As filed with the Securities and Exchange Commission on November 23, 2005.January 5, 2006.

Registration No. 333-128996

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 13

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

H&E EQUIPMENT SERVICES, INC.

(Exact name of registrant as specified in its charter)

| DELAWARE (State or other jurisdiction of incorporation or organization) | 7350 (Primary Standard Industrial Classification Code Number) | 20-3507540 (I.R.S. Employer Identification Number) | ||

11100 Mead Road, Suite 200 Baton Rouge, Louisiana 70816 (225) 298-5200 (Address, including zip code, and telephone number, including area code, of registrant's principal executive offices) | ||||

JOHN M. ENGQUIST PRESIDENT AND CHIEF EXECUTIVE OFFICER 11100 MEAD ROAD, SUITE 200 BATON ROUGE, LOUISIANA 70816 (225) 298-5200 (Name, address including zip code, and telephone number, including area code, of agent for service) | ||||

Copies to: | ||

| BONNIE A. BARSAMIAN, ESQ. DECHERT LLP 30 ROCKEFELLER PLAZA, 23RD FLOOR NEW YORK, NEW YORK 10112 (212) 698-3500 | KIRK A. DAVENPORT II, ESQ. DENNIS LAMONT, ESQ. LATHAM & WATKINS LLP 885 THIRD AVENUE, SUITE 1000 NEW YORK, NEW YORK 10022 (212) 906-1200 | |

Approximate date of proposed sale to the public:

As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. o

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall have filed a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED NOVEMBER 23, 2005JANUARY 5, 2006

10,937,500 Shares

H&E EQUIPMENT SERVICES, INC.

Common Stock

Prior to the offering, there has been no public market for our common stock. The initial public offering price of our common stock is expected to be between $$15.00 and $$17.00 per share. We have applied to have our common stock approved for quotation on The Nasdaq National Market under the symbol "HEES."

The underwriters have an option to purchase a maximum of 1,640,625 additional shares to cover over-allotments.

Investing in our common stock involves risks. See "Risk Factors" on page 12.

| | Price to Public | Underwriting Discounts and Commissions | Proceeds to H&E Equipment Services, Inc. | |||

|---|---|---|---|---|---|---|

Per Share | $ | $ | $ | |||

| Total | $ | $ | $ |

Delivery of the shares of common stock will be made on or about , 2005.2006.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Credit Suisse First Boston | UBS Investment Bank |

Banc of America Securities LLC | Deutsche Bank Securities | JPMorgan |

The date of this prospectus is , 2005.2006.

| | Page | |

|---|---|---|

| PROSPECTUS SUMMARY | 1 | |

| RISK FACTORS | 12 | |

| FORWARD-LOOKING STATEMENTS | 23 | |

| INFORMATION ABOUT THIS PROSPECTUS | 24 | |

| USE OF PROCEEDS | ||

| DIVIDEND POLICY | ||

| CAPITALIZATION | ||

| DILUTION | ||

| UNAUDITED PRO FORMA CONSOLIDATED FINANCIAL DATA | ||

| SELECTED HISTORICAL CONSOLIDATED FINANCIAL DATA | ||

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | ||

| BUSINESS | 67 | |

| MANAGEMENT | ||

| PRINCIPAL STOCKHOLDERS | ||

| RELATED PARTY TRANSACTIONS | ||

| DESCRIPTION OF CAPITAL STOCK | ||

| DESCRIPTION OF INDEBTEDNESS | ||

| SHARES ELIGIBLE FOR FUTURE SALE | ||

| MATERIAL UNITED STATES FEDERAL TAX CONSEQUENCES TO NON-UNITED STATES HOLDERS | ||

| UNDERWRITING | ||

| NOTICE TO CANADIAN RESIDENTS | ||

| LEGAL MATTERS | ||

| EXPERTS | ||

| WHERE YOU CAN FIND MORE INFORMATION | ||

| INDEX TO FINANCIAL STATEMENTS | F-1 |

You should rely only on the information contained in this document or to which we have referred you. We have not authorized anyone to provide you with information that is different. This document may only be used where it is legal to sell these securities. The information in this document may only be accurate as of the date of this document.

Dealer Prospectus Delivery Obligation

Until , 2005,2006, all dealers that effect transitions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealer's obligation to deliver a prospectus when acting as an underwriter and with respect to unsold allotments or subscriptions.

The following summary highlights information contained elsewhere in this prospectus and is qualified in its entirety by more detailed information and consolidated financial statements included elsewhere in this prospectus. Because it is a summary, it does not contain all of the information that you should consider before investing in our common stock. You should read this prospectus carefully, including the section entitled "Risk Factors" and the consolidated financial statements and the related notes to those statements included elsewhere in this prospectusprospectus..

Unless we state otherwise, "we," "us," "our," and similar terms, as well as references to "H&E," "H&E Equipment Services" and the "Company," refer to H&E Equipment Services, Inc., a newly formed Delaware corporation, and our consolidated subsidiaries after giving effect to the reincorporation mergers and other transactions to be completed prior to the consummation of this offering as described in "Related Party Transactions—Reorganization Transactions." References to "H&E LLC" refer to H&E Equipment Services L.L.C., a Louisiana limited liability company and the principal operating subsidiary of H&E Holdings L.L.C., a Delaware limited liability company ("H&E Holdings"), prior to the completion of the reorganization transactions. H&E LLC itself is the result of the merger of ICM Equipment Company LLC and its consolidated subsidiaries ("ICM") and Head & Engquist Equipment, LLC ("Head & Engquist," a wholly-owned subsidiary of Gulf Wide Industries, LLC ("Gulf Wide")), with and into Gulf Wide. We refer to the combination of ICM and Head & Engquist into Gulf Wide as the "Gulf Wide transaction," and the operating results in this prospectus for periods prior to the Gulf Wide transaction reflect the historical results of Head & Engquist. Unless we state otherwise, the information in this prospectus gives effect to the reorganization transactions described in "Related Party Transactions—Reorganization Transactions." Some of the statements in this summary are forward-looking statements. For more information, see "Forward-Looking Statements."

All information in this prospectus assumes that the underwriters do not exercise their over-allotment option, unless otherwise indicated.

"EBITDA" and "Adjusted EBITDA" are defined and discussed in footnote 5 under the heading "Summary Historical and Pro Forma Financial Data."

The Company

We are one of the largest integrated equipment services companies in the United States focused on heavy construction and industrial equipment. We rent, sell and provide parts and service support for four core categories of specialized equipment: (1) hi-lift or aerial platform equipment; (2) cranes; (3) earthmoving equipment; and (4) industrial lift trucks. We engage in five principal business activities in these equipment categories:

By providing rental, sales, parts, repair and maintenance functions under one roof, we offer our customers a one-stop solution for their equipment needs. This full service approach provides us with (1) multiple points of customer contact; (2) cross-selling opportunities among our rental, used and new equipment sales, parts sales and services operations; (3) an effective method to manage our rental fleet through efficient maintenance and profitable distribution of used equipment; and (4) a mix of business activities that enables us to operate effectively throughout economic cycles. We believe that the operating experience and extensive infrastructure we have developed throughout our history as an integrated equipment services company provide us with a competitive advantage over rental-focused

companies and equipment distributors. In addition, our focus on four core categories of heavy construction and industrial equipment enables us to offer specialized knowledge and support to our

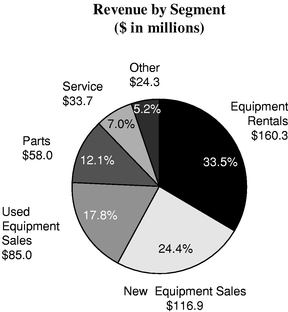

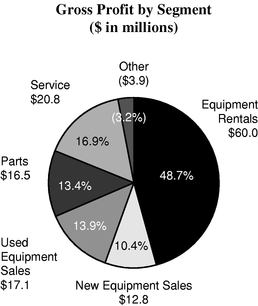

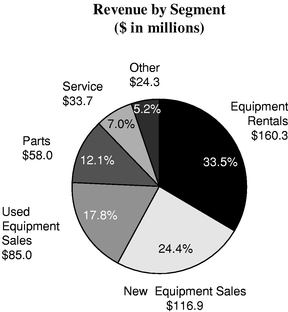

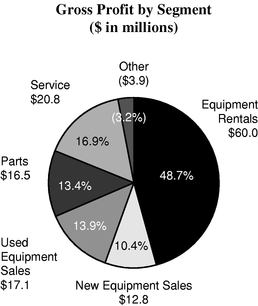

customers. For the year ended December 31, 2004, we generated total revenues of approximately $478.2 million. For the nine months ended September 30, 2005, our total revenues were approximately $414.7 million. The pie charts below illustrate a breakdown of our revenues and gross profit for the year ended December 31, 2004, respectively, by business segment (as reported):

|   |

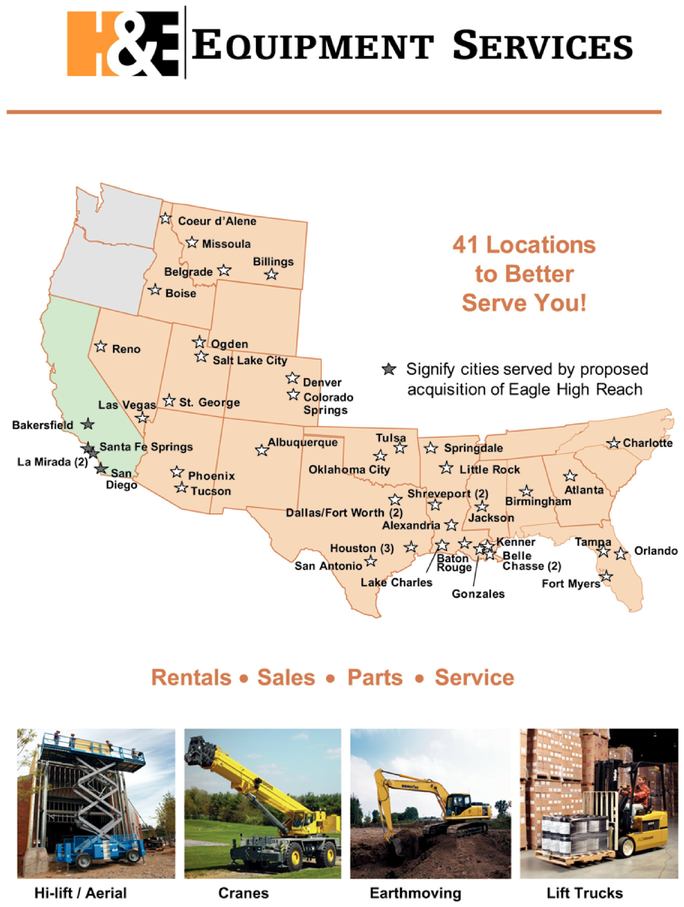

We have operated, through our predecessor companies, as an integrated equipment services company for approximately 44 years and have built an extensive infrastructure that includes 41 full service facilities located throughout the high growth Intermountain, Southwest, Gulf Coast and Southeast regions of the United States. Our management, from the corporate level down to the branch level, has extensive industry experience. We focus our rental and sales activities on, and organize our personnel principally by, our four equipment categories. We believe this allows us to provide specialized equipment knowledge, improve the effectiveness of our rental and equipment sales forces and strengthen our customer relationships. In addition, we operate our day-to-day business on a branch basis, which we believe allows us to more closely service our customers, fosters management accountability at local levels, and strengthens our local and regional relationships.

Products and Services

Equipment Rentals. We rent our heavy construction and industrial equipment on a daily, weekly and monthly basis to our customers. We have an extremely well-maintained rental fleet that, at September 30, 2005, consisted of approximately 14,160 pieces of equipment which have an average age of approximately 41 months. Our rental business creates cross-selling opportunities for us in sales and services.

New Equipment Sales. We sell new equipment in all four equipment categories, and we are a leading distributor for nationally-recognized suppliers including JLG Industries, Gehl, Genie Industries (Terex), Komatsu, Bobcat and Yale Material Handling. In addition, we are the world's largest distributor of Grove and Manitowoc crane equipment. Our new equipment sales operation is a source of new customers for our parts sales and service support activities, as well as for used equipment sales.

Used Equipment Sales. We sell used equipment primarily from our rental fleet, as well as inventoried equipment that we acquire through trade-ins from our equipment customers and selective purchases of high-quality used equipment. Selling used equipment is an effective way for us to manage

the size and composition of our rental fleet and provides a profitable distribution channel for disposal of rental equipment. For the year ended December 31, 2004, approximately 77% of our used equipment sales revenues were derived from sales of rental fleet equipment. Used equipment sales, like new equipment sales, generate parts and services business for us.

Parts Sales. We sell new and used parts to customers and also provide parts to our own rental fleet. We maintain an extensive in-house new and used parts inventory in order to provide timely parts and service support. In addition, our parts operations enable us to maintain a high quality rental fleet and provide additional support to our end users.

Service Support. We provide maintenance and repair services for our customers' owned equipment and to our own rental fleet. In addition to repair and maintenance on an as-needed or scheduled basis, we provide ongoing preventative maintenance services and warranty repairs for our customers. Over time, we have built a full-scale services infrastructure that would be difficult for companies without the requisite resources and lead time to replicate.

In addition to our principal business activities mentioned above, we provide ancillary equipment support activities including transportation, hauling, parts shipping and loss damage waivers.

Our Competitive Strengths

Integrated Platform of Products and Services. We believe that the operating experience and extensive infrastructure we have developed through years of operating as an integrated equipment services company provide us with a competitive advantage over rental-focused companies and equipment distributors. Key strengths of our integrated equipment services platform include:

Complementary, High Margin Parts and Service Operations. Our parts and service businesses allow us to maintain our rental fleet in excellent condition and to offer our customers top quality rental equipment. Our after-market parts and service businesses together provide us with a high-margin revenue source that has proven to be stable throughout a range of economic cycles.

Specialized, High Quality Equipment Fleet. Our focus on four core types of heavy construction and industrial equipment allows us to better provide the specialized knowledge and support that our customers demand when renting and purchasing equipment. These four types of equipment are attractive because they have a long useful life, high residual value and strong industry demand.

Well-Developed Infrastructure. We have built an extensive infrastructure that includes a network of 41 full-service facilities, and a workforce that includes approximately 544 highly-skilled service technicians, a new/used equipment sales force of 75 people and a rental sales force of 79 people. We believe that our well-developed infrastructure helps us to better serve large multi-regional customers than our historically rental focused competitors and provides an advantage when competing for lucrative fleet and project management business.

Leading Distributor for Suppliers. We are a leading distributor for nationally-recognized equipment suppliers, including JLG Industries, Gehl, Genie Industries (Terex), Komatsu, Bobcat and Yale Material Handling. In addition, we are the world's largest distributor of Grove and Manitowoc crane equipment. These relationships improve our ability to negotiate equipment acquisition pricing and allow us to purchase parts at wholesale costs.

Customized Information Technology Systems. Our customized information systems allow us to actively manage our business and our rental fleet. Our customer relationship management system, which is currently being implemented, will provide our sales force with real-time access to customer and sales information.

Experienced Management Team. Our senior management team is led by John M. Engquist, our President and Chief Executive Officer, who has approximately 31 years of industry experience. Our

senior and regional managers have an average of approximately 21 years of industry experience. Our branch managers have extensive knowledge and industry experience as well.

Our Business Strategy

Leverage our Integrated Business Model. We intend to continue to actively leverage our integrated business model to offer a one-stop solution to customers' varied needs with respect to the four categories of heavy construction and industrial equipment on which we focus. We will continue to cross-sell our services to expand and deepen our customer relationships. We believe that our integrated equipment services model provides us with a strong platform for additional growth.

Managing the Life Cycle of our Rental Equipment. We actively manage the size, quality, age and composition of our rental fleet, employing a "cradle through grave" approach. During the life of our rental equipment, we (1) aggressively negotiate on purchase price; (2) use our customized information technology systems to closely monitor and analyze, among other things, time utilization (equipment usage based on customer demand), rental rate trends and targets and equipment demand; (3) continuously adjust our fleet mix and pricing; (4) maintain fleet quality through regional quality control managers and our on-site parts and services support; and (5) dispose of rental equipment through our retail sales force. This allows us to purchase our rental equipment at competitive prices, optimally utilize our fleet, cost-effectively maintain our equipment quality and maximize the value of our equipment at the end of its useful life.

Grow our Parts and Service Operations. Our strong parts and services operations are keystones of our integrated equipment services platform and together provide us with a relatively stable high-margin revenue source. Our parts and services operation helps us develop strong, ongoing customer relationships, attract new customers and maintain a high-quality rental fleet. We intend to grow this product support side of our business and further penetrate our customer base.

Enter Carefully Selected New Markets. We intend to continue to strategically expand our network to solidify our presence in the contiguous regions where we operate. Our proposed acquisition of Eagle High Reach Equipment, Inc., if consummated, will expand our presence into California. The regions in which we operate are attractive because they are among the highest growth areas in the United States. We have a proven track record of successfully entering new markets and we look to add locations that offer attractive growth opportunities, high demand for construction and heavy equipment, and contiguity to our existing markets.

Make Selective Acquisitions. The equipment industry is fragmented and consists of a large number of relatively small, independent businesses servicing discrete local markets. Some of these businesses may represent attractive acquisition candidates. We intend to evaluate and pursue acquisitions on an opportunistic basis, with an objective of increasing our revenues, improving our profitability, entering additional attractive markets and strengthening our competitive position.

History

Through our predecessor companies, we have been in the equipment services business for approximately 44 years. H&E LLC was formed in June 2002 through the combination of Head & Engquist (a wholly-owned subsidiary of Gulf Wide) and ICM. Head & Engquist, founded in 1961, and ICM, founded in 1971, were two leading regional, integrated equipment service companies operating in

contiguous geographic markets. In the Gulf Wide transaction, Head & Engquist and ICM were merged with and into Gulf Wide, which was renamed H&E Equipment Services L.L.C. Prior to the combination, Head & Engquist operated 25 facilities in the Gulf Coast region, and ICM operated 16 facilities in the Intermountain region of the United States.

The Reorganization Transactions

We were formed as a Delaware corporation in September 2005 as a wholly-owned subsidiary of H&E Holdings. The business is currently conducted through H&E LLC, the operating subsidiary of

H&E Holdings. H&E LLC is a Louisiana limited liability company and H&E Holdings is a Delaware limited liability company. In order to have an operating Delaware corporation as the issuer for our initial public offering, immediately prior to the closing of this offering, H&E LLC and H&E Holdings will merge with and into us (H&E Equipment Services, Inc.), with us surviving the reincorporation merger as the operating company. In these transactions, holders of preferred limited liability company interests and holders of common limited liability company interests in H&E Holdings will receive shares of our common stock. As a result of these transactions, immediately prior to the consummation of this offering, Bruckmann, Rosser, Sherrill & Co. II, L.P. and Bruckmann, Rosser, Sherrill & Co., L.P. (collectively, "BRS") and their affiliates will beneficially own approximately %59.9% of our common stock and our executives, directors and principal stockholders will beneficially own approximately %93.8% of our common stock. Immediately following the consummation of this offering, BRS and its affiliates will beneficially own approximately %41.9% of our common stock and our executives, directors and principal stockholders will beneficially own approximately %65.7% of our common stock. Investors in this offering will purchase shares of our common stock. We refer to these transactions, together with the other transactions described in "Related Party Transactions—Reorganization Transactions," collectively in this prospectus as the "Reorganization Transactions."

Proposed Acquisition

On September 22, 2005,January 4, 2006, we entered into a letter of intentan agreement to acquire all of the capital stock of Eagle High Reach Equipment, Inc. and all of the equity interests of its subsidiary, Eagle High Reach Equipment, LLC (together, "Eagle"), for a formula-based purchase price to be determined (which, based on Eagle's Juneunaudited November 30, 2005 financial results, is currently estimated to be approximately $53.0 million, including$57.2 million), subject to adjustment, plus assumed indebtedness)indebtedness of approximately $2.0 million. The actual purchase price may be higher or lower, depending upon Eagle's actual financial results through the end of the month immediately preceding the closing of the acquisition. Eagle High Reach Equipment, Inc. holds a 50% ownership interest in its subsidiary, Eagle High Reach Equipment, LLC, and SBN Eagle LLC holds the remaining 50%. Although this letter of intent expiredBecause in the proposed acquisition we would acquire the ownership interests held by its terms on October 31, 2005,each party, the parties are continuing to negotiate the terms of a definitive purchase agreement.price would be divided equally between them. Eagle is a construction and industrial equipment rental company serving the southern California construction and industrial markets out of four locations. Eagle's principal business activity is renting aerial work platforms, which represents approximately 75% of that company's revenues. The Eagle acquisition provides us with entry into the high growth southern California market and a platform for further expansion on the West Coast. For its most recent fiscal year ended June 30, 2005, Eagle had revenues of $30.6 million. Gary W. Bagley, our Chairman, serves as the Chief Executive Officer and a manager of Eagle High Reach Equipment, LLC and also serves as the interim Chief Executive Officer and a director of Eagle High Reach Equipment, Inc. Kenneth R. Sharp, Jr., one of our executives, serves as a director of Eagle High Reach Equipment, Inc. In addition, Mr. Bagley and Mr. Sharp hold approximately 25.3% and 6.0%, respectively, of the ownership interests in Eagle High Reach Equipment, Inc. Our proposed acquisition of Eagle is subject to the execution and delivery of a definitive purchase agreement and other documentation, receipt of financing and the satisfaction of customary closing conditions. Upon execution of a definitive purchaseIn addition, the acquisition agreement we will be requiredis subject to maketermination by either party under certain circumstances if the closing has not occurred on or before February 28, 2006. We have made a $2.0 million cash deposit that is refundable onlyinto escrow against payment of the purchase price. If the acquisition agreement terminates due to our failure to complete this offering or obtain alternative financing (except under certain circumstances. Since February 2004, Gary W. Bagley, our Chairman, has served ascircumstances), or if Eagle elects to terminate the interim Chief Executive Officer of Eagle. In addition, Mr. Bagley and Kenneth R. Sharp, Jr., oneacquisition agreement because we are in material breach of our executives, hold ownership interests in Eagle.obligations under the acquisition agreement, Eagle will be entitled to retain this $2.0 million deposit. We cannot assure you that we will consummate the Eagle acquisition on favorable terms or at all. We intend to use a portion of the proceeds of this offering to purchase Eagle. For additional information, see "Business—Proposed Acquisition."

Company Information

H&E Equipment Services, Inc. is a Delaware corporation formed in connection with the Reorganization Transactions in September 2005. Our executive offices are located at 11100 Mead Road, Suite 200, Baton Rouge, Louisiana 70816. Our telephone number is (225) 298-5200. Our website address is http://www.he-equipment.com. The information on our website is not a part of this prospectus.

| Shares of common stock offered by us | 10,937,500 shares, or 12,578,125 if the underwriters exercise their over-allotment option in full | |||

| Common stock to be outstanding after this offering | 36,429,517 shares, or 38,070,142 if the underwriters exercise their over-allotment option in full | |||

| Use of proceeds | We estimate that we will receive net proceeds from the sale of shares of our common stock in this offering of | |||

| • | pay approximately | |||

| • | ||||

| purchase approximately | ||||

| • | pay approximately | |||

| repay, with the remaining net proceeds, approximately $50.0 million of | ||||

| The actual amounts of the net proceeds that we will use to fund the Eagle acquisition, purchase rental equipment currently under operating leases and pay deferred compensation will differ from the amounts set forth above based on the then current amounts required for | ||||

| Proposed Nasdaq National Market symbol | HEES | |||

| Dividends | We have never paid any dividends on our common stock and do not anticipate paying any dividends on our common stock in the foreseeable future. Any future determination relating to our dividend policy will be made at the discretion of our board of directors and will depend on then existing conditions, including our financial condition, results of operations, contractual restrictions, capital requirements, business prospects and other factors our board of directors may deem relevant. In addition, our ability to declare and pay dividends is restricted by covenants in our senior secured credit facility and the indentures governing our senior secured notes and senior subordinated notes. | |||

| Risk factors | Investment in our common stock involves substantial risks. You should read this prospectus carefully, including the section entitled "Risk Factors" and the consolidated financial statements and the related notes to those statements included elsewhere in this prospectus before investing in our common stock. | |||

The number of shares of our common stock to be outstanding after this offering is based on shares outstanding as of ,September 30, 2005 after giving effect to the Reorganization Transactions, and excludes:

Unless we specifically state otherwise, all information in this prospectus:

SUMMARY HISTORICAL AND PRO FORMA FINANCIAL DATA

The following tables set forth, for the periods and dates indicated, our summary historical and pro forma financial data. The summary historical consolidated financial data as of and for our fiscal years ended December 31, 2002, 2003 and 2004 have been derived from our audited consolidated financial statements included elsewhere in this prospectus. The summary historical financial data as of and for the nine months ended September 30, 2004 and 2005 have been derived from our unaudited condensed consolidated financial statements included elsewhere in this prospectus. The unaudited condensed consolidated financial statements have been prepared on the same basis as our audited consolidated financial statements and, in the opinion of our management, reflect all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of the results for those periods. The results for any interim period are not necessarily indicative of the results that may be expected for a full year. The historical results included here and elsewhere in this prospectus are not necessarily indicative of future performance or results of operations.

The summarized unaudited pro forma as adjusted financial data as of and for the year ended December 31, 2004 and the nine months ended September 30, 2005 have been prepared to give pro forma as adjusted effect to (1) the proposed Eagle acquisition, (2) the Reorganization Transactions and (3) the sale of shares in this offering, and application of the net proceeds from this offering, in each case as if they had occurred on January 1, 2004 with respect to statement of operations data. This data is subject, and gives effect, to the assumptions and adjustments described in the notes accompanying the unaudited pro forma financial statements included elsewhere in this prospectus. The summary unaudited pro forma financial data is presented for informational purposes only and should not be considered indicative of actual results of operations that would have been achieved had the Eagle acquisition and this offering been consummated on the dates indicated, and do not purport to be indicative of balance sheet data or results of operations as of any future date or for any future period.

The summary consolidated financial data presented below represent portions of our financial statements and are not complete. You should read this information in conjunction with "Use of Proceeds," "Capitalization," "Selected Historical Consolidated Financial Data," "Unaudited Pro Forma Consolidated Financial Data," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the consolidated financial statements and related notes included elsewhere in this prospectus.

| | | For the Year Ended December 31, | For the Nine Months Ended September 30, | | For the Year Ended December 31, | For the Nine Months Ended September 30, | ||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | 2002(1) | 2003 | 2004 | 2004 Pro Forma As Adjusted | 2004 | 2005 | 2005 Pro Forma As Adjusted | | 2002(1) | 2003 | 2004 | 2004 Pro Forma As Adjusted | 2004 | 2005 | 2005 Pro Forma As Adjusted | ||||||||||||||||||||||||||||||||

| | | (Dollars in thousands, except per share data) | | (Dollars in thousands, except per share data) | ||||||||||||||||||||||||||||||||||||||||||||

| Statement of Operations data(2): | Statement of Operations data(2): | Statement of Operations data(2): | ||||||||||||||||||||||||||||||||||||||||||||||

| Revenues: | Revenues: | Revenues: | ||||||||||||||||||||||||||||||||||||||||||||||

| Equipment rentals | $ | 136,624 | $ | 153,851 | $ | 160,342 | $ | 186,499 | $ | 116,722 | $ | 136,576 | $ | 157,356 | Equipment rentals | $ | 136,624 | $ | 153,851 | $ | 160,342 | $ | 186,499 | $ | 116,722 | $ | 136,576 | $ | 157,356 | |||||||||||||||||||

| New equipment sales | 72,143 | 81,692 | 116,907 | 117,264 | 80,570 | 99,867 | 96,433 | New equipment sales | 72,143 | 81,692 | 116,907 | 117,264 | 80,570 | 99,867 | 96,433 | |||||||||||||||||||||||||||||||||

| Used equipment sales | 52,487 | 70,926 | 84,999 | 85,899 | 61,984 | 76,332 | 76,959 | Used equipment sales | 52,487 | 70,926 | 84,999 | 85,899 | 61,984 | 76,332 | 76,959 | |||||||||||||||||||||||||||||||||

| Parts sales | 47,218 | 53,658 | 58,014 | 58,162 | 44,335 | 51,202 | 51,519 | Parts sales | 47,218 | 53,658 | 58,014 | 58,162 | 44,335 | 51,202 | 51,519 | |||||||||||||||||||||||||||||||||

| Service revenue | 27,755 | 33,349 | 33,696 | 33,696 | 25,446 | 29,459 | 29,459 | Service revenue | 27,755 | 33,349 | 33,696 | 33,696 | 25,446 | 29,459 | 29,459 | |||||||||||||||||||||||||||||||||

| Other | 14,778 | 20,510 | 24,214 | 25,186 | 17,564 | 21,300 | 22,100 | Other | 14,778 | 20,510 | 24,214 | 25,185 | 17,564 | 21,300 | 22,100 | |||||||||||||||||||||||||||||||||

| Total revenues | 351,005 | 413,986 | 478,172 | 506,706 | 346,621 | 414,736 | 433,826 | Total revenues | 351,005 | 413,986 | 478,172 | 506,705 | 346,621 | 414,736 | 433,826 | |||||||||||||||||||||||||||||||||

Cost of revenues: | Cost of revenues: | Cost of revenues: | ||||||||||||||||||||||||||||||||||||||||||||||

| Rental depreciation | 46,627 | 55,244 | 49,590 | 66,366 | 36,713 | 39,394 | 51,924 | Rental depreciation | 46,627 | 55,244 | 49,590 | 66,366 | 36,713 | 39,394 | 51,924 | |||||||||||||||||||||||||||||||||

| Rental expense | 37,706 | 49,696 | 50,666 | 41,219 | 38,795 | 35,024 | 28,814 | Rental expense | 37,706 | 49,696 | 50,666 | 41,219 | 38,795 | 35,024 | 28,814 | |||||||||||||||||||||||||||||||||

| New equipment sales | 65,305 | 73,228 | 104,111 | 104,455 | 71,946 | 87,803 | 84,647 | New equipment sales | 65,305 | 73,228 | 104,111 | 104,454 | 71,946 | 87,803 | 84,647 | |||||||||||||||||||||||||||||||||

| Used equipment sales | 43,776 | 58,145 | 67,906 | 68,437 | 49,734 | 58,043 | 57,672 | Used equipment sales | 43,776 | 58,145 | 67,906 | 68,437 | 49,734 | 58,043 | 57,672 | |||||||||||||||||||||||||||||||||

| Parts sales | 34,011 | 39,086 | 41,500 | 41,586 | 31,766 | 36,105 | 36,227 | Parts sales | 34,011 | 39,086 | 41,500 | 41,586 | 31,766 | 36,105 | 36,227 | |||||||||||||||||||||||||||||||||

| Service revenue | 11,438 | 13,043 | 12,865 | 12,865 | 9,639 | 10,973 | 10,973 | Service revenue | 11,438 | 13,043 | 12,865 | 12,865 | 9,639 | 10,973 | 10,973 | |||||||||||||||||||||||||||||||||

| Other | 19,774 | 26,433 | 28,246 | 31,188 | 20,924 | 21,700 | 23,979 | Other | 19,774 | 26,433 | 28,246 | 31,188 | 20,924 | 21,700 | 23,979 | |||||||||||||||||||||||||||||||||

| Total cost of revenues | 258,637 | 314,875 | 354,884 | 366,116 | 259,517 | 289,042 | 294,236 | Total cost of revenues | 258,637 | 314,875 | 354,884 | 366,115 | 259,517 | 289,042 | 294,236 | |||||||||||||||||||||||||||||||||

Gross profit: | Gross profit: | Gross profit: | ||||||||||||||||||||||||||||||||||||||||||||||

| Equipment rentals | 52,291 | 48,911 | 60,086 | 78,914 | 41,214 | 62,158 | 76,618 | Equipment rentals | 52,291 | 48,911 | 60,086 | 78,914 | 41,214 | 62,158 | 76,618 | |||||||||||||||||||||||||||||||||

| New equipment sales | 6,838 | 8,464 | 12,796 | 12,809 | 8,624 | 12,064 | 11,786 | New equipment sales | 6,838 | 8,464 | 12,796 | 12,810 | 8,624 | 12,064 | 11,786 | |||||||||||||||||||||||||||||||||

| Used equipment sales | 8,711 | 12,781 | 17,093 | 17,462 | 12,250 | 18,289 | 19,287 | Used equipment sales | 8,711 | 12,781 | 17,093 | 17,462 | 12,250 | 18,289 | 19,287 | |||||||||||||||||||||||||||||||||

| Parts sales | 13,207 | 14,572 | 16,514 | 16,576 | 12,569 | 15,097 | 15,292 | Parts sales | 13,207 | 14,572 | 16,514 | 16,576 | 12,569 | 15,097 | 15,292 | |||||||||||||||||||||||||||||||||

| Service revenue | 16,317 | 20,306 | 20,831 | 20,831 | 15,807 | 18,486 | 18,486 | Service revenue | 16,317 | 20,306 | 20,831 | 20,831 | 15,807 | 18,486 | 18,486 | |||||||||||||||||||||||||||||||||

| Other | (4,996 | ) | (5,923 | ) | (4,032 | ) | (6,002 | ) | (3,360 | ) | (400 | ) | (1,879 | ) | Other | (4,996 | ) | (5,923 | ) | (4,032 | ) | (6,003 | ) | (3,360 | ) | (400 | ) | (1,879 | ) | |||||||||||||||||||

| Total gross profit | 92,368 | 99,111 | 123,288 | 140,590 | 87,104 | 125,694 | 139,590 | Total gross profit | 92,368 | 99,111 | 123,288 | 140,590 | 87,104 | 125,694 | 139,590 | |||||||||||||||||||||||||||||||||

| Selling, general and administrative expenses | Selling, general and administrative expenses | 78,352 | 93,054 | 97,525 | 113,736 | 72,878 | 81,342 | 88,900 | Selling, general and administrative expenses | 78,352 | 93,054 | 97,525 | 113,736 | 72,878 | 81,342 | 88,900 | ||||||||||||||||||||||||||||||||

| Loss from litigation | Loss from litigation | — | 17,434 | — | — | — | — | — | Loss from litigation | — | 17,434 | — | — | — | — | — | ||||||||||||||||||||||||||||||||

| Related party expense | Related party expense | — | 1,275 | — | — | — | — | — | Related party expense | — | 1,275 | — | — | — | — | — | ||||||||||||||||||||||||||||||||

| Gain on sale of property and equipment | Gain on sale of property and equipment | 59 | 80 | 207 | 207 | 156 | 15 | 15 | Gain on sale of property and equipment | 59 | 80 | 207 | 207 | 156 | 15 | 15 | ||||||||||||||||||||||||||||||||

| Income (loss) from operations | 14,075 | (12,572 | ) | 25,970 | 27,061 | 14,382 | 44,367 | 50,705 | Income (loss) from operations | 14,075 | (12,572 | ) | 25,970 | 27,061 | 14,382 | 44,367 | 50,705 | |||||||||||||||||||||||||||||||

Other income (expense): | Other income (expense): | Other income (expense): | ||||||||||||||||||||||||||||||||||||||||||||||

| Interest expense(3) | (28,955 | ) | (39,394 | ) | (39,856 | ) | (37,738 | ) | (29,836 | ) | (30,982 | ) | (27,760 | ) | Interest expense(3) | (28,955 | ) | (39,394 | ) | (39,856 | ) | (37,954 | ) | (29,836 | ) | (30,982 | ) | (27,988 | ) | |||||||||||||||||||

| Gain on debt restructuring | — | — | — | 13,491 | — | — | — | Gain on debt restructuring | — | — | — | 13,491 | — | — | — | |||||||||||||||||||||||||||||||||

| Loss on swap agreement termination | — | — | — | (2,809 | ) | — | — | — | Loss on swap agreement termination | — | — | — | (2,809 | ) | — | — | — | |||||||||||||||||||||||||||||||

| Other, net | 372 | 221 | 149 | (472 | ) | 95 | 255 | 255 | Other, net | 372 | 221 | 149 | (472 | ) | 95 | 255 | 255 | |||||||||||||||||||||||||||||||

| Total other expense, net | (28,583 | ) | (39,173 | ) | (39,707 | ) | (27,528 | ) | (29,741 | ) | (30,727 | ) | (27,505 | ) | Total other expense, net | (28,583 | ) | (39,173 | ) | (39,707 | ) | (27,744 | ) | (29,741 | ) | (30,727 | ) | (27,733 | ) | |||||||||||||||||||

| Income (loss) before income taxes | (14,508 | ) | (51,745 | ) | (13,737 | ) | (467 | ) | (15,359 | ) | 13,640 | 23,200 | Income (loss) before income taxes | (14,508 | ) | (51,745 | ) | (13,737 | ) | (683 | ) | (15,359 | ) | 13,640 | 22,972 | |||||||||||||||||||||||

| Income tax provision (benefit) | Income tax provision (benefit) | (6,287 | ) | (5,694 | ) | — | 106 | — | 171 | 21 | Income tax provision (benefit) | (6,287 | ) | (5,694 | ) | — | 106 | — | 171 | 21 | ||||||||||||||||||||||||||||

| Net income (loss) | $ | (8,221 | ) | $ | (46,051 | ) | $ | (13,737 | ) | $ | (573 | ) | $ | (15,359 | ) | $ | 13,469 | $ | 23,179 | Net income (loss) | $ | (8,221 | ) | $ | (46,051 | ) | $ | (13,737 | ) | $ | (789 | ) | $ | (15,359 | ) | $ | 13,469 | $ | 22,951 | |||||||||

| Net income (loss) per common unit(9) | (82 | ) | (461 | ) | (137 | ) | NM | (154 | ) | 135 | 232 | Net income (loss) per common unit(10) | (82 | ) | (461 | ) | (137 | ) | NM | (154 | ) | 135 | 230 | |||||||||||||||||||||||||

| Pro forma net income (loss) per common share(4): | Pro forma net income (loss) per common share(4): | Pro forma net income (loss) per common share(4): | ||||||||||||||||||||||||||||||||||||||||||||||

| Basic | Basic | — | — | — | $ | (0.02 | ) | — | — | $ | 0.63 | |||||||||||||||||||||||||||||||||||||

| Diluted | Diluted | — | — | — | $ | (0.02 | ) | — | — | $ | 0.63 | |||||||||||||||||||||||||||||||||||||

| Common shares used to compute pro forma net income (loss) per common share(4): | ||||||||||||||||||||||||||||||||||||||||||||||||

| Basic | ||||||||||||||||||||||||||||||||||||||||||||||||

| Diluted | ||||||||||||||||||||||||||||||||||||||||||||||||

Other financial data: | ||||||||||||||||||||||||

| EBITDA(5) | $ | 64,106 | $ | 46,808 | $ | 79,645 | $ | 108,528 | $ | 54,053 | $ | 87,850 | $ | 107,112 | ||||||||||

| Adjusted EBITDA(5) | 64,106 | 64,242 | 79,645 | 97,846 | 54,053 | 87,850 | 107,112 | |||||||||||||||||

| Depreciation and amortization(6) | 49,659 | 59,159 | 53,526 | 71,257 | 39,576 | 43,228 | 56,152 | |||||||||||||||||

| Total capital expenditures (gross)(7) | 71,974 | 41,923 | 86,790 | 88,758 | 60,724 | 142,968 | 184,344 | |||||||||||||||||

| | As of September 30, 2005 | ||||||

|---|---|---|---|---|---|---|---|

| | H&E Equipment Services | Pro Forma As Adjusted | |||||

| | (Dollars in thousands) | ||||||

| Balance sheet data: | |||||||

| Cash | $ | 4,440 | $ | 4,472 | |||

| Rental equipment, net | 296,237 | 368,439 | |||||

| Goodwill, net | 8,572 | 18,196 | |||||

| Total assets | 494,956 | 589,915 | |||||

| Total debt(8) | 324,501 | 271,303 | |||||

| Members' deficit/stockholders' equity | (19,830 | ) | 132,170 | ||||

| Common shares used to compute pro forma net income (loss) per common share(4): | ||||||||||||||||||||||||

| Basic | — | — | — | 36,429,517 | — | — | 36,429,517 | |||||||||||||||||

| Diluted | — | — | — | 36,429,517 | — | — | 36,429,517 | |||||||||||||||||

Other financial data: | ||||||||||||||||||||||||

| EBITDA(5) | $ | 64,106 | $ | 46,808 | $ | 79,645 | $ | 108,528 | $ | 54,053 | $ | 87,850 | $ | 107,112 | ||||||||||

| Adjusted EBITDA(5) | 64,106 | 64,242 | 79,645 | 97,846 | 54,053 | 87,850 | 107,112 | |||||||||||||||||

| Depreciation and amortization(6) | 49,659 | 59,159 | 53,526 | 71,257 | 39,576 | 43,228 | 56,152 | |||||||||||||||||

| Total capital expenditures (gross)(7) | 71,974 | 41,923 | 86,790 | 88,732 | 60,724 | 142,968 | 184,344 | |||||||||||||||||

| Total capital expenditures (net)(8) | 38,121 | (12,056 | ) | 21,045 | 22,479 | 12,234 | 80,749 | 120,755 | ||||||||||||||||

| | As of September 30, 2005 | ||||||

|---|---|---|---|---|---|---|---|

| | H&E Equipment Services | Pro Forma As Adjusted | |||||

| | (Dollars in thousands) | ||||||

| Balance sheet data: | |||||||

| Cash | $ | 4,440 | $ | 4,472 | |||

| Rental equipment, net | 296,237 | 368,439 | |||||

| Goodwill, net | 8,572 | 22,346 | |||||

| Total assets | 494,956 | 594,065 | |||||

| Total debt(9) | 324,501 | 276,453 | |||||

| Members' deficit/stockholders' equity | (19,830 | ) | 131,170 | ||||

equipment. Any measure that eliminates components of our capital structure and costs associated with carrying significant amounts of fixed assets on our balance sheet has material limitations as a performance measure. Also, EBITDA and Adjusted EBITDA should not measuresbe considered as a measure of profitabilitydiscretionary cash available to us to invest in our business and generate revenue because they do not include costs and expensesreflect (i) our cash expenditures or future requirements for depreciation and amortization,capital expenditures or contractual commitments; (ii) changes in, or cash requirements for, our working capital needs; (iii) cash requirements necessary to service interest and related expenses and income taxes. Although we use EBITDA andor principal payments on our indebtedness; (iv) in the case of Adjusted EBITDA, to evaluate our performance, EBITDAthe cash requirements for the payment of the judgment in connection with the loss from litigation; and (v) in the case of Adjusted EBITDA do not represent operating incomeon a pro forma as adjusted basis, the cash requirements necessary to terminate Eagle's interest rate swap agreement, or net cash provided by operating activities as those items are defined by GAAP and should not be considered by prospective purchasersEagle's benefit arising from retiring debt without the use of securities to be an alternative to operating income or cash flow from operations or indicative of whether cash flows will be sufficient to fund our future cash requirements. EBITDA and Adjusted EBITDA are not complete net cash flow measures or measures of liquidity because EBITDA and Adjusted EBITDA do not include reductions for cash payments for an entity's obligation to service its debt, fund its working capital, make capital expenditures and acquisitions and pay its income taxes. Rather, EBITDA and Adjusted EBITDA are two potential indicators of an entity's ability to fund these cash requirements.cash. In light of the foregoing limitations, we do not rely solely on EBITDA and Adjusted EBITDA as performance measures and also consider our GAAP results. EBITDA and Adjusted EBITDA are not measurements of our financial performance under GAAP and should not be considered as alternatives to net income, operating income, cash flow or any other measures derived in accordance with GAAP. Because EBITDA and Adjusted EBITDA are not calculated in the same manner by all companies, they may not be comparable to other similarly titled measures used by other companies.

Set forth below is a reconciliation of net income (loss) to EBITDA and Adjusted EBITDA for the periods presented.

| | | Fiscal Year Ended December 31, | Nine Months Ended September 30, | | Fiscal Year Ended December 31, | Nine Months Ended September 30, | ||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | 2002 | 2003 | 2004 | 2004 Pro Forma As Adjusted | 2004 | 2005 | 2005 Pro Forma As Adjusted | | 2002 | 2003 | 2004 | 2004 Pro Forma As Adjusted | 2004 | 2005 | 2005 Pro Forma As Adjusted | ||||||||||||||||||||||||||||

| | | (Dollars in thousands) | | (Dollars in thousands) | ||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | Net income (loss) | $ | (8,221 | ) | $ | (46,051 | ) | $ | (13,737 | ) | $ | (573 | ) | $ | (15,359 | ) | $ | 13,469 | $ | 23,179 | Net income (loss) | $ | (8,221 | ) | $ | (46,051 | ) | $ | (13,737 | ) | $ | (789 | ) | $ | (15,359 | ) | $ | 13,469 | $ | 22,951 | ||||

| Income tax provision (benefit) | Income tax provision (benefit) | (6,287 | ) | (5,694 | ) | — | 106 | — | 171 | 21 | Income tax provision (benefit) | (6,287 | ) | (5,694 | ) | — | 106 | — | 171 | 21 | ||||||||||||||||||||||||

| Interest expense | Interest expense | 28,955 | 39,394 | 39,856 | 37,738 | 29,836 | 30,982 | 27,760 | Interest expense | 28,955 | 39,394 | 39,856 | 37,954 | 29,836 | 30,982 | 27,988 | ||||||||||||||||||||||||||||

| Depreciation and amortization(6) | Depreciation and amortization(6) | 49,659 | 59,159 | 53,526 | 71,257 | 39,576 | 43,228 | 56,152 | Depreciation and amortization(6) | 49,659 | 59,159 | 53,526 | 71,257 | 39,576 | 43,228 | 56,152 | ||||||||||||||||||||||||||||

| EBITDA | $ | 64,106 | $ | 46,808 | $ | 79,645 | $ | 108,528 | $ | 54,053 | $ | 87,850 | $ | 107,112 | EBITDA | $ | 64,106 | $ | 46,808 | $ | 79,645 | $ | 108,528 | $ | 54,053 | $ | 87,850 | $ | 107,112 | |||||||||||||||

| Loss from litigation | Loss from litigation | — | 17,434 | — | — | — | — | — | Loss from litigation | — | 17,434 | — | — | — | — | — | ||||||||||||||||||||||||||||

| Gain on debt restructuring | Gain on debt restructuring | — | — | — | (13,491 | ) | — | — | — | Gain on debt restructuring | — | — | — | (13,491 | ) | — | — | — | ||||||||||||||||||||||||||

| Interest rate swap agreement termination expense | Interest rate swap agreement termination expense | — | — | — | 2,809 | — | — | — | Interest rate swap agreement termination expense | — | — | — | 2,809 | — | — | — | ||||||||||||||||||||||||||||

| Adjusted EBITDA | $ | 64,106 | $ | 64,242 | $ | 79,645 | $ | 97,846 | $ | 54,053 | $ | 87,850 | $ | 107,112 | Adjusted EBITDA | $ | 64,106 | $ | 64,242 | $ | 79,645 | $ | 97,846 | $ | 54,053 | $ | 87,850 | $ | 107,112 | |||||||||||||||

Certain monetary amounts, percentages and other figures included in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be the arithmetic aggregation of the figures that precede them, and figures expressed as percentages in the text may not total 100% or when aggregated, may not be the arithmetic aggregation of the percentages that precede them.

Investing in our common stock involves a high degree of risk. You should consider carefully the following risk factors which we believe are all of the risks to our business that are material, and the other information in this prospectus, including our consolidated financial statements and related notes, before you decide to purchase our common stock. If any of the following risks actually occur, our business, financial condition and operating results could be adversely affected. Additional risks and uncertainties not presently known to us or that are currently deemed immaterial may also impair our business, financial condition and operating results. As a result, the trading price of our common stock could decline and you could lose part or all of your investment.

Risks Related to Our Company

We have substantial indebtedness and may be unable to service our debt. Our substantial indebtedness could adversely affect our financial position, limit our available cash and our access to additional capital and prevent us from growing our business.

We have a substantial amount of indebtedness. As of September 30, 2005, our total indebtedness (consisting of the aggregate amounts outstanding under our senior secured credit facility, senior secured notes, senior subordinated notes and notes payable) was approximately $324.5 million, $81.2 million of which was first-priority secured debt and effectively senior to our senior secured notes and senior subordinated notes. As of September 30, 2005, we did not have any outstanding capital lease obligations. In addition, subject to restrictions in our senior secured credit facility and the indenture governing the senior secured notes, we may incur additional first-priority secured borrowings under the senior secured credit facility. There is no limit to the amount of such additional debt. Additionally, as of September 30, 2005, the senior secured notes and senior subordinated notes were effectively subordinated to our obligations under $62.7 million of first-priority secured floor plan financing to the extent of the value of their collateral, $0.5 million in notes payable and $28.0 million in standby letters of credit. As a result of settlement of litigation described in "Business—Legal Proceedings," on November 28, 2005, we funded one of our letters of credit in the amount of approximately $20.1 million through our senior secured credit facility. Accordingly, our outstanding indebtedness increased, and our letters of credit decreased, by such amount. At November 30, 2005, our total outstanding indebtedness (as described above) was approximately $344.2 million.

The level of our indebtedness could have important consequences, including:

To service our indebtedness, we will require a significant amount of cash. Our ability to generate cash depends on many factors beyond our control. An inability to service our indebtedness could lead to a default under our senior secured credit facility and our indentures, which may result in an acceleration of our indebtedness.

To service our indebtedness, we will require a significant amount of cash. For the year ended December 31, 2005, we estimate that we will need approximately $34.3 million to service our indebtedness (not including amounts payable under our leases for rental equipment). Our ability to pay interest and principal on our indebtedness (including the obligations under the senior secured credit facility, the senior secured notes and the senior subordinated notes) and to satisfy our other debt

obligations will depend upon our future operating performance and the availability of refinancing indebtedness, which will be affected by prevailing economic conditions and financial, business and other

factors, some of which are beyond our control. Based on our current level of operations and anticipated cost savings and operating improvements, we believe our cash flow from operations, available cash and available borrowing under the senior secured credit facility, as amended, will be adequate to meet our future liquidity needs for at least the next twelve months.

Our future cash flow may not be sufficient to meet our obligations and commitments. If we are unable to generate sufficient cash flow from operations in the future to service our indebtedness and to meet our other commitments, we will be required to adopt one or more alternatives, such as refinancing or restructuring our indebtedness, selling material assets or operations or seeking to raise additional debt or equity capital. These actions may not be effected on a timely basis or on satisfactory terms or at all, and these actions may not enable us to continue to satisfy our capital requirements. In addition, our existing or future debt agreements, including the indentures governing the senior secured notes and senior subordinated notes and the senior secured credit facility may contain restrictive covenants prohibiting us from adopting any of these alternatives. Our failure to comply with these covenants could result in an event of default which, if not cured or waived, could result in the acceleration of all of our indebtedness. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources."

Our senior secured credit facility and the indentures governing our notes impose certain restrictions. A failure to comply with these restrictions could lead to an event of default, resulting in an acceleration of indebtedness, which may affect our ability to finance future operations or capital needs, or to engage in other business activities.

The operating and financial restrictions and covenants in our debt agreements, including the senior secured credit facility, and the indentures governing our senior secured notes and our senior subordinated notes, may adversely affect our ability to finance future operations or capital needs or to engage in other business activities. Our senior secured credit facility requires us to maintain specified financial ratios and tests, including interest coverage and leverage ratios and maximum capital expenditures, which may require that we take action to reduce debt or to act in a manner contrary to our business objectives. In addition, the senior secured credit facility and the senior secured notes and senior subordinated notes restrict our ability to, among other things:

A failure to comply with the restrictions contained in the senior secured credit facility could lead to an event of default, which could result in an acceleration of our indebtedness. Such an acceleration would constitute an event of default under the indenture governing the senior secured notes. A failure to comply with the restrictions in the senior secured notes indenture or the senior subordinated notes indenture could result in an event of default under those indentures. Our future operating results may

not be sufficient to enable compliance with the covenants in the senior secured credit facility, the indentures or other indebtedness or to remedy any such default. In addition, in the event of an

acceleration, we may not have or be able to obtain sufficient funds to refinance our indebtedness or make any accelerated payments, including those under the senior secured notes and the senior subordinated notes.notes, and the lenders or noteholders could seek to enforce security interests in the collateral securing such indebtedness. In addition, we may not be able to obtain new financing. Even if we were able to obtain new financing, we cannot guarantee that the new financing will be on commercially reasonable terms or terms that are acceptable to us. If we default on our indebtedness, our business financial condition and results of operation could be materially and adversely affected.

Concentration of ownership among our existing executives, directors and principal stockholders may prevent new investors from influencing significant corporate decisions.

After giving effect to the completion of the Reorganization Transactions and this offering, BRS and its affiliates will beneficially own securities representing approximately %41.9% of the voting power of our outstanding common stock and our executives, directors and principal stockholders will beneficially own, in the aggregate, securities representing approximately %65.7% of the voting power of our outstanding common stock. Accordingly, these stockholders can exercise significant influence over our business policies and affairs, including the composition of our board of directors and any action requiring the approval of our stockholders, including the adoption of amendments to our certificate of incorporation and the approval of significant corporate transactions, including mergers or sales of substantially all of our assets. This concentration of ownership will limit your ability to influence corporate actions. The concentration of ownership may also delay, defer or even prevent a change in control of our company and may make some transactions more difficult or impossible without the support of these stockholders. We cannot assure you that the interests of these stockholders will not conflict with your interests. In addition, our interests may conflict with these stockholders in a number of areas relating to our past and ongoing relationships, including:

For additional information regarding the share ownership of, and our relationships with, the stockholders, you should read the information under the headings "Principal Stockholders" and "Related Party Transactions."

Risks Related to Our Business

Our business could be hurt by a decline in construction and industrial activities, which could decrease the demand for equipment or depress rental rates and sales prices, resulting in a decline in our revenues and profitability.

Our equipment is principally used in connection with construction and industrial activities. Consequently, a downturn in construction or industrial activity may lead to a decrease in the demand for our equipment or depress rental rates and the sales prices for the equipment we sell. We have identified below certain of the factors which may cause such a downturn, either temporarily or long-term:

Our revenue and operating results may fluctuate, which could result in a decline in our profitability and make it more difficult for us to grow our business.

Our revenue and operating results have historically varied from quarter to quarter. Periods of decline could result in an overall decline in profitability and make it more difficult for us to make payments on our indebtedness and grow our business. We expect our quarterly results to continue to fluctuate in the future due to a number of factors, including:

In addition, we incur various costs when integrating newly acquired businesses or opening locations, and the profitability of a new location is generally expected to be lower in the initial months of operation.

We purchase a significant amount of our equipment from a limited number of manufacturers. Termination of one or more of our relationships with any of those manufacturers could have a material adverse effect on our business, as we may be unable to obtain adequate or timely rental and sales equipment.

Currently, we purchase most of our rental and sales equipment from leading, nationally-known original equipment manufacturers ("OEMs"). For the year ended December 31, 2004, we purchased more than 83% of our rental and sales equipment from seven manufacturers. Although we believe that we have alternative sources of supply for the rental and sales equipment we purchase in each of our principal product categories, termination of one or more of our relationships with any of these major suppliers could have a material adverse effect on our business, financial condition or results of operation if we were unable to obtain adequate or timely rental and sales equipment.

Our new equipment suppliers may appoint additional distributors, sell directly or unilaterally terminate our distribution agreements, which could have a material adverse effect on our business due to a reduction of, or inability to increase, our revenues.

We are a distributor of new equipment and parts supplied by leading, nationally-known OEMs. Under our distribution agreements with these OEMs, manufacturers retain the right to appoint additional dealers and sell directly to national accounts and governmental agencies. In most instances, they may unilaterally terminate their distribution agreements with us at any time without cause. We have both written and oral distribution agreements with our new equipment suppliers. Under our oral agreements with the OEMs, we operate under our developed course of dealing with the supplier and are subject to the applicable state law regarding such relationship. Any such actions could have a material adverse effect on our business, financial condition and results of operations due to a reduction of, or an inability to increase, revenues. See "Business—Products and Services—New Equipment Sales."

Our rental fleet is subject to residual value risk upon disposition.

The market value of any given piece of rental equipment could be less than its depreciated value at the time it is sold. The market value of used rental equipment depends on several factors, including:

Although for the year ended December 31, 2004 we sold used equipment from our rental fleet at an average selling price of 130.3% of book value, we cannot assure you that used equipment selling prices will not decline. Any significant decline in the selling prices for used equipment could have a material adverse effect on our business, financial condition or results of operations.

We incur maintenance and repair costs associated with our rental fleet equipment that could have a material adverse effect on our business in the event these costs are greater than anticipated.

Determining the optimal age for our rental fleet equipment is subjective and requires considerable estimates by management. We have made estimates regarding the relationship between the age of our rental fleet equipment, and the maintenance and repair costs, and the market value of used equipment. Our future operating results could be adversely affected because our maintenance and repairs costs may be higher than estimated and market values of used equipment may fluctuate.

We may be unsuccessful in integrating our prior acquisitions and our future acquisitions, which may decrease our profitability and make it more difficult for us to grow our business.

We may not have sufficient management, financial and other resources to integrate and consolidate any future acquisitions, including the proposed Eagle acquisition, and we may be unable to operate profitably as a consolidated company. Some of the pro forma financial data contained in this prospectus relates to the proposed Eagle acquisition and may not be indicative of future financial or operating results. Any significant diversion of management's attention or any major difficulties encountered in the integration of the businesses could have a material adverse effect on our business, financial condition or results of operation, which could decrease our profitability and make it more difficult for us to grow our business.

We may not be able to facilitate our growth strategy by identifying or completing transactions with attractive acquisition candidates, which could impede our revenues and profitability.

An important element of our growth strategy is to continue to seek additional businesses to acquire in order to add new customers within our existing markets. We cannot assure you that we will be able to identify attractive acquisition candidates or complete the acquisition of any identified candidates at favorable prices and upon advantageous terms and conditions. Furthermore, competition for attractive acquisition candidates may limit the number of acquisition candidates or increase the overall costs of making acquisitions. The difficulties we may face in identifying or completing acquisitions could impede our revenues and profitability.

We may experience integration and consolidation risks associated with our growth strategy. Future acquisitions may also result in significant transaction expenses and risks associated with entering new markets and we may be unable to profitably operate our consolidated company.

We periodically engage in evaluations of potential acquisitions and start-up facilities. The success of our growth strategy depends, in part, on selecting strategic acquisition candidates at attractive prices and identifying strategic start-up locations. We expect to face competition for acquisition candidates,

which may limit the number of acquisition opportunities and lead to higher acquisition costs. We may not have the financial resources necessary to consummate any acquisitions or to successfully open any new facilities in the future or the ability to obtain the necessary funds on satisfactory terms. Any future acquisitions or the opening of new facilities may result in significant transaction expenses and risks associated with entering new markets in addition to the integration and consolidation risks described above. We may not have sufficient management, financial and other resources to integrate any such future acquisitions or to successfully operate new locations and we may be unable to profitably operate our consolidated company.

We may not consummate the Eagle acquisition.

We have entered into a letter of intentan agreement to purchaseacquire Eagle. Although this letter of intent expired by its terms on October 31, 2005, the parties are continuing to negotiate the terms of a definitive purchase agreement. The closing of this acquisition is subject to the execution and delivery of a definitive purchase agreement and other documentation, receipt of financing and the satisfaction of customary closing conditions. In addition, the acquisition agreement is subject to termination by either party under certain circumstances if the closing has not occurred on or before February 28, 2006. We cannot assure you that we will consummate the Eagle acquisition on favorable terms, or at all. If we do notthe acquisition agreement terminates due to our failure to complete this offering or obtain alternative financing (except under certain circumstances), or if Eagle elects to terminate the Eagle acquisition agreement because we are unable to obtainin material breach of our obligations under the necessary financing (other than due to Eagle) or because there is a material adverse change in general economic, financial or market conditions,acquisition agreement, we will lose a $2.0 million deposit that we will be required to makemade upon execution of a definitive purchasethe acquisition agreement. Also, if we do not complete the Eagle acquisition, our expected results of operations in the future may be adversely affected, and we will have a largerlarge portion of the proceeds of this offering available to us for general corporate purposes.

If we consummate the Eagle acquisition, we may not be able to successfully integrate the acquired business or achieve expected results.

The Eagle acquisition, if completed, will expand our presence into California where we currently do not operate. We may experience difficulties in successfully operating in this new market and in integrating Eagle's business with our own, which could increase our costs or adversely impact our ability to operate our business. In addition, our due diligence with respect to Eagle has not yet been completed so we cannot assure you that the information underlying our expected results of operations or the pro forma information presented elsewhere in this prospectus (including the related assumptions and adjustments) is sufficient or accurate. You should not consider the pro forma financial data to be indicative of actual results had the Eagle acquisition been consummated on the dates indicated, or indicative of our future operating results or financial position.

We are dependent on key personnel. A loss of key personnel could have a material adverse effect on our business, which could result in a decline in our revenues and profitability.

We are dependent on the experience and continued services of our senior management team, including Mr. Engquist, with whom we have an employment agreement which terminates in 2006. Mr. Engquist has approximately 31 years of industry experience and has served as an officer of Head and Engquist since 1990, a director of Gulf Wide since 1995 and an officer and director of H&E LLC since its formation in June 2002. If we lose the services of any member of our senior management team, particularly Mr. Engquist, and are unable to find a suitable replacement, we may not have the depth of senior management resources required to efficiently manage our business and execute our strategy.

Our business could be hurt if we are unable to obtain additional capital as required, resulting in a decrease in our revenues and profitability.

The cash that we generate from our business, together with cash that we may borrow under our senior secured credit facility, may not be sufficient to fund our capital requirements. As a result, we may require additional financing to obtain capital for, among other purposes, purchasing equipment,

completing acquisitions, establishing new locations and refinancing existing indebtedness. Any additional indebtedness that we incur will make us more vulnerable to economic downturns and limit our ability to withstand competitive pressures. Moreover, we may not be able to obtain additional capital on acceptable terms, if at all. If we are unable to obtain sufficient additional financing in the future, our business could be adversely affected by reducing our ability to increase revenues and profitability.

We are subject to competition, which may have a material adverse effect on our business by reducing our ability to increase or maintain revenues or profitability.

The equipment rental and retail distribution industries are highly competitive and the equipment rental industry is highly fragmented. Many of the markets in which we operate are served by numerous competitors, ranging from national and multi-regional equipment rental companies to small, independent businesses with a limited number of locations. We generally compete on the basis of, among other things: (1) quality and breadth of service; (2) expertise; (3) reliability; and (4) price. Some of our competitors have significantly greater financial, marketing and other resources than we do, and may be able to reduce rental rates or sale prices. If competitive pressures were to cause us to reduce our rates, our operating margins may be adversely impacted. If we were to maintain rates in the face of reductions by our competitors, our market share could decline. We may encounter increased competition from existing competitors or new market entrants in the future, which could have a material adverse effect on our business, financial condition and results of operations.

Disruptions in our information technology systems, including our customer relationship management system, could adversely affect our operating results by limiting our capacity to effectively monitor and control our operations.

Our information technology systems facilitate our ability to monitor and control our operations and adjust to changing market conditions. Any disruption in any of these systems, including our customer relationship management system, or the failure of any of these systems to operate as expected could, depending on the magnitude of the problem, adversely affect our operating results by limiting our capacity to effectively monitor and control our operations and adjust to changing market conditions.

The nature of our business exposes us to various liability claims, which may exceed the level of our insurance and thereby not fully protect us.

Our business exposes us to claims for personal injury, death or property damage resulting from the use of the equipment we rent or sell and from injuries caused in motor vehicle accidents in which our delivery and service personnel are involved. We carry comprehensive insurance, subject to deductibles, at levels we believe are sufficient to cover existing and future claims. However, we may be exposed to multiple claims that do not exceed our deductibles, and, as a result, we could incur significant out-of-pocket costs that could adversely affect our financial condition and results of operations. In addition, the cost of such insurance policies may increase significantly as a result of general rate increases for the type of insurance we carry as well as our historical experience and experience in our industry. Although we have not experienced any material losses that were not covered by insurance, our existing or future claims may exceed the level of our insurance, and such insurance may not continue to be available on economically reasonable terms, or at all. If we are required to pay significantly higher premiums for insurance, are not able to maintain insurance coverage at affordable rates or if we must pay amounts in excess of claims covered by our insurance, we could experience higher costs that could adversely affect our financial condition and results of operations.

We could be adversely affected by environmental and safety requirements, which could force us to increase significant capital and other operational costs and may subject us to unanticipated liabilities.

Our operations, like those of other companies engaged in similar businesses, require the handling, use, storage and disposal of certain regulated materials. As a result, we are subject to the requirements of federal, state and local environmental and occupational health and safety laws and regulations. We may not be at all times in complete compliance with all such requirements. We are subject to potentially significant civil or criminal fines or penalties if we fail to comply with any of these requirements. We have made and will continue to make capital and other expenditures in order to comply with these laws and regulations. However, the requirements of these laws and regulations are complex, change frequently, and could become more stringent in the future. It is possible that these requirements will change or that liabilities will arise in the future in a manner that could have a material adverse effect on our business, financial condition and results of operations.

Environmental laws also impose obligations and liability for the cleanup of properties affected by hazardous substance spills or releases. These liabilities can be imposed on the parties generating or disposing of such substances or operator of affected property, often without regard to whether the owner or operator knew of, or was responsible for, the presence of hazardous substances. Accordingly, we may become liable, either contractually or by operation of law, for remediation costs even if a contaminated property is not presently owned or operated by us, or if the contamination was caused by third parties during or prior to our ownership or operation of the property. Given the nature of our operations (which involve the use of petroleum products, solvents and other hazardous substances for fueling and maintaining our equipment and vehicles), there can be no assurance that prior site assessments or investigations have identified all potential instances of soil or groundwater contamination. Future events, such as changes in existing laws or polices or their enforcement, or the discovery of currently unknown contamination, may give rise to additional remediation liabilities which may be material.

Hurricanes or other adverse weather events could negatively affect our local economies or disrupt our operations, which could have an adverse effect on our business or results of operations.

Our market areas in the southeastern United States are susceptible to hurricanes. Such weather events can disrupt our operations, result in damage to our properties and negatively affect the local economies in which we operate. In late summer 2005, Hurricane Katrina and Hurricane Rita struck the Gulf Coast region of the United States and caused extensive and catastrophic physical damage to those areas. While Hurricane Katrina and Hurricane Rita did not have a material adverse effect on our business or results of operations, future hurricanes could affect our operations or the economies in those market areas and result in damage to certain of our facilities and the equipment located at such facilities, or equipment on rent with customers in those areas. Our business or results of operations may be adversely affected by these and other negative effects of future hurricanes.

Risks Related To The Offering

You will experience immediate and substantial dilution.