As filed with the Securities and Exchange Commission on January 5,18, 2006

Registration No. 333-128827

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 23 TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ACORDA THERAPEUTICS, INC.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 2836 | 13-3831168 | ||

| (State or Other Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

15 Skyline Drive

Hawthorne, New York 10532

(914) 347-4300

(Address, Including Zip Code, and Telephone Number,

Including Area Code, of Registrant's Principal Executive Offices)

Ron Cohen

Chief Executive Officer

15 Skyline Drive

Hawthorne, New York 10532

(914) 347-4300

(Name, Address, Including Zip Code, and Telephone Number,

Including Area Code, of Agent For Service)

Copy To:

| Ellen B. Corenswet Covington & Burling 1330 Avenue of the Americas New York, New York 10019 (212) 841-1000 | Danielle Carbone Shearman & Sterling LLP 599 Lexington Avenue New York, New York 10022 (212) 848-4000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If the securities being registered on this form are being offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434 under the Securities Act, please check the following box. o

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JANUARY 5,18, 2006

Prospectus

Shares

Common Stock

Acorda Therapeutics, Inc. is offering shares of common stock. This is our initial public offering, and no public market currently exists for our shares. We anticipate that the initial public offering price will be between $ and $ per share. After the offering, the market price for our shares may be outside this range.

We will apply to list our common stock on the Nasdaq National Market under the symbol "ACOR."

Investing in our common stock involves a high degree of risk. See "Risk Factors" beginning on page 9.

| | Per Share | Total | ||||

|---|---|---|---|---|---|---|

| Offering price | $ | $ | ||||

| Discounts and commissions to underwriters | $ | $ | ||||

Offering proceeds to Acorda Therapeutics, Inc., before expenses | $ | $ | ||||

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or determined if this prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

We have granted the underwriters the right to purchase up to additional shares of common stock to cover any over-allotments. The underwriters can exercise this right at any time within 30 days after the offering. The underwriters expect to deliver the shares on or about , 2006.

Banc of America Securities LLC

| Lazard Capital Markets |

| Piper Jaffray |

| SG Cowen & Co. |

, 2006

You should rely only on the information contained in this prospectus. We have not, and the underwriters have not, authorized anyone to provide you with different information. We are not making offers to sell or seeking offers to buy these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information contained in this prospectus is accurate as of the date on the front of this prospectus only. Our business, financial condition, results of operations and prospects may have changed since that date.

| | Page | |

|---|---|---|

| Summary | 1 | |

| Risk Factors | 9 | |

| Forward-Looking Statements | 25 | |

| Use of Proceeds | 26 | |

| Dividend Policy | 26 | |

| Capitalization | 27 | |

| Dilution | 29 | |

| Selected Consolidated Financial Data | 31 | |

| Management's Discussion and Analysis of Financial Condition and Results of Operations | 34 | |

| Business | 58 | |

| Management | 92 | |

| Summary Compensation Table | ||

| Certain Relationships and Related Transactions | ||

| Principal Stockholders | ||

| Description of Capital Stock | ||

| Shares Eligible for Future Sale | ||

| Certain United States Federal Income and Estate Tax Consequences to Non-U.S. Holders | ||

| Underwriting | ||

| Legal Matters | ||

| Experts | ||

| Where You Can Find Additional Information |

i

This summary highlights information contained elsewhere in this prospectus. You should read the entire prospectus carefully before making an investment decision.

We are a commercial-stage biopharmaceutical company dedicated to the identification, development and commercialization of novel therapies that improve neurological function in people with multiple sclerosis, or MS, spinal cord injury, or SCI, multiple sclerosis, or MS, and other disorders of the central nervous system, or CNS. Our marketed product, Zanaflex Capsules, is FDA-approved for the management of spasticity. Our lead product candidate, Fampridine-SR, is in a Phase 3 clinical trial for the improvement of walking ability in people with MS. Our preclinical programs also target MS and SCI, as well as other CNS disorders, including stroke and traumatic brain injury.

Approximately 650,000 people in the United States suffer from MS or SCI and the combined annual cost of treatment for these conditions exceeds $13 billion. It is estimated that a total of approximately 10 million people live with the long-term consequences of traumatic brain injury and stroke.

Our goal is to continue to grow as a fully-integrated biopharmaceutical company by commercializing pharmaceutical products, developing our product candidates and advancing our preclinical programs for these large and underserved markets. We plan to accomplish this through our sales and marketing infrastructure, our extensive scientific and medical network, our partnerships and our clinical and management experience.

Zanaflex

Our products, Zanaflex Capsules and Zanaflex tablets, are FDA-approved for the management of spasticity, a symptom of conditions such as MS and SCI that is commonly characterized by stiffness and rigidity, restriction of movement and painful muscle spasms. Zanaflex Capsules and Zanaflex tablets contain tizanidine hydrochloride, or tizanidine, one of the two leading treatments currently used for the management of spasticity. We acquired Zanaflex Capsules and Zanaflex tablets from a wholly-owned subsidiary of Elan Corporation, plc, or Elan, in July 2004. This strategic acquisition provided us with the opportunity to build a commercial infrastructure, develop sales and marketing expertise and create a foundation for future product launches, in addition to generating product revenue.

In April 2005, we launched Zanaflex Capsules, a new capsule formulation of tizanidine. This product is protected by an issued U.S. patent. Zanaflex tablets lost compound patent protection in 2002 and both products now compete with 11 generic versions of tizanidine tablets.

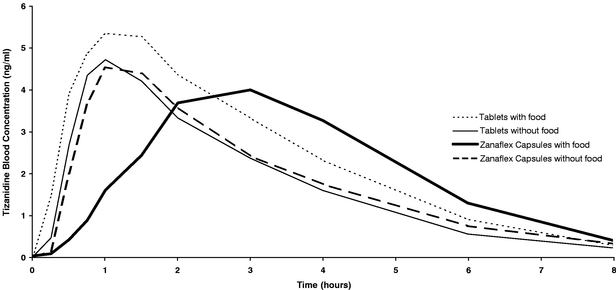

We believe that Zanaflex Capsules offer important benefits over Zanaflex tablets and generic tizanidine tablets. When taken with food, Zanaflex Capsules have a different blood absorption profile, referred to as pharmacokinetic profile, than Zanaflex tablets and generic tizanidine tablets, generally resulting in a lower level and more gradual rise of peak levels of tizanidine in a patient's blood. As a result of this different pharmacokinetic profile, Zanaflex tablets and generic tizanidine tablets are not therapeutically equivalent, or AB-rated, with Zanaflex Capsules. Therefore, under state pharmacy laws, prescriptions written for Zanaflex Capsules may not properly be filled by the pharmacist with Zanaflex tablets or generic tizanidine tablets. Zanaflex Capsules are also available in a higher dose, which gives patients and prescribers an additional choice in dosing and an opportunity to reduce the number of pills a person must take daily. In addition, people who have difficulty swallowing may find Zanaflex Capsules easier to take.

To support our commercialization of Zanaflex Capsules, we have established a sales and marketing infrastructure consisting of our internal specialty sales force, a contract sales force and a pharmaceutical telesales group. Our internal specialty sales force currently consists of 14 sales professionals who call on neurologists and other prescribers specializing in treating patients with conditions that involve spasticity. Members of this sales force also call on managed care organizations, pharmacists and wholesale drug distribution customers. We plan to expand our specialty sales force to approximately 30 sales professionals in the first quarter of 2006. Our contract sales force is provided by Cardinal Health PTS, LLC, or Cardinal Health, and consists of approximately 160 sales representatives who market Zanaflex Capsules to primary care physicians.physicians, on a non-exclusive basis. We also have a contract with Access Worldwide Communications to provide a small, dedicated sales force of pharmaceutical telesales professionals to contact primary care physicians, specialty physicians and pharmacists. Our current sales and marketing infrastructure enables us to reach virtually all high-volume prescribers of Zanaflex tablets and generic tizanidine. We believe that these prescribers are also potential high-volume prescribers for our lead product candidate, Fampridine-SR, if approved.

Fampridine-SR

Fampridine-SR is currently in a Phase 3 clinical trial for the improvement of walking ability in people with MS. The trial is being conducted pursuant to a Special Protocol Assessment, or SPA, with the FDA. The FDA has agreed that, if successful, this trial could qualify as one of the pivotal efficacy studies required for drug approval. Fampridine-SR is a small molecule drug contained in a sustained release oral tablet form. Laboratory studies have shown that fampridine, the active molecule in Fampridine-SR, improves impulse conduction in nerve fibers in which the insulating outer layer, called the myelin sheath, has been damaged. This damage may be caused by the body's own immune system, in the case of MS, or by physical trauma, in the case of SCI.

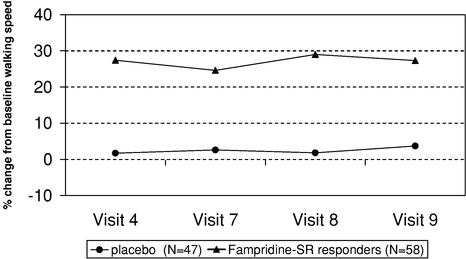

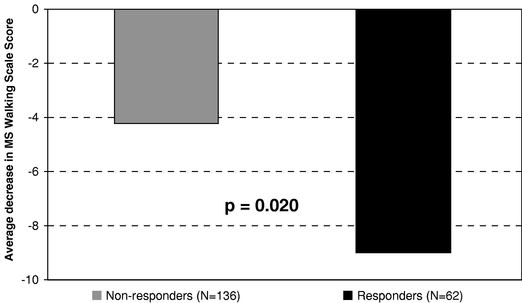

More than 800 people have been treated with Fampridine-SR in over 25 clinical trials, including nine clinical trials in MS and 11 clinical trials in SCI. In six Phase 2 clinical trials, treatment with Fampridine-SR has been associated with a variety of neurological benefits in people with MS or SCI. In our most recently completed Phase 2 clinical trial, there was a trend toward improvement in the primary endpoint of walking speed and, when analyzed using the same methodology that the FDA has now agreed to in the SPA for our Phase 3 clinical trial, these results would have beenare statistically significant. We expect the recruitment period for the current Phase 3 clinical trial, which began in June 2005, to require approximately six to eight months.end in February 2006. The treatment period is 14 weeks and the subjects are involved in trial procedures for approximately five months. We expect to be able to evaluate data from this clinical trial in the third quarter of 2006.

We believe Fampridine-SR is the first potential therapy in late-stage clinical development for MS that seeks to improve the function of damaged nerve fibers, rather than only treating the symptoms of MS or slowing the progression of disease. To our knowledge, there are no current drug therapies that improve walking ability in people with MS. We plan to commercialize Fampridine-SR, if approved, ourselves in the United States, and possibly Canada, and with partners in various markets throughout the rest of the world.

Preclinical programs

We have three preclinical programs focused on novel approaches to repair damaged components of the CNS:

We believe that all of our preclinical therapies have the potential to address conditions for which no effective treatment currently exists. In addition to applicability in MS, SCI and various other CNS disorders, we believe that our preclinical programs also may have applicability in such fields as orthopedics, cardiology, oncology and ophthalmology.

Our strategy is to continue to grow as a fully-integrated biopharmaceutical company focused on the identification, development and commercialization of a range of nervous system therapeutics. We are using our scientific and clinical expertise in MS and SCI as strategic points of access to additional CNS markets, including stroke and traumatic brain injury. Key aspects of our strategy are to:

We have established an advisory team and network of well-recognized scientists, clinicians and opinion leaders in the fields of MS and SCI. Depending on their expertise, these advisors provide assistance in trial design, conduct clinical trials, keep us apprised of the latest scientific advances and help us identify and evaluate business development opportunities. In addition, we have recruited over 35 MS centers and 80 SCI rehabilitation centers in the United States and Canada to conduct our clinical trials. Our clinical management team has extensive experience in the areas of MS and SCI and works closely with this network.

Risks Associated with our Business

Our business is subject to numerous risks, as more fully described in the section entitled "Risk Factors" immediately following this prospectus summary. We may be unable, for many reasons, including those that are beyond our control, to implement our current business strategy. Those reasons

could include failure to successfully promote Zanaflex Capsules and any other future marketed products; delays in obtaining, or a failure to obtain, regulatory approval for our product candidates; and failure to maintain and to protect our proprietary intellectual property assets, among others. The information about our preclinical and clinical trials may be useful to you in evaluating our company's current stage of development and our near-term and long-term prospects; however, you should note that of the large number of drugs in development only a small percentage successfully complete the FDA regulatory approval process and are commercialized.

We have a limited operating history and, as of September 30, 2005, had an accumulated deficit of approximately $198.5 million. We expect to incur losses for at least the next several years. We had net losses of $26.0 million and $44.7 million for the nine months ended September 30, 2005 and for the year ended December 31, 2004, respectively. We are unable to predict the extent of future losses or when we will become profitable, if at all. Even if we succeed in promoting Zanaflex Capsules and developing and commercializing one or more of our product candidates, we may never generate sufficient sales revenue to achieve and sustain profitability.

We were incorporated in 1995 as a Delaware corporation. Our principal executive offices are located at 15 Skyline Drive, Hawthorne, New York 10532. Our telephone number is (914) 347-4300. Our website iswww.acorda.com. The information on our website is not part of this prospectus.

"Acorda Therapeutics" is a registered trademark that we own and "Zanaflex" is a registered trademark that we exclusively license. We have pending U.S. trademark applications for our logo and "Zanaflex Capsules." Other trademarks, trade names and service marks used in this prospectus are the property of their respective owners.

| Common stock offered | shares | |

Common stock outstanding after this offering | shares | |

Use of proceeds | We intend to use the net proceeds of this offering for sales and marketing activities, clinical and preclinical development programs and for general corporate purposes. See "Use of Proceeds." | |

Proposed Nasdaq National Market symbol | ACOR | |

Risk factors | See "Risk Factors" and the other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in shares of our common stock. |

The number of shares of common stock to be outstanding after this offering is based on the number of shares outstanding as of September 30, 2005 and reflects or assumesexcludes the following:

Unless we specifically state otherwise, all information in this prospectus, including the number of shares of common stock to be outstanding after this offering:

In the table above, the number of shares of common stock outstanding after this offering excludes, as of September 30, 2005:

SUMMARY CONSOLIDATED FINANCIAL DATA

The following table presents a summary of our historical financial information. You should read this information in conjunction with our consolidated financial statements and related notes and the information under "Selected Consolidated Financial Data" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" included elsewhere in this prospectus. We changed our fiscal year end from June 30 to December 31, beginning with the six months ended December 31, 2003.

Pro forma amounts in the following table reflect the conversion of our outstanding convertible and mandatorily redeemable convertible preferred stock into 13,338,279 shares of common stock upon completionon the closing of this offering, assuming that shares of our preferred stock were outstanding for the entire periods presented.

| | | | | | | Nine Months Ended September 30, | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | Six Months Ended December 31, | | |||||||||||||||||||

| | Year Ended June 30, | Year Ended December 31, | ||||||||||||||||||||||

| | 2004 | 2005 | ||||||||||||||||||||||

| | 2001 | 2002 | 2003 | 2003 | 2004 | (unaudited) | ||||||||||||||||||

| | ||||||||||||||||||||||||

| | (in thousands, except per share data) | |||||||||||||||||||||||

| Statement of Operations Data: | ||||||||||||||||||||||||

| Gross sales—Zanaflex | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 3,239 | ||||||||||

| Less: discounts and allowances | — | — | — | — | (4,417 | ) | (144 | ) | (992 | ) | ||||||||||||||

| Net sales | — | — | — | — | (4,417 | ) | (144 | ) | 2,247 | |||||||||||||||

| Grant revenue | 462 | 132 | 474 | 382 | 479 | 445 | 184 | |||||||||||||||||

| Total net revenue | 462 | 132 | 474 | 382 | (3,938 | ) | (301 | ) | 2,431 | |||||||||||||||

| Less: cost of sales | — | — | — | — | (885 | ) | (363 | ) | (2,274 | ) | ||||||||||||||

| Gross profit | 462 | 132 | 474 | 382 | (4,823 | ) | (62 | ) | 157 | |||||||||||||||

Operating expenses: | ||||||||||||||||||||||||

| Research and development | 6,142 | 11,147 | 17,527 | 16,743 | 21,999 | 18,621 | 9,652 | |||||||||||||||||

| Research and development—related party | 2,223 | 4,687 | 2,265 | 3,343 | — | — | — | |||||||||||||||||

| Sales and marketing | — | — | — | — | 4,662 | 2,793 | 9,657 | |||||||||||||||||

| General and administrative | 3,489 | 6,636 | 6,388 | 17,069 | 13,283 | 11,034 | 6,339 | |||||||||||||||||

| Total operating expenses | 11,854 | 22,470 | 26,180 | 37,155 | 39,944 | 32,448 | 25,648 | |||||||||||||||||

| Operating loss | (11,392 | ) | (22,338 | ) | (25,706 | ) | (36,773 | ) | (44,767 | ) | (32,510 | ) | (25,491 | ) | ||||||||||

Other income (expense): | ||||||||||||||||||||||||

| Interest and amortization of debt discount expense | — | — | (78 | ) | (38 | ) | (385 | ) | (297 | ) | (824 | ) | ||||||||||||

| Interest and amortization of debt discount expense—related party | (443 | ) | (408 | ) | (369 | ) | (184 | ) | — | — | — | |||||||||||||

| Interest income | 1,824 | 984 | 393 | 276 | 409 | 329 | 347 | |||||||||||||||||

| Other income | — | — | 26 | 7 | 2 | 2 | 1 | |||||||||||||||||

| Total other income (expense) | 1,381 | 576 | (28 | ) | 61 | 26 | 34 | (476 | ) | |||||||||||||||

| Minority interest—related party | 699 | 580 | — | — | — | — | — | |||||||||||||||||

| Cumulative effect of change in accounting principle | — | — | — | — | — | — | 3 | |||||||||||||||||

| Net loss | (9,313 | ) | (21,181 | ) | (25,734 | ) | (36,712 | ) | (44,741 | ) | (32,476 | ) | (25,964 | ) | ||||||||||

Beneficial conversion feature, accretion of issuance costs, preferred dividends, and fair value of warrants issued to convertible preferred stockholders | (36 | ) | (55 | ) | (24,320 | ) | (11,985 | ) | (24,746 | ) | (18,496 | ) | (18,636 | ) | ||||||||||

| Net loss allocable to common stockholders | $ | (9,349 | ) | $ | (21,236 | ) | $ | (50,054 | ) | $ | (48,697 | ) | $ | (69,487 | ) | $ | (50,972 | ) | $ | (44,600 | ) | |||

| Net loss per share allocable to common stockholders—basic & diluted | $ | (50.81 | ) | $ | (111.90 | ) | $ | (261.38 | ) | $ | (252.87 | ) | $ | (351.76 | ) | $ | (259.22 | ) | $ | (221.17 | ) | |||

| | | | | | | Nine Months Ended September 30, | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | Six Months Ended December 31, | | ||||||||||||

| | Year Ended June 30, | Year Ended December 31, | |||||||||||||||

| | 2004 | 2005 | |||||||||||||||

| | 2001 | 2002 | 2003 | 2003 | 2004 | (unaudited) | |||||||||||

| | |||||||||||||||||

| Pro forma net loss per share allocable to common stockholders—basic & diluted (unaudited) | $ | (9.63 | ) | $ | (1.92 | ) | |||||||||||

| Weighted average shares of common stock outstanding used in computing net loss per share allocable to common stockholders—basic & diluted | 184 | 190 | 191 | 193 | 198 | 197 | 202 | ||||||||||

| Weighted average shares of common stock outstanding used in computing pro forma net loss per share allocable to common stockholders—basic & diluted (unaudited) | 13,536 | 13,547 | |||||||||||||||

The following table sets forth our cash, cash equivalents and short-term investments and capitalization as of September 30, 2005:

| | As of September 30, 2005 | As of September 30, 2005 | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Actual (unaudited) | Pro Forma (unaudited) | Pro Forma As Adjusted (unaudited) | Actual (unaudited) | Pro Forma (unaudited) | Pro Forma As Adjusted (unaudited) | |||||||||||

| | (in thousands) | (in thousands) | |||||||||||||||

| Balance Sheet Data: | |||||||||||||||||

| Cash and cash equivalents | $ | 3,581 | $ | 14,879 | $ | 3,581 | $ | 14,879 | |||||||||

| Restricted cash | 261 | 261 | 261 | 261 | |||||||||||||

| Short-term investments | 5,160 | 5,160 | 5,160 | 5,160 | |||||||||||||

| Working capital | (12,203 | ) | (10,506 | ) | (12,203 | ) | (14,207 | ) | |||||||||

| Capitalized transaction costs—PRF transaction | — | 500 | |||||||||||||||

| Total assets | 25,543 | 37,342 | 25,543 | 37,842 | |||||||||||||

| Deferred product revenue—Zanaflex Capsules | 4,960 | 4,960 | 4,960 | 4,960 | |||||||||||||

| Deferred product revenue—Zanaflex tablets | 10,686 | 10,686 | 10,686 | 10,686 | |||||||||||||

| Current portion of notes payable | 2,347 | 1,150 | 2,347 | 1,150 | |||||||||||||

| Revenue interest liability—PRF transaction | — | 11,299 | — | 14,600 | |||||||||||||

| Put/call option liability—PRF transaction | — | 400 | |||||||||||||||

| Long-term portion of notes payable | 3,534 | 1,731 | 3,534 | 1,731 | |||||||||||||

| Long-term convertible notes payable—principal amount plus accrued interest, less unamortized debt discount—related party | 8,695 | 8,695 | 8,695 | 8,695 | |||||||||||||

| Mandatorily redeemable preferred stock | 85,000 | — | 85,000 | — | |||||||||||||

| Total stockholders' (deficit) | (101,669 | ) | (16,869 | ) | (101,669 | ) | (16,869 | ) | |||||||||

An investment in our common stock involves a high degree of risk. You should consider carefully the following risk factors and the other information contained in this prospectus before you decide to purchase our common stock. Additional risks that are not currently known or foreseeable to us may materialize at a future date. The trading price of our common stock could decline if any of these risks or uncertainties occur and you might lose all or part of your investment.

Risks Related To Our Business

We have a history of operating losses and we expect to continue to incur losses and may never be profitable.

As of September 30, 2005, we had an accumulated deficit of approximately $198.5 million. We had net losses of $26.0 million and $44.7 million for the nine months ended September 30, 2005, and the year ended December 31, 2004, respectively. We have had operating losses since inception as a result of our significant clinical development, research and development, general and administrative, sales and marketing and business development expenses. We expect to incur losses for at least the next several years as we expand our sales and marketing capabilities and continue our clinical trials and research and development activities.

Our prospects for achieving profitability will depend primarily on how successful we are in executing our business plan to:

If we are not successful in executing our business plan, we may never achieve or may not sustain profitability.

We will be substantially dependent on sales of one product, Zanaflex Capsules, to generate revenue for the foreseeable future.

We currently derive substantially all of our revenue from the sale of Zanaflex Capsules and Zanaflex tablets, which are our only FDA-approved products. Although we currently distribute Zanaflex tablets, our marketing efforts are focused on Zanaflex Capsules and we do not, and do not intend to, actively promote Zanaflex tablets. As a result, prescriptions for Zanaflex tablets have declined and we expect that they will continue to decline. Our goal is to convert sales of Zanaflex tablets and generic tizanidine tablets to sales of Zanaflex Capsules. We believe that sales of Zanaflex Capsules will constitute a significant portion of our total revenue for the foreseeable future. If we are unable to convert tablet sales to capsule sales or are otherwise unable to increase our revenue from the sale of this product, our business, financial condition and results of operations could be adversely affected.

If we are unable to successfully differentiate Zanaflex Capsules from both Zanaflex tablets and generic tizanidine tablets we may not be able to increase sales of Zanaflex Capsules.

There are currently 11 generic versions of tizanidine tablets on the market and they are significantly cheaper than either Zanaflex Capsules or Zanaflex tablets. In 2004, these generic versions of tizanidine tablets constituted 95% of tizanidine sales in the United States. Although Zanaflex Capsules have a different pharmacokinetic profile when taken with food and are available in a higher dose than Zanaflex tablets and their generic equivalents, we may be unsuccessful in convincing prescribers, patients and third-party payors that these differences justify the higher price of Zanaflex Capsules. Prescribers may prescribe generic tizanidine tablets instead of Zanaflex Capsules, and third-party payors may establish unfavorable reimbursement policies for Zanaflex Capsules or otherwise seek

to encourage patients and prescribers to use generic tizanidine tablets instead of Zanaflex Capsules. In

addition, although the FDA has determined that neither Zanaflex tablets nor generic tizanidine tablets are therapeutically equivalent, or "AB-rated," to Zanaflex Capsules, it is possible that pharmacists may improperly fill prescriptions with generic tizanidine tablets or may seek to influence patients or physicians to change prescriptions from Zanaflex Capsules to generic tizanidine tablets. If we are unable to successfully differentiate Zanaflex Capsules from Zanaflex tablets and generic tizanidine tablets in the minds of prescribers, pharmacists, patients and third-party payors, our ability to generate meaningful revenue from this product will be adversely affected.

Our company has limited sales and marketing experience and we may not be successful in building an effective sales and marketing organization to market Zanaflex Capsules to specialty physicians.

As a company, we have limited sales and marketing experience, having only launched Zanaflex Capsules in April 2005. In order to successfully commercialize Zanaflex Capsules or any other products that we may bring to market, we will need to have adequate sales, marketing and distribution capabilities. OurAlthough we plan to expand our internal specialty sales force of 14 persons to approximately 30 persons in the first quarter of 2006, we may need to be significantly expandedfurther expand that sales force in the future. We may not be able to attract and train skilled sales and marketing personnel, in a timely manner or at all, or integrate and manage a growing sales and marketing organization.

Returns of Zanaflex tablets may adversely affect our results of operations.

Prior to the launch of generic tizanidine tablets in June 2002, wholesalers established larger than normal inventories of Zanaflex tablets. These inventories had expiration dates that extended to June 2005. Our return policy is to accept returns for six months before and 12 months after the product's expiration date. According to our Zanaflex asset purchase agreement with Elan, we are responsible for all returns of Zanaflex tablets after January 17, 2005. Zanaflex tablets sold by Elan can be returned to us through June 2006. In the year ended December 31, 2004, we took a $4.1 million charge to establish a reserve for expected returns of Zanaflex tablets sold by Elan. This charge is an estimate. If returns for products not sold by us are higher than we have estimated, we will have to record additional charges, which will adversely affect our results of operations.

Our product candidates must undergo rigorous clinical testing, the results of which are uncertain and could substantially delay or prevent us from bringing them to market.

Before we can obtain regulatory approval for a product candidate, we must undertake extensive clinical testing in humans to demonstrate safety and efficacy to the satisfaction of the FDA and other regulatory agencies. Clinical trials of new product candidates sufficient to obtain regulatory marketing approval are expensive and take years to complete, and the outcome of such trials is uncertain.

Clinical development of any product candidate that we determine to take into clinical trials may be curtailed, redirected, delayed or eliminated at any time for some or all of the following reasons:

A delay in or termination of any of our clinical development programs could have an adverse effect on our business.

If our Phase 3 clinical trials of Fampridine-SR are unsuccessful, or if we are unable to obtain regulatory approval for this product candidate or any approval is unduly limited in scope, our business prospects will be adversely affected.

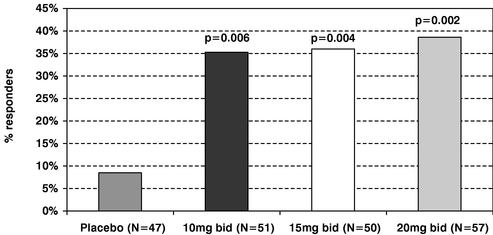

In June 2005, we initiated a Phase 3 clinical trial for Fampridine-SR for the improvement of walking ability in patients with MS. In April 2004, we released results from a Phase 2 clinical trial designed to assess the relative safety and efficacy of varying doses of Fampridine-SR in MS. Our results did not reach statistical significance for the primary endpoint in this trial. Although we have designed the current Phase 3 clinical trial to address the difficulties we encountered in interpreting the patient data from the earlier trial, we cannot be sure that the results from our current clinical trial will be statistically significant.

To achieve the primary endpoint in our current Phase 3 clinical trial for MS, we need to show statistical improvement in the walking speed of the patients in the trial and that this improvement is both sustained and clinically meaningful to these patients. If we fail to achieve the primary endpoint in this clinical trial or the results are ambiguous, we will have to determine whether to re-design our MS trial and protocols and continue with additional testing, or cease development activities in this area. Redesigning the program could be extremely costly and time-consuming. Even if we are able to achieve the primary endpoint, we will need positive results from at least one other clinical trial to support the filing of a new drug application, or NDA, with the FDA. We cannot predict how long the second trial, or any additional trial that might be required by the FDA, will take or what the cost will be.

Our Phase 3 clinical trial for Fampridine-SR in MS is being conducted pursuant to a special protocol assessment, or SPA, with the FDA and the FDA has agreed that, if successful, this trial could qualify as one of the pivotal trials needed to support regulatory approval. This SPA may not be changed by either us or the FDA. However, if the FDA determines that a substantial scientific issue essential to determining the safety or efficacy of Fampridine-SR is identified after the trial began, the FDA may alter its conclusion on the adequacy of the protocol. In addition, even if the SPA remains in place and the trial meets its primary endpoint, the FDA could determine that the overall balance of risks and benefits for Fampridine-SR is not adequate to support approval, or only justifies approval for a narrow set of uses or approval with restricted distribution or other burdensome post-approval requirements and limitations. If the FDA denies approval of Fampridine-SR in MS, FDA approval is substantially delayed, approval is granted on a narrow basis or with restricted distribution or other burdensome post-approval requirements, or if the Fampridine-SR program is terminated, our business prospects will be adversely affected.

In March 2004, we completed two Phase 3 clinical trials of Fampridine-SR in SCI in which our results failed to reach their primary endpoints. We expect to resume development of Fampridine-SR for SCI after we have completed further development of the drug for MS. We cannot predict whether future clinical trials of Fampridine-SR in SCI will achieve their primary endpoints, how long these clinical trials will take or how much they will cost.

Our other drug development programs are in early stages of development and may never be commercialized.

All of our development programs other than Fampridine-SR are in the preclinical phase. Our future success depends, in part, on our ability to select promising product candidates, complete preclinical development of these product candidates and advance them to clinical trials. These product candidates will require significant development, preclinical studies and clinical trials, regulatory clearances and substantial additional investment before they can be commercialized.

Our preclinical programs may not lead to commercially viable products for several reasons. For example, we may fail to identify promising product candidates, our product candidates may fail to be safe and effective in preclinical tests or clinical trials, or we may have inadequate financial or other resources to pursue discovery and development efforts for new product candidates. In addition, because we have limited resources, we are focusing on product candidates that we believe are the most promising. As a result, we may delay or forego pursuit of opportunities with other product candidates. From time to time, we may establish and announce certain development goals for our product candidates and programs; however, given the complex nature of the drug discovery and development process, it is difficult to predict accurately if and when we will achieve these goals. If we are unsuccessful in advancing our preclinical programs into clinical testing or in obtaining regulatory approval, our long-term business prospects will be harmed.

The pharmaceutical industry is subject to stringent regulation and failure to obtain regulatory approval will prevent commercialization of our product candidates.

Our research, development, preclinical and clinical trial activities, as well as the manufacture and marketing of any products that we may successfully develop, are subject to an extensive regulatory approval process by the FDA and other regulatory agencies abroad. The process of obtaining required regulatory approvals for drugs is lengthy, expensive and uncertain, and any regulatory approvals may contain limitations on the indicated usage of a drug, distribution restrictions or may be conditioned on burdensome post-approval study or other requirements, including the requirement that we institute and follow a special risk management plan to monitor and manage potential safety issues, all of which may eliminate or reduce the drug's market potential. Post-market evaluation of a product could result in marketing restrictions or withdrawal from the market.

The results of preclinical and Phase 1 and Phase 2 clinical studies are not necessarily indicative of whether a product will demonstrate safety and efficacy in larger patient populations, as evaluated in Phase 3 clinical trials. Additional adverse events that could impact commercial success, or even continued regulatory approval, might emerge with more extensive post-approval patient use. Of the large number of drugs in development, only a small percentage result in the submission of an NDA to the FDA and even fewer are approved for commercialization.

In order to conduct clinical trials to obtain FDA approval to commercialize any product candidate, an IND application must first be submitted to the FDA and must become effective before clinical trials may begin. Subsequently, an NDA must be submitted to the FDA, including the results of adequate and well-controlled clinical trials demonstrating, among other things, that the product candidate is safe and effective for use in humans for each target indication. In addition, the manufacturing facilities used to produce the products must comply with current good manufacturing practices and must pass a pre-approval FDA inspection. Extensive submissions of preclinical and clinical trial data are required to demonstrate the safety, efficacy, potency and purity for each intended use. The FDA may refuse to accept our regulatory submissions for filing if they are incomplete.

Clinical trials are subject to oversight by institutional review boards and the FDA to ensure compliance with the FDA's good clinical practice requirements, as well as other requirements for the protection of clinical trial participants. We depend, in part, on third-party laboratories and medical institutions to conduct preclinical studies and clinical trials for our products and other third-party organizations to perform data collection and analysis, all of which must maintain both good laboratory

and good clinical practices required by regulators. If any such standards are not complied with in our clinical trials, the resulting data from the clinical trial may not be usable or we, an institutional review board or the FDA may suspend or terminate such trial, which would severely delay our development and possibly end the development of such product candidate. We also depend upon third party manufacturers of our products to qualify for FDA approval and to comply with good manufacturing practices required by regulators. We cannot be certain that our present or future manufacturers and suppliers will comply with current good manufacturing practices. The failure to comply with good

manufacturing practices may result in the termination of clinical studies, restrictions in the sale of, or withdrawal of the products from the market. Compliance by third parties with these standards and practices is outside of our direct control.

In addition, we are subject to regulation under other state and federal laws, including requirements regarding occupational safety, laboratory practices, environmental protection and hazardous substance control, and may be subject to other local, state, federal and foreign regulations. We cannot predict the impact of such regulations on us, although it could impose significant restrictions on our business and additional expenses to comply with these regulations.

Our products and product candidates may not gain market acceptance among physicians, patients and the medical community, thereby limiting our potential to generate revenue.

Market acceptance of our products and product candidates will depend on the benefits of our products in terms of safety, efficacy, convenience, ease of administration and cost effectiveness and our ability to demonstrate these benefits to physicians and patients. We believe market acceptance also depends on the pricing of our products and the reimbursement policies of government and third-party payors, as well as on the effectiveness of our sales and marketing activities. Physicians may not prescribe our products, and patients may determine, for any reason, that our products are not useful to them. For example, physicians may not believe that the benefits of Zanaflex Capsules outweigh their higher cost in relation to Zanaflex tablets or generic tizanidine tablets. The failure of any of our products or product candidates, once approved, to achieve market acceptance would limit our ability to generate revenue and would adversely affect our results of operations.

Our potential products may not be commercially viable if we fail to obtain an adequate level of reimbursement for these products by Medicaid, Medicare or other third-party payors.

Our commercial success will depend in part on third-party payors, such as government health administrative authorities, including Medicaid and Medicare, private health insurers and other such organizations, agreeing to reimburse patients for the cost of our products. Significant uncertainty exists as to the reimbursement status of newly-approved healthcare products. Our business would be materially adversely affected if the Medicaid program, Medicare program or other third-party payors were to deny reimbursement for our products or provide reimbursement only on unfavorable terms. Our business could also be adversely affected if the Medicaid program, Medicare program or other reimbursing bodies or payors limit the indications for which our products will be reimbursed to a smaller set of indications than we believe is appropriate.

Third-party payors frequently require that drug companies negotiate agreements with them that provide discounts or rebates from list prices. At present we do not have any such agreements with private third-party payors and only a small number of such agreements with government payors. If sales of Zanaflex Capsules increase we may need to offer larger discounts or discounts to a greater number of third-party payors to maintain acceptable reimbursement levels. If we were required to negotiate such agreements, there is no guarantee that we would be able to negotiate them at price levels that are profitable to us, or at all. If we are unsuccessful in maintaining reimbursement for our products at acceptable levels, our business will be adversely affected. In addition, if our competitors reduce the prices of their products, or otherwise demonstrate that they are better or more cost effective than our products,

this may result in a greater level of reimbursement for their products relative to our products, which would reduce our sales and adversely affect our results of operations.

We may experience pressure to lower prices on our approved products due to new and/or proposed federal legislation.

Federal legislation enacted in December 2003 added an outpatient prescription drug benefit to Medicare, effective January 2006. In the interim, Congress has established a discount drug card program for Medicare beneficiaries. Both benefits will be provided primarily through private entities,

which will attempt to negotiate price concessions from pharmaceutical manufacturers. These negotiations may increase pressure to lower prescription drug prices. While the new law specifically prohibits the U.S. government from interfering in price negotiations between manufacturers and Medicare drug plan sponsors, some members of Congress are pursuing legislation that would permit the U.S. government to use its enormous purchasing power to demand discounts from pharmaceutical companies, thereby creating de facto price controls on prescription drugs. In addition, the new law contains triggers for Congressional consideration of cost containment measures for Medicare in the event Medicare cost increases exceed a certain level. These cost containment measures could include limitations on prescription drug prices. This Medicare prescription drug coverage legislation, as well as additional healthcare legislation that may be enacted at a future date, could reduce our sales and adversely affect our results of operations.

If our competitors develop and market products that are more effective, safer or more convenient than our approved products, or obtain marketing approval before we obtain approval of future products, our commercial opportunity will be reduced or eliminated.

Competition in the pharmaceutical and biotechnology industries is intense and is expected to increase. Composition of matter patents on tizanidine, the active ingredient in Zanaflex Capsules and Zanaflex tablets, expired in 2002. There are currently 11 generic versions of tizanidine tablets on the market. To the extent that we are not able to differentiate Zanaflex Capsules from Zanaflex tablets and generic tizanidine tablets and/or pharmacists improperly substitute generic tizanidine tablets when filling prescriptions for Zanaflex Capsules, we may be unable to convert a meaningful amount of sales of Zanaflex tablets and generic tizanidine tablets to Zanaflex Capsules and our ability to generate revenue from this product will be adversely affected. Although no other FDA-approved capsule formulation of tizanidine exists, another company could develop a capsule or other formulation of tizanidine that competes with Zanaflex Capsules.

Many biotechnology and pharmaceutical companies, as well as academic laboratories, are involved in research and/or product development for various neurological diseases, including MS and SCI. We are aware of a company developing a sodium/potassium channel blocker and a second company developing an immediate release form of fampridine, both of which may compete with Fampridine-SR, if approved. In certain circumstances, pharmacists are not prohibited from formulating certain drug compounds to fill prescriptions on an individual patient basis. We are aware that at present compounded fampridine is used by some people with MS or SCI and it is possible that some people will want to continue to use compounded formulations even if Fampridine-SR is approved. Several companies are engaged in developing products that include novel immune system approaches and cell transplant approaches to remyelination for the treatment of people with MS. These programs are in early stages of development and may compete in the future with Fampridine-SR or our preclinical candidates.

Our competitors may succeed in developing products that are more effective, safer or more convenient than our products or the ones we have under development or that render our approved or proposed products or technologies noncompetitive or obsolete. In addition, our competitors may achieve product commercialization before we do. If any of our competitors develops a product that is more effective, safer or more convenient for patients, or is able to obtain FDA approval for

commercialization before we do, we may not be able to achieve market acceptance for our products, which would adversely affect our ability to generate revenues and recover the substantial development costs we have incurred and will continue to incur.

Our products may be subject to competition from lower-priced versions of such products and competing products imported into the United States from Canada, Mexico and other countries where there are government price controls or other market dynamics that make the products lower priced.

Our operations could be curtailed if we are unable to obtain any necessary additional financing on favorable terms or at all.

On September 30, 2005, on a pro forma as-adjusted basis after giving effect to this offering and our entry into our revenue interest assignment arrangement with PRF, we would have had approximately $ million in cash, cash equivalents and short-term investments. Although we anticipate this will be sufficient to fund our operations for approximately the next 24 months, we have several product candidates in various stages of development, and all will require significant further investment to develop, test and obtain regulatory approval prior to commercialization. We will likely need to seek additional equity or debt financing or strategic collaborations to continue our product development activities, and could require substantial funding to commercialize any products that we successfully develop. We may also require additional financing to support and expand our commercialization of Zanaflex Capsules. We do not currently have any funding commitments or arrangements with third parties to provide funding. We may not be able to raise additional capital on favorable terms or at all.

To the extent that we are able to raise additional capital through the sale of equity securities, the issuance of those securities would result in dilution to our stockholders. Holders of such new equity securities may also have rights, preference or privileges that are senior to yours. If additional capital is raised through the incurrence of indebtedness, we may become subject to various restrictions and covenants that could limit our ability to respond to market conditions, provide for unanticipated capital investments or take advantage of business opportunities. To the extent funding is raised through collaborations or intellectual property-based financings, we may be required to give up some or all of the rights and related intellectual property to one or more of our products, product candidates or preclinical programs. If we are unable to obtain sufficient financing on favorable terms when and if needed, we may be required to reduce, defer or discontinue one or more of our product development programs or devote fewer resources to marketing Zanaflex Capsules.

Under our financing arrangement with PRF, upon the occurrence of certain events, PRF may require us to repurchase the right to receive revenues that we assigned to it or may foreclose on certain assets that secure our obligations to PRF. Any exercise by PRF of its right to cause us to repurchase the assigned right or any foreclosure by PRF could adversely affect our results of operations and our financial condition.

On December 23, 2005, we entered into a Revenue Interests Assignment Agreementrevenue interests assignment agreement with PRF pursuant to which we assigned to PRF the right to receive a portion of our net revenues from Zanaflex Capsules, Zanaflex tablets and any future Zanaflex products. To secure our obligations to PRF, we also granted PRF a security interest in substantially all of our assets related to Zanaflex.

Under our arrangement with PRF, upon the occurrence of certain events, including if we experience a change of control, undergo certain bankruptcy events, transfer any of our interests in Zanaflex (other than pursuant to a license agreement, development, commercialization, co-promotion, collaboration, partnering or similar agreement), transfer all or substantially all of our assets, or breach certain of the covenants, representations or warranties under the Revenue Interests Assignment Agreement,revenue interests assignment agreement, PRF may (i) require us to repurchase the rights we assigned to it at the "put/call price" in effect on the date such right is exercised or (ii) foreclose on the Zanaflex assets that secure our obligations to PRF. Except in the case of certain bankruptcy events, if PRF exercises its right to cause us to repurchase the rights we assigned to it, PRF may not foreclose unless we fail to pay the put/call price as required. The put/call price on a given date is the greater of (i) 150% of all payments made by

PRF to us as of such date, less all payments received by PRF from us as of such date, and (ii) an amount that would generate an internal rate of return to PRF of 25% on all payments made by PRF to us as of such date, taking into account the amount and timing of all payments received by PRF from us as of such date.

If PRF were to exercise its right to cause us to repurchase the right we assigned to it, we cannot assure you that we would have sufficient funds available to pay the put/call price in effect at that time. Even if we have sufficient funds available, we may have to use funds that we planned to use for other purposes and our results of operations and financial condition could be adversely affected. If PRF were to foreclose on the Zanaflex assets that secure our obligations to PRF, our results of operations and

financial condition could also be adversely affected. Because PRF's right to cause us to repurchase the rights we assigned to it is triggered by, among other things, a change in control, transfer of any of our interests in Zanaflex (other than pursuant to a license agreement, development, commercialization, co-promotion, collaboration, partnering or similar agreement) or transfer of all or substantially all of our assets, the existence of that right could discourage us or a potential acquirer from entering into a business transaction that would result in the occurrence of any of those events.

The loss of our key management and scientific personnel may hinder our ability to execute our business plan.

Our success depends on the continuing contributions of our management team and scientific personnel, and maintaining relationships with our scientific and medical network and the network of centers in the United States and Canada that conducts our clinical trials. We are highly dependent on the services of Dr. Ron Cohen, our President and Chief Executive Officer, as well as the other principal members of our management and scientific staff. Our success depends in large part upon our ability to attract and retain highly qualified personnel. We face intense competition in our hiring efforts with other pharmaceutical and biotechnology companies, as well as universities and nonprofit research organizations, and we may have to pay higher salaries to attract and retain qualified personnel. With the exception of Dr. Ron Cohen, we do not maintain "key man" life insurance policies on the lives of our officers, directors or employees. The loss of one or more of our key employees, or our inability to attract additional qualified personnel, could substantially impair our ability to implement our business plan.

We face an inherent risk of liability in the event that the use or misuse of our products results in personal injury or death.

If the use or misuse of Zanaflex Capsules or any other FDA-approved products we may sell in the future harms people, we may be subject to costly and damaging product liability claims brought against us by consumers, healthcare providers, pharmaceutical companies, third-party payors or others. The use of our product candidates in clinical trials could also expose us to product liability claims. We currently maintain a product liability insurance policy that includes coverage of our clinical trials. This insurance policy has a $10 million per claim limit and the aggregate amount of claims under the policy is also capped at $10 million. We cannot predict all of the possible harms or side effects that may result from the use of our products or the testing of product candidates and, therefore, the amount of insurance coverage we currently have may not be adequate to cover all liabilities or defense costs we might incur. A product liability claim or series of claims brought against us could give rise to a substantial liability that could exceed our resources. Even if claims are not successful, the costs of defending such claims and potential adverse publicity could be harmful to our business.

We are subject to various federal and state laws regulating the marketing of Zanaflex Capsules and, if we do not comply with these regulations, we could face substantial penalties.

Our sales, promotion and other activities related to Zanaflex Capsules, or any of our other products under development following their regulatory approval, are subject to regulatory and law enforcement authorities in addition to the FDA, including the Federal Trade Commission, the

Department of Justice, and state and local governments. We are subject to various federal and state laws pertaining to health care "fraud and abuse," including both federal and state anti-kickback laws. Anti-kickback laws make it illegal for a prescription drug manufacturer to solicit, offer, receive or pay any remuneration as an inducement for the referral of business, including the use, recommendation, purchase or prescription of a particular drug. The federal government has published regulations that identify "safe harbors" or exemptions for certain payment arrangements that do not violate the anti-kickback statutes. Although we seek to comply with these statutes, it is possible that our practices, or those of our contract sales force, might be challenged under anti-kickback or similar laws. Violations of fraud and abuse laws may be punishable by civil or criminal sanctions, including fines and civil monetary penalties, and future exclusion from participation in government healthcare programs.

We may be subject to penalties if we fail to comply with post-approval legal and regulatory requirements and our products could be subject to restrictions or withdrawal from the market.

Any product for which we currently have or may obtain marketing approval, along with the associated manufacturing processes, any post-approval clinical data that we might be required to collect and the advertising and promotional activities for the product, are subject to continual recordkeeping and reporting requirements, review and periodic inspections by the FDA and other regulatory bodies. Regulatory approval of a product may be subject to limitations on the indicated uses for which the product may be marketed or to other restrictive conditions of approval that limit our ability to promote, sell or distribute a product. Furthermore, any approval may contain requirements for costly post-marketing testing and surveillance to monitor the safety or efficacy of the product.

We have an outstanding commitment with the FDA, inherited from Elan, to evaluate Zanaflex Capsules for pediatric use by December 2005February 2007, in accordance with the requirements of the Pediatric Research Equity Act. We intendAct, or PREA. The NDA for Zanaflex Capsules was approved with a plan to discuss this matter withaddress the FDA and seek a deferral or waiverrequirements of the requirementPREA through a pediatric pharmacokinetic study. We have submitted a proposed design for this pharmacokinetic study to conduct pediatric studies. Without a waiver,the FDA. Depending on the FDA's response to our submission or the outcome of this study, we willmay be required to conduct a pediatric study of Zanaflex Capsulesadditional studies. These studies could be more extensive and incurmore costly than the related costs of this clinical trial.currently-planned study.

Our advertising and promotion are subject to stringent FDA rules and oversight. In particular, the claims in our promotional materials and activities must be consistent with the FDA approvals for our products, and must be appropriately substantiated and fairly balanced with information on the safety risks and limitations of the products. Any free samples we distribute to physicians must be carefully monitored and controlled, and must otherwise comply with the requirements of the Prescription Drug Marketing Act, as amended, and FDA regulations. We must continually review adverse event information that we receive concerning our drugs and make expedited and periodic adverse event reports to the FDA and other regulatory authorities.

In addition, the research, manufacturing, distribution, sale and promotion of drug and biological products are potentially subject to regulation by various federal, state and local authorities in addition to the FDA, including the Centers for Medicare and Medicaid Services, other divisions of the U.S. Department of Health and Human Services, the U.S. Department of Justice and individual U.S. Attorney offices within the Department of Justice, and state and local governments. For example, sales, marketing and scientific/educational grant programs must comply with the anti-kickback and fraud and abuse provisions of the Social Security Act, as amended, the False Claims Act, as amended, the privacy provisions of the Health Insurance Portability and Accountability Act and similar state laws. Pricing and rebate programs must comply with the Medicaid rebate requirements of the Omnibus Budget Reconciliation Act of 1990, as amended, and the Veterans Health Care Act of 1992, as amended. If products are made available to authorized users of the Federal Supply Schedule of the General Services Administration, additional laws and requirements apply. All of these activities are also potentially subject to federal and state consumer protection and unfair competition laws.

We may be slow to adapt, or we may not be able to adapt, to changes in existing regulatory requirements or adoption of new legal or regulatory requirements or policies. Later discovery of

previously unknown problems with our products, manufacturing processes, or failure to comply with regulatory requirements, may result in:

In addition, the FDA or another regulatory agency may conduct periodic unannounced inspections. If they determine that we are not in compliance with applicable requirements, they may issue a notice of inspectional observations. If the observations are significant, we may have to devote significant resources to respond and undertake appropriate corrective and preventive actions, which could adversely affect our business prospects. For example, the FDA recently completed an inspection relating to our adverse event and product complaint handling and reporting for Zanaflex. The FDA has informed us that there are several observations that they will be including in a Form 483, Inspectional Observations. We have completed or expect to complete shortly all necessary corrective actions. The cost of the corrective actions is not expected to be material.

State pharmaceutical marketing compliance and reporting requirements may expose us to regulatory and legal action by state governments or other government authorities.

In recent years, several states, including California, Vermont, Maine, Minnesota, New Mexico and West Virginia, have enacted legislation requiring pharmaceutical companies to establish marketing compliance programs and file periodic reports with the state on sales, marketing, pricing and other activities. For example, California has enacted a statute requiring pharmaceutical companies to adopt a comprehensive compliance program that is in accordance with the Office of Inspector General of the Department of Health and Human ServicesCompliance Program Guidance for Pharmaceutical Manufacturers. This compliance program must include policies for compliance with the Pharmaceutical Research and Manufacturers of AmericaCode on Interactions with Healthcare Professionals, as well as a specific annual dollar limit on gifts or other items given to individual healthcare professionals in California. The law requires posting policies on a company's public web site along with an annual declaration of compliance.

Vermont, Maine, Minnesota, New Mexico, and West Virginia have also enacted statutes of varying scope that impose reporting and disclosure requirements upon pharmaceutical companies pertaining to drug pricing and payments and costs associated with pharmaceutical marketing, advertising and promotional activities, as well as restrictions upon the types of gifts that may be provided to healthcare practitioners. Similar legislation is being considered in other states. Many of these requirements are new and uncertain and the penalties for failure to comply with these requirements are unclear. We are not aware of any companies against which fines or penalties have been assessed under these state reporting and disclosure laws to date. We are currently in the process of developing a formal compliance infrastructure and standard operating procedures to comply with such laws. Unless we are in full compliance with these laws, we could face enforcement action and fines and other penalties, and could receive adverse publicity.

If we seek to market our products in foreign jurisdictions, we will need to obtain regulatory approval in these jurisdictions.

In order to market our products in the European Union and many other foreign jurisdictions, we must obtain separate regulatory approvals and comply with numerous and varying regulatory requirements. Approval procedures vary among countries and can involve additional clinical testing. The time required to obtain approval may differ from that required to obtain FDA approval. Should we decide to market our products abroad, we may fail to obtain foreign regulatory approvals on a timely basis, if at all. Approval by the FDA does not ensure approval by regulatory authorities in other countries, and approval by one foreign regulatory authority does not ensure approval by regulatory authorities in other foreign countries or by the FDA. We may not be able to file for, and may not receive, necessary regulatory approvals to commercialize our products in any foreign market, which could adversely affect our business prospects.

If we use biological and hazardous materials in a manner that causes injury, we may be liable for damages.

Our research and development activities involve the controlled use of potentially harmful biological materials, hazardous materials and chemicals that are subject to federal, state and local laws and regulations governing their use, storage, handling and disposal. These materials include ketamine, buprinex,buprenophine, sodium peantabarbitol,pentobarbital, ether, acetonitrile, hexanes, chloroform, xylene, dehydrated alcohol, xylene petroleum, ether methanol, ethyl alcohol, acetonitrile UV, hexanes, chloroform, alcohol-propyl, alcohol isopropylisopropanol and ether formaldehyde solution 37%.formaldehyde. We cannot completely eliminate the risk of accidental contamination or injury from the use, storage, handling or disposal of these materials. If we fail to comply with environmental regulations, we could be subject to criminal sanctions and/or substantial liability for any damages that result, and any substantial liability could exceed our resources. We currently maintain a general liability insurance policy that has a $2 million per claim limit and also caps aggregate claims at $2 million. In addition, we have an umbrella insurance policy that covers up to $9 million of liability in excess of the general liability policy's $2 million limit. This amount of insurance coverage may not be adequate to cover all liabilities or defense costs we might incur. In addition, the cost of compliance with environmental and health and safety regulations may be substantial.

Risks Related to Our Dependence on Third Parties

We currently have no manufacturing capabilities and are substantially dependent upon Elan, Novartis and other third party suppliers to manufacture Zanaflex Capsules, Zanaflex tablets and Fampridine-SR.

We do not own or operate, and currently do not plan to own or operate, manufacturing facilities for production of Zanaflex Capsules, Zanaflex tablets or Fampridine-SR. We rely and expect to continue to rely on third parties for the production of our products and clinical trial materials.

We rely on a single manufacturer, Elan, for the supply of Zanaflex Capsules. Zanaflex Capsules are manufactured using Elan's proprietary SODAS (spheroidal oral drug absorption system) multiparticulate drug delivery technology. Elan is obligated, in the event of a failure to supply Zanaflex Capsules, to use commercially reasonable efforts to assist us in either producing Zanaflex Capsules ourselves or in transferring production of Zanaflex Capsules to a third-party manufacturer, provided that such third-party manufacturer is not a technological competitor of Elan. In the event production is transferred to a third party, the FDA may require us to demonstrate through bioequivalence studies and laboratory testing that the product made by the new supplier is equivalent to the current Zanaflex Capsules before we could distribute products from that supplier. The process of transferring the technology and qualifying the new supplier could take a year or more.

Under our supply agreement with Elan, we provide Elan with monthly written 18-month forecasts and with annual written two-year forecasts of our supply requirements for Zanaflex Capsules. In each of the five months following the submission of our written 18-month forecast we are obligated to purchase the quantity specified in the forecast, even if our actual requirements are greater or less. Elan is not obligated to supply us with quantities in excess of our forecasted amounts, although it has agreed to use commercially reasonable efforts to do so. Because we have a limited history of selling Zanaflex Capsules, our forecasts of our supply requirements may be inaccurate. As a result, we may have an excess or insufficient supply of Zanaflex Capsules.

The Elan facility located in Gainesville, Georgia, which is responsible for bottling Zanaflex Capsules, has been operating under a court-ordered consent decree and injunction since 2001, which were imposed following adverse FDA inspections and FDA allegations that the facility was failing to comply with current good manufacturing requirements. These prior issues were not related to the manufacture of our products. If, however, Elan fails to comply with the requirements of the consent decree and injunction, it could be held in contempt and the facility could be shut down and the manufacturing of our products halted or interrupted.

We currently rely on Novartis for our supply of Zanaflex tablets and tizanidine, the active pharmaceutical ingredient, or API, in both Zanaflex Capsules and Zanaflex tablets. Under a supply

agreement we assumed from Elan, Novartis is responsible for manufacturing Zanaflex tablets and

tizanidine for us through February 2007. This includes the tizanidine that Elan uses to manufacture Zanaflex Capsules for us. Novartis currently produces tizanidine, but has arranged with another party to formulate Zanaflex tablets. We have arranged for another company, Sharp Corporation, ("Sharp"), to package and bottle Zanaflex tablets. Novartis has informed us that it intends to discontinue production of tizanidine by the end of 2005.the first quarter of 2006. It is our understanding that Novartis is currently in the process of qualifying an alternativetransferring the methods of manufacturing tizanidine manufacturer.to Rohner, a manufacturer in Pratteln, Switzerland. We have established relationshipsalso identified an alternate source for tizanidine in collaboration with the companies that currently formulate, bottle and package the tablets, however, weElan but do not have a relationshipan agreement with anthat alternative manufacturer of tizanidine.source or any other alternate manufacturer. By the expiration of our contract with Novartis in 2007, we will need to have established a direct relationship with an alternative supplier of tizanidine.tizanidine for Zanaflex tablets if we want them to continue to be manufactured.

We also rely exclusively on Elan to supply us with our requirements for Fampridine-SR. Elan relies on a third-party manufacturer to supply fampridine, the API in Fampridine-SR. Under our supply agreement with Elan, we are obligated to purchase at least 75% of our yearly supply of Fampridine-SR from Elan, and we are required to make compensatory payments if we do not purchase 100% of our requirements from Elan, subject to certain exceptions. We and Elan have agreed that we may purchase up to 25% of our annual requirements from Patheon, Inc., a mutually agreed-upon and qualified second manufacturing source, without compensatory payment.

Our dependence on others to manufacture our marketed products and clinical trial materials may adversely affect our ability to develop and commercialize our products on a timely and competitive basis.

If third-party contract research organizations do not perform in an acceptable and timely manner, our preclinical testing or clinical trials could be delayed or unsuccessful.

We do not have the ability to conduct all aspects of our preclinical testing or clinical trials ourselves. We rely and will continue to rely on clinical investigators, third-party contract research organizations and consultants to perform some or all of the functions associated with preclinical testing or clinical trials. The failure of any of these vendors to perform in an acceptable and timely manner in the future, including in accordance with any applicable regulatory requirements, such as good clinical and laboratory practices, or preclinical testing or clinical trial protocols, could cause a delay or otherwise adversely affect on our preclinical testing or clinical trials and ultimately on the timely advancement of our development programs.

We rely on a third party to provide the sales representatives to market Zanaflex Capsules to primary care physicians.

We recently entered into a contract with Cardinal Health pursuant to which it provides us with approximately 160 sales representatives who market Zanaflex Capsules to primary care physicians. These sales representatives are not our employees and we do not have control over their performance or compliance with applicable laws. Their failure to increase prescriptions for Zanaflex Capsules from the targeted primary care physicians would negatively impact our sales growth, and their failure to comply with applicable laws could subject us to liability.

Risks Related to Our Intellectual Property

If we cannot protect our intellectual property, our ability to develop and commercialize our products will be severely limited.

Our success will depend in part on our and our licensors' ability to obtain, maintain and enforce patent protection for the technologies, compounds and products, if any, resulting from our licenses and development programs. Without protection for the intellectual property we use, other companies could offer substantially identical products for sale without incurring the sizable discovery, development and

licensing costs that we have incurred. Our ability to recover these expenditures and realize profits upon the sale of products could be diminished.

We have in-licensed or are the assignee of more than 25 U.S. patents, more than 60 foreign patents and over 65 patent applications pending in the United States or abroad for our own technologies and for technologies from our in-licensed programs. The process of obtaining patents can be time consuming and expensive with no certainty of success. Even if we spend the necessary time and money, a patent may not issue or it may not have sufficient scope or strength to protect the technology it was intended to protect or to provide us with any commercial advantage. We may never be certain that we were the first to develop the technology or that we were the first to file a patent application for the particular technology because U.S. patent applications are confidential until they are published, and publications in the scientific or patent literature lag behind actual discoveries. The degree of future protection for our proprietary rights will remain uncertain if our pending patent applications are not approved for any reason or if we are unable to develop additional proprietary technologies that are patentable. Furthermore, third parties may independently develop similar or alternative technologies, duplicate some or all of our technologies, design around our patented technologies or challenge our issued patents or the patents of our licensors.