As filed with the Securities and Exchange Commission on September 26,November 24, 2003

Registration No. 333-105202

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 12 TO

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

EQUITY GOLD TRUST

SPONSORED BY WORLD GOLD TRUST SERVICES, LLC

(Exact name of Registrant as specified in its charter)

| New York | 6189 | • | ||||||||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) | ||||||||

c/o World Gold Trust Services, LLC

444 Madison Avenue, 3rd Floor

New York, New York 10022

(212) 317-3800

(Address, including zip code, and telephone number, including area code, of Registrant's principal executive offices)

Mary Joan Hoene, Esq.

Carter Ledyard & Milburn LLP

2 Wall Street

New York, New York 10005

(212) 732-3200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Mr. J. Stuart Thomas World Gold Trust Services, LLC 444 Madison Avenue, 3rd Floor New York, New York 10022 (212) 317-3800 | John K. Whelan, Esq. Carter Ledyard & Milburn LLP 2 Wall Street New York, New York 10005 (212) 732-3200 | |||||

and

Kevin W. Kelley, Esq.

Clifford Chance US LLP

200 Park Avenue

New York, New York 10166

(212) 878-8000

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statementregistration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ![]()

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ![]()

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ![]()

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ![]()

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. ![]()

Calculation of Registration Fee

| Title of each class of securities to be registered | Title of each class of securities to be registered | Amount to be registered | Proposed maximum offering price per Share(1) | Proposed maximum aggregate offering price(1) | Amount of registration fee | Title of each class of securities to be registered | Amount to be registered | Proposed maximum offering price per Share(1) | Proposed maximum aggregate offering price(1) | Amount of registration fee | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Equity Gold Shares | Equity Gold Shares | 60,400,000 | $ | 33.14 | $ | 2,001,656,000 | $ | 161,933.97 | Equity Gold Shares | 60,400,000 | $ | 33.14 | $ | 2,001,656,000 | $ | 161,933.97 | (2) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (1) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(d) under the Securities Act of 1933. The initial Baskets (a Basket is 100,000 Shares) will be offered at a per Share price equal to the value of one-tenth (1/10) of an ounce of gold based on the price for an ounce of gold as set on the date of the formation of the Equity Gold Trust by the afternoon session of the twice daily fix of the price of an ounce of gold which starts at 3:00 |

| (2) | Previously paid. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY | Subject to Completion |

60,400,000 Shares

Equity Gold Trust [insert logo]SMTM [Insert Logo]

Equity Gold Shares

The Equity Gold Trust (Trust) will issue Equity Gold Shares (Shares) which represent units of fractional undivided beneficial interest in and ownership of the Trust. World Gold Trust Services, LLC is the sponsor of the Trust (Sponsor), The Bank of New York is the trustee of the Trust (Trustee), and HSBC Bank USA is the custodian of the Trust (Custodian). The Trust intends to issue additional Shares on a continuous basis through its Trustee.

The Shares may be purchased from the Trust only by certain authorized participants (Authorized Participants) and only in one or more blocks of 100,000 Shares (a block of 100,000 Shares is called a Basket). The Trust will issue Shares in Baskets to Authorized Participants on an ongoing basis as described in "Plan of Distribution." Baskets will be offered continuously at the net asset value (NAV) for 100,000 Shares on the day that an order to create a Basket is accepted by the Trustee.

Before these issuances,Prior to this offering, there has been no public market for the Shares. The Sponsor has applied for approval to list the Shares on the New York Stock Exchange (NYSE) under the symbol "GLD."

Investing in the Shares involves significant risks. See "Risk Factors" starting on page 7.

Neither the Securities and Exchange Commission (SEC) nor any state securities commission has approved or disapproved of the securities offered in this prospectus, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense. In making an investment decision, investors must rely on their own examination of the issuer and the terms of the offering, including the merits and risks involved.

The Shares are neither interests in nor obligations of either the Sponsor or the Trustee.

"Equity Gold Shares" [insert logo] is a service markTrustTM [Insert Logo] and Equity Gold SharesTM [Insert Logo] are trademarks which are owned by an affiliate of World Gold Trust Services, LLC.the Sponsor and licensed to the Sponsor.

UBS Securities LLC, also called the Initial Purchaser, purchased • Shares, which comprised the seed Basket, on •, 2003, 2004 at a price of $•$ per share.Share. The Trust received all proceeds from the offering of the seed Basket in gold bullion, in an amount equal to the full purchase price of the seed Basket. Delivery of the seed Basket will be made on or about •, 2003., 2004. The Initial Purchaser has, subject to conditions, also agreed to purchase • Shares, which comprise the initial Baskets, as described in "Plan of Distribution." Delivery of the initial Baskets is expected to be made on or about •, 2003., 2004. The Trust will receive all proceeds from the offering of the initial Baskets in gold bullion in an amount equal to the full initial public offering price for the initial Baskets.

| Per Share(1) | Per Basket | ||||||||||||||||||||||||||||

| Initial public offering price for the initial Baskets(2) | $ | $ | |||||||||||||||||||||||||||

| (1) | The initial Baskets will be created at a per Share price equal to the value of one-tenth (1/10) of an ounce of gold based on a price for an ounce of gold of |

| (2) | In connection with the offering and sale of the initial Baskets, the Initial Purchaser will be paid a fee by the Sponsor of |

UBS Investment Bank

The date of this prospectus is , 2003.2004.

This prospectus contains information you should consider when making an investment decision about the Shares. You may rely on the information contained in this prospectus. The Trust and the Sponsor have not authorized any person to provide you with different information and, if anyone provides you with different or inconsistent information, you should not rely on it. This prospectus is not an offer to sell the Shares in any jurisdiction where the offer or sale of the Shares is not permitted.

The Shares are not registered for public sale in any jurisdiction other than the United States.

TABLE OF CONTENTS

| Statement Regarding Forward-Looking Statements | i | |||||

| Glossary of Defined Terms | ii | |||||

| Prospectus Summary | 1 | |||||

| Risk Factors | 7 | |||||

| Use of Proceeds | 13 | |||||

| Overview of the Gold Industry | 14 | |||||

| Operation of the Gold Bullion Market | ||||||

| Analysis of Movements in the Price of Gold | ||||||

| Business of the Trust | ||||||

| Description of the Trust | 30 | |||||

| The Sponsor | ||||||

| The Trustee | ||||||

| The Custodian | ||||||

| Description of the Shares | ||||||

| Custody of the Trust's Gold | ||||||

| Description of the Custody Agreements | ||||||

| Creation and Redemption of Shares | ||||||

| Description of the Trust Indenture | 47 | |||||

| United States Federal Tax Consequences | ||||||

| ERISA and Related Considerations | ||||||

| Plan of Distribution | ||||||

| Report of the Independent Auditors | ||||||

| Statement of Financial Condition | 64 | |||||

| Legal Proceedings | 65 | |||||

| Legal Matters | ||||||

| Experts | ||||||

| Where You Can Find More Information | ||||||

Until • , 20032004 (25 days after the date of this prospectus), all dealers effecting transactions in the offered Shares, whether or not participating in this distribution, may be required to deliver a prospectus. This requirement is in addition to the obligations of dealers to deliver a prospectus when acting as underwriters and with respect to unsold allotments or subscriptions.

Statement Regarding Forward-Looking Statements

This prospectus includes "forward-looking statements" which generally relate to future events or future performance. In some cases, you can identify forward-looking statements by terminology such as "may," "will," "should," "expect," "plan," "anticipate," "believe," "estimate," "predict," "potential" or the negative of these terms or other comparable terminology. All statements (other than statements of historical fact) included in this prospectus that address activities, events or developments that will or may occur in the future, including such matters as changes in commodity prices and market conditions (for gold and the Shares), the Trust's operations, the Sponsor's plans and references to the Trust's future success and other similar matters are forward-looking statements. These statements are only predictions. Actual events or results may differ materially. These statements are based upon certain assumptions and analyses the Sponsor made based on its perception of historical trends, current conditions and expected future developments, as well as other factors appropriate in the circumstances. Whether or not actual results and developments will conform to the Sponsor's expectations and predictions, however, is subject to a number of risks and uncertainties, including the special considerations discussed in this prospectus, general economic, market and business conditions, changes in laws or regulations, including those concerning taxes, made by governmental authorities or regulatory bodies, and other world economic and political developments. See "Risk Factors." Consequently, all the forward-looking statements made in this prospectus are qualified by these cautionary statements, and there can be no assurance that the actual results or developments the Sponsor anticipates will be realized or, even if substantially realized, that they will result in the expected consequences to, or have the expected effects on, the Trust's operations or the value of the Shares. Moreover, neither the Sponsor nor any other person assumes responsibility for the accuracy or completeness of the forward-looking statements. Neither the Trust nor the Sponsor is under a duty to update any of the forward-looking statements to conform such statements to actual results or to reflect a change in the Sponsor's expectations or predictions.

i

Glossary of Defined Terms

In this prospectus, each of the following quoted terms have the meanings set forth after such term:

"Allocated Bullion Account Agreement" — The agreement between the Trustee and the Custodian which establishes the Trust Allocated Account. The Allocated Bullion Account Agreement and the Unallocated Bullion Account Agreement are sometimes referred to together as the "Custody Agreements."

"ANAV" — Adjusted NAV. See "Description of the Trust Indenture — Valuation of Gold, Definition of Net Asset Value and Adjusted Net Asset Value" for a description of how the ANAV of the Trust is calculated. The ANAV of the Trust is used to calculate the fee of the Trustee and the fee of the Sponsor, if any.

"Authorized Participant" — A person who (1) is a registered broker-dealer or other securities market participant such as a bank or other financial institution which is not required to register as a broker-dealer to engage in securities transactions, (2) is a participant in DTC, (3) has entered into a Participant Agreement with the Trustee and (4) has established an Authorized Participant Unallocated Account with the Custodian. Only Authorized Participants may place orders to create or redeem one or more Baskets.

"Authorized Participant Unallocated Account" — An unallocated gold account established with the Custodian by an Authorized Participant. Each Authorized Participant's Authorized Participant Unallocated Account will be used to facilitate the transfer of gold deposits and gold redemption distributions between the Authorized Participant and the Trust in connection with the creation and redemption of Baskets.

"Basket" — A block of 100,000 Shares. Multiple blocks of 100,000 Shares are called "Baskets."

"BNY" — The Bank of New York, a banking corporation organized under the laws of the State of New York with trust powers. BNY is the trustee of the Trust.

"Book Entry System" — The Federal Reserve Treasury Book Entry System for United States and federal agency securities.

"CFTC" — Commodity Futures Trading Commission, an independent agency with the mandate to regulate commodity futures and option markets in the United States.

"Clearing Agency" — Any clearing agency or similar system other than the Book Entry System or DTC.

"Code" — The United States Internal Revenue Code of 1986, as amended.

"Creation Basket Deposit" — The total deposit required to create a BasketBasket. The deposit will be an amount of gold and cash, if any, that is in the same proportion to the total assets of the Trust (net of accrued but unpaid expenses)fees, expenses and other liabilities) on the date the order to purchase is properly received as the number of Shares to be created in respect of the deposit bears to the total number of Shares outstanding on the date the order is received.

"Custodian" — HSBC Bank USA, a New York banking corporation and a market maker, clearer and approved weigher under the rules of the LBMA.

"Custody Agreements" — The Allocated Bullion Account Agreement together with the Unallocated Bullion Account Agreement.

"Custody Rules" — The rules, regulations, practices and customs of the LBMA, the Bank of England or any applicable regulatory body which apply to gold made available in physical form by the Custodian.

"DTC" — The Depository Trust Company. DTC is a limited purpose trust company organized under New York law, a member of the US Federal Reserve System and a clearing agency registered with the SEC. DTC will act as the securities depository for the Shares.

"DTC Participant" — Participants in DTC, such as banks, brokers, dealers and trust companies.

"ERISA" — The Employee Retirement Income Security Act of 1974, as amended.

"Evaluation Time" — The time whenat which the Trustee will evaluate the gold held by the Trust and determine both the NAV and the ANAV of the Trust, which is currently asthe time of the London PM Fix

ii

Glossary of Defined Terms

on each business day when the NYSE is open for regular trading or, if there is no London PM Fix on a businesssuch day or the London PM Fix has not been announced

ii

by 12:00 PM New York time on a businesssuch day, as of 12:00 PM New York time on such day. For purposes of making these calculations, a "business day" means any day other than a day when either the NYSE is closed for trading or banks are authorized to close in New York City.

"Exchange Act" — The Securities Exchange Act of 1934, as amended.

"FSA" — The Financial Services Authority, an independent non-governmental body which exercises statutory regulatory power under the FSM Act.Act and which regulates the major participating members of the LBMA in the United Kingdom.

"FSM Act " — The Financial Services and Markets Act 2000.

"GFMS" — Gold Fields Mineral Services Ltd., an independent precious metals research organization based in London.

"HSBC" — HSBC Bank USA, a New York banking corporation and a market maker, clearer and approved weigher under the rules of the LBMA. HSBC is the custodian of the Trust's gold.

"Indirect Participants" — Those banks, brokers, dealers, trust companies and others who maintain, either directly or indirectly, a custodial relationship with a DTC Participant.

"Initial Purchaser" — UBS Securities LLC, purchaser of the seed Basket and the initial Baskets, as described on the front page of this prospectus.

"IRA" — Individual retirement account.

"IRS" — Internal Revenue Service.

"LBMA" — The London Bullion Market Association. The LBMA is the trade association that acts as the coordinator for activities conducted on behalf of its members and other participants in the London bullion market. In addition to coordinating market activities, the LBMA acts as the principal point of contact between the market and its regulators. A primary function of the LBMA is its involvement in the promotion of refining standards by maintenance of the "London Good Delivery Lists",Lists," which are the lists of LBMA accredited melters and assayers of gold. Further, the LBMA coordinates market clearing and vaulting, promotes good trading practices and develops standard documentation. The major participating members of the LBMA are regulated by the FSA in the United Kingdom under the FSAFSM Act.

"London Good Delivery Bar" — A bar of gold meeting the London Good Delivery Standards.

"London Good Delivery Standards" — The specifications for weight, dimensions, fineness (or purity), identifying marks and appearance of gold bars as set forth in "The Good Delivery Rules for Gold and Silver Bars" published by the LBMA. The London Good Delivery Standards are described in "Operation of the Gold Bullion Market — The London Bullion Market."

"London PM Fix" — The afternoon session of the twice daily fix of the price of an ounce of gold which starts at 3:00 PM London, England time and is performed in London by the five members of the London gold fix. See "Operation of Gold Bullion Market – The London Bullion Market" for a description of the operation of the London PM Fix.

"METI" — Japan's Ministry of Economy, Trade and Industry.

"NASD" — National Association of Securities Dealers.

"NAV" — Net asset value. See "Description of the Trust Indenture — Valuation of Gold, Definition of Net Asset Value and Adjusted Net Asset Value" for a description of how the NAV of the Trust and the NAV per Share are calculated.

"Non-US Shareholder" — A shareholder that is not a US Shareholder.

"NYSE" — The New York Stock Exchange.

"OTC" — The global Over-the-Counter market for the trading of gold which consists of transactions in spot, forwards, and options and other derivatives.

"Participant Agreement" — An agreement entered into by each Authorized Participant, the Sponsor and the Trustee which provides the procedures for the creation and redemption of Baskets and for the delivery of the gold and any cash required for such creations and redemptions.

iii

"Participant Unallocated Bullion Account Agreement" — The agreement between an Authorized Participant and the Custodian which establishes the Authorized Participant Unallocated Account.

"Plans" — Employee benefit plans and certain other plans and arrangements, including individual retirement accounts and annuities, Keogh plans, and certain collective investment funds or insurance company general or separate accounts in which such plans or arrangements are invested, that are subject to ERISA and/or section 4975 of the Code.

"SEC" — The Securities and Exchange Commission.iii

"Securities Act" — The Securities ActGlossary of 1933, as amended.Defined Terms

"Shareholders" — Owners of beneficial interests in the Shares.

"Shares" — Units of fractional undivided beneficial interest in and ownership of the Trust which are issued by the Trust and named "Equity Gold Shares."

"Sponsor" — World Gold Trust Services, LLC, a Delaware limited liability company wholly-owned by the WGC.

"TOCOM" — The Tokyo Commodity Exchange.

"Tonne" — One metric tonne which is equivalent to 1,000 kilograms or 32,150.7465 troy ounces.

"Trust" — The Equity Gold Trust, an investment trust, formed on • , 20032004 under New York law pursuant to the Trust Indenture.

"Trust Allocated Account" — The allocated gold account of the Trust established with the Custodian by the Allocated Bullion Account Agreement. The Trust Allocated Account will be used to hold the gold deposited with the Trust in allocated form (i.e., as individually identified bars of gold).

"Trustee" — The Bank of New York, a banking corporation organized under the laws of the State of New York with trust powers.

"Trust Indenture" — The agreement entered into by the Sponsor and the Trustee under which the Trust is formed and which sets forth the rolesrights and responsibilitiesduties of the Sponsor, the Trustee and Custodian.

"Trust Unallocated Account" — The unallocated gold account of the Trust established with the Custodian by the Unallocated Bullion Account Agreement. The Trust Unallocated Account will be used to facilitate the transfer of gold deposits and gold redemption distributions between Authorized Participants and the Trust in connection with the creation and redemption of Baskets and the sales of gold made by the Trustee for the Trust.

"Unallocated Bullion Account Agreement" — The agreement between the Trustee and the Custodian which establishes the Trust Unallocated Account. The Allocated Bullion Account Agreement and the Unallocated Bullion Account Agreement are sometimes referred to as the "Custody Agreements."

"US Shareholder" — A Shareholder that is (1) an individual who is treated as a citizen or resident of the United States for US federal income tax purposes; (2) a corporation or partnership created or organized in or under the laws of the United States or any political subdivision thereof; (3) an estate, the income of which is includible in gross income for US federal income tax purposes regardless of its source; or (4) a trust, if a court within the United States is able to exercise primary supervision over the administration of the trust and one or more US persons have the authority to control all substantial decisions of the trust.

"WGC" — World Gold Council, a not-for-profit association registered under Swiss law and the sole member of the Sponsor.

"WGTS" — World Gold Trust Services, LLC, a Delaware limited liability company wholly-owned by the WGC. WGTS is the sponsor of the Trust.

iv

Prospectus Summary

This is only a summary of the prospectus and, while it contains material information about the Trust and its Shares, it does not contain or summarize all of the information about the Trust and the Shares contained in this prospectus which is material and/or which may be important to you. You should read this entire prospectus, including "Risk Factors" beginning on page 7, before making an investment decision about the Shares.

TRUST STRUCTURE

The Trust is an investment trust, formed on •, 2003, 2004 under New York law pursuant to a Trust Indenturetrust indenture (Trust Indenture). The Trust holds gold and willis expected to issue Baskets from time to time issue Baskets in exchange for deposits of gold and to distribute gold in connection with redemptions of Baskets. The investment objective of the Trust is for the Shares to reflect the performance of the price of gold bullion, less the Trust's expenses. ForThe Sponsor believes that, for many investors, the Shares will represent a cost effective investment in gold. The material terms of the Trust Indenture are discussed in greater detail under the section "Description of the Trust Indenture" beginning on page [46].47. Shares represent units of fractional undivided beneficial interest in and ownership of the Trust and are expected to be traded under the ticker symbol GLD on the NYSE. The Trust is not a registered investment company under the Investment Company Act of 1940 and is not required to register under such act.

The Trust's Sponsor is World Gold Trust Services, LLC (WGTS), which is wholly-owned by the World Gold Council (WGC), a not-for-profit association registered under Swiss law. The Sponsor is a Delaware limited liability company and was formed on July 17, 2002. Under the Delaware limited liability law and the governing documents of the Sponsor, the WGC, the sole member of the Sponsor, is not responsible for the debts, obligations and liabilities of the Sponsor solely by reason of being the sole member of the Sponsor.

The Sponsor is responsible for establishing the Trust and for the registration of the Shares. The Sponsor will oversee the Trust's administration and will exercise oversight over the Trust's service providers. The Sponsor will not exercise day-to-day oversight over the Trustee or the Custodian. The Sponsor may remove the Trustee and appoint a successor (1) if the Trustee commits certain willful bad acts in performing its duties, (2) if the Trustee's creditworthiness has materially deteriorated or (3) if the Trustee's negligent acts or omissions have had a materiallymaterial adverse effect on the Trust or the interests of Shareholders and the Trustee has not cured the material adverse effect within a certain period of time and established that such material adverse effect will not recur. See "Description of the Trust Indenture — The Trustee — Resignation, discharge andor removal of Trustee; successor trustees" for more information. The Sponsor may remove the Custodian and appoint a successor as long as the removalappointment does not adversely affecthave a material adverse effect on the Trustee's ability to perform its duties. The Sponsor will be responsible for and will oversee any marketing of the Shares. The Sponsor will maintain a public website on behalf of the Trust, www.equitygoldshares.com, containing information about the Trust and the Shares. The Trust's website address is only provided here as a convenience to you and the information contained on or connected to the website is not considered part of this prospectus. The general role and responsibilities of the Sponsor are further discussed in "The Sponsor."

The Trustee is The Bank of New York (BNY) and the Custodian is HSBC Bank USA (HSBC).

The Trustee is generally responsible for the day-to-day administration of the Trust. This includes (1) monitoring the Trust's on-going expenses and selling the Trust's gold as needed to pay the Trust's expenses (gold sales are expected to occur approximately monthly in the ordinary course), (2) calculating the NAV of the Trust, and (3) receiving and processing orders from Authorized Participants to create and redeem Baskets and coordinating the processing of such orders with the Custodian and theThe Depository Trust Company (DTC). and (4) monitoring the Custodian. The general role and responsibilities of the Trustee are further described in "The Trustee."

The Custodian is HSBC Bank USA (HSBC). The Custodian is responsible for the safekeeping forof the TrustTrust's gold deposited with it by Authorized Participants in connection with the creation of Baskets. The

Custodian also facilitates the transfer of gold

1

in and out of the Trust through gold accounts it will maintain for Authorized Participants and the Trust. The Custodian is a market maker, clearer and approved weigher under the rules of the London Bullion Market Association (LBMA). The general role and responsibilities of the Custodian are further described in "The Custodian" and "Custody of the Trust's Gold."

A detailed descriptionDetailed descriptions of certain specific rolesrights and responsibilitiesduties of the Trustee and the Custodian are set forth in "Description of the Trust Indenture" and "Description of the Custody Agreements."

TRUST OVERVIEW

The investment objective of the Trust is for the Shares to reflect the performance of the price of gold bullion, less the expenses of the Trust's operations. The Shares are designed for investors who want a cost effective and convenient way to invest in gold. Advantages of investing in the Shares include:

| • | Ease and Flexibility of Investment. The Shares are exchange-listed equity instruments providing institutional and retail investors with indirect access to the gold bullion market. The Shares may be bought and sold on the NYSE like any other exchange-listed securities. |

| • | Expenses. The Sponsor expects that, for many investors, costs associated with buying and selling the Shares in the secondary market and the payment of the Trust's ongoing expenses will be lower than the costs associated with buying and selling gold bullion and storing and insuring gold bullion in a traditional allocated gold bullion account. |

Investing in the Shares does not insulate the investor from certain risks, including price volatility. See "Risk Factors."

PRINCIPAL OFFICES

The Trust's office is located at 444 Madison Avenue, 3rd Floor, New York, New York 10022 and its telephone number is (212) 317-3800. The Sponsor's office is located at 444 Madison Avenue, 3rd Floor, New York, New York 10022. The Trustee has a trust office at 101 Barclay Street, Floor 6E, New York, New York 10286. The Custodian is located at 8 Canada Square, London, E14 5HQ, United Kingdom.

2

The Offering

| Offering | The Shares represent units of fractional undivided beneficial interest in and ownership of the Trust. | |||||

| Use of proceeds | Proceeds received by the Trust from the issuance and sale of Baskets, including the seed Basket and the initial Baskets | |||||

| New York Stock Exchange symbol | GLD | |||||

| CUSIP | 294686 10 0 | |||||

| Creation and redemption | The Trust expects to create and redeem the Shares on a continuous basis but only in one or more Baskets (a Basket equals a block of 100,000 Shares). | |||||

| Net Asset Value | The NAV of the Trust is the aggregate value of the Trust's assets less its liabilities (which include accrued expenses). In determining the NAV of the Trust, the Trustee will value the gold held by the Trust based on the London PM Fix price. The Trustee will make this determination on each | |||||

3

| Trust expenses | The Trust's ordinary operating expenses are accrued daily and are reflected in the NAV of the Trust. In order to pay the Trust's expenses, the Trustee will sell gold held by the Trust on an | |||||

| Termination events | The Sponsor may direct the Trustee to terminate and liquidate the Trust at any time after the first anniversary of the Trust's formation when the NAV of the Trust is less than $350 million. The Trustee may also terminate the Trust upon the agreement of the owners of beneficial interests in the Shares (Shareholders) owning at least 66 2/3% of the outstanding Shares. | |||||

| The Trustee will terminate and liquidate the Trust if one of the following events occurs: | ||||||

4

| Upon the termination of the Trust, the Trustee will, within a reasonable time after the termination of the Trust, sell the Trust's gold and, after paying or making provision for the Trust's liabilities, distribute the proceeds to the Shareholders. See "Description of the Trust Indenture — Termination of the Trust." | ||||||

| Authorized Participants | Baskets may be created or redeemed only by Authorized Participants. Each Authorized Participant must (1) be a registered broker-dealer or other securities market participant such as a bank or other financial institution which is not required to register as a broker-dealer to engage in securities transactions, (2) be a participant in DTC, | |||||

| Clearance and settlement | The Shares will be evidenced by a global certificate that the Trustee will issue to DTC. The Shares will be available only in book-entry form. Owners may hold their Shares through DTC, if they are participants in DTC, or indirectly through entities that are participants in DTC. | |||||

5

Summary of Financial Condition

As of the opening of business on •, 2003,, 2004, the NAV of the Trust was $•$ and the NAV per Share was $•$ . See "[Form of] Statement"Statement of financial condition"Financial Condition" elsewhere in this prospectus.

6

Risk Factors

You should consider carefully the risks described below before making an investment decision. You should also refer to the other information included in this prospectus, including the Trust's financial statements and the related notes.

The value of the Shares relates directly to the value of the gold held by the Trust and

fluctuations in the price of gold could materially adversely affect an investment in the Shares.

The Shares are designed to mirror as closely as possible the price of gold bullion, and the value of the Shares relates directly to the value of the gold held by the Trust, less the Trust's liabilities (including accrued expenses). The price of gold has fluctuated widely over the past several years. Several factors may affect the price of gold, including:

In the event that the price of gold declines, the Sponsor expects the value of an investment in the Shares to decline proportionately.

The sale of gold by the Trust to pay expenses will reduce the amount of gold represented by each Share on an ongoing basis irrespective of whether the trading price of the Shares rises or falls in response to changes in the price of gold.

Each outstanding Share will represent a proportional interest in the gold held by the Trust. The Trust will not generate any income and the Trust will regularly sell gold over time to pay for its ongoing expenses, so the amount of gold represented by each Share will gradually decline over time. This is true even if additional Shares are issued in exchange for additional deposits of gold into the Trust, as the amount of gold required to create Shares will proportionately reflect the amount of gold represented by the Shares outstanding at the time of creation. As anFor example, assuming a constant gold price, the trading price of the Shares is expected to gradually decline relative to the price of gold as the amount of gold represented by the Shares gradually declines.

Investors should be aware that the gradual decline in the amount of gold represented by the Shares will occur regardless of whether the trading price of the Shares rises or falls in response to changes in the price of gold. In other words, the amount of gold represented by the Shares is independent of the value of the gold held by the Trust.

Expenses of the Trust may be higher than anticipated, thus reducing the NAV of the Trust more rapidly than anticipated and adversely affecting the value of the Shares.

The expenses of the Trust, which accrue daily, are described in "Business of the Trust — Trust Expenses" and "Description of the Trust Indenture — Expenses of the Trust." While these are the reasonably anticipated expenses of the Trust, if additional or increased expenses arise, or extraordinary expenses occur, the Trust will bear such additional expense,these expenses in addition to the Trust's reasonably anticipated expenses, resulting in a decrease in the NAV of the Trust more rapidly than the Sponsor anticipates, which will adversely affect the value of the Shares.

Risk Factors

The sale of the Trust's gold to pay expenses at a time of low gold prices could adversely affect the value of the Shares.

The Trustee will sell gold held by the Trust to pay Trust expenses on an as neededas-needed basis irrespective of then currentthen-current gold prices. The Trust is not actively managed and no attempt will be made to sell gold to

7

Risk Factors

take advantage of fluctuations in the price of gold. Consequently, the Trust's gold may be sold at a time when the gold price is low, resulting in a negative effect on the value of the Shares.

Purchasing activity in the gold market associated with the purchase of SharesBaskets from the Trust may cause a temporary increase in the price of gold. This increase may adversely affect an investment in the Shares.

Purchasing activity associated with acquiring the gold required for deposit into the Trust to createfor the creation of Baskets may temporarily increase the market price of gold, which will result in higher prices for the Shares. Large volumes of purchasing activity connected with the issuance of the SharesBaskets could temporarily increase the market price of the underlying gold, resulting in a higher price for the Shares on their issue date. Temporary increases in the market price of gold may also occur as a result of the purchasing activity of other market participants. Other market participants may attempt to benefit from an increase in the market price of gold that may result from increased purchasing activity of gold connected with the issuance of the Shares.Baskets. Consequently, the market price of gold may decline immediately after Baskets are created. If the price of gold declines, the trading price of the Shares will also decline.

As the Sponsor and its management have no history of operating an investment vehicle like the Trust, their experience may be inadequate or unsuitable to manage the Trust.

The Sponsor was expressly formed to be the sponsor of the Trust and has no history of past performance. The past performances of the Sponsor's management in other positions with the WGC are no indication of their ability to manage an investment vehicle such as the Trust. If the experience of the Sponsor and its management is not adequate or suitable to manage an investment vehicle such as the Trust, the operations of the Trust may be adversely affected.

The Shares are a new securities product and their value could decrease if unanticipated operational or

trading problems arise.

The mechanisms and procedures governing the creation, redemption and offering of the Shares have been developed specifically for this securities product. Consequently, there may be unanticipated problems or issues with respect to the mechanics of the Trust's operations and the trading of the Shares that could have a materiallymaterial adverse effect on an investment in the Shares. In addition, although the Trust is not actively "managed" by traditional methods, to the extent that unanticipated operational or trading problems or issues arise, the Sponsor's past experience and qualifications may not be suitable for solving these problems or issues.

The Trust may be required to terminate and liquidate at a time that is disadvantageous to Shareholders.

If the Trust is required to terminate and liquidate, such termination and liquidation could occur at a time which is disadvantageous to Shareholders, such as when gold prices are lower relative tothan the gold prices at the time when Shareholders purchased their Shares. In such a case, when the Trust's gold is sold as part of the Trust's liquidation, the resulting proceeds distributed to Shareholders will be less than if gold prices were higher at the time of sale. See "Description of the Trust Indenture — Termination of the Trust" for more information about the termination of the Trust, including when the termination of the Trust may be triggered by events outside the direct control of the Sponsor, the Trustee or the Shareholders.

The lack of a market for the Shares may limit the ability of Shareholders to sell the Shares.

Prior to the date of this prospectus, there has been no market for the Shares, and there can be no assurance that an active public market for the Shares will develop. If an active public market for the Shares does not exist or continue, the market prices and liquidity of the Shares may be adversely affected.

Risk Factors

The operations of the Trust and the Sponsor depend on support from the WGC. This support may not be available in the future and, if such support is not available, the operations of the Trust may be adversely affected.

The Sponsor of the Trust is a subsidiary of the WGC, a not-for-profit association that represents members of the gold mining industry through international marketing programs directed at stimulating demand for gold in all forms.

8

Risk Factors

The ongoing operations of the Trust depend on the financial and management support of the Sponsor. The Trustee's agreement to reduce its fee and bear all ordinary expenses of the Trust through the 30th day following commencement of trading of the Shares on the NYSE and thereafter until the first anniversary of the Trust's inception, to the extent the aggregate annual expenses of the Trust exceed 0.30% of the average daily value of the Trust's assets, depends on the financial and management support of the Sponsor. The operations of the Sponsor, in turn, depend on the financial and management support of the WGC. If the WGC limits or ends its support of the Sponsor for any reason, the operations of the Trust and an investment in the Shares may be adversely affected. As a result, the Trust may be required to terminate.

The WGC's members determine the financial plan of the WGC. The WGC's current and reasonably foreseeable operational costs and expenses are underwritten by the WGC's members through the end of 2003.2004. The Sponsor's current and reasonably foreseeable operational costs and expenses, which include expense associated with the marketing the Shares, are also underwritten by the WGC's members through the end of 2004. The WGC's members intend that future financial plans of the WGC will cover a three-year prospective period and will be considered on a rolling basis. There is no assurance that the WGC's members will fund the WGC or, indirectly, the Sponsor in the future in the same manner as they have in the past. LackThe lack of such funding could adversely affect the ability of the Sponsor to support the Trust.

Shareholders will not have the rights enjoyed by investors in certain other vehicles.

As interests in an investment trust, the Shares have none of the statutory rights normally associated with the ownership of shares of a corporation (including, for example, the right to bring "oppression" or "derivative" actions). In addition, Shares have limited voting and distribution rights. See "Description of the Shares" for a description of the limited rights of holders of Shares.

An investment in the Shares may be adversely affected by competition from other methods of investing in gold.

The Trust is a new, and thus untested, type of investment vehicle. It will compete with other financial vehicles, including traditional debt and equity securities issued by companies in the gold industry participants,and other securities backed by or linked to gold, and direct investments in gold. Market and financial conditions, and other conditions beyond the Sponsor's control, may make it more attractive to invest in other financial vehicles or to invest in gold directly, which could limit the market for the Shares and reduce the liquidity of the Shares.

Crises may motivate large-scale sales of gold which could decrease the price of gold and

adversely affect an investment in the Shares.

The possibility of large-scale distress sales of gold in times of crisis may have a short-term negative impact on the price of gold and adversely affect an investment in the Shares. For example, the 1998 Asian financial crisis resulted in significant sales of gold by individuals which depressed the price of gold. Similar situationsCrises in the future may impair gold's price performance andwhich would, in turn, adversely affect an investment in the Shares.

Substantial sales of gold by the official sector could adversely affect an investment in the Shares.

The official sector consists of central banks, other governmental agencies and multi-lateral institutions which hold gold. The official sector holds a significant amount of gold, most of which is static, meaning that it is held in vaults and is not bought, sold, leased or swapped or otherwise mobilized in the open

Risk Factors

market. A number of central banks have sold portions of their gold over the past 10 years, with the result that the official sector, taken as a whole, has been a net supplier to the open market. Since 1999, most sales have been made in a coordinated manner under the terms of the Central Bank Gold Agreement, under which 15 of the world's major central banks (including the European Central Bank) signed an agreement to limit the level of their gold sales and lending to the market for the following five years. See "Overview of the Gold Industry — Sources of Gold Supply" and "Analysis of Movements in the Price of Gold" for more details. Although the Central Bank Gold Agreement is widely expected to be renewed, probably for a further five years, when it expires in September 2004, it is possible that this agreement will not be renewed. In the event that future economic, political or social conditions or pressures require members of

9

Risk Factors

the official sector to liquidate their gold assets all at once or in an uncoordinated manner, the demand for gold might not be sufficient to accommodate the sudden increase in the supply of gold to the market. Consequently, the price of gold could decline significantly, which would adversely affect an investment in the Shares.

A widening of interest rate differentials could negatively affect the price of gold which, in turn, could adverselynegatively affect the price of the Shares.

A combination of rising money interest rates and a continuation of the current low cost of borrowing gold could improve the economics of selling gold forward. This could result in an increase in hedging by gold mining companies and short selling by speculative interests, which would adverselynegatively affect the price of gold. Under such circumstances, the price of the Shares would be similarly affected.

The Trust's gold may be subject to loss, damage, theft or restriction on access.

There is a risk that part or all of the Trust's gold could be lost, damaged or stolen. Access to the Trust's gold could also be restricted by natural events (such as an earthquake) or human actions (such as a terrorist attack). Any of these events may adversely affect the operations of the Trust and, consequently, an investment in the Shares.

The Trust may not have adequate sources of recovery if its gold is lost, damaged, stolen or destroyed.

The Trust's gold isTrust will not insured under an all-risk policy of insurance. Consequently, a loss may be suffered with respect to the gold which is not covered by insurance and for which no person is liable in damages.

The liability of the Custodian for loss to the gold is limited. Under the Allocated Bullion Account Agreement and the Unallocated Bullion Account Agreement (together, the Custody Agreements), the Custodian is not liable for losses that are not the direct result ofinsure its own negligence (or, with respect to the Unallocated Bullion Account Agreement, gross negligence), fraud or willful default in the performance of its duties. The Custodian is not liable for losses which are the result of the acts or omissions of its subcustodians if it has selected the subcustodians with reasonable care. Thus, in the event of a loss caused by the failure of a subcustodian to exercise due care in the safekeeping of the Trust's gold, the Trust may not have recourse to the Custodian for damages and may only have recourse to the subcustodian. Generally, subcustodians will be liable for their own failure to exercise due care in the safekeeping of the Trust's gold and for the failure by any of their own subcustodians to exercise due care.

If the Trust's gold is lost, damaged, stolen or destroyed under circumstances rendering a party liable to the Trust, the responsible party may not have the financial resources sufficient to satisfy the Trust's claim. For example, as to a particular event of loss, the only source of recovery for the Trust might be limited to the Custodian or one or more subcustodians or, to the extent identifiable, other responsible third parties (e.g., a thief or terrorist), any of which may not have the financial resources (including liability insurance coverage) to satisfy a valid claim of the Trust.gold. While the Custodian has agreed to maintain insurance with regard to its business, the Trust will not be a beneficiary of any such insurance and does not have the ability to dictate the nature or amount of coverage. In addition, subcustodians of the Custodian and subcustodians of the Custodian's subcustodians are not required under the customs and practices of the London bullion market, and will not be required by the Custodian or the Trustee, to be insured or bonded with respect to their custodial activities. Consequently, a loss may be suffered with respect to the Trust's gold which is not covered by insurance and for which no person is liable in damages.

The liability of the Custodian for losses affecting the gold is limited. Under the agreements between the Trustee and the Custodian which establish the Trust's unallocated gold account (Unallocated Bullion Account Agreement) and the Trust's allocated gold account (Allocated Bullion Account Agreement), the Custodian is not liable for losses that are not the direct result of its own negligence, fraud or willful default in the performance of its duties. Under the Allocated Bullion Account Agreement, except for an obligation on the part of the Custodian to use commercially reasonable efforts to obtain delivery of the Trust's gold from any subcustodians appointed by it, the Custodian is not liable for the acts or omissions of its subcustodians unless the selection of such subcustodians was made negligently or in bad faith. Thus, if the Trust's gold is lost or damaged while in the custody of a subcustodian, the Trust may not have recourse to the Custodian for damages and may only have recourse to the subcustodian if the subcustodian failed to exercise due care in the safekeeping of the Trust's gold. Generally, subcustodians will be liable to the Trust for their own failure to exercise due care in the safekeeping of the Trust's gold. Whether a subcustodian will be liable for the failure of subcustodians appointed by it to exercise due care in the safekeeping of Trust's gold will depend on the facts and circumstances of the particular situation.

If the Trust's gold is lost, damaged, stolen or destroyed under circumstances rendering a party liable to the Trust, the responsible party may not have the financial resources sufficient to satisfy the Trust's claim. For example, as to a particular event of loss, the only source of recovery for the Trust might be limited to the Custodian or one or more subcustodians or, to the extent identifiable, other responsible third parties

Risk Factors

(e.g., a thief or terrorist), any of which may not have the financial resources (including liability insurance coverage) to satisfy a valid claim of the Trust.

Gold bullion allocated to the Trust in connection with the creation of a Basket may not meet the London Good Delivery Standards and, if a Basket is issued against such gold, the Trust may suffer a loss.

Although the Custodian is responsible for allocating gold bullion which meets the LBMA's standards for gold bars delivered in settlement of a gold trade (London Good Delivery Standards) to the Trust in connection with the creation of a Basket, neither the Trustee nor the Custodian independently confirms the fineness of the gold allocated to the Trust. The gold bullion allocated to the Trust by the Custodian may be of a fineness or weight different from that reported to the Custodian or required by the Trust. If the Trustee nevertheless delivers the Basket, the Trust may suffer a loss. The London Good Delivery Standards are described in "Operation of the Gold Bullion Market — The London Bullion Market."

10

Risk Factors

AsBecause the Trustee and the Custodian do not oversee or monitor the activities of subcustodians who may hold the Trust's gold, there can be no assurance that subcustodians will exercise due care in the safekeeping of the Trust's gold.

Under the Allocated Bullion Account Agreement described in "Description of the Custody Agreements," the Custodian may appoint from time to time one or more subcustodians to hold the Trust's gold. The subcustodians which the Custodian currently uses are the Bank of England and LBMA market-making members that provide bullion vaulting and clearing services to third parties. The Custodian is required under the Allocated Bullion Account Agreement to use reasonable care in appointing its subcustodians. These subcustodians may in turn appoint further subcustodians but the Custodian is not responsible for their selectionthe appointment of these further subcustodians. Beyond using reasonable care in selecting subcustodians, and limiting those subcustodians it selects to the Bank of England and the LBMA members described above, the Custodian does not undertake to monitor the performance by subcustodians of their custody functions or their selection of further subcustodians. The Trustee does not undertake to monitor the performance of any subcustodian. Furthermore, the Trustee may have no right to visit the premises of any subcustodian for the purposes of examining the Trust's gold or any records maintained by the subcustodian, and any subcustodian may not be obligated to cooperate in any review the Trustee may wish to conduct of the facilities, procedures, records or creditworthiness of such subcustodian. In addition, the ability of the Trustee to monitor the performance of the Custodian may be limited because under the Allocated Bullion Account Agreement and the Unallocated Bullion Account Agreement (together, the Custody Agreements) the Trustee has only limited rights to visit the premises of the Custodian for the purpose of examining the Trust's gold and certain related records maintained by the Custodian. See "Custody of the Trust's Gold" for more information about subcustodians that may hold the Trust's gold.

The ability of the Trustee and the Custodian to take legal action against subcustodians may be limited which increases the possibility that the Trust may suffer a loss if a subcustodian does not use due care in the safekeeping of the Trust's gold.

AsIf any subcustodian does not exercise due care in the safekeeping of the Trust's gold, the ability of the Trustee or the Custodian to recover damages against such subcustodian may be limited to only such recourse, if any, as may be available under applicable English law or, if the subcustodian is not located in England, under other applicable law. This is because there are expected to be no written contractual arrangements between subcustodians who may hold the Trust's gold and the Trustee or the Custodian, if any subcustodian does not exercise due care inas the safekeeping of gold, the ability of the Trustee or the Custodian to recover damages against such subcustodianscase may be limited to only such recourse as may be available under applicable United Kingdom common law.be. If the Trustee's or the Custodian's recourse against the subcustodian is so limited, the Trust may not be adequately compensated for the loss. For more information on the Trustee's and the Custodian's ability to seek recovery against subcustodians and the subcustodian's duty to safekeep the Trust's gold, see "Custody of the Trust's Gold."

If the Custodian becomes insolvent, gold held in the Trust's unallocated gold account or any Authorized Participant's unallocated gold account would

represent an unsecured claim against the Custodian, and the Custodian's assets may not be

adequate to satisfy a claim by the Trust.Trust or any Authorized Participant.

Gold which is part of a deposit for a purchase order or part of a redemption distribution will be held for a time in the Trust's unallocated gold account.account and the unallocated gold account of the purchasing or

Risk Factors

redeeming Authorized Participant. During that time,those times, the Trust and the Authorized Participant, as the case may be, will each be an unsecured creditor of the Custodian with respect to the amount so held. In the event the Custodian became insolvent, the Custodian's assets might not be adequate to satisfy a claim by the Trust or the Authorized Participant for the amount of gold held in the Trust'stheir respective unallocated gold account.accounts.

In issuing Shares,Baskets, the Trustee will rely on certain information received from the Custodian which is subject to confirmation after the Trustee has relied on the information. If such information turns out to be incorrect, SharesBaskets may be issued in exchange for an amount of gold which is more or less than the amount of gold which is required to be deposited with the Trust.

The Custodian's definitive records are prepared after the close of its business.business day. However, when issuing Shares,Baskets, the Trustee will rely on information reporting the creditsamount of gold credited to the Trust's accounts which it receives from the Custodian during the business day and which is subject to correction during the preparation of the Custodian's definitive records after the close of business. If the information relied upon by the Trustee is incorrect, the amount of gold actually received by the Trust may be more or less than the amount required to be deposited for the issuance of the Shares.Baskets.

The Trust's obligation to reimburse the Initial Purchaser for certain liabilities in the event the Sponsor fails to indemnify the Initial Purchaser could adversely affect an investment in the Shares.

The Sponsor has agreed to indemnify the Initial Purchaser against any loss, damage, expense, liability or claim that may be incurred by the Initial Purchaser in connection with (1) any untrue statement or alleged untrue statement of a material fact contained in this prospectus and the exhibits to the registration statement of which this prospectus is a part, (2) any untrue statement or alleged untrue statement of a

11

Risk Factors

material fact made by the Sponsor with respect to any representations and warranties or any covenants under the distribution agreement between the Sponsor and the Initial Purchaser, dated •, 2003,, 2004, or failure of the Sponsor or the Trust to perform any agreement or covenant therein, or (3) any untrue statement or alleged untrue statement of a material fact contained in any materials used in connection with the marketing of the Shares or (4) the third party allegations as described in "Legal Proceedings," and to contribute to payments that the Initial Purchaser may be required to make in respect thereof. The Trust has agreed to reimburse the Initial Purchaser in respect of any liabilities arising under (i)subsection (1) of the preceding sentence or under (ii)subsection (2) of the preceding sentence insofar as they relate to statements by or about the Trust or failures of the Trust to perform an agreement or covenant to the extent the Sponsor has not paid such amounts directly when due. In the event the Trust is required to pay any such amounts, the Trustee would be required to sell assets of the Trust to cover the amount of any such payment and the NAV of the Trust would be reduced accordingly.accordingly, thus adversely affecting an investment in the Shares. For information about when the Trust's assets may be used to indemnify (1) the Sponsor or the Trustee, see "Description of the Trust Indenture," and (2) the Custodian, see "Description of the Custody Agreements."

12

Use of Proceeds

Proceeds received by the Trust from the issuance and sale of Baskets, including the seed Basket and the initial Baskets (as(which are described on the front page of this prospectus), will consist of gold deposits and, possibly from time to time, cash. Pursuant to the Trust Indenture, during the life of the Trust such proceeds will only be (i)(1) held by the Trust, (ii)(2) distributed to Authorized Participants in connection with the redemption of Baskets or (iii)(3) disbursed or sold as needed to pay the Trust's ongoing expenses.

13

Overview of the Gold Industry

HOW GOLD TRAVELS FROM THE MINE TO THE CUSTOMER

The following is a general description of the typical path gold takes from the mine to the customer. Individual paths may vary at several stages in the process from the following description.

Gold, a naturally occurring mineral element, is found in ore deposits throughout the world. Ore containing gold is first either dug from the surface or blasted from the rock face underground. The minedMined ore is hauled to a processing plant, where it is crushed or milled. The crushedCrushed or milled ore is then concentrated in order to separate out the coarser gold and heavy mineral particles from the remaining parts of the ore. Gold is extracted from these ore concentrates by a number of processes and, once extracted, is then smelted to a gold-rich doré (generally a mixture of gold and silver) and cast into bars. Smelting, in its simplest definition, involvesis the melting of ores or concentrates with a reagent which results in the separation of the gold from the impurities.

The doré goes through a series of refining processes to upgrade it to a purity and format that is acceptable in the market place. Refining can take a number of different forms, according to the type of ore being treated. The doré is refined to a purity of 99.5% or higher. The most common international standard of purity is the standard established by the London Good Delivery Standards, described in "Operation of the Gold Bullion Market — The London Bullion Market."

The gold mining company pays the refinery a fee, and then sells the bars to a bullion dealer. In some cases, the refinery may buy the gold from the mining company, thus effectively operating as a bullion dealer. Bullion dealers in turn sell the gold to manufacturers of jewelry or industrial products containing gold. Both the sale by the mine and the purchase by the manufacturer will frequently be priced with reference to the London gold price fix, which is widely used as the price benchmark for gold transactions.

Some gold mining companies sell forward their gold to a bullion dealer in order to lock in the cash-flow for revenue management purposes. The price they receive on delivery of the gold will be that which was agreed to at the time of the initial transaction, equivalent to the spot price plus the interest accrued up until the date of delivery.

Once a manufacturer of jewelry or industrial products has taken delivery of the purchased gold, the manufacturer fabricates it and sells the fabricated product to the customer. This is the typical pattern in many parts of the developing world. In some countries, especially in the industrialized world, bullion dealers will consign gold out to a manufacturer. In these cases, the gold will be stored in a secured vault on the premises of the manufacturer, who will use these consignment stocks for fabrication into products as needed. The actual sale of the gold from the bullion dealer to the manufacturer only takes place at the time the manufacturer sells the product, either to a distributor, a retailer or the customer.

In some cases, the manufacturer may, often for cost reasons, ship the gold to another country for fabrication into products. The fabricated products may then be returned to the manufacturer's country of business for onward sale, or shipped to a third country for sale to the customer.

GOLD SUPPLY AND DEMAND

Gold is a physical asset that is accumulated, rather than consumed. As a result, virtually all the gold that has ever been mined still exists today in one form or another. The Gold Fields Mineral Services Ltd. (GFMS) Gold Survey 2003 estimates that existing above-ground stocks of gold amounted to 147,800 tonnes (approximately 4.8 billion ounces) at the end of 2002. These stocks have increased by 1.8% per year on average for the 10 years ending December 2002. When used in this prospectus, "tonne" refers to one metric tonne, which is equivalent to 1,000 kilograms or 32,150.7465 troy ounces.

Existing stocks of gold may be broadly divided into two categories based on the primary reason for the purchase or the holding of the gold:

14

Overview of the Gold Industry

The first category, gold held as a store of value or monetary asset, includes the 33,580 tonnes of gold that is estimated to be owned by the official sector (central banks, other governmental agencies and multi-lateral institutions such as the International Monetary Fund). An estimated 4,280 tonnes of this gold has already been mobilized into the market and fabricated into gold products. This reduces to 29,300 tonnes (19.8% of the estimated total) the total that could theoretically become available in the unlikely event that all official sector holdings were liquidated. The 22,700 tonnes of gold (15.4% of the estimated total) in the hands of private investors also falls into this first category. While much of the gold in this category exists in bullion form and, in theory, could be mobilized and made available to the market, there are currently no indications that a significantly greater amount of gold will be mobilized in the near future than has been mobilized in recent years.

The second category, gold held as a raw material or commodity, includes the 75,500 tonnes of gold (51.1% of the estimated total) that has been manufactured into jewelry. As all gold jewelry exists as fabricated products, the jewelry would need to be remelted and transformed into bullion bars before being mobilized into the market in an acceptable form. While adornment is the primary motivation behind purchases of gold jewelry in the industrialized world, much of the jewelry in the developing world has an additional store of value element, with this jewelry being held, at least in part, as a means of savings. As suchthis jewelry in the developing world tends to be of higher purity, the price of an item of jewelry is more closely correlated with the value of the gold contained in it than is the case in the industrialized world. As a result, this jewelry is more susceptible to recycling. Recycled jewelry, primarily from the developing world, is the largest single component of annual gold scrap supply, which has averaged 696 tonnes annually over the last 10 years.

The second category also includes the 16,700 tonnes of gold (11.3% of the estimated total) that has been manufactured or incorporated into industrial products. Similar to jewelry, this gold would need to be recovered from the industrial products and then remelted and recast into bars before it could be mobilized into the market. Small quantities of remelted gold from industrial products come onto the market each year.

Approximately 3,600 tonnes of above-ground stocks (2.4% of the estimated total) is unaccounted for.

World Gold Supply and Demand (1993 – 2002)

The following table sets forth a summary of the world gold supply and demand for the last 10 years which is based on information reported in the GFMS Gold Survey 2003.

| Supply | 1993 | 1994 | 1995 | 1996 | 1997 | 1998 | 1999 | 2000 | 2001 | 2002 | |||||||||||||||||||||||||||||||||

| (Tonnes) | |||||||||||||||||||||||||||||||||||||||||||

| Mine production | 2,291 | 2,285 | 2,291 | 2,375 | 2,493 | 2,542 | 2,574 | 2,591 | 2,623 | 2,587 | |||||||||||||||||||||||||||||||||

| Old gold scrap | 577 | 621 | 631 | 644 | 626 | 1,099 | 608 | 609 | 708 | 835 | |||||||||||||||||||||||||||||||||

| Official sector sales | 468 | 130 | 167 | 279 | 326 | 363 | 477 | 479 | 529 | 556 | |||||||||||||||||||||||||||||||||

| Net producer hedging | 142 | 105 | 475 | 142 | 504 | 97 | 506 | (15 | ) | (151 | ) | (423 | ) | ||||||||||||||||||||||||||||||

| Total Reported Supply | 3,478 | 3,141 | 3,564 | 3,440 | 3,949 | 4,101 | 4,165 | 3,664 | 3,709 | 3,555 | |||||||||||||||||||||||||||||||||

| Demand | |||||||||||||||||||||||||||||||||||||||||||

| Gold fabrication in carat jewelry | 2,559 | 2,640 | 2,812 | 2,856 | 3,311 | 3,182 | 3,154 | 3,232 | 3,038 | 2,689 | |||||||||||||||||||||||||||||||||

| Gold fabrication in electronics | 178 | 187 | 204 | 207 | 235 | 225 | 247 | 285 | 204 | 210 | |||||||||||||||||||||||||||||||||

| Gold fabrication in dentistry | 63 | 64 | 67 | 68 | 70 | 64 | 66 | 69 | 68 | 69 | |||||||||||||||||||||||||||||||||

| Gold fabrication in other industrial and decorative applications | 100 | 104 | 110 | 113 | 115 | 103 | 99 | 101 | 101 | 82 | |||||||||||||||||||||||||||||||||

| Retail investment | 331 | 349 | 465 | 298 | 493 | 337 | 446 | 335 | 359 | 377 | |||||||||||||||||||||||||||||||||

| Total Reported Demand | 3,232 | 3,344 | 3,657 | 3,541 | 4,223 | 3,911 | 4,011 | 4,022 | 3,769 | 3,427 | |||||||||||||||||||||||||||||||||

| Supply less Demand1 | 246 | (203 | ) | (92 | ) | (102 | ) | (275 | ) | 191 | 154 | (357 | ) | (61 | ) | 128 | |||||||||||||||||||||||||||

| (1) | A negative number means that total reported demand exceeded total reported supply. Totals may not add due to independent rounding. |

15

Overview of the Gold Industry

SOURCES OF GOLD SUPPLY

Sources of gold supply include both mine production and the recycling or mobilizing of existing above-ground stocks. The largest portion of gold supplied into the market annually is from gold mine production. The second largest source of annual gold supply is from old scrap, which is gold that has been recovered from jewelry and other fabricated products and converted back into marketable gold. Official sector sales have outstripped purchases since 1989, creating additional net supply of gold into the marketplace. Net producer hedging accelerates the sale of physical gold and can therefore impact, positively or negatively, supply in a given year.

Mine production

Mine production includes gold produced from both primary deposits and from secondary deposits where the gold is recovered as a by-product metal from other mining activities.

Mine production is derived from more than 900 separate operations on all continents of the world, except Antarctica. Any disruption to production in any one locality is unlikely to affect a significant number of these operations simultaneously. Such potential disruption is unlikely to have a material impact on the overall level of global mine production, and therefore equally unlikely to have a noticeable impact on the gold price.

In the unlikely event of significant disruptions to production occurring simultaneously at a large number of individual mines, any impact on the price of gold would likely be short-lived. Historically, any sudden and significant rise in the price of gold has been followed by a reduction in physical demand which lasts until the period of unusual volatility is past. Gold price increases also tend to lead to an increase in the levels of recycled scrap used for gold supply. Both of these factors have tended to limit the extent and duration of upward movements in the price of gold.

Since 1984, the amount of new gold that is mined each year has been substantially lower than the level of physical demand. For example, during the five years from 1998 to 2002, new mine production only satisfied 67% of the total demand for fabrication and retail investment. The shortfall in total supply has been met by additional supplies from existing above-ground stocks, predominantly coming from the recycling of fabricated gold products, official sector sales and net producer hedging.

Old gold scrap

Gold scrap is gold that has been recovered from fabricated products, melted, refined and cast into bullions bars for subsequent resale into the gold market. The predominant source of gold scrap is recycled jewelry, whichjewelry. This predominance is largely a function of price and economic circumstances. The 1998 peak in gold scrap supply can be attributed to the concurrent collapse of many of the East Asian currencies, which began with the Thai Baht in July 1997, leading to price-driven and distress related selling.

Official sector sales

Historically, central banks have retained gold as a strategic reserve asset. However, since 1989 the official sector has been a net seller of gold to the private sector, supplying an average of 368 tonnes per year from 1989 to 2002 inclusive. This has resulted in net movements of gold from the official to the private sector. Owing to the prominence given by market commentators to this activity and the size of official sector gold holdings, this area has been one of the more visible sources of supply. The official sector will continue to play an important role in the dynamics of the gold market.

The Central Bank Gold Agreement, also known as the Washington Agreement on Gold or "WAG","WAG," announced during the International Monetary Fund meetings in Washington, DC on September 26, 1999, is a voluntary agreement among key central banks to clarify their intentions with respect to their gold holdings. The signatories to the agreement were the European Central Bank and 14 other central banks. These institutions agreed not to enter the gold market as sellers except for already decided sales, which were to be achieved through a five year program that limited annual sales to approximately 400 tonnes and total sales over the period to 2,000 tonnes. The signatories further agreed not to expand their use of gold lending and derivatives over the period. The agreement, unless renewed, expires in September 2004. The United States and Japan, while not signatories, agreed to abide by the spirit of the agreement.

16

Overview of the Gold Industry

The following chart shows the reported gold holdings in the official sector at December 2002.

| (1) | The Euro Area comprises the following countries: Austria, Belgium, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, The Netherlands, Portugal, and Spain, plus the European Central Bank from January 1999 when the European Economic and Monetary Union was implemented. |

Net producer hedging

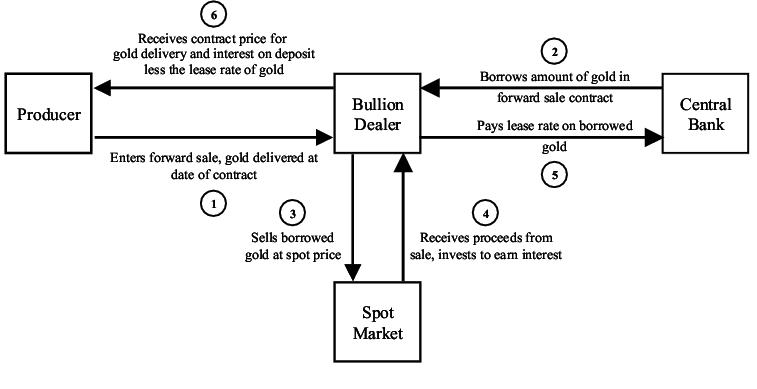

Net producer hedging creates incremental supply in the market by accelerating the timing of the sale of gold. A mining company wishing to protect itself from the risk of a decline in the gold price may elect to sell some or all of its anticipated production for delivery at a future date. A bullion dealer accepting such a transaction will finance it by borrowing an equivalent quantity of gold (typically from a central bank), which is immediately sold into the market. The bullion dealer then invests the cash proceeds from that sale of gold and uses the yield on these investments to pay the gold mining company the contango (i.e., the premium available on gold for future delivery). When the mining company delivers the gold it has contracted to sell to the bullion dealer, the dealer returns the gold to the central bank that lent it, or rolls the loan forward in order to finance similar transactions in the future. While over time hedging transactions involve no net increase in the supply of gold to the market, they do accelerate the timing of the sale of the gold, which has an impact on the balance between supply and demand at the time. Since 2000, there has been an annual net reduction in the volume of outstanding producer hedges that has reduced supply.

The following illustration details a typical hedging transaction (numbering indicates sequential timing).

17

Overview of the Gold Industry

The following illustration details a typical hedging transaction (numbering indicates sequential timing).

SOURCES OF GOLD DEMAND

As reported by published statistics, the demand for gold wasamounted to less than 3.0% of total above ground stocks in 2002. Demand for gold is driven primarily by demand for jewelry, which is used for adornment and, in much of the developing world, also as an investment. Retail investment and industrial applications represent increasingly important, though relatively small, components of overall demand. Retail investment is measured as customer purchases of bars and coins. Gold bonding wire and gold plated contacts and connectors are the two most frequent uses of gold in industrial applications.