risks emerge from time to time. It is not possible for

may cause actual results to differ materially from those contained in any forward-looking

forward-looking statements.

capital. We

have not set an offering price for the shares registered hereunder, as the only shares being registered are those sold pursuant to the GHS Financing Agreement. GHS may

sell all oralso use a portion of the

shares being offered pursuantnet proceeds to

acquire or invest in businesses, technologies, and products that are complementary to our own, although we have no current binding agreements with respect to any acquisitions as of the date of this

Prospectus at fixed pricesprospectus.This expected use of the net proceeds from this offering represents our intentions based upon our current plans and prevailing market prices atbusiness conditions. Pending our use of the timenet proceeds from this offering, we intend to invest the net proceeds in a variety of sale, at varying prices or at negotiated prices.capital preservation investments, including short-term, investment grade, interest bearing instruments and U.S. government securities.

DILUTION

Not applicable. The shares registeredMARKET FOR COMMON STOCK AND RELATED STOCKHOLDER MATTERS

Our common stock is listed on the Nasdaq Capital Market under this Registration Statement are not being offered for purchase. The shares are being registered on behalfthe symbol “SBFM.”

As of February 6, 2024, there were approximately 149 holders of record of our selling stockholders pursuant to the GHS Financing Agreement.

SELLING STOCKHOLDERS

The Selling Stockholder identified in this Prospectus may offer and sell up to 266,417,879 shares of our Common Stock, which consists of shares of Common Stock to be sold by GHS pursuant to the Financing Agreement. If issued presently, the shares of Common Stock registered for resale by GHS would represent approximately 16.8% of our issued and outstanding shares of Common Stock as of September 20, 2018.

We may require the Selling Stockholder to suspend the sales of the shares of our Common Stock being offered pursuant to this Prospectus upon the occurrence of any event that makes any statement in this Prospectus or the related Registration Statement untrue in any material respect or that requires the changing of statements in those documents in order to make statements in those documents not misleading.

The Selling Stockholder identified in the table below may from time to time offer and sell under this Prospectus any or all of the shares of Common Stock described under the column “Shares of Common Stock Being Offered” in the table below.

GHS will be deemed to be an underwriter within the meaning of the Securities Act. Any profits realized by such Selling Stockholder may be deemed to be underwriting commissions.

common stock.Equity Compensation Plan Information concerning the Selling Stockholder may change from time to time and, if necessary, we will amend or supplement this Prospectus accordingly. We cannot give an estimate as to the number of shares of Common Stock that will actually be held by the Selling Stockholder upon termination of this offering, because the Selling Stockholder may offer some or all of the Common Stock under the offering contemplated by this Prospectus or acquire additional shares of Common Stock. The total number of shares that may be sold, hereunder, will not exceed the number of shares offered, hereby. Please read the section entitled “PLAN OF DISTRIBUTION” in this Prospectus.

The manner in which the Selling Stockholder acquired or will acquire shares of our Common Stock is discussed below under “THE OFFERING.”

The following table sets forth the name of each Selling Stockholder, the number of shares ofinformation regarding our Common Stock beneficially owned by such stockholder before this offering, the number of shares to be offered for such stockholder’s account and the number and (if one percent or more) the percentage of the class to be beneficially owned by such stockholder after completion of the offering. The number of shares owned are those beneficially owned, as determined under the rules of the SEC, and such information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares of our Common Stock as to which a person has sole or shared voting power or investment power and any shares of Common Stock which the person has the right to acquire within 60 days, through the exercise of any option, warrant or right, through conversion of any security or pursuant to the automatic termination of a power of attorney or revocation of a trust, discretionary account or similar arrangement, and such shares are deemed to be beneficially owned and outstanding for computing the share ownership and percentage of the person holding such options, warrants or other rights, but are not deemed outstanding for computing the percentage of any other person. Beneficial ownership percentages are calculated based on 1,585,628,494 shares of our Common Stock outstandingequity compensation plans as of September 20, 2018.

Unless otherwise set forth below, (a) the persons and entities named in the table have sole voting and sole investment power with respect to the shares set forth opposite the Selling Stockholder’s name, subject to community property laws, where applicable, and (b) no Selling Stockholder had any position, office or other material relationship within the past three years, with us or with anyDecember 31, 2023.| Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans |

| Equity compensation plans approved by security holders(1) | -- | -- | 3,320,988 |

| Equity compensation plans not approved by security holders | -- | -- | -- |

(1) Represents our predecessors or affiliates. The number of shares of Common Stock shown as beneficially owned before the offering is based on information furnished to us or otherwise based on information available to us at the timing of the filing of the Registration Statement of which this Prospectus forms a part.

| | | Shares Owned by the Selling Stockholders | | Number of Shares to be Owned by Selling Stockholder After the Offering and Percent of Total Issued and Outstanding Shares | |

| Name of Selling Stockholder | | | | | |

| GHS Investments LLC (3) | | 0 | 266,417,879(4) | 0 | 0% |

Notes:

(1) Beneficial ownership is determined in accordance with Securities and Exchange Commission rules and generally includes voting or investment power with respect to shares of Common Stock. Shares of Common Stock subject to options, warrants and convertible debentures currently exercisable or convertible, or exercisable or convertible within 60 days, are counted as outstanding. The actual number of shares of Common Stock issuable upon the conversion of the convertible debentures is subject to adjustment depending on, among other factors, the future market price of our Common Stock, and could be materially less or more than the number estimated in the table.

(2) Because the Selling Stockholder may offer and sell all or only some portion of the 266,417,879 shares of our Common Stock being offered pursuant to this Prospectus and may acquire additional shares of our Common Stock in the future, we can only estimate the number and percentage of shares of our Common Stock that any of the Selling Stockholder will hold upon termination of the offering.

(3) Mark Grober exercises voting and dispositive power with respect to the shares of our Common Stock that are beneficially owned by GHS Investments LLC.

(4) Consists of up to 266,417,879 shares of Common Stock to be sold by GHS pursuant to the Financing Agreement.

THE OFFERING

On September 10, 2018, we entered into an2023 Equity Financing Agreement (the “Financing Agreement”) with GHS Investments LLC (“GHS”). Although we are not mandated to sell shares under the Financing Agreement, the Financing Agreement gives us the option to sell to GHS, up to $10,000,000 worth of our Common Stock over the period ending thirty six (36) months after the date this Registration Statement is deemed effective. The $10,000,000 was stated as the total amount of available funding in the Financing Agreement because this was the maximum amount that GHS agreed to offer us in funding. In connection with the Financing Agreement, the Company executed a promissory note dated September 10, 2018, in the principal amount of $20,000 (the “Note”) as payment of the commitment fee for the Financing Agreement. The Note bears interest at the rate of 8% per annum and has a maturity date of June 30, 2019. There is no assurance the market price of our Common Stock will increase in the future. The number of common shares that remain issuable may not be sufficient, dependent upon the share price, to allow us to access the full amount contemplated under the Financing Agreement. If the bid/ask spread remains the same we will not be able to place a put for the full commitment under the Financing Agreement. Based on the average of the three lowest VWAP’s of our Common Stock during the ten (10) consecutive trading day period preceding the filing date of this Registration Statement was approximately $0.00148, the Registration Statement covers the offer and possible sale of $319,382 worth of our shares.

The purchase price of the Common Stock will be set at eighty one percent (81%) of the average of the three lowest VWAPs of the Company’s Common Stock during the ten (10) consecutive trading day period immediately preceding the date on which the Company delivers a put notice to GHS. In addition, there is a maximum ownership limit for GHS of 9.99% of the issued and outstanding Common Stock of the Company.

GHS is not permitted to engage in short sales involving our Common Stock during the term of the commitment period. In accordance with Regulation SHO, however, sales of our Common Stock by GHS after delivery of a put notice of such number of shares reasonably expected to be purchased by GHS under a put will not be deemed a short sale.

In addition, we must deliver the other required documents, instruments and writings required. GHS is not required to purchase the put shares unless:

●

Our Registration Statement with respect to the resale of the shares of Common Stock delivered in connection with the applicable put shall have been declared effective;

●

We shall have obtained all material permits and qualifications required by any applicable state for the offer and sale of the registrable securities; and

●

We shall have filed all requisite reports, notices, and other documents with the SEC in a timely manner.

As we issue puts under the Financing Agreement, shares of our Common Stock will be sold into the market by GHS. The sale of these shares could cause our stock price to decline. In turn, if our stock price declines and we issue more puts, more shares will come into the market, which could cause a further drop in our stock price. You should be aware that there is an inverse relationship between the market price of our Common Stock and the number of shares to be issued under the Financing Agreement. If our stock price declines, we will be required to issue a greater number of shares. We have no obligation to utilize any or the full amount available under the Financing Agreement.

Neither the Financing Agreement nor any of our rights or GHS’s rights thereunder may be assigned to any other person.

PLAN OF DISTRIBUTION

The Selling Stockholder named above and any of its pledgees and successors-in-interest may, from time to time, sell any or all of their shares of Common Stock on OTC Markets or any other stock exchange, market or trading facility on which the shares of our Common Stock are traded or in private transactions. These sales may be at fixed prices and prevailing market prices at the time of sale, at varying prices or at negotiated prices. The Selling Stockholder may use any one or more of the following methods when selling shares:

●

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

●

block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

●

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

●

privately negotiated transactions;

●

broker-dealers may agree with the Selling Stockholder to sell a specified number of such shares at a stipulated price per share; or

●

a combination of any such methods of sale.

Broker-dealers engaged by the Selling Stockholder may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the Selling Stockholder (or, if any broker-dealer acts as agent for the purchaser of shares, from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this Prospectus, in the case of an agency transaction not in excess of a customary brokerage commission in compliance with FINRA Rule 2440; and in the case of a principal transaction a markup or markdown in compliance with FINRA IM-2440.

GHS is an underwriter within the meaning of the Securities Act of 1933 and any broker-dealers or agents that are involved in selling the shares may be deemed to be “underwriters” within the meaning of the Securities Act of 1933 in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act of 1933. GHS has informed us that it does not have any written or oral agreement or understanding, directly or indirectly, with any person to distribute the Common Stock of our company. Pursuant to a requirement by FINRA, the maximum commission or discount to be received by any FINRA member or independent broker-dealer may not be greater than 8% of the gross proceeds received by us for the sale of any securities being registered pursuant to Rule 415 promulgated under the Securities Act of 1933.

Discounts, concessions, commissions and similar selling expenses, if any, attributable to the sale of shares will be borne by the Selling Stockholder. The Selling Stockholder may agree to indemnify any agent, dealer, or broker-dealer that participates in transactions involving sales of the shares if liabilities are imposed on that person under the Securities Act of 1933.

We are required to pay certain fees and expenses incurred by us incident to the registration of the shares covered by this Prospectus. We have agreed to indemnify the Selling Stockholder against certain losses, claims, damages and liabilities, including liabilities under the Securities Act of 1933. We will not receive any proceeds from the resale of any of the shares of our Common Stock by the Selling Stockholder. We may, however, receive proceeds from the sale of our Common Stock under the Financing Agreement with GHS. Neither the Financing Agreement with GHS nor any rights of the parties under the Financing Agreement with GHS may be assigned or delegated to any other person.

Pursuant to the terms of the Financing Agreement, we have agreed with GHS to keep this Prospectus effective until GHS has sold all of the common shares purchased by it under the Financing Agreement.

The resale shares will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in certain states, the resale shares may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

Under applicable rules and regulations under the Securities Exchange Act of 1934, any person engaged in the distribution of the resale shares may not simultaneously engage in market making activities with respect to the Common Stock for the applicable restricted period, as defined in Regulation M, prior to the commencement of the distribution. In addition, the Selling Stockholder will be subject to applicable provisions of the Securities Exchange Act of 1934 and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of shares of the Common Stock by the Selling Stockholder or any other person. We will make copies of this Prospectus available to the Selling Stockholder.

DESCRIPTION OF SECURITIES TO BE REGISTERED

Capital Stock

The Company’s authorized capital is comprised of 3,000,000,000 shares of $0.001 par value Common Stock and 30,000,000 shares of $0.10 par value Preferred Stock, to have such rights and preferences as the Directors of the Company have or may assign from time to time. Out of the authorized Preferred Stock, the Board has designated 850,000 shares as Series “A” Preferred Stock (“Series A”) and 500,000 shares as Series B Preferred Stock (“Series B”). The Company currently has 1,585,628,494 shares of Common Stock, 0 shares of Series A Preferred Stock and 500,000 shares of Series B Preferred Stock issued and outstanding. The 500,000 shares of Series B Preferred Stock are held by Dr. Steve N. Slilaty, the CEO of the Company. The Series B Preferred Stock are non-convertible, non-redeemable and non-contractible. They give the holder the right to 1,000 votes per share and may vote together with the Common Stock.

Each share of Common Stock shall have one (1) vote per share. Our Common Stock does not provide a preemptive, subscription or conversion rights and there are no redemption or sinking fund provisions or rights. Our Common Stock holders are not entitled to cumulative voting for election of Board of Directors.

Dividends

Incentive Plan.Dividend Policy

We have not paid any dividends on our Common Stock or Preferred Stock since our inceptionincorporation and do not intend to payanticipate paying any dividends in the foreseeable future.

The declaration of any future cash dividends At present, our policy is

at the discretion of our board of directors and depends upon ourto retain earnings, if any,

to develop and market our

products. Our payment of dividends in the future will depend upon, among other factors, our earnings, capital requirements, and

operating financial

position,conditions.CAPITALIZATION

The following table sets forth our general economic conditions,cash and other pertinent conditions. It is our present intention not to pay any cash dividends in the foreseeable future, but rather to reinvest earnings, if any, in our business operations.

Warrants

As of the date hereof, there are no outstanding warrants of any kind issued and outstanding.

Options

As of the date hereof, there are no outstanding options of any kind issued and outstanding. .

Securities Authorized for Issuance Under Equity Compensation Plans

Anti-Takeover EffectsFinancial Condition and Results of Various Provisions of Colorado Law

Provisions of the Colorado Revised Statutes, our articles of incorporation, as amended,Operations,” and our bylaws could make it more difficult to acquire us by means of a tender offer, a proxy contest or otherwise, or to remove incumbent officers and directors. These provisions, summarized below, would be expected to discourage certain types of takeover practices and takeover bids our Board may consider inadequate and to encourage persons seeking to acquire control of us to first negotiate with us. We believe that the benefits of increased protection of our ability to negotiate with the proponent of an unfriendly or unsolicited proposal to acquire or restructure us will outweigh the disadvantages of discouraging takeover or acquisition proposals because, among other things, negotiation of these proposals could result in an improvement of their terms.

Blank Check Preferred Stock

Our articles of incorporation permit our Board to issue Preferred Stock with voting, conversion and exchange rights that could negatively affect the voting power or other rights of our Common Stockholders. The issuance of our Preferred Stock could delay or prevent a change of control of our Company.

Limitations on Liability and Indemnification of Officers and Directors

The Colorado Revised Statutes and the Colorado Business Corporation Act (the “CBCA”) limits or eliminates the personal liability of directors to corporations and their stockholders for monetary damages for breaches of directors’ fiduciary duties as directors.

Section 7-109-102(1) of the Colorado Business Corporation Act (the “CBCA”) permits indemnification of a director of a Colorado corporation, in the case of a third party action, if the director (a) conducted himself or herself in good faith, (b) reasonably believed that (i) in the case of conduct in his or her official capacity, his or her conduct was in the corporation’s best interest, or (ii) in all other cases, his or her conduct was not opposed to the corporation’s best interest, and (c) in the case of any criminal proceeding, had no reasonable cause to believe that his conduct was unlawful. Section 7-109-103 further provides for mandatory indemnification of directors and officers who are successful on the merits or otherwise in litigation.

Section 7-109-102(4) of the CBCA limits the indemnification that a corporation may provide to its directors in two key respects. A corporation may not indemnify a director in a derivative action in which the director is held liable to the corporation, or in any proceeding in which the director is held liable on the basis of his improper receipt of a personal benefit. Sections 7-109-104 of the CBCA permits a corporation to advance expenses to a director, and Section 7-109-107(1)(c) of the CBCA permits a corporation to indemnify and advance litigation expenses to officers, employees and agents who are not directors to a greater extent than directors if consistent with law and provided for by the bylaws, a resolution of directors or shareholders, or a contract between the corporation and the officer, employee or agent.

Authorized but Unissued Shares

Our authorized but unissued shares of Common Stock and Preferred Stock will be available for future issuance without stockholder approval, except as may be required under the listing rules of any stock exchange on which our Common Stock is then listed. We may use additional shares for a variety of corporate purposes, including future public offerings to raise additional capital, corporate acquisitions and employee benefit plans. The existence of authorized but unissued shares of Common Stock and Preferred Stock could render more difficult or discourage an attempt to obtain control of us by means of a proxy contest, tender offer, merger or otherwise.

Penny Stock Considerations

Our shares will be “penny stocks” as that term is generally defined in the Securities Exchange Act of 1934 to mean equity securities with a price of less than $5.00 per share. Thus, our shares will be subject to rules that impose sales practice and disclosure requirements on broker-dealers who engage in certain transactions involving a penny stock. Under the penny stock regulations, a broker-dealer selling a penny stock to anyone other than an established customer must make a special suitability determination regarding the purchaser and must receive the purchaser’s written consent to the transaction prior to the sale, unless the broker-dealer is otherwise exempt.

In addition, under the penny stock regulations, the broker-dealer is required to:

●

Deliver, prior to any transaction involving a penny stock, a disclosure schedule prepared by the Securities and Exchange Commission relating to the penny stock market, unless the broker-dealer or the transaction is otherwise exempt;

●

Disclose commissions payable to the broker-dealer and our registered representatives and current bid and offer quotations for the securities;

●

Send monthly statements disclosing recent price information pertaining to the penny stock held in a customer’s account, the account’s value, and information regarding the limited market in penny stocks; and

●

Make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction, prior to conducting any penny stock transaction in the customer’s account.

Because of these regulations, broker-dealers may encounter difficulties in their attempt to sell shares of our Common Stock, which may affect the ability of selling shareholders or other holders to sell their shares in the secondary market and have the effect of reducing the level of trading activity in the secondary market. These additional sales practice and disclosure requirements could impede the sale of our securities, if our securities become publicly traded. In addition, the liquidity for our securities may be decreased, with a corresponding decrease in the price of our securities. Our shares in all probability will be subject to such penny stock rules and our shareholders will, in all likelihood, find it difficult to sell their securities.

INTERESTS OF NAMED EXPERTS AND COUNSEL

The consolidated financial statements for the Company as of December 31, 2017period ended September 30, 2023, and 2016 and for the years then endedrelated notes thereto, included in this Prospectus have been audited by BF Borgers CPA PC, respectively, an independent registered public accounting firm, to the extentprospectus.| | | As of September 30, 2023 | |

| | | Actual | | | As adjusted | |

| Cash and cash equivalents | | $ | 18,846,140 | | | $ | 27,296,140 | |

| Total liabilities | | | 5,686,801 | | | | 5,686,801 | |

| Stockholders’ equity: | | | | | | | | |

| Series B Preferred Stock, $0.10 par value: 1,000,000 shares authorized; 10,000 shares issued and outstanding | | | 1,000 | | | | 1,000 | |

| Common Stock, $0.001 par value: 3,000,000,000 shares authorized; 25,678,290 shares issued and outstanding, actual; 64,893,977 shares issued and outstanding, as adjusted | | | 25,678 | | | | 64,894 | |

| Capital paid in excess of par value | | | 84,387,890 | | | | 92,798,674 | |

| Accumulated comprehensive income | | | 204,549 | | | | 204,549 | |

| Accumulated (deficit) | | | (62,655,634 | ) | | | (62,655,634 | ) |

| Total stockholders’ equity | | | 21,963,483 | | | | 30,413,483 | |

The above table is based on 25,678,290 shares of common stock outstanding as of September 30, 2023, and for the periods set forth in our report and are incorporated herein in relianceexcludes 23,395,046 shares issuable upon such report given upon the authorityexercise of said firm as experts in auditing and accounting.

The legality of the shares offered under this Registration Statement will be passed upon by Lucosky Brookman LLP.

INFORMATION WITH RESPECT TO THE REGISTRANT

History

We were incorporated in the State of Colorado on August 31, 2006 under the name “Mountain West Business Solutions, Inc.” Until October 2009, our business was to provide management consulting with regard to accounting, computer and general business issues for small and home-office based companies.

In October 2009, we acquired Sunshine Biopharma, Inc., a Colorado corporation holding an exclusive license to a new anticancer drug bearing the laboratory name, Adva-27a. As a result of this transaction we changed our name to “Sunshine Biopharma, Inc. and our officers and directors resigned their positions with us and were replaced by Sunshine’s management at the time, including our current CEO, Dr. Steve N. Slilaty, and our current CFO, Camille Sebaaly each of whom remain part of our current management. Our principal business became that of a pharmaceutical company focusing on the development of our licensed Adva-27a anticancer compound. In December 2015 we acquired all issued and pending patents pertaining to our Adva-27a technology and terminated the license.

In July 2014, we formed a wholly owned Canadian subsidiary, Sunshine Biopharma Canada Inc. (“Sunshine Canada”), for the purposes of offering generic pharmaceutical products in Canada and elsewhere around the world. Sunshine Canada has recently signed licensing agreements for four (4) generic prescription drugs for the treatment of cancer and BPH (Benign Prostatic Hyperplasia).

In January 2018, we acquired Atlas Pharma Inc., a certified company dedicated to chemical analysis of pharmaceutical and other industrial samples whose operations are authorized by a Drug Establishment License issued by Health Canada.

In March 2018, we formed NOX Pharmaceuticals, Inc., a Colorado corporation and assigned all of our interest in our Adva-27a anticancer compound to that company.

Our principal place of business is located at 6500 Trans-Canada Highway, 4th Floor, Pointe-Claire, Quebec, Canada H9R 0A5. . Our phone number is (514) 426-6161and our website address is www.sunshinebiopharma.com.

Business Operations

As of the date of this Registration Statement on Form S-1 we are operating through the following wholly owned subsidiaries:

●

NOX Pharmaceuticals, Inc., a recently formed Colorado company focused on the research, development and commercialization of proprietary drugs for the treatment of cancer including Adva-27a, a multi-purpose anti-tumor compound targeted for the treatment of multidrug resistant cancer;

●

Sunshine Biopharma Canada Inc., a Canadian company, which offers generic prescription drugs for the treatment of cancer and other acute and chronic indications; and

●

Atlas Pharma Inc., a Canadian company acquired in January 2018, offering certified chemical analysis of pharmaceutical and other industrial samples.

Proprietary Drug Development Operations

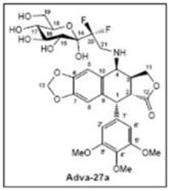

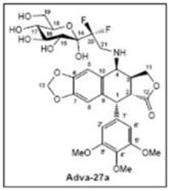

Since inception, our proprietary drug development activities have been focused on the development of a small molecule called Adva-27a for the treatment of aggressive forms of cancer. A Topoisomerase II inhibitor, Adva-27a has been shown to be effective at destroying Multidrug Resistant Cancer cells including Pancreatic Cancer cells, Breast Cancer cells, Small-Cell Lung Cancer cells and Uterine Sarcoma cells (Published in ANTICANCER RESEARCH, Volume 32, Pages 4423-4432, October 2012). Sunshine Biopharma is direct owner of all issued and pending worldwide patents pertaining to Adva-27a including U.S. Patent Number 8,236,935. See “Intellectual Property.”

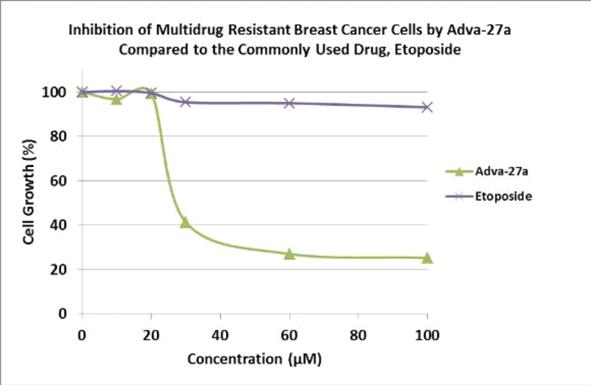

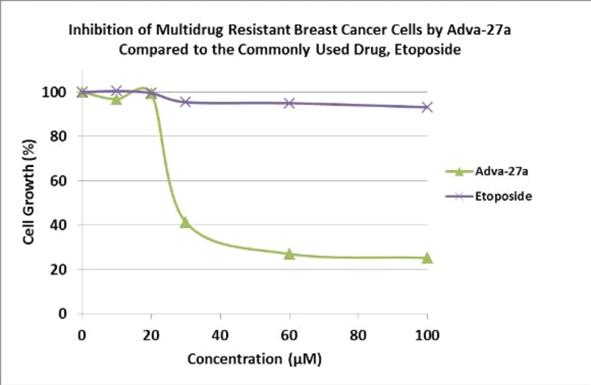

Adva-27a is a GEM-difluorinated C-glycoside derivative of Podophyllotoxin. Another derivative of Podophyllotoxin called Etoposide is currently on the market and is used to treat various types of cancer including leukemia, lymphoma, testicular cancer, lung cancer, brain cancer, prostate cancer, bladder cancer, colon cancer, ovarian cancer, liver cancer and several other forms of cancer. Etoposide is one of the most widely used anticancer drugs. Adva-27a and Etoposide are similar in that they both attack the same target in cancer cells, namely the DNA unwinding enzyme, Topoisomerase II. Unlike Etoposide, and other anti-tumor drugs currently in use, Adva-27a is able to destroy Multidrug Resistant Cancer cells. Adva-27a is the only compound known today that is capable of destroying Multidrug Resistant Cancer. In addition, Adva-27a has been shown to have distinct and more desirable biological and pharmacological properties compared to Etoposide. In side-by-side studies using Multidrug Resistant Breast Cancer cells and Etoposide as a reference, Adva-27a showed markedly improved cell killing activity (see Figure below). Our preclinical studies to date have shown that:

●

Adva-27a is effective at killing different types of Multidrug Resistant cancer cells, including Pancreatic Cancer Cells (Panc-1), Breast Cancer Cells (MCF-7/MDR), Small-Cell Lung Cancer Cells (H69AR), and Uterine Sarcoma Cells (MES-SA/Dx5).

●

Adva-27a is unaffected by P-Glycoprotein, the enzyme responsible for making cancer cells resistant to anti-tumor drugs.

●

Adva-27a has excellent clearance time (half-life = 54 minutes) as indicated by human microsomes stability studies and pharmacokinetics data in rats.

●

Adva-27a clearance is independent of Cytochrome P450, a mechanism that is less likely to produce toxic intermediates.

●

Adva-27a is an excellent inhibitor of Topoisomerase II with an IC50 of only 13.7 micromolar (this number has recently been reduce to 1.44 micromolar as a result of resolving the two isomeric forms of Adva-27a).

●

Adva-27a has shown excellent pharmacokinetics profile as indicated by studies done in rats.

●

Adva-27a does not inhibit tubulin assembly.

These and other preclinical data have been published in ANTICANCER RESEARCH, a peer-reviewed International Journal of Cancer Research and Treatment. The publication which is entitled “Adva-27a, a Novel Podophyllotoxin Derivative Found to Be Effective Against Multidrug Resistant Human Cancer Cells” [ANTICANCER RESEARCH 32: 4423-4432 (2012)] is available on our website atwww.sunshinebiopharma.com.

We have been delayed in our clinical development program due to lack of funding. Our fund raising efforts are continuing and as soon as adequate financing is in place we will continue our clinical development program of Adva-27a by conducting the following next sequence of steps:

●

GMP Manufacturing of 2 kilogram for use in IND-Enabling Studies and Phase I Clinical Trials

●

Regulatory Filing (Fast-Track Status Anticipated)

●

Phase I Clinical Trials (Pancreatic Cancer Indication)

On November 14, 2014, we entered into a Manufacturing Services Agreement with Lonza Ltd. and Lonza Sales Ltd. (hereinafter jointly referred to as “Lonza”), whereby we engaged Lonza to be the manufacturer of our Adva-27a anticancer drug. In June 2015 we received a sample of the pilot manufacturing run for evaluation. Our laboratory analyses showed that, while the sample meets all of the required chemical, physical and biological specifications, the amount of material generated (the “Yield”) by the pilot run was found to be significantly lower than anticipated. We are currently working towards finding possible solutions to increase the Yield and define a path forward. During the course of our discussions concerning the problem of the low Yield, Lonza informed us that they required us to pay them $687,818 prior to moving forward with any activity pertaining to the manufacturing agreement we have with them. We have repeatedly indicated to Lonza that a clear path defining exactly how the extremely low Yield issue would be addressed is imperative prior to us making any payments. As of the date of this Registration Statement on Form S-1, neither party has changed its position.

Adva-27a’s initial indication will be pancreatic cancer for which there are currently little or no treatment options available. We are planning to conduct our clinical trials at McGill University’s Jewish General Hospital in Montreal, Canada. All aspects of the clinical trials in Canada will employ FDA standards at all levels. We estimate that Phase I clinical trials will take 18 months to complete.

According to the American Cancer Society, nearly 1.5 million new cases of cancer are diagnosed in the U.S. each year. We believe that upon successful completion of Phase I Clinical Trials we may receive one or more offers from large pharmaceutical companies to buyout or license our drug. However, there are no assurances that our Phase I Trials will be successful, or if successful, that any pharmaceutical companies will make an acceptable offer to us. In the event we do not consummate such a transaction, we will require significant capital in order to conduct additional clinical trials, manufacture and market our new drug.

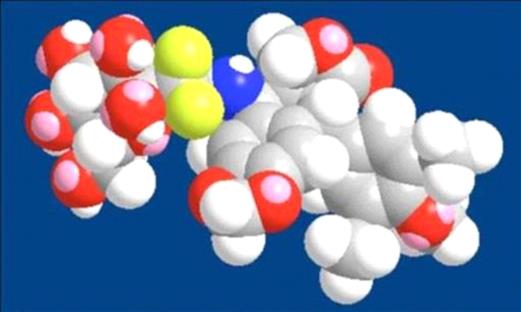

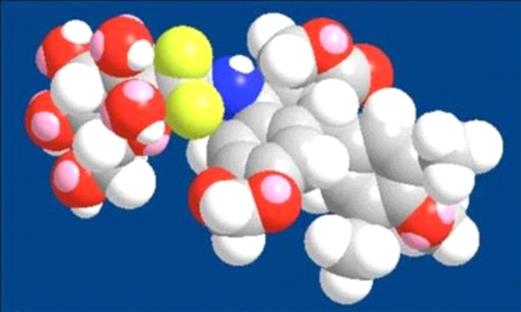

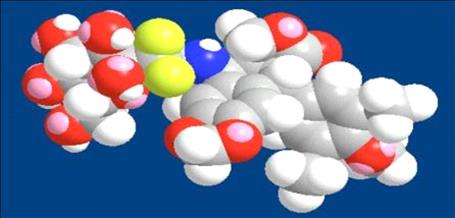

Our Lead Anti-Cancer Compound, Adva-27a, in 3D

Generic Pharmaceuticals Operations

In 2016, our Canadian wholly owned subsidiary, Sunshine Biopharma Canada Inc. (“Sunshine Canada”), signed Cross Referencing Agreementsoutstanding warrants with a major pharmaceutical company for four prescription generic drugs for the treatment of Breast Cancer, Prostate Cancer and Enlarged Prostate. Following this acquisition we have been working towards commencement of marketing of these pharmaceutical products under our own Sunshine Biopharma label. These four generic products are as follows:

●

Anastrozole (brand name Arimidex® by AstraZeneca) for treatment of Breast Cancer;

●

Letrozole (brand name Femara® by Novartis) for treatment of Breast Cancer;

●

Bicalutamide (brand name Casodex® by AstraZeneca) for treatment of Prostate Cancer;

●

Finasteride (brand name Propecia® by Merck) for treatment of BPH (Benign Prostatic Hyperplasia)

Worldwide sales of the brand name version of these products as reported by the respective pharmaceutical company, owner of the registered trademark are as follows:

Sunshine Canada is currently in the process of securing a Drug Identification Number (“DIN”) for each of these products from Health Canada. We are planning to use part of the already approved Atlas Pharma Inc. space as a drug warehouse to facilitate the process of obtaining a Drug Establishment License (“DEL”) from Health Canada. Upon receipt of the DEL and DIN’s, we will be able to accept orders for our own label SBI-Anastrozole, SBI-Letrozole, SBI-Bicalutamide and SBI-Finasteride. We cannot estimate the timing in our obtaining either the DIN’s or the DEL due to variables involved that are out of our control. The figure below shows our 30-Pill blister pack of Anastrozole.

We currently have twenty three (23) additional Generic Pharmaceuticals under review for in-licensing. While no assurances can be provided that we will acquire the rights to all or any of these drugs, we are confident we will acquire most, if not all of these rights. We believe that a larger product portfolio will provide us with more opportunities and a greater reach into the marketplace. We hope to further build our generics portfolio of “SBI” label Generic Pharmaceuticals over time. There are no assurances this will occur.

Various publicly available sources indicate that the worldwide sales of generic pharmaceuticals are approximately $200 billion per year. In the United States and Canada, the sales of generic pharmaceuticals are approximately $50 billion and $5 billion, respectively. The generic pharmaceuticals business is fairly competitive and there are several multinational players in the field including Teva (Israel), Novartis - Sandoz (Switzerland), Hospira (USA), Mylan (Netherlands), Sanofi (France), Fresenius Kabi (Germany) and Apotex (Canada). While no assurances can be provided, with our offering of Canadian approved products we believe that we will be able to access at least a small percentage of the generic pharmaceuticals marketplace.

As part of a subscription agreement entered into in 2016, we have an obligation to pay a royalty of 5% of net sales on one of our generic products (Anastrozole) for a period of three (3) years from the date of the first sale of that product. As of the date of this Registration Statement on Form S-1 we have not yet commenced marketing efforts and no sales or royalty payments have been made. On May 28, 2018 we issued 1,000,000 shares of our Common Stock valued at $5,900 in exchange for cancellation of this royalty obligation.

While no assurances can be provided and subject to the availability of adequate financing, of which there is no assurance, we anticipate that profits from the sales of Generic Products will be used to finance our proprietary drug development program, including Adva-27a, our flagship anticancer compound. In addition to near-term revenue generation, building the generics business infrastructure and securing the proper permits will render us appropriately positioned for the marketing and distribution of our proprietary Adva-27a drug candidate, provided that Adva-27a is approved for such marketing and distribution, of which there can be no assurance.

Analytical Chemistry Services Operations

On January 1, 2018, we entered into an agreement (the “Atlas Agreement”) to acquire Atlas Pharma Inc. (“Atlas”). The purchase price was $848,000 Canadian ($684,697 US). Payment of the purchase price was comprised of (i) a cash payment of $100,500 Canadian ($80,289 US), (ii) the issuance of 20,000,000 shares of our Common Stock valued at $246,000, and (iii) a promissory note in the principal amount of $450,000 Canadian ($358,407 US), with interest payable at the rate of 3% per annum. We are required to make payments of $10,000 Canadian (approximately $8,000 US) per calendar quarter, due and payable on or before the end of each such calendar quarter through December 31, 2023.

Atlas is a certified company dedicated to chemical analysis of pharmaceutical and other industrial samples. Atlas has 9 full-time employees and generated revenues of approximately $500,000 Canadian (approximately $400,000 US) in 2017. Housed in a 5,250 square foot facility, Atlas’s operations are authorized by a Drug Establishment License (DEL) issued by Health Canada and are fully compliant with the requirements of Good Manufacturing Practices (GMP). Atlas is also registered with the FDA.

Atlas is the owner of a relatively large portfolio of analytical chemistry methodology and Standard Operating Procedure. This intellectual property is protected as company secrets and controlled through employee and management confidentiality agreements.

On June 18, 2018, we purchased laboratory equipment at a total cost of $235,870 Canadian (approximately $181,580 US) for Microbiology Testing as part of our plan to expand the operations services offering of Atlas. Presently, Atlas offers Analytical Chemistry Testing and intends to offer Microbiology Testing soon.

Government Regulations

All of our business operations, including the Generic Pharmaceutical Operations, the Proprietary Drug Development Operations, and our newly acquired Analytical Chemistry Services Operations are subject to extensive and frequently changing federal, state, provincial and local laws and regulations.

In the U.S, the Federal Government agency responsible for regulating drugs is the U.S. Food and Drug Administration (“FDA”). The Canadian counterpart to the FDA is the Health Products and Food Branch (“HPFB”) of Health Canada. Both the FDA and HPFB have similar requirements for a drug to be approved for marketing. In addition, the quality standards for brand name drugs and generic drugs are the same. The ingredients, manufacturing processes and facilities for all drugs must meet the guidelines for Good Manufacturing Practices (“GMP”). Moreover, all drug manufacturers must perform a series of tests, both during and after production, to show that every drug batch made meets the regulatory agency’s requirements for that product.

In connection with our development of the new chemical entity, Adva-27a, we will be subject to significant regulations in the U.S. in order to obtain the approval of the FDA to offer our product on the market. The approximate procedure for obtaining FDA approval involves an initial filing of an IND application following which the FDA would review the application and if all the data are in order and acceptable would give the go ahead for the drug sponsor to proceed with Phase I clinical (human) trials. Following completion of Phase I, the results are filed with the FDA and a request is made to proceed to Phase II. Similarly, following completion of Phase II the data are filed with the FDA and a request is made to proceed to Phase III. Following completion of Phase III, a request is made for marketing approval. Depending on various issues and considerations, the FDA could provide limited marketing approval on a humanitarian basis if the drug treats terminally ill patients with limited treatment options available. As of the date of this Registration Statement on Form S-1 we have not made any filings with the FDA or other regulatory bodies in other jurisdictions. We have however had extensive discussions with clinicians at the McGill University’s Jewish General Hospital in Montreal where we plan to undertake our Phase I study for pancreatic cancer and multidrug resistant breast cancer they believe that Health Canada is likely to grant us a so-called fast-track process on the basis of the terminal nature of the cancer types which we will be treating. There are no assurances this will occur.

Employees

As of the date of this Registration Statement on Form S-1 we have a total of twelve (12) employees. In addition to our management team which is comprised of our three (3) officers and directors, new wholly owned subsidiary acquired on January 1, 2018, Atlas Pharma Inc., has 9 full-time employees. We anticipate that if we receive financing we will need additional employees in both our generic pharmaceutical and proprietary drug development operations including accounting, regulatory affairs, marketing, sales and laboratory personnel.

Competition

In the area of proprietary anticancer drug development, we will be competing with large publicly and privately held companies engaged in developing new cancer therapies. There are numerous other entities engaged in this business that have greater resources, both financial and otherwise, than the resources presently available to us. Nearly all major pharmaceutical companies including Amgen, Roche, Pfizer, Bristol-Myers Squibb and Novartis, to name just a few, have on-going anti-cancer drug development programs and some of the drug they may develop could be in direct competition with our drug. Also, a number of small companies are also working in the area of cancer and could develop drugs that may be in competition with ours. However, none of these competitor companies can use molecules similar to ours as they would be infringing our patents.

The generic pharmaceuticals business is fairly competitive and there are many players in the field including several multinationals such as Teva (Israel), Novartis - Sandoz (Switzerland), Hospira (USA), Mylan (Netherlands), Sanofi (France), Fresenius Kabi (Germany) and Apotex (Canada)with annual sales in the range of approximately $2 billion to over $10. With our offering of Canadian approved generic products, we believe that we will be able to access at least a small percentage of the generic pharmaceuticals market.

Intellectual Property

Effective October 8, 2015, we executed a Patent Purchase Agreement (the “October Purchase Agreement”), with Advanomics, a related party, pursuant to which we acquired all of the right, title and interest in and to U.S. Patent Number 8,236,935 (the “US Patent”) for our anticancer compound, Adva-27a. On December 28, 2015, we executed a second Patent Purchase Agreement (the “December Purchase Agreement”), with Advanomics, pursuant to which we acquired all of the right, title and interest in and to all of the remaining worldwide rights covered by issued and pending patents under PCT/FR2007/000697 and PCT/CA2014/000029 (the “Worldwide Patents”) for our anticancer compound, Adva-27a.

Effective December 28, 2015, we entered into amendments (the “Amendments”) of these Purchase Agreements pursuant to which the total purchase price was reduced from $17,142,499 to $618,810, the book value of this intellectual property on the financial statements of Advanomics. Further, the Amendments provided for automatic conversion of the promissory notes representing the new purchase price into an aggregate of 321,305,415 shares of our Common Stock once we increase our authorized capital such that these shares can be issued. In July 2016 we increased our authorized capital and issued the 321,305,415 Common shares to Advanomics thereby completing all aspects of the patent purchase arrangements and securing direct ownership of all worldwide patents and rights pertaining to Adva-27a.

In addition, in 2016 we signed Cross Referencing Agreements with a major pharmaceutical company for four (4) prescription generic drugs for the treatment of Breast Cancer, Prostate Cancer and Enlarged Prostate. These agreements give us the right to register the four (4) generic products, Anastrozole, Letrozole, Bicalutamide and Finasteride in Canada under our own label and obtain a DIN for each in order to be able to place them on the market.

Our new wholly owned subsidiary, Atlas Pharma Inc., which we acquired on January 1, 2018 holds a Drug Establishment License from Health Canada and is registered with the FDA. Atlas Pharma Inc. is the owner of a relatively large portfolio of analytical chemistry methodology and Standard Operating Procedure. This intellectual property is protected as company secrets and controlled through employee and management confidentiality agreements.

Equity Financing Agreement and Registration Rights Agreement

On September 10, 2018, Sunshine Biopharma, Inc., a Colorado corporation (the “Company”), entered into an Equity Financing Agreement (“Equity Financing Agreement”) and Registration Rights Agreement (“Registration Rights Agreement”) with GHS Investments LLC, a Nevada limited liability company (“GHS”). Under the terms of the Equity Financing Agreement, GHS agreed to provide the Company with up to $10,000,000 upon effectiveness of a Registration Statement on Form S-1 (the “Registration Statement”) filed with the U.S. Securities and Exchange Commission (the “Commission”).

Following effectiveness of the Registration Statement, the Company shall have the discretion to deliver puts to GHS and GHS will be obligated to purchase shares of the Company’s Common Stock, par value $0.001 per share (the “Common Stock”) based on the investment amount specified in each put notice. The maximum amount that the Company shall be entitled to put to GHS in each put notice shall not exceed two hundred fifty percent (250%) of theweighted average

daily trading dollar volume of the Company’s Common Stock during the ten (10) trading days preceding the put date, so long as such amount does not exceed $300,000. Pursuant to the Equity Financing Agreement, GHS and its affiliates will not be permitted to purchase and the Company may not put shares of the Company’s Common Stock to GHS that would result in GHS’s beneficial ownership equaling more than 9.99% of the Company’s outstanding Common Stock. Theexercise price of

each put share shall be equal to eighty one percent (81%) of the Market Price (as defined in the Equity Financing Agreement). Puts may be delivered by the Company to GHS until the earlier of thirty-six (36) months after the effectiveness of the Registration Statement or the date on which GHS has purchased an aggregate of $10,000,000 worth of Common Stock under the terms of the Equity Financing Agreement. Additionally, in accordance with the Equity Financing Agreement, the Company shall issue GHS a promissory note in the principal amount of $20,000 to offset transaction costs (the “Note”). The Note bears interest at the rate of 8% per annum, is not convertible and is due on June 30, 2019.$1.94.The Registration Rights Agreement provides that the Company shall (i) use its best efforts to file with the Commission the Registration Statement within 30 days of the date of the Registration Rights Agreement; and (ii) have the Registration Statement declared effective by the Commission within 30 days after the date the Registration Statement is filed with the Commission, but in no event more than 90 days after the Registration Statement is filed.

MARKET PRICE OF THE REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Market Information

Trading of our Common Stock commenced on the OTC MARKETS in September 2007 under the symbol “MWBN.” Effective November 30, 2009, the trading symbol for our Common Stock was changed to “SBFM” as a result of our name change discussed above.

The table below sets forth the reported high and low bid prices for the periods indicated. The bid prices shown reflect quotations between dealers, without adjustment for markups, markdowns or commissions, and may not represent actual transactions in our Common Stock.

| Quarter Ended | | |

| | | |

| March 31, 2016 | $0.0088 | $0.0052 |

| June 30, 2016 | $0.0110 | $0.0061 |

| September 30, 2016 | $0.0039 | $0.0030 |

| December 31, 2016 | $0.0040 | $0.0032 |

| | | |

| March 31, 2017 | $0.0025 | $0.0025 |

| June 30, 2017 | $0.0134 | $0.0110 |

| September 30, 2017 | $0.0155 | $0.0141 |

| December 31, 2017 | $0.0130 | $0.0100 |

| | | |

| March 31, 2018 | $$0.0175 | $0.0079 |

| June 30, 2018 | $0.0087 | $0.0041 |

| September 30, 2018 (through September 26, 2018) | $$0.0078 | $0.0013 |

Trading volume in our Common Stock varies between a few hundred thousand shares to several million shares per day. As a result, the trading price of our Common Stock is subject to significant fluctuations.

Holders of Common Equity

As of the date hereof, there were approximately 146 stockholders of record. An additional number of stockholders are beneficial holders of our Common Stock in “street name” through banks, brokers and other financial institutions that are the record holders.

Dividend Information

We have not paid any cash dividends to our holders of Common Stock or Preferred Stock. The declaration of any future cash dividends is at the discretion of our board of directors and depends upon our earnings, if any, our capital requirements and financial position, our general economic conditions, and other pertinent conditions. It is our present intention not to pay any cash dividends in the foreseeable future, but rather to reinvest earnings, if any, in our business operations.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATION

You should read theOPERATIONSThe following discussion ofhighlights the principal factors that have affected our financial condition and results of operations as well as our liquidity and capital resources for the periods described. This discussion should be read in conjunction with our financial statements and the related notes thereto included elsewhere in this Prospectus. The followingprospectus. This discussion contains forward-looking statements that reflect our plans, estimatesstatements. Please see “Cautionary Note Regarding Forward-Looking Statements” for a discussion of the uncertainties, risks and beliefs. Our actual results could differ materially from those discussed in theassumptions associated with these forward-looking statements. Factors that could cause or contribute to these differences include those discussed below and elsewhere in this Prospectus, particularly in the section labeled “Risk Factors.”

This sectionResults of the Prospectus includes a numberOperations

Comparison of forward-looking statements that reflect our current views with respect to future events and financial performance. Forward-looking statements are often identified by words like “believe,” “expect,” “estimate,” “anticipate,” “intend,” “project,” and similar expressions, or words that, by their nature, refer to future events. You should not place undue certainty on these forward-looking statements, which apply only asresults of the date of this Prospectus. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or our predictions.

Overview And History

We were incorporated in the State of Colorado on August 31, 2006 under the name “Mountain West Business Solutions, Inc.” Until October 2009, our business was to provide management consulting with regard to accounting, computer and general business issues for small and home-office based companies.

In October 2009, we acquired Sunshine Biopharma, Inc., a Colorado corporation holding an exclusive license to a new anticancer drug bearing the laboratory name, Adva-27a. As a result of this transaction we changed our name to “Sunshine Biopharma, Inc.” and our officers and directors resigned their positions with us and were replaced by Sunshine Biopharma, Inc.’s management at the time, including our current CEO, Dr. Steve N. Slilaty, and our current CFO, Camille Sebaaly each of whom remain part of our current management. Our principal business became that of a pharmaceutical company focusing on the development of our licensed Adva-27a anticancer compound. In December 2015 we acquired all issued and pending patents pertaining to our Adva-27a technology and terminated the license.

In July 2014, we formed a wholly owned Canadian subsidiary, Sunshine Biopharma Canada Inc. (“Sunshine Canada”),operations for the

purposes of offering generic pharmaceutical productsthree months ended September 30, 2023 and 2022During the three months ended September 30, 2023, we generated $5,957,668 in Canada and elsewhere around the world. Sunshine Canada has signed licensing agreements for four (4) generic prescription drugssales, compared to $132,808 for the treatmentthree months ended September 30, 2022, an increase of breast cancer, prostate cancer and BPH (Benign Prostatic Hyperplasia). We have applied for and are currently awaiting the issuance$5,824,860. The increase is attributable to sales generated by Health Canada of a Drug Establishment License and a Drug Identification Number for each of our four (4) generic products in order to begin marketing of the same.

In January 2018, we acquired Atlas Pharma Inc. (“Atlas”), a certified company dedicated to chemical analysis of pharmaceutical and other industrial samples whose operations are authorized by a Drug Establishment License issued by Health Canada. Atlas has been generating revenues since its inception in September 2013. The revenues reported in our consolidated financial statements for the first calendar quarter of 2018 are a result of the Atlas operations.

In March 2018, we formed NOX Pharmaceuticals, Inc., a Colorado corporation, and assigned all of our interest in our Adva-27a anticancer compound to that company. NOX Pharmaceuticals Inc.’s mission is to research, develop and commercialize proprietary drugs including Adva-27a.

As a result, we are now a holding company operating through these three wholly owned subsidiaries.

Our principal place of business is located at 6500 Trans-Canada Highway, 4th Floor, Pointe-Claire, Quebec, Canada H9R 0A5. Our phone number is (514) 426-6161and our website address is www.sunshinebiopharma.com.

We have not been subject to any bankruptcy, receivership or similar proceeding.

Operations

Proprietary Drug Development Operations

Since inception, our proprietary drug development activities have been focused on the development of a small molecule called Adva-27a for the treatment of aggressive forms of cancer. A Topoisomerase II inhibitor, Adva-27a has been shown to be effective at destroying Multidrug Resistant Cancer cells including Pancreatic Cancer cells, Breast Cancer cells, Small-Cell Lung Cancer cells and Uterine Sarcoma cells (Published in ANTICANCER RESEARCH, Volume 32, Pages 4423-4432, October 2012). Sunshine Biopharma Inc. owns all of the rights, as well as, all of the issued and pending worldwide patents pertaining to Adva-27a, including U.S. Patent Number 8,236,935.

Adva-27a is a GEM-difluorinated C-glycoside derivative of Podophyllotoxin. Another derivative of Podophyllotoxin called Etoposide is currently on the market and is used to treat various types of cancer including leukemia, lymphoma, testicular cancer, lung cancer, brain cancer, prostate cancer, bladder cancer, colon cancer, ovarian cancer, liver cancer and several other forms of cancer. Etoposide is one of the most widely used anticancer drugs. Adva-27a and Etoposide are similar in that they both attack the same target in cancer cells, namely the DNA unwinding enzyme, Topoisomerase II. Unlike Etoposide, and other anti-tumor drugs currently in use, Adva-27a is able to destroy Multidrug Resistant Cancer cells. Adva-27a is the only compound known today that is capable of destroying Multidrug Resistant Cancer. In addition, Adva-27a has been shown to have distinct and more desirable biological and pharmacological properties compared to Etoposide. In side-by-side studies using Multidrug Resistant Breast Cancer cells and Etoposide as a reference, Adva-27a showed markedly improved cell killing activity (see Figure below). Our preclinical studies to date have shown that:

●

Adva-27a is effective at killing different types of Multidrug Resistant cancer cells, including Pancreatic Cancer Cells (Panc-1), Breast Cancer Cells (MCF-7/MDR), Small-Cell Lung Cancer Cells (H69AR), and Uterine Sarcoma Cells (MES-SA/Dx5).

●

Adva-27a is unaffected by P-Glycoprotein, the enzyme responsible for making cancer cells resistant to anti-tumor drugs.

●

Adva-27a has excellent clearance time (half-life = 54 minutes) as indicated by human microsomes stability studies and pharmacokinetics data in rats.

●

Adva-27a clearance is independent of Cytochrome P450, a mechanism that is less likely to produce toxic intermediates.

●

Adva-27a is an excellent inhibitor of Topoisomerase II with an IC50 of only 13.7 micromolar (this number has recently been reduce to 1.44 micromolar as a result of resolving the two isomeric forms of Adva-27a).

●

Adva-27a has shown excellent pharmacokinetics profile as indicated by studies done in rats.

●

Adva-27a does not inhibit tubulin assembly.

These and other preclinical data have been published in ANTICANCER RESEARCH, a peer-reviewed International Journal of Cancer Research and Treatment. The publication which is entitled “Adva-27a, a Novel Podophyllotoxin Derivative Found to Be Effective Against Multidrug Resistant Human Cancer Cells” [ANTICANCER RESEARCH 32: 4423-4432 (2012)] is available on our website atwww.sunshinebiopharma.com.

We have been delayed in our clinical development program due to lack of funding. Our fund raising efforts are continuing and as soon as adequate financing is in place we will continue our clinical development program of Adva-27a by conducting the following next sequence of steps:

●

GMP Manufacturing of 2 kilogram for use in IND-Enabling Studies and Phase I Clinical Trials

●

Regulatory Filing (Fast-Track Status Anticipated)

●

Phase I Clinical Trials (Pancreatic Cancer Indication)

Adva-27a’s initial indication will be Pancreatic Cancer for which there are currently little or no treatment options available. We are planning to conduct our clinical trials at McGill University’s Jewish General Hospital in Montreal, Canada. All aspects of the clinical trials in Canada will employ FDA standards at all levels. We estimate that the Pancreatic Cancer clinical trials will take approximately 18 months from start to finish.

Our Lead Anti-Cancer Compound, Adva-27a, in 3D

Generic Pharmaceuticals Operations

In 2016, our Canadian wholly owned subsidiary, Sunshine Biopharma Canada Inc. (“Sunshine Canada”), signed Cross Referencing Agreements with a major pharmaceutical company for four prescription generic drugs for the treatment of Breast Cancer, Prostate Cancer and Enlarged Prostate. Following this acquisition we have been working towards commencement of marketing of these pharmaceutical products under our own Sunshine Biopharma label. These four generic products are as follows:

●

Anastrozole (brand name Arimidex® by AstraZeneca) for treatment of Breast Cancer;

●

Letrozole (brand name Femara® by Novartis) for treatment of Breast Cancer;

●

Bicalutamide (brand name Casodex® by AstraZeneca) for treatment of Prostate Cancer;

●

Finasteride (brand name Propecia® by Merck) for treatment of BPH (Benign Prostatic Hyperplasia)

Worldwide sales of the brand name version of these products as reported by the respective pharmaceutical company, owner of the registered trademark are as follows:

In June 2017, Sunshine Canada submitted an application to Health Canada for the procurement of a Drug Establishment License (“DEL”), a requirement for the Company’s drug handling and pharmaceutical operations. Health Canada has assigned the Company DEL Application No. 3002475 and File No. 17938. We are currently awaiting Health Canada to set a date for physical inspection of our warehouse and drug management operations. In addition, we are currently in the process of filing applications for a Drug Identification Number (“DIN”) for each of its four (4) generic products, Anastrozole, Letrozole, Bicalutamide and Finasteride. The Figure below shows our 30-Pill blister pack of Anastrozole.

We currently have twenty three (23) additional Generic Pharmaceuticals under review for in-licensing. We believe that a larger product portfolio will provide us with more opportunities and a greater reach into the marketplace. Our plan is to fund our Proprietary Drug Development Program, including Adva-27a, through the sales of Generic Drugs. In addition to near-term revenue generation, building the generics business infrastructure and securing the proper permits will render us appropriately positioned for the marketing and distribution of our own proprietary drugs as they become available.

Analytical Chemistry Services Operations

On January 1, 2018, we entered into an agreement (the “Atlas Agreement”) to acquire AtlasNora Pharma, Inc. (“Atlas”). The purchase price was $848,000 Canadian ($684,697 US). Payment of the purchase price was comprised of (i) a cash payment of $100,500 Canadian ($80,289 US), (ii) the issuance of 20,000,000 shares of our Common Stock valued at $246,000, and (iii) a promissory note in the principal amount of $450,000 Canadian ($358,407 US), with interest payable at the rate of 3% per annum. We are required to make payments of $10,000 Canadian (approximately $8,000 US) per calendar quarter, due and payable on or before the end of each such calendar quarter through December 31, 2023.

Atlas is a certified company dedicated to chemical analysis of pharmaceutical and other industrial samples. Atlas has 9 full-time employees and generated revenues of approximately $500,000 Canadian (approximately $400,000 US) in 2017. Housed in a 5,250 square foot facility, Atlas’s operations are authorized by a Drug Establishment License (DEL) issued by Health Canada and are fully compliant with the requirements of Good Manufacturing Practices (GMP). Atlas is also registered with the FDA.

Atlas is the owner of a relatively large portfolio of analytical chemistry methodology and Standard Operating Procedure. This intellectual property is protected as company secrets and controlled through employee and management confidentiality agreements.

On June 18, 2018, we purchased laboratory equipment at a total cost of $235,870 Canadian (approximately $181,580 US) for Microbiology Testing as part of our plan to expand the operations services offering of Atlas. Presently, Atlas offers Analytical Chemistry Testing and intends to offer Microbiology Testing soon.

Results Of Operations

Comparison of Results of Operations for the six months ended June 30, 2018 and 2017

During the six months ended June 30, 2018, we generated revenues of $198,418 from the operations of our new wholly owned subsidiary, Atlas Pharma Inc. (“Atlas”), which we acquired on January 1, 2018.in October 2022. The direct cost for generating these revenuessales was $190,913, which$3,967,412 (66.6%) for the three months ended September 30, 2023, compared to $65,783 (49.5%) for the three months ended September 30, 2022. The increase in the cost of goods sold in 2023 is compriseddue to increased cost of salaries ($113,495), laboratory supplies ($24,264), rent ($37,960) and depreciation ($15,194). We did not generate any revenues duringmanufacturing of the comparable period in 2017.

generic prescription drugs sold by Nora Pharma. Our gross profit grew to $1,990,256 for the three months ended September 30, 2023, compared to $67,025 for the three months ended September 30, 2022.General and administrative expenseexpenses during the six monthsthree-month period ended JuneSeptember 30, 2018 was $745,153,2023, were $2,769,730, compared to $581,208$1,785,005 during the six monthsthree-month period ended JuneSeptember 30, 2017,2022, an increase of $163,945. The principal reason for this$984,725. This increase was an increase of $133,051 in executive compensation, as well as increases in accounting, legal and office expenses. These increases were athe result of increased overhead associated with being a Nasdaq listed company and expenses related to Nora Pharma operations. Specifically, we incurred increased costs in consulting ($58,929), office ($467,397), salaries ($549,377) and taxes ($52,586). Overall, we incurred a loss of $779,474 from our increased business activities relatingoperations for the three months ended September 30, 2023, compared to Atlas, as well asa loss of $1,717,980 from our continuing efforts to raise additional funding. The only category that saw a decrease was consulting fees by $32,067, as efforts were made to complete more work in-house.

We incurred $93,338operations in

losses arising from debt conversionthe three-month period ended September 30, 2022.In addition, we had net interest income of $168,904 during the sixthree months ended JuneSeptember 30, 2018,2023, compared to $76,929 in losses from debt conversiona net interest income of approximately $260,936 during the similar period in 2017three months ended September 30, 2022, as a result of some convertible notes having been paid off or reduced prior to maturity.

interest earned on cash on hand.As a result, we incurred a net loss of $909,944$651,482 ($0.000.04 per share) for the six month periodthree months ended JuneSeptember 30, 2018,2023, compared to a net loss of $681,146$1,457,019 ($0.000.08 per share) duringfor the six monththree-month period ended JuneSeptember 30, 2017.

2022.Comparison of Resultsresults of Operationsoperations for the threenine months ended JuneSeptember 30, 20182023 and 2017

For2022During the threenine months ended JuneSeptember 30, 2018,2023, we generated $107,250 in revenues of $16,412,586, compared to no revenues of $405,760 for the same threenine months ended September 30, 2022, an increase of 2017. All of these revenues were$16,006,826. The increase is attributable to sales generated from the operations ofby our newrecently acquired wholly owned subsidiary, Atlas Pharma Inc. (“Atlas”), which we acquired on January 1, 2018.Nora Pharma. The direct cost for generating these revenues was $91,631, which$10,641,461 (64.8%) for the nine months ended September 30, 2023, compared to $200,311 (49.4%) for the nine months ended September 30, 2022. The increase in the cost of goods sold in 2023 is compriseddue to increased cost of salaries ($55,937), laboratory supplies ($10,194), rent ($16,438) and depreciation ($9,062). We did not generate any revenues duringmanufacturing of the comparablegeneric prescription drugs sold by Nora Pharma. Our gross profit increased to $5,771,125 for the nine months ended September 30, 2023, compared to a gross profit of $205,449 for the same period in 2017.

2022.General and administrative expenses during the three monthnine-month period ended JuneSeptember 30, 20182023, were $586,570,$9,369,203 compared to general and administrative expense of $472,218 incurred$3,842,589 during the three monthnine-month period ended JuneSeptember 30, 2017,2022, an increase of $114,352.$5,526,614. This increase is attributable to an increase in executive compensationwas the result of $98,229, as well as increases accounting fees, legal fees, and office expenses due to costsincreased overhead associated with being a Nasdaq listed company and expenses related to Nora Pharma operations. Specifically, we incurred increased costs in accounting ($63,608), consulting ($475,817), office costs ($972,328), research and development ($269,407), salaries ($3,239,801) and taxes ($212,953). Overall, we incurred a loss of $3,598,078 from our operations in the acquisition of Atlas. The only category that saw a decrease was consulting fees by $10,248, as efforts were made to complete more work in-house.

We also incurred $28,375 in interest expense during the three monthsnine-month period ended

JuneSeptember 30,

2018,2023, compared to

$9,598a loss from operations of $3,637,140 in

interest expense during the similar period

in 2017of 2022.In addition, we had net interest income of $517,163 during the nine months ended September 30, 2023, compared to a net interest income of $394,118 during the nine months ended September 30, 2022, as a result of increased borrowings. However, we incurred $54,998 in losses arising from debt conversion during the three months ended June 30, 2018, compared to $0 in losses from debt conversion during the similar period in 2017 as a result of some convertible notes having been paid off prior to maturity in the same period of 2017.

interest earned on cash on hand.As a result, we incurred a net loss of $644,308$3,256,020 ($0.000.12 per share) for the three monthnine-month period ended JuneSeptember 30, 2018,2023, compared to a net loss of $485,444$3,232,125 ($0.000.26 per share) duringfor the three monthnine-month period ended JuneSeptember 30, 2017.

2022.Comparison of Results of Operations for the fiscal years ended December 31, 2022 and 2021

During our fiscal year ended December 31, 2022, we generated revenues of $4,345,603, compared to revenues of $228,426, in 2021. The increase was the result of our acquisition of Nora Pharma in October 2022, which accounted for $3,803,106 of these revenues. The cost of sales in 2022 and 2021 for generating these revenues was $2,649,028 and $117,830, respectively.

General and administrative expenses for our fiscal year ended December 31, 2022, were $28,697,325, compared to $2,550,730 during our fiscal year ended December 31, 2021, an increase of $26,146,595. The increase was largely a result of goodwill impairment of $18,326,719 and costs and expenses relating to the Nora Pharma acquisition.

We also incurred $39,412 in interest expense and $0 in losses from debt conversion in 2022, compared to $328,818 in interest expense and $9,726,485 in losses from debt conversion in 2021. The decrease in interest expense and losses from debt conversion in 2022 was due to our repayment of all outstanding debt in 2022.

As a result, we incurred a net loss of $26,511,136 for the year ended December 31, 2022, compared to a net loss of $12,436,447 for the year ended December 31, 2021.

Liquidity and Capital Resources

As of JuneSeptember 30, 2018,2023, we had cash or cash equivalents of $36,395.

$18,846,140.Net cash used in operating activities was $292,898$6,085,435 during the six monthnine months ended September 30, 2023, compared to $3,001,746 during the nine-month period ended JuneSeptember 30, 2018,2022. The increase was a result of the addition of Nora Pharma’s operations.

Cash flows used in investing activities were $386,920 for the nine months ended September 30, 2023, compared to $185,850$0 for the six month periodnine months ended JuneSeptember 30, 2017. We anticipate that overhead costs and other expenses will2022. The increase was the result of cash invested in the future as we move forward with our proprietary drug development activities and expansion of our generic pharmaceuticals operations as well as our newly acquired analytical chemistry services operations as discussed above.

Nora Pharma.Cash flows fromprovided by financing activities were $249,975 for$3,456,106 during the six month periodsnine months ended JuneSeptember 30, 2018,2023, compared to $275,665$41,561,363 during the sixnine months ended JuneSeptember 30, 2017. Cash flows used by investing activities were $22,428 for2022. The decrease was primarily as a result of one offering made during the six month periodnine months ended JuneSeptember 30, 20182023, compared to $22,295 duringthree offerings completed in February, March, and April 2022, and to a lesser extent due to our repurchase of a total of $540,629 in common stock in the same six month period in 2017.first and third quarter of 2023.

As of December 31, 2022, we had cash and cash equivalents of $21,826,437.

On February 17, 2022, we completed an underwritten public offering of common stock and warrants for gross proceeds of $8 million. We received net proceeds of approximately $6.8 million from the offering.

On March 14, 2022, we completed a private placement of common stock and warrants for gross proceeds of $8 million. We received net proceeds of approximately $6.8 million from the private placement.

On April 28, 2022, we completed a private placement of common stock and warrants for gross proceeds of approximately $19.5 million. We received net proceeds of approximately $16.8 million from the private placement.

During the three months periodfiscal year ended June 30, 2018,December 31, 2022, we received aggregate proceeds of $13,193,177 in connection with warrant exercises.

During the year ended December 31, 2021, we issued a total of 185,369,308559,144 shares of our Common Stock. Of these, 42,584,566 sharescommon stock valued at $290,039 were issued upon$12,705,214 for the conversion of outstanding notes payable, reducing the debt by $188,568$2,867,243 and interest payable by $8,133$127,986 and generating a loss on conversion of $93,585. In addition,$9,726,485.

During the year ended December 31, 2021, we issued 20,000,000 sharesdid not sell any of our Common Stock valued at $246,000 or $0.0123 per share as partcapital stock for cash; however, we entered into the following new debt arrangements:

| · | On January 12, 2021, we issued a note in the principal amount of $150,000 with interest accruing at 5% per year, due January 12, 2023. The note was convertible after 180 days from issuance into common stock at a price of $0.30 per share. This note was converted to common stock on December 20, 2021. |

| | |