As filed with the Securities and Exchange Commission on September 1, 2016

April 9, 2024Registration No. ___________

333‑ 278326 UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C.D. C. 20549

Amendment No. 1

to

FORM S-1

S‑1REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Commission File Number: 001-37479

VISUALANT, INCORPORATED

(Exact name of registrant as specified in charter)

| 90-0273142 |

(State(Exact name of registrant as specified in its charter) |

Nevada | | 3920 | | 90‑0273142 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| |

| 3920 |

| (Primary Standard Industrial Classification Code Number) |

| |

500 Union Street, Suite 420, Seattle, Washington USA

| 98101

|

(Address of principal executive offices) | (Zip Code)(IRS Employer Identification No.) |

| 206-903-1351 | |

| (Registrant's telephone number, including area code) | |

| | |

| | |

| N/A | |

| (Former name, address, and fiscal year, if changed since last report) | |

| | |

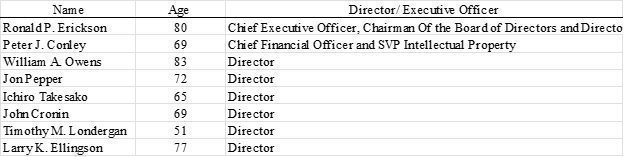

| Ronald P. Erickson, Chief Executive Officer

Visualant, Incorporated

500 Union Street, Suite 420

Seattle, WA 9810

| |

| (Name, address, including zip code, and telephone number, including area code, of agent for service) | |

| | |

| Copies to:

Lawrence W. Horwitz, Esq.

James A. Murphy, Esq.

Horwitz + Armstrong, A Professional Law Corporation

14 Orchard, Suite 200

Lake Forest, California 92630

(949) 540-6540

| |

500 Union Street, Suite 810

Seattle, Washington 98101

206‑903‑1351

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Ronald P. Erickson

Chief Executive Officer

500 Union Street, Suite 810

Seattle, Washington 98101

206‑903‑1351

(Names, address, including zip code and telephone number, including area code, of agent for service)

Copies to:

Joshua E. Little

Dentons Durham Jones Pinegar P.C.

192 East 200 North, 3rd Floor

St. George, UT 84770

(435) 674-0400

joshua.e.little@dentons.com

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statementregistration statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effectivepost‑effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effectivepost‑effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-acceleratednon‑accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of "large“large accelerated filer," "accelerated filer"” “accelerated filer,” “smaller reporting company,” and "smaller reporting company"“emerging growth company” in Rule 12b-212b‑2 of the Exchange Act.

Large accelerated filer | | | Accelerated filer | ☐

|

Non-acceleratedNon‑accelerated filer | ☐

☒ | | Smaller reporting company | ☒ |

CALCULATION OF REGISTRATION FEE

| Title of Each Class | | | | |

| of Securities to | | | | |

| be Registered | | | | |

| Common Stock, $0.001 par value per share related to the potential | | | | |

| conversion of up to $1,250,000 of Series C Convertible Preferred Stock | | | | |

| offered by selling stockholder (3) | 1,785,714 | $0.70 | $1,250,000 | $125.87 |

| | | | | |

| Common Stock, $0.001 par value per share, issuable upon exercise of | | | | |

| Series E Warrants (3) | 1,785,714 | 0.70 | 1,250,000 | 125.87 |

| Total | 3,571,428 | $0.70 | $2,500,000 | $251.75 |

(1)

| Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act.

|

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission acting pursuant to such Section 8(a), may determine.

EXPLANATORY NOTE

This Amendment No. 1 to the Registration Statement on Form S-1 of Know Labs, Inc. (the “Company”) is being filed solely to (i) update the Incorporation by Reference section hereto, and (ii) to revise Item 16. “Exhibits”.

Except as described above, no changes have been made to the Registration Statement.

|

(2)

| Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price. |

| |

(3)

|

There is being registered hereunder an indeterminate number of shares of common stock issuable upon conversion of Series C Convertible Preferred Stock. The Series C Convertible Preferred Stock is convertible at any time at an initial conversion price of $0.70 per share of our common stock subject to adjustment for certain events. Pursuant to Rule 416 under the Securities Act of 1933, as amended, the shares of common stock registered hereby also include an indeterminate number of additional shares of common stock that may be issued in connection with a stock split, stock dividend, recapitalization or similar event or adjustment in the number of shares of common stock issuable as provided in the Series C Convertible Redeemable Preferred Stock Designation. |

|

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARYThe information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(A), MAY DETERMINE.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. WE MAY NOT SELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED. COMPLETION, DATED APRIL 9, 2024

Subject to completion, dated September 1, 2016

Visualant, Incorporated

500 Union Street, Suite 420

Seattle, WA 98101

206-903-1351

KNOW LABS, INC.

10,800,000 Shares of Common Stock

This prospectus covers the resale by the selling stockholder (the “Selling Stockholder”): (i) up to

1,785,714 shares of our common stock that we may issuerelates to the Selling Stockholder upon conversion of Series C Redeemable Convertible Preferred Stock at a conversion price of $0.70 per share, subject to certain adjustments, and (ii) up to 1,785,714 shares (the “Warrant Shares”) of common stock issuable upon the exercise of outstanding Series E Warrants (“Series E Warrant Shares”) at an exercise price of $0.70 per share, subject to certain adjustments. The common stock covered by this prospectus may be offered for resale, from time to time, by the Selling Stockholderselling stockholder identified in this prospectus under the caption “Selling Stockholder,” of up to 4,800,000 shares of Common Stock of Know Labs, Inc., a Nevada corporation (the “Company”), $0.001 par value (the “Common Stock”), which are issuable upon conversion of a secured, convertible note in accordance with the termsprincipal amount of $4,800,000 (the “Note”), at an initial conversion price of $1.00 per share, subject to adjustment, and up to 6,000,000 shares of Common Stock underlying a common stock purchase warrant (the “Warrant”) at an initial exercise price of $0.80 per share.For the details about the selling stockholder, please see “Selling Stockholder.” The selling stockholder may sell these shares from time to time in the principal market on which our Common Stock is traded at the prevailing market price, in negotiated transactions, or through any other means described in the section entitledtitled “Plan of Distribution.”

We are not The selling

anystockholder may be deemed an underwriter within the meaning of the Securities Act of 1933, as amended, of the shares of

our common stock in this offering and, as a result, weCommon Stock that they are offering. We will pay the expenses of registering these shares. We will not receive

any proceeds from the sale of the common stock covered by this prospectus. All of the net proceeds from the sale of our

common stock will goshares by the selling stockholder that are covered by this prospectus.The shares are being registered to permit the Selling Stockholder. Upon exercise ofselling stockholder, or its pledgees, donees, transferees or other successors-in-interest, to sell the Series E Warrants, however, we will receive up to $0.70 per share or such lower price as may result from the anti-dilution protection features of such warrants. Any proceeds received from the exercise of such warrants will be used for general working capital and other corporate purposes.

The Selling Stockholder may sell common stockshares from time to time at prices established onin the Overpublic market. We do not know when or in what amount the Counter Bulletin Board ("OTCBB")selling stockholder may offer the securities for sale. The selling stockholder may sell some, all or as negotiated in private transactions, or as otherwise described under the heading "Plan of Distribution." The common stock may be sold directly or through agents or broker-dealers acting as agents on behalfnone of the Selling Stockholder. The Selling Stockholder may engage brokers, dealers or agents who may receive commissions or discounts from the Selling Stockholder. We will pay all the expenses incident to the registration of the shares; however, we will not pay for sales commissions or other expenses applicable to the sale of our common stock registered hereunder.

securities offered by this prospectus.Our common stock is quoted on the OTCQB Marketplace, operated by OTC Markets Group,NYSE American under the symbol "VSUL".“KNW.” On August 30, 2016,March 25, 2024, the last reported saleclosing price forof our common stock on the OTCQB MarketplaceNYSE American was $1.10$0.65 per share.

On June 17, 2015, we completed a 1-for-150 reverse stock splitThe selling stockholder may sell its shares of our common stock. All warrant, option, share and per share informationCommon Stock described in this prospectus gives retroactive effectin a number of different ways, at prevailing market prices or privately negotiated prices and there is no termination date of the selling stockholder’s offering.

You should read this prospectus, together with additional information described under the headings “Incorporation of Certain Information by Reference” and “Where You Can Find More Information”, carefully before you invest in any of our securities.

Investing in our securities involves a high degree of risk. See “Risk Factors” starting on page 8 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the 1-for-150 split with all numbers rounded up to the nearest whole share.

INVESTING IN OUR SECURITIES INVOLVES A HIGH DEGREE OF RISK. SEE THE SECTION ENTITLED "RISK FACTORS" BEGINNING ON PAGE 11 IN THIS PROSPECTUS. YOU SHOULD CAREFULLY CONSIDER THESE RISK FACTORS, AS WELL AS THE INFORMATION CONTAINED IN THIS PROSPECTUS, BEFORE YOU INVEST.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

No dealer, salesperson or any other personcontrary is authorized to give any information or make any representations in connection with this offering other than those contained in this prospectus and, if given or made, the information or representations must not be relied upon as having been authorized by us. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any security other than the securities offered by this prospectus, or an offer to sell or a solicitation of an offer to buy any securities by anyone in any jurisdiction in which the offer or solicitation is not authorized or is unlawful.

criminal offense.The date of this prospectus is September 1, 2016

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus andor in any applicablefree writing prospectus supplement.that we may specifically authorize to be delivered or made available to you. We have not authorized anyone to provide you with differentany information other than that contained in this prospectus or additional information. If anyone provides you with differentin any free writing prospectus we may authorize to be delivered or inconsistentmade available to you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information you should not rely on it.that others may give you. This prospectus may only be used where it is legal to offer and sell our securities. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of securities described in this prospectus. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus or any prospectus supplement, as well as information we have previously filed with the Securities and Exchange Commission, is accurate as of the date on the front of those documents only.our securities. Our business, financial condition, results of operations and prospects may have changed since those dates.

For investors outside the United States: neither we nor the underwriters have done anything that

would permit this offering or possession or distributiondate. We are not making an offer of

this prospectus or any free writing prospectus we may provide to you in connection with this offeringthese securities in any jurisdiction where

action for that purposethe offer is

required, other than innot permitted.Unless the United States. You are required to inform yourselves aboutcontext otherwise requires, the terms “Know Labs,” the “Company”, “we,” “us” and to observe any restrictions relating to this offering and the distribution of this prospectus and any such free writing prospectus outside of the United States.

Unless otherwise indicated, information contained“our” in this prospectus

concerning ourrefer to Know Labs, Inc., and its subsidiaries and “this offering” refers to the offering contemplated in this prospectus.INDUSTRY AND MARKET DATA

This prospectus includes information with respect to market and industry and the markets in which we operate, including our general expectations and market position, market opportunityconditions and market share isfrom third-party sources or based on information from our own managementupon estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Management estimates are derived from publicly available information, our knowledge of our industry and assumptions based onusing such sources when available. We believe that such information and knowledge, whichestimates are reasonable and reliable. We also believe the information extracted from publications of third-party sources has been accurately reproduced. However, we believe to be reasonable. Our management estimates have not independently verified any of the data from third-party sources. Similarly, our internal research is based upon our understanding of industry conditions, and such information has not been verified by any independent source,sources.

TRADEMARKS, TRADE NAMES AND SERVICE MARKS

We own or have rights to trademarks, service marks and trade names that we have not independently verified any third-party information. In addition, assumptions and estimatesuse in connection with the operation of our business, including our corporate name, logos and our industry's future performance are necessarily subject to a high degree of uncertaintywebsite names. Other trademarks, service marks and risk due to a variety of factors, including those described in "Risk Factors". These and other factors could cause our future performance to differ materially from our assumptions and estimates. See "Special Note Regarding Forward-Looking Statements".

Our trademarks Visualant™ and ChromaID™ are used throughout this prospectus. This prospectus also includes trademarks, trade names and service marks thatappearing in this report are the property of other organizations.their respective owners. Solely for convenience, some of the trademarks, service marks and trade names referred to in this prospectus appearreport are listed without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or that the applicable owner will not assert its rights, to theseour trademarks, service marks and trade names.

This report may include trademarks, service marks and trade names owned by us or other companies. All trademarks, service marks and trade names included in this prospectus are the property of their respective owners.PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you should consider before investingdeciding whether to invest in our common stock.securities. You should carefully read thisthe entire prospectus, carefully, especiallyincluding the "Risk Factors"risks associated with an investment in our company discussed in the “Risk Factors” section of this prospectus and our financial statements and the related notes appearing at the end of this prospectus, before making an investment decision. As usedSome of the statements in this prospectus unlessare forward‑looking statements. See the context otherwise requires, references to "we," "us," "our," "our company," “Visualant, Inc.section titled “Cautionary Statement Regarding Forward‑Looking Statements.” and "Visualant" refer to Visualant, Incorporated and our wholly-owned subsidiary TransTech Systems, Inc., unless the context otherwise requires.

On June 17, 2015, we effected a 1-for-150 reverse stock split of our common stock. All warrant, option, share and per share informationOUR COMPANY

Overview

Know Labs is an emerging leader in this prospectus gives retroactive effect to the 1-for-150 split with all numbers rounded up to the nearest whole share

Overview

Our Company

non-invasive medical diagnostics. We are focused primarily on the development and commercialization of aour proprietary sensor technology whichutilizing radio and microwave spectroscopy. When paired with our machine learning platform, our technology is capable of uniquely identifying and authenticatingmeasuring almost any substancematerial or analyte using lightelectromagnetic energy to create,detect, record, identify, and detectmeasure the unique digital “signature” of said materials or analytes.The first application of our sensor technology is in a product to non-invasively monitor blood glucose levels. Our device will provide the substance.user with real-time information on their blood glucose levels. We call thisrecently announced our “ChromaID™” technology.

Our ChromaID™ Technology

Generation 1 working prototype device. This device embodies the sensor which has been used in internal clinical testing. We have

also announced the work our R&D team is doing on the Generation 2 of our device, which is a wearable format and could be a final form factor, ready for commercial application. We are expanding our testing, both internally and externally, and will refine the device over time, which will require FDA clearance before entering the market.Following FDA clearance of our non-invasive blood glucose monitoring device, Know Labs plans to expand its sensor technology to other non-invasive medical diagnostic applications. As a platform technology, it can identify numerous other analytes in the human body that are important in medical diagnostics and human health and wellness.

While medical diagnostics applications, with blood glucose monitoring paramount, are the focus of Know Labs, the Company’s proprietary radio frequency and microwave spectroscopy platform have broad applicability outside of the medical diagnostic realm. Over time, as resources allow, the Company will explore those opportunities.

The Know Labs Technology

We have internally and under contract with third parties developed a proprietary platform technology to uniquely identify and authenticatemeasure almost any substance. Thisorganic and inorganic material or analyte. Our patented technology utilizes light atdirects electromagnetic energy in the photon (elementary particle of light) levelradio wave and microwave frequencies through a series of emitters and detectorssubstance or material to generatecapture a unique signature or “fingerprint” from a scan of almost any solid, liquid or gaseous material. This signature of reflected or transmitted light is digitized, creating a unique ChromaIDmolecular signature. Each ChromaID signature is comprised of from hundredsWe then perform analytics which will allow the Company to thousands of specific data points.

The ChromaID technology looks beyond visible light frequencies to areas of near infra-redaccurately identify and ultraviolet light that are outside the humanly visible light spectrum. The data obtained allows us to create a very specificmeasure materials and unique ChromaID signature of the substance for a myriad of authentication and verification applications.

Traditional light-based identification technology, called spectrophotometry, has relied upon a complex system of prisms, mirrors and visible light. Spectrophotometers typically have a higher cost and utilize a form factor more suited to a laboratory setting and require trained laboratory personnel to interpret the information. The ChromaID technology uses lower cost LEDs and photodiodes and specific frequencies of light resulting in a more accurate, portable and easy-to-use solution for a wide variety of applications. The ChromaID technology not only has significant cost advantages as compared to spectrophotometry, it is also completely flexible is size, shape and configuration. The ChromaID scan head can range in size from endoscopic to a scale that could be the size of a large ceiling-mounted florescent light fixture.

In normal operation, a ChromaID master or reference scan is generated and stored in a database. The Visualant scan head can then scan similar materials to identify, authenticate or diagnose them by comparing the new ChromaID digital signature scan to that of the original or reference ChromaID signature or scan result.

ChromaID was invented by scientists from the University of Washington under contract with Visualant. We have pursued an aggressive intellectual property strategy and have been granted ten patents. We also have 20 patents pending. We possess all right, title and interest to the issued patents. Ten of the pending patents are licensed exclusively to us in perpetuity by our strategic partner, Intellectual Ventures through its subsidiary IDMC.

In 2010, we acquired TransTech Systems, Inc. (“TransTech”) as an adjunct to our business. TransTech is a distributor of products for employee and personnel identification. TransTech currently provides substantially all of our revenues. We intend, however, to further develop and market our ChromaID technology.

The following summarizes our plans for our proprietary ChromaID technology. Based on our anticipated expenditures on this technology, the expected efforts of our management and our relationship with Intellectual Ventures and its subsidiary, IDMC, and our other strategic partner, Sumitomo Precision Products, Ltd., we expect our ChromaID technology to provide an increasing portion of our revenues in future years from product sales, licenses, royalties and other revenue streams., as discussed further below.

ChromaID: A Foundational Platform Technology

analytes. Our ChromaID technology provides a unique platform upon which a myriad of applications can be developed. As a platform technology, it is analogous to a smartphone, upon which an enormous number of previously unforeseen applications have been developed. The ChromaIDOur radio frequency spectroscopy technology is an enabling“enabling” technology that brings the science of light and photonicselectromagnetic energy to low cost, real worldlow-cost, real-world commercialization opportunities across multiple industries. The technology is foundational and, as such, the basis upon which we believe a significant businessbusinesses can be built.

As While we are pursuing our core focus on commercializing our non-invasive glucose monitor, we believe non-core clinical, non-clinical and medical research applications represent a multitude of opportunities for strategic collaboration, joint development, and licensing agreements with

other foundational technologies, a single application may reach across multipleleading companies in their respective industries.

The ChromaIDWe believe an important competitive differentiator for our sensor technology can, for example effectively differentiate and identify different brands of clear vodkas that appear identical to the human eye. By extension this same technology can identify pure water from water with contaminants present. It can provide real time detection of liquid medicines such as morphine that have been adulterated or compromised. It can detect if jet fuel has water contamination present. It could determine when it is time to change oil in a deep fat fryer. These are but a few of the potential applications of the ChromaID technology based upon extensions ofbe its ability to not only identify different clear liquids.

a wide range of organic and inorganic materials and analytes, but to do so non-invasively, and in real-time, which potentially enables new multivariate models of clinical diagnostics, and health and wellness monitoring.Competitive Advantages

We believe our key competitive strengths include:

| · | Through first principles, our sensor technology’s ability to not only identify a wide range of organic and inorganic materials and analytes, but to do so non-invasively, accurately, and in real time, which potentially enables new multivariate models of clinical diagnostics, and health and wellness monitoring. |

| | |

| · | Our sensor technology is non-invasive, using radio waves to identify and measure what is going on inside the body. |

| | |

| · | Our sensor technology platform can be integrated into a variety of wearable, mobile, or counter-top form factors, and we believe eventual interoperability with existing products from current market leaders. |

| | |

| · | No needles nor invasive transmitters in your body, making our sensor convenient and pain-free. |

| | |

| · | No expensive supplies, such as test strips and lancets, are required to operate our device. |

| | |

| · | A core focus on accessibility and affordability for the populations we will serve around the globe. |

| | |

| · | The current prototype sensor collects approximately 1.5 million data points per hour, which allows us to potentially build a deep understanding of health and wellness that other sensors may not be able to. |

| | |

| · | Know Labs is the world intellectual property leader in non-invasive blood glucose monitoring, according to ipCG Capital and PatSnap. |

Growth Strategy

The cornerstone of a company with a foundational platform technology is its intellectual property. ChromaID was invented by scientists from the University of Washington under contract with Visualant. We have pursued an aggressive intellectual property strategy and have been granted ten patents. We currently have 20 patents pending. We possess all right, title and interest to the issued patents. Ten of the pending patents are licensed exclusively to us in perpetuity by our strategic partner, the IDMC subsidiary of Intellectual Ventures.

At the Photonics West trade show held in San Francisco in February 2013, we were honored to receive a PRISM award from the Society of Photo-Optical Instrumentation Engineers International, better known as SPIE. The PRISM awards recognizes photonic products that break with conventional ideas, solve problems, and improve life through the application of light-based technologies.

IDMC Relationship

In November 2013, we entered into a strategic relationship with Invention Development Management Company, a subsidiary of Intellectual Ventures, a private intellectual property fund with over $5 billion under management. Intellectual Ventures owns over 40,000 IP assets and has broad global relationships for the invention of technology, the filing of patents and the licensing of intellectual property. IDMC has worked to expand the reach and the potential application of the ChromaID technology and has filed ten patents base on the ChromaID technology, which it has licensed to us. In connection with IDMC’s work to expand our intellectual property portfolio, we agreed to curtail outbound marketing activitieskey elements of our technology through the fourth calendar quarter of 2014.

Initial testing in our laboratories and the work of the IDMC inventors have shown that the ChromaID technology has a number of broad and useful applications a few of which include:

●

Milk identification for quality, protein and fat content and impurities

●

Identification of liquids for counterfeits or contaminants

●

Detecting adulterants in food and food products compromising its quality

●

Color grading of diamonds

●

Identifying real cosmetics versus counterfeit cosmetics

●

Identifying counterfeit medications versus real medications

●

Identifying regular flour versus gluten free flour

●

Authenticating secure identification cards

Products

Our first delivered product, the ChromaID Lab Kit, scans and identifies solid surfaces. We are marketing this productstrategy to customers who are considering licensing the technology. Target markets include, but are not limited to, commercial paint manufacturers, pharmaceutical equipment manufacturers, process control companies, currency paper and ink manufacturers, security cards, cosmetic companies, scanner manufactures and food processing companies.

Our second product, the ChromaID Liquid Lab Kit, scans and identifies liquids. This product is currently in prototype form. Similar to our first product, it will be marketed to customers who are considering licensing the technology. Rather than use an LED emitter to reflect light off of a surface that is captured by a photodiode to generate a ChromaID signature the liquid analysis product shines light through the liquid (transmissive) with the LEDs positioned on one side of the liquid sample and the photo detectors on the opposite side. This device is in a functional state in our laboratory and we anticipate having a Liquid ChromaID Lab Kit available for customers by the Company during the fall of 2015. Target markets include, but are not limited to, water companies, petrochemical companies, pharmaceutical companies, and numerous consumer applications.

The ChromaID Lab Kits allows potential licensors of our technology to work with our technology and develop solutions for their particular application. Our contractual arrangements with IDMC are described in greater detail below.

Our next planned product should be an exemplar product is a prototype that will be produced to address several markets. The primary purpose of this prototype will be to demonstrate the technology to prospective business partners, and will consist of a small, hand held, battery powered, Bluetooth enabled scanning device. The scanner should wirelessly connect to a smart phone or tablet to transfer the scanned data. The smart phone application will include two or three industry specific but generic applications that allow for the demonstration of the scanning and matching of the ChromaID signatures. The applications will focus on drug identification, food safety and liquid detection. The prototype device will lend itself to consumer applications and can be a consumer product as well.

Our Commercialization Plans for the ChromaID Technology

We shipped our first ChromaID product, the ChromaID Lab Kits, to our strategic partner IDMC during the last calendar quarter of 2013 and first calendar quarter of 2014, after we completed final assembly and testing. As part of our agreement with IDMC, we curtailed our ChromaID marketing efforts through the fourth calendar quarter of 2014 while IDMC worked to expand our intellectual property portfolio. Thereafter, we began to actively market the ChromaID Lab Kits to interested and qualified customers. Some ChromaID Lab Kits are provided free of charge to potential customers. Others are sold for a modest price. To date, we have achieved limited revenue from the sale of our ChromaID Lab Kits.

The Lab Kit includes the following:

ChromaID Scanner. A small device made with electronic and optical components and firmware which pulses light onto a flat material and records and digitizes the light that is reflected back from that material. The device is the size of a typical flashlight (5.5” long and 1.25” diameter). However, the technology can be incorporated into almost any size, shape and configuration.

ChromaID Lab Software. A software application that runs on a Windows PC. The software allows for configuration of the scanner, controls the behavior of the ChromaID Scanner, displays a graph of the captured ChromaID signature profile, stores the ChromaID signature in a database and uses algorithms to compare the accuracy of the match of the unknown scan to the known ChromaID signature profile. This software is intended for lab and experimental use only and is not required for commercialized product applications.

Software Development Toolkit. A collection of software applications, API (an abbreviation of application program interface – a set of routines, protocols, and tools for building software applications) definitions and file descriptions that allow a customer to extract the raw data from the ChromaID signatures and run their own software routines against that raw data.

The ChromaID Lab Kit allows customers to experiment with and evaluate the ChromaID technology and determine if it is appropriate for their specific applications. The primary electronic and optical parts of the ChromaID scanner, called the “scan head,” could be supplied to customers to integrate into their own products. A set of ChromaID Developer Tools are also available. These allow customers to develop their own applications and products based on the ChromaID technology.

ChromaID signatures must be stored, managed, and readily accessible for comparison, matching and authentication purposes. The database can be owned and operated by the end customer, but in the case of thousands of ChromaID signatures, database management may be outsourced to us or a third party provider. These database services could be made available on a per-access transaction basis or on a monthly or annual subscription basis. The actual storage location of the database can be cloud-based, on a stand-alone scanning device or on a mobile device via a Bluetooth connection depending on the requirements of access, size of the database and security as defined by the customer. As a result, large databases can be accessed by cell phone or other mobile technologies using either local storage or cloud based storage.

Based on the commercialization plans outlined above,grow our business model anticipates deriving revenue from several sources:

●

Sales of the ChromaID Lab Kit and ChromaID Liquid Lab Kit

●

Non Recurring Engineering (NRE) fees to assist customers with scan integration into their products

●

Licensing of the ChromaID technology

●

Royalties per unit generated from the sales of scan heads

●

Multi-unit sales of the above referenced exemplar product for as yet to be determined consumer product applications

●

Per click transaction revenue from accessing the unique ChromaID signatures

●

Developing custom product applications for customers

●

ChromaID database administration and management services

Our Acceleration of Business Development in the United States and Around the World

We are coordinating our internal business development, sales and marketing efforts with those of our strategic partners IDMC, and Sumitomo Precision Products to leverage market data and information in order to focus on specific target vertical markets which have the greatest potential for early adoption. The ChromaID Lab Kit provides a means for us to demonstrate the technology to customers in these markets. It also allows customers to experiment with developing unique applications for their particular use. Our Business Development team is pursuing license opportunities with customers in our target markets. As an example, in March 2016 we entered into a Collaboration Agreement and License with Intellicheck Mobilisa. The agreement provides Intellicheck with exclusive rights to our ChromaID technology in the areas of homeland security, law enforcement and crime prevention.

There is no requirement for FDA or other government approval for the current applications of our ChromaID technology. Over time, as we explore the application of our ChromaID technology for medical diagnostics and other applications, we expect that there will be requirements for FDA and other government approvals before applications using the technology in medical and other regulated fields can enter the marketplace.

Research and Development

Our research and development efforts are primarily focused improving the core foundational ChromaID technology and developing new and unique applications for the technology. As part of this effort, we typically conduct testing to ensure that ChromaID application methods are compatible with the customer’s requirements, and that they can be implemented in a cost effective manner. We are also actively involved in identifying new application methods. Our team has considerable experience working with the application of light-based technologies and their application to various industries. We believe that its continued development of new and enhanced technologies relating to our core business is essential to our future success. We spent $243,114 during the nine months ended June 30, 2016 and $362,661 and $670,742 for the years ended September 30, 2015 and 2014, respectively, on development activities. Our research and development efforts are supported internally, through its relationship with IDMC and through contractors led by Dr. Tom Furness and his team at RATLab LLC.

Our Patents

We believe that our ten patents, 20 patent applications, and two registered trademarks, and our trade secrets, copyrights and other intellectual property rights are important assets for us. Our patents will expire at various times between 2027 and 2033. The duration of our trademark registrations varies from country to country. However, trademarks are generally valid and may be renewed indefinitely as long as they are in use and/or their registrations are properly maintained.

The patents that have been granted to Visualant include:

On August 9, 2011, we were issued US Patent No. 7,996,173 B2 entitled “Method, Apparatus and Article to Facilitate Distributed Evaluation of Objects Using Electromagnetic Energy,” by the United States Office of Patents and Trademarks. The patent expires August 24, 2029.

On December 13, 2011, we were issued US Patent No. 8,076,630 B2 entitled “System and Method of Evaluating an Object Using Electromagnetic Energy” by the United States Office of Patents and Trademarks. The patent expires November 7, 2028.

On December 20, 2011, we were issued US Patent No. 8,081,304 B2 entitled “Method, Apparatus and Article to Facilitate Evaluation of Objects Using Electromagnetic Energy” by the United States Office of Patents and Trademarks. The patent expires July 28, 2030.

On October 9, 2012, we were issued US Patent No. 8,285,510 B2 entitled “Method, Apparatus, and Article to Facilitate Distributed Evaluation of Objects Using Electromagnetic Energy” by the United States Office of Patents and Trademarks. The patent expires July 31, 2027.

On February 5, 2013, we were issued US Patent No. 8,368,878 B2 entitled “Method, Apparatus and Article to Facilitate Evaluation of Objects Using Electromagnetic Energy by the United States Office of Patents and Trademarks. The patent expires July 31, 2027.

On November 12, 2013, we were issued US Patent No. 8,583,394 B2 entitled “Method, Apparatus and Article to Facilitate Distributed Evaluation of Objects Using Electromagnetic Energy by the United States Office of Patents and Trademarks. The patent expires July 31, 2027.

On November 21, 2014, we were issued US Patent No. 8,888,207 B2 entitled “Systems, Methods, and Articles Related to Machine-Readable Indicia and Symbols” by the United States Office of Patents and Trademarks. The patent expires February 7, 2033.

On March 23, 2015, we were issued US Patent No. 8,988,666 B2 entitled “Method, Apparatus, and Article to Facilitate Evaluation of Objects Using Electromagnetic Energy” by the United States Office of Patents and Trademarks. The patent expires July 31, 2027.

On May 26, 2015, we were issued patent US Patent No. 9,041,920 B2 entitled “Device for Evaluation of Fluids using Electromagnetic Energy” by the United States Office of Patents and Trademarks. The patent expires March 12, 2033.

On April 19, 2016, we were issued patent US Patent No. 9,316,581 B2 entitled “Method, Apparatus, and Article to Facilitate Evaluation of Substances Using Electromagnetic Energy” by the United States Office of Patents and Trademarks. The patent expires March 12, 2033.

We pursue an aggressive patent strategy to expand our unique intellectual property in the United States and other countries.

Services and License Agreement Invention Development Management Company, L.L.C.

In November 2013, we entered into a Services and License Agreement with Invention Development Management Company. IDMC is a subsidiary of Intellectual Ventures, which collaborates with inventors and partners with pioneering companies and invests both expertise and capital in the process of invention. On November 19, 2014, we amended the Services and License Agreement with IDMC. This amendment exclusively licenses 10 filed patents to us

The agreement requires IDMC to identify and engage inventors to develop new applications of our ChromaID™ technology, present the developments to us for approval, and file at least 10 patent applications to protect the developments. IDMC is responsible for the development and patent costs. We provided the Chroma ID Lab Kits to IDMC at no cost and are providing ongoing technical support. In addition, to provide time for this accelerated expansion of its intellectual property we delayed the selling of the ChromaID Lab Kits for 140 days except for certain select accounts. We have continued our business development efforts during this period and have worked with IDMC and their global business development resources to secure potential customers and licensees for the ChromaID technology. We shipped 20 ChromaID Lab Kits to inventors in the IDMC network during December 2013 and January 2014. As part of our agreement with IDMC, we curtailed our ChromaID marketing efforts through the fourth calendar quarter of 2014 while IDMC worked to expand our intellectual property portfolio. Thereafter, we began to actively market the ChromaID Lab Kits to interested and qualified customers.

We have received a worldwide, nontransferable, exclusive license to the intellectual property developed under the IDMC agreement during the term of the agreement, and solely within the identification, authentication and diagnostics field of use, to (a) make, have made, use, import, sell and offer for sale products and services; (b) make improvements; and (c) grant sublicenses of any and all of the foregoing rights (including the right to grant further sublicenses).

We received a nonexclusive and nontransferable option to acquire a worldwide, nontransferable, nonexclusive license to the useful intellectual property held by IDMC within the identification, authentication and diagnostics field of use to (a) make, have made, use, import, sell and offer to sell products and services and (b) grant sublicenses to any and all of the foregoing rights. The option to acquire this license may be exercised for up to two years from the effective date of the Agreement.

IDMC is providing global business development services to us for geographies not being pursued by Visualant. Also, IDMC has introduced us to potential customers, licensees and distributors for the purpose of identifying and pursuing a license, sale or distribution arrangement or other monetization event.

We granted to IDMC a nonexclusive, worldwide, fully paid, nontransferable, sublicenseable, perpetual license to our intellectual property solely outside the identification, authentication and diagnostics field of use to (a) make, have made, use, import, sell and offer for sale products and services and (b) grant sublicenses of any and all of the foregoing rights (including the right to grant further sublicenses).

We granted to IDMC a nonexclusive, worldwide, fully paid up, royalty-free, nontransferable, non-sublicenseable, perpetual license to access and use our technology solely for the purpose of marketing the aforementioned sublicenses of our intellectual property to third parties outside the designated fields of use.

In connection with the original license agreement, we issued a warrant to purchase 97,169 shares of common stock to IDMC as consideration for the exclusive intellectual property license and application development services. The warrant has a current exercise price of $2.50 per share and expires November 10, 2018. The per share price is subject to adjustment based on any issuances below $2.50 per share except as described in the warrant.

We agreed to pay IDMC a percentage of license revenue for the global development business services and a percentage of revenue received from any company introduce to us by IDMC. We also have also agreed to pay IDMC a royalty when we receive royalty product revenue from an IDMC-introduced company. IDMC has agreed to pay us a license fee for the nonexclusive license of our intellectual property.

The term of both the exclusive intellectual property license and the nonexclusive intellectual property license commences on the effective date of November 11, 2013, and terminates when all claims of the patents expire or are held in valid or unenforceable by a court of competent jurisdiction from which no appeal can be taken.

The term of the Agreement commences on the effective date until either party terminates the Agreement at any time following the fifth anniversary of the effective date by providing at least ninety days’ prior written notice to the other party.

TransTech Systems, Inc.

Our wholly owned subsidiary, TransTech Systems, Inc., is a distributor of products, including systems solutions, components and consumables, for employee and personnel identification in government and the private sector, document authentication, access control, and radio frequency identification. TransTech provides these products and services, along with marketing and business development assistance to value-added resellers and system integrators throughout North America.

We expect our ownership of TransTech to accelerate our market entry and penetration through well-operated and positioned dealers of security and authentication systems, thus creating a natural distribution channel for products featuring our proprietary ChromaID technology. TransTech currently provides substantially all of our revenues. Its management team functions independently from Visualant’s and its operations require a minimal commitment of our management time and other resources. Our acquisition of TransTech in June 2010 and its operations are described in greater detail below.

Agreements with Sumitomo Precision Products Co., Ltd.

In May 2012, we entered into a Joint Research and Product Development Agreement with SumitomoPrecision Products Co., Ltd., a publicly-traded Japanese corporation, for the commercialization of our ChromaID technology. In March 2013, we entered into an amendment to this agreement, which extended the Joint Development Agreement from March 31, 2013 to December 31, 2013. The extension provided for continuing work between Sumitomo and Visualant focused upon advancing the ChromaID technology and market research aimed at identifying the most significant markets for the ChromaID technology. This collaborative work supported the development of the ChromaID Lab Kit. This agreement expired December 31, 2013. The current version of the technology was introduced to the marketplace as a part of our ChromaID Lab Kit during the fourth quarter of 2013. Sumitomo invested $2,250,000 in exchange for 115,385 shares of restricted shares of common stock priced at $19.50 per share that was funded on June 21, 2012.

We also entered into a License Agreement with Sumitomo in May 2012, under which Sumitomo paid the Company an initial payment of $1 million. The License Agreement granted Sumitomo an exclusive license for the then extant ChromaID technology. The territories covered by this license include Japan, China, Taiwan, Korea and the entirety of Southeast Asia (Burma, Indonesia, Thailand, Cambodia, Laos, Vietnam, Singapore and the Philippines). The Sumitomo License fee was recorded as revenue over the life the Joint Research and Product Development Agreement and was fully recorded as of May 31, 2013. On May 21, 2015, we entered into an amendment to the License Agreement, which, effective as of June 18, 2014, eliminated the Sumitomo exclusivity and provides that if we sell products in certain territories – Japan, China, Taiwan, Korea and the entirety of Southeast Asia (Burma, Indonesia, Thailand, Cambodia, Laos, Vietnam, Singapore and the Philippines) – the Company will pay Sumitomo a royalty rate of 2% of net sales (excluding non-recurring engineering revenues) over the remaining term of the five-year License Agreement (through May 2017).

Risks That We Face

Our business is subject to a number of risks of which you should be aware before making an investment decision. We are exposed to various risks related to our business and financial position (specifically our need for additional financing), this offering, our common stock and our recent reverse stock split. These risks are discussed more fully in the "Risk Factors" section of this prospectus beginning on page 11.

| · | Initially, entering the diabetes glucose monitoring market with our non-invasive glucose monitoring device. |

| | |

| · | Following our entry into the glucose monitoring market, entering other clinical monitoring markets for continuous, non-invasive hormone, medication metabolites, endocrinology components, and biomolecular monitoring. |

| · | Applying our platform technology to lifestyle analysis, clinical trials, and chronic illnesses. We believe that potential use cases include real-time wearable medication monitoring and detection of, for example, ovulation and hormone deficiency. |

| | |

| · | With a potential ever-growing body of non-invasively determined analytes available from individuals utilizing our technology we believe, over time, with longitudinal data we will be able to engage in so-called “predictive health” and provide early warnings of the onset of disease. |

| | |

| · | Significantly, every new application will likely function utilizing the same sensor. We expect that hardware changes will not be required to target new analytes, so you will not need a new device, but an updated software algorithm will be required. |

| | |

| · | Each new application provides potential new opportunities for monetization of the platform technology. Each additional analyte we identify over time may require its own subsequent FDA clearance. |

Corporate Information

We were incorporated under the laws of the State of Nevada on October 8, 1998. Our executive offices areoffice is located at 500 Union Street, Suite 420,810, Seattle, WA 98101. Our telephone number is (206) 903-1351 and our principal website address is located at www.visualant.net.

www.knowlabs.co. The information contained on or that can be accessed through, our website is not incorporated intoby reference in and is not deemed a part of this prospectus. You should not rely on our website or any such information in making your decision whether to purchase our common stock.

Securities offered:Common Stock being offered by Selling Stockholder | | 3,571,428Up to 4,800,000 shares of Common Stock, issuable upon full conversion of a Note in the principal amount of $4,800,000, and up to 6,000,000 shares of Common Stock underlying the Warrant. The selling stockholder may sell its shares of Common Stock at prevailing market prices or privately negotiated prices. We will not receive any proceeds from the sales by the selling stockholder. |

| |

Use of Proceeds | We will not receive any proceeds from the sale of shares by the selling stockholder. |

| |

Common stock outstanding immediately after the offering | 87,312,146 shares |

| |

Trading Symbol | Our common stock is listed on the NYSE American stock exchange under the symbol “KNW.” |

| |

Risk Factors | The securities offered by this prospectus are speculative and involve a high degree of risk and investors purchasing securities should not purchase the securities unless they can afford the loss of their entire investment. You should read “Risk Factors,” beginning on page 8 as well as those risk factors in our Annual Report on Form 10-K for the fiscal year ended September 30, 2023, subsequent Quarterly Reports on Form 10-Q for the period ended December 31, 2023, and our other filings with the SEC, all of which includes (i) upare incorporated by reference herein, before deciding to 1,785,714 invest in our common stock. |

| |

Transfer Agent | Equiniti Trust Company located at 6201 15th Avenue, Brooklyn, New York 11219, telephone number (800) 937-5449, as the transfer agent for our common stock. |

The number of shares of common stock outstanding immediately following this offering is based on 82,512,146 shares outstanding as of March 25, 2024 and excludes:

| · | 29,347,106 shares of common stock that we may issue to the Selling Stockholder upon conversion of Series C Redeemable Convertible Preferred Stock, and (ii) up to 1,785,714 shares ofour common stock issuable upon the exercise of options outstanding Series E Warrants Shares. Our Common Stock is described in further detail in the sectionas of the prospectus titled “DESCRIPTION OF SECURITIES”March 25, 2024 under our 2021 Equity Incentive Plan (the “2021 Plan”), at a weighted average exercise price of $0.853 per share (including unearned stock option grants totaling 4,179,825 shares related to performance milestones); |

| | |

Common stock outstanding before the offering (1): | | 2,356,152 shares2 |

| | |

Common stock to be outstanding after this offering (2):Table of Contents |

| · | 5,950,914 shares

|

| | |

Use of Proceeds:

| | We will not receive any of the proceeds from the sale of7,111,706 additional shares of common stock by the Selling Stockholder. Upon exercise of the Series E Warrants, however, we will receive up to $0.70 per share or such lower price as may result from the anti-dilution protection features of such warrants. Any proceeds received from the exercise of such warrants will be used for general working capital and other corporate purposes. |

| | |

Terms of Warrants: | | Each Series E Warrant entitles the holder thereof to purchase one common share at an exercise price or $0.70 per full share, for a five year period ending August 5, 2021. The price per Warrant Share shall be subject to adjustment for stock splits, combinations, and similar recapitalization events and anti-dilution protection features. |

| | |

Risk Factors:

| | An investment in our common stock involves a high degree of risk. You should carefully consider the risk factors set forththat are reserved for issuance under the "Risk Factors" section hereunder and the other information contained in this prospectus before making an investment decision regarding our common stock. Our common stock should not be purchased by investors who cannot afford the loss of their entire investment.2021 Plan; |

| | |

OTCQB Symbol: | · | Our common stock is currently quoted on the OTCQB (the “OTCQB”) under the symbol “VSUL”. |

| | |

Reverse Split:

| | On June 17, 2015, we effected a 1-for-150 reverse stock split of our common stock. All warrant, option, share and per share information in this prospectus gives retroactive effect to the 1-for-150 split with all numbers rounded up to the nearest whole share. |

(1)

The number of shares of our common stock outstanding before this offering is based on 2,356,152 shares of our common stock outstanding as of September 1, 2016, and excludes, as of that date:

● 50,942 shares of our common stock issuable upon the exercise of outstanding stock options outstanding at a weighted-average exercise price of $18.04 per share;

● 23,334 shares of our common stock issuable upon the conversion of Series A Convertible Preferred Stock;

● 3,188,734 shares of our common stock issuable upon the exercise of outstanding warrants at an average exercise price of $0.89 per share. 1,785,714 shares of our common stock issuable upon the exercise of outstanding warrants, at an exercise price of $0.70, are being registered in this offering. The warrants will expire on or before August 2021;

● Up to 277,106 shares of our common stock issuable upon the exercise of placement agent warrants exercisable at $1.12 per share.

● An unknown number of shares of our common stock issuable upon the conversion of $810,000 of Convertible Notes Payable and an unknown number of our common shares issuable upon the exercise of $710,000 of warrants related to Convertible Notes Payable;

● 27,391 additional shares of our common stock available for future issuance under our 2011 Stock Incentive Plan;

● 1,785,714 shares of our common stock issuable upon the conversion of Series C Convertible Preferred Stock, at an exercise price of $0.70, subject to certain adjustments. These shares of common stock are being registered in this offering.

(2) | This total includes 23,3348,108,356 shares of our common stock issuable upon the conversion of Series AC Convertible Preferred Stock, 1,785,714 and Series D Convertible Preferred Stock as of March 25, 2024, and approximately 3,201,534 shares of common stock issuable upon conversionshares reserved to pay dividends on the outstanding shares of Series C Convertible Preferred Stock and 1,785,714Series D Convertible Preferred Stock, through December 31, 2023; |

| | |

| · | 9,020,264 shares of our common stock issuable upon the conversion of convertible debentures outstanding as of March 25, 2024; and |

| | |

| · | 25,984,961 shares of our common stock issuable upon exercise of all Series E Warrants.warrants outstanding as of March 25, 2024 at a weighted average exercise price of $1.028 per share. |

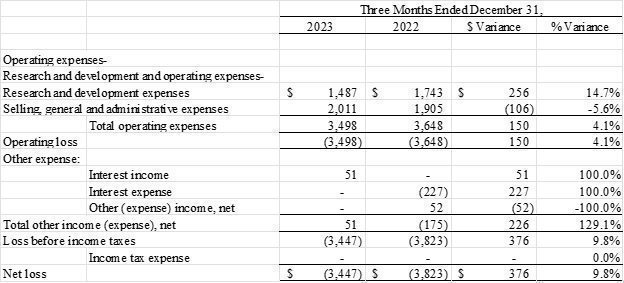

SUMMARY FINANCIAL INFORMATION

The following tables set forth a summary ofCAUTIONARY STATEMENT REGARDING FORWARD‑LOOKING STATEMENTS

This prospectus contains forward‑looking statements that are based on our historical financial data as of,management’s beliefs and for the period endedassumptions and on the dates indicated. We have derived theinformation currently available to us. All statements other than statements of operations data forhistorical facts are forward‑looking statements. The forward‑looking statements are contained principally in, but not limited to, the years ended September 30, 2015 and 2014 from our audited financial statements included in this prospectus. Historical results for any prior period are not necessarily indicative of results to be expected in any future period. You should read the following summary financial data together with our financial statements and the related notes appearing at the end of this prospectus and the "Capitalization” and "Management'ssections entitled “Prospectus Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations" sectionsOperations” and “Business.” These statements relate to future events or to our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward‑looking statements. Forward‑looking statements include, but are not limited to, statements about:

| · | our goals and strategies; |

| | |

| · | our future business development, financial condition and results of operations; |

| | |

| · | expected product development outcomes, including obtaining regulatory clearance; |

| | |

| · | expected changes in our revenue, costs or expenditures; |

| | |

| · | growth of and competition trends in our industry; |

| | |

| · | our expectations regarding demand for, and market acceptance of, our products; |

| | |

| · | our expectations regarding our relationships with investors, institutional funding partners and other parties with whom we collaborate; |

| | |

| · | our expectation regarding the use of proceeds from this offering; |

| | |

| · | fluctuations in general economic and business conditions in the markets in which we operate; and |

| | |

| · | relevant government policies and regulations relating to our industry. |

In some cases, you can identify forward‑looking statements by terms such as “may,” “could,” “will,” “should,” “would,” “expect,” “plan,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “project” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions. You should not place undue reliance on forward‑looking statements because they involve known and unknown risks, uncertainties and other factors, which are, in some cases, beyond our control and which could materially affect results. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed under the heading “Risk Factors” in this prospectus and in our Annual Report on Form 10-K for the fiscal year ended September 30, 2023, subsequent Quarterly Report on Form 10-Q for the period ended December 31, 2023, and our other filings with the SEC, all of which are incorporated by reference. If one or more of these risks or uncertainties occur, or if our underlying assumptions prove to be incorrect, actual events or results may vary significantly from those implied or projected by the forward‑looking statements. No forward‑looking statement is a guarantee of future performance.

The forward‑looking statements made in this prospectus relate only to events or information as of the date on which the statements are made in this prospectus.

StatementsAlthough we will become a public company after this offering and have ongoing disclosure obligations under United States federal securities laws, we do not intend to update or otherwise revise the forward‑looking statements in this prospectus, whether as a result of Operations Data:

(in thousands, except for share and per share data)

| | | | | | | |

| | | Years Ended September 30, |

| | | | | | | |

| | | | | | | |

| STATEMENT OF OPERATIONS DATA: | | | | | | |

| Net revenue | $4,586 | $6,291 | $7,983 | $8,573 | $7,924 | $9,136 |

| Cost of goods sold | 3,835 | 5,274 | 6,694 | 6,717 | 6,344 | 7,570 |

| Gross profit | 751 | 1,017 | 1,289 | 1,856 | 1,580 | 1,566 |

| Research and development expenses | 243 | 363 | 670 | 1,169 | 177 | 134 |

| General and administrative expenses | 2,297 | 2,984 | 3,180 | 4,581 | 3,625 | 3,691 |

| Operating (loss) | (1,789) | (2,330) | (2,561) | (3,894) | (2,222) | (2,259) |

| Other income (expense) | 1,194 | (271) | 1,538 | (2,741) | (533) | (146) |

| Net (loss) | (595) | (2,601) | (1,023) | $(6,635) | $(2,755) | $(2,405) |

| Income taxes expense (current benefit) | - | 30 | (6) | $(30) | $(29) | $(9) |

| Net (loss) | (595) | (2,631) | (1,017) | (6,605) | (2,726) | (2,396) |

| Noncontrolling interest | - | - | - | $17 | $6 | $14 |

| Net (loss) attributable to Visualant, Inc. and Subsidiaries common shareholders | $(595) | $(2,631) | $(1,017) | $(6,622) | $(2,732) | $(2,410) |

| Net (loss) per share | $(0.48) | $(2.33) | $(0.92) | $(8.06) | $(6.24) | $(8.42) |

| Weighted average number of shares | 1,236,721 | 1,131,622 | 1,108,964 | 819,563 | 437,049 | 284,552 |

Balance Sheet Data:

(in thousands)

| |

| |

BALANCE SHEET DATA: | |

Total current assets | $1,706

|

Total assets | 3,055

|

Total current liabilities | 7,230

|

Total current liabilities without derivative liabilities | 6,491

|

Total liabilities | 7,230

|

Stockholders' (deficiency) | (4,174)

|

Stockholders' (deficiency) without derivative liabilities | (3,435)

|

new information, future events or otherwise.

RISK FACTORS

InvestingAn investment in our securities involves a high degree of risk. Before deciding whether to purchase our securities, including the shares of common stock offered by this prospectus, you should carefully consider the risks and uncertainties described under “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended September 30, 2023, subsequent Quarterly Reports on Form 10-Q for the period ended December 31, 2023, and our other filings with the SEC, all of which are incorporated by reference herein. If any of these risks actually occur, our business, financial condition and results of operations could be materially and adversely affected and we may not be able to achieve our goals, the value of our securities could decline and you could lose some or all of your investment. Additional risks not presently known to us or that we currently believe are immaterial may also significantly impair our business operations. If any of these risks occur, our business, results of operations or financial condition and prospects could be harmed. In that event, the market price of our common stock, and you could lose all or part of your investment. Some statements in this prospectus, including statements in the following risk factors, constitute forward-looking statements. Please refer to the section titled “Cautionary Statement Regarding Forward-Looking Statements.”

Summary of Risk Factors

An investment in our common stock involves a high degree of risk. You should carefully consider the risks summarized below. These risks are discussed more fully in the “Risk Factors” section immediately following this summary. These risks include, but are not limited to, the following:

Risks Related to Our Business and uncertaintiesIndustry

| · | We might not be able to continue as a going concern. We believe that our cash on hand will be sufficient to fund our operations at least through August 31, 2024. |

| | |

| · | We are still in the early stages of commercialization, refining our technology. Our success depends on our ability to conclude development and market devices that are recognized as accurate, safe, and cost-effective as other options currently available in the market and cleared by FDA. |

| | |

| · | We are subject to extensive regulation by FDA, which could restrict the sales and marketing of our products and could cause us to incur significant costs; |

Risks Related to Ownership of Our Common Stock

| · | The market price of our common stock may fluctuate, and you could lose all or part of your investment. |

| | |

| · | We may not be able to maintain a listing of our common stock on the NYSE American. |

| | |

| · | We do not expect to declare or pay dividends in the foreseeable future. |

| | |

| · | Future issuances of our common stock or securities convertible into, or exercisable or exchangeable for, our common stock, or the expiration of lock-up agreements that restrict the issuance of new common stock or the trading of outstanding common stock, could cause the market price of our securities to decline and would result in the dilution of your holdings. |

| | |

| · | Future issuances of debt securities, which would rank senior to our common stock upon our bankruptcy or liquidation, and future issuances of preferred stock, which could rank senior to our common stock for the purposes of dividends and liquidating distributions, may adversely affect the level of return you may be able to achieve from an investment in our common stock. |

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully read and consider all of the risks described below, together with all of the other information contained or referred to in this prospectus, including our financial statements and the related notes appearing at the end of this prospectus,report, before decidingmaking an investment decision with respect to invest in our common stock. If any of the following risks actuallyevents occur, our business, prospects, operating results and financial condition, could sufferbusiness and results of operations (including cash flows) may be materially adversely affected. In that event, the tradingmarket price of our common stock could decline, and you could lose all or part of your investment.

Risks RelatingRelated to the Commercialization of Our Products

We may not be able to generate sufficient revenue from the commercialization of our ChromaID technology and related products to achieve or sustain profitability.

We are in the process of commercializing our ChromaID™ technology. To date, we have entered into one License Agreement with Sumitomo Precision Products Co., Ltd. and have a strategic relationship with IDMC. Failure to sell our ChromaID products, grant additional licenses and obtain royalties or develop other revenue streams will have a material adverse effect on our business, financial condition and results of operations.

We believe that our commercialization success is dependent upon our ability to significantly increase the number of customers that are using our products. To date, we have generated minimal revenue from sales of our ChromaID products. In addition, demand for our ChromaID products may not increase as quickly as planned and we may be unable to increase our revenue levels as expected. We are currently not profitable. Even if we succeed in introducing the ChromaID technology and related products to our target markets, we may not be able to generate sufficient revenue to achieve or sustain profitability.

We are in the early stages of commercialization and our ChromaID technology and related products may never achieve significant commercial market acceptance.

Our success depends on our ability to develop and market products that are recognized as accurate and cost-effective. Many of our potential customers may be reluctant to use our new technology. Market acceptance will depend on many factors, including our ability to convince potential customers that our ChromaID technology and related products are an attractive alternative to existing light-based technologies. We will need to demonstrate that our products provide accurate and cost-effective alternatives to existing light-based authentication technologies. Compared to most competing technologies, our technology is relatively new, and most potential customers have limited knowledge of, or experience with, our products. Prior to implementing our ChromaID technology and related products, potential customers are required to devote significant time and effort to testing and validating our products. In addition, during the implementation phase, customers may be required to devote significant time and effort to training their personnel on appropriate practices to ensure accurate results from our technology and products. Any failure of our ChromaID technology or related products to meet customer expectations could result in customers choosing to retain their existing testing methods or to adopt systems other than ours.

Many factors influence the perception of a system including its use by leaders in the industry. If we are unable to induce industry leaders in our target markets to implement and use our ChromaID technology and related products, acceptance and adoption of our products could be slowed. In addition, if our products fail to gain significant acceptance in the marketplace and we are unable to expand our customer base, we may never generate sufficient revenue to achieve or sustain profitability.

We may be unable to manage our future growth effectively, which could make it difficult to execute our business strategy.

We commenced our formal commercial launch in the fourth fiscal quarter of 2014 and anticipate growth in our business operations. Since our inception in 1998, we have increased our number of employees to 16 as of June 30, 2016 and we expect to increase our number of employees further as our business grows. This future growth could create strain on our organizational, administrative and operational infrastructure, including quality control, customer service and sales and marketing. Our ability to manage our growth properly will require us to continue to improve our operational, financial, and management controls, as well as our reporting systems and procedures. If our current infrastructure is unable to handle our growth, we may need to expand our infrastructure and staff and implement new reporting systems. The time and resources required to implement such expansion and systems could adversely affect our operations. Our expected future growth will impose significant added responsibilities on members of management, including the need to identify, recruit, maintain, and integrate additional employees. Our future financial performance and our ability to commercialize our products and to compete effectively will depend, in part, on our ability to manage this potential future growth effectively, without compromising quality.

Risks Relating to our Business and Financial Condition

We have a history of operating losses and there can be no assurance that we can achieve or maintain profitability.