405 | 9,979,510 | ||||||

| Total Current Liabilities | 5,811,303 | 10,364,081 | ||||||

| Total Liabilities | 5,811,303 | 10,364,081 | ||||||

| Total Stockholders’ equity(deficit) | (1,550,898 | ) | (384,571 | ) | ||||

| Nine-Months Ended December 31, | ||||||||

| 2018 | 2017 | |||||||

| Statements of Operations Data: | ||||||||

| Revenues | $ | 8,108,408 | $ | 10,677,416 | ||||

| Operating expenses | ||||||||

| Selling, General and Administrative Expenses | (1,515,952 | ) | (1,153,594 | ) | ||||

| Depreciation | (88,434 | ) | (84,535 | ) | ||||

| Total operating expenses | (1,604,386 | ) | (1,238,129 | ) | ||||

| Loss from Operations | (582,127 | ) | (33,090 | ) | ||||

| Income before provision for income taxes | (562,995 | ) | (27,469 | ) | ||||

| Net Income | $ | (569,586 | ) | $ | (41,182 | ) | ||

| Net income per common share | ||||||||

| Basic* | $ | 0.00 | $ | 0.00 | ||||

| Diluted* | $ | 0.00 | $ | 0.00 | ||||

This prospectus contains forward-looking statements within the meaning of Section 27A of the Securities Act and the Private Securities Litigation Reform Act of 1995, as amended. These forward-looking statements that are based on our management’s belief and assumptions and on information currently available to our management. Although we believe that the expectations reflected in these forward-looking statements are reasonable, these statements relate to future events or our future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue” or the negative of these terms or other comparable terminology. These statements are only predictions. You should not place undue reliance on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, which are, in some cases, beyond our control and which could materially affect results. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed under “Risk Factors” and elsewhere in this prospectus. If one or more of these risks or uncertainties occur, or if our underlying assumptions prove to be incorrect, actual events or results may vary significantly from those implied or projected by the forward-looking statements. No forward-looking statement is a guarantee of future performance. You should read this prospectus and those documents which we have filed with the SEC as exhibits to the registration statement, of which this prospectus is a part, completely and with the understanding that our actual future results may be materially different from any future results expressed or implied by these forward-looking statements.

The forward-looking statements in this prospectus represent our views as of the date of this prospectus. We anticipate that subsequent events and developments may cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable law. You should therefore not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this prospectus.

You should also consider carefully the statements under “Risk Factors” and other sections of this prospectus, which address additional facts that could cause our actual results to differ from those set forth in the forward-looking statements. We caution investors not to place significant reliance on the forward-looking statements contained in this prospectus. We undertake no obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise, except as otherwise required by law.

YouInvesting in our securities involves a high degree of risk. In addition to the other information contained in this prospectus and in the documents we incorporate by reference herein, you should carefully consider the risks describeddiscussed below and elsewhereunder the heading “Risk Factors” in this prospectus, which could materially and adversely affect our business, results of operationsAnnual Report on Form 10-K for the fiscal year ended March 31, 2022 as well as any amendment or financial condition. Our business faces significantupdate to our risk factors reflected in subsequent filings with the SEC, before making a decision about investing in our securities. The risks and uncertainties discussed below and in the risks described below maydocuments incorporated by reference are not be the only risks we face.ones facing us. Additional risks and uncertainties not presently known to us, or that we currently believe aresee as immaterial, may materially affectalso harm our business, results of operations, or financial condition.business. If any of these risks occur, our business, financial condition and operating results could be harmed, the trading price of our common stockstocks could decline and you maycould lose allpart or partall of your investment. You should consider