As filed with the Securities and Exchange Commission on March 6, 2015April 11, 2023

Registration No. 333-________333-269676

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM S-1

FORM S-1/A

(Amendment No. 1)

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

GREY CLOAK TECH INC.

Healthy Extracts Inc.

(Exact name of registrant as specified in its charter)

Nevada | 2833 | 4700 | | 47-2594704 |

(State or other jurisdiction

ofincorporation or organization) organization | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification Number) No.) |

10300 W. Charleston

7375 Commercial Way, Suite 125 Henderson, NV 89011 | (702) 463-1004 |

(Address, including zip code, of registrant’s principal executive offices) | (Telephone number, including area code) |

Las Vegas,

Kevin “Duke” Pitts

President

Healthy Extracts Inc.

7375 Commercial Way, Suite 125

Henderson, NV 8913589011

702-201-6450(702) 463-1004

E-mail: corp@greycloaktech.com

(Address, including zip code, and telephone number,

including area code, of registrant's principal executive offices)

William Bossung

10300 W. Charleston

Las Vegas, NV 89135

702-201-6450

(Name,(Name, address, including zip code, and telephone number,

Includingnumber, including area code, of agent for service)

Copies to:

Brian A. Lebrecht, Esq. Clyde Snow & Sessions, PC 201 S. Main Street, Suite 2200 Salt Lake City, UT 84111 Telephone: (801) 322-2516 | Richard I. Anslow, Esq. Lawrence A. Rosenbloom, Esq. Ellenoff Grossman & Schole LLP 1345 Avenue of the Americas New York, NY 10105

Telephone: (212) 370-1300 |

As soon as practicable after this Registration Statement is declared effective.

(Approximate date of commencement of proposed sale to the public)public:

From time to time after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒[ X ]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.☐ [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.☐ [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.☐ [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,”filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | ☐ | ☐ | | | Accelerated filer | ☐ | | |

Non-accelerated filer | ☐ | ☐ | | | Smaller reporting company | ☒ | | |

(Do not check if a smaller reporting company) | | Smaller reportingEmerging growth company | ☒☐ |

| CALCULATION OF REGISTRATION FEEIf an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. [ ]

| Title of each Class of Securities to be Registered | Amount to be

Registered | Proposed Maximum

Offering Price Per Unit | Proposed Maximum Aggregate Offering Price | Amount of

Registration Fee | | | | | | | (2 | ) | | (3 | ) | | (1 | ) | | Common Stock $0.001 par value to be sold by selling shareholders | | 6,600,000 | | $ | .10 | | $ | 660,000 | | | 81.34 | |

| (1) | Registration Fee has been paid via Fedwire. |

| (2) | This is the initial offering and no current trading market exists for our common stock. The price paid for the currently issued and outstanding common stock was $0.10 for 3,300,000 shares and 3,300,000 common stock purchase warrants to unaffiliated investors. |

| (3) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(a) of the Securities Act. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this Prospectus

The information in this prospectus is not complete and may be changed. We may be changed. We will not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted. | Preliminary Prospectus | Subject to Completion, dated April 11, 2023 |

HEALTHY EXTRACTS INC.

[·] shares

common stock

This is an initial public offering of the common stock, par value $0.001 per share (the “Common Stock”), of Healthy Extracts Inc., a Nevada corporation.

We are hereby registering on the registration statement of which this prospectus forms a part a total of [Ÿ] shares of our Common Stock for sale by us. This offering is being made on a firm commitment basis at an assumed offering price of $[Ÿ] per share, assuming a 1-for-100 reverse stock split of our outstanding shares of Common Stock. The number of shares of Common Stock offered pursuant to this prospectus and all other applicable information, other than in the historical and pro-forma financial statements and related notes included elsewhere in this prospectus, has been determined based on such assumed offering price. The actual offering price of the shares offered hereby will be determined between the underwriters and us at the time of pricing, considering our historical performance and capital structure, prevailing market conditions, and overall assessment of our business. Therefore, the assumed offering price per share of the shares used throughout this prospectus may not be indicative of the actual offering price for the shares (see “Underwriting – Determination of Public Offering Price” for additional information).

On September 23, 2022, our majority shareholder approved by written consent, declared it advisable and in our best interest, to amend our Articles of Incorporation to effect a reverse split of our outstanding Common Stock within a range of 1-for-25 to 1-for-150, the exact ratio and timing to be determined by our board of directors (“Board”) no later than June 30, 2023. On September 23, 2022, our Board of Directors approved the same stock split range. We intend for the Board to determine the exact amount of and effect such reverse stock split in connection with the Offering and our intended listing of our Common Stock on the Nasdaq Capital Market (“Nasdaq”), however we cannot guarantee that The Nasdaq Stock Market LLC will approve our initial listing application for our Common Stock upon such reverse stock split. Unless specifically provided otherwise herein, such numbers and prices above and used elsewhere in this prospectus assume the effectiveness of a 1-for-100 reverse stock split of our Common Stock, an assumed offering price of $[Ÿ] per share, and the listing of our Common Stock on Nasdaq to occur as of the effective date of the registration statement of which this prospectus forms a part but prior to the closing of this offering.

Currently, our common stock is quoted on the OTCQB Marketplace maintained by OTC Markets, Inc. under the symbol “HYEX.” The closing price of our common stock (not adjusted for the anticipated stock split) as reported on the OTCQB on April 6, 2023 was $0.0475. We have applied to list our Common Stock on the Nasdaq Capital Market (“Nasdaq”) under the same symbol. We believe that upon the completion of the offering, we will meet the standards for listing

on Nasdaq. We cannot guarantee that we will be successful in listing our common stock on Nasdaq; however, we will not complete this offering unless we are so listed.

We are a “controlled company” as defined in Rule 5615(c)(1) of the Nasdaq listing rules. However, we do not intend to rely on any exemptions from the corporate governance requirements of being a controlled company. We are relying on the phase-in provisions of Rule 5615(b) as a company transferring from another market related to our audit committee composition.

Investing in the common stock is speculative and involves a high degree of risk. You should not invest unless you can afford to lose your entire investment. See “Risk Factors” beginning on page 12.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | Per Share | | Total (1) |

Price to the public | | $[·] | | $[·] |

Underwriting discounts (2) | | $[·] | | $[·] |

Proceeds, before expenses, to us | | $[·] | | $[·] |

(1)Assumes no exercise of the over-allotment options by the underwriters.

(2)We have agreed to pay the underwriters a cash fee of 8% of the aggregate gross proceeds raised in the Offering of the shares (including proceeds received from shares of Common Stock sold to cover over-allotments, if any). We have also agreed to issue warrants to purchase up to [·] shares of our Common Stock to the underwriters exercisable at a per share price equal to 110% of the offering price of the shares (the “Underwriters’ Warrants”), which number of shares will be equal to 5% of the aggregate number of shares sold in the Offering (including the over-allotment), and to reimburse the underwriters for certain expenses. See “Underwriting” for additional information regarding underwriting compensation.

We have granted to the representative of the underwriters a 45-day option to purchase up to an additional [·] shares of Common Stock to cover over-allotments, if any.

The underwriters expect to deliver the securities against payment to the investors in this offering made on or about [·], 2023.

The date of this prospectus is [·], 2023

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

The registration statement of which this prospectus forms a part that we have filed with the U.S. Securities and Exchange Commission (the “SEC”) includes exhibits that provide more detail of the matters discussed in this prospectus. You should read this prospectus and the related exhibits filed with the SEC, together with the additional information described under the heading “Where You Can Find More Information,” before making your investment decision.

You should rely only on the information provided in this prospectus or in any prospectus supplement or any free writing prospectuses or amendments thereto, or to which we have referred you, before making your investment decision. Neither we nor the underwriters have authorized anyone to provide you with information different from, or in addition to, that contained in this prospectus or any related free writing prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus, any prospectus supplement, or any free writing prospectuses or amendments thereto do not constitute an offer to sell, or a solicitation of an offer to purchase, the shares of Common Stock offered by this prospectus, any prospectus supplement or any free writing prospectuses or amendments thereto in any jurisdiction to or from any person to whom or from whom it is unlawful to make such offer or solicitation of an offer in such jurisdiction. You should not assume that the information contained in this prospectus, any prospectus supplement or any free writing prospectuses or amendments thereto, as well as information we have previously filed with the SEC, is effective. This Prospectusaccurate as of any date other than the date on the front cover of the applicable document.

To the extent there is not an offera conflict between the information contained in this prospectus and any prospectus supplement, you should rely on the information in such prospectus supplement, provided that if any statement in one of these documents is inconsistent with a statement in another document having a later date — for example, a document incorporated by reference in this prospectus or any prospectus supplement — the statement in the document having the later date modifies or supersedes the earlier statement.

Neither the delivery of this prospectus nor any distribution of any shares of Common Stock pursuant to this prospectus shall, under any circumstances, create any implication that there has been no change in the information set forth or incorporated by reference into this prospectus or in our affairs since the date of this prospectus. Our business, financial condition, results of operations and prospects may have changed since such date.

Neither we nor the underwriters are offering to sell these securities and it is not soliciting an offeror seeking offers to buy these securitiespurchase such shares of Common Stock offered hereby in any state or jurisdiction where the offer or sale is not permitted. Neither we nor the underwriters have done anything that would permit this Offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the Offering as to distribution of the prospectus outside of the United States.

PROSPECTUSSolely for convenience, our trademarks and tradenames referred to in this prospectus and the registration statement of which it forms a part may appear without the ® or ™ symbols, but such references are not intended to indicate in any way that we will not assert, to the fullest extent under applicable law, our rights to these trademarks and tradenames.

GREY CLOAK TECH INC.

6,600,000 Information contained in, and that can be accessed through our websites, www.healthyextractsinc.com, www.bergamentna.com, and www.tryubn.com does not constitute part of this prospectus or the registration statement of which it forms a part.

For investors outside the United States: neither we nor the underwriters have done anything that would permit this Offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than the United States. You are required to inform yourselves about and to observe any restrictions relating to this Offering and the distribution of this prospectus.

PROSPECTUS SUMMARY This summary highlights selected information contained in greater detail elsewhere in this prospectus. This summary does not contain all the information you should consider before investing in our common stock. You should read the entire prospectus, including our financial statements and related notes and the information set forth under the heading “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” before investing in our common stock. In this prospectus, the “Company,” “we,” “us,” and “our” refer to Healthy Extracts Inc. Our Business

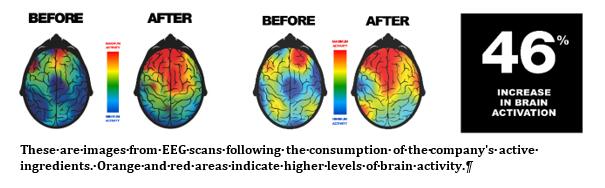

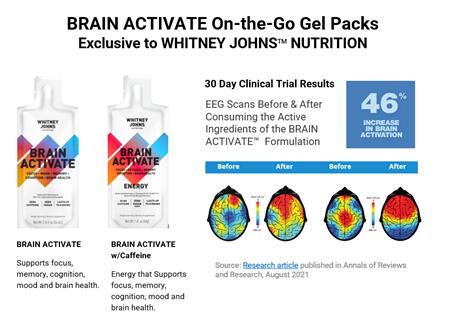

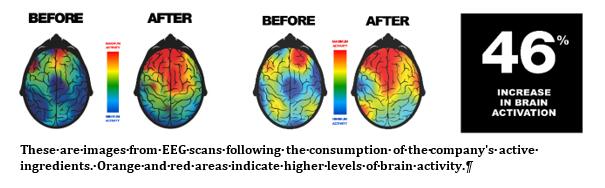

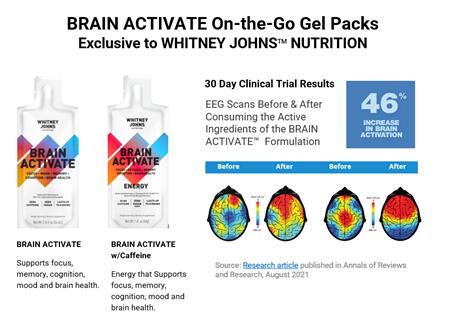

We are a platform for acquiring, developing, researching, patenting, marketing, and distributing plant-based nutraceuticals. Our proprietary and patented products target select high-growth categories within the multibillion-dollar nutraceuticals market, such as heart, brain and immune health. Nutraceuticals are generally considered to be substances that beyond their nutritional value can be used to achieve a benefit for an existing physiological condition or provide protection against potential aliments. Our current principal markets are nutraceutical products targeting customers focused on their own heart and brain health and immune support. Our products have not been evaluated by the U.S. Food and Drug Administration (“FDA”) or any similar regulatory body for safety and efficacy. The primary philosophy behind nutraceuticals is the focus on prevention and the body’s ability to use natural rather than artificially derived substances to treat disease or dysfunction—or as the Greek physician and father of modern medicine, Hippocrates, famously espoused, “Let food be your Medicine.” Today, the role of nutraceuticals in human health and wellbeing has become one of the most active and important areas of scientific investigation, with the latest findings presenting wide-ranging implications for consumers, health care providers, regulators, nutritional supplement producers and distributors. Our mission is to lead and support this investigation and use our findings to acquire or create products with health and performance benefits that have mass consumer appeal. Guided by this mission, our first two acquisitions (in 2019 and 2020, respectively) formed our current operating subsidiaries, Bergamet NA, LLC (“Bergamet”), which offers nutraceutical heart and immune health products, and Ultimate Brain Nutrients, LLC (“UBN”), which offers nutraceutical products for brain health. Through published research, our Bergamet products have been shown to support heart health, support immune response, and address metabolic syndrome. Our UBN brain health formulations have been in development for more than 20 years, over which time it has gained research support. On January 13, 2023, we entered into a definitive agreement to acquire nutraceutical manufacturer, Hyperion, L.L.C. (“Hyperion”), and its digital marketing affiliate, Online Publishing & Marketing, LLC (“OPM”), both based in Lexington, Virginia. We intend to use a portion of the proceeds from this Offering to fund this acquisition. See “Use of Proceeds.” Hyperion products have been formulated to support brain, memory, vision, sinus and digestive health, as well as healthy sleep and aging. OPM provides online advertising and marketing for Hyperion as well as other companies in the health and wellness space. The closing of these two acquisitions is expected to occur following the completion of and using the proceeds from this Offering. |

We anticipate the acquisition of Hyperion and OPM to be transformative to our business, significantly strengthening our manufacturing, marketing and distribution capabilities, expanding our nutraceutical product portfolio, adding positive cash flow, and significantly increasing our annualized gross revenues. We also expect that the greater financial and operational strength afforded by these two acquisitions to better enable us to make future strategic complementary acquisitions, including some of which we have identified and are currently evaluating. Our Markets

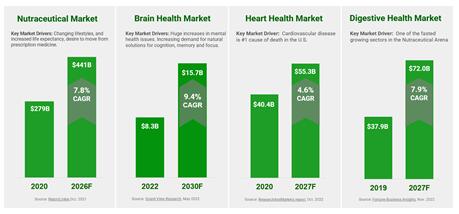

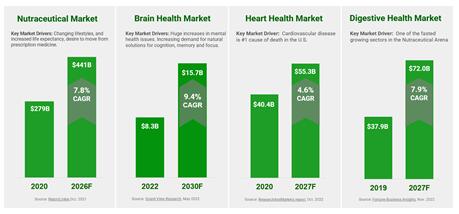

The overall nutraceutical market is growing at a 7.8% compounded annual growth rate (“CAGR”) and is expected to reach $441 billion by 2026, according to ReportLinker. Driving this growth are multiple factors, including changing lifestyles, growing consumer desire to move away from expensive prescription medicine and undesirable side effects, aging population and increased life expectancy. Our current principal markets are nutraceutical products targeting customers focused on their own heart and brain health and immune support. A growing self-care trend is also driving strong demand for nutraceuticals. Given increasingly hectic lifestyles, and the lack of time for preparing and consuming the required nutrients through a regular diet, the desire to replenish or augment essential nutrients with nutraceuticals is also increasing. Our BergaMet all-natural Citrus Bergamot SuperFruit formulations address an expanding global heart health ingredients market that is projected to grow at a 4.6% CAGR to reach $55.3 billion by 2027, according to ResearchAndMarkets. This growth is largely being driven by concerns about cardiovascular disease, which remains the leading cause of premature death globally according to the World Health Organization. Our UBN products tap the fast-growing market for brain health, which is growing at a 9.4% CAGR to reach $15.7 billion by 2030, according to Grandview Research. This market is being driven in part by the rise in the aging adult population in North America and Europe, with consumers increasingly using brain health supplements to prevent or treat mental conditions such as memory loss or dementia, or to improve mental cognition, energy and focus. Our UBN RELIEF product for migraine suffers also address a huge market opportunity, with an estimated 39 million people suffering from migraine headaches in the U.S. and 1 billion worldwide, according to the American Migraine Foundation. Our Competitive Strengths We compete with other manufacturers, distributors and marketers of vitamins, minerals, herbs, and other nutritional supplements both within and outside the U.S. The nutritional supplement industry is highly competitive, and we expect the level of competition to remain high over the near term. We believe the following are our competitive strengths:

High Gross Margins. We have high gross margin categories, with our gross margin ranging from 60% to 80%, depending on product and market channel. |

Nutraceutical Delivery System. Through our exclusive U.S. and Canada licensing and manufacturing agreement with Gelteq Pty Ltd. (“Gelteq”), a third party global leader in ingestible gel technology, we believe we are able to offer a gel-pack delivery system that our competition in North America cannot provide. Gelteq provides a customizable platform for supplement delivery, in that each gel formulation is tailored to solve a particular problem and deliver a specific outcome. Higher BPF Content. As the exclusive North American provider of the world’s highest strength Citrus Bergamot SuperFruit, our heart and immune products have specific advantages. For example, our BergaMet PRO+ product has 47% Bergamot Polyphenolic Fraction Gold (“BPF Gold”) potency as compared to our closest competitor at only 38% BPF. BPF is comprised of five key polyphenols (Naringin, Neohesperidin, Brutieridin, Melitidin, and Neoeriocitrin). These five polyphenols are known to increase the product’s effectiveness, and thus its existence is viewed as a positive factor in its efficacy. Backed by published research, our citrus bergamot has been shown to support heart health, support immune response, and address metabolic syndrome. In January 2022, the World Journal of Advanced Research and Reviews published the results of a clinical study which showed that taking a daily serving of UBN RELIEF for 60 days can naturally reduce or alleviate neurological discomfort. It was also shown to improve cognitive function, sleep satisfaction and overall quality of life. Our Competitive Challenges We compete with other manufacturers, distributors and marketers of vitamins, minerals, herbs, and other nutritional supplements both within and outside the U.S. The nutritional supplement industry is highly competitive, and we expect the level of competition to remain high. Our ability to scale our business and grow our revenue depends on our ability to maintain the value and reputation of our brands in the face of this competition. The nutritional supplement industry is highly fragmented and competition for the sale of nutritional supplements comes from many sources. Such products are sold primarily through retailers (drug store chains, supermarkets, and mass market discount retailers), health and natural food stores, and direct sales channels (network marketing and internet sales). The nutritional supplement industry is highly competitive, and we expect the level of competition to remain high over the near term. We do not believe it is possible to accurately estimate the total number or size of our competitors. The nutritional supplement industry has undergone some consolidation in the recent past and we expect that trend may continue in the near term. We have a limited operating history in our current business, we are not profitable, and we do not expect to be profitable in the near future. There is no assurance our future operations will result in revenues sufficient to obtain or sustain profitability. We face intense competition from competitors that are larger, more established and that possess greater resources than we do, and if we are unable to compete effectively, we may be unable to gain sufficient market share to sustain profitability. If our competitors market nutritional supplement products that are less expensive, safer or otherwise more appealing than our current and potential products, or that reach the market before our current and potential products, we may not achieve operational or financial success. The market may choose to continue utilizing existing products for any number of reasons, including familiarity with or pricing of these existing products. The failure of any of our products to compete with products marketed by our competitors would impair our ability to generate revenue, which would have a material adverse effect on our future business, financial condition, results of operations, and cash flows. Our competitors may: |

·develop and market products that are less expensive, safer, or otherwise more appealing than our products; ·commercialize competing products before we or our partners can launch our products; and ·initiate or withstand substantial price competition more successfully than we can. Our Financial Condition and Ability to Continue as a Going Concern Our net loss from inception to December 31, 2022 was $15,926,742, and we had only very limited cash resources at December 31, 2022 of $65,651. Our financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. Our auditor’s report reflects that our ability to continue as a going concern is dependent upon our ability to raise additional capital from the sale of common stock and, ultimately, the achievement of significant operating revenues. If we are unable to continue as a going concern, our business will fail and stockholders will lose their investment in our company. Even after competition of this offering, we will be required to seek additional capital to fund future growth and expansion. No assurance can be given that such financing will be available or, if available, that it will be on commercially favorable terms. Moreover, financing will likely be dilutive to our stockholders. Future Anticipated Growth Drivers New Sales Channels and Product Launches In order to drive continued sales growth and leverage our growing customer base, we are planning to expand our product portfolio to include supplements that support gut health (the balance between helpful and harmful bacteria and yeast in the digestive system) as well as introduce more products in gel-pack format. Our gut health products are in the early stages of design and development and we have not begun development of any gut health products yet, nor do we have any data that supports that our anticipated formulations will improve gut health. We plan to further expand our sales channels as well as our portfolio of natural formulations for heart and brain health and other indications. Strategic Acquisitions The market for nutraceutical products is highly fragmented, which create many acquisition opportunities. As part of our primary mission, we will continue to evaluate potential acquisition opportunities that could expand our product portfolio and benefit from our marketing strength and multi-channel distribution. We anticipate that the greater financial and operational strength afforded by our planned acquisitions of Hyperion and OPM will better enable us to make future strategic complementary acquisitions. Employees

On the Healthy Extracts holding company level, are employees are comprised of our company’s officers. Our BergaMet subsidiary has two employees. Our UBN subsidiary currently does not have its own employees since it uses outside contract help on an as-needed basis, with management provided by our officers. |

We anticipate all of our employees will continue to work for us for the foreseeable future. We plan to hire appropriate personnel on an as-needed basis and utilize the services of independent contractors as needed. We anticipate that our planned acquisition of Hyperion and OPM will add approximately 14 employees, which will continue to work out of their existing facilities in Lexington, Virginia. Corporate History We were incorporated on December 19, 2014 in the State of Nevada. On February 4, 2019, we acquired BergaMet NA, LLC, a Delaware limited liability company (“BergaMet”). BergaMet is a wholly-owned subsidiary through which we conduct our nutraceuticals business. As a result of the acquisition, Jay Decker became our majority shareholder. The shares of common stock issued in the acquisition were equal to approximately 80.1% of our outstanding common stock immediately following the closing. On April 3, 2020, we acquired Ultimate Brain Nutrients, LLC, a Delaware limited liability company (“UBN”). UBN is a wholly-owned subsidiary through which we conduct our plant-based neuro-products business. As a result of the acquisition, Jay Decker became a significantly larger shareholder. The shares of common stock issued in the acquisition were equal to approximately 42.5% of our outstanding common stock immediately following the closing. On January 13, 2023, we entered into an Acquisition Agreement for the acquisition of Hyperion, L.L.C. and Online Publishing & Marketing, LLC, both Virginia limited liabilities companies, by merging them into our newly-formed wholly-owned subsidiaries, Green Valley Natural Solutions, LLC (“Green Valley”) and Online Publishing & Marketing, LLC (“OPM”), both Nevada limited liability companies. The closing of the acquisition will take place following the completion of and using the proceeds from this Offering. Corporate Information Our corporate headquarters are located at 7375 Commercial Way, Suite 125, Henderson, NV 89011, and our telephone number is (702) 463-1004. Our websites are www.healthyextractsinc.com, www.bergametna.com, and www.tryubn.com. Information contained on our websites is not incorporated into, and does not constitute any part of, this prospectus. Recent Developments Reverse Stock Split On September 23, 2022, our majority shareholder approved by written consent, declared it advisable and in our best interest, to amend our Articles of Incorporation to effect a reverse split of our outstanding Common Stock within a range of 1-for-25 to 1-for-150, the exact ratio and timing to be determined by our board of directors (“Board”) no later than June 30, 2023. On September 23, 2022, our Board of Directors approved the same stock split range. We intend for the Board to determine the exact amount of and effect such reverse stock split in connection with the Offering and our intended listing of our Common Stock on the Nasdaq Capital Market (“Nasdaq”), however we cannot guarantee that The Nasdaq Stock Market LLC will approve our initial listing application for our Common Stock upon such reverse stock split. Unless specifically provided otherwise herein, such numbers and prices above and used elsewhere in this prospectus assume the effectiveness of a 1-for-100 reverse stock split of our Common Stock, an assumed offering price of $[·] per share, and the listing of our Common Stock on |

Nasdaq to occur as of the effective date of the registration statement of which this prospectus forms a part but prior to the closing of the Offering of the shares. We have applied to list our Common Stock on Nasdaq in connection with this offering. We intend for the Board to effect such reverse stock in connection with this Offering and our intended listing of our Common Stock on Nasdaq, however we cannot guarantee that we will receive approval of our initial listing application for our Common Stock on Nasdaq upon such reverse stock split. The number of shares of Common Stock offered pursuant to this prospectus and all other applicable information, other than in the historical financial statements and related notes included elsewhere in this prospectus, assumes the effectiveness of a 1-for-100 reverse stock split of our Common stock. 2023 Pending Acquisitions On January 13, 2023, we entered into an Acquisition Agreement for the acquisition of Hyperion, L.L.C. and Online Publishing & Marketing, LLC, both Virginia limited liabilities companies, by merging them into our newly-formed wholly-owned subsidiaries, Green Valley Natural Solutions, LLC (“Green Valley”) and Online Publishing & Marketing, LLC (“OPM”), both Nevada limited liability companies. The closing of the acquisition will take place following the satisfaction of material closing conditions set forth below, including a capital raise of at least $4,000,000 and the commencement of trading, or approval for the commencement of trading, of our common stock on the Nasdaq Capital Market. The total purchase price for the acquisitions will be $1,750,000 in cash, $1,300,000 in the form of secured promissory notes, and $1,250,000 worth of our common stock (based on a 30% premium to the price paid per share of common stock in the above-referenced capital raise, but in no event more than ninety percent (90%) of the volume weighted average price for our common stock for the ninety (90) trading days up to and including the trading day immediately before the day the price is finally determined for securities sold in the capital raise). The combination of the businesses is expected to significantly increase our current annualized gross revenues. Revenues for Hyperion and OPM were over $10 million for the year ended December 31, 2022. Hyperion is also expected to strengthen our manufacturing and distribution capabilities, as well as expand our product portfolio with 15 proprietary nutraceutical formulations sold under the brand, Green Valley Natural Solutions. These products are formulated to support brain, memory, vision, sinus and digestive health, as well as healthy sleep and aging. Green Valley Natural Solutions products are manufactured and shipped direct-to-consumer from specially temperature-controlled warehouses leased in Shenandoah Valley, Virginia. These facilities would add an East Coast presence to our existing warehouse and shipping facilities in Nevada, with this expected to lower customer shipping costs and order delivery times. Hyperion’s relationships with high-quality contract manufacturers are also expected to lower our manufacturing costs, as well as improve supply chain efficiencies and economies of scale. OPM specializes in creating digital and affiliate marketing content for Hyperion and will enhance our overall marketing strategy and audience reach. They also bring a large email distribution list of hundreds of thousands of potential customers with a new affiliate marketing channel. OPM also produces engaging digital content such as educational videos and newsletters. OPM creates and promotes original content in the health and wellness space. Rather than relying on pharmaceutical and specialized medicine, OPM's content is produced by certified health and wellness professionals who focus on holistic and traditional approaches. The content is a combination of online and offline books, videos, podcasts, DVDs and newsletters that are distributed through email, public |

websites, secure websites and physical mail delivery. The primary marketing method is to advertise the content to a house file of consumers that OPM has developed over the years through opt-in marketing and newsletter subscriptions. The house file is actively managed to ensure online customers who positively opt-in and engage with OPM emails are receiving marketing materials. The secondary method of marketing OPM content is through affiliate partnerships with other online content producers who share OPM content with their positively managed opt-in only house files. This reciprocal email marketing approach eliminates any actual or perceived unwanted emails. The planned acquisition of Hyperion and OPM is expected to add approximately 14 employees, who would continue to work out of the existing facilities in Lexington, Virginia. We expect these two synergistic and accretive acquisitions to accelerate and support our growth and expand our market reach. Our natural heart and brain health formulations are perfect for cross selling or private labeling with Green Valley products, such as their stem cell restore formulation that are sold across various marketing channels. Likewise, Green Valley sales would benefit from our established marketing channels, which includes subscription-based direct-to-consumer, national grocery stores, and a strong presence on Amazon. On a pro forma basis upon the closing of the acquisitions, we would generate over $12 million in annualized gross revenue, including significant recurring revenue being generated by subscriptions. The anticipated positive cash flow would fund future revenue growth from new product introductions and market expansion, as well as other potential strategic acquisitions. The completion of the acquisitions is subject to the following material closing conditions, and there can be no assurance that the transactions will be completed as described: ·we will have entered into a new lease agreement for at least a twelve-month period at the current Hyperion and OPM locations; ·a key employee of Hyperion and OPM will have entered into a consulting agreement with us; ·our independent auditor will have completed an audit of the financial statements of Hyperion and OPM; ·we will have closed on one or more rounds of financing for an aggregate amount of no less than $4,000,000, of which at least $250,000 will be from selling parties to the transaction; and ·we will have commenced trading, or been approved to commence trading, on either the Nasdaq or the NYSE American Exchange. Summary of Risk Factors There are a number of risks related to our business, this offering and our common stock that you should consider before you decide to participate in this offering. You should carefully consider all the information presented in the section titled “Risk Factors” in this prospectus. Some of the principal risks related to our business include the following: |

·We rely on a single supplier relationship for licensing and manufacturing, and the termination of that agreement could have material effect on the cost of our products and the manufacturing of our finished goods. ·We have a limited operating history in our current business, we are not profitable, and we do not expect to be profitable in the near future. There is no assurance our future operations will result in revenues sufficient to obtain or sustain profitability. If we cannot generate sufficient revenues to operate profitably, we may suspend or cease operations. ·We received a warning letter from the FDA in November 2022 regarding one of our products. ·Our success is linked to the size and growth rate of the vitamins, minerals and supplements market and an adverse change in the size or growth rate of that market could have a material adverse effect on us; ·We expect to incur substantial costs and devote substantial time to the integration of Hyperion and OPM, which could have a negative impact on our operating results; ·Our success depends on our ability to maintain the value and reputation of our brands; ·We may fail to attract, acquire or retain customers at our current or anticipated future growth rate, or may fail to do so in a cost-effective manner, which would adversely affect our business, financial condition and results of operations; ·If we are unable to anticipate customer preferences and successfully develop new and innovative products in a timely manner or effectively manage the introduction of new or enhanced products, then our business may be adversely affected; ·We are highly dependent upon consumers’ perception of the safety, quality, and efficacy of our products as well as similar products distributed by other companies in our industry, and adverse publicity and negative public perception regarding particular ingredients or products or our industry in general could limit our ability to increase revenue and grow our business; ·We face intense competition from competitors that are larger, more established and that possess greater resources than we do, and if we are unable to compete effectively, we may be unable to gain sufficient market share to sustain profitability; ·Because we depend on outside suppliers with whom we do not have long-term agreements for raw materials, we may be unable to obtain adequate supplies of raw materials for our products at favorable prices or at all, which could result in product shortages and back orders for our products, with a resulting loss of sales and profitability; ·A disruption in the service, a significant increase in the cost of our primary delivery and shipping services for our products or a significant disruption at shipping ports could adversely affect our business; ·We will require additional financing in the future, and we can provide no assurance that such funding will be available on terms that are acceptable to us, or at all. |

·We are dependent upon our lenders for financing to execute our business strategy and meet our liquidity needs, and the lack of adequate financing could negatively impact our business; ·We and our suppliers are subject to numerous laws and regulations that apply to the manufacturing and sale of nutritional supplements, and compliance with these laws and regulations, as they currently exist or as modified in the future, may increase our costs, limit or eliminate our ability to sell certain products, subject us or our suppliers to the risk of enforcement action, or otherwise adversely affect our business, results of operations and financial condition; and ·Our success is dependent on the accuracy, reliability, and proper use of sophisticated and dependable information processing systems and management information technology and any interruption in these systems could have a material adverse effect on our business, financial condition and results of operations. These and other risks are more fully described in the section titled “Risk Factors” in this prospectus. If any of these risks actually occurs, our business, financial condition, results of operations, cash flows and prospects could be materially and adversely affected. As a result, you could lose all or part of your investment in our common stock. As used in this prospectus, the term “success” generally means (unless the specific context requires otherwise) our ability to establish and grow our brand, scale our manufacturing, marketing and sales activities, integrate acquired products or internally develop new products, grow our revenues and, ultimately, establish cash flow positive and profitable operations. |

Shares of Common Stock to be offered by us: | | [·] shares ([·] shares if the underwriters exercise their over-allotment option in full to purchase shares of Common Stock at the offering price), based on an assumed offering price of $[·] per share. |

| | |

Shares of Common Stock outstanding immediately before this Offering: | | 3,451,724 shares. |

| | |

Shares of Common Stock outstanding immediately after this Offering: | | [·] shares ([·] shares if the underwriters exercise their over-allotment options in full to purchase [·] shares of Common Stock at the offering price), based on an assumed offering price of $[·] per share, and assuming no exercise of any Underwriters’ Warrants. |

| | |

Assumed public offering price: | | $[·] per share. The actual public offering price may be at, above or below such assumed public offering price and will be determined at pricing based on, among other factors, the closing bid price of the Common Stock on the effective date of this registration statement. See “Underwriting — Determination of Public Offering Price” for additional information. |

| | |

Option to purchase additional shares of Common Stock: | | We have granted to the underwriters the option, exercisable for 45 days from the date of this prospectus, to purchase up to [·] additional shares of Common Stock to cover over-allotments, if any. |

| | |

Underwriters’ Warrants: | | The registration statement of which this prospectus forms a part also registers for sale up to an aggregate of [·] shares of Common Stock (based on an assumed public offering price of $[·] per share) underlying the Underwriter’s Warrants as a portion of the underwriting compensation payable to the underwriters in connection with this offering. The Underwriters’ Warrants will be exercisable at any time, and from time to time, in whole or in part, after the closing of this Offering until the fifth anniversary of the date of the commencement of sales of the Shares issued in connection with this Offering at an exercise price of $[·] per share (110% of the public offering price per share of Common Stock). See “Underwriting —Underwriters’ Warrants” for a more detailed description of the Underwriters’ Warrants. |

| | |

Use of Proceeds: | | We estimate that the net proceeds from the sale of our Common Stock in this Offering will be approximately $[·] million, based on an assumed public offering price of $[·] per share, and assuming the underwriters do not exercise their option to purchase additional shares of Common Stock and no exercise of Underwriters’ Warrants. We intend to use $3.1 million of the net proceeds from this Offering to complete the acquisition of Hyperion, L.L.C. and Online Publishing & Marketing, LLC. The remainder of the proceeds will be used for working capital and general corporate purposes. See the section entitled “Use of Proceeds.” |

Reverse Stock Split: | | We anticipate that we will effect a reverse stock split of the outstanding shares of Common Stock at a ratio between 1-for-25 and 1-for-150 on or after the date on which the registration statement of which this prospectus forms a part is declared effective by the SEC, but in no event later than the pricing of this Offering. Unless otherwise noted, the share and per share information in this prospectus, other than in the historical financial statements and related notes included elsewhere in this prospectus, assumes the effectiveness of a 1-for-100 reverse stock split of our outstanding shares of Common Stock. |

| | |

Risk Factors: | | An investment in our shares of Common Stock offered hereby is speculative and involves a high degree of risk. You should read the section entitled “Risk Factors” beginning on page 12 of this prospectus for a discussion of factors you should consider carefully before deciding to purchase our shares of Common Stock offered hereby. |

| | |

Proposed Nasdaq symbol and trading: | | Our Common Stock is presently quoted on the OTCQB Market. We have applied to list our Common Stock on Nasdaq. We cannot guarantee that we will be successful in listing our Common Stock on Nasdaq. We will not consummate this Offering unless our Common Stock is approved for listing on Nasdaq. |

The number of shares of our Common Stock to be outstanding before this Offering is based on 3,451,724 shares of our Common Stock outstanding as of April 11, 2023, giving effect to the anticipated reverse stock split of our outstanding Common Stock on a 1-for-100 basis, and assuming no exercise of the underwriters’ over-allotment option and no exercise of any Underwriters’ Warrants, and includes or excludes the following, as applicable:

·excludes [·] shares of Common Stock

$0.10 issuable upon the closing of the acquisition of Hyperion, L.L.C. and Online Publishing & Marketing, LLC. The number of shares of Common stock will be equal to $1,250,000 based on a 30% premium to the price paid per share of Common Stock in this Offering, but in no event more than ninety percent (90%) of the volume weighted average price for our common stock for the ninety (90) trading days up to and including the trading day immediately before the day the price is finally determined for securities sold in this Offering;

·excludes 168 shares of Common Stock issuable upon the exercise of outstanding warrants with an exercise price of $6,250.00 per share;

·excludes 75,000 shares of Common Stock issuable upon the exercise of outstanding warrants with an exercise price of $5.00 per share;

·excludes 65,000 shares of Common Stock issuable upon the exercise of outstanding warrants with an exercise price of $7.50 per share;

·excludes 104,500 shares of Common Stock issuable upon the exercise of outstanding options with an exercise price of $5.00 per share; and

·excludes 157,750 shares of Common Stock represented by Restricted Stock Units and 360,000 shares of Common Stock represented by Restricted Stock Awards.

DateThe actual number of Prospectus: Subjectshares of our Common Stock to Completionbe outstanding before this Offering will be determined based on the actual public offering price and the final reverse stock split ratio, as determined by the Board.

11

SUMMARY FINANCIAL INFORMATION

| | As of and for the Year Ended December 31, | | As of and for the Year Ended December 31, |

Healthy Extracts Inc. | | 2022 (audited) | | 2021 (audited) |

| | | | |

Statement of Operations Data: | | | | |

| | | | |

Revenue | $ | 2,251,469 | $ | 1,676,598 |

Net operating income (loss) | $ | (911,589) | $ | (1,889,178) |

Net income (loss) | $ | (983,121) | $ | (1,987,122) |

| | | | |

| | | | |

Balance Sheet Data: | | | | |

| | | | |

Cash | $ | 65,651 | $ | 222,098 |

Current assets | $ | 1,990,572 | $ | 2,313,404 |

Total assets | $ | 2,781,118 | $ | 3,029,579 |

| | | | |

Current liabilities | $ | 902,788 | $ | 558,841 |

Total liabilities | $ | 902,788 | $ | 558,841 |

Accumulated deficit | $ | (15,926,742) | $ | (14,943,620) |

| | | | |

Net loss per common share – basic and diluted | $ | [·] | $ | [·] |

12

SUMMARY PRO-FORMA FINANCIAL INFORMATION

Healthy Extracts Inc. | | As of and for the Year Ended December 31, | | As of and for the Year Ended December 31, | | As of and for the Year Ended December 31, |

Hyperion, L.L.C. OP&M | | 2022 (audited) | | 2021 (audited) | | 2020 (audited) |

| | | | | | |

Statement of Operations Data: | | | | | | |

| | | | | | |

Revenue | $ | 13,058,749 | $ | 12,837,096 | $ | 13,025,222 |

Net operating income (loss) | $ | (813,781) | $ | 10,089,485 | $ | 9,161,648 |

Net income (loss) | $ | (861,178) | $ | (1,328,145) | $ | (1,130,008) |

| | | | | | |

| | | | | | |

Balance Sheet Data: | | | | | | |

| | | | | | |

Cash | $ | 2,515,651 | $ | 2,459,584 | $ | 2,603,992 |

Current assets | $ | 5,388,677 | $ | 5,609,481 | $ | 5,897,871 |

Total assets | $ | 9,709,709 | $ | 6,484,902 | $ | 6,720,442 |

| | | | | | |

Current liabilities | $ | 2,581,379 | $ | 1,050,058 | $ | 749,488 |

Total liabilities | $ | 2,581,379 | $ | 1,050,058 | $ | 749,488 |

Accumulated equity (deficit) | $ | (15,926,742) | $ | (11,979,514) | $ | (9,839,370) |

Total stockholders’ equity | | 7,128,330 | | 5,434,844 | | 5,970,954 |

| | | | | | |

Net loss per common share – basic and diluted | $ | 0.003 | $ | 0.004 | $ | 0.005 |

On January 13, 2023, we entered into the Acquisition Agreement to acquire Hyperion and OPM in exchange for $3,050,000 in cash and the issuance of $1,250,000 in shares of our common stock (approximately 25,000,000 shares valued at $0.05), to the former owner of Hyperion and OPM, resulting in Hyperion and OPM becoming a wholly-owned subsidiaries of our company.

For financial accounting purposes, the acquisition of Hyperion and OPM by us (referred to as the “Merger”) will be valued under the purchase price method. Accordingly, financial statements presented following the Merger will be viewed as being fairly valued as of January 13, 2023 or the date the acquisition is closed, and represent the operations of our company prior to the Merger. We expect to continue to operating Hyperion and OPM under the names Green Valley Natural Solutions and Online Publishing and Marketing.

Prior to this Offering, no public marketthe Merger, all the companies involved in the Merger had fiscal year ends of December 31, respectively. The accompanying audited pro forma condensed combined financial statements are prepared based on a December 31 year end, while the period ending of September 30, 2022 has existedbeen prepared as unaudited pro forma condensed combined financial statements. The audited and unaudited pro forma condensed combined balance sheet at September 30, 2022, December 31, 2021, and December 31, 2020 combines the historical consolidated balance sheets of Hyperion, OPM and our company, giving effect to the Merger as if it had been consummated on December 31, 2022. The audited pro forma condensed combined statement of operations for the common stockperiod ended December 31, 2022 combines the historical consolidated statements of GREY CLOAK TECH INC. (GCT) Upon completionincome of Hyperion, OMP, and our company, giving effect to the Merger as if it had occurred on January 1, 2022. The audited pro forma combined financial data should be read in

13

connection with the notes to our audited pro forma condensed combined financial statements and our historical audited consolidated financial statements and the related notes year ended December 31, 2022 and 2021.

The audited and unaudited pro forma condensed combined financial statements have been prepared for informational purposes only. The historical financial information has been adjusted to give effect to pro forma events that are: (1) directly attributable to the Merger and (2) factually supportable and reasonable under the circumstances.

The audited pro forma adjustments represent management’s estimates based on information available at this Offering, we will attempttime. The audited pro forma combined financial statements are not necessarily indicative of what the financial position or results of operations actually would have been had the acquisition been completed at the dates indicated. In addition, the audited pro forma combined financial statements do not purport to haveproject the shares quoted onfuture financial position or operating results of the Overconsolidated company. The audited pro forma combined financial statements do not give consideration to the Counter-Bulletin Board ("OTCBB"), operated by FINRA (Financial Industry Regulatory Authority). There is no assuranceimpact of possible revenue enhancements, expense efficiencies, future underwriting decisions or changes in the book of business that may result from the Shares will ever be quoted on the OTCBB. To be quoted on the OTCBB, a market maker must apply to make a marketacquisition.

14

RISK FACTORS

Any investment in our common stock. As of the date of this Prospectus, we have not made any arrangement with any market makers to quote our shares.

This prospectus covers the resale from time to time by the selling stockholders of up to an aggregate of 6,600,000 common shares. The companystock is registering in this prospectus 3,300,000 common sharesspeculative and 3,300,000 common shares underlying the warrants to purchase common stock. The company issued 3,300,000 common shares and, 3,300,000 common stock purchase warrants to investors that invested in the Company’s Regulation D Rule 506(b) Private Placement Memorandum, dated January 15 2015. The company issued the common stock purchase warrants to the investors who purchased the 3,300,000 common shares on a “one for one” basis. For each share of common stock purchased the investor received one warrant, each warrant entitles the holder to purchase one share of common stock. There are a total of 3,300,000 warrants issued.

The selling shareholders will sell their shares at a fixed price per share of $0.10 for the duration of this Offering, or until our shares are quoted on the OTCBB, and thereafter at prevailing market prices or in privately negotiated transactions. We will not receive any proceeds from the sale of the 3,300,000 shares sold by the selling shareholders. The company will receive $1,650,000 if all the 3,300,000 warrants are exercised at .50 cents per share. This offering will terminate upon the earliest of (i) such time as all of the common stock has been sold pursuant to the registration statement or (ii) 365 days from the effective date of this Prospectus.

GREY CLOAK TECH INC. is a development stage company and currently has limited business operations. Any investment in the Shares offered herein involves a high degree of risk.risk. You should only purchase Shares if you can afford a complete loss of your investment.

We are an "emerging growth company" as defined inconsider carefully the Jumpstart Our Business Startups Act of 2012 (the "JOBS Act") and, as such, may electrisk factors related to comply with certain reduced public company reporting requirements for future filings.

THIS INVESTMENT INVOLVES A HIGH DEGREE OF RISK. BEFORE INVESTING, YOU SHOULD CAREFULLY READ THIS PROSPECTUS AND, PARTICULARLY, THE RISK FACTORS SECTION, BEGINNING ON PAGE 8.

Neither the U.S. Securities and Exchange Commission ("SEC") nor any state securities division has approved or disapproved these securities, or determined if this Prospectus is current, complete, truthful or accurate. Any representation to the contrary is a criminal offense.

TABLE OF CONTENTS

Until _____, 2015, all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers' obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

SUMMARY OF PROSPECTUS

You should read the following summaryour business described below, together with the more detailed businessother information and financial statements and related notes that appear elsewherecontained in this Prospectus. In this Prospectus, unless the context otherwise denotes, referencesprospectus, before you decide to "we," "us," "our", “GCT"buy our common stock. There are numerous and "Company" are to GREY CLOAK TECH INC.

A Cautionary Note on Forward-Looking Statements

This Prospectus contains forward-looking statements, which relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as "may," "should," "expects," "plans," "anticipates," "believes," "estimates," "predicts," "potential," or "continue" or the negative of these terms or other comparable terminology. These statements are only predictions and involvevaried risks, known and unknown, risks, uncertainties and other factors, including the risks in the section entitled "Risk Factors," that may causeprevent us from achieving our industry's actual results, levelsgoals. If one or more of activity, performance, or achievements to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements.

While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction ofrisks actually occurs, our business actualwill suffer, and as a result our financial condition or results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

General Information about Our Company

GREY CLOAK TECH INC. was incorporated in the State of Nevada on December 19, 2014 and our fiscal year end is December 31. The Company was formed to engage in the business of cloud based software to detect advertising fraud on the internet.

The Company's website is currently under development.

We are a development stage company, and have not generated any revenues since inception, we have $322,924 in cash as of January 31, 2015

Where you can find us:

10300 W. Charleston

Las Vegas, NV 89135

702-201-6450

During the software development stage, the company will not be paying any salaries and there are no employment agreements. Mr. Covely the Company’s Director, President and Chief Technology Officeroperations will be devoting between 20 and 25 hours per week on software development. Mr. Bossung,adversely affected. In this case, the Company’s Director, Secretary and CFO will be spending between 20 and 25 hours per week on company operations and will be receiving $4500 dollars per month as a consulting payment. Upon completion of the software the Company will enter into a formal employment agreement with Mr. Covely for his full time employment. The intended date for Mr. Covely’s full time employment is April 1 2015 and his employment contract will be for 2 years at $9,000 per month. Upon completion of the software the Company will enter into a formal employment agreement with Mr. Bossung for his full time employment. The intended date for Mr. Bossung full time employment is April 1 2015 his employment will be for 2 years at $8000 per month. Upon completion of the software the Company intends to enter into a formal employment agreement with Mr. Silver, the company’s Chief Marketing Officer, for his full time employment. The intended date for Mr. Silver’s full employment is April 1 2015 his employment will be for 2 years at $7000 per month. During the period from inception

(December 19, 2014) to January 31, 2015 the Company paid $9,000 to a company owned by William Bossung an officer and director for consulting fees, which is included in general and administrative expenses on the accompanying statement of operations. We feel that the time provided by management is sufficient to develop the business. We do not currently have any contracts or agreements in place with any outside sales or development contractors.

We believe it is advantageous to go public at this time, due to the potential to raise additional funds in the capital markets.

As a public company we would have access to more financing options, as investors generally have greater liquidity to exit their investment. However, there are significant disadvantages to going public, including the possibility that liquidity in our market will not occur, there is no guarantee that we will be able to secure financing at rates favorable to us, and increased costs to be a public company. We anticipate this offering will cost $25,000 and we will incur $10,000 in professional fees to remain public in the next 12-months.

As of January 31 2015, we had $322,924 cash on hand.

At present, we have enough cash on hand to fund the completion of our software development, initial marketing efforts general operating expenses, legal expenses and accounting fees. In order to proceed with our business plan, we will have to find alternative sources of funds, like a second public offering, a private placement of securities or loans from our officer or third parties (such as banks or other institutional lenders). Equity financing could result in additional dilution to then existing shareholders. If we are unable to meet our needs for cash from either money that we raise from our equity, or other alternative sources such as debt financing, we may be unable to continue to maintain, develop or expand our operations.

This is our initial public offering. We are registering a total of 6,600,000 sharesprice of our common stock for sale by the selling shareholders. The company is registeringcould decline, and you could lose all or part of your investment in this prospectus 3,300,000our common shares and 3,300,000 common shares underlying the warrants to purchase common stock. The company issued 3,300,000 common shares and, 3,300,000 common stock purchase warrants to investors that invested in the Company’s Regulation D Rule 506(b) Private Placement Memorandum, dated January 15 2015. The company issued the common stock purchase warrants to investors on a “one for one” basis. For each share of common stock purchased the investor received one warrant to purchase one share of common stock. Each warrant entitles the holder to purchase one share of common stock. There are a total of 3,300,000 warrants issued. The selling shareholders will sell their shares at a fixed price per share of $0.10 until the securities are quoted for trading on the OTC Bulletin Board, or on a recognizable market or exchange, and thereafter at prevailing market prices or privately negotiated prices.The Company will not receive any proceeds from the sale of the 3,300,000 common shares that are being registered.

The company will receive $1,650,000 if all the 3,300,000 warrants are exercised at .50 cents per share.

We will not receive any proceeds from the sale of any of the 3,300,000 shares offered by the selling shareholders. This offering will terminate upon the earliest of (i) such time as all of the common stock has been sold pursuantRisk Factors Related to the registration statement or (ii) 365 days from the effective date of this Prospectus.

Implications of Being an Emerging Growth Company

We are an "emerging growth company," as defined in Section 2(a) of the Securities Act of 1933, or the Securities Act, as modified by the Jumpstart Ourour Business Startups Act of 2012, or the JOBS Act. As such, we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not "emerging growth companies" including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved.

We could remain an "emerging growth company" for up to five years, or until the earliest of (a) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (b) the date that we become a "large accelerated filer" as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (c) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three-year period.

We are also considered a "smaller reporting company," If we are still considered a "smaller reporting company" at such time as we cease to be an "emerging growth company," we will be subject to increased disclosure requirements. However, the disclosure requirements will still be less than they would be if we were not considered either an "emerging growth company" or a "smaller reporting company."

For more information, please see our Risk Factor entitled "As an "emerging growth company" under the jumpstart our business startups act (JOBS), we are permitted to rely on exemptions from certain disclosure requirements."

The Offering

Following is a brief summary of this Offering. Please see thePlan of Distribution andTerms of the Offering sections for a more detailed description of the terms of the Offering.

Offering

Securities being Offered | An aggregate of 6,600,000 shares of common stock: 3,300,000 common shares and 3,300,000 common shares underlying the warrants to purchase common stock, which are being offered by the selling shareholders. The selling shareholders offering will terminate upon the earliest of (i) such time as all of the common stock has been sold pursuant to the registration statement or (ii) 365 days from the effective date of this prospectus. |

Price per share | The selling shareholders will sell their shares at a fixed price per share of $0.10 for the duration of this Offering, or until the securities are quoted for trading on the OTC Bulletin Board or on a recognizable market or exchange, and thereafter at prevailing market prices or privately negotiated prices. |

Securities Issued Outstanding

| 14,306,666 shares of common stock are issued and outstanding. |

Offering Proceeds | The Company will not receive any proceeds from the sale of the 3,300,000 common shares that are being registered. The company will receive $1,650,000 if all the 3,300,000 warrants are exercised at .50 cents per share.

|

Registration costs | We estimate our total offering registration costs to be $25,000. This includes pay for legal expenses, accounting fees, transfer agent costs, filing fees, printing, and correspondence with our shareholders. |

Our officers and directors, control persons and/or affiliates do not intend to purchase any Shares in this Offering. Our executive officers and directors will own 69.9% of our common stock.

RISK FACTORS

An investment in these securities involves a high degree of risk and is speculative in nature. In addition to the other information regarding the Company contained in this Prospectus, you should consider many important factors in determining whether to purchase Shares. Following are what we believe are material risks related to the Company and an investment in the Company.

Risks Associated With GREY CLOAK TECH INC.:

We lackrely on a single supplier relationship for licensing and manufacturing, and the termination of that agreement could have material effect on the cost of our products and the manufacturing of our finished goods.

In August 2021, we signed an exclusive U.S. and Canada licensing and manufacturing agreement with Gelteq, a developer of ingestible gel technology, under which we agreed to develop and manufacture an advanced oral delivery system for our plant-based heart, immune and brain health formulations. Through this agreement we secured the exclusive rights to use Gelteq’s gelification process in the U.S. and Canada for the development and marketing of natural ingestible gels that contain our Citrus Bergamot or UBN ingredients. In the event either party terminates that agreement, our ability to obtain and manufacture our products will be interrupted, and we may not be able to find a replacement at the same cost.

We have a limited operating history in our current business, we are not profitable, and have no profits which we do not expect to continue intobe profitable in the near future. There is no assurance our future operations will result in continued profitable revenues.revenues sufficient to obtain or sustain profitability. If we cannot generate sufficient revenues to operate profitably, we may suspend or cease operations.

We were incorporated on December 19, 2014, but we have changed our business focus with the acquisition of BergaMet in 2019 and weUBN in 2020. We have not fully developed our proposedcurrent business operations and have not generated any revenuesyet to date. Wegenerate significant revenue from such operations. Our ability to continue as a going concern is dependent upon our ability to further establish and then grow our business and to obtain adequate financing in order to reach profitable levels of operations. In that regard we have no operatingproven history upon which an evaluation of our future successperformance, earnings or failure can be made. success.

Our net loss sincefrom inception to JanuaryDecember 31, 2014,2022, was $26,309($15,926,742). Based on our cash position of $65,651 as of December 31, 2022, we have a pressing need to raise additional capital from the sale of our stock or debt (including but also following this offering). Such funding may not be available, or may be available only on terms which most is for professional fees in connection with this Offering. are not beneficial and/or acceptable to us.

Our ability to maintainachieve profitability and positive cash flow in the future is dependent upon:upon our ability to attract new customers who will buy our nutritional supplement products and services, and our ability to generate sufficient revenue through the sale of those products and services.

| · | Our ability to attract new customers who will buy our services, |

| · | Our ability to generate sufficient revenue through the sale of our services. |

Based upon current plans, we expect to incur minimal operating profits or losses in future periods because we will be incurring expenses that may exceed revenues. We cannot guarantee that we will be successful in generating sufficient revenues in the future. In the event the Company is unable to generate sufficient revenues, it may be required to seek additional funding. Such funding may not be available, or may not be available on terms which are beneficial and/or acceptable to the Company. In the event the Companywe cannot generate sufficient revenues and/or secure additional financing, the Companywe may be forced to cease operationsoperations.

15

Our success is linked to the size and investors will likely lose some or allgrowth rate of their investmentthe vitamin, mineral and supplement market and an adverse change in the Company.

We have no clientssize or customers at this time and even when we do, there is no assurancegrowth rate of that we will make a profit.

We have no clients or customers at this time. If we are unable to attract enough customers/clients to purchase services it will have a negative effect on our ability to continue to generate sufficient revenue from which we can operate or expand our business. The lack of sufficient revenues will have a negative effect on the ability of the Company to continue operations and it could force the Company to cease operations.

General domestic and international economic conditionsmarket could have a material adverse effect on our operating results and common stock price and our ability to obtain additional financing.us.

As a resultAn adverse change in size or growth rate of the current economic downturnvitamin, mineral and macro-economic challenges currently affecting the economy of the United States and other parts of the world, some of the consulting services that we may desire to offer to clients could suffer delays or postponement until the economy strengthens, which could in turn effect our ability to obtain additional financing. We anticipate our revenues to be derived from the sale of our services, which could be suffer if customers are suffering from the economic downturn. During weak economic conditions, we may not experience any growth if we are unable to obtain financing to enable us tosupplement market and offer our services. If the domestic and/or international economy were to weaken, the demand for any consulting services we may desire to offer could decline, which could have a material adverse effect on us. Underlying market conditions are subject to change based on economic conditions, consumer preferences and other factors that are beyond our control, including media attention and scientific research, which may be positive or negative. In addition, the vitamin, mineral and supplement market is heavily saturated, and the demand for and market acceptance of new products and services in the market is uncertain. While we predict that the overall vitamin, mineral and supplement market will continue to grow, it is difficult to predict the future growth rates, if any, to the size of our market. We cannot assure you that our market will continue to develop, that the public’s interest in personalized health and wellness will continue, or that our products and services will become widely adopted. If our market does not further develop, develops more slowly than expected, or becomes saturated with competitors, or if our products and services do not achieve market acceptance, our business, financial condition, and operating results and stock price.could be adversely affected.

We are highly dependent upon consumers’ perception of the safety and quality of our products and if we fail to maintain adequate quality standards for our products and services, or if our products become subject to regulatory investigations, our business may be adversely affected and our reputation harmed.

Our products, including nutritional supplements, may contain defects or may not perform as intended. These defects could result in a product recall, market withdrawal, negative publicity or other events that would result in harm to our reputation, loss of customers or revenue, health and safety issues for our customers, product liability claims, refunds, order cancellations, or lack of market acceptance of our products and services. Any such defects, errors, or vulnerabilities would require us to take remedial action, which could require us to allocate significant research and development and customer support resources to address any such problems. Further, if we make acquisitions, we may encounter difficulties in integrating acquired technologies into our services and in augmenting those technologies to meet the quality standards that are consistent with our brand and reputation.