Registration Statement No. 333-112978333-

SECURITIES AND EXCHANGE COMMISSION

AMENDMENT NO. 3

Blackbaud, Inc.

| Delaware | 7372 | 11-2617163 | ||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

2000 Daniel Island Drive

Robert J. Sywolski

Copies to:

| Donald R. Reynolds, Esq. Kevin A. Prakke, Esq. Wyrick Robbins Yates & Ponton LLP 4101 Lake Boone Trail, Suite 300 Raleigh, North Carolina 27607 Telephone: (919) 781-4000 Facsimile: (919) 781-4865 |

Approximate date of commencement of proposed sale to the public: As soon as practicableFrom time to time after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. ox

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. o

CALCULATION OF REGISTRATION FEE

| Proposed Maximum | ||||

| Aggregate Offering | Amount of | |||

| Title of Each Class of Securities to be Registered | Price(1) | Registration Fee | ||

| Common Stock, par value $0.001 per share | $138,950,000 | $16,354.42 | ||

| (1) | Estimated solely for purposes of calculating the registration fee under Rule 457(c) under the Securities Act, based on the average of the high and low prices of the common stock on the Nasdaq National Market on January 12, 2005. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

| The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the SEC is effective. This prospectus is not an offer to sell these securities, and we are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted. |

Subject to completion, dated , 2004January 18, 2005

Prospectus

10,000,000 shares

Common stock

This isprospectus relates to the initial public offeringoffer and sale from time to time of up to an aggregate of 10,000,000 shares of our common stock of Blackbaud, Inc. All offor the sharesaccount of common stock being sold in this offering are being sold by the selling stockholders named in this prospectus. We will not receiveThe selling stockholders may sell the common stock from time to time in public transactions or in privately negotiated transactions, without limitation, through any proceeds frommeans described in the section hereof entitled “Plan of Distribution”, at market prices prevailing at the time of sale or at negotiated prices. The timing and amount of shares in this offering. The estimated initial public offering price is between $ and $ per share.

We have indicated toany sale are within the underwriters an intention to purchase, simultaneously with this underwritten offering and based on the midpointsole discretion of the price range shownselling stockholders.

Our common stock is listed on the cover of this prospectus, shares of our common stock directly from Anthony E. Bakker in a private, non-underwritten transaction at the net per share price to be received by the selling stockholders in this underwritten offering. The repurchase, if consummated, is conditioned on the simultaneous completion of this underwritten offering.

Prior to this offering, there has been no public market for our common stock. We have applied for listing of our common stock on The Nasdaq National Market under the symbol BLKB.

The selling stockholders have granted the underwriters an optionYou should read this prospectus and any prospectus supplement carefully before you invest. See “Where You Can Find More Information” for a period of 30 days to purchase up to additional shares of common stock.more information.

See “Risk factors” beginning on page 76 to read about factors you should consider before buying shares of our common stock.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

, 2004

Table of contents

| Page | ||||

| Prospectus summary | 1 | |||

| Risk factors | ||||

| Forward-looking statements | ||||

| Use of proceeds | ||||

| Dividend policy | ||||

| Capitalization | ||||

| Dilution | ||||

| Selected consolidated financial data | ||||

| Management’s discussion and analysis of financial condition and results of operations | ||||

| Business | 49 | |||

| Management | 66 | |||

| Principal and selling stockholders | 75 | |||

| Certain relationships and related transactions | ||||

| Description of capital stock | ||||

| U.S. federal tax considerations for non-U.S. holders of common stock | ||||

| Legal matters | ||||

| Experts | ||||

| Where you can find more information | ||||

| Index to consolidated financial statements | F-1 | |||

i

Prospectus summary

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all the information you should consider before investing in shares of our common stock. Except as otherwise noted herein, all information in this prospectus reflects [a one-for- reverse stock split of our outstanding shares of common stock and] our reincorporation under the laws of the State of Delaware to be effected in July 2004 prior to the closing of the offering made hereby. You should read this entire prospectus carefully, including “Risk factors” beginning on page 76 and our consolidated financial statements and the related notes thereto, before making an investment decision.

Blackbaud, Inc.

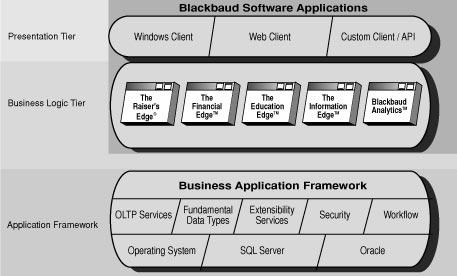

We are the leading global provider of software and related services designed specifically for nonprofit organizations. Our products and services enable nonprofit organizations to increase donations, reduce fundraising costs, improve communications with constituents, manage their finances and optimize internal operations. We have focused solely on the nonprofit market since our incorporation in 1982 and have developed our suite of products and services based upon our extensive knowledge of the operating challenges facing nonprofit organizations. In 2003,2004, we had over 12,50012,700 customers, over 11,90012,300 of which pay us annual maintenance and support fees. Our customers operate in multiple verticals within the nonprofit market including religion, education, foundations, health and human services, arts and cultural, public and societal benefits, environment and animal welfare, and international and foreign affairs.

Industry

Nonprofit organizations are a large part of the U.S. economy, employing one out of every ten Americans. There were greater than 1.41.5 million registered U.S. nonprofit organizations in 20022003 according to data from the Internal Revenue Service. In addition, there are greater than 1.5 million nonprofit organizations outside the United States. Donations to nonprofit organizations in the United States were $241 billion in 2002,2003, having increased almost every year since 1962, with a compound annual growth rate over that period of 7.8%, according to Giving USA. In addition, these organizations received fees of approximately $600 billion in the twelve months prior to December 2003 for services they provided.

Nonprofit organizations often utilize methods of fundraising that are costly and inefficient, largely because of the difficulties in effectively collecting, sharing and using information. Fundraising and administration costs are significant, with the fundraising component alone amounting to more than $0.24 for each dollar donated based on our market research. Furthermore, nonprofit organizations face distinct operational challenges, such as soliciting small cash contributions from numerous contributors and complying with unique accounting, tax and reporting issues. Because of these fundraising costs and operational challenges, we believe nonprofit organizations can benefit from software applications and services specifically designed to serve their particular needs.

1

Our products and services

Our suite of products and services includes:

| • | The Raiser’s Edge®, a complete fundraising software solution that helps nonprofit organizations improve relationships with their donors and constituents to more effectively raise money; |

| • | The Financial Edge™, a complete financial management solution that addresses the specific fund accounting needs of nonprofit organizations; |

1

| • | The Education Edge™, a student information management software suite designed primarily for K-12 independent schools; |

| • | The Patron Edge™, a comprehensive ticketing management solution that streamlines ticketing, marketing, staffing and other administrative tasks; |

| • | The Information Edge™, a comprehensive business intelligence application that extracts, aggregates and analyzes data to improve strategic decision making; |

| • | |

| • | NetCommunity™ and NetSolutions™, internet applications that enable our customers to establish online communities and conduct online fundraising. |

We have web-enabled most of our applications to allow our customers to access them over the Internet. We also offer a variety of Internet applications and consulting services that allow nonprofit organizations to leverage the Internet for online fundraising and other important operations. In addition, we provide a broad range of services, including implementation, business process improvement, training and education services, and maintenance and technical support to enable our customers to more effectively run their organizations.

Our strategy

Our objective is to maintain and leverage our position as the leading provider of software and related services designed specifically for nonprofit organizations. Key elements of our strategy to achieve this objective are to:

| • | grow our customer base; |

| • | maintain and expand existing customer relationships; |

| • | introduce additional products and services; |

| • | leverage the Internet as a means of additional growth; |

| • | expand international presence; and |

| • | pursue strategic acquisitions and alliances. |

Sales and marketing

We primarily sell our products and services to nonprofit organizations through our direct sales force. Our customers enter into license agreements and pay us an upfront license fee and annual maintenance and support fees for our software. We also receive fees, on a subscription and fixed price basis, for our hosted services and access to our data enrichment and analytical services. We sell the majority of our consulting and technical services on a time and materials basis.

Over the past three years we have added an average of 1,3001,400 new customers per year. Our customers are located in 4547 countries, primarily the United States, the United Kingdom and Canada. Ongoing customer relationships that illustrate our broad customer base include the American Red Cross, the Chesapeake Bay Foundation, the Crohn’s & Colitis Foundation of

2

Company information

We originally incorporated in New York in 1982 and moved our operations to Charleston, South Carolina in 1989. We reincorporated in South Carolina in December 1991, engaged in a recapitalization in October 1999 and reincorporated under the laws of the State of Delaware on July ,16, 2004. Our principal executive offices are located at 2000 Daniel Island Drive, Charleston, South Carolina 29492, and our telephone number at that location is (843) 216-6200. Our web site address iswww.blackbaud.com. The information contained on our web site is not a part of, and should not be construed as being incorporated by reference into, this prospectus.

3

The offering

The number of shares of common stock to be outstanding after this offering excludes:

Unless otherwise indicated, all information contained in this prospectus:

4

Summary consolidated financial data

The following table sets forth a summarydata, insofar as it relates to each of ourthe years 1998 -2003, has been derived from annual financial statements, including the consolidated financial databalance sheets at December 31, 2003 and 2002 and the related consolidated statements of operations, cash flows and shareholders’ equity (deficit) and comprehensive income for the periods presented.three years ended December 31, 2003 and notes thereto appearing elsewhere herein. The consolidated financial statements for the year ended December 31, 1998 were audited by other auditors. The consolidated financial statements for the fiscal year ended December 31, 1999 were audited by Arthur Andersen LLP, which has since ceased operations. The data for the nine months ended September 30, 2004 and 2003 has been derived from unaudited financial statements also appearing herein and which, in the opinion of management, include all adjustments, consisting only of normal recurring adjustments, necessary for a fair statement of the results for the unaudited interim periods. This summary consolidated financial data should be read together with “Selected consolidated financial data”, “Management’s discussion and analysis of financial condition and results of operations” and our consolidated financial statements and related notes contained elsewhere in this prospectus. See “Capitalization”.

| Three months | Nine months | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended December 31, | ended March 31, | Year ended December 31, | ended September 30, | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (in thousands, except per share data) | (in thousands, except per share data) | 1998(2)(3) | 1999(2)(3) | 2000(3) | 2001 | 2002 | 2003 | 2003 | 2004 | (in thousands, except per share data) | 1998(2)(3) | 1999(2)(3) | 2000(3) | 2001 | 2002 | 2003 | 2003 | 2004 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Consolidated statements of operations data: | Consolidated statements of operations data: | (unaudited) | Consolidated statements of operations data: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Revenue | Revenue | Revenue | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| License fees | $ | 29,408 | $ | 37,938 | $ | 24,471 | $ | 19,300 | $ | 20,572 | $ | 21,339 | $ | 4,504 | $ | 5,077 | License fees | $ | 29,408 | $ | 37,938 | $ | 24,471 | $ | 19,300 | $ | 20,572 | $ | 21,339 | $ | 15,427 | $ | 18,614 | |||||||||||||||||||||||||||||||||||

| Services | 10,716 | 17,309 | 14,266 | 18,797 | 26,739 | 34,042 | 7,744 | 9,545 | Services | 10,716 | 17,309 | 14,266 | 18,797 | 26,739 | 34,042 | 25,888 | 32,678 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Maintenance and subscriptions | 22,446 | 29,680 | 39,042 | 47,022 | 52,788 | 58,360 | 14,099 | 15,779 | Maintenance and subscriptions | 22,446 | 29,680 | 39,042 | 47,022 | 52,788 | 58,360 | 43,271 | 48,886 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Other revenue | 3,062 | 7,550 | 5,838 | 4,915 | 5,130 | 4,352 | 962 | 954 | Other revenue | 3,062 | 7,550 | 5,838 | 4,915 | 5,130 | 4,352 | 2,906 | 2,849 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Total revenue | 65,632 | 92,477 | 83,617 | 90,034 | 105,229 | 118,093 | 27,309 | 31,355 | Total revenue | 65,632 | 92,477 | 83,617 | 90,034 | 105,229 | 118,093 | 87,492 | 103,027 | |||||||||||||||||||||||||||||||||||||||||||||||||||

Cost of revenue | Cost of revenue | Cost of revenue | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cost of license fees | 709 | 989 | 1,284 | 1,726 | 2,547 | 2,819 | 567 | 729 | Cost of license fees | 709 | 989 | 1,284 | 1,726 | 2,547 | 2,819 | 2,110 | 2,733 | |||||||||||||||||||||||||||||||||||||||||||||||||||

Cost of services(1) | 4,339 | 5,534 | 7,028 | 10,253 | 14,234 | 21,006 | 4,911 | 5,378 | Cost of services(1) | 4,339 | 5,534 | 7,028 | 10,253 | 14,234 | 21,006 | 15,347 | 15,988 | |||||||||||||||||||||||||||||||||||||||||||||||||||

Cost of maintenance and subscriptions(1) | 11,443 | 15,246 | 15,120 | 11,733 | 10,588 | 11,837 | 2,835 | 2,660 | Cost of maintenance and subscriptions(1) | 11,443 | 15,246 | 15,120 | 11,733 | 10,588 | 11,837 | 9,031 | 7,864 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Cost of other revenue | 1,559 | 2,160 | 1,972 | 2,750 | 3,611 | 3,712 | 805 | 860 | Cost of other revenue | 1,559 | 2,160 | 1,972 | 2,750 | 3,611 | 3,712 | 2,556 | 2,577 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Total cost of revenue | 18,050 | 23,929 | 25,404 | 26,462 | 30,980 | 39,374 | 9,118 | 9,627 | Total cost of revenue | 18,050 | 23,929 | 25,404 | 26,462 | 30,980 | 39,374 | 29,044 | 29,162 | |||||||||||||||||||||||||||||||||||||||||||||||||||

Gross profit | Gross profit | 47,582 | 68,548 | 58,213 | 63,572 | 74,249 | 78,719 | 18,191 | 21,728 | Gross profit | 47,582 | 68,548 | 58,213 | 63,572 | 74,249 | 78,719 | 58,448 | 73,865 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Sales and marketing | 11,337 | 13,719 | 12,326 | 15,173 | 19,173 | 21,883 | 5,062 | 6,360 | Sales and marketing | 11,337 | 13,719 | 12,326 | 15,173 | 19,173 | 21,883 | 15,991 | 20,646 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Research and development | 9,604 | 13,923 | 13,912 | 14,755 | 14,385 | 15,516 | 3,620 | 4,276 | Research and development | 9,604 | 13,923 | 13,912 | 14,755 | 14,385 | 15,516 | 11,506 | 13,245 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| General and administrative | 8,938 | 12,833 | 10,390 | 9,031 | 10,631 | 11,085 | 2,823 | 2,851 | General and administrative | 8,938 | 12,833 | 10,390 | 9,031 | 10,631 | 11,085 | 8,042 | 9,093 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Amortization | 2,574 | 2,510 | 2,200 | 2,239 | 1,045 | 848 | 48 | 32 | Amortization | 2,574 | 2,510 | 2,200 | 2,239 | 1,045 | 848 | 800 | 32 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Cost of initial public offering | — | — | — | — | — | — | — | 950 | Cost of initial public offering | — | — | — | — | — | — | — | 2,455 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Stock option compensation | — | — | — | — | — | 23,691 | 5,446 | 667 | Stock option compensation | — | — | — | — | — | 23,691 | 17,326 | 55 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Total operating expenses | 32,453 | 42,985 | 38,828 | 41,198 | 45,234 | 73,023 | 16,999 | 15,136 | Total operating expenses | 32,453 | 42,985 | 38,828 | 41,198 | 45,234 | 73,023 | 53,665 | 45,526 | |||||||||||||||||||||||||||||||||||||||||||||||||||

Income from operations | Income from operations | 15,129 | 25,563 | 19,385 | 22,374 | 29,015 | 5,696 | 1,192 | 6,592 | Income from operations | 15,129 | 25,563 | 19,385 | 22,374 | 29,015 | 5,696 | 4,783 | 28,339 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest income | 1,032 | 716 | 241 | 96 | 138 | 97 | 26 | 25 | Interest income | 1,032 | 716 | 241 | 96 | 138 | 97 | 70 | 133 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest expense | (638 | ) | (2,752 | ) | (11,265 | ) | (7,963 | ) | (4,410 | ) | (2,559 | ) | (863 | ) | (213 | ) | Interest expense | (638 | ) | (2,752 | ) | (11,265 | ) | (7,963 | ) | (4,410 | ) | (2,559 | ) | (2,216 | ) | (268 | ) | |||||||||||||||||||||||||||||||||||

| Other income (expense), net | 6,310 | (79 | ) | (185 | ) | (113 | ) | 63 | 235 | 15 | 349 | Other income (expense), net | 6,310 | (79 | ) | (185 | ) | (113 | ) | 63 | 235 | (100 | ) | 342 | ||||||||||||||||||||||||||||||||||||||||||||

Income before provision for income taxes | Income before provision for income taxes | 21,833 | 23,448 | 8,176 | 14,394 | 24,806 | 3,469 | 370 | 6,753 | Income before provision for income taxes | 21,833 | 23,448 | 8,176 | 14,394 | 24,806 | 3,469 | 2,537 | 28,546 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Income tax provision (benefit) | 158 | (1,456 | ) | 3,080 | 5,488 | 9,166 | 3,947 | 421 | 2,756 | Income tax provision (benefit) | 158 | (1,456 | ) | 3,080 | 5,488 | 9,166 | 3,947 | 2,886 | 11,619 | |||||||||||||||||||||||||||||||||||||||||||||||||

Net income (loss) | Net income (loss) | $ | 21,675 | $ | 24,904 | $ | 5,096 | $ | 8,906 | $ | 15,640 | $ | (478 | ) | $ | (51 | ) | $ | 3,997 | Net income (loss) | $ | 21,675 | $ | 24,904 | $ | 5,096 | $ | 8,906 | $ | 15,640 | $ | (478 | ) | $ | (349 | ) | $ | 16,927 | ||||||||||||||||||||||||||||||

| Earnings (loss) per share | Earnings (loss) per share | Earnings (loss) per share | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Basic | $ | — | $ | — | $ | 0.08 | $ | 0.13 | $ | 0.23 | $ | (0.01 | ) | $ | (0.00 | ) | $ | 0.06 | Basic | $ | — | $ | — | $ | 0.13 | $ | 0.21 | $ | 0.37 | $ | (0.01 | ) | $ | (0.01 | ) | $ | 0.40 | |||||||||||||||||||||||||||||||

| Diluted | $ | — | $ | — | $ | 0.08 | $ | 0.13 | $ | 0.23 | $ | (0.01 | ) | $ | (0.00 | ) | $ | 0.05 | Diluted | $ | — | $ | — | $ | 0.13 | $ | 0.21 | $ | 0.37 | $ | (0.01 | ) | $ | (0.01 | ) | $ | 0.36 | |||||||||||||||||||||||||||||||

| Common shares and equivalents outstanding | Common shares and equivalents outstanding | Common shares and equivalents outstanding | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Basic weighted average shares | N/A | N/A | 64,443 | 66,389 | 67,777 | 67,833 | 67,777 | 67,858 | Basic weighted average shares | N/A | N/A | 40,277 | 41,492 | 42,360 | 42,396 | 42,391 | 42,480 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Diluted weighted average shares | N/A | N/A | 64,443 | 66,389 | 67,777 | 67,833 | 67,777 | 73,823 | Diluted weighted average shares | N/A | N/A | 40,277 | 41,492 | 42,360 | 42,396 | 42,391 | 46,467 | |||||||||||||||||||||||||||||||||||||||||||||||||||

Summary of stock option compensation: | Summary of stock option compensation: | Summary of stock option compensation: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cost of services | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 3,342 | $ | 622 | $ | 294 | Cost of services | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 3,342 | $ | 2,291 | $ | (644 | ) | ||||||||||||||||||||||||||||||||||

| Cost of maintenance and subscriptions | — | — | — | — | — | 505 | 93 | 37 | Cost of maintenance and subscriptions | — | — | — | — | — | 505 | 344 | (106 | ) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total cost of revenue | — | — | — | — | — | 3,847 | 715 | 331 | Total cost of revenue | — | — | — | — | — | 3,847 | 2,635 | (750 | ) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Sales and marketing | — | — | — | — | — | 1,817 | 336 | 254 | Sales and marketing | — | — | — | — | — | 1,817 | 1,201 | (194 | ) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Research and development | — | — | — | — | — | 2,341 | 456 | 174 | Research and development | — | — | — | — | — | 2,341 | 1,639 | (517 | ) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| General and administrative | — | — | — | — | — | 19,533 | 4,654 | 239 | General and administrative | — | — | — | — | — | 19,533 | 14,486 | 766 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Total operating expenses | — | — | — | — | — | 23,691 | 5,446 | 667 | Total operating expenses | — | — | — | — | — | 23,691 | 17,326 | 55 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Total stock option compensation | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 27,538 | $ | 6,161 | $ | 998 | Total stock option compensation | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 27,538 | $ | 19,961 | $ | (695 | ) | ||||||||||||||||||||||||||||||||||

| (1) | Includes stock option compensation as set forth in Summary of stock option compensation. |

| (2) | Earnings per share not computed for this year because we were an S corporation until our recapitalization in October 1999 and therefore the information would not be meaningful. |

| (3) | Certain amounts in the 1998, 1999 and 2000 financial statements have been reclassified to conform to the 2003 financial statement presentation. These reclassifications have no effect on previously reported net income (loss), shareholders’ equity or net income (loss) per share. |

54

| March 31, 2004 (unaudited) | ||||||||||||

| September 30, 2004 (unaudited) | ||||||||||||

| (in thousands) | Actual | As adjusted(4) | ||||||||||

Consolidated balance sheet data: | ||||||||||||

| Cash and cash equivalents | $ | 6,085 | $ | $ | 33,382 | |||||||

| Deferred tax asset | 86,725 | |||||||||||

| Deferred tax asset, including current portion | 81,210 | |||||||||||

| Working capital | (28,442 | ) | (11,879 | ) | ||||||||

| Total assets | 118,242 | 142,585 | ||||||||||

| Deferred revenue | 43,765 | 51,727 | ||||||||||

| Long-term debt and capital lease obligations, excluding current portion | 7 | — | ||||||||||

| Total liabilities | 53,443 | 66,266 | ||||||||||

| Common stock | 41,728 | 43 | ||||||||||

| Additional paid-in capital | 38,056 | |||||||||||

| Total stockholders’ equity | $ | 64,799 | $ | $ | 76,319 | |||||||

65

Risk factors

An investment in our common stock involves a high degree of risk. You should carefully consider the following risk factors and the other information in this prospectus, including our consolidated financial statements and the related notes thereto, before investing in our common stock. Our business, operating results and financial condition could be seriously harmed by any of the following risks. The trading price of our common stock could decline due to any of these risks, in which case you could lose all or part of your investment.

Risks related to our business

The market for software and services for nonprofit organizations might not grow, and nonprofit organizations might not continue to adopt our products and services.

Many nonprofit organizations have not traditionally used integrated and comprehensive software and services for their nonprofit-specific needs. We cannot be certain that the market for such products and services will continue to develop and grow or that nonprofit organizations will elect to adopt our products and services rather than continue to use traditional, less automated methods, attempt to develop software internally, rely upon legacy software systems, or use generalized software solutions not specifically designed for the nonprofit market. Nonprofit organizations that have already invested substantial resources in other fundraising methods or other non-integrated software solutions might be reluctant to adopt our products and services to supplement or replace their existing systems or methods. In addition, the implementation of one or more of our core software products can involve significant time and capital commitments by our customers, which they may be unwilling or unable to make. If demand for and market acceptance of our products and services does not increase, we might not grow our business as we expect.

We might not generate increased business from our current customers, which could limit our revenue in the future.

Our business model is highly dependent on the success of our efforts to increase sales to our existing customers. Many of our customers initially make a purchase of only one or a limited number of our products or only for a single department within their organization. These customers might choose not to expand their use of or make additional purchases of our products and services. If we fail to generate additional business from our current customers, our revenue could grow at a slower rate or even decrease. In addition, as we deploy new applications and features for our existing products or introduce new products and services, our current customers could choose not to purchase these new offerings.

If our customers do not renew their annual maintenance and support agreements for our products or if they do not renew them on terms that are favorable to us, our business might suffer.

Most of our maintenance agreements are for a term of one year. As the end of the annual period approaches, we pursue the renewal of the agreement with the customer. Historically, maintenance renewals have represented a significant portion of our total revenue, including approximately 49% of our total revenue in 2003.2003 and 47% of our total revenue for the fiscal nine months ended September 30, 2004. Because of this characteristic of our business, if our customers choose not to renew their maintenance and support agreements with us on beneficial terms, our business, operating results and financial condition could be harmed.

76

A substantial majority of our revenue is derived from The Raiser’s Edge and a decline in sales or renewals of this product and related services could harm our business.

We derive a substantial majority of our revenue from the sale of The Raiser’s Edge and related services, and revenue from this product and related services is expected to continue to account for a substantial majority of our total revenue for the foreseeable future. For example, revenue from the sale of The Raiser’s Edge and related services represented approximately 72% of our total revenue in 2003 and 70% of our total revenue in 2003.for the nine months ended September 30, 2004. Because we generally sell licenses to our products on a perpetual basis and deliver new versions and enhancements to customers who purchase annual maintenance and support, our future license, services and maintenance revenue are substantially dependent on sales to new customers. In addition, we frequently sell The Raiser’s Edge to new customers and then attempt to generate incremental revenue from the sale of additional products and services. If demand for The Raiser’s Edge declines significantly, our business would suffer.

Our quarterly financial results fluctuate and might be difficult to forecast and, if our future results are below either any guidance we might issue or the expectations of public market analysts and investors, the price of our common stock might decline.

Our quarterly revenue and results of operations are difficult to forecast. We have experienced, and expect to continue to experience, fluctuations in revenue and operating results from quarter to quarter. As a result, we believe that quarter-to-quarter comparisons of our revenue and operating results are not necessarily meaningful and that such comparisons might not be accurate indicators of future performance. The reasons for these fluctuations include but are not limited to:

| • | the size and timing of sales of our software, including the relatively long sales cycles associated with many of our large software sales; |

| • | budget and spending decisions by our customers; |

| • | market acceptance of new products we release, such as our recently-introduced business intelligence tools; |

| • | the amount and timing of operating costs related to the expansion of our business, operations and infrastructure; |

| • | changes in our pricing policies or our competitors’ pricing policies; |

| • | seasonality in our revenue; |

| • | general economic conditions; and |

| • | costs related to acquisitions of technologies or businesses. |

Our operating expenses, which include sales and marketing, research and development and general and administrative expenses, are based on our expectations of future revenue and are, to a large extent, fixed in the short term. If revenue falls below our expectations in a quarter and we are not able to quickly reduce our operating expenses in response, our operating results for that quarter could be adversely affected. It is possible that in some future quarter our operating results may be below either any guidance we might issue or the expectations of public market analysts and investors and, as a result, the price of our common stock might fall.

87

We encounter long sales and implementation cycles, particularly for our largest customers, which could have an adverse effect on the size, timing and predictability of our revenue and sales.

Potential customers, particularly our larger enterprise-wide clients, generally commit significant resources to an evaluation of available software and require us to expend substantial time, effort and money educating them as to the value of our software and services. Sales of our core software products to these larger customers often require an extensive education and marketing effort.

We could expend significant funds and management resources during the sales cycle and ultimately fail to close the sale. Our core software product sales cycle averages approximately two months for sales to existing customers and from six to nine months for sales to new customers and large enterprise-wide sales. Our implementation cycle for large enterprise-wide sales can extend for a year or more, which can negatively impact the timing and predictability of our revenue. Our sales cycle for all of our products and services is subject to significant risks and delays over which we have little or no control, including:

| • | our customers’ budgetary constraints; |

| • | the timing of our clients’ budget cycles and approval processes; |

| • | our clients’ willingness to replace their current methods or software solutions; |

| • | our need to educate potential customers about the uses and benefits of our products and services; and |

| • | the timing and expiration of our clients’ current license agreements or outsourcing agreements for similar services. |

If we are unsuccessful in closing sales after expending significant funds and management resources or if we experience delays as discussed above, it could have a material adverse effect on the size, timing and predictability of our revenue.

We have recorded a significant deferred tax asset, and we might never realize the full value of our deferred tax asset, which would result in a charge against our earnings.

In connection with the initial acquisition of our common stock by our current stockholders in 1999, we recorded approximately $107 million as a deferred tax asset. Our deferred tax asset was approximately $87$81 million as of March 31,September 30, 2004, or approximately 73%57% of our total assets as of that date. Realization of our deferred tax asset is dependent upon our generating sufficient taxable income in future years to realize the tax benefit from that asset. In accordance with Financial Accounting Standards Board Statement of Financial Accounting Standards No. 109, deferred tax assets are reviewed at least annually for impairment. Impairment would result if, based on the available evidence, it is more likely than not that some portion of the deferred tax asset will not be realized. This impairment could be caused by, among other things, deterioration in performance, loss of key contracts, adverse market conditions, adverse changes in applicable laws or regulations, including changes that restrict the activities of or affect the products sold by our business and a variety of other factors. If an impairment were to occur in a future period, it would be recognized as an expense in our results of operations during the period of impairment. Depending on future circumstances, it is possible that we might never realize the full value of our deferred tax asset. Any future determination of impairment of a significant portion of our deferred tax asset would have an

98

Nonprofit organizations might not use the Internet to facilitate their fundraising and organizational efforts in a manner sufficient to allow us to make a profit or even recapture our investment in this area. In addition, even if they increasingly use the Internet for these purposes, if we fail to capitalize on this opportunity, we could lose market share.

The market for online fundraising solutions for nonprofit organizations is new and emerging. Nonprofit organizations have not traditionally used the Internet or web-enabled software solutions for fundraising. We cannot be certain that the market will continue to develop and grow or that nonprofit organizations will elect to use any of our web-enabled products rather than continue to use traditional offline methods, attempt to develop software solutions internally or use standardized software solutions not designed for the specific needs of nonprofits. Nonprofit organizations that have already invested substantial resources in other fundraising methods may be reluctant to use the Internet to supplement their existing systems or methods. In addition, increasing concerns about fraud, privacy, reliability and other problems might cause nonprofit organizations not to adopt the Internet as a method for fundraising. If demand for and market acceptance of Internet-based products for nonprofits does not occur, we might not recapture our investment in this area or grow our business as we expect. On the other hand, even if nonprofits increasingly use the Internet for their fundraising and organizational efforts, if we fail to develop and offer products that meet customer needs in this area, we could lose market share.

Our failure to compete successfully could cause our revenue or market share to decline.

Our market is fragmented, competitive and rapidly evolving, and there are limited barriers to entry for some aspects of this market. We mainly face competition from four sources:

| • | software developers offering integrated specialized products designed to address specific needs of nonprofit organizations; |

| • | providers of traditional, less automated fundraising services, such as services that support traditional direct mail campaigns, special events fundraising, telemarketing and personal solicitations; |

| • | custom-developed products created either internally or outsourced to custom service providers; and |

| • | software developers offering general products not designed to address specific needs of nonprofit organizations. |

The companies we compete with, and other potential competitors, may have greater financial, technical and marketing resources and generate greater revenue and better name recognition than we do. If one or more of our competitors or potential competitors were to merge or partner with one of our competitors, the change in the competitive landscape could adversely affect our ability to compete effectively. For example, a large diversified software enterprise, such as Microsoft, Oracle or PeopleSoft, could decide to enter the market directly, including through acquisitions.

Additionally, Sage and Intuit have recently made acquisitions and product development efforts in the nonprofit market. Our competitors might also establish or strengthen cooperative

109

We might not be able to manage our future growth efficiently or profitably.

We have experienced significant growth since our inception, and we anticipate that continued expansion will be required to address potential market opportunities. For example, we will need to expand the size of our sales and marketing, product development and general and administrative staff and operations, as well as our financial and accounting controls. There can be no assurance that our infrastructure will be sufficiently scalable to manage our projected growth. For example, our anticipated growth will result in a significant increase in demands on our maintenance and support services professionals to continue to provide the high level of quality service that our customers have come to expect. If we are unable to sufficiently address these additional demands on our resources, our profitability and growth might suffer. Also, if we continue to expand our operations, management might not be effective in expanding our physical facilities and our systems, procedures or controls might not be adequate to support such expansion. Our inability to manage our growth could harm our business.

Because competition for highly qualified personnel is intense, we might not be able to attract and retain the employees we need to support our planned growth.

To execute our continuing growth plans, we need to increase the size and maintain the quality of our sales force, software development staff and our professional services organization. To meet our objectives successfully, we must attract and retain highly qualified personnel with specialized skill sets focused on the nonprofit industry. Competition for qualified personnel can be intense, and we might not be successful in attracting and retaining them. The pool of qualified personnel with experience working with or selling to nonprofit organizations is limited overall and specifically in Charleston, South Carolina, where our principal office is located. Our ability to maintain and expand our sales, product development and professional services teams will depend on our ability to recruit, train and retain top quality people with advanced skills who understand sales to, and the specific needs of, nonprofit organizations. For these reasons, we have from time to time in the past experienced, and we expect to continue to experience in the future, difficulty in hiring and retaining highly skilled employees with appropriate qualifications for our business. In addition, it takes time for our new sales and services personnel to become productive, particularly with respect to obtaining and supporting major customer accounts. In particular, we plan to continue to increase the number of services personnel to attempt to meet the needs of our customers and potential new customers. In addition to hiring services personnel to meet our needs, we might also engage additional third-party consultants as contractors, which could have a negative impact on our earnings. If we are unable to hire or retain qualified personnel, or if newly hired personnel fail to develop the necessary skills or reach productivity slower than anticipated, it would be more difficult for us to sell our products and services, and we could experience a shortfall in revenue or earnings, and not achieve our planned growth.

1110

Our services revenue produces substantially lower gross margins than our license revenue, and an increase in services revenue relative to license revenue would harm our overall gross margins.

Our services revenue, which includes fees for consulting, implementation, training, data and technical services and analytics, was approximately 30%32% of our revenue for the fiscal quarternine months ended March 31,September 30, 2004, 29% of our revenue for 2003 and approximately 25% of our revenue for 2002. Our services revenue has substantially lower gross margins than our product license revenue. An increase in the percentage of total revenue represented by services revenue would adversely affect our overall gross margins.

Certain of our services are contracted under fixed fee arrangements, which we base on estimates. If our estimated fees are less than our actual costs, our operating results would be adversely affected.

Services revenue as a percentage of total revenue has varied significantly from quarter to quarter due to fluctuations in licensing revenue, economic changes, changes in the average selling prices for our products and services, our customers’ acceptance of our products and our sales force execution. In addition, the volume and profitability of services can depend in large part upon:

| • | competitive pricing pressure on the rates that we can charge for our services; |

| • | the complexity of the customers’ information technology environment and the existence of multiple non-integrated legacy databases; |

| • | the resources directed by customers to their implementation projects; and |

| • | the extent to which outside consulting organizations provide services directly to customers. |

Any erosion of our margins for our services revenue or any adverse changes in the mix of our license versus service revenue would adversely affect our operating results.

Failure to adapt to technological change and to achieve broad adoption and acceptance of our new products and services could adversely affect our earnings.

If we fail to keep pace with technological change in our industry, such failure would have an adverse effect on our revenue and earnings. We operate in a highly competitive industry characterized by evolving technologies and industry standards, changes in customer requirements and frequent new product introductions and enhancements. During the past several years, many new technological advancements and competing products have entered the marketplace. Our ability to compete effectively and our growth prospects depend upon many factors, including the success of our existing software products and services to address the changing needs of our customers, the timely introduction and success of future software products and services and releases and the ability of our products to perform well with existing and future technologies, including databases, applications, operating systems and other platforms. We have made significant investments in research and development and our growth plans are premised in part on generating substantial revenue from new product introductions. New product introductions involve significant risks. For example, delays in new product introductions, such as our new version of The Education Edge expected in mid-2004, or less-than-anticipated market acceptance of our new products are possible and would have an adverse effect on our revenue and earnings. We cannot be certain that our new products or future enhancements to existing products will meet customer performance needs or expectations when shipped or that they will be free of significant software defects or bugs.

11

12

If our products fail to perform properly due to undetected errors or similar problems, our business could suffer.

Complex software such as ours often contains undetected errors or bugs. Such errors are frequently found after introduction of new software or enhancements to existing software. We continually introduce new products and new versions of our products. If we detect any errors before we ship a product, we might have to delay product shipment for an extended period of time while we address the problem. We might not discover software errors that affect our new or current products or enhancements until after they are deployed, and we may need to provide enhancements to correct such errors. Therefore, it is possible that, despite testing by us, errors may occur in our software. These errors could result in:

| • | harm to our reputation; |

| • | lost sales; |

| • | delays in commercial release; |

| • | product liability claims; |

| • | delays in or loss of market acceptance of our products; |

| • | license terminations or renegotiations; and |

| • | unexpected expenses and diversion of resources to remedy errors. |

Furthermore, our customers may use our software together with products from other companies. As a result, when problems occur, it might be difficult to identify the source of the problem. Even when our software does not cause these problems, the existence of these errors might cause us to incur significant costs, divert the attention of our technical personnel from our product development efforts, impact our reputation and cause significant customer relations problems.

Our failure to integrate third-party technologies could harm our business.

We intend to continue licensing technologies from third parties, including applications used in our research and development activities and technologies which are integrated into our products. These technologies might not continue to be available to us on commercially reasonable terms or at all. Our inability to obtain any of these licenses could delay product development until equivalent technology can be identified, licensed and integrated. This inability in turn would harm our business and operating results. Our use of third-party technologies exposes us to increased risks, including, but not limited to, risks associated with the integration of new technology into our products, the diversion of our resources from development of our own proprietary technology and our inability to generate revenue from licensed technology sufficient to offset associated acquisition and maintenance costs.

12

If the security of our software, in particular our hosted Internet solutions products, is breached, our business and reputation could suffer.

Fundamental to the use of our products is the secure collection, storage and transmission of confidential donor and end user information. Third parties may attempt to breach our security or that of our customers and their databases. We might be liable to our customers for any breach in such security, and any breach could harm our customers, our business and our

13

If we are unable to detect and prevent unauthorized use of credit cards and bank account numbers and safeguard confidential donor data, we could be subject to financial liability, our reputation could be harmed and customers may be reluctant to use our products and services.

We rely on third-party and internally-developed encryption and authentication technology to provide secure transmission of confidential information over the Internet, including customer credit card and bank account numbers, and protect confidential donor data. Advances in computer capabilities, new discoveries in the field of cryptography or other events or developments could result in a compromise or breach of the technology we use to protect sensitive transaction data. If any such compromise of our security, or the security of our customers, were to occur, it could result in misappropriation of proprietary information or interruptions in operations and have an adverse impact on our reputation or the reputation of our customers. If we are unable to detect and prevent unauthorized use of credit cards and bank account numbers or protect confidential donor data, our business could suffer.

We currently do not have any issued patents, but we rely upon trademark, copyright, patent and trade secret laws to protect our proprietary rights, which might not provide us with adequate protection.

Our success and ability to compete depend to a significant degree upon the protection of our software and other proprietary technology rights. We might not be successful in protecting our proprietary technology, and our proprietary rights might not provide us with a meaningful competitive advantage. To protect our proprietary technology, we rely on a combination of patent, trademark, copyright and trade secret laws, as well as nondisclosure agreements, each of which affords only limited protection. We currently do not have patents issued for any of our proprietary technology and we only recently filed patent applications relating to a number of our products. Moreover, we have no patent protection for The Raiser’s Edge, which is one of our core products. Any inability to protect our intellectual property rights could seriously harm our business, operating results and financial condition. It is possible that:

| • | our pending patent applications may not result in the issuance of patents; |

| • | any patents issued to us may not be timely or broad enough to protect our proprietary rights; |

13

| • | any issued patent could be successfully challenged by one or more third parties, which could result in our loss of the right to prevent others from exploiting the inventions claimed in those patents; and |

| • | current and future competitors may independently develop similar technologies, duplicate our products or design around any of our patents. |

In addition, the laws of some foreign countries do not protect our proprietary rights in our products to the same extent as do the laws of the United States. Despite the measures taken

14

If we do not successfully address the risks inherent in the expansion of our international operations, our business could suffer.

We currently have operations in the United Kingdom, Canada and Australia, and we intend to expand further into international markets. We have limited experience in international operations and may not be able to compete effectively in international markets. In 2003, our international offices generated revenues of approximately $10.7 million, an increase of 78% over international revenue of $6.0 million for 2002. In the nine months ended September 30, 2004, our international revenue was $16.0 million. Expansion of our international operations will require a significant amount of attention from our management and substantial financial resources and may require us to add qualified management in these markets. Our direct sales model requires us to attract, retain and manage qualified sales personnel capable of selling into markets outside the United States. In some cases, our costs of sales might increase if our customers require us to sell through local distributors. If we are unable to grow our international operations in a cost effective and timely manner, our business and operating results could be harmed. Doing business internationally involves additional risks that could harm our operating results, including:

| • | difficulties and costs of staffing and managing international operations; |

| • | differing technology standards; |

| • | difficulties in collecting accounts receivable and longer collection periods; |

| • | political and economic instability; |

| • | fluctuations in currency exchange rates; |

| • | imposition of currency exchange controls; |

| • | potentially adverse tax consequences; |

| • | reduced protection for intellectual property rights in certain countries; |

| • | dependence on local vendors; |

| • | protectionist laws and business practices that favor local competition; |

| • | compliance with multiple conflicting and changing governmental laws and regulations; |

| • | seasonal reductions in business activity specific to certain markets; |

| • | longer sales cycles; |

| • | restrictions on repatriation of earnings; |

| • | differing labor regulations; |

| • | restrictive privacy regulations in different countries, particularly in the European Union; |

14

| • | restrictions on the export of technologies such as data security and encryption; and |

| • | import and export restrictions and tariffs. |

Future acquisitions could prove difficult to integrate, disrupt our business, dilute stockholder value and strain our resources.

We intend to acquire companies, services and technologies that we feel could complement or expand our business, augment our market coverage, enhance our technical capabilities, provide

15

| • | difficulties in integrating operations, technologies, services, accounting and personnel; |

| • | difficulties in supporting and transitioning customers of our acquired companies; |

| • | diversion of financial and management resources from existing operations; |

| • | risks of entering new sectors of the nonprofit industry; |

| • | potential loss of key employees; and |

| • | inability to generate sufficient revenue to offset acquisition or investment costs. |

Acquisitions also frequently result in recording of goodwill and other intangible assets, which are subject to potential impairments in the future that could harm our operating results. In addition, if we finance acquisitions by issuing equity securities or securities convertible into equity securities, our existing stockholders would be diluted, which, in turn, could affect the market price of our stock. Moreover, we could finance any acquisition with debt, resulting in higher leverage and interest costs. As a result, if we fail to evaluate and execute acquisitions or investments properly, we might not achieve the anticipated benefits of any such acquisition, and we may incur costs in excess of what we anticipate.

Claims that we infringe upon third parties’ intellectual property rights could be costly to defend or settle.

Litigation regarding intellectual property rights is common in the software industry. We expect that software products and services may be increasingly subject to third-party infringement claims as the number of competitors in our industry segment grows and the functionality of products in different industry segments overlaps. We may from time to time encounter disputes over rights and obligations concerning intellectual property. Although we believe that our intellectual property rights are sufficient to allow us to market our software without incurring liability to third parties, third parties may bring claims of infringement against us. Such claims may be with or without merit. Any litigation to defend against claims of infringement or invalidity could result in substantial costs and diversion of resources. Furthermore, a party making such a claim could secure a judgment that requires us to pay substantial damages. A judgment could also include an injunction or other court order that could prevent us from selling our software. Our business, operating results and financial condition could be harmed if any of these events occurred.

In addition, we have agreed, and will likely agree in the future, to indemnify certain of our customers against certain claims that our software infringes upon the intellectual property rights of others. We could incur substantial costs in defending ourselves and our customers against infringement claims. In the event of a claim of infringement, we and our customers might be required to obtain one or more licenses from third parties. We, or our customers, might be unable to obtain necessary licenses from third parties at a reasonable cost, if at all.

15

If we become subject to product or general liability or errors and omissions claims, they could be time-consuming and costly.

Errors, defects or other performance problems in our software, as well as the negligence or misconduct of our consultants, could result in financial or other damages to our customers. They could seek damages from us for losses associated with these errors, defects or other

16

If we were found subject to or in violation of any laws or regulations governing privacy or electronic fund transfers, we could be subject to liability or forced to change our business practices.

It is possible that the payment processing component of our web-based software is subject to various governmental regulations. Pending legislation at the state and federal levels could also restrict further our information gathering and disclosure practices. Existing and potential future privacy laws might limit our ability to develop new products and services that make use of data we gather from various sources. For example, our custom modeling and analytical services, including ProspectPoint and WealthPoint, rely heavily on securing and making use of data we gather from various sources and privacy laws could jeopardize our ability to market and profit from those services. The provisions of these laws and related regulations are complicated, and we do not have extensive experience with these laws and related regulations. Even technical violations of these laws can result in penalties that are assessed for each non-compliant transaction. In addition, we might be subject to the privacy provisions of the Health Insurance Portability and Accountability Act of 1996 and the Gramm-Leach-Bliley Act and related regulations. If we or our customers were found to be subject to and in violation of any of these laws or other privacy laws or regulations, our business would suffer and we and/or our customers would likely have to change our business practices. In addition, these laws and regulations could impose significant costs on us and our customers and make it more difficult for donors to make online donations.

Increasing government regulation could affect our business.

We are subject not only to regulations applicable to businesses generally but also to laws and regulations directly applicable to electronic commerce. Although there are currently few such laws and regulations, state, Federal and foreign governments may adopt laws and regulations applicable to our business. Any such legislation or regulation could dampen the growth of the Internet and decrease its acceptance. If such a decline occurs, companies may decide in the

16

| • | user privacy; |

| • | the pricing and taxation of goods and services offered over the Internet: |

| • | the content of websites; |

| • | copyrights; |

| • | consumer protection, including the potential application of “do not call” registry requirements on our customers and consumer backlash in general to direct marketing efforts of our customers; |

17

| • | the online distribution of specific material or content over the Internet; and |

| • | the characteristics and quality of products and services offered over the Internet. |

Our operations might be affected by the occurrence of a natural disaster or other catastrophic event in Charleston, South Carolina.

We depend on our principal executive offices and other facilities in Charleston, South Carolina for the continued operation of our business. Although we have contingency plans in effect for natural disasters or other catastrophic events, these events, including terrorist attacks and natural disasters such as hurricanes, which historically have struck the Charleston area with some regularity, could disrupt our operations. Even though we carry business interruption insurance policies and typically have provisions in our contracts that protect us in certain events, we might suffer losses as a result of business interruptions that exceed the coverage available under our insurance policies or for which we do not have coverage. Any natural disaster or catastrophic event affecting us could have a significant negative impact on our operations.

Outstanding employee stock options subject to variable accounting and recent proposed changes to accounting standards could cause us to record significant compensation expense and could significantly reduce our earnings in future periods.

OptionsPrior to our initial public offering in July 2004, options to purchase approximately 10.56.6 million shares under two of our stock option plans arewere subject to variable accounting treatment, and we anticipate that optionstreatment. Options to purchase approximately 5.63.5 million shares will continue to be subject to variable accounting treatment after the offering.and there is volatility in our stock price which could affect operating results. Accordingly, we expect tocould record significant compensation expense at the end of future periods, particularly if our stock price increases significantly. For example, we recorded compensation expense attributable to these options of $27.5 million in 2003 and $1.0 million in the fiscal quarter ended March 31, 2004.2003. This compensation expense could significantly reduce our earnings in future periods, which could cause our stock price to fall and, as a result, you could lose some or all of your investment. See our discussion of “Stock option compensation” in “Management’s discussion and analysis of financial condition and results of operations — Critical accounting policies and estimates”. In addition, under a proposal issued byon December 16, 2004, the Financial Accounting Standards Board on March 31, 2004, we might, ifStatement No. 123 (revised 2004), Share-Based Payment. Statement 123(R) would require us to measure all employee stock-based compensation awards using a fair value method and record such proposal is adopted, be required to record the fair market value of future stock options issued under our stock option plans as compensation expense in our consolidated financial statements, which would reducestatements. In addition, the adoption of Statement 123(R) will require additional accounting related to the income tax effects and additional disclosure

17

The requirements of being a public company might strain our resources and distract management.

As a newly public company, we will beare subject to a number of additional requirements, including the reporting requirements of the Securities Exchange Act of 1934, the Sarbanes-Oxley Act of 2002 and new Nasdaq rules promulgated in response to the Sarbanes-Oxley Act. These requirements might place a strain on our systems and resources. The Securities Exchange Act requires, among other things, that we file annual, quarterly and current reports with respect to our business and financial condition. The Sarbanes-Oxley Act requires, among other things, that we maintain effective disclosure controls and procedures and internal controls for financial reporting. In order to maintain and improve the effectiveness of our disclosure controls and procedures and internal controls over financial reporting, significant resources and management oversight will be required. As a result, our management’s attention might be diverted

18

Risks related to this offeringpurchasing our shares

We cannot assure you that a market will developcontinue for our common stock or what the market price of our common stock will be.

Before thisour initial public offering in July 2004, there was no public trading market for our common stock, and we cannot assure you that one will develop or be sustained after this offering.sustained. If a market does not develop or is not sustained, it might be difficult for you to sell your shares of common stock at an attractive price or at all. We cannot predict the prices at which our common stock will trade. The initial public offering price for our common stock covered by this prospectus will be determined through our and our selling stockholders’ negotiations with the underwriterspotential purchasers and might not bear any relationship to the market price at which it will trade after this offering or to any other established criteria of the value of our business. In future quarters our operating results might be below the expectations of public market analysts and investors and, as a result of these and other factors, the price of our common stock might decline.

The price of our common stock might be volatile.

Our stock price has been volatile and might continue to be, making an investment in our company risky. Between July 26, 2004, when our common stock started trading on the Nasdaq National Market, and January 14, 2005, the price of a share of our common stock varied from $8.30 to $15.22.

18

In the three years prior to 2003, technology stocks listed on The Nasdaq National Market experienced high levels of volatility and significant declines in value from their historic highs. The trading price of our common stock following this offering might fluctuate substantially. The price of the common stock that will prevail in the market after this offering might be higher or lower than the price you pay, depending on many factors, some of which are beyond our control and might not be related to our operating performance. The fluctuations could cause you to lose part or all of your investment in our shares of common stock. Those factors that could cause fluctuations in the trading price of our common stock include the following:

| • | price and volume fluctuations in the overall stock market from time to time; |

| • | significant volatility in the market price and trading volume of software and technology companies; |

| • | actual or anticipated changes in our earnings or fluctuations in our operating results or in the expectations of securities analysts; |

| • | economic conditions and trends in general and in the nonprofit industry; |

| • | major catastrophic events, including terrorist activities, which could reduce or divert funding to, and technology spending by, our core nonprofit customer base; |

| • | changes in our pricing policies or the pricing policies of our customers; |

| • | changes in the estimation of the future size and growth of our market; or |

| • | departures of key personnel. |

19

In the past, following periods of volatility in the market price of a company’s securities, securities class action litigation has often been brought against that company. Due to the potential volatility of our stock price, we might be the target of securities litigation in the future. Securities litigation could result in substantial costs and divert management’s attention and resources from our business.

Insiders will continue to hold a [majority/significant minority]percentage of our stock after this offering and could limit your ability to influence the outcome of key transactions, including a change of control, which could adversely affect the market price of our stock.

Upon completionAssuming it sells all of this offering and our proposed simultaneous repurchase of shares of ourits common stock from Anthony E. Bakker,registered under this prospectus, our largest stockholder, Hellman & Friedman Capital Partners III, L.P. and its affiliates, will beneficially own approximately %47.83% of our common stock, or % if the underwriters’ over-allotment option is exercised in full.stock. In addition, our executive officers, directors and their affiliates will, in the aggregate, beneficially own or control approximately %55.53% of our common stock, or % if the underwriters’ over-allotment option is exercised in full.stock. As a result, Hellman & Friedman will have the abilitysignificant control with respect to control all matters submitted to our stockholders for approval, including the election and removal of directors and the approval of any merger, consolidation or sales of all or substantially all of our assets. These stockholders might make decisions that are adverse to your interests. In addition, Hellman & Friedman and certain of its transferees will not be governed by Section 203 of the Delaware General Corporation Law. See “Description of capital stock—Anti-takeover effects of Delaware law and provisions of our certificate of incorporation and bylaws—Delaware anti-takeover law” for a discussion of Section 203. This fact might make it easier for Hellman & Friedman or its transferees to acquire your shares at a lower price than would otherwise be the case. This provision and the concentration of ownership could have the effect of delaying, preventing or deterring a change of control of our company, could deprive our stockholders of an opportunity to receive a premium for their common stock as part of a sale of our company and might ultimately affect the market price of our common stock.

19

Future sales of our common stock might depress our stock price.

As of the date of this prospectus and after giving effect to our proposed repurchase, simultaneous with this offering, of shares of our common stock from Anthony E. Bakker,December 31, 2004, we have 68,014,571had 42,549,056 shares of common stock outstanding. The 10,000,000 shares that may be sold by the selling stockholders inunder this offering, or shares if the underwriters’ over-allotment option is exercised in full,prospectus will be freely tradable without restriction or further registration under federal securities laws unless purchased by our affiliates. The remaining shares of common stock outstanding will be available for sale in the public market as follows:

The remaining shares held by existing stockholders will become eligible for sale at various times onIf these or before .

The above table assumes the effectiveness of the lock-up agreements under which we, our executive officers and directors and our selling stockholders have agreed that, during the period beginning from the date of this prospectus and continuing to and including the date

20

If our commonother stockholders sell substantial amounts of common stock in the public market, or if the market perceives that these sales may occur, the market price of our common stock might decline. In addition, as soon as practicable afterWe are unable to estimate the completionamount, timing or nature of this offering, we intend to file a registration statement under the Securities Act covering sharesfuture sales of outstanding common stock issuable under our stock plans. Accordingly, shares registered under that registration statement will be available for sale in the open market, subject to the contractual lock-up agreements described above that prohibit the sale or other disposition of the shares of common stock underlying the options for a period of 180 days after the date of this prospectus.stock.

As a new investor, youInvestors in this offering will experience immediate and substantial dilution.

The initial public offering price of the common stock being soldregistered for resale by the selling stockholders inunder this offering andprospectus is expected to us in the proposed simultaneous repurchase isbe considerably more than the net tangible book value per share of our outstanding common stock. Accordingly, we and investors purchasing shares of common stock inoffered under this offeringprospectus will pay a price per share that substantially exceeds, on a per share basis, the value of our assets after subtracting liabilities. Investors will suffer additional dilution to the extent outstanding stock options are exercised and to the extent we issue any restricted stock to our employees under our equity incentive plans. For more information on dilution, see “Dilution”.

We might need to raise capital, which might not be available.

We intend to use up to $10.0 million of our cash, if available, to repurchase shares from Anthony E. Bakker simultaneously with this offering, and we will not receive any of the proceeds from the sale of shares by the selling stockholders inunder this offering.prospectus. Accordingly, the proceeds from this offeringany sales by the selling stockholders will not be available to us to finance our operations, capital expenditures or investment activities. We might need to raise funds to meet these or other needs, and we might not be able to obtain such financing on favorable terms, if at all. If we need capital and cannot raise it on acceptable terms, we might not be able to:

| • | develop enhancements and additional features for our products; |

| • | develop new products and services; |

| • | hire, train and retain employees; |

| • | enhance our infrastructure; |

| • | respond to competitive pressures or unanticipated requirements; |

| • | pursue international expansion; |

| • | pursue acquisition opportunities; or |

| • | continue to fund our operations. |

If any of the foregoing consequences occur, our stock price might fall and you might lose some or all of your investment.

21

Our certificate of incorporation authorizes our board of directors to issue new series of preferred stock that may have the effect of delaying or preventing a change of control, which could adversely affect the value of your shares.

Our certificate of incorporation provides that our board of directors is authorized to issue from time to time, without further stockholder approval, up to 20,000,000 shares of preferred stock in one or more series and to fix or alter the designations, preferences, rights and any qualifications, limitations or restrictions of the shares of each series, including the dividend rights, dividend rates, conversion rights, voting rights, rights of redemption, including sinking fund provisions, redemption price or prices, liquidation preferences and the number of shares

20

Anti-takeover provisions under our charter documents and Delaware law could delay or prevent a change of control and could also limit the market price of our stock.

Our certificate of incorporation and our bylaws contain provisions that effective from and after the date of this offering, could delay or prevent a change of control of our company or changes in our board of directors that our stockholders might consider favorable, including the following:

| • | our board of directors will be classified into three classes, each of which will serve for staggered three year terms; and |

| • | we will require advance notice for stockholder proposals, including nominations for the election of directors. |