As filed with the Securities and Exchange Commission on July 24, 2019.October 2, 2023.

Registration No. 333-333-272623

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Qualigen Therapeutics, Inc.

RITTER PHARMACEUTICALS, INC.

(Exact nameName of Registrant as specifiedSpecified in its charter)Its Charter)

| Delaware | 2834 | 26-3474527 | ||

| (State or | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

Qualigen Therapeutics, Inc.

1880 Century Park East #10005857 Owens Avenue, Suite 300

Los Angeles, CA 90067Carlsbad, California 92008

(310) 203-1000(760) 452-8111

(Address, including zip code,Including Zip Code, and telephone number, including area code,Telephone Number, Including Area Code, of Registrant’s principal executive offices)Principal Executive Offices)

Andrew J. RitterMichael S. Poirier

Chief Executive Officer

Ritter Pharmaceuticals,Qualigen Therapeutics, Inc.

1880 Century Park East #10005857 Owens Avenue, Suite 300

Los Angeles, CA 90067Carlsbad, California 92008

(310) 203-1000(760) 452-8111

(Name, address, including zip code,Address, Including Zip Code, and telephone number, including area code,Telephone Number, Including Area Code, of agent for service)Agent For Service)

Copies to:

Michael Sanders, Esq.

Ashok W. Mukhey, Esq. William D. Davis II, Esq. Reed Smith LLP 1901 Avenue of the Stars, Suite 700 Los Angeles, California 90067

| Leslie Marlow, Esq. Patrick J. Egan, Esq. Blank Rome LLP 1271 Avenue of the Americas New York, New York 10020 (212) 885-5000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.Registration Statement.

If any of the securities being registered on this Formform are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. [X]☒

If this Formform is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]☐

If this Formform is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]☐

If this Formform is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.Act:

| Large accelerated filer | Accelerated filer | |||

| Non-accelerated filer | Smaller reporting company | |||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. [ ]☐

| Title of each class of securities to be registered | Amount to be registered (1) | Proposed maximum offering price per share (2) | Proposed maximum aggregate offering price (2) | Amount of registration fee (2) | ||||||||||||

| Common Stock, $0.001 par value per share | 7,600,000 | $ | 0.98 | $ | 7,448,000 | $ | 903 | |||||||||

The Registrant hereby amends this registration statementRegistration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statementRegistration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statementRegistration Statement shall become effective on such date as the Commission, acting pursuant to suchsaid Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. The selling stockholderThese securities may not sell these securitiesbe sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it iswe are not soliciting an offeroffers to buy these securities in any jurisdiction where the offer or sale is not permitted.

7,600,000Up to Shares

of Common Stock

Up to Pre-Funded Warrants to Purchase up to Shares of Common Stock

This prospectus relatesUp to Shares of Common Stock Underlying the Pre-Funded Warrants

Up to Common Stock Warrants to Purchase up to Shares of Common Stock

Up to Shares of Common Stock Underlying the Common Stock Warrants

We are offering on a “reasonable best efforts” basis up to $ million of shares of common stock together with common stock warrants to purchase shares of common stock. Each share of our common stock is being sold together with a common stock warrant to purchase shares of our common stock. The shares of common stock and common stock warrants are immediately separable and will be issued separately in this offering but must be purchased together as a unit in this offering. The common stock warrants will have an initial exercise price of $ per share and will have a five-year term.

We are also offering pre-funded warrants to purchase up to an aggregate of shares of common stock to those purchasers whose purchase of shares of common stock in this offering would result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock immediately following the consummation of this offering, in lieu of shares of common stock that would result in beneficial ownership in excess of 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock. Each pre-funded warrant is exercisable for one share of our common stock, has an exercise price of $0.001 per share and an indefinite term. Each pre-funded warrant is being offered together with a common stock warrant. The pre-funded warrants and common stock warrants are immediately separable and will be issued separately in this offering but must be purchased together as a unit in this offering. For each pre-funded warrant that we sell, the number of shares of common stock we are offering will be reduced on a one-for-one basis.

There is no established trading market for the pre-funded warrants or common stock warrants, and we do not expect a market to develop. In addition, we do not intend to list the pre-funded warrants or common stock warrants on Nasdaq, any other national securities exchange or any other trading system. Without an active trading market, the liquidity of the pre-funded warrants and common stock warrants may be limited.

We have engaged A.G.P./Alliance Global Partners (whom we refer to herein as the “Placement Agent”) to act as our exclusive placement agent in connection with the securities offered by this prospectus. The Placement Agent has no obligation to buy any of the securities from us or to arrange for the purchase or sale of any specific number or dollar amount of securities but has agreed to use its reasonable best efforts to arrange for the sale of upthe securities offered by this prospectus. We have agreed to 7,600,000pay the Placement Agent a fee based upon the aggregate gross proceeds raised in this offering as set forth in the table below.

The actual public offering price of the securities described in this prospectus will be determined by us, the Placement Agent and the investors in the offering, and may be at a discount to the current market price of our common stock. Therefore, the assumed public offering price used throughout this prospectus may not be indicative of the final offering price.

Pursuant to this prospectus, we are also offering the shares of common stock issuable upon the exercise of pre-funded warrants and common stock warrants offered hereby.

The shares of our common stock, pre-funded warrants or common warrants being offered will be sold in a single closing. We will deliver all securities to be issued in connection with this offering delivery versus payment (DVP)/receipt versus payment (RVP) upon receipt of investor funds received by Aspire Capital Fund, LLC,us. Accordingly, neither we nor the Placement Agent have made any arrangements to place investor funds in an escrow account or Aspire Capital. Aspire Capitaltrust account since the Placement Agent will not receive investor funds in connection with the sale of the securities offered hereunder. Because there is also referredno minimum number of securities or minimum aggregate amount of proceeds for this offering to close, we may sell fewer than all of the securities offered hereby, and investors in this prospectus as the selling stockholder. The prices at which the selling stockholder may sell the shares will be determined by the prevailing market price for the shares or in negotiated transactions. Weoffering will not receive a refund in the event that we do not sell an amount of securities sufficient to pursue the business goals outlined in this prospectus. Because there is no escrow account and there is no minimum offering amount, investors could be in a position where they have invested in our company, but we are unable to fulfill our objectives due to a lack of interest in this offering. Also, any proceeds from the sale of securities offered by us will be available for our immediate use, despite uncertainty about whether we would be able to use such funds to effectively implement our business plan. The offering of the shares by the selling stockholder. However, we may receive proceeds of up to $6.5 million from the sale of our common stock, pre-funded warrants or common warrants will terminate no later than , 2023 unless the offering is fully subscribed before that date or we decide to terminate the selling stockholder,offering (which we may do at any time in our discretion) prior to that date; however, the shares of our common stock underlying the pre-funded warrants and the common warrants will be offered on a continuous basis pursuant to a common stock purchase agreement entered into with the selling stockholder on July 23, 2019, or the Purchase Agreement, once the registration statement, of which this prospectus is a part, is declared effective.

The selling stockholder is an “underwriter” within the meaning ofRule 415 under the Securities Act of 1933, as amended. We will pay the expenses of registering these shares, but all selling and other expenses incurred by the selling stockholder will be paid by the selling stockholder.amended (the “Securities Act”).

Our common stock is listed on theThe Nasdaq Capital Market under the ticker symbol “RTTR.“QLGN.” On July 23, 2019, theThe last reported salesales price per share of our common stock on The Nasdaq Capital Market on September 29, 2023 was $1.01 per share.

You should read this prospectus and We do not intend to list the pre-funded warrants or the common stock warrants on any prospectus supplement, together with additional information described under the headings “Incorporation of Certain Documents by Reference” and “Where You Can Find More Information,” carefully before you invest in any of our securities.

We are an “emerging growth company” as defined by the Jumpstart Our Business Startups Act of 2012 and, as such, we have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings. Please see “Prospectus Summary – Implications of Being an Emerging Growth Company.”national securities exchange or other nationally recognized trading system.

InvestingAn investment in our securities involves a high degree of risk. See “Risk Factors”significant risks. You should carefully consider the risk factors beginning on page 58 of this prospectus.prospectus before you make your decision to invest in our securities.

Neither the Securities and Exchange Commission nor any state securities commissionother regulatory body has approved or disapproved of these securities or passed upon the adequacyaccuracy or accuracyadequacy of this prospectus. Any representation to the contrary is a criminal offense.

Per Share Common Stock | Per Pre-Funded Warrant and Accompanying Common Stock Warrant | Total | ||||||||||

| Public offering price | $ | $ | ||||||||||

| Placement Agent fees(1) | $ | $ | ||||||||||

| Proceeds to us, before expenses(2) | $ | $ | ||||||||||

| (1) | Does not include certain expenses of the Placement Agent. See “Plan of Distribution” beginning on page 23 of this prospectus for additional information regarding compensation to be received by the Placement Agent. |

| (2) | The amount of proceeds, before expenses, to us does not give effect to any exercise of the pre-funded warrants or common warrants. |

Delivery of the shares of our common stock, pre-funded warrants or common warrants is expected to be made on or about , 2023.

Sole Placement Agent

A.G.P.

The date of this prospectus is , 2019.2023

TABLE OF CONTENTS

We incorporate by reference important information into this prospectus. You may obtain the information incorporated by reference without charge by following the instructions under “Where You Can Find More Information.” You should carefully read this prospectus as well as additional information described under “Incorporation of Certain Information by Reference,” before deciding to invest in our common stock.

Neither we nor the selling stockholder hasPlacement Agent have authorized anyone to providegive any information or to make any representations other than asthose contained or incorporated by reference in this prospectus or in any free writing prospectuses we have prepared. We and the selling stockholder take no responsibility for, and provide no assurance as to the reliability of,prospectus. You must not rely on any information that others may give you.or representations not contained or incorporated by reference in this prospectus. This prospectus is an offer to sell only the sharessecurities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

For investors outside of the United States: Neither we nor the selling stockholder have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about, and to observe any restrictions relating to, this offering and the distribution of this prospectus outside of the United States.

This summary highlights certain information about us, this offering and selected information contained elsewhere in theor incorporated by reference into this prospectus. This summary is not complete and does not contain all of the information that you should consider before deciding whether to invest in our common stock. For a more complete understanding of our companysecurities. You should carefully read this entire prospectus and the documents and reports incorporated by reference into this offering, we encourage you to read prospectus before making an investment decision, including the information presented under the headings “Risk Factors” and consider“Cautionary Note Regarding Forward-Looking Statements and Industry Data and Market Information” in this prospectus and the more detailed information in the prospectus, including ourhistorical financial statements and the related notes and other documentsthereto incorporated by reference into this prospectus. You should pay special attention to the information contained under the caption titled “Risk Factors” in this prospectus, as well asin our most recent Annual Report on Form 10-K, in any subsequent Quarterly Reports on Form 10-Q and in our other reports filed from time to time with the information under the caption “Risk Factors” hereinSecurities and under similar headings in the other documents thatExchange Commission, which are incorporated by reference into this prospectus.. Unless we specify otherwise, all references inprospectus, before deciding to buy our securities. In this prospectus, to “Ritter Pharmaceuticals,the terms “Qualigen,” “we,“Qualigen Therapeutics, Inc.,” “our,the “Company,” “us” “we,” “our,” “ours” and “our company” “us” refer to Ritter Pharmaceuticals,Qualigen Therapeutics. Inc. and its subsidiaries.

Company Overview

Ritter Pharmaceuticals, Inc. develops novel therapeutic products that modulate the gut microbiome to treat digestive disordersWe are a clinical stage therapeutics company focused on developing treatments for adult and gastrointestinal diseases. pediatric cancers of high unmet medical need with potential for Orphan Drug designation.

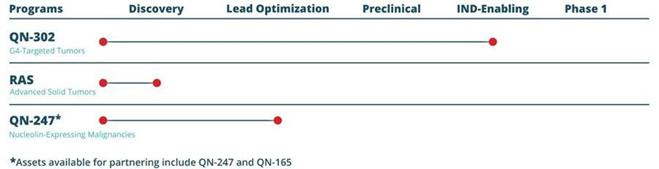

Our cancer therapeutics pipeline includes QN-302, our Pan-RAS Inhibitor platform (formerly RAS-F) and QN-247.

Our lead product candidate, RP-G28,oncology therapeutics program, QN-302, is an orally administered,a high purity galacto-oligosaccharide, currentlypotency small molecule selective transcription inhibitor with strong binding affinity to G-Quadruplexes (G4s) prevalent in Phase 3 clinical development for the treatment of lactose intolerance (“LI”), a condition that affects millions worldwide. RP-G28 is designedcancer cells. By binding to, selectively stimulate the growth of lactose-metabolizing bacteria in the colon, thereby effectively adapting the gut microbiome to assist in digesting lactose (the sugar found in milk) that reaches the large intestine. RP-G28and stabilizing G4s against “unwinding,” QN-302 could potentially help inhibit cancer cell proliferation and induces cancer cell death. QN-302 has the potential to become the first drug approved byreceived Investigational New Drug (IND) clearance from the U.S. Food and Drug Administration (FDA) to proceed with its Phase 1 clinical trial. Earlier this year, QN-302 also received Orphan Drug Designation (ODD) from FDA for the indication of pancreatic cancer.

Our Pan-RAS portfolio consists of a family of Pan-RAS inhibitor small molecules believed to inhibit or block mutated RAS genes’ proteins from binding to their effector proteins. Preventing this binding could stop tumor growth, especially in RAS-driven tumors such as pancreatic, colorectal and lung cancers.

Our investigational oligonucleotide-based drug candidate QN-247 binds nucleolin, a key multi-functional regulatory phosphoprotein that is overexpressed in cancer cells. Such binding could inhibit the cancer cells’ proliferation in nucleolin-expressing malignancies.

| 1 |

Therapeutics Pipeline

Our lead drug compound QN-302 (formerly SOP1812) is being developed to target regulatory regions of cancer genes that down-regulate gene expression in multiple cancer pathways for potential treatment of G4-targeted tumors (e.g., pancreatic cancer).

The investigational compounds within our Pan-RAS Inhibitor portfolio are designed to suppress the interaction of endogenous RAS with c-RAF, upstream of the KRAS, HRAS and NRAS effector pathways, and is being developed for the potential treatment of RAS-driven tumors.

Our anticancer drug candidate, QN-247 (formerly referred to as ALAN or AS1411-GNP) is a DNA aptamer conjugated to a gold nanoparticle, which potentially gives it dramatically increased potency and versatility. On May 2, 2023, we announced that we have de-prioritized deploying our internal resources to our QN-247 program and are seeking a partner to further its development.

On May 26, 2022, we acquired a 52.8% interest in NanoSynex, Ltd. (“FDA”NanoSynex”). NanoSynex is a nanotechnology diagnostics company domiciled in Israel. NanoSynex’s technology is an Antimicrobial Susceptibility Testing (AST) that aims to enable better targeting of antibiotics for their most suitable uses to ultimately result in faster and more efficacious treatment, hence reducing hospitals mortality and morbidity rates. As described below, we have recently reduced our ownership interest in NanoSynex to below 50%.

QN-302 (formerly referred to as SOP1812)

We exclusively in-licensed the global rights to the G4 selective transcription inhibitor platform from University College London (“UCL”) in January 2022. The licensed technology comprises lead compound QN-302 (formerly SOP1812) and back-up compounds that target regulatory regions of cancer genes that down-regulate gene expression in multiple cancer pathways. The license agreement requires (if and when applicable) tiered royalty payments in the low to mid-single digits, clinical/regulatory/sales milestone payments, and a percentage of any non-royalty sublicensing consideration paid to Qualigen.

Developed by Dr. Stephen Neidle and his group at UCL, the G-Quadruplex (G4) binding concept is derived from over 30 years in nucleic acid research, including research on G4s, which are higher order DNA and RNA structures formed by sequences containing guanine-rich repeats. G4s are overrepresented in telomeres (a region of repetitive DNA sequences at the end of a chromosome) as well as promoter sequences and untranslated regions of many oncogenes. Their prevalence is therefore significantly greater in cancer cells compared to normal human cells.

G4-selective small molecules such as QN-302 and backup compounds target the regulatory regions of cancer genes, which have a high prevalence of enriched G4s. Stable G4-QN-302 complexes can be impediments to replication, transcription or translation of those cancer genes containing G4s, and the drugs’ binding to G4s are believed to stabilize the G4s against possible “unwinding.” G4 binders like QN-302 could potentially be efficacious in a variety of cancer types with a high prevalence of G4s.

Pancreatic cancer is the tenth most common cancer and third deadliest cancer in the United States and has one of the lowest rates of survival of all cancer types, with 91% of those diagnosed dying from the disease and one in four dying within the first month of diagnosis. The chemotherapy drug Gemcitabine has been standard of care for patients with metastatic pancreatic cancer for more than 15 years. Numerous clinical trials have tested new drugs, either alone or in combination, with Gemcitabine. Based upon our pre-clinical in-vitro and in-vivo studies, we believe that QN-302 has the potential to demonstrate positive activity against pancreatic ductal adenocarcinoma (“PDAC”).

Our pre-clinical in-vitro and in-vivo studies have shown that G4 stabilization by QN-302 resulted in inhibition of target gene expression and cessation of cell growth in various cancers, including PDAC, which represents 98% of pancreatic cancers. In in-vitro studies, QN-302 was potent in inhibiting the growth of several PDAC cell lines at low nanomolar concentrations. Similarly, in in-vivo studies, QN-302 showed a longer survival duration in a KPC genetic mouse model for PDAC than Gemcitabine has historically shown. Additional preclinical in-vivo studies suggest activity in gemcitabine-resistant PDAC. Data further demonstrated that QN-302 had significant anti-tumor activity in three patient-derived PDAC xenograft models. Early safety indicators suggest no significant adverse toxic effects at proposed therapeutic doses in pancreatic cancer mouse in-vivo models.

| 2 |

On January 9, 2023, the FDA granted Orphan Drug Designation (“ODD”) to QN-302 for the indication of pancreatic cancer. ODD provides advantages to pharmaceutical companies that are developing investigational drugs or biological products that show promise in treating rare diseases or conditions that affect fewer than 200,000 people in the United States, including seven-year marketing exclusivity if the product receives the first FDA approval for the disease for which it has such designation, and eligibility to receive regulatory support and guidance from the FDA in the design of an overall drug development plan.

There are also economic advantages to receiving ODD, including a 25% federal tax credit for expenses incurred in conducting clinical research on the orphan designated product within the United States. Tax credits may be applied to the prior year or applied to up to 20 years of future taxes. ODD recipients may also have their Prescription Drug User Fee Act (PDUFA) application fees waived, a potential savings of around $3.2 million (as of fiscal year 2023) for applications requiring covered clinical data and may qualify to compete for research grants from the Office of Orphan Products Development that support clinical studies.

Pan-RAS Inhibitor Platform (formerly RAS-F)

We entered into a sponsored research agreement with University of Louisville (“UofL”) on March 4, 2019, pursuant to which UofL agreed to conduct ongoing discovery and preclinical efforts for the Pan-RAS platform on our behalf. Under the terms of the agreement, as amended, the collaboration extends until the fourth quarter of 2023.

In July 2020, we entered into an exclusive worldwide license agreement with UofL for the intellectual property covering the “RAS” family of pan RAS inhibitor small molecule drug candidates, which was subsequently amended on March 17, 2021 and June 15, 2023. The Pan-RAS inhibitor compounds are believed to work by blocking RAS mutations directly, thereby inhibiting tumor formation (especially in pancreatic, colorectal and lung cancers). Pursuant to the license agreement, we in-licensed the Pan-RAS compound family of drug candidates and will seek to identify and develop a lead drug candidate from the compound family. The license agreement requires (if and when applicable) tiered royalty payments in the low to mid-single digits, clinical/regulatory/sales milestone payments, and a percentage of any non-royalty sublicensing consideration paid to Qualigen.

RAS is the most common oncogene in human cancer. Activating mutations in one of the three human RAS gene isoforms (KRAS, HRAS or NRAS) are present in about one-fourth to one-third of all cancers. For example, mutant KRAS is found in 98% of pancreatic ductal adenocarcinomas, 52% of colon cancers, and 32% of lung adenocarcinomas. For these three cancer types, cancers with mutant KRAS are diagnosed in more than 170,000 people each year in the United States and cause more than 120,000 deaths. Drugs that target signaling downstream of RAS are available; however, such drugs have shown disappointing clinical durability because RAS is a “hub” that activates multiple effectors, so drugs that block a single pathway downstream may not account for the many other activated pathways.

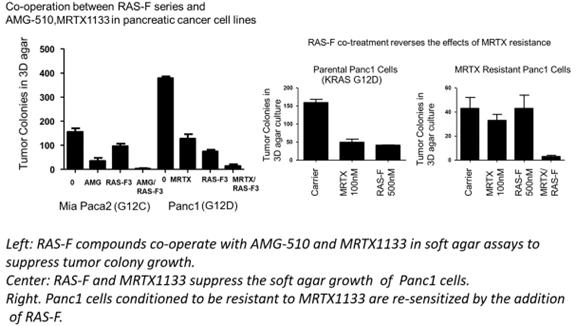

On June 5, 2023, we announced a poster featuring our pan-RAS inhibitor program in pancreatic cancer, which was presented as part of the Scientific Program at the American Society of Clinical Oncology’s (ASCO) 2023 Annual Meeting held June 2 - 6, 2023 in Chicago.

The poster outlines results of concurrent administration of one of our pan-RAS inhibitor molecules (referred to as RAS-F in the figure below) with commonly used therapeutics against pancreatic cancer. In-vivo activity was confirmed in xenograft experiments with cell lines and PDX models, and the molecules were shown to co-operate with AMG-510 (sotorasib) (G12C specific inhibitor) and MRTX1133 (G12D specific inhibitor) against pancreatic cancer cell lines. This agent was also shown to suppress resistance to MRTX1133 in-vitro, which led authors to believe these pan-RAS compounds may have the potential to overcome resistance to AMG-510 and MRTX1133 in-vivo.

| 3 |

QN-247

In June 2018, we entered into an exclusive, worldwide license agreement with UofL for the intellectual property covering QN-247, which was subsequently amended on January 17, 2023 and March 16, 2023.

We also entered into a sponsored research agreement with UofL in August 2018, which was subsequently amended in October 2020, pursuant to which UofL performed various animal studies on our behalf to assess antitumor efficacy and safety of different QN-247 compositions. The sponsored research agreement with UofL for QN-247 expired on August 31, 2022.

QN-247 is an oligonucleotide-based drug candidate that is designed to treat different types of nucleolin-expressing cancers, including liquid and solid tumors. QN-247 inhibits nucleolin, a key multi-functional regulatory phosphoprotein that is overexpressed in cancer cells, and may thereby be able to inhibit the cells’ proliferation. QN-247 has shown promise in preclinical studies for the treatment of LI. We are further exploring the functionality and discovering the therapeutic potential that gut microbiome changesacute myeloid leukemia (“AML”). This novel technology may have several other potential applications, including enhancement of radiation therapy, enhancement of tumor imaging, and delivery of other anti-cancer compounds directly to tumor cells.

QN-247 is an enhanced version of QN-165 (formerly referred to as AS1411), where the DNA oligonucleotide aptamer is conjugated. A key component of QN-247, DNA oligonucleotide aptamer QN-165, has been shown, primarily on treating/preventing a varietypreclinical basis, to have the potential to target and destroy cancer cells. This component has been administered in Phase 1 and Phase 2 clinical trials to over 100 AML or renal cell carcinoma cancer patients and appears to be well tolerated with no evidence of conditions including gastrointestinal diseases,severe adverse events in such trials, with at least seven patients appearing to have clinical responses.

An in-vivo efficacy study with a triple negative breast cancer metabolic,(TNBC) MDA-MB-231 xenograft mouse model was performed with 12 daily doses (1 mg/kg) of QN-247. This study showed statistically significant reductions in mean tumor volumes for all QN-247 formulations compared to baseline and liver diseases.to vehicle control. QN-247 formulations with higher oligonucleotide loading appeared to reduce tumor volumes more than lower oligonucleotide loading. No evidence of adverse toxicity was observed.

| 4 |

We do not have in-house manufacturing capability for our therapeutics product candidates.

Research and Development

For research and development of our drug candidates, we are leveraging the scientific and technical resources and laboratory facilities of UofL and UCL, through technology licensing, sponsored research, and other consulting agreements, which are focused on aptamer technology and applications. We would engage contract research organizations (“CROs”) for any clinical trials of our drug candidates. We intend to expandfocus our product pipelineinternal research and create added value in the future by evaluating RP-G28 in other indications, including orphan indications, developing additional products baseddevelopment on our underlying microbiome-modulating technology, and/or in-licensing complementary products to treatoversight of these or other, conditions.organizations.

In July 2019,Recent Developments

FDA IND Clearance to Initiate Phase 1 Clinical Trial of QN-302

On August 1, 2023, we announced that the last patient had completed their final visitFDA has cleared our IND application for QN-302. Based on this clearance, we plan to initiate the Phase 1 clinical trial in the Company’s first pivotal Phase 3 clinical trial of RP-G28, that trial finalization leading to data lock and top-line data readout had begun, and that data is expected to be publicly released in early fourth quarter of 2019.2023 and will enroll patients with advanced or metastatic solid tumors. The proposed Phase 1 clinical trial is a multicenter, open-label, dose escalation, safety, pharmacokinetic, and pharmacodynamic study with dose expansion to evaluate safety, tolerability, and antitumor activity of QN-302 in patients with advanced solid tumors that have not responded to or that have recurred following treatment with available therapies. We expect ouranticipate the dosing of at least 24 patients in Phase 3 clinical program will include two confirmatory clinical trials1a can be completed by the end of similar trial design.2024, funded in part by proceeds received by the divestiture of the Company’s diagnostics business in July 2023 as described immediately below.

We have devoted substantiallySale of Diagnostics Business

On July 20, 2023, we sold all of the issued and outstanding shares of common stock of Qualigen, Inc., a wholly-owned subsidiary and the legal entity operating our resourcesFastPack™ diagnostic business, to development efforts relatingChembio Diagnostics, Inc. (“Chembio”), a subsidiary of Biosynex, S.A. As consideration for the shares of Qualigen, Inc., we received a cash payment of approximately $4.7 million, which payment is subject to RP-G28, including conducting clinical trialspost-closing adjustments. An additional $450,000 was delivered by Chembio to an escrow account to satisfy our indemnification obligations. Any amounts remaining in the escrow account that have not been offset or reserved for claims will be released to us within five business days following the date that is 18 months after the closing of RP-G28, providing generalthe transaction. Following the consummation of the transaction, Qualigen, Inc. became a wholly-owned subsidiary of Chembio.

Amendment and administrative supportSettlement Agreement with NanoSynex Ltd.

On July 20, 2023, we entered into an Amendment and Settlement Agreement with NanoSynex (the “NanoSynex Amendment”), which amended the Master Funding Agreement for these operationsthe Operational and protectingTechnology Funding of Nanosynex Ltd., dated May 26, 2022, by and between us and NanoSynex (the “Original NanoSynex Agreement”), to, among other things, provide for the further funding of NanoSynex, as contemplated by the Original NanoSynex Agreement.

Pursuant to the terms of the NanoSynex Amendment, we agreed to advance to NanoSynex an aggregate amount of $1,610,000 as follows: (i) $380,000 within five business days of the execution of the NanoSynex Amendment; (ii) $560,000 on or before November 30, 2023, against which NanoSynex will issue a promissory note to us with a face value in the amount of such funding; and (iii) $670,000 on or before March 31, 2024, against which NanoSynex will issue a promissory note to us with a face value in the amount of such funding. The NanoSynex Amendment further provides that the initial payment of $380,000 would be satisfied by our intellectual property. We currentlysurrender of the 281,000 Preferred B Shares of NanoSynex then held by us, and such share surrender has resulted in our ownership in NanoSynex being reduced from approximately 52.8% to approximately 49.97% of the issued and outstanding voting equity of NanoSynex. In the event that we do not satisfy these payment obligations, there would be an additional surrender of our shares in NanoSynex in such number as provided in the NanoSynex Amendment. The NanoSynex Amendment supersedes any payments contemplated by the Original NanoSynex Agreement, such that except as described in the NanoSynex Amendment, we will have any products approvedno further payment obligations to NanoSynex under the Original NanoSynex Agreement or otherwise (including by way of equity investment, loan financing or credit lines).

Reverse Stock Split

Effective as of November 23, 2022, we completed a 1-for-10 reverse stock split of our common stock in order to regain compliance with Nasdaq Listing Rule 5550(a)(2), which requires a minimum bid price of $1.00 per share. As a result of the reverse stock split, each 10 shares of our common stock issued and outstanding as of 12:01 a.m. Eastern Time on November 23, 2022 were combined and converted into one share of common stock. On December 9, 2022, we received written notice from the Listing Qualifications Department of The Nasdaq Stock Market LLC stating that because our shares of common stock had a closing bid price at or above $1.00 per share for salea minimum of 10 consecutive business days, the Company has regained compliance with the minimum bid price requirement of $1.00 per share for continued listing on The Nasdaq Capital Market, as set forth in Nasdaq Listing Rule 5550(a)(2), and wethat the matter is now closed. All references to numbers of shares of Common Stock and per-share information in this prospectus have not generated any revenue from product sales since our inception.been adjusted retroactively, as appropriate, to reflect the 1-for-10 reverse stock split.

Corporate Information

We wereRitter Pharmaceuticals, Inc. (our predecessor) was formed as a Nevada limited liability company on March 29, 2004 under the name Ritter Natural Sciences, LLC. In September 2008, wethis company converted into a Delaware corporation under the name Ritter Pharmaceuticals, Inc. On May 22, 2020, upon completing a “reverse recapitalization” transaction with Qualigen, Inc., Ritter Pharmaceuticals, Inc. was renamed Qualigen Therapeutics, Inc. Qualisys Diagnostics, Inc. was formed as a Minnesota corporation in 1996, reincorporated to become a Delaware corporation in 1999, and then changed its name to Qualigen, Inc. in 2000. Qualigen, Inc. was a wholly-owned subsidiary of the Company. On July 20, 2023, we sold all of the issued and outstanding shares of common stock of Qualigen, Inc. to Chembio, a wholly-owned subsidiary of Biosynex, S.A. Following the consummation of this transaction, Qualigen, Inc. became a wholly-owned subsidiary of Chembio.

Our principal executive offices are located at 1880 Century Park East,5857 Owens Avenue, Suite 1000, Los Angeles, California 90067, and our300, Carlsbad, CA 92008. Our telephone number is (310) 203-1000.(760) 452-8111. Our corporate website address is www.qlgntx.com. Our website address iswww.ritterpharmaceuticals.comand we regularly post copies of our press releases as well as additionalthe information about uscontained on, our website. Information contained in, or that can be accessed through, our website iswill not be deemed to be incorporated by reference intoin, and are not considered part of, this prospectus, and youprospectus. You should not consider informationrely on our website or any such information in making your decision whether to be part of this prospectus.

This prospectus may contain references topurchase our trademark and to trademarks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus, including logos, artwork and other visual displays, may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other company.

Implications of Being an Emerging Growth Companysecurities.

We are an emerging growth company,a “smaller reporting company” as defined in the Jumpstart Our Business Startups ActItem 10(f)(1) of 2012, or the JOBS Act. For as long as we continue to be an emerging growth company, weRegulation S-K. Smaller reporting companies may take advantage of exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies, including not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act,certain reduced disclosure obligations, regarding executive compensation in this prospectus and our periodic reports and proxy statements and exemptions from the requirementsincluding, among other things, providing only two years of holding nonbinding advisory votes on executive compensation and stockholder approval of any golden parachute payments not previously approved.audited financial statements. We canwill remain an emerging growtha smaller reporting company until the earlier of (1) the last day of the fiscal year (a) ending December 31, 2020, which is the end of the fiscal year following the fifth anniversary of the closing of our initial public offering, (b) in which we have total annual gross revenue of at least $1.07 billion, or (c) in which we are deemed to be a large accelerated filer, which means(1) the market value of our common stock that isheld by non-affiliates exceeds $250 million as of the prior June 30, or (2) our annual revenues exceeded $100 million during such completed fiscal year and the market value of our common stock held by non-affiliates exceeds $700 million as of the prior June 30th, and (2) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period. Even after we no longer qualify as an emerging growth company, we may still qualify as a “smaller reporting company” which would allow us to take advantage of many of the same exemptions from disclosure requirements, including reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements. Additionally, even if we no longer qualify as an emerging growth company, as long as we are neither a “large accelerated filer” nor an “accelerated filer,” we would not be required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act.30.

We cannot predict if investors will find our securities less attractive because we may rely on these exemptions, which could result in a less active trading market for our securities and increased volatility in the price of our securities.

Under the JOBS Act, emerging growth companies can also delay adopting new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. We have elected to use this extended transition period. As a result of this election, our timeline to comply with these standards will in many cases be delayed as compared to other public companies that are not eligible to take advantage of this election or have not made this election. Therefore, our financial statements may not be comparable to those of companies that comply with the public company effective dates for these standards.

In addition, if we cease to be an emerging growth company, we will no longer be able to use the extended transition period for complying with new or revised accounting standards. As a result, changes in rules of U.S. generally accepted accounting principles or their interpretation, the adoption of new guidance or the application of existing guidance to changes in our business could significantly affect our financial position and results of operations.

THE OFFERINGThe Offering

Securities we are offering | Up to shares of common stock together with common stock warrants to purchase up to shares of our common stock, and pre-funded warrants to purchase up to shares of common stock together with common stock warrants to purchase up to shares of common stock. The shares of common stock being | ||

| We are offering to those purchasers whose purchase of common stock in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock immediately following the closing of this offering, in lieu of purchasing common stock, pre-funded warrants to purchase up to an aggregate of shares of our common stock. Each pre-funded warrant is exercisable for one share of our common stock. The purchase price of each pre-funded warrant is equal to the price at which a share of common stock is being sold to the public in this offering, minus $0.001. We are also registering the issuance of up to shares of our common stock issuable upon exercise of the pre-funded warrants. For each pre-funded warrant that we sell, the number of shares of common stock that we are offering will be reduced on a one-for-one basis. | |||

Common immediately before this offering | |||

Common stock outstanding immediately after this offering | Up to shares, assuming no exercise of the pre-funded warrants and common stock warrants issued in this offering. | ||

| Use of | We estimate that the net proceeds from this offering will We intend to use the net proceeds from the sale of the | ||

| Risk Factors | |||

| Lock-up | We have agreed, subject to certain exceptions and without the approval of the Placement Agent and purchasers of our securities in this offering, not to (1) issue, enter into any agreement to issue or announce the issuance or proposed issuance of, any shares of common stock (or securities convertible into or exercisable for common stock) or file any registration statement, including any amendments or supplements for a period of days following the closing of the offering of the shares and (2) enter into a variable rate transaction for a period of days following the closing of this offering. Our directors and officers have agreed not to offer, sell, pledge or otherwise transfer or dispose of any of our |

The Nasdaq Capital Market listing symbol | “QLGN.” There is no established trading market for the pre-funded warrants or the common stock warrants and we do not expect a market to develop. In addition, we do not intend to apply for the listing of the pre-funded warrants or the common stock warrants on any national securities exchange or other trading market. Without an active trading market, the liquidity of the pre-funded warrants and common stock warrants will be limited. |

| 6 |

The number of shares of our common stock to be outstanding followingafter this offering is based on an aggregate5,052,463 shares of 9,350,026common stock outstanding on September 27, 2023, does not give effect to the shares outstanding as of July 23, 2019, butcommon stock issuable upon exercise of the pre-funded warrants and common warrants issued in this offering and excludes:

| ● | ||

| ● | ||

| ● | Approximately 1,762,396 shares of common stock issuable | |

| ● | ||

| ● |

Common Stock Issued and IssuableUnless otherwise indicated, all information in this prospectus gives effect to the Selling Stockholder1-for-10 reverse stock split effectuated on November 23, 2022.

The Purchase Agreement provides that, upon the terms and subject to the conditions and limitations set forth therein, Aspire Capital is committed to purchase up to an aggregate of $6.5 million of shares of our common stock, or the Purchase Shares, over the term of the Purchase Agreement, which matures on March 31, 2021.

Concurrently with entering into the Purchase Agreement, we also entered into an amended and restated registration rights agreement with Aspire Capital, or the Registration Rights Agreement, in which we agreed to file one or more registration statements, including the registration statement of which this prospectus is a part, as permissible and necessary to register under the Securities Act of 1933, as amended, or the Securities Act, the sale of the shares of our common stock that may be issued to Aspire Capital under the Purchase Agreement.

As of July 23, 2019 there were 9,350,026 shares of our common stock outstanding, excluding the 7,600,000 shares of common stock that we may issue to Aspire Capital after this registration statement is declared effective under the Securities Act. If all of such 7,600,000 shares of our common stock offered hereby were issued and outstanding as of the date hereof, such shares would represent 44.8% of the total common stock outstanding as of the date hereof. The number of shares of our common stock ultimately offered for sale by Aspire Capital is dependent upon the number of shares purchased by Aspire Capital under the Purchase Agreement.

Pursuant to the terms of the Purchase Agreement, the aggregate number of shares that we may issue to Aspire Capital under the Purchase Agreement may in no case exceed 1,807,562 shares of our common stock, unless (i) stockholder approval is obtained to issue more, in which case this 1,807,562 share limitation will not apply, or (ii) stockholder approval has not been obtained and at any time the 1,807,562 share limitation is reached and at all times thereafter the average price paid for all shares issued under the Purchase Agreement is equal to or greater than $0.86, or the Minimum Price; provided that at no point in time shall Aspire Capital (together with its affiliates) beneficially own more than 19.99% of our common stock.

Pursuant to the Purchase Agreement and the Registration Rights Agreement, we are registering 7,600,000 shares of our common stock under the Securities Act that we may issue to Aspire Capital after this registration statement is declared effective under the Securities Act. All 7,600,000 shares of common stock are being offered pursuant to this prospectus.

After the SEC has declared effective the registration statement of which this prospectus is a part, on any trading day on which the closing sale price of our common stock exceeds $0.25, or the Floor Price, we have the right, in our sole discretion, to present Aspire Capital with a purchase notice, or each a Purchase Notice, directing Aspire Capital (as principal) to purchase up to 100,000 shares of our common stock per trading day, up to $6.5 million of our common stock in the aggregate at a per share price, or the Purchase Price, calculated by reference to the prevailing market price of our common stock (as more specifically described below in the section titled “The Aspire Capital Transaction”); however, in no event shall the shares purchased exceed Five Hundred Thousand Dollars ($500,000) per business day.

In addition, on any date on which we submit a Purchase Notice for 100,000 shares to Aspire Capital, we also have the right, in our sole discretion, to present Aspire Capital with a volume-weighted average price purchase notice, or each a VWAP Purchase Notice, directing Aspire Capital to purchase an amount of stock equal to up to 30% of the aggregate shares of the Company’s common stock traded on the Nasdaq Capital Market on the next trading day, or the VWAP Purchase Date, subject to a maximum number of shares we may determine, or the VWAP Purchase Share Volume Maximum, and a minimum trading price, or the VWAP Minimum Price Threshold (as more specifically described below). The purchase price per Purchase Share pursuant to such VWAP Purchase Notice, or the VWAP Purchase Price, is calculated by reference to the prevailing market price of our common stock (as more specifically described below).

The Purchase Agreement provides that the Company and Aspire Capital will not effect any sales under the Purchase Agreement on any purchase date where the closing sale price of our common stock is less than the Floor Price. This Floor Price and the respective prices and share numbers in the preceding paragraphs will be appropriately adjusted for any reorganization, recapitalization, non-cash dividend, stock split, reverse stock split or other similar transaction. There are no trading volume requirements or restrictions under the Purchase Agreement, and we will control the timing and amount of any sales of our common stock to Aspire Capital. Aspire Capital has no right to require any sales by us, but is obligated to make purchases from us as we direct in accordance with the Purchase Agreement. There are no limitations on use of proceeds, financial or business covenants, restrictions on future fundings, rights of first refusal, participation rights, penalties or liquidated damages in the Purchase Agreement.

Aspire Capital may not assign its rights or obligations under the Purchase Agreement. The Purchase Agreement may be terminated by us at any time, at our discretion, without any penalty or cost to us.

Investing in our common stock, pre-funded warrants and common stock warrants involves a high degree of risk. YouBefore investing in our common stock, pre-funded warrants and common stock warrants, you should consider carefully the following risks and uncertainties as well as the risks and uncertainties described in the section entitled “Risk Factors” contained discussed under “Risk Factors” in our Annual Reportlatest annual report on Form 10-K forand subsequent quarterly reports on Form 10-Q and current reports on Form 8-K, which are incorporated by reference herein in their entirety. You should carefully consider each of the year ended December 31, 2018, as filedfollowing risks, together with the Securities and Exchange Commission, or SEC, on April 1, 2019, as well as in our subsequent Quarterly and Annual Reports filed with the SEC, which descriptions are incorporatedall other information set forth in this prospectus and incorporated by reference in their entirety, as well as in any prospectus supplement hereto. These risksherein, including our consolidated financial statements and uncertainties are not the only risksrelated notes, before deciding to buy our common stock, pre-funded warrants and uncertainties we face. Additional risks and uncertainties not currently known to us, or that we currently view as immaterial, may also impair our business.common stock warrants. If any of the following risks or uncertainties described in our SEC filings or any additional risks and uncertainties actually occur,occurs, our business financial condition, results of operations and cash flow could be materially and adversely affected.harmed. In that case, the trading price of our common stock could decline, and you mightmay lose all or part of your investment. You should carefully consider the following information about risks, together with the other information contained in this prospectus, before making an investment in our common stock.

We will need to raise substantial additional capital in the future to fund our operations and we may be unable to raise such funds when needed and on acceptable terms.

We will need to raise substantial additional capital in the future to fund our operations. The extent to which we utilize the Purchase Agreement with Aspire Capital as a source of funding will depend on a number of factors, including the prevailing market price of our common stock, the volume of trading in our common stock and the extent to which we are able to secure funds from other sources. The number of shares that we may sell to Aspire Capital under the Purchase Agreement on any given day and during the term of the Purchase Agreement is limited. See “The Aspire Capital Transaction” for additional information. Additionally, we and Aspire Capital may not effect any sales of shares of our common stock under the Purchase Agreement during the continuance of an event of default or on any trading day that the closing sale price of our common stock is less than $0.25 per share. Even if we are able to access the full $6.5 million under the Purchase Agreement, we will still need additional capital to fully implement our business, operating and development plans.

The sale of our common stock to Aspire Capital may cause substantial dilution to our existing stockholders and the sale of the shares of common stock acquired by Aspire Capital could cause the price of our common stock to decline.

We are registering for sale 7,600,000 shares that we may sell to Aspire Capital from time to time under the Purchase Agreement. It is anticipated that shares registered in this offering will be sold until the term of the Purchase Agreement matures on March 31, 2021. The number of shares ultimately offered for sale by Aspire Capital under this prospectus is dependent upon the number of shares we elect to sell to Aspire Capital under the Purchase Agreement. Depending on a variety of factors, including market liquidity of our common stock, the sale of shares under the Purchase Agreement may cause the trading price of our common stock to decline.

Aspire Capital may ultimately purchase all, some or none of the $6.5 million of common stock that is the subject of this prospectus. Aspire Capital may sell all, some or none of our shares that it holds or comes to hold under the Purchase Agreement. Sales by us to Aspire Capital of shares pursuant to the Purchase Agreement may result in dilution to the interests of other holders of our common stock. The sale of a substantial number of shares of our common stock by Aspire Capital in this offering, or anticipation of such sales, could cause the trading price of our common stock to decline or make it more difficult for us to sell equity or equity-related securities in the future at a time and at a price that we might otherwise desire.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS AND INDUSTRY DATA

This prospectus and the documents incorporated by reference herein also contain forward-looking statements that reflectinvolve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks faced by us described below and elsewhere in this prospectus. See “Cautionary Note Regarding Forward-Looking Statements” for information relating to these forward-looking statements.

Risks Related to this Offering

The price of our management’s beliefscommon stock may be highly volatile.

The market price of our securities, like that of many other research and viewsdevelopment public pharmaceutical and biotechnology companies, has been highly volatile and the price of our common stock may be volatile in the future due to a wide variety of factors, including:

| ● | announcements by us or others of results of pre-clinical testing and clinical trials; | |

| ● | our quarterly operating results and performance; | |

| ● | developments or disputes concerning patents or other proprietary rights; | |

| ● | mergers or acquisitions or disposition; | |

| ● | litigation and government proceedings; | |

| ● | adverse legislation or regulatory matters; | |

| ● | changes in government regulations; | |

| ● | our available working capital; | |

| ● | failure of our common stock to continue to be listed or quoted on a national exchange or market system, such as Nasdaq or the New York Stock Exchange | |

| ● | economic and other external factors; and | |

| ● | general market conditions. |

Since January 1, 2023, the closing stock price of our common stock has fluctuated between a high of $1.51 per share to a low of $0.87 per share. On September 27, 2023, the last reported sales prices of our common stock on The Nasdaq Capital Market was $1.03 per share. The fluctuation in the price of our common stock has sometimes been unrelated or disproportionate to our operating performance. In addition, potential dilutive effects of future sales of shares of common stock, options and warrants by us, as well as the potential sale of common stock by the holders of options, warrants and the Debenture could have an adverse effect on the market price of our shares.

Our failure to meet the continued listing requirements of Nasdaq could result in a delisting of our common stock, which would limit the ability of broker-dealers to sell our securities and the ability of shareholders to sell their securities in the secondary market and negatively impact our ability to raise capital.

If we fail to satisfy the continued listing requirements of Nasdaq, Nasdaq may take steps to delist our common stock. Such a delisting would likely have a negative effect on the price of our common stock and would impair your ability to sell or purchase our common stock when you wish to do so.

We have in the past been in noncompliance with other Nasdaq’s continued listing rules. For example, on November 23, 2022, we effected a 1-for-10 reverse stock split of our outstanding common stock to cure our noncompliance, for a period of more than 30 consecutive business days, with Nasdaq Listing Rule 5550(a)(2), which requires listed securities to maintain a minimum bid price of $1.00 per share.

In addition, on April 20, 2023, we received a notification letter from the Listing Qualifications Department of Nasdaq indicating that, as a result of our delay in filing our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, we were not in compliance with the timely filing requirements for continued listing under Nasdaq Listing Rule 5250(c)(1). We regained compliance with this listing rule by filing our Annual Report on Form 10-K on May 2, 2023.

| 8 |

If we are unable to maintain compliance with Nasdaq’s continued listing requirements, our stock could be delisted. In the event of a delisting, we would take action to restore our compliance with Nasdaq’s listing requirements, but we can provide no assurance that any such action taken by us would allow our common stock to become listed again, stabilize the market price or improve the liquidity of our common stock, prevent our common stock from dropping below the Nasdaq minimum bid price requirement or prevent future non-compliance with Nasdaq’s other listing requirements.

If our common stock were to be delisted from Nasdaq, it would have a material negative impact on the actual and potential liquidity of our securities, as well as a material negative impact on our ability to raise future capital. If, for any reason, Nasdaq were to delist our common stock from trading on its exchange and we were unable to obtain listing on another national securities exchange or take action to restore our compliance with the Nasdaq continued listing requirements, a reduction in some or all of the following may occur, each of which could have a material adverse effect on our stockholders:

| ● | the liquidity of our common stock; | |

| ● | the market price of our common stock; | |

| ● | our ability to obtain financing for the continuation of our operations; | |

| ● | the number of institutional and general investors that will consider investing in our securities; | |

| ● | the number of market makers in our common stock; | |

| ● | the availability of information concerning the trading prices and volume of our common stock; and | |

| ● | the number of broker-dealers willing to execute trades in shares of our common stock. |

Further, we would likely become a “penny stock”, which would make trading of our common stock much more difficult.

Investors will experience immediate and substantial dilution as a result of this offering and may suffer substantial dilution related to issued stock warrants and options.

Investors will incur immediate and substantial dilution as a result of this offering. After giving effect to this offering for aggregate gross proceeds of $ million, based on a public offering price of $ per share, which was the last reported sale price of our common stock on the Nasdaq Capital Market on , 2023, assuming no sale of pre-funded warrants and no exercise of any common stock warrants issued in this offering, and after deducting estimated offering expenses payable by us, investors in this offering can expect immediate dilution of $ per share of common stock. See “Dilution.”

As of September 27, 2023, we had outstanding options to purchase 416,215 shares of common stock, at a weighted average exercise price of $35.50, and warrants to purchase 4,059,934 shares of common stock, at a weighted average exercise price of $2.19. In addition, the Debenture is convertible, at any time, and from time to time, at the holder’s option, into shares of our common stock, subject to the terms and conditions described in the Debenture, and, subject to the terms and conditions described in the Debenture, we may elect to pay all or a portion of the $110,000 Monthly Redemption Amount (as defined in the Debenture) and/or interest required by the Debenture in shares of our common stock. On July 13, 2023, we obtained stockholder approval, for purposes of complying with Nasdaq Listing Rule 5635(d), the issuance to Alpha Capital Anstalt (“Alpha”) of more than 20% of our issued and outstanding common stock pursuant to the terms and conditions of (a) the Debenture, and (b) our common stock purchase warrant dated December 22, 2022 issued to Alpha. After the first two monthly redemptions, we may elect to pay all or a portion of a Monthly Redemption Amount in shares of our common stock, based on a conversion price equal to the lesser of (i) the then conversion price of the Debenture and (ii) 85% of the average of the VWAPs (as defined in the Debenture) for the five consecutive trading days ending on the trading day that is immediately prior to the applicable Monthly Redemption Date (such average, the “VWAP Price”), subject to the Equity Conditions (as defined in the Debenture) having been satisfied. Accordingly, to the extent that the VWAP Price of our common stock is less than approximately $1.55 per share immediately prior to the applicable Monthly Redemption Date for which we have elected to make a payment of the Monthly Redemption Amount in shares instead of cash, the number of shares we issue to satisfy the Monthly Redemption Amount will increase. As of September 27, 2023, approximately 1,762,396 shares of common stock were issuable under the Debenture, based on the closing sale price of the Company’s common stock as reported on Nasdaq on September 27, 2023.

We also have an incentive compensation plan for our management, employees and consultants and an employee stock purchase plan, which has been temporarily suspended. We have granted, and expect to grant in the future, options to purchase shares of our common stock to our directors, employees and consultants. To the extent that options are exercised, our stockholders will experience dilution and our stock price may decrease.

The sale, or even the possibility of a sale, of the shares of common stock underlying these options, warrants and the Debenture could have an adverse effect on the market price for our securities or on our ability to obtain future financing.

If the offering price of the common stock or the exercise price of the common stock warrants in this offering is lower than the current exercise price of certain of our outstanding warrants with anti-dilution price protection provisions, then, as a result of this offering, such outstanding warrants will have their exercise prices reduced to the offering price.

If the offering price of the common stock or the exercise price of the common stock warrants in this offering is lower than $1.32 per share, which is the current lowest exercise price among our outstanding warrants with anti-dilution price protection provisions, then, as a result of this offering, such warrants, which, prior to this offering, are exercisable for up to 3,856,619 shares of our common stock, will have their exercise prices reduced to at least the offering price per share in this offering. These warrants include: (i) certain Series C preferred stock warrants originally issued in 2004 (as subsequently extended and exchanged for our common stock purchase warrants) which, prior to this offering, are currently exercisable for up to 1,349,571 shares of our common stock, (ii) warrants issued to Alpha in May 2020 which, prior to this offering, are currently exercisable for up to 7,048 shares of our common stock, and (iii) a common stock purchase warrant issued to Alpha in December 2022 which, prior to this offering, is currently exercisable for up to 2,500,000 shares of our common stock.

If the offering price of the common stock or the exercise price of the common stock warrants in this offering is lower than the current conversion price of the Debenture issued to Alpha, then, as a result of this offering, such conversion price will be reduced to the offering price and therefore the number of shares of common stock issuable upon full conversion of the Debenture will increase.

If the offering price of the common stock or the exercise price of the common stock warrants in this offering is lower than $1.32 per share, which is the current conversion price of the Debenture, then this offering could be considered a “Dilutive Issuance” (as defined below) and the conversion price of the Debenture shall be reduced to equal the offering price per share in this offering. As a result, the number of shares of common stock issuable upon full conversion of the Debenture will increase. As an example, if the offering price of the common stock and the exercise price of the common stock warrants in this offering equals the assumed offering price of $ , then the Debenture would be convertible into approximately shares instead of the shares of common stock the Debenture is convertible into prior to this offering.

Our shares of common stock are thinly traded, so stockholders may be unable to sell at or near ask prices or at all if they need to sell shares to raise money or otherwise desire to liquidate their shares.

Our common stock has from time to time been “thinly-traded,” meaning that the number of persons interested in purchasing our common stock at or near ask prices at any given time may be relatively small or non-existent. This situation is attributable to a number of factors, including the fact that we are a small company that is relatively unknown to stock analysts, stock brokers, institutional investors and others in the investment community that generate or influence sales volume, and that even if we came to the attention of such persons, they tend to be risk-averse and would be reluctant to follow an unproven company such as ours or purchase or recommend the purchase of our shares until such time as we become more seasoned and viable. As a consequence, there may be periods of several days or more when trading activity in our shares is minimal or non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on share price. We cannot give stockholders any assurance that a broader or more active public trading market for our common shares will develop or be sustained, or that current trading levels will be sustained.

| 9 |

We do not currently intend to pay dividends on our common stock in the foreseeable future, and consequently, our stockholders’ ability to achieve a return on their investment will depend on appreciation in the price of our common stock.

We have never declared or paid cash dividends on our common stock and do not anticipate paying any cash dividends to holders of our common stock in the foreseeable future. Consequently, our stockholders must rely on sales of their common stock after price appreciation, which may never occur, as the only way to realize any future gains on their investments. There is no guarantee that shares of our common stock will appreciate in value or even maintain the price at which our stockholders have purchased their shares.

Upon our dissolution, our stockholders may not recoup all or any portion of their investment.

In the event of our liquidation, dissolution or winding-up, whether voluntary or involuntary, the proceeds and/or our assets remaining after giving effect to such transaction, and the payment of all of our debts and liabilities, including the Debenture, will be distributed to the holders of common stock on a pro rata basis. There can be no assurance that we will have available assets to pay to the holders of common stock, or any amounts, upon such a liquidation, dissolution or winding-up. In this event, our stockholders could lose some or all of their investment.

Our board of directors can, without stockholder approval, cause preferred stock to be issued on terms that adversely affect holders of our common stock.

Under our Amended and Restated Certificate of Incorporation (as amended, the “Certificate of Incorporation”), our board of directors is authorized to issue up to 15,000,000 shares of preferred stock, of which none are issued and outstanding as of the date of this prospectus. Also, our board of directors, without stockholder approval, may determine the price, rights, preferences, privileges and restrictions, including voting rights, of those shares. If our board of directors causes shares of preferred stock to be issued, the rights of the holders of our common stock would likely be subordinate to those of preferred holders and therefore could be adversely affected. Our board of directors’ ability to determine the terms of preferred stock and to cause its issuance, while providing desirable flexibility in connection with possible acquisitions and other corporate purposes, could have the effect of making it more difficult for a third party to acquire a majority of our outstanding common stock. Preferred shares issued by our board of directors could include voting rights or super voting rights, which could shift the ability to control the Company to the holders of the preferred stock. Preferred stock could also have conversion rights into shares of our common stock at a discount to the market price of our common stock, which could negatively affect the market for our common stock. In addition, preferred stock would have preference in the event of liquidation of the Company, which means that the holders of preferred stock would be entitled to receive the net assets of the Company distributed in liquidation before the holders of our common stock receive any distribution of the liquidated assets.

Our management will have broad discretion over the use of the net proceeds from this offering and we may use the net proceeds in ways with which you disagree, or which do not produce beneficial results.

We currently intend to use the net proceeds from this offering for our operations and for other general corporate purposes, including, but not limited to, our internal research and development programs and the development of new programs, general working capital and possible future acquisitions (see “Use of Proceeds”). We have not allocated specific amounts of the net proceeds from this offering for any of the foregoing purposes. Accordingly, our management will have significant discretion and flexibility in applying the net proceeds of this offering. You will be relying on the judgment of our management with regard to the use of these net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately. It is possible that the net proceeds will be invested in a way that does not yield a favorable, or any, return for us or our stockholders. The failure of our management to use such funds effectively could have a material adverse effect on our business, financial condition, and results of operation.

This is a best efforts offering; no minimum amount of securities is required to be sold, and we may not raise the amount of capital we believe is required for our business.

The Placement Agent has agreed to use its reasonable best efforts to solicit offers to purchase the securities in this offering. The Placement Agent has no obligation to buy any of the securities from us or to arrange for the purchase or sale of any specific number or dollar amount of the securities. There is no required minimum number of securities that must be sold as a condition to completion of this offering. Because there is no minimum offering amount required as a condition to the closing of this offering, the actual offering amount, Placement Agent fees and proceeds to us are not presently determinable and may be substantially less than the maximum amounts set forth in this prospectus. We may sell fewer than all of the securities offered hereby, which may significantly reduce the amount of proceeds received by us, and investors in this offering will not receive a refund in the event that we do not sell an amount of securities sufficient to pursue the business goals outlined in this prospectus. Thus, we may not raise the amount of capital we believe is required for our business and may need to raise additional funds, which may not be available or available on terms acceptable to us. Despite this, any proceeds from the sale of securities offered by us will be available for our immediate use, and because there is no escrow account and no minimum offering amount in this offering, investors could be in a position where they have invested in us, but we are unable to fulfill our objectives due to a lack of interest in this offering.

| 10 |

There is no public market for the pre-funded warrants and common stock warrants being offered in this offering.

There is no established public trading market for the pre-funded warrants or common stock warrants being offered in this offering, and we do not expect a market to develop. In addition, we do not intend to apply to list the pre-funded warrants or common stock warrants on any securities exchange or nationally recognized trading system. Without an active market, the liquidity of the pre-funded warrants and common stock warrants will be extremely limited.

The warrants offered by this prospectus may not have any value.

The common stock warrants have an exercise price of $ per share and will have a five-year term. In the event our common stock price does not exceed the exercise price of the common warrants during the period when the warrants are exercisable, the common stock warrants may not have any value.

Holders of the pre-funded warrants or common stock warrants will not have rights of holders of our shares of common stock until such pre-funded warrants or common stock warrants are exercised.