As filed with the Securities and Exchange Commission on July 26, 2005March 29, 2006

Registration No. 333-124824333-132480

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DCD.C. 20549

Amendment No. 21

to

FORM S-1

REGISTRATION STATEMENTUnder the Securities Act ofUNDER THE SECURITIES ACT OF 1933

RBC BEARINGS INCORPORATED

(Exact Name of Registrant as Specified in its Charter)

| Delaware (State or other jurisdiction of incorporation or organization) | 3562 (Primary Standard Industrial Classification Code number) | 95-4372080 (I.R.S. Employer Identification No.) | |||||

One Tribology Center Oxford, CT 06478 Telephone: (203) 267-7001 (Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant's Principal Executive Offices) | |||||||

Corporation Service Company 2711 Centerville Road Suite 400 Wilmington, DE 19808 Telephone: (800) 927-9800 (Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service) | |||||||

One Tribology CenterOxford, CT 06478Telephone: (203) 267-7001(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant's Principal Executive Offices)

Corporation Service Company2711 Centerville RoadSuite 400Wilmington, DE 19808Telephone: (800) 927-9800

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

Copies to: | ||

| Joshua N. Korff, Esq. Kirkland & Ellis LLP Citigroup Center 153 East 53rd Street New York, New York 10022-4611 (212) 446-4800 | Valerie Ford Jacob, Esq. Stuart H. Gelfond, Esq. Fried, Frank, Harris, Shriver & Jacobson LLP One New York Plaza New York, New York 10004 (212) 859-8000 | |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: box. o

If this Form is filed to registered additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. o

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price(1) | Amount of Registration Fee(1) | Proposed Maximum Aggregate Offering Price(1) | Amount of Registration Fee(1) | ||||

|---|---|---|---|---|---|---|---|---|

| Common Stock, par value $0.01 per share(2) | $152,499,200 | $17,949.16(3) | $159,859,074 | $17,104.92(3) |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to such Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated July 26, 2005March 29, 2006

PROSPECTUS

8,288,0007,067,000 Shares

Common Stock

This is RBC Bearings Incorporated's initial public offering. RBC Bearings Incorporated isWe are selling 6,273,0001,071,471 shares and certain of our stockholders are selling 2,015,0005,995,529 shares.

We expect the public offering price to be between $14.00 and $16.00 per share. Currently, no public market exists for the shares. Our common stock has been approved for quotationshares are quoted on the Nasdaq National Market under the symbol "ROLL." On March 28, 2006, the last sale price of our shares as reported on the Nasdaq National Market was $20.74 per share.

Investing in the common stock involves risks that are described in the "Risk Factors" section beginning on page 109 of this prospectus.

| | Per Share | Total | ||||

|---|---|---|---|---|---|---|

| Public offering price | $ | $ | ||||

| Underwriting discount | $ | $ | ||||

| Proceeds, before expenses, to us | $ | $ | ||||

| Proceeds, before expenses, to the selling stockholders | $ | $ | ||||

The underwriters may also purchase up to an additional 761,5161,060,050 shares from us and up to an additional 481,684 shares from the selling stockholders, at the public offering price, less the underwriting discount, within 30 days from the date of this prospectus to cover overallotments.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The shares will be ready for delivery on or about , 2005.2006.

| Merrill Lynch & Co. Sole Book-Running Manager | |||

KeyBanc Capital Markets | Co-Lead Manager | ||

Co. | |||

The date of this prospectus is , 2005.2006.

| | Page | |

|---|---|---|

| Prospectus Summary | 1 | |

| Risk Factors | ||

| Disclosure Regarding Forward-Looking Statements | ||

| Use of Proceeds | ||

| Industry and Market Data | ||

| Price Range of Our Common Stock | 23 | |

| Dividend Policy | ||

| Capitalization | ||

| Selected Consolidated Historical Financial Data | ||

| Management's Discussion and Analysis of Financial Condition and Results of Operations | ||

| Business | ||

| Management | ||

| Related Party Transactions | ||

| Principal and Selling Stockholders | ||

| Description of Capital Stock | ||

| Description of Certain Indebtedness | ||

| Shares Eligible for Future Sale | ||

| Material U.S. Federal Income Tax Considerations for Non-U.S. Holders | ||

| Underwriting | ||

| Legal Matters | ||

| Experts | ||

| Where You Can Find Additional Information |

You should rely only on the information contained in this prospectus. We have not, and the underwriters have not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

In this prospectus, unless the context otherwise requires, "Company," "RBCI," "we," "our" and "us" refer to RBC Bearings Incorporated and our subsidiaries; "RBCA" refers to Roller Bearing Company of America, Inc., our wholly-owned subsidiary and principal operating company; and "Whitney" refers to Whitney & Co., LLC, our principal equity sponsor.LLC. Our fiscal year consists of 52 or 53 weeks, ending on the Saturday closest to March 31; therefore, references to "fiscal 2005," "fiscal 2004," "fiscal 2003," "fiscal 2002" and "fiscal 2001" refer to our fiscal years ended April 2, 2005, April 3, 2004, March 29, 2003, March 30, 2002 and March 31, 2001, respectively. The term Senior Credit Facility refers, collectively, to our existing $55.0 million revolving credit facility, referred to as our Revolving Credit Facility, and our $150.0 million term loan, referred to as our Term Loan.

This prospectus contains our registered and unregistered trademarks, service marks and trade names including: "Aerocres," "Heim," "Pitchlign," "Quadlube," "RBC Bearings," "RBC Roller," "RBC Southwest Products," "Schaublin" and "Unibal." This prospectus also contains trademarks, service marks, copyrights and trade names of other companies.

i

This summary highlights information contained elsewhere in this prospectus. As a result, it does not contain all of the information that you should consider before investing in our common stock. You should read this entire prospectus, especially the section entitled "Risk Factors" and the consolidated financial statements and the related notes.

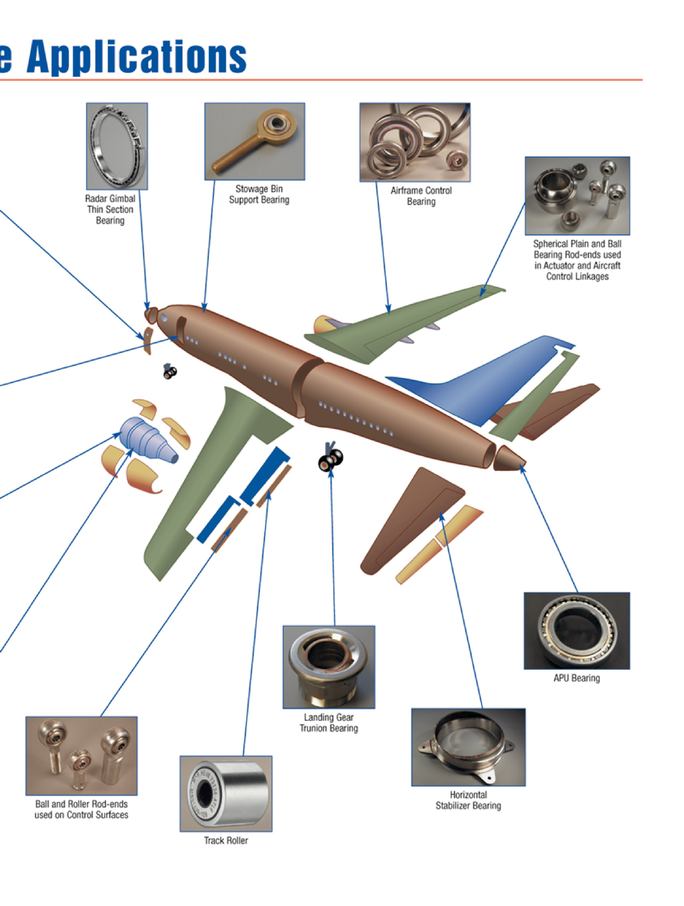

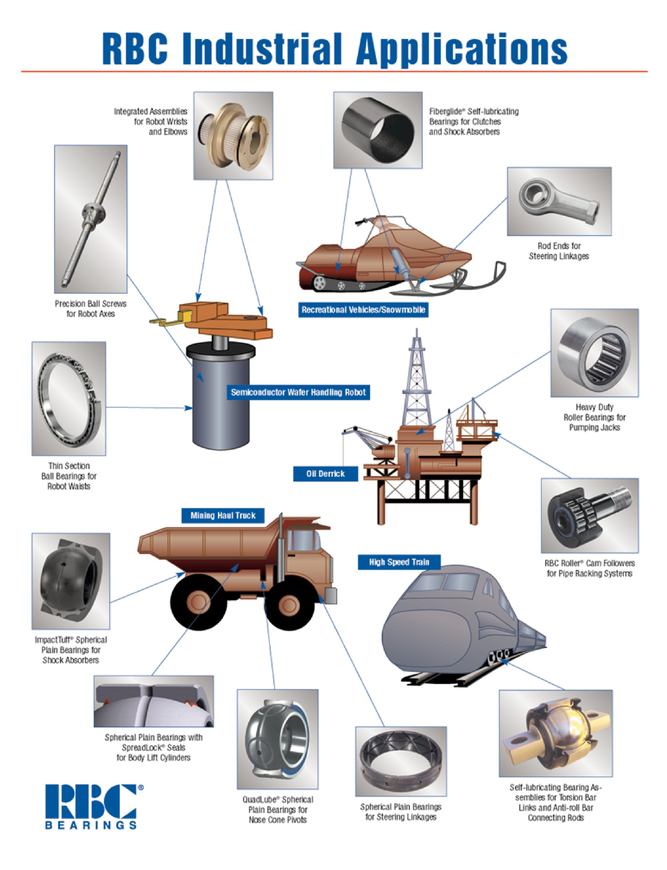

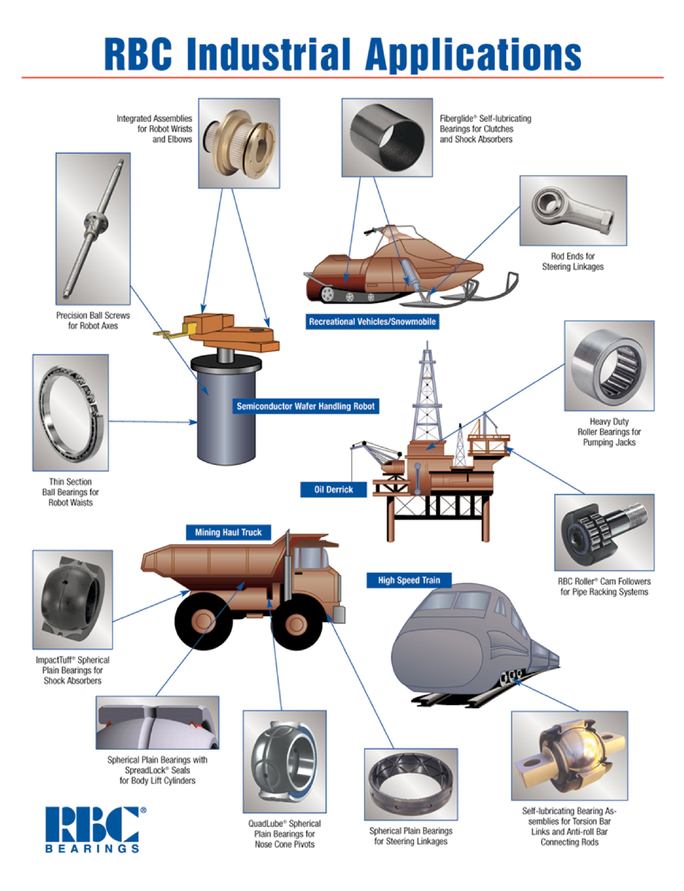

We are a well known international manufacturer and marketer of highly engineered precision plain, roller and ball bearings. Bearings, which are integral to the manufacture and operation of most machines and mechanical systems, reduce wear to moving parts, facilitate proper power transmission and reduce damage and energy loss caused by friction. While we manufacture products in all major bearing categories, we focus primarily on highly technical or regulated bearing products for specialized markets that require sophisticated design, testing and manufacturing capabilities. We believe our unique expertise has enabled us to garner leading positions in many of the product markets in which we primarily compete. We estimate that over one-fourth of our net sales are derived from products for which we are the sole supplier and the only manufacturer able to provide the required bearing solution. We believe that being the sole supplier for these products provides us with a competitive advantage due to the lengthy and rigorous certification processes and/or approvals required by a majority of these customers or government agencies, which typically take anywhere from six months to six years to complete, and due to our long track record with most of these customers of delivering high quality and uniquely designed and engineered products in a timely manner. We estimate that approximately two-thirds of our net sales during fiscal 2005 and during the nine month period ended December 31, 2005 were generated by products for which we hold the number one or two market position. We have been providing bearing solutions to our customers since 1919. Over the past ten years, under the leadership of our current management team, we have significantly broadened our end markets, products, customer base and geographic reach. We currently operate 16 manufacturing facilities in three countries.

We design, manufacture and market a broad portfolio of bearing products. The following table provides a summary of our product segments:

| Segment | FY 2005 Sales | Representative Applications | ||||

|---|---|---|---|---|---|---|

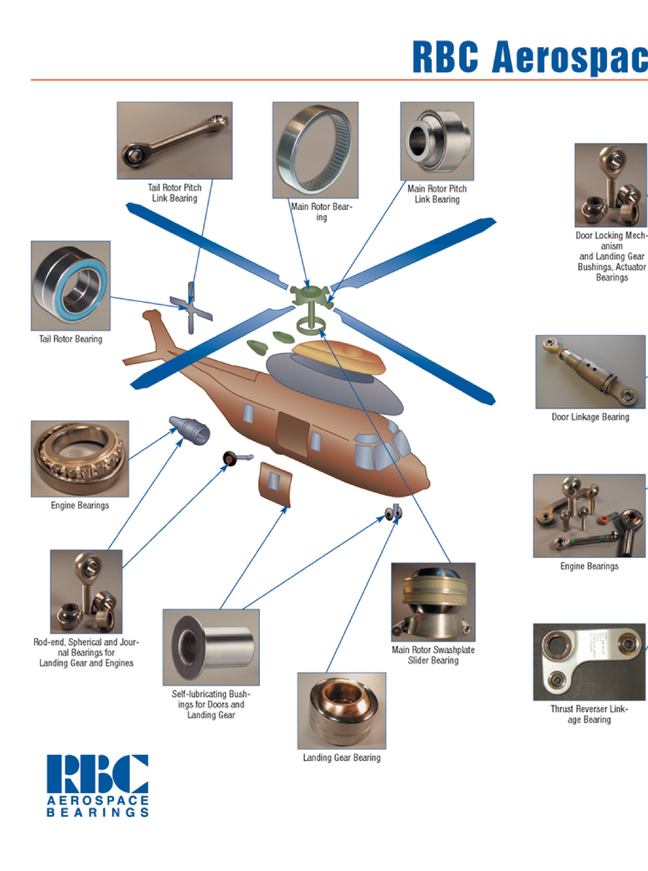

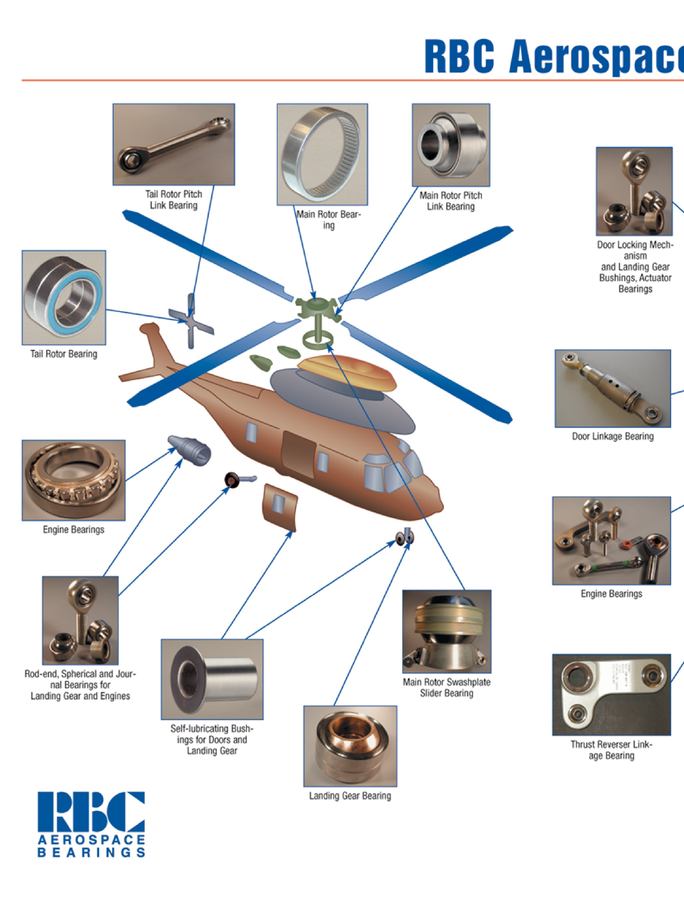

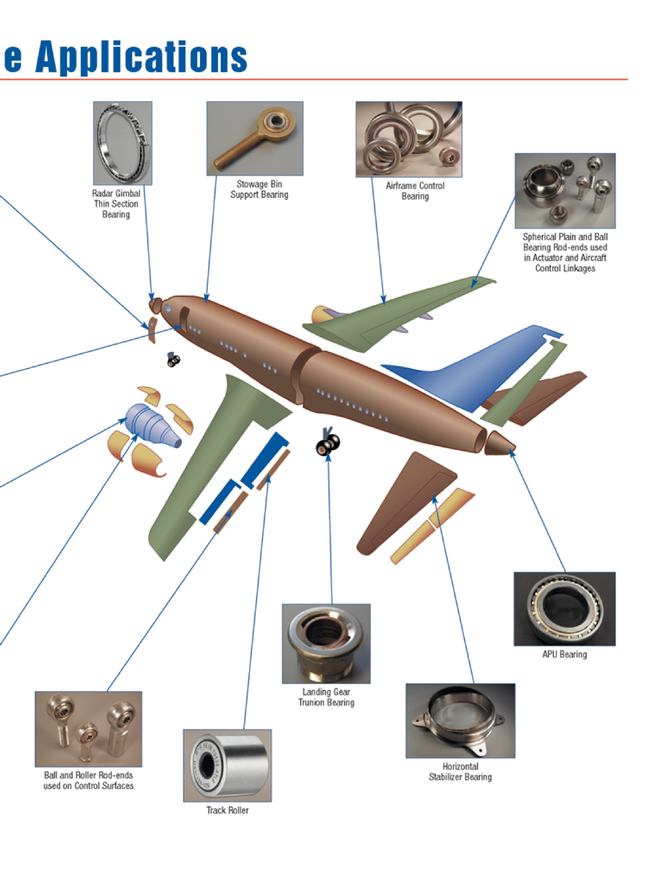

| Plain Bearings | $ | 93,250 | • | Aircraft engine controls and landing gear | ||

| (38%) | • | Helicopter rotors and missile launchers | ||||

| • | Mining and construction equipment | |||||

Roller Bearings | $ | 92,281 | • | Aircraft hydraulics | ||

| (38%) | • | Military and commercial truck chassis | ||||

| • | Packaging machinery and gear pumps | |||||

Ball Bearings | $ | 41,881 | • | Radar and night vision systems | ||

| (17%) | • | Airframe control and actuation | ||||

| • | Semiconductor equipment | |||||

Other | $15,604 (7%) | • | Precision ground ball screws for robotic handling and missile guidance | |||

| • | Collets for machine tools | |||||

| Segment | Net Sales for the Nine Month Period Ended December 31, 2005 | Representative Applications | ||

|---|---|---|---|---|

| Plain Bearings | $82,078 (41%) | • Aircraft engine controls and landing gear • Helicopter rotors and missile launchers • Mining and construction equipment | ||

Roller Bearings | $71,193 (36%) | • Aircraft hydraulics • Military and commercial truck chassis • Packaging machinery and gear pumps | ||

Ball Bearings | $33,239 (17%) | • Radar and night vision systems • Airframe control and actuation • Semiconductor equipment | ||

Other | $12,248 (6%) | • Precision ground ball screws for robotic handling and missile guidance • Collets for machine tools | ||

Our End Markets

We serve a broad range of end markets where we can add value with our specialty, precision bearing applications. We classify our customers into threetwo principal categories: diversified industrial and aerospace and defense.

Diversified Industrial (64%(55% of fiscal 2005 net sales)sales for the nine month period ended December 31, 2005). We manufacture bearing products for a wide range of diversified industrial markets, including construction and mining, oil and natural resource extraction, heavy truck, packaging and semiconductor machinery. Our diversified industrial products target specialized market applications in which our engineering and manufacturing capabilities provide us with unique competitive advantages. We believe opportunities exist for growth and margin expansion in this market as a result of increasing demand for industrial machinery, the introduction of new products and the expansion of aftermarket sales.

Aerospace (28%and Defense (45% of fiscal 2005 net sales)sales for the nine month period ended December 31, 2005). We manufacture bearing products for a wide range of aerospace applications, including commercial airframes, commercial aircraft engines and private aircraft applications. We supply bearings for many of the commercial aircraft currently operating world-wide and are the primary supplier for many of our product lines. Many of our aerospace bearing products are designed and certified during the original development of the aircraft being served, which often makes us the primary bearing supplier for the life of the aircraft. We believe that growth and margin expansion in this segment will be driven primarily by expanding our international presence, new aircraft builds and the refurbishment and maintenance of existing commercial aircraft.

Defense (8% of fiscal 2005 net sales). We In addition, we manufacture bearing products used by the U.S. Department of Defense and certain foreign governments for use in fighter jets, troop transports, naval vessels, helicopters, gas turbine engines, armored vehicles, guided weaponry and satellites. Our bearing products are manufactured to conform to U.S. military specifications and are typically custom designed during the original product design phase which often makes us the sole or primary bearing supplier for the life of the product. We believe that our current installed base of bearing products and our sophisticated engineering and manufacturing capabilities position us to benefit from growing replacement part demand caused by increased equipment utilization as well as the introduction of new weapons and transport systems.

Our Competitive Strengths

Leading Market Positions. We compete in specialized markets where we believe we are often the only supplier with the manufacturing expertise, business plan and engineering resources required to provide the required bearing solution. We estimate that approximately two-thirds of our net sales during fiscal 2005 and during the nine month period ended December 31, 2005 were generated by products for which we hold the number one or two market position.

Diversified Revenue Base. We sell a wide array of bearing products to customers across many diverse end markets, each of which is influenced by different fundamental economic factors. Our products are sold to more than 6,1006,700 customers, including original equipment manufacturers, or OEMs, and aftermarket distributors and service providers.

Large Installed Product Base with Recurring Aftermarket Revenue Stream. We provide bearings to a large and growing number of applications for which our products have been tested and certified. Our bearing products are approved for over 32,000 applications, many of which are part of aerospace, defense and industrial platforms that can be in service for as long as several decades, thereby requiring continuing aftermarket support. Aftermarket sales of replacement parts for existing equipment platforms represented approximately 56% of our net sales for fiscal 2005.

Proprietary Design and Manufacturing Capabilities. We believe that our design and manufacturing capabilities will allow us to maintain a leadership position as our customers continue to rely on us to develop new bearing solutions that can be manufactured cost effectively.

Disciplined Acquisition Program with History of Successful Integration. We have demonstrated expertise in acquiring and integrating bearing and precision-engineered component manufacturers that have complementary products or distribution channels and provide significant potential for margin enhancement. Since October 1992 we have completed 1213 acquisitions which have significantly broadened our end markets, products, customer base and geographic reach. Most recently, in September 2005, we acquired the Southwest Products Company, a manufacturer of spherical bearings, journal bearings and push-pull controls for military weapon systems and military and commercial aerospace applications.

Experienced Management Team. Our management team possesses extensive managerial experience in the bearing industry, with our top five operating executives averaging over 20 years of bearing industry experience. We intend to retain and attract experienced professionals by leveraging our reputation as a premier provider of precision bearing solutions.

Our Growth Strategy

We intend to grow our business while continuing to focus on specialized markets for highly engineered bearing solutions. Key elements of our growth strategy include:

Continue to Develop Innovative Bearing Solutions. We intend to leverage our design and manufacturing expertise and our extensive customer relationships to continue to develop new products for markets where we believe there are substantial growth opportunities. Our ability to develop new custom engineered products strengthens existing customer relationships and creates new business opportunities for us.

Expand Customer Base and Penetrate End Markets. We continually seek opportunities to penetrate new customers, geographic locations and bearing platforms with existing products or profitable new product opportunities. We intend to continue to expand our sales force, customer base and end markets and have identified a number of attractive growth opportunities domestically and abroad, including current projects in semiconductor machinery, airframe controls and missile guidance systems. In addition, our OEM relationships, coupled with our design expertise, provide us with extensive cross-selling opportunities on platforms that we do not currently supply.

Increase Aftermarket Sales. We intend to increase the percentage of our revenues derived from the replacement market by continuing to implement several initiatives. First, we will continue to seek opportunities to increase our sales to key existing distributors as well as expand our base of third party customers. Second, our new product and new end market initiatives are focused on high-growth platforms, such as 300 millimeter semiconductor manufacturing systems and the U.S. government's Joint Strike Fighter program that we expect will be in service for long periods and therefore create significant demand for replacement parts. Additionally, we will seek opportunities to develop new products that can be used as replacement parts for existing platforms. We believe that increasing our aftermarket sales of replacement parts will further enhance the continuity and predictability of our revenues and increase our profitability.

Pursue Selective Acquisitions. We believe that there will continue to be consolidation within the bearing industry that may present us with acquisition opportunities, particularly within the industrial and aerospace markets. We regularly evaluate opportunities to acquire bearing and precision-engineered component manufacturers which have complementary products, customers or distribution

channels, provide significant potential for margin enhancement and further expand the breadth of our product portfolio.

Whitney & Co., LLC

Whitney & Co., LLC is our major equity sponsor and provides financial consulting and management advisory services to us. Whitney was established in 1946 by John Hay Whitney as one of the first U.S. firms involved in the development of the private equity industry. Today, Whitney remains a private firm owned by investing professionals, and its main activities are to provide private equity and debt capital for middle market growth companies. Whitney manages approximately $4 billion of assets for endowments, foundations and pension plans and is currently investing its fifth outside equity fund, Whitney V, L.P., a fund with committed capital of $1.1 billion.

Our Corporate Profile

RBC Bearings Incorporated is a Delaware corporation, and our principal executive offices are located at One Tribology Center, Oxford, CT 06478. Our telephone number is (203) 267-7001. Our website address iswww.rbcbearings.com. Information on our website is not deemed to be a part of this prospectus.

Amendment or Replacement of Our Senior Credit Facility

In connection with this offering we expect to amend or replace our Senior Credit Facility to provide for lower borrowing costs. The amendment or replacement of the Senior Credit Facility is contingent upon the consummation of the primary portion of this offering, but this offering is not contingent upon the amendment or replacement of the Senior Credit Facility. We are in discussions with multiple lenders regarding alternatives for reducing borrowing costs under our Senior Credit Facility, including replacing or amending the facility. Based on discussions with lenders, we expect that after giving effect to the amendment or replacement of the Senior Credit Facility, we will reduce the interest rate on our LIBOR loans by at least 125 basis points. See "Description of Certain Indebtedness—Senior Credit Facility."

Common stock offered: | |||||

By us | |||||

By the selling stockholders | |||||

Common stock outstanding after the offering | |||||

Use of proceeds | We estimate that | ||||

Risk factors | See "Risk Factors" and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in shares of the common stock. | ||||

Nasdaq National Market symbol | "ROLL" | ||||

The number of shares of our common stock that will be outstanding after this offering as shown above is based on the number of16,976,381 shares outstanding after givingon March 29, 2006, adjusted to give effect to the Pre-Offering Transactions, the exercise of options and warrants for cash by certain selling stockholders pursuant to a net share settlement and this offering, and excludes:

Unless otherwise specifically stated or the context otherwise requires, the information in this prospectus:

stock. See "Use of Proceeds" and "Pre-Offering Transactions.Proceeds."

The summary financial data for the fiscal years ended March 29, 2003, April 3, 2004 and April 2, 2005 have been derived from our historical consolidated financial statements audited by Ernst & Young LLP, independent auditors.registered public accounting firm. The summary financial data for the nine month periods ended January 1, 2005 and December 31, 2005 have been derived from our unaudited consolidated financial statements included elsewhere in this prospectus, which in our opinion contain all adjustments necessary for a fair presentation of the consolidated financial data. Results for interim periods are not necessarily indicative of results that may be expected for a full fiscal year. Historical results are not necessarily indicative of the results expected in the future. See "Use of Proceeds" and "Prospectus Summary—The Offering."

You should read the data presented below together with, and qualified by reference to, "Selected Consolidated Historical Financial Data," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements included elsewhere in this prospectus.

| | Fiscal Year Ended | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | March 29, 2003 | April 3, 2004 | April 2, 2005 | ||||||||||

| | | | (Restated)(3) | ||||||||||

| | (in thousands, except share and per share amounts) | ||||||||||||

| Statement of Operations Data: | |||||||||||||

| Net sales(1) | $ | 172,860 | $ | 187,331 | $ | 243,016 | |||||||

| Cost of sales | 124,086 | 135,433 | 174,602 | ||||||||||

| Gross margin | 48,774 | 51,898 | 68,414 | ||||||||||

| Selling, general and administrative | 26,647 | 28,107 | 32,749 | ||||||||||

| Other, net | 1,424 | 1,662 | 3,526 | ||||||||||

| Operating income | 20,703 | 22,129 | 32,139 | ||||||||||

| Interest expense, net | 21,023 | 20,380 | 19,669 | ||||||||||

| Loss (gain) on early extinguishment of debt(2) | (780 | ) | — | 6,950 | |||||||||

| Other non-operating expense (income) | 298 | 16 | (355 | ) | |||||||||

| Income before income taxes | 162 | 1,733 | 5,875 | ||||||||||

| Provision for (benefit from) income taxes | 113 | 1,070 | (1,385 | ) | |||||||||

| Net income | 49 | 663 | 7,260 | ||||||||||

| Preferred stock dividends | (1,313 | ) | (2,144 | ) | (2,280 | ) | |||||||

| Participation rights of preferred stock in undistributed earnings | — | — | (1,142 | ) | |||||||||

| Net income (loss) available to common stockholders | $ | (1,264 | ) | $ | (1,481 | ) | $ | 3,838 | |||||

| Net income (loss) per common share: | |||||||||||||

| Basic: | |||||||||||||

| Class A common stock | $ | (0.20 | ) | $ | (0.24 | ) | $ | 0.62 | |||||

| Class B common stock | $ | (0.20 | ) | $ | (0.24 | ) | $ | 0.62 | |||||

| Diluted: | |||||||||||||

| Class A common stock | $ | (0.20 | ) | $ | (0.24 | ) | $ | 0.40 | |||||

| Class B common stock | $ | (0.20 | ) | $ | (0.24 | ) | $ | 0.00 | |||||

| Weighted average number of common and common equivalent shares outstanding: | |||||||||||||

| Basic: | |||||||||||||

| Class A common stock | 6,188,653 | 6,188,653 | 6,202,365 | ||||||||||

| Class B common stock | 250 | 250 | 250 | ||||||||||

| Diluted: | |||||||||||||

| Class A common stock | 6,188,653 | 6,188,653 | 9,552,579 | ||||||||||

| Class B common stock | 250 | 250 | 1,302,005 | ||||||||||

| | Fiscal Year Ended | Nine Months Ended | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | March 29, 2003 | April 3, 2004 | April 2, 2005 | January 1, 2005 | December 31, 2005(6) | |||||||||||

| | (in thousands, except share and per share amounts) | |||||||||||||||

| Statement of Operations Data: | ||||||||||||||||

| Net sales(1) | $ | 172,860 | $ | 187,331 | $243,016 | $ | 170,731 | $198,758 | ||||||||

| Cost of sales | 124,086 | 135,433 | 174,602 | 123,325 | 139,134 | |||||||||||

| Gross margin | 48,774 | 51,898 | 68,414 | 47,406 | 59,624 | |||||||||||

| Selling, general and administrative(2) | 26,647 | 28,107 | 32,749 | 23,261 | 32,325 | |||||||||||

| Other, net | 1,424 | 1,662 | 3,526 | 2,464 | 1,020 | |||||||||||

| Operating income | 20,703 | 22,129 | 32,139 | 21,681 | 26,279 | |||||||||||

| Interest expense, net | 21,023 | 20,380 | 19,669 | 14,335 | 12,582 | |||||||||||

| Loss (gain) on early extinguishment of debt(3) | (780 | ) | — | 6,950 | 6,956 | 3,771 | ||||||||||

| Other non-operating expense (income) | 298 | 16 | (355 | ) | (98 | ) | — | |||||||||

| Income before income taxes | 162 | 1,733 | 5,875 | 488 | 9,926 | |||||||||||

| Provision for (benefit from) income taxes | 113 | 1,070 | (1,385 | ) | 180 | 3,442 | ||||||||||

| Net income | 49 | 663 | 7,260 | 308 | 6,484 | |||||||||||

| Preferred stock dividends | (1,313 | ) | (2,144 | ) | (2,280 | ) | (1,693 | ) | (893 | ) | ||||||

| Participation rights of preferred stock in undistributed earnings | — | — | (1,142 | ) | (687 | ) | (630 | ) | ||||||||

| Net income (loss) available to common stockholders | $ | (1,264 | ) | $ | (1,481 | ) | $ 3,838 | $ | (2,072 | ) | $ 4,961 | |||||

Net income (loss) per common share:(4) | ||||||||||||||||

| Basic | $ | (0.20 | ) | $ | (0.24 | ) | $ 0.62 | $ | (0.33 | ) | $ 0.43 | |||||

| Diluted | $ | (0.20 | ) | $ | (0.24 | ) | $ 0.35 | $ | (0.33 | ) | $ 0.37 | |||||

| Weighted average common shares:(4) | ||||||||||||||||

| Basic | 6,188,903 | 6,188,903 | 6,202,615 | 6,188,903 | 11,649,073 | |||||||||||

| Diluted | 6,188,903 | 6,188,903 | 10,854,584 | 6,188,903 | 13,307,181 | |||||||||||

Other Financial Data: | ||||||||||||||||

| EBITDA(5) | $ | 29,224 | $ | 31,295 | $ 41,279 | $ | 29,123 | $ 33,417 | ||||||||

| Capital expenditures | 6,522 | 4,951 | 9,526 | 6,604 | 7,772 | |||||||||||

| | Fiscal Year Ended | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | March 29, 2003 | April 3, 2004 | April 2, 2005 | |||||||

| | (in thousands, except share and per share amounts) | |||||||||

| Pro Forma Data:(4) | ||||||||||

| Pro forma net income | $10,765 | |||||||||

| Pro forma net income per common share: | ||||||||||

| Basic | $ 0.70 | |||||||||

| Diluted | $ 0.62 | |||||||||

| Pro forma weighted average number of common and common equivalent shares outstanding: | ||||||||||

| Basic | 15,458,833 | |||||||||

| Diluted | 17,421,506 | |||||||||

Other Financial Data: | ||||||||||

| EBITDA(5) | $ | 29,224 | $ | 31,295 | $41,279 | |||||

| Capital expenditures | 6,522 | 4,951 | 9,526 | |||||||

| | As of April 2, 2005 | ||||||

|---|---|---|---|---|---|---|---|

| | Actual | Pro Forma(4) | |||||

| | (in thousands) | ||||||

| Balance Sheet Data: | |||||||

| Cash | $ | 2,635 | $ | 6,802 | |||

| Working capital | 120,656 | 130,325 | |||||

| Total assets | 250,169 | 261,481 | |||||

| Total debt | 220,079 | 177,130 | |||||

| Total stockholders' equity (deficit) | (7,759 | ) | 46,502 | ||||

| | As of December 31, 2005(6) | ||||||

|---|---|---|---|---|---|---|---|

| | Actual | As Adjusted | |||||

| | (in thousands) | ||||||

| Balance Sheet Data: | |||||||

| Cash | $ | 10,312 | $ | 10,312 | |||

| Working capital | 148,386 | 148,386 | |||||

| Total assets | 271,424 | 271,424 | |||||

| Total debt | 169,030 | 148,868 | |||||

| Total stockholders' equity | 61,972 | 82,134 | |||||

amortization expense, interest expense, net, loss (gain) on early extinguishment of debt and the provision for (benefit from) income taxes and therefore does not necessarily represent an accurate measure of profitability, particularly in situations where a company is highly leveraged or has a disadvantageous tax structure. We use a significant amount of capital assets and depreciation and amortization expense is a necessary element of our costs and ability to generate revenue and therefore its exclusion from EBITDA is a material limitation. We also have a significant amount of debt and interest expense is a necessary element of our costs and ability to generate revenue and therefore its exclusion from EBITDA is a material limitation. We generally incur significant U.S. federal, state and foreign income taxes each year and the provision for (benefit from) income taxes is a necessary element of the our costs and therefore its exclusion from EBITDA is a material limitation. As a result,

EBITDA should be evaluated in conjunction with net income (loss) for a more complete analysis of our profitability, as net income (loss) includes the financial statement impact of these items and is the most directly comparable GAAP operating performance measure to EBITDA. As EBITDA is not defined by GAAP, our definition of EBITDA may differ from and therefore may not be comparable to similarly titled measures used by other companies, thereby limiting its usefulness as a comparative measure. Because of the limitations that EBITDA has as an analytical tool, investors should not consider it in isolation or as a substitute for analysis of our operating results as reported under GAAP.

We use EBITDA as a supplementary non-GAAP operating performance measure to assist with our overall evaluation of our and our subsidiaries' operating performance (including the performance of subsidiary management) relative to outside peer group companies. In addition, we use EBITDA as an operating performance measure in financial presentations to our board of directors, stockholders, the banks participating in our credit facility and rating agencies, among others, as a supplemental non-GAAP operating measure to assist them in their evaluation of our performance. We are also active in mergers, acquisitions and divestitures and use EBITDA as an additional operating performance measure to assess our, our subsidiaries' and potential acquisition target enterprise value and to assist in the overall evaluation of our, our subsidiaries' and potential acquisition target performance on an internal basis and relative to peer group companies. We use EBITDA in conjunction with traditional GAAP operating performance measures as part of our overall assessment of potential valuation and relative performance and therefore do not place undue reliance on EBITDA as our only measure of operating performance. We believe EBITDA is useful for our management and investors as it is a commonly used analytical measurement for comparing company profitability, which eliminates the effects of financing, differing valuations of fixed and intangible assets and tax structure decisions. We believe that EBITDA is specifically relevant to us, due to the different degrees of leverage among our competitors. We have included EBITDA as a supplemental operating performance measure, which should be evaluated by investors in conjunction with the traditional GAAP performance measures for a complete evaluation of our operating performance. The following table provides a reconciliation of net income, the most directly comparable GAAP measure, to EBITDA.

| | Fiscal Year Ended | Nine Months Ended | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | March 29, 2003 | April 3, 2004 | April 2, 2005 | January 1, 2005 | December 31, 2005 | |||||||||||

| | (in thousands) | |||||||||||||||

| Net income | $ | 49 | $ | 663 | $ | 7,260 | $ | 308 | $ | 6,484 | ||||||

| Add: | ||||||||||||||||

| Provision for (benefit from) income taxes | 113 | 1,070 | (1,385 | ) | 180 | 3,442 | ||||||||||

| Interest expense, net | 21,023 | 20,380 | 19,669 | 14,335 | 12,582 | |||||||||||

| Loss (gain) on early extinguishment of debt | (780 | ) | — | 6,950 | 6,956 | 3,771 | ||||||||||

| Depreciation and amortization | 8,819 | 9,182 | 8,785 | 7,344 | 7,138 | |||||||||||

| EBITDA | $ | 29,224 | $ | 31,295 | $ | 41,279 | $ | 29,123 | $ | 33,417 | ||||||

| | Fiscal Year Ended | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| | March 29, 2003 | April 3, 2004 | April 2, 2005 | ||||||||

| | (in thousands) | ||||||||||

| Net income | $ | 49 | $ | 663 | $ | 7,260 | |||||

| Add: | |||||||||||

| Provision for (benefit from) income taxes | 113 | 1,070 | (1,385 | ) | |||||||

| Interest expense, net | 21,023 | 20,380 | 19,669 | ||||||||

| Loss (gain) on early extinguishment of debt | (780 | ) | — | 6,950 | |||||||

| Depreciation and amortization | 8,819 | 9,182 | 8,785 | ||||||||

| EBITDA | $ | 29,224 | $ | 31,295 | $ | 41,279 | |||||

Our business, operating results or financial condition could be materially adversely affected by any of the following risks. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment. You should carefully consider these risks before investing in shares of our common stock.

Risk Factors Related to Our Company

The bearing industry is highly competitive, and this competition could reduce our profitability or limit our ability to grow.

The global bearing industry is highly competitive, and we compete with many U.S. and non-U.S. companies, some of which benefit from lower labor costs and fewer regulatory burdens than us. We compete primarily based on product qualifications, product line breadth, service and price. Certain competitors are larger than us or subsidiaries of larger entities and may be better able to manage costs than us or may have greater financial resources than we have. Due to the competitiveness in the bearing industry we may not be able to increase prices for our products to cover increases in our costs, or we may face pressure to reduce prices, which could materially reduce our revenues, gross margin and profitability. Competitive factors, including changes in market penetration, increased price competition and the introduction of new products and technology by existing and new competitors could result in a material reduction in our revenues and profitability.

The loss of a major customer could result in a material reduction in our revenues and profitability.

Our top ten customers generated 32% of our net sales during fiscal 2005 and 34% of our net sales during the nine month period ended December 31, 2005. Accordingly, the loss of one or more of those customers or a substantial decrease in such customers' purchases from us could result in a material reduction in our revenues and profitability.

In addition, the consolidation and combination of defense or other manufacturers may eliminate customers from the industry and/or put downward pricing pressures on sales of component parts. For example, the consolidation that has occurred in the defense industry in recent years has significantly reduced the overall number of defense contractors in the industry. In addition, if one of our customers is acquired or merged with another entity, the new entity may discontinue using us as a supplier because of an existing business relationship with the acquiring company or because it may be more efficient to consolidate certain suppliers within the newly formed enterprise. The significance of the impact that such consolidation may have on our business is difficult to predict because we do not know when or if one or more of our customers will engage in merger or acquisition activity. However, if such activity involved our material customers it could materially impact our revenues and profitability.

Weakness in any of the industries in which our customers operate, as well as the cyclical nature of our customers' businesses generally, could materially reduce our revenues and profitability.

The commercial aerospace, mining and construction equipment and other diversified industrial industries to which we sell our products are, to varying degrees, cyclical and tend to decline in response to overall declines in industrial production. Margins in those industries are highly sensitive to demand cycles, and our customers in those industries historically have tended to delay large capital projects, including expensive maintenance and upgrades, during economic downturns. As a result, our business is also cyclical, and the demand for our products by these customers depends, in part, on overall levels of industrial production, general economic conditions and business confidence levels. Downward economic cycles have affected our customers and reduced sales of our products resulting in reductions in our revenues and net earnings. Any future material weakness in demand in any of these industries could materially reduce our revenues and profitability.

In addition, many of our customers have historically experienced periodic downturns, which often have had a negative effect on demand for our products. For example, the severe downturn in 2001 in

the aerospace industry resulted in deferrals or cancellations in aircraft orders, which reduced the volume and price of orders placed for products used to manufacture commercial aircraft, including our bearings and other individual parts and components we manufacture. Previous industry downturns have negatively affected, and future industry downturns may negatively affect, our net sales, gross margin and net income.

Future reductions or changes in U.S. government spending could negatively affect our business.

In fiscal 2005, 8% of our net sales were made directly, and we estimate that approximately an additional 11% of our net sales were made indirectly, to the U.S. government to support military or other government projects. Our failure to obtain new government contracts, the cancellation of government contracts or reductions in federal budget appropriations regarding our products could result in materially reduced revenue. In addition, the funding of defense programs also competes with non-defense spending of the U.S. government. Our business is sensitive to changes in national and international priorities and the U.S. government budgets. A shift in government defense spending to other programs in which we are not involved or future reductions in U.S. government defense spending generally could materially reduce our revenues, cash flow from operations and profitability. If we, or our prime contractors for which we are a subcontractor, fail to win any particular bid, or we are unable to replace lost business as a result of a cancellation, expiration or completion of a contract, our revenues or cash flow could be reduced.

Fluctuating supply and costs of raw materials and energy resources could materially reduce our revenues, cash flow from operations and profitability.

Our business is dependent on the availability and costs of energy resources and raw materials, particularly steel, generally in the form of stainless and chrome steel, which are commodity steel products. Raw materials represented approximately 30% of our overall costs for fiscal 2005 and the nine month period ended December 31, 2005, the majority of which consisted of steel and related products. The availability and prices of raw materials and energy sources may be subject to curtailment or change due to, among other things, new laws or regulations, suppliers' allocations to other purchasers, interruptions in production by suppliers, changes in exchange rates and worldwide price levels. Although we currently maintain alternative sources for raw materials, our business is subject to the risk of price fluctuations and periodic delays in the delivery of certain raw materials. Disruptions in the supply of raw materials and energy resources could temporarily impair our ability to manufacture our products for our customers or require us to pay higher prices in order to obtain these raw materials or energy resources from other sources, which could thereby affect our net sales and profitability.

For example, we purchase steel at market prices, which during the past 24 monthstwo years have increased to historical highs as a result of a relatively low level of supply and a relatively high level of demand, and we have recently received notices of additional price increases from our suppliers.demand. As a result, we are currently being assessed surcharges on certain of our purchases of steel, and under certain circumstances, we have experienced difficulty in identifying steel for purchase. If we are unable to purchase steel for our operations for a significant period of time, our operations would be disrupted, which could reduce or delay sales of our products, and, in turn, could result in a material reduction in our revenues, cash flow from operations and profitability. In addition, we may be unable to pass on the increased costs of raw materials to our customers, which could materially reduce our cash flow from operations and profitability.

We seek to pass through a significant portion of our additional costs to our customers through steel surcharges or price increases. However, even if we are able to pass these steel surcharges or price increases to our customers, there may be a time lag of up to 12 weeks or more between the time a cost increase goes into effect and our ability to implement surcharges or price increases, particularly for

orders already in our backlog. As a result our gross margin percentage may decline, and we may not be able to implement other price increases for our products. We cannot provide assurances that we will be able

to continue to pass these additional costs on to our customers at all or on a timely basis or that our customers will not seek alternative sources of supply if there are significant or prolonged increases in the price of steel or other raw materials or energy resources.

We may not be able to address technological advances or maintain customer relationships which are necessary to remain competitive within our businesses.

We believe that our customers rigorously evaluate their suppliers on the basis of product quality, price competitiveness, technical expertise, new product innovation, reliability and timeliness of delivery, product design capability, manufacturing expertise, operational flexibility and customer service. Our success will depend on our ability to continue to meet our customers' changing specifications with respect to these criteria. We must remain committed to product research and development, advanced manufacturing techniques and service to remain competitive. We may not be able to address technological advances in metallurgy or in materials science or introduce new products that may be necessary to remain competitive within our businesses, or our competitors may develop products superior to our products. Furthermore, we may be unable to adequately protect any of our own technological developments to produce a sustainable competitive advantage.

Our products are subject to certain approvals, and the loss of such approvals could materially reduce our revenues and profitability.

Essential to servicing the aerospace market is the ability to obtain product approvals. We have in excess of 32,000 product approvals, which enable us to provide products used in virtually all domestic aircraft platforms presently in production or operation. Product approvals are typically issued by the Federal Aviation Administration, or FAA, to designated OEMs who are Production Approval Holders of FAA approved aircraft. These Production Approval Holders provide quality control oversight and generally limit the number of suppliers directly servicing the commercial aerospace aftermarket. Regulations enacted by the FAA provide for an independent process (the Parts Manufacturer Approval, or PMA, process), which enables suppliers who currently sell their products to the Production Approval Holders, to sell products to the aftermarket. We have received over 2,400 PMA application approvals to date. Our foreign sales may be subject to similar approvals. Although we have not lost any material product approvals in the past, we cannot assure you that we will not lose approvals for our products in the future. The loss of product approvals could result in lost sales and materially reduce our revenues and profitability.

Under certain circumstances, the U.S. government has the right to debar or suspend us from acting as a U.S. government contractor or subcontractor, and if we are suspended or debarred from acting as a government supplier for any reason, such an action would materially reduce our revenues and profitability.

In connection with our performance of government contracts, the federal government audits and reviews our performance, pricing practices and compliance with applicable laws, regulations and standards. It is possible that as a result of these audits, our revenues, cash flow or results of operations could be materially reduced as a result of lost sales or penalties. For example, the government could disallow certain costs that it originally reimbursed, and we may be required to refund cash already collected. It is also possible that a government audit, review or investigation could uncover improper or illegal activities that would subject us to civil, criminal and/or administrative sanctions, including, but not limited to, termination of contracts, reimbursement of payments received, fines, forfeiture of profits and suspension or debarment from doing business with federal government agencies. If any allegations of impropriety were made against us, whether or not true, our reputation could be adversely affected. If we were suspended or debarred from contracting with the federal government, or any specific agency, if our reputation was impaired or if the government ceased or significantly decreased the

amount of business it does with us, our revenues and cash flow could be reduced. As a government

contractor, we are also subject to various federal laws, regulations and standards. New laws, regulations or standards or changes to existing laws, regulations or standards could subject us to additional costs of compliance or liabilities and could result in material reductions to our results of operations, cash flow or revenues.

We have outstanding debt, and may incur additional debt in the future for acquisitions or other purposes, which could materially impact our business.

As of April 2,December 31, 2005 ourwe had total outstanding debt was $220.1 million,indebtedness of which $114.2 million was outstanding under our $165.0 million senior credit facility, referred to as our Senior Credit Facility, comprised of a $55.0 million revolving credit facility, or Revolving Credit Facility, and a $110.0 million term loan, or Term Loan, which will be increased by $40.0 million to $150.0 million, in connection with the amendment and restatement of our Senior Credit Facility in connection with the Refinancing Transaction. As of April 2, 2005, on a pro forma basis after$169.0 million. After giving effect to the Pre-Offering Transactions, including the Refinancing Transaction, and this offering and the use of estimated net proceeds therefrom, our total outstanding debt would have been $177.1 million,approximately $148.9 million. See "Use of which $154.2 million would have been outstanding under our $205.0 million amendedProceeds" and restated Senior Credit Facility. See "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Pre-Offering Transactions—Refinancing Transaction.Operations."

To service our debt, we will require a significant amount of cash. Our ability to generate cash, make scheduled payments or to refinance our obligations depends on our successful financial and operating performance. Our financial and operating performance, cash flow and capital resources depend upon prevailing economic conditions and certain financial, business and other factors, many of which are beyond our control.

We may incur additional indebtedness in the future for acquisitions and other purposes, and the significant debt servicing costs associated with that indebtedness could have significant effects on our operations, including:

The occurrence of any one of these events could materially impact our business, financial condition, results of operations and ability to grow our business.

Restrictions in our indebtedness agreements could limit our growth and our ability to respond to changing conditions.

The Senior Credit Facility our $45.0 million second lien term loan, or Second Lien Term Loan, and our swissSwiss franc 14.0 million Swiss credit facility (approximately $11.6$4.8 million outstanding as of April 2,December 31, 2005), or Swiss Credit Facility, contain a number of restrictive covenants that limit our ability, among other things, to:

In addition, the Senior Credit Facility and the Second Lien Term Loan containcontains other financial covenants requiring us to maintain a minimum fixed charge coverage ratio and maximum senior leverage ratios and to satisfy certain other financial conditions. Our Second Lien Term LoanSenior Credit Facility prohibits us from incurring capital expenditures of more than $10$15 million per year. These restrictions could limit our ability to obtain future financings, make needed capital expenditures, withstand a future downturn in our business or the economy in general or otherwise conduct necessary corporate activities. In connection with the refinancing of our Senior Credit Facility, the amended and restated Senior Credit Facility will incorporate substantially similar restrictive covenants to those in our existing Senior Credit Facility and Second Lien Term Loan.

As of April 2,December 31, 2005, we had no outstanding borrowings of $5.0 million and letters of credit of $20.3$20.6 million under our $55.0 million Revolving Credit Facility. Under the Revolving Credit Facility, we had borrowing availability of $26.1$34.4 million as of April 2,December 31, 2005. Under the revolving credit facility under our Swiss Credit Facility, or Swiss Revolver, we had borrowing availability of approximately $3.5$3.0 million (4.0 million SFr) as of April 2, 2005.

If interest rates increase, interest expense will increase and could materially reduce our profitability and cash flow.

As of April 2, 2005, after giving effect to the offering and the Pre-Offering Transactions, including the Refinancing Transaction, substantially all of our debt will be variable rate debt. On December 31, 2004, we entered into a Rate Cap Transaction Agreement capping LIBOR at 5.00% on a notional amount of $50.0 million. This agreement expires on December 31, 2005. We may

If we amend or may not enter intoreplace our Senior Credit Facility in connection with this offering, we expect that we will be subject to substantially similar agreements in the future. An increase in interest rates will increase our interest expense and could materially reduce our profitability and cash flow and our ability to service our indebtedness and to make distributions to our stockholders. In addition, an increase in interest rates may inhibit our ability to incur additional debt in the future, which may impair our ability to consummate desirable acquisitions. A 1% increase in interest rates would increase our interest expense by approximately $1.8 million over a 12-month period.restrictive covenants as described above. See "Description of Certain Indebtedness—Senior Credit Facility."

Work stoppages and other labor problems could materially reduce our ability to operate our business.

As of April 2,December 31, 2005, approximately 29%26% of our hourly employees in the U.S. and abroad were represented by labor unions. While we believe our relations with our employees are satisfactory, a lengthy strike or other work stoppage at any of our facilities, particularly at some of our larger facilities, could materially reduce our ability to operate our business. We most recently experienced a four-month work stoppage in calendar years 2003-2004 at our Nice Bearings facility. This strike did not materially impact our operations, but we cannot assure you that a work stoppage at one or more of our facilities will not materially impair our ability to operate our business in the future. In addition, any attempt by our employees not currently represented by a union to join a union could result in additional expenses, including with respect to wages, benefits and pension obligations. One of ourWe currently have four collective bargaining agreements covering approximately 50 employees was originally due to expire in July 2004 and was extended to October 29, 2005. Of our remaining four collective bargaining

agreements, one agreement covering approximately 5153 employees will expire in June of 2007, two agreementsone agreement covering approximately 12138 employees will expire in October 2009, one agreement covering approximately 72 employees will expire in January of 2008 and one agreement covering approximately 125113 employees will expire in June 2008. In February 2006 we entered into a shutdown agreement which effectively terminated one collective bargaining agreement covering approximately 43 employees. We expect that the facility will be shutdown in the first quarter of 2008.fiscal 2007. We expect that such shutdown will not be material to our operations or financial results.

Negotiations for the extension of these agreements may result in modifications to the terms of these agreements, and these modifications could cause us to incur increased costs relating to our labor force.

In addition, work stoppages at one or more of our customers or suppliers, including suppliers of transportation services, many of which have large unionized workforces, for labor or other reasons could also cause disruptions to our business that we cannot control, and these disruptions may materially reduce our revenues and profitability.

Our business is capital intensive and may consume cash in excess of cash flow from our operations.

Our ability to remain competitive, sustain our growth and expand our operations largely depends on our cash flow from operations and our access to capital. We intend to fund our cash needs through operating cash flow and borrowings under our Senior Credit Facility. We may require additional equity or debt financing to fund our growth and debt repayment obligations. In addition, we may need

additional capital to fund future acquisitions. Our business may not generate sufficient cash flow, and we may not be able to obtain sufficient funds to enable us to pay our debt obligations and capital expenditures or we may not be able to refinance on commercially reasonable terms, if at all. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Liquidity."

Unexpected equipment failures, catastrophic events or capacity constraints may increase our costs and reduce our sales due to production curtailments or shutdowns.

Our manufacturing processes are dependent upon critical pieces of equipment, such as furnaces, continuous casters and rolling equipment, as well as electrical equipment, such as transformers, and this equipment may, on occasion, be out of service as a result of unanticipated failures. In addition to equipment failures, our facilities are also subject to the risk of catastrophic loss due to unanticipated events such as fires, explosions, earthquakes or violent weather conditions. In the future, we may experience material plant shutdowns or periods of reduced production as a result of these types of equipment failures or catastrophes. Interruptions in production capabilities will inevitably increase our production costs and reduce sales and earnings for the affected period.

Certain of our facilities are operating at a single shift with light second and third shifts, and additional demand may require additional shifts and/or capital investments at these facilities. We cannot assure you that we will be able to add additional shifts as needed in a timely way and production constraints may result in lost sales. In certain markets we refrain from making additional capital investments to expand capacity where we believe market expansion in a particular end market is not sustainable or otherwise does not justify the expansion or capital investment. Our assumptions and forecasts regarding market conditions in these end markets may be erroneous and may result in lost earnings, potential sales going to competitors and inhibit our growth.

The occurrence of extraordinary events, such as a major terrorist attack in the U.S., may adversely affect our business, resulting in a decrease in our revenues.

Future terrorist attacks cannot be predicted, and their occurrence can be expected to negatively affect the economy of the U.S. and other countries in which we do business. Such attacks may have a material impact on the markets in which we operate, particularly commercial aerospace, as increased terrorist activity around the world is likely to cause a reduction in air travel. For example, in the period following September 11, 2001, aircraft orders declined significantly and materially reduced our sales to the aerospace market. Similar effects are likely to result if there is a significant increase in terrorist activity around the world, particularly if commercial airliners are again involved in one or more major terrorist incidents. Other kinds of significant terror incidents may also impair our ability to conduct our manufacturing and other business activities for extended periods depending on the nature and severity of the event.

We may not be able to continue to make the acquisitions necessary for us to realize our growth strategy.

The acquisition of businesses that complement or expand our operations has been and continues to be an important element of our business strategy. We cannot assure you that we will be successful in identifying attractive acquisition candidates or completing acquisitions on favorable terms in the future. Our inability to acquire businesses, or to operate them profitably once acquired, could have a material adverse effect on our business, financial position, cash flow and growth.

The costs and difficulties of integrating acquired businesses could impede our future growth.

We cannot assure you that any future acquisition will enhance our financial performance. Our ability to effectively integrate any future acquisitions will depend on, among other things, the adequacy of our implementation plans, the ability of our management to oversee and operate effectively the combined operations and our ability to achieve desired operating efficiencies and sales goals. The

integration of any acquired businesses might cause us to incur unforeseen costs, which would lower our future earnings and would prevent us from realizing the expected benefits of these acquisitions.

Even if we are able to integrate future acquired businesses with our operations successfully, we cannot assure you that we will realize all of the cost savings, synergies or revenue enhancements that we anticipate from such integration or that we will realize such benefits within the expected time frame.

We depend heavily on our senior management and other key personnel, the loss of whom could materially affect our financial performance and prospects.

Our business is managed by a small number of key executive officers, including Dr. Michael J. Hartnett. Our future success will depend on, among other things, our ability to keep the services of these executives and to hire other highly qualified employees at all levels. Dr. Hartnett is the only member of our senior management team with a long-term employment contract. The remainder of our key executives are at-will employees.

We compete with other potential employers for employees, and we may not be successful in hiring and retaining executives and other skilled employees that we need. Our ability to successfully execute our business strategy, market and develop our products and serve our customers could be adversely affected by a shortage of available skilled employees or executives.

Our international operations are subject to risks inherent in such activities.

We have established operations in certain countries outside the U.S., including Mexico, France and Switzerland. Of our 18 facilities, 4 are located outside the U.S., including 2 manufacturing facilities.

Approximately one-fifth21% of our net sales were derived directly or indirectly from sales outside the U.S. during fiscal year 2005 and during the nine month period ended December 31, 2005. We expect that this proportion is likely to increase as we seek to increase our penetration of foreign markets, including through acquisitions, particularly within the aerospace and defense markets. Our foreign operations are subject to the risks inherent in such activities such as: currency devaluations, logistical and communications challenges, costs of complying with a variety of foreign laws and regulations, greater difficulties in protecting and maintaining our rights to intellectual property, difficulty in staffing and managing geographically diverse operations, acts of terrorism or war or other acts that may cause social disruption which are difficult to quantify or predict and general economic conditions in these foreign markets. We are not aware of any proposed material regulatory changes, but our international operations may be negatively impacted by changes in government policies, such as changes in laws and regulations (or the interpretation thereof), restrictions on imports and exports, sources of supply, duties or tariffs, the introduction of measures to control inflation and changes in the rate or method of taxation. To date we have not experienced significant difficulties with the foregoing risks associated with our international operations, however, as the size of our international operations has continued to grow, we expect these risks to become increasingly important to our business operations.

Currency translation risks may have a material impact on our results of operations.

Our Swiss operations utilize the Swiss franc as the functional currency and our French operations utilize the Euro as the functional currency. Foreign currency transaction gains and losses are included in earnings. Foreign currency transaction exposure arises primarily from the transfer of foreign currency from one subsidiary to another within the group and to foreign currency denominated trade receivables. Unrealized currency translation gains and losses are recognized upon translation of the foreign subsidiaries' balance sheets to U.S. dollars. Because our financial statements are denominated in U.S. dollars, changes in currency exchange rates between the U.S. dollar and other currencies have had, and will continue to have, an impact on our earnings. While we monitor exchange rates, we currently do not have exchange rate hedges in place to reduce the risk of an adverse currency exchange movement. Although currency fluctuations have not had a material impact on our financial performance in the past, such fluctuations may affect our financial performance in the future. The impact of future

exchange rate fluctuations on our results of operations cannot be accurately predicted. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Foreign Currency Exchange Rates."

Our pension plans are underfunded, and we may be required to make significant future contributions to the plans.

As of April 2,December 31, 2005, we maintained noncontributory defined benefit pension plans covering substantially all of our union employees in our Heim division plant in Fairfield, Connecticut, our Nice subsidiary plant in Kulpsville, Pennsylvania, our Bremen subsidiary plant in Plymouth, Indiana and our Tyson subsidiary plant in Glasgow, Kentucky. As of April 2, 2005, our plans were underfunded by $3.4 million, which is the amount by which the accumulated benefit obligations exceed the sum of the fair market value of plans' assets. We are required to make cash contributions to our pension plans to the extent necessary to comply with minimum funding requirements imposed by employee benefit and tax laws. The amount of any such required contributions is determined based on annual actuarial valuation of the plans as performed by the plan's actuaries. The amount of future contributions will depend upon asset returns, then-current discount rates and a number of other factors, and, as a result, the amount we may elect or be required to contribute to our pension plans in the future may increase significantly. Additionally, there is a risk that if the Pension Benefit Guaranty Corporation concludes that its risk with respect to our pension plan may increase unreasonably if the plan continues to operate, if we are unable to satisfy the minimum funding requirement for the plans or if the plans become unable to pay benefits, then the Pension Benefit Guaranty Corporation could terminate the plans and take control of their assets. In such event, we may be required to make an immediate

payment to the Pension Benefit Guaranty Corporation of all or a substantial portion of the underfunding as calculated by the Pension Benefit Guaranty Corporation based upon its own assumptions. The underfunding calculated by the Pension Benefit Guaranty Corporation could be substantially greater than the underfunding we have calculated because, for example, the Pension Benefit Guaranty Corporation may use a significantly lower discount rate. If such payment is not made, then the Pension Benefit Guaranty Corporation could place liens on a material portion of our assets and the assets of any members of our controlled group. Such action could result in a material increase in our pension related expenses and a corresponding reduction in our cash flow and net income. For additional information concerning our pension plans and plan liabilities, see Note 9 to our unaudited consolidated financial statements for the nine months ended December 31, 2005 and Note 13 to our consolidated financial statements for the fiscal year ended April 2, 2005 attached to this prospectus.

We may incur material losses for product liability and recall related claims.

We are subject to a risk of product and recall related liability in the event that the failure of any of our products results in personal injury or death, property damage or does not conform to our customers' specifications. In particular, our products are installed in a number of types of vehicle fleets, including airplanes, trains, automobiles, heavy trucks and farm equipment, many of which are subject to government ordered as well as voluntary recalls by the manufacturer. If one of our products is found to be defective, causes a fleet to be disabled or otherwise results in a product recall, significant claims may be brought against us. Although we have not had any material product liability or recall related claims made against us, and we currently maintain product liability insurance coverage for product liability, although not for recall related claims, we cannot assure you that product liability or recall related claims, if made, would not exceed our insurance coverage limits or would be covered by insurance which, in turn, may result in material losses related to these claims, increased future insurance costs and a corresponding reduction in our cash flow and net income.

Environmental regulations impose substantial costs and limitations on our operations, and environmental compliance may be more costly than we expect.

We are subject to various federal, state and local environmental laws and regulations, including those governing discharges of pollutants into the air and water, the storage, handling and disposal of wastes and the health and safety of employees. These laws and regulations could subject us to material costs and liabilities, including compliance costs, civil and criminal fines imposed for failure to comply with these laws and regulations and litigation costs. We also may be liable under the federal Comprehensive Environmental Response, Compensation, and Liability Act, or similar state laws, for the costs of investigation and clean-up of contamination at facilities currently or formerly owned or operated by us or at other facilities at which we have disposed of hazardous substances. In connection with such contamination, we may also be liable for natural resource damages, government penalties and claims by third parties for personal injury and property damage. Compliance with these laws and regulations may prove to be more limiting and costly than we anticipate. New laws and regulations, stricter enforcement of existing laws and regulations, the discovery of previously unknown contamination or the imposition of new clean-up requirements could require us to incur costs or become the basis for new or increased liabilities that could cause a material increase in our environmental related compliance costs and a corresponding reduction in our cash flow and net income. Investigation and remediation of contamination at some of our sites is ongoing. Actual costs to clean-up these sites may exceed our current estimates. Although we have indemnities for certain pre-closing environmental liabilities from the prior owners in connection with our acquisition of several of our facilities, we cannot assure you that the indemnities will be adequate to cover known or newly discovered pre-closing liabilities.

The interests of certain stockholders, particularly Whitney Investor and Dr. Hartnett, could conflict with those of other holders of our securities.

When this offering is completed, our executive officers, directors and stockholders who beneficially owned more than 5% of our common stock before the completion of this offering, will, in aggregate, beneficially own shares representing approximately 50.9% of our capital stock assuming exercise of options and warrants only by such persons. Whitney RBHC Investor, LLC, or Whitney Investor, and Dr. Hartnett and his affiliates will control 44.7% and 10.8% of our common stock, respectively, assuming exercise of options and warrants only by such persons. In addition, if these stockholders were to choose to act together, or with other significant stockholders, they could control, and will, in any event, have a large degree of influence over, matters submitted to our stockholders for approval, as well as our management and affairs. For example, these persons, if they choose to act together, could control the election of directors and approval of any merger, consolidation or sale of all or substantially all of our assets. This concentration of voting power could delay or prevent an acquisition of our company on terms that other stockholders may desire.

Our intellectual property and other proprietary rights are valuable, and any inability to protect them could adversely affect our business and results of operations; in addition, we may be subject to infringement claims by third parties.

Our ability to compete effectively is dependent upon our ability to protect and preserve the intellectual property and other proprietary rights and materials owned, licensed or otherwise used by us. We have numerous U.S. and foreign patents, U.S. trademark registrations and U.S. copyright registrations. Our issued patents are expected to expire by their own terms at various dates and most such patents will not expire for at least 5 years. We also have U.S. trademark and patent applications pending. We cannot assure you that our pending trademark and patent applications will result in trademark registrations and issued patents, and our failure to secure rights under these applications may limit our ability to protect the intellectual property rights that these applications were intended to cover. Although we have attempted to protect our intellectual property and other proprietary rights both in the United States and in foreign countries through a combination of patent, trademark, copyright and trade secret protection and non-disclosure agreements, these steps may be insufficient to prevent unauthorized use of our intellectual property and other proprietary rights, particularly in foreign countries where the protection available for such intellectual property and other proprietary rights may be limited. To date we are not currently engaged in and have not had any material infringement or other claims pertaining to our intellectual property brought by us or against us in recent years. We cannot assure you that any of our intellectual property rights will not be infringed upon or that our trade secrets will not be misappropriated or otherwise become known to or independently developed by competitors. We may not have adequate remedies available for any such infringement or other unauthorized use. We cannot assure you that any infringement claims asserted by us will not result in our intellectual property being challenged or invalidated, that our intellectual property will be held to be of adequate scope to protect our business or that we will be able to deter current and former employees, contractors or other parties from breaching confidentiality obligations and misappropriating trade secrets. In addition, we may become subject to claims against us which could require us to pay damages or limit our ability to use certain intellectual property and other proprietary rights found to be in violation of a third party's rights, and, in the event such litigation is

successful, we may be unable to use such intellectual property and other proprietary rights at all or on reasonable terms. Regardless of its outcome, any litigation, whether commenced by us or third parties, could be protracted and costly and could result in increased litigation related expenses, the loss of intellectual property rights or payment of money or other damages, which may result in lost sales and reduced cash flow and decrease our net income. See "Business—Intellectual Property."

Cancellation of orders in our backlog of orders could negatively impact our revenues.

As of April 2,December 31, 2005, we had an order backlog of $134.8$152.6 million, which we estimate will be fulfilled within the next 12 months. However, orders included in our backlog are subject to cancellation, delay or other modifications by our customers prior to fulfillment. For these reasons, we cannot assure you that orders included in our backlog will ultimately result in the actual receipt of revenues from such orders.

If we fail to maintain an effective system of internal controls, we may not be able to accurately report our financial results or prevent fraud.