As filed with the Securities and Exchange Commission on April 28,30, 2004

Registration No. 333-112009333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 4to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Genworth Financial, Inc.

(Exact Name of Registrant as Specified in its Charter)

| Delaware (State or Other Jurisdiction of Incorporation or Organization) | 6311 (Primary Standard Industrial Classification Code Number) | 33-1073076 (I.R.S. Employer Identification Number) | ||

6620 West Broad Street Richmond, Virginia 23230 (804) 281-6000 (Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant's Principal Executive Offices) | ||||

Leon E. Roday, Esq. Senior Vice President, General Counsel and Secretary Genworth Financial, Inc. 6620 West Broad Street Richmond, Virginia 23230 (804) 281-6000 (Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service) |

Copies to:

| David S. Lefkowitz, Esq. Weil, Gotshal & Manges LLP 767 Fifth Avenue New York, New York 10153 (212) 310-8000 | Alexander M. Dye, Esq. LeBoeuf, Lamb, Greene & MacRae, L.L.P. 125 West 55th Street New York, New York 10019 (212) 424-8000 | Richard J. Sandler, Esq. Davis Polk & Wardwell 450 Lexington Avenue New York, New York 10017 (212) 450-4000 |

Approximate date of commencement of proposed sale to the public:As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. / /

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. / /

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. / /

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. / /

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. / /

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Proposed maximum aggregate offering amount(1)(2) | Amount of registration fee | Title of Each Class of Securities to be Registered | Proposed maximum aggregate offering amount(1)(2) | Amount of registration fee | ||||

|---|---|---|---|---|---|---|---|---|---|

| Class A Common Stock, par value $0.001 per share | $3,835,250,000(3) | $463,027(4) | |||||||

| Equity Units | Equity Units | $600,000,000 | $76,020 | ||||||

| Senior notes due 2009 (3) | Senior notes due 2009 (3) | ||||||||

| Class A Common Stock, par value $0.001 per share (4) | Class A Common Stock, par value $0.001 per share (4) | $600,000,000 | $76,020 | ||||||

| Purchase contracts (5) | Purchase contracts (5) | ||||||||

| Total | $1,200,000,000 | $152,040 | |||||||

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PROSPECTUSPROSPECTUS (Subject(Subject to Completion)

Issued April 28,30, 2004

145,000,000 Shares24,000,000 Equity Units

(Initially Consisting of 24,000,000 Corporate Units)

Class A Common Stock% Equity Units

GE Financial Assurance Holdings, Inc., the selling stockholderseller and an indirect subsidiary of General Electric Company, or GE, is offering all the 145,000,000 shares24,000,000 % Equity Units of Class A Common StockGenworth Financial, Inc. to be sold in this offering.

Each Equity Unit will have a stated amount of $25 and will consist of a purchase contract issued by us and, initially, a 1/40, or 2.5%, undivided beneficial ownership interest in a $1,000 principal amount senior note due May 16, 2009, issued by us, which we refer to as a Corporate Unit.

This offering of Equity Units is our initial public offering, and no public market currently exists for our shares. We anticipate thatbeing made concurrently with the initial public offering price of the shares will be between $21.00 and $23.00 per share.

The selling stockholder has granted the underwriters the right to purchase up to an additional 21,750,000 shares ofour Class A Common Stock and the offering of our % Series A Cumulative Preferred Stock by the seller pursuant to cover over-allotments.

separate prospectuses. The Class A Common Stock has been approved for listing on The New York Stock Exchange under the symbol "GNW."

Concurrently with The Corporate Units have been approved for listing on The New York Stock Exchange under the symbol "GNW Pr E." Prior to this offering, there has been no public market for the selling stockholderCorporate Units or our Class A Common Stock. This offering of Equity Units is offering, by meanscontingent upon the completion of a separate prospectus, $600 million of our % Equity Units. Each Equity Unit will have a stated amount of $25 and will initially consist of a contract to purchase sharesthe offerings of our Class A Common Stock and an interest in a % senior note due 2009 issued by us. Concurrently with this offering, the selling stockholder also is offering, by means of a separate prospectus, $100 million of our % Series A Cumulative Preferred Stock.

We will not receive any proceeds from the sale by the selling stockholderseller of Class A Common Stockthe Equity Units in this offering or the Equity UnitsClass A Common Stock or Series A Cumulative Preferred Stock in the concurrent offerings.

Investing in our Class A Common StockCorporate Units involves risks. See "Risk Factors" beginning on page 20.28.

PRICE $ A SHARE

| | Per | Total | ||

|---|---|---|---|---|

| Price to public | $ | $ | ||

| Underwriting discounts and commissions | $ | $ | ||

| Proceeds to | $ | $ |

The initial public offering price set forth above does not include accumulated contract adjustment payments and accrued interest, if any. Contract adjustment payments on the purchase contracts and interest attributable to the undivided beneficial ownership interests in the notes will accrue from , 2004.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the adequacyaccuracy or accuracyadequacy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of Class A Common StockCorporate Units to purchasers on , 2004.

| Morgan Stanley | Goldman, Sachs & Co. |

Banc of America Securities LLC |

| Deutsche Bank Securities Merrill Lynch & Co. | Citigroup JPMorgan UBS Investment Bank |

, 2004

| | Page | |

|---|---|---|

| Prospectus Summary | 1 | |

| Risk Factors | ||

| Forward-Looking Statements | ||

| Use of Proceeds | ||

| Dividend Policy | ||

| Capitalization | ||

| Accounting Treatment | 71 | |

| Ratio of Earnings to Fixed Charges | 72 | |

| Selected Historical and Pro Forma Financial Information | ||

| Management's Discussion and Analysis of Financial Condition and Results of Operations | ||

| Corporate Reorganization | ||

| Business | ||

| Regulation | ||

| Management | ||

Arrangements Between GE and Our Company | ||

| Description of Equity Units | 280 | |

| Description of the Purchase Contracts | 284 | |

| Certain Provisions of the Purchase Contracts and the Purchase Contract and Pledge Agreement | 295 | |

| Description of the Notes | 301 | |

| Ownership of Common Stock | ||

| Description of Capital Stock | ||

| Description of Certain Indebtedness | ||

| Shares Eligible for Future Sale | ||

| Certain United States Federal Income Tax Consequences | ||

| ERISA Considerations | 338 | |

| Underwriters | ||

| Legal Matters | ||

| Experts | ||

| Additional Information | ||

| Index to Financial Statements | F-1 | |

| Glossary of Selected Insurance Terms | G-1 |

i

This summary highlights information contained elsewhere in this prospectus and may not contain all of the information that may be important to you. You should read this entire prospectus carefully, including the information set forth in "Risk Factors," before making an investment decision.

We are a leading insurance company in the U.S., with an expanding international presence, serving the life and lifestyle protection, retirement income, investment and mortgage insurance needs of more than 15 million customers. We have leadership positions in key products that we expect will benefit from a number of significant demographic, governmental and market trends. We distribute our products and services through an extensive and diversified distribution network that includes financial intermediaries, independent producers and dedicated sales specialists. We conduct operations in 20 countries and have approximately 5,850 employees.

We have the following three operating segments:

We also have a Corporate and Other segment, which consists primarily of net realized investment gains (losses), most of our interest and other financing expenses, unallocated corporate income and expenses, and the results of several small, non-core businesses that are managed outside our operating segments.

For the year ended December 31, 2003, our Corporate and Other segment had a pro forma segment net loss of $8 million.

We had $11.0 billion of total stockholder's interest and $97.8 billion of total assets as of December 31, 2003, on a pro forma basis. For the year ended December 31, 2003, on a pro forma basis, our revenues were $9.8 billion and our net earnings from continuing operations were $935 million. Upon the completion of this offering, we expect our principal life insurance companies to have financial strength ratings of "AA-" (Very Strong) from S&P, "Aa3" (Excellent) from Moody's and "A+" (Superior) from A.M. Best, and we expect our rated mortgage insurance companies to have financial strength ratings of "AA" (Very Strong) from S&P, "Aa2" (Excellent) from Moody's and "AA" (Very Strong) from Fitch. The "AA" and "AA-" ratings are the third- and fourth-highest of S&P's 21 ratings categories, respectively. The "Aa2" and "Aa3" ratings are the third- and fourth-highest of Moody's 21 ratings categories, respectively. The "A+" rating is the second-highest of A.M. Best's 15 ratings categories. The "AA" rating is the third-highest of Fitch's 24 ratings categories.

Market Environment and Opportunities

We believe we are well positioned to benefit from a number of significant demographic, governmental and market trends, including the following:

Competitive Strengths

We believe the following competitive strengths will enable us to capitalize on opportunities in our targeted markets:

independent producers and dedicated sales specialists. In addition, we maintain strong relationships with leading distributors by providing a high level of specialized and differentiated distribution support and by pursuing joint business improvement efforts.

Growth Strategies

Our objective is to increase operating earnings and enhance returns on equity. We intend to pursue this objective by focusing on the following strategies:

Retirement income, where we believe growth will be driven by a variety of favorable demographic trends and the approximately $4.4 trillion of invested financial assets in the U.S. that are held by people within 10 years of retirement. Our products are designed to enable the growing retired population to convert their invested assets into reliable retirement income.

Protection, particularly long-term care insurance, where we believe growth will be driven by the increasing protection needs of the expanding aging population and a shifting of the burden for funding these needs to individuals from governments and employers. For example, it is estimated that approximately 70% of individuals in the U.S. aged 65 and older will require long-term care at some time in their lives, but in 2001, only 7% of individuals in the U.S. aged 55 and older had long-term care insurance.

International mortgage insurance, where we continue to see attractive growth opportunities with the expansion of homeownership and low-down-payment loans. The net premiums written in

our international mortgage insurance business have increased by a compound annual growth rate of 46% for the three years ended December 31, 2003.

Product and service innovations, as illustrated by new product introductions, such as the introduction in 2002 of our GE Retirement Answer®, our introduction of innovative private mortgage insurance products in the European market, and our service innovations, which include programs such as our policyholder wellness initiatives in our long-term care insurance business and our AU Central® Internet platform in our mortgage insurance business.

Collaborative approach to key distributors, which includes a joint business improvement program (originally developed by GE), called "At the Customer, For the Customer," or ACFC, and our platinum customer service desks, which have benefited our distributors and helped strengthen our relationships with them.

Technology initiatives, such as our GENIUS® underwriting system, which makes it easier for distributors to do business with us, improves our term life and long-term care insurance underwriting speed and accuracy, and lowers our operating costs.

Rigorous product pricing and return discipline. We intend to maintain strict product pricing disciplines that are designed to achieve our target returns on capital. Over the past two years, we introduced restructured pricing on newly issued policies in each of our operating segments and exited products that were not achieving our target returns. We expect our returns on capital to improve as the benefits of these actions emerge and as we continue our focus on maintaining target returns.

Capital efficiency enhancements. We continually seek opportunities to use our capital more efficiently to support our business, while maintaining our ratings and strong capital position. For example, in 2003, we took actions to reduce the statutory capital required to support most of our new term and universal life insurance policies and to reduce excess capital at our mortgage insurance subsidiaries by operating at an "AA/Aa2" rating level.

Investment income enhancements. As part of GE, the yield on our investment portfolio has been affected by the practice in recent years of realizing investment gains through the sale of appreciated securities and other assets during a period of historically low interest rates. This strategy was pursued to offset impairments and losses in our investment portfolio, fund consolidations and restructurings in our business and provide current income. As we transition to being an independent public company, our investment strategy will be to optimize investment income without relying on realized investment gains. We will seek to improve our investment yield by continuously evaluating our asset class mix and pursuing additional investment classes.

Ongoing operating cost reductions and efficiencies. We will continually focus on reducing our cost base while maintaining strong service levels for our customers. We expect to accomplish this in each of our operating units through a wide range of cost management disciplines, including consolidating operations, using low-cost operating locations, reducing supplier costs, leveraging Six Sigma and other process improvement efforts, forming dedicated teams to identify opportunities for cost reductions and investing in new technology, particularly for web-based, digital end-to-end processes.

Formation of Genworth Financial, Inc.

We were incorporated in Delaware on October 23, 2003 in preparation for our corporate reorganization and this offering.

Prior to the completion of this offering and the concurrent offerings, we will acquire substantially all of the assets and liabilities of GE Financial Assurance Holdings, Inc., or GEFAHI. GEFAHI is an indirect subsidiary of GE and a holding company for a group of companies that provide life insurance, long-term care insurance, group life and health insurance, annuities and other investment products and U.S. mortgage insurance. We also will acquire certain other insurance businesses currently owned by other GE subsidiaries but managed by members of the Genworth management team. These businesses include international mortgage insurance, European payment protection insurance, a Bermuda reinsurer and mortgage contract underwriting.

In consideration for the assets that we will acquire and the liabilities that we will assume in connection with our corporate reorganization, we will issue to GEFAHI the following securities:

U.S. mortgage insurance business to us are subject to statutory limitations, regulatory approval and the absence of any impact on our financial ratings. If regulatory approval has been obtained by the first anniversary date but our financial ratings have not been affirmed, the term of this

note will be extended for a period of up to twelve months to obtain affirmation of our financial ratings. Any portion of the Contingent Note that is not repaid by the first anniversary of the completion of this offering or by the extended term, if applicable, will be canceled. We will record any portion of the Contingent Note that is canceled as a capital contribution. For a description of the terms of this note see "Description of Certain Indebtedness—Contingent Note."

The liabilities we will assume from GEFAHI include ¥60 billion aggregate principal amount of 1.6% notes due 2011 issued by GEFAHI, ¥3 billion of which GEFAHI currently owns and will transfer to us. We refer to these notes in this prospectus as the Yen Notes. We have entered into arrangements to swap our obligations under these notes to a U.S. dollar obligation with a principal amount of $491 million and bearing interest at a rate of 4.84% per annum.

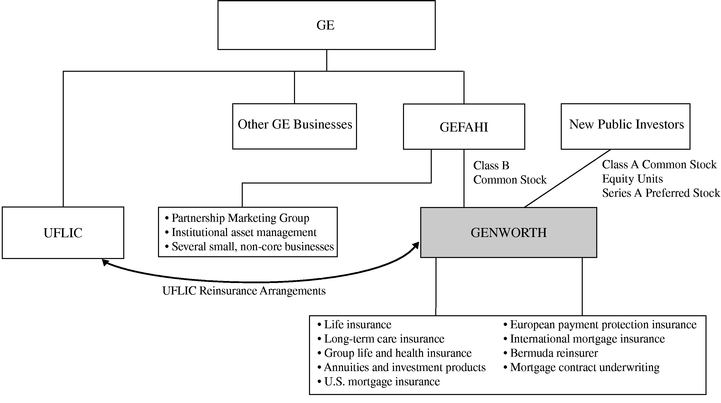

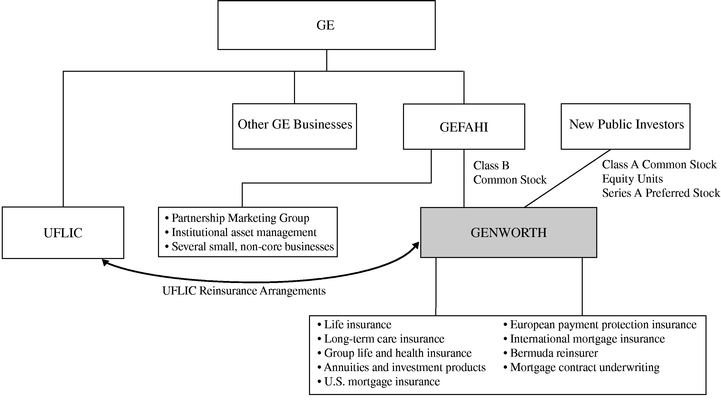

Prior to the completion of this offering and the concurrent offerings, GEFAHI will own 100% of our outstanding common stock, which will consist solely of Class B Common Stock. Shares of Class B Common Stock convert automatically into shares of Class A Common Stock when they are held by any person other than GE or an affiliate of GE or when GE no longer beneficially owns at least 10% of our outstanding common stock. As a result, all the shares of common stock offered in thisthe concurrent offering consist of Class A Common Stock. Upon the completion of this offering and the concurrent offerings, GE will beneficially own approximately 70% of our outstanding common stock, assuming the underwriters' over-allotment option in the concurrent offering of Class A Common Stock is not exercised, and 66%, if it is exercised in full. GE has informed us that, after completion of this offering, it intends, subject to market conditions, to divest its remaining interest in us as soon as practicable. GE has also informed us that, in any event, it expects to reduce its interest to below 50% within two years of the completion of this offering. GE currently expects to reduce its interest through one or more additional public offerings of our common stock, but it is not obligated to divest our shares in this or any other manner.

Prior to the completion of this offering, we will enter into a number of arrangements with GE governing our separation from GE and a variety of transition and other matters, including our relationship with GE while GE remains a significant stockholder in our company. These arrangements include several significant reinsurance transactions with Union Fidelity Life Insurance Company, or UFLIC, an indirect subsidiary of GE. As part of these transactions, we will cede to UFLIC, effective as of January 1, 2004, all of our in-force structured settlement contracts, substantially all of our in-force variable annuity contracts, and a block of long-term care insurance policies that we reinsured in 2000 from The Travelers Insurance Company, a subsidiary of Citigroup, Inc., which we refer to in this prospectus as Travelers. In the aggregate, these blocks of business do not meet our target return thresholds, and although we remain liable under these contracts and policies as the ceding insurer, the reinsurance transactions will have the effect of transferring the financial results of the reinsured blocks to UFLIC. We are continuing new sales of structured settlement, variable annuity and long-term care insurance products, and we expect to achieve our targeted returns on these new sales. In addition, we will continue to service these blocks of business, which will preserve our operating scale and enable us to service and grow our new sales of these products. See "Arrangements Between GE and Our Company."

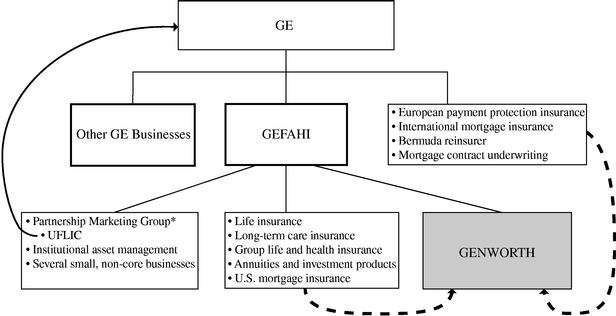

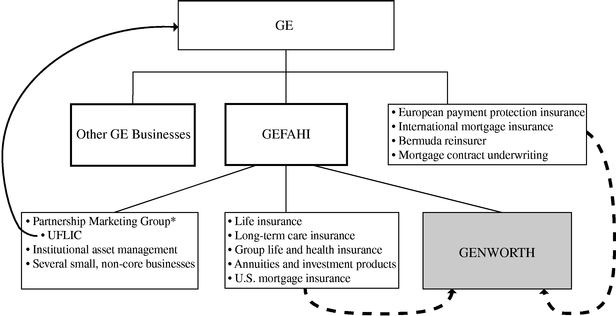

The diagram below shows the relationships among GE, GEFAHI and Genworth prior to the completion of our corporate reorganization. The dotted lines indicate the businesses that will be transferred to Genworth in connection with our corporate reorganization.

* The Partnership Marketing Group offers life and health insurance, auto club memberships and other financial products and services directly to consumers through affinity marketing arrangements with a variety of organizations. The Partnership Marketing Group historically included UFLIC, a subsidiary that offered the life and health insurance for these arrangements.

The diagram below shows the relationships among GE, GEFAHI and Genworth after the completion of our corporate reorganization and this offering.

In this prospectus, unless the context otherwise requires, "Genworth," "we," "us," and "our" refer to Genworth Financial, Inc. and its combined subsidiaries and include the operations of the businesses acquired from GEFAHI and other GE subsidiaries in connection with our corporate reorganization.

Unless otherwise indicated, all information in this prospectus:

The number of our stock options, restricted stock units and stock appreciation rights that will be issued in exchange for GE stock options, restricted stock units and stock appreciation rights will depend upon the initial public offering price of our Class A Common Stock in that concurrent offering and the weighted-average stock price of GE common stock for the trading day immediately prior to the date of this prospectus. Information in this prospectus assumes a price of $30.85 per share of GE common stock, which was the weighted-average stock price on April 27, 2004.

Risks Relating to Our Company

As part of your evaluation of our company, you should consider the risks associated with our business, our separation from GE and this offering. These risks include:

For a further discussion of these and other risks, see "Risk Factors."

Additional Information

Our corporate headquarters and principal executive offices are located at 6620 West Broad Street, Richmond, Virginia 23230. Our telephone number at that address is (804) 281-6000. We maintain a variety of websites to communicate with our distributors and customers and to provide information about various insurance and investment products to the general public. None of the information on our websites is part of this prospectus.

What are Corporate Units?

Unless otherwise indicated, all informationThe Equity Units offered by the seller will initially consist of 24,000,000 Corporate Units, each with a stated amount of $25. You can create Treasury Units from Corporate Units in this prospectus:

What are the components of a Corporate Unit?

Each Corporate Unit initially consists of a purchase contract and a 1/40, or 2.5%, undivided beneficial ownership interest in $1,000 principal amount of our corporate reorganization, whereby wesenior notes due May 16, 2009. The undivided beneficial ownership interest in notes corresponds to $25 principal amount of our notes. The notes will acquire substantially allbe issued in minimum denominations of $1,000 and integral multiples of $1,000, except in certain limited circumstances. Your undivided beneficial ownership interest in notes comprising part of each Corporate Unit is owned by you, but it will be pledged to us through the collateral agent to secure your obligation under the related purchase contract. If a special event redemption occurs prior to the earlier of the assetsdate of a successful remarketing and liabilitiesthe purchase contract settlement date, the notes comprising part of GEFAHIthe Corporate Units will be replaced by the Treasury portfolio described below under "What is the Treasury Portfolio?", and acquire certain other GE insurance businesses,the applicable ownership interest in exchangethe Treasury portfolio will then be pledged to us through the collateral agent to secure your obligation under the related purchase contract.

What is a purchase contract?

Each purchase contract that is a component of a Corporate Unit obligates you to purchase, and obligates us to sell, on May 16, 2007, which we refer to as the purchase contract settlement date, for 489.5 million$25 in cash, a number of newly issued shares of our Class BA Common Stock $600 millionequal to the "settlement rate." The settlement rate will be calculated, subject to adjustment under the circumstances set forth in "Description of our Equity Units, $100 million of our Series A Preferred Stock, the $2.4 billion Short-term Intercompany Note and the $550 million Contingent Note, allPurchase Contracts—Anti-Dilution Adjustments," as described under "Corporate Reorganization;"

"Applicable market value" means the dateaverage of this prospectus in exchange for vested GE stock options held bythe closing price per share of our Chairman, President and Chief Executive Officer, at a weighted average exercise price of $16.83 per share;

"Description of the Purchase Contracts—Anti-Dilution Adjustments." The number of our stock options, restricted stock units and stock appreciation rights that will be issued in exchange for GE stock options, restricted stock units and stock appreciation rights will depend uponreference price is the initial public offering price of our Class A Common Stock. The "threshold appreciation price" represents a % appreciation over the reference price.

We will not issue any fractional shares of our Class A Common Stock upon settlement of a purchase contract. Instead of a fractional share, you will receive an amount of cash equal to this fraction multiplied by the applicable market value.

You may satisfy your obligation to purchase our common stock pursuant to the purchase contracts as described under "How can I satisfy my obligation under the purchase contracts?" below.

Can I settle the purchase contract early?

You can settle a purchase contract at any time following , 2005 (12 calendar months following the completion of the concurrent initial public offering of our Class A Common Stock) but on or prior to the seventh business day immediately preceding the purchase contract settlement date, in the case of Corporate Units, and on or prior to the second business day immediately preceding the purchase contract

settlement date, in the case of Treasury Units, by paying $25 cash, in which case shares of our Class A Common Stock will be issued to you pursuant to the purchase contract. In addition, if we are involved in a merger in which at least 30% of the consideration for our Class A Common Stock consists of cash or cash equivalents, you will have the right to settle a purchase contract early at the settlement rate in effect immediately prior to the closing of that merger. You may only elect early settlement in integral multiples of 40 Corporate Units and 40 Treasury Units. If the Treasury portfolio has replaced the notes as a component of the Corporate Units, holders of Corporate Units may settle early on or prior to the second business day immediately preceding the purchase contract settlement date only in integral multiples of Corporate Units. See "Description of the Purchase Contracts—Early Settlement" and "—Early Settlement Upon Cash Merger."

Your early settlement right is subject to the condition that, if required under the U.S. federal securities laws, we have a registration statement under the Securities Act of 1933 in effect and an available prospectus covering the shares of Class A Common Stock and other securities, if any, deliverable upon settlement of a purchase contract. We have agreed that, if required by U.S. federal securities laws, we will use our commercially reasonable efforts to have a registration statement in effect and to provide a prospectus covering those shares of Class A Common Stock or other securities to be delivered in respect of the weighted-average stock pricepurchase contracts being settled.

What is a Treasury Unit?

A Treasury Unit is a unit created from a Corporate Unit and consists of GE common stocka purchase contract and a 1/40, or 2.5%, undivided beneficial ownership interest in a zero-coupon U.S. Treasury security with a principal amount of $1,000 that matures on May 15, 2007 (the business day preceding the purchase contract settlement date or earlier) (CUSIP No. 912828AC4) which we refer to as a Treasury security. The ownership interest in the Treasury security that is a component of a Treasury Unit will be owned by you, but will be pledged to us through the collateral agent to secure your obligation under the related purchase contract.

How can I create Treasury Units from Corporate Units?

Each holder of Corporate Units will have the right, at any time on or prior to the seventh business day immediately preceding the purchase contract settlement date, to substitute for the tradingrelated undivided beneficial ownership interest in notes or applicable ownership interests in the Treasury portfolio, as the case may be, held by the collateral agent, Treasury securities with a total principal amount at maturity equal to the aggregate principal amount of the notes underlying the undivided beneficial ownership interests in notes for which substitution is being made. Because Treasury securities and the notes are issued in minimum denominations of $1,000, holders of Corporate Units may make this substitution only in integral multiples of 40 Corporate Units. If the Treasury portfolio has replaced the notes as a component of the Corporate Units, holders of Corporate Units may substitute Treasury securities for the applicable ownership interests in the Treasury portfolio only in integral multiples of Corporate Units. This substitution will create Treasury Units, and the notes underlying the undivided beneficial ownership interest in notes, or the applicable ownership interests in the Treasury portfolio, will be released to the holder and such notes will be separately tradable from the Treasury Units.

How can I recreate Corporate Units from Treasury Units?

Each holder of Treasury Units will have the right, at any time on or prior to the seventh business day immediately preceding the purchase contract settlement date, to substitute for the related Treasury securities held by the collateral agent, notes or applicable ownership interests in the Treasury portfolio, as the case may be, having a principal amount equal to the aggregate principal amount at stated maturity of the Treasury securities for which substitution is being made. Because Treasury securities and the notes are issued in minimum denominations of $1,000, holders of Treasury Units may make these substitutions only in integral multiples of 40 Treasury Units. If the Treasury portfolio has replaced the notes as a component of the Corporate Units, holders of Treasury Units may substitute applicable ownership interests in the Treasury portfolio for Treasury securities only in integral multiples of Corporate Units. This substitution will recreate Corporate Units and the applicable Treasury securities will be released to the holder and will be separately tradable from the Corporate Units.

What payments am I entitled to as a holder of Corporate Units?

Holders of Corporate Units will be entitled to receive quarterly cash distributions consisting of their pro rata share of interest payments on the notes, equivalent to the rate of % per year on the undivided beneficial ownership interest in notes (or distributions on the applicable ownership interests in the Treasury portfolio if the notes have been replaced by the Treasury portfolio) and contract adjustment payments payable by us at the rate of % per year on the stated amount of $25 per Corporate Unit until the earliest of the purchase contract settlement date, the early settlement date (in the case of a cash merger early settlement) and the most recent quarterly payment date on or before any early settlement of the related purchase contracts (in the case of early settlement other than upon a cash merger).

What payments will I be entitled to if I convert my Corporate Units to Treasury Units?

Holders of Treasury Units will be entitled to receive quarterly contract adjustment payments payable by us at the rate of % per year on the stated amount of $25 per Treasury Unit. There will be no distributions in respect of the Treasury securities that are a component of the Treasury Units but the holders of the Treasury Units will continue to receive the scheduled quarterly interest payments on the notes that were released to them when they created the Treasury Units as long as they continue to hold such notes.

Do we have the option to defer current payments?

No, we do not have the right to defer the payment of contract adjustment payments in respect of the Corporate Units or Treasury Units or the payment of interest on the notes.

What are the payment dates for the Corporate Units and Treasury Units?

The payments described above in respect of the Equity Units will be payable quarterly in arrears on February 16, May 16, August 16 and November 16 of each year, commencing August 16, 2004. We will make these payments to the person in whose name the Equity Unit is registered at the close of business on the first day of the month in which the payment date falls.

What is remarketing?

Unless the Treasury portfolio has replaced the notes as a component of the Corporate Units as a result of a special event redemption, remarketing of the notes will be attempted on May 9, 2007 (the fifth business day immediately preceding the purchase contract settlement date) and, if the remarketing on that date fails, on May 10, 2007 (the fourth business day immediately preceding the purchase contract settlement date) and, if the remarketing on that date fails, on May 11, 2007 (the third business day immediately preceding the purchase contract settlement date), the fifth, fourth and third business days, respectively, immediately preceding the purchase contract settlement date of May 16, 2007. The remarketing agent will use its reasonable efforts to obtain a price for the notes to be remarketed that results in proceeds of at least 100% of the aggregate principal amount of such notes.

Upon a successful remarketing, the portion of the proceeds equal to the total principal amount of the notes underlying the Corporate Units will automatically be applied to satisfy in full the Corporate Unit holders' obligations to purchase Class A Common Stock under the related purchase contracts. If any proceeds remain after this application, the remarketing agent will remit such proceeds for the benefit of the holders. We will separately pay a fee to the remarketing agent for its services as remarketing agent. Corporate Unit holders whose notes are remarketed will not be responsible for the payment of any remarketing fee in connection with the remarketing.

What happens if the notes are not successfully remarketed?

Unless the Treasury portfolio has replaced the notes as a component of the Corporate Units as a result of a special event redemption, if (1) despite using its reasonable efforts, the remarketing agent cannot remarket the notes in a remarketing on or prior to May 11, 2007 (the third business day immediately preceding the purchase contract settlement date), other than to us, at a price equal to or greater than 100% of the aggregate principal amount of the notes remarketed, or (2) the remarketing has not occurred because a condition precedent to the remarketing has not been fulfilled, in each case resulting in a failed final remarketing, holders of all notes will have the right to put their notes to us for an amount equal to the

principal amount of their notes, plus accrued and unpaid interest, on the purchase contract settlement date. A holder of Corporate Units will be deemed to have automatically exercised this put right with respect to the notes underlying such Corporate Units unless, prior to 5:00 p.m., New York City time, on the second business day immediately prior to the purchase contract settlement date, the holder provides written notice of this prospectus. Informationan intention to settle the related purchase contracts with separate cash and on or prior to the business day immediately preceding the purchase contract settlement date delivers to the collateral agent $25 in cash. This settlement with separate cash may only be effected in integral multiples of 40 Corporate Units. Unless a holder of Corporate Units has settled the related purchase contracts with separate cash on or prior to the purchase contract settlement date, the holder will be deemed to have elected to apply a portion of the proceeds of the put price equal to the principal amount of the notes against such holder's obligations to us under the related purchase contracts, thereby satisfying such obligations in full, and we will deliver to the holder our Class A Common Stock pursuant to the related purchase contracts.

Do I have to participate in the remarketing?

You may elect not to participate in any remarketing and to retain the notes underlying the undivided beneficial ownership interests in notes comprising part of your Corporate Units by (1) creating Treasury Units at any time on or prior to the seventh business day immediately prior to the purchase contract settlement date or (2) notifying the purchase contract agent of your intention to pay cash to satisfy your obligation under the related purchase contracts on or prior to the seventh business day before the purchase contract settlement date and delivering the cash payment required under the purchase contracts to the collateral agent on or prior to the sixth business day before the purchase contract settlement date. You can only elect to satisfy your obligation in cash in increments of 40 Corporate Units. See "Description of the Purchase Contracts—Notice to Settle with Cash."

If I am holding a note as a separate security from the Corporate Units, can I still participate in a remarketing of the notes?

If you hold notes separately you may elect, in the manner described in this prospectus, assumesto have your notes remarketed by the remarketing agent along with the notes underlying the Corporate Units. See "Description of the Notes—Optional Remarketing of Notes that are not Included in Corporate Units." You may also participate in any remarketing by recreating Corporate Units from your Treasury Units at any time on or prior to the seventh business day immediately prior to the purchase contract settlement date.

How can I satisfy my obligation under the purchase contracts?

You may satisfy your obligations under the purchase contracts as follows:

In addition, your obligations under the purchase contracts will be terminated without any further action upon the termination of the purchase contracts as a result of our bankruptcy, insolvency or reorganization.

If you settle a purchase contract early (other than as a result of a cash merger early settlement), or if your purchase contract is terminated as a result of our bankruptcy, insolvency or reorganization, you will have no right to receive any accrued but unpaid contract adjustment payments.

What interest payments will I receive on the notes or on the undivided beneficial ownership interests in notes?

The notes will bear interest initially at the rate of % per year from the original issuance date to the purchase contract settlement date, initially payable quarterly in arrears on February 16, May 16, August 16 and November 16 of each year until the purchase contract settlement date. On and after the purchase contract settlement date, interest on each note will be payable semi-annually in arrears on May 16 and November 16 of each year, commencing November 16, 2007, at the reset interest rate or, if the interest rate has not been reset, at the rate of % per year. Interest will be payable to the person in whose name the note is registered at the close of business on the first day of the month in which the interest payment date falls.

When will the interest rate on the notes be reset and what is the reset rate?

The interest rate on the notes will be reset on May 16, 2007 in connection with the remarketing as described above under "What is remarketing?" The reset rate will be the interest rate determined by the remarketing agent as the rate the notes should bear in order for the aggregate principal amount of notes remarketed to have an aggregate market value on the remarketing date of at least 100% of the aggregate principal amount of such notes. The reset rate may be higher or lower than the initial interest rate of the notes depending on the results of the remarketing and market conditions at that time. The interest rate on the notes will not be reset if there is not a successful remarketing and the notes will continue to bear interest at the initial interest rate. The reset rate may not exceed the maximum rate, if any, permitted by applicable law.

When may the notes be redeemed?

The notes are redeemable at our option, in whole but not in part, upon the occurrence and continuation of a tax event or an accounting event at any time prior to the earlier of the date of a successful remarketing and the purchase contract settlement date, as described in this prospectus under "Description of the Notes—Optional Redemption—Special Event." Following any such redemption of the notes, which we refer to as a special event redemption, the redemption price for the notes that are a component of $30.85the Corporate Units will be paid to the collateral agent who will use a portion of the redemption price to purchase the Treasury portfolio described below and remit any remaining proceeds to the holders. Thereafter, the applicable ownership interests in the Treasury portfolio will replace the notes as a component of the Corporate Units and will be pledged to us through the collateral agent. Holders of notes that are not a component of the Corporate Units will receive directly the redemption price paid in such special event redemption.

What is the Treasury portfolio?

If a special event redemption as described under "Description of the Notes—Optional Redemption—Special Event" occurs prior to the earlier of the date of a successful remarketing and the purchase contract settlement date, the notes will be replaced by the Treasury portfolio. The Treasury portfolio is a portfolio of U.S. Treasury securities consisting of:

What is the ranking of the notes?

The notes will rank equally with all of our other unsecured and unsubordinated obligations. The notes will not be obligations of or guaranteed by any of our subsidiaries. As a result, the notes will be structurally subordinated to all debt and other liabilities of our subsidiaries (including liabilities to policyholders and

contractholders), which means that creditors of our subsidiaries will be paid from their assets before holders of the notes would have any claims to those assets. As of December 31, 2003, on a pro forma basis, our subsidiaries had outstanding $81,629 million of total liabilities, including $1,618 million of debt (excluding, in each case, intercompany liabilities). The indenture under which the notes will be issued will not limit our ability, or the ability of our subsidiaries, to issue or incur other debt or issue preferred stock. As a holding company, we depend on the ability of our subsidiaries to transfer funds to us to meet our obligations, including our obligations to pay interest on the notes. See "Risk Factors—Risks Relating to Our Business—As a holding company, we depend on the ability of our subsidiaries to transfer funds to us to pay dividends and to meet our obligations, including our obligation to pay interest on the notes and make contract adjustment payments on the purchase contracts." and "Description of the Notes."

What are the principal United States federal income tax consequences related to Equity Units and notes?

An owner of Equity Units will be treated as owning an undivided beneficial interest in the purchase contract and the notes, the applicable ownership interests in the Treasury portfolio or Treasury securities constituting the Equity Unit, and by purchasing the Equity Units you agree to treat the purchase contracts and notes, the applicable ownership interests in the Treasury portfolio or Treasury securities in that manner for all tax purposes. The indenture under which the notes will be issued will require you to allocate all of the purchase price paid for Equity Units to your undivided interest in notes, which will establish your initial tax basis in your interest in each purchase contract as $0 and your initial tax basis in your undivided interest in notes as $25. You will be required to include in gross income interest payments on the notes when such interest is paid or accrued in accordance with your regular method of tax accounting. If the Treasury portfolio has replaced the notes as a component of the Corporate Units as a result of a special event redemption, a beneficial owner of Corporate Units will generally be required to include in gross income its allocable share of any interest payments made with respect to the applicable ownership interests in the Treasury portfolio and, if appropriate, original issue discount on the applicable ownership interests in the Treasury portfolio as it accrues on a constant yield to maturity basis, or, if appropriate, acquisition discount on the applicable ownership interests in the Treasury portfolio. We intend to report contract adjustment payments as income to you, but you may want to consult your tax advisor concerning possible alternative characterizations.

FOR ADDITIONAL INFORMATION, SEE "CERTAIN UNITED STATES FEDERAL INCOME TAX CONSEQUENCES."

Are there conditions to the closing of this offering of the Equity Units?

This offering of Equity Units is conditioned upon the completion of the offerings of the Class A Common Stock and the Series A Preferred Stock by the seller. The offerings of the Class A Common Stock and the Series A Preferred Stock are conditioned upon the completion of this offering.

What are the rights and privileges of the Class A Common Stock?

The shares of our Class A Common Stock that you will be obligated to purchase under the purchase contracts have one vote per share for all matters on which stockholders are entitled to vote, except:

The specific number of directors that holders of the Class A Common Stock and the Class B Common Stock will have the separate rights to elect and remove will vary, depending upon the percentage of our common stock owned by GE. See "Description of Capital Stock—Common Stock."

What are the uses of proceeds from the offering?

We will not receive any proceeds this offering of Equity Units by the seller.

The Offering—Explanatory Diagrams

The following diagrams illustrate some of the key features of the purchase contracts, undivided beneficial ownership interests in notes, Corporate Units and Treasury Units.

The following diagrams assume that the notes are successfully remarketed, there has not been a special event redemption and the interest rate on the notes is reset on the reset effective date.

Purchase Contract

Corporate Units and Treasury Units both include a purchase contract under which was the weighted-average stock priceholder agrees to purchase shares of our Class A Common Stock on April 27, 2004.the purchase contract settlement date. In addition, these purchase contracts include unsecured contract adjustment payments as shown in the diagrams on the following pages.

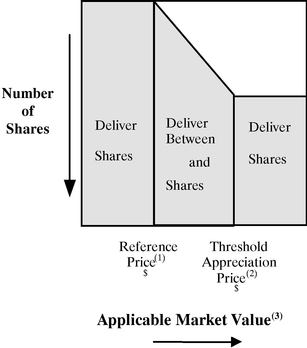

Number of Shares Delivered

Upon Settlement of a Purchase Contract on the

Purchase Contract Settlement Date

| Notes: | (1) | The "reference price" is the initial public offering price of our Class A Common Stock. | ||

| (2) | The "threshold appreciation price" represents a % appreciation over the reference price. | |||

| (3) | The "applicable market value" means the average of the closing price per share of our Class A Common Stock on each of the twenty consecutive trading days ending on the third trading day immediately preceding the purchase contract settlement date. |

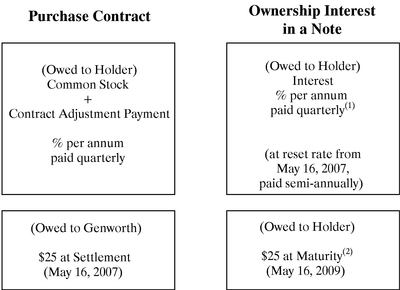

Corporate Units

A Corporate Unit consists of two components as described below:

Notes:

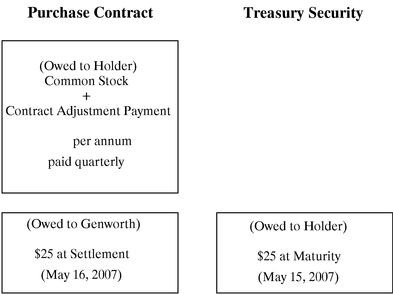

Treasury Units

A Treasury Unit consists of two components as described below:

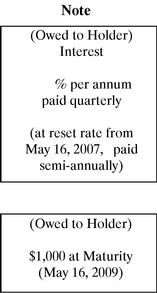

The Notes

Notes have the terms described below(1):

Notes:

Summary Historical and Pro Forma Financial Information

The following table sets forth summary historical combined and pro forma financial information. You should read this information in conjunction with the information under "Selected Historical and Pro Forma Financial Information," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our combined financial statements and the related notes included elsewhere in this prospectus.

Prior to the completion of this offering, we will acquire substantially all of the assets and liabilities of GEFAHI. We also will acquire certain other insurance businesses currently owned by other GE subsidiaries but managed by members of the Genworth management team. These businesses include international mortgage insurance, European payment protection insurance, a Bermuda reinsurer and mortgage contract underwriting. In consideration for the assets that we will acquire and the liabilities that we will assume in connection with our corporate reorganization, we will issue to GEFAHI 489.5 million shares of our Class B Common Stock, $600 million of our Equity Units, $100 million of our Series A Preferred Stock, the $2.4 billion Short-term Intercompany Note and the $550 million Contingent Note.

We have prepared our combined financial statements as if Genworth had been in existence throughout all relevant periods. Our historical combined financial information and statements include all businesses that were owned by GEFAHI including those that will not be transferred to us, as well as the other insurance businesses that we will acquire from other GE subsidiaries, each in connection with our corporate reorganization.

The unaudited pro forma information set forth below reflects our historical combined financial information, as adjusted to give effect to the transactions described under "Selected Historical and Pro Forma Financial Information" as if each had occurred as of January 1, 2003, in the case of earnings information, and December 31, 2003, in the case of financial position information. The following transactions are reflected in the pro forma financial information:

The unaudited pro forma information below is based upon available information and assumptions that we believe are reasonable. The unaudited pro forma financial information is for illustrative and informational purposes only and is not intended to represent or be indicative of what our financial condition or results of operations would have been had the transactions described above occurred on the dates indicated. The unaudited pro forma information also should not be considered representative of our future financial condition or results of operations.

In addition to the pro forma adjustments to our historical combined financial statements, various other factors will have an effect on our financial condition and results of operations after the completion of this offering, including those discussed under "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations."

| | Historical | Pro forma | |||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Years ended December 31, | Year ended December 31, | |||||||||||||||||||||

| (Amounts in millions, except per share amounts) | 2003(1) | 2002 | 2001 | 2000(2) | 1999 | 2003 | |||||||||||||||||

| Combined Statement of Earnings Information | |||||||||||||||||||||||

| Revenues: | |||||||||||||||||||||||

| Premiums | $ | 6,703 | $ | 6,107 | $ | 6,012 | $ | 5,233 | $ | 4,534 | $ | 6,252 | |||||||||||

| Net investment income | 4,015 | 3,979 | 3,895 | 3,678 | 3,440 | 2,928 | |||||||||||||||||

| Net realized investment gains | 10 | 204 | 201 | 262 | 280 | 38 | |||||||||||||||||

| Policy fees and other income | 943 | 939 | 993 | 1,053 | 751 | 557 | |||||||||||||||||

| Total revenues | 11,671 | 11,229 | 11,101 | 10,226 | 9,005 | 9,775 | |||||||||||||||||

Benefits and expenses: | |||||||||||||||||||||||

| Benefits and other changes in policy reserves | 5,232 | 4,640 | 4,474 | 3,586 | 3,286 | 4,191 | |||||||||||||||||

| Interest credited | 1,624 | 1,645 | 1,620 | 1,456 | 1,290 | 1,358 | |||||||||||||||||

| Underwriting, acquisition, and insurance expenses, net of deferrals | 1,942 | 1,808 | 1,823 | 1,813 | 1,626 | 1,614 | |||||||||||||||||

| Amortization of deferred acquisition costs and intangibles(3) | 1,351 | 1,221 | 1,237 | 1,394 | 1,136 | 1,144 | |||||||||||||||||

| Interest expense | 140 | 124 | 126 | 126 | 78 | 138 | |||||||||||||||||

| Total benefits and expenses | 10,289 | 9,438 | 9,280 | 8,375 | 7,416 | 8,445 | |||||||||||||||||

Earnings from continuing operations before income taxes | 1,382 | 1,791 | 1,821 | 1,851 | 1,589 | 1,330 | |||||||||||||||||

| Provision for income taxes | 413 | 411 | 590 | 576 | 455 | 395 | |||||||||||||||||

| Net earnings from continuing operations | $ | 969 | $ | 1,380 | $ | 1,231 | $ | 1,275 | $ | 1,134 | $ | 935 | |||||||||||

Pro forma earnings from continuing operations per share: | |||||||||||||||||||||||

| Basic | $ | 1.98 | $ | 1.91 | |||||||||||||||||||

| Diluted | $ | 1.98 | $ | 1.91 | |||||||||||||||||||

| Pro forma shares outstanding: | |||||||||||||||||||||||

| Basic | 489.5 | 489.5 | |||||||||||||||||||||

| Diluted | 490.0 | 490.0 | |||||||||||||||||||||

Selected Segment Information | |||||||||||||||||||||||

| Total revenues: | |||||||||||||||||||||||

| Protection | $ | 6,153 | $ | 5,605 | $ | 5,443 | $ | 4,917 | $ | 5,839 | |||||||||||||

| Retirement Income and Investments | 3,781 | 3,756 | 3,721 | 3,137 | 2,707 | ||||||||||||||||||

| Mortgage Insurance | 982 | 946 | 965 | 895 | 982 | ||||||||||||||||||

| Affinity(4) | 566 | 588 | 687 | 817 | — | ||||||||||||||||||

| Corporate and Other | 189 | 334 | 285 | 460 | 247 | ||||||||||||||||||

| Total | $ | 11,671 | $ | 11,229 | $ | 11,101 | $ | 10,226 | $ | 9,775 | |||||||||||||

Net earnings (loss) from continuing operations: | |||||||||||||||||||||||

| Protection | $ | 487 | $ | 554 | $ | 538 | $ | 492 | $ | 481 | |||||||||||||

| Retirement Income and Investments | 151 | 186 | 215 | 250 | 93 | ||||||||||||||||||

| Mortgage Insurance | 369 | 451 | 428 | 414 | 369 | ||||||||||||||||||

| Affinity(4) | 16 | (3 | ) | 24 | (13 | ) | — | ||||||||||||||||

| Corporate and Other | (54 | ) | 192 | 26 | 132 | (8 | ) | ||||||||||||||||

| Total | $ | 969 | $ | 1,380 | $ | 1,231 | $ | 1,275 | $ | 935 | |||||||||||||

| | Historical | Pro forma | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | December 31, | December 31, | ||||||||||||||||||

| (Dollar amounts in millions) | 2003(1) | 2002 | 2001 | 2000(2) | 1999 | 2003 | ||||||||||||||

| Combined Statement of Financial Position Information | ||||||||||||||||||||

| Total investments | $ | 78,693 | $ | 72,080 | $ | 62,977 | $ | 54,978 | $ | 48,341 | $ | 59,778 | ||||||||

| All other assets | 24,738 | 45,277 | 41,021 | 44,598 | 27,758 | 38,034 | ||||||||||||||

| Total assets | $ | 103,431 | $ | 117,357 | $ | 103,998 | $ | 99,576 | $ | 76,099 | $ | 97,812 | ||||||||

Policyholder liabilities | $ | 66,545 | $ | 63,195 | $ | 55,900 | $ | 48,291 | $ | 45,042 | $ | 66,046 | ||||||||

| Non-recourse funding obligations(5) | 600 | — | — | — | — | 600 | ||||||||||||||

| Short-term borrowings | 2,239 | 1,850 | 1,752 | 2,258 | 990 | 2,400 | ||||||||||||||

| Long-term borrowings | 529 | 472 | 622 | 175 | 175 | 529 | ||||||||||||||

| All other liabilities | 17,718 | 35,088 | 31,559 | 35,865 | 18,646 | 17,275 | ||||||||||||||

| Total liabilities | $ | 87,631 | $ | 100,605 | $ | 89,833 | $ | 86,589 | $ | 64,853 | $ | 86,850 | ||||||||

| Accumulated nonowner changes in stockholder's interest | $ | 1,672 | $ | 835 | $ | (664 | ) | $ | (424 | ) | $ | (862 | ) | $ | 1,006 | |||||

| Total stockholder's interest | 15,800 | 16,752 | 14,165 | 12,987 | 11,246 | 10,962 | ||||||||||||||

U.S. Statutory Information | ||||||||||||||||||||

Statutory capital and surplus | 7,021 | 7,207 | 7,940 | 7,119 | 6,140 | |||||||||||||||

| Asset valuation reserve | 413 | 390 | 477 | 497 | 500 | |||||||||||||||

The following table sets forth our historical combined and pro forma financial information as of March 31, 2004 and for the three months ended March 31, 2004 and March 31, 2003. The pro forma financial information is prepared on a basis comparable to the pro forma financial information set forth under "Selected Historical and Pro Forma Financial Information," except that the financial position information as of March 31, 2004 is adjusted to give effect to the transactions described in that section as if each had occurred as of that date.

| | Historical | Pro forma | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Three months ended March 31, | Three months ended March 31, | ||||||||||||

| (Amounts in millions, except per share amounts) | 2004 | 2003 | 2004 | 2003 | ||||||||||

| Combined Statement of Earnings Information | ||||||||||||||

| Revenues: | ||||||||||||||

| Premiums | $ | 1,722 | $ | 1,585 | $ | 1,619 | $ | 1,476 | ||||||

| Net investment income | 1,020 | 993 | 755 | 722 | ||||||||||

| Net realized investment gains | 16 | 21 | 15 | 20 | ||||||||||

| Policy fees and other income | 263 | 233 | 166 | 137 | ||||||||||

| Total revenues | 3,021 | 2,832 | 2,555 | 2,355 | ||||||||||

| Benefits and expenses: | ||||||||||||||

| Benefits and other changes in policy reserves | 1,348 | 1,253 | 1,086 | 996 | ||||||||||

| Interest credited | 396 | 409 | 330 | 343 | ||||||||||

| Underwriting, acquisition, and insurance expenses, net of deferrals | 508 | 488 | 414 | 404 | ||||||||||

| Amortization of deferred acquisition costs and intangibles | 345 | 300 | 286 | 251 | ||||||||||

| Interest expense | 47 | 28 | 45 | 27 | ||||||||||

| Total benefits and expenses | 2,644 | 2,478 | 2,161 | 2,021 | ||||||||||

| Earnings from continuing operations before income taxes | 377 | 354 | 394 | 334 | ||||||||||

| Provision for income taxes | 117 | 100 | 128 | 94 | ||||||||||

| Net earnings from continuing operations | $ | 260 | $ | 254 | $ | 266 | $ | 240 | ||||||

Pro forma earnings from continuing operations per share: | ||||||||||||||

| Basic | $ | 0.53 | $ | 0.52 | $ | 0.54 | $ | 0.49 | ||||||

| Diluted | $ | 0.53 | $ | 0.52 | $ | 0.54 | $ | 0.49 | ||||||

| Pro forma shares outstanding: | ||||||||||||||

| Basic | 489.5 | 489.5 | 489.5 | 489.5 | ||||||||||

| Diluted | 490.0 | 490.0 | 490.0 | 490.0 | ||||||||||

Selected Segment Information | ||||||||||||||

| Total revenues: | ||||||||||||||

| Protection | $ | 1,566 | $ | 1,476 | $ | 1,489 | $ | 1,397 | ||||||

| Retirement Income and Investments | 976 | 955 | 725 | 686 | ||||||||||

| Mortgage Insurance | 263 | 227 | 263 | 227 | ||||||||||

| Affinity | 139 | 137 | — | — | ||||||||||

| Corporate and Other | 77 | 37 | 78 | 45 | ||||||||||

| Total | $ | 3,021 | $ | 2,832 | $ | 2,555 | $ | 2,355 | ||||||

Net earnings (loss) from continuing operations: | ||||||||||||||

| Protection | $ | 124 | $ | 131 | $ | 123 | $ | 124 | ||||||

| Retirement Income and Investments | 31 | 42 | 32 | 26 | ||||||||||

| Mortgage Insurance | 103 | 85 | 103 | 85 | ||||||||||

| Affinity | (2 | ) | — | — | — | |||||||||

| Corporate and Other | 4 | (4 | ) | 8 | 5 | |||||||||

| Total | $ | 260 | $ | 254 | $ | 266 | $ | 240 | ||||||

The increases in historical and pro forma net earnings for the three months ended March 31, 2004 compared with the three months ended March 31, 2003 include, in each case, $12 million due to the favorable impact of changes in foreign exchange rates.

| | Historical | Pro forma | |||||

|---|---|---|---|---|---|---|---|

| (Dollar amounts in millions) | As of March 31, 2004 | As of March 31, 2004 | |||||

| Combined Statement of Financial Position Information | |||||||

| Total investments | $ | 81,466 | $ | 61,776 | |||

| All other assets | 25,070 | 38,430 | |||||

| Total assets | $ | 106,536 | $ | 100,206 | |||

Policyholder liabilities | $ | 67,346 | $ | 66,841 | |||

| Non-recourse funding obligations | 600 | 600 | |||||

| Short-term borrowings | 2,497 | 2,401 | |||||

| Long-term borrowings | 516 | 516 | |||||

| All other liabilities | 18,152 | 17,580 | |||||

| Total liabilities | $ | 89,111 | $ | 87,938 | |||

Accumulated nonowner changes in stockholder's interest | $ | 2,976 | $ | 1,987 | |||

| Total stockholder's interest | 17,425 | 12,268 | |||||

Protection

The following table sets forth the historical and pro forma results of operations relating to our Protection segment.

| | Historical | Pro forma | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Three months ended March 31, | Three months ended March 31, | |||||||||||

| (Dollar amounts in millions) | 2004 | 2003 | 2004 | 2003 | |||||||||

| Revenues | |||||||||||||

| Life insurance | $ | 373 | $ | 360 | $ | 373 | $ | 360 | |||||

| Long-term care insurance | 606 | 572 | 529 | 493 | |||||||||

| European payment protection insurance | 416 | 370 | 416 | 370 | |||||||||

| Group life and health insurance | 171 | 174 | 171 | 174 | |||||||||

| Total revenues | $ | 1,566 | $ | 1,476 | $ | 1,489 | $ | 1,397 | |||||

Segment net earnings | |||||||||||||

| Life insurance | $ | 57 | $ | 55 | $ | 57 | $ | 55 | |||||

| Long-term care insurance | 40 | 42 | 39 | 35 | |||||||||

| European payment protection insurance | 20 | 22 | 20 | 22 | |||||||||

| Group life and health insurance | 7 | 12 | 7 | 12 | |||||||||

| Total segment net earnings | $ | 124 | $ | 131 | $ | 123 | $ | 124 | |||||

Annualized first-year premiums and deposits(1) | |||||||||||||

| Life insurance(2) | $ | 37 | $ | 44 | $ | 37 | $ | 44 | |||||

| Long-term care insurance | 42 | 62 | 42 | 62 | |||||||||

| Group life and health insurance | 26 | 21 | 26 | 21 | |||||||||

| Total annualized first-year premiums and deposits | $ | 105 | $ | 127 | $ | 105 | $ | 127 | |||||

Gross written premiums | |||||||||||||

| European payment protection insurance | $ | 179 | $ | 373 | $ | 179 | $ | 373 | |||||

Segment net earnings decreased by $7 million, or 5%, to $124 million for the three months ended March 31, 2004 from $131 million for the three months ended March 31, 2003. This decrease was primarily the result of decreases in net earnings for group life and health, long-term care and European payment protection insurance products, offset in part by an increase in net earnings for life insurance products. The decrease in group life and health insurance was primarily attributable to higher lapse rates in our dental insurance and administration fee products, as well as higher claims incidence in our life insurance products. The decrease in long-term care insurance was primarily attributable to the loss of $4 million of investment income resulting from a reallocation of capital from our long-term care insurance business to our Corporate and Other segment. The decrease in long-term care insurance was offset in part by growth of the in-force block. The decrease in European payment protection insurance was primarily the result of increased claims in our run-off block of U.K. travel insurance and the loss of certain foreign tax benefits, offset in part by $3 million due to the favorable impact of changes in foreign exchange rates.

Pro forma segment net earnings decreased $1 million, or 1%, to $123 million for the three months ended March 31, 2004 from $124 million for the three months ended March 31, 2003. Pro forma segment net earnings differ from historical segment net earnings due primarily to the reinsurance with UFLIC of the block of long-term care insurance policies that we reinsured from Travelers in 2000. Pro forma net earnings for long-term care insurance increased $4 million, or 11%, to $39 million for the three months ended March 31, 2004 from $35 million for the three months ended March 31, 2003.

Annualized first-year premiums and deposits for our life insurance products decreased $7 million, or 16%, to $37 million for the three months ended March 31, 2004 from $44 million for the three months ended March 31, 2003. This decrease was primarily a result of term life insurance price increases implemented in March 2003 that contributed to lower sales of term life insurance in the remainder of 2003 and the three months ended March 31, 2004.

In the third quarter of 2003, we started selling our newest long-term care insurance products in selected markets. These products were priced to achieve our target returns on capital and to reflect new features and benefits, trends in lapse rates, interest rates, morbidity and adverse claims experience in certain higher risk policyholder classes. Our pricing strategy for these products has contributed to lower sales in recent periods, with annualized first-year premiums for our long-term care insurance products decreasing $20 million, or 32%, to $42 million for the three months ended March 31, 2004 from $62 million for the three months ended March 31, 2003. We believe that our pricing strategy is appropriate relative to the underlying risk exposure of these products and that it will lead to increased net earnings over time.

Gross written premiums for our European payment protection insurance products decreased $194 million, or 52%, to $179 million for the three months ended March 31, 2004 from $373 million for the three months ended March 31, 2003. To enable us to achieve our targeted returns on capital on our European payment protection insurance products, we decided not to renew certain distribution relationships in the U.K. market. As a result of that decision, gross written premiums in the U.K. decreased by 84%, to $46 million for the three months ended March 31, 2004 from $279 million for the three months ended March 31, 2003. This decline in the U.K. was partially offset in Continental Europe, where gross written premiums increased by 42%, to $133 million for the three months ended March 31, 2004 from $94 million for the three months ended March 31, 2003.

Annualized first-year premiums for our group life and health insurance products increased $5 million, or 24%, to $26 million for the three months ended March 31, 2004 from $21 million for the three months ended March 31, 2003. This increase was primarily a result of a 53% increase in annualized first-year premiums attributable to growth in our dental, disability and life insurance products.

Retirement Income and Investments

The following table sets forth the historical and pro forma results of operations relating to our Retirement Income and Investments segment.

| | Historical | Pro forma | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Three months ended March 31, | Three months ended March 31, | ||||||||||||

| | 2004 | 2003 | 2004 | 2003 | ||||||||||

| (Dollar amounts in millions) | | | | | ||||||||||

| Revenues | ||||||||||||||

| Spread-based retail products | $ | 788 | $ | 781 | $ | 584 | $ | 562 | ||||||

| Spread-based institutional products | 76 | 95 | 76 | 95 | ||||||||||

| Fee-based products | 112 | 79 | 65 | 29 | ||||||||||

| Total revenues | $ | 976 | $ | 955 | $ | 725 | $ | 686 | ||||||

Segment net earnings | ||||||||||||||

| Spread-based retail products | $ | 22 | $ | 33 | $ | 17 | $ | 19 | ||||||

| Spread-based institutional products | 6 | 11 | 6 | 11 | ||||||||||

| Fee-based products | 3 | (2 | ) | 9 | (4 | ) | ||||||||

| Total segment net earnings | $ | 31 | $ | 42 | $ | 32 | $ | 26 | ||||||

Annualized first-year premiums and deposits(1) | ||||||||||||||

| Spread-based retail products(2) | $ | 643 | $ | 683 | $ | 643 | $ | 683 | ||||||

| Spread-based institutional products(3) | 501 | 783 | 501 | 783 | ||||||||||

| Fee-based products | 517 | 557 | 517 | 557 | ||||||||||

| Total annualized first-year premiums and deposits | $ | 1,661 | $ | 2,023 | $ | 1,661 | $ | 2,023 | ||||||

Segment net earnings decreased $11 million, or 26%, to $31 million for the three months ended March 31, 2004 from $42 million for the three months ended March 31, 2003. This decrease was primarily the result of declining yields on invested assets, resulting in lower earnings from our spread-based retail and institutional products. The decrease was also the result of favorable mortality experience in our structured settlement business during the three months ended March 31, 2003 that did not recur in the three months ended March 31, 2004. Segment net earnings were favorably affected by an increase in fees earned pursuant to new arrangements we entered into, effective as of January 1, 2004, to provide investment administrative services related to a pool of municipal guaranteed investment contracts, or GICs, issued by affiliates of GE.

Pro forma segment net earnings increased $6 million, or 23%, to $32 million for the three months ended March 31, 2004 from $26 million for the three months ended March 31, 2003. Pro forma segment net earnings differ from historical segment net earnings due to the reinsurance with UFLIC of our in-force blocks of structured settlements and substantially all of our in-force blocks of variable annuities. Pro forma net earnings for spread-based retail products decreased $2 million in the three months ended March 31, 2004 from the three months ended March 31, 2003, and historical net earnings decreased $11 million over the same periods. Pro forma net earnings for fee-based products increased $13 million in the three months ended March 31, 2004 from the three months ended March 31, 2003, and historical net earnings increased $5 million over the same periods.

Annualized first-year premiums and deposits for our spread-based retail products decreased $40 million, or 6%, to $643 million for the three months ended March 31, 2004 from $683 million for the three months ended March 31, 2003. This decrease was primarily the result of lower sales of structured settlements and deposits for fixed annuities, offset in part by an increase in sales of income annuities. The decrease in structured settlements was primarily due to our decision to write those contracts on an opportunistic basis where we are able to achieve our targeted returns. The decrease in fixed annuities was primarily due to lower minimum guaranteed crediting rates introduced throughout 2003, which resulted in lower sales in the three months ended March 31, 2004, compared to the three months ended March 31, 2003. Deposits for our spread-based institutional products decreased $282 million, or 36%, to $501 million for the three months ended March 31, 2004 from $783 million for the three months ended March 31, 2003. The decrease in spread-based institutional products was primarily due to fewer requests for bids following the announcement in November 2003 of our planned separation from GE. We believe this decrease was due primarily to the limited availability to our customers of information about our company prior to the completion of this offering. Deposits for our fee-based products decreased $40 million, or 7%, to $517 million for the three months ended March 31, 2004 from $557 million for the three months ended March 31, 2003. This decrease was primarily the result of lower sales of variable annuities, which we believe was attributable to a market shift to variable annuity products with certain guaranteed benefit features that we did not offer during the three months ended March 31, 2004.

Mortgage Insurance

The following table sets forth the historical results of operations relating to our Mortgage Insurance segment. The Mortgage Insurance segment's results are not affected by any of the pro forma adjustments.

| | Historical | ||||||

|---|---|---|---|---|---|---|---|

| | Three months ended March 31, | ||||||

| (Dollar amounts in millions) | 2004 | 2003 | |||||

| Revenues | |||||||

| U.S. mortgage insurance | $ | 154 | $ | 170 | |||

| International mortgage insurance | 109 | 57 | |||||

| Total revenues | $ | 263 | $ | 227 | |||

| Segment net earnings | |||||||

| U.S. mortgage insurance | $ | 59 | $ | 57 | |||

| International mortgage insurance | 44 | 28 | |||||

| Total segment net earnings | $ | 103 | $ | 85 | |||

| New insurance written | |||||||

| U.S. mortgage insurance | $ | 6,798 | $ | 14,530 | |||

| International mortgage insurance | 10,905 | 6,257 | |||||

| Total new insurance written | $ | 17,703 | $ | 20,787 | |||

Segment net earnings increased $18 million, or 21%, to $103 million for the three months ended March 31, 2004 from $85 million for the three months ended March 31, 2003. This increase was primarily the result of a $16 million increase in international net earnings, attributable to higher levels of insurance in force and invested assets. The increase in our international net earnings included $9 million due to the favorable impact of changes in foreign exchange rates. Net earnings of our U.S. mortgage business increased $2 million, primarily as a result of lower underwriting costs due to lower mortgage refinance activity. The lower mortgage refinancing activity resulted in increased persistency in our U.S. mortgage insurance business, with policy cancellation rates in our U.S. flow mortgage insurance business decreasing to 32% for the three months ended March 31, 2004 from 53% for the three months ended March 31, 2003.

New insurance written decreased $3,084 million, or 15%, to $17,703 million for the three months ended March 31, 2004 from $20,787 million for the three months ended March 31, 2003. This decrease was primarily the result of a $7,732 million decrease in U.S. new insurance written, primarily attributable to lower mortgage refinancing activity. The decrease in U.S. new insurance written was offset in part by a $4,648 million increase in international new insurance written. The increase in our international new insurance written included $2,168 million due to the favorable impact of changes in foreign exchange rates.

Affinity

Segment net earnings on a historical basis decreased $2 million to a ($2) million loss for the three months ended March 31, 2004. Pro forma financial information is not presented for the Affinity segment because we will not acquire any of the Affinity segment businesses from GEFAHI.

Corporate and Other