As filed with the Securities and Exchange Commission on June 3, 2022.

Registration No. 333-262399

UNITED STATES

SECURITIES AND EXCHANGE COMMISSIONWashington,

WASHINGTON, D.C. 20549

FORM S-1S-1/A

Amendment No. 2

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

FLUX TECHNOLOGIES, CORP.

BRAZIL MINERALS, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 39-2078861 | |

(State or

|

|

(IRS Employer |

1400

Primary Standard Industrial Classification Code Number

21 Komorowo Street, Ste. 2Wolsztyn

Brazil Minerals, Inc.

Rua Bahia, 2463 -Suite 205

Poland 64200

Tel. +48-71-7106868

E-mail:fluxtechcorp@gmail.comBelo Horizonte, Minas Gerais30.160-012, Brazil

+55-11-3956-1109

(Address, telephone number and e-mail address of principal executive offices)

Incorp Services, Inc.

2360 Corporate Circle, Ste. 400

Henderson, Nevada 89074-7722

Tel. (702) 866-2500

Fax. (702) 866-2689

(Name, address(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Marc Fogassa

Chief Executive Officer

433 North Camden Drive, Suite 810

Beverly Hills, CA90210

(833)661-7900

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

1 | Page

FitzGerald Kreditor Bolduc Risbrough LLP 2 Park Plaza, Suite 850 Irvine, CA 92614 (949) 788-8900 Peter J. Wilke, Esq. 8117 W. Manchester Avenue, Suite 700 Playa del Rey, CA 90293 (323) 397-5380 |

John P. Kennedy, Esq. Disclosure Law Group, a Professional Corporation 655 West Broadway, Suite 870 San Diego, CA 92101 (619) 272-7050 |

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after the effective date of this Registration Statement

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box |X|box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. |__|☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. |__|☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. |__|☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company:company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act (Check one):Act:

Large accelerated filer |__| Accelerated filer |__|

Non-accelerated filer |__| Smaller reporting company | X |

(Do not check if a smaller reporting company)

CALCULATION OF REGISTRATION FEE

TITLE OF EACH |

| PROPOSED | PROPOSED |

|

Common Stock | 880,000 | $0.06 per share | $52,800 | $3.76 |

| Large accelerated filer | ☐ | Non-accelerated filer | ☒ |

|

| Smaller reporting company | ☒ |

|

|

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SECTION 8(a), MAY DETERMINE.

SUBJECT TO COMPLETION,Dated April 6, 2012

2 | Page

PROSPECTUSFlux Technologies, Corp.

880,000SHARESCOMMON STOCK

The selling shareholders named in this prospectus are offering allIf an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the sharesSecurities Act. ☐

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of common stock offered throughthe Securities Act of 1933 or until this prospectus for a period of upRegistration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to two years from the effective date.said Section 8(a), may determine.

Our common stock is presently not traded on any market or securities exchange.

THE PURCHASE OF THE SECURITIES OFFERED THROUGH THIS PROSPECTUS INVOLVES A HIGH DEGREE OF RISK.

See section entitled "Risk Factors" on pages 7-13.

The information in this preliminary prospectus is not complete and may be changed. WeThese securities may not sell these securitiesbe sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities andnor does it is not solicitingseek an offer to buy these securities in any statejurisdiction where the offer or sale is not permittedpermitted..

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED JUNE 3, 2022 |

[●] Units

Each Unit Consisting of

[●] Share(s) of Common Stock

and

[●] Warrant(s) to Purchase [●] Share(s) of Common Stock

This prospectus relates to a firm commitment public offering of [●] Units (collectively, the “Units,” and each, a “Unit”), at an assumed offering price of $[●] per Unit, based on the assumed public offering price of $[●] per Unit, the last reported bid price of our common stock on the OTCQB on [●], 2022. Each Unit consisting of [●] share(s) of our common stock, $0.001 par value per share, and [●] warrant(s), each exercisable for [●] share of common stock, of Brazil Minerals, Inc., a Nevada corporation (the “Company”). Each warrant is immediately exercisable for [●] share of common stock at an exercise price of $[●] per share (equal to [●]% of the price of each share of common stock sold in this offering), and will expire [●] from the date of issuance. The selling shareholdersshares of common stock and warrants that are part of the Units are immediately separable and will sellbe issued separately. This offering also includes the shares of common stock issuable from time to time upon exercise of the warrants.

Our common stock is currently traded on the OTCQB Marketplace (“OTCQB”) operated by the OTC Markets Group, Inc. under the symbol “BMIX.”

We have applied to list our common stock under the symbol “BMIX” and our warrants under the symbol “BMIXW,” both on the Nasdaq Capital Market. No assurance can be given that our application will be approved, and we will not consummate this offering unless our common stock and warrants are approved for listing on the Nasdaq Capital Market.

On June 2, 2022, the last reported sale price for our common stock was $0.0063 per share. Quotes of stock trading prices on an over-the-counter marketplace may not be indicative of the market price on a national securities exchange.

INVESTING IN OUR SECURITIES INVOLVES A HIGH DEGREE OF RISK. SEE “RISK FACTORS” BEGINNING ON PAGE 9 OF THIS PROSPECTUS FOR A DISCUSSION OF INFORMATION THAT SHOULD BE CONSIDERED IN CONNECTION WITH AN INVESTMENT IN OUR SECURITIES.

| Per Unit | Total | |||||||

| Assumed public offering price(1) | ||||||||

| Underwriting discounts and commissions(2) | ||||||||

| Proceeds to us, before expenses | ||||||||

| (1) | Based on the last reported bid price of our common stock on the OTCQB on [●], 2022. |

| (2) | Does not include the following additional compensation payable to the underwriters. In addition to the compensation referenced above, we have agreed to pay to EF Hutton, division of Benchmark Investments, LLC, the representative of the underwriters (the “Representative”), a non-accountable expense allowance equal to three-quarters of one percent (0.75%) of the total proceeds raised and to reimburse the underwriters for certain expenses incurred relating to this offering. In addition, we will issue to the Representative warrants to purchase up to that number of shares of our common stock equal to five percent (5%) of the number of shares common stock sold in this offering. The registration statement of which this prospectus forms a part also registers the issuance of the shares of common stock issuable upon exercise of the Representative’s warrants. See “Underwriting” for a description of compensation and other items of value payable to the underwriters. |

We have granted to the underwriter a 45-day option, exercisable one or more times in whole or in part, to purchase up to an additional [●] shares of common stock and/or warrants (an amount equal to 15% of the Units sold in the offering, assuming a total of [●] units are sold at the public offering price per Unit of $[●] (which is the last reported closing price of our common stock, as reported on the OTCQB [●], 2022)) at the public offering price per Unit and, in each case, less the underwriting discounts and commissions, to cover over-allotments, if any.

We have also agreed to issue to the underwriters warrants to purchase up to an aggregate of [●] shares of our common stock. See “Underwriting” beginning on page 57 for additional information regarding these warrants and underwriting compensation generally.

The underwriters expect to deliver our shares and warrants to purchasers in this offering on or about [●], 2022.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Sole Book Running Manager

EF HUTTON

division of Benchmark Investments, LLC

The date of this prospectus is [●], 2022.

TABLE OF CONTENTS

Through and including [●], 2022 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

You should rely only on the information contained in this prospectus or in any free writing prospectus we or the underwriters may authorize to be delivered or made available to you. Neither we nor the underwriters have authorized anyone to provide you with different information. We are offering to sell, and seeking offers to buy, shares of common stock only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of shares of our common stock. Our business, financial condition, operating results and prospects may have changed since that date.

For investors outside of the United States: No action is being taken in any jurisdiction outside of the United States that would permit a public offering of the shares of our common stock or possession or distribution of this prospectus in any such jurisdiction. Persons outside of the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside of the United States.

In this prospectus, unless the context indicates otherwise, references to “Brazil Minerals, “we,” the “Company,” “our” and “us” refer to Brazil Minerals, Inc., a Nevada corporation, and references to the “Board” or the “Board of Directors” means the Board of Directors of Brazil Minerals, Inc.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements that involve substantial risks and uncertainties. The forward-looking statements are contained principally in the sections of this prospectus entitled “Prospectus Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business,” but are also contained elsewhere in this prospectus. In some cases, you can identify forward-looking statements by the words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “objective,” “ongoing,” “plan,” “predict,” “project,” “potential,” “should,” “will,” or “would,” or the negative of these terms, or other comparable terminology intended to identify statements about the future. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. Although we believe that we have a reasonable basis for each forward-looking statement contained in this prospectus, we caution you that these statements are based on a combination of facts and factors currently known by us and our expectations of the future, about which we cannot be certain. Forward-looking statements include statements about:

| ● | our ability to continue as a going concern and our history of losses; | |

| ● | our ability to obtain additional financing; | |

| ● | our use of the net proceeds from this offering; | |

| ● | our ability to study and properly explore the various mineral rights that we own; | |

| ● | our ability to obtain the necessary permitting for mining and operating mining properties in Brazil; | |

| ● | the accuracy of our estimates regarding expenses, future revenues and capital requirements; | |

| ● | the implementation of our business model and strategic plans for our business; | |

| ● | our ability to retain key management personnel; and | |

| ● | regulatory developments and our compliance with applicable laws. |

Forward-looking statements are inherently subject to risks and uncertainties, many of which we cannot predict with accuracy and some of which we might not even anticipate. Although we believe that the expectations reflected in such forward-looking statements are based upon reasonable assumptions at $0.06the time made, we can give no assurance that such expectations will be achieved. Actual events or results may differ materially. Readers are cautioned not to place undue reliance on forward-looking statements. We have no duty to update or revise any forward-looking statements after the date of this prospectus or to conform them to actual results, new information, future events or otherwise.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of these forward-looking statements.

You should read the risk factors and the other cautionary statements made in this prospectus as being applicable to all related forward-looking statements wherever they appear in this prospectus. If one or more of these factors materialize, or if any underlying assumptions prove incorrect, our actual results, performance or achievements may vary materially from any future results, performance or achievements expressed or implied by these forward-looking statements. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

| 1 |

INDUSTRY AND MARKET DATA

This prospectus contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry. We obtained the industry and market data in this prospectus from our own research as well as from industry and general publications, surveys and studies conducted by third parties. This data involves a number of assumptions and limitations and contains projections and estimates of the future performance of the industries in which we operate that are subject to a high degree of uncertainty, including those discussed in “Risk Factors.” We caution you not to give undue weight to such projections, assumptions and estimates. Further, industry and general publications, studies and surveys generally state that they have been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe that these publications, studies and surveys are reliable, we have not independently verified the data contained in them. In addition, while we believe that the results and estimates from our internal research are reliable, such results and estimates have not been verified by any independent source.

CAUTIONARY NOTE REGARDING DISCLOSURE OF MINERAL PROPERTIES

We are subject to the reporting requirements of the applicable U.S. securities laws. U.S. reporting requirements currently applicable to us are governed by the Securities Act of 1933, as amended (“Securities Act”), and the Exchange Act of 1934, as amended (“Exchange Act”), including Regulation S-K, Subpart 1300 (“Item 1300 of Regulation S-K”).

Under Item 1300 of Regulation S-K, mineralization may not be classified as a reserve unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. We are an exploration stage company, and we have no reserves as defined by Item 1300 of Regulation S-K.

| 2 |

PROSPECTUS SUMMARY

The following summary highlights selected information contained elsewhere in this prospectus and is qualified in its entirety by the more detailed information and financial statements included elsewhere in this prospectus. It does not contain all the information that may be important to you and your investment decision. You should carefully read this entire prospectus, including the matters set forth under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our financial statements and related notes included elsewhere in this prospectus.

Unless otherwise expressly provided herein, all share and per share untilnumbers set forth herein relating to our common stock assume no exercise of (a) any warrants and/or options, (b) the representatives’ common stock purchase warrants and/or (c) the representatives’ over-allotment option.

Company Overview

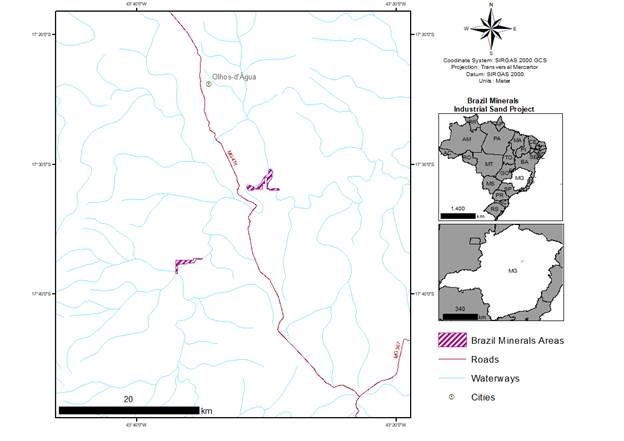

Brazil Minerals, Inc. (“Brazil Minerals,” the “Company,” “we,” “us,” or “our”) is a U.S. mineral exploration and mining company with projects and properties in essentially all battery metals to power the Green Energy Revolution – lithium, rare earths, nickel, cobalt, graphite, and titanium. Our current focus is on developing our hard-rock lithium project located in a premier pegmatitic district in Brazil – as lithium is essential for batteries in electric vehicles. Additionally, through subsidiaries, we participate in iron, gold, and quartzite projects. We also own multiple mining concessions for gold, diamond, and industrial sand.

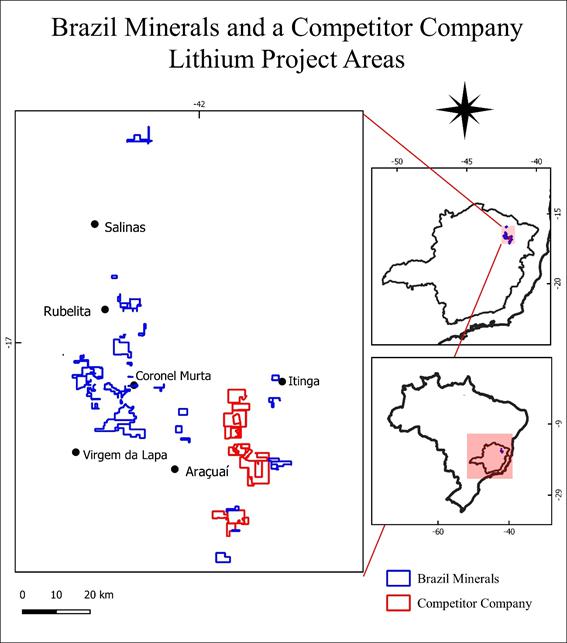

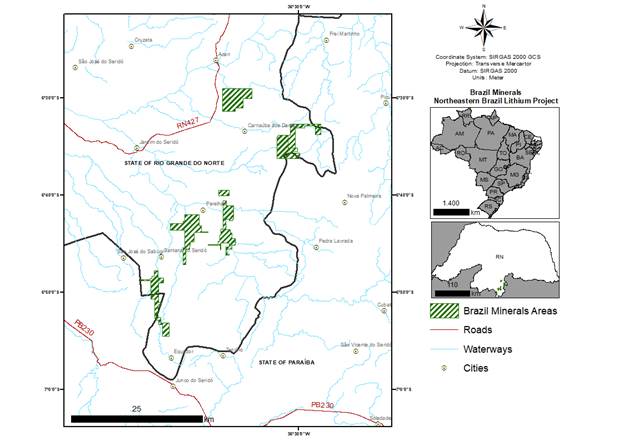

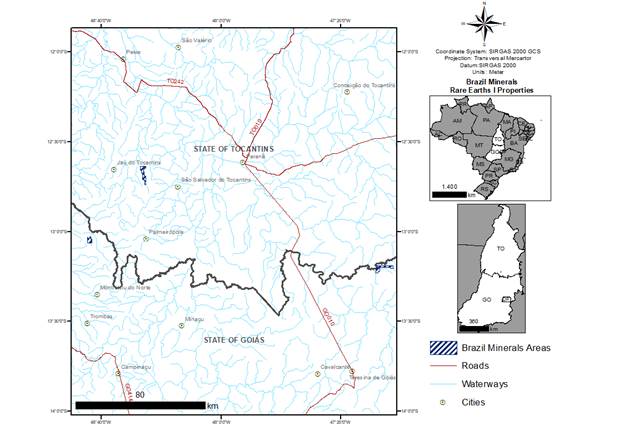

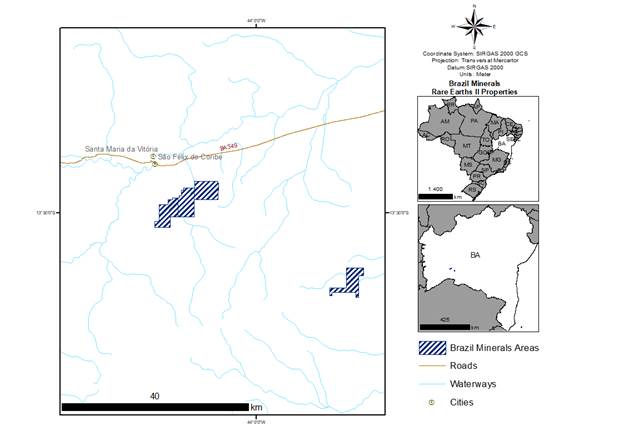

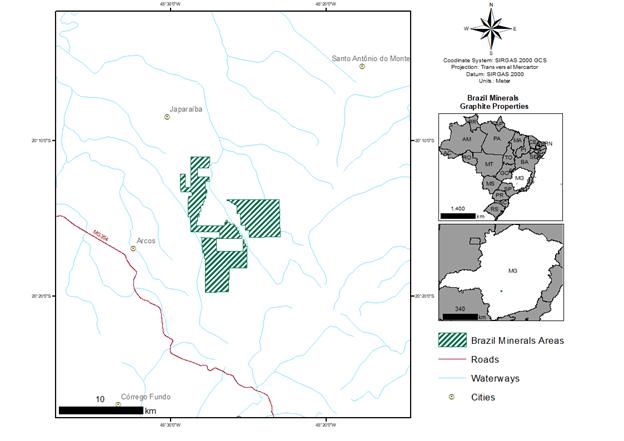

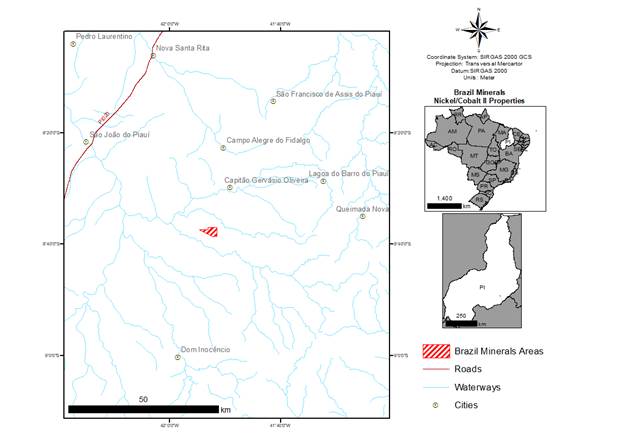

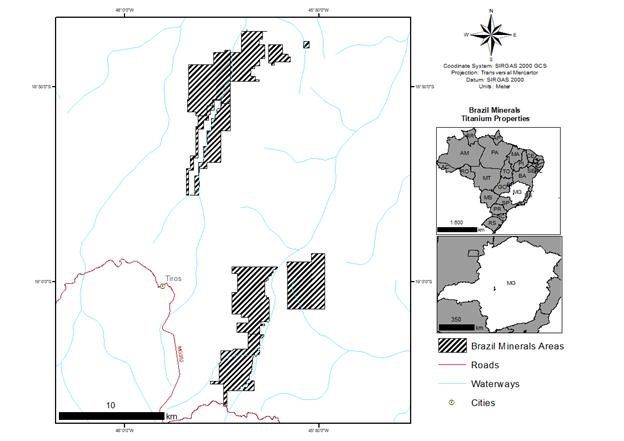

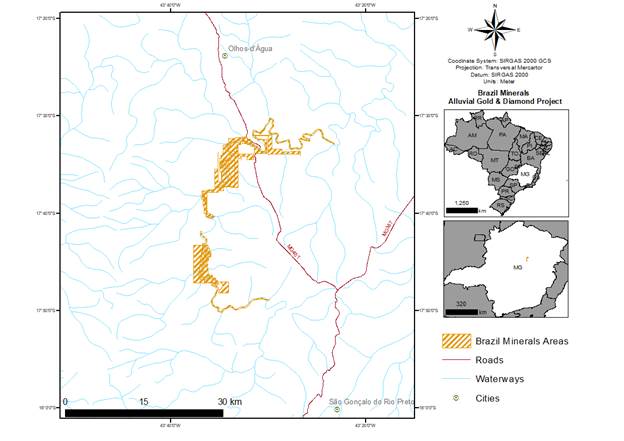

All of our mineral projects and properties are located in Brazil and, as of the date of this prospectus, our mineral rights portfolio for battery metals includes approximately 60,077 acres (243 km2) for lithium, 30,009 acres (121 km2) for rare earths, 27,652 acres for nickel and cobalt (112 km2), 22,050 acres (89 km2) for titanium, and 14,507 acres (59 km2) for graphite. We believe we are among the largest listed companies by size and breadth in exploration projects for strategic minerals and battery metals in Brazil, a premier mineral jurisdiction.

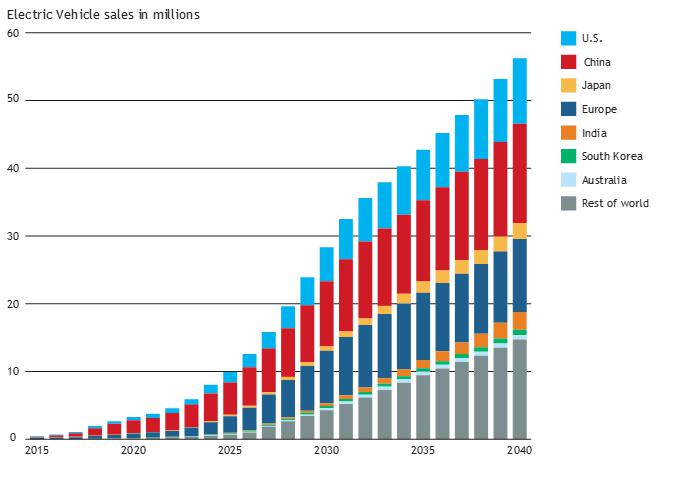

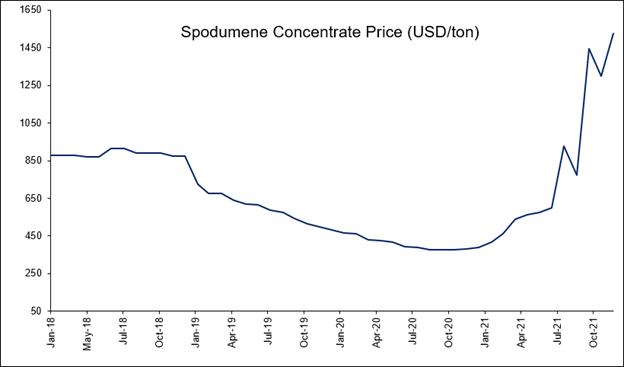

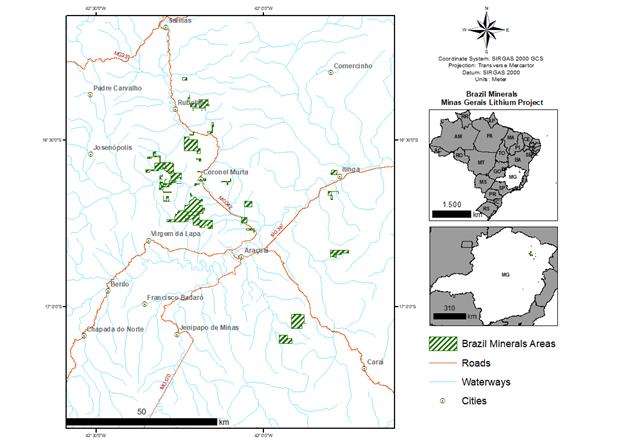

We are primarily focused on advancing and developing our hard-rock lithium project located in the state of Minas Gerais, Brazil, where some of our high-potential mineral rights are adjacent to or near large lithium deposits that belong to a competitor, a Nasdaq listed company. Our Minas Gerais Lithium Project is our largest endeavor and consists of 44 mineral rights spread over 45,456 acres (184 km2) and predominantly located within the Brazilian Eastern Pegmatitic Province which has been surveyed by the Brazilian Geological Survey and is known for the presence of hard rock formations known as pegmatites which contain lithium-bearing minerals such as spodumene and petalite. Generally, lithium derived from pegmatites is less costly to purify for uses in high technology applications than lithium obtained from brine. Such applications include the battery supply chain for electric vehicles (“EVs”), an area of expected high growth for the next several decades.

We believe that we can materially increase our value by the acceleration of our exploratory work and quantification of our lithium mineralization. Our initial commercial goal is to be able to enter production of lithium-bearing concentrate, a product which is highly sought after in the battery supply chain for EVs.

We also have 100%-ownership of early-stage projects and properties in other minerals that are needed in the battery supply chain and high technology applications such as rare earths, nickel, cobalt, graphite, and titanium. Our goal is to become “the Mineral Resources Company for the Green Energy Revolution.” We believe that the shift from fossil fuels to battery power will yield long-term opportunities for us not only in lithium but also in such other minerals.

Additionally, we have 100%-ownership of several mining concessions for gold and diamonds. Historically, we have had revenues from mining and selling gold and diamonds. More recently we have had revenues from mining and selling industrial sand for the local construction industry, which is at the time of this prospectus is our primary source of revenues. Such endeavors have given us the critical management experience needed to take early-stage projects in Brazil from the exploration phase through successful licensing from regulators and to revenues.

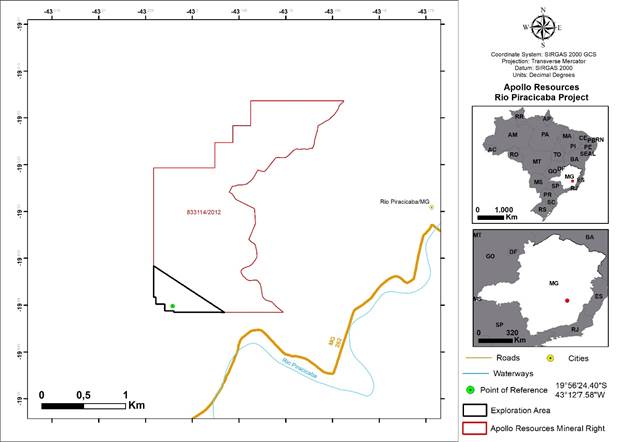

As of the date of this prospectus, we also own 44.41% of the common shares of Apollo Resources Corporation, (“Apollo Resources”), a private company currently primarily focused on the development of its initial iron mine, expected to start operations and revenues in early 2023.

As of the date of this prospectus, we also own approximately 24.56% of Jupiter Gold Corporation (“Jupiter Gold”), a company focused on the development of gold projects and of a quartzite mine, and whose common shares are quoted on the OTC Bulletin Board,OTCQB under the symbol “JUPGF.” The quartzite mine is expected to start operations and thereafter at prevailing market prices or privately negotiated prices. We determined this offering price arbitrarily by adding a $0.03 premiumrevenues in 2022.

The results of operations from both Apollo Resources and Jupiter Gold are consolidated in our financial statements under accounting principles generally accepted in the United States (“U.S. GAAP”).

Risk Factors

Our business is subject to numerous risks and uncertainties, including those highlighted in the last sale pricesection titled “Risk Factors,” that represent challenges that we face in connection with the successful implementation of our common stock to investors. This offering is priced at the timestrategy. The occurrence of one or more of the commencementevents or circumstances described in the section titled “Risk Factors,” alone or in combination with other events or circumstances, may have an adverse effect on our business, cash flows, financial condition, and results of the offering and must remain offered at such price during the entire duration of the offering until and unless the security is subsequently listed on an exchange or is listed by a market maker on the OTC BB. Currently the company isoperations. Such risks include, but are not so listed and there is no assurance that the stock will ever be so listed.limited to:

There has been no market for our securities. Our common stock is not traded on any exchange or on the Over-the-Counter market. After the effective date of the registration statement relating to this prospectus, we hope to have a market maker file an application with FINRA for our common stock to become eligible for trading on the Over-the-Counter Bulletin Board. We do not yet have a market maker who has agreed to file such application. There is no assurance that a trading market will develop or, if developed, that it will be sustained. Consequently, a purchaser of our common stock may find it difficult to resell the securities offered herein should the purchaser desire to do so.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The Date of This Prospectus Is: April 6, 2012

3 | Page

| ● | Our future performance is difficult to evaluate because we have a limited operating history. | ||

| |||

| There is substantial doubt about our ability to continue as a going concern. | ||

|

| ||

|

| We are an exploration stage company, and there is no guarantee that our properties will result in the commercial extraction of mineral deposits. | |

|

| ||

| ● | Because the probability of |

|

|

| ||

|

| We face risks related to mining, exploration, and mine construction, if warranted, on our properties. | |

|

| ||

|

| Our long-term success will depend ultimately on our ability to achieve and maintain profitability and to develop positive cash flow from our mining activities. | |

|

| ||

| ● | We depend on our ability to successfully access the capital and |

|

|

| ||

|

| Our quarterly and annual operating and financial results and our revenue are likely to fluctuate significantly in future periods. |

| 3 |

Corporate Information

4 | Page

Summary

Prospective investors are urged to read this prospectus in its entirety.

Flux Technologies, Corp. was foundWe were originally incorporated in the State of Nevada on December 15, 2011.2011 under the name “Flux Technologies, Corp.” On January 24, 2013, an amendment to our articles of incorporation was filed with the Nevada Secretary of State changing our name to “Brazil Minerals, Inc.” Our principal place of business is located at Rua Bahia, 2463, Suite 205, Belo Horizonte, Minas Gerais 30.160-012, Brazil. We also maintain an office at 433 North Camden Drive, Suite 810, Beverly Hills, CA 90210. Our telephone numbers are a Poland based corporation+55-31-3956-1109 (Brazil) and operate a three-dimensional (3D) computer animation business in Poland. We plan to expand(833) 661-7900 (U.S.). Our website address is www.brazil-minerals.com. The information contained on our services to Europeanwebsite is not incorporated by reference into this prospectus, and North American markets in the future if we have the available resources and growth to warrant it. We are a development stage company and cannot state with certainty whether we will achieve profitability. We doyou should not have revenues, have minimal assets and have incurred losses since inception. To date,consider any information contained on, or that can be accessed through, our business operations have been limited to primarily, the development of a business plan and the signing of the service agreement with Paliwa Spólka z o. o. a private Polish company.

We must raise additional capital in order for our business plan to succeed. We are not raising any money in this offering. The most likely source of future funds available to us is through the sale of additional shares of common stock or advances from our sole director. There is no assurance that any additional financing will be available or if available, on terms that will be acceptable to us. Failure to raise additional financing will cause us to go out of business. If this happens, you could lose all orwebsite as part of your investment.this prospectus or in deciding whether to purchase our common shares.

Our auditors have issued

Listing on a going concern opinion. This means that that there is substantial doubt that we can continue as an ongoing business for the next twelve months.National Stock Exchange

On February 17, 2012 service agreement was signed withPaliwa Spólka z o. o., a Poland based company.

We have no other companies interested in signing service agreements as of April 6, 2012.

Even thoughapplied to list our common stock under the negotiation of additional agreements with customerssymbol “BMIX” and our warrants under the symbol “BMIXW,” both on the Nasdaq Capital Market. No assurance can be given that our application will be ongoing during the life of our operations, we cannot guarantee that we will be able to find successful agreements, in which case our business may failapproved, and we will have to ceasenot consummate this offering unless our operations.common stock and warrants are approved for listing on the Nasdaq Capital Market.

We were incorporated on December 15, 2011

Controlled Company

Marc Fogassa, our Chief Executive Officer and Chairman, currently controls approximately [●]% of the voting power of our capital stock and will control approximately [●]% of the combined voting power of our capital stock upon completion of this offering, and we believe may be a “controlled company,” as such term is defined under the laws of the state of Nevada. Our principal office is located at 21 Komorowo Street, Ste. 2, Wolsztyn, Poland 64200. Our telephone number is +48-717106868 . Our fiscal year end is February 29.Nasdaq Listing Rules.

5 | Page

| 4 |

THE OFFERING

The Offering:

| Securities Offered: | ||

|

| |

| This prospectus also relates to the offering of the shares of common stock issuable upon exercise of the warrants. See “Description of Capital Stock” on page [●]. | ||

| Assumed Public Offering |

| $[●] per Unit |

| Number of Shares of Common Stock Offered: | Up to [●] shares | |

|

| |

|

| Up to [●] warrants to purchase up to [●] shares of common stock, |

|

| |

| Shares of Common Stock Outstanding before the Offering: | 3,370,472,433 shares | |

| Shares of Common Stock to be | [●] shares (not including the possible sale of over-allotment shares and/or warrants, and assuming none of the warrants issued in this offering are exercised). | |

| Trading Symbol: | Our common stock is presently quoted on the OTCQB under the symbol “BMIX.” We have applied to list our common stock under the symbol “BMIX” and our warrants under the symbol “BMIXW,” both on the Nasdaq Capital Market. | |

| Reverse Stock Split: | On [●], 2022, our Board and the holder of a majority of our outstanding voting securities approved of a reverse stock split within the range of 1-for-[●] to 1-for-[●] of our issued and outstanding shares of common stock (the “Reverse Split”) and authorized the Board, in its sole discretion, to determine the final ratio any time before [●], 2022. We expect to effect the Reverse Split prior to the consummation of this offering. See “Description of Securities” for additional information regarding the Reverse Split and other matters related to our common stock. | |

| The purpose of the reverse stock split is to allow us to meet the stock price threshold of the listing requirements of a national securities exchange. All option, share, and per share information in this prospectus |

| 5 |

| Over-Allotment Option: | We have granted to the underwriters a 45-day option to purchase from us up to an additional 15% of the shares of common stock and/or warrants sold in the offering in any combination thereof, solely to cover over-allotments, if any, at the public offering price per Unit, less the underwriting discounts. | |

| Use of Proceeds: | We estimate that we will receive net proceeds of approximately $[●] from our sale of Units in this offering, after deducting underwriting discounts and | |

| Risk Factors: | Investing in our securities involves substantial risks. You should carefully review and consider the “Risk Factors” section of this prospectus beginning on page 9 and the other information in this prospectus for a discussion of the factors you should consider before you decide to invest in this offering. | |

| Lock-up | We, our directors, and officers have agreed with the underwriters not to offer for sale, issue, sell, contract to sell, pledge or otherwise dispose of any of our common stock or securities convertible into common stock for 180 days after the date of this prospectus. | |

| Representative’s Warrant: | We will issue to EF Hutton, division of Benchmark Investments, LLC, as Sole Book Running Manager and underwriter, at the closing of this offering warrants to purchase the number of common shares equal to 5.0% of the aggregate number of common | |

|

| |

|

|

| The number of shares of our common stock outstanding after the completion of this offering is based on 3,370,472,433 shares of our common stock outstanding as of June 2, 2022, does not give effect to |

| ● | 285,655,055 shares of common stock issuable upon the exercise of outstanding options and warrants with a | |

| ● | 25,000,000 shares of common stock reserved for the future issuance of awards under our 2017 Stock Incentive Plan; | |

| ● | One share of common stock issuable upon the conversion of our outstanding Series A Convertible Preferred Stock; and | |

| ● | 2,140,060,000 shares of common stock issuable upon the conversion of our outstanding Series D Convertible Preferred Stock. |

Except as otherwise indicated herein, all information in this prospectus assumes the following:

| ● | no exercise of the outstanding warrants or conversion of the convertible preferred stock described above; | |

| ● | no exercise of the warrants included in the Units; | |

| ● | no exercise by the underwriter of their option to purchase additional Units consisting of common shares and warrants to purchase common shares to cover over-allotments, if any; and | |

| ● | no exercise of the underwriter’s warrants. |

| 6 |

SUMMARY FINANCIAL DATA

The following table sets forth our selected financial data as of the dates and for the periods indicated. We have derived the statement of operations data for the years ended December 31, 2021 and 2020 from our audited financial statements included elsewhere in this prospectus. The statements of operations data for the three-months ended March 31, 2022 and 2021 and the balance sheet data as of March 31, 2022 have been derived from our unaudited financial statements included elsewhere in this prospectus and have been prepared on the same basis as the audited financial statements. In the opinion of our management, the unaudited data reflects all adjustments, consisting of normal and recurring adjustments, necessary for a fair presentation of results as of and for these periods. You should read this data together with our financial statements and related notes included elsewhere in this prospectus and the sections in this prospectus entitled “Selected Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our historical results for any prior period are not indicative of our future results, and our results for the three-months ended March 31, 2022 may not be indicative of our results for the year ending December 31, 2022.

Year Ended December 31, | Three Months Ended March 31, | |||||||||||||||

| 2021 | 2020 | 2022 | 2021 | |||||||||||||

| (unaudited) | ||||||||||||||||

| Statements of Operations and Comprehensive Loss Data: | ||||||||||||||||

| Revenue | $ | 10,232 | $ | 23,446 | $ | 477 | $ | 4,459 | ||||||||

| Cost of revenue | 245,810 | 129,943 | 9,855 | 22,989 | ||||||||||||

| Gross loss | (235,578 | ) | (106,497 | ) | (9,378 | ) | (18,530 | ) | ||||||||

| Operating expenses: | ||||||||||||||||

| Professional fees | 259,547 | 170,071 | 119,841 | 82,291 | ||||||||||||

| General and administrative | 1,114,061 | 551,584 | 221,465 | 273,051 | ||||||||||||

| Compensation and related costs | 436,560 | 329,044 | 97,992 | 45,508 | ||||||||||||

| Stock based compensation | 1,470,346 | 124,357 | 388,019 | 711,446 | ||||||||||||

| Total operating expenses | 3,280,514 | 1,175,056 | 827,317 | 1,112,296 | ||||||||||||

| Loss from operations | (3,516,092 | ) | (1,281,553 | ) | (836,695 | ) | (1,130,826 | ) | ||||||||

| Other expense (income) | 509,373 | 264,482 | (1,952 | ) | 64,542 | |||||||||||

| Net loss | $ | (4,025,465 | ) | $ | (1,546,035 | ) | $ | (834,743 | ) | $ | (1,195,368 | ) | ||||

| Net loss per share attributable to common stockholders(1) | ||||||||||||||||

| Basic | $ | 0.0 | $ | 0.0 | $ | 0.0 | $ | 0.0 | ||||||||

| Diluted | $ | 0.0 | $ | 0.0 | $ | 0.0 | $ | 0.0 | ||||||||

| Weighted average shares outstanding used in computing net loss per share attributable to common stockholders(1) | ||||||||||||||||

| Basic and diluted | 2,767,248,003 | 1,271,251,526 | 3,191,757,168 | 2,267,306,033 | ||||||||||||

| Comprehensive loss: | ||||||||||||||||

| Net loss | (4,025,465 | ) | (1,546,035 | ) | (834,743 | ) | (1,195,368 | ) | ||||||||

| Foreign currency translation adjustment | 56,815 | (134,914 | ) | 56,815 | (36,367 | ) | ||||||||||

| Comprehensive loss | (3,968,650 | ) | (1,680,949 | ) | (777,928 | ) | (1,231,735 | ) | ||||||||

| Comprehensive loss attributable to noncontrolling interests | (1,258,595 | ) | (345,130 | ) | (308,741 | ) | (452,468 | ) | ||||||||

| Comprehensive loss attributable to Brazil Minerals, Inc. stockholders | (2,710,055 | ) | (1,335,819 | ) | (469,187 | ) | (779,267 | ) | ||||||||

| (1) | See Note 1 to each of our audited and unaudited condensed financial statements, respectively, included elsewhere in this prospectus for an |

| 7 |

As of March 31, 2022 (unaudited) | ||||||||||||

| Actual | Proforma (1) | Proforma, as adjusted(2) | ||||||||||

| (unaudited) | ||||||||||||

| Balance Sheet Data: | ||||||||||||

| Cash | $ | 54,230 | 1,247,412 | |||||||||

| Working capital | (822,917 | ) | (149,735) | |||||||||

| Total assets | 1,861,208 | 3,704,390 | ||||||||||

| Current liabilities | 923,659 | 1,443,659 | ||||||||||

| Other noncurrent liabilities | 129,885 | 129,885 | ||||||||||

| Additional paid-in capital | 52,162,095 | 53,185,277 | ||||||||||

| Accumulated other comprehensive loss | (460,316 | ) | (460,316 | ) | ||||||||

| Accumulated deficit | (55,488,919 | ) | (55,488,919 | ) | ||||||||

| Total Brazil Minerals Inc. stockholders’ equity (deficit) | (587,447 | ) | 435,735 | |||||||||

| Non-controlling interest | 1,395,111 | 1,695,111 | ||||||||||

| Total stockholders’ equity (deficit) | 807,664 | 2,130,846 | ||||||||||

| Total liabilities and stockholders’ deficit | 1,861,208 | 3,704,390 | ||||||||||

| (1) | Pro forma bases giving effect to, as of the date of this prospectus: (a) the sale of a total of 12,982,363 shares of our common stock to (b) the sale of a |

6 | Page

Summary Financial Information

The following financial information summarizes the more complete historical financial information at the end of this prospectus.

(d) the increase of $650,000 in intangible assets related to the acquisition of two mineral properties, and the increase of $520,000 in current liabilities related to such acquisitions during the period from April 1, 2022 to June 3, 2022. | |||

| |||

|

|

| |

|

|

| |

|

|

| |

| |||

| |||

|

|

| |

|

|

| |

|

|

| |

| 8 |

Risk Factors related to our Business and IndustryRISK FACTORS

Please consider the following risk factors before deciding to invest in our common stock. Any investment

Investing in our common stock is speculative.involves a high degree of risk. You should carefully consider the risks described below, and all ofas well as the other information contained in this Prospectusprospectus, including our financial statements and the related notes thereto and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” before deciding whether to purchaseinvest in our common stock. Ifsecurities. The occurrence of any of the following risks actually occur,events or developments described below could harm our business, financial condition, operating results, and results of operations could be harmed. If any of these risks materialize,growth prospects. In such an event, the tradingmarket price of our common stock could decline, and you may lose all or part of your investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations.

WE LACK AN OPERATING HISTORY AND THERE IS NO ASSURANCE OUR FUTURE OPERATIONS WILL RESULT IN REVENUES OR PROFITABILITY. IF WE CANNOT GENERATE SUFFICIENT REVENUES TO OPERATE PROFITABLY, WE MAY SUSPEND OR CEASE OPERATIONS.

WeBusiness Risks

Our future performance is difficult to evaluate because we have a limited operating history.

Investors should evaluate an investment in us considering the uncertainties encountered by developing companies. Although we were incorporated in 2011, we began to implement our current business strategy in 2016. Our current business strategy is focused on December 15, 2011,the exploration of strategic minerals and battery metals, and, through specific subsidiaries, the exploration of iron and gold. While we have had a small amount of revenues from the sales of gold and diamonds mined by us, and currently have a small amount of revenue from the sale of sand mined by us and for construction use, we have not realized any revenues to date from the sale of strategic minerals and battery metals or iron. Our operating cash flow needs have been financed primarily through debt or equity and not through cash flows derived from our net loss since inceptionoperations. As a result, we have little historical financial and operating information available to help you evaluate and predict our future performance. There can be no assurance that our efforts will be successful or that we will ultimately be able to attain profitability.

There is $4,712,substantial doubt about our ability to continue as a going concern.

We have not been profitable and such condition raises substantial doubt about our ability to continue as a going concern. There is uncertainty regarding our ability to implement our business plan and to grow our business to a greater extent than we can with our existing financial resources without additional financing. Our long-term future growth and success is dependent upon our ability to raise additional capital and implement our business plan. There is no assurance that we will be successful in implementing our business plan or that we will be able to generate sufficient cash from operations, sell securities or borrow funds on favorable terms or at all. Our inability to generate significant revenue or obtain additional financing could have a material adverse effect on our ability to fully implement our business plan and grow our business to a greater extent than we can with our existing financial resources.

We are an exploration stage company, and there is no guarantee that our properties will result in the commercial extraction of mineral deposits.

We are engaged in the business of exploring and developing mineral properties with the intention of locating economic deposits of minerals. An economic deposit is a mineral property which can be reasonably expected to generate profits upon extraction and commercialization of its minerals after considering all costs involved. Our property interests are at the exploration stage. Accordingly, it is unlikely that we will realize profits in the short term, and we also cannot assure you that we will realize profits in the medium to long term. Any profitability in the future from our business will be dependent upon development of at least one economic deposit and most likely further exploration and development of other economic deposits, each of which $317 is for bank charges, $60 for telephone charges, $335subject to numerous risk factors.

Further, we cannot assure you that, even if an economic deposit of minerals is for an incorporation service feelocated, any of our property interests can be commercially mined. The exploration and $4,000 fordevelopment of mineral deposits involves a high degree of financial risk over a significant period which a combination of careful evaluation, experience and knowledge of management may not eliminate. While discovery of additional ore-bearing deposits may result in substantial rewards, few properties which are explored are ultimately developed into producing mines. Major expenses may be required to establish reserves by drilling and to construct mining and processing facilities at a particular site. It is impossible to ensure that our current exploration programs will result in profitable commercial mining operations. The profitability of our operations will be, in part, related to the audit fees. Wecost and success of its exploration and development programs which may be affected by several factors. Additional expenditures are required to establish reserves which are sufficient to commercially mine and to construct, complete and install mining and processing facilities in those properties that are mined and developed.

In addition, exploration-stage projects like ours have very littleno operating history upon which to base estimates of future operating costs and capital requirements. Exploration project items, such as any future estimates of reserves, metal recoveries or cash operating costs will to a large extent be based upon the interpretation of geologic data, obtained from a limited number of drill holes and other sampling techniques, as well as future feasibility studies. Actual operating costs and economic returns of all exploration projects may materially differ from the costs and returns estimated, and accordingly our financial condition, results of operations, and cash flows may be negatively affected.

| 9 |

Because the probability of an individual prospect ever having reserves is not known, our properties may not contain any reserves, and any funds spent on exploration and evaluation of our future success or failure canmay be made. Based upon current plans, we expect to incur operating losses in the foreseeable future because we will be incurring large expenseslost.

We are an exploration stage company, and generating small revenues. Failure to generate significant revenues in the future will cause us to go out of business.

IF WE DO NOT OBTAIN ADDITIONAL FINANCING, OUR BUSINESS WILL FAIL.

While on February 29, 2012, we had cash on hand of $21,488 we have accumulated a deficitno “reserves” as such term is defined by Item 1300 of $4,712 in business development and administrative expenses and audit fees. Our current cash reserves are not sufficient to meet our obligations forRegulation S-K. We cannot assure you about the next twelve-month period. We anticipate thatexistence of economically extractable mineralization at this time, nor about the minimum additional capital necessary to fund our planned operations for the 12-month period will be approximately $8,500 and will be needed for general administrative expenses, business development, marketing costs, support materials and costs associated with being a publicly reporting company. We have not generatedquantity or grade of any revenue from operations to date. In order to expand our business operations, we anticipate that we will have to raise additional funding. If we are not able to raise the capital necessary to fund our business expansion objectives,mineralization we may have to delayfound. Because the implementationprobability of an individual prospect ever having reserves is uncertain, our business plan.

7 | Page

properties may not contain any reserves and any funds spent on evaluation and exploration may be lost. Even if we confirm reserves on our properties, any quantity or grade of reserves we indicate must be considered as estimates only until such reserves are mined. We do not currently haveknow with certainty that economically recoverable minerals exist on our properties. In addition, the quantity of any arrangements for financing. Obtaining additional fundingreserves may vary depending on commodity prices. Any material change in the quantity or grade of reserves may affect the economic viability of our properties. Further, our lack of established reserves means that we are uncertain about our ability to generate revenue from our operations.

We face risks related to mining, exploration and mine construction, if warranted, on our properties.

Our level of profitability, if any, in future years will depend to a great degree on prices of minerals set by global markets and whether our exploration-stage properties can be brought into production. It is impossible to ensure that the current and future exploration programs and/or feasibility studies on our existing properties will establish reserves. Whether it will be subjecteconomically feasible to extract a mineral depends on a number of factors, including, general market conditions, investor acceptancebut not limited to: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; mineral prices; mining, processing and transportation costs; the willingness of lenders and investors to provide project financing; labor costs and possible labor strikes; and governmental regulations, including, without limitation, regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting materials, foreign exchange, environmental protection, employment, worker safety, transportation, and reclamation and closure obligations. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in us receiving an inadequate return on invested capital.

Our long-term success will depend ultimately on our ability to achieve and maintain profitability and to develop positive cash flow from our mining activities.

Our long-term success, including the recoverability of the carrying values of our assets, our ability to continue with exploration, development and commissioning and mining activities on our existing projects or to acquire additional projects, will depend ultimately on our ability to achieve and maintain profitability and to develop positive cash flow from our operations by establishing ore bodies that contain commercially recoverable minerals and to develop these into profitable mining activities. We cannot assure you that any ore body that we extract mineralized materials from will result in achieving and maintaining profitability and developing positive cash flow.

We depend on our ability to successfully access the capital and financial markets. Any inability to access the capital or financial markets may limit our ability to fund our ongoing operations, execute our business plan or pursue investments that we may rely on for future growth.

Until commercial production is achieved from one of our larger projects, we will continue to incur operating and investing net cash outflows associated with among other things maintaining and acquiring exploration properties, undertaking ongoing exploration activities and the development of mines. As a result, we rely on access to capital markets as a source of funding for our capital and operating requirements. We cannot assure you that such additional funding will be available to us on satisfactory terms, or at all.

In order to finance our current operations and future capital needs, we will require additional funds through the issuance of additional equity and/or debt securities. In addition to the proceeds of this offering, we may continue to seek capital through private placement transactions and by utilizing proceeds available under the Triton Equity Line Agreement. Depending on the type and the terms of any financing we pursue, shareholders’ rights and the value of their investment in our shares could be reduced. Any additional equity financing will dilute shareholdings, and new or additional debt financing, if available, may involve restrictions on financing and operating activities. In addition, if we issue secured debt securities, the holders of the debt would have a claim to our assets that would be prior to the rights of shareholders until the debt is paid. Interest on such debt securities would increase costs and negatively impact operating results.

If we are unable to obtain additional financing, as needed, at competitive rates, our ability to fund our current operations and implement our business plan and initialstrategy will be affected, and we would be required to reduce the scope of our operations and scale back our exploration, development and mining programs. There is, however, no guarantee that we will be able to secure any additional funding or be able to secure funding which will provide us with sufficient funds to meet our objectives, which may adversely affect our business and financial position.

Our quarterly and annual operating and financial results and our revenue are likely to fluctuate significantly in future periods.

Our quarterly and annual operating and financial results are difficult to predict and may fluctuate significantly from period to period. Our revenues, net income and results of operations may fluctuate as a result of a variety of factors that are outside our control including, but not limited to, lack of sufficient working capital, equipment malfunction and breakdowns, inability to timely find spare machines or parts to fix the broken equipment, regulatory or licensing delays and severe weather phenomena.

| 10 |

We may be unable to find sources of funding if and when needed, resulting in the failure of our business.

As of today, we need additional equity or debt financing beyond our existing cash to operate. In addition to the proceeds of this offering, we may continue to seek capital through private placement transactions and by utilizing proceeds available under the Triton Equity Line Agreement. This additional financing may not become available and, if available, may not be available on terms that are acceptable to us. If we do obtain acceptable funding, the terms and conditions of receiving such capital would likely result in further dilution. If we are not successful in raising capital or sufficient capital, we will have to modify our business plans and substantially reduce or eliminate operations, or even seek reorganization. In these events, the holders of our securities could lose a substantial part or all of their investment.

Our ability to manage growth will have an impact on our business, financial condition and results of operations.

Future growth may place strains on our financial, technical, operational and administrative resources and cause us to rely more on project partners and independent contractors, potentially adversely affecting our financial position and results of operations. Our ability to grow will depend on several factors, including:

| ● | our ability to develop existing projects; | |

| ● | our ability to identify new projects; | |

| ● | our ability to continue to retain and attract skilled personnel; | |

| ● | our ability to maintain or enter into relationships with project partners and independent contractors; | |

| ● | the results of our exploration programs; | |

| ● | the market prices for our minerals; | |

| ● | our access to capital; and | |

| ● | our ability to enter into agreements for the sale of our minerals. |

We may not be successful in upgrading our technical, operational and administrative resources or increasing our internal resources sufficiently to provide certain of the services currently provided by third parties, and we may not be able to maintain or enter into new relationships with project partners and independent contractors on financially attractive terms, if at all. Our inability to achieve or manage growth may materially and adversely affect our business, results of operations and financial condition.

We depend upon Marc Fogassa, our Chief Executive Officer and Chairman.

Our success is largely dependent upon the personal efforts of Marc Fogassa, our Chief Executive Officer and Chairman. Currently he is the only member of our management team that is fluent and fully conversant in both Portuguese, the language of Brazil, and English. The loss of the services of Mr. Fogassa would have a material adverse effect on our business and prospects. We maintain key-man life insurance on the life of Mr. Fogassa. See “Management.”

Our growth will require new personnel, which we will be required to recruit, hire, train and retain.

Our ability to recruit and assimilate new personnel will be critical to our performance. We will be required to recruit additional personnel and to train, motivate and manage employees, which may adversely affect our plans.

Certain executive officers and directors may be in a position of conflict of interest.

Marc Fogassa, our Chief Executive and Chairman, also serves as chief executive officer and director of Apollo Resources Corporation (“Apollo Resources”) and Jupiter Gold Corporation (“Jupiter Gold”). Joel Monteiro, Esq., one of our officers, is a director in both Apollo Resources and Jupiter Gold. Areli Nogueira, one of our officers, is a director in Jupiter Gold. We have partial equity ownership in both Apollo Resources and Jupiter Gold. There exists the possibility that one or more of these individuals, or others, may in the future be in a position of conflict of interest. Any decision made by such persons involving us will be made in accordance with their duties and obligations to deal fairly and in good faith with us and such other companies. In addition, any such officer or directors will declare, and refrain from voting on, any matter in which they may have a material interest.

| 11 |

Regulatory and Industry Risks

The mining industry subjects us to several risks.

In our operations, we are subject to the risks normally encountered in the mining industry, such as:

| ● | the discovery of unusual or unexpected geological formations; | |

| ● | accidental fires, floods, earthquakes or other natural disasters; | |

| ● | unplanned power outages and water shortages; | |

| ● | controlling water and other similar mining hazards; | |

| ● | operating labor disruptions and labor disputes; | |

| ● | the ability to obtain suitable or adequate machinery, equipment, or labor; | |

| ● | our liability for pollution or other hazards; and | |

| ● | other known and unknown risks involved in the conduct of exploration and operation of mines. |

The nature of these risks is such that liabilities could exceed any applicable insurance policy limits or could be excluded from coverage. There are also risks against which we cannot insure or against which we may elect not to insure. The potential costs which could be associated with any liabilities not covered by insurance, or in excess of insurance coverage, or compliance with applicable laws and regulations may cause substantial delays and require significant capital outlays, adversely affecting our future earnings and competitive position and, potentially our financial viability.

Our mineral projects will be subject to significant governmental regulations.

Mining activities in Brazil are subject to extensive federal, state, and local laws and regulations governing environmental protection, natural resources, prospecting, development, production, post-closure reclamation costs, taxes, labor standards and occupational health and safety laws and regulations, including mine safety, toxic substances and other matters. The costs associated with compliance with such laws and regulations can be substantial. In addition, changes in such laws and regulations, or more restrictive interpretations of current laws and regulations by governmental authorities, could result in unanticipated capital expenditures, expenses, or restrictions on, or suspensions of our operations and delays in the development of our properties.

We will be required to obtain governmental permits in order to conduct development and mining operations, a process which is often costly and time-consuming.

We are required to obtain and renew governmental permits for our exploration activities and, prior to developing or mining any mineralization that we discover, we will be required to obtain new governmental permits. Obtaining and renewing governmental permits is a complex, costly and time-consuming process. The timeliness and success of permitting efforts are contingent upon many variables not within our control, including the interpretation of permit approval requirements administered by the applicable permitting authority. We may not be able to obtain or renew permits that are necessary to our planned operations, or the cost and time required to obtain or renew such permits may exceed our expectations. Any unexpected delays or costs associated with the permitting process could delay the exploration, development or operation of our properties, which in turn could materially adversely affect our future revenues and profitability. In addition, key permits and approvals may be revoked or suspended or may be changed in a manner that adversely affects our activities.

Private parties, such as environmental activists, frequently attempt to intervene in the permitting process and to persuade regulators to deny necessary permits or seek to overturn permits that have been issued. Obtaining the necessary governmental permits involves numerous jurisdictions, public hearings and possibly costly undertakings. These third-party actions can materially increase the costs and cause delays in the permitting process and could cause us to not proceed with the development or operation of a property. In addition, our ability to successfully obtain key permits and approvals to explore for, develop, operate and expand operations will likely depend on our ability to undertake such activities in a manner consistent with the creation of social and economic benefits in the surrounding communities, which may or may not be required by law. Our ability to obtain permits and approvals and to successfully operate in particular communities may be adversely affected by real or perceived detrimental events associated with our activities.

Compliance with environmental regulations and litigation based on environmental regulations could require significant expenditures.

Environmental regulations mandate, among other things, the maintenance of air and water quality standards, and the rules on land development and reclamation. They also set forth limitations on the generation, transportation, storage, and disposal of solid and hazardous waste. Environmental legislation is evolving in a manner that may require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects, and a heightened degree of responsibility for mining companies and their officers, directors and employees. In connection with our current exploration activities or with our prior mining operations, we may incur environmental costs that could have a material adverse effect on our financial condition and results of operations. Any failure to remedy an environmental problem could require us to suspend operations or enter into interim compliance measures pending completion of the required remedy.

| 12 |

Moreover, governmental authorities and private parties may bring lawsuits based upon damage to property and injury to persons resulting from the environmental, health and safety impacts of prior and current operations, including operations conducted by other mining companies many years ago at sites located on properties that we currently own or formerly owned. These lawsuits could lead to the imposition of substantial fines, remediation costs, penalties and other civil and criminal sanctions. We cannot assure you that any such law, regulation, enforcement or private claim would not have a material adverse effect on our financial condition, results of operations or cash flows.

Our operations face substantial regulation of health and safety.

Our operations are subject to extensive and complex laws and regulations governing worker health and safety across our operating regions and our failure to comply with applicable legal requirements can result in substantial penalties. Future changes in applicable laws, regulations, permits and approvals or changes in their enforcement or regulatory interpretation could substantially increase costs to achieve compliance, lead to the revocation of existing or future exploration or mining rights or otherwise have an adverse impact on our results of operations and financial position.

Our mines are inspected on a regular basis by government regulators who may issue citations and orders when they believe a violation has occurred under local mining regulations. If inspections result in an alleged violation, we may be subject to fines, penalties or sanctions and our mining operations could be subject to temporary or extended closures.

In addition to potential government restrictions and regulatory fines, penalties or sanctions, our ability to operate (including the effect of any impact on our workforce) and thus, our results of operations and our financial position (including because of potential related fines and sanctions), could be adversely affected by accidents, injuries, fatalities or events detrimental (or perceived to be detrimental) to the health and safety of our employees, the environment or the communities in which we operate.

Our operations are subject to extensive environmental laws and regulations.

Our exploration, development, mining and processing operations are subject to extensive laws and regulations governing land use and the protection of the environment, which generally apply to air and water quality, protection of endangered, protected or other specified species, hazardous waste management and reclamation. We have made, and expect to make in the future, significant expenditures to comply with such laws and regulations. Compliance with these laws and regulations imposes substantial costs and burdens, and can cause delays in obtaining, or failure to obtain, government permits and approvals which may adversely impact our closure processes and operations.

Increased global attention or regulation of consumption of water by industrial activities, as well as water quality discharge, and on restricting or prohibiting the use of cyanide and other hazardous substances in processing activities could similarly have an adverse impact on our results of operations and financial position due to increased compliance and input costs.

Mineral prices are subject to unpredictable fluctuations.

Portions of our revenues may come from the extraction and sale of minerals. The price of minerals may fluctuate widely and is affected by numerous factors beyond our control, including international, economic and political trends, expectations of inflation, currency exchange fluctuations, interest rates, global or regional consumptive patterns, speculative activities, increased production due to new extraction developments and improved extraction and production methods and technological changes in the markets for the end products. The effect of these factors on the price of minerals, and therefore the economic viability of any of our exploration properties, cannot accurately be predicted.

Country and Currency Risks

Our ability to execute our business plan depends primarily on the continuation of a favorable mining environment in Brazil and our ability to freely sell our minerals.

Mining operations in Brazil are heavily regulated. Any significant change in mining legislation or other changes in Brazil’s current mining environment may slow down or alter our business prospects. Further, countries in which we may wish to sell our mined minerals may impose special taxes, tariffs, or otherwise place limits and controls on consumption of our mined minerals.

The perception of Brazil by the international community may affect us.

Brazil’s political environment and its environmental policies, in particular the preservation of the Amazon rain forest, are continuously scrutinized by the global media. If Brazil’s situation or policies are perceived as being inadequate, we may lose the interest of investor groups or potential buyers of our minerals, which will have a negative impact on us.

| 13 |

Exposure to foreign exchange fluctuations and capital controls may adversely affect our costs, earnings and the value of some of our assets.

Our reporting currency is the U.S. dollar; however, we conduct our business in Brazil utilizing the Brazilian real. A large portion of our operating expenses are incurred in Brazilian real. An appreciation of the Brazilian real against the U.S. dollar would increase our costs in U.S. dollar terms. Our consolidated financials are directly impacted by movements in the Brazilian real to U.S. dollar exchange rate.

While not expected, Brazil may choose to adopt measures to restrict the entry of U.S. dollars or the repatriation of capital across borders. These measures would have a number of negative effects on us, reducing the immediately available capital that we could otherwise deploy for investment opportunities or the payment of expenses, and the ability to repatriate any profits.

Common Stock Risks

Our common stock price may be volatile.

The market price of our common stock has been and is likely to continue to be volatile and could fluctuate in price in response to various factors, many of which are beyond our control, including the following:

| ● | our ability to grow revenues; | |

| ● | our ability to achieve profitability; | |

| ● | our ability to raise capital when needed; | |

| ● | our ability to execute our business plan; | |

| ● | legislative, regulatory, and competitive developments; and | |

| ● | economic and external factors. |

In addition, the securities markets have from time-to-time experienced significant price and volume fluctuations that are unrelated to the operating performance of any company. These market fluctuations may also materially and adversely affect the market price of our common stock regardless of our actual operations and the results from our businessthose operations. These factors may impact the timing, amount, terms or conditions of additional financing available to us.

We are not raising any money in this offering. The most likely source of future funds available to us is through the sale of additional shares of common stock or advances from our sole director.

There is no assurance that any additional financingan active, liquid and orderly trading market will develop for our common stock or what the market price of our common stock will be available or if available,and, as a result, it may be difficult for you to sell your shares of our common stock.

Since we became a publicly traded company in April 2012, there has been a limited public market for shares of our common stock on termsthe OTCQB. We do not yet meet the initial listing standards of the Nasdaq Capital Market, and, although we have applied to list our common stock on the Nasdaq Capital Market concurrently upon completion of this offering, no assurances can be given that we will be acceptablesuccessful. Until our common stock is listed on that market or a broader exchange, we anticipate that it will remain quoted on the OTCQB. In that venue, investors may find it difficult to us. Failureobtain accurate quotations as to the market value of our common stock. In addition, if we fail to meet the criteria set forth in SEC regulations, various requirements would be imposed by law on broker-dealers who sell our securities to persons other than established customers and accredited investors. Consequently, such regulations may deter broker-dealers from recommending or selling our common stock, which may further affect liquidity. This could also make it more difficult to raise additional financingcapital.

We cannot predict the extent to which investor interest in our Company will lead to the development of a more active trading market on the OTCQB, whether we will meet the initial listing standards of the Nasdaq Capital Market, or how liquid that market might become. If an active trading market does not develop, you may have difficulty selling any of the shares of our common stock that you buy.

Our common stock is currently defined as “penny stock” and the rules imposed on the sale of the shares may affect your ability to resell any shares you may purchase, if at all.

Our common stock currently trades below $5 and is therefore defined as a “penny stock” under the Securities Exchange Act of 1934 (the “Exchange Act”). The Exchange Act and penny stock rules generally impose additional sales practice and disclosure requirements on broker-dealers who sell our securities. For transactions covered by the penny stock rules, a broker-dealer must make a suitability determination for each purchaser and receive the purchaser’s written agreement prior to the sale. In addition, the broker-dealer must make certain mandated disclosures in penny stock transactions, including the actual sale or purchase price and actual bid and offer quotations, the compensation to be received by the broker-dealer and certain associated persons, and deliver certain disclosures required by the Commission. Consequently, the penny stock rules may affect the ability of broker-dealers to make a market in or trade our common stock and may consequently affect a stockholder’s ability to resell any of our shares in the public markets.

| 14 |

We do not intend to pay regular future dividends on our common stock and thus stockholders must look to appreciation of our common stock to realize a gain on their investments.

We have never paid a dividend and we do not have any plans to pay dividends in the foreseeable future. Our future dividend policy is within the discretion of our Board of Directors and will depend upon various factors, including future earnings, if any, our capital requirements and general financial condition, and other factors. Accordingly, stockholders must look solely to appreciation of our common stock to realize a gain on their investment. This appreciation may not occur or may occur only over a longer timeframe.

We may seek to raise additional funds, finance acquisitions, or develop strategic relationships by issuing securities that would dilute your ownership.

We may largely finance our operations by issuing equity securities, which may materially reduce the percentage ownership of our existing stockholders. Furthermore, any newly issued securities could have rights, preferences, and privileges senior to those of our existing common stock. Moreover, any issuances by us of equity securities may be at or below the prevailing market price of our stock and in any event may have a dilutive impact on ownership interest of existing common stockholders, which could cause the market price of our common stock to decline. We may also raise additional funds through the incurrence of debt or the issuance or sale of other securities or instruments senior to our Common Stock. The holders of any debt securities or instruments that we may issue could have rights superior to the rights of our common stockholders.

Our Series A Convertible Preferred Stock has the effect of concentrating voting control over us in Marc Fogassa, our Chief Executive Officer and Chairman.

One share of our Series A Convertible Preferred Stock (“Series A Stock”) is issued, outstanding and held since 2012 by Marc Fogassa, our Chief Executive Officer and Chairman. The Certificate of Designations, Preferences and Rights of our Series A Stock provides that for so long as Series A Stock is issued and outstanding, the holders of Series A Stock shall vote together as a single class with the holders of our common stock, with the holders of Series A Stock being entitled to 51% of the total votes on all matters regardless of the actual number of shares of Series A Stock then outstanding, and the holders of common stock and any other class or series of capital stock entitled to vote with the common stock being entitled to their proportional share of the remaining 49% of the total votes based on their respective voting power. As a result, you may have limited ability to impact our operations and activities.

Marc Fogassa, our Chief Executive Officer and member of our Board of Directors, owns greater than 50% of the Company’s voting securities, which will cause us to go outbe deemed a “controlled company” under the rules of business. If this happens,Nasdaq.