As filed with the Securities and Exchange Commission on December 17, 2018.11, 2023

Registration No. 333- 333-275121

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

UNITED STATESFORM S-1

SECURITIES AND EXCHANGE COMMISSION(Amendment No. 2)

Washington, D.C. 20549

Form S-1

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

Motus

MOTUS GI Holdings, Inc.HOLDINGS, INC.

(Exact Namename of Registrantregistrant as Specifiedspecified in its Charter)charter)

| Delaware | 3841 | 81-4042793 | ||||

(State or other jurisdiction of

| (Primary Standard Industrial Classification Code Number) | (

|

Identification |

1301 East Broward Boulevard, 3rd Floor

Ft. Lauderdale, FL 33301

Telephone: (954) 541-8000

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Timothy P. Moran

Mark Pomeranz

Chief Executive Officer

Motus GI Holdings, Inc.

1301 East Broward Boulevard, 3rd3rd Floor

Ft. Lauderdale, FL 33301

Telephone: (954) 541-8000

(Address,Name, address, including zip code, and telephone number,

including area code, of agent for service)

CopiesPlease send copies of all communications to:

Steven M. Skolnick, Esq.

Lowenstein Sandler LLP 1251 Avenue of the Americas New York, NY 10020 Telephone: (212) 262-6700 | Faith L. Charles Thompson Hine LLP 300 Madison Avenue, 27th Floor New York, New York Telephone: (212) |

|

Approximate date of commencement of proposed sale to the public:

As soon as practicable on or after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.¨box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨ ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨ ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨ ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company”,company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | Accelerated filer |

| Non-accelerated filer | Smaller reporting company |

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.x ☒

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to Be Registered | Proposed Maximum Aggregate Offering Price(1)(2) | Amount of Registration Fee | ||||||

| Common Stock, par value $0.0001 per share | $ | 18,572,500 | $ | 2,250.99 | ||||

The Registrantregistrant hereby amends this Registration Statementregistration statement on such date or dates as may be necessary to delay its effective date until the Registrantregistrant shall file a further amendment whichthat specifically states that this Registration Statementregistration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 as amended, or until this Registration Statementthe registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to suchsaid Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it iswe are not soliciting an offer to buy these securities in any statejurisdiction where the offer or sale is not permitted.

Motus GI Holdings, Inc.SUBJECT TO COMPLETION, DATED DECEMBER 11, 2023

5,000,000 Shares

Common StockPRELIMINARY PROSPECTUS

Up to 1,511,335 Shares of Common Stock

Up to 1,511,335 Pre-Funded Warrants to Purchase up to 1,511,335 Shares of Common Stock

Up to 1,511,335 Series A Common Warrants to Purchase up to 1,511,335 Shares of Common Stock

Up to 1,511,335 Series B Common Warrants to Purchase up to 1,511,335 Shares of Common Stock

Up to 1,511,335 Shares of Common Stock issuable upon exercise of the Pre-Funded Warrants

Up to 3,022,670 Shares of Common Stock issuable upon exercise of the Common Warrants

We are offering 5,000,000on a “reasonable best efforts” basis up to $6.0 million of shares of our common stock and Series A Common Warrants and Series B Common Warrants (collectively, the “Common Warrants”) to purchase shares of our common stock (and the shares of common stock that are issuable from time to time upon exercise of the Common Warrants), at an assumed public offering price of $3.97 per share and accompanying Series A Common Warrant to purchase one share of common stock and Series B Common Warrant to purchase one share of common stock, which was the closing price of our common stock on The Nasdaq Capital Market on December 8, 2023. We are also offering to certain purchasers whose purchase of shares of common stock in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock immediately following the consummation of this offering, the opportunity to purchase, if any such purchaser so chooses, pre-funded warrants to purchase shares of our common stock, in lieu of shares of common stock that would otherwise result in such purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock. Each pre-funded warrant will be exercisable for one share of our common stock. The purchase price of each pre-funded warrant and accompanying Common Warrants will be equal to the price at which a share of common stock and accompanying Common Warrants are sold to the public in this offering, minus $0.0001, and the exercise price of each pre-funded warrant will be $0.0001 per share. The pre-funded warrants will be immediately exercisable and may be exercised at any time until all of the pre-funded warrants are exercised in full. Each share of common stock and pre-funded warrant is being sold together with a Series A Common Warrant to purchase one share of our common stock and a Series B Common Warrant to purchase one share of our common stock, each with an exercise price of $ per share (representing 100% of the price at which a share of common stock and accompanying Common Warrants are sold to the public in this offering). The Common Warrants will be exercisable immediately and will expire as follows: the Series A Common Warrant will expire on the fifth anniversary of the date of issuance and the Series B Common Warrant will expire on the eighteen month anniversary of the date of issuance. For each pre-funded warrant we sell, the number of shares of common stock we are offering will be decreased on a one-for-one basis. Because we will issue two Common Warrants for each share of our common stock and two Common Warrants for each pre-funded warrant to purchase one share of our common stock sold in this offering, the number of Common Warrants sold in this offering will not change as a result of a change in the mix of the shares of our common stock and pre-funded warrants sold. The shares of common stock and pre-funded warrants, and the accompanying Common Warrants, can only be purchased together in this offering but will be issued separately and will be immediately separable upon issuance. This offering also relates to the shares of common stock issuable upon exercise of any Common Warrants and pre-funded warrants sold in this offering.

Immediately following the closing of this offering, pursuant to the 2021 Loan Agreement (as defined in this prospectus), an aggregate of $4.0 million of the principal amount under such loan will be automatically converted into an assumed 1,007,556 shares of common stock (and/or pre-funded warrants in lieu thereof), at a conversion price equal to the public offering price per share of common stock and accompanying Common Warrants in this offering, based on the assumed combined public offering price of $3.97 per share of common stock and accompanying Common Warrants, which is the last reported sale price of our common stock on The Nasdaq Capital Market on December 8, 2023. The Lender (as defined in this prospectus) will also be issued Conversion Common Warrants (as defined in this prospectus) to purchase an assumed 2,015,112 shares of common stock, representing warrant coverage on the shares being issued to the Lender in the same form and terms and at the same proportion as investors in this offering, and will have executed a customary lock-up agreement with respect to such shares and warrants for a 90-day period following the closing. We will also prepay $1.5 million of the principal amount of such loan from the net proceeds of this offering. The securities issued to the Lender in the conversion will be issued in reliance on the exemption from registration set forth in Section 3(a)(9) of the Securities Act, and this offering does not relate to the issuance of such securities.

Our common stock is listed on theThe Nasdaq Capital Market under the symbol “MOTS.” On December 13, 2018,8, 2023 the last reported sale price of our common stock as reported on theThe Nasdaq Capital Market was $3.23$3.97 per share. There is no established public trading market for the pre-funded warrants or the Common Warrants, and we do not expect a market to develop. In addition, we do not intend to apply for a listing of the pre-funded warrants or the Common Warrants on any national securities exchange. Without an active trading market, the liquidity of the pre-funded warrants and the Common Warrants will be limited.

The public offering price per share of common stock and accompanying Common Warrants and any pre-funded warrant and accompanying Common Warrants, as the case may be, will be determined by us at the time of pricing, may be at a discount to the current market price, and the recent market price used throughout this prospectus may not be indicative of the final offering price.

You should read this prospectus, together with additional information described under the headings “Information Incorporated by Reference” and “Where You Can Find More Information,” carefully before you invest in any of our securities.

We are an “emerging growth company” as defined under the federal securities laws.laws and, as such, have elected to comply with certain reduced public company reporting requirements.

Investing in our common stocksecurities involves risks that are described in the “Risk Factors” sectiona high degree of risk. See “Risk Factors” beginning on page 8 of this prospectus.prospectus and in the documents incorporated by reference into this prospectus for a discussion of risks that should be considered in connection with an investment in our securities.

The underwriters may also exercise their option to purchase up to an additional 750,000 shares from us at the public offering price, less the underwriting discount, for 30 days after the date of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined ifpassed upon the adequacy or accuracy of this prospectus is truthful or complete.prospectus. Any representation to the contrary is a criminal offense.

We may sell fewer than all of the securities offered hereby, provided that we will only consummate an offering of $5.0 million or more in gross proceeds. This offering may be closed without further notice to you. We expect to close the offering on , 2023, but the offering will be terminated on or before December 31, 2023, provided that the closing of the offering has not occurred by such date, and may not be extended. Investors will deposit their investment in us with the placement agent, which will settle the offering in a single closing on a Delivery Versus Payment (“DVP”) settlement basis (i.e., on the closing date, we will issue the securities registered in the investors’ names and addresses and released by the transfer agent (with respect to common stock) or us (with respect to warrants) directly to the account(s) at the placement agent identified by each investor; upon receipt of such securities, the placement agent will promptly electronically deliver such securities to the applicable investor, and payment therefor shall be made by the placement agent (or its clearing firm) by wire transfer to us). Also, any proceeds from the sale of securities offered by us will be available for our immediate use, despite uncertainty about whether we would be able to use such funds to effectively implement our business plan.

We have engaged A.G.P./Alliance Global Partners (“A.G.P.”) as our placement agent in connection with this offering. We refer to A.G.P. as the “placement agent” in this prospectus. The placement agent is not purchasing or selling the securities offered by us, and is not required to arrange for the purchase or sale of any specific number or dollar amount of our securities, but will use its reasonable best efforts to solicit offers to purchase the securities offered by this prospectus. The securities will be offered at a fixed price and are expected to be issued in a single closing. Although we will only consummate an offering of $5.0 million or more in gross proceeds, the actual public offering amount, placement agent’s fees, and proceeds to us, if any, are not presently determinable and may be less than the total maximum offering amounts set forth above, subject to the $5.0 million minimum.

| Per Share and Accompanying Common Warrants | Per Pre-Funded Accompanying Common Warrants | Total | ||||||||||

| Public offering price | $ | $ | $ | |||||||||

| Placement agent fees (1) | $ | $ | $ | |||||||||

| Proceeds to us, before expenses | $ | $ | $ | |||||||||

(1) We have agreed to pay the placement agent a cash fee equal to 7% (or 5% with respect to proceeds from certain investors agreed upon between us and the placement agent). We have also agreed to reimburse the placement agent for certain of their offering-related expenses. See “Plan of Distribution” for a description of the compensation to be received by the placement agent.

The underwriters expectdelivery of the securities offered hereby to deliver the shares against payment thereforpurchasers is expected to be made on or about , 2018.2023.

Piper JaffraySole Placement Agent

A.G.P.

The date of this prospectus is, 2018.2023.

TABLE OF CONTENTS

TABLE OF CONTENTSABOUT THIS PROSPECTUS

We incorporate by reference important information into this prospectus. You may obtain the information incorporated by reference without charge by following the instructions under “Where You Can Find More Information.” You should carefully read this prospectus as well as additional information described under “Information Incorporated by Reference,” before deciding to invest in our securities.

You should rely only onNeither we nor the placement agent have authorized anyone to provide you with additional information or information different from that contained or incorporated by reference in this prospectus filed with the Securities and any related free writing prospectus that we mayExchange Commission (the “SEC”). We take no responsibility for, and can provide no assurance as to you in connection with this offering. We have not, and the underwriters have not, authorizedreliability of, any other personinformation that others may give you. The placement agent is seeking offers to provide you with different information. If anyone provides you with differentbuy our securities only in jurisdictions where offers and sales are permitted. The information contained in this prospectus, or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing ordocument incorporated by reference in this prospectus, is accurate only as of the date onof those respective documents, regardless of the front covertime of delivery of this prospectus or the dateany sale of the applicable document incorporated by reference.our securities. Our business, financial condition, results of operations and prospects may have changed since that date.

The information incorporated by reference or provided in this prospectus contains statistical data and estimates, including those relating to market size and competitive position of the markets in which we participate, that we obtained from our own internal estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Industry publications, studies and surveys generally state that they have been obtained from sources believed to be reliable. While we believe our internal company research is reliable and the definitions of our market and industry are appropriate, neither this research nor these definitions have been verified by any independent source.

For investors outside the United States (“U.S.”): neither we nor any ofWe and the underwriters hasplacement agent have not done anything that would permit this offering or the possession or distribution of this prospectus or any free writing prospectus we may provide to you in connection with this offering in any jurisdiction where action for that purposethose purposes is required, other than in the United States.U.S. Persons outside the United StatesU.S. who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of our common stocksecurities and the distribution of this prospectus and any such free writing prospectus outside of the United States.U.S.

CAUTIONARY NOTE CONCERNING FORWARD-LOOKING STATEMENTS

InThis prospectus contains forward-looking statements that involve substantial risks and uncertainties for purposes of the safe harbor provided by the Private Securities Litigation Reform Act of 1995. All statements contained in this prospectus we rely on and refer to information and statisticsother than statements of historical fact, including statements regarding our industry. We obtained this statistical, marketstrategy, future operations, future financial position, liquidity, future revenue, projected expenses, results of operations, expectations concerning the timing and other industryour ability to commence and subsequently report data from planned non-clinical studies and forecastsclinical trials, prospects, plans and objectives of management are forward-looking statements. The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “plan,” “expect,” “predict,” “potential,” “opportunity,” “goals,” or “should,” and similar expressions are intended to identify forward-looking statements. Such statements are based on management’s current expectations and involve risks and uncertainties. Actual results and performance could differ materially from publicly available information.those projected in the forward-looking statements as a result of many factors.

We based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties, and assumptions, including those described in “Risk Factors” in this prospectus, and under a similar heading in any other annual, periodic or current report incorporated by reference into this prospectus or that we may file with the SEC in the future. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge quickly and from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the future events and trends discussed in this prospectus, may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. All forward-looking statements are qualified in their entirety by this cautionary statement.

You should also read carefully the factors described in the “Risk Factors” section of this prospectus, and under a similar heading in any other annual, periodic or current report incorporated by reference into this prospectus, to better understand the risks and uncertainties inherent in our business and underlying any forward-looking statements. You are advised to consult any further disclosures we make on related subjects in our future public filings.

This summary highlights information about our company, this offering and information contained in greater detail in other parts of this prospectus andor incorporated by reference into this prospectus from our filings with the SEC listed in the documents incorporatedsection entitled “Information Incorporated by reference.Reference.” Because it is only a summary, it does not contain all of the information that you should consider before purchasing our securities in making your investment decision. Before investingthis offering and it is qualified in our common stock, youits entirety by, and should carefullybe read in conjunction with, the more detailed information appearing elsewhere or incorporated by reference into this prospectus. You should read the entire prospectus, the registration statement of which this prospectus is a part, and the documentsinformation incorporated by reference into this prospectus in their entirety, including the “Risk Factors” included in this prospectus at page 8 and incorporated by reference and “Management’s Discussion and Analysis of Financial Condition and Results of Operation” and theour financial statements and the related notes to those financial statements incorporated by reference into this prospectus, before purchasing our securities in this offering.

Except as otherwise indicated herein or as the context otherwise requires, references in this prospectus before investing in our common stock.

When used herein, unless the context requires otherwise, references to the “Company,” “Holdings,“the Company,” “we,” “our”“us” and “us”“our” refer to Motus GI Holdings, Inc., a Delaware corporation, collectively with and our direct wholly-owned subsidiaries, Motus GI Medical Technologies, Ltd., an Israeli corporation, and Motus GI, Inc., a Delaware corporation.subsidiaries.

Corporate Overview

All trademarksMotus GI Holdings, Inc. (“we,” “us,” “our” or trade names referred to in this prospectus are the property of their respective owners. Solely for convenience, the trademarks and trade names in this prospectus are referred to without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend the use or display of other companies’ trademarks and trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

Our Company

General

We have“Company”), has developed the Pure-Vu System, (the “Pure-Vu System”), a medical device that has received 510(k) clearance frombeen cleared by the U.S. Food and Drug Administration (the “FDA”) to help facilitate the cleansing of a poorly prepared gastrointestinal tract during colonoscopy and to help facilitate upper gastrointestinal (“GI”) endoscopy procedures. The Pure-Vu System is also CE mark approvalmarked in the European Economic Area.Area (EEA) for use in colonoscopy. The Pure-Vu System is indicated to help facilitate the cleaning of a poorly prepared colon during the colonoscopy procedure. The device integrates with standard and slim colonoscopes, as well as gastroscopes, to enable safeimprove visualization during colonoscopy and rapid cleansing during the procedureupper GI procedures while preserving established procedural workflow and techniquestechniques. Through irrigation and evacuation of debris, the Pure-Vu System is designed to provide better-quality exams. Challenges exist for inpatient colonoscopy and endoscopy, particularly for patients who are elderly, with comorbidities, or active bleeds, where the ability to visualize, diagnose and treat is often compromised due to debris, including fecal matter, blood, or blood clots. We believe this is especially true in high acuity patients, like GI bleeding where the existence of blood and blood clots can impair a physician’s view and removing them can be critical in allowing a physician the ability to identify and treat the source of bleeding on a timely basis. We believe use of the Pure-Vu System may lead to positive outcomes and lower costs for hospitals by irrigatingsafely and quickly improving visualization of the colon and evacuatingupper GI tract, potentially enabling effective diagnosis and treatment without delay. In multiple clinical studies to date, involving the irrigation fluid (water)treatment of challenging inpatient and outpatient cases, the Pure-Vu System has consistently helped achieve adequate bowel cleanliness rates greater than 95% following a reduced prep regimen. We also believe that the technology may be useful in the future as a tool to help reduce user dependency on conventional pre-procedural bowel prep regimens. Based on our review and analysis of 2019 market data and 2021 projections for the U.S. and Europe, as obtained from iData Research Inc., feces and other bodily fluids and matter. Challenges with bowel preparation for inpatient colonoscopy represent a significant area of unmet needwe believe that directly affects clinical outcomes and increases the cost of care for a hospital in a market segment where most of the reimbursement is under a bundle payment based on a Diagnostic Related Group (a “DRG”), comprising ofduring 2022 approximately 1.5 million annualinpatient colonoscopy procedures were performed in the U.S. and approximately 3.84.8 million annual procedures worldwide. Upper GI bleeds occurred in the U.S. at a rate of approximately 400,000 cases per year in 2019, according to iData Research Inc. The Pure-Vu System has been assigned an ICD-10 code in the US. The system does not currently have a unique reimbursement codecodes with any private or governmental third-party payors in any country. To date, as part ofother country or for any other use; however, we may pursue reimbursement activities in the limited market development launch, we have focused on collecting additional clinical and health economic data, as exemplified byfuture, particularly in the recently initiated Reliable Endoscopic Diagnosis Utilizing Cleansing Enhancement Study (the “REDUCE Study”), along with garnering valuable experienceoutpatient colonoscopy market. We received 510(k) clearance in key hospitals onOctober 2023 from the use ofFDA for the Pure-Vu EVS System to support a planned full launchfor use in the United States inpatient colonoscopyUpper GI tract as well as an enhanced version for the colon. We expect to begin market introduction of these products in 2019. We dothe coming months. The Company does not expect to generate significant revenue from product sales unless and until we expand ourit further expands its commercialization efforts.

efforts, which is subject to significant uncertainty.

Recent Developments

Clinical Data & Safety2021 Loan Amendment

On July 16, 2021 (the “Effective Date”), we entered into a loan facility (the “2021 Loan Agreement”) with a private institutional lender (the “Lender”). Under the 2021 Loan Agreement, the Lender agreed to provide us with access to term loans in an aggregate principal amount of up to $12.0 million (the “Loan”) in three tranches as follows: (a) on the Effective Date, a loan in the aggregate principal amount of $4.0 million (the “Convertible Note”, or “Tranche A”), (b) on the effective date of the Loan, a loan in the aggregate principal amount of $5.0 million (“Tranche B”), and (c) available until December 31, 2021, a loan in the aggregate principal amount of $3.0 million (“Tranche C” and, together with Tranche B, the “Term Loan”). The 2021 Loan Agreement contains customary representations and warranties, indemnification provisions in favor of the Lender, events of default and affirmative and negative covenants, including, among others, covenants that limit or restrict our ability to, among other things, incur additional indebtedness, merge or consolidate, make acquisitions, pay dividends or other distributions or repurchase equity, make investments, dispose of assets and enter into certain transactions with affiliates, in each case subject to certain exceptions. Outstanding borrowings under the Loan are secured by a first priority security interest on substantially all of our personal property assets, including our material intellectual property and equity interests in its subsidiaries. There are no liquidity or financial covenants.

InThe Convertible Note and Tranche B were funded on the effective date. As of December 31, 2021, we drew down the full $3 million aggregate principal amount of Tranche C.

The Convertible Note requires forty-eight monthly interest only payments at 7.75% per annum commencing after the Effective Date and thereafter full payment of the then outstanding principal balance of the Convertible Note on July 1, 2025. The Tranche B loan requires interest only monthly payments commencing on the Effective Date until September 30, 2022 and, thereafter, thirty-three (33) monthly payments of principal and interest accrued thereon until June 1, 2025. The Tranche C loan, to the extent drawn on or prior to December 31, 2021, requires monthly payments of interest only commencing on the date drawn until September 30, 2022 and, thereafter, thirty-three (33) monthly payments of principal and interest accrued thereon until June 1, 2025. Interest on the Tranche B and Tranche C loans accrues at 9.5% per annum.

The 2021 Loan Agreement contains features that would permit the Lender to convert all or any portion of the outstanding principal balance of the Convertible Note at any time, pursuant to which the converted part of the Convertible Note will be converted into that number of shares of our common stock to be issued to the Lender at a recent clinical study performedprice per share equal to the conversion price, of $420.00 per share. Following the conversion of any portion of the outstanding principal balance of the Convertible Note, the principal balance of the Convertible Note remaining outstanding shall continue to bear interest at 7.75% per annum.

On November 28, 2023, we and the Lender entered into a First Amendment to the 2021 Loan Agreement (the “Amendment”), pursuant to which, among other things, (a)(i) on the effective date of the Amendment, we paid to the Lender a sum of $750,000 in cash via wire transfer in immediately available funds (the “Amendment Execution Date Payment”), and (ii) upon consummation of a First Amendment Capital Raise (as defined below) and immediately following the Convertible Note Securities Exchange (as defined below), we will prepay to the Lender a sum of $1,500,000 in cash via wire transfer in immediately available funds (the “Closing Payment”), which sums set forth in (i) and (ii) shall be applied towards partial prepayment of the outstanding principal balance of the Term Loan; and (b) subject to the satisfaction (or waiver by Lender) of certain Exchange Conditions (as defined in the United States,Amendment), immediately following the consummation of a First Amendment Capital Raise, which we assume this offering will be, $4.0 million (the “Conversion Amount”) of the outstanding aggregate principal balance of the Convertible Note will automatically convert into such number of shares of our common stock (the “Convertible Note Securities Exchange”) at a price per share equal to the public offering price per share in the First Amendment Capital Raise representing the Conversion Amount; provided, that, (A) the Lender shall have executed a customary lock-up agreement for a 90-day period following the Convertible Note Securities Exchange, (B) the Lender shall receive the same warrant coverage (the “Conversion Common Warrants”) per share of common stock, if any, as investors purchasing securities in the First Amendment Capital Raise and (C) the Lender shall receive a pre-funded warrant (the “Conversion Pre-Funded Warrant”) in lieu of shares of common stock otherwise issuable upon the Convertible Note Securities Exchange for such number of shares that would represent more than 4.5% of the pre-exercise outstanding shares of common stock, providing that the Lender will not own (x) more than 4.99% of the post-exercise outstanding shares of common stock at any time and (y) to the extent required under the rules of The Nasdaq Capital Market, more than 19.99% of the shares of common stock outstanding immediately prior to the Convertible Note Securities Exchange (but after the consummation of the First Amendment Capital Raise) unless applicable shareholder approval is obtained. “First Amendment Capital Raise” means the Company raising additional cash through one equity financing registered under the Securities Act (to be consummated no later than December 29, 2023) with gross proceeds of at least $5.0 million. The securities issued to Lender in the Convertible Note Securities Exchange will be issued in reliance on the exemption from registration set forth in Section 3(a)(9) of the Securities Act, and this offering does not relate to the issuance of such securities. We also agreed to file a resale registration statement to register the securities being issued to Lender in the Convertible Note Securities Exchange as promptly as practicable (and in no event later than 91 calendar days after the closing of the Convertible Note Securities Exchange). Assuming this offering will satisfy the definition of the First Amendment Capital Raise, we will issue to the Lender an aggregate of 1,007,556 shares of our common stock (or Conversion Pre-Funded Warrants in lieu thereof) and Conversion Common Warrants to purchase 2,015,112 shares of our common stock at an exercise price equal to the exercise price and a term of each of the classes of the Common Warrants sold in this offering, based on the assumed combined public offering price of $3.97 per share of common stock and accompanying Common Warrants, which is the last reported sale price of our common stock on The Nasdaq Capital Market on December 8, 2023. We do not intend to price this offering for less than $5.0 million in gross proceeds.

Nasdaq Deficiencies and Reverse Stock Split

As previously disclosed, we received a letter from the Nasdaq Stock Market, LLC (“Nasdaq”) indicating that we are not in compliance with the minimum stockholders’ equity requirement for continued listing on Nasdaq under Rule 5550(b)(1) (the “Equity Rule”). In addition, as previously disclosed on the Current Report on Form 8-K filed April 5, 2023, we received a letter from Nasdaq indicating that the bid price of the Company’s common stock had failed to close above the minimum $1 requirement for the past 30 trading days in violation of Listing Rule 5550(a)(2) (the “Bid Price Rule”). The Company was provided 180 calendar days, or until September 27, 2023, to regain compliance with the Bid Price Rule. On September 27, 2023, we received notice that the Nasdaq Hearings Panel (the “Hearings Panel”) granted us an extension to regain compliance with the Equity Rule and the Bid Price Rule until January 2, 2024.

At our annual meeting of stockholders held on September 21, 2023, our stockholders approved a proposed amendment to our Certificate of Incorporation to effect a reverse stock split of our outstanding common stock at a ratio of not less than two-for-one (2:1) and not greater than twenty-for-one (20:1), at any time prior to the one year anniversary date of our annual meeting of stockholders, with the exact ratio to be determined by our Board of Directors. On November 2, 2023, we effected a reverse stock split of our issued and outstanding common stock at a ratio of 1-for-15 (the “2023 Reverse Stock Split”), and on November 21, 2023, we received a letter from Nasdaq confirming that we had regained compliance with the Bid Price Rule. All historical information in this prospectus (other than information incorporated by reference herein dated prior to November 2, 2023) has been retroactively adjusted for the 2023 Reverse Stock Split. We intend to regain compliance with the Equity Rule through the consummation of this offering and the Convertible Note Securities Exchange. Even if we regain compliance with the Equity Rule prior to the January 2, 2024 deadline, we expect that we will need to raise additional capital to remain in compliance with the Equity Rule for future reporting periods, which capital raises may result in additional dilution to investors in our securities.

Operations in Israel

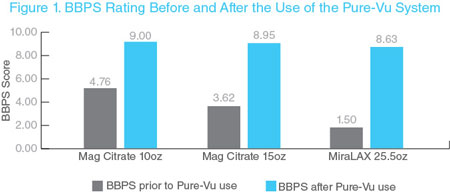

We have research and development capabilities in electrical and mechanical engineering with laboratories in our facility in Israel for development and prototyping, and electronics design and testing. Currently, the workstation and loading fixture component of our Pure-Vu System demonstrated safe and effective colonic cleaningis manufactured by Sanmina Corporation at their facilities in 46 patients receiving a reduced prep regimen.Israel. The study was initially designed to compare two different minimal bowel preparation regimens. Initially patients were randomized to receive one of two minimal bowel preparations: three doses of 17 gr. MiraLAX each mixed in 8.5 oz. of clear liquids or two doses of 7.5 oz. magnesium citrate (MgC) each taken with 19.5 oz. of clear liquid. A study amendment early on replaced the MiraLAX arm, due to obvious inferior Boston Bowel Preparation Scale (“BBPS”), a validated assessment instrument, scoring from the outset. The replacement arm consisted of two doses of 5 oz. MgC taken with 16 oz. of clear liquid. All patients were allowed to eat a low residue diet on the day prior and were asked to avoid seeds and nuts for five days prior to their procedure. Study objectives evaluated for each study arm included: (1) improvement of colon cleansing from presentation baseline to completion of the procedure (as assessed by the BBPS) through the usedisposable portion of the Pure-Vu System, (2) time required to reach the cecum, (3) total procedure time, and (4) safety. No significant differences were found between the three groups with regard to demographics or indication for colonoscopy. No serious adverse events related to the device were reported.EVS is manufactured by Sterling Industries in their Michigan, U.S. facility. The usedisposable portion of the Pure-Vu System enabled successful intraprocedural cleansing of the colon and ensured successful completion of all colonoscopies performed (100% success rate). Although there were only 46 patients in the study, there was a highly significant difference in the study population (p value <0.0001) between the baseline preparation and that seen post cleansing with the Pure-Vu System. The use of the Pure-Vu System added some time to the procedure, but the total procedure time was approximately 25 minutes in this study.

The clinical data showing performance of the Pure-Vu System in this study using the BBPS is shown below. The clinical results from the study were presented at the 2018 American College of Gastroenterology (“ACG”) Annual Meeting in October 2018.

REDUCE Study

Published studies have found that the inpatient population experiences rates of insufficiently prepped colons at the time of colonoscopy as high as 55%. This has been shown to lead directly to significantly longer hospital stays and other additional costs due to the need for repeated preps, repeated colonoscopies and additional diagnostic procedures. This is exemplified in a recently published study from Northwestern University Hospital System which showed an average hospital stay extension of two days and cost increase of as much as $8,000 per patient as a result of challenges associated with bowel preparation. We believe the Pure-Vu System may improve outcomes and lower costs for hospitals by reducing the time to a successful colonoscopy, minimizing delayed and incomplete procedures, and improving the quality of an exam.

On May 23, 2018, we announced the initiation of the Reliable Endoscopic Diagnosis Utilizing Cleansing Enhancement Study (the “REDUCE Study”). The REDUCE Study is a multi-center inpatient prospective trial designed to evaluate the Pure-Vu System’s ability to consistently and reliably cleanse the colon to facilitate a successful colonoscopy in a timely manner in patients who are indicated for a diagnostic colonoscopy. The study will enroll approximately 100 subjects in at least five hospital centers in the United States and Europe.

We expect to announce a top-line readout of the REDUCE Study data in the first quarter of 2019. The primary endpoint of the study is to determine the Pure-Vu System’s rate of improved bowel cleansing level using the BBPS index. Other key data being collected in the study includes the proportion of patients who receive a successful colonoscopy for the intended indication in the first attempt, which impacts the quality of the exam as well as hospital length of stay and costs required for the episode of care. The savings to the hospital can be meaningful as National Inpatient Sample (“NIS”) and other literature sources note that the cost for a standard hospital bed averages $2,298 and the cost for an intensive care unit (“ICU”) bed averages $6,546 per day in the U.S.

FDA Clearance to Market Pure-Vu Slim Sleeve

On September 13, 2018, we announced that we received special 510(k) clearance from FDA for the Pure-Vu Slim Sleeve (the “Pure-Vu Slim Sleeve”), a compatible extension to the Pure-Vu System for slim colonoscopes. The Pure-Vu Slim Sleeve design allows the Pure-Vu System access to the full range of procedures in the colonoscopy market as we estimate, through consultation with colonoscope manufacturing companies, approximately 30% of procedures are performed with a slim colonoscope. The Pure-Vu Slim Sleeve has the same cleansing performance as the standard Pure-Vu System sleeve, and both versions work with the same Pure-Vu workstation control system. The Pure-Vu Slim Sleeve has been designed to be compatible with smaller diameter and more flexible slim colonoscopes with additional enhancements to our low friction lubricious coating technology to aid in navigation through the colon. The first successful clinical cases using the Pure-Vu Slim Sleeve were completed in October 2018.

Second Generation of Pure-Vu

We expect to submit a Special 510(k) Notice to FDA in the first quarter of 2019 for the Second-Generation (“Gen 2”) of the Pure-Vu System. This premarket notification is a premarket submission used to review with FDA modifications to our devices that can be validated within our Quality Systems and which do not affect the device’s intended use or alter the device’s fundamental scientific technology.

The Gen 2 Pure-Vu System has been designed to improveis manufactured by Polyzen, Inc., at their facilities in North Carolina, U.S. Both Sterling Industries and Polyzen use Medacys in Shenzhen, China as key sub-supplier for the mobility and logisticsinjection molded parts in the setupPure Vu disposables. On October 7, 2023, the “Swords of Iron” war stroke between Israel and the system and will retain allterrorist organizations in the same functionality asGaza Strip, following a surprise attack on Israel led by certain armed groups in the current generation ofGaza Strip. To date, our operations in Israel have not been significantly impacted by the Pure-Vu System in terms of how it cleansesongoing war or the colon. The Gen 2 Pure-Vu System Workstation will have a reduced footprint and be mounted on a roll stand to allow nursing staff to easily move the Gen 2 Pure-Vu System to different procedure rooms or to the ICU as needed. The Gen 2 Pure-Vu System also has improvements that reduce the number of steps to set up the system and simplifies the loading process onto the colonoscope.

Additional Clinical Studies and Market Expansion OpportunitiesOctober 7, 2023 terrorist attack.

We expectFor additional information, see “Risk Factors—Risks Related to initiate the EXPEDITE Study (the “EXPEDITE Study”)Our Operations in the first quarter of 2019. The EXPEDITE Study is a planned feasibility study in hospitalized patients which will be designed to analyze the Pure-Vu System’s ability to minimize the preparation in order to shorten the time to a successful colonoscopy in the inpatient population. We are also working with key centers to generate clinical data on outpatient populations that have difficulty with the pre-procedural preparation to study the Pure-Vu System’s ability to allow these patients to have a successful exam. This data is expected to lay the ground work for future expansion into high need outpatient populations.Israel.”

Our resources are currently focused on the planned full launch of the Pure-Vu System in the United States inpatient colonoscopy market in 2019. However, we have identified two follow-on market expansion opportunities we may explore in the future. These include the inpatient upper gastrointestinal bleed (“Upper GI”) endoscopy market and the outpatient high medical need colonoscopy market. In the Upper GI bleed endoscopy market, we believe the Pure-Vu System has the potential to be used during endoscopy procedures to remove clots and debris to provide a clear field of view for the endoscopist. Separately, the outpatient high medical need colonoscopy market presents a large potential commercial market opportunity for the Pure-Vu System, as close to 26 million outpatient colonoscopy procedures are performed worldwide. Based on published literature in several peer reviewed journals from 2010 to 2015 and surveys of physicians conducted in 2015, approximately 23% of such colonoscopy patients can have an inadequate preparation, which may lead to repeat procedures earlier than the medical guidelines suggest. We believe use of the Pure-Vu System has the potential to reduce the need for such repeat procedures if used in the outpatient high medical need colonoscopy market. Additionally, if we choose to explore either market, we may be able to leverage our existing hospital and doctor relationships developed through our inpatient colonoscopy sales force to facilitate such expansion.

Intellectual Property Update

Our intellectual property position comprises a highly innovative portfolio covering technologies rooted in systems and methods for cleaning body cavities with or without the use of an endoscope. Currently we have six granted or allowed patents in the U.S., six patents in Asia, four patents in the EU and 27 (11 in the U.S.) pending patent applications in various regions of the world with a focus on the U.S., EU and Japan.

On March 20, 2018, we announced that the European Patent Office (“EPO”) issued Patent No. 3079556 to us titled, “Apparatus and method for coupling between a colonoscope and add-on tubes.” The patent provides intellectual property protection for our use of the Pure-Vu System in the European market through June 2035.

On March 27, 2018, we announced that the U.S. Patent and Trademark Office (“USPTO”) issued U.S. Patent No. 9,895,483 to us titled, “Systems and methods for cleaning body cavities.” The patent provides intellectual property protection for our use of the Pure-Vu System in the United States through January 2031.

On May 21, 2018, we announced that the Chinese Patent Office (“SIPO”) issued Patent No. ZL201580037467.6 to us titled, “Apparatus and method for coupling between a colonoscope and add on tubes.” The patent provides intellectual property protection for our use of the Pure-Vu System in China through June 2035.

On July 30, 2018, we announced that the Japanese Patent Office (“JPO”) issued Patent No. 6,362,640 to us titled, “System and method for cleaning body cavities.” The patent provides intellectual property protection for our use of the Pure-Vu System in Japan through June 2031.

Our Risks

Investing in our common stock involves a high degree of risk. You should carefully consider all of the information in this prospectus and in the documents incorporated by reference prior to investing in our common stock. These risks are discussed more fully in the section titled “Risk Factors” beginning on page 8 herein and in our Annual Report on Form 10-K for the year ended December 31, 2017, as updated by our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2018, June 30, 2018 and September 30, 2018, which are incorporated by reference in this prospectus. These risks and uncertainties include, but are not limited to, the following:

Implications of Being an Emerging Growth Company

We are an “emerging growth company,”company” as defined in Section 2(a)(19) of the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”),. As such, we are eligible for and for as long as we continue to be an “emerging growth company,” we may chooseintend to take advantage of certain exemptions from various reporting requirements applicable to other public companies butthat are not to “emergingemerging growth companies” for as long as we continue to be an emerging growth company, including, but not limited to, not being required to comply with(i) the exemption from the auditor attestation requirements ofwith respect to internal control over financial reporting under Section 404404(b) of the Sarbanes-Oxley Act of 2002, as amended, (the “Sarbanes-Oxley“Sarbanes Oxley Act”), (ii) the exemptions from say-on-pay, say-on-frequency and say-on-golden parachute voting requirements and (iii) reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions fromstatements.

Our eligibility to qualify as an emerging growth company will end on December 31, 2023 (which is the requirementslast day of holding a nonbinding advisory vote on executive compensation and stockholder approvalthe fiscal year following the fifth anniversary of any golden parachute payments not previously approved. We could be an “emerging growth company” for up to five years from the dateclosing of our initial public offering, in February 2018, or untilwhich occurred during 2018). In addition, the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1.07 billion, (ii) the dateJOBS Act provides that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three-year period. We intend toan emerging growth company can take advantage of these reporting exemptions described above until we are no longer an “emerging growth company.” Under the JOBS Act, “emerging growth companies” can also delay adoptingextended transition period for complying with new or revised accounting standards. This allows an emerging growth company to delay the adoption of certain accounting standards until such time as those standards would otherwise apply to private companies. We have irrevocably elected not to avail ourselves of this exemption fromextended transition period and, as a result, we will adopt new or revised accounting standards and, therefore, we are subject toon the same new or revised accountingrelevant dates on which adoption of such standards asis required for non-public companies instead of the dates required for other public companies that are not “emerging growth companies.”

Corporate History and Information

We are a Delaware corporation formed in September 2016 under the name Eight-Ten Merger Corp. In November 2016, we changed our name to Motus GI Holdings, Inc. We are the parent company of Motus GI Medical Technologies Ltd., an Israeli corporation, and Motus GI, LLC (formerly Motus GI, Inc.), a Delaware corporation.

On February 16, 2018, we closed our initial public offering (the “IPO”) in which we sold 3,500,000 shares of our common stock atlimited liability company. Motus GI, Inc. was converted from a public offering price of $5.00 per share. In connection with the closing of the IPO, we received net proceeds of approximately $15 million after deducting underwriting discounts and commissions of approximately $1.4 million and other offering expenses of approximately $1.1 million. In addition, on March 12, 2018, we closed the sale of an additional 56,000 shares of our common stock pursuant toCorporation into a partial exercise of the underwriters’ 30-day option to purchase up to an additional 525,000 shares of our common stock in connection with the IPO, resulting in net proceeds to us of approximately $258,000 after deducting underwriting discounts and commissions and other offering expenses. Shares of our common stock commenced trading on the Nasdaq Capital Market under the symbol “MOTS” on February 14, 2018.Limited Liability Company effective January 1, 2021.

Our principal executive offices are located at 1301 East Broward Boulevard, 3rd Floor, Ft. Lauderdale, FL 33301. Our phone number is (954) 541-8000 and our web address is http://www.motusgi.com. InformationOur website and the information contained inon, or accessiblethat can be accessed through, our web site is not, and shouldwebsite will not be deemed to be incorporated by reference in, orand are not considered part of, this prospectus. You should not rely on any such information in making your decision whether to purchase our common stock.

“Motus GI,” “Pure-Vu,” and our other registered or common law trademarks, service marks or trade names appearing herein are the property of Motus GI Holdings, Inc. Some trademarks referred to in this prospectusreport are referred to without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend the use or display of other companies’ trademarks and trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

The following summary contains basic information about this offering. The summary is not intended to be complete. You should read the full text and more specific details contained elsewhere in this prospectus and in the documents incorporated by reference.

Common Stock | Up to 1,511,335 shares, based on the sale of our common stock at an assumed combined public offering price of $3.97 per share of common stock and accompanying Common Warrants, which is the last reported sale price of our common stock on The Nasdaq Capital Market on December 8, 2023. | |

| Pre-funded Warrants to be Offered | ||

Common Warrants to be Offered | Up to 3,022,670 Common Warrants to purchase an aggregate of up to 3,022,670 shares of our common stock, based on the sale of our common stock at an assumed combined public offering price of $3.97 per share of common stock and accompanying Common Warrants, which is the last reported sale price of our common stock on The Nasdaq Capital Market on December 8, 2023. Each share of our common stock and each pre-funded warrant to purchase one share of our common stock is being sold together with a Series A Common Warrant to purchase one share of our common stock and a Series B Common Warrant to purchase one share of our common stock. Each Common Warrant will have an exercise price of $ per share (representing 100% of the price at which a share of common stock and accompanying Common Warrants are sold to the public in this offering), will be immediately exercisable and will expire (i) in the case of the Series A Common Warrant, on the fifth anniversary of the original issuance date and (ii) in the case of the Series B Common Warrant, on the eighteen month anniversary of the original issuance date. The shares of common stock and pre-funded warrants, and the accompanying Common Warrants, as the case may be, can only be purchased together in this offering but will be issued separately and will be immediately separable upon issuance. This prospectus also relates to the offering of the shares of common stock issuable upon exercise of the Common Warrants. |

| Debt Conversion | Immediately following the closing of this offering, pursuant to the 2021 Loan Agreement, an aggregate of $4.0 million of the principal amount under such loan will be automatically converted into an assumed 1,007,556 shares of common stock (and/or pre-funded warrants in lieu thereof), at a conversion price equal to the public offering price per share of common stock and accompanying Common Warrants in this offering, based on the assumed combined public offering price of $3.97 per share of common stock and accompanying Common Warrant, which is the last reported sale price of our common stock on The Nasdaq Capital Market on December 8, 2023. The Lender will also be issued Conversion Common Warrants to purchase an assumed 2,015,112 shares of common stock, representing warrant coverage on the shares being issued to the Lender in the same form and terms and at the same proportion as investors in this offering, and will have executed a customary lock-up agreement with respect to such shares and warrants for a 90-day period following the closing. We will also prepay $1.5 million of the principal amount of such loan from the net proceeds of this offering. The securities issued to the Lender in the conversion will be issued in reliance on the exemption from registration set forth in Section 3(a)(9) of the Securities Act, and this offering does not relate to the issuance of such securities The Nasdaq Capital Market. | |||

| Common Stock to be | ||||

| Use of Proceeds | We estimate that

We currently intend to use the net proceeds from this offering to | |||

| Risk Factors | ||||

| National Securities Exchange Listing | Our common stock is listed on The Nasdaq Capital Market under the symbol |

(1) The number of shares of our common stock tothat will be outstanding upon completion ofimmediately after this offering is based on 15,690,151690,247 shares of our common stock outstanding as of September 30, 2018November 15, 2023, and assumes the sale and issuance by us of 1,511,335 shares of common stock (and no sale of any pre-funded warrants) in this offering and excludes:

| ● | ||

| ● | 61,975 shares of common stock issuable upon the exercise of | |

| ● | 312,107 shares of |

| ● | ||

| ● | ||

| ● |

Unless otherwise indicated, all information in this prospectus reflects and assumes no issuances or assumes the following:

exercises of any other outstanding shares, options or warrants after November 15, 2023.

An investmentInvesting in our common stock is speculative and illiquid andsecurities involves a high degree of risk includingrisk. We urge you to carefully consider all of the information contained in this prospectus and other information which may be incorporated by reference in this prospectus as provided under “Information Incorporated by Reference.” In particular, you should consider the risk of a loss of your entire investment. You should carefully consider the following risk factors as well asbelow, together with those set forth under the heading “Risk Factors” in our most recent Annual Report on Form 10-K, for the year ended December 31, 2017, as updated by our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2018, June 30, 2018 and September 30, 2018, which areis incorporated by reference ininto this prospectus. Theseprospectus, as those risk factors contain, in addition to historical information, forward looking statements that involveare amended or supplemented by our subsequent filings with the SEC. These risks and uncertainties. Our actual results could differ significantly from the results discussed in the forward looking statements. The order in which the following risks are presented is not intended to reflect the magnitude of the risks described. The occurrence of any of the following adverse developments described in the following risk factors and in the documents incorporated by reference could materially and adversely harm our business, financial condition, results of operations or prospects. In such event, the value of our common stock could decline, and you could lose all or a substantial portion of the money that you pay for our common stock. In addition, the risks and uncertainties discussed below and in the documents incorporated by reference are not the only onesrisks and uncertainties we face. Our business, financial condition, results of operations or prospects could also be harmed byAdditional risks and uncertainties not currently known to us, or that we currently do not believe are material, and theseview as immaterial, may also impair our business. If any of the risks or uncertainties described below or in our SEC filings or any additional risks and uncertainties actually occur, our business, financial condition, results of operations and cash flow could results inbe materially and adversely affected. As a complete lossresult, you could lose all or part of your investment. In assessing the risks and uncertainties described below, you should also refer to the other information contained in this prospectus (as supplemented or amended) and the documents incorporated by reference in this prospectus.

Risks RelatedRISKS RELATED TO OUR OPERATIONS IN ISRAEL

Our research and development facilities and some of our suppliers are located in Israel and, therefore, our business, financial condition and results of operation may be adversely affected by political, economic and military instability in Israel.

Our research and development facilities are located in northern Israel. In addition, most of our employees are residents of Israel. Accordingly, political, economic and military conditions in Israel may directly affect our business. Since the State of Israel was established in 1948, the State of Israel and its economy has experienced significant growth and expansion, coupled with an increase in the standard of living, and has developed one of the most advanced high-tech industries in the world. However, it continues to face many geo-political and other challenges that may affect companies located in Israel, such as ours. For example, a number of armed conflicts have occurred between Israel and its Arab neighbors. Although Israel has entered into peace agreements with Egypt and Jordan, comprehensive agreements with the Palestinian Authority, and other agreements with neighboring Arab countries regarding public normalization of relations, there continues to be unrest and terrorist activity in Israel with varying levels of severity, as well as ongoing hostilities and armed conflicts between Israel and the Palestinian Authority, and other groups in the West Bank and Gaza Strip, recent unrest was due to the United States’ relocation of its embassy from Tel Aviv to Jerusalem. The effects of these hostilities and violence on the Israeli economy and our operations are unclear, and we cannot predict the effect on us of a further increase in these hostilities or any future armed conflict, political instability or violence in the region. We could be harmed by any major hostilities involving Israel, the interruption or curtailment of trade between Israel and its trading partners, boycotts or a significant downturn in the economic or financial condition of Israel. The impact of Israel’s relations with its Arab neighbors in general, or on our operations in the region in particular, remains uncertain. The establishment of new fundamentalist Islamic regimes or governments more hostile to Israel could have serious consequences for the stability in the region, place additional political, economic and military confines upon Israel, materially adversely affect our operations and limit our ability to sell our products to countries in the region.

In particular, on October 7, 2023, the “Swords of Iron” war stroke between Israel and the terrorist organizations in the Gaza Strip, following a surprise attack on Israel led by certain armed groups in the Gaza Strip. To date, our operations in Israel have not been significantly impacted by the ongoing war or the October 7, 2023 terrorist attack, however we will disclose via Current Report on Form 8-K any material changes to our operations resulting from the conflict.

Additionally, several countries, principally in the Middle East, still restrict doing business with Israel and Israeli companies, and additional countries and groups have imposed or may impose restrictions on doing business with Israel and Israeli companies if hostilities in Israel or political instability in the region continues or increases. These restrictions may limit our ability to sell our products to companies in these countries. Furthermore, the Boycott, Divestment and Sanctions Movement, a global campaign attempting to increase economic and political pressure on Israel to comply with the stated goals of the movement, may gain increased traction and result in a boycott of Israeli products and services. Any hostilities involving Israel or the interruption or curtailment of trade between Israel and its present trading partners, or significant downturn in the economic or financial condition of Israel, could adversely affect our business, results of operations and financial condition.

Our Financial Positioncommercial insurance policy does not cover losses associated with armed conflicts and Needterrorist attacks. Although the Israeli government in the past covered the reinstatement value of certain damages that were caused by terrorist attacks or acts of war, we cannot assure you that this government coverage will be maintained, or if maintained, will be sufficient to compensate us fully for Capitaldamages incurred. Any losses or damages incurred by us could have a material adverse effect on our business.

Our operations could also be disrupted by the obligations of some of our employees to perform military service. Some of our employees in Israel may be called upon to perform up to 54 days in each three year period (and in the case of military officers, up to 84 days in each three year period) of military reserve duty until they reach the age of 40 (and in some cases, depending on their specific military profession and rank up to 45 or even 49 years of age) and, in certain emergency circumstances, may be called to immediate and unlimited active duty. In response to increases in terrorist activity, there have been periods of significant call-ups of military reservists and it is possible that there will be similar large-scale military reserve duty call-ups in the future. Our operations could be disrupted by the absence of a significant number of employees related to military service, which could materially adversely affect our business and results of operations. To date, none of our employees have been called upon to perform reserve duty as a result of the October 7, 2023 attack and ongoing war.

RISKS RELATED TO THIS OFFERING

There is substantial doubt about our ability to continue as a going concern, which will affect our ability to obtain future financing and may require us to curtail our operations.

Our financial statements as of December 31, 2017 were prepared under the assumption that we will continue as a going concern. The independent registered public accounting firm that audited our 2017 financial statements, in their report, included an explanatory paragraph referring to our recurring losses since inception and expressing substantial doubt in our ability to continue as a going concern. Our financial statements do not include any adjustments that might result from the outcome of this uncertainty. Our ability to continue as a going concern depends on our ability to obtain additional equity or debt financing, attain further operating efficiencies, reduce expenditures, and, ultimately, to generate revenue. We cannot assure you, however, that we will be able to achieve any of the foregoing.

Risks Related to this Offering and Ownership of our Common Stock

After this offering, our officers, directors, and principal stockholders will continue to exercise significant control over our Company, and will control our company for the foreseeable future, including the outcome of matters requiring stockholder approval.

When this offering is completed our officers, directors, entities controlled by our officers and directors, and principal stockholders who beneficially own more than 5% of our common stock before this offering will in the aggregate, beneficially own shares representing approximately 47.76% of our outstanding capital stock immediately after this offering (based upon an assumed public offering price of $3.23 per share, the last reported sale price of our common stock on the Nasdaq Capital Market on December 13, 2018). As a result, such entities and individuals have the ability, acting together, to control the election of our directors and the outcome of corporate actions requiring stockholder approval, such as: (i) a merger or a sale of our company, (ii) a sale of all or substantially all of our assets, and (iii) amendments to our certificate of incorporation and bylaws. This concentration of voting power and control could have a significant effect in delaying, deferring or preventing an action that might otherwise be beneficial to our other stockholders and be disadvantageous to our stockholders with interests different from those entities and individuals. These individuals also have significant control over our business, policies and affairs as officers and directors of our company. Therefore, you should not invest in reliance on your ability to have any control over our company.

Investors in this offering will pay a higher price than the book value of our common stock.

If you purchase shares of common stock in this offering, you will pay more for your shares than the amounts paid by existing stockholders for their shares. You will incurexperience immediate and substantial dilution of $2.07in your investment. You will experience further dilution if we issue additional equity or equity-linked securities in the future.

Because the price per share representingof our common stock being offered is substantially higher than the difference between ourpro forma as adjusted net tangible book value per share after giving effectof our common stock, you will suffer immediate and substantial dilution with respect to the net tangible book value of the common stock you purchase in this offering andoffering. Based on an assumed combined public offering price of $3.23$3.97 per share the last reported sale price of our common stock on the Nasdaq Capital Market on December 13, 2018. To the extent any outstanding options or warrants are ultimately converted or exercised,and accompanying Common Warrants being sold in this offering, and our pro forma as adjusted net tangible book value as of September 30, 2023 of $2.08 per share, if you purchase shares of common stock in this offering, you will sustain further dilution. For further information, seesuffer immediate and substantial dilution of $1.89 per share with respect to the pro forma as adjusted net tangible book value of the common stock. See the section entitled “Dilution.”

If we sell shares“Dilution” for a more detailed discussion of ourthe dilution you will incur if you purchase common stock in future financings, stockholders may experience immediate dilution and, as a result, our stock price may decline.this offering.

We may from time to timeIf we issue additional shares of common stock, or securities convertible into or exchangeable or exercisable for shares of common stock, our stockholders, including investors who purchase shares of common stock and/or pre-funded warrants and accompanying Common Warrants in this offering, will experience additional dilution, and any such issuances may result in downward pressure on the price of our common stock. We also cannot assure you that we will be able to sell shares or other securities in any other offering at a discountprice per share that is equal to or greater than the price per share paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders.

This is a reasonable best efforts offering, which we will only consummate for $5.0 million or more in gross proceeds.

The placement agent has agreed to use its reasonable best efforts to solicit offers to purchase the securities in this offering. The placement agent has no obligation to buy any of the securities from us or to arrange for the purchase or sale of any specific number or dollar amount of the securities. Although we will only consummate an offering of $5.0 million or more in gross proceeds, the actual public offering amount, placement agent’s fees, and proceeds to us, if any, are not presently determinable and may be less than the total maximum offering amounts set forth above, subject to the $5.0 million minimum, and there can be no assurance that the offering contemplated hereby will ultimately be consummated.

If we fail to regain compliance with the requirements for continued listing on Nasdaq, our common stock could be delisted from trading, which would adversely affect the liquidity of our common stock and our ability to raise additional capital.

The Nasdaq Capital Market’s rules for listed companies requires us to meet certain financial, public float, bid price and liquidity standards on an ongoing basis in order to continue the listing of our common stock. In order to maintain our listing on Nasdaq, we must satisfy the continued listing requirements of Nasdaq for inclusion in The Nasdaq Capital Market, including among other things, a minimum stockholders’ equity of $2.5 million and a minimum bid price for our common stock of $1.00 per share.

As previously disclosed, we received a letter from the currentNasdaq Stock Market, LLC (“Nasdaq”) indicating that we are not in compliance with the minimum stockholders’ equity requirement for continued listing on Nasdaq under Rule 5550(b)(1) (the “Equity Rule”). In addition, as previously disclosed on the Current Report on Form 8-K filed April 5, 2023, we received a letter from Nasdaq indicating that the bid price of the Company’s common stock had failed to close above the minimum $1 requirement for the past 30 trading days in violation of Listing Rule 5550(a)(2) (the “Bid Price Rule”). The Company was provided 180 calendar days, or until September 27, 2023, to regain compliance with the Bid Price Rule. On September 27, 2023, we received notice that the Nasdaq Hearings Panel (the “Hearings Panel”) granted us an extension to regain compliance with the Equity Rule and the Bid Price Rule until January 2, 2024.

At our annual meeting of stockholders held on September 21, 2023, our stockholders approved a proposed amendment to our Certificate of Incorporation to effect a reverse stock split of our outstanding common stock at a ratio of not less than two-for-one (2:1) and not greater than twenty-for-one (20:1), at any time prior to the one year anniversary date of our annual meeting of stockholders, with the exact ratio to be determined by our Board of Directors. On November 2, 2023, we effected a reverse stock split of our issued and outstanding common stock at a ratio of 1-for-15.